Exhibit 10.1 GLOBAL PERFORMANCE SHARE AWARD AGREEMENT UNDER THE ENERPAC TOOL GROUP 2017 OMNIBUS INCENTIVE PLAN (as amended and restated November 9, 2020) (Executive Grant) This Global Performance Share Award Agreement (the “PSA Agreement”) between Enerpac Tool Group Corp., a Wisconsin corporation (the “Company”) and “________________” (the “Grantee”) is effective as of the date set forth in the Plan’s online administrative system. The Company and the Grantee shall collectively be referred to as the “Parties” and individually as a “Party.” The Company and the Grantee hereby agree as follows: 1. Performance Share Award Grant. The Company hereby grants to the Grantee an award of Performance Shares (the “Award”) under the Enerpac Tool Group 2017 Omnibus Incentive Plan (the “Plan”). The Award entitles the Grantee to payment in the form of shares of Common Stock following the attainment of certain Performance Objectives (as defined in Paragraph 4 below) and subject to satisfaction of certain employment requirements set forth below. Performance Shares Awarded under this PSA Agreement are forfeitable until they are both earned and vested in accordance with this PSA Agreement. The period of time during which the Performance Shares Awarded are forfeitable (because they are not both earned and vested) is referred to as the “Restricted Period”. Performance Shares shall become vested if the Grantee remains continuously employed for the entire Performance Period set forth in the Plan’s online administrative system (at the conclusion of the current and two subsequent fiscal reporting years) (the “Performance Period”). A grant price of US “____”, reflecting the Company’s stock price at the close of trading on “____________”, was used to determine the number of Performance Awards granted related to the TSR performance award. The date of grant of this Award, “___________”, and the target number of Performance Shares subject to this Award (the “Target Award”) are provided on the Plan’s online administrative system, but the actual number of shares of Common Stock to be issued under the Award will be determined as described below in this PSA Agreement. After the end of the Performance Period, the Compensation Committee of the Board of Directors of the Company (the “Committee”) will review the Performance Objectives and determine the actual numbers of shares of Common Stock which the Grantee has earned under this PSA Agreement. No stock certificates will be issued with respect to any Award of Performance Shares until the date set forth in Paragraph 6, if applicable. The Performance Shares are granted under and are subject to the terms of the Plan and this PSA Agreement, including any additional terms and conditions set forth in the appendices attached hereto. In the event of any conflict between any provisions of this PSA Agreement and the provisions of the Plan, the provisions of the Plan shall control. Terms defined in the Plan where used herein shall have the meanings as so defined. The Grantee hereby acknowledges receipt of a copy of the Plan. 2. Definition: Total Shareholder Return (TSR) Performance. “TSR Performance” shall mean the change in the value of the Company’s Common Stock over the Performance Period relative to the change in value of common stock of the Company’s Peer Companies (as defined below) over the

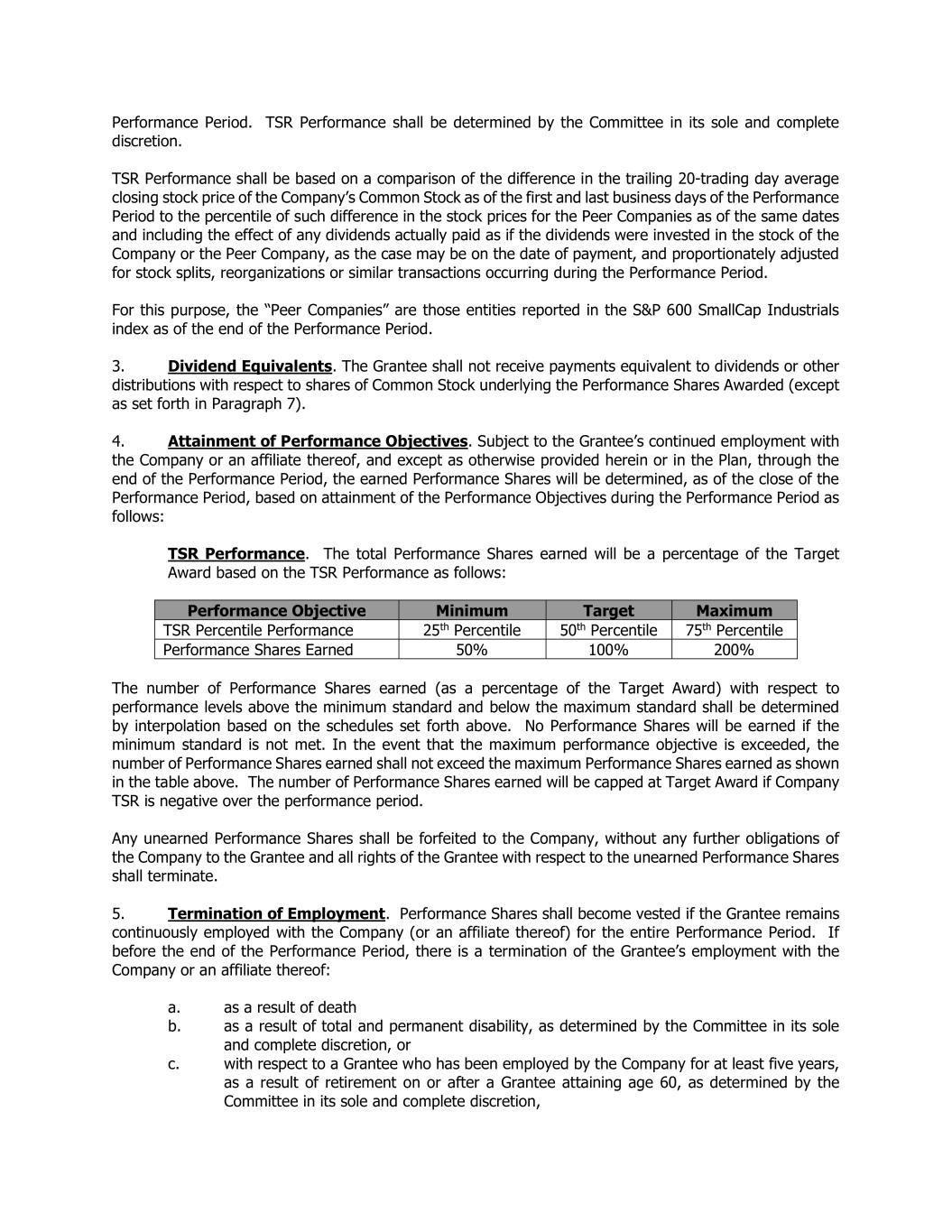

Performance Period. TSR Performance shall be determined by the Committee in its sole and complete discretion. TSR Performance shall be based on a comparison of the difference in the trailing 20-trading day average closing stock price of the Company’s Common Stock as of the first and last business days of the Performance Period to the percentile of such difference in the stock prices for the Peer Companies as of the same dates and including the effect of any dividends actually paid as if the dividends were invested in the stock of the Company or the Peer Company, as the case may be on the date of payment, and proportionately adjusted for stock splits, reorganizations or similar transactions occurring during the Performance Period. For this purpose, the “Peer Companies” are those entities reported in the S&P 600 SmallCap Industrials index as of the end of the Performance Period. 3. Dividend Equivalents. The Grantee shall not receive payments equivalent to dividends or other distributions with respect to shares of Common Stock underlying the Performance Shares Awarded (except as set forth in Paragraph 7). 4. Attainment of Performance Objectives. Subject to the Grantee’s continued employment with the Company or an affiliate thereof, and except as otherwise provided herein or in the Plan, through the end of the Performance Period, the earned Performance Shares will be determined, as of the close of the Performance Period, based on attainment of the Performance Objectives during the Performance Period as follows: TSR Performance. The total Performance Shares earned will be a percentage of the Target Award based on the TSR Performance as follows: Performance Objective Minimum Target Maximum TSR Percentile Performance 25th Percentile 50th Percentile 75th Percentile Performance Shares Earned 50% 100% 200% The number of Performance Shares earned (as a percentage of the Target Award) with respect to performance levels above the minimum standard and below the maximum standard shall be determined by interpolation based on the schedules set forth above. No Performance Shares will be earned if the minimum standard is not met. In the event that the maximum performance objective is exceeded, the number of Performance Shares earned shall not exceed the maximum Performance Shares earned as shown in the table above. The number of Performance Shares earned will be capped at Target Award if Company TSR is negative over the performance period. Any unearned Performance Shares shall be forfeited to the Company, without any further obligations of the Company to the Grantee and all rights of the Grantee with respect to the unearned Performance Shares shall terminate. 5. Termination of Employment. Performance Shares shall become vested if the Grantee remains continuously employed with the Company (or an affiliate thereof) for the entire Performance Period. If before the end of the Performance Period, there is a termination of the Grantee’s employment with the Company or an affiliate thereof: a. as a result of death b. as a result of total and permanent disability, as determined by the Committee in its sole and complete discretion, or c. with respect to a Grantee who has been employed by the Company for at least five years, as a result of retirement on or after a Grantee attaining age 60, as determined by the Committee in its sole and complete discretion,

