.2

January 4, 2021

Cautionary Statement on Forward-Looking Statements of Centene All statements, other than statements of

current or historical fact, contained in this presentation are forward-looking statements. Without limiting the foregoing, forward-looking statements often use words such as “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,”

“seek,” “target,” “goal,” “may,” “will,” “would,” “could,” “should,” “can,” “continue” and other similar words or expressions (and the negative thereof). Centene Corporation (the “Company”, “our”, or “we”) intends such forward-looking

statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of complying with these safe-harbor

provisions. In particular, these statements include, without limitation, statements about our future operating or financial performance, market opportunity, growth strategy, competition, expected activities in completed and future

acquisitions, including statements about the impact of our proposed acquisition of Magellan Health (the “Magellan Transaction”), our recently completed acquisition (the “WellCare Acquisition”) of WellCare Health Plans, Inc. (“WellCare”),

other recent and future acquisitions, investments and the adequacy of our available cash resources. These forward-looking statements reflect our current views with respect to future events and are based on numerous assumptions and assessments

made by us in light of our experience and perception of historical trends, current conditions, business strategies, operating environments, future developments and other factors we believe appropriate. By their nature, forward-looking

statements involve known and unknown risks and uncertainties and are subject to change because they relate to events and depend on circumstances that will occur in the future, including economic, regulatory, competitive and other factors that

may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions. All forward-looking statements included in this presentation are based on information available to us on the date

hereof. Except as may be otherwise required by law, we undertake no obligation to update or revise the forward-looking statements included in this presentation, whether as a result of new information, future events or otherwise, after the

date hereof. You should not place undue reliance on any forward-looking statements, as actual results may differ materially from projections, estimates, or other forward-looking statements due to a variety of important factors, variables and

events including but not limited to: the risk that regulatory or other approvals required for the Magellan Transaction may be delayed or not obtained or are obtained subject to conditions that are not anticipated that could require the

exertion of management’s time and our resources or otherwise have an adverse effect on the Company; the risk that Magellan's stockholders do not adopt the definitive merger agreement; the possibility that certain conditions to the

consummation of the Magellan Transaction will not be satisfied or completed on a timely basis and accordingly the Magellan Transaction may not be consummated on a timely basis or at all; the impact of COVID-19 on global markets, economic

conditions, the healthcare industry and our results of operations, which is unknown, and the response by governments and other third parties; uncertainty as to the expected financial performance of the combined company following completion of

the Magellan Transaction; uncertainty as to our expected financial performance during the period of integration of the WellCare Acquisition; the possibility that the expected synergies and value creation from the Magellan Transaction or the

WellCare Acquisition will not be realized, or will not be realized within the expected time period; the exertion of management’s time and our resources, and other expenses incurred and business changes required, in connection with complying

with the undertakings in connection with any regulatory, governmental or third party consents or approvals for the Magellan Transaction; the risk that unexpected costs will be incurred in connection with the completion and/or integration of

the Magellan Transaction or the integration of the WellCare Acquisition or that the integration of Magellan or WellCare will be more difficult or time consuming than expected; the risk that potential litigation in connection with the Magellan

Transaction may affect the timing or occurrence of the Magellan Transaction or result in significant costs of defense, indemnification and liability; a downgrade of the credit rating of our indebtedness, which could give rise to an obligation

to redeem existing indebtedness; unexpected costs, charges or expenses resulting from the Magellan Transaction or the WellCare Acquisition; the possibility that competing offers will be made to acquire Magellan; the inability to retain key

personnel; disruption from the announcement, pendency and/or completion of the Magellan Transaction or the integration of the WellCare Acquisition, including potential adverse reactions or changes to business relationships with customers,

employees, suppliers or regulators, making it more difficult to maintain business and operational relationships; the risk that, following the Magellan Transaction, the combined company may not be able to effectively manage its expanded

operations; our ability to accurately predict and effectively manage health benefits and other operating expenses and reserves, including fluctuations in medical utilization rates due to the impact of COVID-19; competition; membership and

revenue declines or unexpected trends; changes in healthcare practices, new technologies, and advances in medicine; increased healthcare costs; changes in economic, political or market conditions; changes in federal or state laws or

regulations, including changes with respect to income tax reform or government healthcare programs as well as changes with respect to the Patient Protection and Affordable Care Act (ACA) and the Health Care and Education Affordability

