© 2025 CRS Holdings, LLC. All rights reserved. CARPENTER TECHNOLOGY CORPORATION 2nd Quarter Fiscal Year 2026 Earnings Call January 29, 2026

© 2025 CRS Holdings, LLC. All rights reserved. Cautionary Statement Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ from those projected, anticipated or implied. The most significant of these uncertainties are described in Carpenter Technology’s filings with the Securities and Exchange Commission, including its report on Form 10-K for the fiscal year ended June 30, 2025, Form 10-Q for the fiscal quarter ended September 30, 2025, and the exhibits attached to those filings. They include but are not limited to: (1) the cyclical nature of the specialty materials business and certain end-use markets, including aerospace, defense, medical, energy, transportation, industrial and consumer, or other influences on Carpenter Technology's business such as new competitors, the consolidation of competitors, customers, and suppliers or the transfer of manufacturing capacity from the United States to foreign countries; (2) the ability of Carpenter Technology to achieve cash generation, growth, earnings, profitability, operating income, cost savings and reductions, qualifications, productivity improvements or process changes; (3) the ability to recoup increases in the cost of energy, raw materials, freight or other factors; (4) domestic and foreign excess manufacturing capacity for certain metals; (5) fluctuations in currency exchange and interest rates; (6) the effect of government trade actions, including tariffs; (7) the valuation of the assets and liabilities in Carpenter Technology's pension trusts and the accounting for pension plans; (8) possible labor disputes or work stoppages; (9) the potential that our customers may substitute alternate materials or adopt different manufacturing practices that replace or limit the suitability of our products; (10) the ability to successfully acquire and integrate acquisitions; (11) the availability of credit facilities to Carpenter Technology, its customers or other members of the supply chain; (12) the ability to obtain energy or raw materials, especially from suppliers located in countries that may be subject to unstable political or economic conditions; (13) Carpenter Technology's manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama for which there may be limited alternatives if there are significant equipment failures or a catastrophic event; (14) the ability to hire and retain a qualified workforce and key personnel, including members of the executive management team, management, metallurgists and other skilled personnel; (15) fluctuations in oil and gas prices and production; (16) the impact of potential cyber attacks and information technology or data security breaches; (17) the ability of suppliers to meet obligations due to supply chain disruptions or otherwise; (18) the ability to meet increased demand, production targets or commitments; (19) the ability to manage the impacts of natural disasters, climate change, pandemics and outbreaks of contagious diseases and other adverse public health developments; (20) geopolitical, economic, and regulatory risks relating to our global business, including geopolitical and diplomatic tensions, instabilities and conflicts, such as the war in Ukraine, the war between Israel and HAMAS, the war between Israel and Hezbollah, Houthi attacks on commercial shipping vessels and other naval vessels as well as compliance with U.S. and foreign trade and tax laws, sanctions, embargoes and other regulations; (21) challenges affecting the commercial aviation industry or key participants including, but not limited to production and other challenges at The Boeing Company; and (22) the consequences of the announcement, maintenance or use of Carpenter Technology’s share repurchase program. Any of these factors could have an adverse and/or fluctuating effect on Carpenter Technology's results of operations. The forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation or as of the dates otherwise indicated in such forward-looking statements. Carpenter Technology undertakes no obligation to update or revise any forward-looking statements. Non-GAAP and other financial measures Financial information included in this presentation is unaudited. Some of the information included in this presentation is derived from Carpenter Technology's consolidated financial information but is not presented in Carpenter Technology's financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation. 2

© 2025 CRS Holdings, LLC. All rights reserved. 3 2nd QUARTER FISCAL YEAR 2026 Tony Thene | Chairman of the Board and Chief Executive Officer

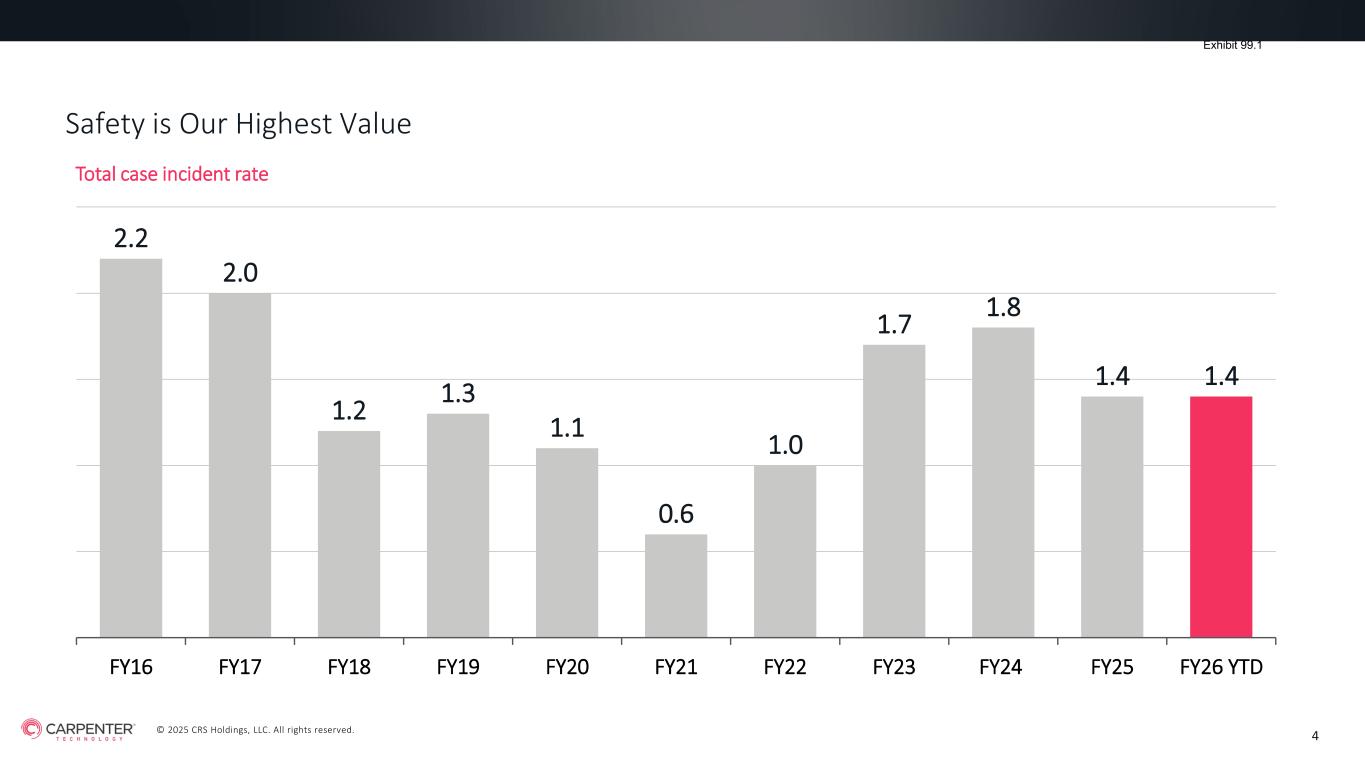

© 2025 CRS Holdings, LLC. All rights reserved. 4 Safety is Our Highest Value 2.2 2.0 1.2 1.3 1.1 0.6 1.0 1.7 1.8 1.4 1.4 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 YTD Total case incident rate

