October 29, 2025 Third Quarter 2025 Financial Results Bio-Rad Laboratories, Inc.

2 Safe Harbor Some statements in this presentation may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding management s̓ goals, plans, and expectations, our future financial performance, our future financial projections, our growth strategy, and other matters. Forward looking statements generally can be identified by the use of forward-looking terminology such as, “anticipate,ˮ “believe,ˮ “expect,ˮ “assume,ˮ “continue,ˮ “may,ˮ “will,ˮ “intend,ˮ “estimate,ˮ or similar expressions or the negative of those terms or expressions, although not all forward-looking statements contain these words. These statements are based on assumptions and expectations of future events that are subject to risks and uncertainties. Our actual results may differ materially from these plans and expectations. Undue reliance should not be placed on these forward-looking statements, and it is encouraged to review our SEC filings, where the risk factors in our business are discussed in detail. The forward-looking statements contained in this presentation reflect our views and assumptions only as of the date of this presentation. While we may elect to update forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if estimates change, so you should not rely on these forward-looking statements as representing our views as of any date other than the date of this presentation. In addition to financial measures prepared in accordance with generally accepted accounting principles GAAP, this presentation also contains non- GAAP financial measures. Calculations of these measures, explanations of what these measures represent, the reasons why we believe these measures provide useful information to investors, a reconciliation of these measures to the most directly comparable GAAP measures, as applicable, and other information relating to these non-GAAP measures can be found in the Appendix at the end of this presentation. In addressing various financial metrics, the presentation describes some of the factors that impacted year-over-year performance. For additional factors that impacted year-over-year performance, please refer to our earnings release and our third quarter Form 10Q, which are available in the “Investor Relationsˮ section of our web site under the subheadings “Financials/Financial Resultsˮ and “Quarterly Results."

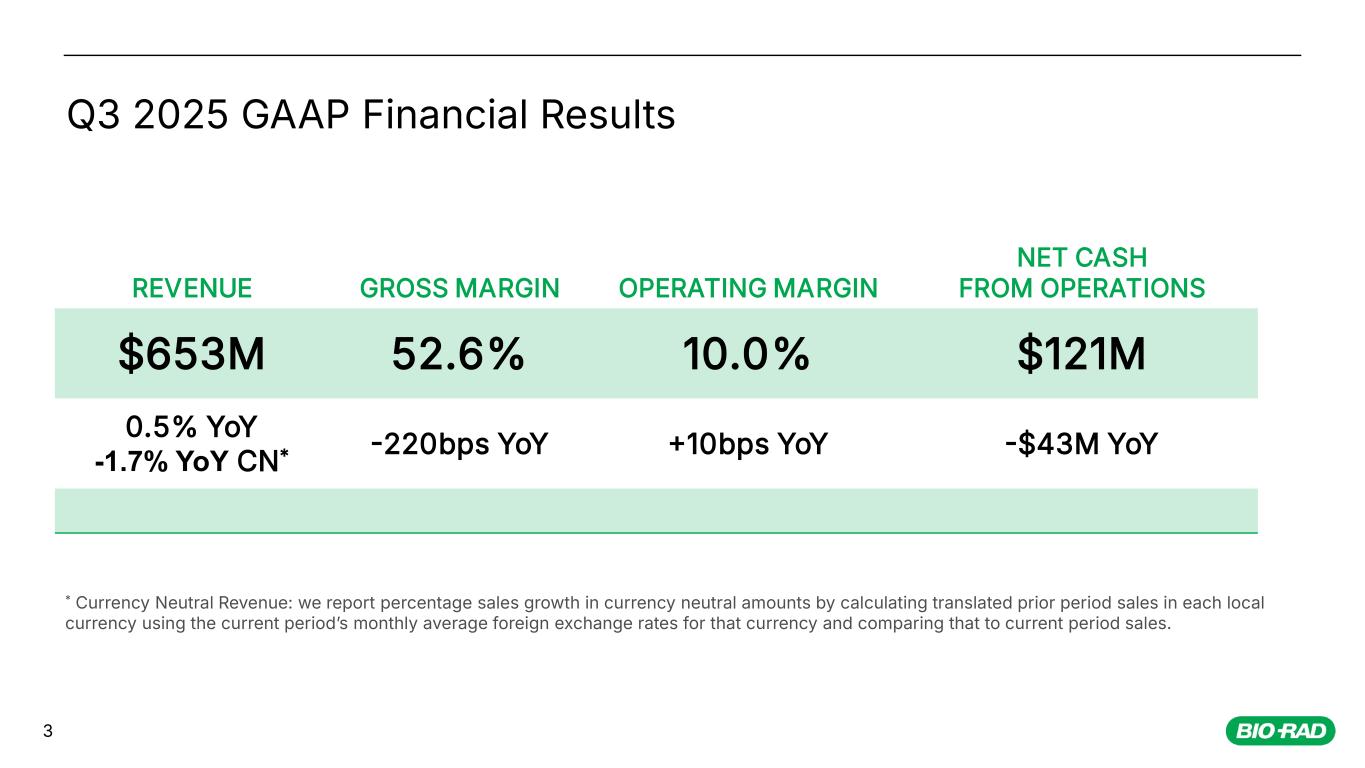

REVENUE GROSS MARGIN OPERATING MARGIN NET CASH FROM OPERATIONS $653M 52.6% 10.0% $121M 0.5% YoY -1.7% YoY CN* 220bps YoY 10bps YoY $43M YoY 3 Q3 2025 GAAP Financial Results * Currency Neutral Revenue: we report percentage sales growth in currency neutral amounts by calculating translated prior period sales in each local currency using the current period s̓ monthly average foreign exchange rates for that currency and comparing that to current period sales.

