Third Quarter 2025 Financial Results CRD-A & CRD-B (NYSE) ® Crawford & Company

Forward-Looking Statements & Additional Information Q3 2025 FINANCIAL RESULTS Forward-Looking Statements This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations portion of Crawford & Company's website at https://ir.crawco.com. Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. Revenues Before Reimbursements ("Revenues") Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. Segment and Consolidated Operating Earnings Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings represent segment earnings, including the direct and indirect costs of certain administrative functions required to operate our business, but excludes unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of acquisition-related intangible assets, contingent earnout adjustments, non-service pension costs, income taxes and net income or loss attributable to noncontrolling interests. Earnings Per Share The Company's two classes of stock are substantially identical, except with respect to voting rights for the Class B Common Stock (CRD-B) and protections for the non-voting Class A Common Stock (CRD-A). More information available on the Company’s website. The two-class method is an earnings allocation method under which earnings per share ("EPS") is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. As a result, the Company may report different EPS for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". Segment Gross Profit Segment gross profit is defined as revenues, less direct costs, which exclude indirect centralized administrative support costs allocated to the business. Indirect expenses consist of centralized administrative support costs, regional and local shared services that are allocated to each segment based on usage. Non-GAAP Financial Information For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation.

STRATEGIC UPDATE Rohit Verma President & Chief Executive Officer 3 Q3 2025 FINANCIAL RESULTS

Countries 70 Employees 10,000+ $20B+ Claims Managed Annually Global Reach; Trusted Partner Q3 2025 FINANCIAL RESULTS

Natural disasters continue to drive global demand in weather-related claims Gaining share within fragmented U.S. market as carriers pursue a flight to quality with well-established partners Industry-leading expertise and technology capabilities enhancing market share Growing and strengthening strategic partnerships across business segments Diversified global business model addresses multiple verticals Multiple Growth Drivers Benefitting Crawford Q3 2025 FINANCIAL RESULTS

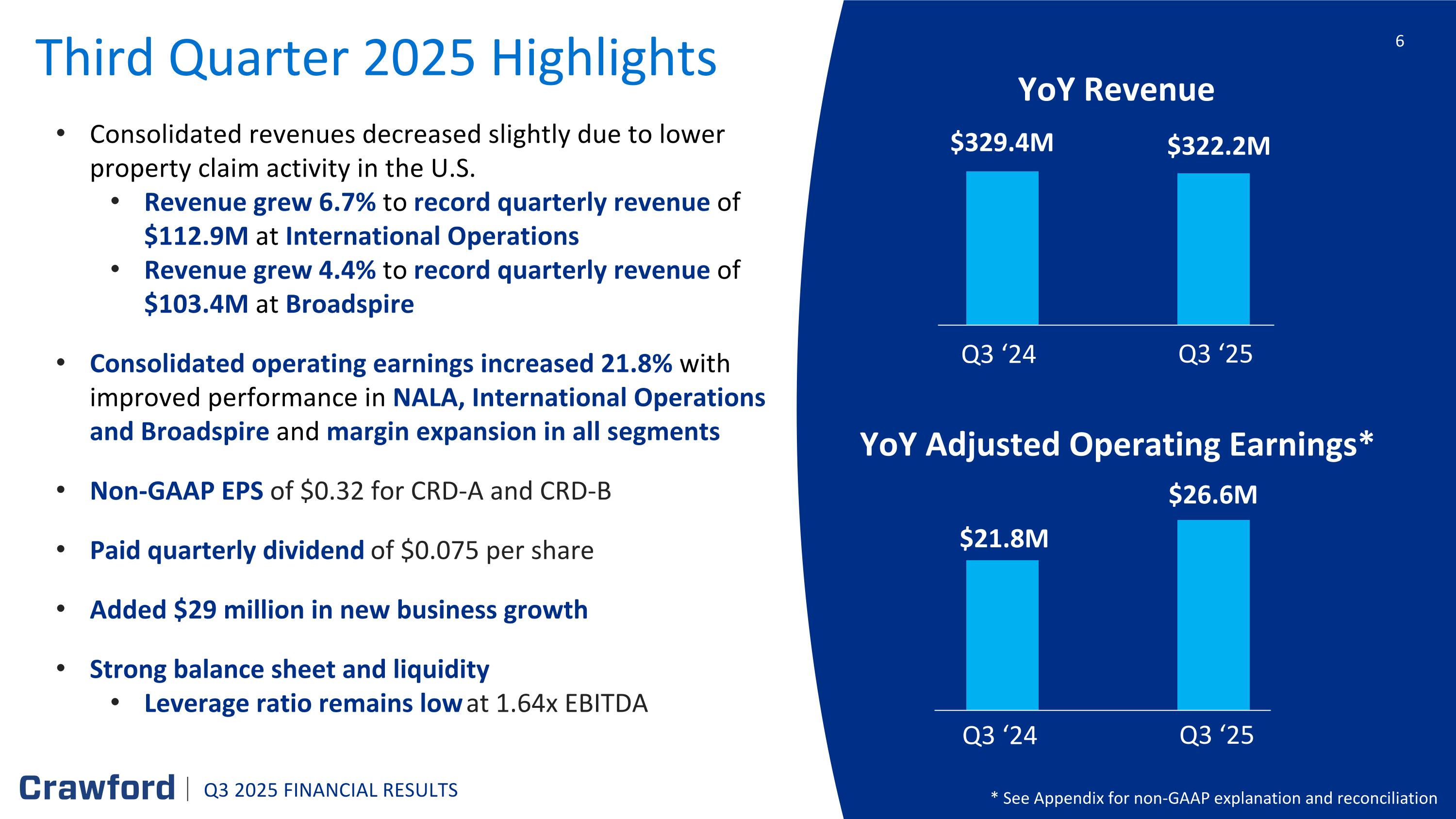

Third Quarter 2025 Highlights Consolidated revenues decreased slightly due to lower property claim activity in the U.S. Revenue grew 6.7% to record quarterly revenue of $112.9M at International Operations Revenue grew 4.4% to record quarterly revenue of $103.4M at Broadspire Consolidated operating earnings increased 21.8% with improved performance in NALA, International Operations and Broadspire and margin expansion in all segments Non-GAAP EPS of $0.32 for CRD-A and CRD-B Paid quarterly dividend of $0.075 per share Added $29 million in new business growth Strong balance sheet and liquidity Leverage ratio remains low at 1.64x EBITDA YoY Revenue YoY Adjusted Operating Earnings* $329.4M $21.8M 6 * See Appendix for non-GAAP explanation and reconciliation Q3 ‘24 Q3 ‘25 Q3 ‘24 Q3 ‘25 Q3 2025 FINANCIAL RESULTS $322.2M $26.6M

Our Capital Allocation Strategy Investing in long-term growth through Cap Ex and M&A Strong liquidity Leverage ratio of 1.64x EBITDA significantly below industry average Returning capital to shareholders: Paid quarterly dividend of $0.075 per share for CRD-A and CRD-B Active share repurchase program Q3 2025 FINANCIAL RESULTS Committed to Industry-Leading Financial Strength and Employing a Disciplined Approach to Capital Allocation

OPERATIONAL UPDATE Bruce Swain, Chief Financial Officer Q3 2025 FINANCIAL RESULTS 8

