UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a-12

|

|

Cantel Medical Corp.

|

||

|

(Name of Registrant as Specified In Its Charter)

|

||

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

||

|

Payment of Filing Fee (Check the appropriate box):

|

||

|

☒

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

Cantel Medical Corp.

150 Clove Road

Little Falls, NJ 07424

150 Clove Road

Little Falls, NJ 07424

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On December 18, 2019

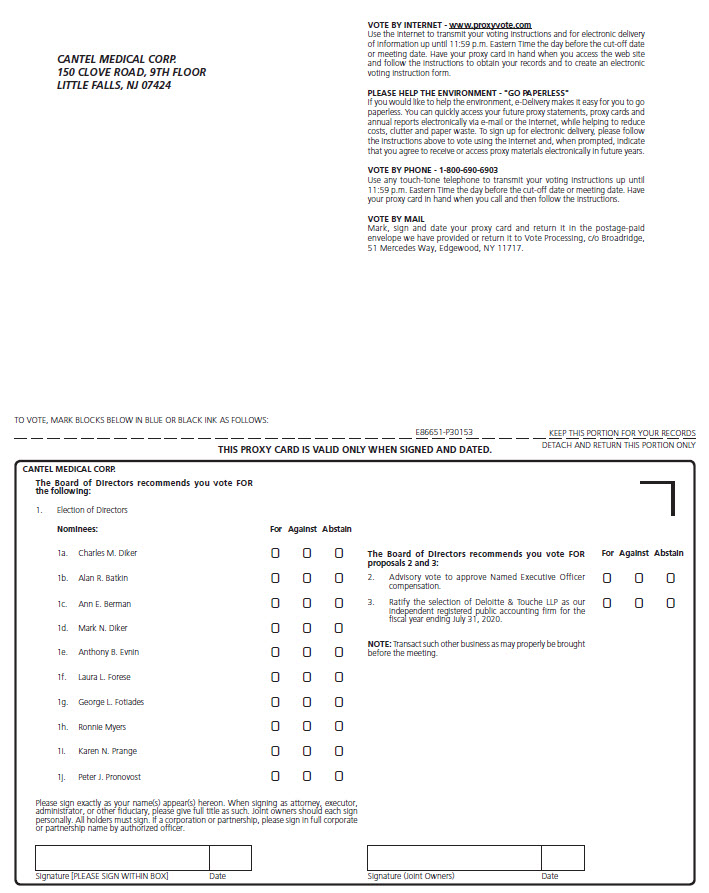

The Annual Meeting of Stockholders of Cantel Medical Corp. will be held on Wednesday, December 18, 2019 at 9:30 a.m., Eastern Standard Time, at Loews Regency New York Hotel, 540

Park Avenue, New York, New York. We are holding the Annual Meeting to:

| 1. |

Elect as directors the ten (10) nominees named in the attached Proxy Statement (Proposal 1);

|

| 2. |

Conduct an advisory vote on the compensation of the Company’s Named Executive Officers (Proposal 2);

|

| 3. |

Ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending July 31, 2020 (Proposal 3); and

|

| 4. |

Transact such other business as may properly be brought before the meeting.

|

The record date for the Annual Meeting is November 5, 2019. Only our stockholders of record at the close of business on that date may vote at the meeting, or any adjournment of the meeting. A copy of our Annual Report to

Stockholders for the fiscal year ended July 31, 2019 is being mailed with this Proxy Statement.

You are invited to attend the Annual Meeting. Your vote is very important. Whether or not you plan to attend the meeting, we hope that you will read the proxy statement and vote your proxy by

telephone, via the Internet or by requesting a printed copy of the proxy materials and completing, signing, and returning the proxy card enclosed therein in order that your vote can be recorded.

|

By the order of the Board of Directors

|

|

|

|

|

Jeff Z. Mann

|

|

|

Corporate Secretary

|

Little Falls, New Jersey

November 15, 2019

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

to Be Held on December 18, 2019.

to Be Held on December 18, 2019.

This Proxy Statement and the Company’s Annual Report are all available free of charge at www.proxyvote.com.

Cantel Medical Corp.

150 Clove Road

Little Falls, NJ 07424

Little Falls, NJ 07424

PROXY STATEMENT

Information about the Annual Meeting

Cantel Medical Corp. (we, us, our, Cantel or the Company) is providing these proxy materials in connection with the solicitation by our Board of Directors (the Board) of proxies to be voted at our 2019 Annual Meeting of Stockholders to be held on

Wednesday, December 18, 2019 beginning at 9:30 a.m. Eastern Standard Time at Loews Regency New York Hotel, 540 Park Avenue, New York, New York and at any adjournments thereof. This Proxy Statement is being sent to stockholders on or about

November 15, 2019. You should review this information together with our 2019 Annual Report to Stockholders, which accompanies this Proxy Statement.

Q: Why did you send me this Proxy Statement?

A: We sent you this Proxy Statement and the enclosed proxy card because the Board is soliciting your proxy to vote at our 2019 Annual Meeting of Stockholders (the meeting) to be held on Wednesday, December 18, 2019, or any adjournments of the

meeting. This Proxy Statement summarizes information that is intended to assist you in making an informed vote on the proposals described in this Proxy Statement.

Q: Who can vote at the meeting?

A: Only stockholders of record as of the close of business on November 5, 2019 are entitled to vote at the meeting. On that date, there were 42,576,825 shares of our common stock (each, a share) outstanding and entitled to vote.

Q: How many shares must be present to conduct the meeting?

A: We must have a “quorum” present in person or by proxy to hold the meeting. A quorum is a majority of the outstanding shares entitled to vote. Abstentions and broker non-votes (defined below) will be counted for the purpose of determining the

existence of a quorum.

Q: What matters are to be voted upon at the meeting?

A: Three proposals are scheduled for a vote:

| • |

Election as directors of the ten nominees named in this Proxy Statement, to serve until the first Annual Meeting of Stockholders following the fiscal year ending July 31, 2020 (fiscal year 2020);

|

| • |

Approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers (as defined below); and

|

| • |

Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2020.

|

As of the date of this Proxy Statement, these three proposals are the only matters that our Board intends to present at the meeting. Our Board does not know of any other business to be presented at the meeting. If other business is properly

brought before the meeting, the persons named on the enclosed proxy card will vote on these other matters in their discretion.

Q: How does the Board recommend that I vote?

A: The Board recommends that you vote:

| • |

FOR the election of each of the nominees for director named in this Proxy Statement;

|

| • |

FOR the proposal to approve (on an advisory basis) the compensation of the Company’s Named Executive Officers; and

|

| • |

FOR the proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2020.

|

1

Q: How do I vote before the meeting?

A: You may vote your shares by mail by filling in, signing and returning the enclosed proxy card. For your convenience, you may also vote your shares by telephone and Internet by following the instructions on the enclosed proxy card. If you vote by telephone or via the Internet, you do not need to return your proxy card.

With respect to the election of directors, you may vote “FOR” or “AGAINST” or abstain from voting with respect to each nominee. Similarly, for the approval of all other matters, you may vote “FOR” or “AGAINST” or abstain from voting.

Q: May I vote at the meeting?

A: Yes, you may vote your shares at the meeting if you attend in person. Even if you plan to attend the meeting in person, we recommend that you also submit your proxy or voting instructions as described above so that your vote will be counted if

you later decide not to attend the meeting in person. For information on how to obtain directions to the meeting, please contact us at (973) 890-7220.

Q: How do I vote if my broker holds my shares in “street name”?

