Q4 FY 2025 Supplemental Slides

1Q4 FY25 Supplemental Slides October 16, 2025 This presentation contains forward-looking statements within the meaning of the federal securities laws with respect to the proposed acquisitions of Concrete Pipe & Precast ("CP&P") and Foley Products Company ("Foley") and the timing thereof, the ability to obtain regulatory approvals and meet other closing conditions for the proposed acquisitions, the expected benefits of the proposed acquisitions, general economic conditions, key macro-economic drivers that impact our business, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and growth provided by acquisitions and strategic investments, demand for our products, shipment volumes, metal margins, the ability to operate our steel mills at full capacity particularly during periods of domestic mill start-ups, future availability and cost of supplies of raw materials and energy for our operations, growth rates in certain reportable segments, product margins within our Emerging Businesses Group segment, share repurchases, legal proceedings, construction activity, international trade, the impact of geopolitical conditions, capital expenditures, tax credits, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, anticipated benefits and the timeline for execution of our growth plan and initiatives, including our TAG operational and commercial excellence program, and our expectations or beliefs concerning future events. The statements in this presentation that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “future,” “intends,” “may,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases, as well as by discussions of strategy, plans or intentions. Our forward-looking statements are based on management’s expectations and beliefs as of the date of this presentation. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, “Risk Factors” of our annual report on Form 10-K for the fiscal year ended August 31, 2024 and Part II, Item 1A, "Risk Factors" of our subsequent quarterly reports on Form 10-Q, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of downstream contracts within our vertically integrated steel operations due to rising commodity pricing; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of additional steelmaking capacity expected to come online from a number of electric arc furnace projects in the U.S.; the impact of geopolitical conditions, including political turmoil and volatility, regional conflicts, terrorism and war on the global economy, inflation, energy supplies and raw materials; increased attention to environmental, social and governance (“ESG”) matters, including any targets or other ESG, environmental justice or regulatory initiatives; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; impacts from global public health crises on the economy, demand for our products, global supply chain and on our operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non-compliance with their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our share repurchase program; financial and non-financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions and realize any or all of the anticipated synergies or other benefits of acquisitions; the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third-party consents and approvals; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; the impact of goodwill or other indefinite-lived intangible asset impairment charges; the impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; our ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; our ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks, including risks related to the unfavorable judgment against us in the Pacific Steel Group (“PSG”) litigation; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots. This presentation includes financial information that gives effect to the consummation of pending CP&P and Foley acquisitions. Pro forma and combined company financial information is presented for illustrative purposes only and is based on available information and certain assumptions and estimates that we believe are reasonable. The pro forma and combined company financial information may not necessarily reflect what our results of operations and financial position would have been had the transactions occurred during the periods discussed or what our results of operations and financial position will be in the future. Forward-Looking Statements

2Q4 FY25 Supplemental Slides October 16, 2025 Financial Information of CP&P and Foley; Pro Forma and Combined Company Measures This presentation contains unaudited financial information about CP&P and Foley, some of which reflects preliminary estimates and forecasts based on currently available information and management estimates. This presentation does not contain a comprehensive statement of CP&P’s or Foley’s respective actual financial results or position. Actual results may be different from this preliminary and/or forecasted information and any such changes may be material. Investors should not place undue reliance upon the preliminary estimates and forecasts. Estimates and forecasts are subject to risks and uncertainties, many of which are outside of management’s control. See “Forward-Looking Statements.” This presentation also includes pro forma and combined company forward-looking financial information that gives effect to the consummation of the acquisitions of CP&P and Foley (together, the “Acquisitions”). Pro forma and combined company forward-looking financial information included herein is presented for illustrative purposes only and is based upon available information that is preliminary in nature, as well as certain assumptions and estimates that we believe are reasonable. This pro forma and combined company forward-looking financial information may not necessarily reflect what our results of operations and financial position would have been had the Acquisitions occurred during the periods presented herein or what our results of operations and financial position will be in the future. The pro forma financial information presented herein has not been prepared and presented in accordance with the requirements of Regulation S-X. The assumptions and estimates underlying the combined company forward-looking financial information are inherently uncertain and are subject to a variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information, including the risks and uncertainties described under “Forward-Looking Statements” above. The Company’s auditors have not audited, reviewed, compiled or performed any procedures with respect to the accompanying financial information. Acquisition Risks Although certain information included in this presentation generally assumes consummation of the Acquisitions and we expect that the Acquisitions will result in benefits to the Company, we may be unable to consummate the Acquisitions on a timely basis or at all, and if the Acquisitions are consummated, we may not realize the anticipated benefits because of integration difficulties, increased debt and other challenges. The success of the Acquisitions will depend, in large part, on CMC’s ability to realize the anticipated benefits from the Acquisitions.

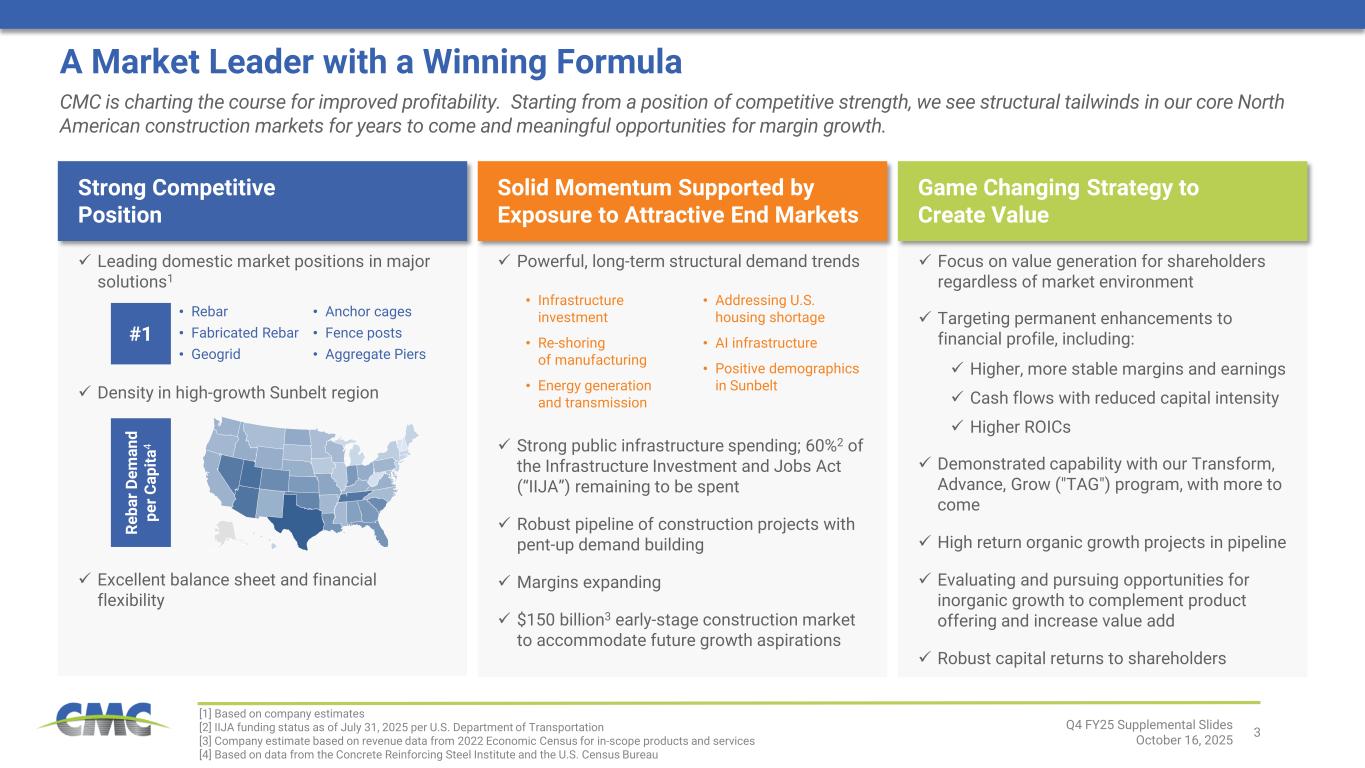

3 © GeoNames, Microsoft, TomTom Powered by Bing A Market Leader with a Winning Formula CMC is charting the course for improved profitability. Starting from a position of competitive strength, we see structural tailwinds in our core North American construction markets for years to come and meaningful opportunities for margin growth. Strong Competitive Position Solid Momentum Supported by Exposure to Attractive End Markets Game Changing Strategy to Create Value Leading domestic market positions in major solutions1 Density in high-growth Sunbelt region Excellent balance sheet and financial flexibility #1 • Rebar • Fabricated Rebar • Geogrid • Anchor cages • Fence posts • Aggregate Piers Re ba r D em an d pe r C ap ita 4 Powerful, long-term structural demand trends Strong public infrastructure spending; 60%2 of the Infrastructure Investment and Jobs Act (“IIJA”) remaining to be spent Robust pipeline of construction projects with pent-up demand building Margins expanding $150 billion3 early-stage construction market to accommodate future growth aspirations • Infrastructure investment • Re-shoring of manufacturing • Energy generation and transmission • Addressing U.S. housing shortage • AI infrastructure • Positive demographics in Sunbelt Focus on value generation for shareholders regardless of market environment Targeting permanent enhancements to financial profile, including: Higher, more stable margins and earnings Cash flows with reduced capital intensity Higher ROICs Q4 FY25 Supplemental Slides October 16, 2025 Demonstrated capability with our Transform, Advance, Grow ("TAG") program, with more to come High return organic growth projects in pipeline Evaluating and pursuing opportunities for inorganic growth to complement product offering and increase value add Robust capital returns to shareholders [1] Based on company estimates [2] IIJA funding status as of July 31, 2025 per U.S. Department of Transportation [3] Company estimate based on revenue data from 2022 Economic Census for in-scope products and services [4] Based on data from the Concrete Reinforcing Steel Institute and the U.S. Census Bureau

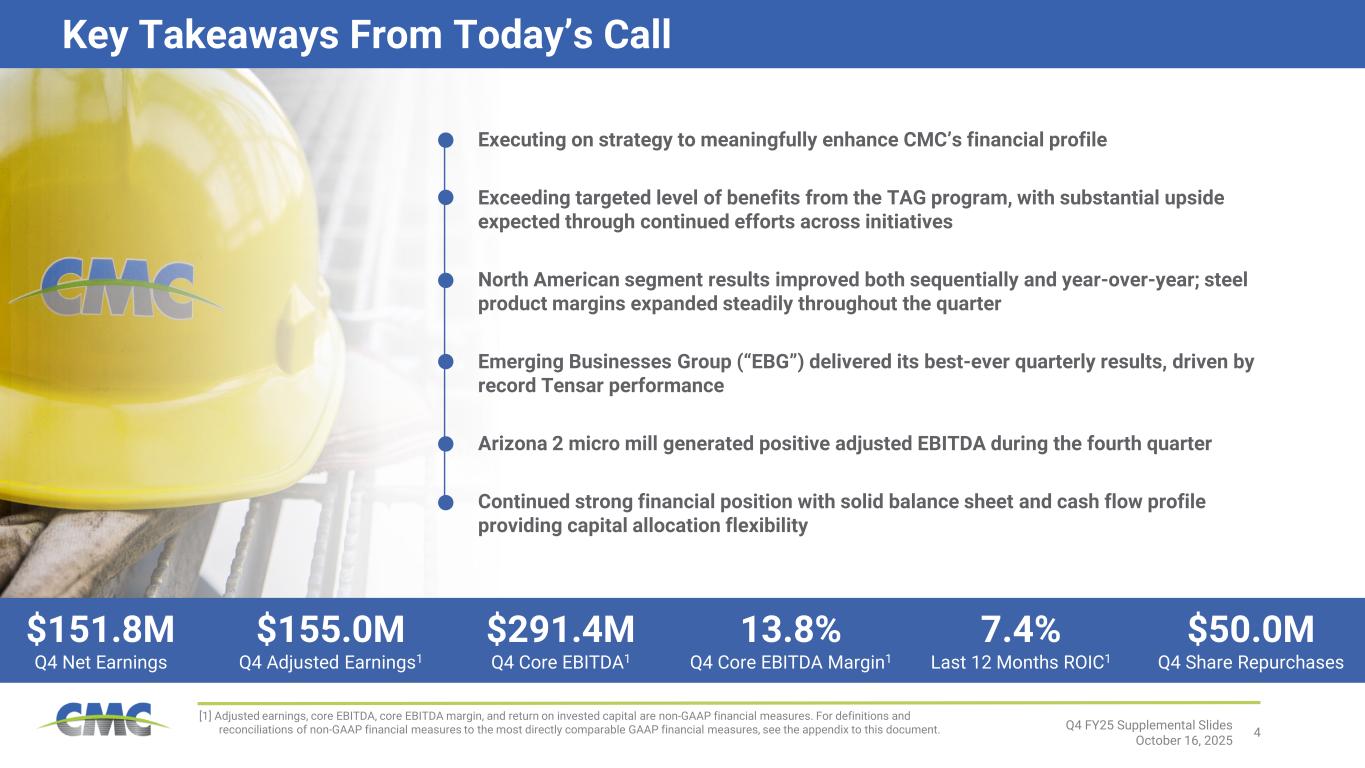

4Q4 FY25 Supplemental Slides October 16, 2025 [1] Adjusted earnings, core EBITDA, core EBITDA margin, and return on invested capital are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Executing on strategy to meaningfully enhance CMC’s financial profile Exceeding targeted level of benefits from the TAG program, with substantial upside expected through continued efforts across initiatives North American segment results improved both sequentially and year-over-year; steel product margins expanded steadily throughout the quarter Emerging Businesses Group (“EBG”) delivered its best-ever quarterly results, driven by record Tensar performance Arizona 2 micro mill generated positive adjusted EBITDA during the fourth quarter Continued strong financial position with solid balance sheet and cash flow profile providing capital allocation flexibility $151.8M Q4 Net Earnings $155.0M Q4 Adjusted Earnings1 $291.4M Q4 Core EBITDA1 13.8% Q4 Core EBITDA Margin1 7.4% Last 12 Months ROIC1 $50.0M Q4 Share Repurchases Key Takeaways From Today’s Call