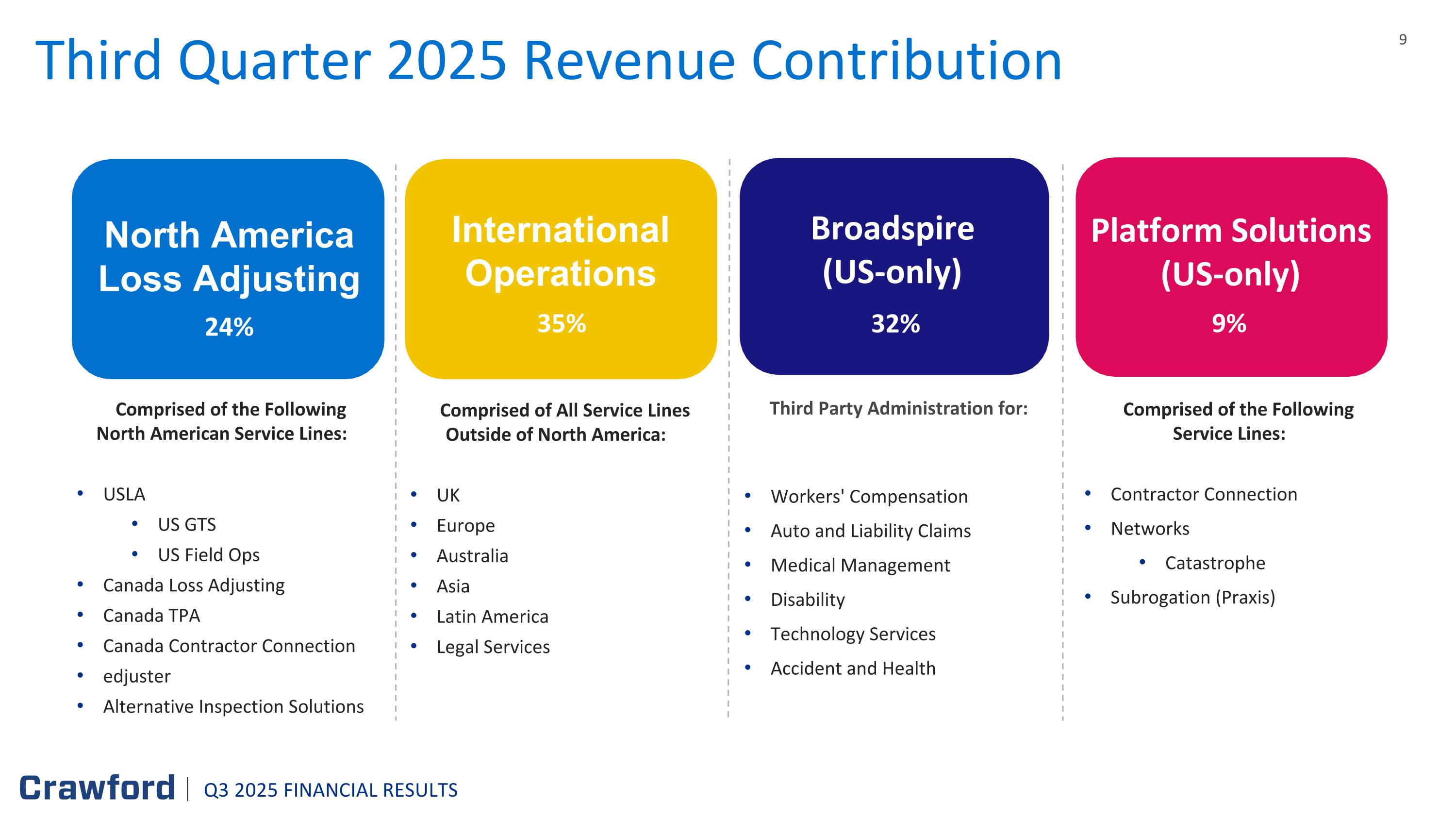

Comprised of All Service Lines Outside of North America: UK Europe Australia Asia Latin America Legal Services International Operations 35% Third Party Administration for: Workers' Compensation Auto and Liability Claims Medical Management Disability Technology Services Accident and Health Comprised of the Following Service Lines: Contractor Connection Networks Catastrophe Subrogation (Praxis) Comprised of the Following North American Service Lines: USLA US GTS US Field Ops Canada Loss Adjusting Canada TPA Canada Contractor Connection edjuster Alternative Inspection Solutions North America Loss Adjusting 24% Broadspire (US-only) 32% Platform Solutions (US-only) 9% Third Quarter 2025 Revenue Contribution Q3 2025 FINANCIAL RESULTS

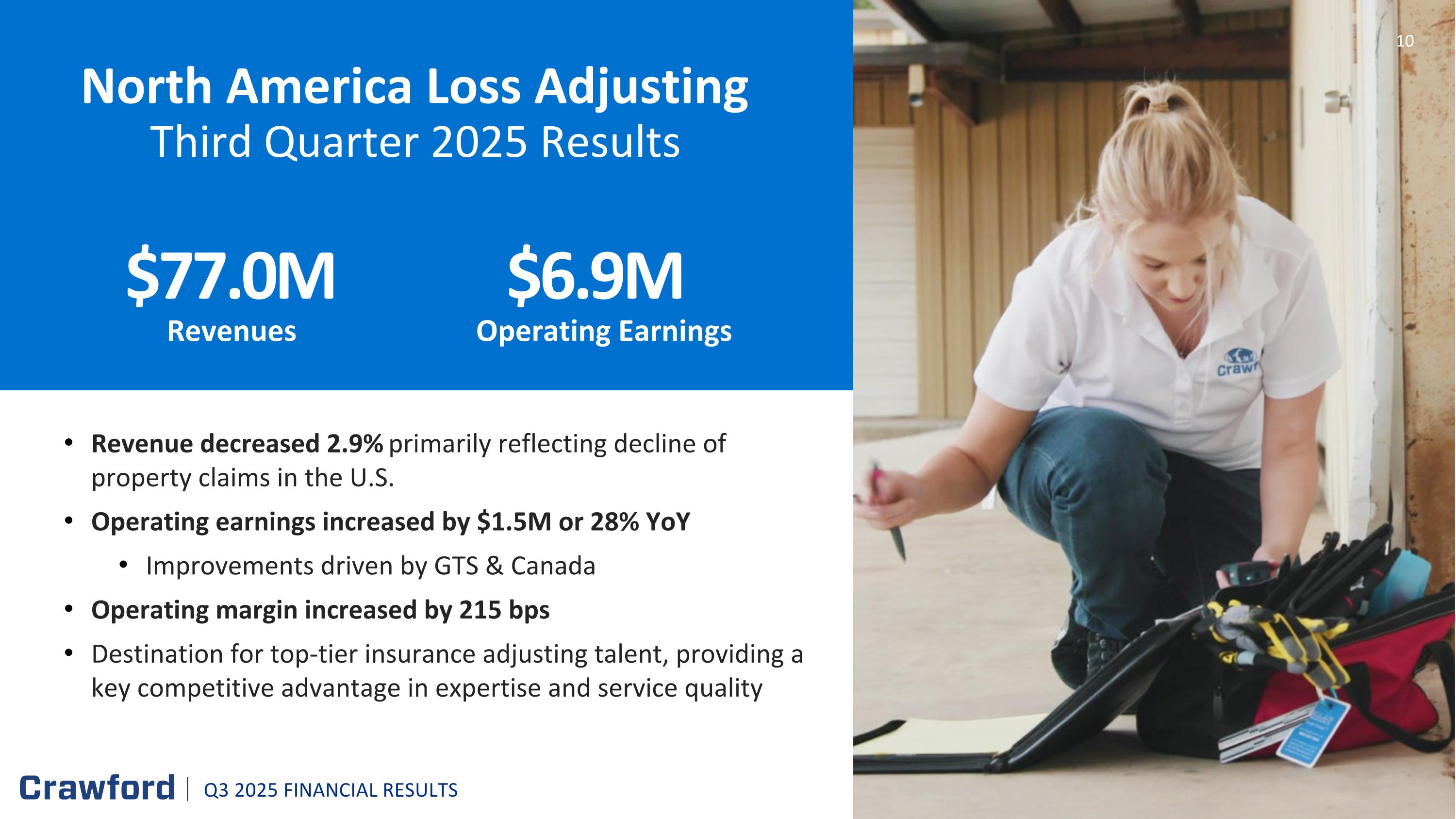

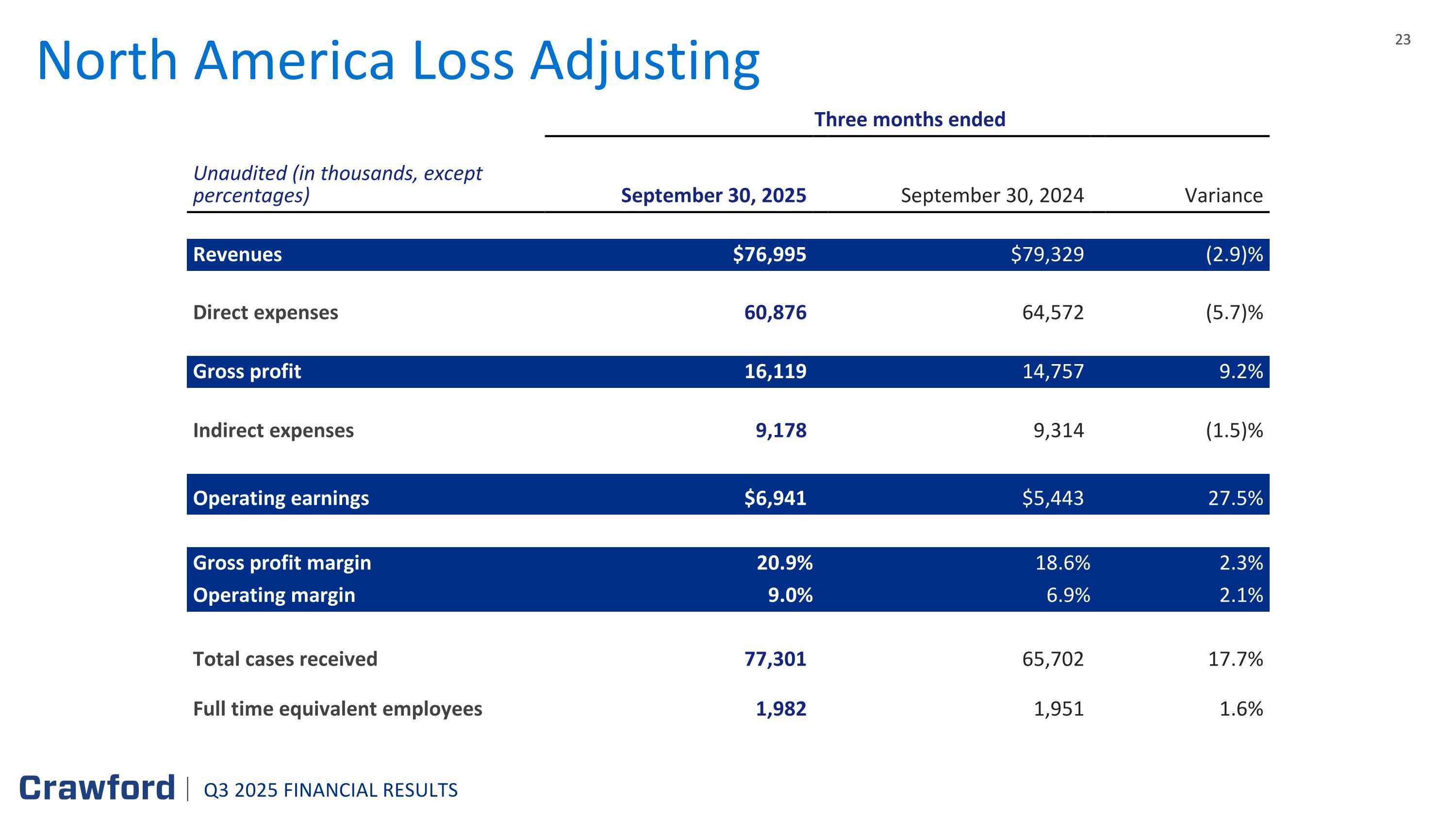

Revenue decreased 2.9% primarily reflecting decline of property claims in the U.S. Operating earnings increased by $1.5M or 28% YoY Improvements driven by GTS & Canada Operating margin increased by 215 bps Destination for top-tier insurance adjusting talent, providing a key competitive advantage in expertise and service quality North America Loss Adjusting Third Quarter 2025 Results Revenues $77.0M Operating Earnings $6.9M 10 Q3 2025 FINANCIAL RESULTS