then the Grantee shall vest in and be entitled to receive the issuance of a pro rata portion of the Award that would have otherwise been payable under Paragraph 4 at the end of the Performance Period (and based on the actual achievement of Performance Objectives for the entire Performance Period); such prorated portion to be based on the number of whole months that the Grantee was employed with the Company (or an affiliate thereof) during the Performance Period divided by the number of whole months in the Performance Period. For the avoidance of doubt, if, in the case of the events described in a., b., or c., above, the Performance Objectives are not met as of the end of the Performance Period, all Performance Shares shall be considered unearned and shall be forfeited to the Company, without any further obligations of the Company to the Grantee (and all rights of the Grantee with respect to the unearned Performance Shares Awarded shall terminate). The issuance of Performance Shares pursuant to such prorated Award will be made at the end of the Performance Period (determined based on the actual achievement of the Performance Objectives for the entire Performance Period) and will be made in accordance with the general payment and timing provisions in Paragraph 6. The portion of the Award not earned, vested and issued to the Grantee pursuant to this PSA Agreement shall be deemed forfeited by the Grantee, unless otherwise determined by the Committee. 6. Distribution of Shares and Tax Withholding. Performance Shares that are both earned and vested pursuant to this PSA Agreement will be distributed to the Grantee as soon as practicable following the conclusion of the Restricted Period, and in any event, no later than 2½ months after the end of the Restricted Period. Notwithstanding the foregoing, the distribution described in the previous sentence may occur after the applicable 2½ month period if the Company reasonably anticipates that making the payment by the end of the applicable 2½ month period would have violated Federal securities laws or other Applicable Laws, in which case, the distribution shall be made as soon as reasonably practicable following the first date on which the Company anticipates or reasonably should anticipate that making the payment would not cause such violation. For the purposes of the previous sentence, a distribution that would cause inclusion in gross income or the application of any penalty provision or other provision of the Code is not treated as a violation of Applicable Laws. If withholding of taxes is not required, none will be taken. If withholding is required, in satisfaction of any withholding obligations under federal, state or local tax laws, the Company may: (i) require the Grantee to pay to the Company in cash the entire amount or any portion of any taxes which the Company is required to withhold, or (ii) require the Grantee to authorize any properly authorized third-party to sell the number of shares of Common Stock that are the subject of the Performance Shares awarded having a Fair Market Value equal to the sums required to be withheld, along with any related expenses, and to remit the proceeds thereof to the Company for payment of the taxes which the Company is required to withhold with respect to the Performance Shares awarded, or (iii) reduce the number of shares of Common Stock distributed to the Grantee by the number of shares of Common Stock underlying the Performance Shares awarded having Fair Market Value equal to the sums required to be withheld for the payment of the taxes which the Company is required to withhold with respect to the Performance Shares awarded. For purposes of administrative ease, the number of shares of Common Stock withheld or sold may be rounded up or down to the nearest whole share. The Grantee shall be responsible for any taxes relating to the Award not satisfied by the Company’s satisfaction of its withholding obligations. Unless otherwise determined by the Company, the Grantee shall be entitled to elect, in accordance with procedures determined by the Company, the method of satisfying his or her withholding obligations, and, in the event no such election is properly made, the Company shall require the shares to be withheld using the method described in (iii) above. 7. No Rights as a Stockholder. Without limiting the foregoing, including Paragraph 3, the Grantee shall have no rights as a stockholder of the Company in respect to the Award, including the right to vote or receive dividends, unless and until shares of Common Stock earned pursuant to the Award have been issued to the Grantee, and recorded on the stock records of the Company.

8. No Rights To Continued Employment. Neither the Plan nor this PSA Agreement nor the Award shall confer upon the Grantee any right with respect to continuance of employment by the Company, nor shall they interfere in any way with the right of the Company to terminate the Grantee’s employment at any time. 9. Change in Control. If a Change in Control (as defined in the Plan) of the Company occurs after the date of grant and before the end of the Performance Period, any Performance Shares, which, by their terms, were not vested in full prior to the date of such Change in Control shall become immediately vested and nonforfeitable consistent with and in accordance with the terms of the Plan, including to the extent consistent with the terms of the Plan: (a) upon the Change in Control to the extent the Performance Shares are not continued in effect, assumed or substituted with an equivalent Award by the successor corporation or a parent or subsidiary of the successor corporation; or (b) to the extent the Performance Shares continue in effect, are assumed or are substituted with an equivalent Award by the successor corporation or a parent or subsidiary of the successor corporation, upon the date the surviving or successor company terminates the Grantee’s employment or service without Cause upon or within twenty-four (24) months following the Change in Control if such date precedes the end of the Restricted Period. For purposes of determining the extent to which the Performance Objectives have been met in the case of a Change in Control, the Performance Objectives shall be deemed satisfied based upon whichever of (a) or (b) results in the greatest payout: (a) actual performance through the date of the Change in Control; provided that the Committee, in its sole discretion, shall determine the level of achieved performance through the date of the Change in Control and whether, and to what extent, Performance Objectives should be modified to appropriately reflect the truncation of the applicable Performance Period, or (b) the assumption that the “Target” level of the Performance Objectives was achieved. Any issuance of Common Stock pursuant to such determination upon a Change in Control or upon a qualifying termination of employment upon or following a Change in Control under this Paragraph 9 will be made in accordance with the payment and timing provisions of Section 16(a)(iii) or Section 16(b)(iii) of the Plan, whichever is applicable. Definition: Cause means any of the occurrence of any of the following: (i) the Executive’s conviction, or a plea of guilty or no contest, of a felony; (ii) the Executive’s conviction, or a plea of guilty or no contest, of a crime involving dishonesty, disloyalty or fraud; (iii) the Executive reporting to work under the influence of alcohol; (iv) the Executive’s use of illegal drugs (whether or not at the workplace); (v) the Executive’s conviction of, or a plea of guilty or no contest to, conduct in conjunction with the Executive’s duties hereunder which could reasonably be expected to, or which does, cause, in the good faith determination of the Board, the Company or any of its affiliates public disgrace or disrepute or economic harm; (vi) the Executive’s repeated failure to perform duties as reasonably directed by the Board (or the person to whom the Executive directly reports); (vii) the Executive’s gross negligence or willful misconduct with respect to the Company; (viii) the Executive obtaining any personal profit not thoroughly disclosed to and approved in writing by the Board (or the person to whom the Executive directly reports) in connection with any transaction entered into by, or on behalf of, the Company or its affiliates; (ix) the Executive’s violation of any of the terms of the Company’s established policies which is not cured to the Board’s reasonable satisfaction within twenty (20) working days after the Executive receives written notice thereof; (x) an Executive’s unauthorized use or disclosure of any confidential or proprietary information of the Company; or (xi) the willful failure of an Executive to cooperate in a Company investigation. 10. Special Rule for Certain Corporate Executives. In the case of a corporate executive who (a) voluntarily terminates employment after eight years with the Company, (b) provides at least one year’s advance notice to the Committee of such termination and has such termination accepted by the Committee, (c) in fact remains an employee for such period, (d) terminates his or her employment at the end of the agreed-upon period, and (e) will attain age 60 as of or before the end of the one year period described in