Reconciliation Act, collectively referred to as the ACA and any regulations enacted thereunder that may result from changing political conditions or judicial actions, including the ultimate outcome in “Texas v. United States of America”

regarding the constitutionality of the ACA; rate cuts or other payment reductions or delays by governmental payors and other risks and uncertainties affecting our government businesses; our ability to adequately price products on the Health

Insurance Marketplaces and other commercial and Medicare products; tax matters; disasters or major epidemics; the outcome of legal and regulatory proceedings; changes in expected contract start dates; provider, state, federal, foreign and

other contract changes and timing of regulatory approval of contracts; the expiration, suspension, or termination of our contracts with federal or state governments (including but not limited to Medicaid, Medicare, TRICARE or other

customers); the difficulty of predicting the timing or outcome of pending or future litigation or government investigations; challenges to our contract awards; cyber-attacks or other privacy or data security incidents; the possibility that

the expected synergies and value creation from acquired businesses, including businesses we may acquire in the future, will not be realized, or will not be realized within the expected time period; the exertion of management’s time and our

resources, and other expenses incurred and business changes required in connection with complying with the undertakings in connection with any regulatory, governmental or third party consents or approvals for acquisitions; disruption caused

by significant completed and pending acquisitions, including, among others, the WellCare Acquisition, making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred in connection

with the completion and/or integration of acquisition transactions; changes in expected closing dates, estimated purchase price and accretion for acquisitions; the risk that acquired businesses will not be integrated successfully;

restrictions and limitations in connection with our indebtedness; our ability to maintain or achieve improvement in the Centers for Medicare and Medicaid Services (CMS) Star ratings and maintain or achieve improvement in other quality scores

in each case that can impact revenue and future growth; availability of debt and equity financing, on terms that are favorable to us; inflation; foreign currency fluctuations and risks and uncertainties discussed in the reports that Centene

has filed with the Securities and Exchange Commission.This list of important factors is not intended to be exhaustive. We discuss certain of these matters more fully, as well as certain other factors that may affect our business operations,

financial condition and results of operations, in our filings with the Securities and Exchange Commission (SEC), including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Due to these important

factors and risks, we cannot give assurances with respect to our future performance, including without limitation our ability to maintain adequate premium levels or our ability to control our future medical and selling, general and

administrative costs. 2

Important Additional Information and Where to Find ItIn connection with the Magellan Transaction,

Magellan Health intends to file with the SEC a proxy statement for its stockholders (the “Proxy Statement”). Magellan will send the Proxy Statement to its stockholders and may file other documents regarding the Magellan Transaction with the

SEC. This communication is not a substitute for the Proxy Statement or any other document that Magellan may send to its stockholders in connection with the Magellan Transaction. INVESTORS AND SECURITY HOLDERS OF MAGELLAN ARE URGED TO READ THE

PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT MAGELLAN, THE TRANSACTION AND RELATED MATTERS. Investors and security holders of Magellan will be able to obtain free copies of the Proxy Statement and other documents (including any amendments or supplements thereto) containing

important information about Magellan once those documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Magellan makes available free of charge at www.magellanhealth.com copies of materials it files with,

or furnishes to, the SEC.Participants In The SolicitationCentene Corporation and certain of its respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders of

Magellan in connection with the Magellan Transaction.Information about the directors and executive officers of Centene is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on

