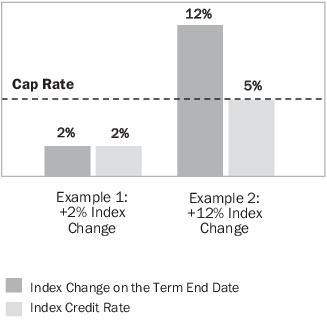

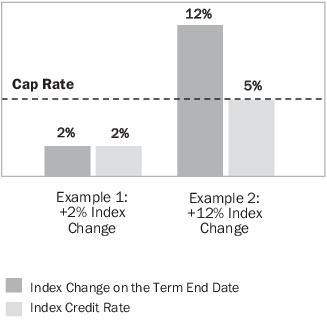

(Assuming a Cap Rate of 5%)

As filed with the Securities and Exchange Commission on May 31, 2024

Registration No. 333-277203

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

American General Life Insurance Company

(Exact Name of Registrant as specified in its charter)

| Texas | 6311 | 25-0598210 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2727-A Allen Parkway, Houston, Texas 77019

Telephone Number: (713) 522-1111

(Address, including zip code, and telephone number, including area code, of Principal Executive Offices)

Trina Sandoval, Esq.

American General Life Insurance Company

21650 Oxnard Street, Suite 750, Woodland Hills California 91367

(213) 218-1918

(Name, Address, including zip code, and telephone number, including area code, of Agent for Service)

Copies to:

Chip Lunde

Willkie Farr & Gallagher LLP

1875 K Street, N.W., Washington, DC 20006

(202) 303-1018

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||

| Non-Accelerated Filer | ☒ | Smaller Reporting Company | ☐ | |||

| Emerging Growth Company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| 4 | |

| 9 | |

| 13 | |

| 20 | |

| 20 | |

| 20 | |

| 20 | |

| 21 | |

| 21 | |

| 21 | |

| 22 | |

| 22 | |

| 23 | |

| 23 | |

| 24 | |

| 25 | |

| 25 | |

| 25 | |

| 26 | |

| 27 | |

| 28 | |

| 28 | |

| 28 | |

| 28 | |

| 29 | |

| 29 | |

| 39 | |

| 41 | |

| 41 | |

| 41 | |

| 41 | |

| 41 | |

| 41 | |

| 42 | |

| 42 | |

| 44 | |

| 44 | |

| 46 | |

| 46 | |

| 48 | |

| 48 | |

| 48 | |

| 50 | |

| 50 | |

| 51 | |

| 52 | |

| 53 | |

| 53 | |

| 54 | |

| 54 | |

| 55 | |

| 55 | |

| 56 | |

| 56 | |

| 56 | |

| 56 | |

| 57 | |

| 57 | |

| 57 | |

| 58 | |

| 60 | |

| 67 | |

| 67 | |

| 67 | |

| 68 | |

| 68 | |

| 68 |

| 69 | |

| 69 | |

| 69 | |

| A-1 | |

| B-1 | |

| C-1 | |

| D-1 | |

| E-1 | |

| F-1 | |

| G-1 |

| 1-Year Strategy Account Options |

|||||

| Term |

Index |

Buffer Rate |

Upside

Parameter |

Guaranteed Limit on

Upside Parameter rates/

Lock Buffer Rates |

Performance Lock

(Manual/Automatic) |

| 1-Year |

S&P 500® |

10% |

Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

S&P 500® |

20% |

Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

S&P 500® |

10% |

Trigger |

Trigger Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

S&P 500® |

10% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual |

| 1-Year |

NASDAQ-100® |

10% |

Cap |

Cap Rate:

No Lower than [•]% |

Manual |

| 1-Year |

NASDAQ-100® |

10% |

Trigger |

Trigger Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

NASDAQ-100® |

10% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 3-Year Strategy Account Options |

|||||

| Term |

Index |

Buffer Rate |

Upside

Parameter |

Guaranteed Limit on

Upside Parameter rates/

Lock Buffer Rates |

Performance Lock

(Manual/Automatic) |

| 3-Year |

S&P 500® |

Lock Buffer Rate |

Lock [30] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 3-Year |

S&P 500® |

Lock Buffer Rate |

Lock [40] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 3-Year |

S&P 500® |

Lock Buffer Rate |

Lock [50] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 6-Year Strategy Account Options |

|||||

| Term |

Index |

Buffer Rate |

Upside

Parameter |

Guaranteed Limit on

Upside Parameter rates/

Lock Buffer Rates |

Performance Lock

(Manual/Automatic) |

| 6-Year |

S&P 500® |

10% |

Cap |

Cap Rate:

No Lower than [•]/ [•] % |

Manual / Automatic |

| 6-Year |

S&P 500® |

20% |

Cap |

Cap Rate:

No Lower than [•] /[•] % |

Manual / Automatic |

| 6-Year |

S&P 500® |

10% |

Participation |

Participation Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

20% |

Participation |

Participation Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

10% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

20% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

15% |

Cap Secure |

Cap Secure Rate:

No Lower than [•]% |

Manual |

| 6-Year |

S&P 500® |

Lock Buffer Rate |

Lock [50] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 6-Year |

S&P 500® |

Lock Buffer Rate |

Lock [75] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 6-Year |

S&P 500® |

Lock Buffer Rate |

Lock [100] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| Term |

Guaranteed Minimum Interest Rate |

| 1 Year |

[0.25%] |

| |

KEY FEATURES |

LOCATION IN

PROSPECTUS |

| Purchase

Payment |

Your Purchase Payment must be at least $25,000.

Company approval is required before making a Purchase Payment in

excess of $2,000,000. For purposes of this limit, the

aggregate Purchase Payments are based on all contracts

issued by AGL and/or The United States Life Insurance Company in the

City of New York (“US Life”) to the same

Owner and/or Annuitant. After your Contract Issue Date,

additional Purchase Payments are not allowed. |

Purchasing a

Corebridge

MarketLock® Annuity - Allocation of Purchase Payment |

| Rate Lock |

On your Contract Issue Date, we will apply the Fixed Account Option

interest rates, Upside Parameter rates and Lock Buffer

Rates applicable to your Contract, for your initial

Allocation Account elections.

