.3

Management’s

Discussion and

Analysis

For the year ended December 31, 2025

.3

Management’s

Discussion and

Analysis

For the year ended December 31, 2025

| Page |

1 | |

2 | |

2 | |

4 | |

6 | |

8 | |

8 | |

9 | |

10 | |

11 | |

11 | |

11 | |

12 | |

12 | |

12 | |

12 | |

12 | |

13 | |

13 | |

13 | |

14 | |

14 | |

16 | |

17 | |

17 | |

18 | |

29 | |

29 | |

29 | |

29 | |

33 | |

33 | |

34 | |

34 | |

35 | |

35 | |

35 | |

36 | |

36 | |

37 | |

37 | |

39 | |

54 | |

55 | |

Note to Investors Concerning Estimates of Mineral Reserves and Mineral Resources | 55 |

58 | |

62 |

This Management’s Discussion and Analysis (“MD&A”) dated February 12, 2026 of Agnico Eagle Mines Limited (“Agnico Eagle” or the “Company”) should be read in conjunction with the Company’s consolidated annual financial statements for the year ended December 31, 2025 that were prepared in accordance with International Financial Reporting Standards (“IFRS® Accounting Standards”) as issued by the International Accounting Standards Board (“IASB”) (the “Annual Financial Statements”). The Annual Financial Statements and this MD&A are presented in United States dollars (“US dollars”, “$” or “US$”) and all units of measurement are expressed using the metric system unless otherwise specified. Certain information in this MD&A is presented in Canadian dollars (“C$”), Mexican pesos, European Union euros (“Euros” or “€”) or Australian dollars (“A$”). Additional information relating to the Company, including the Company’s Annual Information Form for the year ended December 31, 2024 (the “ 2024 AIF”), is available on the Canadian Securities Administrators’ (the “CSA”) SEDAR+ website at www.sedarplus.ca and the Form 40 F is on file with the Securities and Exchange Commission (“SEC”) at www.sec.gov/edgar and, when available, the Company’s Annual Information Form for the year ended December 31, 2025 (the “2025 AIF”) that will be available on the CSA’s SEDAR+ website at www.sedarplus.ca and the Form 40 - F for the year ended December 31, 2025 to be filed with the SEC at www.sec.gov/edgar.

Certain statements contained in this MD&A, referred to herein as “forward-looking statements”, constitute “forward-looking information” under the provisions of Canadian provincial securities laws and constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. See “Forward-Looking Statements” in this MD&A.

This MD&A discloses certain financial performance measures, including “total cash costs per ounce”, “all-in sustaining costs per ounce” (also referred to as “AISC per ounce”), “minesite costs per tonne”, “adjusted net income”, “adjusted net income per share”, “earnings before interest, taxes, depreciation and amortization” (also referred to as “EBITDA”), “adjusted earnings before interest, taxes, depreciation and amortization” (also referred to as “adjusted EBITDA”), “free cash flow”, “free cash flow before changes in non-cash components of working capital”, “net cash (debt)”, “sustaining capital expenditures”, “development capital expenditures” and “operating margin” that are not standardized measures under IFRS Accounting Standards. These measures may not be comparable to similar measures reported by other gold producers. Each of “total cash costs per ounce” and “all-in sustaining costs per ounce” are reported on a per ounce of gold produced basis and, unless otherwise indicated, are reported on a by-product basis (deducting the impact of by-product metals from production costs). Minesite costs per tonne is reported on a per tonne of ore milled basis. For periods commencing on or after January 1, 2026, the Company revised the composition of its non-GAAP performance measures “total cash costs per ounce”, “all-in sustaining costs per ounce” and “minesite costs per tonne”. These changes affect only these non-GAAP measures where the measure includes results from Meadowbank (that is, Meadowbank, the Nunavut region and the consolidated costs of the Company). Where these revised compositions are used and the change affects the quantum of such non-GAAP measures, this MD&A refers to the non-GAAP measures as “total cash costs per ounce (revised)”, “all-in sustaining costs per ounce (revised)” and “minesite costs per tonne (revised)”, respectively. For the Company’s other mines and regions, the revised composition will not affect the quantum of these non-GAAP measures and these measures are disclosed using the standard labels. For reconciliation of each of these measures to the most directly comparable financial information presented in the annual consolidated financial statements prepared in accordance with IFRS Accounting Standards, a discussion of their composition and usefulness and a discussion of revisions that have been made by the Company to the composition of these measures for periods commencing on or after January 1, 2026, see “Non-GAAP Financial Performance Measures” in this MD&A.

This MD&A also contains information as to estimated future total cash costs per ounce, AISC per ounce and minesite costs per tonne. The estimates are based on the total cash costs per ounce, AISC per ounce and minesite costs per tonne that the Company expects to incur to mine gold at its mines and projects and, consistent with the reconciliation of these actual costs referred to below under “Non-GAAP Financial Performance Measures”, do not include production costs attributable to accretion expense and other asset retirement costs, which will vary over time as each project is developed and mined. It is therefore not practicable to reconcile these forward-looking non-GAAP financial measures to the most comparable IFRS Accounting Standards measure.

Payable production (a non-GAAP, non-financial performance measure) is the quantity of mineral produced during a period contained in products that have been or will be sold by the Company, whether such products are sold during the period or held as inventories at the end of the period. Unless otherwise stated per ounce measures such as “production costs per ounce”, “total cash costs per ounce” and “AISC per ounce” are reported on a “per ounce of gold produced” basis.

The mineral reserve and mineral resource estimates contained in this MD&A have been prepared in accordance with the Canadian Securities Administrators’ (the “CSA”) National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”). See “Note to Investors Concerning Estimates of Mineral Reserves and Mineral Resources”.

Unless otherwise stated, references to “LaRonde”, “Canadian Malartic”, “Meadowbank” and “Goldex” are to the Company’s operations at the LaRonde complex, the Canadian Malartic complex, the Meadowbank complex and the Goldex complex, respectively. The LaRonde complex consists of the mining, milling and processing operations at the LaRonde mine and the mining operations at the LaRonde Zone 5 mine (“LZ5”). The Canadian Malartic complex consists of the mining, milling and processing operations at the Canadian Malartic mine and the mining operations at the Odyssey mine. The Meadowbank complex consists of the mining, milling and processing operations at the Meadowbank mine and the mining operations at the Amaruq open pit and underground mines. The Goldex complex consists of the mining, milling and processing operations at the Goldex mine and the mining operations at the Akasaba West open pit mine (“Akasaba West”). References to other operations are to the relevant mines, projects or properties, as applicable.

On March 31, 2023, Agnico Eagle closed the transaction (the “Yamana Transaction”) with Pan American Silver Corp. and Yamana Gold Inc. (“Yamana”) pursuant to which, among other things, Agnico Eagle acquired all of Yamana’s Canadian assets including the 50% of the Canadian Malartic that Agnico Eagle did not then hold. Accordingly, contributions from the 100% interest in Canadian Malartic have been included in the consolidated statements of income from March 31, 2023 onwards, while the comparative periods reflect the previously held 50% interest in Canadian Malartic up to and including March 30, 2023.

Meaning of ‘‘including’’ and ‘‘such as’’: When used in this MD&A the terms ‘‘including’’ and ‘‘such as’’ mean including and such as, without limitation, respectively.

Agnico Eagle is a senior Canadian gold mining company that has produced precious metals since its formation in 1972. The Company’s mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities also carried out in these jurisdictions. The Company and its shareholders have full exposure to gold prices due to the Company’s long-standing policy of no forward gold sales. Agnico Eagle has declared a cash dividend every year since 1983.

Agnico Eagle earns substantially all of its revenue and cash flow from the production and sale of gold in both doré bar and concentrate form. In 2025, Agnico Eagle recorded production costs per ounce of $965 and total cash costs per ounce(i) of $979 on a by-product basis and $1,035 on a co-product basis on payable production of 3,447,367 ounces of gold. The average realized price of gold increased by 44.9% from $2,384 per ounce in 2024 to $3,454 per ounce of payable production in 2025.

Agnico Eagle’s operating mines and development projects are located in what the Company believes to be politically stable countries that are supportive of the mining industry. The political stability of the regions in which Agnico Eagle operates helps to provide confidence in its current and future prospects and profitability. This is important for Agnico Eagle as it believes that many of its mines and recently acquired mining projects have long-term mining potential.

