1 4Q25 Fixed Income Investor Presentation December 2025 Chief Financial Officer, Jamie Gregory Corporate Treasurer, Dake Madray Chief Credit Officer, Anne Fortner

This slide presentation contains statements that constitute "forward-looking statements" within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus' use of words such as "believes," "anticipates," "expects," "may," "will," "assumes," "predicts," "could," "should," "would," "intends," "targets," "estimates," "projects," "plans," "potential" and other similar words and expressions of the future or otherwise regarding the outlook for Synovus' future business and financial performance and/or the performance of the banking industry and economy in general. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus' management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation. Many of these factors are beyond Synovus' ability to control or predict. These forward-looking statements are based upon information presently known to Synovus' management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus' filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2024 under the captions "Cautionary Notice Regarding Forward-Looking Statements" and "Risk Factors" and in Synovus' quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: adjusted return on average assets; adjusted non-interest revenue; adjusted revenue; adjusted non-interest expense; and adjusted tangible efficiency ratio. The most comparable GAAP measures to these measures are return on average assets; total non-interest revenue; total revenue; total non-interest expense; efficiency ratio-TE, respectively. Management believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management and investors in evaluating Synovus' operating results, financial strength, the performance of its business and the strength of its capital position. However, these non-GAAP financial measures have inherent limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of operating results or capital position as reported under GAAP. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant items and other factors, and since they are not required to be uniformly applied, they may not be comparable to other similarly titled measures at other companies. Adjusted return on average assets is a measure used by management to evaluate operating results exclusive of items that are not indicative of ongoing operations and impact period-to-period comparisons. Adjusted non-interest revenue and adjusted revenue are measures used by management to evaluate non-interest revenue and total revenue exclusive of net investment securities gains (losses), fair value adjustments on non-qualified deferred compensation, and other items not indicative of ongoing operations that could impact period-to-period comparisons. Adjusted non-interest expense and the adjusted tangible efficiency ratio are measures utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the appendix to this slide presentation. Forward-Looking Statements Use of Non-GAAP Financial Measures 2 No Offer or Solicitation This presentation has been prepared solely for informational purposes. It is not an offer, recommendation or solicitation of any offer to buy or sell any securities. If Synovus were to conduct an offering of securities in the future, it would be made pursuant to an offering document related to that offering. When available, a copy of any such offering document, as well as any final term sheet relating to such transaction, would be able to be obtained from the book-running managers of that offering or from Synovus. You are advised to obtain copy of any such offering document and to carefully review the information contained or incorporated by reference therein before making any investment decision.