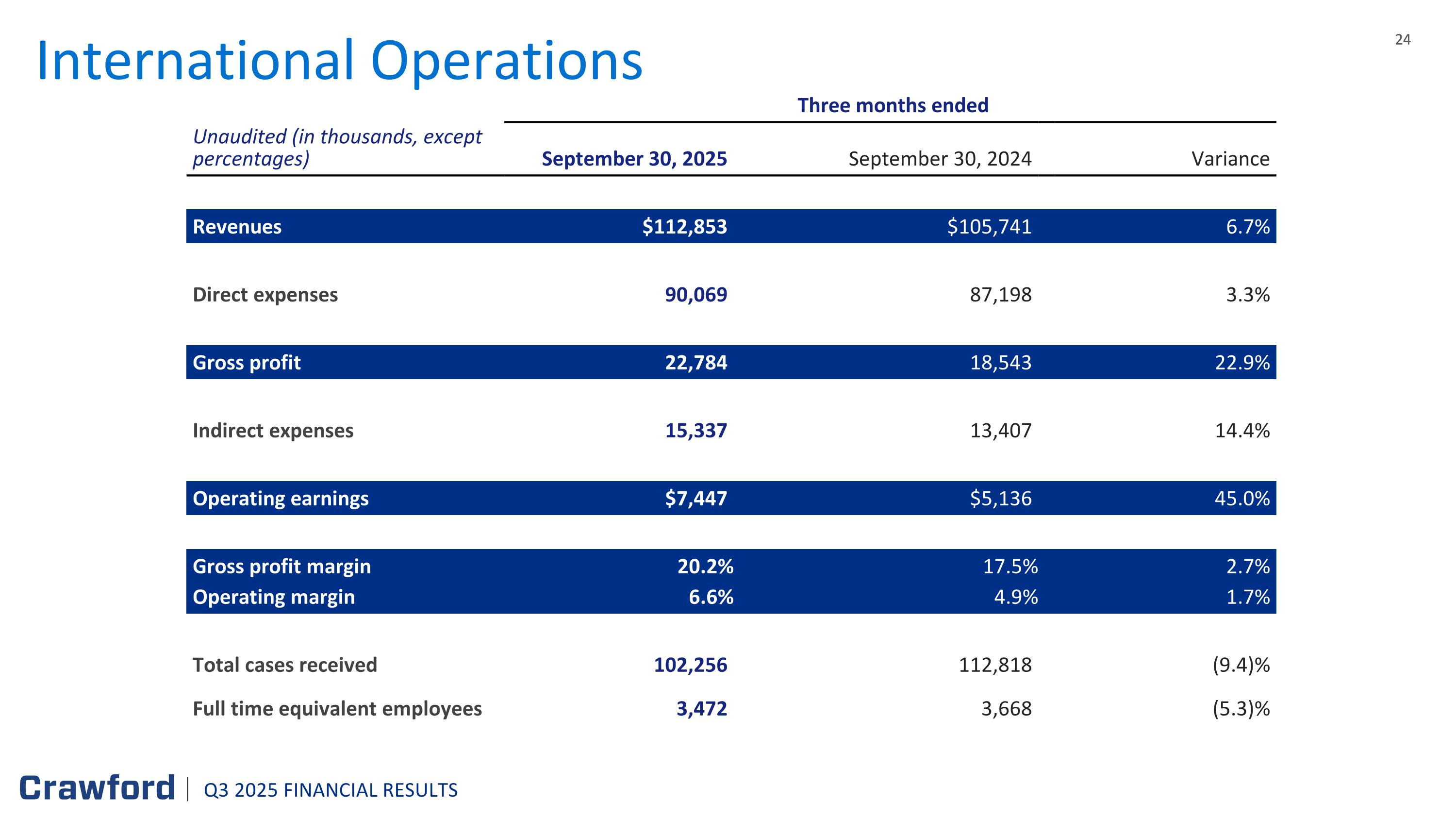

Revenue growth of 6.7% Broad-based growth across UK, Europe, Asia, and Australia Operating earnings increased by $2.3M or 45% YoY Operating margin expanded by 174 bps Strong international performance reflects operational discipline and commitment to revenue growth International Operations Third Quarter 2025 Results Revenues $112.9M Operating Earnings $7.4M 11 Q3 2025 FINANCIAL RESULTS

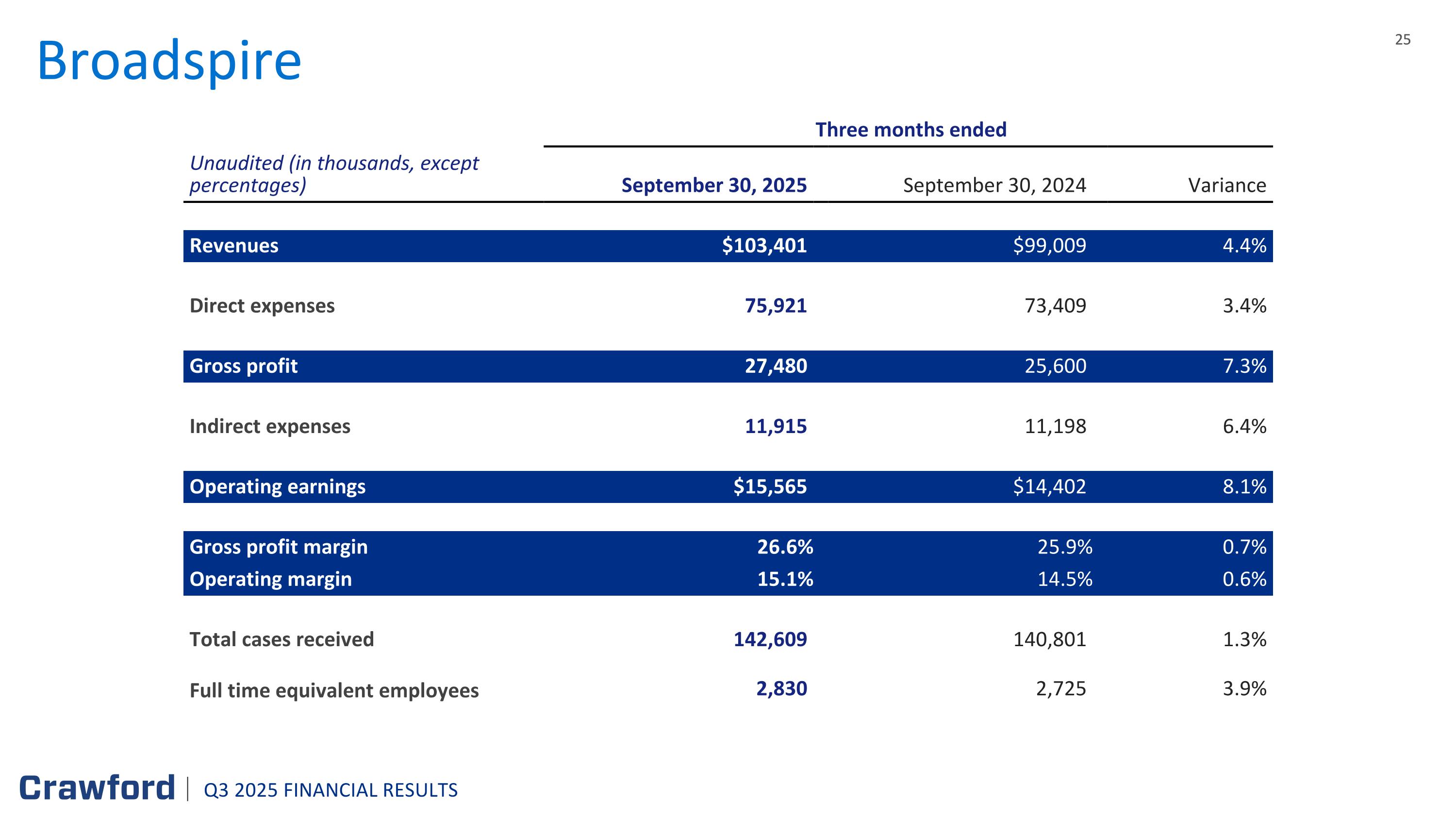

Broadspire Third Quarter 2025 Results Revenues $103.4M $15.6M Operating Earnings 12 Q3 2025 FINANCIAL RESULTS Record quarterly revenues YoY growth of 4.4% driven by continued growth in client demand and case volumes Retention rate of 93.5% Operating earnings increased by $1.2M or 8.1% YoY Operating margin increased by 51 bps Strong new business pipeline