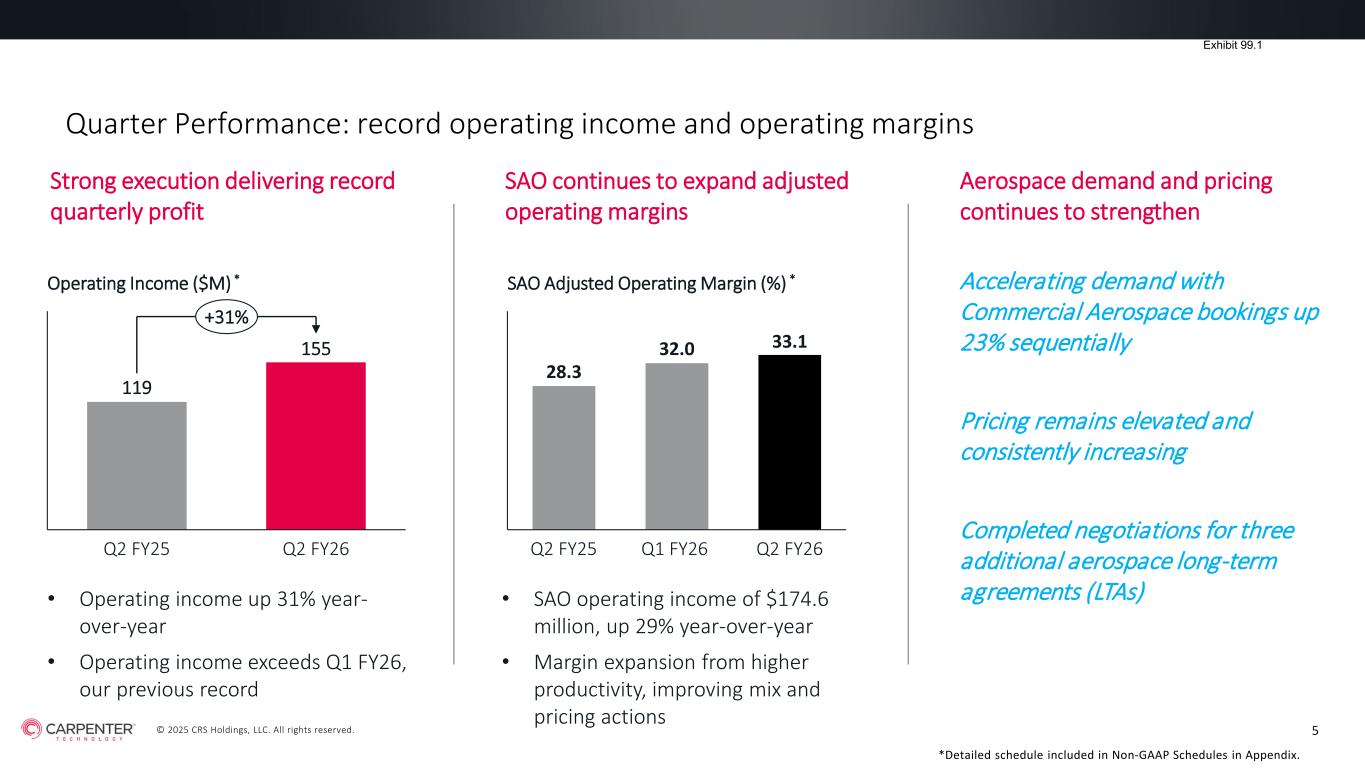

© 2025 CRS Holdings, LLC. All rights reserved. Quarter Performance: record operating income and operating margins Strong execution delivering record quarterly profit 5 155 Operating Income ($M) * Q2 FY25 Q2 FY26 119 +31% *Detailed schedule included in Non-GAAP Schedules in Appendix. SAO continues to expand adjusted operating margins 33.1 SAO Adjusted Operating Margin (%) * Q2 FY25 Q1 FY26 Q2 FY26 28.3 32.0 • SAO operating income of $174.6 million, up 29% year-over-year • Margin expansion from higher productivity, improving mix and pricing actions • Operating income up 31% year- over-year • Operating income exceeds Q1 FY26, our previous record Aerospace demand and pricing continues to strengthen Accelerating demand with Commercial Aerospace bookings up 23% sequentially Pricing remains elevated and consistently increasing Completed negotiations for three additional aerospace long-term agreements (LTAs)

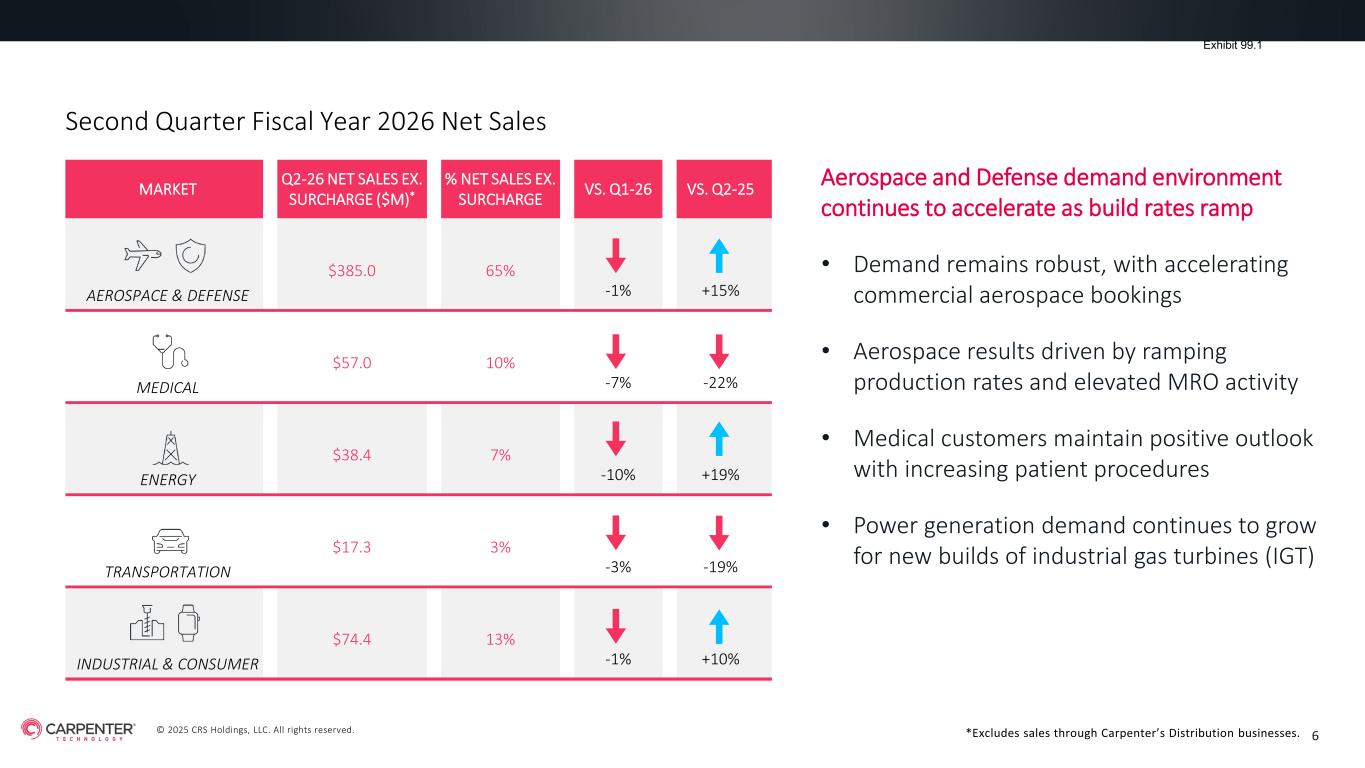

© 2025 CRS Holdings, LLC. All rights reserved. Second Quarter Fiscal Year 2026 Net Sales MARKET Q2-26 NET SALES EX. SURCHARGE ($M)* % NET SALES EX. SURCHARGE VS. Q1-26 VS. Q2-25 AEROSPACE & DEFENSE $385.0 65% -1% +15% MEDICAL $57.0 10% -7% -22% ENERGY $38.4 7% -10% +19% TRANSPORTATION $17.3 3% -3% -19% INDUSTRIAL & CONSUMER $74.4 13% -1% +10% Aerospace and Defense demand environment continues to accelerate as build rates ramp • Demand remains robust, with accelerating commercial aerospace bookings • Aerospace results driven by ramping production rates and elevated MRO activity • Medical customers maintain positive outlook with increasing patient procedures • Power generation demand continues to grow for new builds of industrial gas turbines (IGT) 6*Excludes sales through Carpenter’s Distribution businesses.

