July 24, 2025 SECOND- QUARTER 2025 FINANCIAL RESULTS American Airlines Group Inc. .2

Certain of the statements contained in this report should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, downturns in economic conditions; our inability to obtain sufficient financing or other capital to operate successfully; our high level of debt and other obligations; our significant pension and other postretirement benefit funding obligations; any deterioration of our financial condition; any loss of key personnel, or our inability to attract, develop and retain additional qualified personnel; changing economic, geopolitical, commercial, regulatory and other conditions beyond our control, including the recently announced tariffs and other global events that affect travel behavior; changes in current legislation, regulations and economic conditions regarding federal governmental tariffs, the implementation of federal government budget cuts and the potential that any of the foregoing affects the demand for, or restricts the use of, travel by government employees and their families or private sector enterprises that contract or otherwise interface with the federal government; the intensely competitive and dynamic nature of the airline industry; union disputes, employee strikes and other labor-related disruptions; problems with any of our third-party regional operators or third-party service providers; any damage to our reputation or brand image; losses and adverse publicity stemming from any public incidents involving our company, our people or our brand; changes to our business model that may not be successful and may cause operational difficulties or decreased demand; our inability to protect our intellectual property rights, particularly our branding rights; litigation in the normal course of business or otherwise; our inability to use net operating losses and other carryforwards; any new U.S. and international tax legislation; any impairment of goodwill and intangible assets or long-lived assets; any inability of our commercial relationships with other companies to produce the returns or results we expect; our dependence on price and availability of aircraft fuel; extensive government regulation and compliance risks; economic and political instability outside of the U.S. where we have significant operations; ongoing security concerns due to conflicts, terrorist attacks or other acts of violence, domestically or abroad; climate change; environmental and social matters, and compliance risks with environmental, health and noise regulations; a shortage of pilots; our dependence on a limited number of suppliers for aircraft, aircraft engines and parts; any failure of technology and automated systems, including artificial intelligence, that we rely on to operate our business; evolving data privacy requirements, risks from cyberattacks and data privacy incidents, and compliance risks with regulations related therewith; any inability to effectively manage the costs, rights and functionality of third-party distribution channels; any inability to obtain and maintain adequate facilities and infrastructure throughout our system and, at some airports, adequate slots; interruptions or disruptions in service at one or more of our key facilities; increases in insurance costs or reductions in insurance coverage; heavy taxation in the airline industry; risks related to ownership of American Airlines Group Inc. common stock; and other risks set forth herein as well as in the company’s latest annual report on Form 10-K for the year ended December 31, 2024 (especially in Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations) and subsequent quarterly reports on Form 10-Q (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors ), and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward- looking statements speak only as of the date hereof or as of the dates indicated in the statement. Forward-looking statements 2

Commercial update

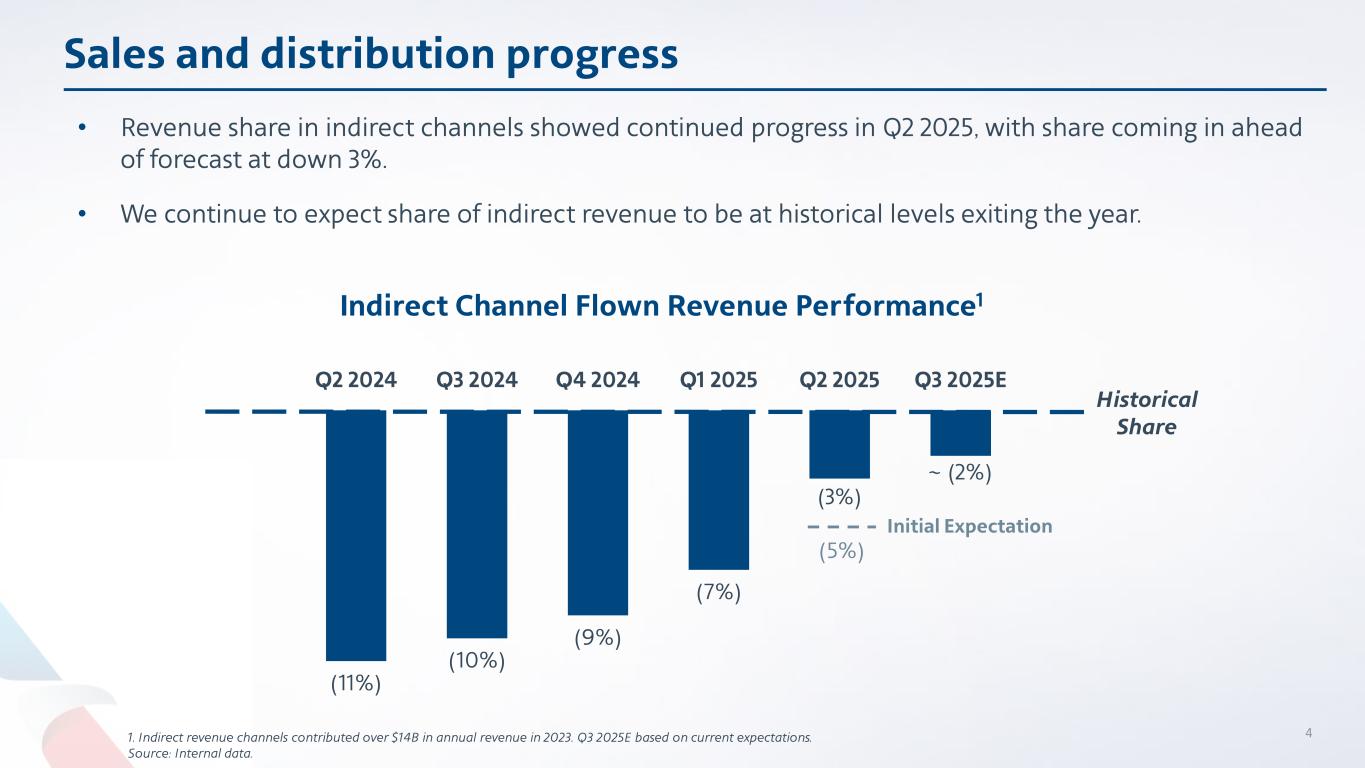

(11%) (10%) (9%) (7%) (3%) ~ (2%) Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025E Sales and distribution progress Indirect Channel Flown Revenue Performance1 4 • Revenue share in indirect channels showed continued progress in Q2 2025, with share coming in ahead of forecast at down 3%. • We continue to expect share of indirect revenue to be at historical levels exiting the year. Historical Share 1. Indirect revenue channels contributed over $14B in annual revenue in 2023. Q3 2025E based on current expectations. Source: Internal data. Initial Expectation (5%)