5 Running and Growing a Great Business Q4 FY25 Supplemental Slides October 16, 2025 We are aiming for a new level of performance by getting more out of our existing business while investing in value enhancing capabilities Investing in Our People & Pursuing Excellence Value Accretive Organic Growth Capability Enhancing Inorganic Growth 1 2 3 Focus on the safety of our people and building a world-class team Execute operational and commercial excellence (TAG program) initiatives that drive improvement across the enterprise Achieve sustainably higher, less volatile, through-the-cycle margins Commission our newest micro mill project to complete our flexible operating network Invest in automation and process efficiency solutions, including supporting operational and commercial excellence efforts Invest to support growth in high margin proprietary solutions (e.g., geogrids and proprietary reinforcing steels) Open sizeable new growth lanes in $150 billion1 early-stage construction market Broaden CMC’s portfolio, improve value proposition, and strengthen existing business through expansion of early-stage construction solutions [1] Company estimate based on revenue data from 2022 Economic Census for in-scope products and services

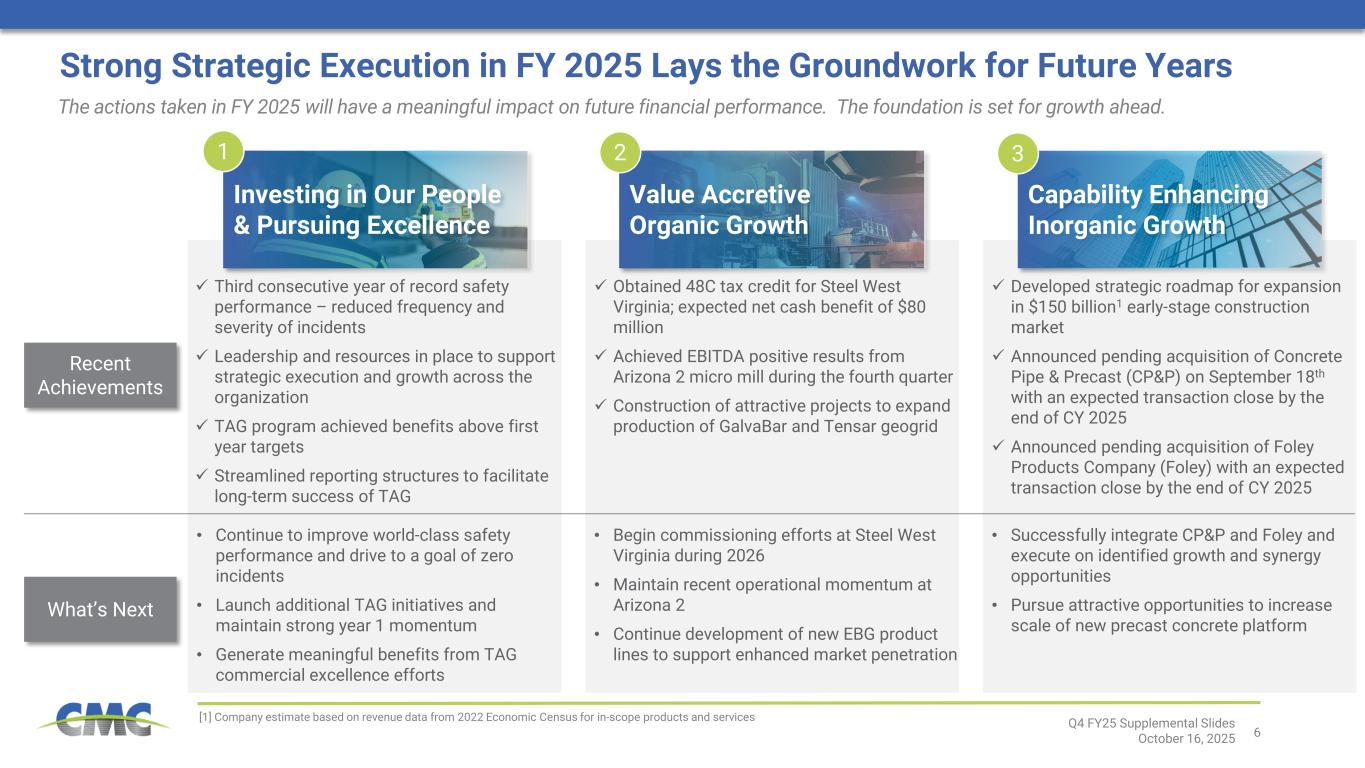

6 Strong Strategic Execution in FY 2025 Lays the Groundwork for Future Years Q4 FY25 Supplemental Slides October 16, 2025 The actions taken in FY 2025 will have a meaningful impact on future financial performance. The foundation is set for growth ahead. Investing in Our People & Pursuing Excellence 1 Value Accretive Organic Growth 2 Capability Enhancing Inorganic Growth 3 [1] Company estimate based on revenue data from 2022 Economic Census for in-scope products and services Third consecutive year of record safety performance – reduced frequency and severity of incidents Leadership and resources in place to support strategic execution and growth across the organization TAG program achieved benefits above first year targets Streamlined reporting structures to facilitate long-term success of TAG • Continue to improve world-class safety performance and drive to a goal of zero incidents • Launch additional TAG initiatives and maintain strong year 1 momentum • Generate meaningful benefits from TAG commercial excellence efforts Obtained 48C tax credit for Steel West Virginia; expected net cash benefit of $80 million Achieved EBITDA positive results from Arizona 2 micro mill during the fourth quarter Construction of attractive projects to expand production of GalvaBar and Tensar geogrid • Begin commissioning efforts at Steel West Virginia during 2026 • Maintain recent operational momentum at Arizona 2 • Continue development of new EBG product lines to support enhanced market penetration Developed strategic roadmap for expansion in $150 billion1 early-stage construction market Announced pending acquisition of Concrete Pipe & Precast (CP&P) on September 18th with an expected transaction close by the end of CY 2025 Announced pending acquisition of Foley Products Company (Foley) with an expected transaction close by the end of CY 2025 • Successfully integrate CP&P and Foley and execute on identified growth and synergy opportunities • Pursue attractive opportunities to increase scale of new precast concrete platform Recent Achievements What’s Next

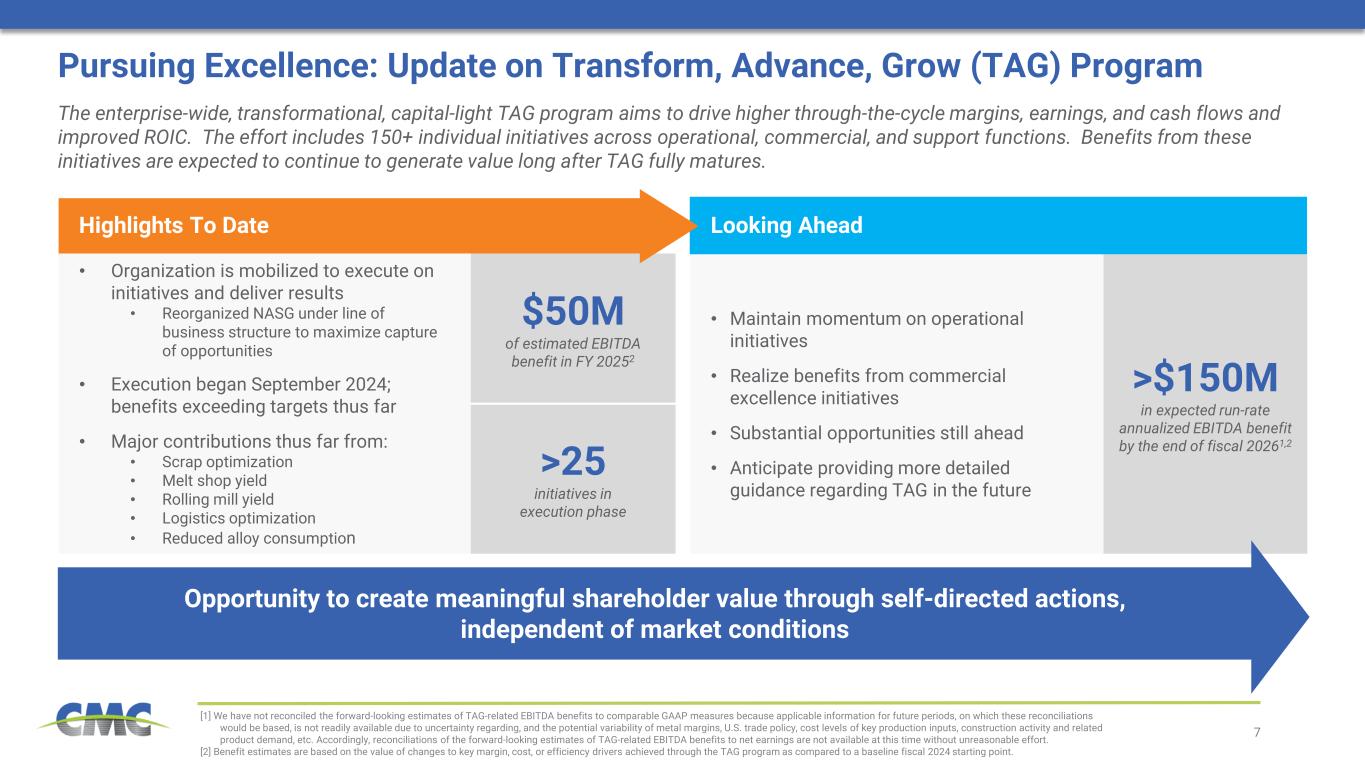

7 Pursuing Excellence: Update on Transform, Advance, Grow (TAG) Program The enterprise-wide, transformational, capital-light TAG program aims to drive higher through-the-cycle margins, earnings, and cash flows and improved ROIC. The effort includes 150+ individual initiatives across operational, commercial, and support functions. Benefits from these initiatives are expected to continue to generate value long after TAG fully matures. Opportunity to create meaningful shareholder value through self-directed actions, independent of market conditions Looking AheadHighlights To Date • Organization is mobilized to execute on initiatives and deliver results • Reorganized NASG under line of business structure to maximize capture of opportunities • Execution began September 2024; benefits exceeding targets thus far • Major contributions thus far from: • Scrap optimization • Melt shop yield • Rolling mill yield • Logistics optimization • Reduced alloy consumption $50M of estimated EBITDA benefit in FY 20252 >25 initiatives in execution phase • Maintain momentum on operational initiatives • Realize benefits from commercial excellence initiatives • Substantial opportunities still ahead • Anticipate providing more detailed guidance regarding TAG in the future >$150M in expected run-rate annualized EBITDA benefit by the end of fiscal 20261,2 [1] We have not reconciled the forward-looking estimates of TAG-related EBITDA benefits to comparable GAAP measures because applicable information for future periods, on which these reconciliations would be based, is not readily available due to uncertainty regarding, and the potential variability of metal margins, U.S. trade policy, cost levels of key production inputs, construction activity and related product demand, etc. Accordingly, reconciliations of the forward-looking estimates of TAG-related EBITDA benefits to net earnings are not available at this time without unreasonable effort. [2] Benefit estimates are based on the value of changes to key margin, cost, or efficiency drivers achieved through the TAG program as compared to a baseline fiscal 2024 starting point.

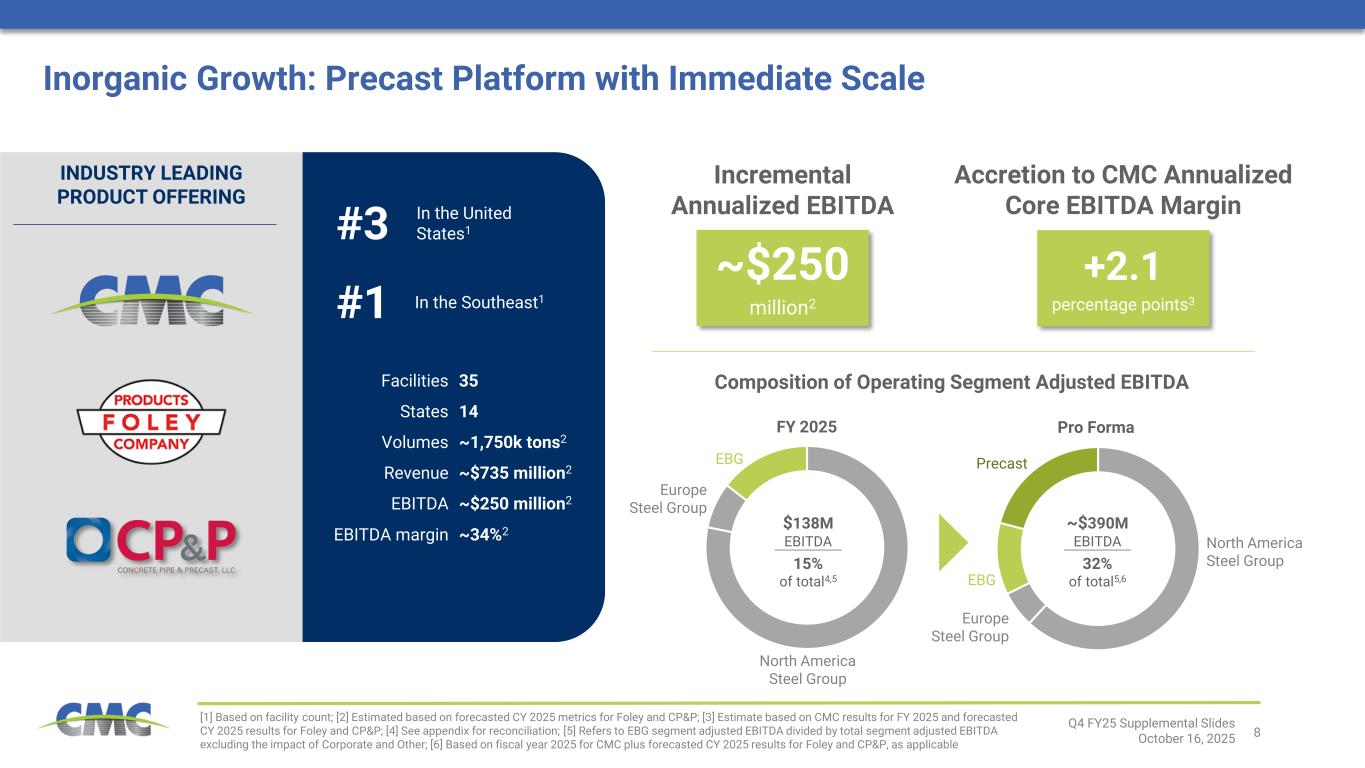

8 Inorganic Growth: Precast Platform with Immediate Scale Facilities 35 States 14 Volumes ~1,750k tons2 Revenue ~$735 million2 EBITDA ~$250 million2 EBITDA margin ~34%2 In the United States1 In the Southeast1 #3 #1 INDUSTRY LEADING PRODUCT OFFERING Incremental Annualized EBITDA ~$250 million2 Composition of Operating Segment Adjusted EBITDA Accretion to CMC Annualized Core EBITDA Margin +2.1 percentage points3 Q4 FY25 Supplemental Slides October 16, 2025 EBG EBG Precast $138M EBITDA 15% of total4,5 ~$390M EBITDA 32% of total5,6 FY 2025 Pro Forma Europe Steel Group North America Steel Group Europe Steel Group North America Steel Group [1] Based on facility count; [2] Estimated based on forecasted CY 2025 metrics for Foley and CP&P; [3] Estimate based on CMC results for FY 2025 and forecasted CY 2025 results for Foley and CP&P; [4] See appendix for reconciliation; [5] Refers to EBG segment adjusted EBITDA divided by total segment adjusted EBITDA excluding the impact of Corporate and Other; [6] Based on fiscal year 2025 for CMC plus forecasted CY 2025 results for Foley and CP&P, as applicable