A: If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker. For directions on how to vote shares held beneficially in street name, please refer to the voting instruction card provided by your

broker.

Q: What should I do if I receive more than one set of proxy materials?

A: You may receive more than one set of these proxy materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may

receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign,

date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted.

Q: How many votes do I have?

A: Each share that you own as of the close of business on November 5, 2019 entitles you to one vote on each matter voted upon at the meeting. As of the close of business on November 5, 2019, there were 42,576,825 shares

outstanding.

Q: May I change my vote?

A: Yes, you may change your vote or revoke your proxy at any time before the vote at the meeting. You may change your vote prior to the meeting by executing a valid proxy bearing a later date and delivering it to us prior to the meeting at Cantel

Medical Corp., 150 Clove Road, Little Falls, New Jersey 07424, Attn: Secretary. You may withdraw your vote at the meeting and vote in person by giving written notice to our Secretary. You may also revoke your vote without voting by sending written

notice of revocation to our Secretary at the above address.

Q: How are my shares voted if I submit a proxy but do not specify how I want to vote?

A: If you submit a properly executed proxy card, the persons named in the proxy card (or, if applicable, their substitutes) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to

vote your shares, your shares will be voted as the Board recommends, which is:

| • |

FOR the election of each of the nominees for director named in this Proxy Statement;

|

| • |

FOR the proposal to approve (on an advisory basis) the compensation of the Company’s Named Executive Officers; and

|

| • |

FOR the proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2020.

|

2

Q: What is a broker non-vote?

A: If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does

not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker can register your shares as being present at the meeting for purposes of determining the presence of a quorum but will not be able to vote on

those matters for which specific authorization is required under the rules of the New York Stock Exchange (NYSE). If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NYSE

rules to vote your shares on the proposal to ratify the selection of Deloitte & Touche LLP even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of

directors or the advisory vote on executive compensation without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

Your vote is important and we strongly encourage you to vote your shares by following the instructions provided on the voting instruction card. Please return your proxy card to your broker, bank or other nominee and contact the person responsible

for your account to ensure that a proxy card is voted on your behalf.

Q: What vote is required to elect directors?

A: Under our By-laws and our Corporate Governance Guidelines, nominees for director must be elected by a majority of the votes cast in uncontested elections, such as the election of directors at the meeting. This means that the number of votes

cast “FOR” a director nominee must exceed the number of votes cast “AGAINST” that nominee. Abstentions and broker non-votes are not counted as votes “FOR” or “AGAINST” a director nominee and therefore have no impact on the outcome of director

elections. Any nominee who does not receive a majority of votes cast “FOR” his or her election would be required to tender his or her resignation promptly following the failure to receive the required vote. Our Board’s Nominating and Governance

Committee (Nominating Committee) would then be required to make a recommendation to the Board as to whether the Board should accept the resignation, and the Board would be required to decide whether to accept the resignation and to publicly disclose

its decision. In a contested election, the required vote would be a plurality of votes cast.

Q: What happens in an uncontested election if an incumbent director does not receive enough votes to be elected?

A: Pursuant to our Corporate Governance Guidelines, each director who fails to receive the required number of votes cast for his or her re-election is required to tender his or her resignation to the Board. Such resignation is subject to

acceptance by the Board. In order to ensure that the Company always has a fully functioning Board, if an incumbent director fails to receive the required number of votes cast, he or she continues as a director. The Nominating Committee will act on an

expedited basis to determine whether to accept or reject the director’s resignation and will submit such recommendation to the Board for prompt consideration. The Nominating Committee and the Board may consider any factors they deem relevant in

deciding whether to accept a director’s resignation. The Board will make its decision public as soon as practicable following the meeting.

Q: What vote is required to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers?

A: This matter is being submitted to enable stockholders to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers. Since it is an advisory vote, the provisions of our By-laws regarding the vote required to

“approve” a proposal are not applicable to this matter. In order to be approved on an advisory basis, this proposal must receive the “FOR” vote of a majority of the votes cast by stockholders present in person or by proxy and entitled to vote on the

matter. Abstentions will not be counted as votes cast and, therefore, have no effect on the proposal. Broker non-votes will have no effect on this proposal as brokers are not entitled to vote on such proposal in the absence of voting instructions

from the beneficial owner.

Q: What vote is required to ratify the selection of Deloitte & Touche LLP as Cantel’s independent registered public accounting firm for fiscal year 2020?

A: For approval of this proposal, the proposal must receive the “FOR” vote of a majority of the votes cast by stockholders present in person or by proxy and entitled to vote on the matter. Because this proposal is considered a discretionary item

for which a broker will have discretionary voting power if you do not give instructions with respect to this proposal, there will be no broker non-votes with respect to this proposal. Abstentions will not be counted as votes cast and, therefore, have

no effect on the proposal.

3

Q: Who will count the votes?

A: Votes will be counted by an independent inspector of election appointed by the Company.

Q: Who pays for the solicitation of proxies?

A: We will pay for the entire cost of soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. In addition, our directors and employees may solicit proxies

in person, by telephone, via the Internet, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies.

Q: How can I find out the results of the voting at the meeting?

A: We will announce preliminary results at the meeting. We will report final results in a filing with the U.S. Securities and Exchange Commission (SEC) on a Current Report on Form 8-K within four business days after the meeting.

Q: What is “householding” and how does it work?

A: The SEC’s “householding” rules permit us to deliver only one set of proxy materials to stockholders who share an address unless otherwise requested. This procedure reduces printing and mailing costs. If

you share an address with another stockholder and have received only one set of proxy materials, you may request a separate copy of these materials at no cost to you by writing to Cantel Medical Corp., 150 Clove Road, Little Falls, New Jersey 07424,

Attn: Secretary, or by calling us at (973) 890-7220. Alternatively, if you are currently receiving multiple copies of the proxy materials at the same address and wish to receive a single copy in the future, you may contact us by calling or writing to

us at the telephone number or address given above.

If you are a beneficial owner (i.e., your shares are held in the name of a bank, broker or other holder of record), the bank, broker or other holder of record may deliver only one copy of the notices of

stockholder meetings and related proxy statements to stockholders who have the same address unless the bank, broker or other holder of record has received contrary instructions from one or more of the stockholders. If you wish to receive a separate

copy of the notices of stockholder meetings and proxy statements, now or in the future, you may contact us at the address or telephone number above and we will promptly deliver a separate copy. Beneficial owners sharing an address, who are currently

receiving multiple copies of the notice of stockholders meetings and proxy statements and wish to receive a single copy in the future, should contact their bank, broker or other holder of record to request that only a single copy be delivered to all

stockholders at the shared address in the future.