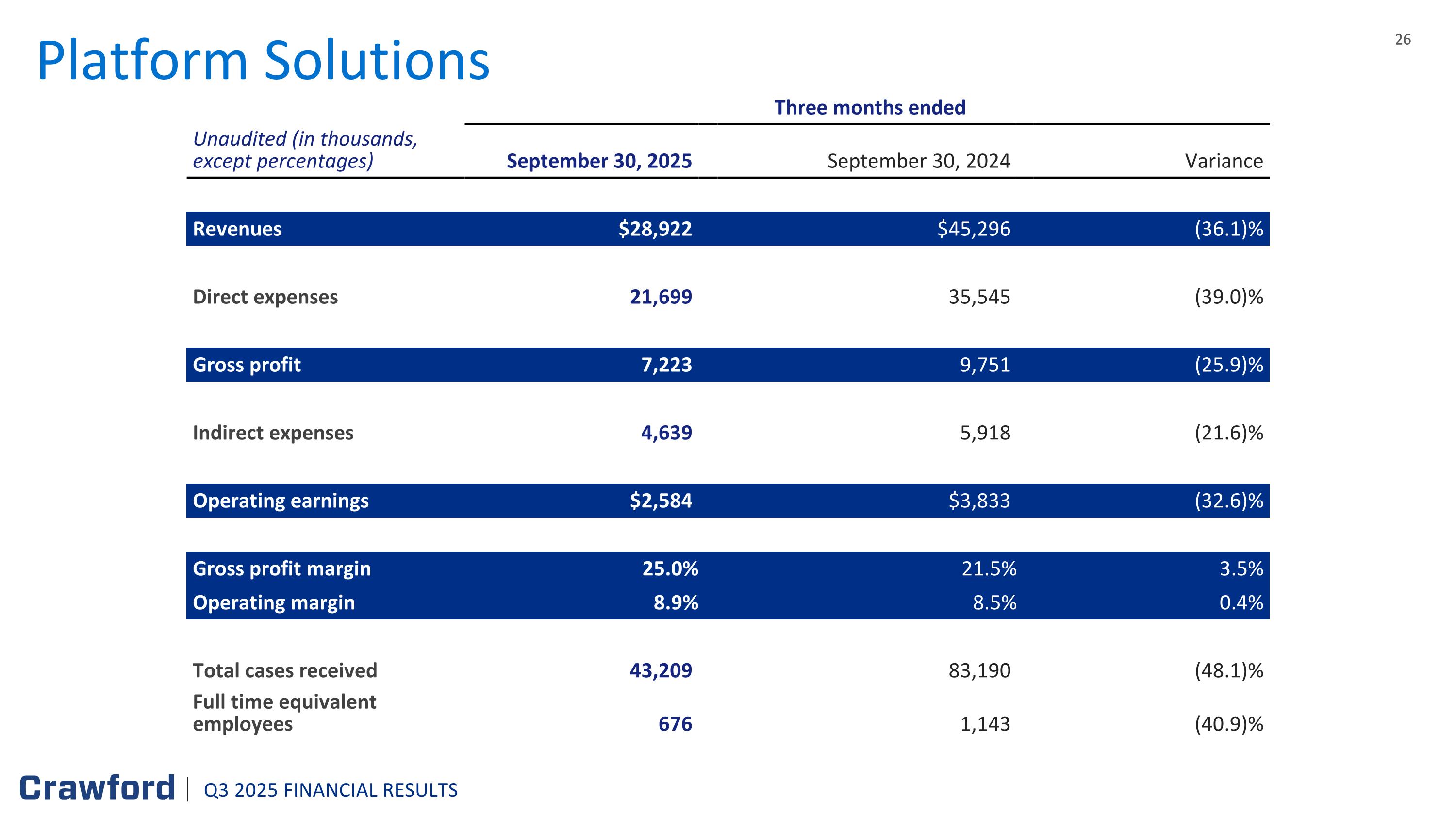

Platform Solutions Third Quarter 2025 Results Revenues $28.9M Operating Earnings $2.6M 13 Q3 2025 FINANCIAL RESULTS Revenue down by 36% YoY Ongoing weather-related declines in the CAT and Contractor Connection business lines Operating earnings decreased by $1.2M or 33% YoY Operating margin improved by 47 bps

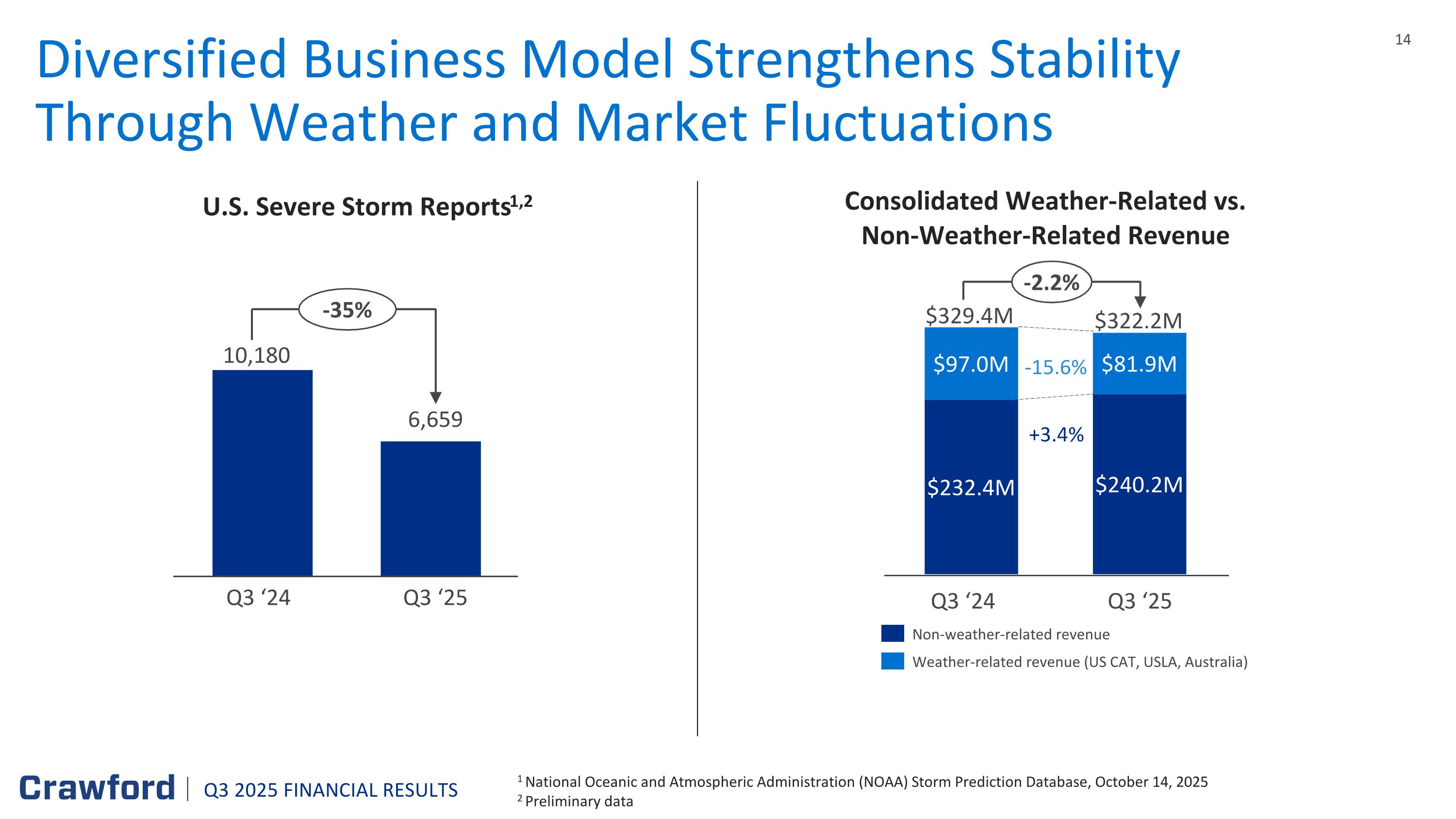

Q3 ‘24 Q3 ‘25 Non-weather-related revenue Weather-related revenue (US CAT, USLA, Australia) Diversified Business Model Strengthens Stability Through Weather and Market Fluctuations U.S. Severe Storm Reports1,2 1 National Oceanic and Atmospheric Administration (NOAA) Storm Prediction Database, October 14, 2025 2 Preliminary data Q3 2025 FINANCIAL RESULTS Q3 ‘24 Q3 ‘25 -35% 10,180 6,659 Consolidated Weather-Related vs. Non-Weather-Related Revenue $329.4M $322.2M -2.2% +3.4% -15.6%

FINANCIAL UPDATE Bruce Swain, Chief Financial Officer Q3 2025 FINANCIAL RESULTS 15