The initial Upside Parameter rates and Lock Buffer Rates, as

applicable, applied on your Contract Issue Date are

guaranteed for the length of the initial Term. The initial Fixed Account Option interest rate is guaranteed for one Contract Year. The initial interest rates,

Upside Parameter rates and Lock Buffer Rates are determined as

follows: If the Contract is issued within 60 days from

the date the application was signed or the electronic

order submission date, rates will be the better of the rates in effect on: (1) the application-signed date or electronic order submission date, or

(2) the Contract Issue Date.

If the Contract Issue Date is not within the 60th day after the date

the application is signed or the electronic order

submission date, then rates will be those in effect on the Contract Issue Date. Rate locks apply to all rates except guaranteed minimum interest rates and the Performance

Lock Fixed Rate. |

Purchasing a

Corebridge

MarketLock® Annuity – Rate Lock |

| Allocation

Accounts |

You can invest your Purchase Payment and Contract Value among the

available Allocation Accounts under the Contract, which

include the Strategy Account Options and the Fixed

Account Option.

Strategy Account Option:

Strategy Account Option(s) apply an Index Credit Rate based on the

performance of an Index over the Term. The Index Credit

Rate may be positive, negative or zero. Positive returns

may be limited based on the applicable Upside Parameter, and negative returns may be limited based on the Buffer, which provides limited protection from negative Index

performance.

Fixed Account Option:

The Fixed Account Option credits a fixed rate of interest that is

guaranteed for 1-year Terms, subject to a guaranteed

minimum interest rate of [0.25%]. |

Allocation Accounts |

| Indices |

We currently offer the following reference Indices:

•S&P 500®

•NASDAQ-100®

|

The Indices |

| Strategy Account

Option Terms |

We currently offer 1-year, 3-year and 6-year Terms.

|

Allocation Accounts – Strategy Account Options |

| |

KEY FEATURES |

LOCATION IN

PROSPECTUS |

| Downside

Parameter - the

Buffer |

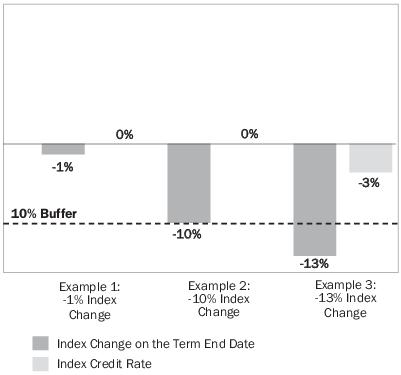

The Buffer is a component of each Strategy Account Option that

determines the Index Credit Rate that will be applied to

your Strategy Account Option Value on the Term End Date

(and the annual performance on each Contract Anniversary for Cap Secure Strategy Account Options) if the Index performance is negative. It provides a limited level of

protection from loss. You will incur a loss if negative Index

performance is greater than the Buffer Rate on the Term

End Date (and on each Contract Anniversary for Cap Secure

Strategy Account Options). For example, if the Index Change is

negative 15% and your Buffer Rate is 10%, your Index

Credit Rate would be negative 5% (for Cap Secure

Strategy Account Options, the annual measured performance on that

Contract Anniversary would be negative 5%).

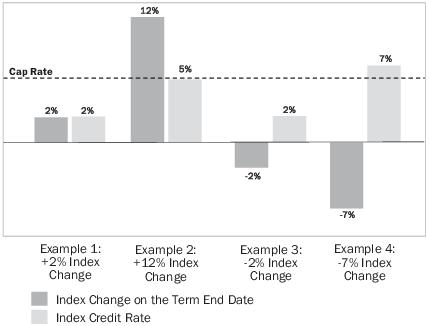

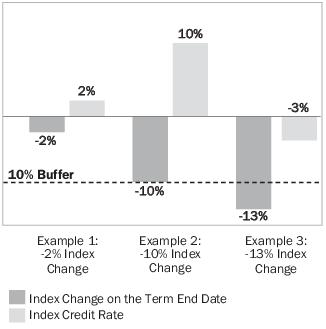

For Dual Direction with Cap, the Buffer provides a gain equal to the

absolute value of the negative Index Change, not limited

by the Cap Rate, if the negative Index performance is up

to and including the Buffer Rate. If the absolute value of the negative Index performance exceeds the Buffer Rate, your negative Index Credit Rate will equal the

negative Index performance in excess of the Buffer Rate. For example,

if the Index Change is negative 15% and your Buffer Rate

is 10%, your Index Credit Rate would be negative 5%.

However, if the Index Change is negative 8% and your Buffer Rate is 10%, your Index Credit Rate would be positive 8%. The minimum guaranteed Buffer Rate for all Strategy Account options other than Lock is

[•]%. Buffer Rates for all Strategy Account Options other than

Lock will not change from one Term to the next. The Lock

Buffer Rates will change from one Term to the next

subject to the minimum guaranteed Lock Buffer Rate of [•]%. If

negative Index performance exceeds the Buffer Rate, your

negative index performance will equal the negative Index

performance in excess of the Buffer Rate. For example, with a Buffer Rate of 10%, in extreme circumstances, you could lose 90% of your investment in the Strategy

Account Option if negative Index performance on the Term End Date is

100%. Please see “ALLOCATION

ACCOUNTS” in this prospectus for further examples of the Buffer. |

Allocation Accounts – Strategy Account Options |

| |

KEY FEATURES |

LOCATION IN

PROSPECTUS |

| Upside

Parameters |

An Upside Parameter is a component of each Strategy Account Option

that determines the Index Credit Rate that will be

applied to your Strategy Account Option Value on the Term

End Date if the Index performance is positive (or greater than or

equal to zero for Trigger). We currently offer the

following Upside Parameters: Cap: The Cap limits your participation in positive Index performance on the Term End Date

up to and including the Cap Rate. If you select a Strategy Account

Option with a Cap, and Index performance exceeds the Cap

Rate, you will receive the Cap Rate. For example, if the

Index Change is 15% and your Cap Rate is 10%, you will receive an

Index Credit Rate of 10% on the Term End

Date. Cap Secure: Cap Secure limits your participation in positive Index performance each

Contract Anniversary of a multi-year Term Strategy Account Option up

to and including the Cap Secure Rate. The Cap Secure

Rate will remain the same for the entire multi-year Term.