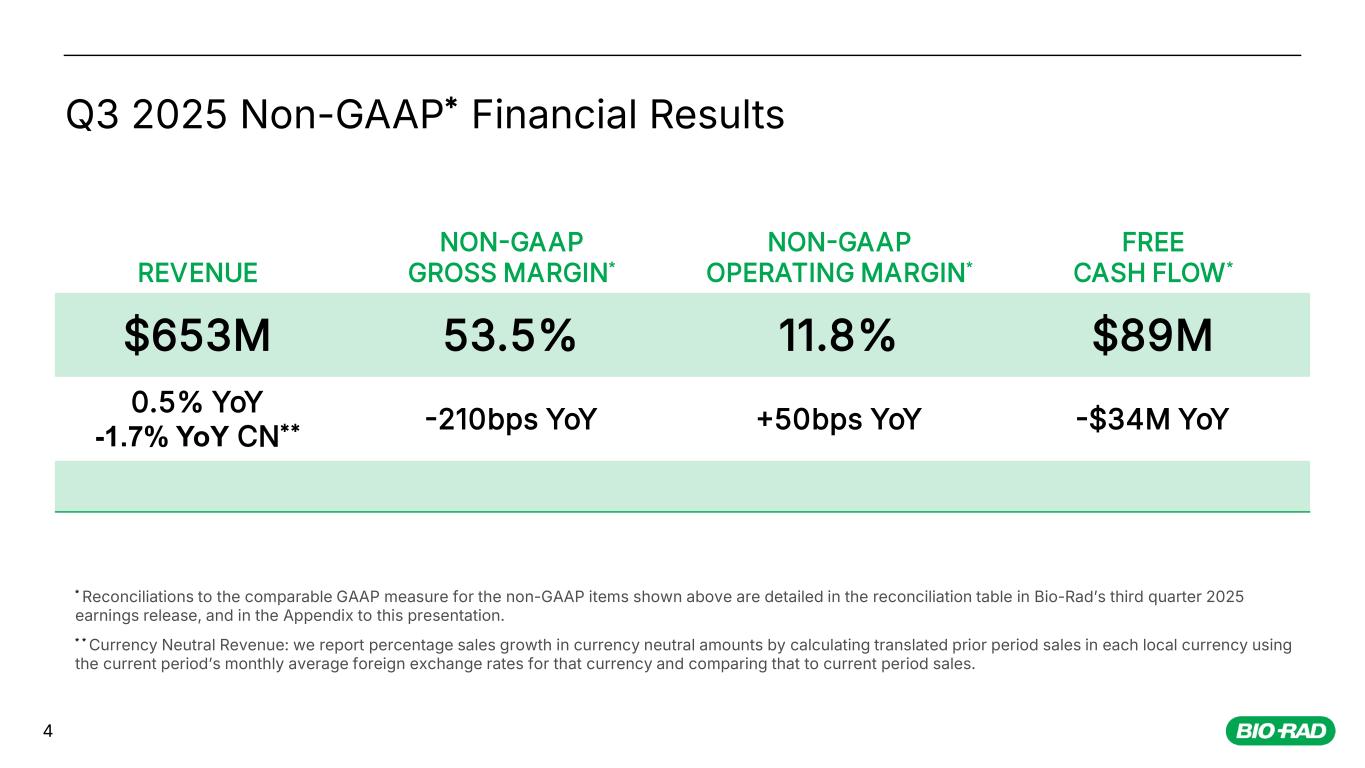

REVENUE NONGAAP GROSS MARGIN* NONGAAP OPERATING MARGIN* FREE CASH FLOW* $653M 53.5% 11.8% $89M 0.5% YoY -1.7% YoY CN** 210bps YoY 50bps YoY $34M YoY 4 Q3 2025 Non-GAAP* Financial Results * Reconciliations to the comparable GAAP measure for the non-GAAP items shown above are detailed in the reconciliation table in Bio-Radʼs third quarter 2025 earnings release, and in the Appendix to this presentation. * * Currency Neutral Revenue: we report percentage sales growth in currency neutral amounts by calculating translated prior period sales in each local currency using the current periodʼs monthly average foreign exchange rates for that currency and comparing that to current period sales.

