| © CTO Realty Growth, Inc. | ctoreit.com Ashley Park Atlanta, GA Supplemental Reporting Information Q3 2025 |

| © CTO Realty Growth, Inc. | ctoreit.com 2 Table of Contents Third Quarter 2025 Earnings Release 4 Key Financial Information ▪ Consolidated Balance Sheets 14 ▪ Consolidated Statements of Operations 15 ▪ Non-GAAP Financial Measures 16 Capitalization & Dividends 19 Summary of Debt 20 Debt Maturity Schedule 21 Year -to -Date Investment & Disposition Activity 22 Real Estate Portfolio Capital Investments 23 Real Estate Portfolio Summary 24 Real Estate Portfolio Detail 25 Leasing Summary 27 |

| © CTO Realty Growth, Inc. | ctoreit.com 3 Table of Contents Comparable Leasing Summary 28 Same-Property NOI 29 Lease Expiration Schedule 30 Top Tenant Summary 32 Geographic Diversification 33 Other Assets 34 2025 Guidance 35 Contact Information & Research Coverage 36 Safe Harbor, Non-GAAP Financial Measures, and Definitions and Terms 37 |

| Page 4 DRAFT DRATDDD Press Release FIRST 2024 OPERATING RESULTS FOR IMMEDIATE RELEASE CTO REALTY GROWTH REPORTS THIRD QUARTER 2025 OPERATING RESULTS – Raises Full-Year 2025 Outlook – – Strengthens balance sheet with $150 million term loan financing – – Current signed-not-open pipeline of $5.5 million – WINTER PARK, FL – October 28, 2025 – CTO Realty Growth, Inc. (NYSE: CTO) (the “Company” or “CTO”), an owner and operator of retail-based properties located primarily in higher-growth markets, today announced its operating and financial results for the quarter ended September 30, 2025. Third Quarter and Other 2025 Highlights ▪ Net Income attributable to common stockholders of $0.03 per diluted share. ▪ Core Funds from Operations (“FFO”) attributable to common stockholders, of $0.48 per diluted share. ▪ Adjusted Funds from Operations (“AFFO”) attributable to common stockholders of $0.50 per diluted share. ▪ Same-Property NOI totaled $18.6 million, an increase of 2.3% as compared to the quarter ended September 30, 2024. ▪ Current signed-not-open pipeline, as of October 28, 2025, represents $5.5 million, or 5.3%, of annual cash base rent in place at quarter end. ▪ Closed on $150.0 million in new term loan financings at an initial fixed interest rate of 4.2%. ▪ Repaid $65.0 million term loan due in March 2026. ▪ Repurchased during the quarter and through October 28, 2025, 571,473 shares of common stock for $9.3 million, or a weighted average price per share of $16.27. ▪ The Company had $170.3 million of liquidity as of September 30, 2025. ▪ Increased full year Core FFO and AFFO guidance per diluted share attributable to common stockholders. “We continued to produce strong operating and leasing results across our portfolio during the third quarter. We leased 143,000 square feet for the quarter bringing our year-to-date leasing to 482,000 square feet and our portfolio to 94.2% leased. Notably, we have now signed 424,000 square feet of comparable leases for the year at a positive rent spread of 21.7%,” stated John P. Albright, President and Chief Executive Officer of CTO Realty Growth. “Further, we are in lease negotiations for our remaining four vacant anchor spaces that along with our $5.5 million signed-not open pipeline should drive NOI in 2026 and beyond.” |

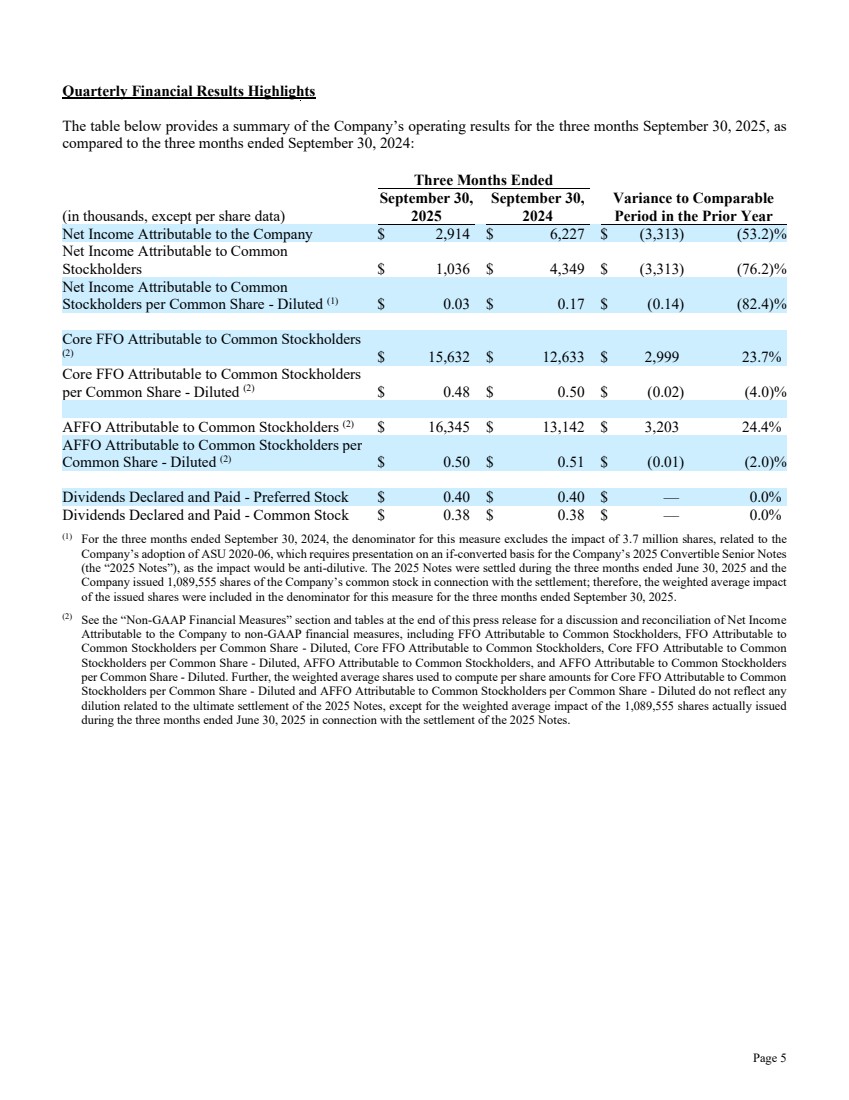

| Page 5 Quarterly Financial Results Highlights The table below provides a summary of the Company’s operating results for the three months September 30, 2025, as compared to the three months ended September 30, 2024: Three Months Ended (in thousands, except per share data) September 30, 2025 September 30, 2024 Variance to Comparable Period in the Prior Year Net Income Attributable to the Company $ 2,914 $ 6,227 $ (3,313) (53.2)% Net Income Attributable to Common Stockholders $ 1,036 $ 4,349 $ (3,313) (76.2)% Net Income Attributable to Common Stockholders per Common Share - Diluted (1) $ 0.03 $ 0.17 $ (0.14) (82.4)% Core FFO Attributable to Common Stockholders (2) $ 15,632 $ 12,633 $ 2,999 23.7% Core FFO Attributable to Common Stockholders per Common Share - Diluted (2) $ 0.48 $ 0.50 $ (0.02) (4.0)% AFFO Attributable to Common Stockholders (2) $ 16,345 $ 13,142 $ 3,203 24.4% AFFO Attributable to Common Stockholders per Common Share - Diluted (2) $ 0.50 $ 0.51 $ (0.01) (2.0)% Dividends Declared and Paid - Preferred Stock $ 0.40 $ 0.40 $ — 0.0% Dividends Declared and Paid - Common Stock $ 0.38 $ 0.38 $ — 0.0% (1) For the three months ended September 30, 2024, the denominator for this measure excludes the impact of 3.7 million shares, related to the Company’s adoption of ASU 2020-06, which requires presentation on an if-converted basis for the Company’s 2025 Convertible Senior Notes (the “2025 Notes”), as the impact would be anti-dilutive. The 2025 Notes were settled during the three months ended June 30, 2025 and the Company issued 1,089,555 shares of the Company’s common stock in connection with the settlement; therefore, the weighted average impact of the issued shares were included in the denominator for this measure for the three months ended September 30, 2025. (2) See the “Non-GAAP Financial Measures” section and tables at the end of this press release for a discussion and reconciliation of Net Income Attributable to the Company to non-GAAP financial measures, including FFO Attributable to Common Stockholders, FFO Attributable to Common Stockholders per Common Share - Diluted, Core FFO Attributable to Common Stockholders, Core FFO Attributable to Common Stockholders per Common Share - Diluted, AFFO Attributable to Common Stockholders, and AFFO Attributable to Common Stockholders per Common Share - Diluted. Further, the weighted average shares used to compute per share amounts for Core FFO Attributable to Common Stockholders per Common Share - Diluted and AFFO Attributable to Common Stockholders per Common Share - Diluted do not reflect any dilution related to the ultimate settlement of the 2025 Notes, except for the weighted average impact of the 1,089,555 shares actually issued during the three months ended June 30, 2025 in connection with the settlement of the 2025 Notes. |

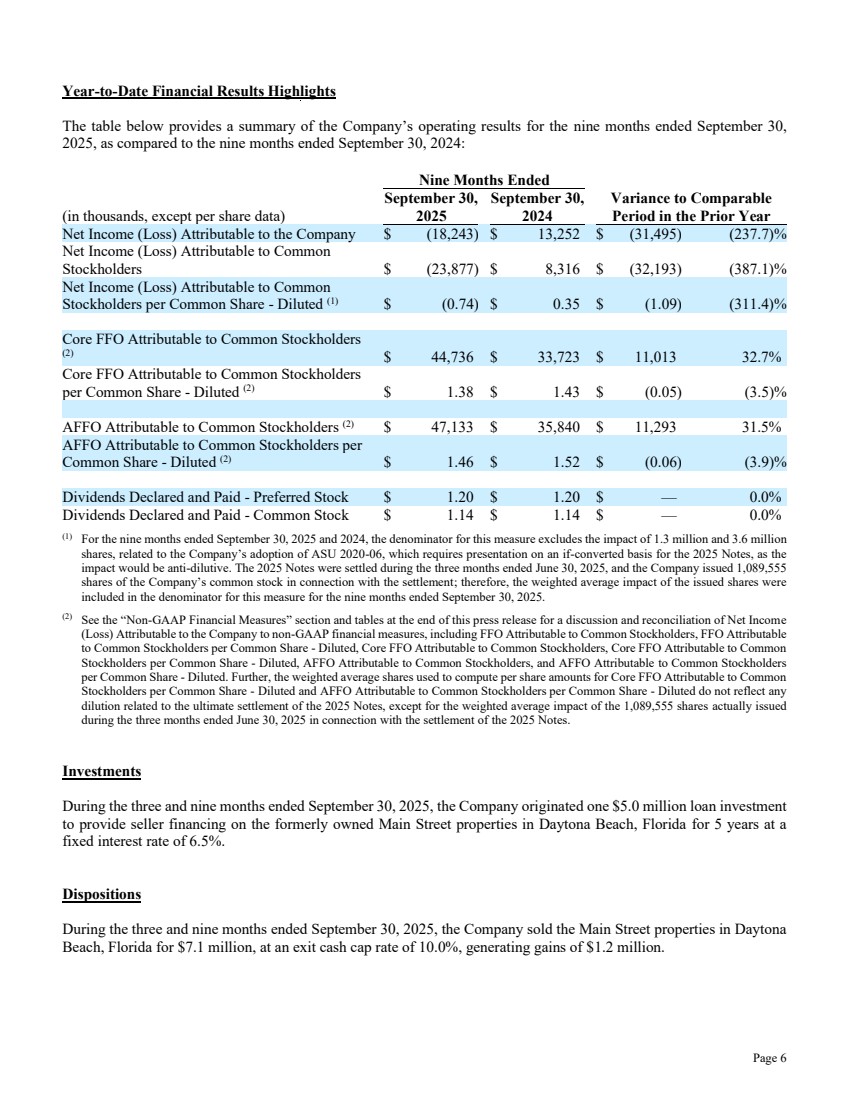

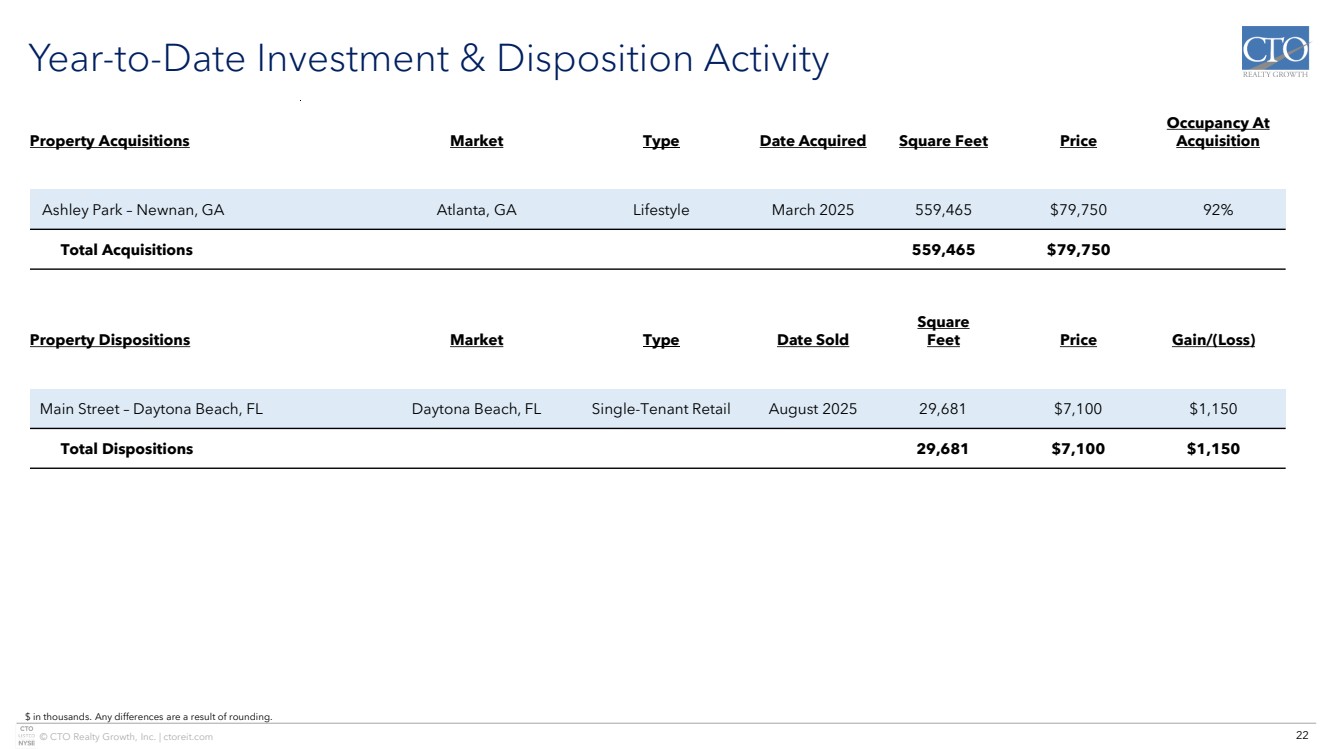

| Page 6 Year-to-Date Financial Results Highlights The table below provides a summary of the Company’s operating results for the nine months ended September 30, 2025, as compared to the nine months ended September 30, 2024: Nine Months Ended (in thousands, except per share data) September 30, 2025 September 30, 2024 Variance to Comparable Period in the Prior Year Net Income (Loss) Attributable to the Company $ (18,243) $ 13,252 $ (31,495) (237.7)% Net Income (Loss) Attributable to Common Stockholders $ (23,877) $ 8,316 $ (32,193) (387.1)% Net Income (Loss) Attributable to Common Stockholders per Common Share - Diluted (1) $ (0.74) $ 0.35 $ (1.09) (311.4)% Core FFO Attributable to Common Stockholders (2) $ 44,736 $ 33,723 $ 11,013 32.7% Core FFO Attributable to Common Stockholders per Common Share - Diluted (2) $ 1.38 $ 1.43 $ (0.05) (3.5)% AFFO Attributable to Common Stockholders (2) $ 47,133 $ 35,840 $ 11,293 31.5% AFFO Attributable to Common Stockholders per Common Share - Diluted (2) $ 1.46 $ 1.52 $ (0.06) (3.9)% Dividends Declared and Paid - Preferred Stock $ 1.20 $ 1.20 $ — 0.0% Dividends Declared and Paid - Common Stock $ 1.14 $ 1.14 $ — 0.0% (1) For the nine months ended September 30, 2025 and 2024, the denominator for this measure excludes the impact of 1.3 million and 3.6 million shares, related to the Company’s adoption of ASU 2020-06, which requires presentation on an if-converted basis for the 2025 Notes, as the impact would be anti-dilutive. The 2025 Notes were settled during the three months ended June 30, 2025, and the Company issued 1,089,555 shares of the Company’s common stock in connection with the settlement; therefore, the weighted average impact of the issued shares were included in the denominator for this measure for the nine months ended September 30, 2025. (2) See the “Non-GAAP Financial Measures” section and tables at the end of this press release for a discussion and reconciliation of Net Income (Loss) Attributable to the Company to non-GAAP financial measures, including FFO Attributable to Common Stockholders, FFO Attributable to Common Stockholders per Common Share - Diluted, Core FFO Attributable to Common Stockholders, Core FFO Attributable to Common Stockholders per Common Share - Diluted, AFFO Attributable to Common Stockholders, and AFFO Attributable to Common Stockholders per Common Share - Diluted. Further, the weighted average shares used to compute per share amounts for Core FFO Attributable to Common Stockholders per Common Share - Diluted and AFFO Attributable to Common Stockholders per Common Share - Diluted do not reflect any dilution related to the ultimate settlement of the 2025 Notes, except for the weighted average impact of the 1,089,555 shares actually issued during the three months ended June 30, 2025 in connection with the settlement of the 2025 Notes. Investments During the three and nine months ended September 30, 2025, the Company originated one $5.0 million loan investment to provide seller financing on the formerly owned Main Street properties in Daytona Beach, Florida for 5 years at a fixed interest rate of 6.5%. Dispositions During the three and nine months ended September 30, 2025, the Company sold the Main Street properties in Daytona Beach, Florida for $7.1 million, at an exit cash cap rate of 10.0%, generating gains of $1.2 million. |

