Third Quarter 2025 Results October 30, 2025

© 2025 Lumen Technologies. All Rights Reserved. 1 Forward-Looking Statements Except for historical and factual information, the matters set forth in this presentation and other of our oral or written statements identified by words such as “estimates,” “expects,” “anticipates,” “believes,” “plans,” “intends,” “will,” and similar expressions with respect to the future are forward-looking statements as defined by the federal securities laws, and are subject to the “safe harbor” protections thereunder. The forward-looking statements in this presentation, include, without limitation, statements regarding our future financial results and financials condition, our transformation strategy, our completed, pending, or proposed transactions, including with respect to the anticipated sale of our consumer fiber business, our modernization efforts and our competitive position, and the assumptions on which they are based, are not guarantees of future results and are based on current expectations only, are inherently speculative, and are subject to a number of risks and uncertainties, many of which are beyond our control. Actual events and results may differ materially from those anticipated, estimated, projected, or implied by us in those statements if one or more of these risks or uncertainties materialize, or if our underlying assumptions prove incorrect. Factors that could cause our actual results to differ materially from those anticipated, estimated, projected or implied by us in those forward-looking statements include but are not limited to: the effects of intense competition from a wide variety of competitive providers, including decreased demand for our more mature service offerings and increased pricing pressures; the effects of new, emerging, or competing technologies, including those that could make our products less desirable or obsolete; our ability to successfully and timely attain our key operating imperatives, including attaining projected cost savings, simplifying and consolidating our network, simplifying, and automating our service support systems, attaining our infrastructure buildout targets, replacing aging or obsolete plant and equipment, and strengthening our relationships with customers; our ability to successfully and timely monetize our network related assets through leases, commercial service arrangements or similar transactions (including as part of our Private Connectivity FabricSM solutions), including the possibility that the benefits of or demand for these transactions may be less than anticipated, that the costs thereof may be more than anticipated, or that we may be unable to satisfy any conditions of any such transactions in a timely manner, or at all; our ability to safeguard our network, and to avoid the adverse impact of cyber-attacks, security breaches, service outages, system failures, or similar events impacting our network or the availability and quality of our services; the effects of ongoing changes in the regulation of the communications industry, including the outcome of legislative, regulatory, or judicial proceedings relating to content liability standards, intercarrier compensation, universal service, service standards and obligations, broadband deployment, data protection, network security, privacy, and net neutrality; our ability to generate cash flows sufficient to fund our financial commitments and objectives, including our capital expenditures, operating costs, debt obligations, taxes, and pension contributions and other benefits payments; our ability to effectively retain and hire key personnel and to successfully negotiate collective bargaining agreements on reasonable terms without work stoppages; our ability to successfully adjust to changes in customer demand for our products and services, including increased demand for high-speed data transmission services, low-latency connectivity, and scalable infrastructure driven largely by the growth of artificial intelligence applications and workloads, and the risk that we may misjudge the timing, scale, or nature of such demand, leading to potential misalignment of our investments or strategic priorities; our ability to enhance our growth products and manage the decline of our legacy products, including by maintaining the quality and profitability of our existing offerings, introducing profitable new offerings on a timely and cost-effective basis, and transitioning customers from our legacy products to our newer offerings; our ability to successfully and timely implement our corporate strategies, including our transformation, modernization and simplification, buildout and deleveraging strategies; our ability to successfully consummate and timely realize the anticipated benefits from the pending sale of our Mass Markets fiber-to-the-home business in 11 states to AT&T; our ability to successfully and timely realize the anticipated benefits from our 2022 and 2023 divestitures, our 2024 debt modification and extinguishment transactions ,and our 2025 debt refinancing transactions, in each case as described in our prior reports fi led with the U.S. Securities and Exchange Commission (the "SEC"); changes in our operating plans, corporate strategies, or capital allocation plans, whether based upon changes in our cash flows, cash requirements, financial performance, financial position, market or regulatory conditions, or otherwise; the impact of any future material acquisitions or divestitures that we may transact, including our pending sale of our Mass Markets fiber-to-the-home business in 11 states; the negative impact of increases in the costs of our pension, healthcare, post-employment, or other benefits, including those caused by changes in capital markets, interest rates, mortality rates, demographics, or regulations; the impact of events that harm our reputation or brands, including the potential negative impact of customer or shareholder complaints, government investigations, security breaches, or service outages impacting us or our industry; adverse changes in our access to credit markets on acceptable terms, whether caused by unstable markets, debt covenant restrictions, changes in our financial position, lower credit ratings, or otherwise; our ability to meet the terms and conditions of our debt obligations and covenants, including our ability to make transfers of cash in compliance therewith; our ability to maintain favorable relations with our security holders, key business partners, suppliers, vendors, landlords, or lenders; our ability to timely obtain necessary hardware, software, equipment, services, governmental permits, and other items on favorable terms; the potential adverse effects arising out of allegations regarding the release of hazardous materials into the environment from network assets owned or operated by us or our predecessors, including any resulting governmental actions, removal costs, litigation, compliance costs, or penalties; our ability to collect our receivables from, or continue to do business with, financially-troubled customers; our ability to continue to use intellectual property necessary to conduct our operations; any adverse developments in legal or regulatory proceedings involving us; changes in tax, trade, tariff, pension, healthcare, or other laws or regulations, in governmental support programs, or in general government funding levels, including any adverse impact of a prolonged shutdown of the U.S. government; our ability to use our net operating loss carryforwards in the amounts projected and to fully realize any anticipated benefits from recently-enacted federal tax legislation; the effects of changes in accounting policies, practices, or assumptions, including changes that could potential ly require additional future impairment charges; the effects of adverse weather, terrorism, epidemics, pandemics, war, rioting, vandalism, societal unrest, political discord, or other natural or man-made disasters or disturbances; the potential adverse effects if our internal controls over financial reporting have weaknesses or deficiencies, or otherwise fail to operate as intended; the effects of changes in interest rates or inflation; the effects of more general factors such as changes in exchange rates, in operating costs, in public policy, in the views of financial analysts, or in general market, labor, economic, public health, or geopolitical conditions; and other risks referenced in our filings with the SEC. You are cautioned not to unduly rely upon our forward-looking statements, which speak only as of the date made. We undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise. Furthermore, any information about our intentions contained in any of our forward-looking statements reflects our intentions as of the date of such forward-looking statement, and is based upon, among other things, our assessment of regulatory, technological, industry, competitive, economic. and market conditions as of such date. We may change our intentions, strategies or plans (including our capital allocation plans) at any time and without notice, based upon any changes in such factors or otherwise.

© 2025 Lumen Technologies. All Rights Reserved. 2 Non-GAAP Measures This presentation includes certain historical and forward-looking non-GAAP financial measures, including but not limited to adjusted EBITDA, adjusted EBITDA margin, and free cash flow, each excluding the effects of special items, and adjustments to GAAP and other non-GAAP measures to exclude the effect of special items. In addition to providing key metrics for management to evaluate the company’s performance, we believe these measurements assist investors in their understanding of period-to-period operating performance and in identifying historical and prospective trends. Reconciliations of non-GAAP financial measures to the most comparable GAAP measures are included in the financial schedules to the Company’s accompanying earnings release. Reconciliation of information and additional non-GAAP historical financial measures that may be discussed during the call, along with further descriptions of non-GAAP financial measures, will be available in the Investor Relations portion of the company’s website at http://ir.lumen.com. Non-GAAP measures are not presented to be replacements or alternatives to the GAAP measures, and investors are urged to consider these non-GAAP measures in addition to, and not in substitution for, measures prepared in accordance with GAAP. Lumen may present or calculate its non-GAAP measures differently from other companies.