(b), the Committee, in its complete discretion, may determine the treatment of the Award, including the extent to which the Performance Objectives will be deemed to have been satisfied and the Award deemed to be earned and vested in accordance with the general payment and timing provisions. Any issuance of Performance Shares pursuant to such determination will be made in accordance with the general payment and timing provisions in Paragraph 6. 11. Compensation Recovery. The Grantee’s rights with respect to this PSA Agreement and the Award (including any shares of Common Stock or other cash or property received by or on behalf of the Grantee with respect to the Award) will be subject to reduction, cancellation, forfeiture, recoupment, reimbursement, or reacquisition under the Company’s Recoupment Policy, as may be amended from time to time (“Recoupment Policy”), whether or not such policy is mandated by Applicable Law, or as may be necessary to comply with Applicable Laws, rules, regulations or stock exchange listing standards. For example (but not by way of limitation), the Grantee might be required to repay to the Company part or all of the shares of Common Stock (if any) that the Grantee receives under this PSA Agreement and to forfeit some or all of the Award at no cost to the Company. Further, if the Grantee receives any amount in excess of the amount the Grantee should have received under the terms of this PSA Agreement for any reason (including without limitation by reason of a financial restatement, mistake in calculations or administrative error), all as determined by the Committee, then the Grantee shall be required to promptly repay any such excess amount to the Company. No recovery of compensation under the Recoupment Policy or to comply with Applicable Laws, rules regulations or stock exchange listing standards will constitute “good reason” or “constructive termination” (or similar term) for the Grantee’s resignation under any agreement with the Company or any Affiliate. To satisfy any recoupment obligation arising under the Recoupment Policy or recovery policy of the Company or otherwise under Applicable Laws, rules, regulations or stock exchange listing standards, among other things, the Grantee expressly and explicitly authorizes the Company to issue instructions, on the Grantee's behalf, to any brokerage firm or stock plan service provider engaged by the Company to hold any shares of Common Stock or other amounts acquired pursuant to the Award to re-convey, transfer or otherwise return the shares of Common Stock and/or other amounts to the Company upon the Company’s enforcement of the Recoupment Policy or recovery policy. 12. Code Section 409A. This PSA Agreement is intended to comply with, or otherwise be exempt from, Code Section 409A. This PSA Agreement shall be administered, interpreted, and construed in a manner consistent with Code Section 409A or an exemption therefrom. Should any provision of this PSA Agreement be found not to comply with, or otherwise be exempt from, the provisions of Code Section 409A, such provision shall be modified and given effect (retroactively if necessary), in the sole discretion of the Committee, and without the consent of the Grantee, in such manner as the Committee determines to be necessary or appropriate to comply with, or to effectuate an exemption from, Code Section 409A. If any of the payments under this PSA Agreement are subject to Code Section 409A and the Company determines that the Employee is a “specified employee” under Code Section 409A at the time of the Employee’s separation from service, then each such payment will not be made or commence until the date which is the first day of the seventh month after the Employee’s separation from service, and any payments that otherwise would have been paid during the first six months after the Employee’s separation from service will be paid in a lump sum on the first day of the seventh month after the Employee’s separation from service or upon the Employee’s death, if earlier. Such deferral will be affected only to the extent required to avoid adverse tax treatment to the Employee under Code Section 409A. 13. Transferability of Award. The Award and, prior to issuance, the Performance Shares may not be transferred or encumbered by the Grantee, except by will or the laws of descent and distribution, or pursuant to a qualified domestic relations order. 14. Prohibition Against Pledge, Attachment, etc. Except as otherwise herein provided, this

Award and any rights and privileges pertaining thereto shall not be transferred, assigned, pledged or hypothecated by the Grantee in any way, whether by operation of law or otherwise, and shall not be subject to execution, attachment or similar process. 15. Notices. Any notice to be given to the Company under the terms of this PSA Agreement shall be addressed to the Company in care of its Secretary, and any notice to be given to the Grantee may be addressed to him/her at his/her address as it appears on the Company's records, or at such other address as either party may hereafter designate in writing to the other. Any such notice shall be deemed to have been duly given if and when enclosed in a properly sealed envelope addressed as aforesaid, and deposited, postage prepaid, in the United States mail or sent via electronic means (fax or e-mail). 16. Agreement Barring Unfair Activities. As a condition of participating in the Plan pursuant to the terms of this PSA Agreement, the Grantee agrees to comply with the terms of the “Stock Award Agreement Barring Unfair Activities” attached to this PSA Agreement as Appendix A. The Grantee understands that the Grantee’s employment or continued employment with the Company is not contingent upon entering into this PSA Agreement or participation in the Plan and the Grantee has voluntarily elected to enter into this PSA Agreement and participate in the Plan pursuant to the terms and conditions of this PSA Agreement including, but not limited to, agreeing to the terms and conditions of the “Stock Award Agreement Barring Unfair Activities.” 17. Country-Specific Appendix. If the Grantee is subject to the laws in a jurisdiction reflected in Appendix B attached hereto, this Award shall be subject to such terms and conditions set forth in Appendix B, or as may later become applicable, as described herein. If the Grantee becomes subject to the laws of a jurisdiction to which Appendix B applies, the terms and conditions for such jurisdiction will apply to this Award to the extent the Committee or its delegate determines that the application of such terms and conditions is necessary or advisable to comply with Applicable Laws or to facilitate the administration of the Plan. Appendix B shall be considered a part of this PSU Agreement. 18. Applicable Law and Venue. This award has been granted in Wisconsin, U.S.A. This Award and this PSA Agreement, including its Appendix A and Appendix B, shall be governed by and construed in accordance with the internal laws of the State of Wisconsin. Any dispute between the Parties arising out of or related to the terms of this PSA Agreement shall be heard only by the Circuit Court for Waukesha County, Wisconsin, or by the United States District Court for the Eastern District of Wisconsin; and the Parties hereby consent to these courts as the exclusive venues for resolving any such disputes. 19. Entire Agreement. This PSA Agreement, including its Appendix A and Appendix B, constitutes the entire agreement and understanding between the Company and the Grantee concerning the subject matter addressed herein and supersedes and extinguishes any and all other or previous discussions, agreements, or understandings between the Parties regarding the subject matter herein. 20. Acknowledgment. The Grantee is hereby advised to consult with the Grantee’s own legal counsel, and the Grantee acknowledges that the Grantee has had an opportunity to do so before signing. The Grantee acknowledges that by signing below, the Grantee is bound by the terms of this PSA Agreement. Accepted as of the date of grant in accordance with, and subject to, the above terms and conditions of this PSA Agreement and of the Plan document, a copy of which has been received by the Grantee.