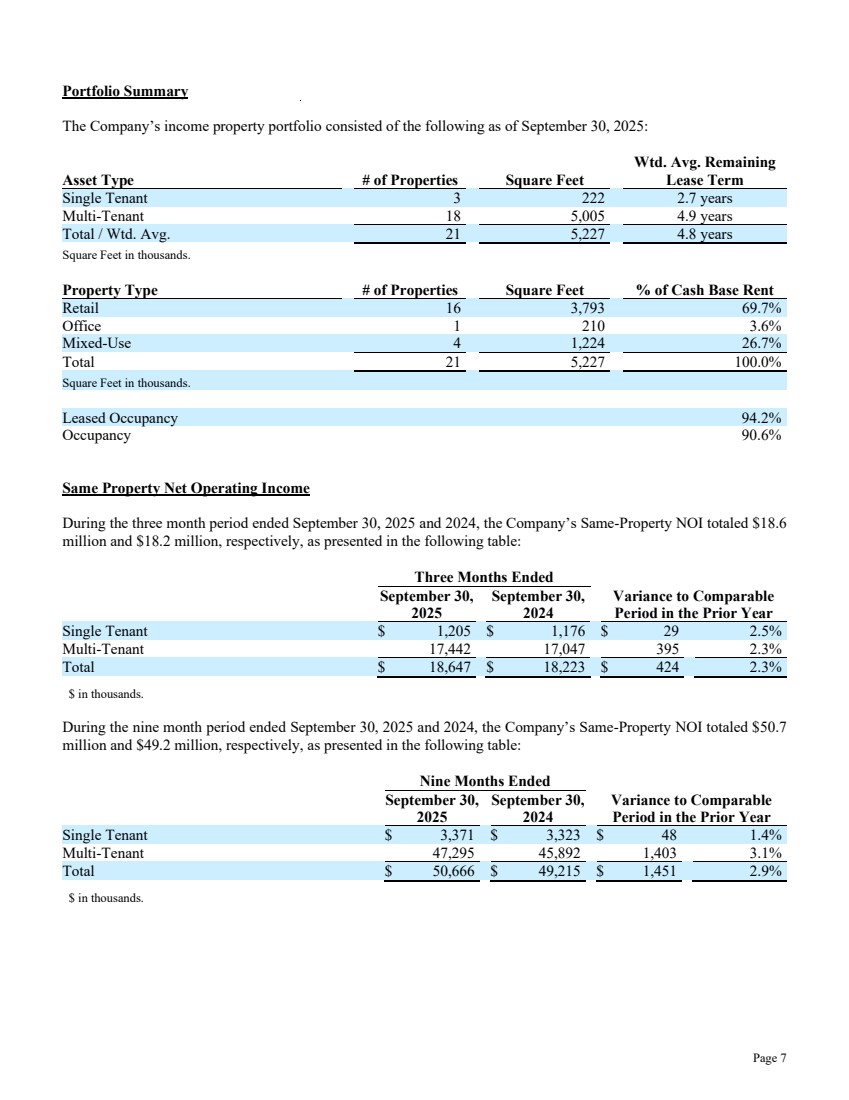

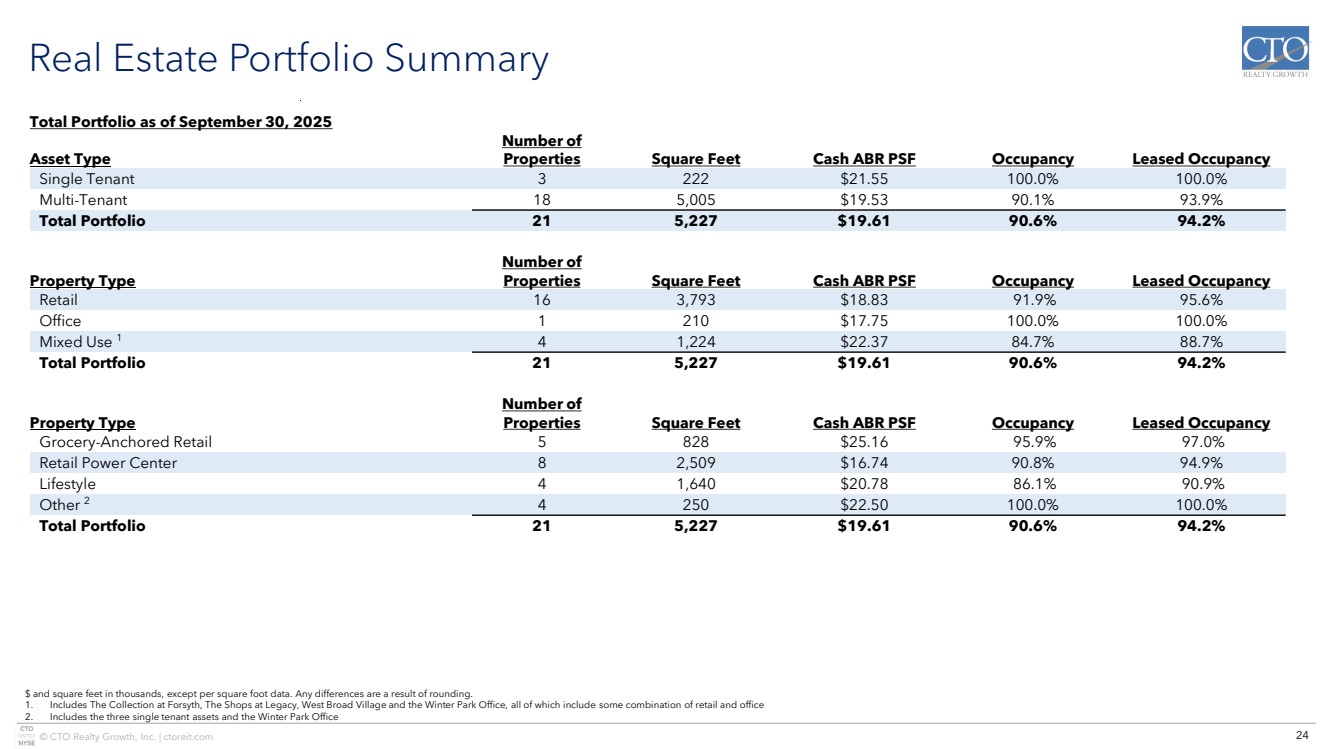

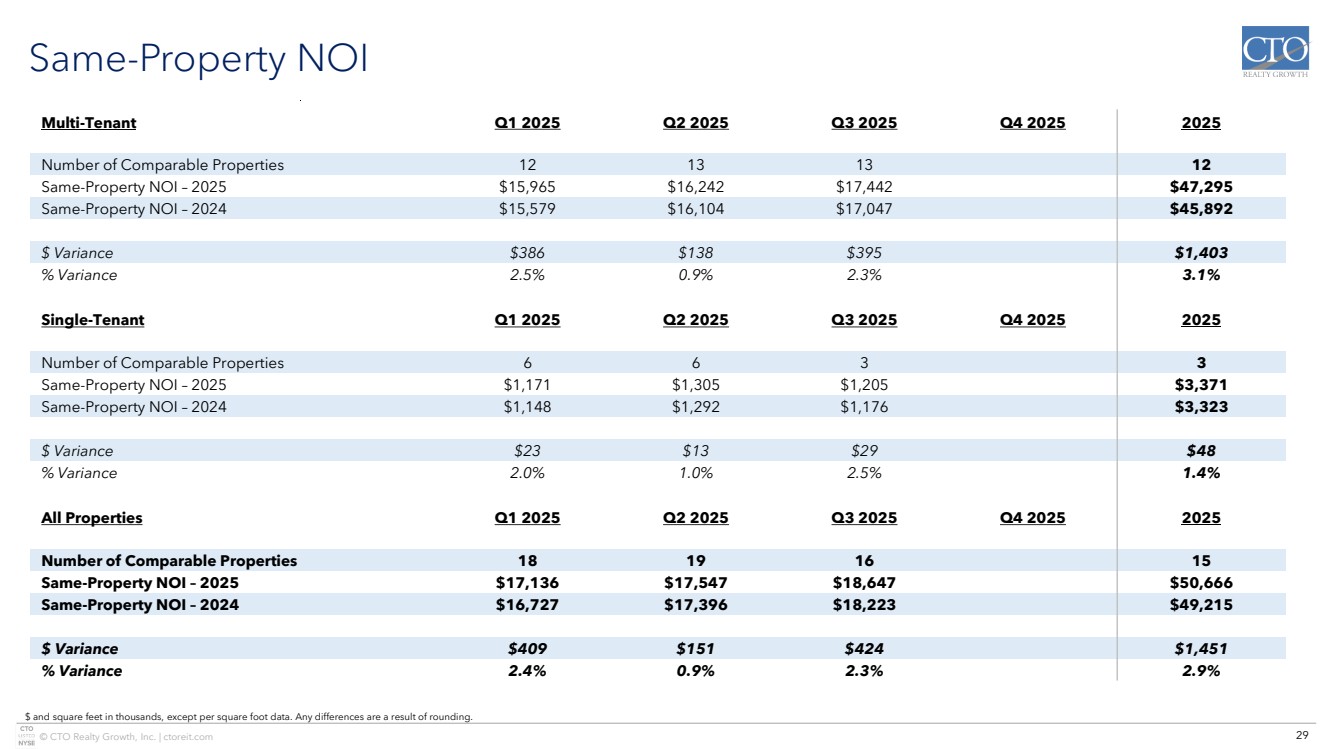

| Page 7 Portfolio Summary The Company’s income property portfolio consisted of the following as of September 30, 2025: Wtd. Avg. Remaining Asset Type # of Properties Square Feet Lease Term Single Tenant 3 222 2.7 years Multi-Tenant 18 5,005 4.9 years Total / Wtd. Avg. 21 5,227 4.8 years Square Feet in thousands. Property Type # of Properties Square Feet % of Cash Base Rent Retail 16 3,793 69.7% Office 1 210 3.6% Mixed-Use 4 1,224 26.7% Total 21 5,227 100.0% Square Feet in thousands. Leased Occupancy 94.2% Occupancy 90.6% Same Property Net Operating Income During the three month period ended September 30, 2025 and 2024, the Company’s Same-Property NOI totaled $18.6 million and $18.2 million, respectively, as presented in the following table: Three Months Ended September 30, 2025 September 30, 2024 Variance to Comparable Period in the Prior Year Single Tenant $ 1,205 $ 1,176 $ 29 2.5% Multi-Tenant 17,442 17,047 395 2.3% Total $ 18,647 $ 18,223 $ 424 2.3% $ in thousands. During the nine month period ended September 30, 2025 and 2024, the Company’s Same-Property NOI totaled $50.7 million and $49.2 million, respectively, as presented in the following table: Nine Months Ended September 30, 2025 September 30, 2024 Variance to Comparable Period in the Prior Year Single Tenant $ 3,371 $ 3,323 $ 48 1.4% Multi-Tenant 47,295 45,892 1,403 3.1% Total $ 50,666 $ 49,215 $ 1,451 2.9% $ in thousands. |

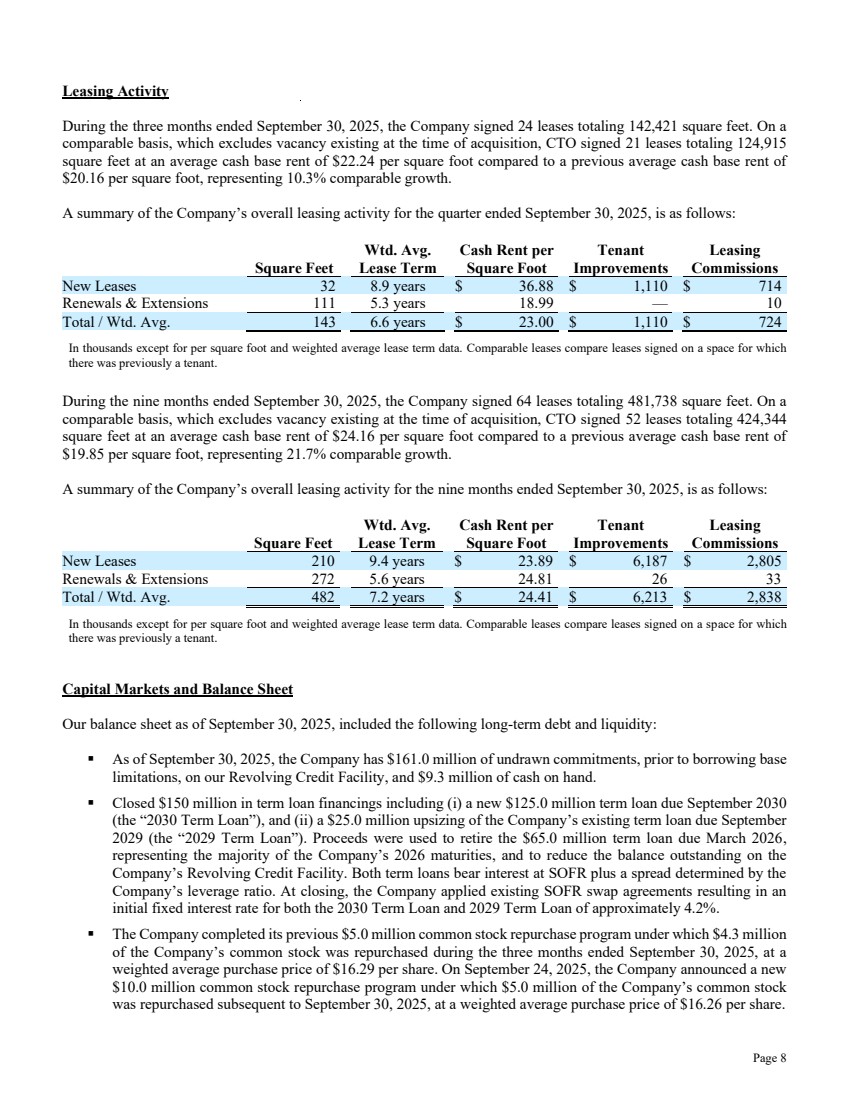

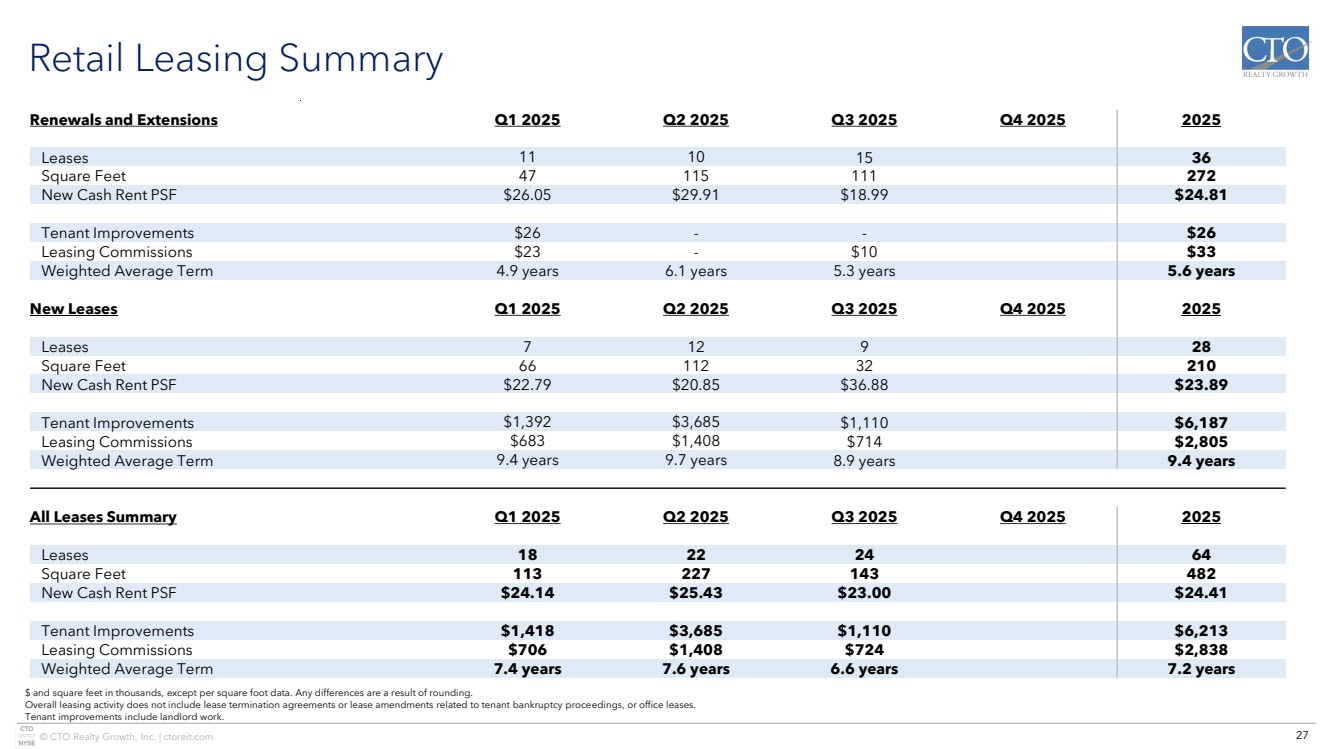

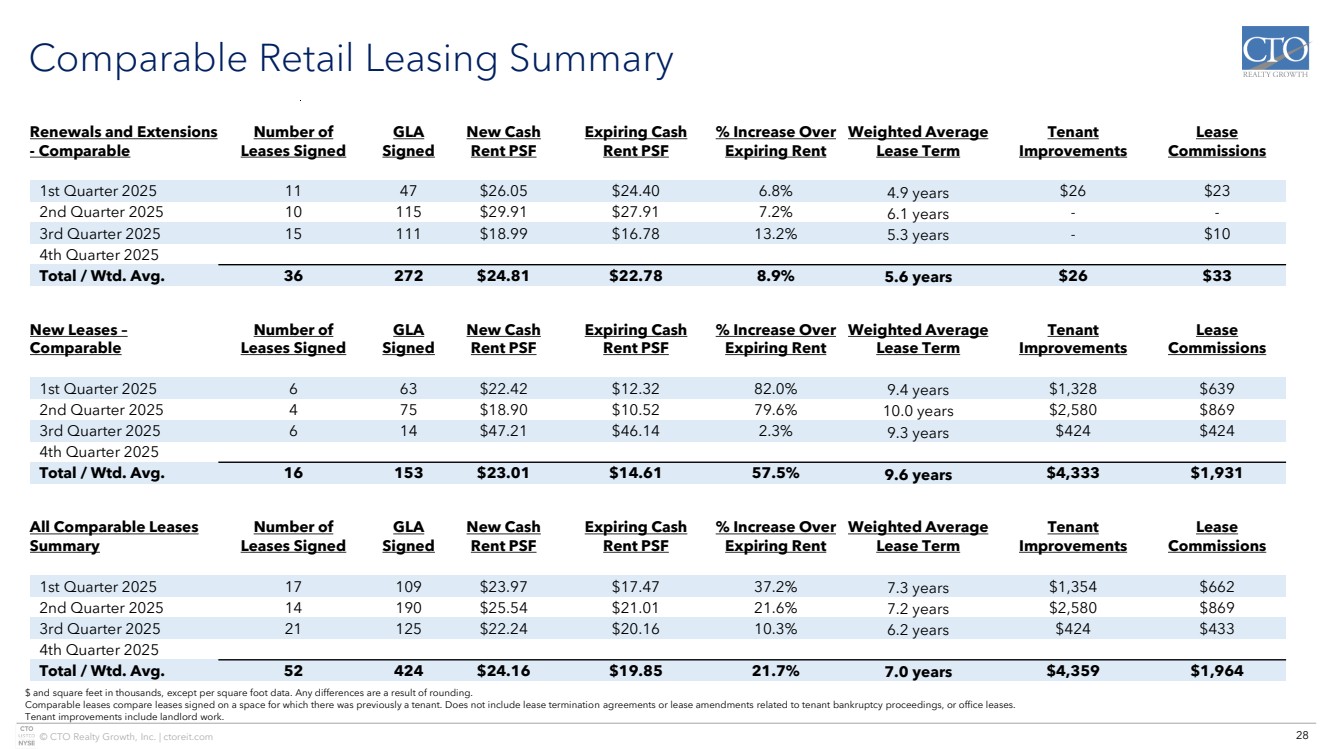

| Page 8 Leasing Activity During the three months ended September 30, 2025, the Company signed 24 leases totaling 142,421 square feet. On a comparable basis, which excludes vacancy existing at the time of acquisition, CTO signed 21 leases totaling 124,915 square feet at an average cash base rent of $22.24 per square foot compared to a previous average cash base rent of $20.16 per square foot, representing 10.3% comparable growth. A summary of the Company’s overall leasing activity for the quarter ended September 30, 2025, is as follows: Wtd. Avg. Cash Rent per Tenant Leasing Square Feet Lease Term Square Foot Improvements Commissions New Leases 32 8.9 years $ 36.88 $ 1,110 $ 714 Renewals & Extensions 111 5.3 years 18.99 — 10 Total / Wtd. Avg. 143 6.6 years $ 23.00 $ 1,110 $ 724 In thousands except for per square foot and weighted average lease term data. Comparable leases compare leases signed on a space for which there was previously a tenant. During the nine months ended September 30, 2025, the Company signed 64 leases totaling 481,738 square feet. On a comparable basis, which excludes vacancy existing at the time of acquisition, CTO signed 52 leases totaling 424,344 square feet at an average cash base rent of $24.16 per square foot compared to a previous average cash base rent of $19.85 per square foot, representing 21.7% comparable growth. A summary of the Company’s overall leasing activity for the nine months ended September 30, 2025, is as follows: Wtd. Avg. Cash Rent per Tenant Leasing Square Feet Lease Term Square Foot Improvements Commissions New Leases 210 9.4 years $ 23.89 $ 6,187 $ 2,805 Renewals & Extensions 272 5.6 years 24.81 26 33 Total / Wtd. Avg. 482 7.2 years $ 24.41 $ 6,213 $ 2,838 In thousands except for per square foot and weighted average lease term data. Comparable leases compare leases signed on a space for which there was previously a tenant. Capital Markets and Balance Sheet Our balance sheet as of September 30, 2025, included the following long-term debt and liquidity: ▪ As of September 30, 2025, the Company has $161.0 million of undrawn commitments, prior to borrowing base limitations, on our Revolving Credit Facility, and $9.3 million of cash on hand. ▪ Closed $150 million in term loan financings including (i) a new $125.0 million term loan due September 2030 (the “2030 Term Loan”), and (ii) a $25.0 million upsizing of the Company’s existing term loan due September 2029 (the “2029 Term Loan”). Proceeds were used to retire the $65.0 million term loan due March 2026, representing the majority of the Company’s 2026 maturities, and to reduce the balance outstanding on the Company’s Revolving Credit Facility. Both term loans bear interest at SOFR plus a spread determined by the Company’s leverage ratio. At closing, the Company applied existing SOFR swap agreements resulting in an initial fixed interest rate for both the 2030 Term Loan and 2029 Term Loan of approximately 4.2%. ▪ The Company completed its previous $5.0 million common stock repurchase program under which $4.3 million of the Company’s common stock was repurchased during the three months ended September 30, 2025, at a weighted average purchase price of $16.29 per share. On September 24, 2025, the Company announced a new $10.0 million common stock repurchase program under which $5.0 million of the Company’s common stock was repurchased subsequent to September 30, 2025, at a weighted average purchase price of $16.26 per share. |