4

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

Director and Officer Owners

The table below shows the number of shares of our common stock beneficially owned as of the close of business on November 5, 2019 by each of our current directors and nominees for director, and each Named Executive Officer listed in the 2019

Summary Compensation Table below, as well as the number of shares beneficially owned by all of our directors and current executive officers as a group. For Named Executive Officers who are no longer with the Company, the number of shares listed is

current as of their last reporting event. The table and footnotes also include information about stock options held by directors and executive officers under the Company’s 2006 Equity Incentive Plan (2006 Equity Plan) and 2016 Equity Incentive Plan

(2016 Equity Plan).

|

Beneficial Owners

|

Number

of

Shares(1)

|

Options Currently

Exercisable or

Exercisable

Within 60 Days

|

Total Beneficial Ownership(2)

|

Percent of Class

|

|

Alan R. Batkin

|

54,937

|

—

|

54,937

|

*

|

|

Ann E. Berman

|

7,011

|

—

|

7,011

|

*

|

|

Shaun M. Blakeman

|

—

|

—

|

—

|

*

|

|

Peter G. Clifford

|

11,625

|

—

|

11,625

|

*

|

|

Charles M. Diker(3)

|

3,862,901

|

15,000

|

3,877,901

|

9.1%

|

|

Mark N. Diker(4)

|

473,064

|

—

|

473,064

|

1.1%

|

|

Dottie Donnelly

|

6,090

|

—

|

6,090

|

*

|

|

Anthony B. Evnin

|

6,984

|

—

|

6,984

|

*

|

|

Laura L. Forese

|

4,922

|

—

|

4,922

|

*

|

|

George L. Fotiades

|

93,205

|

—

|

93,205

|

*

|

|

Jorgen B. Hansen

|

59,339

|

—

|

59,339

|

*

|

|

Ronnie Myers

|

1,242

|

—

|

1,242

|

*

|

|

Eric W. Nodiff

|

34,618

|

—

|

34,618

|

*

|

|

Karen N. Prange

|

—

|

—

|

—

|

*

|

|

Peter J. Pronovost

|

20,322

|

—

|

20,322

|

*

|

|

Seth M. Yellin

|

20,540

|

—

|

20,540

|

*

|

|

All Directors, Nominees for Director, and Executive Officers as a group (20 persons)(5)

|

4,612,507

|

15,000

|

4,627,507

|

10.9%

|

_____________________________________

| * |

Represents beneficial ownership of less than one percent (1.0%).

|

| (1) |

Includes unvested restricted stock awards (RSAs) for which the named person has voting rights. Excludes unvested restricted stock units (RSUs) for which the named person does not have voting or disposition rights within 60 days from

November 5, 2019.

|

| (2) |

Unless otherwise noted, we believe that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them. A person is deemed to be the beneficial owner of

securities that can be acquired by such person within 60 days from November 5, 2019 upon the exercise of options. Each beneficial owner’s percentage ownership is determined by assuming that options that are held by such person (but not

those held by any other person) and that are exercisable within 60 days from November 5, 2019 have been exercised.

|

| (3) |

Includes an aggregate of 1,047,889 shares for which Mr. Diker may be deemed to be the beneficial owner comprised of (i) 450,188 shares owned by Mr. Diker’s wife, (ii) 88,134 shares held in accounts for Mr. Diker’s grandchildren over

which he exercises investment discretion (including 48,544 shares disclosed in the chart above as beneficially owned by Mark N. Diker), (iii) 29,430 shares held by the DicoGroup, Inc., a corporation of which Mr. Diker serves as Chairman

of the Board, (iv) 179,121 shares owned by a non-profit corporation of which Mr. Diker and his wife are the principal officers and directors and (vi) 103,524 shares held in certain other trading accounts over which Mr. Diker exercises

investment discretion.

|

| (4) |

Includes an aggregate of 48,544 shares owned by a trust for the benefit of his children for which Mr. Diker may be deemed to be the beneficial owner.

|

| (5) |

Includes those shares set forth in footnotes (3) and (4) above (but without double counting the 48,544 shares beneficially owned by both Charles M. Diker and Mark N. Diker disclosed in footnotes (3) and (4) above).

|

5

Beneficial Owners

Based on filings made under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended (Exchange Act), as of November 5, 2019, the only persons known by us to be the beneficial owner of more than 5% of our common stock was as

follows:

|

Name

|

Address

|

Number of Shares

|

Percent of Class

|

|

BlackRock, Inc.

|

55 East 52nd Street

New York, NY 10055

|

3,611,910(1)

|

8.5%

|

|

Brown Capital Management, LLC

|

1201 N. Calvert Street

Baltimore, MD 21202 |

3,580,500(2)

|

8.4%

|

|

Charles M. Diker

|

150 Clove Road

Little Falls, NJ 07424

|

3,877,901(3)

|

9.1%

|

|

The Vanguard Group

|

100 Vanguard Blvd.

Malvern, PA 19355

|

3,217,163(4)

|

7.6%

|

________________________

| (1) |

This information is based solely on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on February 4, 2019.

|

| (2) |

This information is based solely on a Schedule 13G/A filed by Brown Capital Management, LLC with the SEC on November 8, 2019.

|

| (3) |

See Footnote 3 under table of Director and Officer Owners above.

|

| (4) |

This information is based solely on a Schedule 13G/A filed by The Vanguard Group with the SEC on February 11, 2019.

|

Delinquent Section 16(a) Reports

Federal securities laws require our executive officers and directors and persons owning more than 10% of our common stock to file certain reports on ownership and changes in

ownership with the SEC. Based on a review of our records and other information, we believe that during the fiscal year ended July 31, 2019 (fiscal year 2019), our executive officers and directors and all persons holding more than 10% of our common stock timely filed all such Section 16(a) reports except as described herein. On July 31, 2018, Anthony Evnin was granted 712 shares for which a Form 4 was required to be filed within two business days of the grant. The Form 4 was

filed on August 10, 2018. On October 4, 2018, Charles Diker exercised 30,000 options from which a total of 19,210 shares were withheld for taxes and for which a Form 4 was required to be filed within two business days of the exercise and

withholdings. The Form 4 was filed on October 9, 2018. On December 3, 2018 and December 28, 2018, two of the trusts for which Charles Diker may be deemed to be the beneficial owner transferred an aggregate of 108,271 shares to the beneficiaries of

those trusts for which a Form 4 was required to be filed within two business days of the transfers. The Form 4 was filed on January 10, 2019. On January 3, 2019, Dottie Donnelly had 434 shares withheld by the Company to fulfill income tax obligations

on the vesting of a grant for which a Form 4 was required to be filed within two business days of the withholding. The Form 4 was filed on February 20, 2019. On January 15, 2019, Ronnie Myers sold 1,006 shares in an open market transaction and was

required to file a Form 4 to report such disposition within two business days of the sale. The Form 4 was filed on January 18, 2019. On April 17, 2019, Brian Capone had 172 shares withheld by the Company to fulfill income tax obligations on the

vesting of a grant for which a Form 4 was required to be filed within two business days of the withholding. The Form 4 was filed on April 24, 2019. On March 13, 2019, Jean Casner became a reporting person and a Form 3 was required to be filed by

March 23, 2019. The Form 3 was filed on March 28, 2019.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Our entire Board is elected each year at the Annual Meeting of Stockholders. The Board is currently comprised of ten members. All of the nominees listed below are incumbent directors. All of the nominees listed below were elected at the 2018

Annual Meeting of Stockholders, except Ms. Prange who was appointed to the Board in October 2019. The nomination of each nominee to serve for a one-year term was recommended by our Nominating Committee and approved by the Board. The ten nominees

include seven independent directors as defined in the NYSE rules and regulations.

A majority of the votes cast is required for the election of directors in an uncontested election (which is the case for the election of directors at the meeting). A majority of the votes cast means that the number of votes cast “FOR” a director

nominee must exceed the number of votes cast “AGAINST” that nominee. Our Corporate Governance Guidelines contain detailed procedures to be followed in the event that one or more directors do not receive a majority of the votes cast. Each nominee

elected as a director will continue in office until his or her successor has been elected or appointed and qualified, or until his or her earlier death, resignation or retirement. Each

person nominated has agreed to serve if elected.

The persons named as proxies intend to vote the proxies “FOR” the election of each of the nominees unless you indicate on the proxy card that your vote should be against or abstain from voting with respect

to any of the nominees. If for some reason any director nominee is unable to serve, the persons named as proxies may vote for a

substitute nominee recommended by the Board, and unless you indicate otherwise on the proxy card, the proxies will be voted in favor of the remaining nominees.