GRANTEE ______________________________ #ParticipantName#

APPENDIX A Stock Award Agreement Barring Unfair Activities This Stock Award Agreement Barring Unfair Activities (“Agreement”) is Appendix A to the Performance Share Award Agreement under the Enerpac Tool Group 2017 Omnibus Incentive Plan (the “PSA Agreement”) between Enerpac Tool Group Corp., a Wisconsin corporation (“Company”), and “______________” (“Grantee”). Company and Grantee shall collectively be referred to as the “Parties” and individually as a “Party.” WHEREAS, Grantee wishes to participate in the PSA Agreement by Enerpac Tool Group Corp., a Wisconsin Corporation; and WHEREAS, Grantee’s participation in the PSA Agreement is conditioned on entering into this Agreement; and WHEREAS, Grantee has been informed and Grantee understands that Grantee’s employment or continued employment with Company is not contingent on participation in the PSA Agreement and Grantee has voluntarily elected to participate in the PSA Agreement pursuant to the terms and conditions of the PSA Agreement including, but not limited to, agreeing to the terms and conditions of this Agreement; and WHEREAS, Grantee acknowledges that Company has protectable legitimate business interests in preventing the unauthorized acquisition, disclosure and use of its Confidential Information and Trade Secrets, as well as in protecting its existing and specific prospective customer relationships, associate relationships, productive and competent workforce, specialized training, and business goodwill and reputation, and that this Agreement is for the protection of these protectable interests; NOW, THEREFORE, in consideration of the foregoing recitals, Grantee’s participation in the PSA Agreement, and the promises and covenants set forth herein, and for other good and valuable consideration, the existence and sufficiency of which are hereby acknowledged, the Parties agree as follows: 1. Incorporation of Recitals. The above recitals are incorporated herein as part of this Agreement. 2. Definitions. When used in this Agreement, the following terms have the definition set forth below: (a) “Competing Product” means any product or service that could be used to replace, in whole or in part, a product or service produced, designed, sold, or provided on behalf of Company by Grantee, either individually or as part of a team (or by one or more employees or Company business units managed, supervised or directed by Grantee or receiving executive or management support from Grantee) during the twelve (12) months immediately preceding the Termination Date. (b) “Confidential Information” means information, other than Trade Secrets, whether oral, written, recorded magnetically or electronically, or otherwise stored, and whether originated by Grantee or otherwise coming into the possession or knowledge of Grantee, which is possessed by or developed for Company, which relates to Company’s existing or potential business, which is not reasonably ascertainable by

Company’s competitors or by the general public through lawful means, and which Company treats as confidential. Information that meets the definition above is Confidential Information, regardless of whether it is about Company’s negotiations, agreements, strategies, products, finances, costs, margins, computer programs, research, customers, purchasing, marketing, or other topics. (c) “Current Pending Customer” means a person or entity for which Company is actively preparing a business proposal as of the Termination Date, or which has a pending proposal from Company for goods or services as of the Termination Date. However, the term “Current Pending Customer” is limited to persons or entities concerning which Grantee learns, creates, or reviews Confidential Information or Trade Secrets on behalf of the Company or with which Grantee interacted on behalf of the Company in the three (3) month period immediately preceding the Termination Date. (d) “Key Employee” means any person who is employed or engaged by Company and with or about whom Grantee, as a result of Grantee’s relationship with Company, has developed a relationship or learned information that would assist in soliciting said employee to leave Company’s employment. However, the term “Key Employee” is limited to employees who (i) are in possession of Confidential Information and/or Trade Secrets; (ii) are employed or engaged by Company as a manager, officer, director, or executive of Company; or (iii) were directly managed by or reported to Grantee during the last 12 months prior to the Termination Date. (e) “Key Services” means services of the type performed by a Key Employee for the Company during the final twelve (12) months preceding the Termination Date, but shall not include clerical, menial, or manual labor. (f) “Proprietary Creations” means all inventions, discoveries, designs, improvements, creations, and works conceived, authored, or developed by Grantee, either individually or with others, any time during Grantee’s employment with the Company that: (i) relate to the Company’s current or contemplated business or activities; (ii) relate to the Company’s actual or demonstrably anticipated research or development; (iii) result from any work performed by Grantee for the Company; (iv) involve the use of Company equipment, supplies, facilities, Confidential Information or Trade Secrets; (v) result from or are suggested by any work done by the Company or at the Company’s request, or any projects specifically assigned to Grantee; or (vi) result from Grantee’s access to any Company memoranda, notes, records, drawings, sketches, models, maps, customer lists, research results, data, formulae, specifications, inventions, processes, equipment Confidential Information, Trade Secrets or other materials. (g) “Referral Client” means a person or entity that does not directly purchase products or services from Company, but which has the ability to effectively specify or recommend that others purchase products or services from Company or its competitors. The term Referral Client is limited to persons or entities to or through which Grantee (or one or more individuals or Company business units supervised, managed or directed by Grantee) markets or sells Company products or services during the twelve (12) month period immediately preceding the Termination Date. (h) “Restricted Customer” means a customer of Company that purchases or receives a product or service from Company during the twelve (12) month period immediately preceding the Termination Date, but is limited to customers (i) to which Grantee (or one or more individuals or Company business units supervised, managed, or directed by Grantee) sells or provides products or services on behalf of Company during the twelve (12) month period immediately preceding the Termination Date; (ii) concerning which Grantee learns, creates, or reviews Confidential Information or Trade Secrets

on behalf of Company during the twelve (12) month period immediately preceding the Termination Date; (i) “Restricted Territory” means a county within the United States of America, or a city, town or other municipality within a foreign nation, in which, during the twelve (12) month period immediately preceding the Termination Date, Grantee (or one or more other Company employees or Company business units supervised, managed or directed by or receiving management or executive support from Grantee), on behalf of Company provided, sold, or solicited the sale of products or services; or Company sold or provided products or services that Grantee (or one or more other Company employees or Company business units supervised, managed or directed by or receiving management or executive support from Grantee) designed, developed, tested, or produced, either individually or in collaboration with other Company employees. (j) “Services” means services of the type performed for Company by Grantee (or one or more Company employees managed, supervised, or directed by Grantee) during the final twelve (12) months preceding the Termination Date, but shall not include clerical, menial, or manual labor. (k) “Termination Date” means the last date that Grantee serves as an employee of the Company. (l) “Third Party Confidential Information” means information received by Company from others that Company has an obligation to treat as confidential. (m) “Trade Secret” means a Trade Secret as that term is defined under applicable state or federal law. 3. Duty of Loyalty. Grantee acknowledges that Grantee is a key employee of the Company and owes the Company a fiduciary duty of loyalty. During employment with Company, Grantee shall owe Company an undivided duty of loyalty, and shall take no action adverse to that duty of loyalty. Grantee’s duty of loyalty to Company includes but is not limited to a duty to promptly disclose to Company any information that might cause Company to take or refrain from taking any action, or which otherwise might cause Company to alter its behavior. Without limiting the generality of the foregoing, Grantee shall promptly notify Company at any time that Grantee decides to terminate employment with Company or enter into competition with Company, as Company may decide at such time to limit, suspend, or terminate Grantee’s employment or access to Company’s Confidential Information, Trade Secrets, and/or customer relationships. Grantee’s privileges to access and use Company’s computers, and to access and use Company’s electronically stored information including Company’s Confidential Information and Trade Secrets, are revoked the moment Grantee takes any action adverse to Grantee’s duty of loyalty to Company. The duty of loyalty contained in this Agreement supplements, and does not supplant, duties arising under common law or otherwise. 4. Representation and Disclosure. Grantee represents that Grantee is not bound by an agreement with any previous employer or other third party that, by its terms, could restrict Grantee’s activities such as to prevent Grantee’s employment by Company in the position contemplated. Grantee will show this Agreement to any prospective employer of Grantee, and consents to Company showing this Agreement to any third party believed by Employer to be a prospective or actual employer of Grantee, and to insisting on Grantee’s compliance with the terms of this Agreement. 5. Nondisclosure of Third Party Confidential Information. Other than as required in the course of Company’s business, Grantee shall not use or disclose Third Party Confidential Information for as long as the relevant third party has required Company to maintain its confidentiality, or