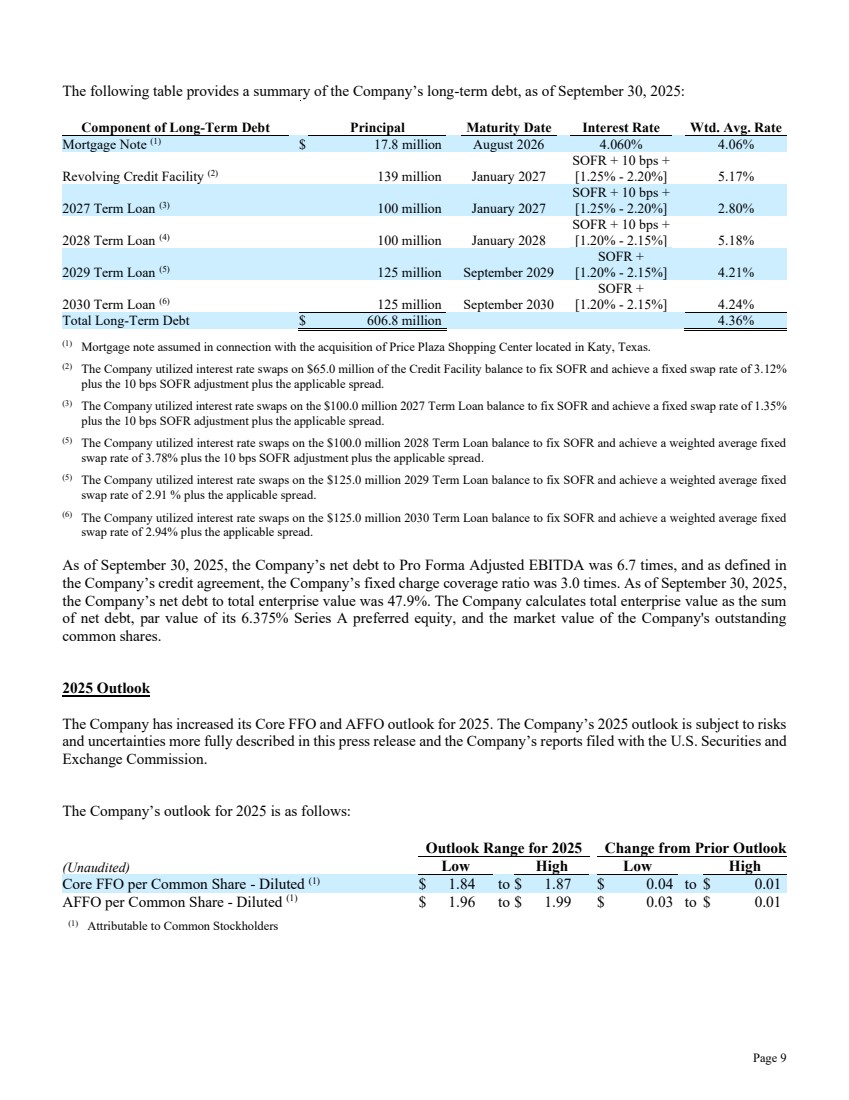

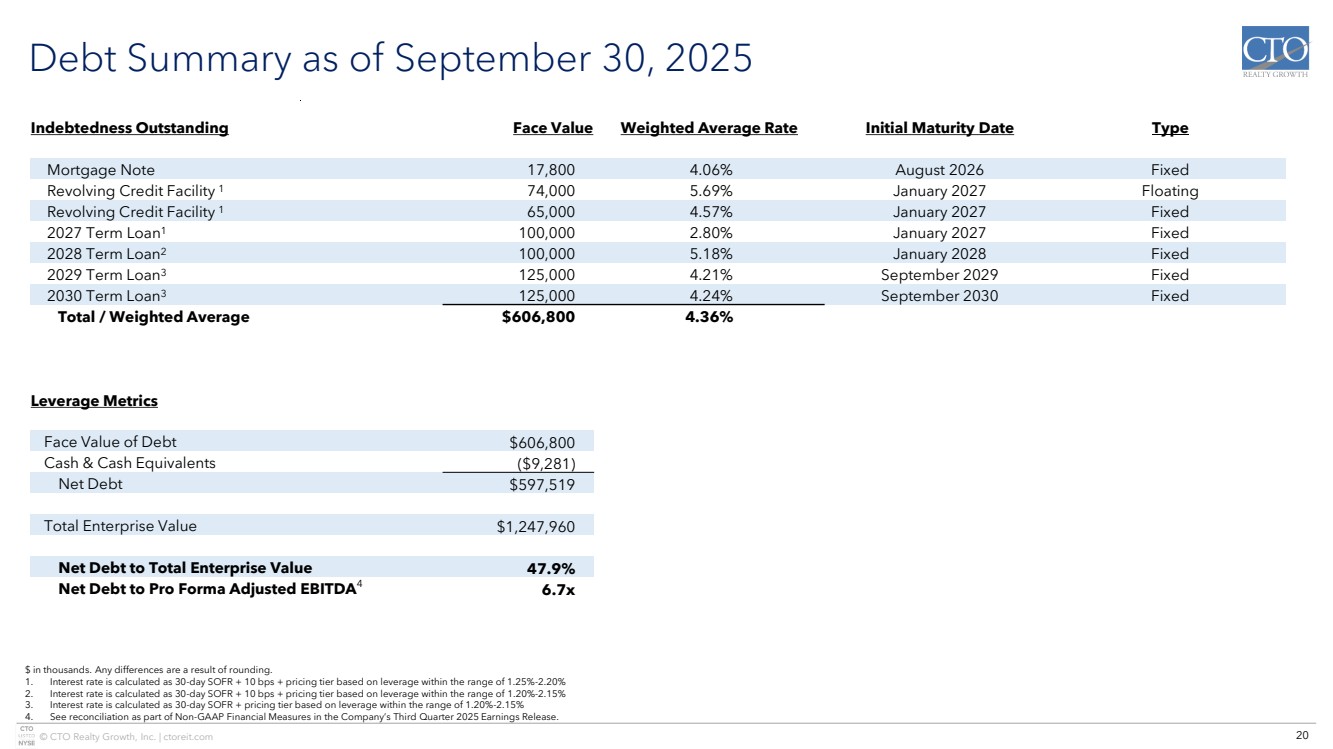

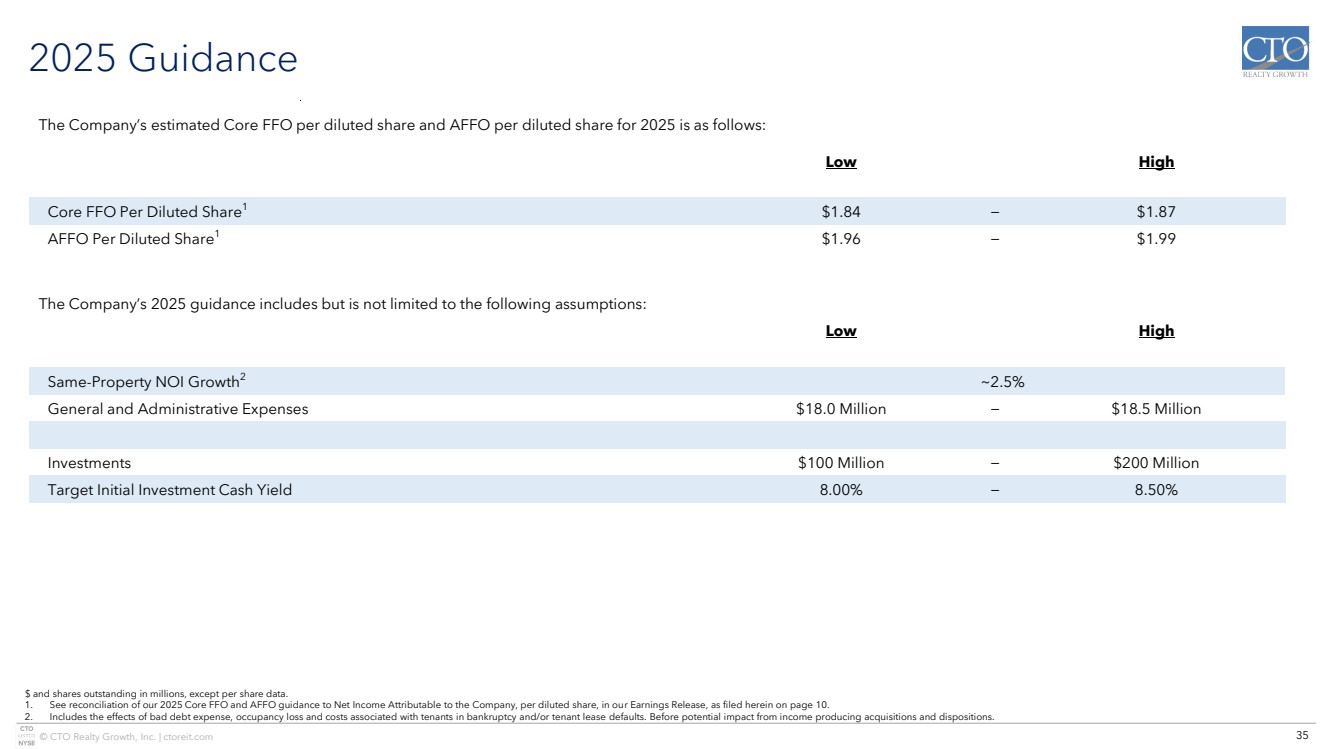

| Page 9 The following table provides a summary of the Company’s long-term debt, as of September 30, 2025: Component of Long-Term Debt Principal Maturity Date Interest Rate Wtd. Avg. Rate Mortgage Note (1) $ 17.8 million August 2026 4.060% 4.06% Revolving Credit Facility (2) 139 million January 2027 SOFR + 10 bps + [1.25% - 2.20%] 5.17% 2027 Term Loan (3) 100 million January 2027 SOFR + 10 bps + [1.25% - 2.20%] 2.80% 2028 Term Loan (4) 100 million January 2028 SOFR + 10 bps + [1.20% - 2.15%] 5.18% 2029 Term Loan (5) 125 million September 2029 SOFR + [1.20% - 2.15%] 4.21% 2030 Term Loan (6) 125 million September 2030 SOFR + [1.20% - 2.15%] 4.24% Total Long-Term Debt $ 606.8 million 4.36% (1) Mortgage note assumed in connection with the acquisition of Price Plaza Shopping Center located in Katy, Texas. (2) The Company utilized interest rate swaps on $65.0 million of the Credit Facility balance to fix SOFR and achieve a fixed swap rate of 3.12% plus the 10 bps SOFR adjustment plus the applicable spread. (3) The Company utilized interest rate swaps on the $100.0 million 2027 Term Loan balance to fix SOFR and achieve a fixed swap rate of 1.35% plus the 10 bps SOFR adjustment plus the applicable spread. (5) The Company utilized interest rate swaps on the $100.0 million 2028 Term Loan balance to fix SOFR and achieve a weighted average fixed swap rate of 3.78% plus the 10 bps SOFR adjustment plus the applicable spread. (5) The Company utilized interest rate swaps on the $125.0 million 2029 Term Loan balance to fix SOFR and achieve a weighted average fixed swap rate of 2.91 % plus the applicable spread. (6) The Company utilized interest rate swaps on the $125.0 million 2030 Term Loan balance to fix SOFR and achieve a weighted average fixed swap rate of 2.94% plus the applicable spread. As of September 30, 2025, the Company’s net debt to Pro Forma Adjusted EBITDA was 6.7 times, and as defined in the Company’s credit agreement, the Company’s fixed charge coverage ratio was 3.0 times. As of September 30, 2025, the Company’s net debt to total enterprise value was 47.9%. The Company calculates total enterprise value as the sum of net debt, par value of its 6.375% Series A preferred equity, and the market value of the Company's outstanding common shares. 2025 Outlook The Company has increased its Core FFO and AFFO outlook for 2025. The Company’s 2025 outlook is subject to risks and uncertainties more fully described in this press release and the Company’s reports filed with the U.S. Securities and Exchange Commission. The Company’s outlook for 2025 is as follows: Outlook Range for 2025 Change from Prior Outlook (Unaudited) Low High Low High Core FFO per Common Share - Diluted (1) $ 1.84 to $ 1.87 $ 0.04 to $ 0.01 AFFO per Common Share - Diluted (1) $ 1.96 to $ 1.99 $ 0.03 to $ 0.01 (1) Attributable to Common Stockholders |

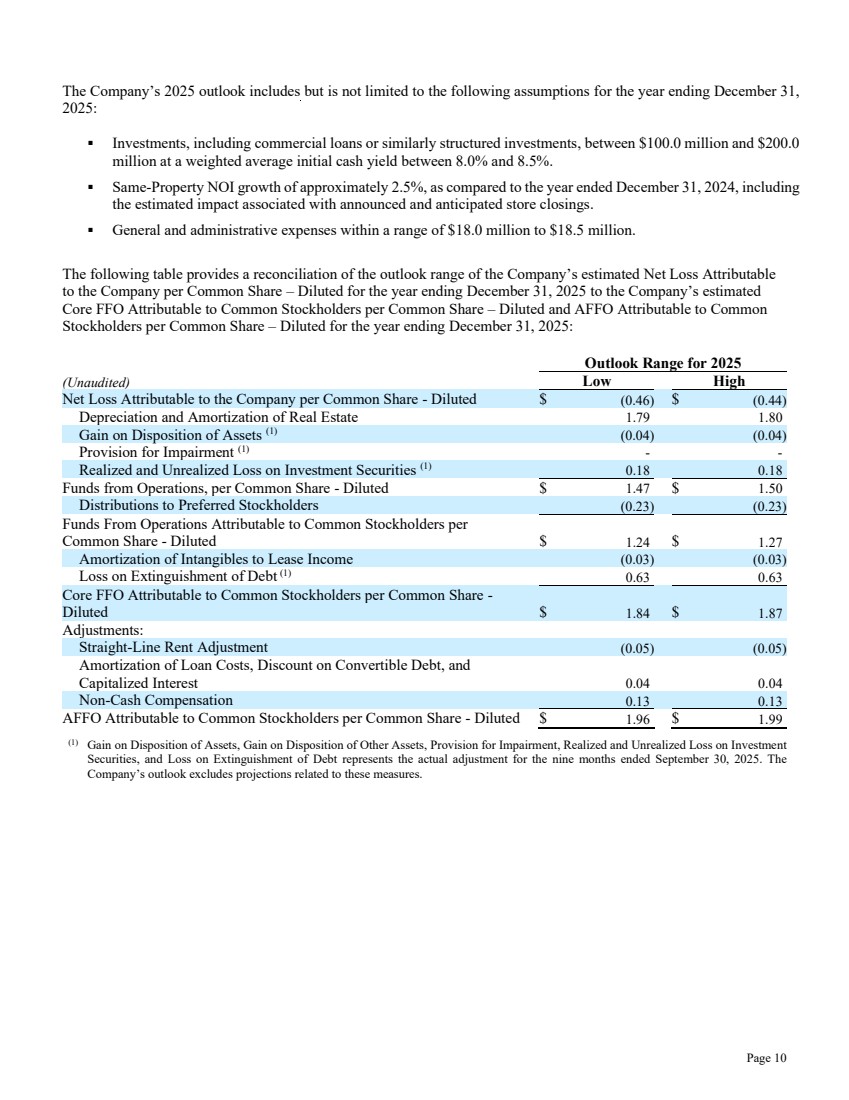

| Page 10 The Company’s 2025 outlook includes but is not limited to the following assumptions for the year ending December 31, 2025: ▪ Investments, including commercial loans or similarly structured investments, between $100.0 million and $200.0 million at a weighted average initial cash yield between 8.0% and 8.5%. ▪ Same-Property NOI growth of approximately 2.5%, as compared to the year ended December 31, 2024, including the estimated impact associated with announced and anticipated store closings. ▪ General and administrative expenses within a range of $18.0 million to $18.5 million. The following table provides a reconciliation of the outlook range of the Company’s estimated Net Loss Attributable to the Company per Common Share – Diluted for the year ending December 31, 2025 to the Company’s estimated Core FFO Attributable to Common Stockholders per Common Share – Diluted and AFFO Attributable to Common Stockholders per Common Share – Diluted for the year ending December 31, 2025: Outlook Range for 2025 (Unaudited) Low High Net Loss Attributable to the Company per Common Share - Diluted $ (0.46) $ (0.44) Depreciation and Amortization of Real Estate 1.79 1.80 Gain on Disposition of Assets (1) (0.04) (0.04) Provision for Impairment (1) - - Realized and Unrealized Loss on Investment Securities (1) 0.18 0.18 Funds from Operations, per Common Share - Diluted $ 1.47 $ 1.50 Distributions to Preferred Stockholders (0.23) (0.23) Funds From Operations Attributable to Common Stockholders per Common Share - Diluted $ 1.24 $ 1.27 Amortization of Intangibles to Lease Income (0.03) (0.03) Loss on Extinguishment of Debt (1) 0.63 0.63 Core FFO Attributable to Common Stockholders per Common Share - Diluted $ 1.84 $ 1.87 Adjustments: Straight-Line Rent Adjustment (0.05) (0.05) Amortization of Loan Costs, Discount on Convertible Debt, and Capitalized Interest 0.04 0.04 Non-Cash Compensation 0.13 0.13 AFFO Attributable to Common Stockholders per Common Share - Diluted $ 1.96 $ 1.99 (1) Gain on Disposition of Assets, Gain on Disposition of Other Assets, Provision for Impairment, Realized and Unrealized Loss on Investment Securities, and Loss on Extinguishment of Debt represents the actual adjustment for the nine months ended September 30, 2025. The Company’s outlook excludes projections related to these measures. |

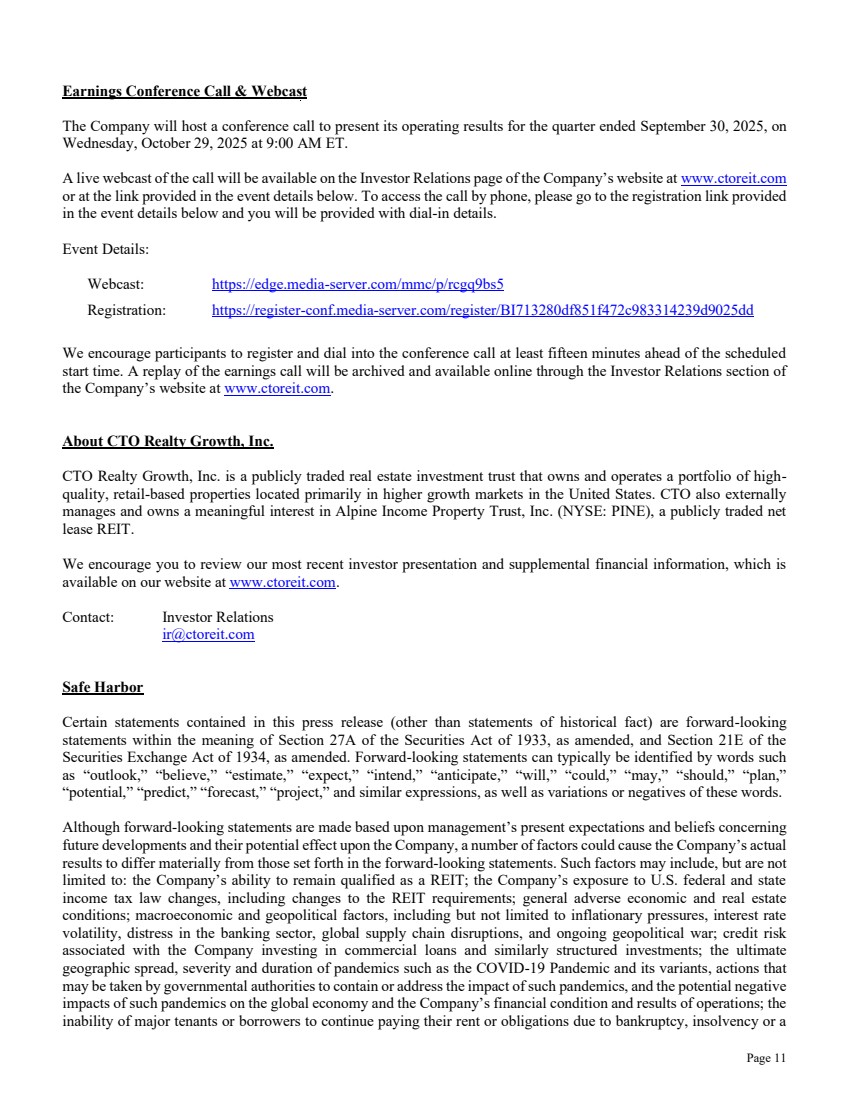

| Page 11 Earnings Conference Call & Webcast The Company will host a conference call to present its operating results for the quarter ended September 30, 2025, on Wednesday, October 29, 2025 at 9:00 AM ET. A live webcast of the call will be available on the Investor Relations page of the Company’s website at www.ctoreit.com or at the link provided in the event details below. To access the call by phone, please go to the registration link provided in the event details below and you will be provided with dial-in details. Event Details: Webcast: https://edge.media-server.com/mmc/p/rcgq9bs5 Registration: https://register-conf.media-server.com/register/BI713280df851f472c983314239d9025dd We encourage participants to register and dial into the conference call at least fifteen minutes ahead of the scheduled start time. A replay of the earnings call will be archived and available online through the Investor Relations section of the Company’s website at www.ctoreit.com. About CTO Realty Growth, Inc. CTO Realty Growth, Inc. is a publicly traded real estate investment trust that owns and operates a portfolio of high-quality, retail-based properties located primarily in higher growth markets in the United States. CTO also externally manages and owns a meaningful interest in Alpine Income Property Trust, Inc. (NYSE: PINE), a publicly traded net lease REIT. We encourage you to review our most recent investor presentation and supplemental financial information, which is available on our website at www.ctoreit.com. Contact: Investor Relations ir@ctoreit.com Safe Harbor Certain statements contained in this press release (other than statements of historical fact) are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements can typically be identified by words such as “outlook,” “believe,” “estimate,” “expect,” “intend,” “anticipate,” “will,” “could,” “may,” “should,” “plan,” “potential,” “predict,” “forecast,” “project,” and similar expressions, as well as variations or negatives of these words. Although forward-looking statements are made based upon management’s present expectations and beliefs concerning future developments and their potential effect upon the Company, a number of factors could cause the Company’s actual results to differ materially from those set forth in the forward-looking statements. Such factors may include, but are not limited to: the Company’s ability to remain qualified as a REIT; the Company’s exposure to U.S. federal and state income tax law changes, including changes to the REIT requirements; general adverse economic and real estate conditions; macroeconomic and geopolitical factors, including but not limited to inflationary pressures, interest rate volatility, distress in the banking sector, global supply chain disruptions, and ongoing geopolitical war; credit risk associated with the Company investing in commercial loans and similarly structured investments; the ultimate geographic spread, severity and duration of pandemics such as the COVID-19 Pandemic and its variants, actions that may be taken by governmental authorities to contain or address the impact of such pandemics, and the potential negative impacts of such pandemics on the global economy and the Company’s financial condition and results of operations; the inability of major tenants or borrowers to continue paying their rent or obligations due to bankruptcy, insolvency or a |