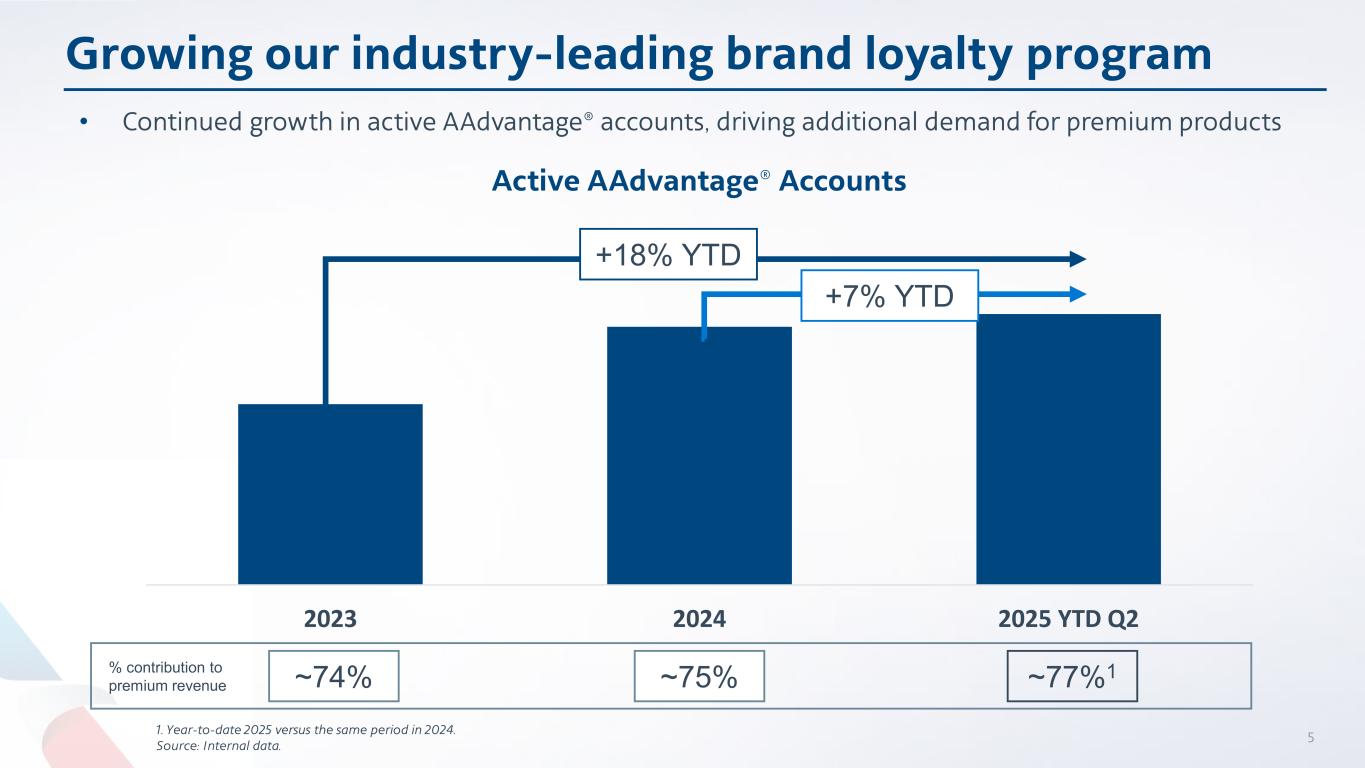

2023 2024 2025 YTD Q2 Growing our industry-leading brand loyalty program 51. Year-to-date 2025 versus the same period in 2024. Source: Internal data. • Continued growth in active AAdvantage® accounts, driving additional demand for premium products +7% YTD % contribution to premium revenue ~77%1~74% Active AAdvantage® Accounts ~75% +18% YTD

Renewed focus on the customer experience 6 • Introduced Flagship Suite® to offer a private premium experience with a privacy door in addition to chaise lounge seating and more personal storage space. • Offers more premium lounges than any other U.S. carrier. Opened ninth premium lounge in Philadelphia in May and announced a new Flagship® lounge and expanded Admirals Club® lounge footprint in Miami. • First carrier to test and implement One Stop Security for flights into the U.S., starting with American’s LHR-DFW flights, allowing customers to bypass baggage reclaim and TSA rescreening upon arrival. • Rolled out new boarding process enhancements to reduce delays and gate checked bags. • Implemented Connect Assist tool at DFW to save customer connections and expect to expand to other hubs later this summer.

