January 13, 2026 4Q25 Financial Results

Agenda Page 1 4Q25 and FY25 Financial Results 1 2 Financial Outlook 10 3 Notes 13

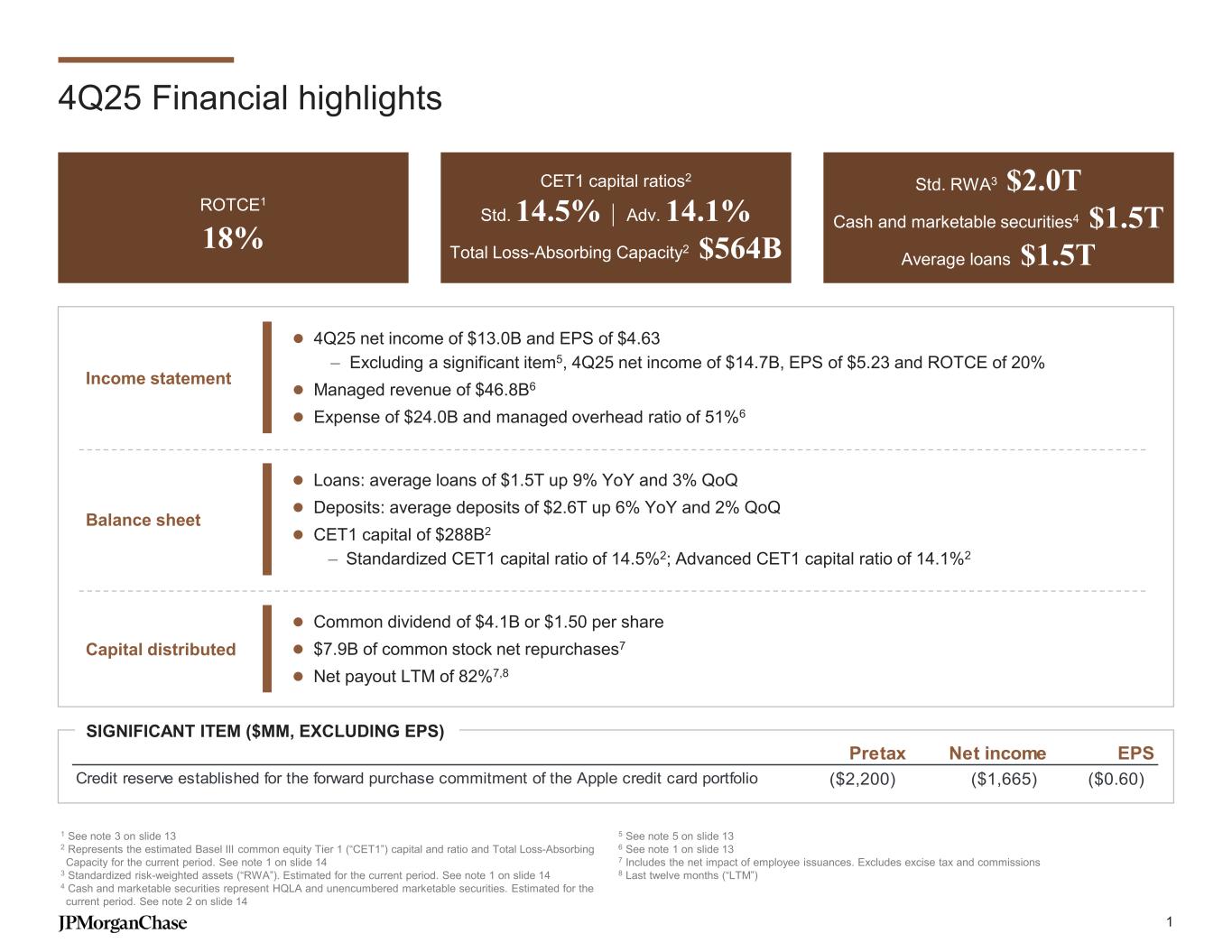

4Q25 Financial highlights ROTCE1 18% CET1 capital ratios2 Std. 14.5% | Adv. 14.1% Total Loss-Absorbing Capacity2 $564B Std. RWA3 $2.0T Cash and marketable securities4 $1.5T Average loans $1.5T Balance sheet Loans: average loans of $1.5T up 9% YoY and 3% QoQ Deposits: average deposits of $2.6T up 6% YoY and 2% QoQ CET1 capital of $288B2 – Standardized CET1 capital ratio of 14.5%2; Advanced CET1 capital ratio of 14.1%2 Capital distributed Common dividend of $4.1B or $1.50 per share $7.9B of common stock net repurchases7 Net payout LTM of 82%7,8 Income statement 4Q25 net income of $13.0B and EPS of $4.63 – Excluding a significant item5, 4Q25 net income of $14.7B, EPS of $5.23 and ROTCE of 20% Managed revenue of $46.8B6 Expense of $24.0B and managed overhead ratio of 51%6 SIGNIFICANT ITEM ($MM, EXCLUDING EPS) 1 See note 3 on slide 13 2 Represents the estimated Basel III common equity Tier 1 (“CET1”) capital and ratio and Total Loss-Absorbing Capacity for the current period. See note 1 on slide 14 3 Standardized risk-weighted assets (“RWA”). Estimated for the current period. See note 1 on slide 14 4 Cash and marketable securities represent HQLA and unencumbered marketable securities. Estimated for the current period. See note 2 on slide 14 5 See note 5 on slide 13 6 See note 1 on slide 13 7 Includes the net impact of employee issuances. Excludes excise tax and commissions 8 Last twelve months (“LTM”) Pretax Net income EPS Credit reserve established for the forward purchase commitment of the Apple credit card portfolio ($2,200) ($1,665) ($0.60) 1