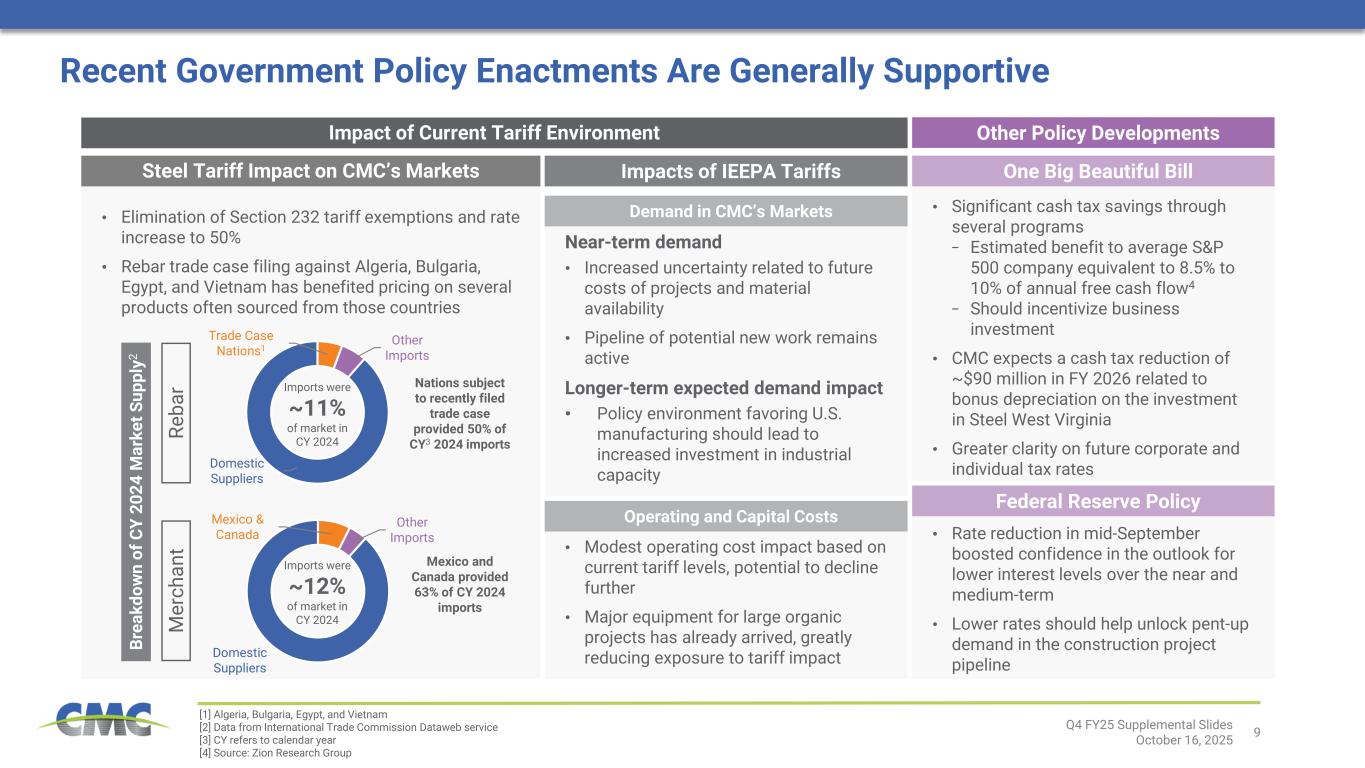

9 • Rate reduction in mid-September boosted confidence in the outlook for lower interest levels over the near and medium-term • Lower rates should help unlock pent-up demand in the construction project pipeline • Significant cash tax savings through several programs − Estimated benefit to average S&P 500 company equivalent to 8.5% to 10% of annual free cash flow4 − Should incentivize business investment • CMC expects a cash tax reduction of ~$90 million in FY 2026 related to bonus depreciation on the investment in Steel West Virginia • Greater clarity on future corporate and individual tax rates • Modest operating cost impact based on current tariff levels, potential to decline further • Major equipment for large organic projects has already arrived, greatly reducing exposure to tariff impact Near-term demand • Increased uncertainty related to future costs of projects and material availability • Pipeline of potential new work remains active Longer-term expected demand impact • Policy environment favoring U.S. manufacturing should lead to increased investment in industrial capacity Demand in CMC’s Markets• Elimination of Section 232 tariff exemptions and rate increase to 50% • Rebar trade case filing against Algeria, Bulgaria, Egypt, and Vietnam has benefited pricing on several products often sourced from those countries Mexico & Canada Other Imports Domestic Suppliers Trade Case Nations1 Other Imports Domestic Suppliers Recent Government Policy Enactments Are Generally Supportive Steel Tariff Impact on CMC’s Markets Impacts of IEEPA Tariffs Br ea kd ow n of C Y 20 24 M ar ke t S up pl y2 Re ba r M er ch an t Q4 FY25 Supplemental Slides October 16, 2025 Nations subject to recently filed trade case provided 50% of CY3 2024 imports Imports were ~11% of market in CY 2024 Imports were ~12% of market in CY 2024 Mexico and Canada provided 63% of CY 2024 imports [1] Algeria, Bulgaria, Egypt, and Vietnam [2] Data from International Trade Commission Dataweb service [3] CY refers to calendar year [4] Source: Zion Research Group Operating and Capital Costs Impact of Current Tariff Environment Other Policy Developments One Big Beautiful Bill Federal Reserve Policy

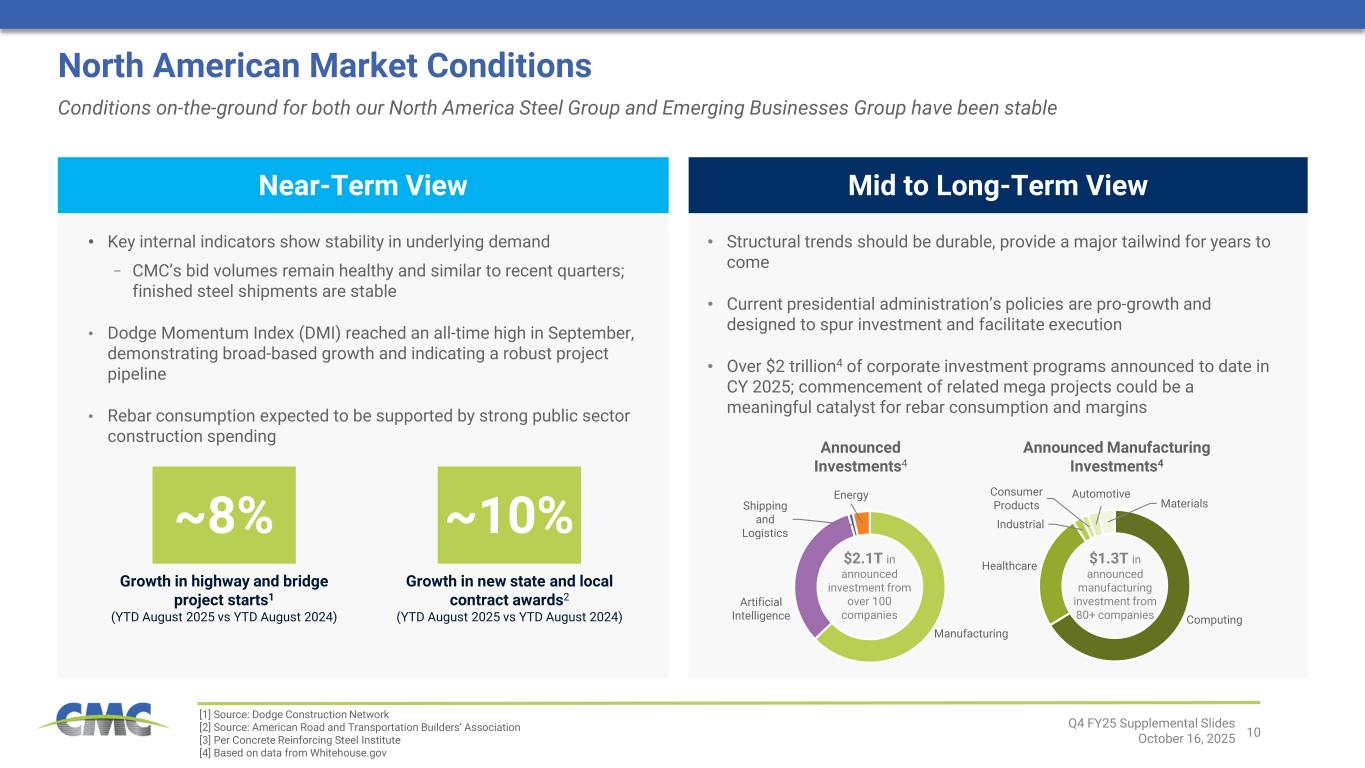

10 Computing Healthcare Industrial Consumer Products Automotive Materials Manufacturing Artificial Intelligence Shipping and Logistics Energy North American Market Conditions Q4 FY25 Supplemental Slides October 16, 2025 [1] Source: Dodge Construction Network [2] Source: American Road and Transportation Builders’ Association [3] Per Concrete Reinforcing Steel Institute [4] Based on data from Whitehouse.gov Conditions on-the-ground for both our North America Steel Group and Emerging Businesses Group have been stable Near-Term View Mid to Long-Term View • Key internal indicators show stability in underlying demand − CMC’s bid volumes remain healthy and similar to recent quarters; finished steel shipments are stable • Dodge Momentum Index (DMI) reached an all-time high in September, demonstrating broad-based growth and indicating a robust project pipeline • Rebar consumption expected to be supported by strong public sector construction spending Growth in highway and bridge project starts1 (YTD August 2025 vs YTD August 2024) • Structural trends should be durable, provide a major tailwind for years to come • Current presidential administration’s policies are pro-growth and designed to spur investment and facilitate execution • Over $2 trillion4 of corporate investment programs announced to date in CY 2025; commencement of related mega projects could be a meaningful catalyst for rebar consumption and margins $2.1T in announced investment from over 100 companies Announced Investments4 Announced Manufacturing Investments4 $1.3T in announced manufacturing investment from 80+ companies ~8% Growth in new state and local contract awards2 (YTD August 2025 vs YTD August 2024) ~10%

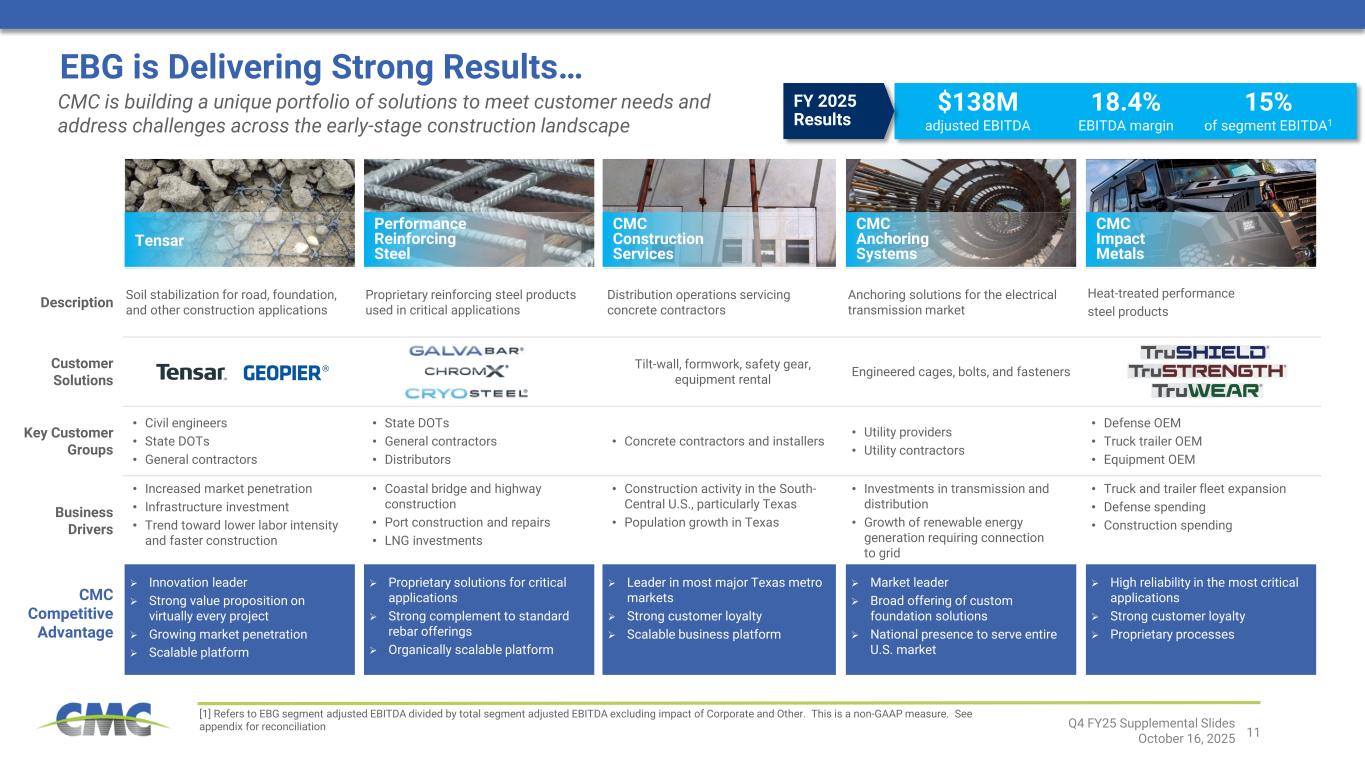

11 EBG is Delivering Strong Results… Q4 FY25 Supplemental Slides October 16, 2025 $138M adjusted EBITDA 18.4% EBITDA margin 15% of segment EBITDA1 CMC Construction Services Tensar CMC Impact Metals CMC Anchoring Systems Performance Reinforcing Steel Description Soil stabilization for road, foundation, and other construction applications Proprietary reinforcing steel products used in critical applications Distribution operations servicing concrete contractors Anchoring solutions for the electrical transmission market Heat-treated performance steel products Customer Solutions Tilt-wall, formwork, safety gear, equipment rental Engineered cages, bolts, and fasteners Key Customer Groups • Civil engineers • State DOTs • General contractors • State DOTs • General contractors • Distributors • Concrete contractors and installers • Utility providers • Utility contractors • Defense OEM • Truck trailer OEM • Equipment OEM Business Drivers • Increased market penetration • Infrastructure investment • Trend toward lower labor intensity and faster construction • Coastal bridge and highway construction • Port construction and repairs • LNG investments • Construction activity in the South- Central U.S., particularly Texas • Population growth in Texas • Investments in transmission and distribution • Growth of renewable energy generation requiring connection to grid • Truck and trailer fleet expansion • Defense spending • Construction spending CMC Competitive Advantage Innovation leader Strong value proposition on virtually every project Growing market penetration Scalable platform Leader in most major Texas metro markets Strong customer loyalty Scalable business platform Proprietary solutions for critical applications Strong complement to standard rebar offerings Organically scalable platform High reliability in the most critical applications Strong customer loyalty Proprietary processes Market leader Broad offering of custom foundation solutions National presence to serve entire U.S. market FY 2025 Results CMC is building a unique portfolio of solutions to meet customer needs and address challenges across the early-stage construction landscape [1] Refers to EBG segment adjusted EBITDA divided by total segment adjusted EBITDA excluding impact of Corporate and Other. This is a non-GAAP measure. See appendix for reconciliation