Financial update

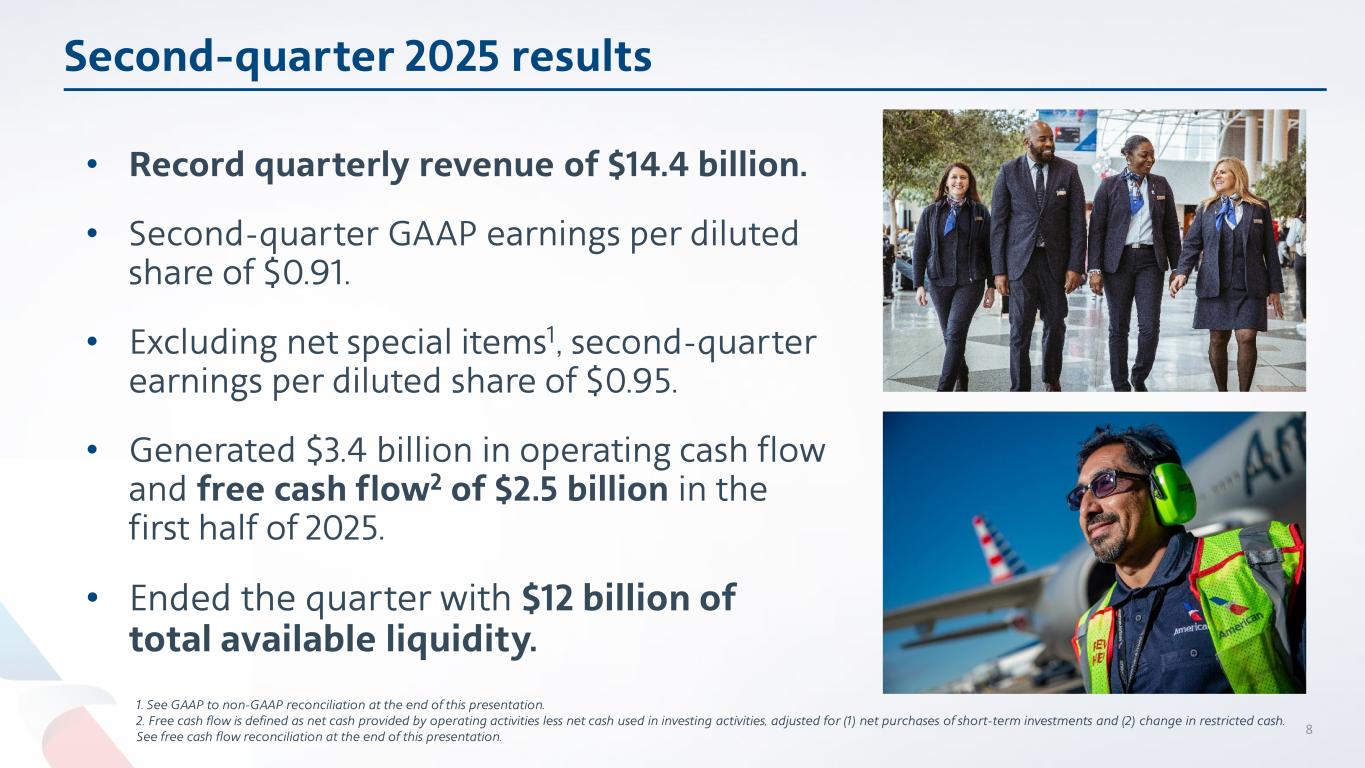

Second-quarter 2025 results • Record quarterly revenue of $14.4 billion. • Second-quarter GAAP earnings per diluted share of $0.91. • Excluding net special items1, second-quarter earnings per diluted share of $0.95. • Generated $3.4 billion in operating cash flow and free cash flow2 of $2.5 billion in the first half of 2025. • Ended the quarter with $12 billion of total available liquidity. 1. See GAAP to non-GAAP reconciliation at the end of this presentation. 2. Free cash flow is defined as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. See free cash flow reconciliation at the end of this presentation. 8

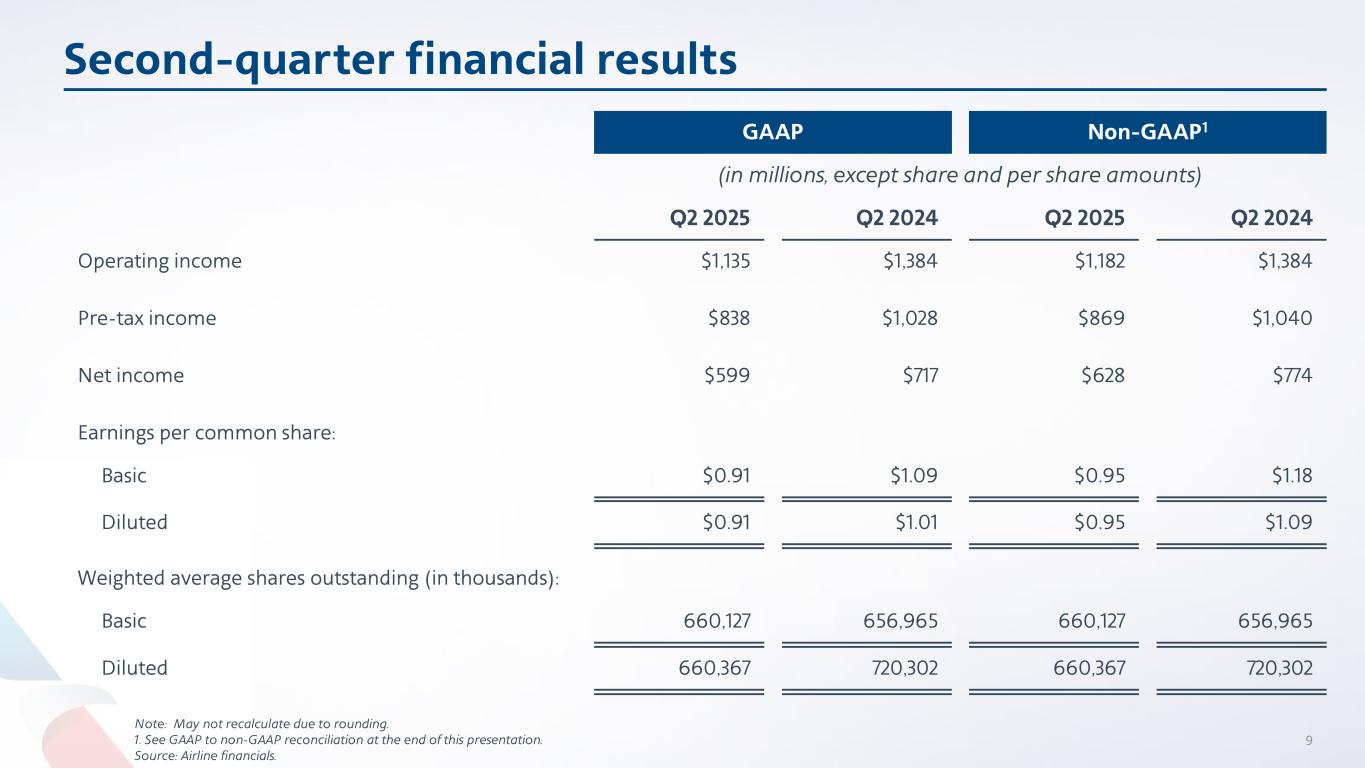

Second-quarter financial results Note: May not recalculate due to rounding. 1. See GAAP to non-GAAP reconciliation at the end of this presentation. Source: Airline financials. GAAP Non-GAAP1 (in millions, except share and per share amounts) Q2 2025 Q2 2024 Q2 2025 Q2 2024 Operating income $1,135 $1,384 $1,182 $1,384 Pre-tax income $838 $1,028 $869 $1,040 Net income $599 $717 $628 $774 Earnings per common share: Basic $0.91 $1.09 $0.95 $1.18 Diluted $0.91 $1.01 $0.95 $1.09 Weighted average shares outstanding (in thousands): Basic 660,127 656,965 660,127 656,965 Diluted 660,367 720,302 660,367 720,302 9