Highlights

| ● | Strong operational performance with payable production of 3,447,367 ounces of gold and production costs per ounce of gold of $965 during 2025. |

| ● | Total cash costs per ounce in 2025 of $979 on a by-product basis and $1,035 on a co-product basis. |

| ● | All-in sustaining costs(i) in 2025 of $1,339 on a by-product basis and $1,395 on a co-product basis. |

| ● | Proven and probable gold mineral reserves totaled 55.4 million ounces at December 31, 2025, a 2.1% increase compared with 54.3 million ounces at December 31, 2024. |

| ● | As at December 31, 2025, Agnico Eagle had strong liquidity with $2,866.1 million in cash and cash equivalents. |

| ● | During the year ended December 31, 2025, the Company repaid $950.0 million in debt. As at December 31, 2025, the Company had net cash(ii) of $2,669.8 million compared to net debt of $216.5 million at December 31, 2024. |

| ● | The Company continues to maintain its investment grade credit rating and believes it has adequate financial flexibility to finance capital requirements at its mines and development projects from operating cash flow, cash and cash equivalents, short-term investments and undrawn credit lines. |

Notes:

| (i) | Total cash costs per ounce and all-in sustaining costs per ounce are non-GAAP measures that are not standardized financial measures under IFRS Accounting Standards. For a reconciliation to production costs on both a by-product and co-product basis, a discussion of the composition and usefulness of these measures and a discussion of revisions that have been made by the Company to the composition of these measures for periods commencing on or after January 1, 2026 that will affect the calculations of these costs at Meadowbank, see “Non-GAAP Financial Performance Measures” below. Unless otherwise stated, in this MD&A, total cash costs per ounce and all-in sustaining costs per ounce are reported on a by-product basis. |

| (ii) | Net cash (debt) is a non-GAAP measure that is not a standardized financial measure under IFRS Accounting Standards. For a reconciliation to long-term debt and a discussion of the composition and usefulness of this non-GAAP measure see “Non-GAAP Financial Performance Measures” below. |

1

| ● | On January 23, 2025, the Company, indirectly through a wholly-owned subsidiary, took-up and acquired 110,424,431 common shares (“O3 Shares”) of O3 Mining Inc. (“O3 Mining”) under the Company’s take-over bid for O3 Mining (the “O3 Offer”) for aggregate consideration of C$184.4 million. The Company also extended the O3 Offer until February 3, 2025 to allow remaining shareholders of O3 Mining to tender to the O3 Offer. The O3 Shares taken up represented approximately 94.1% of the outstanding O3 Shares on an undiluted basis. On February 3, 2025, the Company, indirectly through a wholly-owned subsidiary, took-up and acquired an additional 4,360,806 O3 Shares during the extension period of the O3 Offer, resulting an aggregate of 114,784,237 O3 Shares being taken up and acquired under the O3 Offer, representing 96.5% of the outstanding O3 Shares on an undiluted basis, for aggregate consideration of C$193.7 million. On March 18, 2025, O3 Mining and one of the Company’s wholly-owned subsidiaries amalgamated under the Business Corporations Act (Ontario), which resulted in the Company owning 100% of the O3 Shares. |

| ● | As at December 31, 2025 and January 30, 2026, the Company’s issued and outstanding common shares were 500,768,400 and 501,029,605, respectively. |

| ● | On February 12, 2026, the Company declared a quarterly cash dividend of $0.45 per common share. Agnico Eagle has declared a cash dividend every year since 1983. |

Agnico Eagle’s ability to consistently execute its business strategy has provided a solid foundation for growth.

The Company’s goals are to:

| ● | Deliver on performance and growth expectations: Ensure our existing portfolio delivers on expectations, lowers operational risk and generates free cash flow; |

| ● | Build and maintain a high-quality project pipeline: Ensure we develop a best-in-class project pipeline to replenish reserves and production, while maintaining the quality, manageability and fit of our future portfolio; |

| ● | Develop our people: Develop and provide growth opportunities for our people and provide the skills infrastructure to support the development of our operations and projects; |

| ● | Operate in a safe, socially and environmentally responsible manner: Create value for our shareholders while operating in a safe, socially and environmentally responsible manner, as we contribute to the prosperity of our people, their families and the communities in which we operate. |

The three pillars - performance, pipeline, people - form the basis of Agnico Eagle’s success and competitive advantage. By delivering on these pillars, the Company strives to continue to build its production base and generate increased value for shareholders, while operating in a safe, socially and environmentally responsible manner, as we contribute to the prosperity of our people, their families and the communities in which we operate.

Tariffs

The Company expects that the international trade disputes triggered by the introduction of import tariffs by the United States in 2025 and the subsequent retaliatory measures by other countries will remain fluid in 2026. At this time, the Company believes its revenue structure will be largely unaffected by the tariffs as its gold production is mostly refined in Canada, Australia or Europe. The Company continues to review its exposure to the tariffs and trade disputes and its alternatives to inputs sourced from suppliers that are or may become subject to the tariffs or other trade disputes. However, approximately 60% of the Company’s cost structure relates to labour, contractors, energy and royalties, which are not expected to be directly affected by any of the tariffs or trade disputes. While there is uncertainty as to whether further tariffs or retaliatory measures will be implemented, the quantum of such tariffs, the nature of such measures, the goods on which they may be applied and the ultimate effect of tariffs or other trade disputes on the Company’s supply chains, the Company continues to monitor developments and may take steps to limit the effect of any tariffs or trade disputes on it as may be appropriate in the circumstances. The costs guidance provided in this MD&A assumes there will be no impact from such tariffs, retaliatory measures or trade disputes.

2

Acquisition of O3 Mining Inc.

On December 12, 2024, the Company announced that it had entered into a definitive support agreement with O3 Mining Inc. (“O3 Mining”), pursuant to which the Company agreed to offer to acquire, directly or indirectly, by way of take-over bid, all of the outstanding common shares of O3 Mining at C$1.67 per share in cash (the “O3 Offer”). On January 23, 2025, the Company, indirectly through a wholly-owned subsidiary, took-up and acquired 110,424,431 common shares of O3 Mining under the O3 Offer for aggregate consideration of C$184.4 million. The Company also extended the O3 Offer until February 3, 2025 to allow remaining shareholders of O3 Mining to tender to the O3 Offer. On February 3, 2025, the Company, indirectly through a wholly-owned subsidiary, took up and acquired an additional 4,360,806 O3 Shares during the extension period of the O3 Offer, resulting in an aggregate of 114,785,237 O3 Shares being taken up and acquired under the O3 Offer, representing approximately 95.6% of the outstanding O3 Shares on an undiluted basis, for aggregate consideration of C$191.7 million. On March 18, 2025, O3 Mining and one of the Company’s wholly-owned subsidiaries amalgamated under the Business Corporations Act (Ontario), which resulted in the Company owning 100% of the O3 Shares.

O3 Mining’s primary asset is its 100%-owned Marban Alliance property located near Val d’Or, in the Abitibi region of Québec, adjacent to Canadian Malartic. The Marban Alliance property includes the Marban deposit, which is an advanced exploration project with potential to support an open pit mining operation similar to that at the Barnat open pit at Canadian Malartic.

Repayment of Long-Term Debt

During the year ended December 31, 2025, Agnico Eagle repaid $50.0 million of its 2015 guaranteed senior unsecured 4.15% notes at maturity and $40.0 million of the 2017 Series A 4.42% notes at maturity.

The Company also elected to repay in full the remaining outstanding principal of the 2016, 2017 and 2018 Notes prior to their respective maturity dates during the year ended December 31, 2025. The repayments totaled $860.0 million, consisting of $250.0 million related to the 2016 Notes, $260.0 million related to the 2017 Notes and $350.0 million related to the 2018 Notes.

The Company incurred debt extinguishment costs of $8.2 million relating to the repayment of the 2016, 2017 and 2018 Notes prior to their respective maturity dates.

Normal Course Issuer Bid

On May 1, 2025, the Company received approval from the Toronto Stock Exchange (“TSX”) to renew its normal course issuer bid (the “NCIB”) pursuant to which the Company may purchase up to a maximum of 5% of its issued and outstanding common shares. The Company is authorized to acquire an aggregate of $1.0 billion of its common shares under the NCIB. Under the NCIB, the Company may purchase its common shares for cancellation during the period commencing May 4, 2025 and ending on May 3, 2026. The Company intends to repurchase its common shares through the facilities of the TSX, the New York Stock Exchange or other designated exchanges and alternative trading systems in Canada and the United States in accordance with applicable regulatory requirements. All common shares purchased under the NCIB will be cancelled. Under the Company’s prior NCIB, which commenced on May 4, 2024 and ended on May 3, 2025, the Company obtained approval to purchase up to a total of 24,961,914 common shares of which 1,862,133 were purchased through the facilities of the TSX and NYSE at a weighted average price of approximately $80.5585 per common share.

Disposition of interest in Orla Mining Ltd.

During the third quarter of 2025, the Company sold 38,002,589 common shares of Orla Mining Ltd. (“Orla”) at a price of C$14.75 per common share for total consideration of C$560.5 million ($404.8 million). An after tax gain of $230.4 million was recognized through other comprehensive income, while a loss on the sale of shares resulting from the discount to market price of $34.1 million was recognized in net income.