February 18, 2020, its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on March 13, 2020, and on its website at www.centene.com.Investors may obtain additional information regarding the interests of

such participants, which may, in some cases, be different than those of Magellan's stockholders generally, and a description of their direct and indirect interests, by security holdings or otherwise, by reading the Proxy Statement and other

materials to be filed with the SEC in connection with the Magellan Transaction when they become available. You may obtain these documents free of charge through the website maintained by the SEC at www.sec.gov and from the websites of Centene

or Magellan as described above. 3

Earnings Guidance Policy Our Company’s policy is “that the Company undertakes no obligation to update

its earnings guidance, other than as part of its quarterly or yearly earnings disclosure, and that silence on guidance by the Company or Company officials should not be interpreted that guidance has or has not changed. In any event, no

updated guidance would ever be given that is not previously or simultaneously disclosed in an SEC filing or other broad non-exclusionary means.” 4

Participants Michael F. NeidorffChairman & Chief Executive Officer, CenteneKenneth J. FasolaChief

Executive Officer, MagellanSarah LondonSVP Technology, Innovation and Modernization and President, Health Care Enterprises, CenteneJeffrey A. SchwanekeExecutive Vice President, Chief Financial Officer, Centene 5

Establishing a Leader in Behavioral Health and Specialty Health One of the nation’s largest behavioral

health platformsCentene + Magellan will provide behavioral services for 41mm U.S. members Manages fastest-growing, most complex areas of health associated with behavioral health conditionsExpands combined national reach to drive value for

customers across all markets Combined with Centene's Health Care Enterprises establishes a scaled, independent, health solutions businessSignificant 3rd party customer base – 35mm behavioral and specialty membersMission-aligned with Centene's

focus on government-sponsored members and vulnerable populations Enhances Centene's scale and product diversification with high value solutionsAdvanced management capabilities in specialized areas of spend such as pharmacy, radiology,

oncologyEnhances whole health capabilities alongside medical, pharmacy, dental and visionAttractive specialty platform with cross-sell opportunity and ability to expand into new products Further reinforces Centene's position as the leader in

government-sponsored healthcare Adds 5.5mm new behavioral and specialty members enrolled in government-sponsored programs Adds new pharmacy services in 26 states and D.C.Value creation for shareholdersAccretive to adjusted EPS (low to

mid-single digit percent by the second full year)$50mm in annual net cost synergies projected by the second full year, incremental to the cost reduction plan of $75mm already initiated by Magellan + 6

Magellan focuses on high cost and growing medical categories Sources: 2012 National Library

of Medicine Study Primary Care and Behavioral Health Practice Size: The Challenge for Healthcare Reform; Prevalence and medical costs of chronic diseases, Am J PrevMed, 2017;Drug Channels Institute “The 2019 Economic Report on U.S. Pharmacies

and PBMs”. Milliman: Potential Economic Impact of Integrated Medical-Behavioral Healthcare, 2018.1. Segment profit adjusted for net other BTO and unallocated corporate expenses pro rata for revenue contribution. 2. Estimated spend from

2018-2023. Behavioral Health market is valued at ~$300bn 71% of total healthcare costs spent on complex patients Pharmacy spend is projected to reach $550bn by 2023 47% projected growth in specialty pharmacy spend(2) US Healthcare

spending is estimated to be $4tn in 2020Focus has shifted to sickest 5% who represent 50% of the spendMagellan's offerings focus on the portion of this spend that is addressable and attributed toward complex, high cost care. Behavioral

Health, Specialty Health and Pharmacy are among the highest cost addressable areas. Magellan Overview Heightened behavioral health needs driven by the pandemic Magellan Overview (1) Specialty spend approaching 50% of total drug