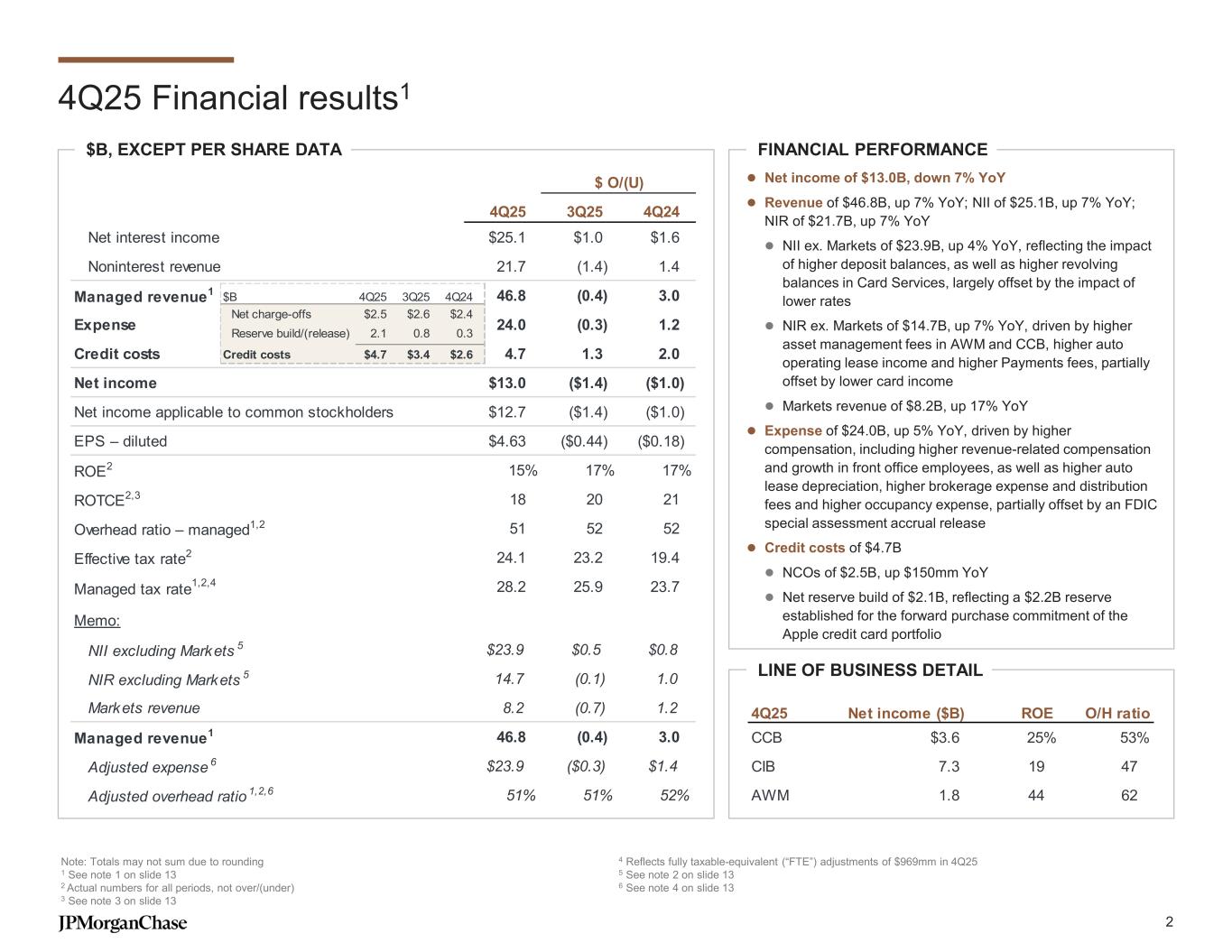

4Q25 Financial results1 Note: Totals may not sum due to rounding 1 See note 1 on slide 13 2 Actual numbers for all periods, not over/(under) 3 See note 3 on slide 13 4 Reflects fully taxable-equivalent (“FTE”) adjustments of $969mm in 4Q25 5 See note 2 on slide 13 6 See note 4 on slide 13 FINANCIAL PERFORMANCE LINE OF BUSINESS DETAIL $B, EXCEPT PER SHARE DATA $B 4Q25 3Q25 4Q24 Net charge-offs $2.5 $2.6 $2.4 Reserve build/(release) 2.1 0.8 0.3 Credit costs $4.7 $3.4 $2.6 Net income of $13.0B, down 7% YoY Revenue of $46.8B, up 7% YoY; NII of $25.1B, up 7% YoY; NIR of $21.7B, up 7% YoY NII ex. Markets of $23.9B, up 4% YoY, reflecting the impact of higher deposit balances, as well as higher revolving balances in Card Services, largely offset by the impact of lower rates NIR ex. Markets of $14.7B, up 7% YoY, driven by higher asset management fees in AWM and CCB, higher auto operating lease income and higher Payments fees, partially offset by lower card income Markets revenue of $8.2B, up 17% YoY Expense of $24.0B, up 5% YoY, driven by higher compensation, including higher revenue-related compensation and growth in front office employees, as well as higher auto lease depreciation, higher brokerage expense and distribution fees and higher occupancy expense, partially offset by an FDIC special assessment accrual release Credit costs of $4.7B NCOs of $2.5B, up $150mm YoY Net reserve build of $2.1B, reflecting a $2.2B reserve established for the forward purchase commitment of the Apple credit card portfolio 4Q25 3Q25 4Q24 Net interest income $25.1 $1.0 $1.6 Noninterest revenue 21.7 (1.4) 1.4 Managed revenue1 46.8 (0.4) 3.0 Expense 24.0 (0.3) 1.2 Credit costs 4.7 1.3 2.0 Net income $13.0 ($1.4) ($1.0) Net income applicable to common stockholders $12.7 ($1.4) ($1.0) EPS – diluted $4.63 ($0.44) ($0.18) ROE2 15% 17% 17% ROTCE2,3 18 20 21 Overhead ratio – managed1,2 51 52 52 Effective tax rate2 24.1 23.2 19.4 Managed tax rate1,2,4 28.2 25.9 23.7 Memo: NII excluding Markets 5 $23.9 $0.5 $0.8 NIR excluding Markets 5 14.7 (0.1) 1.0 Markets revenue 8.2 (0.7) 1.2 Managed revenue1 46.8 (0.4) 3.0 Adjusted expense 6 $23.9 ($0.3) $1.4 Adjusted overhead ratio 1,2,6 51% 51% 52% $ O/(U) 4Q25 Net income ($B) ROE O/H ratio CCB $3.6 25% 53% CIB 7.3 19 47 AWM 1.8 44 62 2

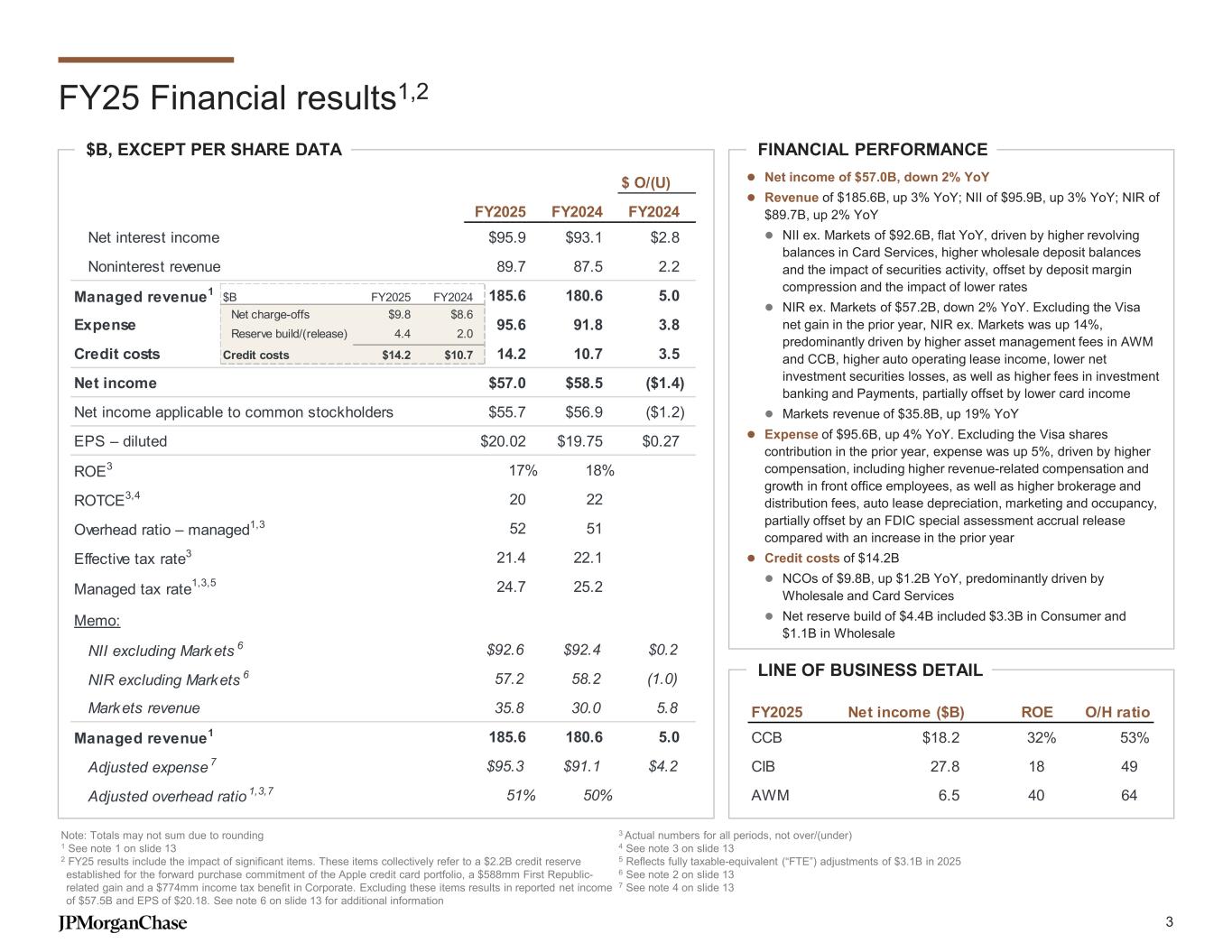

$ O/(U) FY2025 FY2024 FY2024 Net interest income $95.9 $93.1 $2.8 Noninterest revenue 89.7 87.5 2.2 Managed revenue1 185.6 180.6 5.0 Expense 95.6 91.8 3.8 Credit costs 14.2 10.7 3.5 Net income $57.0 $58.5 ($1.4) Net income applicable to common stockholders $55.7 $56.9 ($1.2) EPS – diluted $20.02 $19.75 $0.27 ROE3 17% 18% ROTCE3,4 20 22 Overhead ratio – managed1,3 52 51 Effective tax rate3 21.4 22.1 Managed tax rate1,3,5 24.7 25.2 Memo: NII excluding Markets 6 $92.6 $92.4 $0.2 NIR excluding Markets 6 57.2 58.2 (1.0) Markets revenue 35.8 30.0 5.8 Managed revenue1 185.6 180.6 5.0 Adjusted expense 7 $95.3 $91.1 $4.2 Adjusted overhead ratio 1,3,7 51% 50% FY25 Financial results1,2 Note: Totals may not sum due to rounding 1 See note 1 on slide 13 2 FY25 results include the impact of significant items. These items collectively refer to a $2.2B credit reserve established for the forward purchase commitment of the Apple credit card portfolio, a $588mm First Republic- related gain and a $774mm income tax benefit in Corporate. Excluding these items results in reported net income of $57.5B and EPS of $20.18. See note 6 on slide 13 for additional information 3 Actual numbers for all periods, not over/(under) 4 See note 3 on slide 13 5 Reflects fully taxable-equivalent (“FTE”) adjustments of $3.1B in 2025 6 See note 2 on slide 13 7 See note 4 on slide 13 FINANCIAL PERFORMANCE Net income of $57.0B, down 2% YoY Revenue of $185.6B, up 3% YoY; NII of $95.9B, up 3% YoY; NIR of $89.7B, up 2% YoY NII ex. Markets of $92.6B, flat YoY, driven by higher revolving balances in Card Services, higher wholesale deposit balances and the impact of securities activity, offset by deposit margin compression and the impact of lower rates NIR ex. Markets of $57.2B, down 2% YoY. Excluding the Visa net gain in the prior year, NIR ex. Markets was up 14%, predominantly driven by higher asset management fees in AWM and CCB, higher auto operating lease income, lower net investment securities losses, as well as higher fees in investment banking and Payments, partially offset by lower card income Markets revenue of $35.8B, up 19% YoY Expense of $95.6B, up 4% YoY. Excluding the Visa shares contribution in the prior year, expense was up 5%, driven by higher compensation, including higher revenue-related compensation and growth in front office employees, as well as higher brokerage and distribution fees, auto lease depreciation, marketing and occupancy, partially offset by an FDIC special assessment accrual release compared with an increase in the prior year Credit costs of $14.2B NCOs of $9.8B, up $1.2B YoY, predominantly driven by Wholesale and Card Services Net reserve build of $4.4B included $3.3B in Consumer and $1.1B in Wholesale LINE OF BUSINESS DETAIL $B, EXCEPT PER SHARE DATA $B FY2025 FY2024 Net charge-offs $9.8 $8.6 Reserve build/(release) 4.4 2.0 Credit costs $14.2 $10.7 FY2025 Net income ($B) ROE O/H ratio CCB $18.2 32% 53% CIB 27.8 18 49 AWM 6.5 40 64 3