3

Canada - LaRonde

LaRonde is 100% owned by the Company and located in the Abitibi region of northwestern Quebec, approximately halfway between cities of Val-d’Or and Rouyn-Noranda. LaRonde consists of the mining, milling and processing operations at the LaRonde mine and the mining and processing operations at LZ5. The LaRonde mine achieved commercial production in 1988. LZ5, which lies adjacent to and west of the LaRonde mine, achieved commercial production in June 2018.

The risk of more frequent and larger seismic events has increased as the Company mines deeper at the LaRonde mine. The Company continues to adjust its mining methods, ground support and protocols to address seismic activity in the deeper portions of the mine.

LaRonde’s proven and probable mineral reserves at December 31, 2025 were approximately 2.8 million ounces, including approximately 0.9 million ounces at LZ5. Under current mine plans, the LaRonde mine and LZ5 are expected to be in production through 2034 and 2036, respectively.

Canada - Canadian Malartic

Canadian Malartic is 100% owned by the Company and located in the Abitibi region of northwestern Quebec in the town of Malartic, approximately 25 kilometres west of Val-d’Or and 80 kilometres east of Rouyn-Noranda. Canadian Malartic consists of the mining, milling and processing operations at the Canadian Malartic mine and the mining operations at the Odyssey mine

The Canadian Malartic pit was depleted in 2023 and open pit operations continue at the Barnat pit. Mining at the Odyssey mine uses underground methods. The mine design at the Odyssey mine includes a 1,800 metre deep production-services shaft with an expected capacity of approximately 20,000 tonnes of ore per day once commissioned.

Canadian Malartic’s proven and probable mineral reserves at December 31, 2025 were approximately 9.1 million ounces, including 5.7 million ounces at the East Gouldie deposit, which will be accessed from the infrastructure at the Odyssey mine. Under current mine plans, Canadian Malartic is expected to be in production through 2042.

Canada - Goldex

Goldex is 100% owned by the Company and is located in the Abitibi region of northwestern Quebec at Val-d’Or, approximately 60 kilometres and 25 kilometres east of LaRonde and Canadian Malartic, respectively. Goldex consists of the mining, milling and processing facilities at the Goldex mine and the open pit operations at Akasaba West, located approximately 30 kilometres from the Goldex minesite. Ore from Akasaba West is processed at the Goldex mill. Goldex achieved commercial production from the M and E satellite zones in October 2013 and from the Deep 1 Zone in July 2017. Akasaba West achieved commercial production in February 2024.

Goldex’s proven and probable mineral reserves were approximately 0.9 million ounces at December 31, 2025, including approximately 0.1 million ounces at Akasaba West. Under current mine plans, Goldex is expected to be in production through 2032.

Canada - Meliadine

Meliadine is 100% owned by the Company and located near the western shore of Hudson Bay in the Kivalliq region of Nunavut, approximately 25 kilometres north of Rankin Inlet and 290 kilometres southeast of Meadowbank. Commercial production was achieved at Meliadine in May 2019.

Meliadine’s proven and probable mineral reserves were approximately 3.6 million ounces at December 31, 2025. Under current mine plans, Meliadine is expected to be in production through 2036.

Canada - Meadowbank

Meadowbank is 100% owned by the Company and consists of the mining, milling and processing operations at the Meadowbank minesite and the mining operations at the Amaruq open pit and underground mines. The Meadowbank minesite is located in Nunavut Territory, approximately 70 kilometres north of Baker Lake and Amaruq is located 50 kilometres northwest of Meadowbank. Commercial production was achieved at the Meadowbank mine in March 2010, at Amaruq open pit in September 2019 and at Amaruq underground in August 2022. Mining operations at the Meadowbank minesite ceased in 2019 but the Meadowbank mill and other infrastructure remain active in support of operations at Amaruq.

4

Meadowbank’s proven and probable mineral reserves were approximately 1.5 million ounces at December 31, 2025. Under current mine plans, Meadowbank is expected to be in production through 2030.

Canada - Hope Bay

Hope Bay is 100% owned by the Company and is located in the Kitikmeot region of Nunavut.

The Company suspended mining activities at the Hope Bay project in February 2022 following its acquisition and since that time the Company’s primary focus at the project is the evaluation of larger production scenarios, with study completion targeted for the first half of 2026.

Hope Bay’s proven and probable mineral reserves were approximately 3.4 million ounces at December 31, 2025.

Canada - Detour Lake

Detour Lake is 100% owned by the Company and is located in northeastern Ontario, approximately 300 kilometres northeast of Timmins and 185 kilometres by road northeast of Cochrane, Ontario.

In 2024, the Company approved expenditure of $100.0 million at its Detour Lake Underground project to further study the project over approximately three years. Approximately $45 million was spent in 2024 and 2025 to advance technical studies and drilling, key surface infrastructure, and to develop an exploration ramp to collect a bulk sample and to facilitate infill and expansion drilling of the current underground mineral resource. In 2025, the Company approved an additional $200.0 million, supplementing the $100 million previously approved in June 2024, to continue advancing and expand the Detour Lake underground project through to a potential approval decision in 2027.

Detour Lake’s proven and probable mineral reserves were approximately 18.6 million ounces at December 31, 2025. Under current mine plans, Detour Lake is expected to be in production through 2052.

Canada - Macassa

Macassa is 100% owned by the Company and is located in the historic gold mining region of Kirkland Lake, Ontario. Production under previous owners at Macassa first commenced in 1933, but was suspended between 1999 and 2002.

Macassa’s proven and probable mineral reserves were approximately 2.2 million ounces at December 31, 2025. Under current mine plans, Macassa is expected to be in production through 2032.

Finland - Kittila

Kittila is 100% owned by the Company and is located in the Lapland region of northern Finland, approximately 900 kilometres north of Helsinki and 150 kilometres north of the Arctic Circle. Commercial production was achieved at Kittila in May 2009.

Proven and probable mineral reserves at Kittila were approximately 3.3 million ounces at December 31, 2025. Under current mine plans, Kittila is expected to be in production through 2037.

Australia - Fosterville

Fosterville is 100% owned by the Company and located approximately 20 kilometres northeast of the city of Bendigo and 130 kilometres north of the city of Melbourne in Victoria, Australia. Commercial production was achieved at Fosterville in April 2005.

Fosterville’s proven and probable mineral reserves were approximately 1.7 million ounces at December 31, 2025. Under current mine plans, Fosterville is expected to be in production through 2037.

Mexico - Pinos Altos

Pinos Altos is 100% owned by the Company and is located in northern Mexico, approximately 220 kilometres west of the city of Chihuahua. Commercial production was achieved at Pinos Altos in November 2009.

5

Pinos Altos’ proven and probable mineral reserves were approximately 0.3 million ounces at December 31, 2025. Under current mine plans, the mine is expected to be in production through 2028.

Mexico - San Nicolás

The San Nicolás copper-zinc project is an advanced exploration project located in central Mexico, approximately 60 kilometres southeast of the city of Zacatecas.

Agnico Eagle is earning into a 50% interest in the project in April 2023 from Teck Resources Limited and the two companies have formed a joint venture to advance permitting and development of San Nicolás.

San Nicolás’ proven and probable mineral reserves, on a 50% basis representing the Company’s interest were approximately 52.6 million tonnes at average grades of 1.12% copper, 1.48% zinc, 0.40 g/t gold and 22 g/t silver at December 31, 2025.

The key drivers of financial performance for Agnico Eagle for the year ended December 31, 2025 include:

| ● | the spot price of gold; |

| ● | production volumes; |

| ● | production costs; and |

| ● | US dollar/Canadian dollar, US dollar/Australian dollar, US dollar/Euro and US dollar/Mexican peso exchange rates. |

Details on future drivers of financial performance are discussed in the Outlook section of this MD&A.

Spot Price of Gold

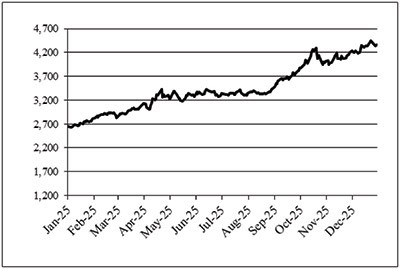

GOLD ($ per ounce)

| | 2025 | | 2024 | | % Change |

| ||

High price | | $ | 4,449 | | $ | 2,778 |

| 60.2 | % |

Low price | | $ | 2,633 | | $ | 1,985 |

| 32.6 | % |

Average market price | | $ | 3,432 | | $ | 2,386 |

| 43.8 | % |

Average realized price | | $ | 3,454 | | $ | 2,384 |

| 44.9 | % |

6

Gold prices remained a primary driver of the Company’s financial performance in 2025. The average market price per ounce of gold in 2025 was 43.8% higher than in 2024, reflecting a strong and sustained improvement in global pricing conditions. The Company achieved an average realized gold price that was 44.9% higher than in the prior year, benefiting from the favourable commodity environment and the Company’s ability to consistently secure realized prices that closely track underlying market movements. The significant increase in gold price supported higher revenue generation across the Company’s operating portfolio.