costs 7

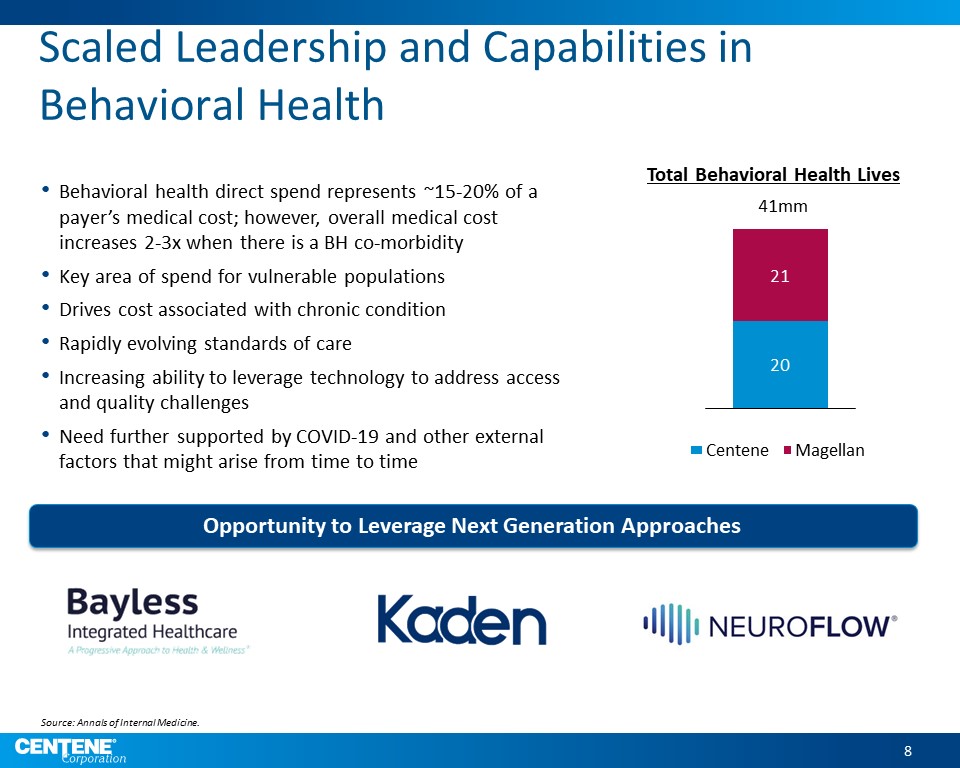

Source: Annals of Internal Medicine. Scaled Leadership and Capabilities in Behavioral

Health Opportunity to Leverage Next Generation Approaches Behavioral health direct spend represents ~15-20% of a payer’s medical cost; however, overall medical cost increases 2-3x when there is a BH co-morbidityKey area of spend for

vulnerable populationsDrives cost associated with chronic conditionRapidly evolving standards of careIncreasing ability to leverage technology to address access and quality challengesNeed further supported by COVID-19 and other external

factors that might arise from time to time Total Behavioral Health Lives Centene Magellan 8

Transaction Represents a Compelling Opportunity for All Magellan Stakeholders 9

Centene's Health Care Enterprises Core Operating Principles Innovative technology and service model

companies Leverage scaled Centene membership and healthcare experience Focus on external market to maximize scalabilityIncentive to attract best-in-class talent and technologies Strictly independent governance and decision makingIT / Data