12 Q4 FY25 Supplemental Slides October 16, 2025 Demand Factors Recent Market Developments • Increased inflows of EU funds − Funding amount equal to roughly 3.5% of Polish GDP − Expected to support highway, rail, and energy investment programs • Major projects entering market, including nuclear power generation and national transportation projects • Polish economic growth accelerated in CY 2025 and should maintain momentum in CY 2026 • German proposal to enact €500 billion stimulus package to fund infrastructure and defense investment Supply Factors • Trade policy adjustments proposed by the European Commission would reduce tariff-free import quotas by nearly 50%. Import volumes above the quota would be subject to 50% tariffs. Once approved, the new policy would take effect in July 2026 • Some regional capacity temporarily idled Green Shoots Continue to Emerge for Our Europe Steel Group Market conditions have improved modestly in recent quarters. Emerging green shoots point to further strengthening ahead.

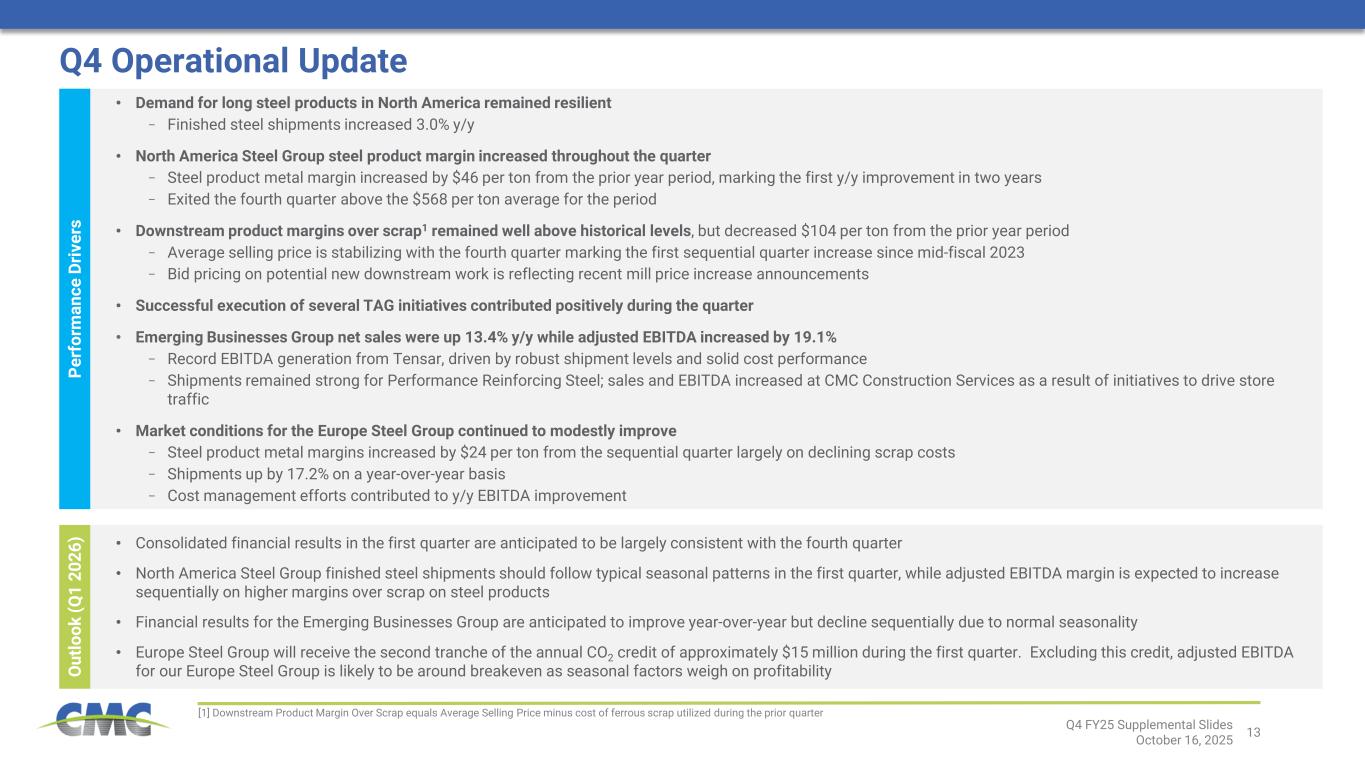

13 • Consolidated financial results in the first quarter are anticipated to be largely consistent with the fourth quarter • North America Steel Group finished steel shipments should follow typical seasonal patterns in the first quarter, while adjusted EBITDA margin is expected to increase sequentially on higher margins over scrap on steel products • Financial results for the Emerging Businesses Group are anticipated to improve year-over-year but decline sequentially due to normal seasonality • Europe Steel Group will receive the second tranche of the annual CO2 credit of approximately $15 million during the first quarter. Excluding this credit, adjusted EBITDA for our Europe Steel Group is likely to be around breakeven as seasonal factors weigh on profitability • Demand for long steel products in North America remained resilient − Finished steel shipments increased 3.0% y/y • North America Steel Group steel product margin increased throughout the quarter − Steel product metal margin increased by $46 per ton from the prior year period, marking the first y/y improvement in two years − Exited the fourth quarter above the $568 per ton average for the period • Downstream product margins over scrap1 remained well above historical levels, but decreased $104 per ton from the prior year period − Average selling price is stabilizing with the fourth quarter marking the first sequential quarter increase since mid-fiscal 2023 − Bid pricing on potential new downstream work is reflecting recent mill price increase announcements • Successful execution of several TAG initiatives contributed positively during the quarter • Emerging Businesses Group net sales were up 13.4% y/y while adjusted EBITDA increased by 19.1% − Record EBITDA generation from Tensar, driven by robust shipment levels and solid cost performance − Shipments remained strong for Performance Reinforcing Steel; sales and EBITDA increased at CMC Construction Services as a result of initiatives to drive store traffic • Market conditions for the Europe Steel Group continued to modestly improve − Steel product metal margins increased by $24 per ton from the sequential quarter largely on declining scrap costs − Shipments up by 17.2% on a year-over-year basis − Cost management efforts contributed to y/y EBITDA improvement Pe rf or m an ce D riv er s O ut lo ok (Q 1 20 26 ) Q4 Operational Update [1] Downstream Product Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized during the prior quarter Q4 FY25 Supplemental Slides October 16, 2025

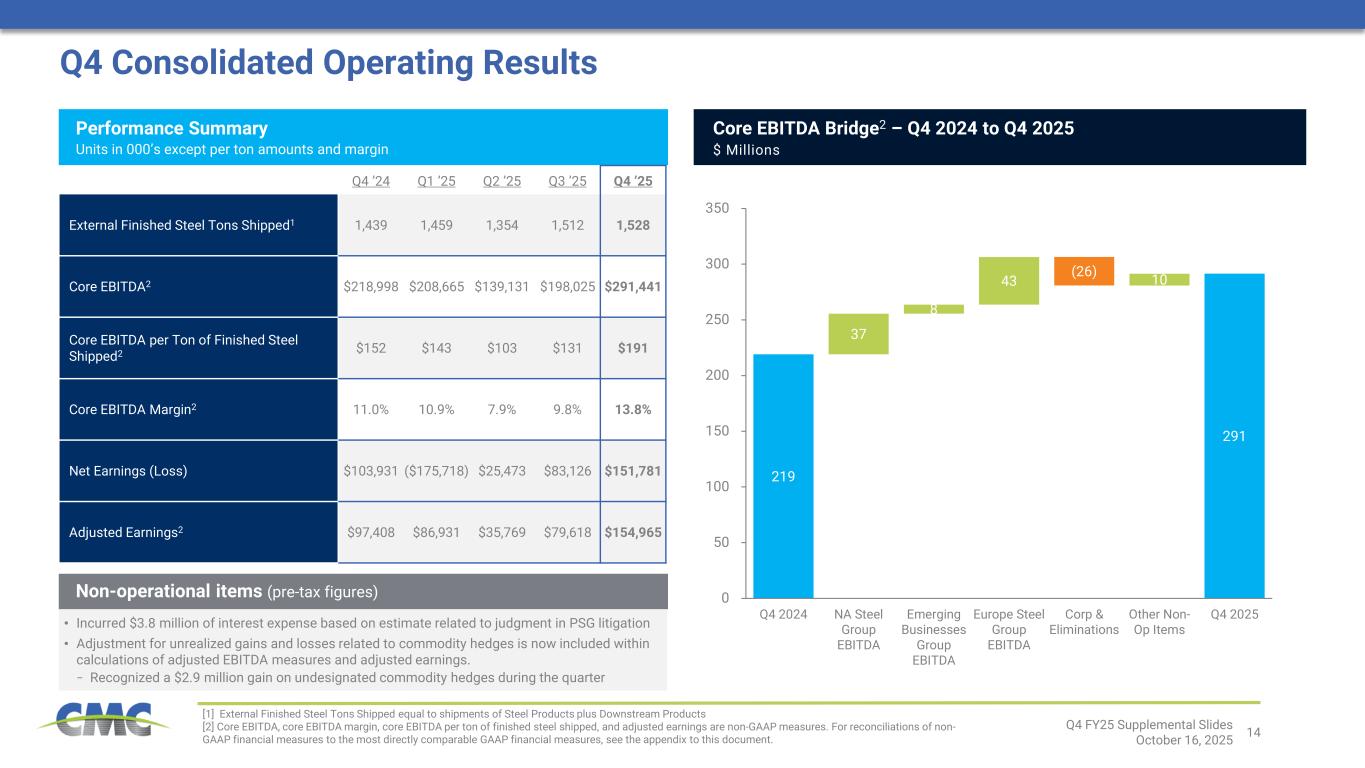

14 219 291 37 8 43 (26) 10 0 50 100 150 200 250 300 350 Q4 2024 NA Steel Group EBITDA Emerging Businesses Group EBITDA Europe Steel Group EBITDA Corp & Eliminations Other Non- Op Items Q4 2025 Q4 Consolidated Operating Results Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 Q4 ’25 External Finished Steel Tons Shipped1 1,439 1,459 1,354 1,512 1,528 Core EBITDA2 $218,998 $208,665 $139,131 $198,025 $291,441 Core EBITDA per Ton of Finished Steel Shipped2 $152 $143 $103 $131 $191 Core EBITDA Margin2 11.0% 10.9% 7.9% 9.8% 13.8% Net Earnings (Loss) $103,931 ($175,718) $25,473 $83,126 $151,781 Adjusted Earnings2 $97,408 $86,931 $35,769 $79,618 $154,965 Performance Summary Units in 000’s except per ton amounts and margin • Incurred $3.8 million of interest expense based on estimate related to judgment in PSG litigation • Adjustment for unrealized gains and losses related to commodity hedges is now included within calculations of adjusted EBITDA measures and adjusted earnings. − Recognized a $2.9 million gain on undesignated commodity hedges during the quarter Non-operational items (pre-tax figures) [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Core EBITDA, core EBITDA margin, core EBITDA per ton of finished steel shipped, and adjusted earnings are non-GAAP measures. For reconciliations of non- GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Core EBITDA Bridge2 – Q4 2024 to Q4 2025 $ Millions Q4 FY25 Supplemental Slides October 16, 2025