Director Nominees at a Glance

|

Name

|

Age

|

Director Since

|

Primary Occupation

|

|

Alan R. Batkin

|

75

|

2004

|

Former Vice Chairman of Eton Park Capital Management, L.P. and Kissinger Associates, Inc.; Director of Omnicon Group Inc., Pattern Energy Group, Inc., and Mack-Cali Realty Corporation

|

|

Ann E. Berman

|

67

|

2011

|

Certified Public Accountant and Former Senior Advisor to the President of Harvard University; Director of Loews Corporation and Eaton Vance Corporation

|

|

Charles M. Diker

|

84

|

1985

|

Chairman of the Board of Cantel Medical Corp. and Member of the Office of the Chairman; Director of Loews Corporation

|

|

Mark N. Diker

|

53

|

2007

|

Chief Executive Officer and Co-Founder of Diker Management LLC

|

|

Anthony B. Evnin

|

78

|

2017

|

Partner of VR Management, LLC; Director of AVEO Pharmaceuticals, Inc., Constellation Pharmaceuticals, Inc. and Infinity Pharmaceuticals, Inc.

|

|

Laura L. Forese

|

58

|

2015

|

Executive Vice President and Chief Operating Officer of NewYork Presbyterian; Chairwoman of the Board of Directors of NIH Clinical Center

|

|

George L. Fotiades

|

66

|

2008

|

President and Chief Executive Officer of Cantel Medical Corp.

|

|

Ronnie Myers

|

67

|

2016

|

Dean of Touro College of Dental Medicine at New York Medical College

|

|

Karen N. Prange

|

55

|

2019

|

Former Executive Vice President and Chief Executive Officer of Global Animal Health, Medical and Dental Surgical Group at Henry Schein Inc.; Strategic Advisory Board of Nuvo Group

|

|

Peter J. Pronovost

|

54

|

2017

|

Chief Clinical Transformation Officer of University Hospitals

|

7

Diversity of Experience

|

90%

|

|

50%

|

|

||

|

Industry

|

Global Operations and Manufacturing

|

||||

|

30%

|

|

70%

|

|

||

|

Medical/Dental Professional

|

Investor

|

||||

|

80%

|

|

80%

|

|

||

|

Finance and Accounting

|

Risk Management

|

||||

|

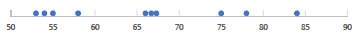

Diversity of Age

|

Diversity of Tenure

|

|

80% of directors less than 15 years

50% of directors less than 6 years

|

|

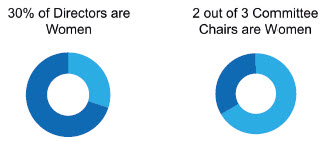

Diversity

|

Independence

|

|

70% of directors are independent

100% of committee members are independent

|

|

|

8

The following persons have been nominated as directors:

|

ALAN R. BATKIN

|

|

|

|

Former Vice Chairman of Eton Park Capital Management, L.P. and Kissinger Associates, Inc.

|

|||

|

Director since: 2004; Independent

|

Other Public Company Boards:

|

||

|

Age: 75

|

Director of Omnicon Group, Inc.,

|

||

|

Lead Independent Director

|

Pattern Energy Group, Inc. and

|

||

|

Mack-Cali Realty Corporation

|

|||

Executive Highlights:

Prior to his retirement in 2018, Mr. Batkin served as Chairman and Chief Executive Officer of Converse Associates, Inc., a strategic advisory firm, since January 2013, and continues to serve as a consultant for the firm. From February 2007 until

December 2012, Mr. Batkin served as Vice Chairman of Eton Park Capital Management, L.P., an investment firm. For more than five years prior thereto, Mr. Batkin served as Vice Chairman of Kissinger Associates, Inc., a geopolitical consulting firm that

advises multi-national companies. He is also a director of Omnicom Group, Inc. (NYSE), a global marketing and corporate communications company, director of Pattern Energy Group, Inc. (Nasdaq), an independent power company, and director of Mack-Cali

Realty Corporation (NYSE), a real estate investment trust. We believe that Mr. Batkin’s specific banking, international business, consulting and directorial experience described above qualify him for service on the Board.

|

ANN E. BERMAN

|

|

|

|

Certified Public Accountant and Former Senior Advisor to the President of Harvard University

|

|||

|

Director since: 2011; Independent

|

Other Public Company Boards:

|

||

|

Age: 67

|

Director of Loews Corporation and

|

||

|

Eaton Vance Corporation

|

|||

Executive Highlights:

From October 1994 through June 2009, Ms. Berman served in various financial and risk management capacities at Harvard University, most recently (commencing April 2006) as senior advisor to the president of Harvard University and prior thereto as

Vice President of Finance and Chief Financial Officer. Ms. Berman is a Certified Public Accountant, and is also a director of Loews Corporation (NYSE), a holding company whose subsidiaries include: a commercial property-casualty insurer; an offshore

drilling company; a natural gas transportation and storage company; a luxury lodging company; and a packaging solutions company; and director and Audit Committee Chair for Eaton Vance Corporation, an investment manager. In addition, Ms. Berman serves

on the Board of Trustees of Beth Israel Deaconess Medical Center and is chairwoman of its Compliance and Risk Committee. We believe that Ms. Berman’s accounting and financial management expertise, service as an audit committee member and chair of

other public companies, and depth of experience in risk management qualify her for service on the Board.

9

|

CHARLES M. DIKER

|

|

|

|

Chairman of the Board of Cantel Medical Corp. and Member of the Office of the Chairman

|

|||

|

Director since: 1985

|

Other Public Company Boards:

|

||

|

Age: 84

|

Director of Loews Corporation

|

||

Executive Highlights:

Chairman of the Board since 1986 and a member of the Office of the Chairman since April 2008. Mr. Diker was responsible for the Company’s transitioning into infection prevention. He has also served as Chairman and co-founder of Diker Management

LLC, a registered investment adviser investing in innovative small cap growth companies across technology, consumer, industrial and healthcare industries. He is also a director of Loews Corporation (NYSE), a holding company whose subsidiaries

include: a commercial property-casualty insurer; an offshore drilling company; a natural gas transportation and storage company; a luxury lodging company; and a packaging solutions company. Previously, Mr. Diker was a director of six NYSE-listed

companies and two additional companies on the Nasdaq. We believe that Mr. Diker’s thirty-four years of service as Chairman and a director of Cantel, knowledge of the Company’s business and his strong strategic vision for the Company qualify him to

serve on the Board.

|

MARK N. DIKER

|

|

|

|

Chief Executive Officer and Co-Founder of Diker Management LLC

|

|||

|

Director since: 2007

|

|||

|

Age: 53

|

|||

Executive Highlights:

Chief Executive Officer and co-founder of Diker Management LLC, a registered investment adviser investing in innovative small cap growth companies across technology, consumer, industrial and healthcare industries. Mr. Diker was also a co-founding

partner of Arsenal Capital Partners, a middle-market private equity firm making control investments in healthcare and industrial companies. Prior, Mr. Diker was a general partner at Geocapital Partners, a venture capital firm where he focused on

investing in software, e-commerce, and business service growth stage companies, and held board positions of several private companies and one public company. Mr. Diker also worked for Bankers Trust Company in project finance and equity derivatives as

a Vice President, stationed in Japan. We believe that Mr. Diker’s experience in business strategy, capital markets, information technology, and investment-related matters qualifies him to serve on the Board.