for so long as required by applicable law, whichever period is longer. 6. Nondisclosure of Trade Secrets. Grantee shall not use or disclose Company’s Trade Secrets so long as they remain Trade Secrets. Nothing in this Agreement shall limit either Grantee’s statutory or other duties not to use or disclose Company’s Trade Secrets, or Company’s remedies in the event Grantee uses or discloses Company’s Trade Secrets. 7. Obligations Not to Disclose or Use Confidential Information. Except as set forth herein or as expressly authorized in writing on behalf of Company, Grantee agrees that while Grantee is employed by Company and during the two (2) year period commencing at the Termination Date, Grantee will not use or disclose (other than as required in the course of Company’s business) anywhere in the United States (and, if Grantee works in another country, anywhere in that country) any Confidential Information, whether such Confidential Information is in Grantee’s memory or it is set forth electronically, in writing or other form. This prohibition does not prohibit Grantee’s disclosure of information after it ceases to meet the definition of “Confidential Information,” or Grantee’s use of general skills and know-how acquired during and prior to employment by Company, so long as such use does not involve the use or disclosure of Confidential Information; nor does this prohibition restrict Grantee from providing prospective employers with an employment history or description of Grantee’s duties with Company, so long as Grantee does not use or disclose Confidential Information. Notwithstanding the foregoing, with respect to information which is subject to a law governing confidentiality or non-disclosure, Grantee shall keep such information confidential for so long as required by law, or for two (2) years, whichever period is longer. This Paragraph shall not preclude employees within the meaning of the National Labor Relations Act from exercising Section 7 rights they may have to communicate about working conditions. This Paragraph shall not bar Grantee from making disclosures to government entities to the extent required by applicable law or disclosures made in good faith pursuant to applicable “whistleblower” laws or regulations. 8. Return of Property; No Copying or Transfer of Documents. All equipment, books, records, papers, notes, catalogs, compilations of information, data bases, correspondence, recordings, stored data (including but not limited to data or files that exist on any personal computer or other electronic storage device), software, and any physical items, including copies and duplicates, that Grantee generates or develops or which come into Grantee’s possession or control, which relate directly or indirectly to, or are a part of Company’s (or its customers’) business matters, whether of a public nature or not (collectively “Company Records”), shall be and remain the property of Company. Grantee will not copy, duplicate, or otherwise reproduce, or permit copying, duplicating, or reproduction of Company Records without the express written consent of Company, or, as a part of Grantee’s duties performed hereunder for the benefit of Company. Grantee expressly covenants and warrants that, upon termination of Grantee’s employment for any reason (or no reason), and at any time upon Company’s request, Grantee shall promptly deliver to Company any and all originals and copies of Company Records in Grantee’s possession, custody, or control, and that Grantee shall not make, retain, or transfer to any third party any copies thereof. In the event any Confidential Information or Trade Secrets are stored or otherwise kept in or on a computer hard drive or other storage device owned by or otherwise in the possession or control of Grantee (each individually a “Grantee Storage Device”), immediately upon or prior to separation of employment Grantee will present every such Grantee Storage Device to Company for inspection and removal of all information regarding Company or its customers (including but not limited to Confidential Information or Trade Secrets) that is stored on the Grantee Storage Device. Grantee expressly authorizes Company’s designated representatives to access such equipment or devices for this limited purpose and shall provide any passwords, passcodes, or

access codes necessary to accomplish this task. This Paragraph shall not bar Grantee from retaining Grantee’s own payroll, retirement, insurance, tax, and other personnel documents related to Company. 9. Covenants Barring Certain Unfair Activities. Grantee agrees that for the twelve (12) month period immediately following the Termination Date, Grantee shall not do any of the following: (a) sell or solicit the sale of a Competing Product to a Restricted Customer or Current Pending Customer, or through or to a Referral Client, or assist others in doing so; (b) perform Services as part of or in support of providing, selling, or soliciting the sale of a Competing Product to a Restricted Customer or Current Pending Customer or through or to a Referral Client, or assist others in doing so; (c) encourage or cause a Restricted Customer, Current Pending Customer, or Referral Client to curtail, withdraw or cancel any business with Company or assist others in doing so; (d) perform Services for any individual or entity engaged in selling, providing, soliciting the sale of, developing, designing, testing, or producing, Competing Products in the Restricted Territory; (e) perform Services as part of or in support of the business of selling, providing, or soliciting the sale of Competing Products in the Restricted Territory in any capacity in which it is reasonably likely that Grantee would inevitably use or disclose the Company’s Confidential Information or Trade Secrets; (f) perform Services as part of or in support of developing, designing, testing, or producing Competing Products for sale in the Restricted Territory in any capacity in which it is reasonably likely that Grantee would inevitably use or disclose the Company’s Confidential Information or Trade Secrets; (g) perform Services as part of or in support of the business of selling, providing, or soliciting the sale of Competing Products in the Restricted Territory if—and only if—during the one (1) year period immediately preceding the Termination Date, Grantee is involved in sales or sales management, or served as an executive or officer of the Company; (h) perform Services as part of or in support of developing, designing, testing, or producing Competing Products for sale in the Restricted Territory if—and only if—during the one (1) year period immediately preceding the Termination Date, Grantee is involved in product development design, testing, or production, or served as an executive or officer of the Company. 10. Non-Solicitation of Certain Employees. Grantee agrees that for the twelve (12) month period immediately following the Termination Date, Grantee shall not, directly or indirectly, without the prior written consent of Company: (a) encourage, cause, or solicit, or assist others in encouraging, causing, or soliciting, a Key Employee to provide Key Services in competition with Company; or (b) hire or cause or assist another to hire a Key Employee. 11. Proprietary Creations. All Proprietary Creations are the sole and exclusive property of the Company whether patentable or registrable or not, and Grantee assigns all of Grantee’s rights, title, and interest in same to the Company. Further, all Proprietary Creations which are copyrightable shall be considered “work(s) made for hire” as that term is defined by U.S. Copyright Law. If for any reason a U.S. Court of competent jurisdiction determines such Proprietary Creations not to be works made for hire, Grantee will assign all rights, title, and interest in such works to the Company, its successors and assigns, or the Company’s designee, without further compensation and, to the extent permitted by law, Grantee hereby assigns all of Grantee’s rights, title, and interest in such Proprietary Creations to the Company. Grantee

will promptly disclose all Proprietary Creations to the Company and, if requested to do so, provide the Company a written description or copy thereof. Grantee is not required to assign rights to any invention for which no equipment, supplies, facility, or trade secret information of the Company was used and which was developed entirely on Grantee's own time, unless (a) the invention relates (i) to the business of the Company or (ii) to the Company's actual or demonstrably anticipated research or development, or (b) the invention results from any work performed by Grantee for the Company. Grantee has set out below a complete list of all inventions, if any, patented or unpatented, including the numbers of all patents and patent applications filed thereon, and a brief description of all unpatented inventions, which Grantee made prior to the date of Grantee signing this Agreement or any similar agreement with Company, and which are not to be included in this Agreement (“Reserved Inventions”). If any of the listed inventions related to Company research, product fields, processes or business procedures, then Grantee hereby assigns to Company any improvement made upon the listed items during Grantee’s employment and during the period of one (1) year following the Termination Date. List of Reserved Inventions: (if none, leave blank): _________________________________________________________________________ _________________________________________________________________________ 12. Remedies. In addition to other remedies provided by law or equity, the Parties agree that in the event of any breach or threatened breach of this Agreement, Company may obtain interim or other injunctive relief, in addition to any other remedies available, without the need to post a bond. Grantee further agrees that any breach of this Agreement would result in irreparable harm to Company entitling Company to an injunction prohibiting further breaches of these Paragraphs. Any such equitable relief sought or obtained pursuant to this Agreement will not be Company’s exclusive remedy to address Grantee’s breach or threatened breach of the provisions herein, and Company shall be entitled to pursue all remedies available, including but not limited to actual damages, pursuant to applicable law. No claim, demand, action, or cause of action that Grantee may have against Company shall constitute a defense to Company’s enforcement of any of its rights or Grantee’s obligations hereunder by Company or Company’s past, present, or future parents, subsidiaries, or affiliates. The Parties agree that if Grantee breaches this Agreement, Grantee shall pay Company’s reasonable attorney’s fees and costs arising out of any litigation resulting from Grantee’s breach. 13. WAIVER OF JURY TRIAL. THE PARTIES WAIVE, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT THEY MAY HAVE TO A TRIAL BY JURY IN RESPECT TO ANY SUIT, ACTION, OR PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER, OR IN CONNECTION WITH THIS AGREEMENT. 14. At-Will Employment. Neither this Agreement, nor any other understanding between Grantee and Company, creates a contract of employment for a definite term, or otherwise limits the circumstances under which Grantee’s employment may be terminated. Instead, Grantee’s employment with Employer is “at will” and, therefore, may be terminated by either Party at any time, for any lawful reason or no reason, without cause or prior notice. 15. Binding Effect, Successors, and Assigns. This Agreement shall be binding upon Grantee, Grantee’s heirs, executors and administrators, and upon Company, and its successors and assigns, and shall inure to the benefit of and be enforceable by Company and its successors and assigns. This Agreement may not be assigned by Grantee. For the avoidance of doubt, this Agreement, including but not limited to the restrictions in Paragraphs 3-10, shall survive the termination of Grantee’s employment.