KATE JOHNSON President & CEO

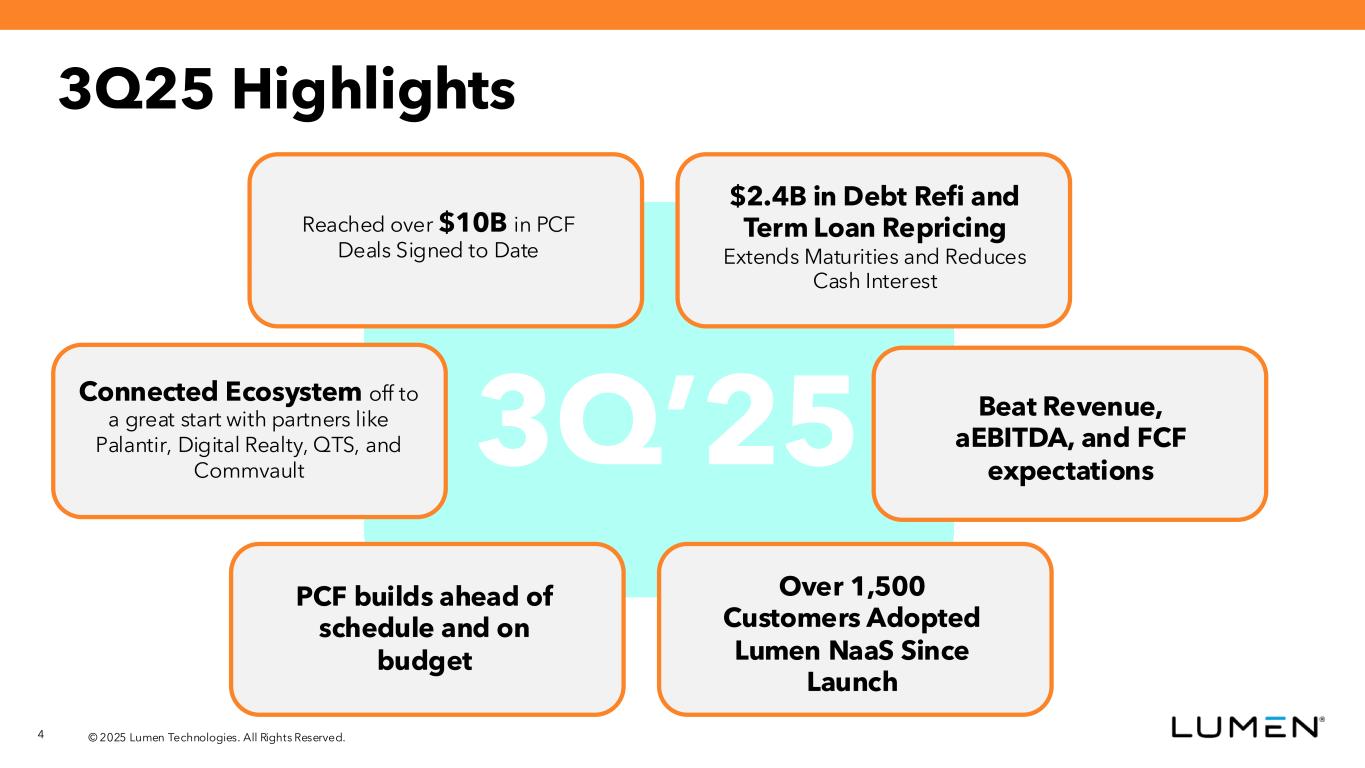

© 2025 Lumen Technologies. All Rights Reserved. 4 3Q25 Highlights Reached over $10B in PCF Deals Signed to Date $2.4B in Debt Refi and Term Loan Repricing Extends Maturities and Reduces Cash Interest Connected Ecosystem off to a great start with partners like Palantir, Digital Realty, QTS, and Commvault Beat Revenue, aEBITDA, and FCF expectations PCF builds ahead of schedule and on budget Over 1,500 Customers Adopted Lumen NaaS Since Launch 3Q’25

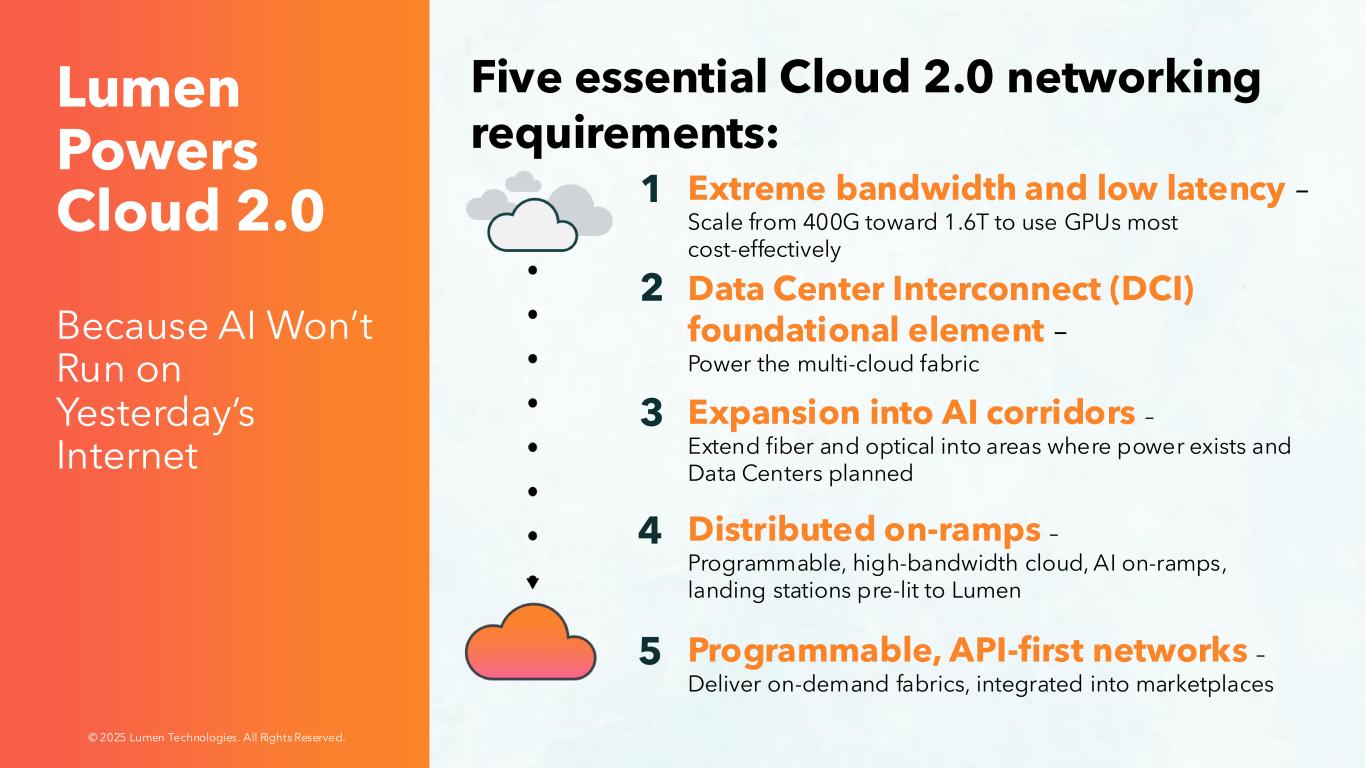

Data Center Interconnect (DCI) foundational element – Power the multi-cloud fabric Extreme bandwidth and low latency – Scale from 400G toward 1.6T to use GPUs most cost-effectively Programmable, API-first networks – Deliver on-demand fabrics, integrated into marketplaces Expansion into AI corridors – Extend fiber and optical into areas where power exists and Data Centers planned Distributed on-ramps – Programmable, high-bandwidth cloud, AI on-ramps, landing stations pre-lit to Lumen Lumen Powers Cloud 2.0 Because AI Won’t Run on Yesterday’s Internet 1 2 3 4 5 © 2025 Lumen Technologies. All Rights Reserved. Five essential Cloud 2.0 networking requirements:

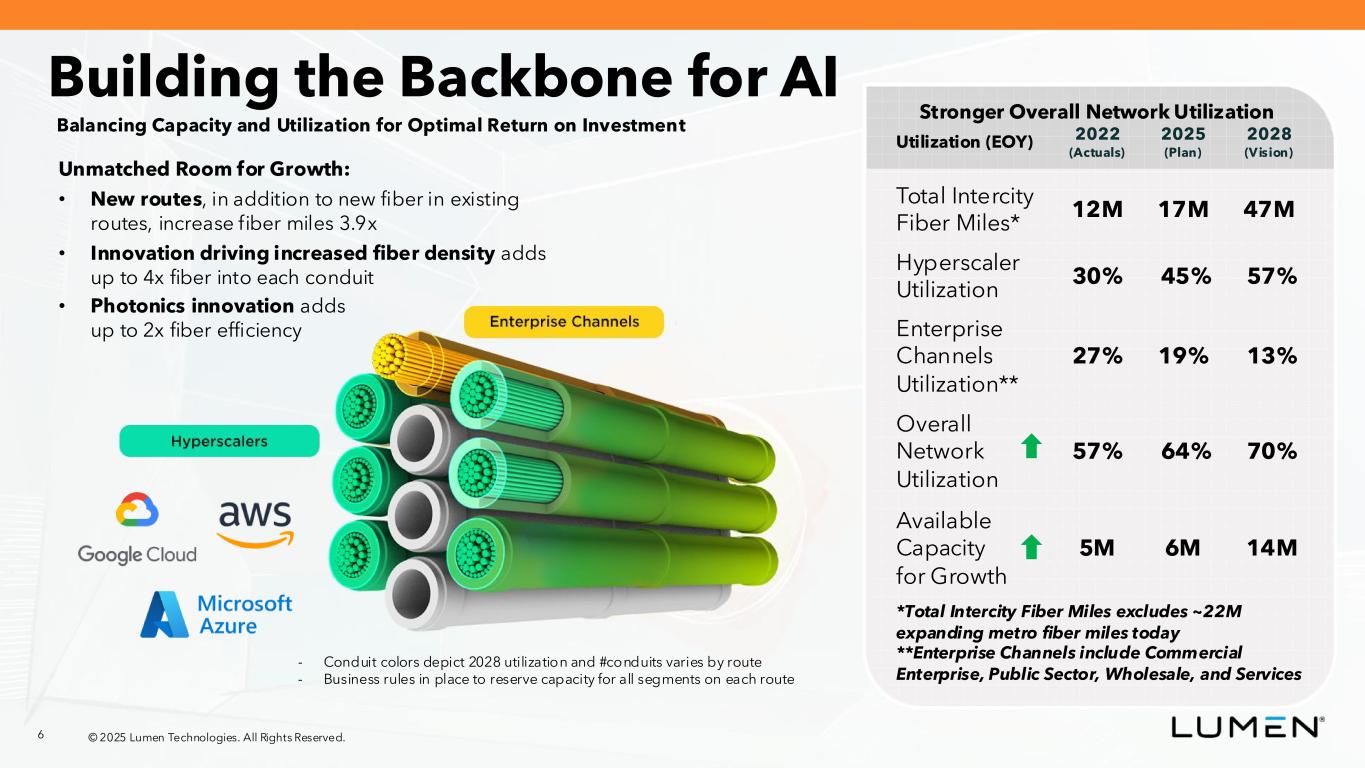

© 2025 Lumen Technologies. All Rights Reserved. 6 Utilization (EOY) 2022 (Actuals) 2025 (Plan) 2028 (Vision) Total Intercity Fiber Miles* 12M 17M 47M Hyperscaler Utilization 30% 45% 57% Enterprise Channels Utilization** 27% 19% 13% Overall Network Utilization 57% 64% 70% Available Capacity for Growth 5M 6M 14M Building the Backbone for AI Balancing Capacity and Utilization for Optimal Return on Investment Unmatched Room for Growth: • New routes, in addition to new fiber in existing routes, increase fiber miles 3.9x • Innovation driving increased fiber density adds up to 4x fiber into each conduit • Photonics innovation adds up to 2x fiber efficiency *Total Intercity Fiber Miles excludes ~22M expanding metro fiber miles today **Enterprise Channels include Commercial Enterprise, Public Sector, Wholesale, and Services - Conduit colors depict 2028 utilization and #conduits varies by route - Business rules in place to reserve capacity for all segments on each route Stronger Overall Network Utilization

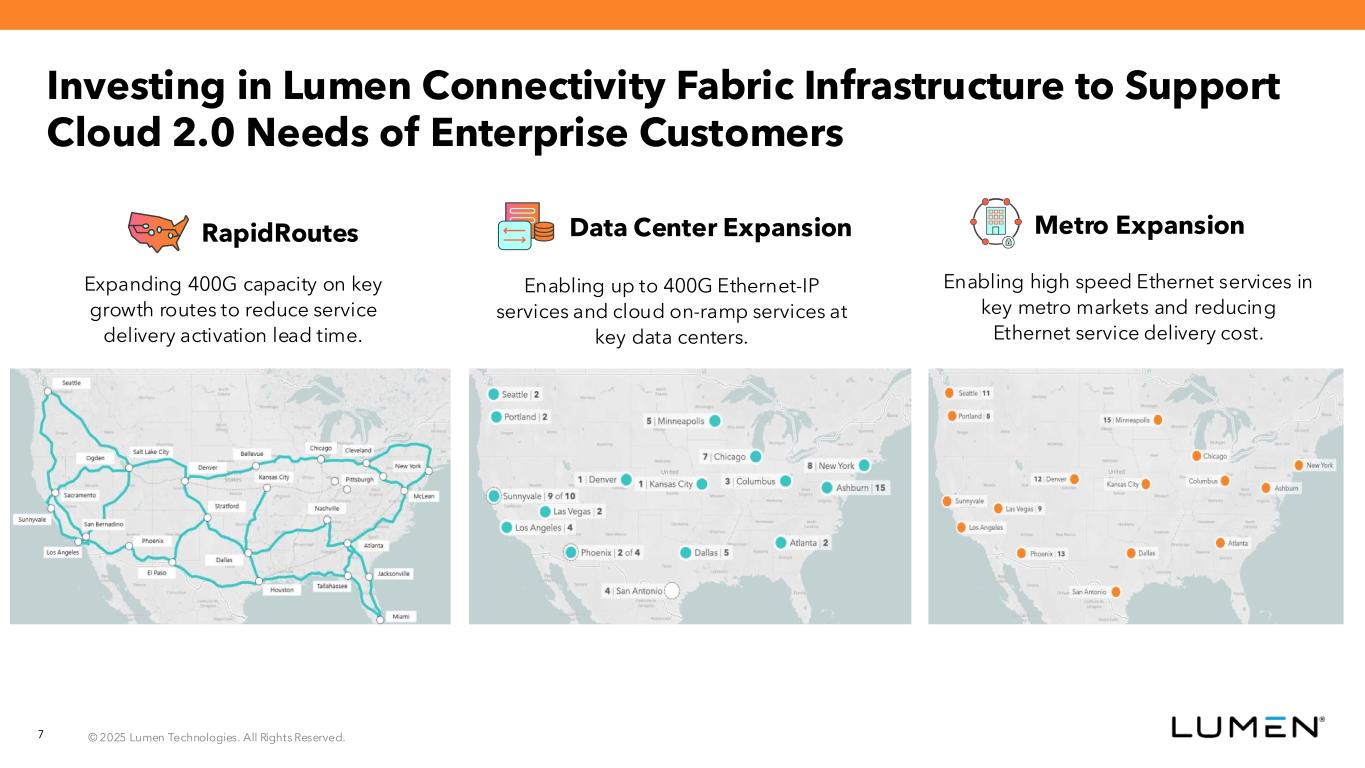

© 2025 Lumen Technologies. All Rights Reserved. 7 Investing in Lumen Connectivity Fabric Infrastructure to Support Cloud 2.0 Needs of Enterprise Customers Data Center Expansion Enabling up to 400G Ethernet-IP services and cloud on-ramp services at key data centers. RapidRoutes Expanding 400G capacity on key growth routes to reduce service delivery activation lead time. Enabling high speed Ethernet services in key metro markets and reducing Ethernet service delivery cost. Metro Expansion

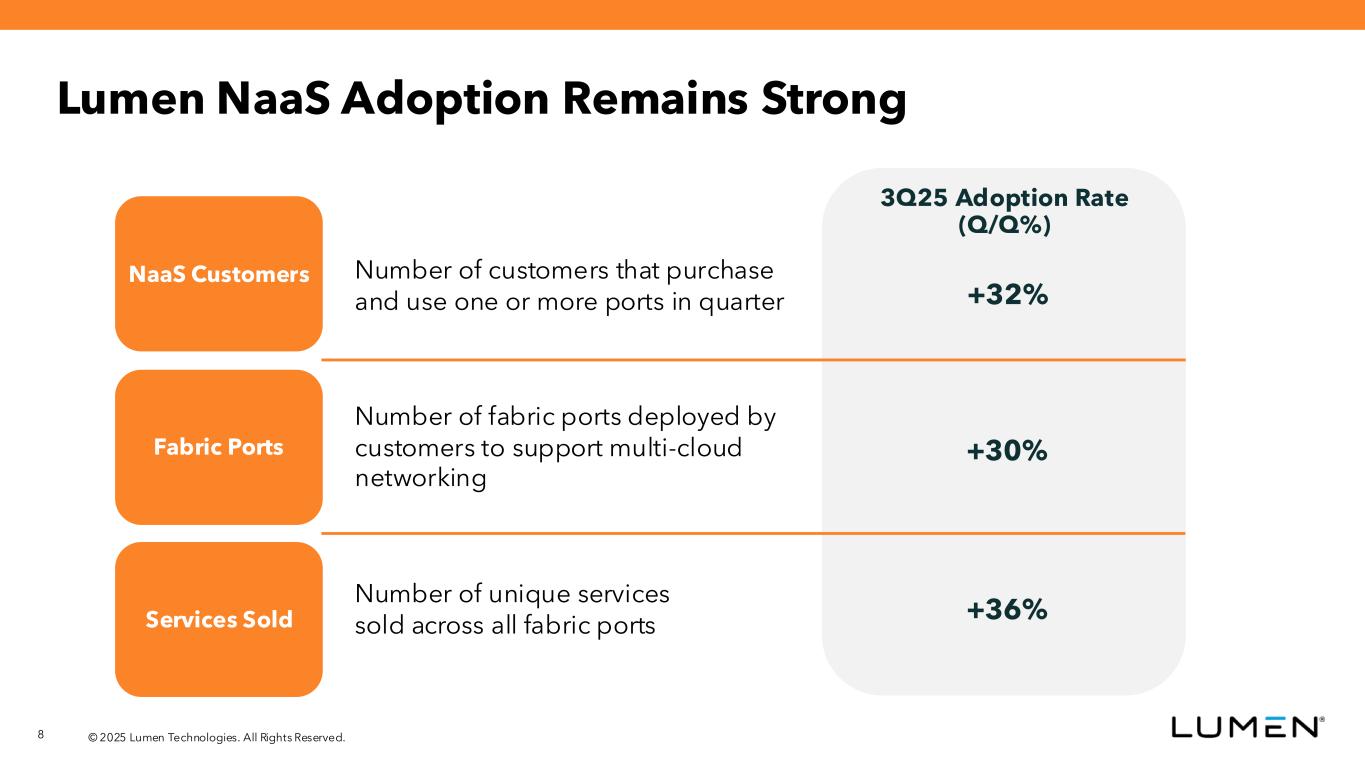

© 2025 Lumen Technologies. All Rights Reserved. 8 NaaS Customers Services Sold Fabric Ports 3Q25 Adoption Rate (Q/Q%) +32% +36% +30% Number of customers that purchase and use one or more ports in quarter Number of fabric ports deployed by customers to support multi-cloud networking Number of unique services sold across all fabric ports Lumen NaaS Adoption Remains Strong