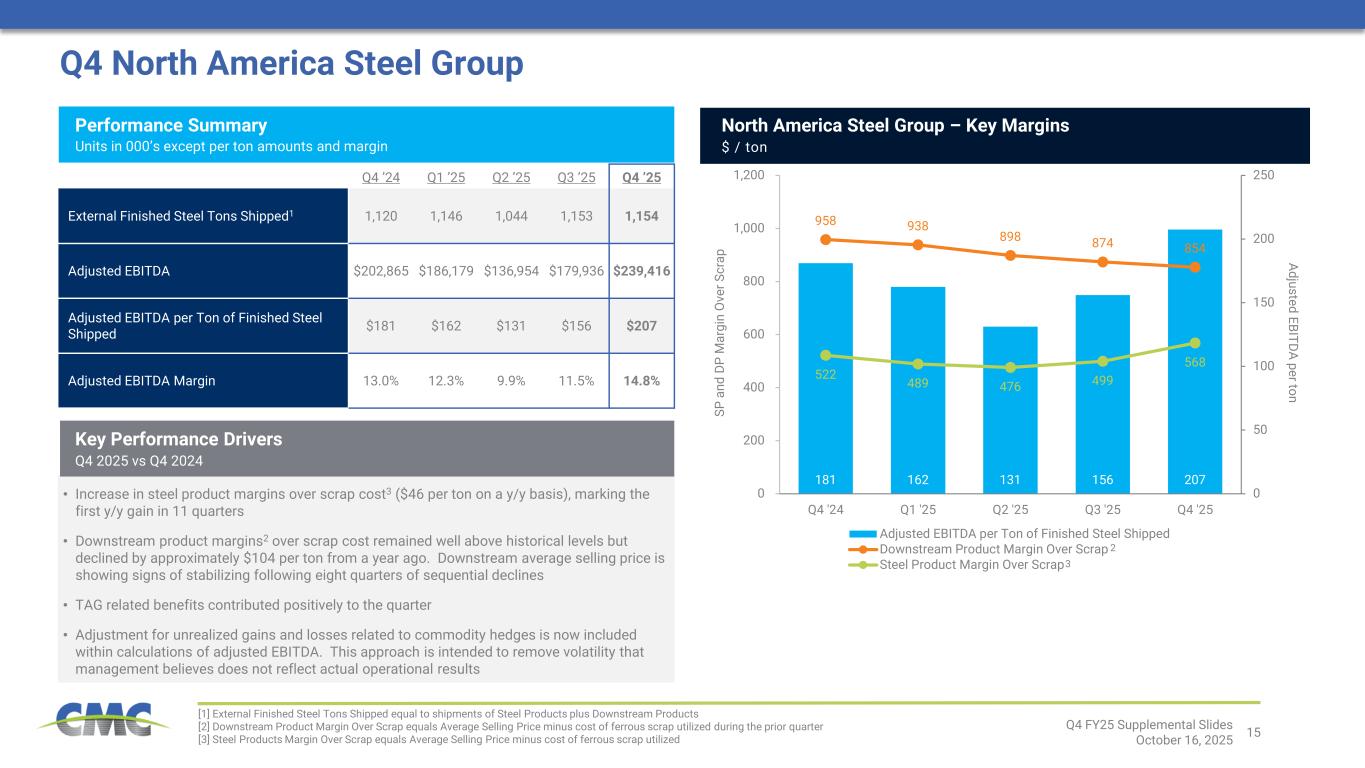

15 181 162 131 156 207 958 938 898 874 854 522 489 476 499 568 0 50 100 150 200 250 0 200 400 600 800 1,000 1,200 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Adjusted EBITDA per Ton of Finished Steel Shipped Downstream Product Margin Over Scrap Steel Product Margin Over Scrap Q4 North America Steel Group Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 Q4 ’25 External Finished Steel Tons Shipped1 1,120 1,146 1,044 1,153 1,154 Adjusted EBITDA $202,865 $186,179 $136,954 $179,936 $239,416 Adjusted EBITDA per Ton of Finished Steel Shipped $181 $162 $131 $156 $207 Adjusted EBITDA Margin 13.0% 12.3% 9.9% 11.5% 14.8% Performance Summary Units in 000’s except per ton amounts and margin • Increase in steel product margins over scrap cost3 ($46 per ton on a y/y basis), marking the first y/y gain in 11 quarters • Downstream product margins2 over scrap cost remained well above historical levels but declined by approximately $104 per ton from a year ago. Downstream average selling price is showing signs of stabilizing following eight quarters of sequential declines • TAG related benefits contributed positively to the quarter • Adjustment for unrealized gains and losses related to commodity hedges is now included within calculations of adjusted EBITDA. This approach is intended to remove volatility that management believes does not reflect actual operational results [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Downstream Product Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized during the prior quarter [3] Steel Products Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized Q4 FY25 Supplemental Slides October 16, 2025 North America Steel Group – Key Margins $ / ton SP a nd D P M ar gi n O ve r S cr ap Adjusted EBITDA per ton 2 3 Key Performance Drivers Q4 2025 vs Q4 2024

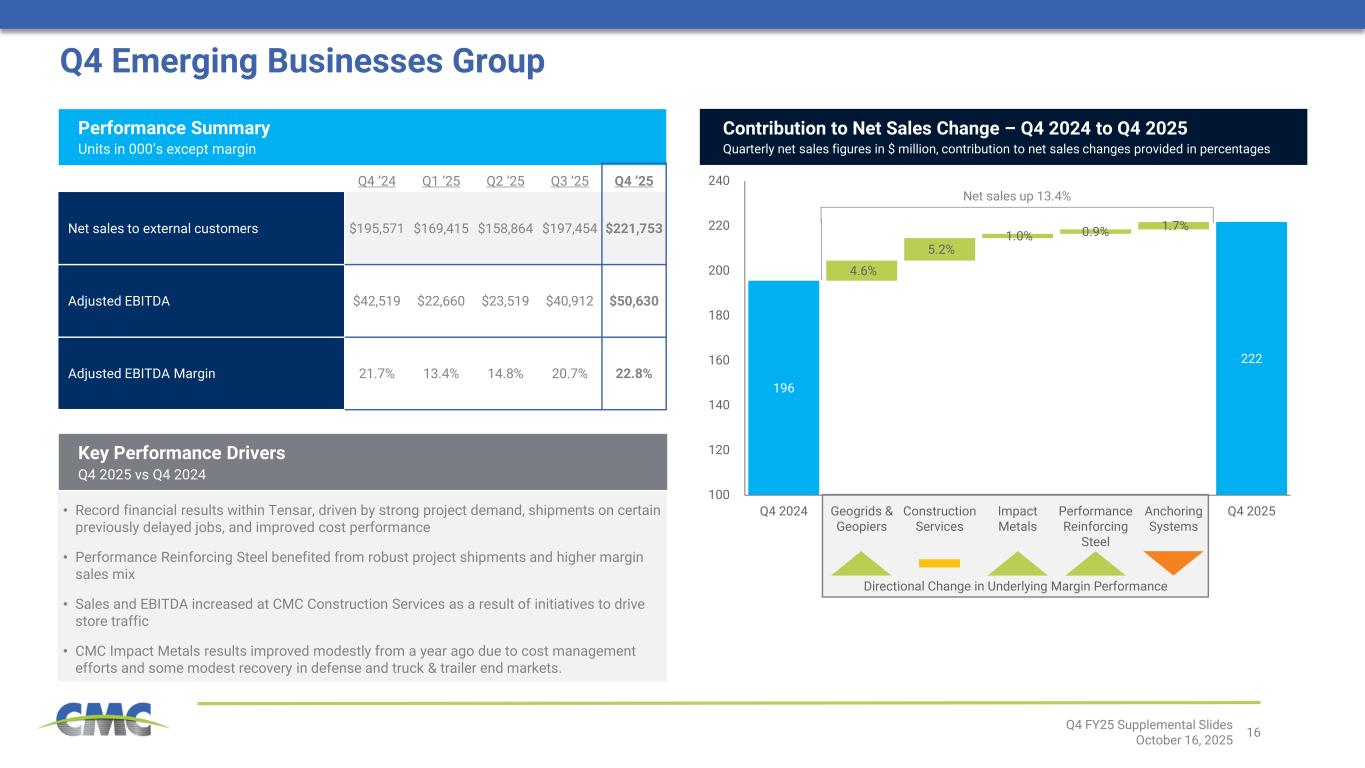

16 196 222 4.6% 5.2% 1.0% 0.9% 1.7% 100 120 140 160 180 200 220 240 Q4 2024 Geogrids & Geopiers Construction Services Impact Metals Performance Reinforcing Steel Anchoring Systems Q4 2025 Key Performance Drivers Q4 2025 vs Q4 2024 Q4 Emerging Businesses Group Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 Q4 ’25 Net sales to external customers $195,571 $169,415 $158,864 $197,454 $221,753 Adjusted EBITDA $42,519 $22,660 $23,519 $40,912 $50,630 Adjusted EBITDA Margin 21.7% 13.4% 14.8% 20.7% 22.8% Performance Summary Units in 000’s except margin • Record financial results within Tensar, driven by strong project demand, shipments on certain previously delayed jobs, and improved cost performance • Performance Reinforcing Steel benefited from robust project shipments and higher margin sales mix • Sales and EBITDA increased at CMC Construction Services as a result of initiatives to drive store traffic • CMC Impact Metals results improved modestly from a year ago due to cost management efforts and some modest recovery in defense and truck & trailer end markets. Contribution to Net Sales Change – Q4 2024 to Q4 2025 Quarterly net sales figures in $ million, contribution to net sales changes provided in percentages Q4 FY25 Supplemental Slides October 16, 2025 Net sales up 13.4% Directional Change in Underlying Margin Performance

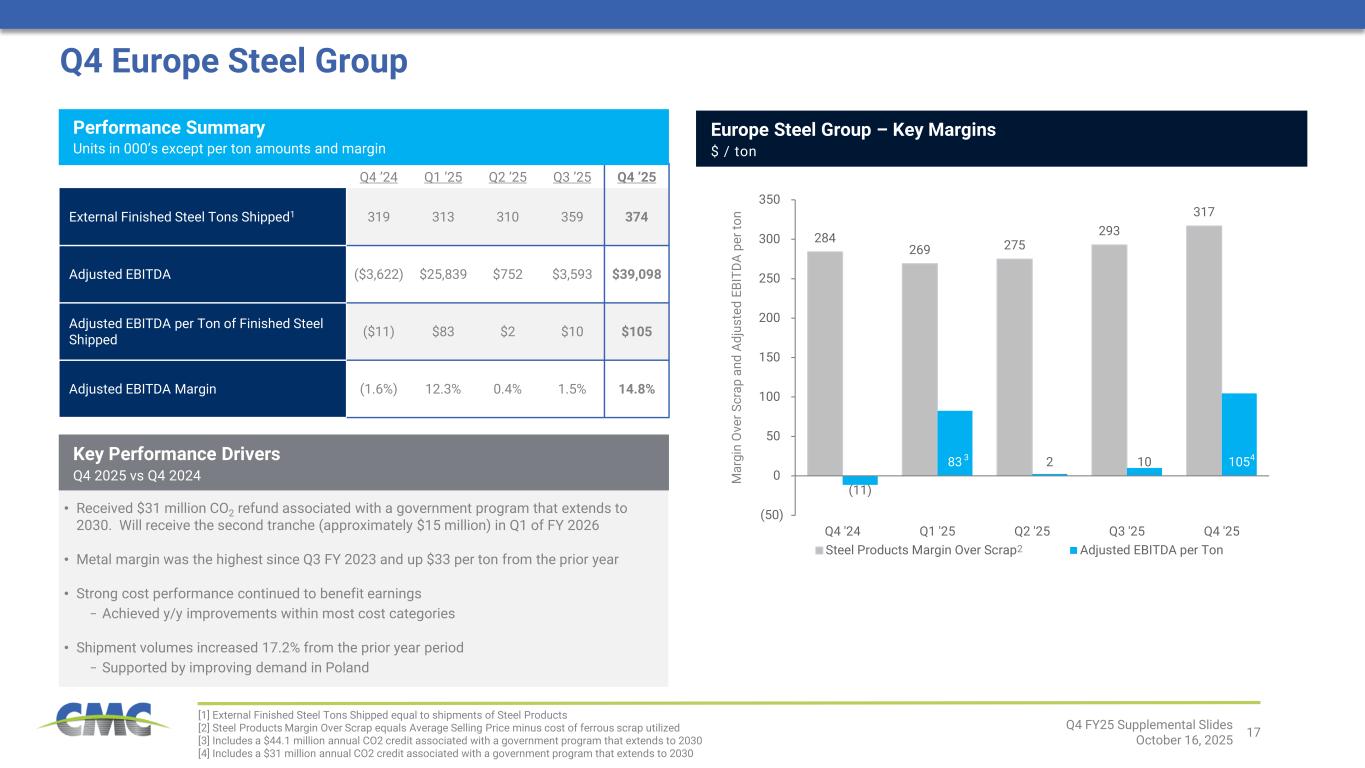

17 284 269 275 293 317 (11) 83 2 10 105 (50) 0 50 100 150 200 250 300 350 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Steel Products Margin Over Scrap Adjusted EBITDA per Ton Q4 Europe Steel Group Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 Q4 ’25 External Finished Steel Tons Shipped1 319 313 310 359 374 Adjusted EBITDA ($3,622) $25,839 $752 $3,593 $39,098 Adjusted EBITDA per Ton of Finished Steel Shipped ($11) $83 $2 $10 $105 Adjusted EBITDA Margin (1.6%) 12.3% 0.4% 1.5% 14.8% • Received $31 million CO2 refund associated with a government program that extends to 2030. Will receive the second tranche (approximately $15 million) in Q1 of FY 2026 • Metal margin was the highest since Q3 FY 2023 and up $33 per ton from the prior year • Strong cost performance continued to benefit earnings − Achieved y/y improvements within most cost categories • Shipment volumes increased 17.2% from the prior year period − Supported by improving demand in Poland [1] External Finished Steel Tons Shipped equal to shipments of Steel Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized [3] Includes a $44.1 million annual CO2 credit associated with a government program that extends to 2030 [4] Includes a $31 million annual CO2 credit associated with a government program that extends to 2030 2 M ar gi n O ve r S cr ap a nd A dj us te d EB IT DA p er to n Q4 FY25 Supplemental Slides October 16, 2025 Performance Summary Units in 000’s except per ton amounts and margin Key Performance Drivers Q4 2025 vs Q4 2024 Europe Steel Group – Key Margins $ / ton 3 4