If you select a Strategy Account Option with a Cap Secure, and Index

performance exceeds the Cap Secure Rate in any year,

only the Cap Secure Rate will apply for that year. The

Index Credit Rate is applied at the Term End Date based upon the

values measured on each Contract Anniversary (including

the Term End Date). For example, if the annual Index

Change is 15% and your Cap Secure Rate is 8%, your adjusted annual

Index performance is 8% on that Contract Anniversary.

The adjusted annual Index performance on each Contract

Anniversary within the multi- year term would be compounded to

establish the Index Credit Rate on the Term End

Date. For example, if the adjusted annual Index

performance is 5% on each Contract Anniversary for a

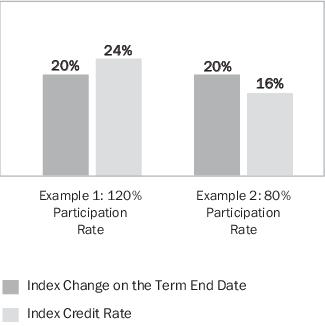

six-year term, the Index Credit Rate on the Term End Date would be 34.01% ({(1+5%)6}-1=34.01%). Participation: Participation limits your

participation in positive Index performance on the Term

End Date at a percentage equal to the Participation Rate. If Index performance is positive on the Term End Date, the Participation Rate is multiplied by Index Change to

determine the Index Credit Rate. For example, with a 100%

Participation Rate, if the Index Change is 10% on the

Term End Date, you will receive an Index Credit Rate of 10%. Alternatively, with an 80% Participation Rate, if the Index Change is 10% on the Term End

Date, you will receive an Index Credit Rate of 8%.

Dual Direction with Cap: Dual Direction with Cap allows you to participate in positive

Index performance on the Term End Date up to the Cap Rate, or the

absolute value of any negative Index performance up to

and including the Buffer Rate. If the positive Index

performance exceeds the Cap Rate, your positive Index performance will

equal the Cap Rate. For example, if the Index Change is

11% and your Cap Rate is 8%, your Index Credit Rate

would be 8%. Since the Index Change was positive, the Buffer would not come into play. If the negative Index performance was within or equal to the Buffer Rate, you gain

the absolute value of the negative Index performance. For example, if

the Index Change is –10% and your Buffer Rate is

10%, your Index Credit Rate would be 10%. Alternatively,

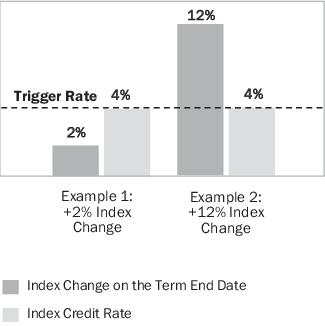

if the Index Change is -13% and your Buffer Rate is 10%, your Index Credit Rate would be -3%. Trigger: Trigger allows you to receive an Index

Credit Rate equal to the Trigger Rate if Index

performance is greater than or equal to zero on the Term End Date. If you select a Strategy Account option with a Trigger, and Index performance exceeds the Trigger Rate,

you will receive the Trigger Rate. For example, if the Index Change is

2% and the Trigger Rate is 4%, your Index Credit Rate

would be 4% because the Index Change was greater than

zero. However, if the Index Change is 12% and the Trigger Rate is 4%, your Index Credit Rate would be 4% because the Index Change was greater than the Trigger Rate.

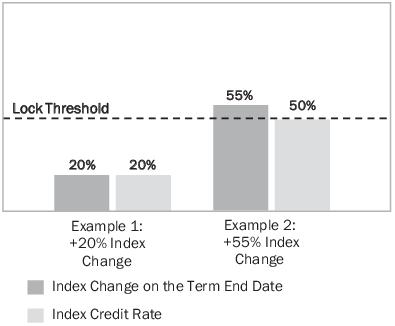

Lock: Lock allows you to receive an Index Credit Rate equal to the Lock Threshold if the

Index performance meets or exceeds the Lock Threshold on any day

during a Term. For example, if the Lock Threshold is 50%

and the Index Change on any day during a Term is 50% or

greater, you will receive an Index Credit Rate equal to 50%. If the Index Change does not reach the Lock Threshold during the Term, but is positive on the Term End Date,

you will receive an Index Credit Rate equal to the Index Change on the

Term End Date. |

Allocation Accounts – Strategy Account Options |

| |

KEY FEATURES |

LOCATION IN

PROSPECTUS |

| Upside

Parameters

(continued) |

Please see “ALLOCATION ACCOUNTS” in this

prospectus for further examples of the

Upside Parameters. The Upside Parameters, with the

exception of Lock, including their applicable rates, can

change from one Term to the next, however, each Upside Parameter rate

is subject to minimum guaranteed rates. The minimum

guaranteed rates for each of the Upside Parameters

available under the Contract are: Cap Rate: No lower than

[•]% Cap Secure Rate: No lower than [•]% Participation Rate: No lower than [•]% Trigger Rate: No lower than [•]% The Lock Threshold for a Strategy Account Option with Lock will not change from one

Term to the next. The Lock Thresholds available are: [30], [40], [50],

[75], and [100]. |

Allocation Accounts

– Strategy Account

Options |

| Performance

Lock |

If available, Performance Lock allows you to “lock-in” the

Interim Value of a Strategy Account Option prior to the

Term End Date. The Performance Lock feature may not be

available on all Strategy Account Options. Once a Performance Lock

occurs, the Strategy Account Option will earn an annual

rate with daily credited interest at the Performance

Lock Fixed Rate until the next Contract Anniversary. There are risks

associated with the Performance Lock. Once a Performance

Lock occurs, the Interim Value within the Strategy

Account Option will no longer be tied to Index performance, and you

will not receive an Index Credit Rate on the Term End

Date. The locked-in Interim Value cannot be transferred

to a new Allocation Account or a new Term in the same Strategy Account Option until the next Contract Anniversary. You may only exercise the Performance Lock

once during a Term on the full amount allocated to an applicable

Strategy Account Option, and the exercise is

irrevocable. You will not know the Interim Value at the time

Performance Lock occurs and you may be “locking

in” a loss. The loss may be

significant. You should speak with your financial

representative before exercising

Performance Lock. |

Valuing Your

Investment in A

Strategy Account

Option –

Performance Lock |

| Contract

Value/Cash Value |

Contract Value. Prior to annuitization, your Contract Value represents the value of your

investment in your Allocation Accounts, which may include the Fixed

Account Option and one or more Strategy Account

Option(s). If you invest in a Strategy Account Option, your Contract Value will reflect the Interim Values of your investment on any day other than the

Term Start Date or the Term End Date.

