Please wait

0000014272DEF 14Afalseiso4217:USD00000142722024-01-012024-12-310000014272bmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272bmy:DrChrisBoernerMember2023-01-012023-12-3100000142722023-01-012023-12-3100000142722022-01-012022-12-3100000142722021-01-012021-12-3100000142722020-01-012020-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2022-01-012022-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-01-012022-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2021-01-012021-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-01-012021-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2020-01-012020-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-01-012020-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2024-01-012024-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2024-01-012024-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberbmy:DrGiovanniCaforioMember2023-01-012023-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-01-012021-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-01-012021-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-01-012020-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-01-012020-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-01-012024-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-01-012024-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberbmy:DrChrisBoernerMember2023-01-012023-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000014272ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000014272ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000001427212024-01-012024-12-31000001427232024-01-012024-12-31000001427252024-01-012024-12-31000001427272024-01-012024-12-31000001427222024-01-012024-12-31000001427242024-01-012024-12-31000001427262024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Bristol-Myers Squibb Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Table of Contents

| | | | | | | | | | | |

| | | |

| | |

| | | |

| Meeting Details Date: May 6, 2025 Time: 10:00 a.m. Eastern Time Location: Virtually | |

| | | |

| Your Vote is Important Regardless of the number of shares you own, your vote is important. If you do not attend the Annual Meeting to vote on the virtual meeting platform, your vote will not be counted unless a proxy representing your shares is presented at the meeting. To ensure that your shares will be voted at the meeting, please vote in one of these ways: | |

| | | |

| | Go to www.proxyvote.com and vote via the Internet; | |

| | | |

| | Call the toll-free telephone number (800) 690-6903 (this call is toll-free in the U.S.); or | |

| | | |

| | Mark, sign, date and promptly return the enclosed proxy card in the postage-paid envelope. | |

| If you do attend the Annual Meeting, you may revoke your proxy and vote your shares on the virtual meeting platform during the meeting. | |

| | | |

Notice of Annual Meeting of Shareholders

Notice is hereby given that the 2025 Annual Meeting of Shareholders (the “Annual Meeting” or “2025 Annual Meeting”) will be held virtually on May 6, 2025, at 10:00 a.m. Eastern Time for the following purposes as set forth in the accompanying Proxy Statement:

| | | | | |

| 1 | to elect to the Board of Directors the 11 persons nominated by the Board, each for a term of one year; |

| 2 | to conduct an advisory vote to approve the compensation of our Named Executive Officers; |

| 3 | to ratify the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting firm for 2025; |

4-5 | to consider two shareholder proposals, if presented at the meeting; and |

| 6 | to transact such other business as may properly come before the meeting or any adjournments thereof. |

Holders of record of our common and preferred stock at the close of business on March 14, 2025, will be entitled to vote at the meeting.

The Annual Meeting will be held in a virtual-only meeting format. To be admitted to the Annual Meeting, you will need to visit www.virtualshareholdermeeting.com/BMY2025 and enter the 16-digit control number included on your Important Notice Regarding the Availability of Proxy Materials, on your proxy card, or on the instructions that accompanied your proxy materials. Guests may join the Annual Meeting in a listen-only mode, but they will not have the option to vote shares or ask questions during the virtual meeting. Once admitted, you may submit questions or vote during the Annual Meeting by following the instructions that will be available on the meeting website. You may log into the meeting platform beginning at 9:50 a.m. Eastern Time on May 6, 2025. To submit a question before the meeting, visit www.proxyvote.com with your 16-digit control number and select the “Submit a Question for Management” option. To submit a question during the meeting, visit www.virtualshareholdermeeting.com/BMY2025, enter your 16-digit control number and type your question into the “Ask a Question” field and click “Submit.” The company will provide direct and specific information to shareholder proponents on how they can present their shareholder proposals during the meeting.

By Order of the Board of Directors

Amy Fallone

Senior Vice President and Corporate Secretary

Dated: March 26, 2025

| | | | | |

Message from Christopher S. Boerner Board Chair and Chief Executive Officer | |

Dear BMS shareholders,

2024 was a productive year driven by strong execution for Bristol Myers Squibb (BMS). We made important progress, strengthened our financial foundation, and clearly articulated our strategy to reshape the company’s growth profile. Of course, we could not do any of this without our remarkable, global workforce and their continued commitment to delivering for patients. We are anchored in our mission, and I firmly believe we have the right talent and resources in place as we collectively write the next chapter in BMS’ history.

Last year the company saw 7% year-over-year revenue growth, with our Growth Portfolio now comprising 47% of annual total sales and our Legacy Portfolio generating significant cash flow to reinvest in future growth drivers. We closed and integrated several important transactions, received key regulatory approvals, executed well and advanced what I believe is the best pipeline we have ever had.

As we position the company to navigate the opportunities and challenges ahead, we are reshaping BMS to deliver sustained, top-tier growth and long-term shareholder returns. To do this, we are executing against three key objectives:

1.Focusing on transformational medicines where we have a competitive advantage;

2.Driving operational excellence throughout the organization; and

3.Strategically allocating capital for long-term growth and shareholder returns.

Focusing on Transformational Medicines

This past year, we re-established our presence in neuroscience with the U.S. approval of Cobenfy. This medicine epitomizes our focus on innovative treatments. It represents the first new mechanism of action in schizophrenia in decades and has the potential to expand into multiple additional indications.

We have extended our leadership positions across hematology, oncology and cardiovascular disease, while honing our efforts in immunology. In 2024, we received significant approvals and indication expansions in multiple major markets across key growth products, including Breyanzi, Camzyos and Reblozyl. We also extended the durability of our immuno-oncology portfolio with the U.S. approval of Opdivo Qvantig, the first and only subcutaneously administered PD-1 inhibitor, providing patients with a new option for faster administration.

Driving Operational Excellence

As our company evolves, our commitment to operational excellence will help drive efficiency, emphasize accountability and improve productivity. In 2024, we announced a new initiative to achieve $1.5 billion in cost savings by the end of 2025, and we realized the majority of these savings in 2024. We recently announced the expansion of this initiative to capture additional cost savings through 2027.

It is truly an exciting time for innovation at the company. Our collective focus on productivity and execution will continue to drive meaningful results. We are constantly pursuing bold science to deliver first-in-class or best-in class medicines as we define what is possible for patients—we are employing the responsible use of artificial intelligence (AI) to accelerate clinical trials in areas of significant unmet need. This includes pulmonary fibrosis, for which we are testing admilparant, an LPA1 antagonist, that has the potential to transform the current standard of care. We are also redefining anticoagulant therapy with the promise of FXIa inhibition in thrombotic diseases, and we are investing in CELMoDs, which can offer tailored treatment approaches in combinations across multiple myeloma and lymphoma.

Strategically Allocating Capital

Last year we strategically deployed our capital to (i) pursue sources of external innovation, (ii) return cash to shareholders, and (iii) strengthen our balance sheet. We closed the acquisitions of Karuna Therapeutics, bringing in Cobenfy, RayzeBio, adding radiopharmaceutical capabilities — one of the fastest-growing new modalities for treating patients with solid tumors, and Mirati Therapeutics, adding Krazati — to our portfolio.