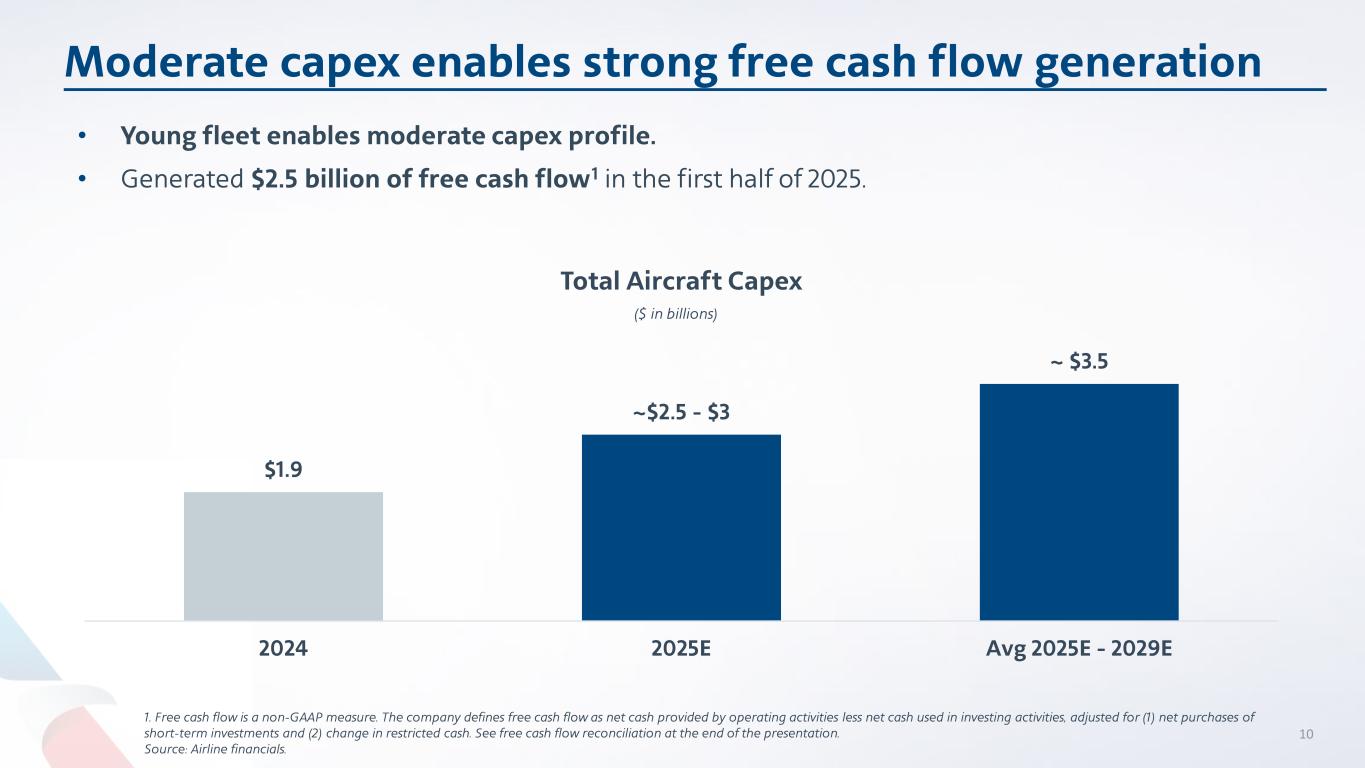

$1.9 ~$2.5 - $3 ~ $3.5 2024 2025E Avg 2025E - 2029E • Young fleet enables moderate capex profile. • Generated $2.5 billion of free cash flow1 in the first half of 2025. Moderate capex enables strong free cash flow generation Total Aircraft Capex ($ in billions) 10 1. Free cash flow is a non-GAAP measure. The company defines free cash flow as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. See free cash flow reconciliation at the end of the presentation. Source: Airline financials.

$39 $38 < $35 YE 2024 Q2 2025 YE 2027E • Ended the second quarter with approximately $29 billion in net debt1. • Cash settled $1 billion 6.5% convertible note on July 1, 2025. • Ongoing commitment to take total debt2 below $35 billion by YE 2027. • Now hold $11 billion in unencumbered assets and have approximately $12 billion of additional first-lien borrowings allowable under existing financing arrangements. Continued progress toward deleveraging goals 11 Total Debt2 ($ in billions) Note: Numbers may not recalculate due to rounding. See total debt and net debt reconciliation at the end of the presentation. 1. Net debt is defined as total debt net of unrestricted cash and short-term investments. 2. Total debt includes debt, finance and operating lease liabilities and pension obligations. Source: Airline financials.

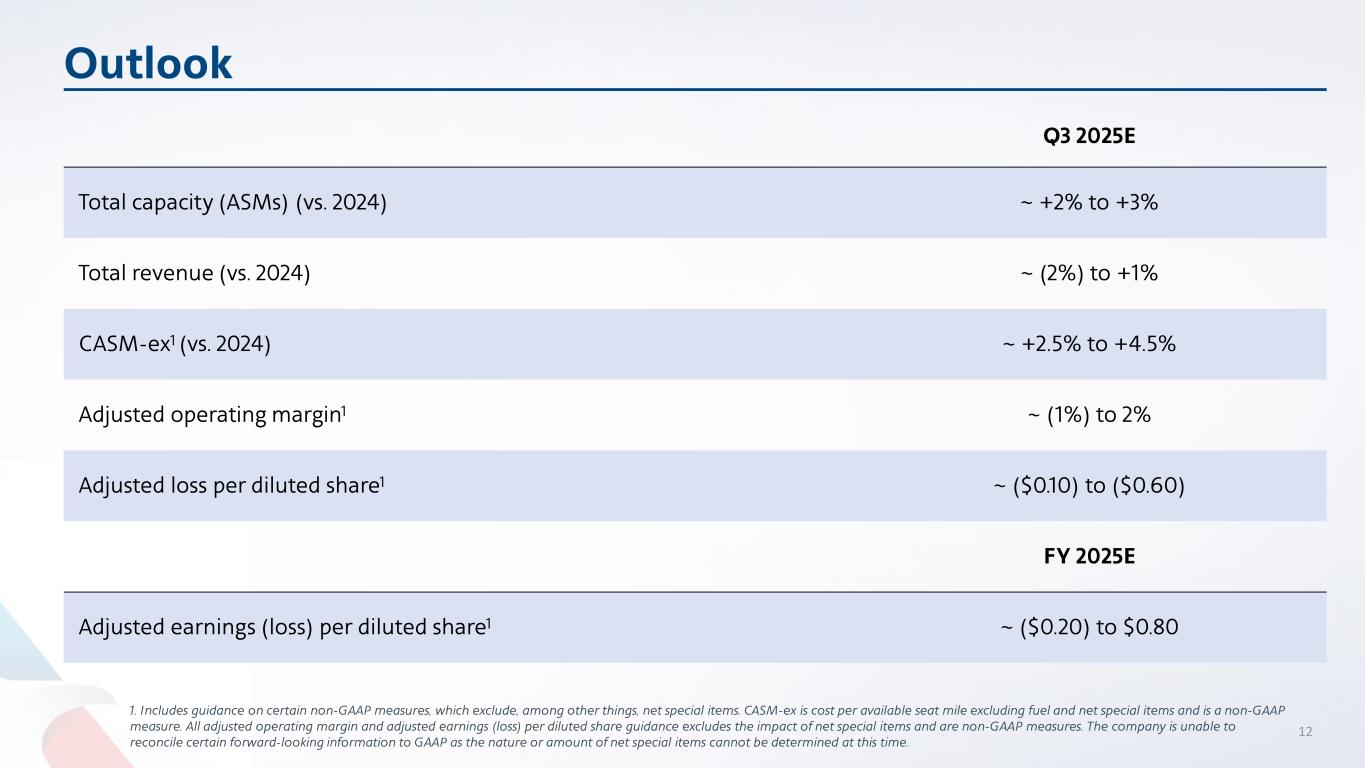

Outlook 1. Includes guidance on certain non-GAAP measures, which exclude, among other things, net special items. CASM-ex is cost per available seat mile excluding fuel and net special items and is a non-GAAP measure. All adjusted operating margin and adjusted earnings (loss) per diluted share guidance excludes the impact of net special items and are non-GAAP measures. The company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. Q3 2025E Total capacity (ASMs) (vs. 2024) ~ +2% to +3% Total revenue (vs. 2024) ~ (2%) to +1% CASM-ex1 (vs. 2024) ~ +2.5% to +4.5% Adjusted operating margin1 ~ (1%) to 2% Adjusted loss per diluted share1 ~ ($0.10) to ($0.60) FY 2025E Adjusted earnings (loss) per diluted share1 ~ ($0.20) to $0.80 12

Update photos Thank you, #AATeam!