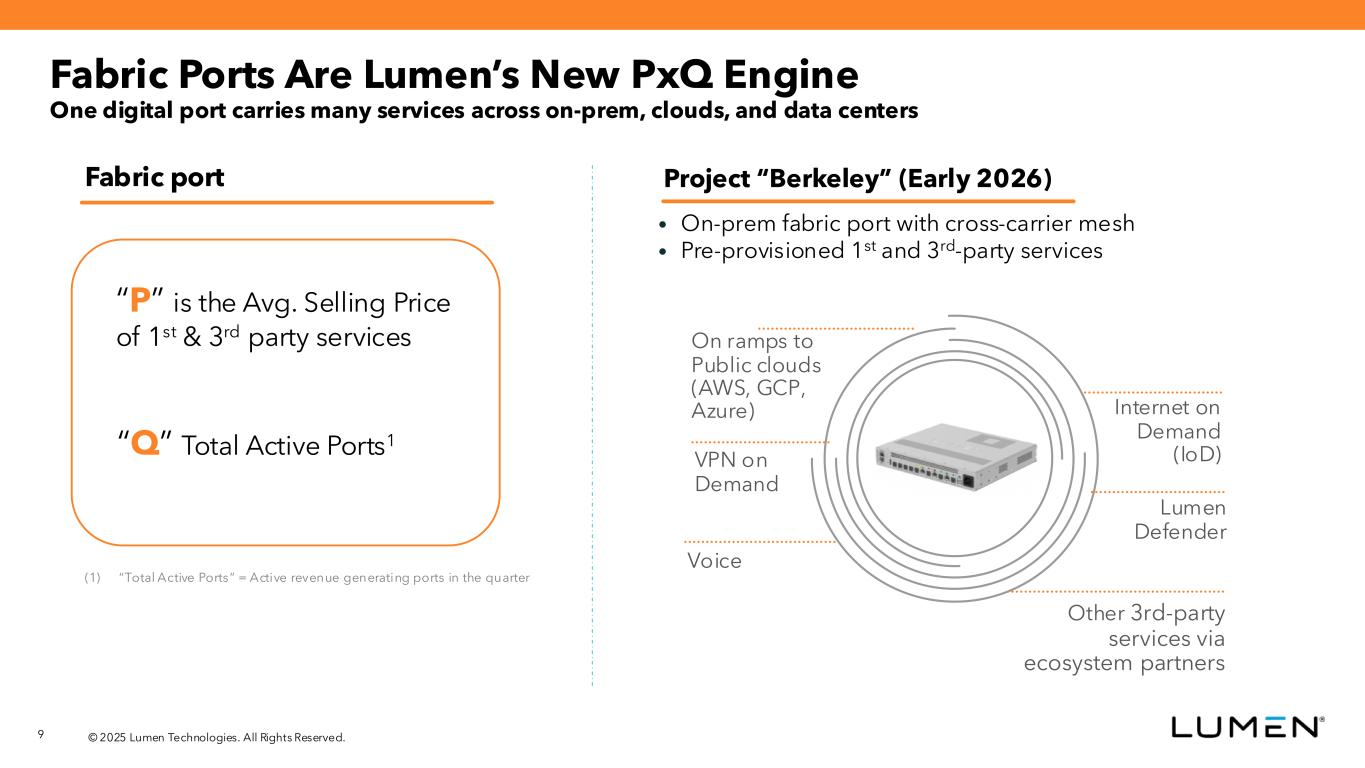

© 2025 Lumen Technologies. All Rights Reserved. 9 Fabric Ports Are Lumen’s New PxQ Engine One digital port carries many services across on-prem, clouds, and data centers On ramps to Public clouds (AWS, GCP, Azure) VPN on Demand Lumen Defender Other 3rd-party services via ecosystem partners Internet on Demand (IoD) Voice Project “Berkeley” (Early 2026) • On-prem fabric port with cross-carrier mesh • Pre-provisioned 1st and 3rd-party services Fabric port “Q” Total Active Ports1 “P” is the Avg. Selling Price of 1st & 3rd party services (1) “Total Active Ports” = Active revenue generating ports in the quarter

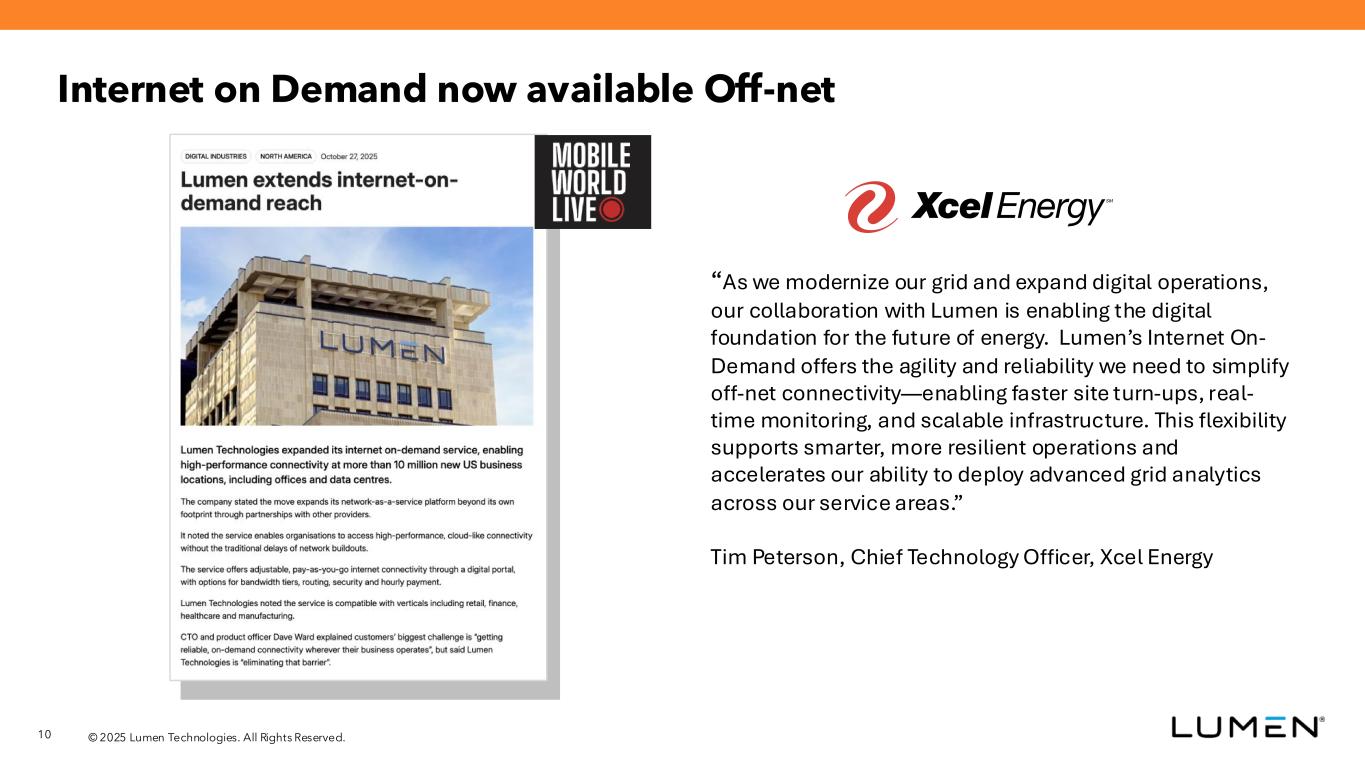

© 2025 Lumen Technologies. All Rights Reserved. 10 Internet on Demand now available Off-net “As we modernize our grid and expand digital operations, our collaboration with Lumen is enabling the digital foundation for the future of energy. Lumen’s Internet On- Demand offers the agility and reliability we need to simplify off-net connectivity—enabling faster site turn-ups, real- time monitoring, and scalable infrastructure. This flexibility supports smarter, more resilient operations and accelerates our ability to deploy advanced grid analytics across our service areas.” Tim Peterson, Chief Technology Officer, Xcel Energy