| Page 12 general downturn in their business; the loss or failure, or decline in the business or assets of PINE; the completion of 1031 exchange transactions; the availability of investment properties that meet the Company’s investment goals and criteria; the uncertainties associated with obtaining required governmental permits and satisfying other closing conditions for planned acquisitions and sales; and the uncertainties and risk factors discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and other risks and uncertainties discussed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on the Company will be those anticipated by management. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update the information contained in this press release to reflect subsequently occurring events or circumstances. Non-GAAP Financial Measures Our reported results are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We also disclose Funds From Operations (“FFO”), Core Funds From Operations (“Core FFO”), Adjusted Funds From Operations (“AFFO”), Pro Forma Earnings Before Interest, Taxes, Depreciation and Amortization (“Pro Forma Adjusted EBITDA”), and Same-Property Net Operating Income (“Same-Property NOI”), each of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO, Core FFO, AFFO, Pro Forma Adjusted EBITDA, and Same-Property NOI do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operating activities as reported on our statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts, or NAREIT. NAREIT defines FFO as GAAP net income or loss adjusted to exclude real estate related depreciation and amortization, as well as extraordinary items (as defined by GAAP) such as net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets and impairments associated with the implementation of current expected credit losses on commercial loans and investments at the time of origination, including the pro rata share of such adjustments of unconsolidated subsidiaries. The Company also excludes the gains or losses from sales of assets incidental to the primary business of the REIT which specifically include the sales of mitigation credits, subsurface sales, investment securities, and land sales, in addition to the mark-to-market of the Company’s investment securities and interest related to the 2025 Notes, if the effect is dilutive. To derive Core FFO, we modify the NAREIT computation of FFO to include other adjustments to GAAP net income related to gains and losses recognized on the extinguishment of debt, amortization of above- and below-market lease related intangibles, and other unforecastable market- or transaction-driven non-cash items, as well as adding back the interest related to the 2025 Notes, if the effect is dilutive. To derive AFFO, we further modify the NAREIT computation of FFO and Core FFO to include other adjustments to GAAP net income related to non-cash revenues and expenses such as straight-line rental revenue, non-cash compensation, and other non-cash amortization. Such items may cause short-term fluctuations in net income but have no impact on operating cash flows or long-term operating performance. We use AFFO as one measure of our performance when we formulate corporate goals. To derive Pro Forma Adjusted EBITDA, GAAP net income or loss attributable to the Company is adjusted to exclude real estate related depreciation and amortization, as well as extraordinary items (as defined by GAAP) such as net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, impairments associated with the implementation of current expected credit losses on commercial loans and |

| Page 13 investments at the time of origination, including the pro rata share of such adjustments of unconsolidated subsidiaries, non-cash revenues and expenses such as straight-line rental revenue, amortization of deferred financing costs, gains and losses recognized on the extinguishment of debt, above- and below-market lease related intangibles, non-cash compensation, other non-recurring items such as termination fees, forfeitures of tenant security deposits, certain adjustments to reconciliation estimates related to reimbursable revenue for recently acquired properties, and other non-recurring items, and other non-cash income or expense. The Company also excludes the gains or losses from sales of assets incidental to the primary business of the REIT which specifically include the sales of mitigation credits, subsurface sales, investment securities, and land sales, in addition to the mark-to-market of the Company’s investment securities. Cash interest expense is also excluded from Pro Forma Adjusted EBITDA, and GAAP net income or loss is adjusted for the annualized impact of acquisitions, dispositions and other similar activities. To derive Same-Property NOI, GAAP net income or loss attributable to the Company is adjusted to exclude real estate related depreciation and amortization, as well as extraordinary items (as defined by GAAP) such as net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, impairments associated with the implementation of current expected credit losses on commercial loans and investments at the time of origination, including the pro rata share of such adjustments of unconsolidated subsidiaries, non-cash revenues and expenses such as straight-line rental revenue, amortization of deferred financing costs, gains and losses recognized on the extinguishment of debt, above- and below-market lease related intangibles, non-cash compensation, other non-recurring items such as termination fees, forfeitures of tenant security deposits, certain adjustments to reconciliation estimates related to reimbursable revenue for recently acquired properties, and other non-recurring items, and other non-cash income or expense. Interest expense, general and administrative expenses, investment and other income or loss, income tax benefit or expense, real estate operations revenues and direct cost of revenues, management fee income, and interest income from commercial loans and investments are also excluded from Same-Property NOI. GAAP net income or loss is further adjusted to remove the impact of properties that were not owned for the full current and prior year reporting periods presented. Cash rental income received under the leases pertaining to the Company’s assets that are presented as commercial loans and investments in accordance with GAAP is also used in lieu of the interest income equivalent. FFO is used by management, investors and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains or losses on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. We believe that Core FFO and AFFO are additional useful supplemental measures for investors to consider because they will help them to better assess our operating performance without the distortions created by other non-cash revenues or expenses. We also believe that Pro Forma Adjusted EBITDA is an additional useful supplemental measure for investors to consider as it allows for a better assessment of our operating performance without the distortions created by other non-cash revenues, expenses or certain effects of the Company’s capital structure on our operating performance. We use Same-Property NOI to compare the operating performance of our assets between periods. It is an accepted and important measurement used by management, investors and analysts because it includes all property-level revenues from the Company’s properties, less operating and maintenance expenses, real estate taxes and other property-specific expenses (“Net Operating Income” or “NOI”) of properties that have been owned and stabilized for the entire current and prior year reporting periods. Same-Property NOI attempts to eliminate differences due to the acquisition or disposition of properties during the particular period presented, and therefore provides a more comparable and consistent performance measure for the comparison of the Company’s properties. FFO, Core FFO, AFFO, Pro Forma Adjusted EBITDA, and Same-Property NOI may not be comparable to similarly titled measures employed by other companies. |

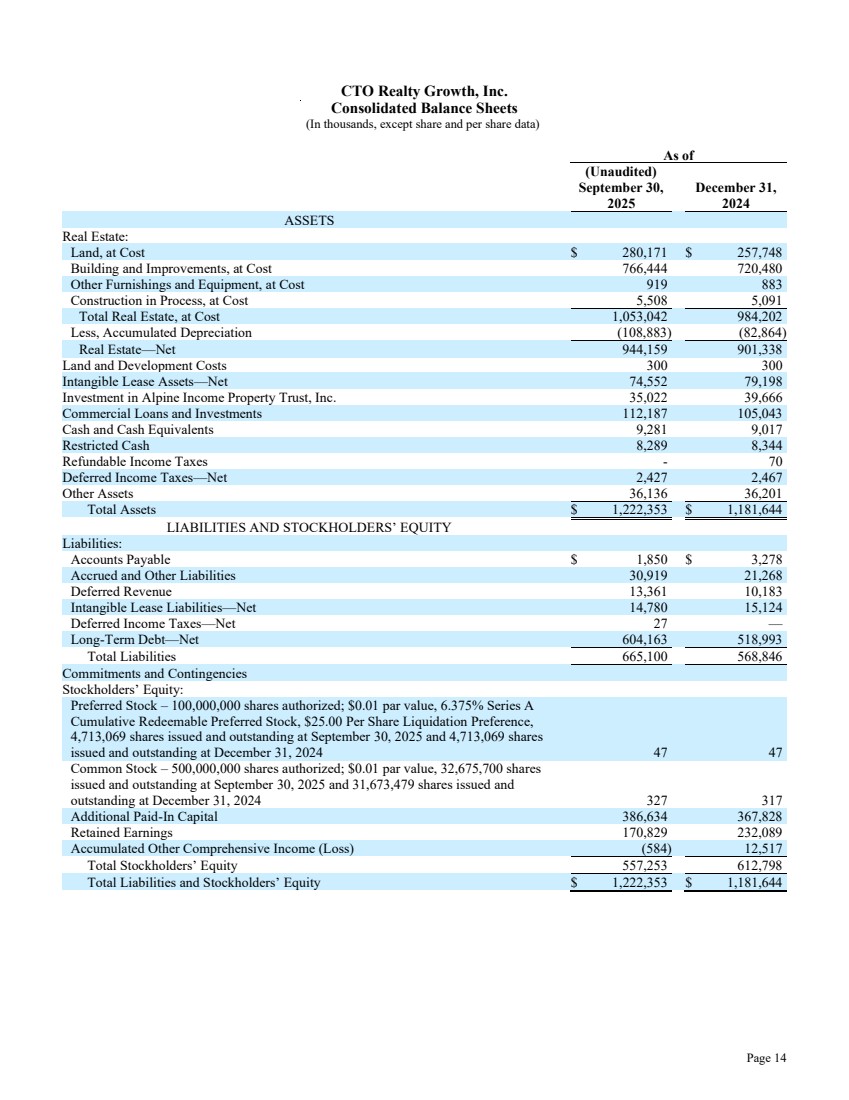

| Page 14 CTO Realty Growth, Inc. Consolidated Balance Sheets (In thousands, except share and per share data) As of (Unaudited) September 30, 2025 December 31, 2024 ASSETS Real Estate: Land, at Cost $ 280,171 $ 257,748 Building and Improvements, at Cost 766,444 720,480 Other Furnishings and Equipment, at Cost 919 883 Construction in Process, at Cost 5,508 5,091 Total Real Estate, at Cost 1,053,042 984,202 Less, Accumulated Depreciation (108,883) (82,864) Real Estate—Net 944,159 901,338 Land and Development Costs 300 300 Intangible Lease Assets—Net 74,552 79,198 Investment in Alpine Income Property Trust, Inc. 35,022 39,666 Commercial Loans and Investments 112,187 105,043 Cash and Cash Equivalents 9,281 9,017 Restricted Cash 8,289 8,344 Refundable Income Taxes - 70 Deferred Income Taxes—Net 2,427 2,467 Other Assets 36,136 36,201 Total Assets $ 1,222,353 $ 1,181,644 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities: Accounts Payable $ 1,850 $ 3,278 Accrued and Other Liabilities 30,919 21,268 Deferred Revenue 13,361 10,183 Intangible Lease Liabilities—Net 14,780 15,124 Deferred Income Taxes—Net 27 — Long-Term Debt—Net 604,163 518,993 Total Liabilities 665,100 568,846 Commitments and Contingencies Stockholders’ Equity: Preferred Stock – 100,000,000 shares authorized; $0.01 par value, 6.375% Series A Cumulative Redeemable Preferred Stock, $25.00 Per Share Liquidation Preference, 4,713,069 shares issued and outstanding at September 30, 2025 and 4,713,069 shares issued and outstanding at December 31, 2024 47 47 Common Stock – 500,000,000 shares authorized; $0.01 par value, 32,675,700 shares issued and outstanding at September 30, 2025 and 31,673,479 shares issued and outstanding at December 31, 2024 327 317 Additional Paid-In Capital 386,634 367,828 Retained Earnings 170,829 232,089 Accumulated Other Comprehensive Income (Loss) (584) 12,517 Total Stockholders’ Equity 557,253 612,798 Total Liabilities and Stockholders’ Equity $ 1,222,353 $ 1,181,644 |

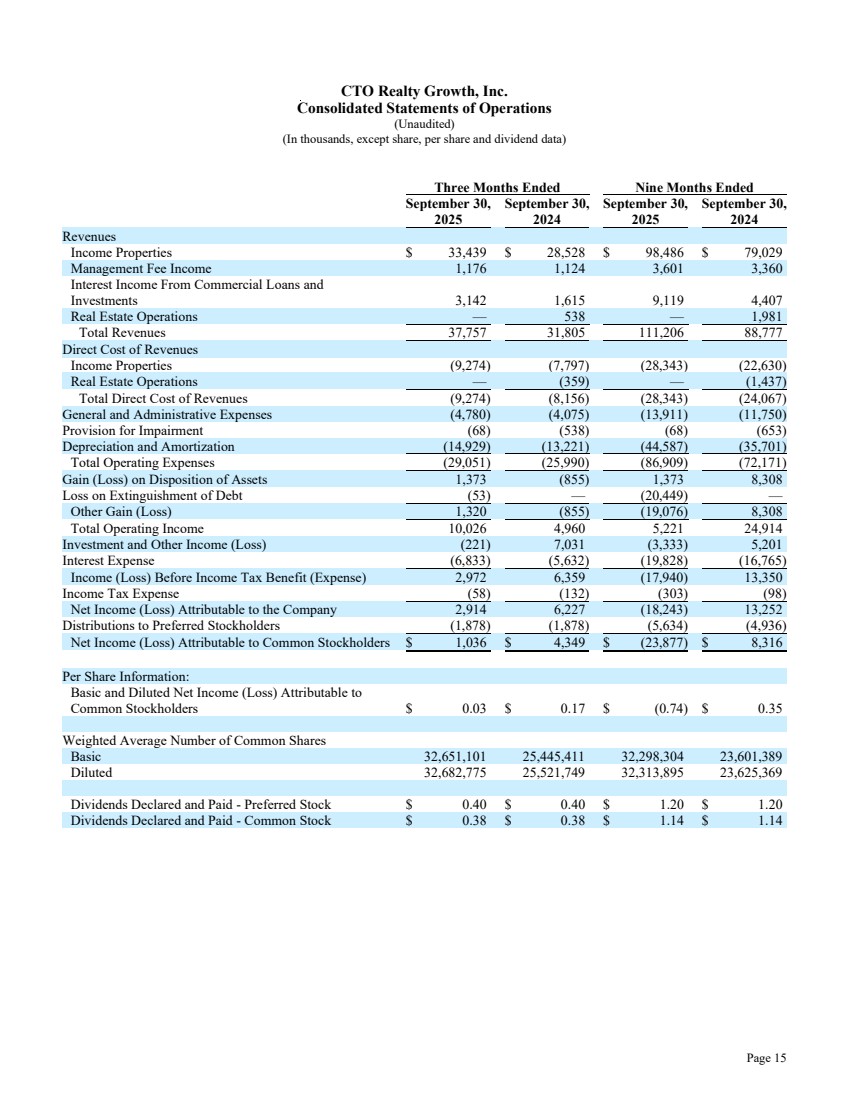

| Page 15 CTO Realty Growth, Inc. Consolidated Statements of Operations (Unaudited) (In thousands, except share, per share and dividend data) Three Months Ended Nine Months Ended September 30, September 30, September 30, September 30, 2025 2024 2025 2024 Revenues Income Properties $ 33,439 $ 28,528 $ 98,486 $ 79,029 Management Fee Income 1,176 1,124 3,601 3,360 Interest Income From Commercial Loans and Investments 3,142 1,615 9,119 4,407 Real Estate Operations — 538 — 1,981 Total Revenues 37,757 31,805 111,206 88,777 Direct Cost of Revenues Income Properties (9,274) (7,797) (28,343) (22,630) Real Estate Operations — (359) — (1,437) Total Direct Cost of Revenues (9,274) (8,156) (28,343) (24,067) General and Administrative Expenses (4,780) (4,075) (13,911) (11,750) Provision for Impairment (68) (538) (68) (653) Depreciation and Amortization (14,929) (13,221) (44,587) (35,701) Total Operating Expenses (29,051) (25,990) (86,909) (72,171) Gain (Loss) on Disposition of Assets 1,373 (855) 1,373 8,308 Loss on Extinguishment of Debt (53) — (20,449) — Other Gain (Loss) 1,320 (855) (19,076) 8,308 Total Operating Income 10,026 4,960 5,221 24,914 Investment and Other Income (Loss) (221) 7,031 (3,333) 5,201 Interest Expense (6,833) (5,632) (19,828) (16,765) Income (Loss) Before Income Tax Benefit (Expense) 2,972 6,359 (17,940) 13,350 Income Tax Expense (58) (132) (303) (98) Net Income (Loss) Attributable to the Company 2,914 6,227 (18,243) 13,252 Distributions to Preferred Stockholders (1,878) (1,878) (5,634) (4,936) Net Income (Loss) Attributable to Common Stockholders $ 1,036 $ 4,349 $ (23,877) $ 8,316 Per Share Information: Basic and Diluted Net Income (Loss) Attributable to Common Stockholders $ 0.03 $ 0.17 $ (0.74) $ 0.35 Weighted Average Number of Common Shares Basic 32,651,101 25,445,411 32,298,304 23,601,389 Diluted 32,682,775 25,521,749 32,313,895 23,625,369 Dividends Declared and Paid - Preferred Stock $ 0.40 $ 0.40 $ 1.20 $ 1.20 Dividends Declared and Paid - Common Stock $ 0.38 $ 0.38 $ 1.14 $ 1.14 |