16. Assignment. Company may assign its rights under the Agreement to any assignee or successor. Such assignment shall not require the authorization of Grantee. Grantee may not assign or delegate Grantee’s rights or obligations under this Agreement. 17. Waiver. The waiver by any Party of the breach of any covenant or provision in this Agreement shall not operate or be construed as a waiver of any subsequent breach by any Party. 18. Severability and Modification. The provisions of this Agreement are severable. If any provision of this Agreement is held by a court of competent jurisdiction to be invalid or unenforceable, such invalidity or unenforceability of any provision shall not affect the remaining provisions hereof, which shall remain in full force and effect to the fullest extent permitted by law as if such invalid or unenforceable provision were omitted. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under law, but if any provision of this Agreement is held to be prohibited by or invalid under applicable law, Company and Grantee agree that such provision is to be reformed to the extent necessary for the provision to be valid and enforceable to the fullest and broadest extent permitted by applicable law, without invalidating the remainder of this Agreement. 19. Headings. Headings in this Agreement are for informational purposes only and shall not be used to construe the intent of this Agreement. 20. Construction. This Agreement shall be deemed to have been drafted by both Parties, and it shall not be interpreted for or against any Party on the grounds that one Party drafted the Agreement or any portion of it. 21. Counterparts. This Agreement may be executed simultaneously in any number of counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same agreement. 22. Reserved Rights. Nothing in this Agreement shall serve to limit or restrict Grantee’s right to the following: (a) Immunity. An individual shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that (i) is made (a) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney; and (b) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. (b) Use Of Trade Secret Information In Anti-Retaliation Lawsuit. An individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if the individual (i) files any document containing the trade secret under seal; and (ii) does not disclose the trade secret, except pursuant to court order. 23. Reasonableness of Restrictions. GRANTEE HAS READ THIS AGREEMENT AND AGREES THAT THE RESTRICTIONS ON GRANTEE’S ACTIVITIES OUTLINED IN THIS AGREEMENT ARE REASONABLE AND NECESSARY TO PROTECT COMPANY’S LEGITIMATE BUSINESS INTERESTS, THAT THE CONSIDERATION PROVIDED BY COMPANY IS FAIR AND REASONABLE, AND FURTHER AGREES THAT GIVEN THE IMPORTANCE TO COMPANY OF ITS CONFIDENTIAL

INFORMATION, TRADE SECRETS, AND CUSTOMER RELATIONSHIPS, THE POST- EMPLOYMENT RESTRICTIONS ON GRANTEE’S ACTIVITIES ARE LIKEWISE FAIR AND REASONABLE. GRANTEE AGREES THAT THE GEOGRAPHIC RESTRICTIONS ON GRANTEE’S ACTIVITIES ARE REASONABLE. 24. Knowing and Voluntary Acceptance. Grantee acknowledges that Grantee has read, understood, and accepts the provisions of this Agreement.

APPENDIX B Additional Terms, Conditions and Notifications for Grantees Outside the United States Capitalized terms used but not defined in this Appendix B to the PSA Agreement have the meanings set forth in the Plan or the PSA Agreement. This Appendix B constitutes part of the PSA Agreement. Terms and Conditions Notwithstanding any provisions in the PSA Agreement, the Award shall also be subject to the terms and conditions for the Grantee’s country, if any, set forth in this Appendix B. Moreover, if the Grantee is not a resident of any of the countries listed in this Appendix B as of the date of grant specified in the Plan’s online administrative system but relocates to one of the countries included in this Appendix B, the terms and conditions for such country will apply to the Grantee to the extent that the Company determines that the application of such terms and conditions is necessary or advisable for legal or administrative reasons (or the Company may establish alternative terms as may be necessary or advisable to accommodate the Grantee’s relocation). These terms and conditions supplement or replace (as indicated) the terms and conditions set forth in the PSA Agreement to which this Appendix B is attached. Notifications This Appendix B also includes information regarding securities laws, exchange controls and certain other issues of which the Grantee should be aware with respect to the Grantee’s participation in the Plan. The information is based on the securities, exchange control and other laws in effect in the respective countries as of October 2023. Such laws are often complex and change frequently. In addition, other laws and regulations generally applicable to the acquisition, holding or disposal of securities and financial instruments as well as cross-border fund transfers may apply to the Grantee. As a result, the Grantee should not rely on the information noted herein as the only source of information relating to the consequences of participation in the Plan because the information may be out of date at the time the Award vests or the Grantee receives or sells shares of Common Stock underlying the Award. ALL COUNTRIES OUTSIDE THE UNITED STATES Terms and Conditions 1. Settlement of Award. Notwithstanding any provisions in the PSA Agreement to the contrary, if the Grantee is employed and/or resides outside the United States, the Company, in its sole discretion, may provide for the settlement of the Award in the form of: a. shares of Common Stock; or b. a cash payment (in an amount equal to the Fair Market Value of the shares of Common Stock that correspond to the vested portion of the Award) to the extent that settlement in shares of Common Stock (i) is prohibited under Applicable Laws, (ii) would require the Grantee, the Company or any of its Affiliates to obtain the approval of any governmental or regulatory body in the Grantee’s country of employment and/or residency, (iii) would result in adverse tax consequences for the Grantee, the Company or any of its Affiliates or (iv) is administratively burdensome. 2. Distribution of Shares and Tax Withholding. The following provisions supplement Paragraph 6 of the PSA Agreement.

a. Responsibility for Taxes. The Grantee acknowledges that, regardless of any action taken by the Company or if different, the Grantee’s employer or Affiliate of the Company to which the Grantee provides services (the “Service Recipient”), the ultimate liability for all income tax, social insurance, payroll tax, fringe benefits tax, payment on account and other tax- related items and withholdings related to the Grantee’s participation in the Plan and legally applicable to the Grantee or deemed by the Company or the Service Recipient in their discretion to be an appropriate charge to the Grantee even if legally applicable to the Company or the Service Recipient (the “Tax-Related Items”) is and remains the Grantee’s responsibility and may exceed the amount (if any) withheld by the Company or the Service Recipient. The Grantee further acknowledges that the Company and the Service Recipient (i) make no representations or undertakings regarding the treatment of any Tax-Related Items; and (ii) do not commit to and are under no obligation to structure the terms of the grant or any aspects of the Award to reduce or eliminate the Grantee’s liability for Tax-Related Items or achieve any particular tax result. Further, if the Grantee is subject to Tax-Related Items in more than one jurisdiction, the Grantee acknowledges that the Company and/or the Service Recipient (or former service recipient, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction. b. Withholding. Prior to the relevant taxable or withholding event, as applicable, the Grantee agrees to make arrangements satisfactory to the Company and/or the Service Recipient to satisfy any withholding obligation for Tax-Related Items. In this regard, the Grantee authorizes the Company and/or the Service Recipient, or their respective agents, at their discretion, to satisfy any withholding obligation for Tax-Related Items by one or a combination of the methods set forth in Paragraph 6 of the PSA Agreement or any other method determined by the Company and permitted under Applicable Laws. Depending on the withholding method, the Company may withhold or account for Tax- Related Items by considering applicable minimum statutory withholding rates or other applicable withholding rates, including up to the applicable maximum rate in the Grantee’s jurisdiction, in which case the Grantee may receive a refund of any over-withheld amount in cash and the Grantee will not be entitled to the equivalent amount in shares of Common Stock. If the obligation for Tax-Related Items is satisfied by withholding shares of Common Stock, for tax purposes, the Grantee will be deemed to have been issued the full number of shares of Common Stock subject to the vested Award, notwithstanding that shares of Common Stock were held back solely for the purpose of satisfying the Tax-Related Items. The Grantee agrees to pay to the Company or the Service Recipient any amount of Tax- Related Items that the Company or the Service Recipient may be required to withhold or account for as a result of the Grantee’s participation in the Plan that cannot be satisfied by the means previously described. The Company may refuse to issue or deliver shares of Common Stock or proceeds from the sale of shares of Common Stock until arrangements satisfactory to the Company have been made in connection with the Tax-Related Items. 3. Nature of Grant. By accepting the Award, the Grantee acknowledges, understands and agrees that: a. the Plan is established voluntarily by the Company, it is discretionary in nature and it may be terminated, suspended or amended by the Company, in its sole discretion, at any time, to the extent permitted by the Plan; b. the Award is voluntary and does not create any contractual or other right to receive future Award or benefits in lieu of Award, even if Award have been granted in the past;