The company announced a 5.3% dividend increase for 2025; the 15th consecutive year of a dividend increase and the 92nd consecutive year we have paid a dividend. We paid down $6 billion in debt consistent with our commitment to pay down approximately $10 billion of debt by 2026. These actions make clear our focus on maintaining our strong financial profile and prioritizing opportunities where we see the highest return for our patients and shareholders.

Our vision to transform patients’ lives through science extends to all patients. In 2024, we announced ASPIRE (Accessibility, Sustainability, Patient-centric, Impact, Responsibility and Equity), a strategy to advance access to our medicines and help patients in low- and middle-income countries (LMICs) gain access to potentially life-saving medicines. This is embedded in our overall commercial strategy.

We also received validation for our near-term and net-zero science-based targets from the Science Based Targets initiative (SBTi), highlighting our progress in reducing emissions across our operations and supply chain. Notably, our employee led initiative, Coast 2 Coast 4 Cancer, entered its 11th year and nearly 350 global colleagues representing 30 nations rode 6,200 miles cross-country to fund cancer research, further showing our mission in action.

As you can see, 2024 was a productive start to our broader transformation as a company. As we progress on this journey, we will be relentless in our pursuit to deliver innovative medicines to patients around the world. We have built the foundation and have a clear path forward.

Thank you for your continued investment in Bristol Myers Squibb and for your support of our mission. I am excited to see all that we will achieve together in 2025 and beyond.

Sincerely,

Christopher S. Boerner, Ph.D.

Board Chair and Chief Executive Officer

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| $48.3B annual revenues | | | 47% of revenues from Growth Portfolio | | | $6B of debt repaid as part of commitment to repay $10B by 2026 | | | 5.3% quarterly dividend increase for 2025 | | | 15 consecutive years of dividend increases | |

| | | | | | | | | | | | | | |

1 Bristol Myers Squibb | 2025 Proxy Statement

| | | | | |

Message from

Theodore R. Samuels Lead Independent Director | |

Dear fellow shareholders and stakeholders,

2024 was an eventful year for BMS and for the Board, which closely collaborated with management to strengthen the company’s governance profile and enhance the foundation for long-term, sustainable growth. We are excited to build on this progress as we write the next chapter in the company’s history.

When I first became Lead Independent Director, I said that maintaining our commitment to sound corporate governance was a top priority. This has not changed.

Since then, we have experienced a transition in leadership, and the relationship we have built with Chris in his capacity as CEO and Board Chair has been incredibly productive. I and my fellow independent directors are thankful for his and the management team’s continued partnership. Collectively, we value open communication and transparency, which fosters a constructive and continuous dialogue about how the company can continue delivering for patients, shareholders and all other stakeholders.

As directors, we play a significant role in supporting and overseeing BMS’s strategic direction. Each of our nine meetings with management last year offered opportunities to discuss the company’s execution against its strategy and the goal of becoming one of the sector’s fastest-growing companies by the end of the decade. We were consistently available to management and offered insights and guidance as the company approached and achieved key milestones, including its re-entry into neuroscience through the successful integration of Karuna Therapeutics and the U.S. launch of Cobenfy.

I’m confident that the Board is well positioned to help management navigate the challenges and opportunities ahead, especially as we continue identifying ways to enhance our effectiveness and expand our competencies to address oversight of existing and emerging risks, including drug pricing and access, artificial intelligence, and cybersecurity. Each year, as we complete an annual assessment of the Board, we are reminded it is critical that we continually evaluate our composition to ensure we maintain highly qualified directors with the right mix of skills to exercise proper oversight of management and the company’s strategy. In July 2024, we welcomed the newest member of our Board, Michael McMullen. Mike, the former president and CEO of Agilent Technologies, Inc., brings global management experience and a proven track record of business and cultural transformation that has already enhanced our contributions and the support we provide.

The Board we have today is strong and engaged, and I am tremendously excited about the impact we are making together. Our 11 director nominees bring a wide variety of experiences and expertise spanning corporate finance, commercialization, scientific research, risk management, practical medicine, academia, corporate leadership, and more. Six members were onboarded within the past five years, providing a steady refreshment of new talent and viewpoints.

Each year, we prioritize engaging with shareholders and answering their questions about the business and our areas of focus. In 2024, the company extended meeting invitations to approximately 50 of our top institutional shareholders, representing about 52% of our voting shares outstanding. We also used this opportunity to include our new CEO as well as the CFO and me in a few of the engagement meetings. These conversations are tremendously valuable, as they allow us to share recent milestones and key updates on the company’s progress. They also provide an opportunity to learn from our investors and better understand their perspectives on how BMS is performing and where we can improve.

Across our recent engagements, there was consistent interest in the company’s strategy, the relationship between management and the Board, and BMS’s plans to overcome potential near-term headwinds. The feedback we received was shared with the full Board and will help inform decisions we make throughout the coming year. We look forward to more of these discussions in 2025.

Beyond the governance, Board effectiveness and shareholder engagement efforts I’ve mentioned, we advanced our work to deliver value for patients and employees while furthering our environmental, social and governance (Sustainability and Social Impact) initiatives. Importantly, last year marked a watershed moment for BMS with the launch of our ASPIRE strategy, which is designed to enhance access to medicines in LMICs. The company also published its 2024 Climate Change Report, outlining a strategy for managing and mitigating climate risk.

Core to the company’s ongoing transformation are its people. We continue to prioritize a strong people strategy to ensure the best talent is in place to carry out our strategy. We are grateful to all BMS employees around the world who live our mission and deliver for patients day in and day out. The culture they have helped build, their tireless efforts, and the work of management and the Board to foster those efforts continue to be recognized, with Forbes naming the company to its 2024 list of the World’s Best Employers.

Thank you for your investment in our company and your support of our patient-centric mission. As you review the ballot items in this year’s Proxy Statement, please know that your vote matters. By taking the few minutes required to cast your vote, you are making your voice and opinions heard at the company’s Annual Meeting.