GAAP to non-GAAP reconciliation Reconciliation of GAAP Financial Information to Non-GAAP Financial Information American Airlines Group Inc. (the Company) sometimes uses financial measures that are derived from the condensed consolidated financial statements but that are not presented in accordance with GAAP to understand and evaluate its current operating performance and to allow for period-to-period comparisons. The Company believes these non-GAAP financial measures may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. The Company is providing a reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis. The tables below present the reconciliations of the following GAAP measures to their non-GAAP measures: - Operating Income (GAAP measure) to Operating Income Excluding Net Special Items (non-GAAP measure) - Operating Margin (GAAP measure) to Operating Margin Excluding Net Special Items (non-GAAP measure) - Pre-Tax Income (GAAP measure) to Pre-Tax Income Excluding Net Special Items (non-GAAP measure) - Pre-Tax Margin (GAAP measure) to Pre-Tax Margin Excluding Net Special Items (non-GAAP measure) - Net Income (GAAP measure) to Net Income Excluding Net Special Items (non-GAAP measure) - Basic and Diluted Earnings Per Share (GAAP measure) to Basic and Diluted Earnings Per Share Excluding Net Special Items (non-GAAP measure) Management uses these non-GAAP financial measures to evaluate the Company's current operating performance and to allow for period-to-period comparisons. As net special items may vary from period-to-period in nature and amount, the adjustment to exclude net special items provides management with an additional tool to understand the Company’s core operating performance. Additionally, the tables below present the reconciliations of total operating costs (GAAP measure) to total operating costs excluding net special items and fuel (non- GAAP measure) and total operating costs per available seat mile (CASM) to CASM excluding net special items and fuel. Management uses total operating costs excluding net special items and fuel and CASM excluding net special items and fuel to evaluate the Company's current operating performance and for period-to-period comparisons. The price of fuel, over which the Company has no control, impacts the comparability of period-to-period financial performance. The adjustment to exclude fuel and net special items provides management with an additional tool to understand and analyze the Company’s non-fuel costs and core operating performance. 14