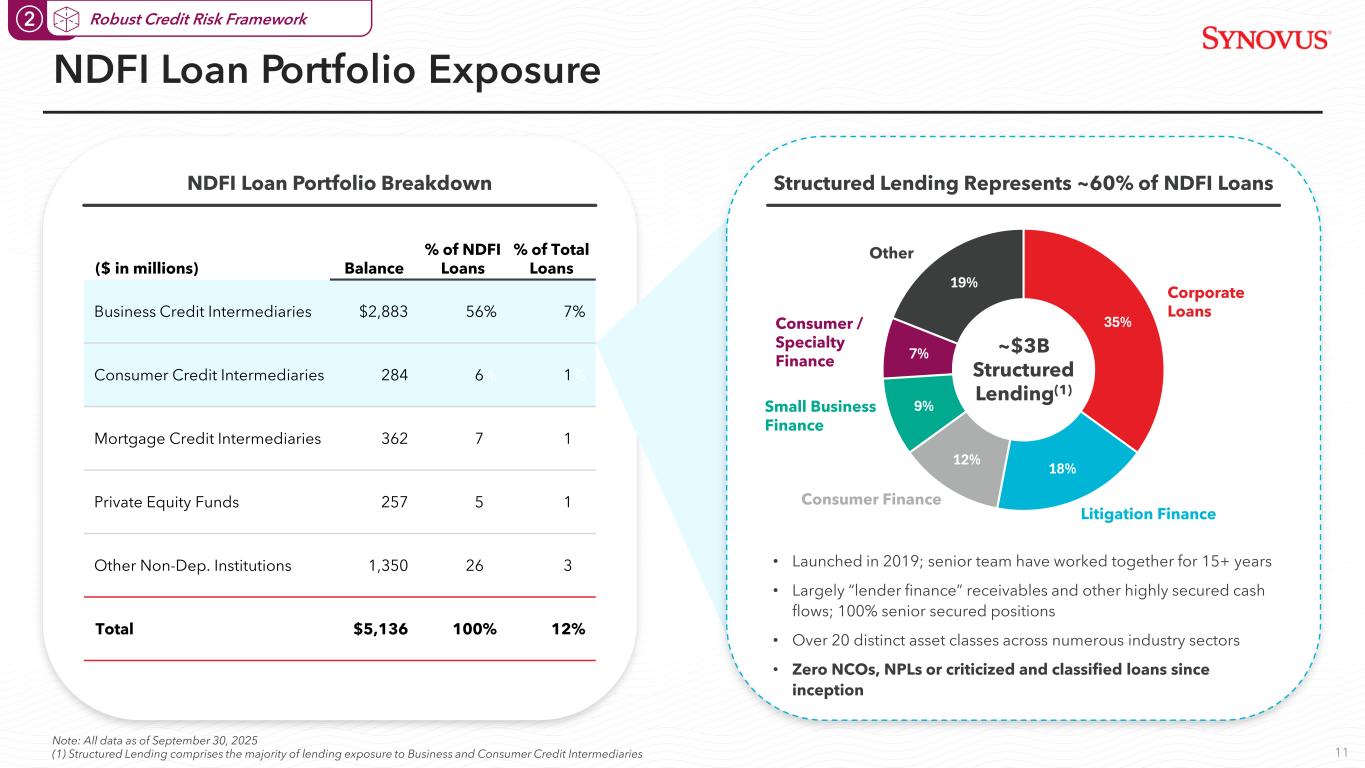

NDFI Loan Portfolio Breakdown Structured Lending Represents ~60% of NDFI Loans NDFI Loan Portfolio Exposure 11 2 Robust Credit Risk Framework Note: All data as of September 30, 2025 (1) Structured Lending comprises the majority of lending exposure to Business and Consumer Credit Intermediaries ($ in millions) Balance % of NDFI Loans % of Total Loans Business Credit Intermediaries $2,883 56% 7% Consumer Credit Intermediaries 284 6% 1% Mortgage Credit Intermediaries 362 7% 1% Private Equity Funds 257 5% 1% Other Non-Dep. Institutions 1,350 26% 3% Total $5,136 100% 12% • Launched in 2019; senior team have worked together for 15+ years • Largely “lender finance” receivables and other highly secured cash flows; 100% senior secured positions • Over 20 distinct asset classes across numerous industry sectors • Zero NCOs, NPLs or criticized and classified loans since inception 35% 18% 12% 9% 7% 19% Corporate Loans Litigation Finance Consumer Finance Small Business Finance Consumer / Specialty Finance Other ~$3B Structured Lending(1)