Theodore R. Samuels

Lead Independent Director

Chair, Committee on Directors and Corporate Governance

Bristol Myers Squibb | 2025 Proxy Statement 2

Bristol Myers Squibb

The Story

| | | | | | | | | | | |

| | | |

| At Bristol Myers Squibb, we are inspired by a single vision —transforming patients’ lives through science. | |

| | | |

| | | |

| | | |

| | Our vision is to transform patients’ lives through science. At Bristol Myers Squibb, we are in the business of breakthroughs — the kind that transform patients’ lives through life-saving, innovative medicines. Our talented workforce is relentlessly dedicated to our mission of discovering, developing and delivering innovative medicines that help patients prevail over serious diseases. Evolution is in our DNA, and we are reinventing to lead where we have a competitive advantage — because our success means success for patients in need. | |

| | | |

| | | |

| | We are a biopharmaceutical leader, powered by science. We combine the agility and mindset of a biotech with the reach and resources of an established pharmaceutical company to create a leading, global biopharmaceutical company. By extending our leadership positions across hematology, oncology and cardiovascular disease, honing our efforts in immunology and re-establishing our presence in neuroscience, we are focusing on innovations that drive meaningful change. Supported by a deep and innovative pipeline, we bring a human touch to every treatment we deliver. | |

| | | |

| | | |

| | We are committed to the health of people, society and the planet. Our passion for making an impact extends beyond the discovery, development and delivery of innovative medicines that help patients prevail over serious diseases. Through our Sustainability and Social Impact strategy, we seek to mobilize our capabilities and resources to positively impact the communities where we live and work, and those we serve around the world. Our Sustainability and Social Impact strategy and initiatives center on expanding the boundaries of science to address unmet patient needs and advancing equitable access to life-transforming medicines around the globe. This strategy is guided by our commitment to inclusion in all aspects of our business and to reducing our environmental impact. | |

| | | |

| | | |

| | We are people-focused, creating an environment for our employees to thrive. Among our highest priorities are the health, safety, professional development, and wellbeing of our employees. We prioritize our people by cultivating a high-performing and inclusive global workforce. We unite as ONE BMS, believing that the varied experiences and perspectives of all our employees help to bring out our best ideas, drive innovation and achieve transformative business results. We remain committed to providing a comprehensive rewards and wellbeing strategy to enable our workforce to deliver on our business strategy and transform patients' lives through science. | |

| | | |

| | | |

| | We put patients at the center of everything we do, defining what’s possible. Our focus on patients and their families motivates us to work smarter, faster and better. We commit to scientific excellence and invest in research and development (R&D) for our patients. Core to who we are is the belief that all patients who need our life-saving medicines should have access to them. We take a thoughtful approach to pricing our medicines and we support policies that help advance access. To that end, we are committed to working collaboratively with relevant stakeholders, including payers, physicians, advocates, patients and civil societies around the world. We are reimagining the patient experience by leveraging digital health to improve diagnosis, treatment and monitoring. We are motivated by the power of science. Together, we are reshaping the treatment of schizophrenia with the U.S. approval of Cobenfy — the first new mechanism of action in decades for the treatment of schizophrenia. The advancements of first- or best-in-class medicines Reblozyl, Camzyos and Breyanzi build on our legacy across disease areas in oncology, cardiovascular, and hematology. In immunology, we are focused on novel treatment approaches such as the use of cell therapy to reset the immune system. We are passionately pursuing the next wave of treatments and scientific advancements. This includes radiopharmaceutical therapeutics (RPTs), one of the fastest-growing new modalities for treating patients with solid tumors, which we’ve added to our manufacturing platform. We have a history of scientific excellence and transforming patient outcomes. This is driven by our global workforce, who work together to define what’s possible for the future of science and the patients we serve. | |

| | | |

3 Bristol Myers Squibb | 2025 Proxy Statement

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Reshaping BMS to achieve sustained top-tier growth, maximize long-term value and accelerate our ability to deliver breakthrough medicines to even more patients faster. 2024 was a productive year marked by strong execution and the advancement of the best pipeline in our history. Our Growth Portfolio delivered strong sales growth versus 2023, and we built momentum through important regulatory milestones, including the U.S. approval of Cobenfy and Opdivo Qvantig. To position the organization for continued success, we began reshaping the company by focusing on transformational medicines where we have a competitive advantage, driving operational excellence and strategically allocating capital. We serve millions of patients globally and our progress last year accelerated our ability to deliver more innovative medicines to more patients, strengthening our profile heading into 2025. | |

| | | | | | | |

| | | | | | | | | | |

| Highlights from the year include: üReceived 23 approvals from the FDA and other markets, including: •Cobenfy; launched the first-in-class transformational treatment for adults with schizophrenia in the U.S. in decades •Opdivo Qvantig; received U.S. approval for the subcutaneous formulation of nivolumab across most previously approved adult, solid tumor Opdivo indications •Reblozyl; expanded approval in the E.U. to include the first-line treatment of adult patients with transfusion-dependent anemia •Breyanzi; received U.S. approval to expand into follicular lymphoma and mantle cell lymphoma üStrong R&D and pipeline progress: •Advanced our promising pipeline with increased depth across therapeutic areas of focus to address high unmet needs •Took steps to expedite delivery through trial acceleration •Received nine investigational new drug/clinical trial authorization (IND/CTA)* approvals •Expanded our registrational pipeline, which includes over 15 assets •Began efforts to further increase and sustain R&D productivity and bring treatments to patients faster | | |

üLeveraged external innovation through business development and partnerships to address areas of high unmet need. •Closed and integrated the acquisitions of Mirati Therapeutics, RayzeBio, and Karuna Therapeutics. These transactions enhance our oncology portfolio, add an important radiopharmaceutical platform, and accelerate our re-entry into neuroscience. •Completed an exclusive license and collaboration agreement with SystImmune, adding another antibody-drug conjugate to our diverse pipeline. •Deepened our capabilities across our research platforms and core therapeutic areas through partnerships with Cellares and BioArctic. üAnnounced ASPIRE (Accessibility, Sustainability, Patient-centric, Impact, Responsibility and Equity) strategy to advance access to our innovative treatments and help patients in low- and middle-income countries (LMICs) gain access to potentially life-saving medicines and received validation for our near-term and net-zero science-based targets from the Science Based Targets initiative (SBTi), progressing our Sustainability and Social Impact initiatives. Throughout the year, we remained strategic in our approach to capital allocation. We harnessed our strong financial position to invest in both internal and external innovation. We remain committed to returning capital to shareholders and to the dividend, which we increased for the fifteenth consecutive year. We also strengthened our balance sheet, paying down $6 billion in debt in 2024. | |

| | | | | | |

| | | | | | |

23 Approvals from the FDA and other markets | 20 Submissions to the FDA and other markets | 9 IND/CTA approvals | | |

| | | | | | | | | | |

*An Investigational New Drug (IND) is a drug or biological product that has not been approved for general use by the FDA.

Bristol Myers Squibb | 2025 Proxy Statement 4

Who We Are

2025 Director Nominees

Our Board of Directors

Our Board of Directors (the “Board”) has nominated 11 current directors, Christopher Boerner, Ph.D., Theodore R. Samuels, Peter J. Arduini, Deepak L. Bhatt, M.D., M.P.H., M.B.A., Julia A. Haller, M.D., Manuel Hidalgo Medina, M.D., Ph.D., Michael R. McMullen, Paula A. Price, Derica W. Rice, Karen H. Vousden, Ph.D., and Phyllis R. Yale, to serve as directors of Bristol-Myers Squibb Company. All of our nominees are willing to serve as directors and have consented to being named in our proxy materials. When elected, these directors will hold office until the 2026 Annual Meeting or until their successors are duly elected.

We believe that tone is set at the top, so we begin by introducing you to who we are. We follow that with a description of how our directors are selected and elected, how we govern and are governed, how we are organized, how you can communicate with us and how we are paid. We ask in Item 1 for your voting support so we can continue our important work and build on our significant successes in 2025.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Board Nominees | | | | | | |

| Christopher S. Boerner, Ph.D. | Theodore R. Samuels | Peter J.