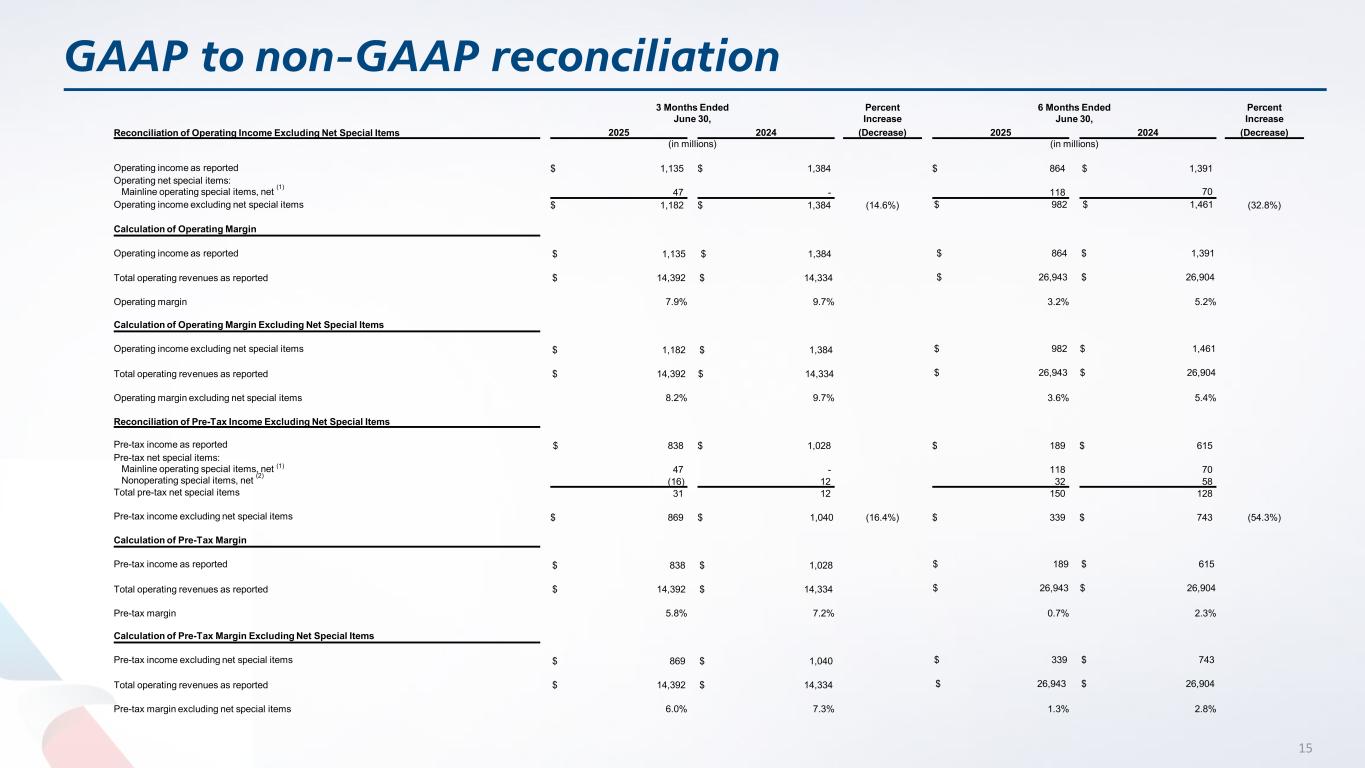

GAAP to non-GAAP reconciliation Reconciliation of Operating Income Excluding Net Special Items 3 Months Ended June 30, Percent Increase 6 Months Ended June 30, Percent Increase 2025 2024 (Decrease) 2025 2024 (Decrease) (in millions) (in millions) Operating income as reported $ 1,135 $ 1,384 $ 864 $ 1,391 Operating net special items: Mainline operating special items, net (1) 47 - 118 70 Operating income excluding net special items $ 1,182 $ 1,384 (14.6%) $ 982 $ 1,461 (32.8%) Calculation of Operating Margin Operating income as reported $ 1,135 $ 1,384 $ 864 $ 1,391 Total operating revenues as reported $ 14,392 $ 14,334 $ 26,943 $ 26,904 Operating margin 7.9% 9.7% 3.2% 5.2% Calculation of Operating Margin Excluding Net Special Items Operating income excluding net special items $ 1,182 $ 1,384 $ 982 $ 1,461 Total operating revenues as reported $ 14,392 $ 14,334 $ 26,943 $ 26,904 Operating margin excluding net special items 8.2% 9.7% 3.6% 5.4% Reconciliation of Pre-Tax Income Excluding Net Special Items Pre-tax income as reported $ 838 $ 1,028 $ 189 $ 615 Pre-tax net special items: Mainline operating special items, net (1) 47 - 118 70 Nonoperating special items, net (2) (16) 12 32 58 Total pre-tax net special items 31 12 150 128 Pre-tax income excluding net special items $ 869 $ 1,040 (16.4%) $ 339 $ 743 (54.3%) Calculation of Pre-Tax Margin Pre-tax income as reported $ 838 $ 1,028 $ 189 $ 615 Total operating revenues as reported $ 14,392 $ 14,334 $ 26,943 $ 26,904 Pre-tax margin 5.8% 7.2% 0.7% 2.3% Calculation of Pre-Tax Margin Excluding Net Special Items Pre-tax income excluding net special items $ 869 $ 1,040 $ 339 $ 743 Total operating revenues as reported $ 14,392 $ 14,334 $ 26,943 $ 26,904 Pre-tax margin excluding net special items 6.0% 7.3% 1.3% 2.8% 15

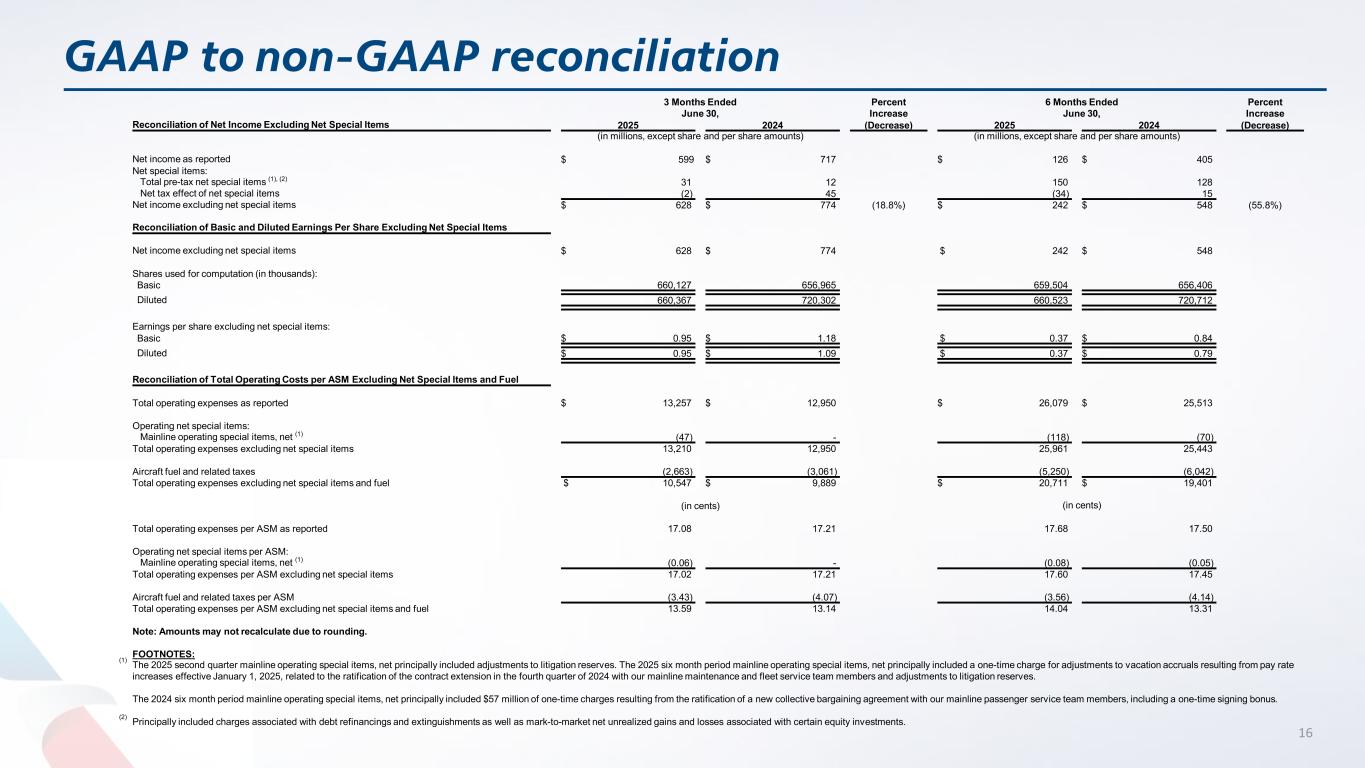

GAAP to non-GAAP reconciliation 3 Months Ended June 30, Percent Increase 6 Months Ended June 30, Percent Increase Reconciliation of Net Income Excluding Net Special Items 2025 2024 (Decrease) 2025 2024 (Decrease) (in millions, except share and per share amounts) (in millions, except share and per share amounts) Net income as reported $ 599 $ 717 $ 126 $ 405 Net special items: Total pre-tax net special items (1), (2) 31 12 150 128 Net tax effect of net special items (2) 45 (34) 15 Net income excluding net special items $ 628 $ 774 (18.8%) $ 242 $ 548 (55.8%) Reconciliation of Basic and Diluted Earnings Per Share Excluding Net Special Items Net income excluding net special items $ 628 $ 774 $ 242 $ 548 Shares used for computation (in thousands): Basic 660,127 656,965 659,504 656,406 Diluted 660,367 720,302 660,523 720,712 Earnings per share excluding net special items: Basic $ 0.95 $ 1.18 $ 0.37 $ 0.84 Diluted $ 0.95 $ 1.09 $ 0.37 $ 0.79 Reconciliation of Total Operating Costs per ASM Excluding Net Special Items and Fuel Total operating expenses as reported $ 13,257 $ 12,950 $ 26,079 $ 25,513 Operating net special items: Mainline operating special items, net (1) (47) - (118) (70) Total operating expenses excluding net special items 13,210 12,950 25,961 25,443 Aircraft fuel and related taxes (2,663) (3,061) (5,250) (6,042) Total operating expenses excluding net special items and fuel $ 10,547 $ 9,889 $ 20,711 $ 19,401 (in cents) (in cents) Total operating expenses per ASM as reported 17.08 17.21 17.68 17.50 Operating net special items per ASM: Mainline operating special items, net (1) (0.06) - (0.08) (0.05) Total operating expenses per ASM excluding net special items 17.02 17.21 17.60 17.45 Aircraft fuel and related taxes per ASM (3.43) (4.07) (3.56) (4.14) Total operating expenses per ASM excluding net special items and fuel 13.59 13.14 14.04 13.31 Note: Amounts may not recalculate due to rounding. FOOTNOTES: (1) The 2025 second quarter mainline operating special items, net principally included adjustments to litigation reserves. The 2025 six month period mainline operating special items, net principally included a one-time charge for adjustments to vacation accruals resulting from pay rate increases effective January 1, 2025, related to the ratification of the contract extension in the fourth quarter of 2024 with our mainline maintenance and fleet service team members and adjustments to litigation reserves. The 2024 six month period mainline operating special items, net principally included $57 million of one-time charges resulting from the ratification of a new collective bargaining agreement with our mainline passenger service team members, including a one-time signing bonus. (2) Principally included charges associated with debt refinancings and extinguishments as well as mark-to-market net unrealized gains and losses associated with certain equity investments. 16