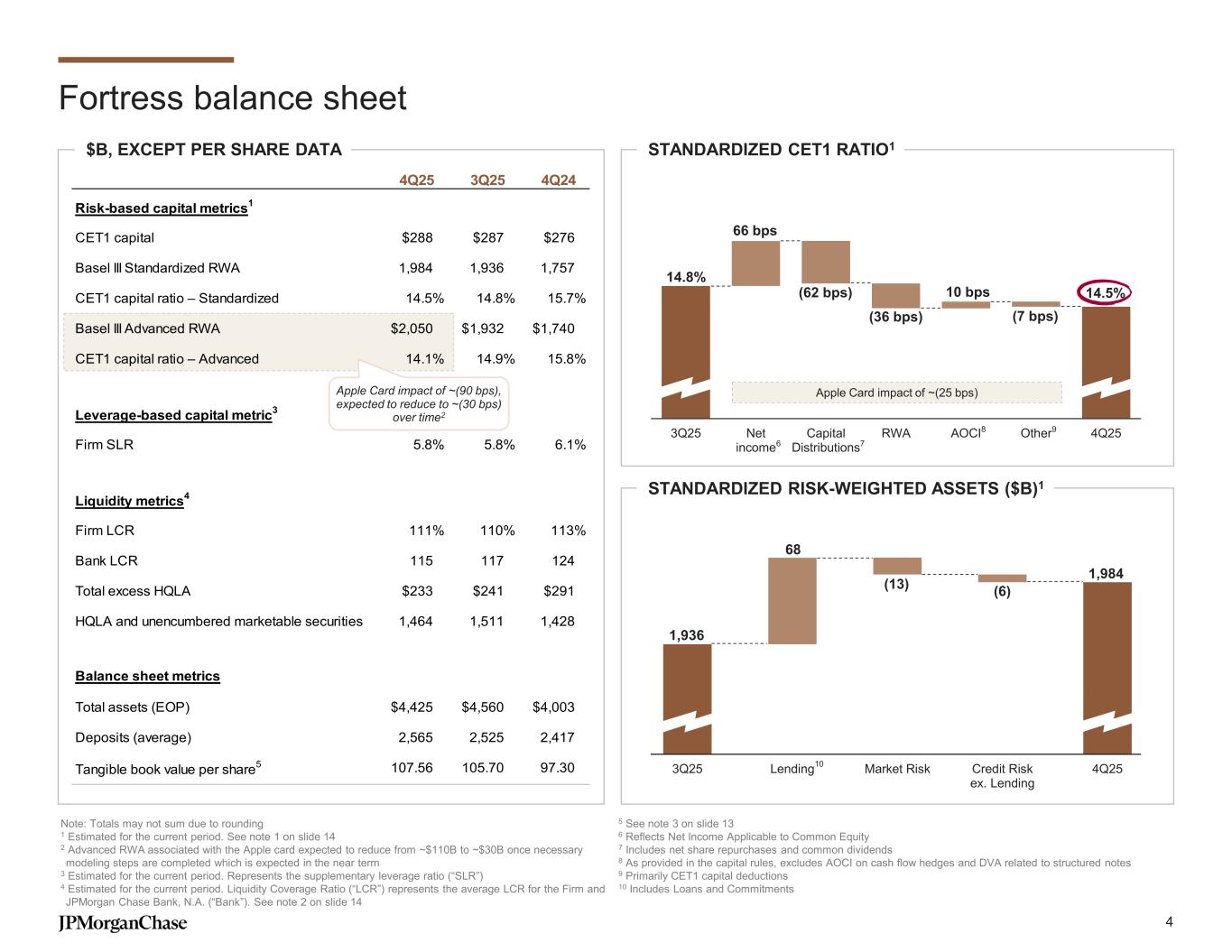

Fortress balance sheet $B, EXCEPT PER SHARE DATA Note: Totals may not sum due to rounding 1 Estimated for the current period. See note 1 on slide 14 2 Advanced RWA associated with the Apple card expected to reduce from ~$110B to ~$30B once necessary modeling steps are completed which is expected in the near term 3 Estimated for the current period. Represents the supplementary leverage ratio (“SLR”) 4 Estimated for the current period. Liquidity Coverage Ratio (“LCR”) represents the average LCR for the Firm and JPMorgan Chase Bank, N.A. (“Bank”). See note 2 on slide 14 5 See note 3 on slide 13 6 Reflects Net Income Applicable to Common Equity 7 Includes net share repurchases and common dividends 8 As provided in the capital rules, excludes AOCI on cash flow hedges and DVA related to structured notes 9 Primarily CET1 capital deductions 10 Includes Loans and Commitments STANDARDIZED CET1 RATIO1 4Q25 3Q25 4Q24 Risk-based capital metrics1 CET1 capital $288 $287 $276 Basel III Standardized RWA 1,984 1,936 1,757 CET1 capital ratio – Standardized 14.5% 14.8% 15.7% Basel III Advanced RWA $2,050 $1,932 $1,740 CET1 capital ratio – Advanced 14.1% 14.9% 15.8% Leverage-based capital metric3 Firm SLR 5.8% 5.8% 6.1% Liquidity metrics4 Firm LCR 111% 110% 113% Bank LCR 115 117 124 Total excess HQLA $233 $241 $291 HQLA and unencumbered marketable securities 1,464 1,511 1,428 Balance sheet metrics Total assets (EOP) $4,425 $4,560 $4,003 Deposits (average) 2,565 2,525 2,417 Tangible book value per share5 107.56 105.70 97.30 Apple Card impact of ~(90 bps), expected to reduce to ~(30 bps) over time2 14.8% 14.5%(62 bps) (36 bps) (7 bps) 66 bps 10 bps 3Q25 Net income Capital Distributions RWA AOCI Other 4Q25 76 8 9 Apple Card impact of ~(25 bps) 1,936 (13) (6) 68 3Q25 Lending Market Risk Credit Risk ex. Lending 4Q25 1,984 10 STANDARDIZED RISK-WEIGHTED ASSETS ($B)1 4