Arduini | Deepak L. Bhatt, M.D., M.P.H., M.B.A. | Julia A.

Haller, M.D. | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Manuel Hidalgo Medina, M.D., Ph.D. | Michael R. McMullen | Paula A.

Price | Derica W.

Rice | Karen H.

Vousden, Ph.D. | Phyllis R.

Yale | |

| | | | | | | |

All Director Nominees possess these qualities:

| | | | | | | | | | | |

| | | |

| | | |

| Leadership | Strategic Thinking | Sound Business Judgment | Integrity & Ethics |

| | | |

5 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| Who We Are: 2025 Director Nominees |

Overview of 2025 Director Nominees Skills, Age & Tenure

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Chris S. Boerner, PhD (CEO) | Theodore R. Samuels (LID) | Peter J.

Arduini | Deepak L. Bhatt,

MD, MPH, MBA | Julia A.

Haller, MD | Manuel Hidalgo Medina, MD, PhD | Michael R. McMullen | Paula A.

Price | Derica W.

Rice | Karen H.

Vousden, PhD | Phyllis R.

Yale |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Director Since | 2023 | 2017 | 2016 | 2022 | 2019 | 2021 | 2024 | 2020 | 2020 | 2018 | 2019 |

| Compliance |

| Independent Director | | l | l | l | l | l | l | l | l | l | l |

| Designated Financial Expert | | l | | | | | l | l | l | | |

| Key Skills & Experience |

| Public Co. CEO | l | | l | | | | l | | | | |

| Public Co. CFO | | | | | | | | l | l | | |

| Healthcare | l | l | l | l | l | l | l | l | l | l | l |

| Science/Technology/Innovation | l | | l | l | l | l | l | | | l | |

| Financial | l | l | l | | l | | l | l | l | | l |

| Risk Management | l | l | l | | l | | l | l | l | | l |

| Sales & Marketing | l | l | l | | | | l | | | | l |

| International | l | l | l | | | l | l | l | l | l | |

Academia/

Non-Profit | | l | | l | l | l | | l | | l | l |

| Digital | l | | l | | | | l | l | l | | |

| Demographics |

Age (years)† | 54 | 70 | 60 | 57 | 70 | 57 | 64 | 63 | 60 | 67 | 67 |

Tenure (years)† | 2.0 | 8.2 | 9.1 | 2.9 | 5.5 | 3.9 | 0.8 | 4.7 | 4.7 | 7.4 | 5.5 |

† As of May 6, 2025 |

| | | | | | | | | | | |

Key Skills & Experience Definitions

Healthcare

Experience in relevant areas within the healthcare industry, including science, manufacturing, regulatory compliance, payer dynamics, and working with health care providers.

Science/Technology/Innovation

Relevant scientific expertise in the healthcare industry, and experience with technology and innovation, including the use of innovative technologies in the discovery, development and delivery of medicines.

Financial

Experience in corporate finance, and financial reporting and internal controls at a large organization.

Risk Management

Experience managing critical enterprise risks.

Sales & Marketing

Experience in commercialization, digital advertising, marketing and brand development.

International

Experience leading a complex global organization or understanding different regulatory and commercial requirements.

Public Company CEO/CFO

Experience serving as a CEO/CFO at a public or private company.

Academia/Non-Profit

Experience as professor, researcher or leader at a large university or non-profit organization.

Digital

Experience or expertise managing or overseeing information technology, including related to the use of digital technologies to facilitate business objectives, cybersecurity and data privacy.

Bristol Myers Squibb | 2025 Proxy Statement 6

| | |

|

| Who We Are: 2025 Director Nominees |

Overview of 2025 Director Nominees Background

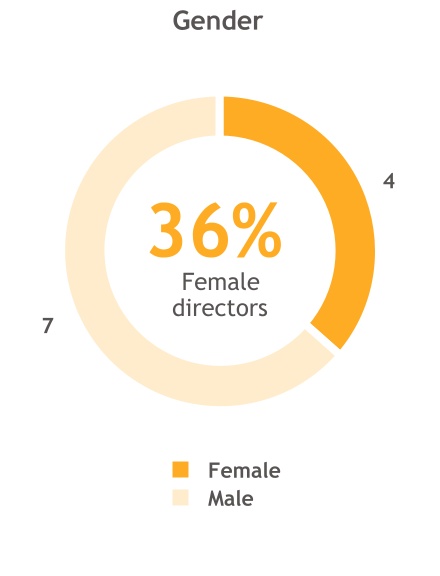

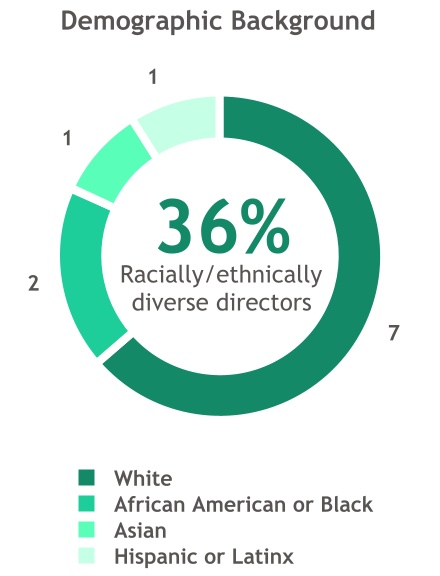

Our 11 Director nominees provide the Board with a comprehensive collection of varied backgrounds, industry experiences and personal characteristics.

| | | | | | | | | | | | | | | | | |

| | | | | |

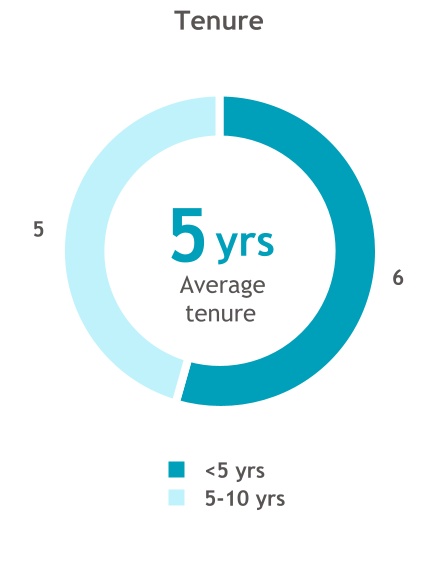

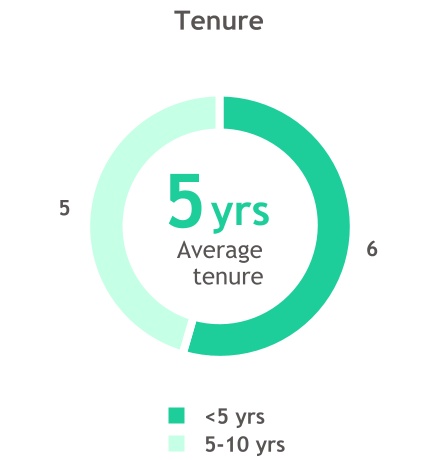

| Age distribution | | | Board refreshment | |

| 63 | | | 6 | |

| Average age of Directors (years) | | | New Directors over the past five years | |

| | | | | |

7 Bristol Myers Squibb | 2025 Proxy Statement

Item 1

Election of the Board of Directors

2025 Director Nominees

The following biographies of our director nominees reflect their Board Committee membership and Chair positions as of the date of this year’s Annual Meeting. Each of our Board members has experience and skills in the enumerated categories included in our skills matrix chart above, however, we have designated in the biographies only the top three to five skills to indicate that a director has particular strength in those areas.