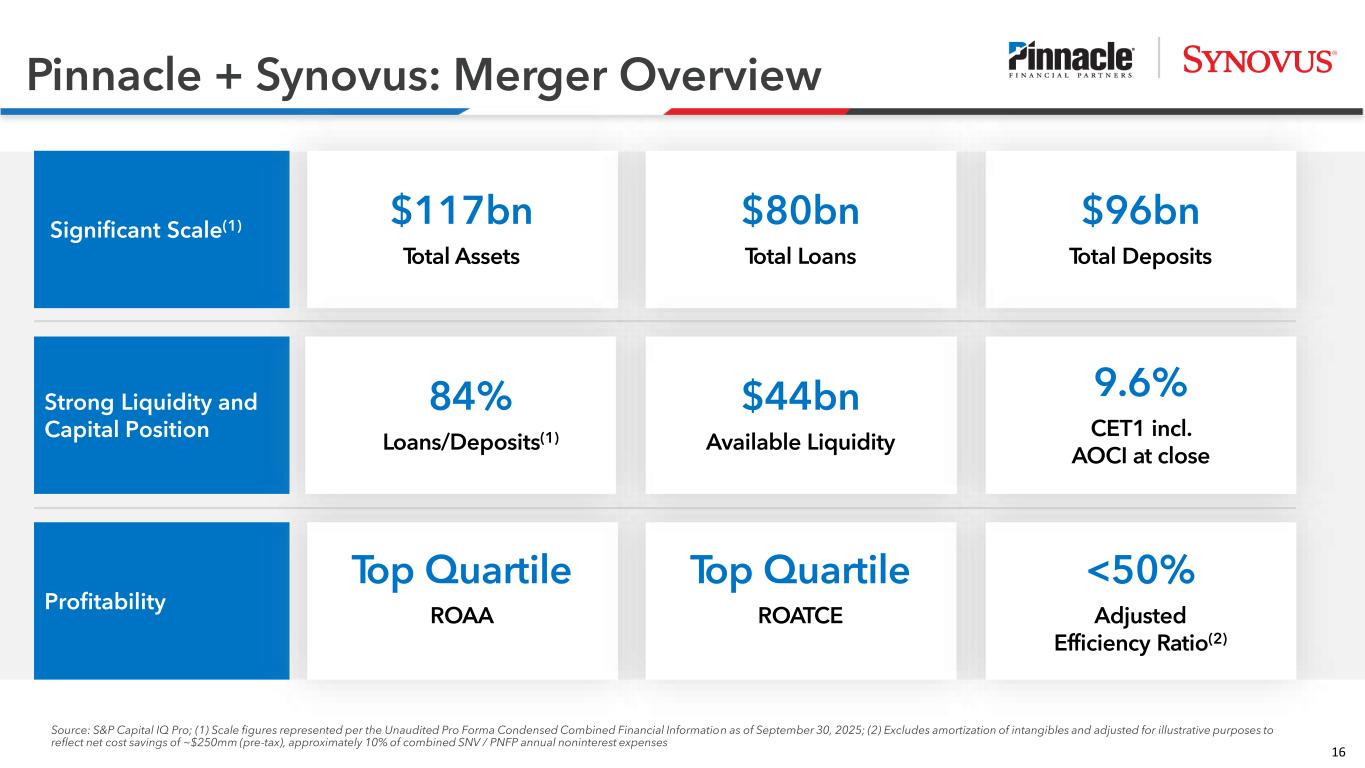

16 Pinnacle + Synovus: Merger Overview Significant Scale(1) Profitability Strong Liquidity and Capital Position Top Quartile ROAA Top Quartile ROATCE $117bn Total Assets $96bn Total Deposits $44bn Available Liquidity $80bn Total Loans <50% Adjusted Efficiency Ratio(2) 84% Loans/Deposits(1) 9.6% CET1 incl. AOCI at close Source: S&P Capital IQ Pro; (1) Scale figures represented per the Unaudited Pro Forma Condensed Combined Financial Information as of September 30, 2025; (2) Excludes amortization of intangibles and adjusted for illustrative purposes to reflect net cost savings of ~$250mm (pre-tax), approximately 10% of combined SNV / PNFP annual noninterest expenses