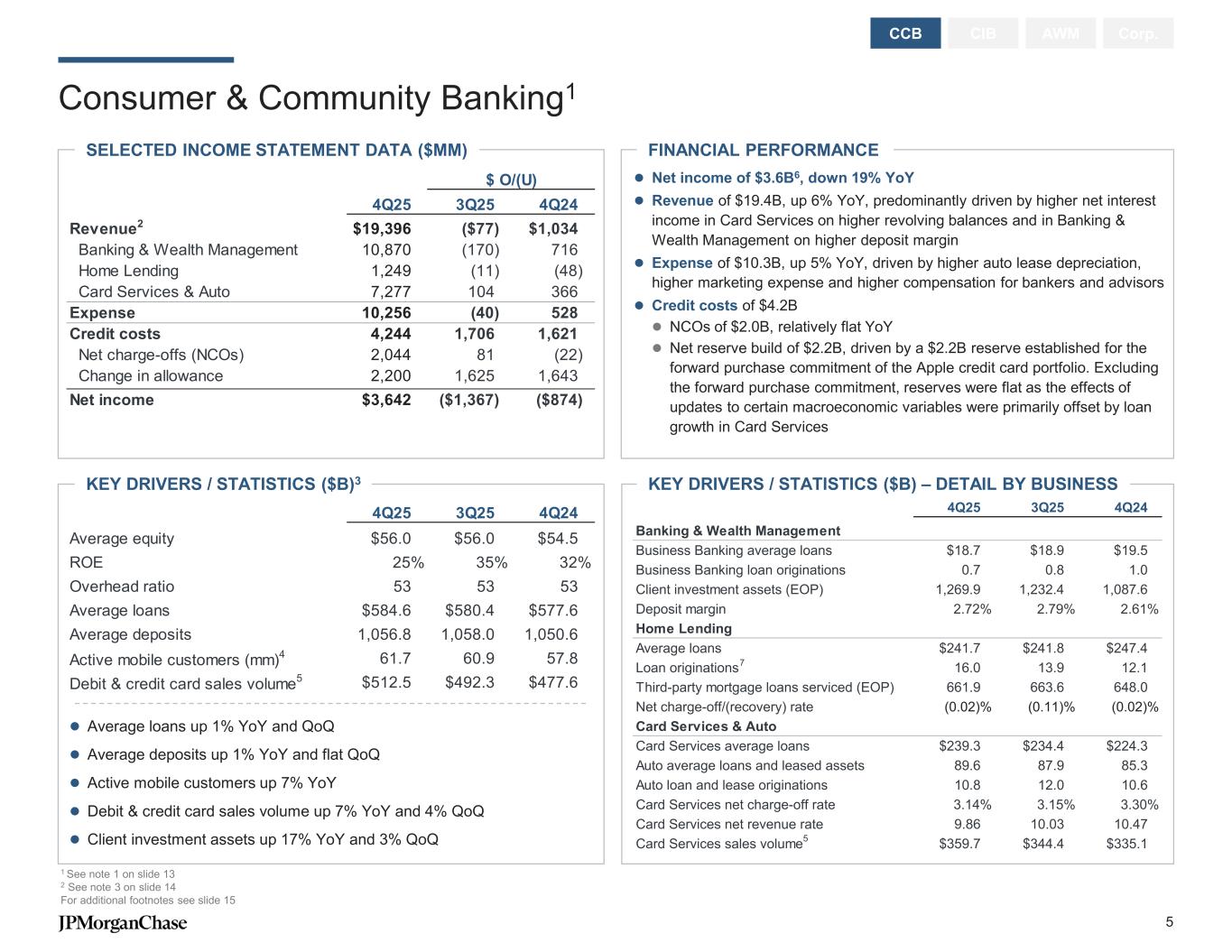

Consumer & Community Banking1 CIB AWM Corp.CCB Average loans up 1% YoY and QoQ Average deposits up 1% YoY and flat QoQ Active mobile customers up 7% YoY Debit & credit card sales volume up 7% YoY and 4% QoQ Client investment assets up 17% YoY and 3% QoQ KEY DRIVERS / STATISTICS ($B) – DETAIL BY BUSINESS FINANCIAL PERFORMANCESELECTED INCOME STATEMENT DATA ($MM) KEY DRIVERS / STATISTICS ($B)3 Net income of $3.6B6, down 19% YoY Revenue of $19.4B, up 6% YoY, predominantly driven by higher net interest income in Card Services on higher revolving balances and in Banking & Wealth Management on higher deposit margin Expense of $10.3B, up 5% YoY, driven by higher auto lease depreciation, higher marketing expense and higher compensation for bankers and advisors Credit costs of $4.2B NCOs of $2.0B, relatively flat YoY Net reserve build of $2.2B, driven by a $2.2B reserve established for the forward purchase commitment of the Apple credit card portfolio. Excluding the forward purchase commitment, reserves were flat as the effects of updates to certain macroeconomic variables were primarily offset by loan growth in Card Services 1 See note 1 on slide 13 2 See note 3 on slide 14 For additional footnotes see slide 15 $ O/(U) 4Q25 3Q25 4Q24 Revenue $19,396 ($77) $1,034 Banking & Wealth Management 10,870 (170) 716 Home Lending 1,249 (11) (48) Card Services & Auto 7,277 104 366 Expense 10,256 (40) 528 Credit costs 4,244 1,706 1,621 Net charge-offs (NCOs) 2,044 81 (22) Change in allowance 2,200 1,625 1,643 Net income $3,642 ($1,367) ($874) 2 4Q25 3Q25 4Q24 Average equity $56.0 $56.0 $54.5 ROE 25% 35% 32% Overhead ratio 53 53 53 Average loans $584.6 $580.4 $577.6 Average deposits 1,056.8 1,058.0 1,050.6 Active mobile customers (mm)4 61.7 60.9 57.8 Debit & credit card sales volume5 $512.5 $492.3 $477.6 4Q25 3Q25 4Q24 Banking & Wealth Management Business Banking average loans $18.7 $18.9 $19.5 Business Banking loan originations 0.7 0.8 1.0 Client investment assets (EOP) 1,269.9 1,232.4 1,087.6 Deposit margin 2.72% 2.79% 2.61% Home Lending Average loans $241.7 $241.8 $247.4 Loan originations 16.0 13.9 12.1 Third-party mortgage loans serviced (EOP) 661.9 663.6 648.0 Net charge-off/(recovery) rate (0.02)% (0.11)% (0.02)% Card Services & Auto Card Services average loans $239.3 $234.4 $224.3 Auto average loans and leased assets 89.6 87.9 85.3 Auto loan and lease originations 10.8 12.0 10.6 Card Services net charge-off rate 3.14% 3.15% 3.30% Card Services net revenue rate 9.86 10.03 10.47 Card Services sales volume $359.7 $344.4 $335.1 7 5 5