Christopher S. Boerner, Ph.D.

Board Chair & Chief Executive Officer of the Company

Director Since: 2023

Age: 54

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •None | | | Other Public Company Boards •None | |

| | | | | |

| | | | | |

| Experience •Bristol Myers Squibb, Chief Executive Officer (November 2023-present) •Board Chair (April 2024-present); Board Member (2023-present) •Executive Vice President, Chief Operating Officer (April 2023-October 2023) •Executive Vice President, Chief Commercialization Officer (2018-2023) •Head of International Markets (2017-2018); Head of U.S. Commercial Markets (2015-2017) •Held leadership roles of increasing responsibility at Seattle Genetics, Inc. (2010-2015) •Served in marketing leadership roles at Genentech (2002-2010) •Worked at McKinsey & Company, earlier in his career, serving global pharmaceutical and biotechnology clients Key Skills and Experience •Public Company CEO/CFO •Healthcare •Sales & Marketing •Financial •Risk Management Other •Board of Directors of PhRMA (Pharmaceutical Research and Manufacturers of America) •Board member, Chair of the Nominating and Corporate Governance Committee of Achaogen, Inc. (2014-2015) | |

| | | | | |

Bristol Myers Squibb | 2025 Proxy Statement 8

| | |

|

| Item 1 – Election of the Board of Directors |

Theodore R. Samuels

Lead Independent Director & Chair of the Committee on Directors and Corporate Governance

Director Since: 2017

Age: 70

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Committee on Directors and Corporate Governance (Chair) •Audit Committee | | | Other Public Company Boards •Centene Corporation •Iron Mountain Incorporated Former Public Company Boards •Stamps.com •Perrigo Company plc | |

| | | | | |

| | | | | |

| Experience •President of the Capital Guardian Trust Company (2010-2016) •Board member, Capital Group (2005-2009); Capital Group Audit Committee; Capital Group Finance Committee (2013-2016); Chair of Capital International (North America) Proxy Committee; Capital Guardian Trust Company (North American) Management Committee member •Portfolio Manager at Capital Group (1990-2016 and analyst 1981-1990) Key Skills and Experience •Financial •Sales & Marketing •Risk Management •International Other •Director of BJC HealthCare •Trustee of Children’s Hospital Los Angeles Foundation; served as Director of Children’s Hospital Los Angeles (2004-2019; co-chair 2012-2015) •Director of the Edward Mallinckrodt, Jr. Foundation •Director of Research Corporation Technologies, Inc. •Trustee of the John Burroughs School, St. Louis (2018-2024) •Co-Chair of Tuft’s President Council (2016-2022) | |

| | | | | |

9 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| Item 1 – Election of the Board of Directors |

Peter J. Arduini

Chair of the Compensation and Management Development Committee

Director Since: 2016

Age: 60

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Compensation and Management Development Committee (Chair) | | | Other Public Company Boards •GE Healthcare Former Public Company Boards •Integra LifeSciences Holdings Corporation | |

| | | | | |

| | | | | |

| Experience •President and Chief Executive Officer at GE Healthcare, a medical technology and digital solutions innovator (2022-present) •President and Chief Executive Officer at Integra LifeSciences Holdings Corporation (2012-2021); President and Chief Operating Officer (2010-2012) •Corporate Vice President and President of Medication Delivery, Baxter Healthcare (2005-2010) •Previously spent 15 years at General Electric Healthcare in a variety of management roles for domestic and global businesses, culminating in leading the global functional imaging business Key Skills and Experience •Public Company CEO/CFO •Healthcare •Sales & Marketing •Financial Other •Board of Directors of AdvaMed (the Advanced Medical Technology Association) •Board of Directors of the National Italian American Foundation •Board of Trustees of Susquehanna University (2016-2022) | |

| | | | | |

Bristol Myers Squibb | 2025 Proxy Statement 10

| | |

|

| Item 1 – Election of the Board of Directors |

Deepak L. Bhatt, M.D., M.P.H., M.B.A.

Director Since: 2022

Age: 57

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Science & Technology Committee •Compensation and Management Development Committee | | | Other Public Company Boards •None | |

| | | | | |

| | | | | |

| Experience •Director of Mount Sinai Fuster Heart Hospital and the Dr. Valentin Fuster Professor of Cardiovascular Medicine at the Icahn School of Medicine at Mount Sinai (2022-present) •Professor of Medicine at Harvard Medical School (2012-2022); Visiting Professor of Medicine at Harvard Medical School (2022-2024) •Executive Director of Interventional Cardiovascular Programs at Brigham and Women’s Hospital (2013-2022) •Cardiologist at Dana Farber Cancer Institute (2009-2022) •Chief of Cardiology at VA Boston Heathcare (2008-2013) •Held a number of roles of increasing responsibility at the Cleveland Clinic in Cleveland, Ohio, in addition to being an attending physician, including Associate Director of the Cleveland Clinic Cardiovascular Coordinating Center, Director of the interventional cardiology fellowship, and Associate Director of the cardiovascular medicine fellowship (2001-2008) Key Skills and Experience •Science/Technology/Innovation •Healthcare •Academia/Non-Profit Other •Former Member of the Board of Trustees of the American College of Cardiology | |

| | | | | |

11 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| Item 1 – Election of the Board of Directors |

Julia A. Haller, M.D.

Chair of the Science & Technology Committee

Director Since: 2019

Age: 70

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Science & Technology Committee (Chair) •Committee on Directors and Corporate Governance | | | Other Public Company Boards •Ophtea Limited •Outlook Therapeutics, Inc. Former Public Company Boards •Celgene Corporation •Eyenovia, Inc. | |

| | | | | |

| | | | | |

| Experience •Ophthalmologist-in-Chief of Wills Eye Hospital in Philadelphia, PA, where she holds the William Tasman, M.D. Endowed Chair (2007-present) •Professor and Chair of the Department of Ophthalmology at Sidney Kimmel Medical College at Thomas Jefferson University and Thomas Jefferson University Hospitals (present) •Member of the Johns Hopkins faculty, where she held the Katharine Graham Chair in Ophthalmology (until 2007) •Trained at the Wilmer Eye Institute at Johns Hopkins, where she served as the first female Chief Resident Key Skills and Experience •Academia/Non-Profit •Healthcare •Science/Technology/Innovation Other •Member of the National Academy of Medicine •Chair of the Board of Trustees for the College of Physicians of Philadelphia •Chair of the HEED Ophthalmic Foundation Board •President of the John Hopkins Medicine Alumni Society | |

| | | | | |

Bristol Myers Squibb | 2025 Proxy Statement 12

| | |

|

| Item 1 – Election of the Board of Directors |

Manuel Hidalgo Medina, M.D., Ph.D.