© 2025 CRS Holdings, LLC. All rights reserved. 7 2nd QUARTER FISCAL YEAR 2026 FINANCIAL OVERVIEW Tim Lain | Senior Vice President and Chief Financial Officer

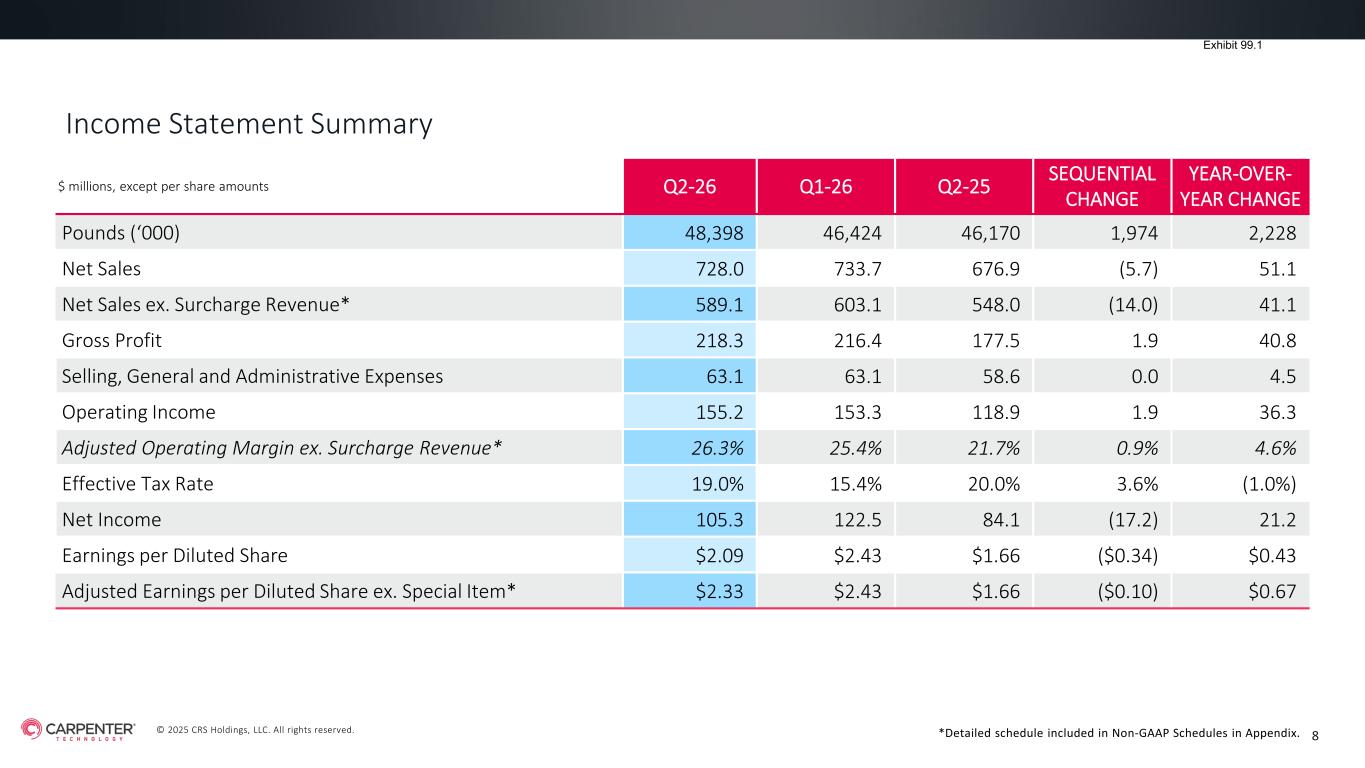

© 2025 CRS Holdings, LLC. All rights reserved. 8*Detailed schedule included in Non-GAAP Schedules in Appendix. $ millions, except per share amounts Q2-26 Q1-26 Q2-25 SEQUENTIAL CHANGE YEAR-OVER- YEAR CHANGE Pounds (‘000) 48,398 46,424 46,170 1,974 2,228 Net Sales 728.0 733.7 676.9 (5.7) 51.1 Net Sales ex. Surcharge Revenue* 589.1 603.1 548.0 (14.0) 41.1 Gross Profit 218.3 216.4 177.5 1.9 40.8 Selling, General and Administrative Expenses 63.1 63.1 58.6 0.0 4.5 Operating Income 155.2 153.3 118.9 1.9 36.3 Adjusted Operating Margin ex. Surcharge Revenue* 26.3% 25.4% 21.7% 0.9% 4.6% Effective Tax Rate 19.0% 15.4% 20.0% 3.6% (1.0%) Net Income 105.3 122.5 84.1 (17.2) 21.2 Earnings per Diluted Share $2.09 $2.43 $1.66 ($0.34) $0.43 Adjusted Earnings per Diluted Share ex. Special Item* $2.33 $2.43 $1.66 ($0.10) $0.67 Income Statement Summary