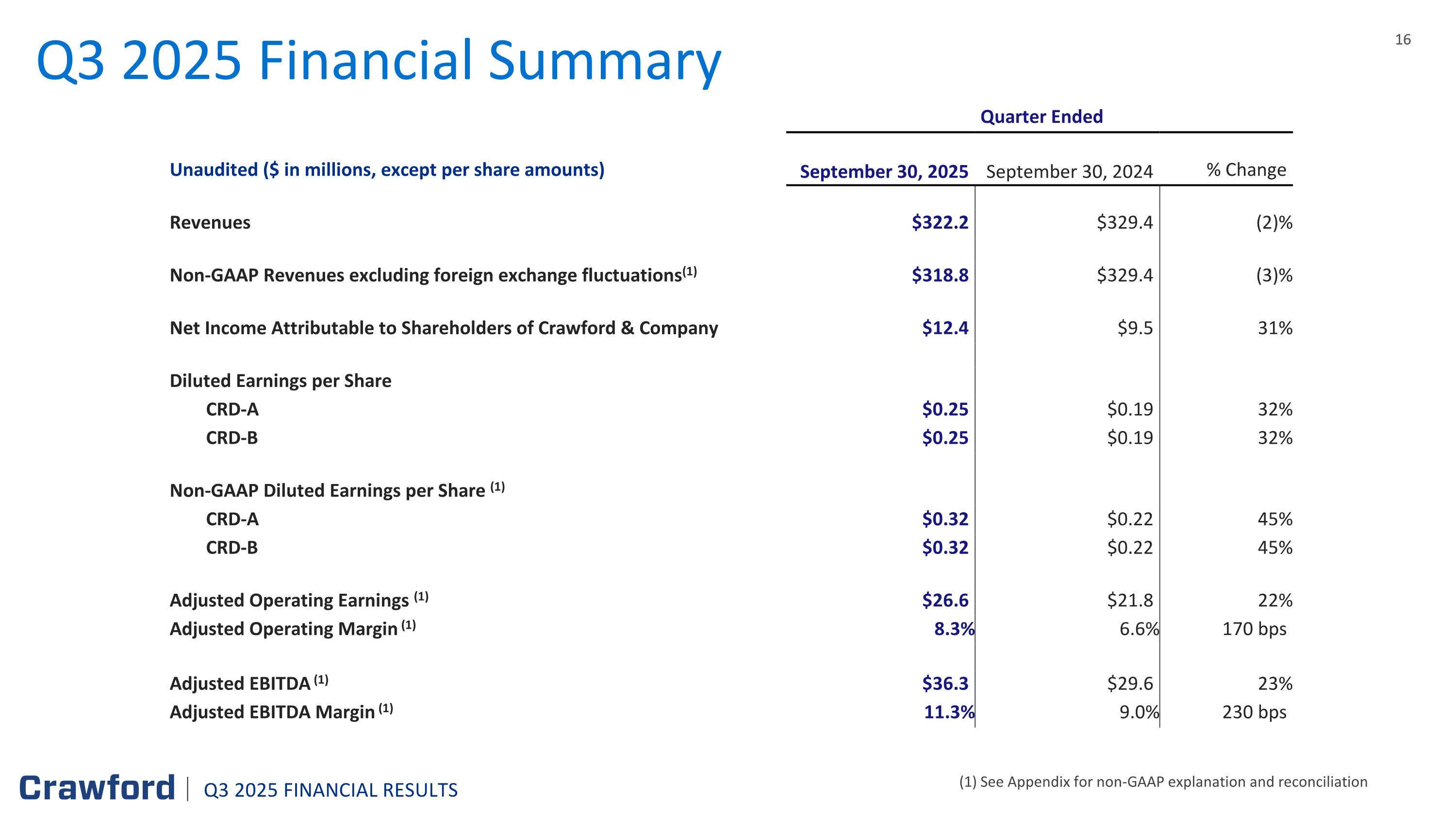

Q3 2025 Financial Summary (1) See Appendix for non-GAAP explanation and reconciliation Quarter Ended Unaudited ($ in millions, except per share amounts) September 30, 2025 September 30, 2024 % Change Revenues $322.2 $329.4 (2)% Non-GAAP Revenues excluding foreign exchange fluctuations(1) $318.8 $329.4 (3)% Net Income Attributable to Shareholders of Crawford & Company $12.4 $9.5 31% Diluted Earnings per Share CRD-A $0.25 $0.19 32% CRD-B $0.25 $0.19 32% Non-GAAP Diluted Earnings per Share (1) CRD-A $0.32 $0.22 45% CRD-B $0.32 $0.22 45% Adjusted Operating Earnings (1) $26.6 $21.8 22% Adjusted Operating Margin (1) 8.3% 6.6% 170 bps Adjusted EBITDA (1) $36.3 $29.6 23% Adjusted EBITDA Margin (1) 11.3% 9.0% 230 bps Q3 2025 FINANCIAL RESULTS

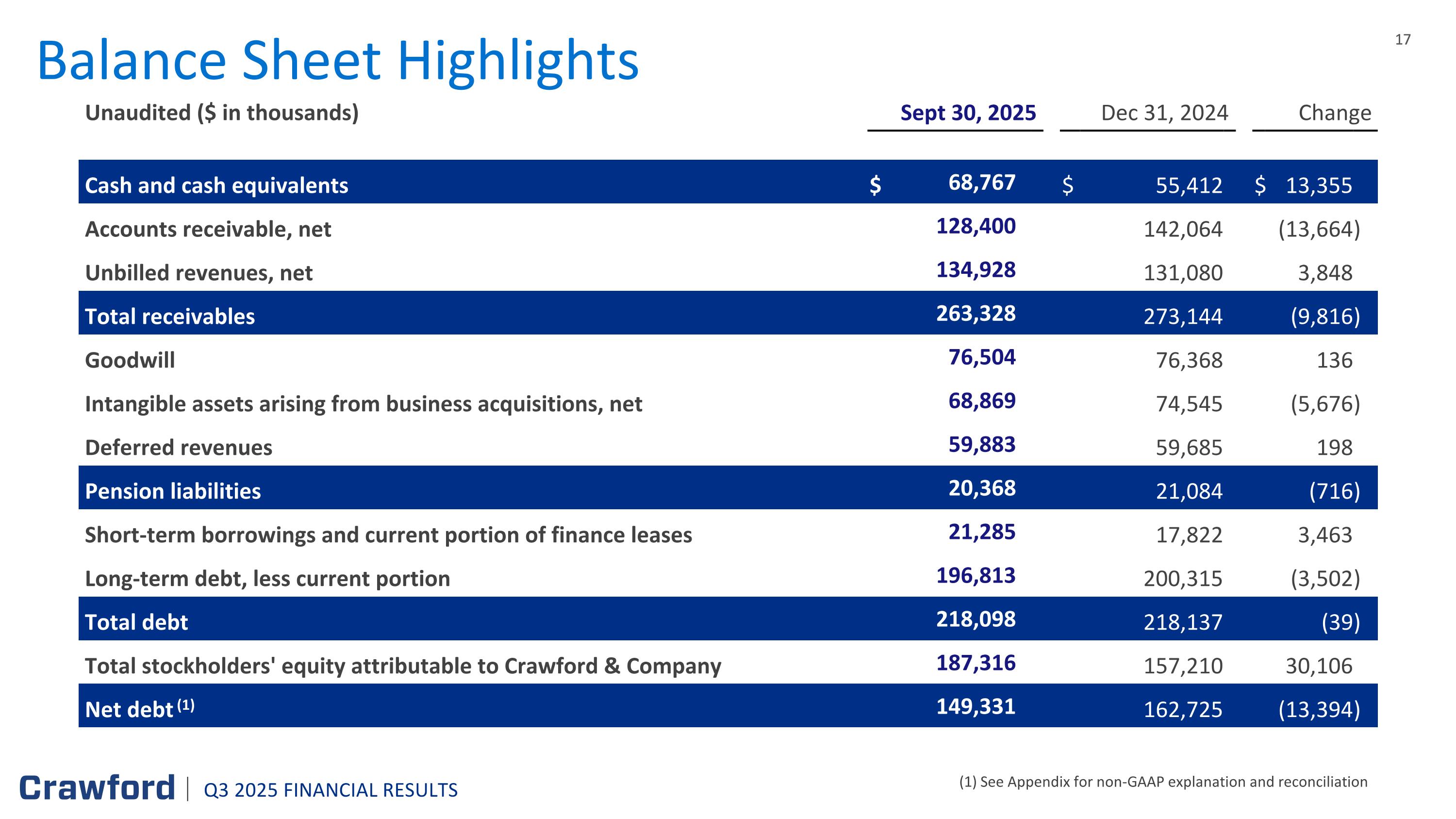

Balance Sheet Highlights (1) See Appendix for non-GAAP explanation and reconciliation Unaudited ($ in thousands) Sept 30, 2025 December 31, 2019 Dec 31, 2024 December 31, 2018 Change Change Cash and cash equivalents $ 68,767 $ 55,412 $ 13,355 Accounts receivable, net 128,400 142,064 (13,664 ) Unbilled revenues, net 134,928 131,080 3,848 Total receivables 263,328 273,144 (9,816 ) Goodwill 76,504 76,368 136 Intangible assets arising from business acquisitions, net 68,869 74,545 (5,676 ) Deferred revenues 59,883 59,685 198 Pension liabilities 20,368 21,084 (716 ) Short-term borrowings and current portion of finance leases 21,285 17,822 3,463 Long-term debt, less current portion 196,813 200,315 (3,502 ) Total debt 218,098 218,137 (39 ) Total stockholders' equity attributable to Crawford & Company 187,316 157,210 30,106 Net debt (1) 149,331 162,725 (13,394 ) Q3 2025 FINANCIAL RESULTS