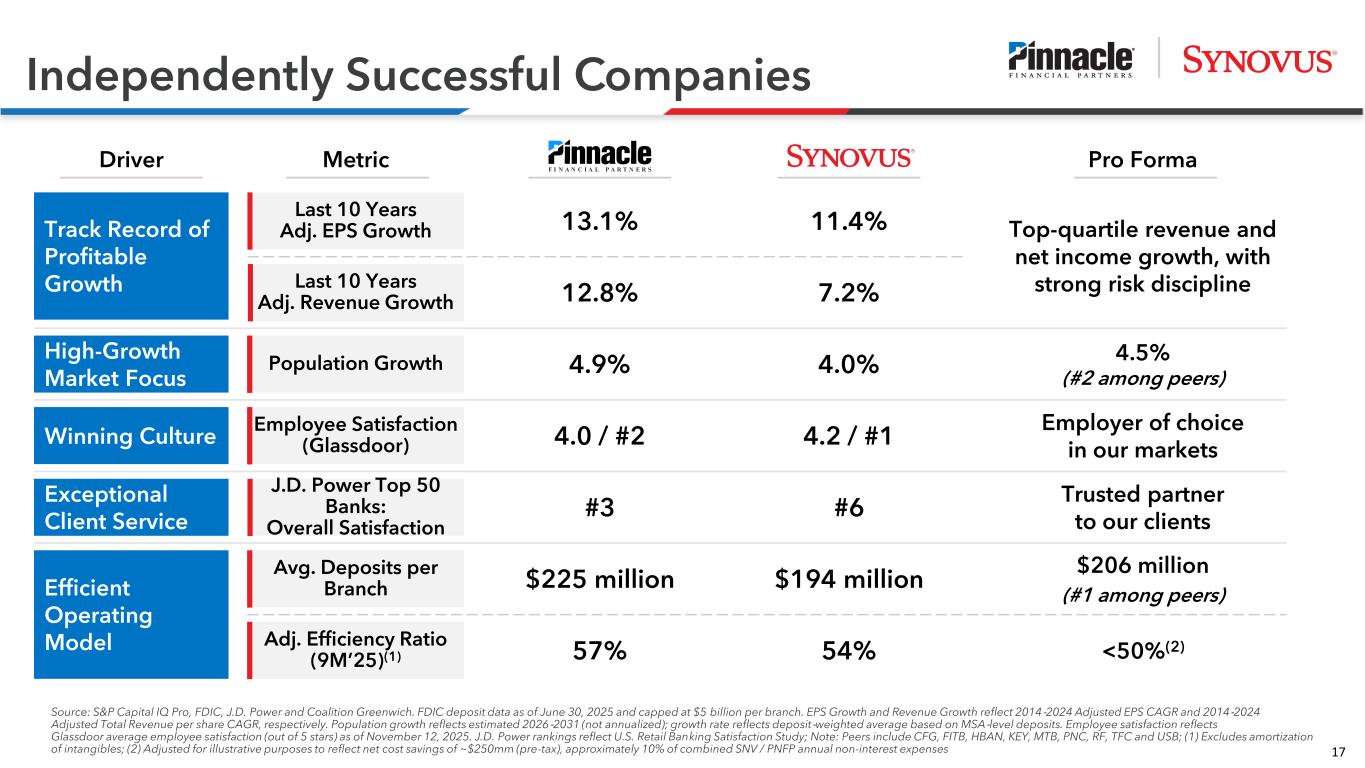

17 Independently Successful Companies High-Growth Market Focus Winning Culture Exceptional Client Service Track Record of Profitable Growth Efficient Operating Model Driver Pro Forma 4.9% 4.0% 4.5% (#2 among peers) 4.0 / #2 4.2 / #1 Employer of choice in our markets #3 #6 $225 million $194 million 13.1% 11.4% Top-quartile revenue and net income growth, with strong risk discipline Trusted partner to our clients $206 million (#1 among peers) 57% 54% <50%(2) 12.8% 7.2% Metric Last 10 Years Adj. EPS Growth Last 10 Years Adj. Revenue Growth Population Growth Employee Satisfaction (Glassdoor) J.D. Power Top 50 Banks: Overall Satisfaction Avg. Deposits per Branch Adj. Efficiency Ratio (9M’25)(1) Source: S&P Capital IQ Pro, FDIC, J.D. Power and Coalition Greenwich. FDIC deposit data as of June 30, 2025 and capped at $5 billion per branch. EPS Growth and Revenue Growth reflect 2014‐2024 Adjusted EPS CAGR and 2014‐2024 Adjusted Total Revenue per share CAGR, respectively. Population growth reflects estimated 2026‐2031 (not annualized); growth rate reflects deposit‐weighted average based on MSA‐level deposits. Employee satisfaction reflects Glassdoor average employee satisfaction (out of 5 stars) as of November 12, 2025. J.D. Power rankings reflect U.S. Retail Banking Satisfaction Study; Note: Peers include CFG, FITB, HBAN, KEY, MTB, PNC, RF, TFC and USB; (1) Excludes amortization of intangibles; (2) Adjusted for illustrative purposes to reflect net cost savings of ~$250mm (pre-tax), approximately 10% of combined SNV / PNFP annual non-interest expenses