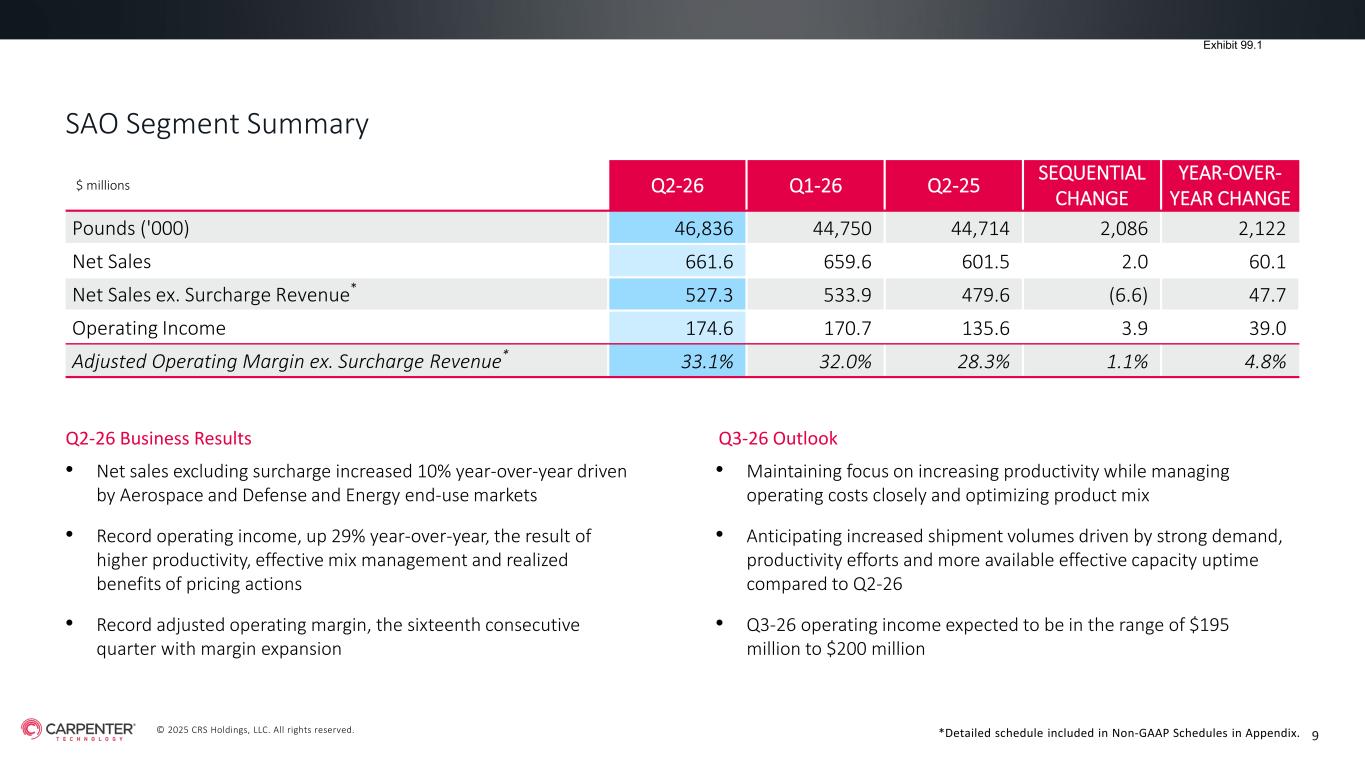

© 2025 CRS Holdings, LLC. All rights reserved. 9 SAO Segment Summary • Net sales excluding surcharge increased 10% year-over-year driven by Aerospace and Defense and Energy end-use markets • Record operating income, up 29% year-over-year, the result of higher productivity, effective mix management and realized benefits of pricing actions • Record adjusted operating margin, the sixteenth consecutive quarter with margin expansion • Maintaining focus on increasing productivity while managing operating costs closely and optimizing product mix • Anticipating increased shipment volumes driven by strong demand, productivity efforts and more available effective capacity uptime compared to Q2-26 • Q3-26 operating income expected to be in the range of $195 million to $200 million $ millions Q2-26 Q1-26 Q2-25 SEQUENTIAL CHANGE YEAR-OVER- YEAR CHANGE Pounds ('000) 46,836 44,750 44,714 2,086 2,122 Net Sales 661.6 659.6 601.5 2.0 60.1 Net Sales ex. Surcharge Revenue* 527.3 533.9 479.6 (6.6) 47.7 Operating Income 174.6 170.7 135.6 3.9 39.0 Adjusted Operating Margin ex. Surcharge Revenue* 33.1% 32.0% 28.3% 1.1% 4.8% Q2-26 Business Results Q3-26 Outlook *Detailed schedule included in Non-GAAP Schedules in Appendix.

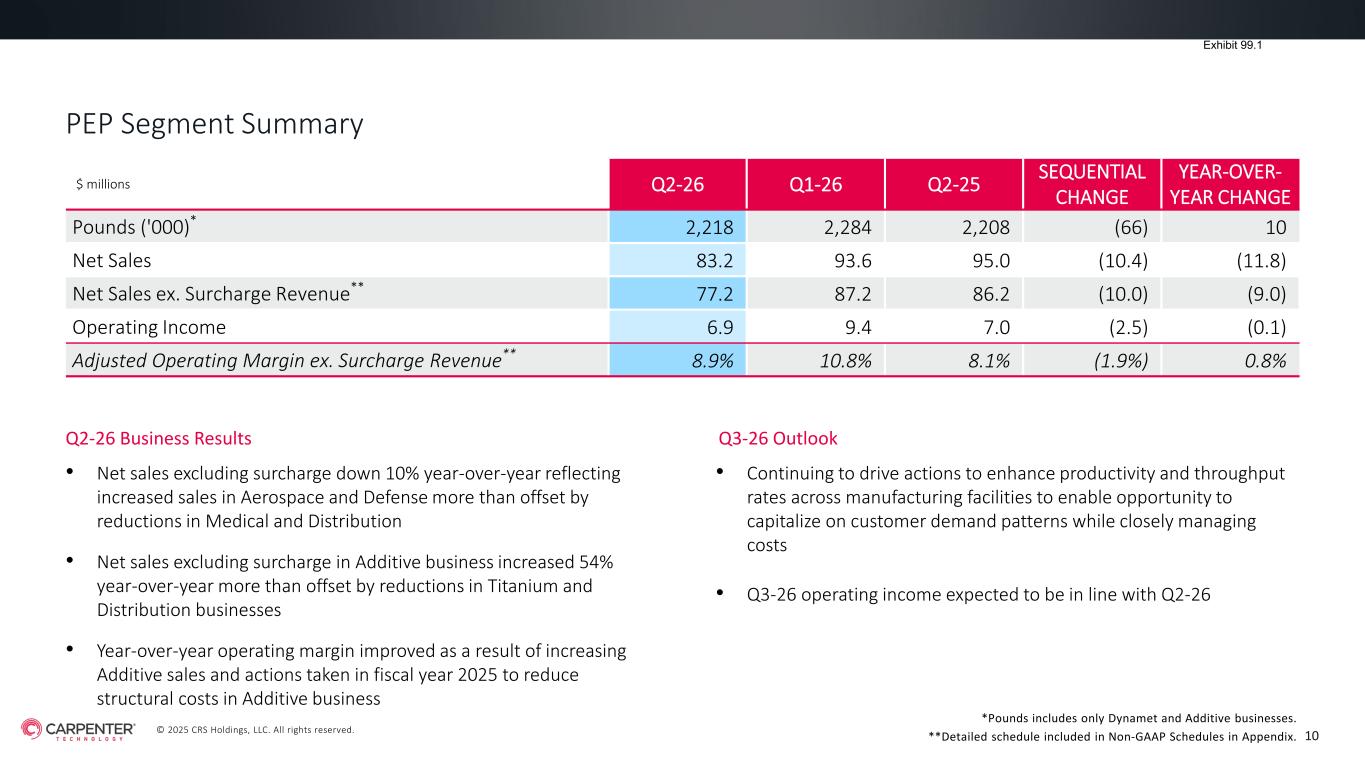

© 2025 CRS Holdings, LLC. All rights reserved. 10 PEP Segment Summary • Net sales excluding surcharge down 10% year-over-year reflecting increased sales in Aerospace and Defense more than offset by reductions in Medical and Distribution • Net sales excluding surcharge in Additive business increased 54% year-over-year more than offset by reductions in Titanium and Distribution businesses • Year-over-year operating margin improved as a result of increasing Additive sales and actions taken in fiscal year 2025 to reduce structural costs in Additive business • Continuing to drive actions to enhance productivity and throughput rates across manufacturing facilities to enable opportunity to capitalize on customer demand patterns while closely managing costs • Q3-26 operating income expected to be in line with Q2-26 *Pounds includes only Dynamet and Additive businesses. **Detailed schedule included in Non-GAAP Schedules in Appendix. $ millions Q2-26 Q1-26 Q2-25 SEQUENTIAL CHANGE YEAR-OVER- YEAR CHANGE Pounds ('000)* 2,218 2,284 2,208 (66) 10 Net Sales 83.2 93.6 95.0 (10.4) (11.8) Net Sales ex. Surcharge Revenue** 77.2 87.2 86.2 (10.0) (9.0) Operating Income 6.9 9.4 7.0 (2.5) (0.1) Adjusted Operating Margin ex. Surcharge Revenue** 8.9% 10.8% 8.1% (1.9%) 0.8% Q2-26 Business Results Q3-26 Outlook