c. all decisions with respect to future awards of Performance Shares or other grants, if any, will be at the sole discretion of the Company; d. the Grantee is voluntarily participating in the Plan; e. the Award and the Grantee’s participation in the Plan shall not create a right to employment or be interpreted as forming an employment contract with the Company or any of its Affiliates and shall not interfere with the ability of the Service Recipient to terminate the Grantee’s employment relationship (as otherwise may be permitted under Applicable Laws); f. for purposes of the Award, unless otherwise determined by the Company, the Grantee’s termination of employment will be considered to occur on the date the Grantee is no longer actively providing services to the Company or any of its Affiliates (regardless of the reason for such termination and whether or not later found to be invalid or in breach of employment laws in the jurisdiction where the Grantee is employed or the terms of the Grantee’s employment agreement, if any) and such date will not be extended by any notice period (e.g., the Grantee’s period of employment or service would not include any contractual notice period or any period of “garden leave” or similar period mandated under employment laws in the jurisdiction where the Grantee provides services or the terms of the Grantee’s service agreement, if any); the Company shall have the exclusive discretion to determine when the Grantee is no longer actively providing service for purposes of the Award (including whether the Grantee may still be considered to be providing service while on a leave of absence)]; g. unless otherwise agreed with the Company, the Award and any shares of Common Stock acquired upon vesting of the Award, and the income from and value of same, are not granted as consideration for, or in connection with, any service the Grantee may provide as a director of any Affiliate; h. the Award and any shares of Common Stock acquired under the Plan, and the income from and value of same, are not intended to replace any pension rights or compensation; i. the Award and any shares of Common Stock acquired under the Plan, and the income from and value of same, are extraordinary items that do not constitute compensation of any kind for services of any kind rendered to the Company or the Service Recipient, and which are outside the scope of the Grantee’s employment and the Grantee’s employment contract, if any; j. the Award and any shares of Common Stock acquired under the Plan, and the income from and value of same, are not part of normal or expected compensation or salary for any purpose, including, without limitation, calculating any severance, resignation, termination, redundancy, dismissal, end-of-service payments, holiday pay, bonuses, long-service awards, leave-related payments, holiday top-up, pension or retirement or welfare benefits or similar mandatory payments; k. the future value of the underlying shares of Common Stock is unknown, indeterminable and cannot be predicted with certainty and the value of such shares of Common Stock issued under the Plan may increase or decrease in the future; l. no claim or entitlement to compensation or damages shall arise from (i) forfeiture of the Award resulting from the termination of the Grantee’s employment (regardless of the reason for the termination and whether or not the termination is later found to be invalid

or in breach of employment laws in the jurisdiction where the Grantee is employed or the terms of the Grantee’s employment agreement, if any) and/or (ii) forfeiture or cancellation of the Award or recoupment of any shares of Common Stock, cash, or other benefits acquired upon settlement of the vested Award resulting from the application of the Company’s Recoupment Policy or other policy that the Company may adopt from time to time or any recovery policy otherwise required by Applicable Laws, rules, regulations or stock exchange listing standards; and m. neither the Company nor any of its Affiliates shall be liable for any foreign exchange rate fluctuation between the Grantee’s local currency and the United States dollar that may affect the value of the shares of Common Stock or any amounts due pursuant to the issuance of shares of Common Stock, or the subsequent sale of any shares of Common Stock acquired under the Plan. 4. Data Privacy. The Company is located at N86 W12500 Westbrook Crossing, Menomonee Falls, Wisconsin 53051, United States, and grants Performance Shares under the Plan to Eligible Individuals in its sole discretion. The Company is the controller responsible for the processing of the Grantee’s personal data and the third parties noted below. In conjunction with the Company’s grants of Performance Shares under the Plan and its ongoing administration of such grants, the Company is providing the following information about its data collection, processing and transfer practices. Where required by Applicable Laws, in accepting the Award, the Grantee expressly acknowledges and, where required by Applicable Laws, explicitly consents to the personal data activities as described herein. a. Data Collection, Processing and Usage. Pursuant to applicable data protection laws, the Grantee is hereby notified that the Company collects, processes and uses certain personal information about the Grantee for the legitimate purpose of implementing, administering and managing the Plan and generally administering the Award, including the Grantee’s name, home address, email address, and telephone number, date of birth, social insurance number or other identification number, salary, job title, and details of all Awards or any other equity compensation awards granted, canceled, exercised, vested, or outstanding in the Grantee’s favor (“Personal Data”). In granting the Award under the Plan, the Company will collect, process, use disclose and transfer (collectively “Processing”) Personal Data for purposes of implementing, administering and complying with its contractual and statutory obligations, as well as the necessity of the Processing for the Company to perform its contractual obligations under this PSA Agreement and the Plan. Where strictly required by Applicable Laws, the Company’s legal basis for the Processing of Personal Data is the Grantee’s consent. The Grantee’s refusal to provide Personal Data would make it impossible for the Company to perform its contractual obligations and may affect the Grantee’s ability to participate in the Plan. As such, by accepting the Award, the Grantee voluntarily acknowledges the Processing of the Grantee’s Personal Data as described herein. b. Sharing of Data with Affiliates and Stock Plan Administration Service Providers. The Company and the Service Recipient may transfer Personal Data to Fidelity Stock Plan Services, a third-party service provider based, in relevant part, in the United States, which may assist the Company with the implementation, administration and management of the Plan (the “Stock Plan Administrator”). In the future, the Company may select a different Stock Plan Administrator and share Personal Data with another company that services in a similar manner. The Processing of Personal Data by the Stock Plan Administrator will take place through both electronic and non-electronic means. Personal Data will only be accessible by those individuals requiring access to it for the purposes of implementing, administering and operating the Plan. When receiving the Grantee’s Personal Data, if applicable, the Stock Plan Administrator provides appropriate safeguards in accordance

