.5

Stock Symbol: | AEM (NYSE and TSX) |

| |

For further information: | Investor Relations |

| (416) 947-1212 |

(All amounts expressed in U.S. dollars unless otherwise noted)

AGNICO EAGLE PROVIDES AN UPDATE ON 2025 EXPLORATION RESULTS AND 2026 EXPLORATION PLANS – YEAR OVER YEAR MINERAL RESERVES INCREASE 2% TO 55.4 MOZ; INDICATED MINERAL RESOURCES INCREASE 10% TO 47.1 MOZ AND INFERRED MINERAL RESOURCES INCREASE 15% TO 41.8 MOZ

Toronto (February 12, 2026) – Agnico Eagle Mines Limited (NYSE:AEM, TSX:AEM) (“Agnico Eagle” or the “Company”) is pleased to provide an update on year-end 2025 mineral reserves and mineral resources, exploration activities at mine sites and select advanced projects in 2025, and the Company’s exploration plans and guidance for 2026. The Company’s exploration focus remains on extending mine life at existing operations, testing near-mine opportunities and advancing key value driver projects.

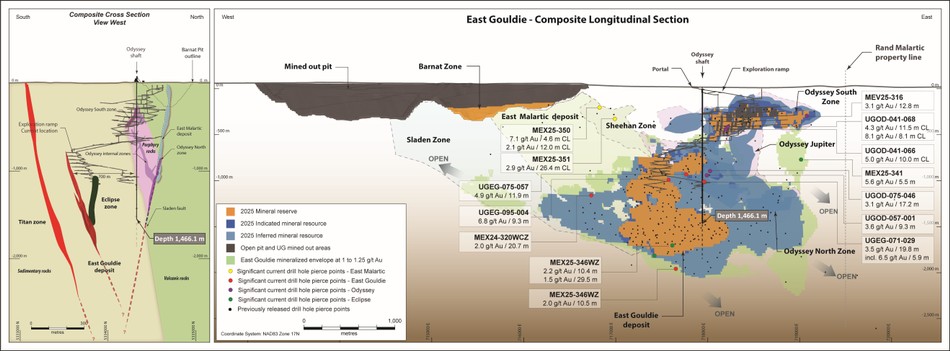

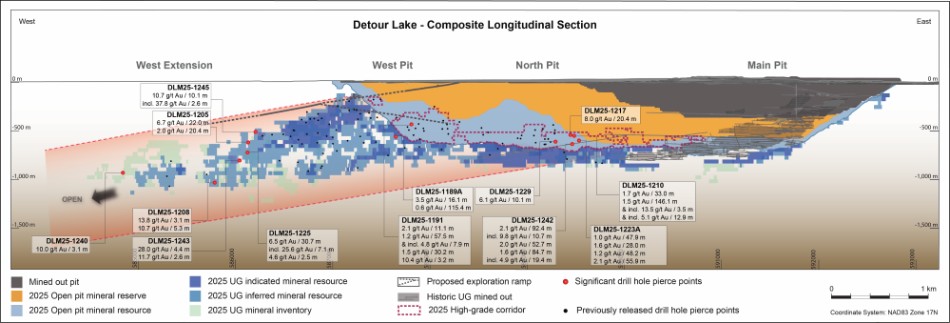

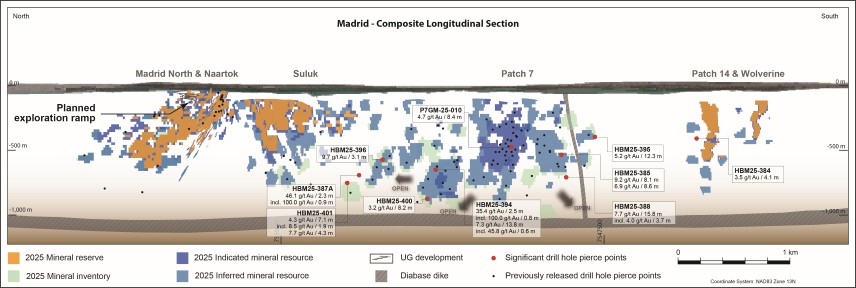

“I would like to congratulate our exploration team for their performance in 2025 in terms of safety, productivity and cost control with an average of 120 diamond drill rigs in operation drilling 1.4 million metres of core. The exploration program continued to yield exciting results at our mines and key pipeline projects, which drove an increase in our mineral reserves and in our measured, indicated and inferred mineral resources primarily from additions at Detour Lake, Odyssey and Hope Bay,” said Guy Gosselin, Agnico Eagle’s Executive Vice-President, Exploration. “The success of our 2025 exploration program reinforces our view that we have built the strongest project pipeline in the Company’s history, with exceptional exploration upside—arguably the best in the gold mining sector,” added Mr. Gosselin.

Highlights from 2025 include:

| ● | Gold mineral reserves increase to record level – Year-end 2025 gold mineral reserves increased by 2.1% to 55.4 million ounces of gold (1,330 million tonnes grading 1.30 grams per tonne (“g/t”) gold). The year-over-year increase in mineral reserves is due to a combination of mineral reserve replacement from operating mines and the initial declaration of mineral reserves at the Marban deposit in Malartic. At year-end 2025, measured and indicated mineral resources were up 9.6% to 47.1 million ounces (1,200 million tonnes grading 1.22 g/t gold) and inferred mineral resources were up 15.5% to 41.8 million ounces (522 million tonnes grading 2.49 g/t gold) |

| ● | Detour Lake – The Company’s exploration program continued to de-risk the Detour Lake underground project in the western plunge of the main orebody hosting the producing open pits. Conversion drilling further increased underground indicated mineral resources below the resources open pit to 3.47 million ounces of gold (52.9 million tonnes grading 2.04 g/t gold) at year-end while exploration drilling below and to the west of the open pit increased underground inferred mineral resources to 3.88 million ounces of gold (59.6 million tonnes grading 2.03 g/t gold) at year-end |

1