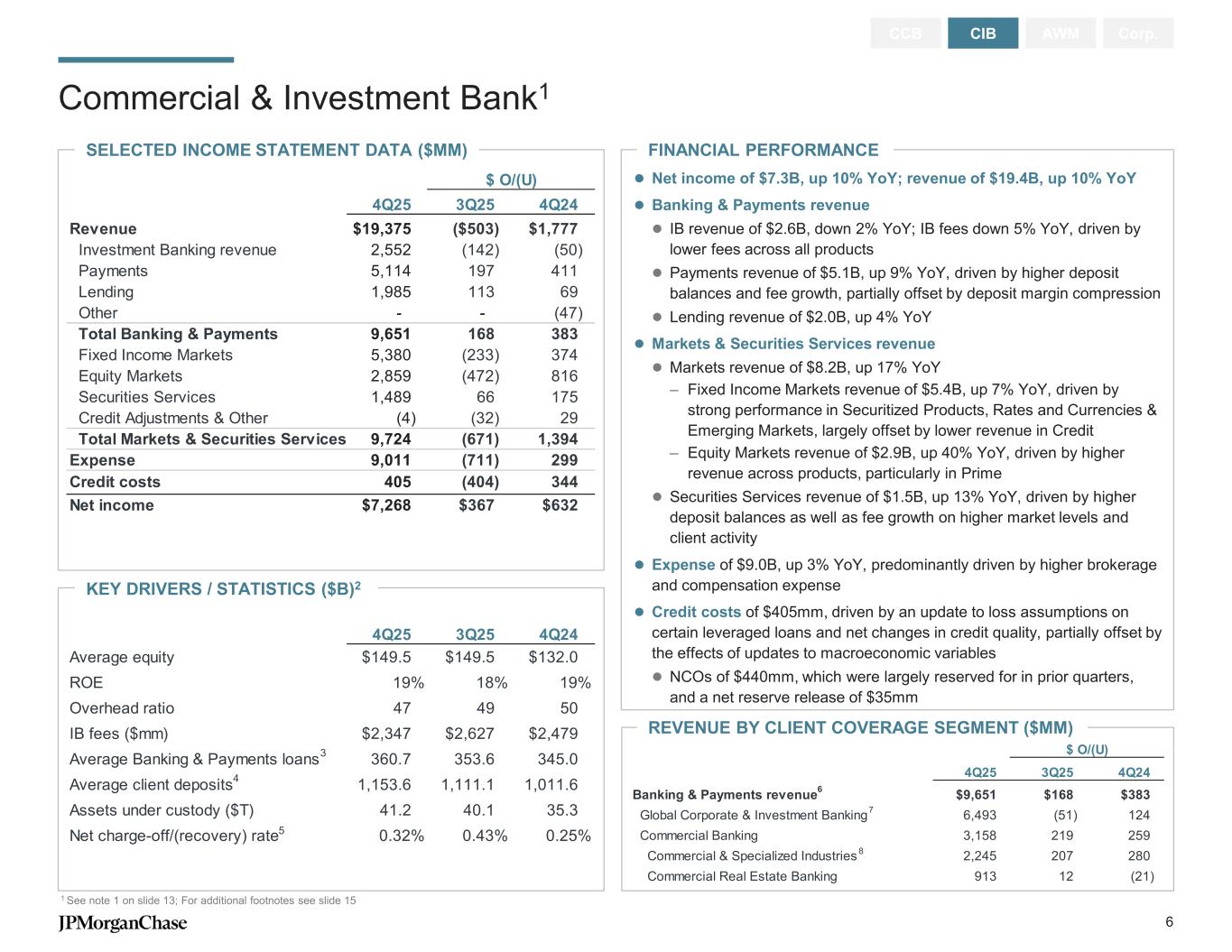

REVENUE BY CLIENT COVERAGE SEGMENT ($MM) KEY DRIVERS / STATISTICS ($B)2 FINANCIAL PERFORMANCE Commercial & Investment Bank1 1 See note 1 on slide 13; For additional footnotes see slide 15 CCB CIB AWM Corp. SELECTED INCOME STATEMENT DATA ($MM) Net income of $7.3B, up 10% YoY; revenue of $19.4B, up 10% YoY Banking & Payments revenue IB revenue of $2.6B, down 2% YoY; IB fees down 5% YoY, driven by lower fees across all products Payments revenue of $5.1B, up 9% YoY, driven by higher deposit balances and fee growth, partially offset by deposit margin compression Lending revenue of $2.0B, up 4% YoY Markets & Securities Services revenue Markets revenue of $8.2B, up 17% YoY – Fixed Income Markets revenue of $5.4B, up 7% YoY, driven by strong performance in Securitized Products, Rates and Currencies & Emerging Markets, largely offset by lower revenue in Credit – Equity Markets revenue of $2.9B, up 40% YoY, driven by higher revenue across products, particularly in Prime Securities Services revenue of $1.5B, up 13% YoY, driven by higher deposit balances as well as fee growth on higher market levels and client activity Expense of $9.0B, up 3% YoY, predominantly driven by higher brokerage and compensation expense Credit costs of $405mm, driven by an update to loss assumptions on certain leveraged loans and net changes in credit quality, partially offset by the effects of updates to macroeconomic variables NCOs of $440mm, which were largely reserved for in prior quarters, and a net reserve release of $35mm $ O/(U) 4Q25 3Q25 4Q24 Revenue $19,375 ($503) $1,777 Investment Banking revenue 2,552 (142) (50) Payments 5,114 197 411 Lending 1,985 113 69 Other - - (47) Total Banking & Payments 9,651 168 383 Fixed Income Markets 5,380 (233) 374 Equity Markets 2,859 (472) 816 Securities Services 1,489 66 175 Credit Adjustments & Other (4) (32) 29 Total Markets & Securities Services 9,724 (671) 1,394 Expense 9,011 (711) 299 Credit costs 405 (404) 344 Net income $7,268 $367 $632 4Q25 3Q25 4Q24 Average equity $149.5 $149.5 $132.0 ROE 19% 18% 19% Overhead ratio 47 49 50 IB fees ($mm) $2,347 $2,627 $2,479 Average Banking & Payments loans 360.7 353.6 345.0 Average client deposits 1,153.6 1,111.1 1,011.6 Assets under custody ($T) 41.2 40.1 35.3 Net charge-off/(recovery) rate 0.32% 0.43% 0.25% 3 5 4 $ O/(U) 4Q25 3Q25 4Q24 Banking & Payments revenue $9,651 $168 $383 Global Corporate & Investment Banking 6,493 (51) 124 Commercial Banking 3,158 219 259 Commercial & Specialized Industries 2,245 207 280 Commercial Real Estate Banking 913 12 (21) 7 8 6 6

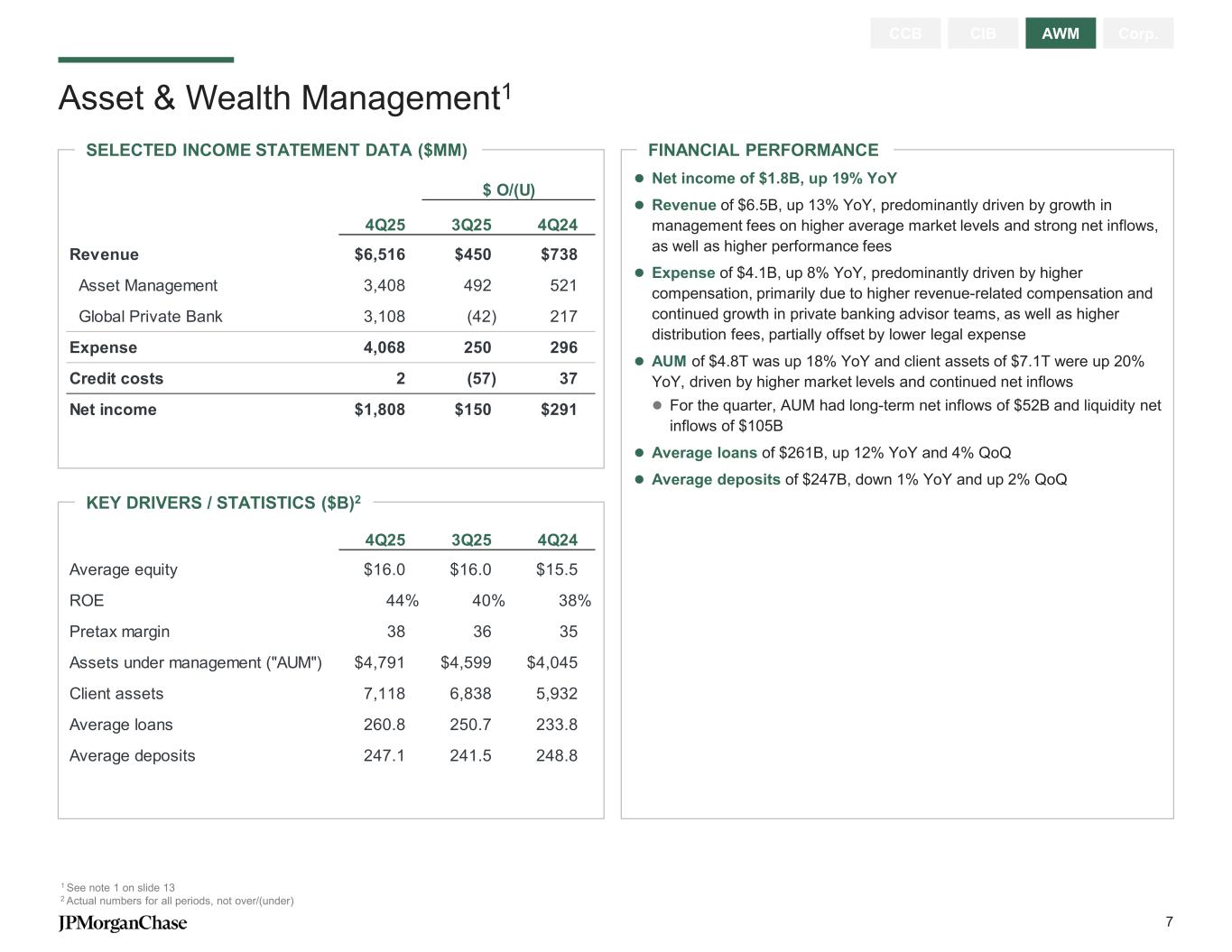

FINANCIAL PERFORMANCESELECTED INCOME STATEMENT DATA ($MM) Asset & Wealth Management1 1 See note 1 on slide 13 2 Actual numbers for all periods, not over/(under) CCB CIB AWM Corp. KEY DRIVERS / STATISTICS ($B)2 Net income of $1.8B, up 19% YoY Revenue of $6.5B, up 13% YoY, predominantly driven by growth in management fees on higher average market levels and strong net inflows, as well as higher performance fees Expense of $4.1B, up 8% YoY, predominantly driven by higher compensation, primarily due to higher revenue-related compensation and continued growth in private banking advisor teams, as well as higher distribution fees, partially offset by lower legal expense AUM of $4.8T was up 18% YoY and client assets of $7.1T were up 20% YoY, driven by higher market levels and continued net inflows For the quarter, AUM had long-term net inflows of $52B and liquidity net inflows of $105B Average loans of $261B, up 12% YoY and 4% QoQ Average deposits of $247B, down 1% YoY and up 2% QoQ $ O/(U) 4Q25 3Q25 4Q24 Revenue $6,516 $450 $738 Asset Management 3,408 492 521 Global Private Bank 3,108 (42) 217 Expense 4,068 250 296 Credit costs 2 (57) 37 Net income $1,808 $150 $291 4Q25 3Q25 4Q24 Average equity $16.0 $16.0 $15.5 ROE 44% 40% 38% Pretax margin 38 36 35 Assets under management ("AUM") $4,791 $4,599 $4,045 Client assets 7,118 6,838 5,932 Average loans 260.8 250.7 233.8 Average deposits 247.1 241.5 248.8 7