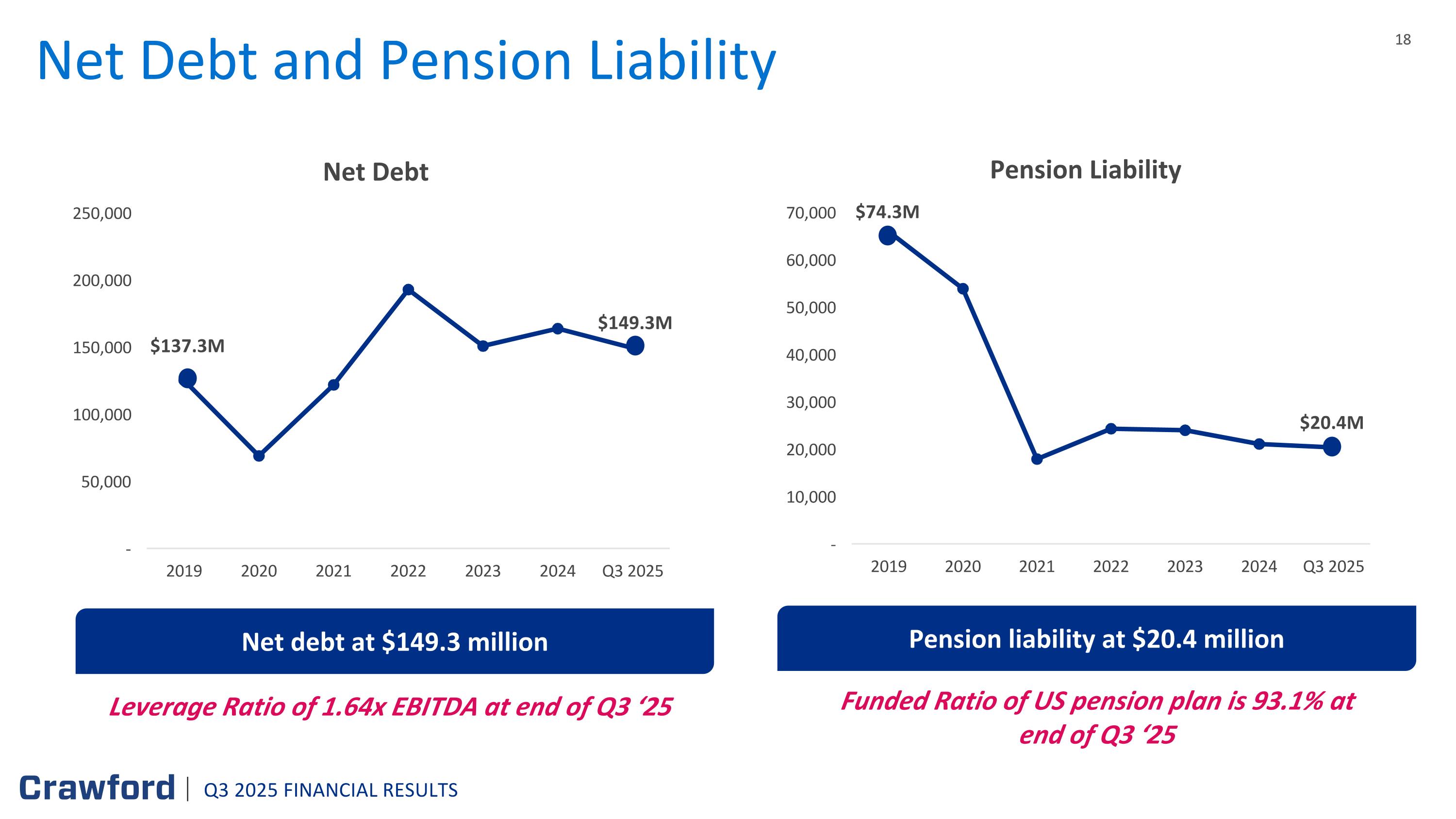

Net Debt and Pension Liability $149.3M Net debt at $149.3 million $137.3M Leverage Ratio of 1.64x EBITDA at end of Q3 ‘25 $20.4M Pension liability at $20.4 million $74.3M Funded Ratio of US pension plan is 93.1% at end of Q3 ‘25 Q3 2025 FINANCIAL RESULTS

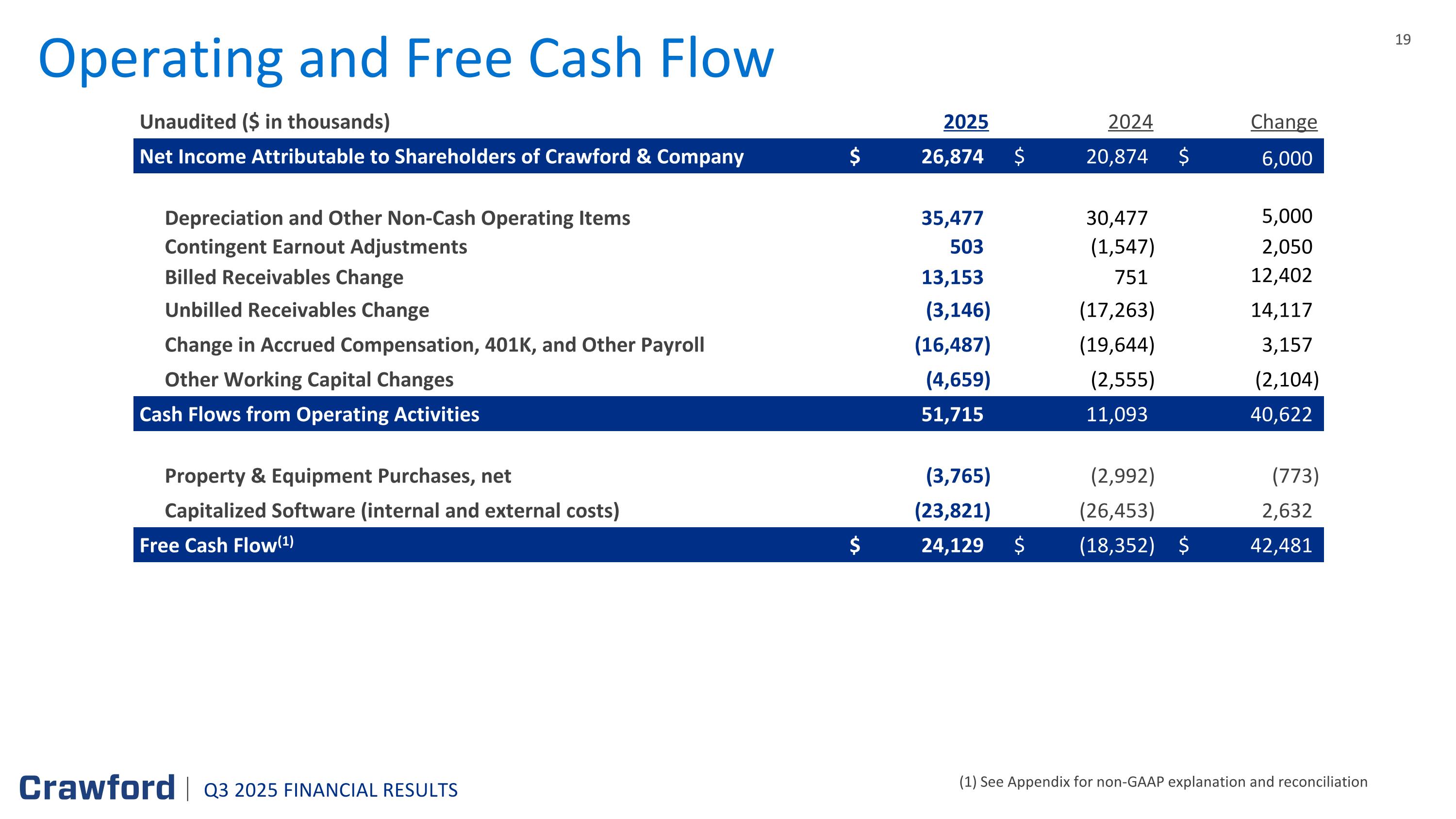

Operating and Free Cash Flow (1) See Appendix for non-GAAP explanation and reconciliation Unaudited ($ in thousands) 2025 2019 2024 2018 Change Change Net Income Attributable to Shareholders of Crawford & Company $ 26,874 $ 20,874 $ 6,000 Depreciation and Other Non-Cash Operating Items 35,477 30,477 5,000 Contingent Earnout Adjustments 503 (1,547 ) 2,050 Billed Receivables Change 13,153 751 12,402 Unbilled Receivables Change (3,146 ) (17,263 ) 14,117 Change in Accrued Compensation, 401K, and Other Payroll (16,487 ) (19,644 ) 3,157 Other Working Capital Changes (4,659 ) (2,555 ) (2,104 ) Cash Flows from Operating Activities 51,715 11,093 40,622 Property & Equipment Purchases, net (3,765 ) (2,992 ) (773 ) Capitalized Software (internal and external costs) (23,821 ) (26,453 ) 2,632 Free Cash Flow(1) $ 24,129 $ (18,352 ) $ 42,481 Q3 2025 FINANCIAL RESULTS