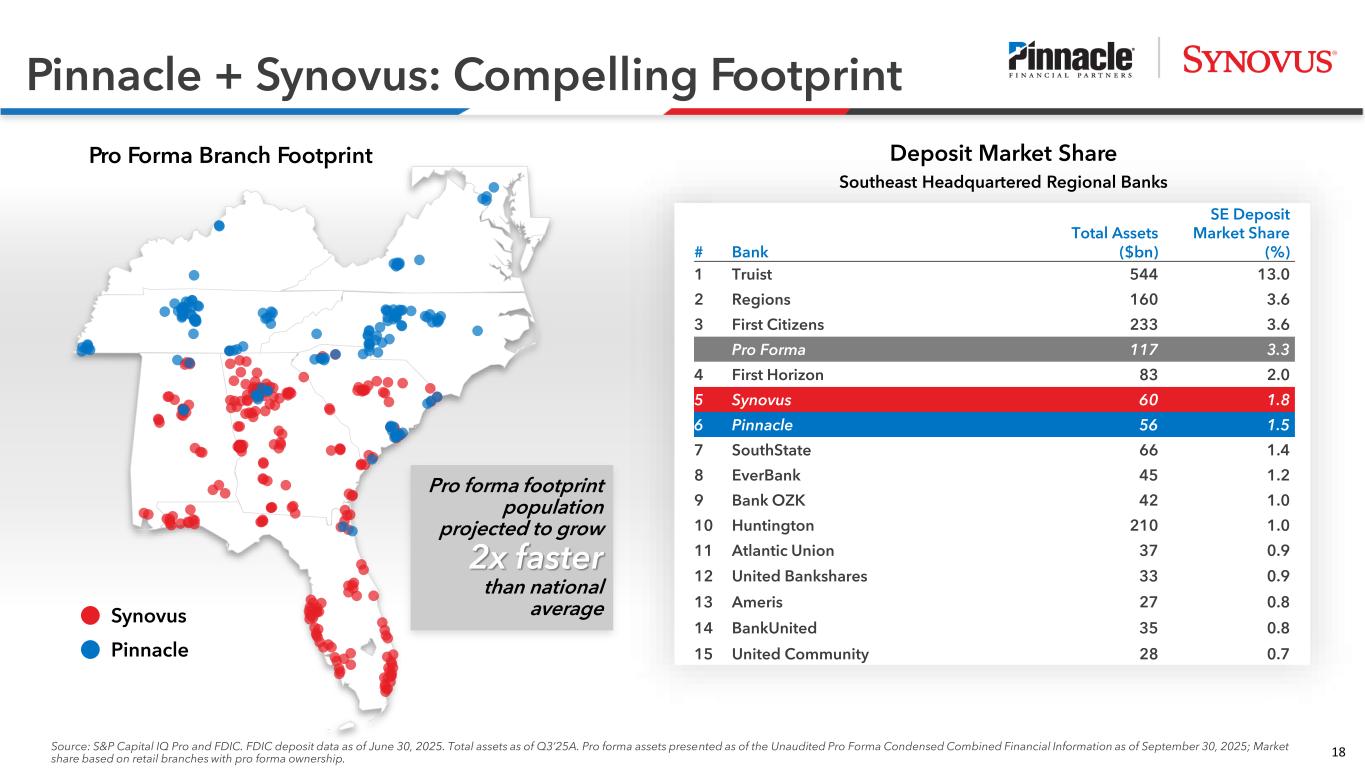

18 Pinnacle + Synovus: Compelling Footprint Pro Forma Branch Footprint Deposit Market Share Southeast Headquartered Regional Banks Synovus Pinnacle Pro forma footprint population projected to grow 2x faster than national average Total Assets SE Deposit Market Share # Bank ($bn) (%) 1 Truist 544 13.0 2 Regions 160 3.6 3 First Citizens 233 3.6 Pro Forma 117 3.3 4 First Horizon 83 2.0 5 Synovus 60 1.8 6 Pinnacle 56 1.5 7 SouthState 66 1.4 8 EverBank 45 1.2 9 Bank OZK 42 1.0 10 Huntington 210 1.0 11 Atlantic Union 37 0.9 12 United Bankshares 33 0.9 13 Ameris 27 0.8 14 BankUnited 35 0.8 15 United Community 28 0.7 Source: S&P Capital IQ Pro and FDIC. FDIC deposit data as of June 30, 2025. Total assets as of Q3’25A. Pro forma assets presented as of the Unaudited Pro Forma Condensed Combined Financial Information as of September 30, 2025; Market share based on retail branches with pro forma ownership.