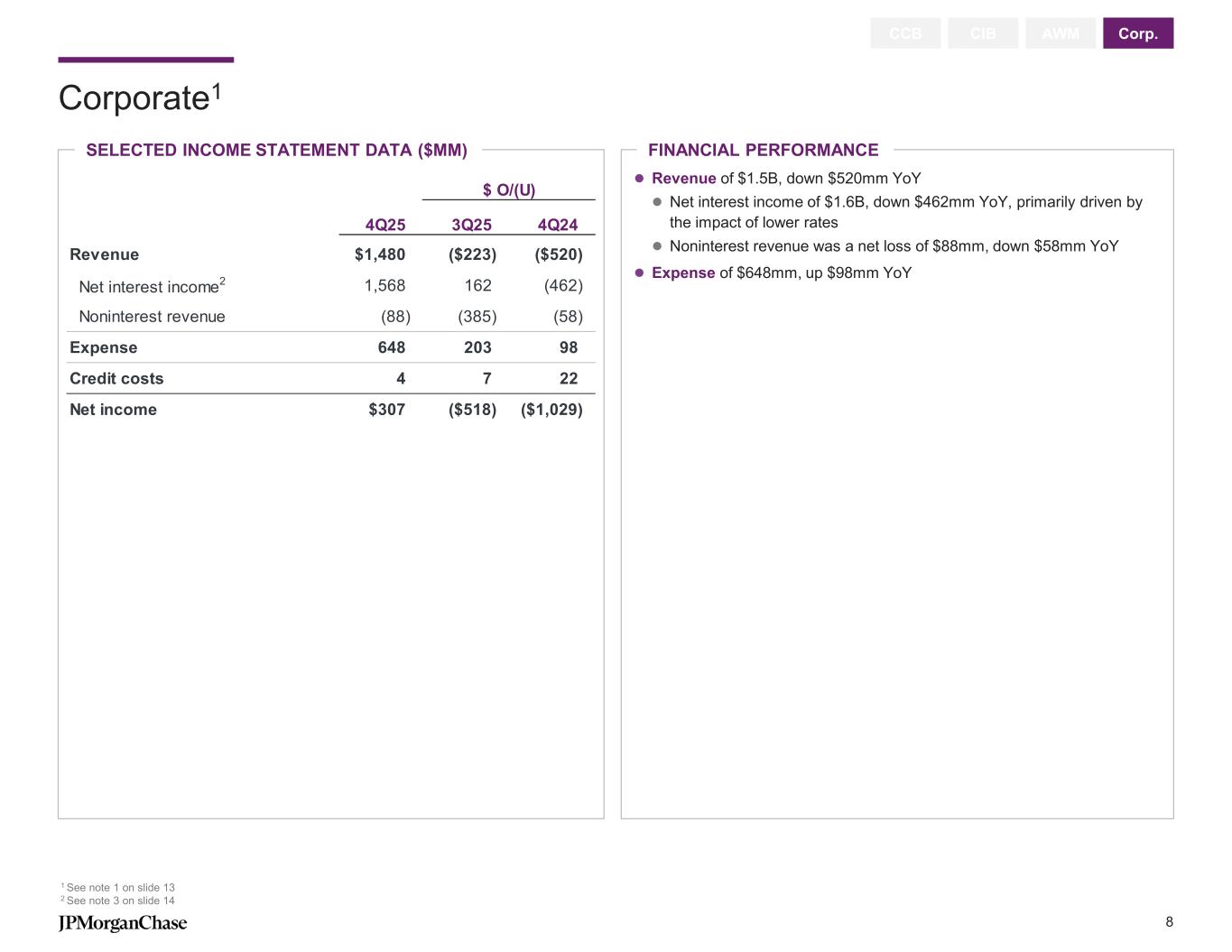

Corporate1 1 See note 1 on slide 13 2 See note 3 on slide 14 CCB CIB AWM Corp. SELECTED INCOME STATEMENT DATA ($MM) FINANCIAL PERFORMANCE Revenue of $1.5B, down $520mm YoY Net interest income of $1.6B, down $462mm YoY, primarily driven by the impact of lower rates Noninterest revenue was a net loss of $88mm, down $58mm YoY Expense of $648mm, up $98mm YoY $ O/(U) 4Q25 3Q25 4Q24 Revenue $1,480 ($223) ($520) Net interest income2 1,568 162 (462) Noninterest revenue (88) (385) (58) Expense 648 203 98 Credit costs 4 7 22 Net income $307 ($518) ($1,029) 8

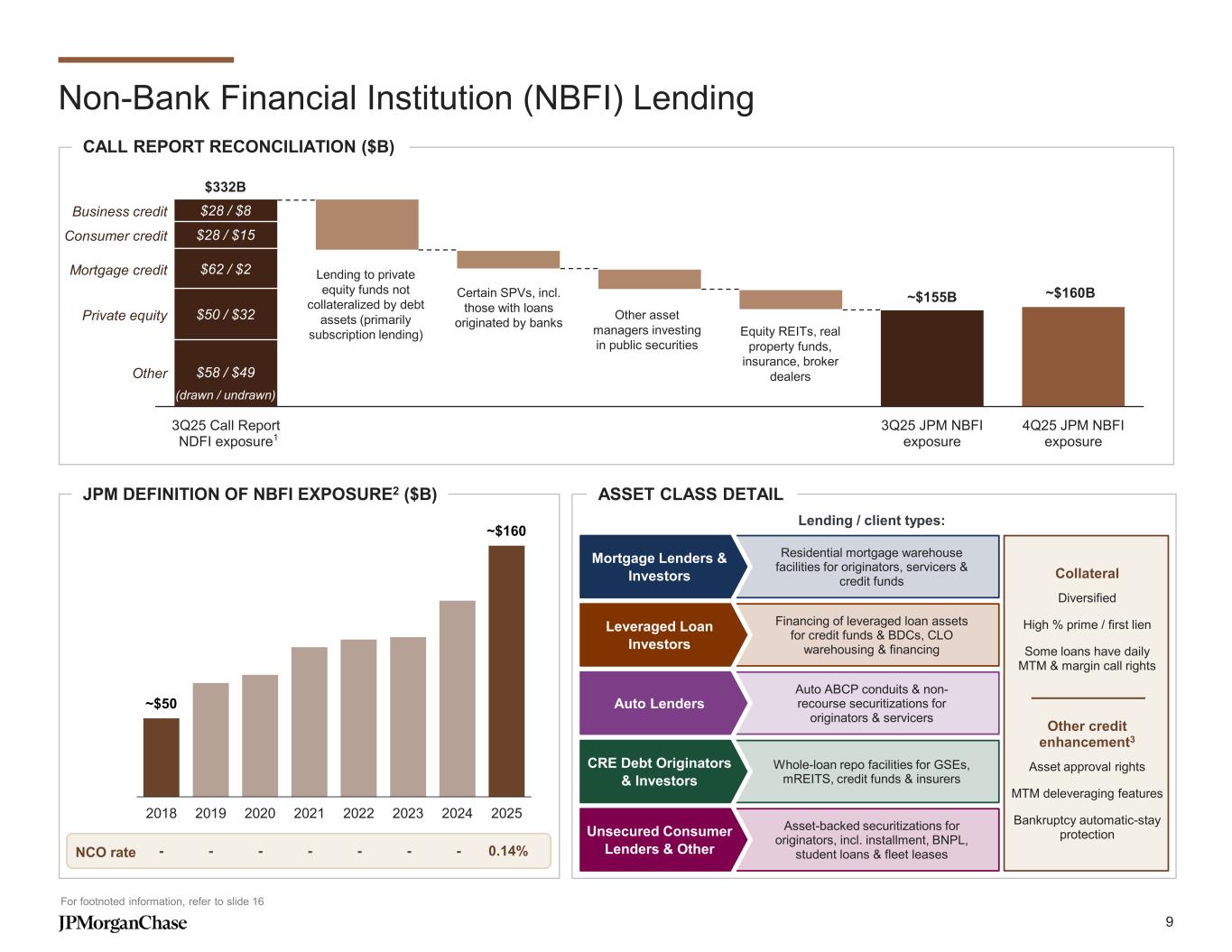

Non-Bank Financial Institution (NBFI) Lending For footnoted information, refer to slide 16 ~$155B 3Q25 Call Report NDFI exposure 3Q25 JPM NBFI exposure 4Q25 JPM NBFI exposure CALL REPORT RECONCILIATION ($B) Other Private equity Mortgage credit Consumer credit Business credit $332B (drawn / undrawn) $58 / $49 $50 / $32 $62 / $2 $28 / $15 $28 / $8 1 Lending to private equity funds not collateralized by debt assets (primarily subscription lending) Other asset managers investing in public securities Certain SPVs, incl. those with loans originated by banks Equity REITs, real property funds, insurance, broker dealers JPM DEFINITION OF NBFI EXPOSURE2 ($B) ~$50 ~$160 2018 2019 2020 2021 2022 2023 2024 2025 Lending / client types: ASSET CLASS DETAIL Auto ABCP conduits & non- recourse securitizations for originators & servicers Auto Lenders Residential mortgage warehouse facilities for originators, servicers & credit funds Mortgage Lenders & Investors Financing of leveraged loan assets for credit funds & BDCs, CLO warehousing & financing Leveraged Loan Investors Asset-backed securitizations for originators, incl. installment, BNPL, student loans & fleet leases Unsecured Consumer Lenders & Other Whole-loan repo facilities for GSEs, mREITS, credit funds & insurers CRE Debt Originators & Investors Collateral Diversified High % prime / first lien Some loans have daily MTM & margin call rights Other credit enhancement3 Asset approval rights MTM deleveraging features Bankruptcy automatic-stay protection -NCO rate - - - - - - 0.14% ~$160B 9