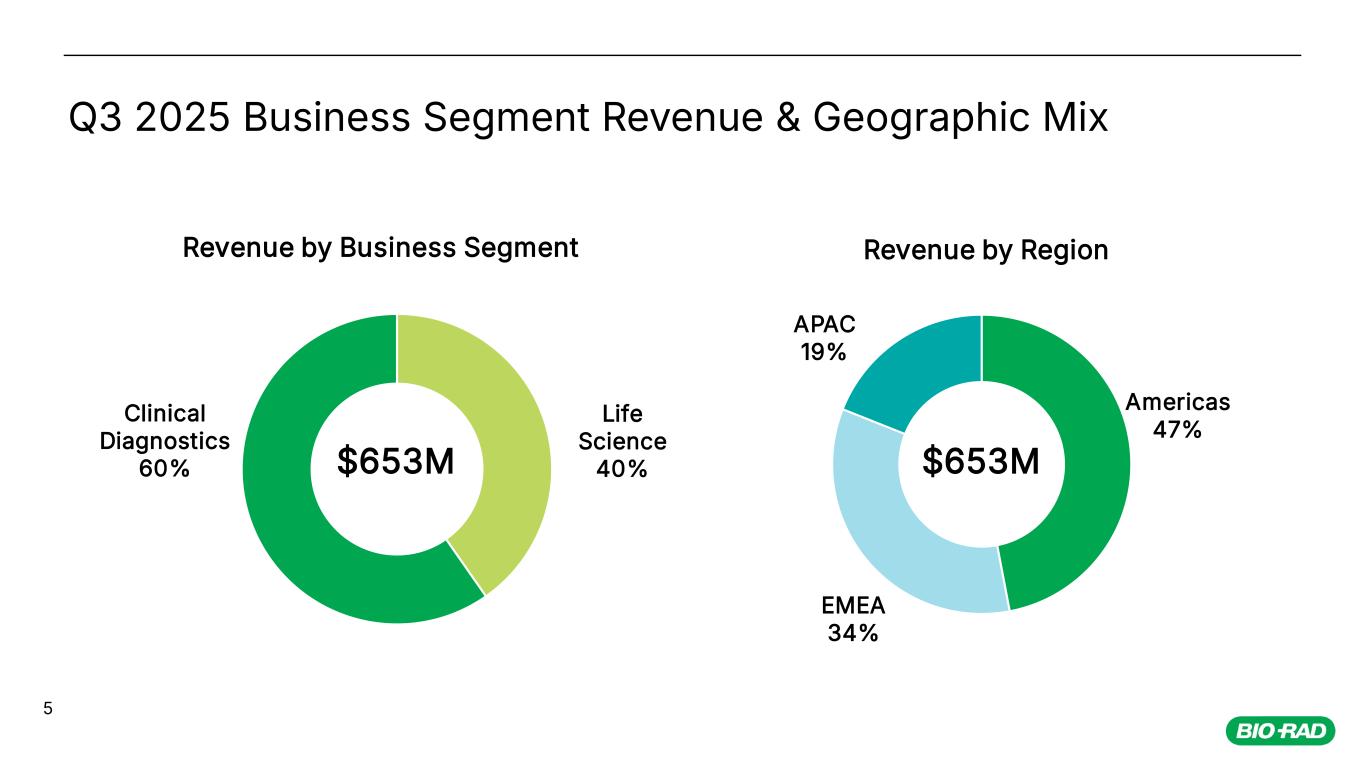

5 Life Science 40% Clinical Diagnostics 60% Revenue by Business Segment Q3 2025 Business Segment Revenue & Geographic Mix Americas 47% EMEA 34% APAC 19% Revenue by Region $653M $653M

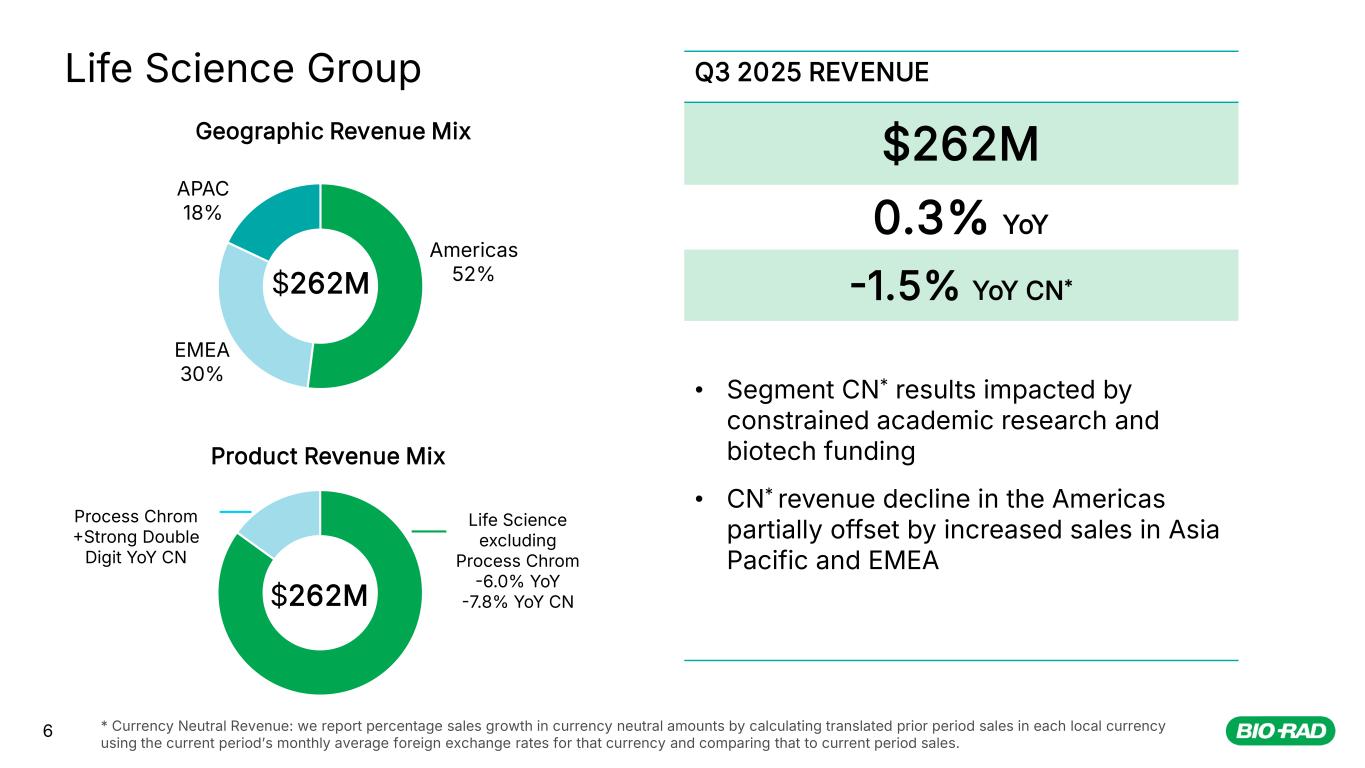

6 Q3 2025 REVENUE $262M 0.3% YoY 1.5% YoY CN* • Segment CN* results impacted by constrained academic research and biotech funding • CN* revenue decline in the Americas partially offset by increased sales in Asia Pacific and EMEA Life Science Group Americas 52% EMEA 30% APAC 18% Geographic Revenue Mix $262M $262M Life Science excluding Process Chrom 6.0% YoY 7.8% YoY CN Process Chrom Strong Double Digit YoY CN * Currency Neutral Revenue: we report percentage sales growth in currency neutral amounts by calculating translated prior period sales in each local currency using the current periodʼs monthly average foreign exchange rates for that currency and comparing that to current period sales. Product Revenue Mix