Production Volumes and Costs

Changes in production volumes remain a critical driver of the Company’s operating and financial performance, given its direct influence on revenue generation. In 2025, payable gold production totaled 3,447,367 ounces, representing a 0.9% decrease from 3,485,336 ounces in 2024. The slight decline in production in 2025 is mainly due to a decrease in gold production from Fosterville and Canadian Malartic, consistent with their expected grade and sequencing profiles, as well as the planned closure of the La India mine at the end of 2024. The impacts of these declines were partially mitigated by increased production at LaRonde, Macassa and Detour Lake.

Production costs are discussed in detail in the Results of Operations section below.

Foreign Exchange Rates (ratio to US dollars)

The exchange rate of the Canadian dollar, Australian dollar, Euro and Mexican peso relative to the US dollar is an important financial driver for the Company due to the Company’s multi‑jurisdictional operating footprint and that all revenues are denominated in US dollars. A significant portion of operating costs at LaRonde, Canadian Malartic, Goldex, Meliadine, Meadowbank, Detour Lake and Macassa are incurred in Canadian dollars; at Fosterville in Australian dollars; at Kittila in Euros; and at Pinos Altos in Mexican pesos. As a result, fluctuations in these currencies relative to the US dollar directly influence reported production costs.

The Company partially mitigates this foreign currency exposure through its established currency hedging strategies.

CANADIAN DOLLAR | | AUSTRALIAN DOLLAR |

| |

|

EURO | | MEXICAN PESO |

| |

|

7

On average in 2025 compared with 2024, the Canadian dollar, Australian dollar and Mexican Peso weakened, while the Euro strengthened relative to the US dollar. These currency movements generally reduced the US dollar equivalent of costs incurred in currencies that depreciated, providing a favourable impact on operating costs, while the stronger Euro resulted in higher reported costs at Kittila.

Agnico Eagle reported net income of $4,461.5 million, or $8.89 per share, in 2025 compared with net income of $1,895.6 million, or $3.79 per share in 2024 and net income of $1,941.3 million, or $3.97 per share in 2023. Agnico Eagle reported adjusted net income(i) of $4,169.2 million, or $8.31 per share(i), in 2025 compared with adjusted net income of $2,117.8 million, or $4.24 per share, in 2024 and adjusted net income of $1,095.9 million, or $2.24 per share in 2023.

EBITDA(i) totaled $8,440.4 million in the year ended December 31, 2025 compared with $4,462.4 million in 2024 and $3,980.9 million in 2023. Adjusted EBITDA(i) totaled $8,089.8 million in the year ended December 31, 2025 compared with $4,693.7 million in 2024 and $3,236.5 million in 2023. In 2025, operating margin(i) increased to $8,567.2 million from $5,199.7 million in 2024. In 2023, operating margin was $3,693.6 million.

Agnico Eagle reported free cash flow(i) of $4,398.9 million in 2025, compared with free cash flow of $2,142.9 million in 2024 and $947.4 million in 2023. Free cash flow before changes in non-cash components of working capital(i) totaled $3,594.6 million in 2025 compared with $2,062.9 million in 2024 and $1,093.8 million in 2023.

Revenues from Mining Operations

Revenues from mining operations, net of selling costs, increased by $3,622.1 million, or 43.7%, to $11,907.9 million in 2025 from $8,285.8 million in 2024 primarily due to a 44.9% increase in realized gold prices, partially offset by a 1.0% decrease in the sales volume of gold. The lower sales volume of gold from Fosterville, La India and Canadian Malartic, was partially offset by higher sales volume of gold from LaRonde, Macassa and Detour Lake. Revenues from mining operations were $6,626.9 million in 2023.

Sales of precious metals (gold and silver) accounted for 99.5% of revenues from mining operations in 2025, consistent with the contribution levels in 2024 and 2023.

Note:

| (i) | Adjusted net income, adjusted net income per share, EBITDA, adjusted EBITDA, free cash flow, free cash flow before changes in non-cash components of working capital and operating margin are non-GAAP measures that are not standardized financial measures under IFRS Accounting Standards. For a reconciliation to net income, net income per share and cash provided by operating activities and discussion of the composition and usefulness of these non-GAAP measures see “Non-GAAP Financial Performance Measures”. |

8

The table below sets out revenues from mining operations, payable production volumes and sales volumes by metal:

| | 2025 | | 2024 | | 2023 | |||

Revenues from mining operations: | | (thousands of United States dollars) | |||||||

Gold | | $ | 11,741,876 | | $ | 8,174,102 | | $ | 6,540,077 |

Silver | |

| 105,265 | |

| 79,270 | |

| 63,544 |

Zinc | |

| 8,674 | |

| 4,008 | |

| 4,736 |

Copper | |

| 52,036 | |

| 28,373 | |

| 18,552 |

Total revenues from mining operations | | $ | 11,907,851 | | $ | 8,285,753 | | $ | 6,626,909 |

Payable production: | |

| | |

| | |

| |

Gold (ounces) | |

| 3,447,367 | |

| 3,485,336 | |

| 3,439,654 |

Silver (thousands of ounces) | |

| 2,501 | |

| 2,485 | |

| 2,408 |

Zinc (tonnes) | |

| 8,446 | |

| 6,339 | |

| 7,702 |

Copper (tonnes) | |

| 5,393 | |

| 3,951 | |

| 2,617 |

Payable metal sold(i): | |

| | |

| | |

| |

Gold (ounces) | |

| 3,400,919 | |

| 3,434,094 | |

| 3,364,132 |

Silver (thousands of ounces) | |

| 2,376 | |

| 2,483 | |

| 2,354 |

Zinc (tonnes) | |

| 8,799 | |

| 6,209 | |

| 8,526 |

Copper (tonnes) | |

| 5,337 | |

| 3,952 | |

| 2,630 |

Production costs increased to $3,340.7 million in 2025 compared with $3,086.1 million in 2024 due to higher production costs mainly at Meadowbank, Detour Lake, Meliadine and Pinos Altos, partially offset by lower production costs at La India and Canadian Malartic. Production costs were $2,933.3 million in 2023 which included fair value adjustments to inventory at Canadian Malartic.

Production costs increased in 2025 when compared to the prior-year period primarily due to higher royalties arising from higher gold prices combined with increased contractor and labour costs related to underground mining operations, partially offset by the benefit of the weaker Canadian dollar during the period. A detailed discussion of production costs and cost metrics by mine is provided in the “Minesite Discussion” section below.

Note:

| (i) | Payable metals sold at Canadian Malartic, Detour Lake and Macassa exclude the in-kind royalties of 5.0%, 2.0% and 1.5%, respectively, paid in respect of gold production at such mines. For the year ended December 31, 2025, it excludes 2,500 payable gold ounces sold at La India. |

9

The table below sets out production costs by mine:

| | 2025 | | 2024 | | 2023 | |||

| | (thousands of United States dollars) | |||||||

LaRonde | | $ | 360,025 | | $ | 319,495 | | $ | 299,644 |

Canadian Malartic(i) | |

| 488,160 | |

| 532,037 | |

| 465,814 |

Goldex | |

| 148,952 | |

| 129,977 | |

| 112,022 |

Quebec | |

| 997,137 | |

| 981,509 | |

| 877,480 |

Detour Lake | |

| 565,439 | |

| 497,079 | |

| 453,498 |

Macassa | |

| 221,718 | |

| 201,371 | |

| 155,046 |

Ontario | |

| 787,157 | |

| 698,450 | |

| 608,544 |

Meliadine | |

| 402,385 | |

| 350,280 | |

| 343,650 |

Meadowbank | |

| 552,470 | |

| 463,464 | |

| 524,008 |

Nunavut | |

| 954,855 | |

| 813,744 | |

| 867,658 |

Fosterville | |

| 146,382 | |

| 147,045 | |

| 131,298 |

Australia | |

| 146,382 | |

| 147,045 | |

| 131,298 |

Kittila | |

| 236,238 | |

| 227,334 | |

| 205,857 |

Europe | |

| 236,238 | |

| 227,334 | |

| 205,857 |

Pinos Altos | |

| 205,808 | |

| 168,231 | |

| 145,936 |

La India | |

| — | |

| 49,767 | |

| 96,490 |

Mexico | |

| 205,808 | |

| 217,998 | |

| 242,426 |

Corporate and Other | |

| 13,107 | |

| — | |

| — |

Total production costs | | $ | 3,340,684 | | $ | 3,086,080 | | $ | 2,933,263 |

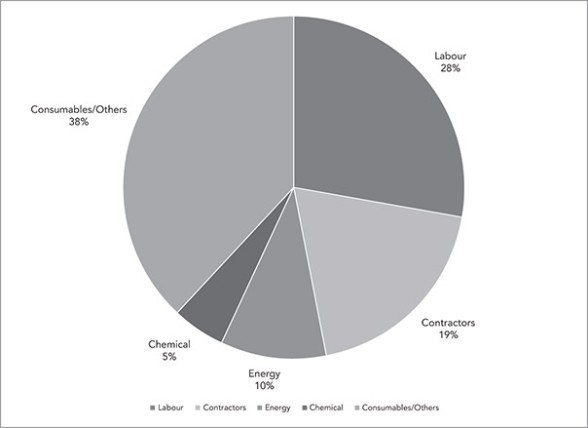

The chart below sets out the major components of production costs:

Total Production Costs by Category 2025

Note:

| (i) | The information set out in this table reflects the Company’s 50% interest in Canadian Malartic up to and including March 30, 2023 and 100% interest thereafter following the closing of the Yamana Transaction. |

Exploration and Corporate Development Expense

Exploration and corporate development expense decreased by 5.9% to $206.7 million in 2025 from $219.6 million in 2024. Exploration and corporate development expense was $215.8 million in 2023.

10

A summary of the Company’s significant 2025 exploration and corporate development activities is set out below:

| ● | Exploration expenses at various mine sites increased by 48% to $57.7 million in 2025 compared with $39.0 million in 2024 primarily due to higher expensed exploration at Canadian Malartic and Fosterville. |

| ● | Exploration expenses in Canada decreased by 35% to $65.1 million in 2025 compared with $100.5 million in 2024 primarily due to lower expensed exploration drilling at regional targets at Canadian Malartic and Hope Bay. |

| ● | Increased exploration expenses in regional targets located in Europe and Latin America were offset by decreased exploration expenses in the United States. |

The table below sets out exploration expense by region and total corporate development expense:

| | 2025 | | 2024 | | 2023 | |||

| | (thousands of United States dollars) | |||||||

Minesites | | $ | 57,747 | | $ | 39,003 | | $ | 56,475 |

Canada | |

| 65,147 | |

| 100,484 | |

| 79,509 |

Latin America | |

| 12,037 | |

| 10,221 | |

| 13,585 |

United States | |

| 1,567 | |

| 4,670 | |

| 4,177 |

Europe | |

| 9,145 | |

| 6,167 | |

| 4,986 |

Australia | |

| 5,282 | |

| 5,088 | |

| 4,033 |

Corporate development and project evaluation expenses | |

| 55,759 | |

| 53,977 | |

| 53,016 |

Total exploration and corporate development expense | | $ | 206,684 | | $ | 219,610 | | $ | 215,781 |

Amortization of Property, Plant and Mine Development

Amortization of property, plant and mine development expense increased to $1,645.3 million in 2025 compared with $1,514.1 million in 2024 and $1,491.8 million in 2023. The increase in amortization of property, plant and mine development between 2025 and 2024 was primarily due to higher amortization at Meliadine, Canadian Malartic and Detour Lake, partially offset by a decrease at Macassa.

General and Administrative Expense

General and administrative expenses were $235.9 million in 2025, an increase of $28.5 million compared to $207.5 million in 2024. The increase in general and administrative expenses was primarily due to higher stock-based compensation driven by an increase in the Company’s share price between periods. General and administrative expenses were $208.5 million in 2023.

Finance costs were $91.1 million in 2025 compared with $126.7 million in 2024 and $130.1 million in 2023. The decrease between 2025 and 2024 was primarily due to a decrease in interest expense on the Company’s guaranteed senior unsecured notes as a result of $950.0 million in note repayments during 2025.

The table below sets out the components of finance costs:

| | 2025 | | 2024 | | 2023 | |||

Interest on Notes | | $ | 32,070 | | $ | 53,229 | | $ | 57,192 |

Interest on Term Loan Facility | |

| — | |

| 32,712 | |

| 26,273 |

Interest on Credit Facility | |

| — | |

| 3,350 | |

| 10,928 |

Credit Facility fees | |

| 6,731 | |

| 6,167 | |

| 6,374 |

Amortization of credit and term loan financing and note issuance costs | |

| 4,490 | |

| 3,845 | |

| 3,290 |

Debt extinguishment costs | |

| 8,245 | |

| — | |

| — |

Accretion expense on reclamation provisions | |

| 38,237 | |

| 33,815 | |

| 32,906 |

Interest on lease obligations and other interest expense (income) | |

| 5,552 | |

| (3,566) | |

| (3,699) |

Interest capitalized to assets under construction | |

| (4,180) | |

| (2,814) | |

| (3,177) |

Total finance costs | | $ | 91,145 | | $ | 126,738 | | $ | 130,087 |

11

See Note 14 in the consolidated financial statements for additional details on the Company’s Credit Facility, the Term Loan Facility and Notes referenced above.

Derivative Financial Instruments

Gain on derivative financial instruments was $224.0 million in 2025 compared to a loss on derivative financial instruments of $155.8 million in 2024 and a gain of $68.4 million in 2023. The change between 2025 and 2024 was primarily due to more favourable market conditions that generated $127.6 million in unrealized gains on currency and commodity derivatives in 2025 compared to $142.4 million in unrealized losses in 2024. Unrealized gains on warrants also totalled $111.2 million in 2025 compared to unrealized gains of $20.4 million in 2024.

In 2025, the Company identified indicators of impairment reversal at Macassa driven by the effect of the significant and sustained increase in the gold price which supported higher long-term gold price assumptions, and accordingly performed a reversal assessment of Macassa. As the estimated recoverable amount exceeded the carrying amount (adjusted for amortization that would have been recognized absent the previous impairment), the Company recorded an impairment reversal of $229.0 million ($156.0 million net of tax) in the consolidated statements of income.

See Note 24 in the consolidated financial statements for further details on impairment reversals.

Foreign Currency Translation (Gain) Loss

The Company’s operating results and cash flow are significantly affected by changes in the exchange rate between the US dollar and each of the Canadian dollar, Australian dollar, Euro and Mexican peso as all of the Company’s revenues are earned in US dollars while a significant portion of its operating and capital costs are incurred in such other currencies. During the period from January 1, 2025 through December 31, 2025, the daily US dollar closing exchange rate per US$1.00 fluctuated between C$1.36 and C$1.46 as reported by the Bank of Canada, A$1.53 and A$1.67 as reported by the Reserve Bank of Australia, €0.84 and €0.98 as reported by the European Central Bank and 17.90 and 20.85 Mexican pesos as reported by the Central Bank of Mexico.

A foreign currency translation gain of $25.7 million was recorded in 2025 compared with a $9.4 million loss in 2024 and a $0.3 million gain in 2023. On average in 2025, the US dollar strengthened relative to the Canadian dollar, the Australian dollar, and the Mexican peso. As at December 31, 2025, the US dollar weakened relative to the Canadian dollar, the Australian dollar, the Euro and the Mexican peso as compared to December 31, 2024. The net foreign currency translation gain in 2025 was primarily due to the translation impact on the Company’s net monetary assets denominated in foreign currencies between periods.

Other income and expenses increased to $93.0 million in the year ended December 31, 2025 compared with $84.5 million in the year ended December 31, 2024, primarily due to the loss on the sale of equity securities in the current period, partially offset by higher levels of interest income on cash balances. Other income and expenses amounted to $66.3 million in the year ended December 31, 2023.

Income and Mining Taxes Expense

In 2025, the Company recorded income and mining taxes expense of $2,242.5 million on income before income and mining taxes of $6,703.9 million yielding an effective tax rate of 33.4%. In 2024, the Company recorded income and mining taxes expense of $926.0 million on income before income and mining taxes of $2,821.6 million yielding an effective tax rate of 32.8%. The Company’s 2025 and 2024 effective tax rate is higher than the applicable statutory tax rate of 26.0% due to the impact of mining taxes. In 2023, the Company recorded income and mining taxes expense of $417.8 million on income before income and mining taxes of $2,359.1 million at an effective tax rate of 17.7%.

Net deferred income and mining tax liabilities increased by $222.1 million between December 31, 2025 and December 31, 2024 primarily due to the origination and reversal of net taxable temporary differences.

Net income taxes payable increased by $871.1 million between December 31, 2025 and December 31, 2024 as a result of the Company’s current tax expense exceeding payments to tax authorities during the year.