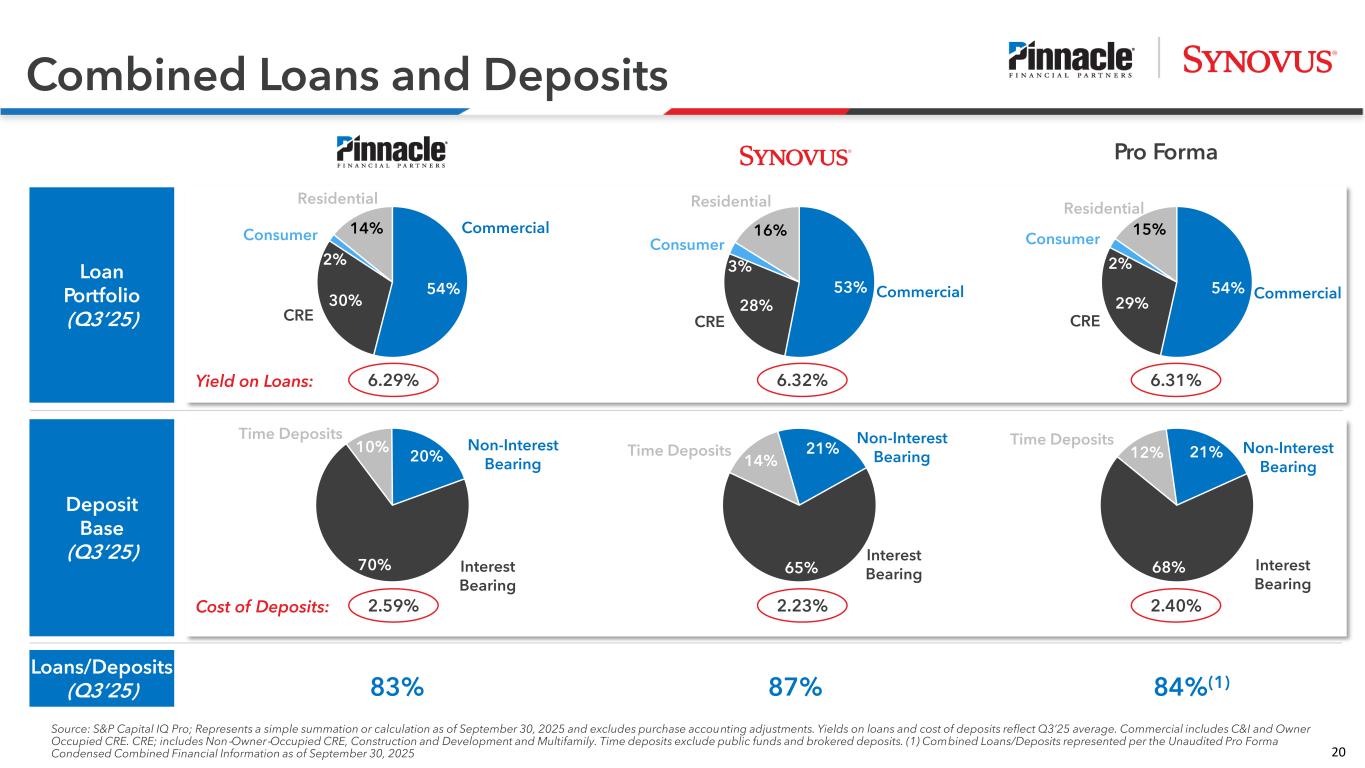

20 Combined Loans and Deposits Loan Portfolio (Q3’25) Deposit Base (Q3’25) Loans/Deposits (Q3’25) Cost of Deposits: Pro Forma 2.59% 2.23% Yield on Loans: 6.29% 6.32% 54% 30% 2% 14% Commercial CRE Consumer Residential 53% 28% 3% 16% Commercial CRE Consumer Residential 54% 29% 2% 15% Commercial CRE Consumer Residential 6.31% 2.40% 83% 87% 84%(1) 10% 20% 70% Time Deposits Non-Interest Bearing Interest Bearing 14% 21% 65% Time Deposits Non-Interest Bearing Interest Bearing 12% 21% 68% Time Deposits Non-Interest Bearing Interest Bearing Source: S&P Capital IQ Pro; Represents a simple summation or calculation as of September 30, 2025 and excludes purchase accounting adjustments. Yields on loans and cost of deposits reflect Q3’25 average. Commercial includes C&I and Owner Occupied CRE. CRE; includes Non‐Owner‐Occupied CRE, Construction and Development and Multifamily. Time deposits exclude public funds and brokered deposits. (1) Combined Loans/Deposits represented per the Unaudited Pro Forma Condensed Combined Financial Information as of September 30, 2025