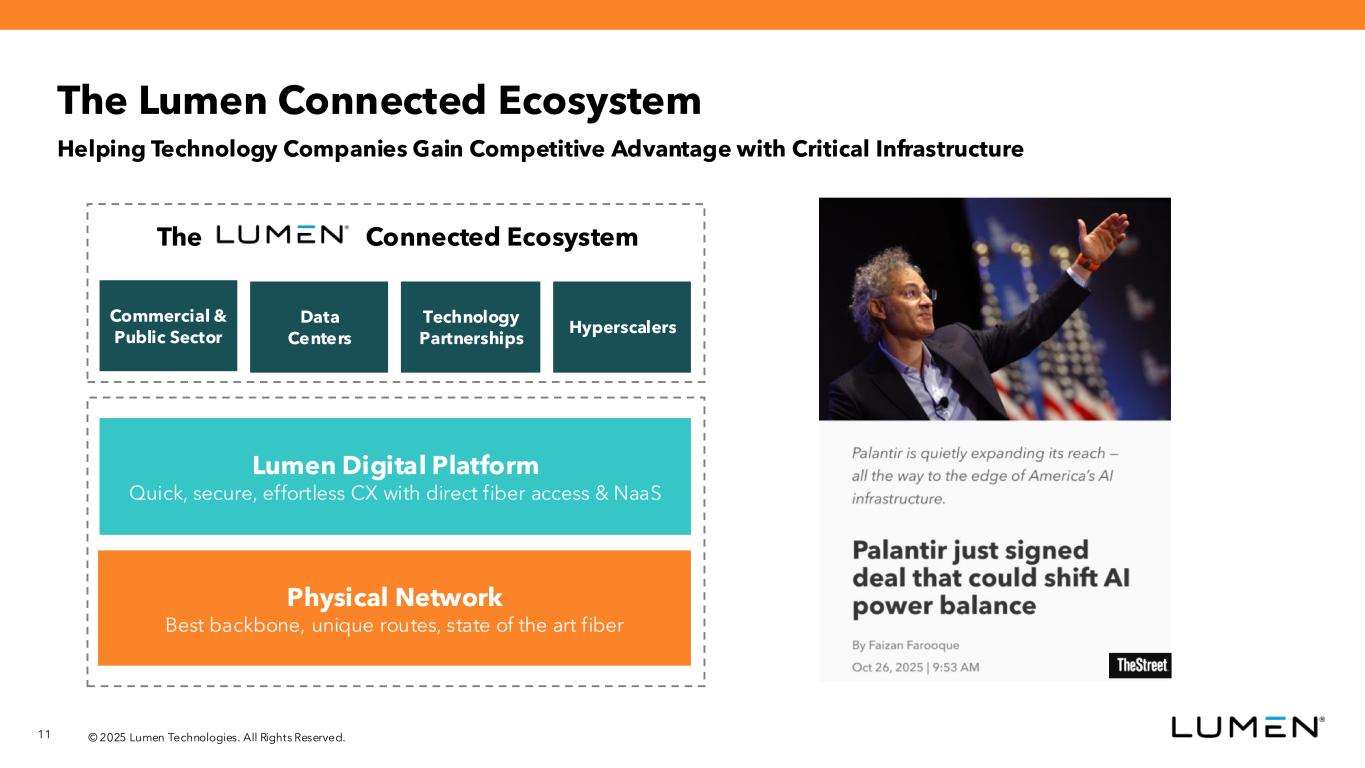

© 2025 Lumen Technologies. All Rights Reserved. 11 Physical Network Best backbone, unique routes, state of the art fiber Lumen Digital Platform Quick, secure, effortless CX with direct fiber access & NaaS Commercial & Public Sector Data Centers Technology Partnerships Hyperscalers Connected EcosystemThe Helping Technology Companies Gain Competitive Advantage with Critical Infrastructure The Lumen Connected Ecosystem

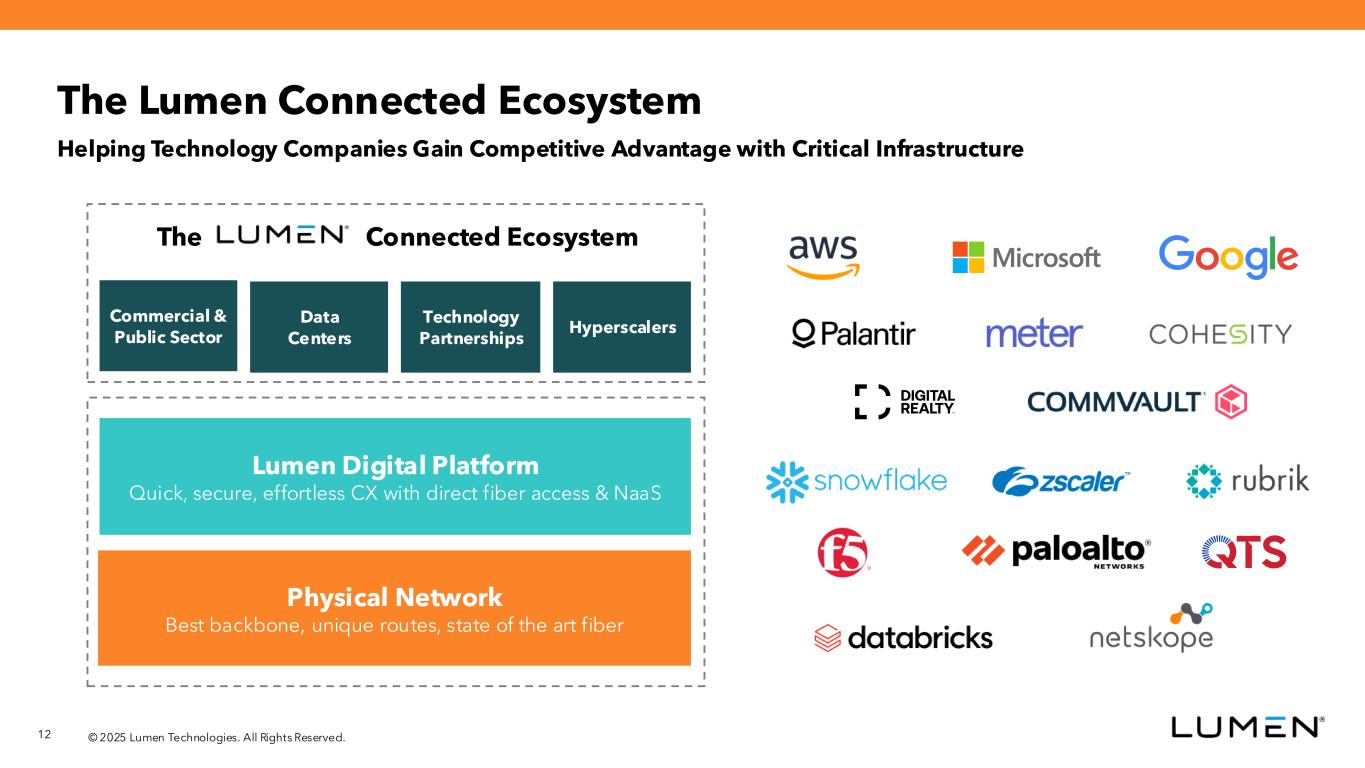

© 2025 Lumen Technologies. All Rights Reserved. 12 Physical Network Best backbone, unique routes, state of the art fiber Lumen Digital Platform Quick, secure, effortless CX with direct fiber access & NaaS Commercial & Public Sector Data Centers Technology Partnerships Hyperscalers Connected EcosystemThe Helping Technology Companies Gain Competitive Advantage with Critical Infrastructure The Lumen Connected Ecosystem