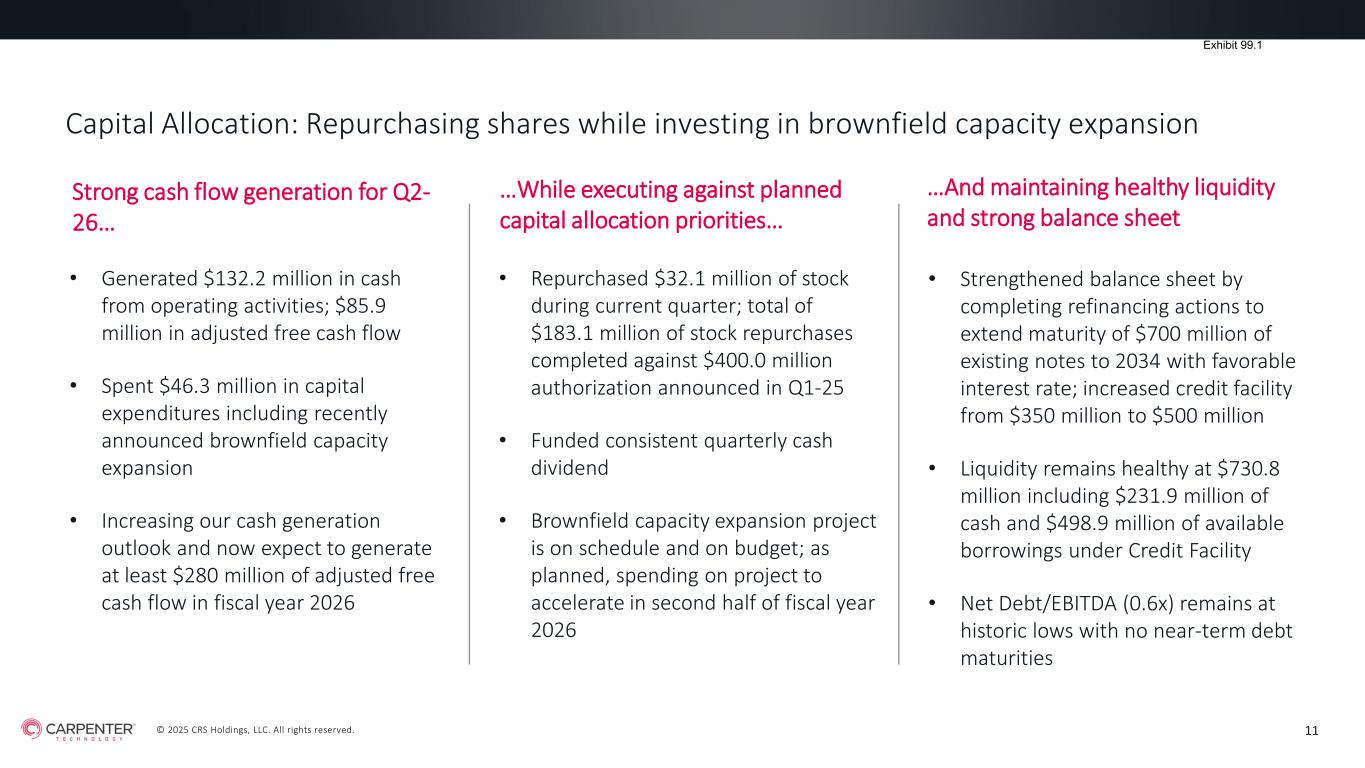

© 2025 CRS Holdings, LLC. All rights reserved. Strong cash flow generation for Q2- 26… 11 …And maintaining healthy liquidity and strong balance sheet …While executing against planned capital allocation priorities… • Repurchased $32.1 million of stock during current quarter; total of $183.1 million of stock repurchases completed against $400.0 million authorization announced in Q1-25 • Funded consistent quarterly cash dividend • Brownfield capacity expansion project is on schedule and on budget; as planned, spending on project to accelerate in second half of fiscal year 2026 • Generated $132.2 million in cash from operating activities; $85.9 million in adjusted free cash flow • Spent $46.3 million in capital expenditures including recently announced brownfield capacity expansion • Increasing our cash generation outlook and now expect to generate at least $280 million of adjusted free cash flow in fiscal year 2026 • Strengthened balance sheet by completing refinancing actions to extend maturity of $700 million of existing notes to 2034 with favorable interest rate; increased credit facility from $350 million to $500 million • Liquidity remains healthy at $730.8 million including $231.9 million of cash and $498.9 million of available borrowings under Credit Facility • Net Debt/EBITDA (0.6x) remains at historic lows with no near-term debt maturities Capital Allocation: Repurchasing shares while investing in brownfield capacity expansion

© 2025 CRS Holdings, LLC. All rights reserved. 12 2nd QUARTER FISCAL YEAR 2026 CLOSING COMMENTS Tony Thene | Chairman of the Board and Chief Executive Officer

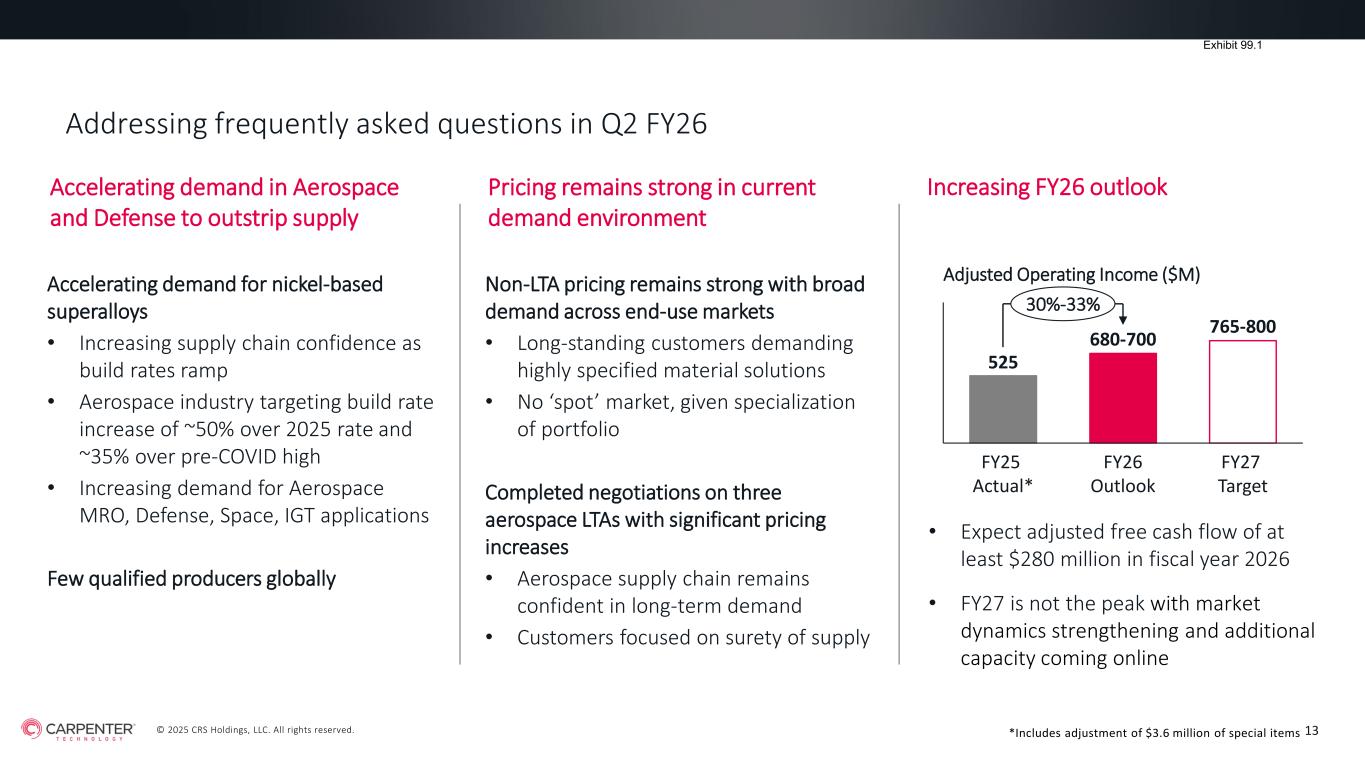

© 2025 CRS Holdings, LLC. All rights reserved. 13 Pricing remains strong in current demand environment *Includes adjustment of $3.6 million of special items Non-LTA pricing remains strong with broad demand across end-use markets • Long-standing customers demanding highly specified material solutions • No ‘spot’ market, given specialization of portfolio Completed negotiations on three aerospace LTAs with significant pricing increases • Aerospace supply chain remains confident in long-term demand • Customers focused on surety of supply Addressing frequently asked questions in Q2 FY26 Accelerating demand for nickel-based superalloys • Increasing supply chain confidence as build rates ramp • Aerospace industry targeting build rate increase of ~50% over 2025 rate and ~35% over pre-COVID high • Increasing demand for Aerospace MRO, Defense, Space, IGT applications Few qualified producers globally 525 Adjusted Operating Income ($M) FY25 Actual* FY26 Outlook FY27 Target 680-700 765-800 30%-33% Increasing FY26 outlook • Expect adjusted free cash flow of at least $280 million in fiscal year 2026 • FY27 is not the peak with market dynamics strengthening and additional capacity coming online Accelerating demand in Aerospace and Defense to outstrip supply