On any day during the Accumulation Phase, your total Contract Value is

equal to: •Your Purchase Payment; minus •Your total gross Withdrawals from the Contract (including

any applicable amounts deducted for Withdrawal Charges

and MVAs); plus •Your accumulated gains on amounts allocated to Strategy Account Option(s); minus

•Your accumulated losses on amounts allocated to Strategy Account Option(s); plus

•Interest credited on amounts allocated to the Fixed Account Option; minus

•Amounts deducted for fees, charges, and taxes, if any. Upon annuitization, you will no longer be able to take Withdrawals of Contract Value and

all other features and benefits of your Contract will terminate,

including your ability to Surrender your

Contract. Cash Value. Prior to annuitization, your Cash Value represents the total amount that is

available for Withdrawal or Surrender. Your Cash Value is equal to the

Contract Value after adjustment for any applicable

Withdrawal Charges, fees, and MVA. Your Cash Value may

be less than or equal to your Contract Value. Your Cash Value will never be less than the Minimum Withdrawal Value. Upon annuitization, your Contract does not have a Cash

Value. |

Contract Value and Cash Value |

| |

KEY FEATURES |

LOCATION IN

PROSPECTUS |

| Death Benefit |

Contract Value Death Benefit:

The Contract provides a Contract Value death benefit at no additional

charge. The Contract Value death benefit is equal to the

greater of the Contract Value or the Minimum Withdrawal

Value on the Business Day we receive all required documentation in Good Order. Optional Return of Purchase Payment Death Benefit:

For an additional fee, you may elect the Return of Purchase Payment

Death Benefit which can provide greater protection for

your Beneficiaries. You may only elect the Return of

Purchase Payment Death Benefit at the time you purchase your Contract,

and you cannot change your election thereafter at any

time. The fee for the Return of Purchase Payment Death

Benefit is 0.20% (annually based on remaining Net

Purchase Payments). The fee will be deducted proportionally from all Allocation Account Option(s) and charged on each Contract Anniversary. The fee is

pro-rated upon death or Surrender. You may pay for the optional Return

of Purchase Payment Death Benefit and your Beneficiary

may never receive the benefit once you begin the Income

Phase. The Return of Purchase Payment Death Benefit can only be elected prior to your 76th birthday. The Return of Purchase Payment Death Benefit is the greatest of:

1. Contract Value less applicable fees associated with the Return of

Purchase Payment Death Benefit;

2. Minimum Withdrawal Value; or

3. Net Purchase Payments.

Withdrawals will reduce Net Purchase Payments, and

therefore the Return of Purchase

Payment Death Benefit, on a proportionate basis, and this reduction could be more than the amount of the Withdrawal. |

Death Benefits |

| |

FEES AND CHARGES |

LOCATION IN

PROSPECTUS |

| Withdrawal

Charges |

You may be subject to charges for early Withdrawals. If you withdraw

money from your Contract within six (6) years following

the Contract Issue Date, you may be assessed a

Withdrawal Charge of up to 8%, as a percentage of the Contract Value

withdrawn. Withdrawal Charges do not apply to certain

Withdrawals including a Withdrawal up to the annual free

Withdrawal amount equal to 10% of the previous Contract Anniversary Contract Value (and if withdrawn in the first Contract Year, the Purchase Payment amount).

For example, if you withdraw $100,000 in excess of the free Withdrawal

amount during the Withdrawal Charge Period, you could be

assessed a Withdrawal Charge of up to $8,000 if your

Withdrawal Charge is 8%. Withdrawals will also be subject

to MVA during the Withdrawal Charge Period. The MVA

reflects the change in market interest rates between the Contract

Issue Date and the date of your Withdrawal which may

increase or decrease your Withdrawal amount. |

Fees and Charges |

| Market Value

Adjustments |

A Market Value Adjustment applies if you take Withdrawals in excess of

the annual free Withdrawal amount or Surrender your

Contract during the first six years after the Contract

Issue Date. A Market Value Adjustment is an increase or decrease to

your Withdrawal or Surrender based on charges in

interest rates between the Contract Issue Date and the date of your Withdrawal or Surrender. The maximum potential loss as a result of a negative

Market Value Adjustment is [100%] of the amount of your Withdrawal or

Surrender, subject to the Minimum Withdrawal

Value. |

Fees and Charges |

| |

FEES AND CHARGES |

LOCATION IN

PROSPECTUS |

| Interim Value |

The Interim Value is the amount in the Strategy Account Option that is

available for transactions that occur during the Term.

The Interim Value could be less than your investment in

a Strategy Account Option even if the Index is performing positively. Withdrawals or Surrenders that cause the Interim Value to be recalculated could result in

the loss of principal investment and previously applied Index Credit

Rates, and such losses could be as high as 100%. All

Withdrawals taken, and fees and charges deducted, from a

Strategy Account Option before the Term End date (including fees and

charges that are periodically deducted from your

Contract) will trigger a Negative Adjustment which will

lower your Strategy Base in the Strategy Account Option in the same

proportion that the Interim Value is reduced (rather

than on a dollar-for-dollar basis) and will proportionately reduce the death benefit. Such a reduction will reduce your Strategy Base for the remainder

of the Term and the proportionate reduction may be greater than the

dollar amount withdrawn, or the fee or charge deducted.