CHRIS STANSBURY EVP & CFO

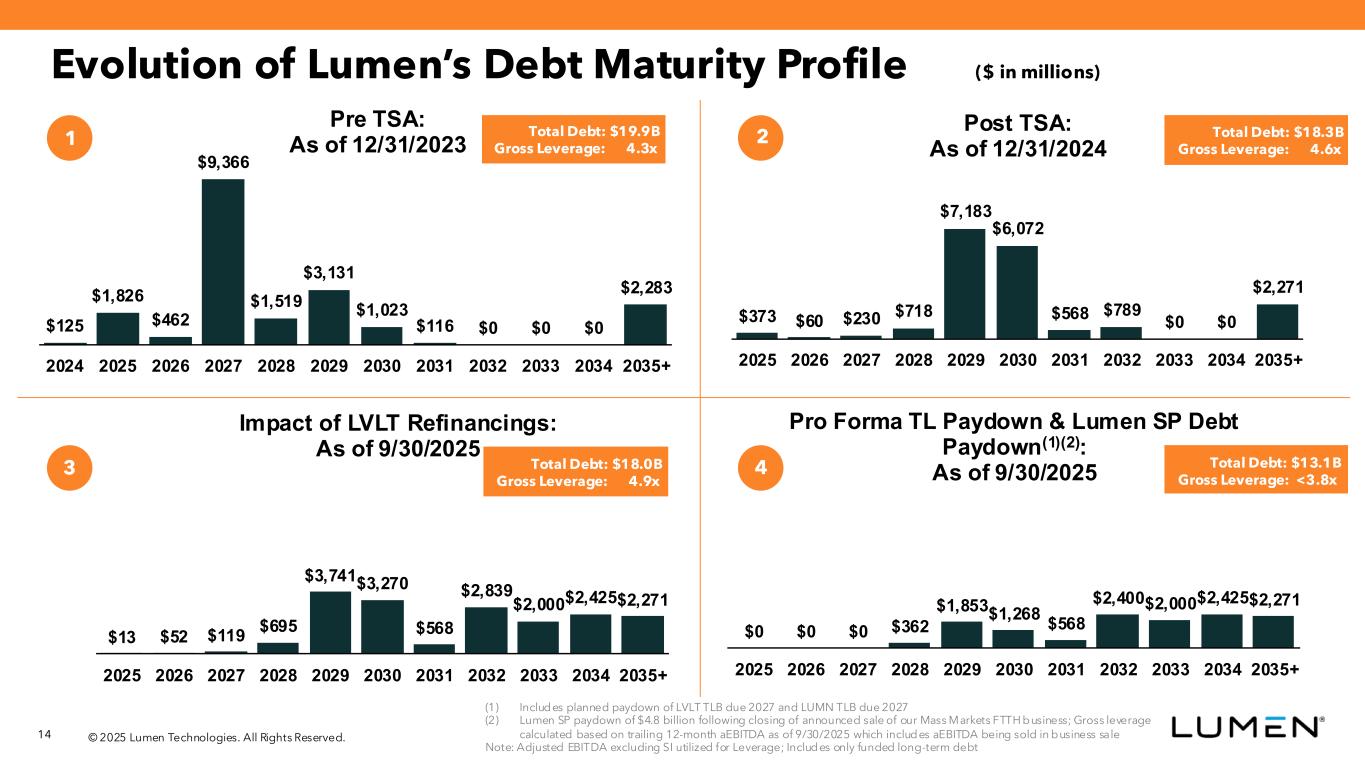

© 2025 Lumen Technologies. All Rights Reserved. 14 Evolution of Lumen’s Debt Maturity Profile ($ in millions) $125 $1,826 $462 $9,366 $1,519 $3,131 $1,023 $116 $0 $0 $0 $2,283 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035+ Pre TSA: As of 12/31/2023 Total Debt: $19.9B Gross Leverage: 4.3x 1 $373 $60 $230 $718 $7,183 $6,072 $568 $789 $0 $0 $2,271 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035+ Post TSA: As of 12/31/2024 Total Debt: $18.3B Gross Leverage: 4.6x 2 $13 $52 $119 $695 $3,741$3,270 $568 $2,839 $2,000$2,425$2,271 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035+ Impact of LVLT Refinancings: As of 9/30/2025 Total Debt: $18.0B Gross Leverage: 4.9x 3 $0 $0 $0 $362 $1,853 $1,268 $568 $2,400$2,000$2,425$2,271 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035+ Pro Forma TL Paydown & Lumen SP Debt Paydown(1)(2): As of 9/30/2025 Total Debt: $13.1B Gross Leverage: <3.8x 4 (1) Includes planned paydown of LVLT TLB due 2027 and LUMN TLB due 2027 (2) Lumen SP paydown of $4.8 billion following closing of announced sale of our Mass Markets FTTH business; Gross leverage calculated based on trailing 12-month aEBITDA as of 9/30/2025 which includes aEBITDA being sold in business sale Note: Adjusted EBITDA excluding SI utilized for Leverage; Includes only funded long-term debt

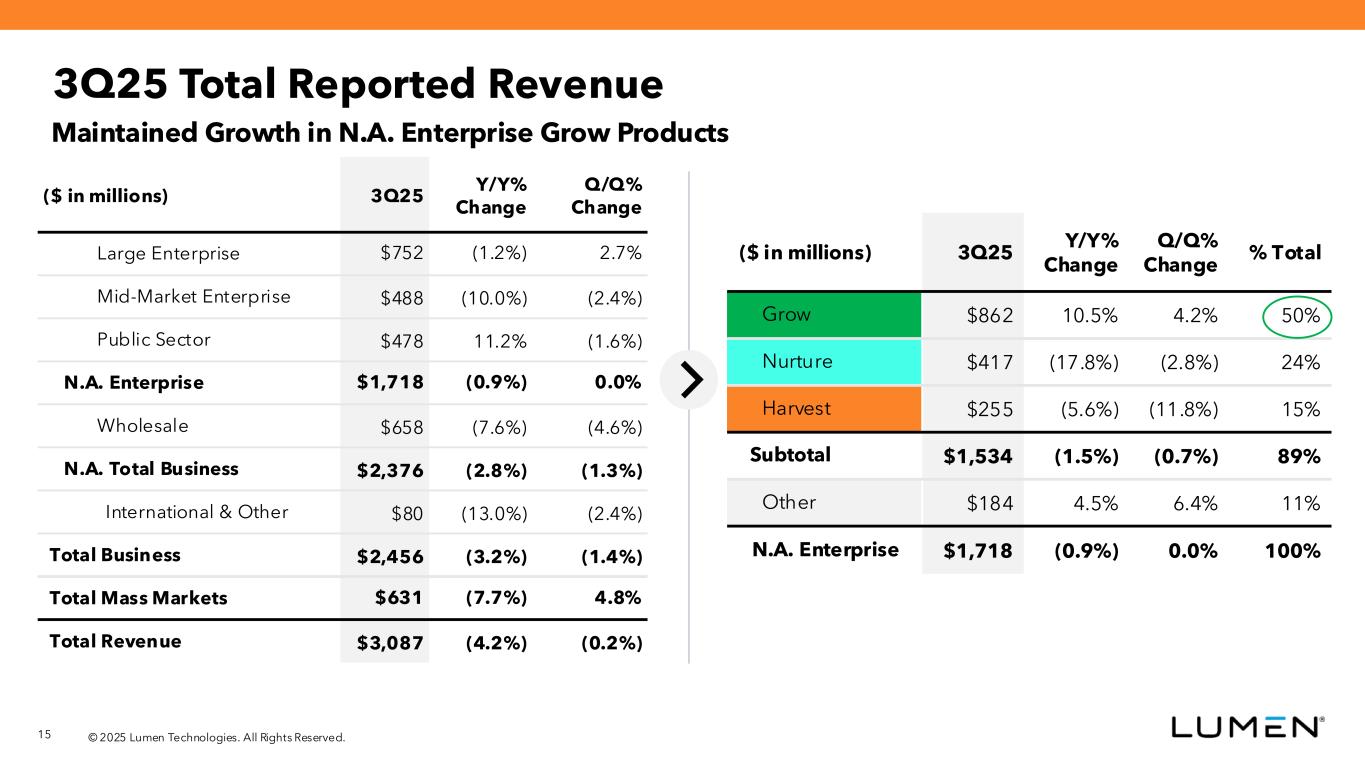

© 2025 Lumen Technologies. All Rights Reserved. 15 ($ in millions) 3Q25 Y/Y% Change Q/Q% Change Large Enterprise $752 (1.2%) 2.7% Mid-Market Enterprise $488 (10.0%) (2.4%) Public Sector $478 11.2% (1.6%) N.A. Enterprise $1,718 (0.9%) 0.0% Wholesale $658 (7.6%) (4.6%) N.A. Total Business $2,376 (2.8%) (1.3%) International & Other $80 (13.0%) (2.4%) Total Business $2,456 (3.2%) (1.4%) Total Mass Markets $631 (7.7%) 4.8% Total Revenue $3,087 (4.2%) (0.2%) ($ in millions) 3Q25 Y/Y% Change Q/Q% Change % Total Grow $862 10.5% 4.2% 50% Nurture $417 (17.8%) (2.8%) 24% Harvest $255 (5.6%) (11.8%) 15% Subtotal $1,534 (1.5%) (0.7%) 89% Other $184 4.5% 6.4% 11% N.A. Enterprise $1,718 (0.9%) 0.0% 100% 3Q25 Total Reported Revenue Maintained Growth in N.A. Enterprise Grow Products