10

|

ANTHONY B. EVNIN

|

|

|

|

Partner of VR Management, LLC

|

|||

|

Director since: 2017; Independent

|

Other Public Company Boards:

|

||

|

Age: 78

|

Director of AVEO Pharmaceuticals Inc.,

|

||

|

Constellation Pharmaceuticals Inc. and

|

|||

|

Infinity Pharmaceuticals Inc.

|

|||

Executive Highlights:

Partner, VR Management, LLC, a capital investment firm focused on technology and health care sectors. Previously, Partner at Venrock, a venture capital firm, from 1975 to 2007. Mr. Evnin currently serves on the Board of Directors of AVEO

Pharmaceuticals, Inc. (Nasdaq), Constellation Pharmaceuticals, Inc. (Nasdaq), and Infinity Pharmaceuticals, Inc. (Nasdaq) as well as on the Board of two private companies. He was formerly a Director of over 35 companies, both public and private, in

the life sciences area, including Juno Therapeutics, Inc. (Nasdaq). He is a Member of the Boards of Overseers and Managers of Memorial Sloan Kettering Cancer Center, a Trustee of The Jackson Laboratory, a Director of the New York Genome Center, a

Member of the Board of Directors of the Albert and Mary Lasker Foundation, a Trustee Emeritus of Princeton University, and a Trustee Emeritus of The Rockefeller University. He holds a Ph.D. in Chemistry from the Massachusetts Institute of

Technology. We believe that Mr. Evnin’s long time experience in the healthcare and life sciences area qualifies him to serve on the Board.

|

LAURA L. FORESE

|

|

|

|

Executive Vice President and Chief Operating Officer of NewYork-Presbyterian

|

|||

|

Director since: 2015; Independent

|

|||

|

Age: 58

|

|||

Executive Highlights:

Executive Vice President and Chief Operating Officer of NewYork-Presbyterian, a comprehensive academic health care delivery system in collaboration with two renowned medical schools, Weill Cornell Medicine and Columbia University College of

Physicians & Surgeons. NewYork-Presbyterian includes academic medical centers, regional hospitals, employed and affiliated physician practices and ambulatory and post-acute facilities. Dr. Forese is responsible for all enterprise operations, risk

management, and strategy and execution of acquisitions and partnerships. She is also chairwoman of the board of directors of NIH Clinical Center, the nation’s premier hospital devoted to clinical research. Dr. Forese was President of NYP Healthcare

System (now subsumed into NewYork-Presbyterian) from 2013 to 2015 and Group Senior Vice President and Chief Operating Officer of NYP/Weill Cornell from 2011 to 2015. We believe that Dr. Forese’s experience as a hospital executive, faculty member and

practicing physician in one of the largest health care enterprises in the United States, as well as her depth of experience in risk management, qualify her to serve on the Board.

11

|

GEORGE L. FOTIADES

|

|

|

|

President and Chief Executive Officer of Cantel Medical Corp.

|

|||

|

Director since: 2008

|

Other Public Company Boards:

|

||

|

Age: 66

|

Director of Prologis Inc. and Chairman

|

||

|

of the Board of AptarGroup Inc.

|

|||

Executive Highlights:

President and Chief Executive Officer of Cantel Medical Corp. Previously, Operating Partner at Five Arrows Capital Partners (Rothschild Merchant Banking) from April 2017 through February 2019. From April 2007 through April 2017, Mr. Fotiades was

Partner, Healthcare investments at Diamond Castle Holdings, LLC, a private equity firm. For more than five years prior thereto, he served as President and Chief Operating Officer of Cardinal Health, Inc., a leading provider of healthcare products and

services. Prior to that position, he served as President and Chief Executive Officer of Cardinal Health, Inc.’s Pharmaceutical Technologies and Services segment, as well as in a variety of executive roles, including president of Warner-Lambert’s

consumer healthcare business and senior positions at Bristol-Myers Squibb, Wyeth and Procter & Gamble. Mr. Fotiades is also a director of Prologis, Inc. (NYSE), a leading owner, operator and developer of industrial real estate, and Chairman of

the Board of AptarGroup Inc. (NYSE), a leader in the global dispensing systems industry. He has served as Vice Chairman of the Board of Cantel and a non-executive member of the Office of the Chairman since April 2008. We believe that Mr. Fotiades’

detailed knowledge of the Company’s business and operations, his current service as President and Chief Executive Officer of the Company, and his extensive experience in executive management of global operations, strategic planning, and sales and

marketing, particularly in the healthcare industry, qualify him to serve on the Board.

|

RONNIE MYERS

|

|

|

|

Dean of the Touro College of Dental Medicine at New York Medical College

|

|||

|

Director since: 2016; Independent

|

|||

|

Age: 67

|

|||

Executive Highlights:

Dean of the Touro College of Dental Medicine at New York Medical College since July 2017, previously having served as Senior Associate Dean for Academic and Administrative Affairs since June 2016. From January 2011 to June 2012 and then again from

August 2013 to May 2016, Dr. Myers served as Vice Dean for Administration of Columbia University College of Dental Medicine. He served as Interim Dean of Columbia University College of Dental Medicine from July 2012 to July 2013 and Associate Dean

for Clinical Affairs from 1997 to 2010. Dr. Myers maintained a private practice in general dentistry for 36 years and currently delivers lectures on the topic of infection prevention in the field of dentistry. We believe that Dr. Myers’ experience in

dentistry and infection prevention, coupled with his practical experience, qualify him to serve on the Board.

12

|

KAREN N. PRANGE

|

|

|

|

Former Executive Vice President and Chief Executive Officer of Global Animal Health, Medical and Dental Surgical Group at Henry Schein Inc.; Strategic Advisory Board of Nuvo Group

|

|||

|

Director since: 2019; Independent

|

|||

|

Age: 55

|

|||

Executive Highlights:

Most recently Executive Vice President and Chief Executive Officer of Global Animal Health, Medical and Dental Surgical Group at Henry Schein Inc. Prior to that, she has held senior executive positions with leading medical device companies,

including Boston Scientific Corporation, as Senior Vice President and President of the Urology and Pelvic Health business unit from 2012 to 2016 and Johnson & Johnson, where she spent 17 years in several cardiovascular, neurovascular and

neuroscience medical device businesses. She also serves on the strategic advisory board of Nuvo Group, an emerging leader in maternal-fetal connected health. We believe that Ms. Prange’s extensive experience in executive management, market

development, portfolio strategy and global product commercialization, particularly in the healthcare industry, qualifies her to serve on the Board.

|

PETER J. PRONOVOST

|

|

|

|

Chief Clinical Transformation Officer of University Hospitals

|

|||

|

Director since: 2017; Independent

|

|||

|

Age: 54

|

|||

Executive Highlights:

Chief Clinical Transformation Officer, University Hospitals since October 2018. Prior to that, beginning in January 2018, Dr. Pronovost served UnitedHealth Group Incorporated as its Senior Vice President for Clinical Strategy and then as its Chief

Medical Officer. Previously, Dr. Pronovost was professor of anesthesiology and critical care medicine, surgery, nursing, health policy and management, engineering, and business at the Johns Hopkins University School of Medicine, where he had served

since July 2011. He is a practicing critical care physician who is dedicated to finding ways to make hospitals and healthcare safer for patients. In June 2011, he was named director of the new Armstrong Institute for Patient Safety and Quality at

Johns Hopkins, as well as Johns Hopkins Medicine’s senior vice president for patient safety and quality. Dr. Pronovost is also a member of the Institute of Medicine-National Academy of Science. In 2008 he was named one of Time magazine’s 100 most

influential people in the world for his work in improving healthcare safety. He is a lecturer and author in the fields of patient safety and healthcare management. Additionally, Dr. Pronovost is a researcher centered on improving the quality of

care. Previously, from January 2010 to June 2015, Dr. Pronovost served as a director of the Company. We believe that Dr. Pronovost’s position as a world renowned leader of patient safety and quality qualifies him to serve on the Board.