Director Since: 2021

Age: 57

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Committee on Directors and Corporate Governance •Science & Technology Committee | | | Other Public Company Boards •Guardant Health, Inc. | |

| | | | | |

| | | | | |

| Experience •Professor of Medicine and Chief of Division of Hematology and Medical Oncology at Weill Cornell Medical College (2019-present) •Attending Physician at New York-Presbyterian Hospital (2019-present) •Associate Director, Clinical Services of Meyer Cancer Center, Weill Cornell Medical College (2019-2024) •Deputy Associate Director, Clinical Sciences at Dana Farber/Harvard Cancer Center (2015-2019) •Chief of Division of Hematology, Oncology and Director at Rosenberg Clinical Cancer Center of Beth Israel Deaconess Medical Center (2015-2019) •Professor of Medicine at Harvard University (2015-2019) Key Skills and Experience •Science/Technology/Innovation •Healthcare •Academia/Non-Profit •International Other •Director of Methods of Special Conference Clinical Cancer Research Course of American Association for Cancer Research (2018-2024) •Steering Committee of Pancreatic Cancer Action Network (2016-present) •Director of American Association of Cancer Research (2024-2027) •Director of Guardant Health (2024-present) | |

| | | | | |

13 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| Item 1 – Election of the Board of Directors |

Michael R. McMullen

Director Since: 2024

Age: 64

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Audit Committee •Compensation and Management Development Committee | | | Other Public Company Boards •KLA Corporation Former Public Company Boards •Agilent Technologies, Inc. •Coherent, Inc. | |

| | | | | |

| | | | | |

| Experience •Chief Executive Officer of Agilent Technologies, Inc. (2015-2024) •President and Chief Operating Officer of Agilent Technologies, Inc. (2014-2015) •Senior Vice President, Agilent and President, Chemical Analysis Group at Agilent (2009-2014) Key Skills and Experience •Public Company CEO/CFO •Science/Technology/Innovation •Healthcare •International •Digital Other •Board of Trustees, University of Delaware (2024-present) | |

| | | | | |

Bristol Myers Squibb | 2025 Proxy Statement 14

| | |

|

| Item 1 – Election of the Board of Directors |

Paula A. Price

Director Since: 2020

Age: 63

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Audit Committee •Committee on Directors and Corporate Governance | | | Other Public Company Boards •Accenture plc •Warner Brothers Discovery •Mondelez International, Inc. Former Public Company Boards •Davita, Inc. •Dollar General Corporation •Western Digital Corporation | |

| | | | | |

| | | | | |

| Experience •Executive Vice President and Chief Financial Officer at Macy’s, Inc. (2018-2020) •Senior Lecturer at Harvard Business School in the Accounting and Management Unit (2014-2018) •Executive Vice President and Chief Financial Officer of Ahold USA (2009-2014) •Senior Vice President, Controller and Chief Accounting Officer at CVS Caremark (2006-2009) Key Skills and Experience •Public Company CEO/CFO •Financial •Risk Management •Academia/Non-Profit •Digital Other •Director of Blue Cross Blue Shield of Massachusetts •Member of Advisory Board of Columbia University Mailman School of Public Health •Director of Mutual of America | |

| | | | | |

15 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| Item 1 – Election of the Board of Directors |

Derica W. Rice

Chair of the Audit Committee

Director Since: 2020

Age: 60

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Audit Committee (Chair) •Compensation and Management Development Committee | | | Other Public Company Boards •Target Corporation •The Walt Disney Company •The Carlyle Group | |

| | | | | |

| | | | | |

| Experience •Executive Vice President of CVS Health, and President, Pharmacy Benefits Management Business of CVS Caremark (2018-2020) •Executive Vice President of Global Services (2010-2017) and Chief Financial Officer (2006-2017) of Eli Lilly and Company •Vice President and Controller (2003-2006) and various executive positions at Eli Lilly and Company (1990-2005) Key Skills and Experience •Public Company CEO/CFO •Financial •Healthcare •Risk Management •Digital Other •Director of Center for Leadership Development •Director of Tessera Therapeutics | |

| | | | | |

Bristol Myers Squibb | 2025 Proxy Statement 16

| | |

|

| Item 1 – Election of the Board of Directors |

Karen H. Vousden, Ph.D.

Director Since: 2018

Age: 67

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Compensation and Management Development Committee •Science & Technology Committee | | | Other Public Company Boards •None | |

| | | | | |

| | | | | |

| Experience •Principal Group Leader at the Francis Crick Institute in London (2017-present) •Chief Scientist of Cancer Research UK (2016-2022) •Director of the Cancer Research UK (CRUK) Beatson Institute in Glasgow (2002-2016) •Held leadership roles at the National Cancer Institute in Maryland (1995-2002) Key Skills and Experience •Academia/Non-Profit •Healthcare •Science/Technology/Innovation •International Other •Founder and Consultant of Faeth Therapeutics, Inc. •Member of the Science Advisory Boards of the Allison Institute (MD Anderson, Texas), Kovina Therapeutics, the Ludwig Institute for Cancer Research and Volastra Therapeutics •Fellow of the Royal Society •Foreign Member of the U.S. National Academy of Sciences •Former President of the British Association of Cancer Research | |

| | | | | |

17 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| Item 1 – Election of the Board of Directors |

Phyllis R. Yale

Director Since: 2019

Age: 67

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board Committees •Audit Committee •Science & Technology Committee | | | Other Public Company Boards •Davita, Inc. | |

| | | | | |

| | | | | |

| Experience •Advisory Partner, Bain & Company (2010-present); Partner (1987-2010) •Since 1982, has served in a number of leadership roles and has been a leader in building Bain’s healthcare practice Key Skills and Experience •Financial •Risk Management •Healthcare •Academia/Non-Profit Other •Director of Aledade, Inc. •Member of the Advisory Board of the Health Policy and Management Department at the Harvard Chan School of Public Health •Member of the Board of The Trustees of Reservations, a conservation and preservation organization •Former director of Blue Cross Blue Shield of Massachusetts •Former member of the Advisory Board of Harvard Business School Healthcare Initiative | |

| | | | | |

| | | | | | | | | | | | | | |

| | | | |

| | | We ask in Item 1 for your voting support so we can continue our important work and build on our significant successes in 2025. | |

| | | | |

Bristol Myers Squibb | 2025 Proxy Statement 18

How We Are Selected

and Elected

The BMS management team puts a great deal of thought into talent recruitment and retention, and as directors, we are similarly committed to identifying and attracting the best directors to serve the Company. In the subsections that follow, we describe our standards, policies and processes designed to achieve this goal.