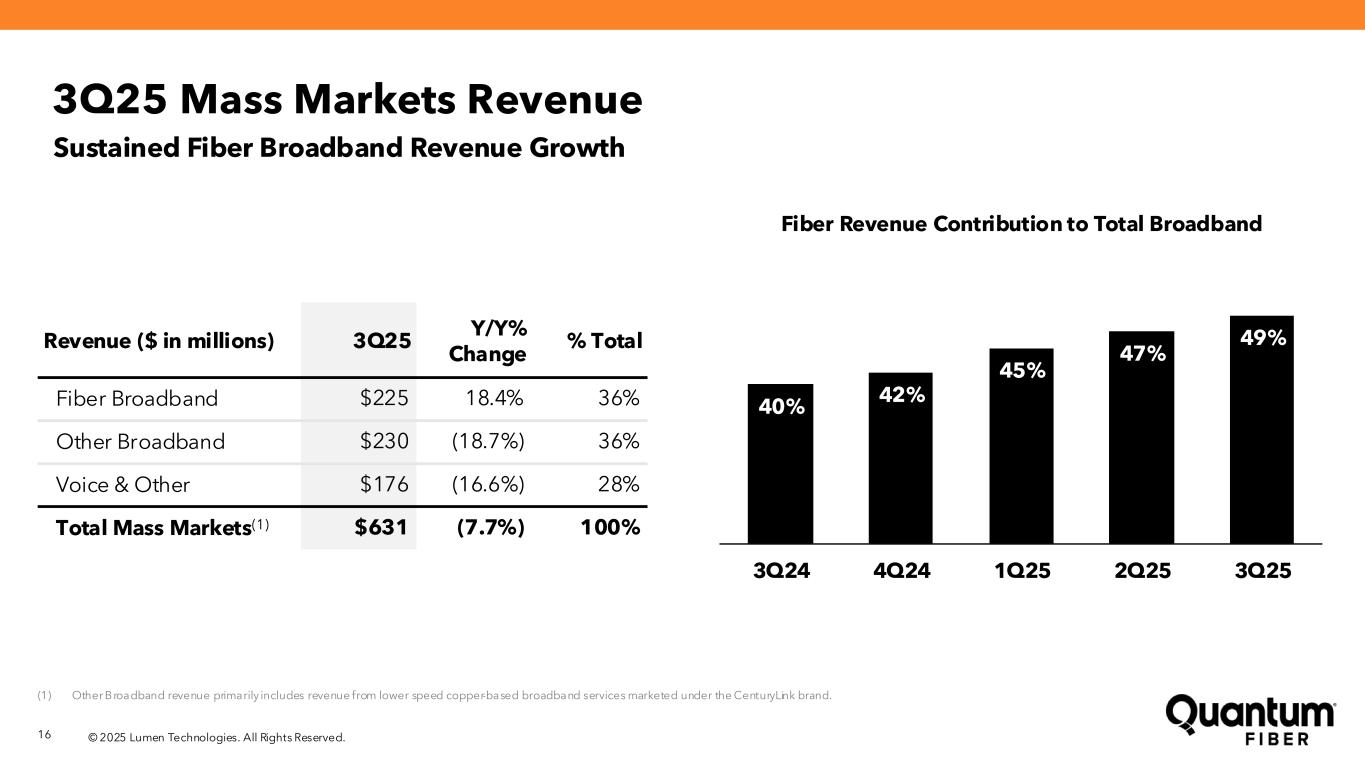

© 2025 Lumen Technologies. All Rights Reserved. 16 3Q25 Mass Markets Revenue 40% 42% 45% 47% 49% 3Q24 4Q24 1Q25 2Q25 3Q25 Fiber Revenue Contribution to Total Broadband Revenue ($ in millions) 3Q25 Y/Y% Change % Total Fiber Broadband $225 18.4% 36% Other Broadband $230 (18.7%) 36% Voice & Other $176 (16.6%) 28% Total Mass Markets(1) $631 (7.7%) 100% (1) Other Broadband revenue primarily includes revenue from lower speed copper-based broadband services marketed under the CenturyLink brand. Sustained Fiber Broadband Revenue Growth

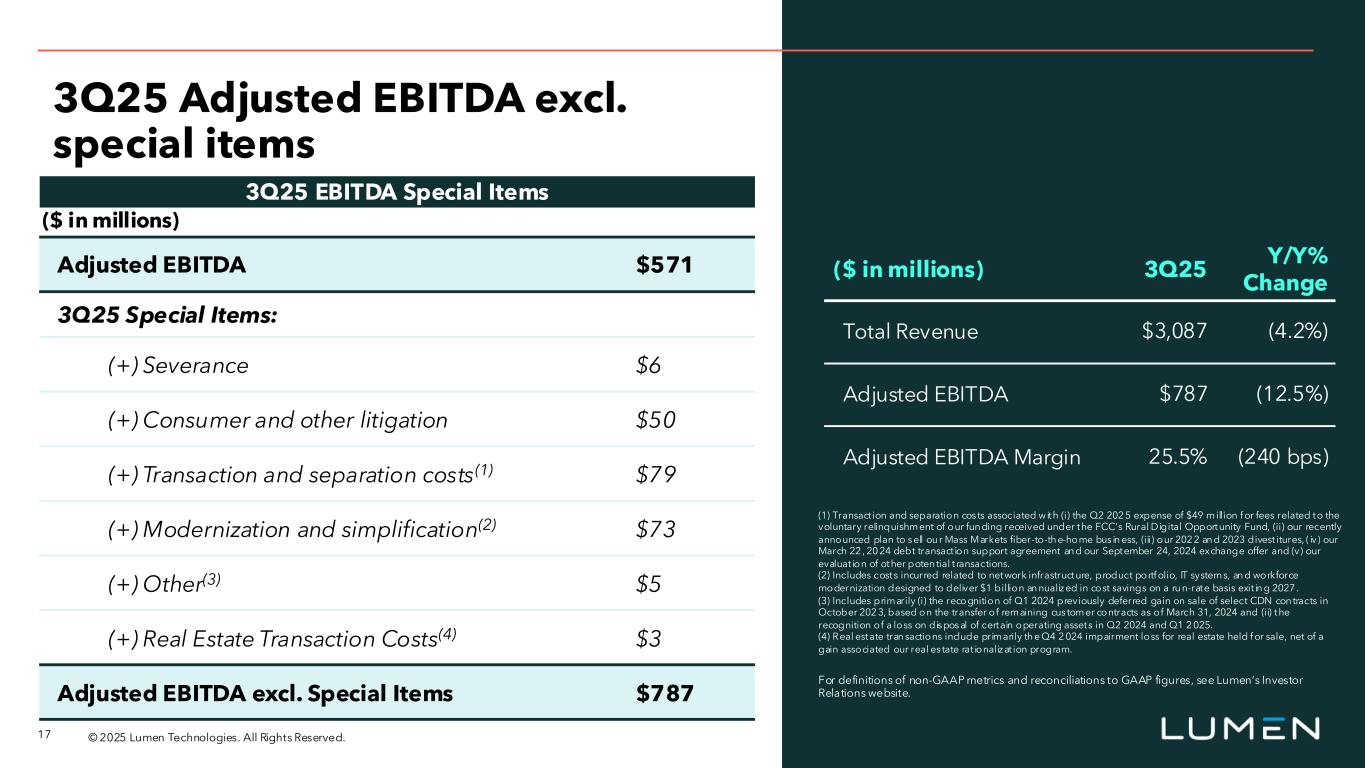

© 2025 Lumen Technologies. All Rights Reserved. 17 3Q25 Adjusted EBITDA excl. special items ($ in millions) 3Q25 Y/Y% Change Total Revenue $3,087 (4.2%) Adjusted EBITDA $787 (12.5%) Adjusted EBITDA Margin 25.5% (240 bps) Adjusted EBITDA $571 3Q25 Special Items: (+) Severance $6 (+) Consumer and other litigation $50 (+) Transaction and separation costs(1) $79 (+) Modernization and simplification(2) $73 (+) Other(3) $5 (+) Real Estate Transaction Costs(4) $3 Adjusted EBITDA excl. Special Items $787 3Q25 EBITDA Special Items ($ in millions) (1) Transact ion and separation cos ts associated with (i) the Q2 202 5 expense of $49 million f or fees related to the voluntary relinquishment of our fun ding received under the FCC's Rural Digital Opportunity Fund, (ii) our recently announced plan to s ell ou r Mass Markets fiber-to-th e-home bus in ess, (iii) our 202 2 an d 2023 divest itures, ( iv) our March 22 , 20 24 debt transact ion support agreement an d our September 24, 2024 exchange offer and (v) our evaluat ion of other poten tial t ransactions. (2) Includes costs incurred related to network infrastructure, product portf olio, IT systems, an d workforce modernization designed to deliver $1 billion an nualiz ed in cost savings on a ru n-rate basis exit in g 2027 . (3) Includes primarily (i) the recognition of Q1 2024 previously deferred gain on sale of select CDN con tracts in October 202 3, based on the transfer of remaining cus tomer contracts as of March 31, 2024 and (ii) the recognition of a loss on dis pos al of certain operating assets in Q2 2024 and Q1 2 025. (4) Real estate tran sactions include primarily th e Q4 2 024 impairment loss for real estate held f or sale, net of a gain associated our real es tate rat ionaliz at ion program. For definitions of non-GAAP metrics and reconciliations to GAAP figures, see Lumen’s Investor Relations website.