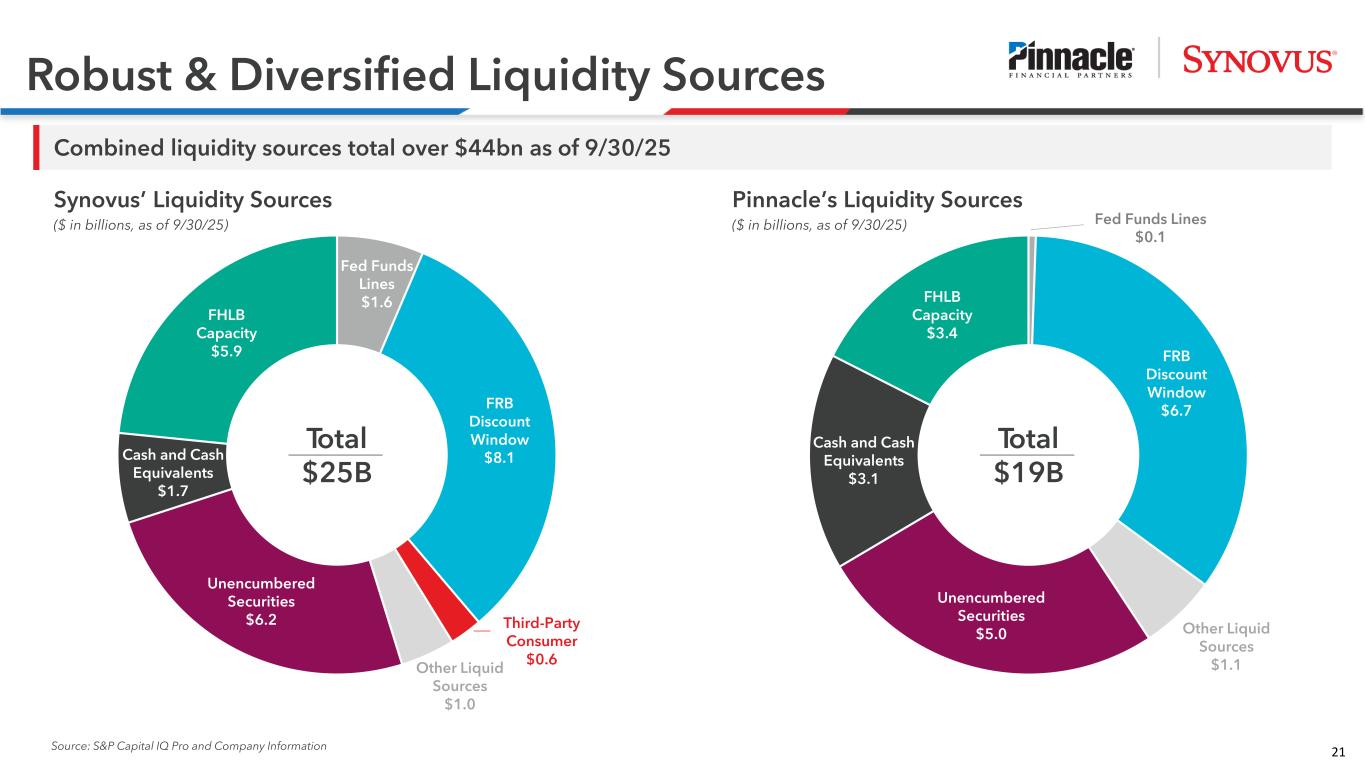

21 Fed Funds Lines $1.6 FRB Discount Window $8.1 Third-Party Consumer $0.6 Other Liquid Sources $1.0 Unencumbered Securities $6.2 Cash and Cash Equivalents $1.7 FHLB Capacity $5.9 Robust & Diversified Liquidity Sources Source: S&P Capital IQ Pro and Company Information Total $25B Combined liquidity sources total over $44bn as of 9/30/25 Fed Funds Lines $0.1 FRB Discount Window $6.7 Other Liquid Sources $1.1 Unencumbered Securities $5.0 Cash and Cash Equivalents $3.1 FHLB Capacity $3.4 Synovus’ Liquidity Sources ($ in billions, as of 9/30/25) Pinnacle’s Liquidity Sources ($ in billions, as of 9/30/25) Total $19B