Agenda Page 1 4Q25 and FY25 Financial Results 1 2 Financial Outlook 10 3 Notes 13

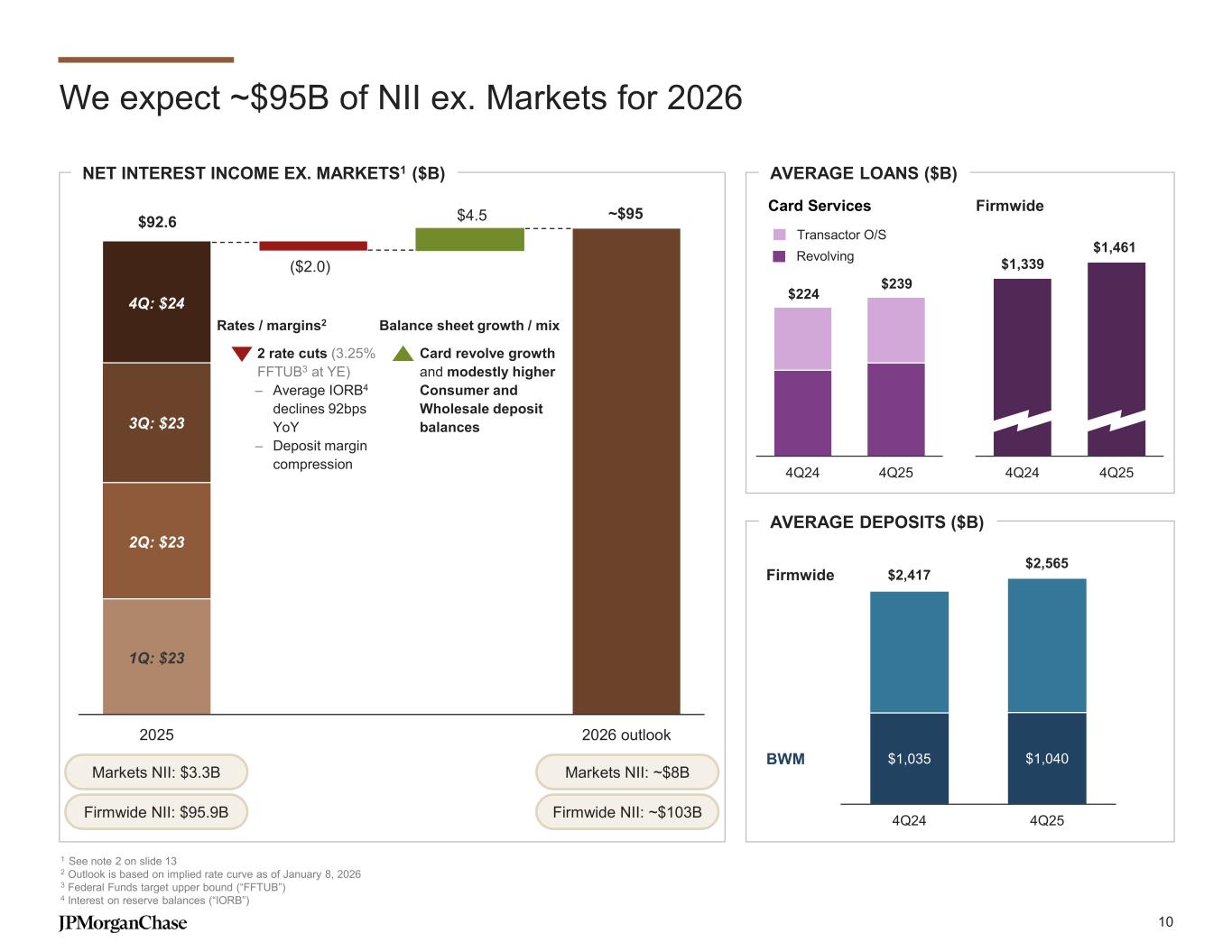

$224 $239 4Q24 4Q25 $91 ($2.0) $4.5 2025 2026 outlook We expect ~$95B of NII ex. Markets for 2026 1 See note 2 on slide 13 2 Outlook is based on implied rate curve as of January 8, 2026 3 Federal Funds target upper bound (“FFTUB”) 4 Interest on reserve balances (“IORB”) Rates / margins2 2 rate cuts (3.25% FFTUB3 at YE) – Average IORB4 declines 92bps YoY – Deposit margin compression 2Q: $23 3Q: $23 4Q: $24 $92.6 ~$95 Balance sheet growth / mix Card revolve growth and modestly higher Consumer and Wholesale deposit balances NET INTEREST INCOME EX. MARKETS1 ($B) 1Q: $23 Markets NII: $3.3B Firmwide NII: $95.9B Markets NII: ~$8B Firmwide NII: ~$103B AVERAGE LOANS ($B) Firmwide BWM FirmwideCard Services $1,339 $1,461 4Q24 4Q25 Revolving Transactor O/S AVERAGE DEPOSITS ($B) $1,035 $1,040 $2,417 $2,565 4Q24 4Q25 10

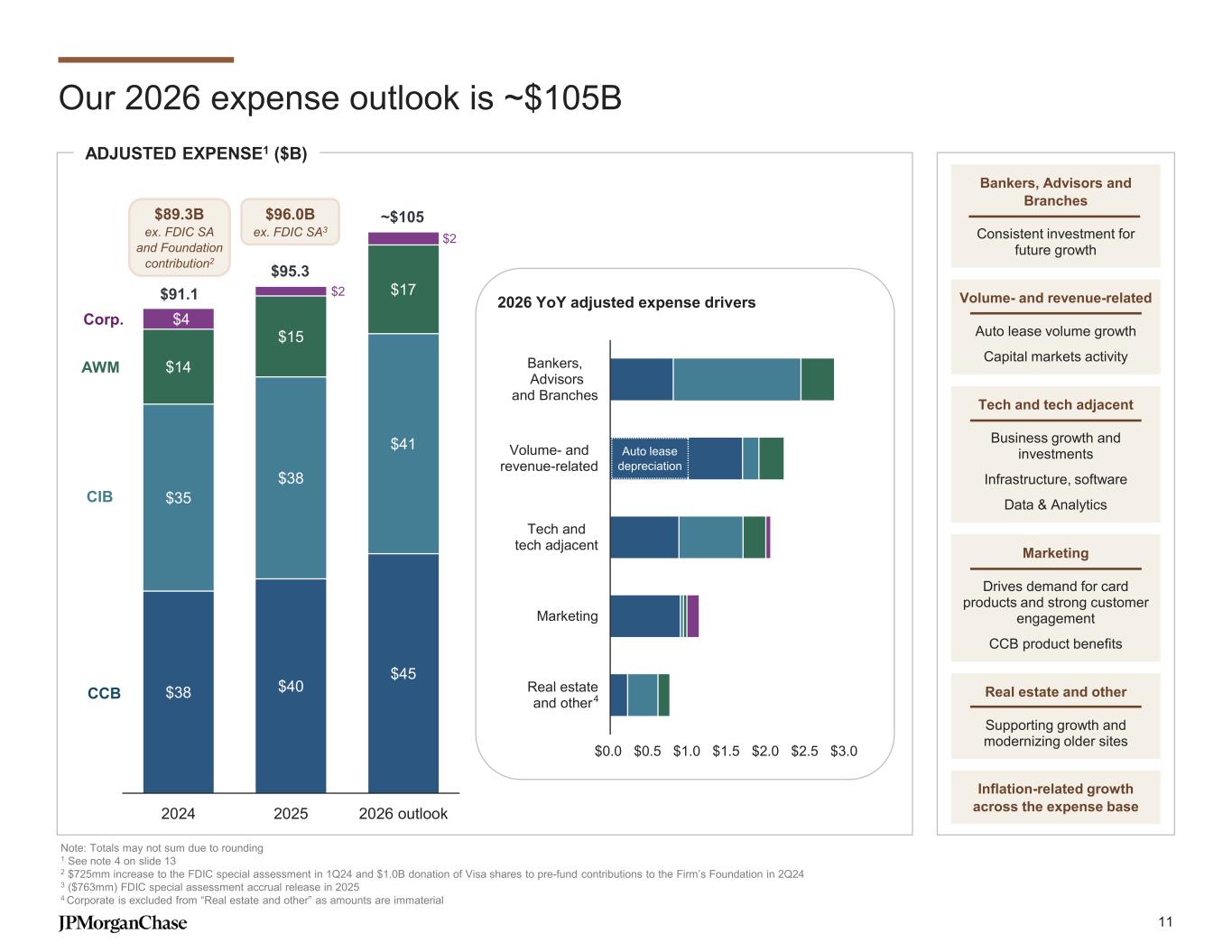

$38 $40 $45 $35 $38 $41 $14 $15 $17 $4 $2 $2 2024 2025 2026 outlook Our 2026 expense outlook is ~$105B CCB CIB AWM Corp. $95.3 Note: Totals may not sum due to rounding 1 See note 4 on slide 13 2 $725mm increase to the FDIC special assessment in 1Q24 and $1.0B donation of Visa shares to pre-fund contributions to the Firm’s Foundation in 2Q24 3 ($763mm) FDIC special assessment accrual release in 2025 4 Corporate is excluded from “Real estate and other” as amounts are immaterial ADJUSTED EXPENSE1 ($B) ~$105$96.0B ex. FDIC SA3 2026 YoY adjusted expense drivers Bankers, Advisors and Branches Consistent investment for future growth $91.1 $89.3B ex. FDIC SA and Foundation contribution2 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 Real estate and other Marketing Tech and tech adjacent Volume- and revenue-related Bankers, Advisors and Branches Auto lease depreciation Volume- and revenue-related Auto lease volume growth Capital markets activity Tech and tech adjacent Business growth and investments Infrastructure, software Data & Analytics Marketing Drives demand for card products and strong customer engagement CCB product benefits Real estate and other Supporting growth and modernizing older sites 4 Inflation-related growth across the expense base 11