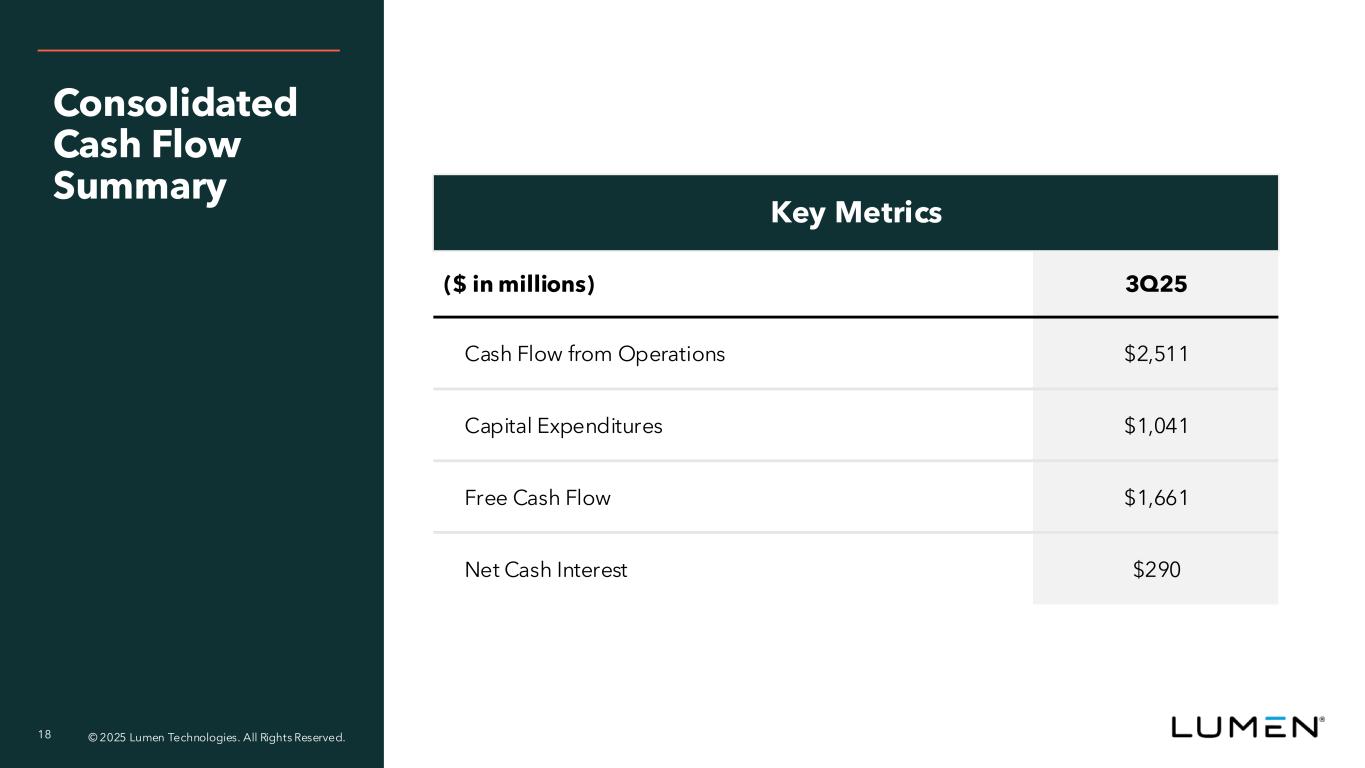

© 2025 Lumen Technologies. All Rights Reserved. 18 Consolidated Cash Flow Summary ($ in millions) 3Q25 Cash Flow from Operations $2,511 Capital Expenditures $1,041 Free Cash Flow $1,661 Net Cash Interest $290 Key Metrics

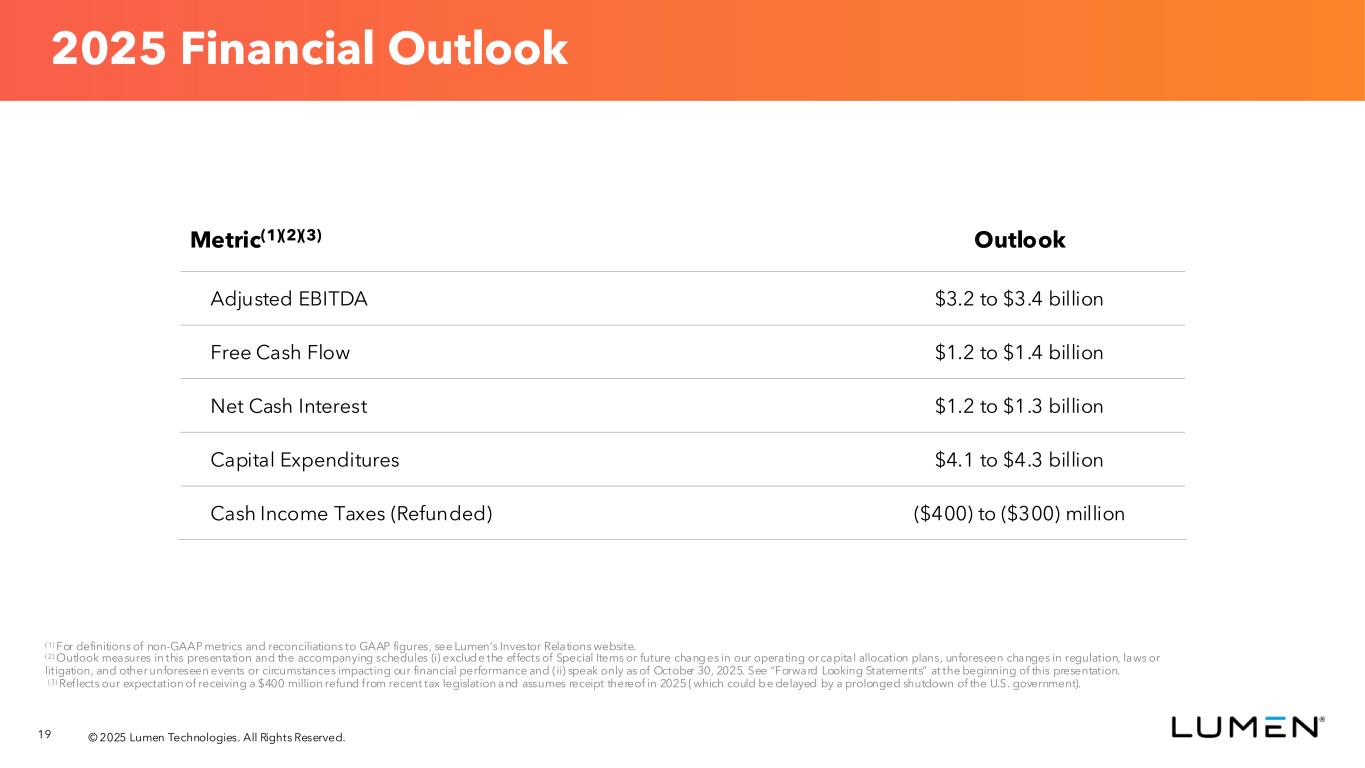

© 2025 Lumen Technologies. All Rights Reserved. 19 2025 Financial Outlook Metric(1)(2)(3) Outlook Adjusted EBITDA $3.2 to $3.4 billion Free Cash Flow $1.2 to $1.4 billion Net Cash Interest $1.2 to $1.3 billion Capital Expenditures $4.1 to $4.3 billion Cash Income Taxes (Refunded) ($400) to ($300) million (1) For definitions of non-GAAP metrics and reconciliations to GAAP figures, see Lumen’s Investor Relations website. (2) Outlook measures in this presentation and the accompanying schedules (i) exclude the effects of Special Items or future changes in our operating or capital allocation plans, unforeseen changes in regulation, laws or litigation, and other unforeseen events or circumstances impacting our financial performance and (ii) speak only as of October 30, 2025. See “Forward Looking Statements” at the beginning of this presentation. (3) Reflects our expectation of receiving a $400 million refund from recent tax legislation and assumes receipt thereof in 2025 ( which could be delayed by a prolonged shutdown of the U.S. government).