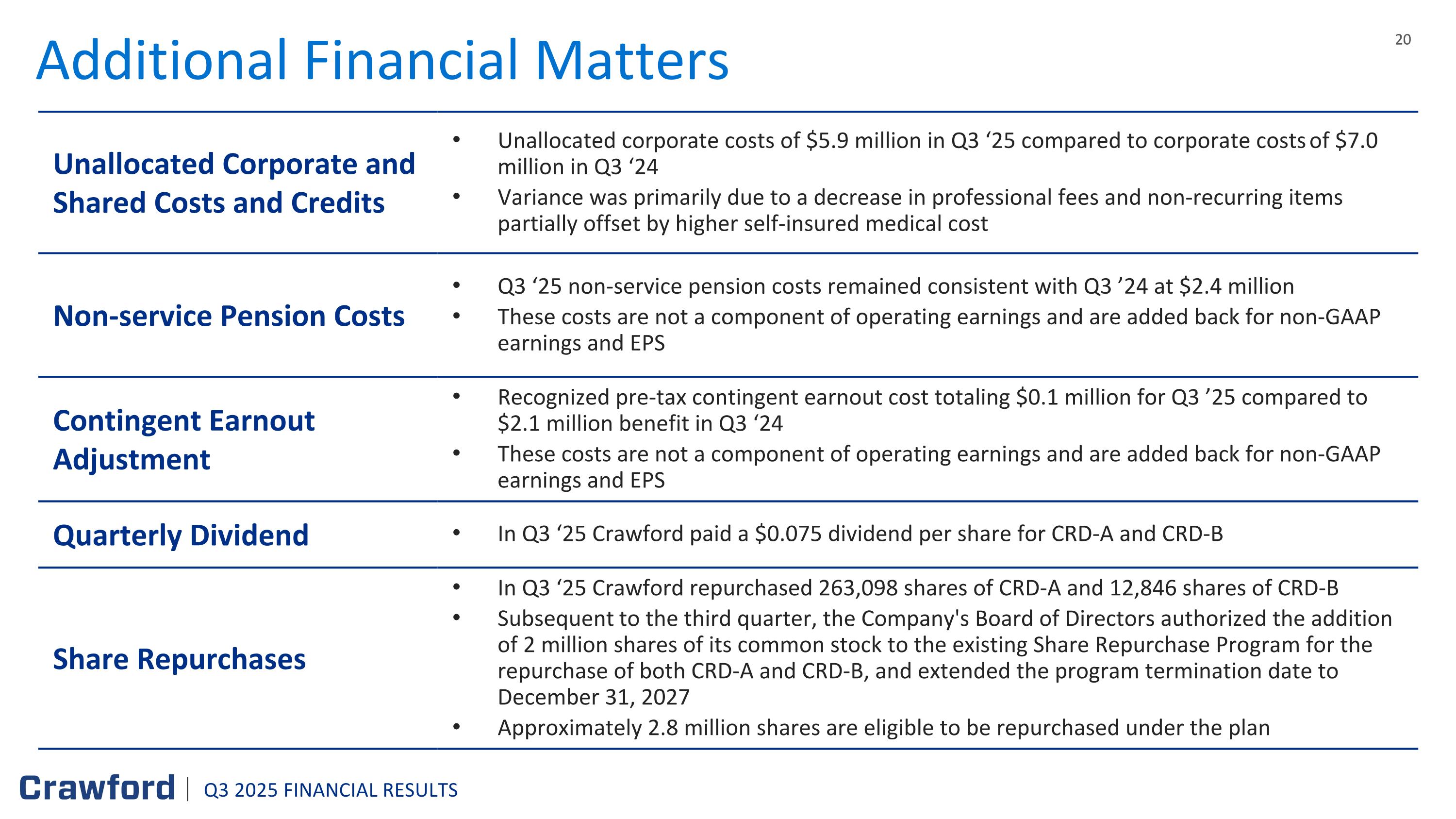

Additional Financial Matters Unallocated Corporate and Shared Costs and Credits Unallocated corporate costs of $5.9 million in Q3 ‘25 compared to corporate costs of $7.0 million in Q3 ‘24 Variance was primarily due to a decrease in professional fees and non-recurring items partially offset by higher self-insured medical cost Non-service Pension Costs Q3 ‘25 non-service pension costs remained consistent with Q3 ’24 at $2.4 million These costs are not a component of operating earnings and are added back for non-GAAP earnings and EPS Contingent Earnout Adjustment Recognized pre-tax contingent earnout cost totaling $0.1 million for Q3 ’25 compared to $2.1 million benefit in Q3 ‘24 These costs are not a component of operating earnings and are added back for non-GAAP earnings and EPS Quarterly Dividend In Q3 ‘25 Crawford paid a $0.075 dividend per share for CRD-A and CRD-B Share Repurchases In Q3 ‘25 Crawford repurchased 263,098 shares of CRD-A and 12,846 shares of CRD-B Subsequent to the third quarter, the Company's Board of Directors authorized the addition of 2 million shares of its common stock to the existing Share Repurchase Program for the repurchase of both CRD-A and CRD-B, and extended the program termination date to December 31, 2027 Approximately 2.8 million shares are eligible to be repurchased under the plan Q3 2025 FINANCIAL RESULTS

Summary Q3 2025 FINANCIAL RESULTS NEXT-GEN TECHNOLOGY Leading the industry with next generation Insurtech capabilities DIVERSIFIED REVENUE STREAMS Diverse business lines and international footprint support long term growth and cash generation EXPANDING MARKET PRESENCE Driving profitable growth across the globe STRONG FINANCIAL BASE Financial strength and liquidity provide flexibility to pursue market opportunities

Appendix: Segment Results and Non-GAAP Financial Information Q3 2025 FINANCIAL RESULTS 22

North America Loss Adjusting Three months ended Unaudited (in thousands, except percentages) September 30, 2025 September 30, 2024 Variance Revenues $76,995 $79,329 (2.9)% Direct expenses 60,876 64,572 (5.7)% Gross profit 16,119 14,757 9.2% Indirect expenses 9,178 9,314 (1.5)% Operating earnings $6,941 $5,443 27.5% Gross profit margin 20.9% 18.6% 2.3% Operating margin 9.0% 6.9% 2.1% Total cases received 77,301 65,702 17.7% Full time equivalent employees 1,982 1,951 1.6% Q3 2025 FINANCIAL RESULTS

International Operations Three months ended Unaudited (in thousands, except percentages) September 30, 2025 September 30, 2024 Variance Revenues $112,853 $105,741 6.7% Direct expenses 90,069 87,198 3.3% Gross profit 22,784 18,543 22.9% Indirect expenses 15,337 13,407 14.4% Operating earnings $7,447 $5,136 45.0% Gross profit margin 20.2% 17.5% 2.7% Operating margin 6.6% 4.9% 1.7% Total cases received 102,256 112,818 (9.4)% Full time equivalent employees 3,472 3,668 (5.3)% Q3 2025 FINANCIAL RESULTS

Broadspire Three months ended Unaudited (in thousands, except percentages) September 30, 2025 September 30, 2024 Variance Revenues $103,401 $99,009 4.4% Direct expenses 75,921 73,409 3.4% Gross profit 27,480 25,600 7.3% Indirect expenses 11,915 11,198 6.4% Operating earnings $15,565 $14,402 8.1% Gross profit margin 26.6% 25.9% 0.7% Operating margin 15.1% 14.5% 0.6% Total cases received 142,609 140,801 1.3% Full time equivalent employees 2,830 2,725 3.9% Q3 2025 FINANCIAL RESULTS

Platform Solutions Three months ended Unaudited (in thousands, except percentages) September 30, 2025 September 30, 2024 Variance Revenues $28,922 $45,296 (36.1)% Direct expenses 21,699 35,545 (39.0)% Gross profit 7,223 9,751 (25.9)% Indirect expenses 4,639 5,918 (21.6)% Operating earnings $2,584 $3,833 (32.6)% Gross profit margin 25.0% 21.5% 3.5% Operating margin 8.9% 8.5% 0.4% Total cases received 43,209 83,190 (48.1)% Full time equivalent employees 676 1,143 (40.9)% Q3 2025 FINANCIAL RESULTS

Non-GAAP Financial Information Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings. As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. Q3 2025 FINANCIAL RESULTS