Majority Vote Standard and Director Resignation Policy

A majority of the votes cast is required to elect directors. To be eligible for nomination to the Board, all director nominees must submit an irrevocable resignation, contingent on (A) that person not receiving a majority of the votes cast in an election that is not a contested election, and (B) acceptance of that resignation by the Board in accordance with policies and procedures adopted by the Board for such purpose. In the event an incumbent director fails to receive a majority of the votes cast in an election that is not a contested election, the Committee on Directors and Corporate Governance, without participation by any director tendering their resignation, will make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board, without participation by any director tendering their resignation, will act on the resignation, taking into account the committee’s recommendation at its next regularly scheduled meeting to be held within 60 days after the certification of the shareholder vote. BMS will publicly disclose the Board’s decision and, if such resignation is rejected, the reasons for that decision in a broadly disseminated press release that will also be furnished to the U.S. Securities and Exchange Commission (SEC) on Form 8-K within 90 days after the certification of the shareholder vote. The Committee on Directors and Corporate Governance, in making its recommendation, and the Board, in making its decision, each may consider any factors and other information that they consider appropriate and relevant. If any nominee is unable to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless our Board of Directors provides for a lesser number of directors.

Criteria for Board Membership

As specified in our Corporate Governance Guidelines, members of our Board should have broad experience in areas important to the operation and long-term success of BMS. These include areas such as business, science, medicine, finance/accounting, law, business strategy, crisis management, risk management, corporate governance, education or government. Board members should possess qualities reflecting integrity, independence, leadership, good business judgment, wisdom, an inquiring mind, vision, a proven record of accomplishment and an ability to work well with others.

We generally restrict the number of other public company boards that non-employee directors and a director serving as chief executive officer can serve on to four and two, respectively, including our Board, and all of our directors are in compliance with these restrictions.

Director Independence

Our Corporate Governance Guidelines provide that a substantial majority of Board members be independent from management. The Board observes all relevant criteria established by the SEC and the New York Stock Exchange (NYSE) and has adopted independence standards that meet the listing standards of the NYSE (See Exhibit A). The Board has determined that, except for Christopher Boerner, Ph.D., who is our Chief Executive Officer, each of our directors and each director nominee for election at this Annual Meeting is independent of BMS and its management.

| | | | | | | | |

| | |

| Independence | |

| 10 | |

| out of 11 director nominees are currently independent | |

| | |

19 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| How We Are Selected and Elected |

Process for Determining Independence

In accordance with our Corporate Governance Guidelines, the Board undertakes an annual review of director independence. Under our Corporate Governance Guidelines and the NYSE listing standards, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company. In February 2025, the Board considered all commercial and charitable relationships of our independent directors and director nominees, including the following relationship, which was deemed immaterial under our categorical standards:

•Mr. Arduini was appointed President and Chief Executive Officer of GE Healthcare in January 2022. BMS has a prior business relationship with GE Healthcare, pursuant to which we made ordinary course of business payments to GE Healthcare in 2024, including related to some early development and license agreements. All of the business dealings were entered into on terms no more favorable to GE Healthcare than terms that would be available to unaffiliated third parties under similar circumstances, and the payments made by BMS did not exceed the greater of $1 million or 2% of GE Healthcare’s consolidated gross revenues.

The Board determined that none of our independent directors had any relationships that would impair their independence under the NYSE’s independence standards or otherwise.

Director Succession Planning and Identification of Board Candidates

Regular Assessment of Our Board Composition

The Committee on Directors and Corporate Governance regularly assesses the appropriate size and composition of the Board. This assessment incorporates the results of the Board’s annual evaluation process, which are described more fully under “Annual Evaluation Process” beginning on page 22. The Committee also considers succession planning for its directors. Identification and Selection of Director Nominees

In connection with the Board’s ongoing director identification process, the Committee on Directors and Corporate Governance, in consultation with the Board Chair, conducts an initial evaluation of prospective nominees against the established Board membership criteria discussed above. The Committee also reviews the skills of the current directors and compares them to the particular skills of potential candidates. In particular, the Board is committed to identifying and evaluating all highly qualified candidates for Board positions, including candidates with varied backgrounds, industry experiences and personal characteristics. In addition, the Committee annually evaluates each current director’s prior service on and contributions to the Board, which includes consideration of each director’s attendance, job responsibilities, service on other public company boards, and leadership positions on such boards prior to recommending a director or nominee for election to our Board.

Bristol Myers Squibb | 2025 Proxy Statement 20

| | |

|

| How We Are Selected and Elected |

Candidates may come to the attention of the Committee on Directors and Corporate Governance through current Board members, third-party search firms, management, shareholders or others. Search firms together with management and directors develop a candidate profile that includes the relevant skills and experiences being sought at that time and incorporates the Board membership criteria. Prospective candidates are identified based on that profile. Additional information relevant to the qualifications of prospective nominees may be requested from third-party search firms, other directors, management or other sources. After this initial evaluation, prospective nominees may be interviewed by telephone or in person by the members of the Committee on Directors and Corporate Governance, the Board Chair, the Lead Independent Director and other directors, as applicable. After completing this evaluation and interview process, the Committee on Directors and Corporate Governance makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the full Board determines the nominees after considering the recommendation and any additional information it may deem appropriate.

Following a robust process that began in 2023, Mr. McMullen was elected to join the Board, effective July 1, 2024. He was identified as a potential candidate for election to the Board by a third-party search firm retained by the Committee on Directors and Corporate Governance and was subsequently interviewed by members of the Board.

Shareholder Nominations for Director

In accordance with the Company’s Bylaws and other governing documents, the Board considers and evaluates qualified shareholder recommendations and nominations of candidates for election to the Board in substantially the same manner as other director nominees and will not impose unnecessary requirements for such candidates. Shareholder recommendations must be accompanied by disclosure, including written information about the recommended nominee’s business experience and background with consent in writing signed by the recommended nominee that he or she is willing to be considered as a nominee and, if nominated and elected, he or she will serve as a director. Shareholders should send their written recommendations of nominees accompanied by the required documents to: Bristol-Myers Squibb Company, Route 206 & Province Line Road, Princeton, NJ 08543, Attention: Corporate Secretary.

Proxy Access Shareholder Right

Following extensive engagement with our shareholders, the Board determined to adopt proxy access in 2016, permitting a shareholder or group of up to 20 shareholders, in each case, holding at least 3% of our outstanding shares of common stock for at least three years, to nominate a number of directors constituting the greater of two directors or 20% of the number of directors on the Board, as set forth in detail in our Bylaws. If you wish to propose any action pursuant to our proxy access bylaw provision, you must deliver a notice to BMS containing certain information set forth in our Bylaws, not less than 120 but not more than 150 days before the anniversary of the prior year’s filing of the proxy materials. For our 2026 Annual Meeting, we must receive this notice between October 27, 2025, and November 26, 2025. Shareholders should send their notices to our principal executive office: Bristol-Myers Squibb Company, Route 206 & Province Line Road, Princeton, NJ 08543, Attention: Corporate Secretary.