and analytics firewall 10

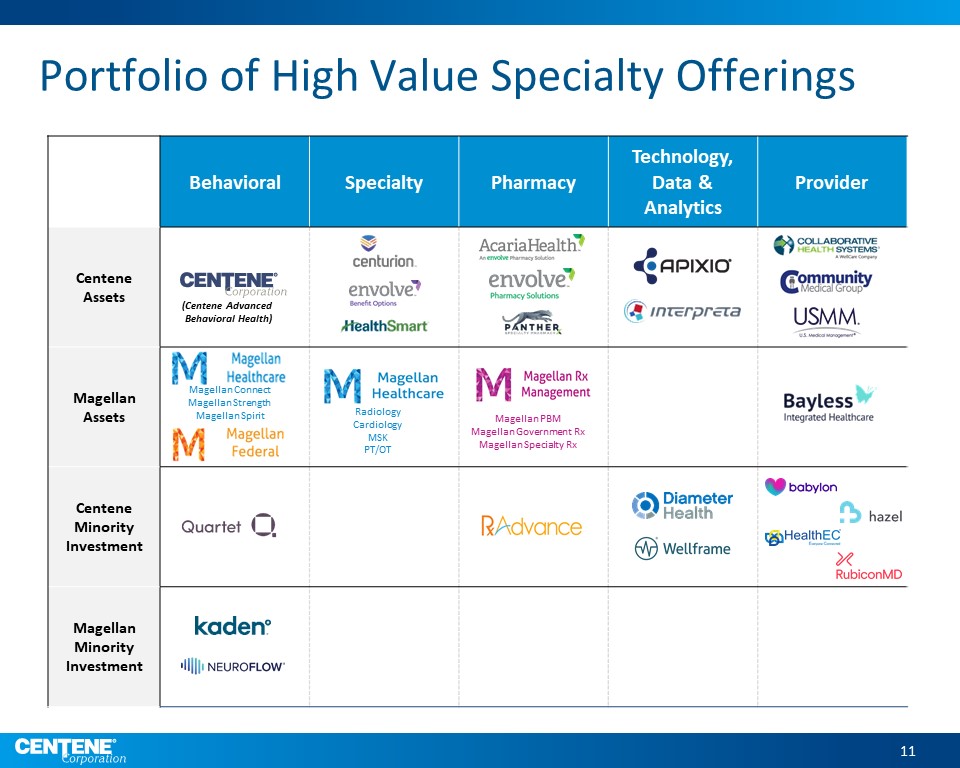

Behavioral Specialty Pharmacy Technology, Data & Analytics Provider Centene

Assets Magellan Assets Centene Minority Investment Magellan Minority Investment Magellan ConnectMagellan StrengthMagellan Spirit Magellan PBMMagellan Government RxMagellan Specialty

Rx RadiologyCardiologyMSKPT/OT Portfolio of High Value Specialty Offerings (Centene Advanced Behavioral Health) 11

Transaction Overview Purchase Price Financing $95 in cash per Magellan shareTotal transaction

enterprise value of $2.2bn Financial Impact Closing Slightly accretive to adjusted EPS in the first full yearLow to mid-single digit percent adjusted EPS accretion projected by the second full year$50mm in annual net cost synergies

projected by the second full year, incremental to the cost reduction plan of $75mm already initiated by Magellan Funded with new debt and cash on handClosing debt-to-capital ratio expected to be in the low 40% rangeExpect to achieve targeted

debt-to-capital ratio of upper 30% range within 12 to 18 months post close Expected to close in the second half of 2021Subject to Magellan shareholder approval and customary regulatory approvals 12