The following transactions impact the Interim Value of

Strategy Account Option: •A fee or charge is deducted from the Strategy Account Option; •An amount is deducted from the Strategy Account Option due

to a Surrender or Withdrawal (including a systematic

Withdrawal, RMDs, free Withdrawal amounts or any other

Withdrawal); •The Contract is annuitized; •The death benefit is paid; or

•A performance Lock occurs. You may obtain the Interim Value(s) of your Strategy Account Option(s) online at

[www.corebridgefinancial.com/annuities] or by contacting your

financial representative. |

Valuing Your

Investment in a

Strategy Account

Option |

| Optional Return

of Purchase

Payment Death

Benefit Fee |

If you elect the optional Return of Purchase Payment Death Benefit at

the time you purchase the Contract, you will be subject

to an additional fee of 0.20% (annually based on

remaining Net Purchase Payments). The feel will be deducted

proportionally from all Allocation Account Options and

charged on each Contract Anniversary. The fee is pro-rated

upon death or Surrender. Deduction of the fee will trigger an Interim

Value adjustment and Negative Adjustment.

|

Fees and Charges |

| Premium Taxes |

Certain states charge the Company a tax on Purchase Payments that

ranges from 0% to 3.5%. Some states assess this premium

tax when the Contract is issued while other states only

assess the tax upon annuitization. The Company may advance any tax amount due, but we will deduct such amount from your Contract Value only when and if you begin the

Income Phase (annuitization). See “Appendix F: STATE VARIATIONS.” |

Fees and Charges |

| |

RESTRICTIONS |

|

| Investments |

Transfer Restrictions. Contract Value allocated to a Strategy Account Option may only be

transferred on the Term End Date. Contract Value allocated to the

Fixed Account Option may not be transferred until the

next Contract Anniversary. If you do not want to remain

invested in the Fixed Account Option until the next Contract

Anniversary, or in a Strategy Account Option until the

Term End Date, your only options will be to take a Withdrawal from or Surrender the Contract, or exercise the Performance Lock feature (if available) and

transfer your Strategy Account Option Value on the next Contract

Anniversary. If you elect one of these options, the

transaction will be based on the Interim Values of the Strategy Account Options. The Interim Value could be substantially less than the amount invested in

the Strategy Account Option and could result in significant loss. All

Withdrawals taken (and fees and charges deducted from

your Contract) will trigger a Negative Adjustment which

will lower your Strategy Base in the Strategy Account Option in the same proportion that the Interim Value is reduced (rather than a dollar-for-dollar basis) and will

proportionately reduce the death benefit. Such a reduction will reduce

your Strategy Base for the remainder of the Term and the

proportionate reduction may be greater than the dollar

amount withdrawn and the fee or charge deducted. Withdrawals and Surrenders may be subject to Withdrawal Charges, MVA, any applicable fees, and taxes (including a 10%

Federal tax penalty before age 59½).

Transfer requests may only be submitted to us within [25] days of the

Term End Date (or Contract Anniversary after a

Performance Lock), and must be provided before Market Close on the Term End Date (or Contract Anniversary after a Performance Lock). If the Term

End Date (or Contract Anniversary after a Performance Lock) is not a

Business Day, we must receive your instructions before

Market Close on the Business Day before the Term End

Date (or Contract Anniversary after a Performance Lock).

If we do not receive transfer instructions from you within the

appropriate time frame, we will automatically transfer

or renew, as applicable, your Strategy Account Option and/or Fixed Account Option Value as follows: •Your Contract Value in any expiring Strategy Account

Option with a 1-year Term will remain in its current

allocation for the next Term, subject to the Upside Parameter rates and Lock Buffer Rates, if applicable, declared for that Term. If your Contract Value is

invested in a Strategy Account Option with a 1-year Term that that

will no longer available for investment after the Term

End Date, the Contract Value remaining in that Strategy

Account Option will automatically be transferred to the Fixed Account Option on the Term End Date, subject to the renewal interest rate, and will remain there until the

next Contract Anniversary after you provide transfer instructions. The

Contract Value automatically transferred to the Fixed

Account Option in the absence of transfer instructions

cannot be transferred to another available Strategy Account Option until the next Contract Anniversary. •Any Contract Value in an expiring Strategy Account Option

with a multi-year Term or Fixed Account Option will

automatically be transferred or renewed to the Fixed Account Option, subject to the applicable renewal interest rates. Amounts that are automatically

renewed or transferred in the absence of transfer instructions cannot

be transferred until the next Contract

Anniversary. Performance Lock

Restrictions. Manual Performance Lock is not allowed, and automatic

Performance Lock settings cannot be changed, during the five (5) days

prior to a Term End Date. Once you exercise Performance

Lock, it cannot be revoked. Investment

Restrictions. •Some Strategy Account Options may only be available on Contract Issue Date. On the

Term End Date, you will only be able to invest in the Strategy Account

Options available at that time.

•At an time we are crediting the guaranteed minimum interest rate specified in your

Contract, we reserve the right to restrict your ability to invest in

the Fixed Account Option.

•When allocating Contract Value on a Term End Date among the available Allocation

Accounts, you may not invest in any Strategy Account Option that has a

Term that extends beyond the Latest Annuity Date. If

there is no eligible Strategy Account Option, only the

Fixed Account Option will be available to you for investment. •The Company reserves the right to stop

offering all but one Strategy Account

Option. We will provide you with written notice before adding, replacing, or removing a

Strategy Account Option or Index. |

Allocation Accounts Transfers between Allocation Accounts |

| |

RESTRICTIONS |

|

| Investments

(continued) |

Availability of Strategy Account Options and

Indices. We reserve the right to add, replace or remove Strategy Account Options offered, change the Indices, and limit the

number of offered Strategy Account Options to only one. If all but one

Strategy Account Option is available, you will be

limited to investing in only that Strategy Account Option

with terms that may not be acceptable to you. We may change the

Strategy Account Options, the Upside Parameters rates,

and the Lock Buffer Rates subject to the stated

guaranteed minimum rates. There is no guarantee that a particular

Strategy Account Option or Index will be available

during the entire time that you own your Contract.