12

(thousands of United States dollars) | | As at December 31, 2025 | | As at December 31, 2024 | | As at December 31, 2023 | |||

Current assets | | $ | 4,993,942 | | $ | 2,805,281 | | $ | 2,191,152 |

Non-current assets | |

| 29,477,349 | |

| 27,181,737 | |

| 26,493,797 |

Total assets | | $ | 34,471,291 | | $ | 29,987,018 | | $ | 28,684,949 |

Current liabilities | | $ | 2,472,206 | | $ | 1,511,965 | | $ | 1,048,026 |

Non-current liabilities | |

| 7,256,621 | |

| 7,642,153 | |

| 8,214,008 |

Total liabilities | | $ | 9,728,827 | | $ | 9,154,118 | | $ | 9,262,034 |

Total assets at December 31, 2025 of $34.5 billion increased by 15.0%, or $4.5 billion compared with total assets of $30.0 billion at December 31, 2024. The Company’s total assets are primarily comprised of non-current assets such as property, plant and mine development and goodwill.

Total liabilities at December 31, 2025 of $9.7 billion increased by 6.3%, or $0.6 billion compared with total liabilities of $9.2 billion at December 31, 2024. The Company’s total liabilities are primarily comprised of non-current liabilities such as deferred income and mining tax liabilities and reclamation provisions.

The increase in total assets between December 31, 2025 and December 31, 2024 was primarily due to an increase in cash and cash equivalents, property, plant and mine development and investments. The increase in total liabilities between December 31, 2025 and December 31, 2024 was primarily due to an increase in income taxes payable and reclamation provisions, partially offset by a decrease in long-term debt due to repayments of Notes.

The increase in total assets between December 31, 2024 and December 31, 2023 was primarily due to an increase in cash and cash equivalents and increases in current and non-current inventory balances. The decrease in total liabilities between December 31, 2024 and December 31, 2023 was primarily due to the repayment of the $600.0 million Term Loan Facility in 2024.

Liquidity and Capital Resources

As at December 31, 2025, the Company’s cash and cash equivalents totaled $2,866.1 million compared with $926.4 million as at December 31, 2024. The Company’s policy is to invest excess cash in what the Company believes to be highly liquid investments of high credit quality to attempt to reduce risks associated with these investments. Investments with remaining maturities of less than three months at the time of purchase are classified as cash equivalents. The Company’s decisions regarding the length of maturities it holds are based on anticipated cash flow requirements, rates of return and other factors.

Working capital (current assets less current liabilities) increased to $2,521.7 million as at December 31, 2025, compared with $1,293.3 million as at December 31, 2024, primarily due to a $1,939.6 million increase in cash and cash equivalents as a result of higher operating margins, partially offset by an increase in income taxes payable.

In August 2025, Moody’s revised its rating outlook for the Company to stable from positive and upgraded the Company’s long-term issuer rating to A3 from Baa1, reflecting the Company’s strengthening credit profile and financial position.

Subject to various risks and uncertainties, including those set out in this MD&A, and in the Company’s 2025 AIF, the Company believes it will generate sufficient cash flow from operations and has adequate cash and debt facilities available to finance its current operations, working capital requirements, contractual obligations, debt maturities, planned capital expenditure and exploration programs. While the Company believes its capital resources will be sufficient to satisfy all its mandatory and discretionary commitments, the Company may choose to decrease its discretionary expenditure commitments, which include certain capital expenditures and exploration and corporate development expenses, should unexpected financial circumstances arise in the future. See “Risk Profile” in this MD&A for further details.

Cash provided by operating activities increased by $2,856.2 million to $6,817.1 million in 2025 compared with $3,960.9 million in 2024. The increase in cash provided by operating activities was primarily due to higher operating margin and favourable working capital movements. Cash provided by operating activities was $2,601.6 million in 2023.

13

Cash used in investing activities increased to $2,598.3 million in 2025 compared to $2,007.1 million in 2024. The increase in cash used in investing activities was primarily due to higher capital expenditures between periods, increased purchases of equity securities and the purchase of O3 Mining in the first quarter of 2025. Cash used in investing activities was $2,760.8 million in 2023, which included $1,000.6 million in net cash consideration paid by the Company in the Yamana Transaction.

In 2025, additions to property, plant and mine development totaled $2,418.2 million compared with $1,817.9 million in 2024. The $600.3 million increase in additions to property, plant and mine development between 2025 and 2024 was primarily due to an increase in capital expenditures at Canadian Malartic and Hope Bay.

In 2025, the Company purchased $447.5 million of equity securities and other investments compared with $183.0 million in 2024 and $104.7 million in 2023. The Company’s investments in equity securities consist primarily of investments in common shares of entities in the mining industry. In 2025, the Company received $402.7 million in proceeds from the sale of equity securities and other investments primarily from the sale of the Company’s investment in Orla.

Cash used in financing activities increased to $2,287.1 million in 2025 compared with $1,356.3 million in 2024 primarily due to the $950.0 million repayment of the guaranteed senior notes during the current year and an increase in the repurchase of common shares between periods under the NCIB. Cash used in financing activities was $164.0 million in 2023.

The Company issued common shares for net proceeds of $118.1 million in 2025 compared to $235.5 million in 2024, attributable to employee stock option plan exercises, issuances under the incentive share purchase plan and the dividend reinvestment plan. Net proceeds from the issuance of common shares were $70.3 million in 2023.

On May 1, 2025, the Company received approval from the TSX to renew its NCIB pursuant to which the Company may purchase up to a maximum of 5% of its issued and outstanding common shares. The Company is authorized to acquire an aggregate of $1.0 billion of its common shares under the NCIB. Under the NCIB, the Company may purchase its common shares for cancellation during the period commencing May 4, 2025 and ending on May 3, 2026. The Company intends to repurchase its common shares through the facilities of the TSX, the New York Stock Exchange or other designated exchanges and alternative trading systems in Canada and the United States in accordance with applicable regulatory requirements. All common shares purchased under the NCIB will be cancelled.

During the year ended December 31, 2025, the Company repurchased 4,114,150 common shares for $599.7 million at an average price of $145.76 under the NCIB. During the year ended December 31, 2024, the Company repurchased 1,749,086 common shares for $119.9 million at an average price of $68.54 under the NCIB. During the year ended December 31, 2023, the Company repurchased 100,000 common shares for $4.8 million at an average price of $47.74 under the NCIB.

In 2025, the Company declared dividends of $1.60 per share and paid cash dividends totaling $728.1 million compared with dividends declared of $1.60 per share and cash dividends paid of $671.7 million in 2024. In 2023, the Company declared dividends of $1.60 per share and paid cash dividends totaling $638.6 million. Agnico Eagle has declared a cash dividend every year since 1983. Although the Company expects to continue paying dividends, future dividends will be at the discretion of the Board and will be subject to factors such as income, financial condition and capital requirements.

During the year ended December 31, 2025, Agnico Eagle repaid $50.0 million of its 2015 guaranteed senior unsecured 4.15% notes at maturity and $40.0 million of the 2017 Series A 4.42% notes at maturity. Agnico Eagle also elected to repay in full the remaining outstanding principal of the 2016, 2017 and 2018 Notes prior to their respective maturity dates during the year ended December 31, 2025. The repayment totaled $860.0 million, consisting of $250.0 million related to the 2016 Notes, $260.0 million related to the 2017 Notes and $350.0 million related to the 2018 Notes. The Company incurred debt extinguishment costs of $8.2 million relating to the repayment of the 2016, 2017 and 2018 Notes prior to their respective maturity dates.

On February 12, 2024, the Company terminated its previous credit facility and entered into the Credit Facility. The Credit Facility matures and all indebtedness thereunder is due and payable on February 12, 2029. The Credit Facility is available in US dollars through Secured Overnight Financing Rate (“SOFR”) and base rate advances, or in Canadian dollars through Canadian Overnight Repo Rate Average (“CORRA”) and prime rate advances, priced at the applicable rate plus a margin that ranges from 0.00% to 2.00%. The Credit Facility also provides for the issuance of letters of credit, priced at the applicable rate plus a margin that varies from 0.60% to 2.00%.

14

The lenders under the Credit Facility are each paid a standby fee at a rate that ranges from 0.09% to 0.25% of the undrawn portion of the Credit Facility. In each case, the applicable margin or standby fees vary depending on the Company’s credit rating. The Company’s payment and performance of its obligations under the Credit Facility are not guaranteed by any of its subsidiaries, however the Company must provide guarantees from certain of its subsidiaries (i) if any existing material indebtedness of the Company benefits from guarantees and the Company no longer maintains an investment grade credit rating, (ii) or if the Company incurs new material indebtedness for borrowed money, or refinances existing material indebtedness (including material alterations to the terms of such indebtedness, but excluding maturity date extensions), and provides guarantees of such new or refinanced indebtedness from any of its subsidiaries.