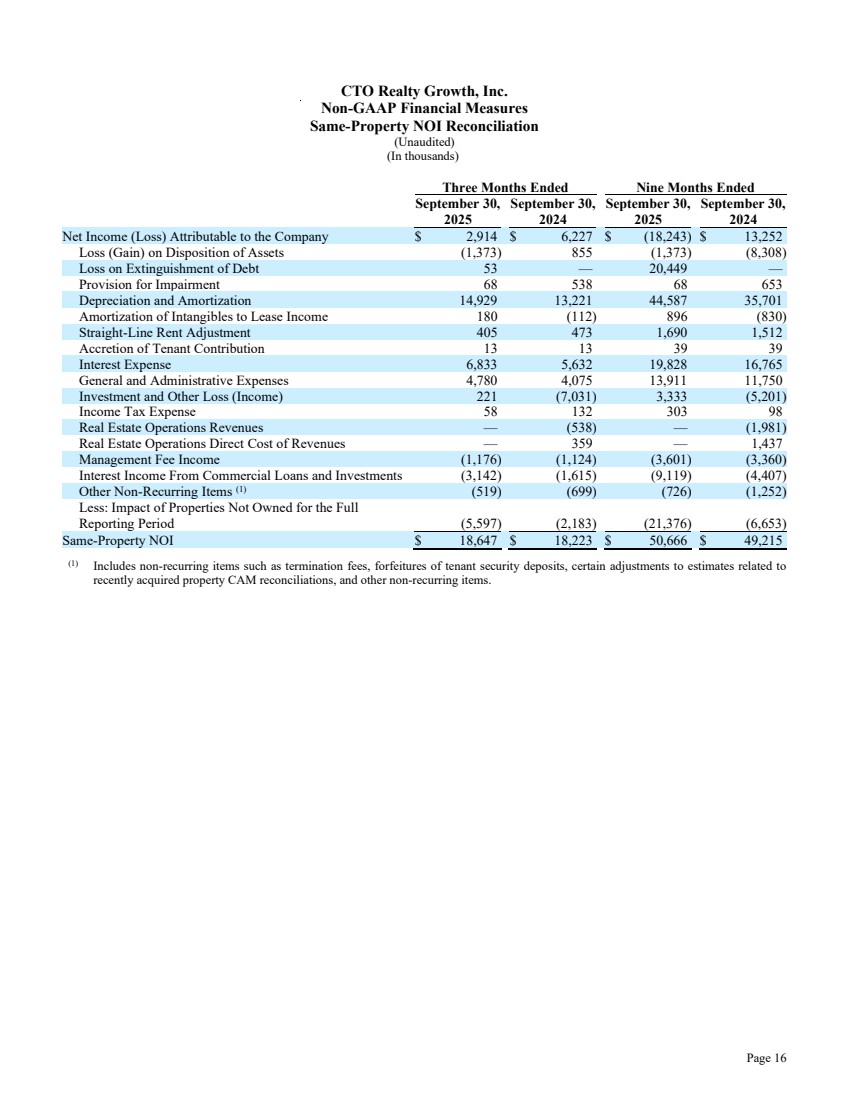

| Page 16 CTO Realty Growth, Inc. Non-GAAP Financial Measures Same-Property NOI Reconciliation (Unaudited) (In thousands) Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Net Income (Loss) Attributable to the Company $ 2,914 $ 6,227 $ (18,243) $ 13,252 Loss (Gain) on Disposition of Assets (1,373) 855 (1,373) (8,308) Loss on Extinguishment of Debt 53 — 20,449 — Provision for Impairment 68 538 68 653 Depreciation and Amortization 14,929 13,221 44,587 35,701 Amortization of Intangibles to Lease Income 180 (112) 896 (830) Straight-Line Rent Adjustment 405 473 1,690 1,512 Accretion of Tenant Contribution 13 13 39 39 Interest Expense 6,833 5,632 19,828 16,765 General and Administrative Expenses 4,780 4,075 13,911 11,750 Investment and Other Loss (Income) 221 (7,031) 3,333 (5,201) Income Tax Expense 58 132 303 98 Real Estate Operations Revenues — (538) — (1,981) Real Estate Operations Direct Cost of Revenues — 359 — 1,437 Management Fee Income (1,176) (1,124) (3,601) (3,360) Interest Income From Commercial Loans and Investments (3,142) (1,615) (9,119) (4,407) Other Non-Recurring Items (1) (519) (699) (726) (1,252) Less: Impact of Properties Not Owned for the Full Reporting Period (5,597) (2,183) (21,376) (6,653) Same-Property NOI $ 18,647 $ 18,223 $ 50,666 $ 49,215 (1) Includes non-recurring items such as termination fees, forfeitures of tenant security deposits, certain adjustments to estimates related to recently acquired property CAM reconciliations, and other non-recurring items. |

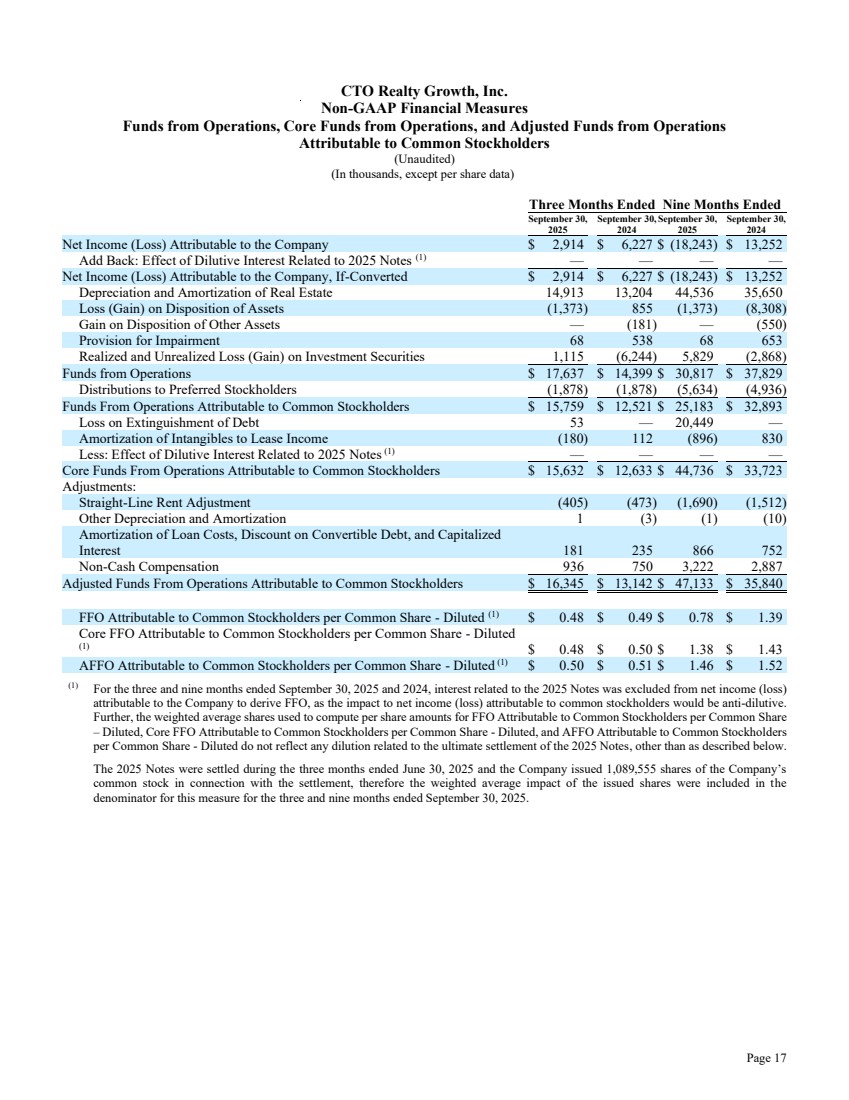

| Page 17 CTO Realty Growth, Inc. Non-GAAP Financial Measures Funds from Operations, Core Funds from Operations, and Adjusted Funds from Operations Attributable to Common Stockholders (Unaudited) (In thousands, except per share data) Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Net Income (Loss) Attributable to the Company $ 2,914 $ 6,227 $ (18,243) $ 13,252 Add Back: Effect of Dilutive Interest Related to 2025 Notes (1) — — — — Net Income (Loss) Attributable to the Company, If-Converted $ 2,914 $ 6,227 $ (18,243) $ 13,252 Depreciation and Amortization of Real Estate 14,913 13,204 44,536 35,650 Loss (Gain) on Disposition of Assets (1,373) 855 (1,373) (8,308) Gain on Disposition of Other Assets — (181) — (550) Provision for Impairment 68 538 68 653 Realized and Unrealized Loss (Gain) on Investment Securities 1,115 (6,244) 5,829 (2,868) Funds from Operations $ 17,637 $ 14,399 $ 30,817 $ 37,829 Distributions to Preferred Stockholders (1,878) (1,878) (5,634) (4,936) Funds From Operations Attributable to Common Stockholders $ 15,759 $ 12,521 $ 25,183 $ 32,893 Loss on Extinguishment of Debt 53 — 20,449 — Amortization of Intangibles to Lease Income (180) 112 (896) 830 Less: Effect of Dilutive Interest Related to 2025 Notes (1) — — — — Core Funds From Operations Attributable to Common Stockholders $ 15,632 $ 12,633 $ 44,736 $ 33,723 Adjustments: Straight-Line Rent Adjustment (405) (473) (1,690) (1,512) Other Depreciation and Amortization 1 (3) (1) (10) Amortization of Loan Costs, Discount on Convertible Debt, and Capitalized Interest 181 235 866 752 Non-Cash Compensation 936 750 3,222 2,887 Adjusted Funds From Operations Attributable to Common Stockholders $ 16,345 $ 13,142 $ 47,133 $ 35,840 FFO Attributable to Common Stockholders per Common Share - Diluted (1) $ 0.48 $ 0.49 $ 0.78 $ 1.39 Core FFO Attributable to Common Stockholders per Common Share - Diluted (1) $ 0.48 $ 0.50 $ 1.38 $ 1.43 AFFO Attributable to Common Stockholders per Common Share - Diluted (1) $ 0.50 $ 0.51 $ 1.46 $ 1.52 (1) For the three and nine months ended September 30, 2025 and 2024, interest related to the 2025 Notes was excluded from net income (loss) attributable to the Company to derive FFO, as the impact to net income (loss) attributable to common stockholders would be anti-dilutive. Further, the weighted average shares used to compute per share amounts for FFO Attributable to Common Stockholders per Common Share – Diluted, Core FFO Attributable to Common Stockholders per Common Share - Diluted, and AFFO Attributable to Common Stockholders per Common Share - Diluted do not reflect any dilution related to the ultimate settlement of the 2025 Notes, other than as described below. The 2025 Notes were settled during the three months ended June 30, 2025 and the Company issued 1,089,555 shares of the Company’s common stock in connection with the settlement, therefore the weighted average impact of the issued shares were included in the denominator for this measure for the three and nine months ended September 30, 2025. |

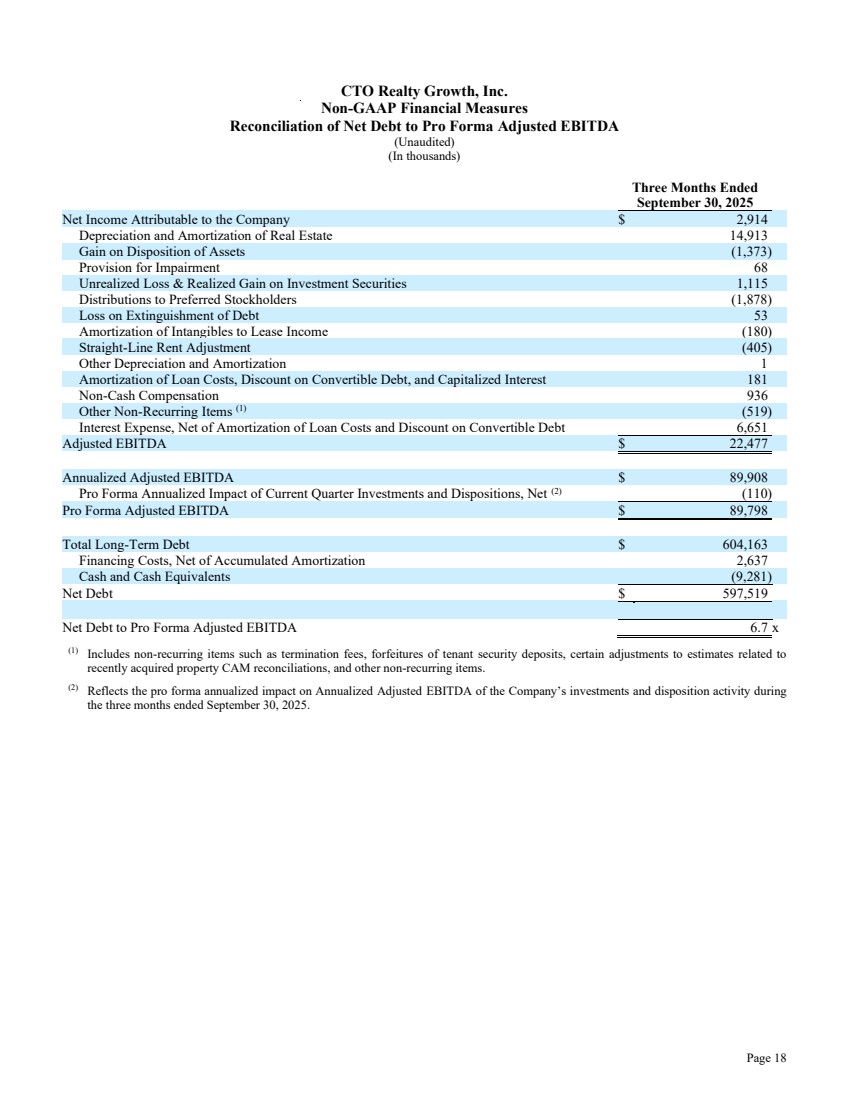

| Page 18 CTO Realty Growth, Inc. Non-GAAP Financial Measures Reconciliation of Net Debt to Pro Forma Adjusted EBITDA (Unaudited) (In thousands) Three Months Ended September 30, 2025 Net Income Attributable to the Company $ 2,914 Depreciation and Amortization of Real Estate 14,913 Gain on Disposition of Assets (1,373) Provision for Impairment 68 Unrealized Loss & Realized Gain on Investment Securities 1,115 Distributions to Preferred Stockholders (1,878) Loss on Extinguishment of Debt 53 Amortization of Intangibles to Lease Income (180) Straight-Line Rent Adjustment (405) Other Depreciation and Amortization 1 Amortization of Loan Costs, Discount on Convertible Debt, and Capitalized Interest 181 Non-Cash Compensation 936 Other Non-Recurring Items (1) (519) Interest Expense, Net of Amortization of Loan Costs and Discount on Convertible Debt 6,651 Adjusted EBITDA $ 22,477 Annualized Adjusted EBITDA $ 89,908 Pro Forma Annualized Impact of Current Quarter Investments and Dispositions, Net (2) (110) Pro Forma Adjusted EBITDA $ 89,798 Total Long-Term Debt $ 604,163 Financing Costs, Net of Accumulated Amortization 2,637 Cash and Cash Equivalents (9,281) Net Debt $ 597,519 Net Debt to Pro Forma Adjusted EBITDA 6.7 x (1) Includes non-recurring items such as termination fees, forfeitures of tenant security deposits, certain adjustments to estimates related to recently acquired property CAM reconciliations, and other non-recurring items. (2) Reflects the pro forma annualized impact on Annualized Adjusted EBITDA of the Company’s investments and disposition activity during the three months ended September 30, 2025. |

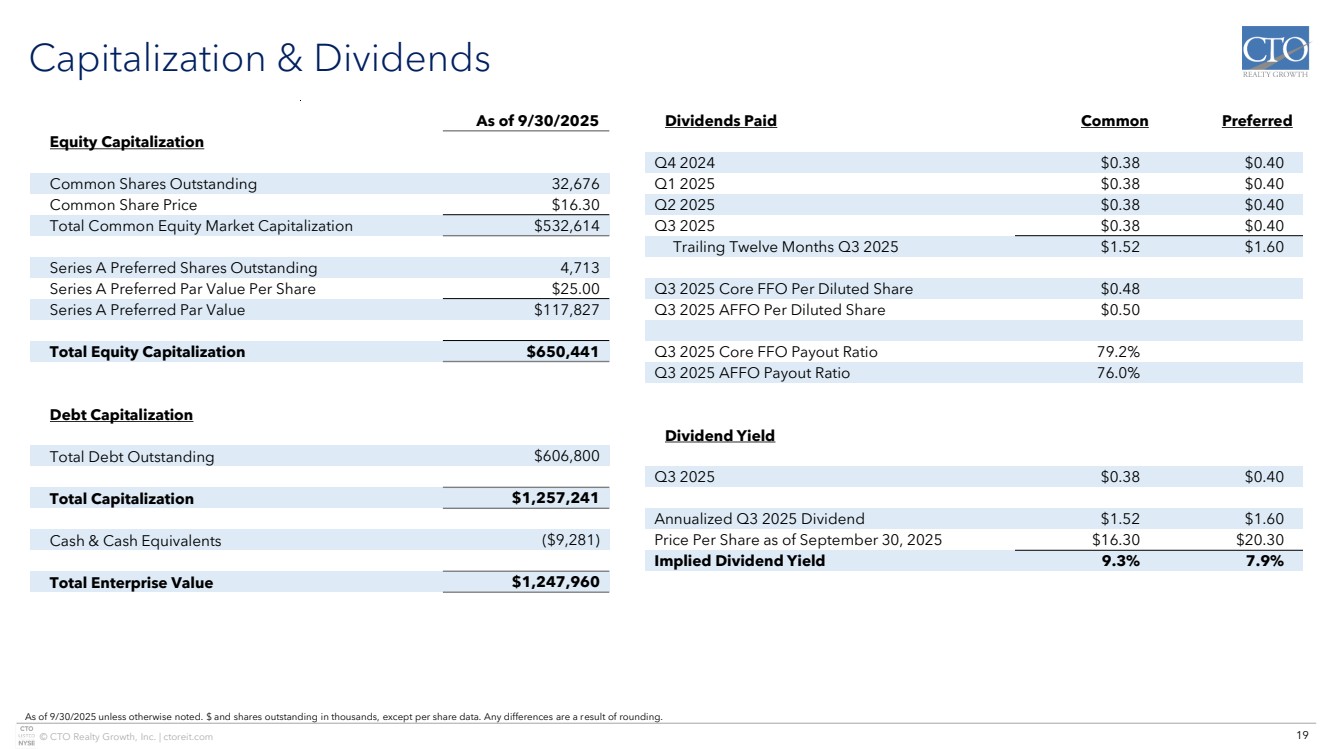

| © CTO Realty Growth, Inc. | ctoreit.com Capitalization & Dividends As of 9/30/2025 Equity Capitalization Common Shares Outstanding 32,676 Common Share Price $16.30 Total Common Equity Market Capitalization $532,614 Series A Preferred Shares Outstanding 4,713 Series A Preferred Par Value Per Share $25.00 Series A Preferred Par Value $117,827 Total Equity Capitalization $650,441 Debt Capitalization Total Debt Outstanding $606,800 Total Capitalization $1,257,241 Cash & Cash Equivalents ($9,281) Total Enterprise Value $1,247,960 Dividends Paid Common Preferred Q4 2024 $0.38 $0.40 Q1 2025 $0.38 $0.40 Q2 2025 $0.38 $0.40 Q3 2025 $0.38 $0.40 Trailing Twelve Months Q3 2025 $1.52 $1.60 Q3 2025 Core FFO Per Diluted Share $0.48 Q3 2025 AFFO Per Diluted Share $0.50 Q3 2025 Core FFO Payout Ratio 79.2% Q3 2025 AFFO Payout Ratio 76.0% Dividend Yield Q3 2025 $0.38 $0.40 Annualized Q3 2025 Dividend $1.52 $1.60 Price Per Share as of September 30, 2025 $16.30 $20.30 Implied Dividend Yield 9.3% 7.9% As of 9/30/2025 unless otherwise noted. $ and shares outstanding in thousands, except per share data. Any differences are a result of rounding. 19 |

| © CTO Realty Growth, Inc. | ctoreit.com Debt Summary as of September 30, 2025 $ in thousands. Any differences are a result of rounding. 1. Interest rate is calculated as 30-day SOFR + 10 bps + pricing tier based on leverage within the range of 1.25%-2.20% 2. Interest rate is calculated as 30-day SOFR + 10 bps + pricing tier based on leverage within the range of 1.20%-2.15% 3. Interest rate is calculated as 30-day SOFR + pricing tier based on leverage within the range of 1.20%-2.15% 4. See reconciliation as part of Non-GAAP Financial Measures in the Company’s Third Quarter 2025 Earnings Release. Indebtedness Outstanding Face Value Weighted Average Rate Initial Maturity Date Type Mortgage Note 17,800 4.06% August 2026 Fixed Revolving Credit Facility 1 74,000 5.69% January 2027 Floating Revolving Credit Facility 1 65,000 4.57% January 2027 Fixed 2027 Term Loan1 100,000 2.80% January 2027 Fixed 2028 Term Loan2 100,000 5.18% January 2028 Fixed 2029 Term Loan3 125,000 4.21% September 2029 Fixed 2030 Term Loan3 125,000 4.24% September 2030 Fixed Total / Weighted Average $606,800 4.36% Leverage Metrics Face Value of Debt $606,800 Cash & Cash Equivalents ($9,281) Net Debt $597,519 Total Enterprise Value $1,247,960 Net Debt to Total Enterprise Value 47.9% Net Debt to Pro Forma Adjusted EBITDA4 6.7x 20 |