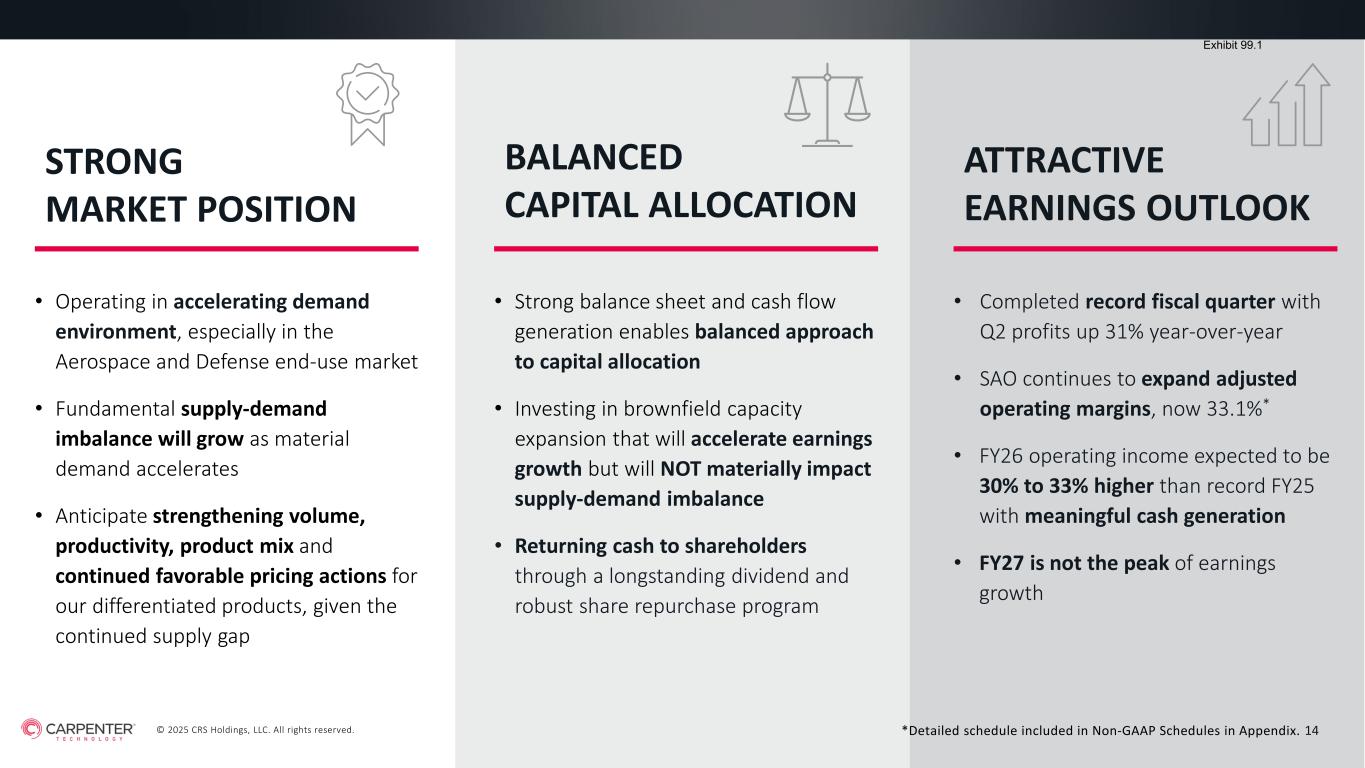

© 2025 CRS Holdings, LLC. All rights reserved. 14 • Operating in accelerating demand environment, especially in the Aerospace and Defense end-use market • Fundamental supply-demand imbalance will grow as material demand accelerates • Anticipate strengthening volume, productivity, product mix and continued favorable pricing actions for our differentiated products, given the continued supply gap • Strong balance sheet and cash flow generation enables balanced approach to capital allocation • Investing in brownfield capacity expansion that will accelerate earnings growth but will NOT materially impact supply-demand imbalance • Returning cash to shareholders through a longstanding dividend and robust share repurchase program *Detailed schedule included in Non-GAAP Schedules in Appendix. STRONG MARKET POSITION BALANCED CAPITAL ALLOCATION ATTRACTIVE EARNINGS OUTLOOK • Completed record fiscal quarter with Q2 profits up 31% year-over-year • SAO continues to expand adjusted operating margins, now 33.1%* • FY26 operating income expected to be 30% to 33% higher than record FY25 with meaningful cash generation • FY27 is not the peak of earnings growth