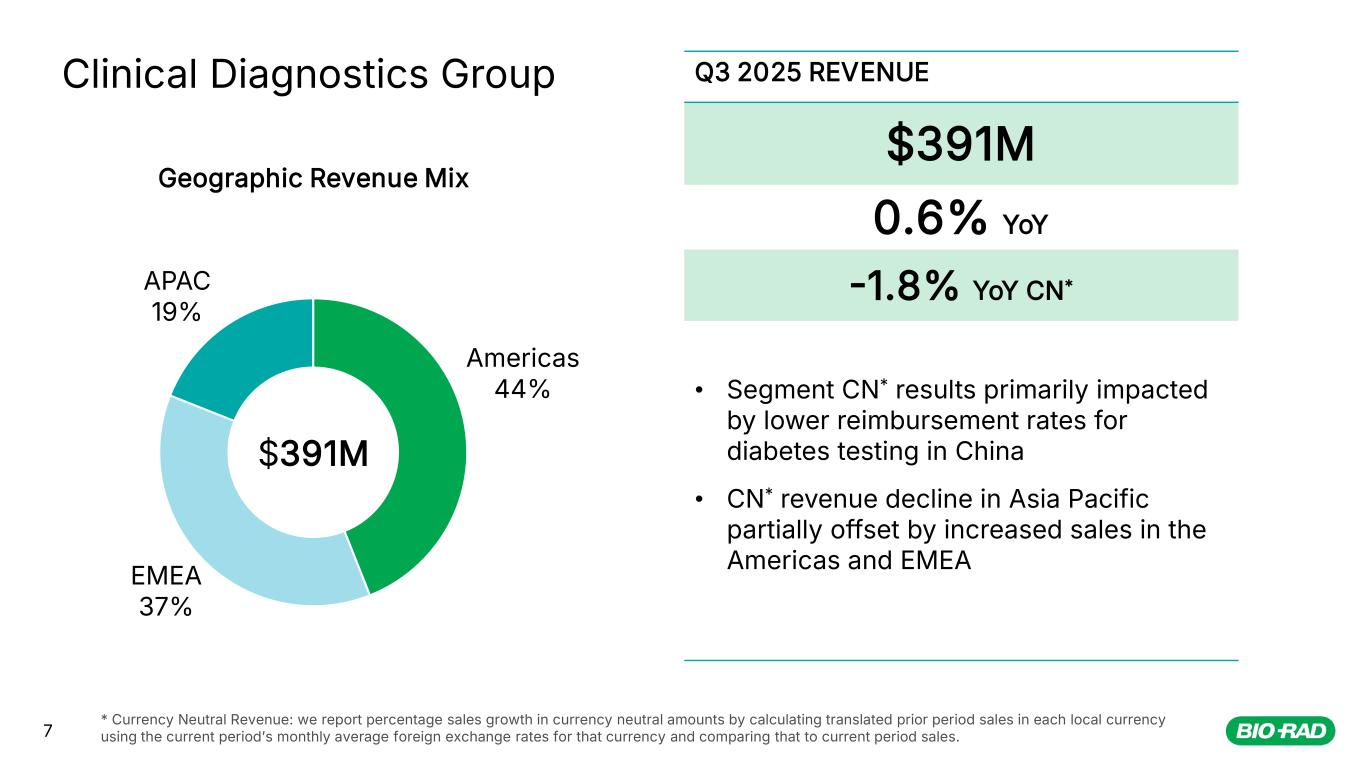

7 Q3 2025 REVENUE $391M 0.6% YoY 1.8% YoY CN* • Segment CN* results primarily impacted by lower reimbursement rates for diabetes testing in China • CN* revenue decline in Asia Pacific partially offset by increased sales in the Americas and EMEA Clinical Diagnostics Group * Currency Neutral Revenue: we report percentage sales growth in currency neutral amounts by calculating translated prior period sales in each local currency using the current periodʼs monthly average foreign exchange rates for that currency and comparing that to current period sales. Americas 44% EMEA 37% APAC 19% Geographic Revenue Mix $391M

