Excerpts from the Investor Presentation

.3

EXCERPTS FROM THE PRELIMINARY OFFERING MEMORANDUM DATED NOVEMBER 12, 2025

AND INVESTOR PRESENTATION

Excerpts from the Preliminary Offering Memorandum dated November 12, 2025

Beyond our mills, we are making investments to meet customer demand and strengthen our core offerings by growing our capabilities in higher margin, more specialized solutions, particularly within our Emerging Businesses Group segment. These undertakings include the expansion of CMC’s post-tension cable production, adding a second GalvaBar coating line, and increasing geogrid manufacturing capacity.

***

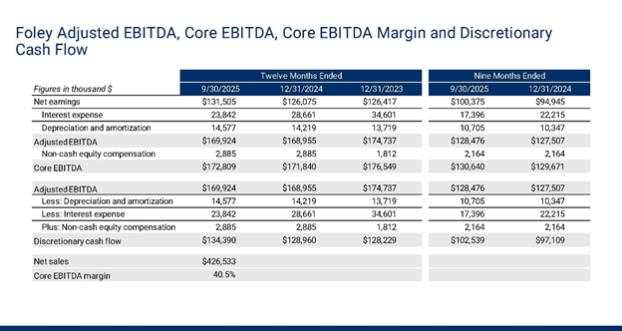

Elsewhere in this offering memorandum, we provide an estimate of net leverage, which is defined as net debt (after giving effect to the offering and the intended use of proceeds, including to fund the purchase price for the Foley Acquisition) divided by combined core EBITDA. The net leverage calculation does not reflect the impact of the CP&P Acquisition. Net debt is defined as total debt less cash and cash equivalents. Total debt is defined as long-term debt plus current maturities of long-term debt. A reconciliation of long-term debt to net debt, as adjusted to give effect to this offering and the intended use of proceeds, is provided below.

| August 31, 2025 | ||||

| (in thousands, except ratio) |

||||

| Long-term debt |

$ | 1,319,769 | ||

| New senior notes due 2033 and 2035 |

2,000,000 | |||

| Current maturities of long-term debt |

44,289 | |||

|

|

|

|||

| Total debt |

3,364,085 | |||

| Less: cash and cash equivalents |

1,043,252 | |||

| Less: expected cash proceeds |

135,000 | |||

|

|

|

|||

| Net debt |

$ | 2,185,833 | ||

| Combined core EBITDA |

$ | 1,010,071 | ||

| Net leverage |

2.2 | |||

***

[W]e expect to enter into a third amendment to the Credit Agreement concurrently with the closing of the Foley Acquisition (such amendment, the “Third Amendment”), which will increase the borrowing capacity under the Revolver to $1,000.0 million and extend the maturity date five years from the effective date of the Third Amendment.

Excerpts from the Investor Presentation