Filed Pursuant to Rule 424(b)(2)

Registration Nos. 333-283810 and 333-283810-01

Subject to Completion, dated November 3, 2025

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY PROSPECTUS SUPPLEMENT

(to Prospectus dated October 31, 2025)

€

BMS Ireland Capital Funding Designated Activity Company

€ % Notes due 20

€ % Notes due 20

€ % Notes due 20

€ % Notes due 20

€ % Notes due 20

Fully and Unconditionally Guaranteed by

Bristol-Myers Squibb Company

BMS Ireland Capital Funding Designated Activity Company, a designated activity company limited by shares incorporated under the laws of Ireland (the “Issuer”), is offering € of % Notes due 20 (the “20 Notes”), € of % Notes due 20 (the “20 Notes”), € of % Notes due 20 (the “20 Notes”), € of % Notes due 20 (the “20 Notes”) and € of % Notes due 20 (the “20 Notes” and, together with the 20 Notes, the 20 Notes, the 20 Notes and the 20 Notes, the “Notes”).

The 20 Notes will bear interest at a rate of % per annum and will mature on , 20 . The 20 Notes will bear interest at a rate of % per annum and will mature on , 20 . The 20 Notes will bear interest at a rate of % per annum and will mature on , 20 . The 20 Notes will bear interest at a rate of % per annum and will mature on , 20 . The 20 Notes will bear interest at a rate of % per annum and will mature on , 20 .

Interest on the 20 Notes will be payable annually in cash in arrears on of each year, beginning on , 2026. Interest on the 20 Notes will be payable annually in cash in arrears on of each year, beginning on , 2026. Interest on the 20 Notes will be payable annually in cash in arrears on of each year, beginning on , 2026. Interest on the 20 Notes will be payable annually in cash in arrears on of each year, beginning on , 2026. Interest on the 20 Notes will be payable annually in cash in arrears on of each year, beginning on , 2026.

The Issuer has the option to redeem all or a portion of the 20 Notes, the 20 Notes, the 20 Notes, the 20 Notes and the 20 Notes at any time prior to maturity, at the applicable redemption price as described in this prospectus supplement under the heading “Description of Notes—Optional Redemption of the Notes.” In addition, the Issuer may redeem the Notes in whole, but not in part, at any time in the event of certain developments affecting taxation. See “Description of Notes—Redemption for Tax Reasons.”

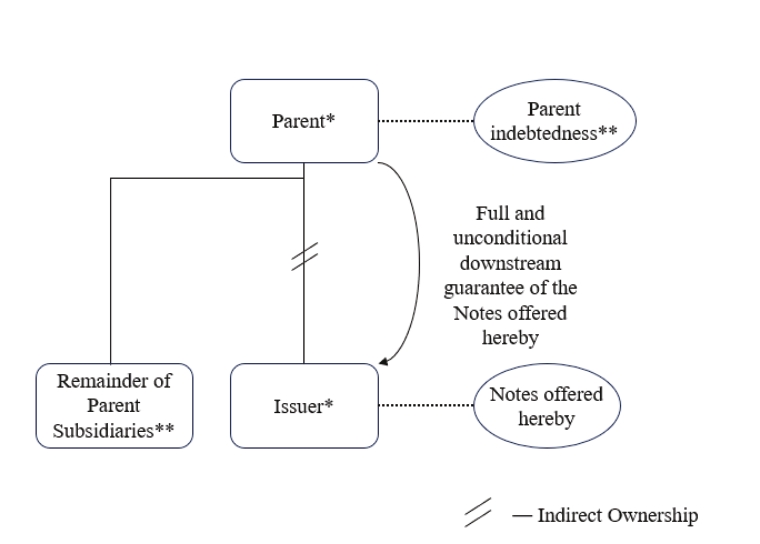

The Notes will be the Issuer’s general, unsecured senior obligations and will be fully and unconditionally guaranteed (the “Notes Guarantee”) on a senior unsecured basis by Bristol-Myers Squibb Company, the Issuer’s ultimate parent company (the “Parent”). The Notes will rank equally in right of payment with all of the existing and future unsecured senior indebtedness of the Issuer, will rank senior in right of payment to all of the existing and future unsecured, subordinated indebtedness of the Issuer, will be effectively subordinated to all of the existing and future secured indebtedness of the Issuer, to the extent of the value of the assets securing such indebtedness, and will be structurally subordinated to all of the existing and future indebtedness (including trade payables) of the Issuer’s subsidiaries (other than indebtedness and liabilities owed to the Issuer, if any). The Notes Guarantee will rank equally in right of payment with all of the existing and future unsecured senior indebtedness of the Parent, will rank senior in right of payment to all of the existing and future unsecured, subordinated indebtedness of the Parent, will be effectively subordinated to all of the existing and future secured indebtedness of the Parent, to the extent of the value of the assets securing such indebtedness, and will be structurally subordinated to all of the existing and future indebtedness (including trade payables) of the Parent’s subsidiaries (other than (i) by virtue of the Issuer’s obligations as issuer of the Notes, the Issuer and (ii) with respect to any indebtedness and liabilities owed to the Parent, if any).

Substantially concurrently with this offering, the Parent commenced a tender offer (the “Tender Offer”) to purchase, for cash, various series of the Parent’s outstanding notes (the “Tender Offer Notes”) as further described in “Summary—Recent Developments.” We intend to use the net proceeds of this offering, together with approximately $3.0 billion of cash on hand, (i) to fund the Tender Offer and/or other repurchase, repayment or redemption of the notes subject to the Tender Offer, (ii) to pay fees and expenses in connection therewith and with this offering and (iii) to the extent of any remaining proceeds, for general corporate purposes.

This offering is not contingent on the consummation of the Tender Offer or the purchase of any of the Tender Offer Notes in connection therewith.

The Notes will be issued only in registered form in minimum denominations of €100,000 and integral multiples of €1,000 in excess thereof.

The Notes are a new issue of securities with no established trading market. We intend to apply to list the Notes on the New York Stock Exchange (“NYSE”). The listing application will be subject to approval by the NYSE. If such a listing is obtained, we have no obligation to maintain it, and we may delist the Notes at any time. We do not otherwise intend to list the Notes on any securities exchange or to seek approval for quotation through any automated quotation system.

Investing in the Notes involves a high degree of risk. See “

Risk Factors” beginning on page S-

9 of this prospectus supplement and page

5 of the accompanying prospectus and those risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of certain risks that you should consider before investing in the Notes.

Neither the Securities and Exchange Commission nor any state securities commission or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | |

Public offering price(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting commission | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds, before expenses, to the Issuer(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)

| Plus accrued interest, if any, from , 2025, if settlement occurs after such date. |

The underwriters expect that delivery of the Notes will be made to investors in book-entry form only through the facilities of Clearstream Banking société anonyme and Euroclear Bank SA/NV as operator of the Euroclear System, on or about , 2025.

Joint Lead Managers and Joint Book-Running Managers

| | | | | | | | | | | | |

Citigroup

Global Coordinator | | | Barclays | | | BNP PARIBAS | | | J.P. Morgan | | | Société Générale

Corporate & Investment Banking |

The date of this prospectus supplement is , 2025.