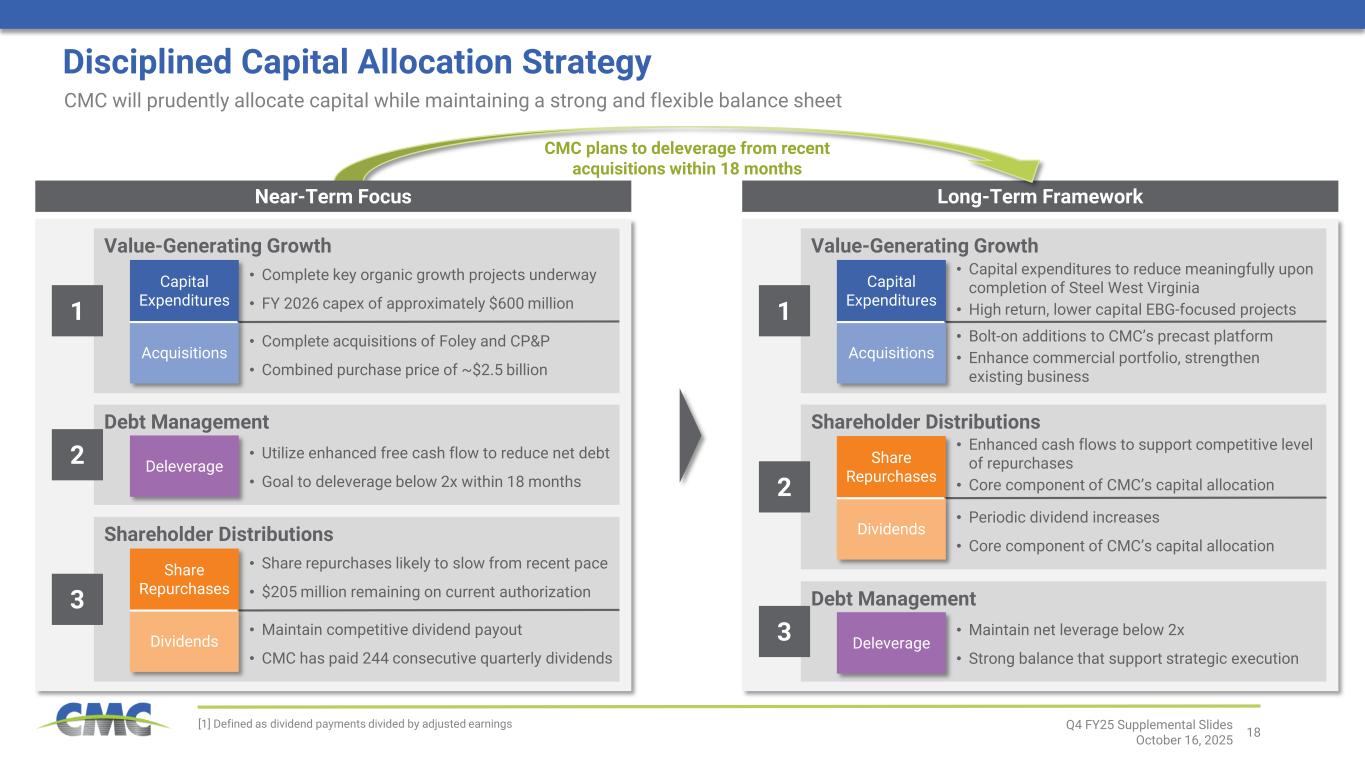

18 Long-Term Framework Debt Management Value-Generating Growth Disciplined Capital Allocation Strategy CMC will prudently allocate capital while maintaining a strong and flexible balance sheet Q4 FY25 Supplemental Slides October 16, 2025 [1] Defined as dividend payments divided by adjusted earnings Deleverage 1 2 • Complete key organic growth projects underway • FY 2026 capex of approximately $600 million Capital Expenditures Acquisitions • Complete acquisitions of Foley and CP&P • Combined purchase price of ~$2.5 billion • Utilize enhanced free cash flow to reduce net debt • Goal to deleverage below 2x within 18 months Shareholder Distributions 3 • Share repurchases likely to slow from recent pace • $205 million remaining on current authorization Share Repurchases Dividends • Maintain competitive dividend payout • CMC has paid 244 consecutive quarterly dividends Value-Generating Growth 1 • Capital expenditures to reduce meaningfully upon completion of Steel West Virginia • High return, lower capital EBG-focused projects Capital Expenditures Acquisitions • Bolt-on additions to CMC’s precast platform • Enhance commercial portfolio, strengthen existing business Debt Management Deleverage3 • Maintain net leverage below 2x • Strong balance that support strategic execution Shareholder Distributions 2 • Enhanced cash flows to support competitive level of repurchases • Core component of CMC’s capital allocation Share Repurchases Dividends • Periodic dividend increases • Core component of CMC’s capital allocation Near-Term Focus CMC plans to deleverage from recent acquisitions within 18 months

© CMC Appendix

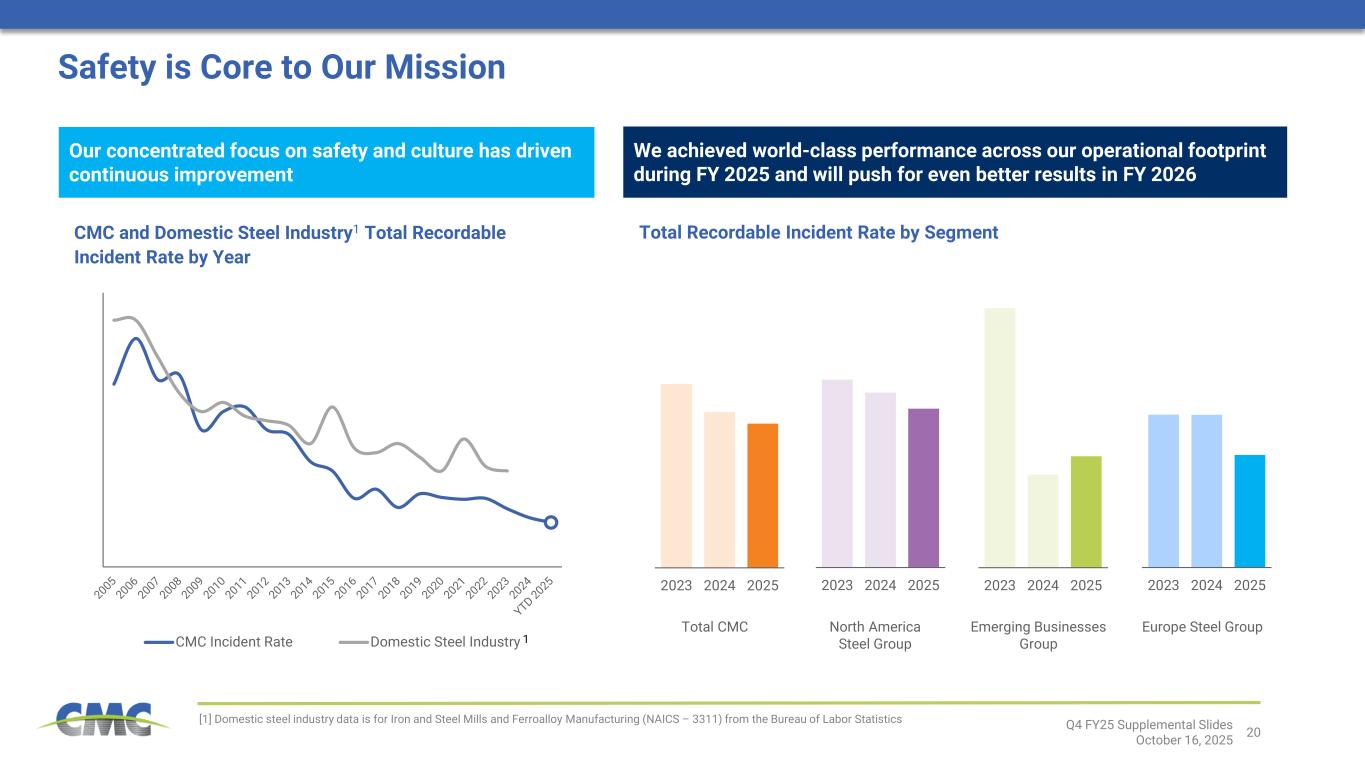

20 2023 2024 20252023 2024 20252023 2024 2025 CMC Incident Rate Domestic Steel Industry 1 Safety is Core to Our Mission [1] Domestic steel industry data is for Iron and Steel Mills and Ferroalloy Manufacturing (NAICS – 3311) from the Bureau of Labor Statistics CMC and Domestic Steel Industry1 Total Recordable Incident Rate by Year Total CMC North America Steel Group Europe Steel Group Total Recordable Incident Rate by Segment Q4 FY25 Supplemental Slides October 16, 2025 Our concentrated focus on safety and culture has driven continuous improvement We achieved world-class performance across our operational footprint during FY 2025 and will push for even better results in FY 2026 2023 2024 2025 Emerging Businesses Group

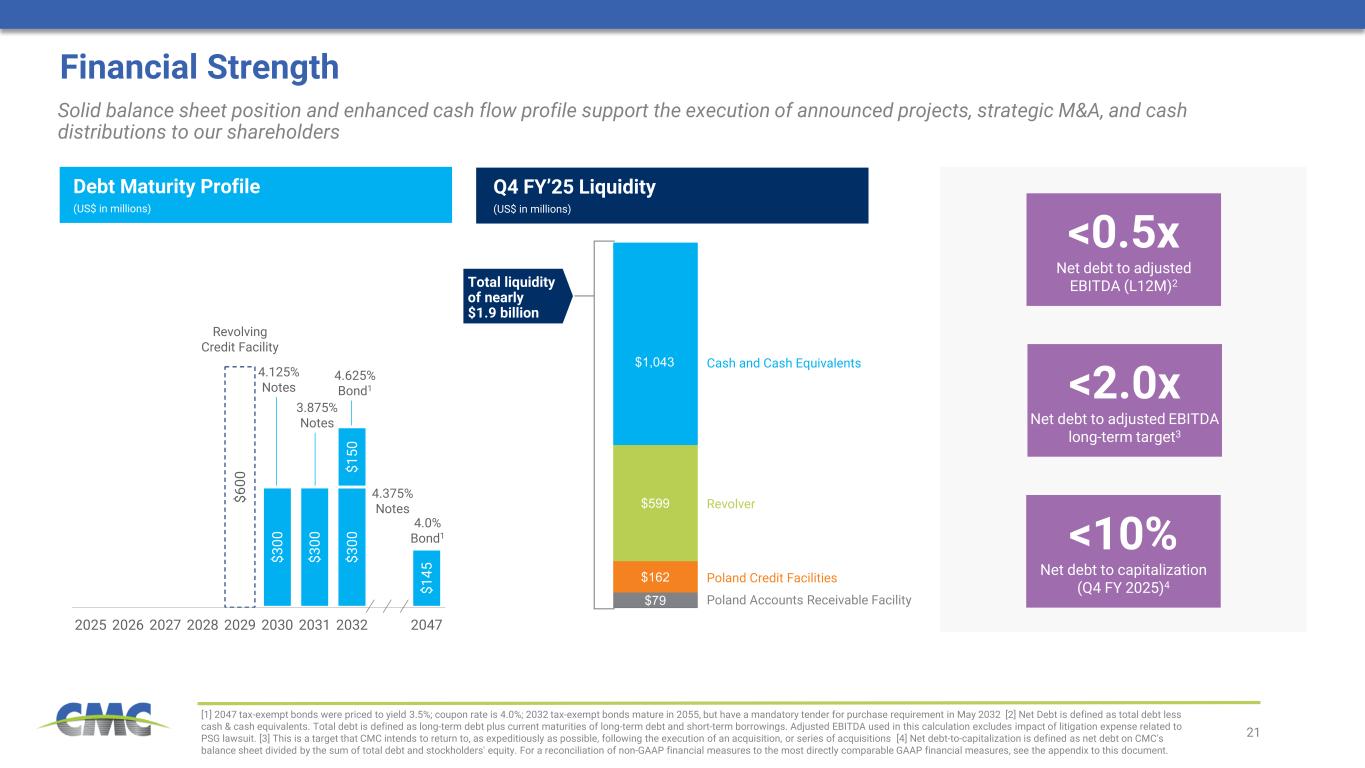

21 $79 $162 $599 $1,043 $3 00 $3 00 $3 00 $1 45 $6 00 $1 50 2025 2026 2027 2028 2029 2030 2031 2032 2047 Financial Strength [1] 2047 tax-exempt bonds were priced to yield 3.5%; coupon rate is 4.0%; 2032 tax-exempt bonds mature in 2055, but have a mandatory tender for purchase requirement in May 2032 [2] Net Debt is defined as total debt less cash & cash equivalents. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings. Adjusted EBITDA used in this calculation excludes impact of litigation expense related to PSG lawsuit. [3] This is a target that CMC intends to return to, as expeditiously as possible, following the execution of an acquisition, or series of acquisitions [4] Net debt-to-capitalization is defined as net debt on CMC's balance sheet divided by the sum of total debt and stockholders' equity. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Revolver Poland Credit Facilities (US$ in millions) Revolving Credit Facility 4.125% Notes Cash and Cash Equivalents 3.875% Notes Solid balance sheet position and enhanced cash flow profile support the execution of announced projects, strategic M&A, and cash distributions to our shareholders Debt Maturity Profile Q4 FY’25 Liquidity (US$ in millions) 4.375% Notes 4.0% Bond1 Poland Accounts Receivable Facility <0.5x Net debt to adjusted EBITDA (L12M)2 <2.0x Net debt to adjusted EBITDA long-term target3 <10% Net debt to capitalization (Q4 FY 2025)4 Total liquidity of nearly $1.9 billion 4.625% Bond1

22Q4 FY25 Supplemental Slides │ October 16, 2025 Note: GHG emissions statistics for CMC include only steel mill operations, which represents over 95% of CMC’s emissions footprint Sources: CMC 2024 Sustainability Report; virgin material content for industry based on data from Bureau of International Recycling; all other industry data sourced from the World Steel Association Clear Sustainability Leader CMC plays a key role in the circular steel economy, turning end of life metals into the steel that forms the backbone of modern society Scopes 1&2 Greenhouse Gas Emissions (GHG) Intensity ACCOUNTABILITY FOR OUR ACTIONS RESPECT FOR OUR ENVIRONMENT ACTING WITH INTEGRITY2.2 1.8 1.0 0.42 Integrated Average Global Average U.S. Average CMCtC O 2e p er M T of s te el 1.18 28.60 CMCGlobal Industry 3.76 21.27 CMCGlobal Industry 0.73 1.92 CMCGlobal Industry Energy Intensity G J pe r M T of s te el Water Withdrawal Intensity Cu bi c m et er p er M T of s te el 2% 69% CMCGlobal Industry % o f s te el c on te nt Scopes 1-3 GHG Emissions Intensity tC O 2e p er M T of s te el Virgin Materials Used in Steelmaking