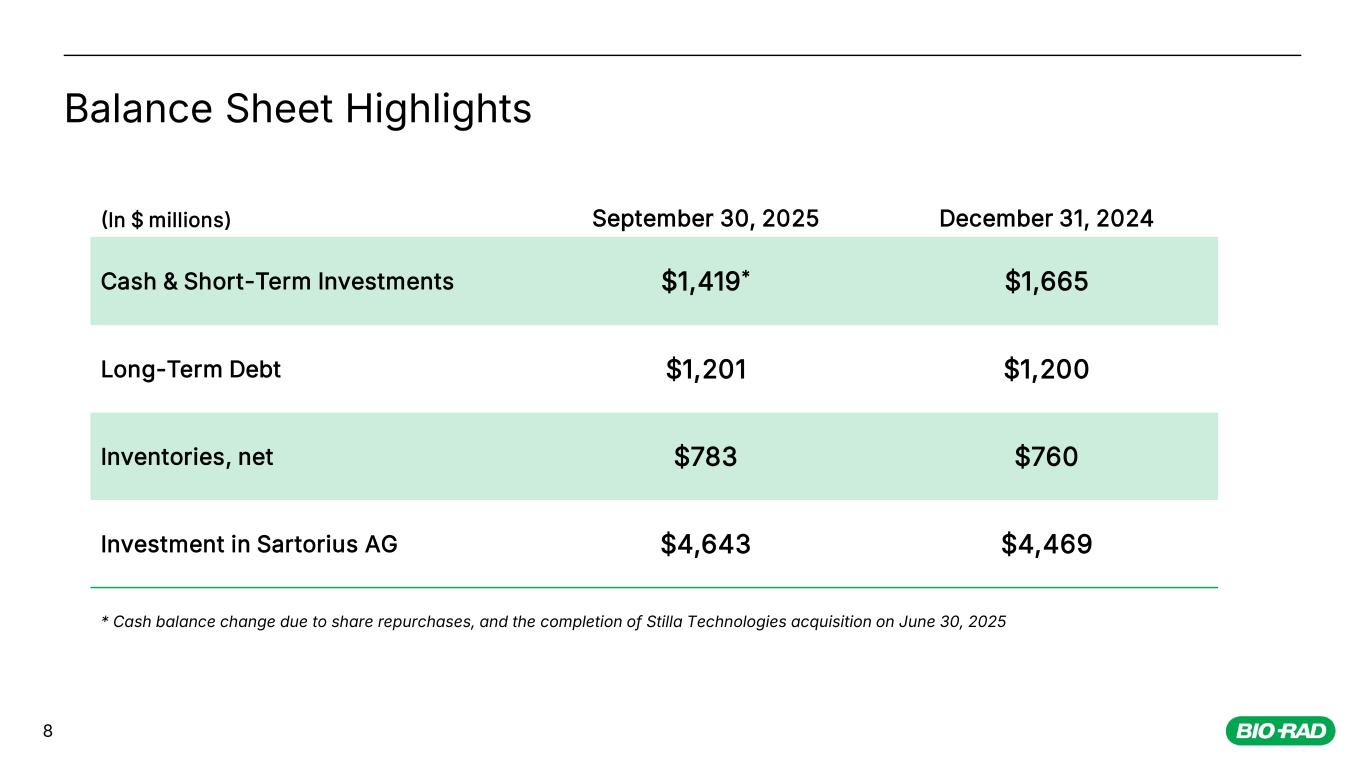

8 Balance Sheet Highlights In $ millions) September 30, 2025 December 31, 2024 Cash & Short-Term Investments $1,419* $1,665 Long-Term Debt $1,201 $1,200 Inventories, net $783 $760 Investment in Sartorius AG $4,643 $4,469 * Cash balance change due to share repurchases, and the completion of Stilla Technologies acquisition on June 30, 2025