21 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| How We Are Selected and Elected |

Annual Evaluation Process

The Board recognizes the critical role Board and Committee evaluations play to ensure the effective functioning of the Board. We also believe in the importance of continuously improving the functioning of the Board and Board Committees. Under the leadership and guidance of our Lead Independent Director, the Committee on Directors and Corporate Governance annually reviews the Board evaluation process. For the last few years, the formal Board evaluation process has included a written questionnaire for the Board and the Board Committees. In addition to the Board and Board Committee questionnaires, for individual director assessments, the Lead Independent Director engages in one-on-one discussions with each director regarding, without limitation, governance, Board functioning and effectiveness, interaction with management, meetings and materials and performance. The Lead Independent Director conveys directors’ feedback on an ongoing basis to the Board Chair and has regular one-on-one discussions with the other members of the Board. The formal 2024 Board and Committee evaluation processes were as follows:

•Board: Directors completed an electronic questionnaire on an unattributed basis responding to questions about the Board and Committee structure and responsibilities, Board culture and dynamics, adequacy of information to the Board, Board skills and effectiveness, and Committee effectiveness. In addition, the Lead Independent Director completed one-on-one individual director assessments guided by predetermined questions covering the foregoing topics. The robust feedback and comments from the directors were anonymously compiled and then presented by the Board Chair and the Lead Independent Director to the full Board for discussion and action. The 2024 Board evaluation was completed in February 2025.

•Committees: Committee members completed an electronic questionnaire, which included questions approved by each Committee chair with topics covering each Committee’s composition, culture, and functioning as well as each Committee’s responsibilities and effectiveness. The results from the questionnaires were compiled and Committee chairs led discussions in executive sessions of their respective committees. Committee chairs then reported to the full Board the results of their respective committee’s evaluation and any follow-up actions. The 2024 Committee evaluations were completed in the beginning of 2025 and reported to the Board in February 2025.

Bristol Myers Squibb | 2025 Proxy Statement 22

How We Govern and Are Governed

Director Orientation and Continuing Education

Director education is an ongoing, year-round process, which begins when a director joins the Board. Upon joining the Board, new directors are provided with a comprehensive orientation program to learn about our company, including our business, strategy and governance. The orientation program is led by senior business and functional leaders from all areas of the company, where strategic priorities and key risks and opportunities are discussed. All of our directors periodically attend site visits to one or more of our locations. On an ongoing basis, our directors receive presentations on a variety of topics related to their work on the Board and within the biopharmaceutical industry, both from senior management and from experts outside of the company. We also encourage all of our directors to enroll, at our expense, in continuing education programs provided by third parties.

Active Board Oversight of Our Governance

Our business is managed under the direction of the Board pursuant to the Delaware General Corporation Law and our Bylaws. The Board has responsibility for establishing broad corporate policies and for the overall performance of our company. The Board keeps itself informed of company business through regular written reports and analyses from management, and regular discussions with the Chief Executive Officer and other company officers; by reviewing other materials provided by management and by external advisors; and by participating in Board and Board Committee meetings.

The Committee on Directors and Corporate Governance continually reviews corporate governance topics, trends, and is responsible for identifying and recommending the adoption of corporate governance initiatives. In addition, our Compensation and Management Development Committee regularly reviews our compensation policies and procedures and, when appropriate, recommends changes that strengthen our compensation practices.

The Board has adopted Corporate Governance Guidelines that govern its operation and that of its committees. The Board annually reviews the Corporate Governance Guidelines and, from time to time, revises them in response to changing regulatory requirements, evolving best practices and feedback from our shareholders and other stakeholders.

Board’s Role in Strategic Planning and Risk Oversight

The Board meets regularly to discuss our company’s strategic direction and the issues and opportunities facing our company in light of trends and developments in the biopharmaceutical industry and the broader business environment. The Board has been instrumental in determining our short-term and long-term company strategy.

The Board is dedicated to oversight of risk management and is responsible for risk oversight as part of its fiduciary duty of care to monitor business operations effectively. Specifically, the Board plays a critical role in the determination of the types and appropriate levels of risk undertaken by the company. Some of the key risks the Board is focused on relate to: (i) potential legislative or other regulatory actions impacting the pharmaceutical industry in the U.S. and internationally, including related to drug pricing and access; (ii) intellectual property protection and upcoming losses of exclusivity; (iii) competition; (iv) business continuity; (v) key environmental, social and governance risks, inclusive of human capital management, covering, among other things, compensation program design, and our Sustainability and Social Impact initiatives; and (vi) information technology, including cybersecurity, data privacy and artificial intelligence, among others.

23 Bristol Myers Squibb | 2025 Proxy Statement

| | |

|

| How We Govern and Are Governed |

The Board administers its strategic planning and risk oversight function as a whole and through its Board Committees. The following are examples of how the Board Committees are involved in this process:

| | | | | | | | | | | | | | |

| | | | |

| Audit Committee | | Regularly reviews and discusses with management our policies and guidelines regarding risk assessment and risk management, including their effectiveness, our process for mitigating and monitoring enterprise risks, including those related to market/environment, strategic, financial, operational, legal, compliance, regulatory, cybersecurity and reputational risks. With respect to cybersecurity risk, the Audit Committee receives regular updates from management on matters related to cybersecurity and data privacy incidents. Our Chief Information Security Officer also provides updates on significant threats to our systems, risk mitigation strategies, program assessments, planned improvements, and status of information security initiatives. | |

| | | | |

| | | | |

| Compensation and Management Development Committee | | Annually evaluates our incentive compensation programs and determines whether incentive pay encourages excessive or inappropriate risk-taking. In particular, the Committee evaluates the components of our executive compensation program that work to minimize excessive or inappropriate risk-taking, including the use of different forms of long-term equity incentives, linking incentive payout opportunities to each executive’s demonstration and role modeling of our BMS Values, placing caps on our incentive award payout opportunities, requiring clawback/recoupment of incentive compensation when our policies are violated, following equity grant practices that limit potential for timing awards and having stock ownership and retention requirements. With such measures in place, we reduce the sensitivity to short-term performance and appropriately balance risk and reward in a manner that does not encourage our executives to expose the company to imprudent risk-taking. These elements work to ensure our compensation program is properly aligned with our strategy and the interests of our shareholders. | |

| | | | |

| | | | |

| Committee on Directors and Corporate Governance | | Focuses on risks associated with corporate governance, Board refreshment, Board succession planning and regularly considers and makes recommendations to the Board concerning the appropriate size, function and needs of the Board; determines the criteria for Board membership; provides oversight of our corporate governance affairs and reviews corporate governance practices and policies to manage related risks. Identifies and oversees monitoring and management of risks related to the company’s political activities; environmental, social and governance strategy and reporting and the impact on the company’s employees and shareholders. | |

| | | | |

| | | | |

| Science and Technology Committee | | Regularly reviews our pipeline and potential business development opportunities to evaluate our progress in achieving our near-term and long-term strategic R&D goals and objectives and assures that we make well-informed choices in the investment of our R&D resources, among other things. | |

| | | | |

Bristol Myers Squibb | 2025 Proxy Statement 24

| | |

|

| How We Govern and Are Governed |

The Board and Board Committees engage regularly with management on risks to the business, including the risks described above.

| | | | | | | | | | | | | | | | | |

| | | | | |