© CMC Appendix: Non-GAAP Financial Reconciliations

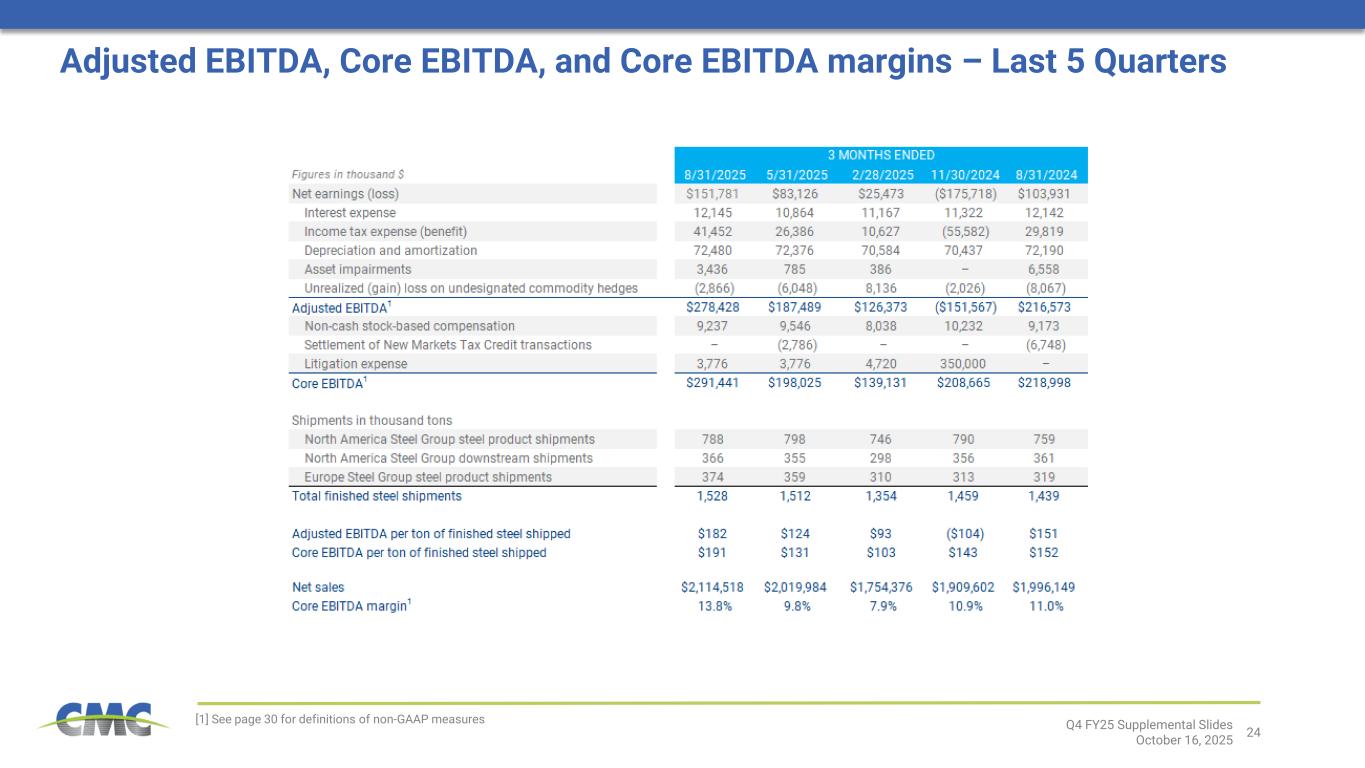

24 [1] See page 30 for definitions of non-GAAP measures Q4 FY25 Supplemental Slides October 16, 2025 Adjusted EBITDA, Core EBITDA, and Core EBITDA margins – Last 5 Quarters

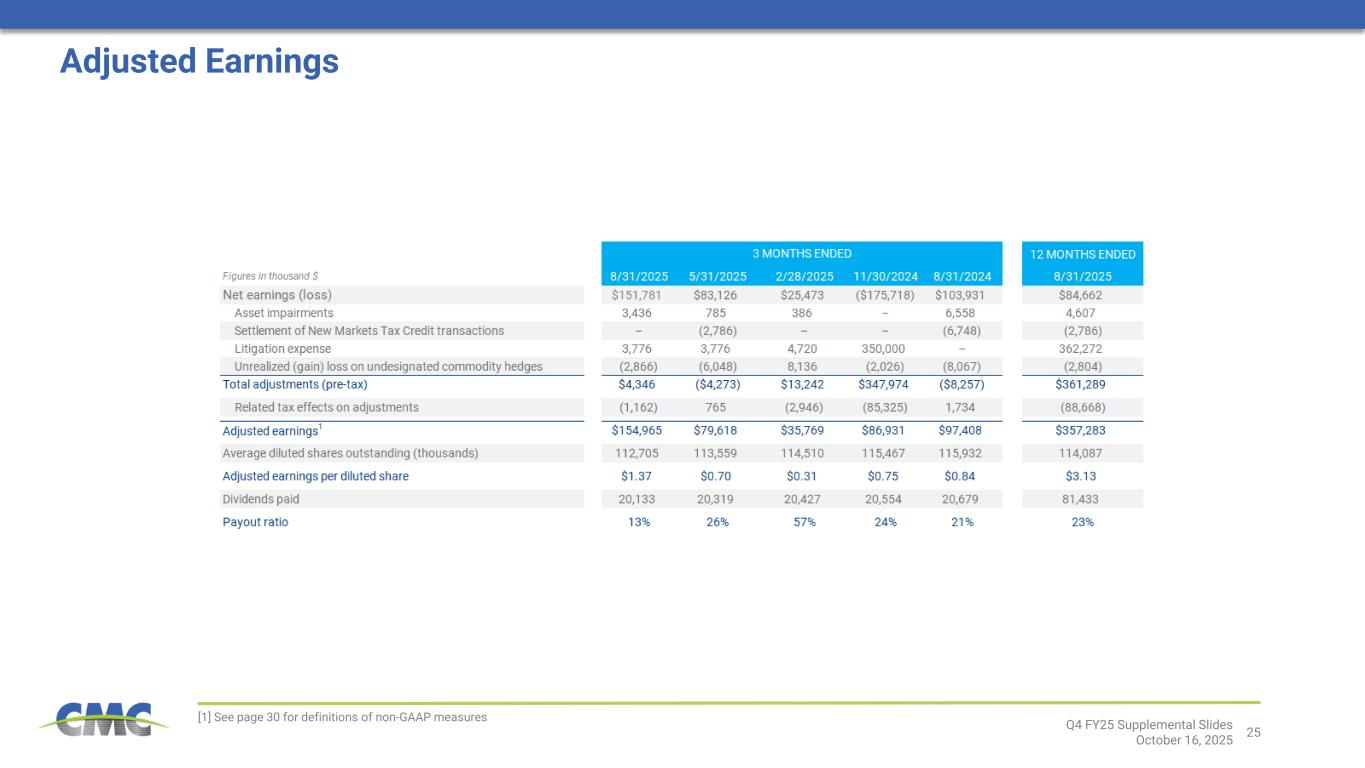

25 [1] See page 30 for definitions of non-GAAP measures Q4 FY25 Supplemental Slides October 16, 2025 Adjusted Earnings

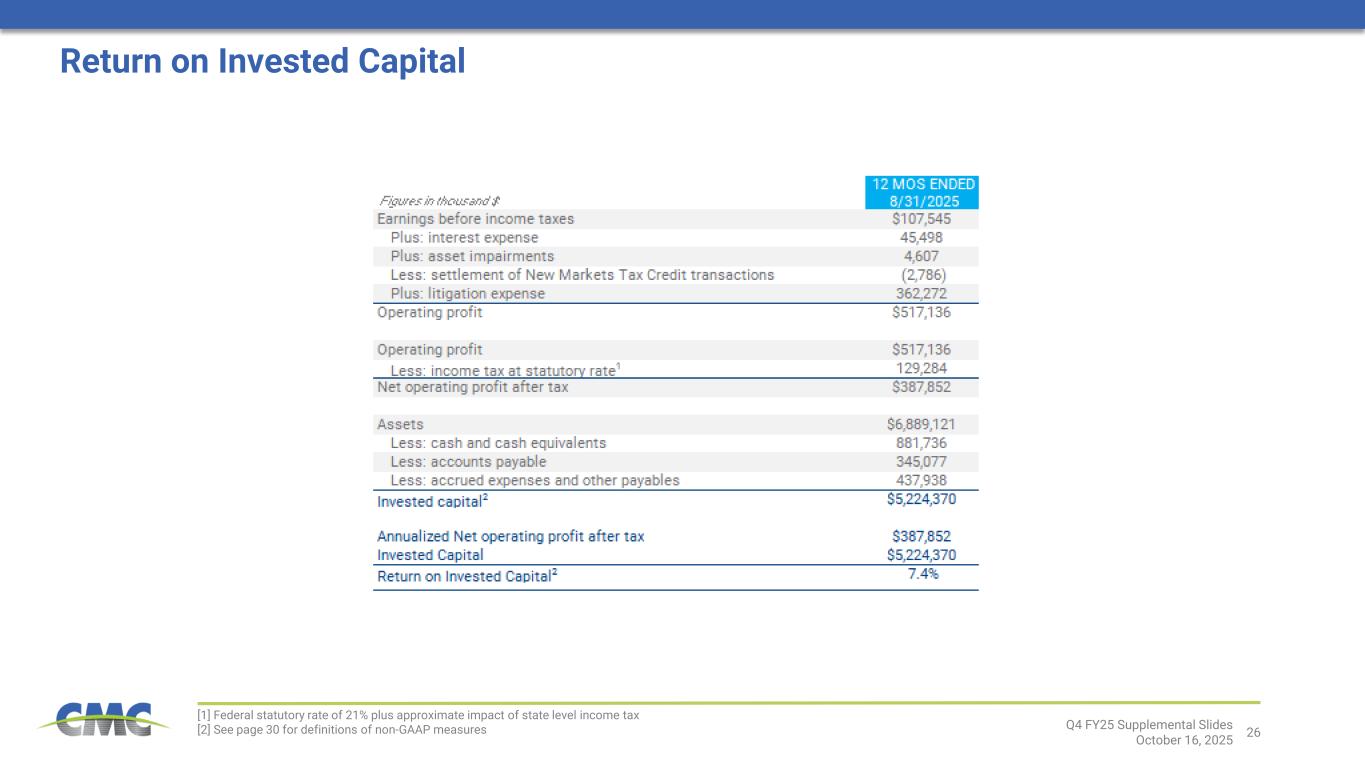

26 [1] Federal statutory rate of 21% plus approximate impact of state level income tax [2] See page 30 for definitions of non-GAAP measures Q4 FY25 Supplemental Slides October 16, 2025 Return on Invested Capital

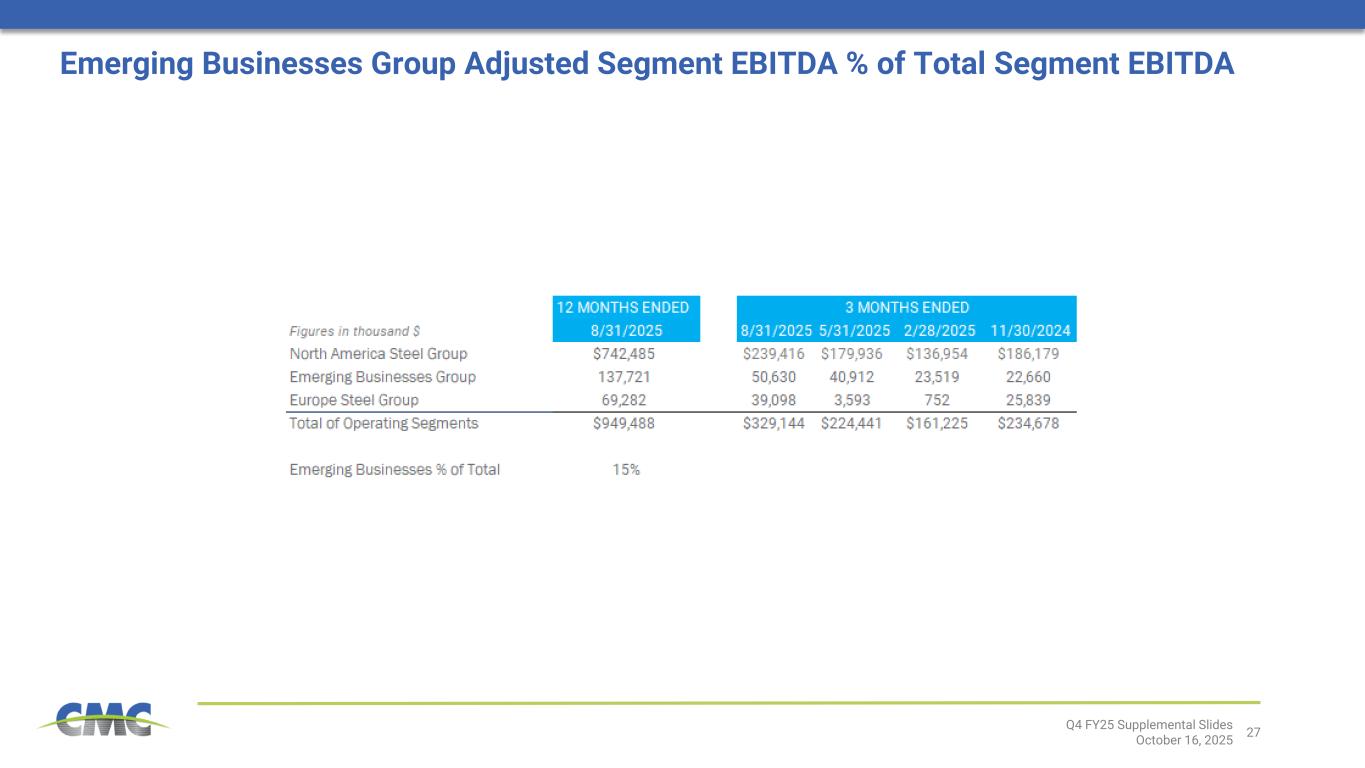

27Q4 FY25 Supplemental Slides October 16, 2025 Emerging Businesses Group Adjusted Segment EBITDA % of Total Segment EBITDA