with the Standard Contractual Clauses, adequacy decisions, or other appropriate cross- border solutions. By participating in the Plan, the Grantee understands that the Stock Plan Administrator will process the Grantee’s Personal Data for the purposes of implementing, administering and managing the Grantee’s participation in the Plan. c. International Personal Data Transfers. The Plan and the Award are administered in the United States, which means it will be necessary for Personal Data to be transferred to, and Processed in, the United States. When transferring Personal Data to the United States, the Company provides appropriate safeguards in accordance with the Standard Contractual Clauses, adequacy decisions, or other appropriate cross-border transfer solutions. The Grantee may request a copy of the appropriate safeguards with the Stock Plan Administrator or the Company by contacting the Compensation Department at compensation@enerpac.com (“Compensation Department”). Where required by Applicable Laws, the Company’s legal basis for the transfer of Grantee’s Personal Data to the United States is the Grantee’s explicit consent. d. Personal Data Retention. The Company and the Service Recipient will use Personal Data only as long as is necessary to implement, administer and manage the Grantee’s participation in the Plan, or as required to comply with legal or regulatory obligations, including under tax, exchange control, labor and securities laws. The period may extend beyond the Grantee’s employment or service with the Company or the Service Recipient. When the Company and the Service Recipient no longer need Personal Data for any of the above purposes, they will cease processing it in this context and remove it from all of their systems used for such purposes, to the fullest extent practicable. e. Voluntariness and Consequences of Consent Denial or Withdrawal. Where the Grantee’s consent is required by Applicable Laws, the Grantee acknowledges that the Grantee’s participation in the Plan and the Grantee’s grant of consent hereunder is purely voluntary. The Grantee may deny or withdraw the Grantee’s consent at any time. If the Grantee does not consent, or if the Grantee later withdraws consent, the Grantee may be unable to participate in the Plan. This would not affect the Grantee’s existing employment, service or salary; instead, the Grantee merely may forfeit the opportunities associated with participation in the Plan. f. Data Subjects Rights. The Grantee may have a number of rights under the data privacy laws in the Grantee’s jurisdiction. Depending on where the Grantee is based, such rights may include the right to (i) subject to certain exceptions, request access to or copies of Personal Data the Company Processes, (ii) request rectification of incorrect Personal Data, (iii) request deletion of Personal Data, (iv) place restrictions on the processing of Personal Data, (v) lodge complaints with competent authorities in the Grantee’s jurisdiction and/or (vi) request a list with the names and addresses of any potential recipients of Personal Data. To receive clarification regarding these rights or to exercise these rights, the Grantee can contact the Compensation Department. The Grantee also has the right to object, on grounds related to a particular situation, to the Processing of Grantee’s Personal Data, as well as opt-out of the Plan, in any case without cost, by contacting the Compensation Department in writing. The Grantee’s provision of Personal Data is a contractual requirement. The Grantee understands, however, that the only consequence of refusing to provide Personal Data is that the Company may not be able to administer the Award, or grant other awards or administer or maintain such awards. For more information on the consequences of the refusal to provide Personal Data, the Grantee may contact the Compensation Department in writing.

5. Language. The Grantee acknowledges and represents that the Grantee is sufficiently proficient in the English language or has consulted with an advisor who is sufficiently proficient in English as to allow the Grantee to understand the terms and conditions of this PSA Agreement and any other documents related to the Plan. If the Grantee has received this PSA Agreement or any other document related to the Plan translated into a language other than English and if the meaning of the translated version is different from the English version, the English version will control, unless otherwise required by Applicable Laws. 6. Electronic Delivery and Participation. The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means. The Grantee hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an online or electronic system established and maintained by the Company or a third party designated by the Company. 7. Insider Trading/Market Abuse Laws. The Grantee acknowledges that the Grantee may be subject to insider trading restrictions and/or market abuse laws in applicable jurisdictions, including, but not limited to, the United States and the Grantee’s country, which may affect the Grantee’s ability to accept, acquire, sell or otherwise dispose of shares of Common Stock, rights to shares of Common Stock (e.g., the Award) or rights linked to the value of shares of Common Stock under the Plan during such times as the Grantee is considered to have “inside information” regarding the Company (as defined by the laws in the applicable jurisdictions). Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any applicable Company insider trading policy. The Grantee acknowledges that the Grantee is responsible for complying with any applicable restrictions and that the Grantee should speak to the Grantee’s personal legal advisor for further details regarding any applicable insider trading and/or market abuse laws. 8. Compliance with Law. The Company shall not be required to deliver any shares of Common Stock pursuant to the Award prior to the completion of any registration or qualification of the Award, the shares of Common Stock or the Plan under any applicable securities or exchange control law or under rulings or regulations of any governmental regulatory body, or prior to obtaining any approval or other clearance from any governmental agency, which registration, qualification or approval the Company shall, in its absolute discretion, deem necessary or advisable. The Grantee understands that the Company is under no obligation to register or qualify the shares of Common Stock with any governmental authority or to seek approval or clearance from any governmental authority for the issuance of the shares of Common Stock. Further, the Grantee agrees that the Company shall have unilateral authority to amend the PSA Agreement without the Grantee’s consent to the extent necessary to comply with securities or other laws applicable to issuance of shares of Common Stock. In addition, the Grantee agrees to take any and all actions, and consents to any and all actions taken by the Company and any of its Affiliates, as may be required to allow the Company and any of its Affiliates to comply with local laws, rules and/or regulations in the Grantee’s country. Finally, the Grantee agrees to take any and all actions as may be required to comply with the Grantee’s personal obligations under Applicable Laws, rules and/or regulations in the Grantee’s country. 9. Imposition of Other Requirements. The Company reserves the right to impose other requirements on the Grantee’s participation in the Plan, on the Award, and on any shares of Common Stock acquired under the Plan, to the extent the Company determines it is necessary or advisable for legal or administrative reasons, and to require the Grantee to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. 10. Waiver. The Grantee acknowledges that a waiver by the Company of breach of any provision of this PSA Agreement shall not operate or be construed as a waiver of any other provision of this

PSA Agreement, or of any subsequent breach by the Grantee or any other grantee. Notifications 1. Not a Public Offering. The grant of Award is not intended to be a public offering of securities in the Grantee’s country. The Company has not submitted any registration statement, prospectus or other filings with the local securities authorities (unless otherwise required under local law), and the grant of the Award is not subject to the supervision of the local securities authorities. 2. No Advice Regarding Award. The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Grantee’s participation in the Plan or sale of the shares of Common Stock acquired upon vesting of the Award. Investment in shares of Common Stock involves a degree of risk. The Grantee should consult the Grantee’s own personal tax, legal and financial advisors regarding the Grantee’s participation in the Plan before taking any action related to the Plan. 3. Foreign Asset / Account Reporting and Exchange Control Notification. The Grantee’s country may have certain foreign asset and/or account reporting requirements and exchange controls that may affect the Grantee’s ability to acquire or hold shares of Common Stock under the Plan or cash received from participating in the Plan (including from any dividends or sale proceeds arising from the sale of shares of Common Stock) in a brokerage or bank account outside the Grantee’s country. The Grantee may be required to report such accounts, assets or transactions to the tax or other authorities in the Grantee’s country. The Grantee also may be required to repatriate sale proceeds or other funds received as a result of the Grantee’s participation in the Plan to the Grantee’s country through a designated bank or broker and/or within a certain time after receipt. In addition, the Grantee may be subject to tax payment and/or reporting obligations in connection with any income realized under the Plan and/or from the sale of shares of Common Stock. It is the Grantee’s responsibility to be compliant with all such requirements. The Grantee should consult the Grantee’s personal legal and tax advisors to ensure compliance with all applicable requirements. AUSTRALIA Notifications Securities Law Information. This offer is being made under Division 1A, Part 7.12 of the Australia Corporations Act (Cth). Please note that if the Grantee offers shares of Common Stock for sale to a person or entity resident in Australia, the offer may be subject to disclosure requirements under Australian law. The Grantee should obtain legal advice on the relevant disclosure obligations prior to making any such offer. Tax Information. The Plan is a plan to which Subdivision 83A-C of the Income Tax Assessment Act 1997 (Cth) applies (subject to the conditions in the Act). BRAZIL Terms and Conditions Compliance with Law. By accepting the Award and participating in the Plan, the Grantee acknowledges their agreement to comply with applicable Brazilian laws and to pay any and all applicable Tax-Related Items associated with the vesting of the Award, the sale of shares of Common Stock acquired under the Plan or the receipt of dividends, if any. Labor Law Acknowledgement. By accepting the Award and participating in the Plan, the Grantee agrees