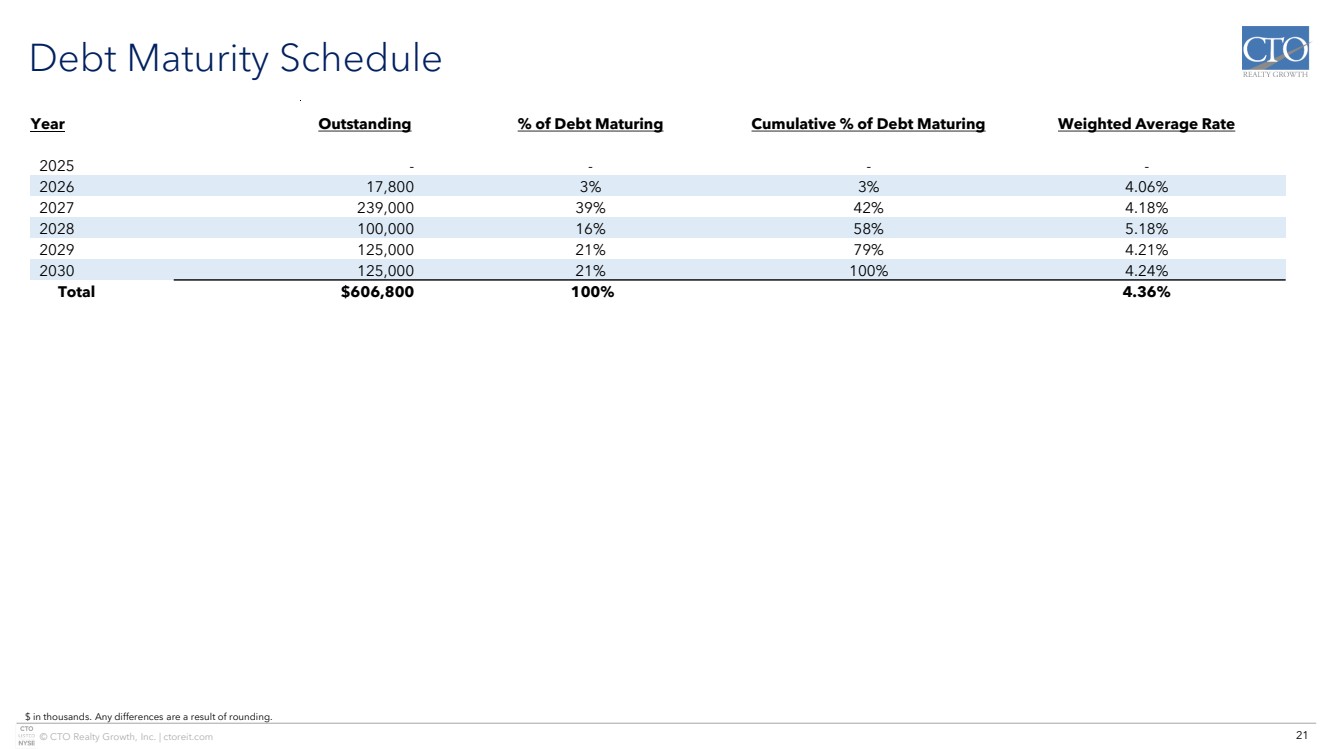

| © CTO Realty Growth, Inc. | ctoreit.com Debt Maturity Schedule Year Outstanding % of Debt Maturing Cumulative % of Debt Maturing Weighted Average Rate 2025 - - - - 2026 17,800 3% 3% 4.06% 2027 239,000 39% 42% 4.18% 2028 100,000 16% 58% 5.18% 2029 125,000 21% 79% 4.21% 2030 125,000 21% 100% 4.24% Total $606,800 100% 4.36% $ in thousands. Any differences are a result of rounding. 21 |

| © CTO Realty Growth, Inc. | ctoreit.com Year-to-Date Investment & Disposition Activity Property Acquisitions Market Type Date Acquired Square Feet Price Occupancy At Acquisition Ashley Park – Newnan, GA Atlanta, GA Lifestyle March 2025 559,465 $79,750 92% Total Acquisitions 559,465 $79,750 Property Dispositions Market Type Date Sold Square Feet Price Gain/(Loss) Main Street – Daytona Beach, FL Daytona Beach, FL Single-Tenant Retail August 2025 29,681 $7,100 $1,150 Total Dispositions 29,681 $7,100 $1,150 $ in thousands. Any differences are a result of rounding. 22 |

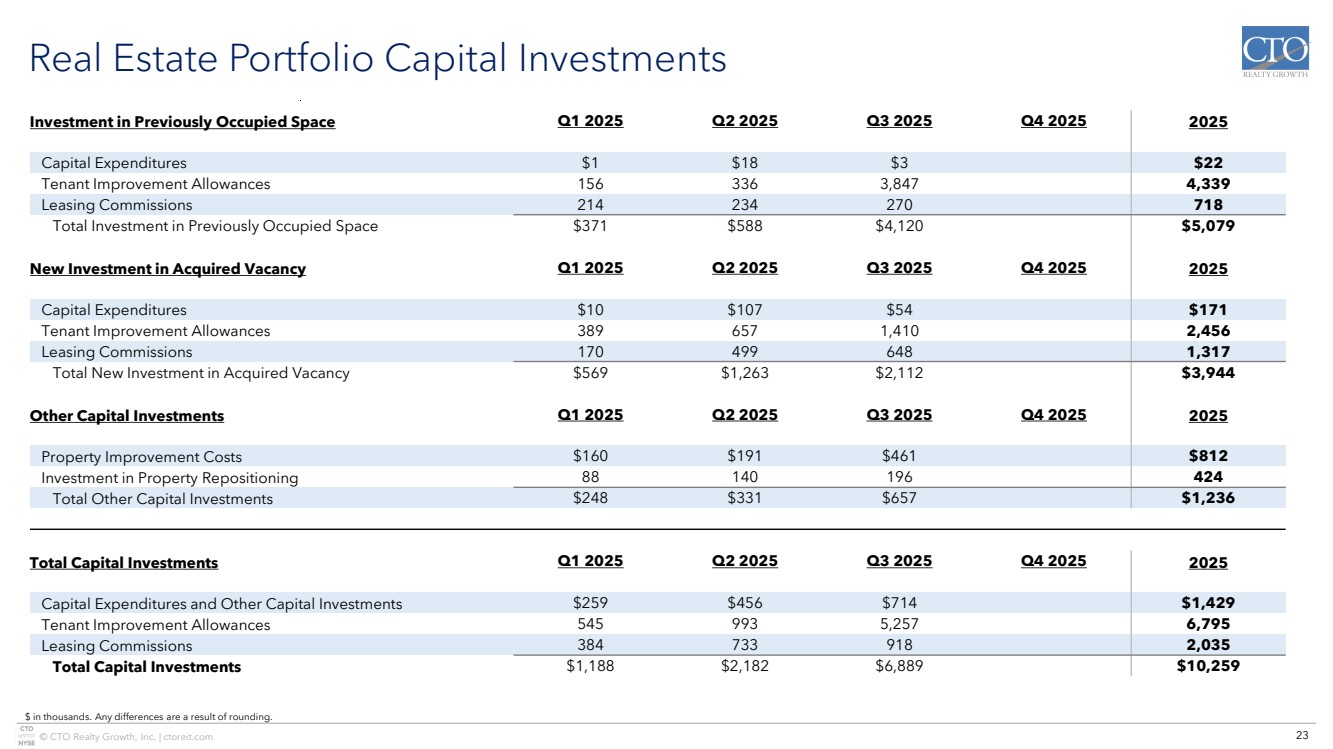

| © CTO Realty Growth, Inc. | ctoreit.com Real Estate Portfolio Capital Investments Investment in Previously Occupied Space Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Capital Expenditures $1 $18 $3 $22 Tenant Improvement Allowances 156 336 3,847 4,339 Leasing Commissions 214 234 270 718 Total Investment in Previously Occupied Space $371 $588 $4,120 $5,079 New Investment in Acquired Vacancy Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Capital Expenditures $10 $107 $54 $171 Tenant Improvement Allowances 389 657 1,410 2,456 Leasing Commissions 170 499 648 1,317 Total New Investment in Acquired Vacancy $569 $1,263 $2,112 $3,944 Other Capital Investments Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Property Improvement Costs $160 $191 $461 $812 Investment in Property Repositioning 88 140 196 424 Total Other Capital Investments $248 $331 $657 $1,236 Total Capital Investments Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Capital Expenditures and Other Capital Investments $259 $456 $714 $1,429 Tenant Improvement Allowances 545 993 5,257 6,795 Leasing Commissions 384 733 918 2,035 Total Capital Investments $1,188 $2,182 $6,889 $10,259 $ in thousands. Any differences are a result of rounding. 23 |

| © CTO Realty Growth, Inc. | ctoreit.com Real Estate Portfolio Summary Total Portfolio as of September 30, 2025 Asset Type Number of Properties Square Feet Cash ABR PSF Occupancy Leased Occupancy Single Tenant 3 222 $21.55 100.0% 100.0% Multi-Tenant 18 5,005 $19.53 90.1% 93.9% Total Portfolio 21 5,227 $19.61 90.6% 94.2% Property Type Number of Properties Square Feet Cash ABR PSF Occupancy Leased Occupancy Retail 16 3,793 $18.83 91.9% 95.6% Office 1 210 $17.75 100.0% 100.0% Mixed Use 1 4 1,224 $22.37 84.7% 88.7% Total Portfolio 21 5,227 $19.61 90.6% 94.2% Property Type Number of Properties Square Feet Cash ABR PSF Occupancy Leased Occupancy Grocery-Anchored Retail 5 828 $25.16 95.9% 97.0% Retail Power Center 8 2,509 $16.74 90.8% 94.9% Lifestyle 4 1,640 $20.78 86.1% 90.9% Other 2 4 250 $22.50 100.0% 100.0% Total Portfolio 21 5,227 $19.61 90.6% 94.2% $ and square feet in thousands, except per square foot data. Any differences are a result of rounding. 1. Includes The Collection at Forsyth, The Shops at Legacy, West Broad Village and the Winter Park Office, all of which include some combination of retail and office 2. Includes the three single tenant assets and the Winter Park Office 24 |

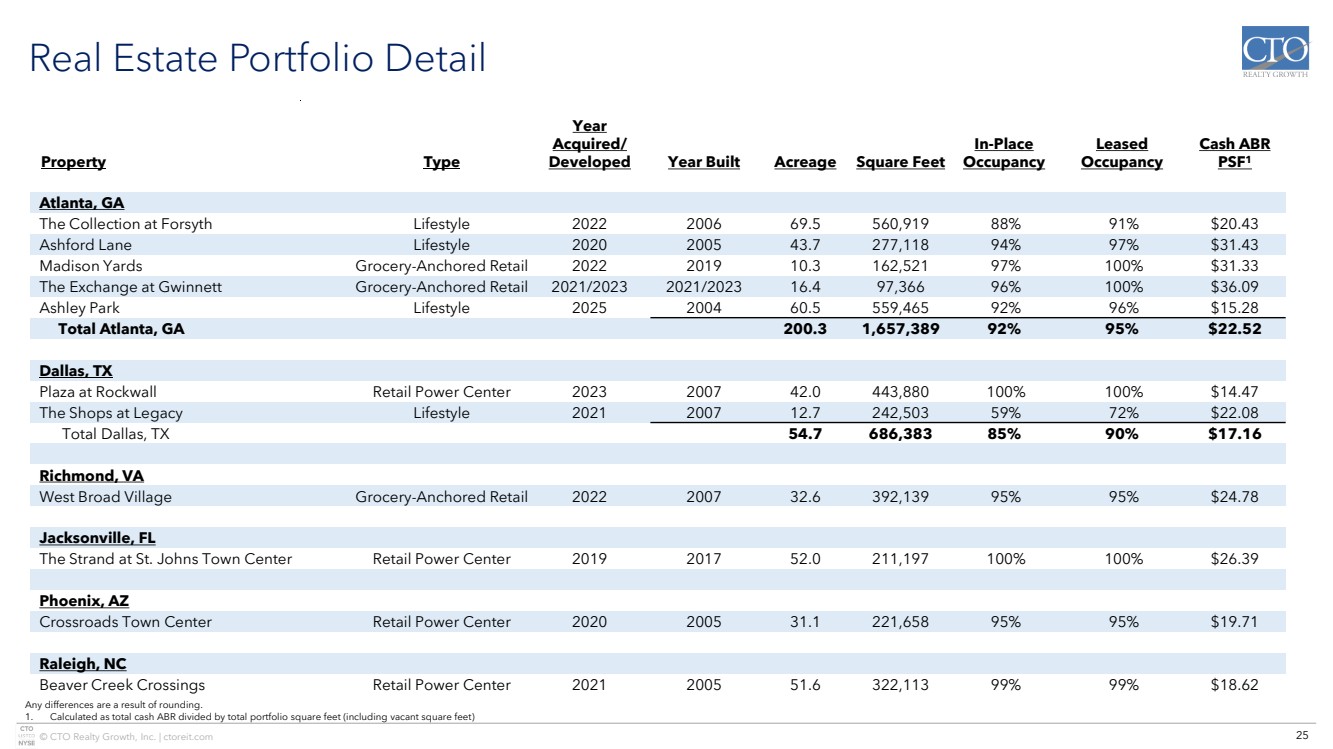

| © CTO Realty Growth, Inc. | ctoreit.com Real Estate Portfolio Detail Property Type Year Acquired/ Developed Year Built Acreage Square Feet In-Place Occupancy Leased Occupancy Cash ABR PSF1 Atlanta, GA The Collection at Forsyth Lifestyle 2022 2006 69.5 560,919 88% 91% $20.43 Ashford Lane Lifestyle 2020 2005 43.7 277,118 94% 97% $31.43 Madison Yards Grocery-Anchored Retail 2022 2019 10.3 162,521 97% 100% $31.33 The Exchange at Gwinnett Grocery-Anchored Retail 2021/2023 2021/2023 16.4 97,366 96% 100% $36.09 Ashley Park Lifestyle 2025 2004 60.5 559,465 92% 96% $15.28 Total Atlanta, GA 200.3 1,657,389 92% 95% $22.52 Dallas, TX Plaza at Rockwall Retail Power Center 2023 2007 42.0 443,880 100% 100% $14.47 The Shops at Legacy Lifestyle 2021 2007 12.7 242,503 59% 72% $22.08 Total Dallas, TX 54.7 686,383 85% 90% $17.16 Richmond, VA West Broad Village Grocery-Anchored Retail 2022 2007 32.6 392,139 95% 95% $24.78 Jacksonville, FL The Strand at St. Johns Town Center Retail Power Center 2019 2017 52.0 211,197 100% 100% $26.39 Phoenix, AZ Crossroads Town Center Retail Power Center 2020 2005 31.1 221,658 95% 95% $19.71 Raleigh, NC Beaver Creek Crossings Retail Power Center 2021 2005 51.6 322,113 99% 99% $18.62 Any differences are a result of rounding. 1. Calculated as total cash ABR divided by total portfolio square feet (including vacant square feet) 25 |

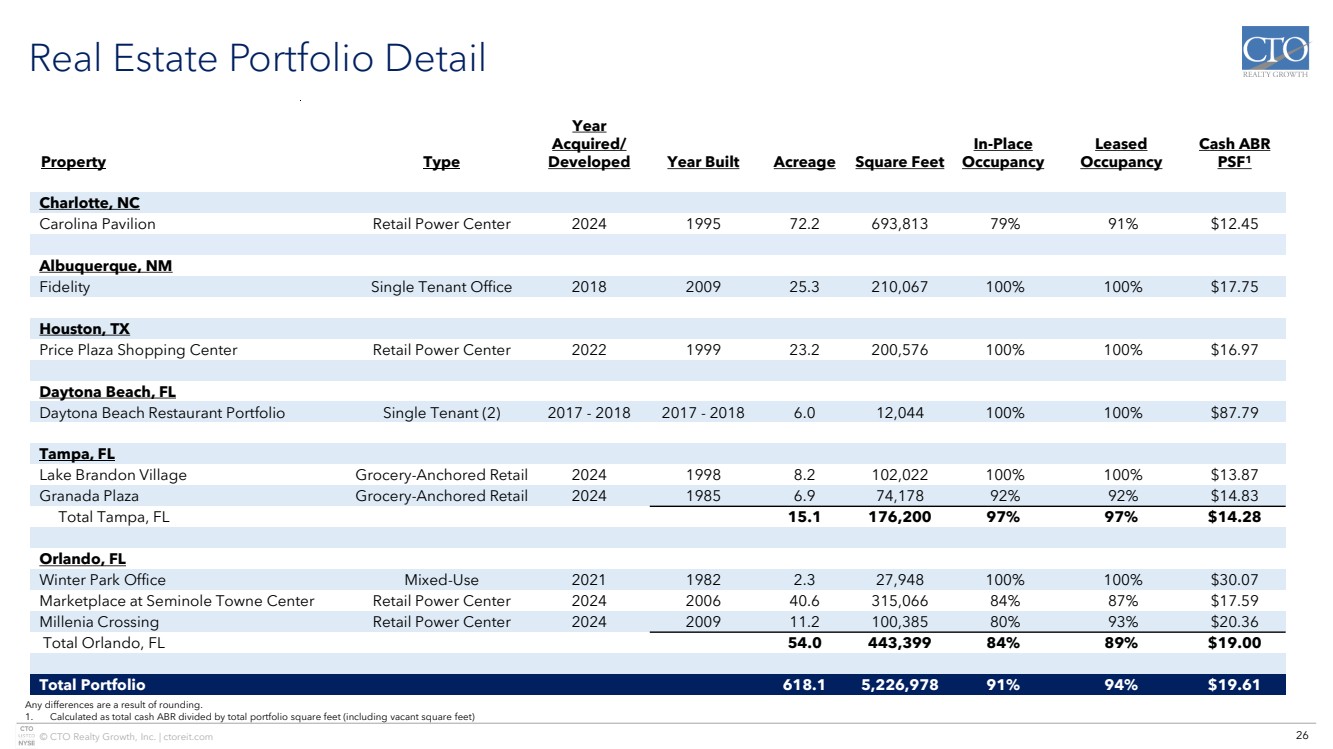

| © CTO Realty Growth, Inc. | ctoreit.com Real Estate Portfolio Detail Property Type Year Acquired/ Developed Year Built Acreage Square Feet In-Place Occupancy Leased Occupancy Cash ABR PSF1 Charlotte, NC Carolina Pavilion Retail Power Center 2024 1995 72.2 693,813 79% 91% $12.45 Albuquerque, NM Fidelity Single Tenant Office 2018 2009 25.3 210,067 100% 100% $17.75 Houston, TX Price Plaza Shopping Center Retail Power Center 2022 1999 23.2 200,576 100% 100% $16.97 Daytona Beach, FL Daytona Beach Restaurant Portfolio Single Tenant (2) 2017 - 2018 2017 - 2018 6.0 12,044 100% 100% $87.79 Tampa, FL Lake Brandon Village Grocery-Anchored Retail 2024 1998 8.2 102,022 100% 100% $13.87 Granada Plaza Grocery-Anchored Retail 2024 1985 6.9 74,178 92% 92% $14.83 Total Tampa, FL 15.1 176,200 97% 97% $14.28 Orlando, FL Winter Park Office Mixed-Use 2021 1982 2.3 27,948 100% 100% $30.07 Marketplace at Seminole Towne Center Retail Power Center 2024 2006 40.6 315,066 84% 87% $17.59 Millenia Crossing Retail Power Center 2024 2009 11.2 100,385 80% 93% $20.36 Total Orlando, FL 54.0 443,399 84% 89% $19.00 Total Portfolio 618.1 5,226,978 91% 94% $19.61 Any differences are a result of rounding. 1. Calculated as total cash ABR divided by total portfolio square feet (including vacant square feet) 26 |

| © CTO Realty Growth, Inc. | ctoreit.com Retail Leasing Summary Renewals and Extensions Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Leases 11 10 15 36 Square Feet 47 115 111 272 New Cash Rent PSF $26.05 $29.91 $18.99 $24.81 Tenant Improvements $26 - - $26 Leasing Commissions $23 - $10 $33 Weighted Average Term 4.9 years 6.1 years 5.3 years 5.6 years New Leases Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Leases 7 12 9 28 Square Feet 66 112 32 210 New Cash Rent PSF $22.79 $20.85 $36.88 $23.89 Tenant Improvements $1,392 $3,685 $1,110 $6,187 Leasing Commissions $683 $1,408 $714 $2,805 Weighted Average Term 9.4 years 9.7 years 8.9 years 9.4 years All Leases Summary Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Leases 18 22 24 64 Square Feet 113 227 143 482 New Cash Rent PSF $24.14 $25.43 $23.00 $24.41 Tenant Improvements $1,418 $3,685 $1,110 $6,213 Leasing Commissions $706 $1,408 $724 $2,838 Weighted Average Term 7.4 years 7.6 years 6.6 years 7.2 years $ and square feet in thousands, except per square foot data. Any differences are a result of rounding. Overall leasing activity does not include lease termination agreements or lease amendments related to tenant bankruptcy proceedings, or office leases. Tenant improvements include landlord work. 27 |

| © CTO Realty Growth, Inc. | ctoreit.com Comparable Retail Leasing Summary Renewals and Extensions - Comparable Number of Leases Signed GLA Signed New Cash Rent PSF Expiring Cash Rent PSF % Increase Over Expiring Rent Weighted Average Lease Term Tenant Improvements Lease Commissions 1st Quarter 2025 11 47 $26.05 $24.40 6.8% 4.9 years $26 $23 2nd Quarter 2025 10 115 $29.91 $27.91 7.2% 6.1 years - - 3rd Quarter 2025 15 111 $18.99 $16.78 13.2% 5.3 years - $10 4th Quarter 2025 Total / Wtd. Avg. 36 272 $24.81 $22.78 8.9% 5.6 years $26 $33 New Leases – Comparable Number of Leases Signed GLA Signed New Cash Rent PSF Expiring Cash Rent PSF % Increase Over Expiring Rent Weighted Average Lease Term Tenant Improvements Lease Commissions 1st Quarter 2025 6 63 $22.42 $12.32 82.0% 9.4 years $1,328 $639 2nd Quarter 2025 4 75 $18.90 $10.52 79.6% 10.0 years $2,580 $869 3rd Quarter 2025 6 14 $47.21 $46.14 2.3% 9.3 years $424 $424 4th Quarter 2025 Total / Wtd. Avg. 16 153 $23.01 $14.61 57.5% 9.6 years $4,333 $1,931 All Comparable Leases Summary Number of Leases Signed GLA Signed New Cash Rent PSF Expiring Cash Rent PSF % Increase Over Expiring Rent Weighted Average Lease Term Tenant Improvements Lease Commissions 1st Quarter 2025 17 109 $23.97 $17.47 37.2% 7.3 years $1,354 $662 2nd Quarter 2025 14 190 $25.54 $21.01 21.6% 7.2 years $2,580 $869 3rd Quarter 2025 21 125 $22.24 $20.16 10.3% 6.2 years $424 $433 4th Quarter 2025 Total / Wtd. Avg. 52 424 $24.16 $19.85 21.7% 7.0 years $4,359 $1,964 $ and square feet in thousands, except per square foot data. Any differences are a result of rounding. Comparable leases compare leases signed on a space for which there was previously a tenant. Does not include lease termination agreements or lease amendments related to tenant bankruptcy proceedings, or office leases. Tenant improvements include landlord work. 28 |

| © CTO Realty Growth, Inc. | ctoreit.com Same-Property NOI Multi-Tenant Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Number of Comparable Properties 12 13 13 12 Same-Property NOI – 2025 $15,965 $16,242 $17,442 $47,295 Same-Property NOI – 2024 $15,579 $16,104 $17,047 $45,892 $ Variance $386 $138 $395 $1,403 % Variance 2.5% 0.9% 2.3% 3.1% Single-Tenant Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Number of Comparable Properties 6 6 3 3 Same-Property NOI – 2025 $1,171 $1,305 $1,205 $3,371 Same-Property NOI – 2024 $1,148 $1,292 $1,176 $3,323 $ Variance $23 $13 $29 $48 % Variance 2.0% 1.0% 2.5% 1.4% All Properties Q1 2025 Q2 2025 Q3 2025 Q4 2025 2025 Number of Comparable Properties 18 19 16 15 Same-Property NOI – 2025 $17,136 $17,547 $18,647 $50,666 Same-Property NOI – 2024 $16,727 $17,396 $18,223 $49,215 $ Variance $409 $151 $424 $1,451 % Variance 2.4% 0.9% 2.3% 2.9% $ and square feet in thousands, except per square foot data. Any differences are a result of rounding. 29 |