Certain Strategy Account Options and Indices may not be available

through your financial representative. You may obtain

information about the Strategy Account Options and Indices

that are available to you by contacting your financial

representative. Availability of the

optional Return of Purchase Payment Death Benefit. The optional

Return of Purchase Payment Death Benefit may not be available through

certain selling broker-dealer firms. You should ask your

financial representative if the optional Return of

Purchase Payment Death Benefit is available under your

Contract. |

Allocation Accounts

Transfers between

Allocation Accounts |

| |

TAXES |

|

| Tax Implications |

•You should consult with a tax professional to determine the tax implications of an

investment in and payments received under the Contract.

•If you purchase the Contract through an IRA, there is no additional tax benefit under the

Contract.

•Earnings under your Contract are taxed at ordinary income tax rates when withdrawn.

You may be subject to a tax penalty if you take a Withdrawal before

age 59½. |

Taxes |

| |

CONFLICTS OF INTEREST |

LOCATION IN

PROSPECTUS |

| Investment

Professional

Compensation |

Your financial representative may receive compensation for selling

this Contract to you in the form of commissions,

additional cash compensation, and/or non-cash compensation. We may share the revenue we earn on this Contract with your financial representative’s firm.

Revenue sharing arrangements and commissions may provide selling firms

and/or their registered representatives with an

incentive to favor sales of our contracts over other

annuity contracts (or other investments) with respect to which a

selling firm does not receive the same level of

additional compensation. You should ask your financial

representative about how they are compensated. |

Payments in

Connection with

Distribution of the

Contract |

| Exchanges |

Some financial representatives may have a financial incentive to offer

you a new contract in place of the one you already own.

You should exchange a contract you already own only if

you determine, after comparing the features, fees, and risks of both

contracts, that it is better for you to purchase the new

contract rather than continue to own your existing

contract. |

Purchasing a Corebridge MarketLock® Annuity – Exchange Offers |

| 1-Year Strategy Account Options |

|||||

| Term |

Index |

Buffer Rate |

Upside

Parameter |

Guaranteed Limit on

Upside Parameter rates/

Lock Buffer Rates |

Performance Lock

(Manual/Automatic) |

| 1-Year |

S&P 500® |

10% |

Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

S&P 500® |

20% |

Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

S&P 500® |

10% |

Trigger |

Trigger Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

S&P 500® |

10% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual |

| 1-Year |

NASDAQ-100® |

10% |

Cap |

Cap Rate:

No Lower than [•]% |

Manual |

| 1-Year |

NASDAQ-100® |

10% |

Trigger |

Trigger Rate:

No Lower than [•]% |

Manual / Automatic |

| 1-Year |

NASDAQ-100® |

10% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 3-Year Strategy Account Options |

|||||

| Term |

Index |

Buffer Rate |

Upside

Parameter |

Guaranteed Limit on

Upside Parameter rates/

Lock Buffer Rates |

Performance Lock

(Manual/Automatic) |

| 3-Year |

S&P 500® |

Lock Buffer Rate |

Lock [30] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 3-Year |

S&P 500® |

Lock Buffer Rate |

Lock [40] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 3-Year |

S&P 500® |

Lock Buffer Rate |

Lock [50] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 6-Year Strategy Account Options |

|||||

| Term |

Index |

Buffer Rate |

Upside

Parameter |

Guaranteed Limit on

Upside Parameter rates/

Lock Buffer Rates |

Performance Lock

(Manual/Automatic) |

| 6-Year |

S&P 500® |

10% |

Cap |

Cap Rate:

No Lower than [•]/ [•] % |

Manual / Automatic |

| 6-Year |

S&P 500® |

20% |

Cap |

Cap Rate:

No Lower than [•] /[•] % |

Manual / Automatic |

| 6-Year |

S&P 500® |

10% |

Participation |

Participation Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

20% |

Participation |

Participation Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

10% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

20% |

Dual Direction with Cap |

Cap Rate:

No Lower than [•]% |

Manual / Automatic |

| 6-Year |

S&P 500® |

15% |

Cap Secure |

Cap Secure Rate:

No Lower than [•]% |

Manual |

| 6-Year |

S&P 500® |

Lock Buffer Rate |

Lock [50] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 6-Year |

S&P 500® |

Lock Buffer Rate |

Lock [75] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| 6-Year |

S&P 500® |

Lock Buffer Rate |

Lock [100] |

Lock Buffer Rate:

No Lower than [•]% |

Automatic by design |

| Contract Anniversary |

1 |

2 |

3 |

4 |

5 |

6 |

Term End Date

Calculation |

| Annual Index Performance |

5% |

-8% |

-18% |

13% |

1% |

3% |

N/A |

| Annual Index Performance

(adjusted for Cap Secure and

Buffer) |

5% |

0% |

-8% |

5% |

1% |

3% |

N/A |

| Compounding Calculation of

Annual Index Performance |

105% |

x 100% =

105.00% |

x 92% =

96.60% |

x 105% =

101.43% |

x 101% =

102.44% |

x 103% =

105.52% |

= 105.5176% |

| Compounded Return |

5.00% |

5.00% |

-3.40% |

1.43% |

2.44% |

5.52% |

N/A |

| Index Credit Rate |

|

5.5176% | |||||

| Index Credit Assuming $10,000

Strategy Base at Term End

Date |

N/A |

$10,000

x 5.5176% =

$551.76 | |||||

| Strategy Account Option Value |

Interim Values apply up to Term End Date |

$10,551.76 | |||||

| Initial Index Value for original Index |

1000 |

| Index Value for original Index on substitution date |

1050 |

| Index Change for original Index on substitution date |

(1050 / 1000) -– 1 = 5% |

| Index Change for original Index on substitution date |

5% |

| Index Value for replacement Index on substitution date

|

1000 |

| Revised Initial Index Value for replacement Index |

1000/(100% +5%) = 952.38 |

| Telephone: (800) 445-7862 |

| Internet:

www.corebridgefinancial.com/annuities |

| United States Postal Service (first-class mail): Annuity Service Center P.O. Box 15570

Amarillo, Texas 79105-5570 |

| Facsimile:

(818) 615-1543 |

| |

Minimum

Withdrawal

Amount |

Minimum

Contract

Value(1) |

| Partial Withdrawal |

$1,000 |

$2,500(2) |

| Systematic Withdrawal |

$100 |

$2,500(2) |

| Owner |

Payable Upon the Death of |

| Natural persons |

Owner (or first to die, if jointly owned) |

| Non-natural person (e.g., Trust) |

Annuitant |

| Years Since Purchase Payment Receipt |

0 |

1 |

2 |

3 |

4 |

5 |

6+ |

| Withdrawal Charge percentage |

8% |

8% |

7% |

6% |

5% |

4% |

0% |

| |

1-Year -10% Buffer

with Cap |

6-Year -10% Buffer with

Participation Rate |

| Term Start Date |

|

|

| Strategy Base |

$100,000 |

$100,000 |

| Index Value |

1,000 |

1,000 |

| Number of Days in Term |

365 |

2,191 |

| Hypothetical Option Unit Value |

1.62% |

10.27% |

| Example A: Negative Index Change near the beginning of the

Term | ||

| Interim Value Date |

|

|

| Index Value |

950 |

950 |

| Index Change |

-5% |

-5% |

| Days Remaining in Term |

334 |

2,160 |

| Hypothetical Option Unit Value |

-2.15% |

5.42% |

| Trading Costs |

0.15% |

0.15% |

| Interim Value Calculation |

$100,000 x (1 + (-2.15%) - 1.62% x

(334/365) - 0.15%) |

$100,000 x (1 + 5.42% - 10.27% x

(2160/2191) - 0.15%) |

| Interim Value Result |

$96,217.59 |

$95,145.31 |

| Example B: Negative Index Change near the end of the

Term | ||

| Interim Value Date |

|

|

| |

1-Year -10% Buffer

with Cap |

6-Year -10% Buffer with

Participation Rate |

| Index Value |

950 |

950 |

| Index Change |

-5% |

-5% |

| Days Remaining in Term |

30 |

30 |

| Hypothetical Option Unit Value |

-0.48% |

-0.36% |

| Trading Costs |

0.15% |

0.15% |

| Interim Value Calculation |

$100,000 x (1 + (-0.48%) - 1.62% x

(30/365) - 0.15%) |

$100,000 x (1 + (-0.36%) - 10.27% x

(30/2191) - 0.15%) |

| Interim Value Result |

$99,236.85 |

$99,349.38 |

| Example C: Positive Index Change near the beginning of the

Term | ||

| Interim Value Date |

|

|

| Index Value |

1050 |

1050 |

| Index Change |

5% |

5% |

| Days Remaining in Term |

334 |

2,160 |

| Hypothetical Option Unit Value |

3.37% |

11.43% |

| Trading Costs |

0.15% |

0.15% |

| Interim Value Calculation |

$100,000 x (1 + 3.37% - 1.62% x

(334/365) - 0.15%) |

$100,000 x (1 + 11.43% - 10.27% x

(2160/2191) - 0.15%) |

| Interim Value Result |

$101,737.59 |

$101,155.31 |

| Example D: Positive Index Change near the end of the

Term | ||

| Interim Value Date |

|

|

| Index Value |

1050 |

1050 |

| Index Change |

5% |

5% |

| Days Remaining in Term |

30 |

30 |

| Hypothetical Option Unit Value |

5.23% |

6.87% |

| Trading Costs |

0.15% |

0.15% |

| Interim Value Calculation |

$100,000 x (1 + 5.23% - 1.62% x

(30/365) -0.15%) |

$100,000 x (1 + 6.87% - 10.27% x

(30/2191) - 0.15%) |

| Interim Value Result |

$104,946.85 |

$106,579.38 |

| Withdrawal Charge Period Length in Months |

|

72 Months |

| Purchase Payment |

|

$100,000 |

| Contract Value Immediately prior to Withdrawal |

|

$103,257 |

| Withdrawal Amount Requested |

W |

$24,000 |

| Free Withdrawal amount |

F |

$10,000 |

| [Index A] on date of Withdrawal |

J |

3.50 % |

| [Index A] on Contract Issue Date |

I |

3.00 % |

| Number of complete months remaining in Withdrawal Charge Period |

N |

64 |

| Market Value Adjustment (MVA) = (W - F) * [(J - I) * (N / 12)] |

|

$373.33 |

| The Net Withdrawal Amount will be REDUCED by $373.33

because we subtract the Market Value Adjustment. | ||

| Withdrawal Charge Period Length in Months |

|

72 Months |

| Purchase Payment |

|

$100,000 |

| Contract Value Immediately prior to Withdrawal |

|

$103,257 |

| Withdrawal Amount Requested |

W |

$24,000 |

| Free Withdrawal amount |

F |

$10,000 |

| [Index A] on date of Withdrawal |

J |

3.50 % |

| [Index A] on Contract Issue Date |

I |

3.00 % |

| Number of complete months remaining in Withdrawal Charge Period |

N |

7 |

| Market Value Adjustment (MVA) = (W - F) * [(J - I) * (N / 12)] |

|

$40.83 |

| The Net Withdrawal Amount will be REDUCED by $40.83

because we subtract the Market Value Adjustment. | ||

| Withdrawal Charge Period Length in Months |

|

72 Months |

| Purchase Payment |

|

$100,000 |

| Contract Value Immediately prior to Withdrawal |

|

$103,257 |

| Withdrawal Amount Requested |

W |

$24,000 |

| Free Withdrawal amount |

F |

$10,000 |

| [Index A] on date of Withdrawal |

J |

2.60 % |

| [Index A] on Contract Issue Date |

I |

3.00 % |

| Number of complete months remaining in Withdrawal Charge Period |

N |

64 |

| Market Value Adjustment (MVA) = (W - F) * [(J - I) * (N / 12)] |

|

-$

298.67 |

| The Net Withdrawal Amount will be INCREASED by $298.67

because we subtract the Market Value Adjustment. | ||

| Withdrawal Charge Period Length in Months |

|

72 Months |

| Purchase Payment |

|

$100,000 |

| Contract Value Immediately prior to Withdrawal |

|

$103,257 |

| Withdrawal Amount Requested |

W |

$24,000 |

| Free Withdrawal amount |

F |

$10,000 |

| [Index A] on date of Withdrawal |

J |

2.60 % |

| [Index A] on Contract Issue Date |

I |

3.00 % |

| Number of complete months remaining in Withdrawal Charge Period |

N |

7 |

| Market Value Adjustment (MVA) = (W - F) * [(J - I) * (N / 12)] |

|

-$

32.67 |

| The Net Withdrawal Amount will be INCREASED by $32.67

because we subtract the Market Value Adjustment. | ||

| Values as of |