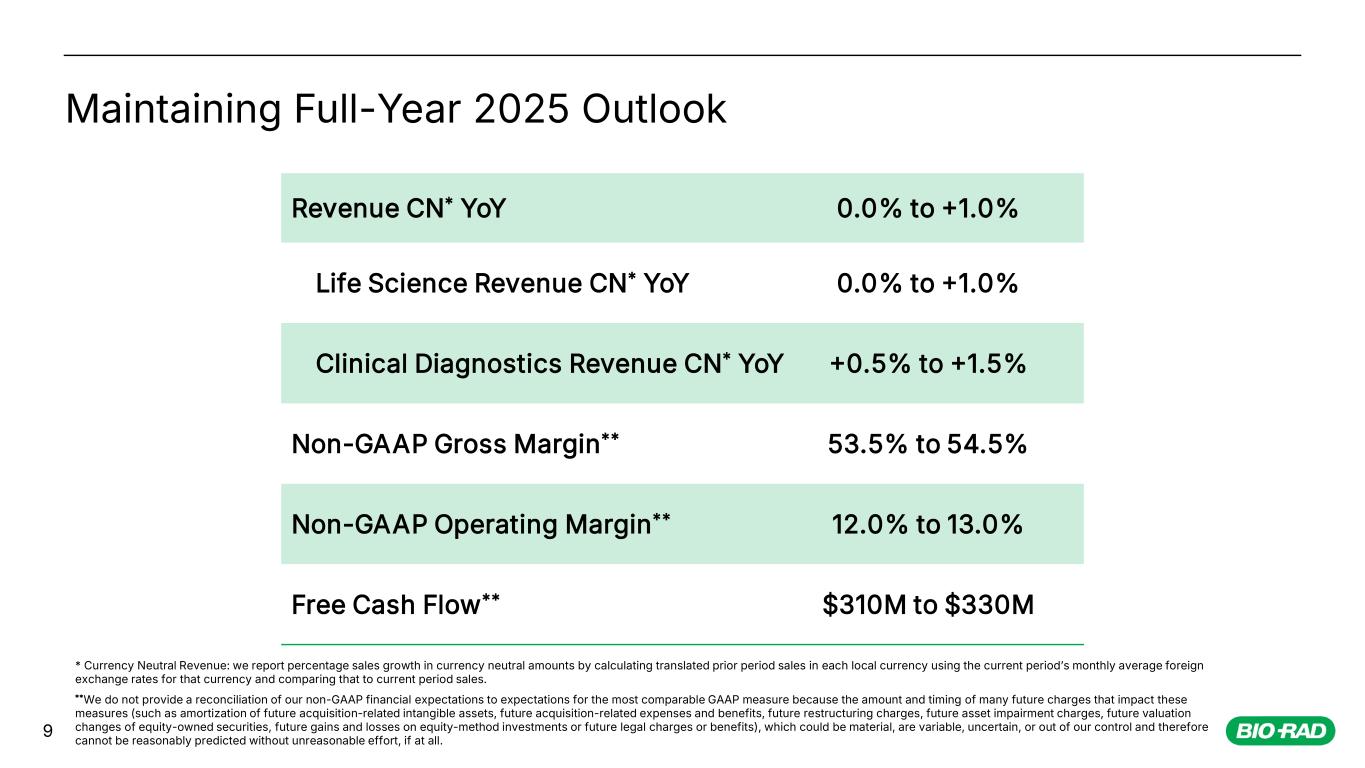

9 Revenue CN* YoY 0.0% to 1.0% Life Science Revenue CN* YoY 0.0% to 1.0% Clinical Diagnostics Revenue CN* YoY 0.5% to 1.5% Non-GAAP Gross Margin** 53.5% to 54.5% Non-GAAP Operating Margin** 12.0% to 13.0% Free Cash Flow** $310M to $330M Maintaining Full-Year 2025 Outlook * Currency Neutral Revenue: we report percentage sales growth in currency neutral amounts by calculating translated prior period sales in each local currency using the current periodʼs monthly average foreign exchange rates for that currency and comparing that to current period sales. **We do not provide a reconciliation of our non-GAAP financial expectations to expectations for the most comparable GAAP measure because the amount and timing of many future charges that impact these measures (such as amortization of future acquisition-related intangible assets, future acquisition-related expenses and benefits, future restructuring charges, future asset impairment charges, future valuation changes of equity-owned securities, future gains and losses on equity-method investments or future legal charges or benefits), which could be material, are variable, uncertain, or out of our control and therefore cannot be reasonably predicted without unreasonable effort, if at all.

10 Appendix

11 Use of Non-GAAP Financial Measures This presentation includes GAAP financial measures as well as non-GAAP financial measures, which are not meant to be considered in isolation or as a substitute for comparable GAAP measures. We present certain non-GAAP financial measures to evaluate business performance, guide operating decisions, support forecasting and planning, and determine compensation. These measures exclude items outside normal operations, those difficult to forecast, isolated gains and losses not expected to recur predictably, related tax provisions or benefits, and significant discrete tax events. We believe these disclosures provide useful supplemental information that, while not a substitute for GAAP, enhance transparency, assist in evaluating operating results and future prospects in the same manner as management, and facilitate comparisons across periods and with peer companies.