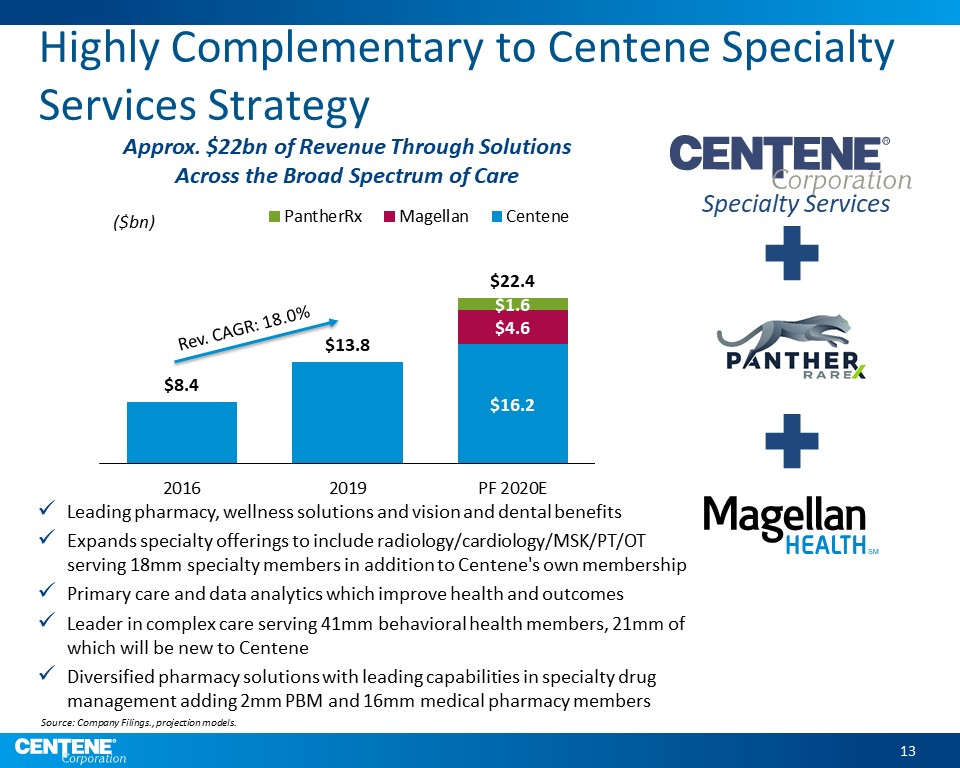

Source: Company Filings., projection models. Highly Complementary to Centene Specialty Services

Strategy ($bn) Rev. CAGR: 18.0% Approx. $22bn of Revenue Through Solutions Across the Broad Spectrum of Care Leading pharmacy, wellness solutions and vision and dental benefitsExpands specialty offerings to include

radiology/cardiology/MSK/PT/OT serving 18mm specialty members in addition to Centene's own membershipPrimary care and data analytics which improve health and outcomesLeader in complex care serving 41mm behavioral health members, 21mm of which

will be new to CenteneDiversified pharmacy solutions with leading capabilities in specialty drug management adding 2mm PBM and 16mm medical pharmacy members Specialty Services 13