The Board recommends that you vote “FOR” the election of each of the ten nominees.

13

CORPORATE GOVERNANCE

We seek to follow best practices in corporate governance in a manner that is in the best interests of our business and our stockholders. We are in compliance with the corporate governance requirements imposed by the Sarbanes-Oxley Act, the SEC and

the NYSE and will continue to review our policies and practices to meet ongoing developments in this area.

|

||

|

WHAT WE DO

|

||

|

Annual Director Election

Majority Election

Substantial Majority of Independent Directors

|

Independent Lead Director

Annual Say-on-Pay Vote

Regular Executive Sessions

|

|

|

||

|

WHAT WE DON’T DO

|

||

|

No Supermajority Voting Provisions

|

No Poison Pill

|

|

Code of Business Conduct and Ethics; Executive Compensation Clawback Policy

All of our directors, executive officers and employees are required to comply with our Code of Business Conduct and Ethics. You can access our Code of Business Conduct and Ethics by clicking on the “Corporate Governance” link in the “Investor

Relations” section of our website at www.cantelmedical.com. The Code of Business Conduct and Ethics is also available without charge in print to any requesting stockholder. We post amendments to,

and waivers of, our Code of Business Conduct and Ethics, as applicable, on our website.

We have an Executive Compensation Clawback Policy under which a designated officer of the Company, if found to have engaged in misconduct causing a restatement of our financial statements, could have a portion of his or her compensation recovered

by the Company to the extent of the benefit received by such officer based on the financial statements that were restated. You can access our Executive Compensation Clawback Policy by clicking on the “Corporate Governance” link in the “Investor

Relations” section of our website at www.cantelmedical.com.

Corporate Governance Guidelines

Our Corporate Governance Guidelines reflect the principles by which we operate. From time to time, the Nominating Committee and the Board review and revise our Corporate Governance Guidelines in response to regulatory requirements and evolving best practices. You can access our Corporate Governance Guidelines by clicking on the “Corporate Governance” link in the

“Investor Relations” section of our website at www.cantelmedical.com. The Corporate Governance Guidelines are also available without charge in print to any requesting stockholder.

Certain Relationships and Related Person Transactions

Our Corporate Governance Guidelines address, among other things, the consideration and approval of any related person transactions. Under these Governance Guidelines, any related person transaction that would require disclosure by us under Item

404(a) of Regulation S-K of the rules and regulations of the SEC, including those with respect to a director, a nominee for director or an executive officer, must be reviewed and approved or ratified by the Nominating Committee, excluding any

director(s) interested in such transaction. Any such related person transactions will only be approved or ratified if the Nominating Committee determines that such transaction will not impair the involved person(s)’ service to, and exercise of

judgment on behalf of, the Company, or otherwise create a conflict of interest that would be detrimental to the Company.

14

Mark N. Diker, our Chairman’s son, has served as a director of Cantel since October 18, 2007. Because of such family relationship, he is not treated as an independent director. During fiscal

year 2019, as with our other non-employee directors, Mr. Mark Diker received compensation of $50,000 and was awarded 713 RSUs under the 2016 Equity Plan in connection with his directorship at Cantel.

Other than compensation paid to our executive officers and directors and disclosed in this Proxy Statement or otherwise approved by our Compensation Committee or Board, we did not

engage in any related person transactions in fiscal year 2019.

BOARD MATTERS; COMMITTEES

Board Meetings and Attendance of Directors

The Board held five meetings, four regular meetings and one special meeting, during fiscal year 2019. During fiscal year 2019, each of the directors attended 75% or more of the combined total

meetings of the Board and the respective committees on which he or she served. Directors are required to make every reasonable effort to attend the Annual Meeting of Stockholders. All ten

individuals then serving as members of the Board attended our last Annual Meeting of Stockholders.

Director Independence

In determining independence pursuant to NYSE standards, each year the Board affirmatively determines whether directors have a direct or indirect material relationship with the Company that may interfere with their ability to exercise their

independence from the Company. When assessing the materiality of a director’s relationship with the Company, the Board considers all relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or

organizations with which the director has an affiliation. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. The Board has affirmatively determined that the

following seven directors have no material relationship with us and are independent within the meaning of Rule 10A-3 of the Exchange Act and within the NYSE definition of “independence”: Alan R. Batkin, Ann E. Berman, Anthony B. Evnin, Laura L.

Forese, Ronnie Myers, Karen N. Prange and Peter J. Pronovost. Our Board has also concluded that none of these directors possessed the objective relationships set forth in the NYSE listing standards that prevent independence. None of our independent

directors has any relationship with the Company other than his or her service as a director and on committees of the Board. Independent directors receive no compensation from us for service on the Board or the Committees other than directors’ fees

and equity grants under our 2016 Equity Plan.

Executive Sessions; Lead Independent Director

As required by the NYSE listing standards, our non-management directors meet in executive sessions at which only non-management directors are present. Such meetings are held following every regular meeting of the board of directors. Meetings of

non-management directors are generally followed by meetings of the independent directors.

Mr. Batkin serves as the lead independent director and is the chairperson for all non-management and independent director meetings. He has been selected by our non-management directors to serve in such position this year after serving as presiding

director each year since December 2004. The lead independent director’s responsibilities include presiding at all meetings of the Board at which the chairman is not present, including executive sessions of the independent directors; serving as

liaison between the chairman and the independent directors; approving information sent to the Board; approving meeting agendas for the Board; approving meeting schedules to assure that there is sufficient time for discussion of all agenda items;

having the authority to call meetings of the independent directors; and if requested by any major shareholders, ensuring that he or she is available for consultation and direct communication.

Communications with Directors; Hotline

Cantel takes seriously the concerns of its employees and stockholders. Cantel has re-launched its global third-party hotline site, with the ability to report anonymously where local law permits or requires, including

matters to be addressed to the Board, any individual director, any Committee or to the lead independent director. Cantel’s Speak-Up! Line is accessible at https://secure.ethicspoint.com/domain/media/en/gui/61652/index.html. You may file a report or inquiry through the online portal; the site also provides telephone

numbers to access the hotline in over 100 countries. An outside vendor collects all reports or complaints and delivers them to our Chief Compliance Officer or General Counsel, who, in appropriate cases, forwards them to the Audit Committee or the

appropriate director or group of directors or members of management. You may also communicate directly with the Board at the meeting.

Additional information regarding the hotline can be found by clicking on the “Corporate Governance” link in the “Investor Relations” section of our website at www.cantelmedical.com.

15

Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating Committee. All members of the Audit Committee, the Compensation Committee, and the Nominating Committee are independent directors within

the definition in the NYSE listing standards and Rule 10A-3 of the Exchange Act. Each of the Committees has the authority to retain independent advisors and consultants, with all fees and expenses to be paid by the Company. The Board-approved

charters of each of the Committees can be found by clicking on the “Corporate Governance” link in the “Investor Relations” section of our website at www.cantelmedical.com or (free of charge) by sending a written request to Cantel Medical Corp., 150

Clove Road, Little Falls, NJ 07424, Attn: Secretary.