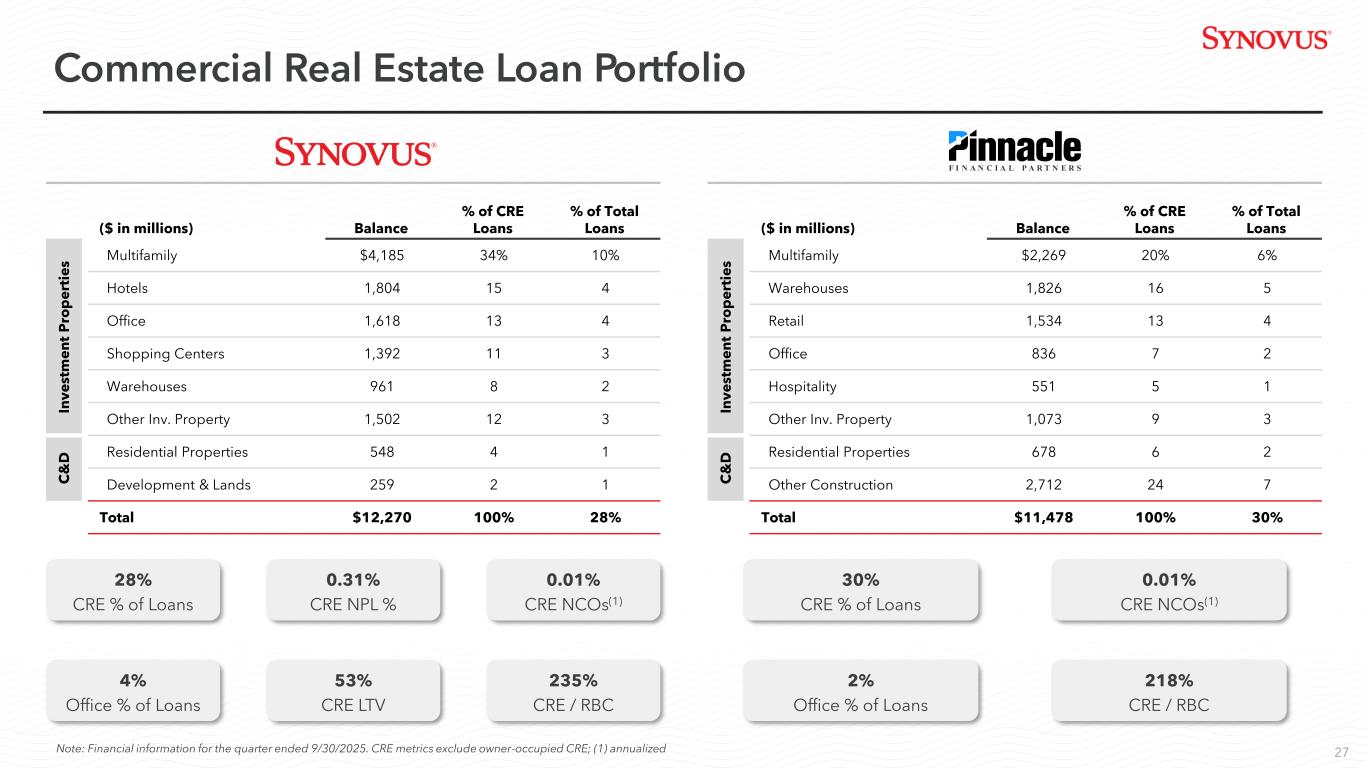

27 Commercial Real Estate Loan Portfolio Note: Financial information for the quarter ended 9/30/2025. CRE metrics exclude owner-occupied CRE; (1) annualized ($ in millions) Balance % of CRE Loans % of Total Loans In v e st m e n t P ro p e rt ie s Multifamily $4,185 34% 10% Hotels 1,804 15 4 Office 1,618 13 4 Shopping Centers 1,392 11 3 Warehouses 961 8 2 Other Inv. Property 1,502 12 3 C & D Residential Properties 548 4 1 Development & Lands 259 2 1 Total $12,270 100% 28% ($ in millions) Balance % of CRE Loans % of Total Loans In v e st m e n t P ro p e rt ie s Multifamily $2,269 20% 6% Warehouses 1,826 16 5 Retail 1,534 13 4 Office 836 7 2 Hospitality 551 5 1 Other Inv. Property 1,073 9 3 C & D Residential Properties 678 6 2 Other Construction 2,712 24 7 Total $11,478 100% 30% 28% CRE % of Loans 0.31% CRE NPL % 0.01% CRE NCOs(1) 4% Office % of Loans 53% CRE LTV 235% CRE / RBC 30% CRE % of Loans 0.01% CRE NCOs(1) 2% Office % of Loans 218% CRE / RBC