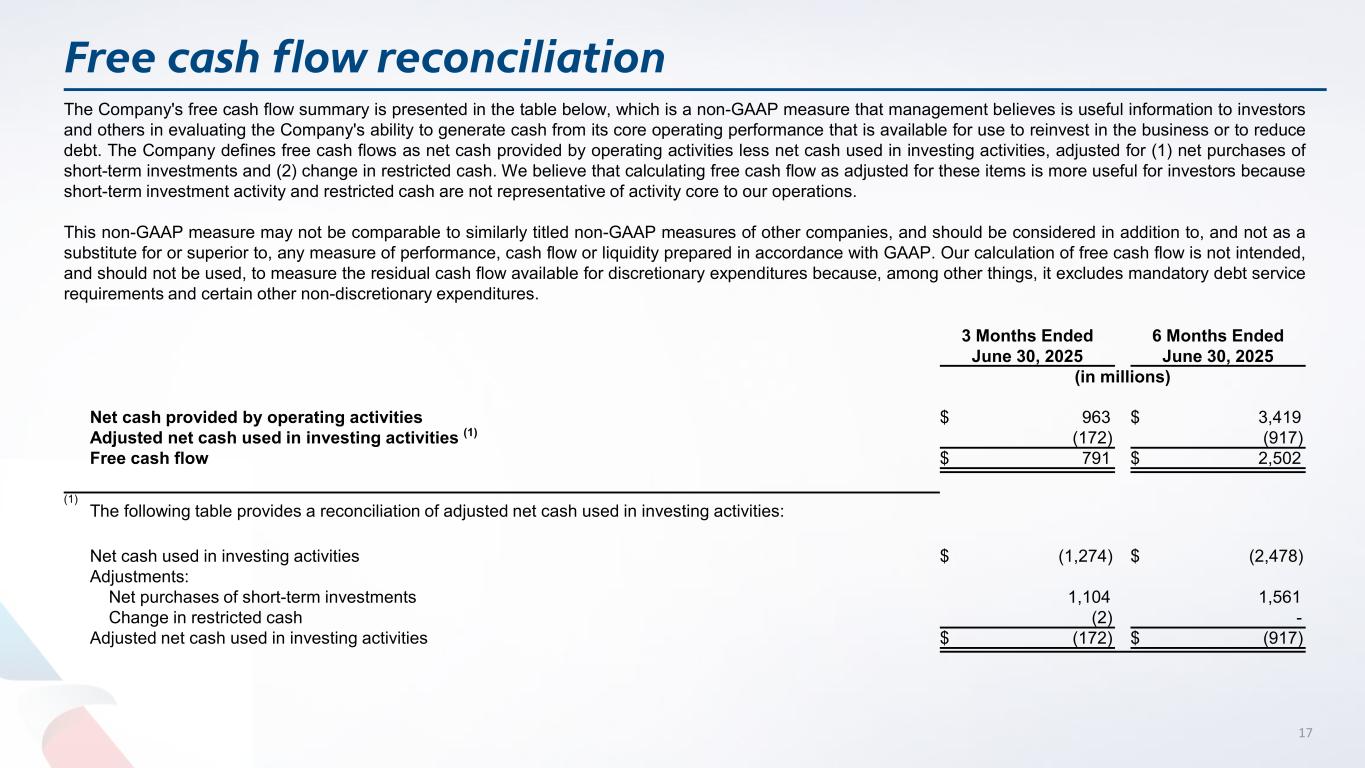

Free cash flow reconciliation The Company's free cash flow summary is presented in the table below, which is a non-GAAP measure that management believes is useful information to investors and others in evaluating the Company's ability to generate cash from its core operating performance that is available for use to reinvest in the business or to reduce debt. The Company defines free cash flows as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. We believe that calculating free cash flow as adjusted for these items is more useful for investors because short-term investment activity and restricted cash are not representative of activity core to our operations. This non-GAAP measure may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Our calculation of free cash flow is not intended, and should not be used, to measure the residual cash flow available for discretionary expenditures because, among other things, it excludes mandatory debt service requirements and certain other non-discretionary expenditures. 3 Months Ended June 30, 2025 6 Months Ended June 30, 2025 (in millions) Net cash provided by operating activities $ 963 $ 3,419 Adjusted net cash used in investing activities (1) (172) (917) Free cash flow $ 791 $ 2,502 (1) The following table provides a reconciliation of adjusted net cash used in investing activities: Net cash used in investing activities $ (1,274) $ (2,478) Adjustments: Net purchases of short-term investments 1,104 1,561 Change in restricted cash (2) - Adjusted net cash used in investing activities $ (172) $ (917) 17