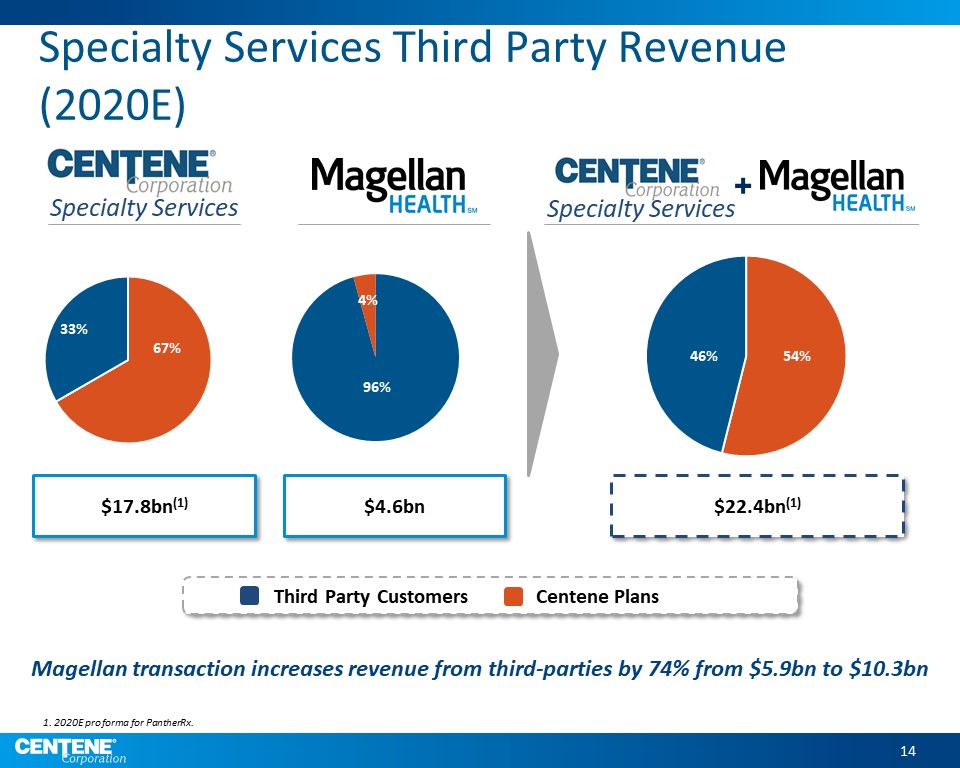

Specialty Services $17.8bn(1) $4.6bn Specialty Services Third Party Revenue

(2020E) Third Party Customers $22.4bn(1) + Centene Plans Magellan transaction increases revenue from third-parties by 74% from $5.9bn to $10.3bn 1. 2020E pro forma for PantherRx. Specialty Services Specialty Services 14

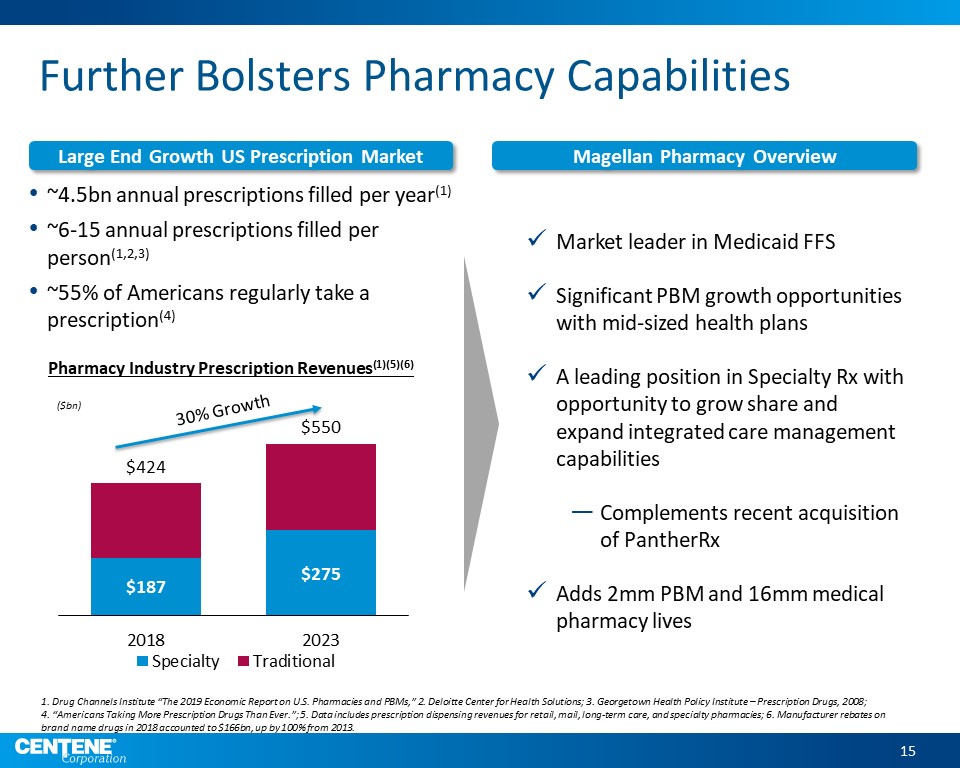

Further Bolsters Pharmacy Capabilities Large End Growth US Prescription Market ~4.5bn annual

prescriptions filled per year(1)~6-15 annual prescriptions filled per person(1,2,3)~55% of Americans regularly take a prescription(4) Market leader in Medicaid FFSSignificant PBM growth opportunities with mid-sized health plansA leading

position in Specialty Rx with opportunity to grow share and expand integrated care management capabilitiesComplements recent acquisition of PantherRxAdds 2mm PBM and 16mm medical pharmacy lives 30% Growth ($bn) Pharmacy Industry

Prescription Revenues(1)(5)(6) Magellan Pharmacy Overview 1. Drug Channels Institute “The 2019 Economic Report on U.S. Pharmacies and PBMs,” 2. Deloitte Center for Health Solutions; 3. Georgetown Health Policy Institute – Prescription