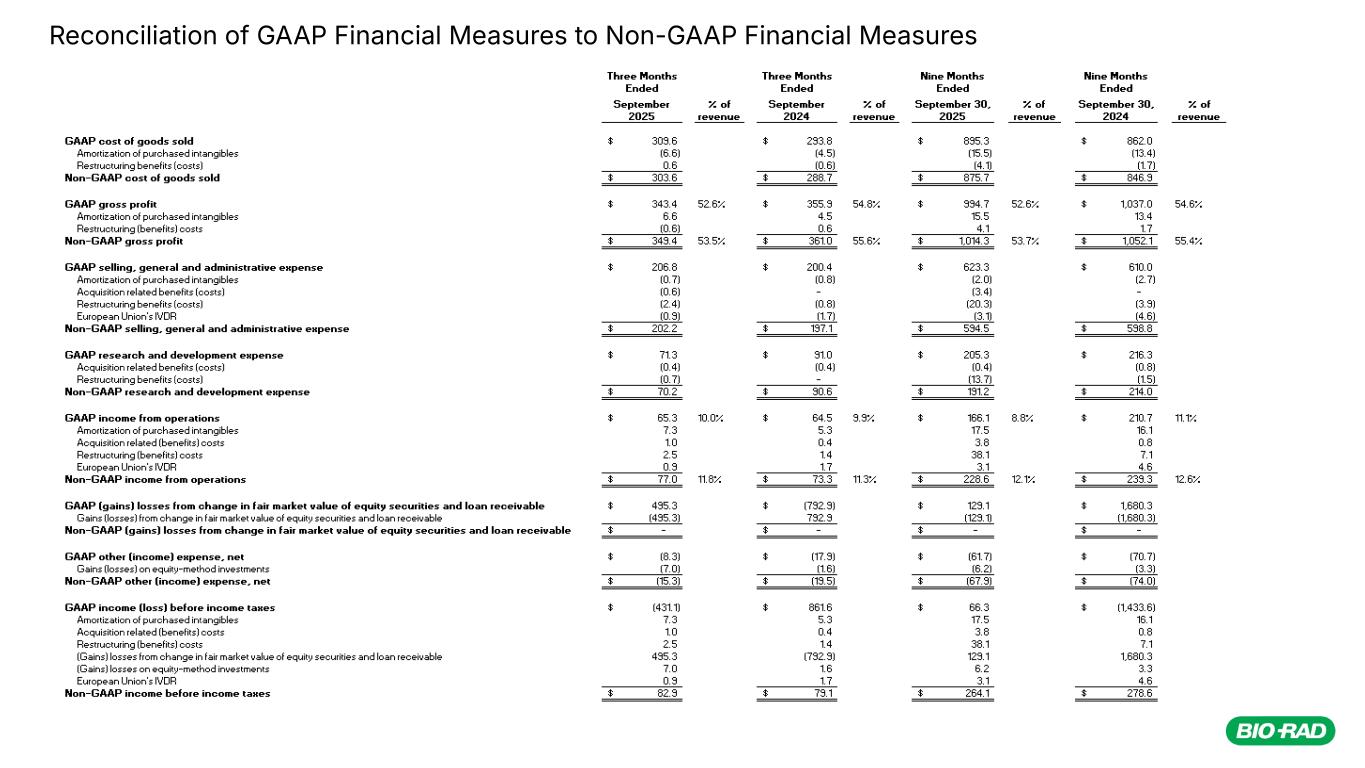

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures

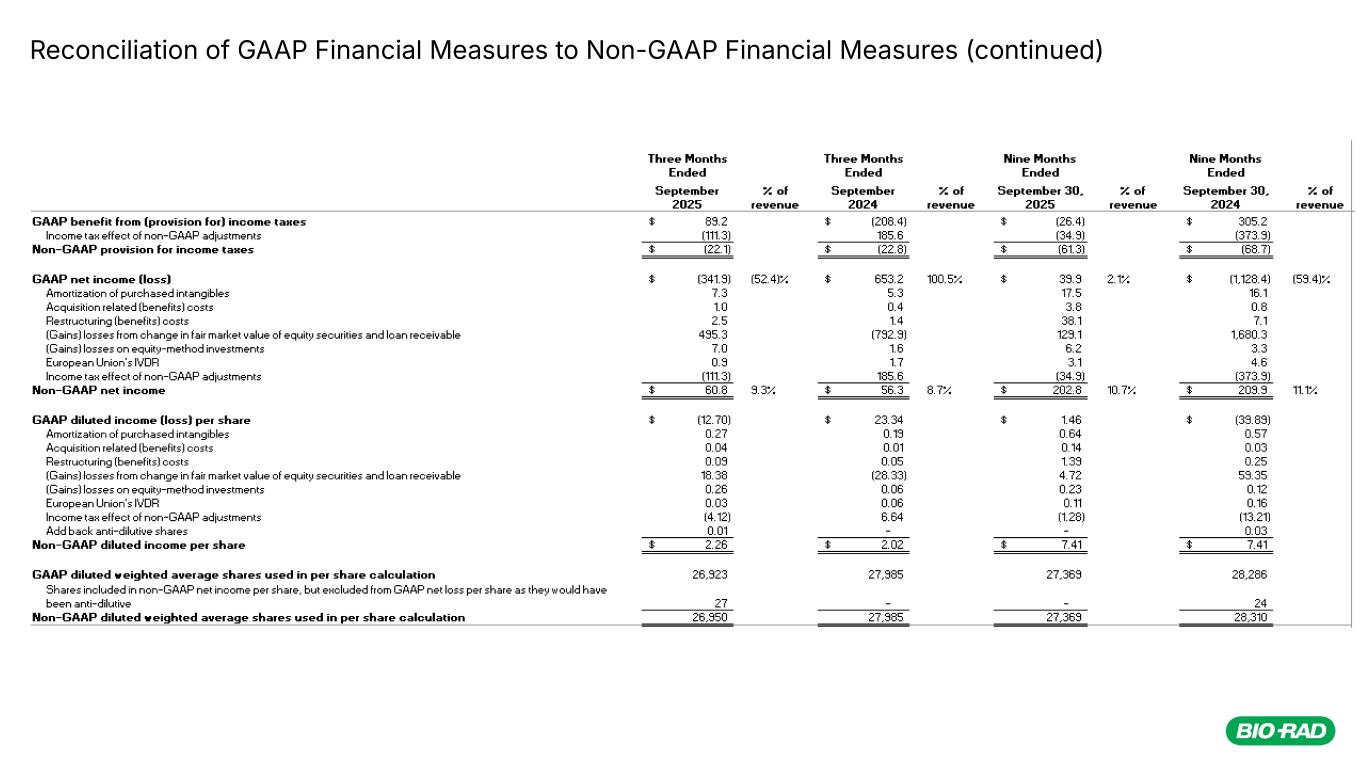

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (continued)