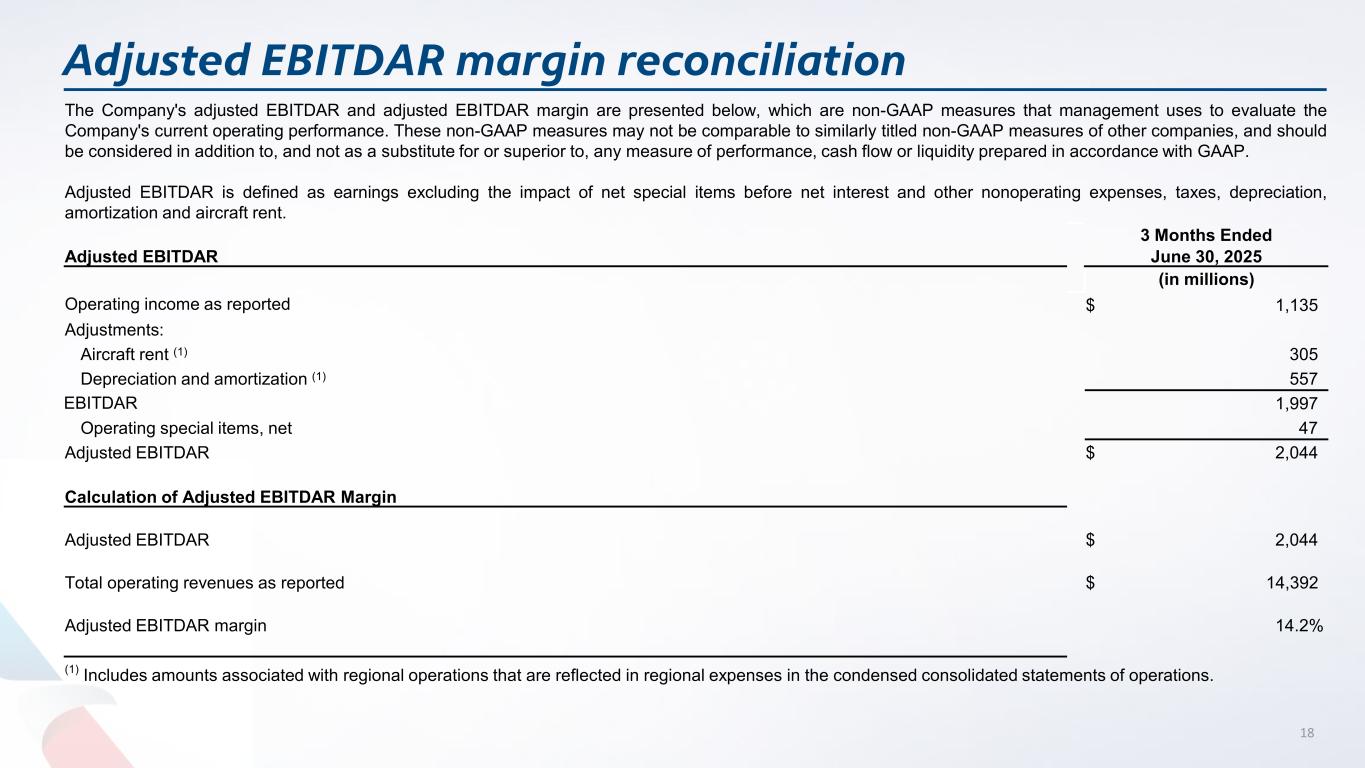

Adjusted EBITDAR margin reconciliation The Company's adjusted EBITDAR and adjusted EBITDAR margin are presented below, which are non-GAAP measures that management uses to evaluate the Company's current operating performance. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Adjusted EBITDAR is defined as earnings excluding the impact of net special items before net interest and other nonoperating expenses, taxes, depreciation, amortization and aircraft rent. 3 Months Ended Adjusted EBITDAR June 30, 2025 (in millions) Operating income as reported $ 1,135 Adjustments: Aircraft rent (1) 305 Depreciation and amortization (1) 557 EBITDAR 1,997 Operating special items, net 47 Adjusted EBITDAR $ 2,044 Calculation of Adjusted EBITDAR Margin Adjusted EBITDAR $ 2,044 Total operating revenues as reported $ 14,392 Adjusted EBITDAR margin 14.2% (1) Includes amounts associated with regional operations that are reflected in regional expenses in the condensed consolidated statements of operations. 18

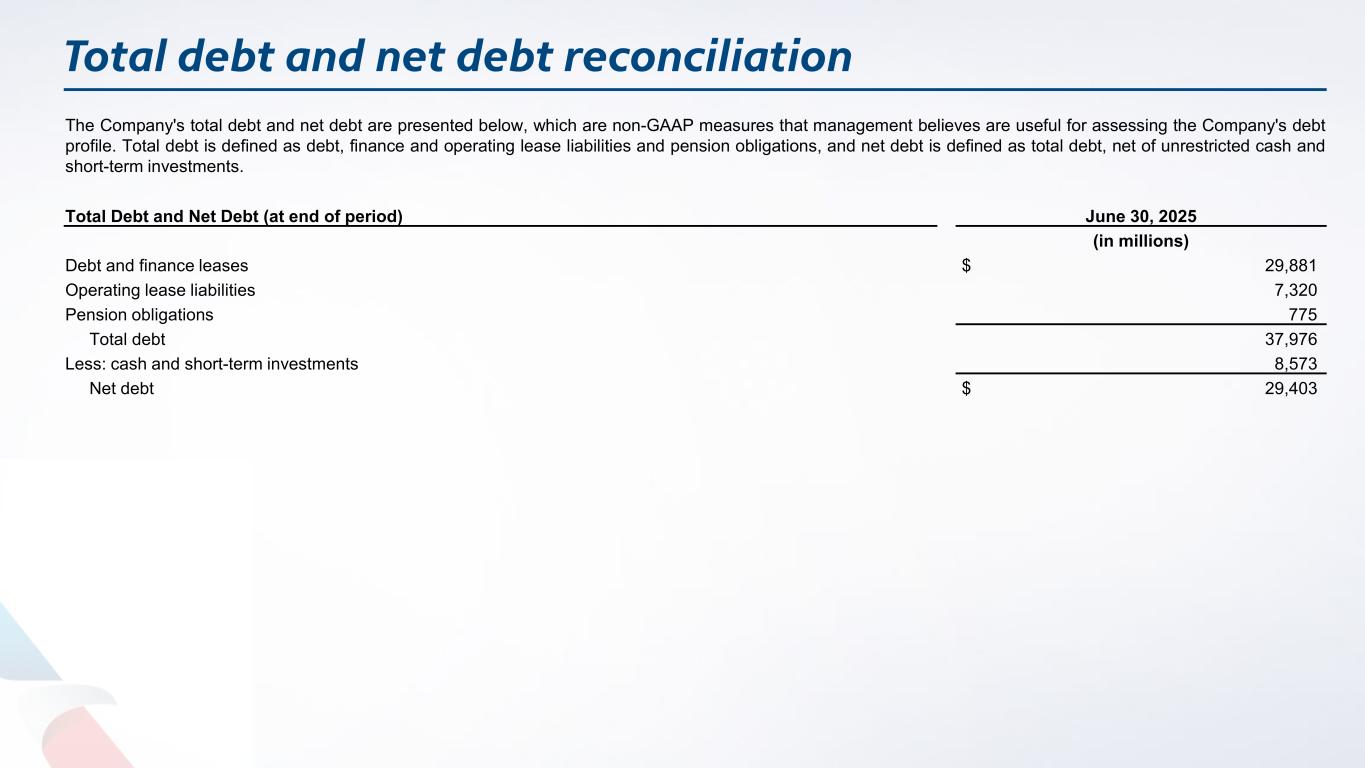

Total debt and net debt reconciliation The Company's total debt and net debt are presented below, which are non-GAAP measures that management believes are useful for assessing the Company's debt profile. Total debt is defined as debt, finance and operating lease liabilities and pension obligations, and net debt is defined as total debt, net of unrestricted cash and short-term investments. Total Debt and Net Debt (at end of period) June 30, 2025 (in millions) Debt and finance leases $ 29,881 Operating lease liabilities 7,320 Pension obligations 775 Total debt 37,976 Less: cash and short-term investments 8,573 Net debt $ 29,403