Drugs, 2008; 4. “Americans Taking More Prescription Drugs Than Ever.”; 5. Data includes prescription dispensing revenues for retail, mail, long-term care, and specialty pharmacies; 6. Manufacturer rebates on brand name drugs in 2018 accounted

to $166bn, up by 100% from 2013. 15

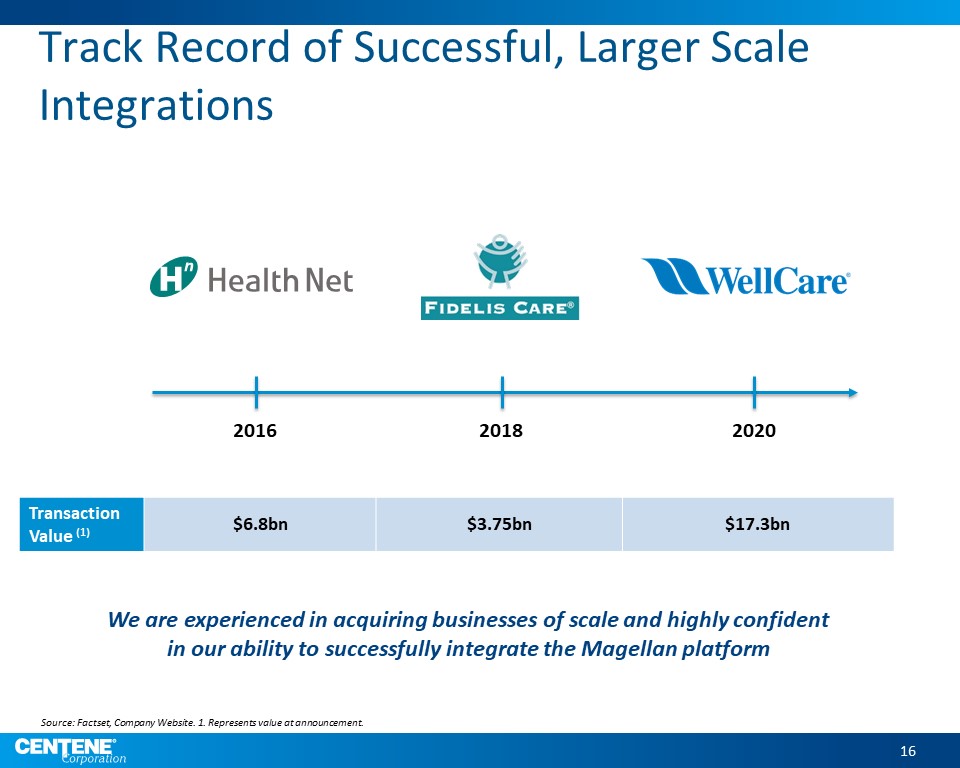

Source: Factset, Company Website. 1. Represents value at announcement. Track Record of Successful,

Larger Scale Integrations 2016 2018 2020 Transaction Value (1) $6.8bn $3.75bn $17.3bn We are experienced in acquiring businesses of scale and highly confident in our ability to successfully integrate the Magellan platform 16

Path to Long-Term Value Creation Expected to generate $50mm of annual net synergies by second full

year Near-term synergies including medical costs efficiencies by leveraging Magellan capabilities across existing Centene portfolio, PBM consolidation, and G&A efficienciesLonger term opportunities including expansion of behavioral

health platform and cross-sell of Magellan and Centene capabilities with third-party customersWe believe in Magellan's long-term growth potential and plan to continue to invest and deploy capital into the platform Successfully integrated

Health Net and Fidelis, achieving targeted synergies 17

Combination Strengthens Our Platform Value creation and earnings accretion Deepens Centene's whole

health capabilities Increases internal and external specialty benefit and pharmacy management capabilities Creates leader in behavioral health with significant scale and expertise Continued diversification of Centene's businesses

with establishment of growing independent services platform Reinforces Centene's leadership position in government sponsored programs 18