As at December 31, 2025, the Company’s outstanding balance under the Credit Facility was nil. Credit Facility availability is reduced by outstanding letters of credit which were $24.2 million as of December 31, 2025, resulting in $1,975.8 million available for future drawdown.

Effective September 20, 2022, the Company amended its credit agreement with a financial institution relating to an uncommitted letter of credit facility (as amended, the “First LC Facility”) to increase the amount available to C$400.0 million. The First LC Facility may be used to support the reclamation obligations or non-financial or performance obligations of the Company or its subsidiaries. As at December 31, 2025, the aggregate undrawn face amount of letters of credit under the First LC Facility is $291.9 million.

Effective September 16, 2021, the Company amended its uncommitted standby letter of credit facility (as amended, the “Second LC Facility”) to increase the amount available to C$200.0 million. Payment and performance of the Company’s obligations under the Second LC Facility are supported by an account performance security guarantee issued by Export Development Canada in favour of the lender. The Second LC Facility may be used by the Company to support the reclamation obligations of the Company, its subsidiaries or any entity in which the Company has a direct or indirect interest or the performance obligations (other than with respect to indebtedness for borrowed money) of the Company, its subsidiaries or any entity in which the Company has a direct or indirect interest that are not directly related to reclamation obligations. As at December 31, 2025, the aggregate undrawn face amount of letters of credit under the Second LC Facility is nil.

Effective May 25, 2023, the Company amended its uncommitted standby letter of credit facility with a financial institution (the “Third LC Facility”) to increase the amount available to C$200.0 million. Letters of credit issued under the Third LC Facility may be used to support the reclamation obligations or non-financial or performance obligations of the Company or its subsidiaries; however the subsidiary guarantees were released in connection with the entry into the Credit Facility. As at December 31, 2025, the aggregate undrawn face amount of letters of credit under the Third LC Facility was $120.7 million.

In October 2021, the Company entered into a $75.0 million uncommitted standby letter of credit facility (the “Fourth LC Facility”) with a financial institution. Letters of credit issued under the Fourth LC Facility may be used to support the reclamation obligations or non-financial or performance obligations of the Company or its subsidiaries. In October 2024, the Fourth LC Facility was amended to increase the amount available to $150.0 million. As at December 31, 2025, the aggregate undrawn face amount of letters of credit under the Fourth LC Facility was $145.4 million.

In January 2022, the Company entered into a C$100.0 million uncommitted standby letter of credit facility (the “Fifth LC Facility”) with a financial institution. Upon the acquisition of Kirkland in February 2022, the Company acquired a standby letter of credit facility with the same financial institution providing for an additional C$120.0 million uncommitted letter of credit facility for the Kirkland subsidiary. Effective September 2022, an amended and restated standby letter of facility combined these facilities and the amount available under the amended and restated facility was increased to C$320.0 million. Letters of credit issued under the Fifth LC Facility may be used to support the reclamation obligations or non-financial or performance obligations of the Company or its subsidiaries. As at December 31, 2025, the aggregate undrawn face amount of letters of credit under the Fifth LC Facility was $204.3 million.

The obligations of the Company under each of the LC Facilities other than then Second LC Facility were guaranteed by certain of its subsidiaries, however in connection with the Company’s entry into the Credit Facility on February 12, 2024, these subsidiary guarantees were released.

In February 2022, upon the acquisition of Kirkland, the Company acquired a standby letter of guarantee facility (the “Guarantee Facility”) with a financial institution providing for a $25.0 million uncommitted letter of guarantee facility. Guarantees issued under the Guarantee Facility may be used to support the reclamation obligations or non-financial or performance obligations of certain subsidiaries of the Company. The obligations of the Company under this Guarantee Facility were guaranteed by certain of its subsidiaries; however, the subsidiary guarantees were released in connection with the entry into the Credit Facility. In October 2024, the Company entered into a $200.0 million uncommitted standby letter of credit facility (the “Sixth LC Facility” and, together with the First LC Facility, the

15

Second LC Facility, the Third LC Facility, the Fourth LC Facility and the Fifth LC Facility, the “LC Facilities”) with a financial institution, which superseded and canceled the Guarantee Facility. As at December 31, 2025, the aggregate undrawn face amount of letters of credit under the Sixth LC Facility was $42.0 million.

As at December 31, 2025, the Company has indemnity agreements with four companies for the issuance of surety bonds of which $506.1 million of such surety bonds have been issued under these agreements.

The Company was in compliance with all covenants contained in the Credit Facility, the LC Facilities, and the Notes as at December 31, 2025.

Off-Balance Sheet Arrangements

The Company’s off-balance sheet arrangements as at December 31, 2025 include outstanding letters of credit for environmental and site restoration costs, custom credits, government grants and other general corporate purposes of $1,338.5 million under the Credit Facility and the LC Facilities (see Note 27 to the consolidated financial statements). If the Company were to terminate these off-balance sheet arrangements, the Company’s liquidity position (as outlined in the table below) is sufficient to satisfy any related penalties or obligations.

16

Agnico Eagle’s contractual obligations as at December 31, 2025 are set out below:

| | Total | | 2026 | | 2027-2028 | | 2029-2030 | | Thereafter | |||||

|

| (millions of United States dollars) | |||||||||||||

Reclamation provisions(i) | | $ | 1,535.1 | | $ | 149.5 | | $ | 287.4 | | $ | 244.5 | | $ | 853.7 |

Contractual commitments(ii) | |

| 728.9 | |

| 596.3 | |

| 45.5 | |

| 41.5 | |

| 45.6 |

Pension obligations(iii) | |

| 105.4 | |

| 5.6 | |

| 36.4 | |

| 7.6 | |

| 55.8 |

Lease obligations | |

| 133.7 | |

| 33.7 | |

| 34.9 | |

| 23.1 | |

| 42.0 |

Long-term debt - principal(iv) | |

| 200.0 | |

| — | |

| — | |

| 100.0 | |

| 100.0 |

Long-term debt - interest(iv) | |

| 35.7 | |

| 5.7 | |

| 11.4 | |

| 11.4 | |

| 7.2 |

Total(v) | | $ | 2,738.8 | | $ | 790.8 | | $ | 415.6 | | $ | 428.1 | | $ | 1,104.3 |

Notes:

| (i) | Mining operations are subject to environmental regulations that require companies to reclaim and remediate land disturbed by mining operations. The Company has submitted closure plans to the appropriate governmental agencies which estimate the nature, extent and costs of reclamation for each of its mining properties. Expected reclamation cash flows are presented above on an undiscounted basis. Reclamation provisions recorded in the Company’s consolidated financial statements are measured at the expected value of future cash flows discounted to their present value using a risk-free interest rate. |

| (ii) | Purchase commitments include contractual commitments for the acquisition of property, plant and mine development. In addition to the above, the Company has $290.0 million of committed subscription proceeds related to the San Nicolás project. |

| (iii) | Agnico Eagle provides defined benefit plans for certain current and former senior officers and certain employees. The benefits are generally based on the employee’s years of service, age and level of compensation. The data included in this table have been actuarially determined. |

| (iv) | The Company has assumed that repayment of its long-term debt obligations will occur on each instrument’s respective maturity date. |

| (v) | The Company’s future operating cash flows are expected to be sufficient to satisfy its contractual obligations. |

2026 Liquidity and Capital Resources Analysis

The Company believes that it has sufficient capital resources to satisfy its 2026 mandatory expenditure commitments (including the contractual obligations set out above) and discretionary expenditure commitments. The following table sets out expected capital requirements and resources for 2026:

| | Amount | |

| | (millions of United States dollars) | |

2026 Mandatory Commitments: | | | |

Contractual obligations, including capital expenditures (see table above) | | $ | 790.8 |

Accounts payable and accrued liabilities (as at December 31, 2025) | |

| 1,033.4 |

Total 2026 mandatory expenditure commitments | | $ | 1,824.2 |

2026 Discretionary Commitments: | |

| |

Expected capital expenditures | | $ | 2,575.0 |

Expected exploration and corporate development expenses | |

| 290.0 |

Total 2026 discretionary expenditure commitments | |

| 2,865.0 |

Total 2026 mandatory and discretionary expenditure commitments | | $ | 4,689.2 |

As of December 31, 2025, the Company believes it had adequate capital resources available to satisfy its commitments, which include cash and cash equivalents of $2,866.1 million and approximately $2.0 billion of available credit under the Credit Facility. In addition, the Company anticipates funding its commitments through cash provided by operating activities.

While the Company believes its capital resources will be sufficient to satisfy all 2026 commitments (mandatory and discretionary), the Company may choose to decrease certain of its discretionary expenditure commitments, which include certain capital expenditures and exploration and corporate development expenses, should unexpected financial circumstances arise in the future. The Company believes that it will continue to have sufficient capital resources available to satisfy its planned development and growth activities.