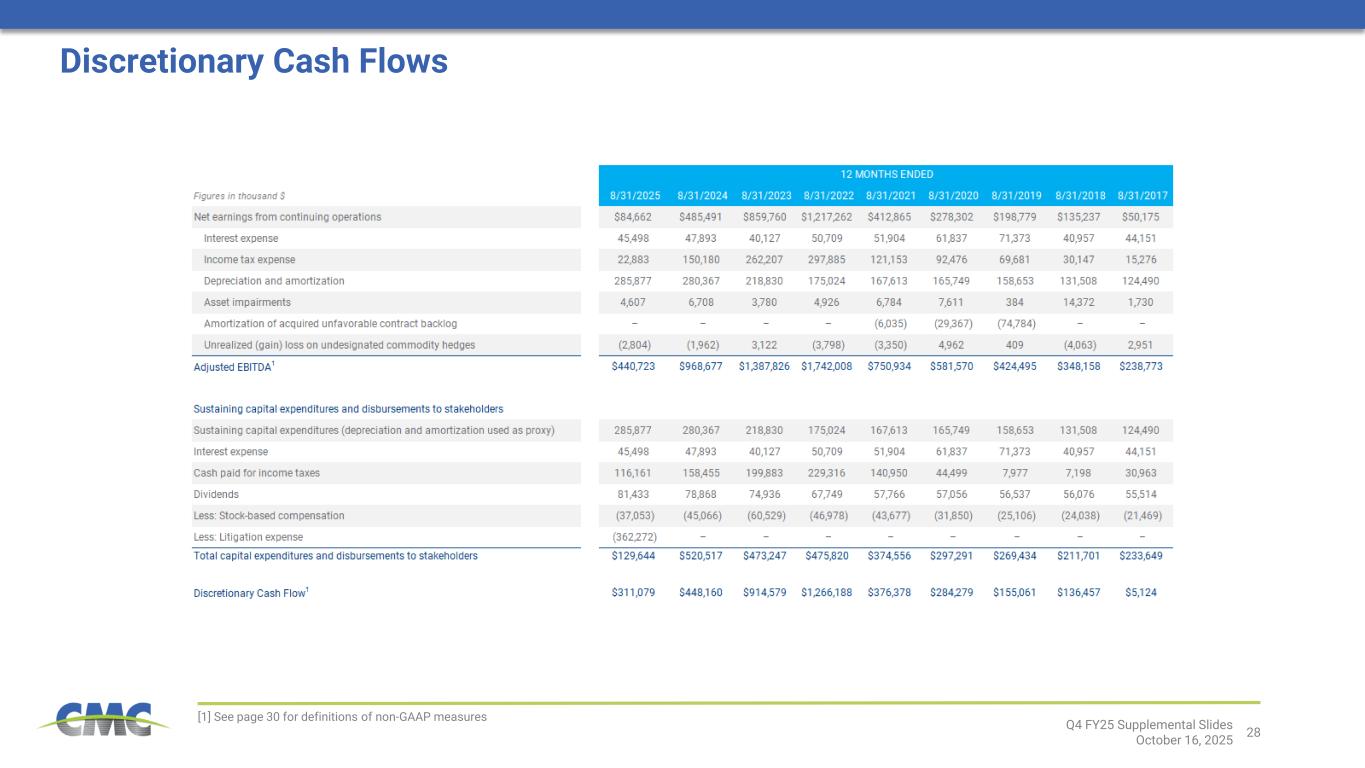

28 [1] See page 30 for definitions of non-GAAP measures Q4 FY25 Supplemental Slides October 16, 2025 Discretionary Cash Flows

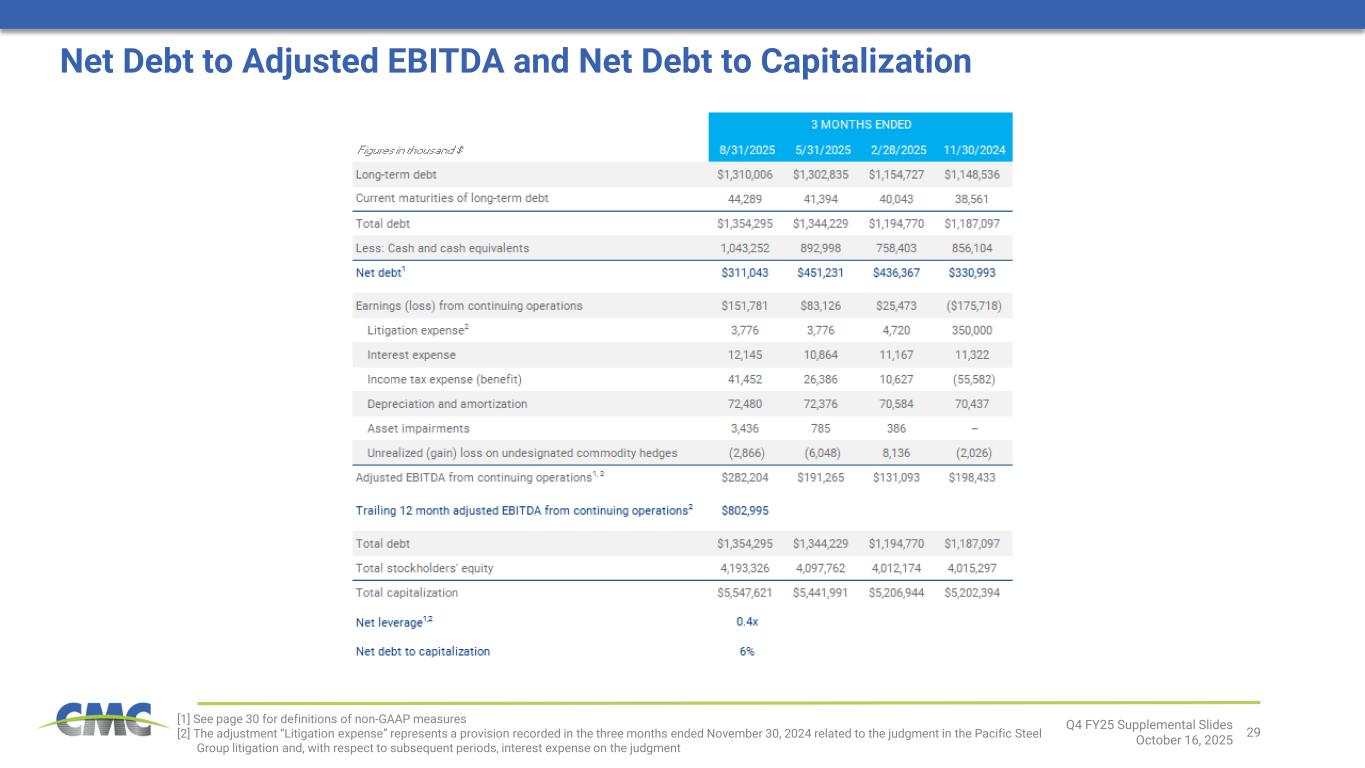

29 [1] See page 30 for definitions of non-GAAP measures [2] The adjustment “Litigation expense” represents a provision recorded in the three months ended November 30, 2024 related to the judgment in the Pacific Steel Group litigation and, with respect to subsequent periods, interest expense on the judgment Q4 FY25 Supplemental Slides October 16, 2025 Net Debt to Adjusted EBITDA and Net Debt to Capitalization

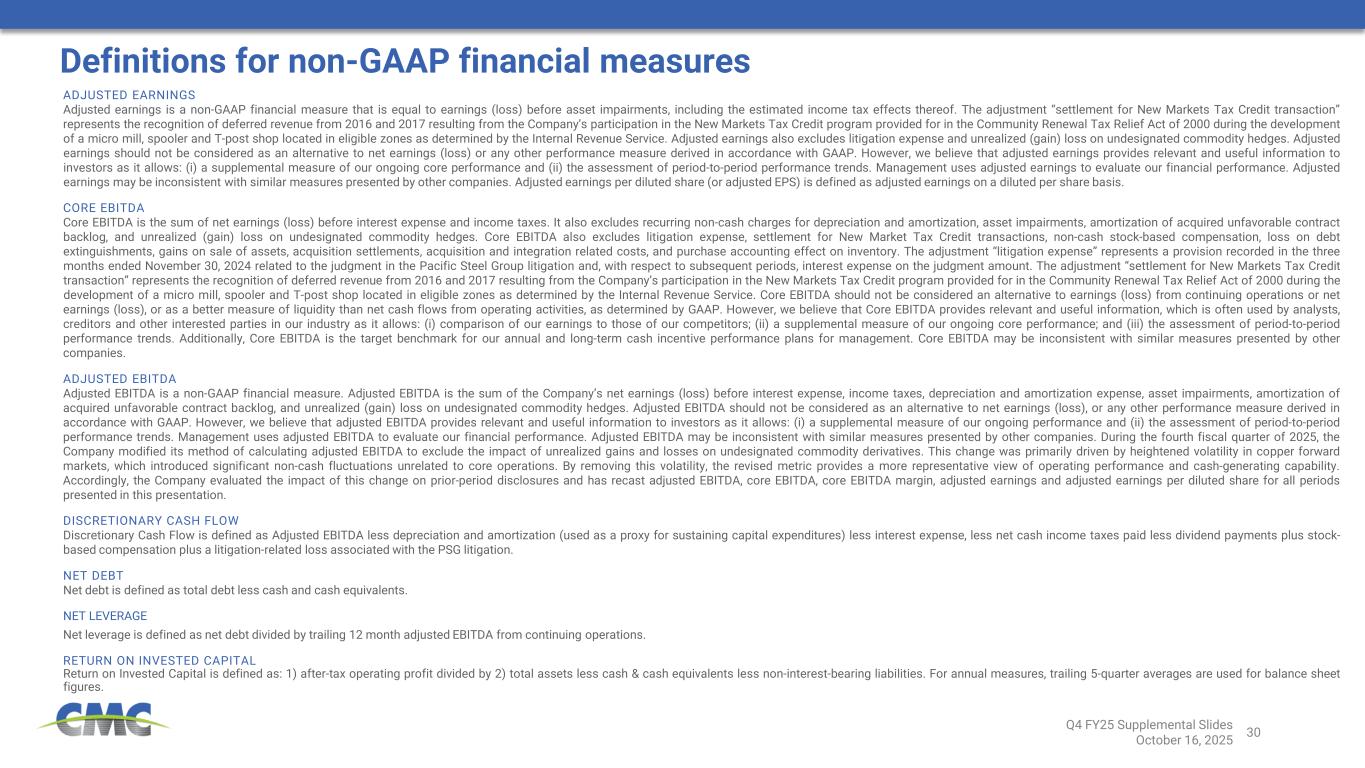

30 ADJUSTED EARNINGS Adjusted earnings is a non-GAAP financial measure that is equal to earnings (loss) before asset impairments, including the estimated income tax effects thereof. The adjustment “settlement for New Markets Tax Credit transaction” represents the recognition of deferred revenue from 2016 and 2017 resulting from the Company’s participation in the New Markets Tax Credit program provided for in the Community Renewal Tax Relief Act of 2000 during the development of a micro mill, spooler and T-post shop located in eligible zones as determined by the Internal Revenue Service. Adjusted earnings also excludes litigation expense and unrealized (gain) loss on undesignated commodity hedges. Adjusted earnings should not be considered as an alternative to net earnings (loss) or any other performance measure derived in accordance with GAAP. However, we believe that adjusted earnings provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing core performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted earnings to evaluate our financial performance. Adjusted earnings may be inconsistent with similar measures presented by other companies. Adjusted earnings per diluted share (or adjusted EPS) is defined as adjusted earnings on a diluted per share basis. CORE EBITDA Core EBITDA is the sum of net earnings (loss) before interest expense and income taxes. It also excludes recurring non-cash charges for depreciation and amortization, asset impairments, amortization of acquired unfavorable contract backlog, and unrealized (gain) loss on undesignated commodity hedges. Core EBITDA also excludes litigation expense, settlement for New Market Tax Credit transactions, non-cash stock-based compensation, loss on debt extinguishments, gains on sale of assets, acquisition settlements, acquisition and integration related costs, and purchase accounting effect on inventory. The adjustment “litigation expense” represents a provision recorded in the three months ended November 30, 2024 related to the judgment in the Pacific Steel Group litigation and, with respect to subsequent periods, interest expense on the judgment amount. The adjustment “settlement for New Markets Tax Credit transaction” represents the recognition of deferred revenue from 2016 and 2017 resulting from the Company’s participation in the New Markets Tax Credit program provided for in the Community Renewal Tax Relief Act of 2000 during the development of a micro mill, spooler and T-post shop located in eligible zones as determined by the Internal Revenue Service. Core EBITDA should not be considered an alternative to earnings (loss) from continuing operations or net earnings (loss), or as a better measure of liquidity than net cash flows from operating activities, as determined by GAAP. However, we believe that Core EBITDA provides relevant and useful information, which is often used by analysts, creditors and other interested parties in our industry as it allows: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our ongoing core performance; and (iii) the assessment of period-to-period performance trends. Additionally, Core EBITDA is the target benchmark for our annual and long-term cash incentive performance plans for management. Core EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is the sum of the Company’s net earnings (loss) before interest expense, income taxes, depreciation and amortization expense, asset impairments, amortization of acquired unfavorable contract backlog, and unrealized (gain) loss on undesignated commodity hedges. Adjusted EBITDA should not be considered as an alternative to net earnings (loss), or any other performance measure derived in accordance with GAAP. However, we believe that adjusted EBITDA provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted EBITDA to evaluate our financial performance. Adjusted EBITDA may be inconsistent with similar measures presented by other companies. During the fourth fiscal quarter of 2025, the Company modified its method of calculating adjusted EBITDA to exclude the impact of unrealized gains and losses on undesignated commodity derivatives. This change was primarily driven by heightened volatility in copper forward markets, which introduced significant non-cash fluctuations unrelated to core operations. By removing this volatility, the revised metric provides a more representative view of operating performance and cash-generating capability. Accordingly, the Company evaluated the impact of this change on prior-period disclosures and has recast adjusted EBITDA, core EBITDA, core EBITDA margin, adjusted earnings and adjusted earnings per diluted share for all periods presented in this presentation. DISCRETIONARY CASH FLOW Discretionary Cash Flow is defined as Adjusted EBITDA less depreciation and amortization (used as a proxy for sustaining capital expenditures) less interest expense, less net cash income taxes paid less dividend payments plus stock- based compensation plus a litigation-related loss associated with the PSG litigation. NET DEBT Net debt is defined as total debt less cash and cash equivalents. NET LEVERAGE Net leverage is defined as net debt divided by trailing 12 month adjusted EBITDA from continuing operations. RETURN ON INVESTED CAPITAL Return on Invested Capital is defined as: 1) after-tax operating profit divided by 2) total assets less cash & cash equivalents less non-interest-bearing liabilities. For annual measures, trailing 5-quarter averages are used for balance sheet figures. Q4 FY25 Supplemental Slides October 16, 2025 Definitions for non-GAAP financial measures

CMC.COM