Purchase Payment

Invested |

Contract Value |

Net Purchase Payments

(“NPP”) |

Return of Purchase

Payment Death Benefit |

| Contract Issue Date |

$250,000 |

$250,000 |

$250,000 |

$250,000 |

| Values as of |

Assumed Contract

Value |

Withdrawal Taken |

Contract Value after

Withdrawal |

Net Purchase

Payments (“NPP”) |

Assumed Payment

Death Benefit |

| Contract Year 3 |

$300,000 |

$15,000 |

$285,000 |

$237,500 |

$285,000 |

| 3rd Contract Anniversary |

$265,000 |

N/A |

$265,000 |

$237,500 |

$265,000 |

| Contract Year 4 |

$230,000 |

$23,000 |

$207,000 |

$213,750 |

$213,750 |

| 4th Contract Anniversary |

$220,000 |

N/A |

$220,000 |

$213,750 |

$220,000 |

| PROSPECTUS PROVISION |

AVAILABILITY OR VARIATION |

ISSUE STATE |

| Annuity Date |

You may switch to the Income Phase any time after your first Contract

Anniversary. |

Florida |

| Free Look |

If you are age 60 or older on the Contract Issue Date:

The free look period is 30 days; and

If you invest immediately in any Strategy Account Option(s), the free

look amount is calculated as the Contract Value plus any

fees previously deducted on the day we received your request in Good Order at the Annuity Service Center; or If you choose to invest the Purchase Payment in a fixed account during the free look period, the free

look amount is calculated as the Purchase Payment paid. Additionally,

the initial Term for the Strategy Account Option(s) is

shortened by [36] days. If you are younger than age 60 on

the Contract Issue Date, the free look amount is calculated as the Contract Value plus any fees previously deducted on the day we received your request in Good Order

at the Annuity Service Center.

The Company will apply the Interim Value when calculating the Contract

Value to be refunded to you. Therefore, this amount

could be less than the amount paid with the application. |

California |

| Free Look |

The free look period is 21 calendar days, and the amount is calculated

as the cash value provided in the annuity, plus any fees

or charges deducted from the Purchase Payment or imposed under the Contract on the day we received your request in Good Order at the Annuity Service Center. |

Florida |

| Joint Ownership |

Benefits and features to be made available to Domestic

Partners. |

California

District of Columbia

Maine

Nevada

Oregon

Washington

Wisconsin |

| Joint Ownership |

Benefits and features to be made available to Civil Union

Partners. |

California

Colorado

Hawaii

Illinois

New Jersey

Rhode Island |

| Extended Care

Waiver/Terminal Illness

Waiver |

The Extended Care Waiver and Terminal Illness Waiver are not

available. |

California |

PART II – INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 13. | Other Expenses of Issuance and Distribution. |

[TO BE UPDATED BY AMENDMENT]

The registrant’s expenses in connection with the issuance and distribution of the contracts, other than any underwriting commissions, are as follows:

| SEC Filing Fee |

[$ | 147.60 | ] | |

| Estimated Printing and Filing Costs |

[$ | ] | ||

| Estimated Accounting Fees and Expenses |

[$ | ] | ||

| Estimated Legal Fees and Expenses |

[$ | ] | ||

| Consulting Fees |

[$ | ] |

| Item 14. | Indemnification of Directors and Officers. |

[TO BE UPDATED BY AMENDMENT]

| Item 15. | Recent Sales of Unregistered Securities. |

Not Applicable

| Item 16. | Exhibits and Financial Statement Schedules. |

| (a) | Exhibits |

| (b) | Financial Statement Schedules |

[MANAGEMENT’S DISCUSSION & ANALYSIS AND STATUTORY FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULES TO BE UPDATED BY AMENDMENT]

| Item 17. | Undertakings. |

| (A) | The undersigned registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made of the securities registered hereby, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement. |

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

| (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (B) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 (“Act”) may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Houston, State of Texas, on May 30, 2024.

| BY: | AMERICAN GENERAL LIFE INSURANCE COMPANY (Registrant) | |

| BY: | *CHRISTOPHER B. SMITH | |

| CHRISTOPHER B. SMITH Director, Chairman of the Board and President | ||

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and dates indicated:

| Signature |

Title |

Date | ||

| *CHRISTOPHER B. SMITH CHRISTOPHER B. SMITH |

Director, Chairman of the Board and President (Principal Executive Officer) |

May 30, 2024 | ||

| *CHRISTOPHER P. FILIAGGI CHRISTOPHER P. FILIAGGI |

Director, Senior Vice President, and Chief Financial Officer (Principal Financial Officer) (Principal Accounting Officer) |

May 30, 2024 | ||

| *TERRI N. FIEDLER |

Director |

May 30, 2024 | ||

| TERRI N. FIEDLER |

||||

| *TIMOTHY M. HESLIN |

Director |

May 30, 2024 | ||

| TIMOTHY M. HESLIN |

||||

| *LISA M. LONGINO |

Director |

May 30, 2024 | ||

| LISA M. LONGINO |

||||

| *JONATHAN J. NOVAK |

Director |

May 30, 2024 | ||

| JONATHAN J. NOVAK |

||||

| *BRYAN A. PINSKY |

Director |

May 30, 2024 | ||

| BRYAN A. PINSKY |

||||

| *ELIZABETH B. CROPPER |

Director |

May 30, 2024 | ||

| ELIZABETH B. CROPPER |

||||

| *BY: |

/s/ TRINA SANDOVAL | May 30, 2024 | ||||

| TRINA SANDOVAL Attorney-in-Fact pursuant to Powers of Attorney filed previously. |

||||||