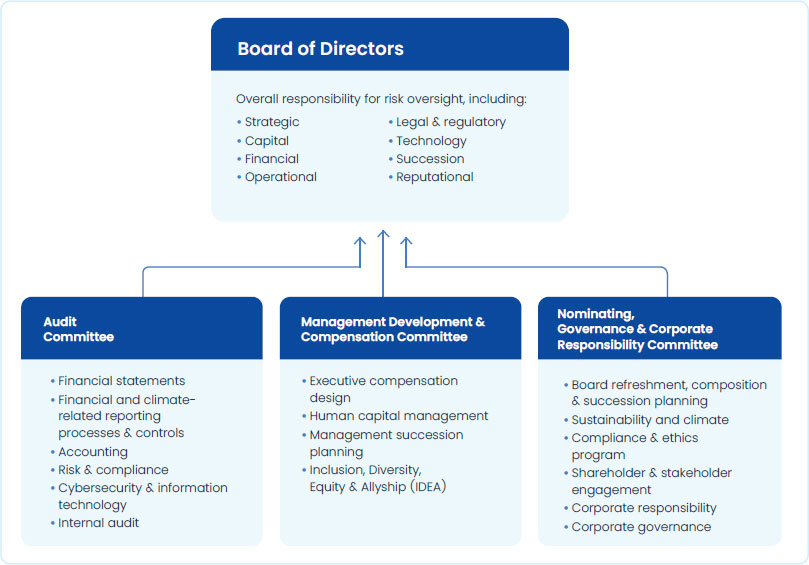

Oversight

of Key Risks

Cybersecurity

Risk Management and Preparedness

The

Company’s technology risk management team is led by our chief information and data officer and our chief information security

and infrastructure officer. Some key features of our cybersecurity risk management program:

•

Structure that leverages the National Institute of

Standards and Technology (NIST) Cybersecurity and Zero Trust Architecture frameworks for managing cybersecurity risks.

•

Maintenance of security policies and standards, regular

updates to response planning and protocols, and monitoring vulnerabilities, emerging threats and risks through industry information

sharing channels and new technology.

•

A cybersecurity response plan designed to facilitate

cross-functional coordination across the Company (including escalation based on severity of the impact of an incident), mitigate

brand and reputational damage, and comply with applicable legal obligations, which includes guidance to support the Company’s

assessment of whether an incident is considered “material” for purposes of U.S. securities laws.

•

Executive and information technology team tabletop

exercises.

•

A cybersecurity insurance program to reimburse, up

to policy limits, covered costs, losses and claims relating to a data or security breach.

•

Use of consultants, third-party service providers

and information security firms to provide technology systems or support aspects of this program, conduct assessments of the Company’s

cybersecurity practices and penetration testing, and cybersecurity, risk management and legal experts.

•

A third-party vendor risk management process that

utilizes a risk-based approach for vendors engaged through the Company’s procurement process.

•

Cybersecurity awareness training for all employees

who have access to company email and connected devices, periodic phishing awareness simulations, and cybersecurity and phishing

awareness content on the Company’s intranet site.

The

Board, through the Audit Committee, is responsible for oversight of the Company’s compliance with legal and regulatory requirements

relating to data privacy, cybersecurity and IT risks and its framework and guidelines with respect to risk assessment and risk

management. In order to fulfill its duties, the Audit Committee receives regular updates from our chief information security

and infrastructure officer, chief information and data officer, and chief legal and external affairs officer & corporate secretary

on these topics. The Board and Audit Committee include directors with knowledge, skills and experience in data security, privacy,

IT governance, and management of cyber risk.

Information

security and cybersecurity risks are also reviewed by the full Board as part of the Board’s oversight of enterprise risks.

The Board also engages in various activities to stay abreast of the evolving cyber landscape.

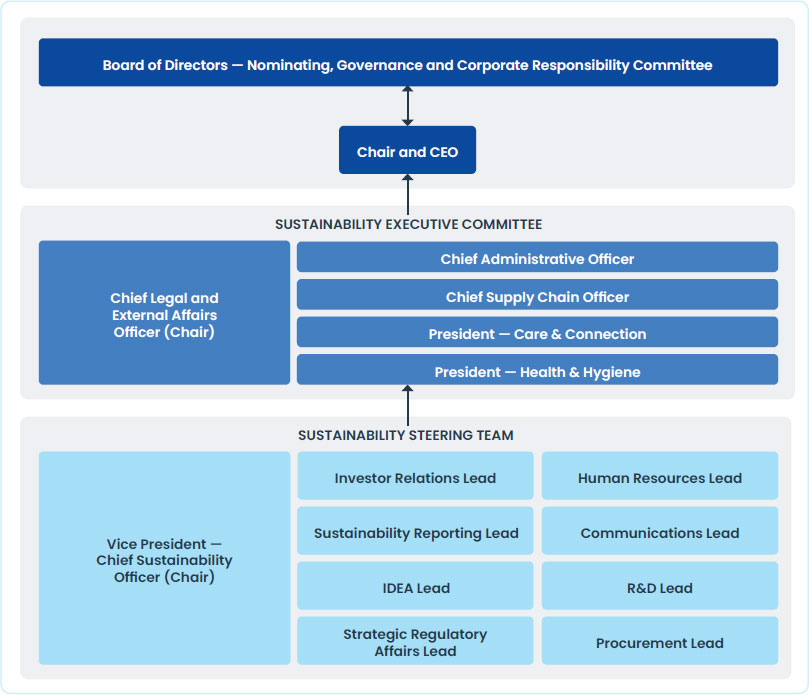

Sustainability

and Climate

The

Board actively oversees sustainability risks and issues, including climate change and environmental sustainability policies, programs,

goals and progress. See the Sustainability Governance section of this proxy statement for more information about Board

oversight of our sustainability matters and overall sustainability governance structure.

Human

Capital Management and Corporate Culture

To

aid its responsibility for oversight of the Company’s corporate culture, the Board receives information through a number

of channels, including:

•

Updates from the chief administrative officer and

the chief diversity and social impact officer on data and metrics from periodic pulse surveys and inclusion, diversity, equity

and allyship (IDEA) updates,

•

Our annual employee engagement survey which assesses

employee perception of the Company as a place to work as well as their views of leadership,

•

Engagements with employees such as site visits and

townhalls – for instance, this past fiscal year, Clorox hosted a global town hall with four of our Board members, including

the lead independent director and our newest directors, where employees were able to engage directly with our Board,

•

Curated Company and industry updates between Board

meetings, covering employee resource group activities, town halls, community events, employee features, financial coverage, and

Company-wide communications, and

•

Updates from the chief legal and external affairs

officer & corporate secretary on any significant compliance and hotline

matters, and discrimination and harassment complaints.

As

part of its oversight of the Company’s corporate culture, the Board also evaluates management’s ongoing efforts to

align corporate culture with the Company’s values and strategy.