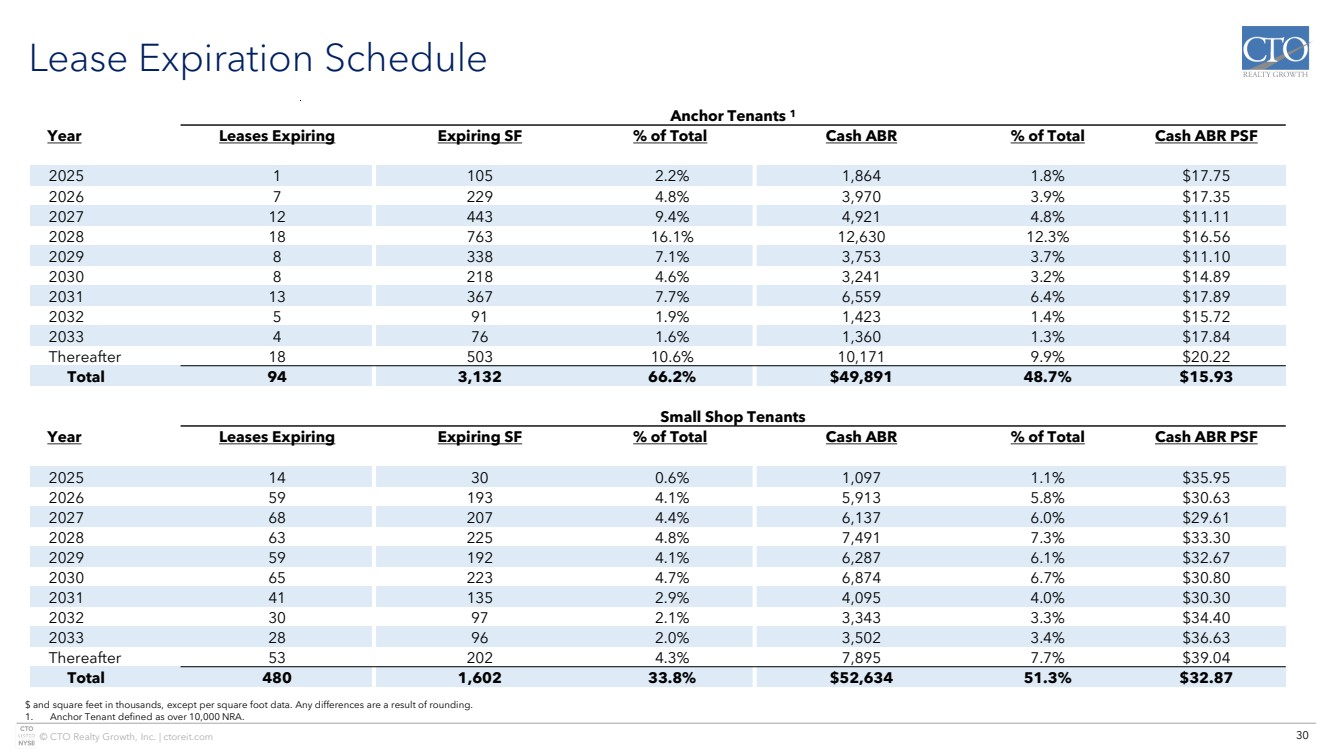

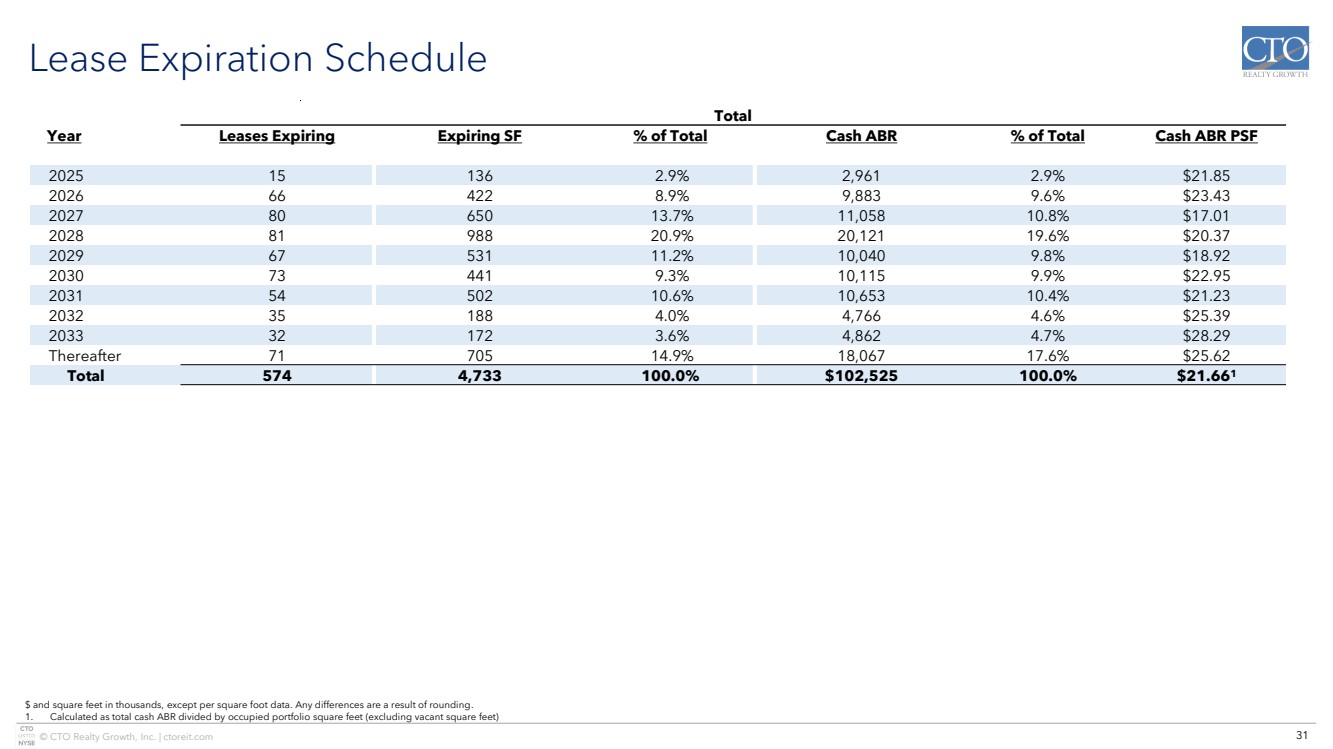

| © CTO Realty Growth, Inc. | ctoreit.com Lease Expiration Schedule Anchor Tenants 1 Year Leases Expiring Expiring SF % of Total Cash ABR % of Total Cash ABR PSF 2025 1 105 2.2% 1,864 1.8% $17.75 2026 7 229 4.8% 3,970 3.9% $17.35 2027 12 443 9.4% 4,921 4.8% $11.11 2028 18 763 16.1% 12,630 12.3% $16.56 2029 8 338 7.1% 3,753 3.7% $11.10 2030 8 218 4.6% 3,241 3.2% $14.89 2031 13 367 7.7% 6,559 6.4% $17.89 2032 5 91 1.9% 1,423 1.4% $15.72 2033 4 76 1.6% 1,360 1.3% $17.84 Thereafter 18 503 10.6% 10,171 9.9% $20.22 Total 94 3,132 66.2% $49,891 48.7% $15.93 Small Shop Tenants Year Leases Expiring Expiring SF % of Total Cash ABR % of Total Cash ABR PSF 2025 14 30 0.6% 1,097 1.1% $35.95 2026 59 193 4.1% 5,913 5.8% $30.63 2027 68 207 4.4% 6,137 6.0% $29.61 2028 63 225 4.8% 7,491 7.3% $33.30 2029 59 192 4.1% 6,287 6.1% $32.67 2030 65 223 4.7% 6,874 6.7% $30.80 2031 41 135 2.9% 4,095 4.0% $30.30 2032 30 97 2.1% 3,343 3.3% $34.40 2033 28 96 2.0% 3,502 3.4% $36.63 Thereafter 53 202 4.3% 7,895 7.7% $39.04 Total 480 1,602 33.8% $52,634 51.3% $32.87 $ and square feet in thousands, except per square foot data. Any differences are a result of rounding. 1. Anchor Tenant defined as over 10,000 NRA. 30 |

| © CTO Realty Growth, Inc. | ctoreit.com Lease Expiration Schedule Total Year Leases Expiring Expiring SF % of Total Cash ABR % of Total Cash ABR PSF 2025 15 136 2.9% 2,961 2.9% $21.85 2026 66 422 8.9% 9,883 9.6% $23.43 2027 80 650 13.7% 11,058 10.8% $17.01 2028 81 988 20.9% 20,121 19.6% $20.37 2029 67 531 11.2% 10,040 9.8% $18.92 2030 73 441 9.3% 10,115 9.9% $22.95 2031 54 502 10.6% 10,653 10.4% $21.23 2032 35 188 4.0% 4,766 4.6% $25.39 2033 32 172 3.6% 4,862 4.7% $28.29 Thereafter 71 705 14.9% 18,067 17.6% $25.62 Total 574 4,733 100.0% $102,525 100.0% $21.661 $ and square feet in thousands, except per square foot data. Any differences are a result of rounding. 1. Calculated as total cash ABR divided by occupied portfolio square feet (excluding vacant square feet) 31 |

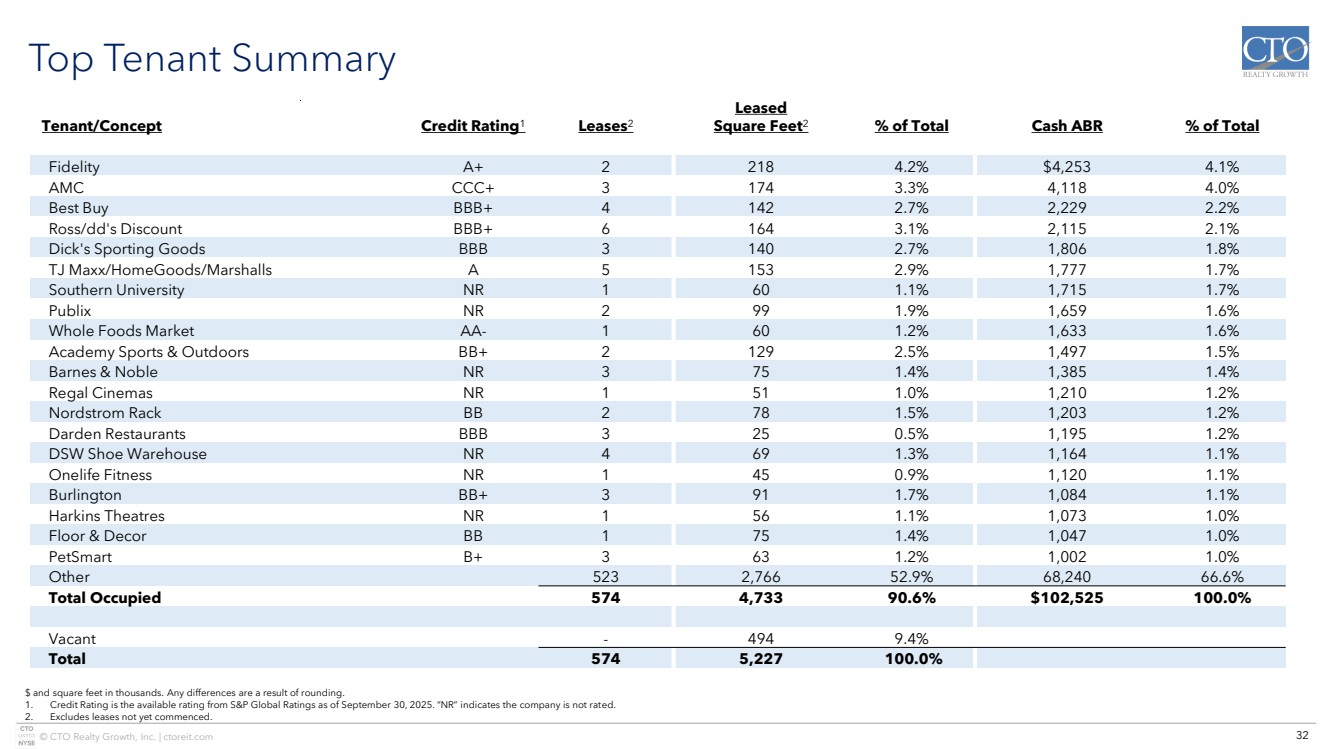

| © CTO Realty Growth, Inc. | ctoreit.com Top Tenant Summary Tenant/Concept Credit Rating1 Leases2 Leased Square Feet2 % of Total Cash ABR % of Total Fidelity A+ 2 218 4.2% $4,253 4.1% AMC CCC+ 3 174 3.3% 4,118 4.0% Best Buy BBB+ 4 142 2.7% 2,229 2.2% Ross/dd's Discount BBB+ 6 164 3.1% 2,115 2.1% Dick's Sporting Goods BBB 3 140 2.7% 1,806 1.8% TJ Maxx/HomeGoods/Marshalls A 5 153 2.9% 1,777 1.7% Southern University NR 1 60 1.1% 1,715 1.7% Publix NR 2 99 1.9% 1,659 1.6% Whole Foods Market AA- 1 60 1.2% 1,633 1.6% Academy Sports & Outdoors BB+ 2 129 2.5% 1,497 1.5% Barnes & Noble NR 3 75 1.4% 1,385 1.4% Regal Cinemas NR 1 51 1.0% 1,210 1.2% Nordstrom Rack BB 2 78 1.5% 1,203 1.2% Darden Restaurants BBB 3 25 0.5% 1,195 1.2% DSW Shoe Warehouse NR 4 69 1.3% 1,164 1.1% Onelife Fitness NR 1 45 0.9% 1,120 1.1% Burlington BB+ 3 91 1.7% 1,084 1.1% Harkins Theatres NR 1 56 1.1% 1,073 1.0% Floor & Decor BB 1 75 1.4% 1,047 1.0% PetSmart B+ 3 63 1.2% 1,002 1.0% Other 523 2,766 52.9% 68,240 66.6% Total Occupied 574 4,733 90.6% $102,525 100.0% Vacant - 494 9.4% Total 574 5,227 100.0% $ and square feet in thousands. Any differences are a result of rounding. 1. Credit Rating is the available rating from S&P Global Ratings as of September 30, 2025. “NR” indicates the company is not rated. 2. Excludes leases not yet commenced. 32 |

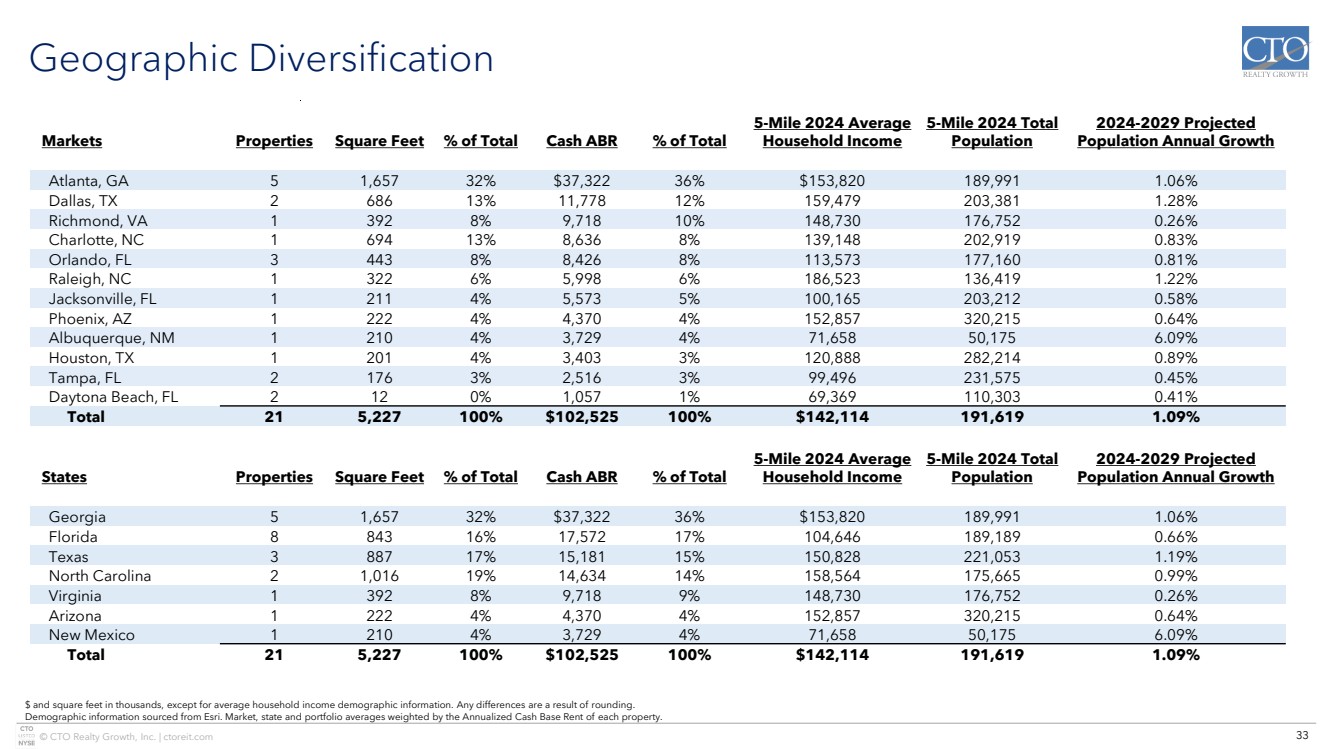

| © CTO Realty Growth, Inc. | ctoreit.com Geographic Diversification Markets Properties Square Feet % of Total Cash ABR % of Total 5-Mile 2024 Average Household Income 5-Mile 2024 Total Population 2024-2029 Projected Population Annual Growth Atlanta, GA 5 1,657 32% $37,322 36% $153,820 189,991 1.06% Dallas, TX 2 686 13% 11,778 12% 159,479 203,381 1.28% Richmond, VA 1 392 8% 9,718 10% 148,730 176,752 0.26% Charlotte, NC 1 694 13% 8,636 8% 139,148 202,919 0.83% Orlando, FL 3 443 8% 8,426 8% 113,573 177,160 0.81% Raleigh, NC 1 322 6% 5,998 6% 186,523 136,419 1.22% Jacksonville, FL 1 211 4% 5,573 5% 100,165 203,212 0.58% Phoenix, AZ 1 222 4% 4,370 4% 152,857 320,215 0.64% Albuquerque, NM 1 210 4% 3,729 4% 71,658 50,175 6.09% Houston, TX 1 201 4% 3,403 3% 120,888 282,214 0.89% Tampa, FL 2 176 3% 2,516 3% 99,496 231,575 0.45% Daytona Beach, FL 2 12 0% 1,057 1% 69,369 110,303 0.41% Total 21 5,227 100% $102,525 100% $142,114 191,619 1.09% States Properties Square Feet % of Total Cash ABR % of Total 5-Mile 2024 Average Household Income 5-Mile 2024 Total Population 2024-2029 Projected Population Annual Growth Georgia 5 1,657 32% $37,322 36% $153,820 189,991 1.06% Florida 8 843 16% 17,572 17% 104,646 189,189 0.66% Texas 3 887 17% 15,181 15% 150,828 221,053 1.19% North Carolina 2 1,016 19% 14,634 14% 158,564 175,665 0.99% Virginia 1 392 8% 9,718 9% 148,730 176,752 0.26% Arizona 1 222 4% 4,370 4% 152,857 320,215 0.64% New Mexico 1 210 4% 3,729 4% 71,658 50,175 6.09% Total 21 5,227 100% $102,525 100% $142,114 191,619 1.09% $ and square feet in thousands, except for average household income demographic information. Any differences are a result of rounding. Demographic information sourced from Esri. Market, state and portfolio averages weighted by the Annualized Cash Base Rent of each property. 33 |