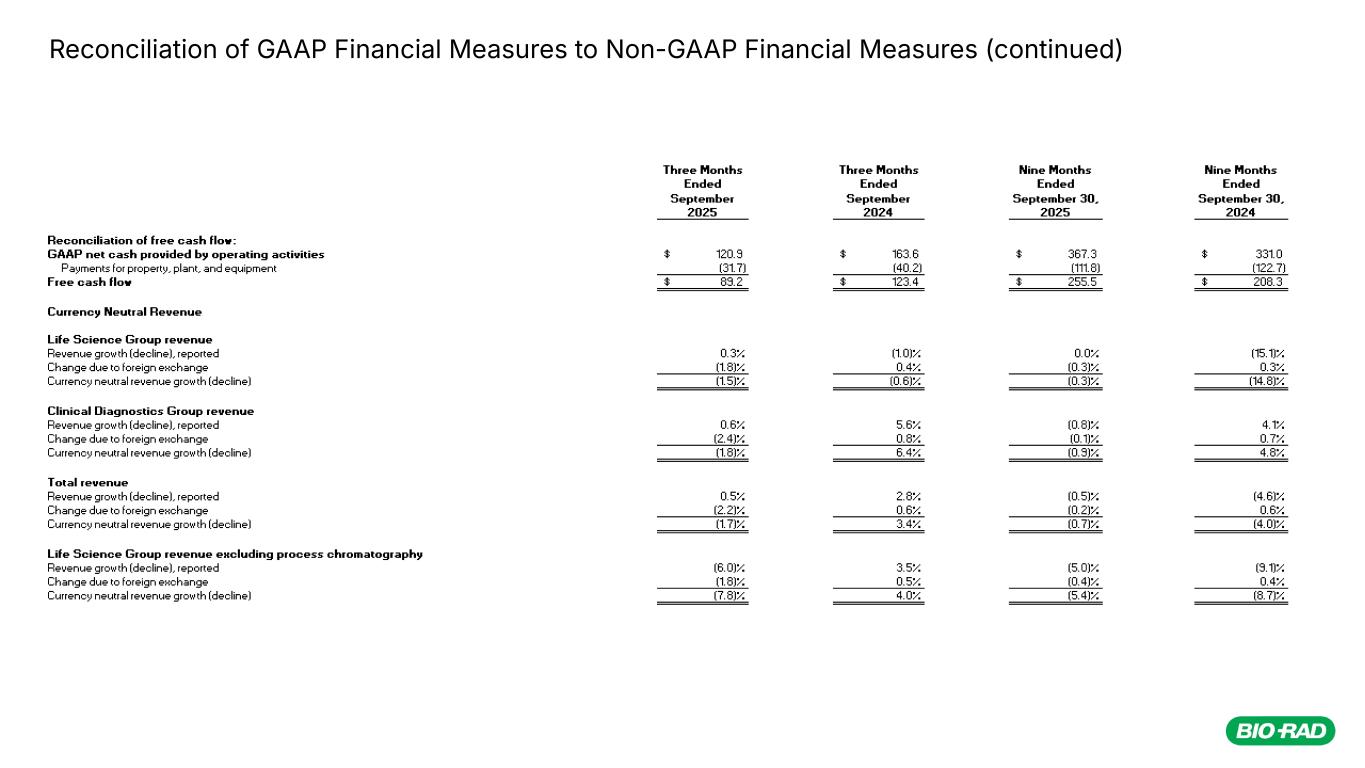

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (continued)

15 Explanations of Non-GAAP Adjustments Amortization of purchased intangible assets: we do not acquire businesses and assets on a predictable cycle. The amount of purchase price allocated to purchased intangible assets and the terms of amortization can vary significantly and are unique to each acquisition. We believe that excluding amortization of purchased intangible assets allows the users of our financial statements to better review and understand the historic and current results of our operations. Acquisition-related amounts: we incur expenses or benefits with respect to certain items associated with our acquisitions, including professional fees for assistance with the transaction; valuation costs, integration costs, changes in the fair value of contingent consideration, and gains and losses on the settlement of pre-existing relationships with the acquired entity. We exclude such acquisition-related amounts because they have no direct correlation to the operation of our on-going business. Restructuring charges: we incur costs associated with our restructuring actions, including termination benefits related to reductions in employee headcount and the closure or exit of facilities. We exclude the costs associated with these unique restructuring actions in order to provide comparability of our on-going operations with prior and future periods. Impairment charges: we incur non-cash expenses associated primarily with impairment of long-lived assets including, but not limited to, goodwill, intangible assets and property, plant and equipment. By excluding these impairment charges, we believe this assists investors with evaluating our cash spending and analyzing our core operating performance period-over-period. Gains and losses from change in fair market value of equity securities and loan receivable, and gains and losses on equity-method investments: our net income (loss) is impacted by gains and losses from change in fair market value of equity securities and loan receivable, and gain and losses associated with our equity- method investments included in Other income, net. These gains and losses arise from unforeseen circumstances and/or often occur outside of the ordinary course of our on-going business. By excluding these gains and losses, we believe this assists investors in evaluating our core operating performance period-over-period. Significant litigation amounts and legal costs: we may incur charges or benefits, in connection with litigation and other contingencies and legal costs unrelated to our core operations. We exclude these litigation amounts, when significant, as well as legal costs associated with significant legal matters, because we do not believe they are reflective of our on-going business and operating results. European Union's IVDR: we incur incremental costs to comply with the European Union's In Vitro Diagnostics Regulation ("IVDR") for previously approved products. Income tax expense: we estimate the tax effect of the excluded items identified above to determine a non-GAAP annual effective tax rate applied to the pretax amount in order to calculate the non-GAAP provision for income taxes. We also adjust for items for which the nature and/or tax jurisdiction requires the application of a specific tax rate or treatment. From time to time in the future, there may be other items excluded if we believe that doing so is consistent with the goal of providing useful information to investors and management.

16 Other Key Metrics Free Cash Flow: we report free cash flow, which is operating cash flow excluding net capital expenditures, to provide a view of the continuing operationsʼ ability to generate cash for acquisitions and other investing and financing activities. The company also uses this measure as an indication of the strength of the company. Free cash flow is not a measure of cash available for discretionary expenditures since we have certain non-discretionary obligations such as debt service that are not deducted from the measure. Currency Neutral Revenue: we report percentage sales growth in currency neutral amounts by calculating translated prior period sales in each local currency using the current periodʼs monthly average foreign exchange rates for that currency and comparing that to current period sales.

17 2025 Financial Outlook Forecasted non-GAAP operating margin excludes 103 basis points related to amortization of purchased intangibles. Forecasted non-GAAP operating margin does not reflect future gains and charges that are inherently difficult to predict and estimate due to their unknown timing, effect and/or significance, such as foreign currency fluctuations, future gains or losses associated with certain legal matters, acquisitions and restructuring activities. We do not provide a reconciliation of our non-GAAP financial expectations to expectations for the most comparable GAAP measure because the amount and timing of many future charges that impact these measures (such as amortization of future acquisition-related intangible assets, future acquisition-related expenses and benefits, future restructuring charges, future asset impairment charges, future valuation changes of equity-owned securities, future gains and losses on equity-method investments or future legal charges or benefits), which could be material, are variable, uncertain, or out of our control and therefore cannot be reasonably predicted without unreasonable effort, if at all.