© 2025 CRS Holdings, LLC. All rights reserved. 15 APPENDIX OF NON-GAAP SCHEDULES

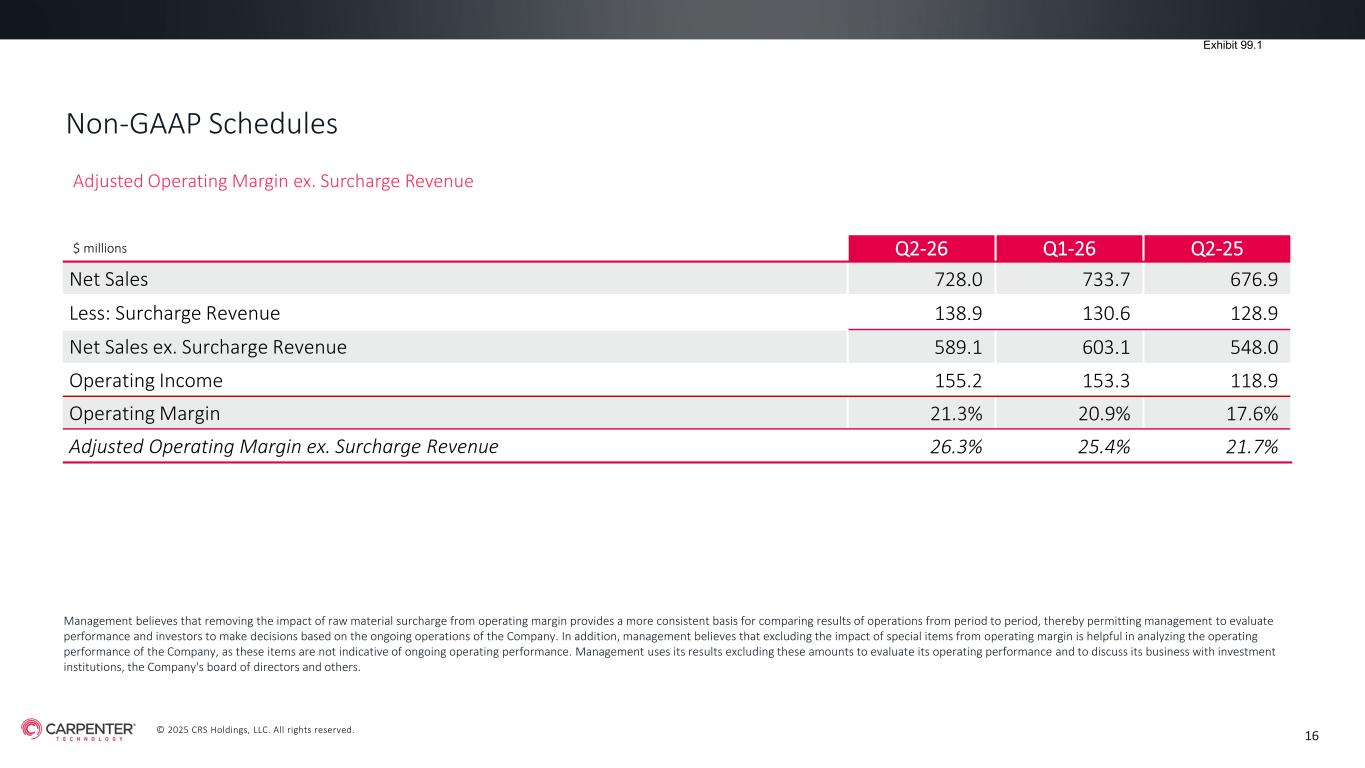

© 2025 CRS Holdings, LLC. All rights reserved. 16 $ millions Q2-26 Q1-26 Q2-25 Net Sales 728.0 733.7 676.9 Less: Surcharge Revenue 138.9 130.6 128.9 Net Sales ex. Surcharge Revenue 589.1 603.1 548.0 Operating Income 155.2 153.3 118.9 Operating Margin 21.3% 20.9% 17.6% Adjusted Operating Margin ex. Surcharge Revenue 26.3% 25.4% 21.7% Management believes that removing the impact of raw material surcharge from operating margin provides a more consistent basis for comparing results of operations from period to period, thereby permitting management to evaluate performance and investors to make decisions based on the ongoing operations of the Company. In addition, management believes that excluding the impact of special items from operating margin is helpful in analyzing the operating performance of the Company, as these items are not indicative of ongoing operating performance. Management uses its results excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others. Adjusted Operating Margin ex. Surcharge Revenue Non-GAAP Schedules

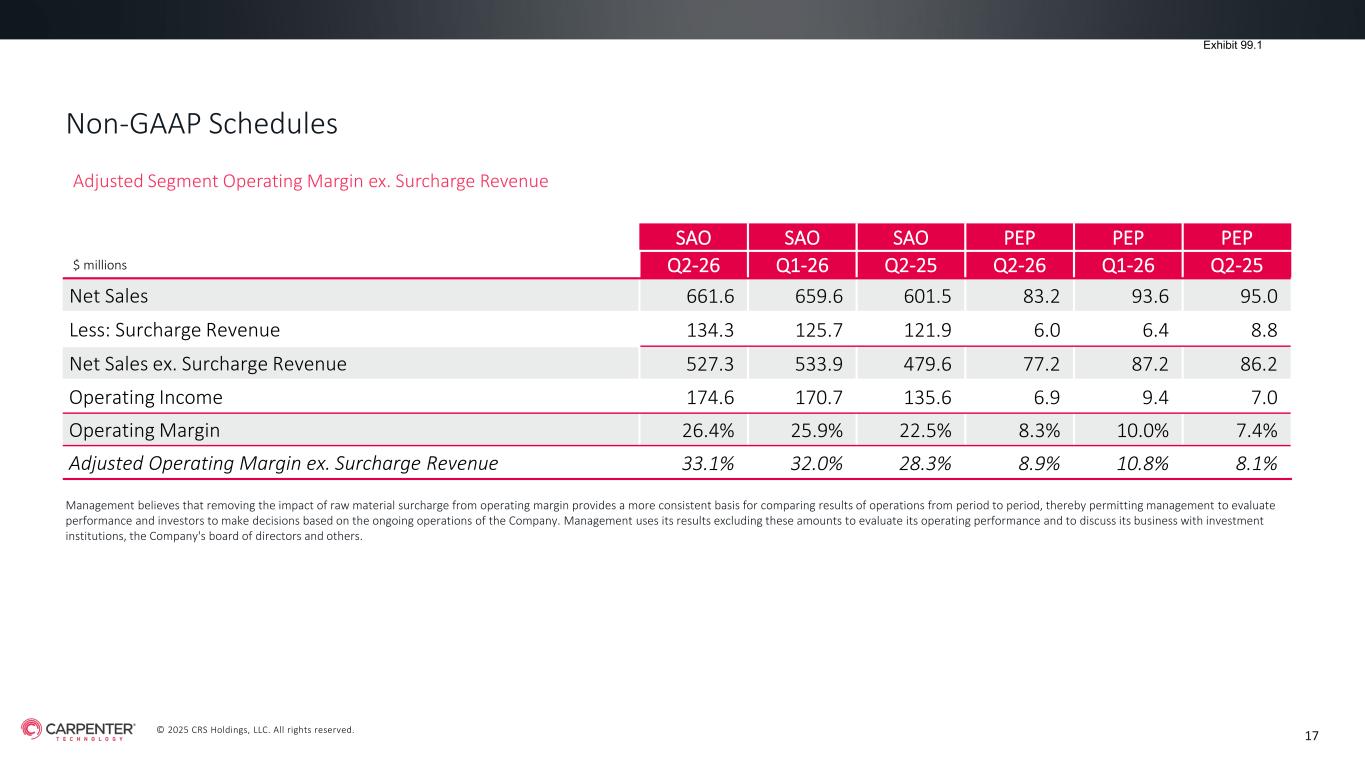

© 2025 CRS Holdings, LLC. All rights reserved. 17 SAO SAO SAO PEP PEP PEP $ millions Q2-26 Q1-26 Q2-25 Q2-26 Q1-26 Q2-25 Net Sales 661.6 659.6 601.5 83.2 93.6 95.0 Less: Surcharge Revenue 134.3 125.7 121.9 6.0 6.4 8.8 Net Sales ex. Surcharge Revenue 527.3 533.9 479.6 77.2 87.2 86.2 Operating Income 174.6 170.7 135.6 6.9 9.4 7.0 Operating Margin 26.4% 25.9% 22.5% 8.3% 10.0% 7.4% Adjusted Operating Margin ex. Surcharge Revenue 33.1% 32.0% 28.3% 8.9% 10.8% 8.1% Management believes that removing the impact of raw material surcharge from operating margin provides a more consistent basis for comparing results of operations from period to period, thereby permitting management to evaluate performance and investors to make decisions based on the ongoing operations of the Company. Management uses its results excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others. Adjusted Segment Operating Margin ex. Surcharge Revenue Non-GAAP Schedules