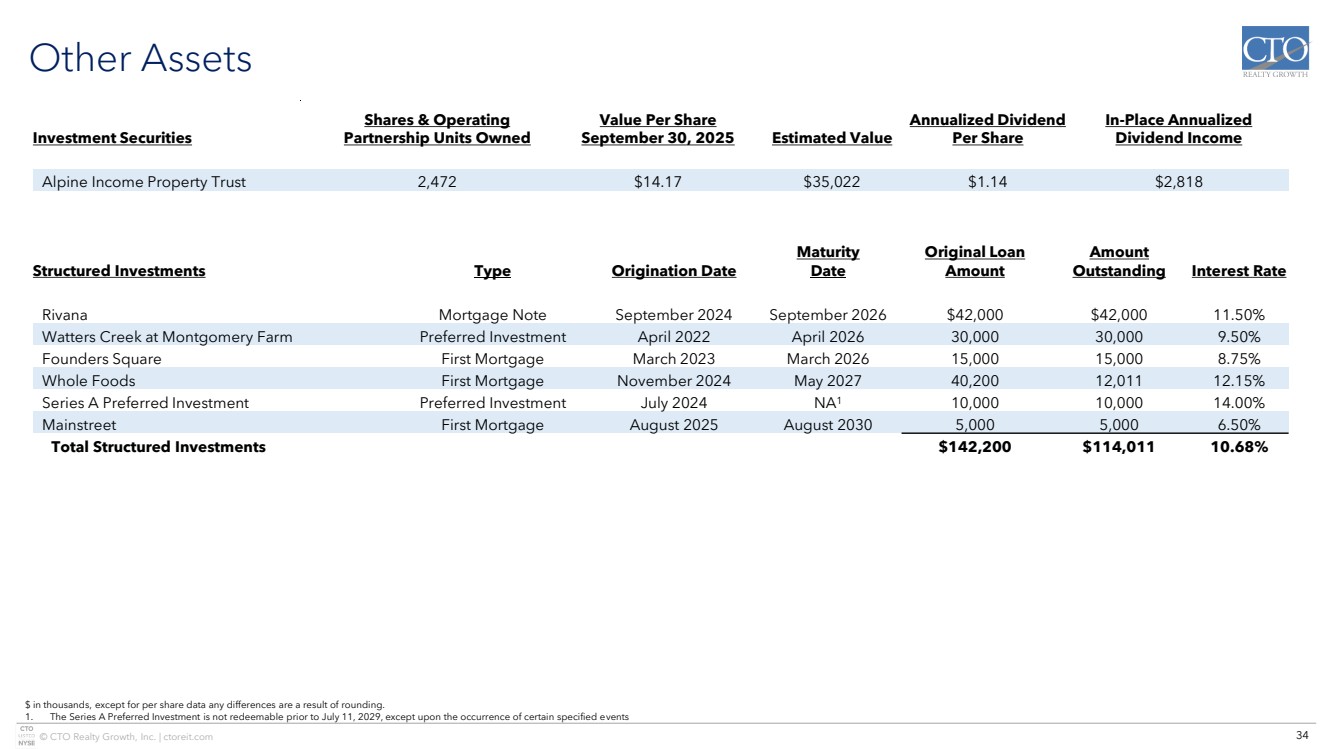

| © CTO Realty Growth, Inc. | ctoreit.com Other Assets Investment Securities Shares & Operating Partnership Units Owned Value Per Share September 30, 2025 Estimated Value Annualized Dividend Per Share In-Place Annualized Dividend Income Alpine Income Property Trust 2,472 $14.17 $35,022 $1.14 $2,818 Structured Investments Type Origination Date Maturity Date Original Loan Amount Amount Outstanding Interest Rate Rivana Mortgage Note September 2024 September 2026 $42,000 $42,000 11.50% Watters Creek at Montgomery Farm Preferred Investment April 2022 April 2026 30,000 30,000 9.50% Founders Square First Mortgage March 2023 March 2026 15,000 15,000 8.75% Whole Foods First Mortgage November 2024 May 2027 40,200 12,011 12.15% Series A Preferred Investment Preferred Investment July 2024 NA1 10,000 10,000 14.00% Mainstreet First Mortgage August 2025 August 2030 5,000 5,000 6.50% Total Structured Investments $142,200 $114,011 10.68% $ in thousands, except for per share data any differences are a result of rounding. 1. The Series A Preferred Investment is not redeemable prior to July 11, 2029, except upon the occurrence of certain specified events 34 |

| © CTO Realty Growth, Inc. | ctoreit.com 2025 Guidance Low High Core FFO Per Diluted Share1 $1.84 − $1.87 AFFO Per Diluted Share1 $1.96 − $1.99 The Company’s estimated Core FFO per diluted share and AFFO per diluted share for 2025 is as follows: The Company’s 2025 guidance includes but is not limited to the following assumptions: Low High Same-Property NOI Growth2 ~2.5% General and Administrative Expenses $18.0 Million − $18.5 Million Investments $100 Million − $200 Million Target Initial Investment Cash Yield 8.00% − 8.50% $ and shares outstanding in millions, except per share data. 1. See reconciliation of our 2025 Core FFO and AFFO guidance to Net Income Attributable to the Company, per diluted share, in our Earnings Release, as filed herein on page 10. 2. Includes the effects of bad debt expense, occupancy loss and costs associated with tenants in bankruptcy and/or tenant lease defaults. Before potential impact from income producing acquisitions and dispositions. 35 |

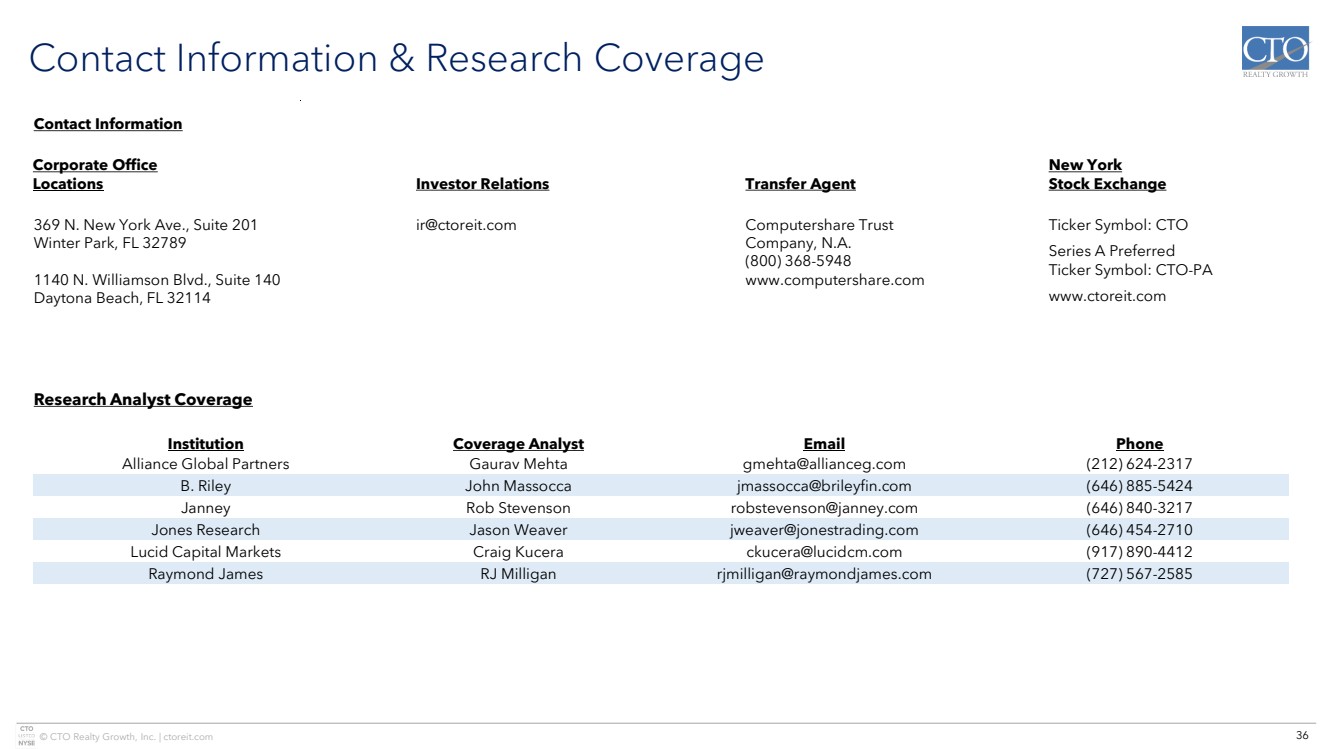

| © CTO Realty Growth, Inc. | ctoreit.com Contact Information & Research Coverage Contact Information Corporate Office Locations Investor Relations Transfer Agent New York Stock Exchange 369 N. New York Ave., Suite 201 Winter Park, FL 32789 1140 N. Williamson Blvd., Suite 140 Daytona Beach, FL 32114 ir@ctoreit.com Computershare Trust Company, N.A. (800) 368-5948 www.computershare.com Ticker Symbol: CTO Series A Preferred Ticker Symbol: CTO-PA www.ctoreit.com Research Analyst Coverage Institution Coverage Analyst Email Phone Alliance Global Partners Gaurav Mehta gmehta@allianceg.com (212) 624-2317 B. Riley John Massocca jmassocca@brileyfin.com (646) 885-5424 Janney Rob Stevenson robstevenson@janney.com (646) 840-3217 Jones Research Jason Weaver jweaver@jonestrading.com (646) 454-2710 Lucid Capital Markets Craig Kucera ckucera@lucidcm.com (917) 890-4412 Raymond James RJ Milligan rjmilligan@raymondjames.com (727) 567-2585 36 |

| © CTO Realty Growth, Inc. | ctoreit.com Safe Harbor Certain statements contained in this presentation (other than statements of historical fact) are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements can typically be identified by words such as “outlook”, “believe,” “estimate,” “expect,” “intend,” “anticipate,” “will,” “could,” “may,” “should,” “plan,” “potential,” “predict,” “forecast,” “project,” and similar expressions, as well as variations or negatives of these words. Although forward-looking statements are made based upon management’s present expectations and beliefs concerning future developments and their potential effect upon the Company, a number of factors could cause the Company’s actual results to differ materially from those set forth in the forward-looking statements. Such factors may include, but are not limited to: the Company’s ability to remain qualified as a REIT; the Company’s exposure to U.S. federal and state income tax law changes, including changes to the REIT requirements; general adverse economic and real estate conditions; macroeconomic and geopolitical factors, including but not limited to inflationary pressures, interest rate volatility, distress in the banking sector, global supply chain disruptions, and ongoing geopolitical war; credit risk associated with the Company investing in commercial loans and similarly structured investments; the ultimate geographic spread, severity and duration of pandemics such as the COVID-19 Pandemic and its variants, actions that may be taken by governmental authorities to contain or address the impact of such pandemics, and the potential negative impacts of such pandemics on the global economy and the Company’s financial condition and results of operations; the inability of major tenants or borrowers to continue paying their rent or obligations due to bankruptcy, insolvency or a general downturn in their business; the loss or failure, or decline in the business or assets of PINE; the completion of 1031 exchange transactions; the availability of investment properties that meet the Company’s investment goals and criteria; the uncertainties associated with obtaining required governmental permits and satisfying other closing conditions for planned acquisitions and sales; and the uncertainties and risk factors discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and other risks and uncertainties discussed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on the Company will be those anticipated by management. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to update the information contained in this presentation to reflect subsequently occurring events or circumstances. 37 |

| © CTO Realty Growth, Inc. | ctoreit.com Non-GAAP Financial Measures Our reported results are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We also disclose Funds From Operations (“FFO”), Core Funds From Operations (“Core FFO”), Adjusted Funds From Operations (“AFFO”), Pro Forma Earnings Before Interest, Taxes, Depreciation and Amortization (“Pro Forma Adjusted EBITDA”), and Same-Property Net Operating Income (“Same-Property NOI”), each of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO, Core FFO, AFFO, Pro Forma Adjusted EBITDA, and Same-Property NOI do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operating activities as reported on our statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts, or NAREIT. NAREIT defines FFO as GAAP net income or loss adjusted to exclude real estate related depreciation and amortization, as well as extraordinary items (as defined by GAAP) such as net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets and impairments associated with the implementation of current expected credit losses on commercial loans and investments at the time of origination, including the pro rata share of such adjustments of unconsolidated subsidiaries. The Company also excludes the gains or losses from sales of assets incidental to the primary business of the REIT which specifically include the sales of mitigation credits, subsurface sales, investment securities, and land sales, in addition to the mark-to-market of the Company’s investment securities and interest related to the 2025 Notes, if the effect is dilutive. To derive Core FFO, we modify the NAREIT computation of FFO to include other adjustments to GAAP net income related to gains and losses recognized on the extinguishment of debt, amortization of above- and below-market lease related intangibles, and other unforecastable market- or transaction-driven non-cash items, as well as adding back the interest related to the 2025 Notes, if the effect is dilutive. To derive AFFO, we further modify the NAREIT computation of FFO and Core FFO to include other adjustments to GAAP net income related to non-cash revenues and expenses such as straight-line rental revenue, non-cash compensation, and other non-cash amortization. Such items may cause short-term fluctuations in net income but have no impact on operating cash flows or long-term operating performance. We use AFFO as one measure of our performance when we formulate corporate goals. To derive Pro Forma Adjusted EBITDA, GAAP net income or loss attributable to the Company is adjusted to exclude real estate related depreciation and amortization, as well as extraordinary items (as defined by GAAP) such as net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, impairments associated with the implementation of current expected credit losses on commercial loans and investments at the time of origination, including the pro rata share of such adjustments of unconsolidated subsidiaries, non-cash revenues and expenses such as straight-line rental revenue, amortization of deferred financing costs, gains and losses recognized on the extinguishment of debt, above- and below-market lease related intangibles, non-cash compensation, other non-recurring items such as termination fees, forfeitures of tenant security deposits, certain adjustments to reconciliation estimates related to reimbursable revenue for recently acquired properties, and other non-recurring items, and other non-cash income or expense. The Company also excludes the gains or losses from sales of assets incidental to the primary business of the REIT which specifically include the sales of mitigation credits, subsurface sales, investment securities, and land sales, in addition to the mark-to-market of the Company’s investment securities. Cash interest expense is also excluded from Pro Forma Adjusted EBITDA, and GAAP net income or loss is adjusted for the annualized impact of acquisitions, dispositions and other similar activities. 38 |

| © CTO Realty Growth, Inc. | ctoreit.com Non-GAAP Financial Measures (Continued) To derive Same-Property NOI, GAAP net income or loss attributable to the Company is adjusted to exclude real estate related depreciation and amortization, as well as extraordinary items (as defined by GAAP) such as net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, impairments associated with the implementation of current expected credit losses on commercial loans and investments at the time of origination, including the pro rata share of such adjustments of unconsolidated subsidiaries, non-cash revenues and expenses such as straight-line rental revenue, amortization of deferred financing costs, gains and losses recognized on the extinguishment of debt, above- and below-market lease related intangibles, non-cash compensation, other non-recurring items such as termination fees, forfeitures of tenant security deposits, certain adjustments to reconciliation estimates related to reimbursable revenue for recently acquired properties, and other non-recurring items, and other non-cash income or expense. Interest expense, general and administrative expenses, investment and other income or loss, income tax benefit or expense, real estate operations revenues and direct cost of revenues, management fee income, and interest income from commercial loans and investments are also excluded from Same-Property NOI. GAAP net income or loss is further adjusted to remove the impact of properties that were not owned for the full current and prior year reporting periods presented. Cash rental income received under the leases pertaining to the Company’s assets that are presented as commercial loans and investments in accordance with GAAP is also used in lieu of the interest income equivalent. FFO is used by management, investors and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains or losses on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. We believe that Core FFO and AFFO are additional useful supplemental measures for investors to consider because they will help them to better assess our operating performance without the distortions created by other non-cash revenues or expenses. We also believe that Pro Forma Adjusted EBITDA is an additional useful supplemental measure for investors to consider as it allows for a better assessment of our operating performance without the distortions created by other non-cash revenues, expenses or certain effects of the Company’s capital structure on our operating performance. We use Same-Property NOI to compare the operating performance of our assets between periods. It is an accepted and important measurement used by management, investors and analysts because it includes all property-level revenues from the Company’s properties, less operating and maintenance expenses, real estate taxes and other property-specific expenses (“Net Operating Income” or “NOI”) of properties that have been owned and stabilized for the entire current and prior year reporting periods. Same-Property NOI attempts to eliminate differences due to the acquisition or disposition of properties during the particular period presented, and therefore provides a more comparable and consistent performance measure for the comparison of the Company’s properties. FFO, Core FFO, AFFO, Pro Forma Adjusted EBITDA, and Same-Property NOI may not be comparable to similarly titled measures employed by other companies. 39 |

| © CTO Realty Growth, Inc. | ctoreit.com Definitions & Terms References and terms used in this presentation that are in addition to terms defined in the Non-GAAP Financial Measures include: ▪ This presentation was published on October 28, 2025. ▪ All information is as of September 30, 2025, unless otherwise noted. ▪ Any calculation differences are assumed to be a result of rounding. ▪ “2025 Guidance” in this presentation is based on the 2025 Guidance provided in the Company’s Third Quarter 2025 Operating Results press release filed on October 28, 2025. ▪ “Alpine” or “PINE” refers to Alpine Income Property Trust, a publicly traded net lease REIT traded on the New York Stock Exchange under the ticker symbol PINE. ▪ “Annualized Base Rent”, “ABR” or “Rent” and the statistics based on ABR are calculated based on our current portfolio and represent straight-line rent calculated in accordance with GAAP. ▪ “Annualized Cash Base Rent”, “Cash ABR” and the statistics based on Cash ABR are calculated based on our current portfolio and represent the annualized cash base rent calculated in accordance with GAAP due from the tenants at a specific point in time. ▪ “Credit Rated” is a tenant or the parent of a tenant with a credit rating from S&P Global Ratings, Moody’s Investors Service, Fitch Ratings or the National Association of Insurance Commissioners (NAIC) (together, the “Major Rating Agencies”). The Company defines an Investment Grade Rated Tenant as a tenant or the parent of a tenant with a credit rating from S&P Global Ratings, Moody’s Investors Service, Fitch Ratings or the National Association of Insurance Commissioners of Baa3, BBB-, or NAIC-2 or higher. If applicable, in the event of a split rating between S&P Global Ratings and Moody’s Investors Services, the Company utilizes the higher of the two ratings as its reference point as to whether a tenant is defined as an Investment Grade Rated Tenant. ▪ “Dividend” or “Dividends”, subject to the required dividends to maintain our qualification as a REIT, are set by the Board of Directors and declared on a quarterly basis and there can be no assurances as to the likelihood or number of dividends in the future. ▪ “Investment in Alpine Income Property Trust” or “Alpine Investment” or “PINE Ownership” is calculated based on the 2,471,556 common shares and partnership units CTO owns in PINE and is based on PINE’s closing stock price as of the referenced period on the respective slide. ▪ “Leased Occupancy” refers to space that is currently leased but for which rent payments have not yet commenced. ▪ “MSA” or “Metropolitan Statistical Area” is a region that consists of a city and surrounding communities that are linked by social and economic factors, as established by the U.S. Office of Management and Budget. The names of the MSA have been shortened for ease of reference. ▪ “Net Debt” is calculated as our total long-term debt as presented on the face of our balance sheet; plus financing costs, net of accumulated amortization and unamortized convertible debt discount; less cash, restricted cash and cash equivalents. ▪ “Net Operating Income” or “NOI” is revenues from all income properties less operating expense, maintenance expense, real estate taxes and rent expense. ▪ “Total Enterprise Value” is calculated as the Company’s Total Common Shares Outstanding multiplied by the common stock price; plus the par value of the Series A perpetual preferred equity outstanding and Net Debt. 40 |