Outlook1 1 See notes 1, 2 and 4 on slide 13 Expect FY2026 net interest income of ~$103B, market dependent Expect FY2026 net interest income excluding Markets of ~$95B, market dependent Expect FY2026 Card Services NCO rate of ~3.4%3 Expect FY2026 adjusted expense of ~$105B, market dependent – Adjusted expense excludes Firmwide legal expense2 1 12

Agenda Page 1 4Q25 and FY25 Financial Results 1 2 Financial Outlook 10 3 Notes 13

Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews Firmwide results, including the overhead ratio, on a “managed” basis; these Firmwide managed basis results are non-GAAP financial measures. The Firm also reviews the results of the lines of business on a managed basis. The Firm’s definition of managed basis starts, in each case, with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm as a whole and for each of the reportable business segments and Corporate on a fully taxable-equivalent basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable investments and securities. These financial measures allow management to assess the comparability of revenue from year-to-year arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by each of the lines of business and Corporate. For a reconciliation of the Firm’s results from a reported to managed basis, refer to page 7 of the Earnings Release Financial Supplement 2. In addition to reviewing net interest income (“NII”) and noninterest revenue (“NIR”) on a managed basis, management also reviews these metrics excluding Markets, which is composed of Fixed Income Markets and Equity Markets. Markets revenue consists of principal transactions, fees, commissions and other income, as well as net interest income. These metrics, which exclude Markets, are non-GAAP financial measures. Management reviews these metrics to assess the performance of the Firm’s lending, investing (including asset-liability management) and deposit-raising activities, apart from any volatility associated with Markets activities. In addition, management also assesses Markets business performance on a total revenue basis as offsets may occur across revenue lines. For example, securities that generate net interest income may be risk-managed by derivatives that are reflected at fair value in principal transactions revenue. Management believes these measures provide investors and analysts with alternative measures to analyze the revenue trends of the Firm. For a reconciliation of NII and NIR from reported to excluding Markets, refer to page 28 of the Earnings Release Financial Supplement. For additional information on Markets revenue, refer to pages 81-82 of the Firm’s 2024 Form 10-K 3. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”) are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than mortgage servicing rights), net of related deferred tax liabilities. For a reconciliation from common stockholders’ equity to TCE, refer to page 10 of the Earnings Release Financial Supplement. ROTCE measures the Firm’s net income applicable to common equity as a percentage of average TCE. TBVPS represents the Firm’s TCE at period-end divided by common shares at period-end. Book value per share was $126.99, $124.96 and $116.07 at December 31, 2025, September 30, 2025 and December 31, 2024, respectively. TCE, ROTCE and TBVPS are utilized by the Firm, as well as investors and analysts, in assessing the Firm’s use of equity 4. Adjusted expense and adjusted overhead ratio are each non-GAAP financial measures. Adjusted expense represents noninterest expense excluding Firmwide legal expense of $60mm, $62mm and $236mm for the three months ended December 31, 2025, September 30, 2025 and December 31, 2024, respectively; and $361mm and $740mm for the full year 2025 and 2024, respectively. The adjusted overhead ratio measures the Firm’s adjusted expense as a percentage of managed net revenue. Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm’s performance 5. Fourth-quarter 2025 net income, earnings per share and ROTCE excluding the $2.2B credit reserve established for the forward purchase commitment of the Apple credit card portfolio are non-GAAP financial measures. Excluding this item resulted in an increase of $1.7B (after tax) to each of reported Firmwide net income from $13.0B to $14.7B and reported CCB net income from $3.6B to $5.3B, an increase of $0.60 per share to reported EPS from $4.63 to $5.23 and an increase of 2ppts to reported ROTCE from 18% to 20%. Management believes these measures provide useful information to investors and analysts in assessing the Firm’s results 6. Full-year 2025 results included the impact of significant items. These items collectively refer to a $2.2B credit reserve established for the forward purchase commitment of the Apple credit card portfolio in the fourth quarter of 2025, as well as a $588mm First Republic-related gain and a $774mm income tax benefit in Corporate, both of which were previously disclosed in the first and second quarters of 2025, respectively. Full-year 2025 revenue, net income, earnings per share and ROTCE excluding significant items are non-GAAP financial measures. Excluding these items resulted in a decrease of $588mm to managed revenue from $185.6B to $185.0B, an increase of $445mm (after tax) to net income from $57.0B to $57.5B, an increase of $0.16 per share to reported EPS from $20.02 to $20.18 and no change to reported ROTCE of 20%. For additional information on managed basis reporting, refer to note 1 above. Management believes these measures provide useful information to investors and analysts in assessing the Firm’s results 13

Additional notes 1. As of January 1, 2025, the benefit from the Current Expected Credit Losses ("CECL") capital transition provision had been fully phased-out. As of December 31, 2024, CET1 capital and Total Loss-Absorbing Capacity reflected the remaining $720mm CECL benefit. Refer to Note 21 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2025 and Note 27 of the Firm’s 2024 Form 10-K for additional information 2. Total excess high-quality liquid assets (“HQLA”) represent the average eligible unencumbered liquid assets that are in excess of what is required to meet the estimated Firm and Bank total net cash outflows over a prospective 30 calendar-day period of significant stress under the LCR rule. HQLA and unencumbered marketable securities include end-of-period HQLA, excluding regulatory prescribed haircuts under the LCR rule where applicable, for both the Firm and the excess HQLA-eligible securities included as part of the excess liquidity at JPMorgan Chase Bank, N.A., which are not transferable to non-bank affiliates and thus excluded from the Firm’s LCR. Also include other end-of-period unencumbered marketable securities, such as equity and debt securities. Does not include borrowing capacity at Federal Home Loan Banks and the discount window at the Federal Reserve Bank. Refer to Liquidity Risk Management on pages 51-58 of the Firm’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2025 and pages 108-115 of the Firm’s 2024 Form 10-K for additional information 3. During the fourth quarter of 2024, the Firm made a change to its funds transfer pricing with respect to consumer deposits, resulting in an increase in the funding benefit reflected within CCB net interest income which is fully offset within Corporate net interest income. Refer to page 20 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2025 and page 71 of the Firm’s 2024 Form 10-K for additional information 14

Additional notes on slides 5-6 Slide 5 – Consumer & Community Banking 3. Actual numbers for all periods, not over/(under) 4. Users of all mobile platforms who have logged in within the past 90 days 5. Excludes Commercial Card 6. See note 5 on slide 13 7. Firmwide mortgage origination volume was $19.0B, $16.9B and $14.2B for the three months ended December 31, 2025, September 30, 2025 and December 31, 2024, respectively Slide 6 – Commercial & Investment Bank 2. Actual numbers for all periods, not over/(under) 3. On January 1, 2025, $5.6B of loans were realigned from Global Corporate Banking to Fixed Income Markets 4. Client deposits and other third-party liabilities (“client deposits”) pertain to the Payments and Securities Services businesses 5. Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate 6. Refer to page 78 of the Firm’s Annual Report on Form 10-K for the year ended December 31, 2024 for a description of each of the client coverage segments 7. In the second quarter of 2025, amounts were reclassified from Other to Global Corporate Banking & Global Investment Banking reflecting the subsequent alignment of certain business activities after the Firm’s Business Segment reorganization in the second quarter of 2024. Prior-period amounts have been revised to conform with the current presentation 8. In the second quarter of 2025, the Middle Market Banking client coverage segment was renamed Commercial & Specialized Industries 15

Additional notes on slide 9 1. The $332B includes $226B drawn and $106B undrawn commitments by category. The terms NBFI and NDFI (non-depository financial institutions) are used interchangeably in different contexts 2. Extension of credit that is directly collateralized by the debt asset held by the NBFI 3. Reflects features that are generally present across NBFI lending facilities 16

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2024 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (https://jpmorganchaseco.gcs-web.com/ir/sec-other- filings/overview), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update any forward-looking statements. 17