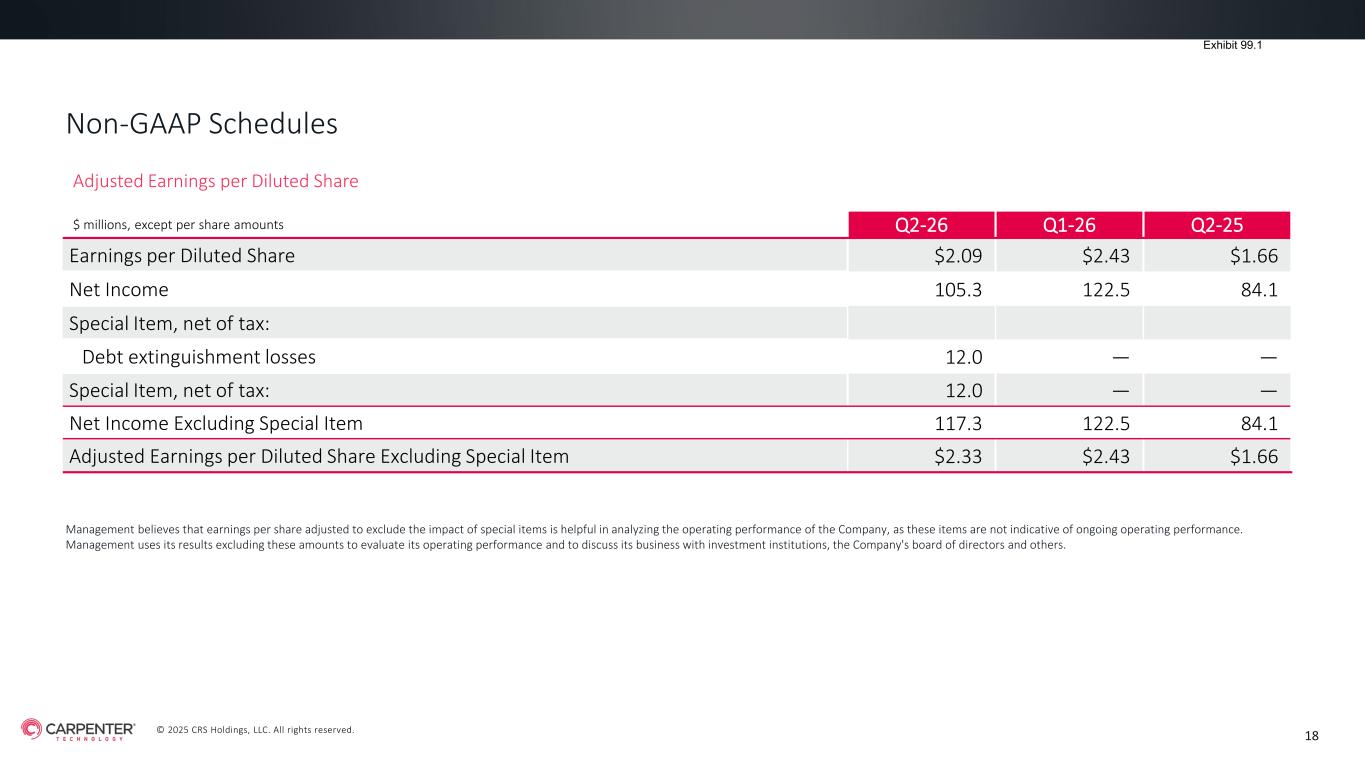

© 2025 CRS Holdings, LLC. All rights reserved. 18 $ millions, except per share amounts Q2-26 Q1-26 Q2-25 Earnings per Diluted Share $2.09 $2.43 $1.66 Net Income 105.3 122.5 84.1 Special Item, net of tax: Debt extinguishment losses 12.0 — — Special Item, net of tax: 12.0 — — Net Income Excluding Special Item 117.3 122.5 84.1 Adjusted Earnings per Diluted Share Excluding Special Item $2.33 $2.43 $1.66 Adjusted Earnings per Diluted Share Non-GAAP Schedules Management believes that earnings per share adjusted to exclude the impact of special items is helpful in analyzing the operating performance of the Company, as these items are not indicative of ongoing operating performance. Management uses its results excluding these amounts to evaluate its operating performance and to discuss its business with investment institutions, the Company's board of directors and others.

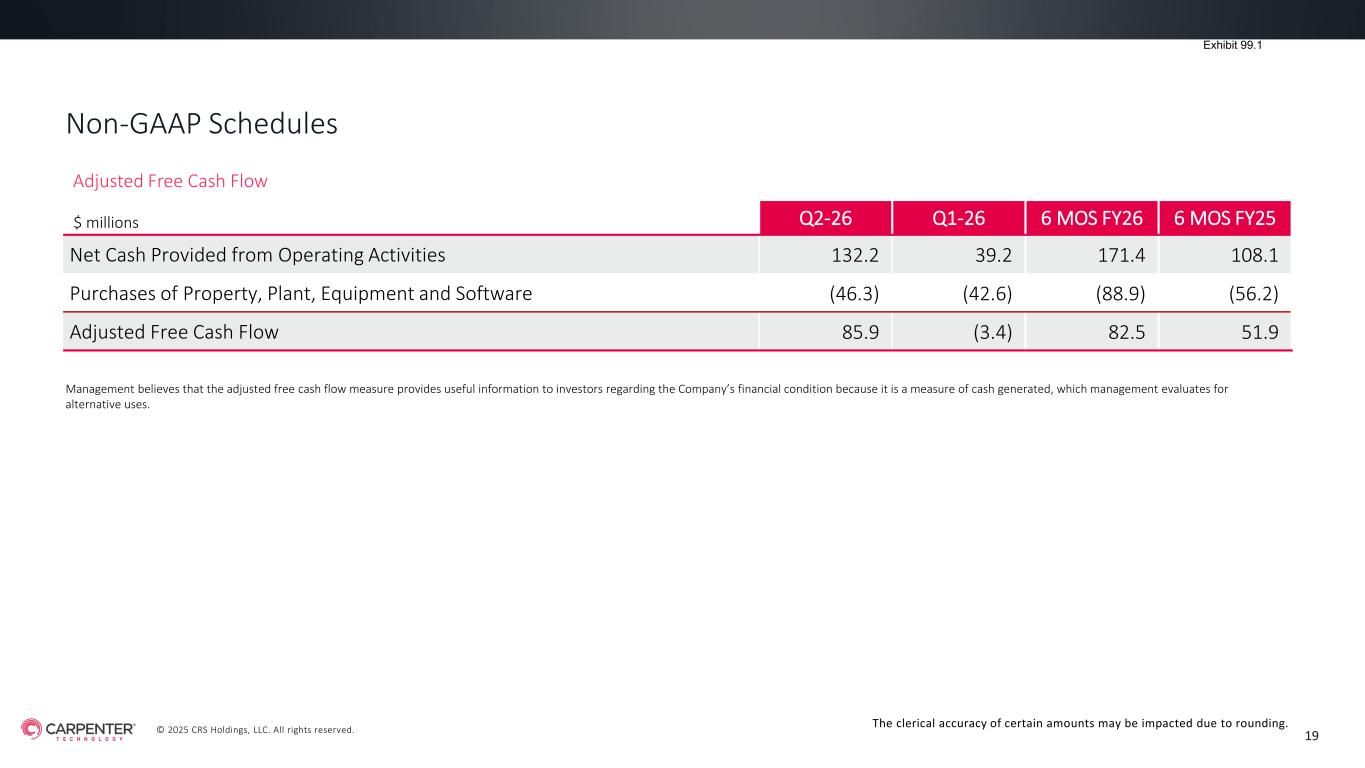

© 2025 CRS Holdings, LLC. All rights reserved. 19 $ millions Q2-26 Q1-26 6 MOS FY26 6 MOS FY25 Net Cash Provided from Operating Activities 132.2 39.2 171.4 108.1 Purchases of Property, Plant, Equipment and Software (46.3) (42.6) (88.9) (56.2) Adjusted Free Cash Flow 85.9 (3.4) 82.5 51.9 Management believes that the adjusted free cash flow measure provides useful information to investors regarding the Company’s financial condition because it is a measure of cash generated, which management evaluates for alternative uses. The clerical accuracy of certain amounts may be impacted due to rounding. Non-GAAP Schedules Adjusted Free Cash Flow

For additional information, please contact info@cartech.com | 610 208 2000 https://www.carpentertechnology.com Carpenter Technology Corporation (NYSE: CRS) is a recognized leader in high-performance specialty alloy materials and process solutions for critical applications in the aerospace and defense, medical, and other markets. Founded in 1889, Carpenter Technology has evolved to become a pioneer in premium specialty alloys including nickel, cobalt, and titanium and material process capabilities that solve our customers' current and future material challenges. Your trusted partner in innovation. 2 0