Audit Committee. The Audit Committee is composed of Ms. Berman (Chair), Mr. Batkin and Dr. Myers. All of the

Audit Committee members are financially literate, and at least one member has accounting and financial management expertise. The Board has determined that Ms. Berman qualifies as an “audit committee financial expert” for purposes of the federal securities laws. Ms. Berman developed such qualifications through her skills as a CPA and her service as a Vice President of Finance and CFO of Harvard University.

The Audit Committee performs the following functions: (1) assisting the Board in fulfilling its oversight responsibilities with respect to (a) the integrity of our financial statements, (b) our compliance with legal and regulatory requirements,

(c) the independent registered public accounting firm’s qualifications and independence, and (d) the performance of our internal audit function and independent registered public accounting firm and (2) preparing a report in accordance with the rules

of the SEC to be included in our annual proxy statement.

Additionally, the Audit Committee supervises our enterprise risk management committee, which monitors and escalates enterprise level issues, including cybersecurity matters, to the appropriate management levels within our organization and to

members of our Board of Directors as appropriate. The Audit Committee receives regular reports from both the enterprise risk management committee and the internal auditor. Matters determined by the enterprise risk management committee to present

potential material impacts to our financial results, operations or reputation are immediately reported by management to the chair of our Audit Committee. In addition, the Audit Committee regularly meets in executive session with the internal and

external auditors, as well as the Company’s General Counsel and the Company’s Chief Compliance Officer.

The Audit Committee held seven meetings during fiscal year 2019, of which four were meetings held prior to the filing of our Quarterly Reports on Form 10-Q or Annual Report on Form 10-K for the primary purpose of reviewing such reports and the

quarterly financial closing process.

Compensation Committee. The Compensation Committee is composed of Mr. Batkin (Chair), Ms. Berman, and Drs.

Forese and Myers. The Compensation Committee performs the following functions: (1) discharging the Board’s responsibilities relating to compensation of our executive officers; (2) producing an annual report on executive compensation for inclusion in

our proxy statement in accordance with applicable rules and regulations; and (3) administering our equity incentive plans in accordance with the terms of such plans. The Compensation Committee held five meetings during fiscal year 2019. In

discharging its responsibilities, the Compensation Committee, among other things, evaluates the CEO’s performance and determines and approves the CEO’s compensation level based on such evaluation. The Compensation Committee also determines and

approves the compensation of other executive officers. The CEO makes recommendations to the Compensation Committee regarding the amount and form of his compensation and the compensation of our other executive officers.

As described further in “Compensation Discussion and Analysis” below, the Compensation Committee retained Frederic W. Cook & Co., Inc. (“FW Cook”), an independent compensation consultant, to provide advice with respect to executive

compensation for fiscal year 2019. FW Cook’s primary responsibilities in fiscal year 2019 included updating our peer group companies, benchmarking the compensation of our CEO and other executive officers, incentive design and facilitating the

compensation risk assessment.

Compensation Committee Interlocks and Insider Participation. None of the directors who served on the Compensation Committee during

fiscal year 2019 is or has been an officer or employee of the Company or had any relationship that is required to be disclosed as a transaction with a related person. During fiscal year 2019, none of our executive officers served as a member of the

board of directors or compensation committee of any entity that has one or more executive officers who serve on our Board or our Compensation Committee.

Nominating Committee. The Nominating Committee is composed of Dr. Forese (Chair), Mr. Evnin and Dr. Pronovost.

The Nominating Committee performs the following functions: (1) identifying individuals qualified to become Board members, consistent with criteria approved by the Board and recommending that the Board select the director nominees for the next Annual

Meeting of Stockholders; (2) developing and recommending to the Board the Corporate Governance Guidelines; (3) overseeing evaluation of the Board and management and (4) reviewing and assessing the compensation paid to members of the Board and its

committees. The Nominating Committee held four meetings during fiscal year 2019.

16

Board Leadership Structure

The CEO and Chairman roles at Cantel are separated between George L. Fotiades and Charles M. Diker, respectively, in recognition of their differing responsibilities. The CEO is responsible for leading the organization’s day-to-day performance,

executing the Company’s strategies and ensuring the success of our acquisition program. The Chairman is responsible for advising the CEO on matters such as the strategic direction of the Company, collaborating on acquisitions and presiding over

meetings of the Board. Although we do not have a formal policy regarding whether the offices of Chairman and CEO should be separate, our Board believes that the existing leadership structure, with the separation of the Chairman of the Board and CEO

roles, enhances the accountability of the CEO to the Board and strengthens the Board’s independence from management. In addition, the Board believes that having a separate Chairman creates an environment that is more conducive to the objective

evaluation and oversight of management’s performance, increasing management accountability, and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and our stockholders.

Board Role in Risk Oversight

The Board, through its Audit Committee, is responsible for oversight of the Company’s management of enterprise risks, including cybersecurity. Cantel’s senior management is responsible for the Company’s risk management process and the day-to-day

supervision and mitigation of enterprise risks, as well running its enterprise risk management committee, which is supervised by the Audit Committee. Additional details are set forth above under “Audit Committee.”

Management of the Company advises the Audit Committee and Board on areas of material Company risk, including strategic, operational, financial, legal and regulatory risks. We do not believe our Board’s oversight of risk influences our leadership

structure, though we believe our leadership structure helps mitigate risk by separating oversight of our day-to-day business from the oversight of our Board.

Selection of Nominees for Election to the Board

The Nominating Committee has established a process for identifying and evaluating nominees for director. Although the Nominating Committee will consider nominees recommended by stockholders, the Nominating Committee believes that the process it

utilizes to identify and evaluate nominees for director is designed to produce nominees that possess the educational, professional, business and personal attributes that are best suited to further our purposes. Any interested person may recommend a

nominee by submitting the nomination, together with appropriate biographical information, to the Nominating Committee, c/o Cantel Medical Corp., 150 Clove Road, Little Falls, NJ 07424, Attn: Secretary. All recommended candidates will be considered

using the criteria set forth in our Corporate Governance Guidelines.

The Nominating Committee will consider, among other things, the following factors to evaluate recommended nominees: the Board’s current composition, including expertise, diversity, balance of management and non-management directors, independence

and other qualifications required or recommended by applicable laws, rules and regulations (including NYSE requirements) and company policies or procedures. Although the Board considers diversity as a factor to be considered in identifying and

evaluating nominees, it does not have any formal policy with respect to diversity. The Nominating Committee will also consider the general qualifications of potential nominees, including, but not limited to personal integrity; concern for Cantel’s

success and welfare; experience at strategy/policy setting level; high-level leadership experience in business or administrative activity; breadth of knowledge about issues affecting Cantel; an ability to work effectively with others; sufficient time

to devote to the Company; and freedom from conflicts of interests.

Annual Performance Evaluation of the Board

The Board of Directors conducts a self-evaluation annually to determine whether it, its Committees, and its individual directors are functioning effectively. This evaluation is required to be performed by an external evaluator at least once every

three years. The full Board discusses the evaluation report to determine what, if any, action could improve Board, Board committee, and individual director performance.