17

Minesite Discussion

LaRonde

LaRonde – Operating Statistics | | Three Months Ended | | Year Ended | ||||||||

| | December 31, | | December 31, | | December 31, | | December 31, | ||||

| | 2025 | | 2024 | | 2025 | | 2024 | ||||

Tonnes of ore milled (thousands of tonnes) | | | 692 | | | 802 | | | 2,805 | | | 2,849 |

Tonnes of ore milled per day |

| | 7,522 |

| | 8,717 |

| | 7,685 |

| | 7,784 |

Gold grade (g/t) |

| | 3.85 |

| | 3.78 |

| | 4.08 |

| | 3.62 |

Gold production (ounces) |

| | 80,290 |

| | 90,447 |

| | 344,555 |

| | 306,750 |

Production costs per tonne (C$) |

| C$ | 239 |

| C$ | 118 |

| C$ | 179 |

| C$ | 153 |

Minesite costs per tonne (C$) |

| C$ | 177 |

| C$ | 146 |

| C$ | 166 |

| C$ | 154 |

Production costs per ounce | | $ | 1,480 | | $ | 751 | | $ | 1,045 | | $ | 1,042 |

Total cash costs per ounce | | $ | 851 | | $ | 834 | | $ | 829 | | $ | 945 |

Gold production

Fourth Quarter of 2025 – Gold production at LaRonde decreased by 11.2% to 80,290 ounces in the fourth quarter of 2025 compared with 90,447 ounces in the fourth quarter of 2024, primarily due to lower throughput levels combined with lower gold grades, consistent with the planned mining sequence.

Full Year 2025 – Gold production at LaRonde increased by 12.3% to 344,555 ounces in 2025 compared with 306,750 ounces in 2024, due to higher gold grades as per the mining sequence and positive grade reconciliation, partially offset by lower throughput levels.

Production costs

Fourth Quarter of 2025 – Production costs at LaRonde increased by 74.9% in the fourth quarter of 2025 when compared with the fourth quarter of 2024, primarily due to the timing of inventory sales, combined with higher milling and royalty costs when compared to the prior year period.

Production costs per tonne increased when compared to the prior-year period due to the lower volume of ore milled in the current period and higher production costs as discussed above. Production costs per ounce increased when compared to the prior year due to higher production costs, combined with fewer ounces of gold being produced in the current period.

Full Year 2025 – Production costs at LaRonde increased by 12.7% in 2025 compared with 2024 primarily due to the timing of inventory sales, higher milling and royalty costs, partially offset by a build-up of stockpiles.

Production costs per tonne increased when compared to the prior year due to the same reasons outlined above for higher production costs. Production costs per ounce increased when compared to the prior year primarily due to higher production costs as described above, partially offset by more ounces of gold being produced in the current year.

Minesite costs per tonne and total cash costs per ounce

Fourth Quarter of 2025 – Minesite costs per tonne increased when compared to the prior-year period due to the lower volume of ore milled, combined with higher milling and royalty costs when compared to the prior-year period. Total cash costs per ounce increased when compared to the prior year primarily due to higher minesite costs, combined with fewer ounces of gold being produced in the current period.

Full Year 2025 – Minesite costs per tonne increased when compared to the prior year primarily due to higher milling and royalty costs, and the lower volume of ore milled, partially offset by a build-up of stockpiles. Total cash costs per ounce decreased when compared to the prior year primarily due to the higher impact of by-product metals and more ounces of gold being produced in the current year.

18

Canadian Malartic

Canadian Malartic – Operating Statistics | | Three Months Ended | | Year Ended | ||||||||

| | December 31, | | December 31, | | December 31, | | December 31, | ||||

| | 2025 | | 2024 | | 2025 | | 2024 | ||||

Tonnes of ore milled (thousands of tonnes) | | | 5,204 |

| | 5,100 |

| | 20,123 |

| | 20,317 |

Tonnes of ore milled per day |

| | 56,565 |

| | 55,446 |

| | 55,132 |

| | 55,511 |

Gold grade (g/t) |

| | 1.01 |

| | 0.97 |

| | 1.08 |

| | 1.09 |

Gold production (ounces) |

| | 153,433 |

| | 146,485 |

| | 642,612 |

| | 655,654 |

Production costs per tonne (C$) |

| C$ | 34 |

| C$ | 36 |

| C$ | 34 |

| C$ | 36 |

Minesite costs per tonne (C$) |

| C$ | 43 |

| C$ | 41 |

| C$ | 43 |

| C$ | 41 |

Production costs per ounce | | $ | 842 | | $ | 902 | | $ | 760 | | $ | 811 |

Total cash costs per ounce | | $ | 1,033 | | $ | 1,014 | | $ | 946 | | $ | 930 |

Gold production

Fourth Quarter of 2025 – At Canadian Malartic, gold production increased by 4.7% to 153,433 ounces in the fourth quarter of 2025 compared with gold production of 146,485 ounces in the fourth quarter of 2024, due to higher grades from the Barnat pit combined with higher throughput levels, partially offset by lower recovery rates.

Full Year 2025 – At Canadian Malartic, gold production decreased by 2.0% to 642,612 ounces in 2025 compared with gold production of 655,654 ounces in 2024, due to lower throughput levels, slightly lower gold grades and lower recovery resulting from an increased volume of ore being sourced from the low-grade stockpiles.

Production costs

Fourth Quarter of 2025 – Production costs at Canadian Malartic were $129.1 million in the fourth quarter of 2025, a decrease of 2.3% compared with production costs of $132.1 million in the fourth quarter of 2024, primarily due to lower open pit mining costs and the timing of inventory sales, partially offset by higher royalty costs.

Production costs per tonne decreased when compared to the prior-year period for the same reasons outlined above for lower production costs, combined with the increase in throughput. Production costs per ounce decreased when compared to the prior-year period due to the same reasons outlined above for production costs and more ounces of gold produced in the current period.

Full Year 2025 – Production costs at Canadian Malartic were $488.2 million in 2025, a decrease of 8.2% compared with production costs of $532.0 million in 2024, due to lower open pit costs and the timing of inventory sales, partially offset by higher royalty costs in the current year.

Production costs per tonne decreased when compared to the prior year for the same reasons outlined above for lower production costs, partially offset by the decrease in throughput. Production costs per ounce decreased when compared to the prior year due to the same reasons outlined above for production costs, partially offset by fewer ounces of gold produced in the current year.

Minesite costs per tonne and total cash costs per ounce

Fourth Quarter of 2025 – Minesite costs per tonne increased when compared to the prior-year period due to higher royalty costs during the quarter, partially offset by lower open pit costs and the increase in throughput in the current period. Total cash costs per ounce increased when compared to the prior-year period due to higher royalty costs during the quarter, partially offset by lower open pit mining costs and more ounces of gold produced in the current period.

Full Year 2025 – Minesite costs per tonne increased when compared to the prior year due to higher royalty costs and the lower throughput in the current year, partially offset by lower open pit mining costs. Total cash costs per ounce increased when compared to the prior year due to higher royalty costs and fewer ounces of gold produced, partially offset by lower open pit mining costs in the current year.

19

Goldex

Goldex – Operating Statistics | | Three Months Ended | | Year Ended | ||||||||

| | December 31, | | December 31, | | December 31, | | December 31, | ||||

| | 2025 | | 2024 | | 2025 | | 2024 | ||||

Tonnes of ore milled (thousands of tonnes) |

| | 847 |

| | 812 |

| | 3,301 |

| | 3,076 |

Tonnes of ore milled per day |

| | 9,207 |

| | 8,826 |

| | 9,044 |

| | 8,404 |

Gold grade (g/t) |

| | 1.44 |

| | 1.45 |

| | 1.40 |

| | 1.55 |

Gold production (ounces) |

| | 32,992 |

| | 32,341 |

| | 125,501 |

| | 130,813 |

Production costs per tonne (C$) |

| C$ | 67 |

| C$ | 51 |

| C$ | 63 |

| C$ | 58 |

Minesite costs per tonne (C$) |

| C$ | 67 |

| C$ | 56 |

| C$ | 64 |

| C$ | 59 |

Production costs per ounce | | $ | 1,232 | | $ | 910 | | $ | 1,187 | | $ | 994 |

Total cash costs per ounce | | $ | 1,015 | | $ | 859 | | $ | 1,002 | | $ | 923 |

Commercial production was achieved at Akasaba West in February 2024 and the comparative information set out herein for the year ended December 31, 2024 only includes ten months of production from Akasaba West.

Gold production

Fourth Quarter of 2025 – Gold production at Goldex increased by 2.0% to 32,992 ounces in the fourth quarter of 2025, compared with 32,341 ounces in the fourth quarter of 2024, primarily due to higher throughput levels from additional ore sourced from Akasaba West.