17

EXECUTIVE OFFICERS OF CANTEL

|

Name

|

Age

|

Position

|

|

Charles M. Diker

|

84

|

Chairman of the Board, and member of Office of the Chairman

|

|

George L. Fotiades

|

66

|

President and Chief Executive Officer, and member of Office of the Chairman

|

|

Shaun M. Blakeman

|

41

|

Senior Vice President and Chief Financial Officer, and member of Office of the Chairman

|

|

Peter G. Clifford

|

49

|

Executive Vice President and Chief Operating Officer, and member of Office of the Chairman

|

|

Seth M. Yellin

|

45

|

Executive Vice President, Strategy and Corporate Development, and member of Office of the Chairman

|

|

Lawrence Conway

|

56

|

Senior Vice President, Business Systems and Procurement

|

|

Brian R. Capone

|

44

|

Senior Vice President, Corporate Controller and Chief Accounting Officer

|

|

Jean M. Casner

|

61

|

Senior Vice President and Chief Human Resources Officer

|

|

Jeff Z. Mann

|

47

|

Senior Vice President, General Counsel and Secretary, and member of Office of the Chairman

|

Set forth below is certain biographical information concerning our current executive officers who are not also directors:

Mr. Blakeman has served as Senior Vice President and Chief Financial Officer of the Company since May 2019. In this role, he is responsible for all financial reporting, financial planning and analysis, auditing, treasury, strategic planning and

management, and investor relations. Mr. Blakeman worked for Cantel from 2016 to 2018 as the Vice President of Finance for Cantel’s Medical division. Prior to rejoining the Company, Mr. Blakeman was Senior Finance Director at Medtronic plc. Prior to

that, he held leadership roles with increasing responsibility including Vice President, Diaphragm and Dosing Pump Platform business at IDEX Corporation and Controller for Latin American Operations for Warren Rupp, Inc., another division of IDEX.

Mr. Clifford has served as the Executive Vice President and Chief Operating Officer of the Company since May 2019. Prior to his appointment as Chief Operating Officer, Mr. Clifford served as Executive Vice President and Chief Financial Officer of

the Company since May 2015. Prior to joining the Company, Mr. Clifford served in various financial positions with increasing responsibility for over twenty years. For more than five years prior to joining the Company, he was Group Vice President of

Operations Finance and Information Technology for IDEX Corporation.

Mr. Yellin has served as Executive Vice President, Strategy and Corporate Development of the Company since September 2016. Prior thereto, from March 2013 to September 2016, he served as Senior Vice President, Corporate Development, and from April

2012 through March 2013, he served as Vice President, Corporate Development. From January 2011 through January 2012, Mr. Yellin was an analyst in the Medical Devices & Life Science Tools segment of Citadel Asset Management.

Mr. Conway was appointed Senior Vice President, Business Systems and Procurement of the Company in November 2017, having served as Vice President, Business Systems and Procurement since September 2013 and as an independent consultant of the

Company since May 2013. For more than 10 years prior to joining, Mr. Conway served in various management positions at Convatec, most recently as Vice President and General Manager Ostomy Care.

Mr. Capone was appointed Senior Vice President, Corporate Controller and Chief Accounting Officer in October 2018, having previously served as Vice President, Chief Accounting Officer and Vice President, Corporate Controller for the Company since

April 2017. Prior to joining the Company, Mr. Capone served as the Assistant Corporate Controller for Stryker Corporation from October 2014 to April 2017, and Director, External Financial Reporting and Technical Accounting for Quest Diagnostics

Incorporated from March 2012 to October 2014. Prior to those roles, Mr. Capone served in various financial reporting roles at Genzyme Corporation and CVS Health Corporation.

Ms. Casner has served as the Company’s Senior Vice President and Chief Human Resources Officer since March 2019. In this role, she is responsible for the global human resources function, including its people strategy, policies, systems and

processes such as talent management, succession planning, learning and development, compensation and benefits, performance and recruiting.

18

Ms. Casner joined Cantel in 2017 as Vice President, Benefits, Compensation and HR Operations. Prior to Cantel, Ms. Casner held HR leadership positions at the National Basketball Association from July 2008 to May 2015, Merck & Co., Inc. from

January 2004 to June 2008, The Dial Corporation (now owned by Henkel Corporation) from July 1993 to July 2001, Johnson & Johnson from 1991 to 1993, and ORC Worldwide (now owned by Mercer LLC) from September of 1980 to December 1990.

Mr. Mann was appointed Senior Vice President, General Counsel and Secretary of the Company as of August 1, 2019. Prior to that, Mr. Mann served as the Vice President, Deputy General Counsel of the Company since June 2018. Mr. Mann joined the

Company after serving in various legal leadership roles at Boston Scientific Corporation since 2004.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis (CD&A) describes our executive compensation philosophy and program, the compensation decisions made under this program and the specific factors we considered in making those decisions. This CD&A

focuses on the compensation of our “Named Executive Officers” (NEOs) for fiscal year 2019, who were:

| • |

Charles M. Diker - Chairman of the Board

|

| • |

George L. Fotiades - President and Chief Executive Officer

|

| • |

Shaun M. Blakeman - Senior Vice President and Chief Financial Officer

|

| • |

Peter G. Clifford - Executive Vice President and Chief Operating Officer

|

| • |

Seth M. Yellin - Executive Vice President, Strategy and Corporate Development

|

| • |

Jorgen B. Hansen - President and Chief Executive Officer (until March 2019)

|

| • |

Eric W. Nodiff - Executive Vice President, General Counsel and Secretary (retired July 31, 2019)

|

| • |

Dottie Donnelly - Senior Vice President and Chief Human Resources Officer (until March 2019)

|

Fiscal Year 2019 Performance Results

Key financial results for fiscal year 2019 compared with fiscal year 2018 were as follows:

| • |

Net sales increased by 5.3% to a record $918.2 million from $871.9 million, with organic sales growth of 3.9%, and

|

| • |

Net income under generally accepted accounting principles (GAAP) decreased by 39.5% to $55.0 million from $91.0 million.

|

Executive Compensation Program Best Practices

Our Compensation Committee believes that a strong foundation for our compensation program is necessary to execute our executive compensation philosophy effectively. The following best practices serve as the foundation for our executive

compensation program.

|

||

|

WHAT WE DO

|

||

|

Mixture of short-term and long-term incentives

Mixture of fixed and variable compensation

Clawbacks

Double-trigger for change in control vesting

|

Stock ownership guidelines

Peer group reviews

Independent compensation consultant

Compensation risk assessment

|

|

|

||

|

WHAT WE DON’T DO

|

||

|

General tax gross ups

Executive perquisites (beginning fiscal year 2020)

|

Stock repricing

Hedging or pledging

|

|

19

How Pay Was Tied to the Company’s Performance in Fiscal Year 2019

Our fiscal year 2019 results and compensation decisions illustrate that our pay-for-performance philosophy works as intended, with incentive-based cash bonuses and equity awards being driven by performance. As discussed below, payments of cash

incentive awards are tied to financial performance and we have, since fiscal year 2017, granted performance-based equity grants in addition to strictly time-based equity grants for our senior corporate executives. The incentive payout for each of our

NEOs was below target for our annual cash bonuses due to the Company’s financial metric achievements being slightly below our fiscal year 2019 targets, as established for purposes of executive compensation.

Compensation Philosophy and Objectives

The approach to our compensation is designed to accomplish the following objectives:

| • |

Pay-for-Performance. To reward performance that drives the achievement of the Company’s short-term

and long-term goals and ultimately, stockholder value.

|

| • |

Align Management and Stockholder Interests. To align the interests of our executive officers with our stockholders by

using long-term, equity-based incentives, maintaining stock ownership and retention guidelines that encourage a culture of ownership, and rewarding executive officers for sustained and superior Company performance as measured by operating

results and relative total stockholder return (TSR).

|

| • |

Attract, Retain, and Motivate Talented Executives. To compete and provide incentives for talented, high-performing

executives.

|

| • |

Address Risk-Management Considerations. To motivate our executives to pursue objectives that create long-term