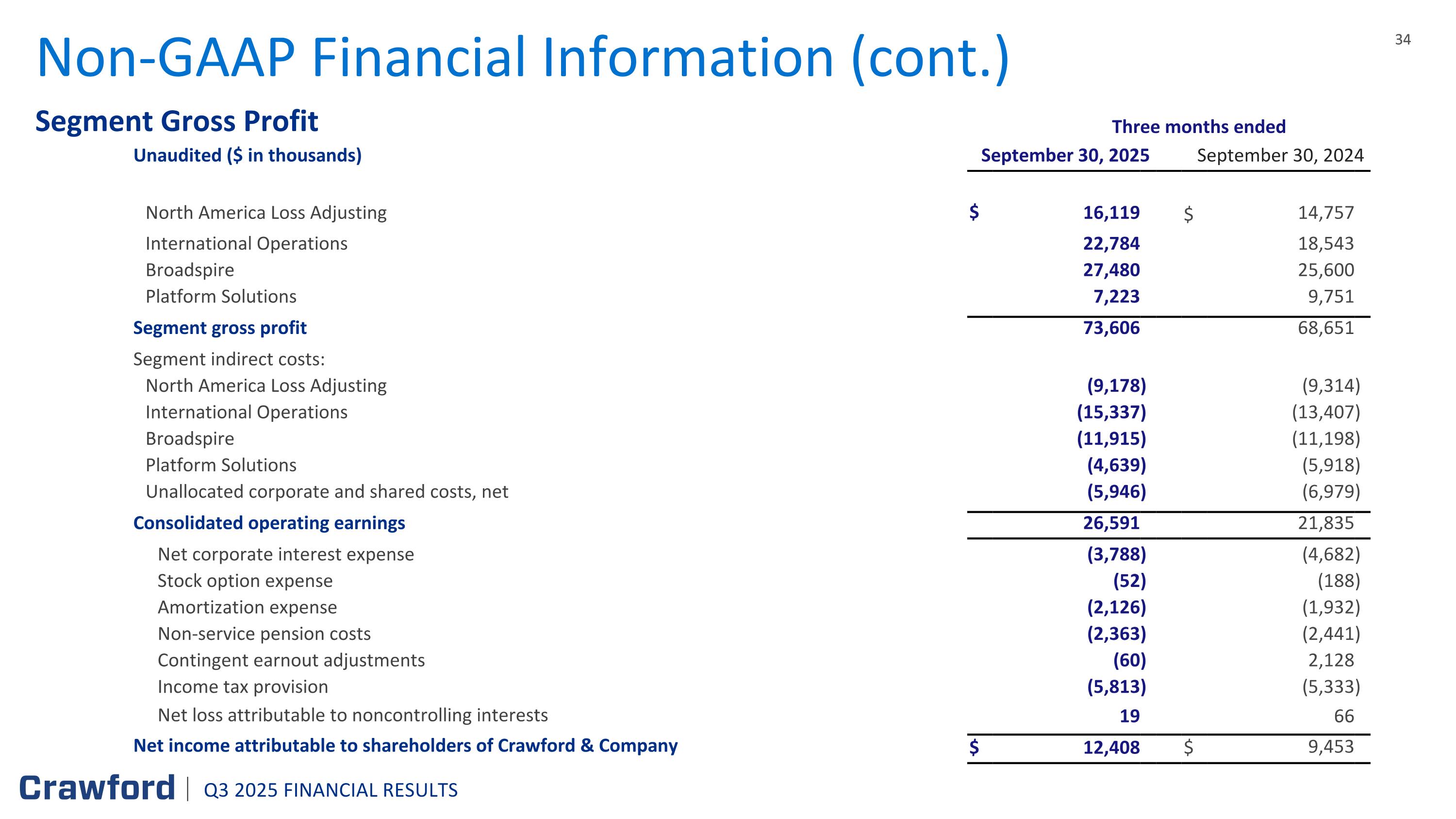

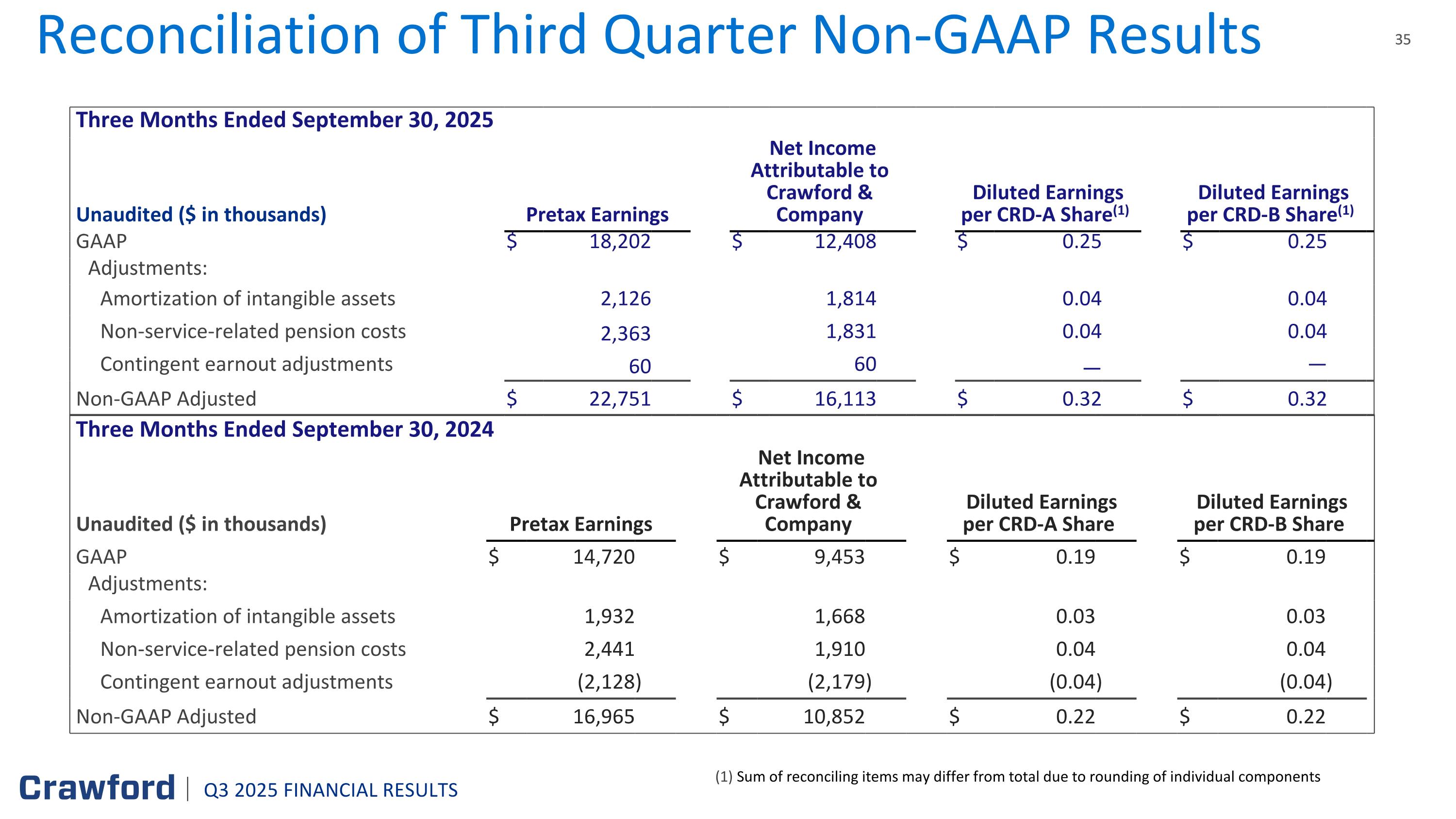

Non-GAAP Financial Information (cont.) Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of acquisition-related intangible assets, contingent earnout adjustments, non-service pension costs, income taxes and net income or loss attributable to noncontrolling interests. Segment and Consolidated Gross Profit Gross profit is defined as revenues less direct expenses which exclude indirect overhead expenses allocated to the business. Indirect expenses consist of centralized administrative support costs, regional and local shared services that are allocated to each segment based on usage. Adjusted EBITDA Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income attributable to shareholders of the Company with recurring adjustments for depreciation and amortization, net corporate interest expense, contingent earnout adjustments, non-service pension costs, income taxes and stock-based compensation expense. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. Adjusted Pretax Earnings, Net Income, and Diluted Earnings per Share Included in non-GAAP adjusted measurements as an add back or subtraction to GAAP measurements, are impacts of amortization of acquisition-related intangible assets, contingent earnout adjustments, and non-service pension costs which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes it is useful to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations. Q3 2025 FINANCIAL RESULTS

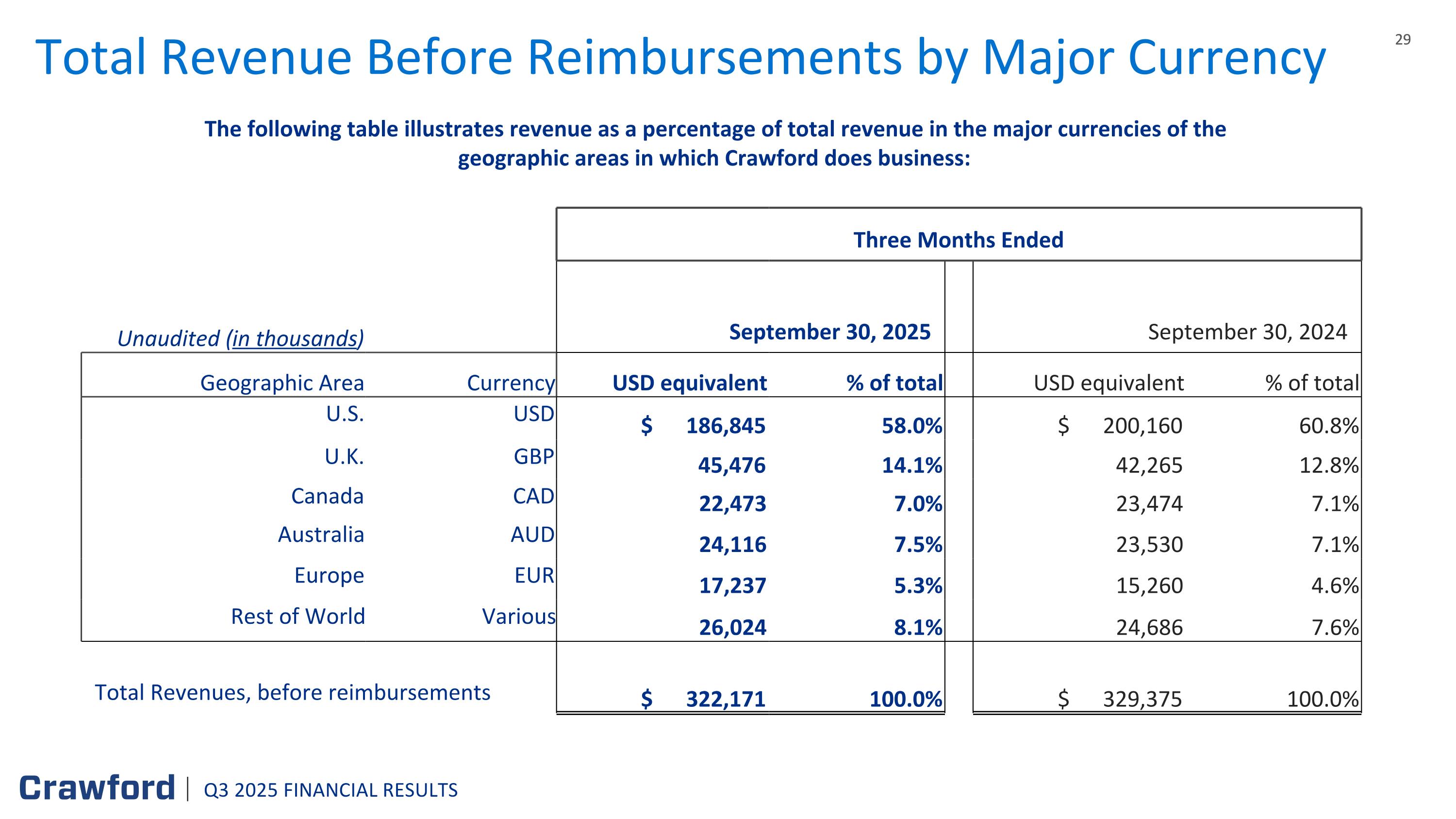

The following table illustrates revenue as a percentage of total revenue in the major currencies of the geographic areas in which Crawford does business: Total Revenue Before Reimbursements by Major Currency Three Months Ended Unaudited (in thousands) September 30, 2025 September 30, 2024 Geographic Area Currency USD equivalent % of total USD equivalent % of total U.S. USD $ 186,845 58.0% $ 200,160 60.8% U.K. GBP 45,476 14.1% 42,265 12.8% Canada CAD 22,473 7.0% 23,474 7.1% Australia AUD 24,116 7.5% 23,530 7.1% Europe EUR 17,237 5.3% 15,260 4.6% Rest of World Various 26,024 8.1% 24,686 7.6% Total Revenues, before reimbursements $ 322,171 100.0% $ 329,375 100.0% Q3 2025 FINANCIAL RESULTS

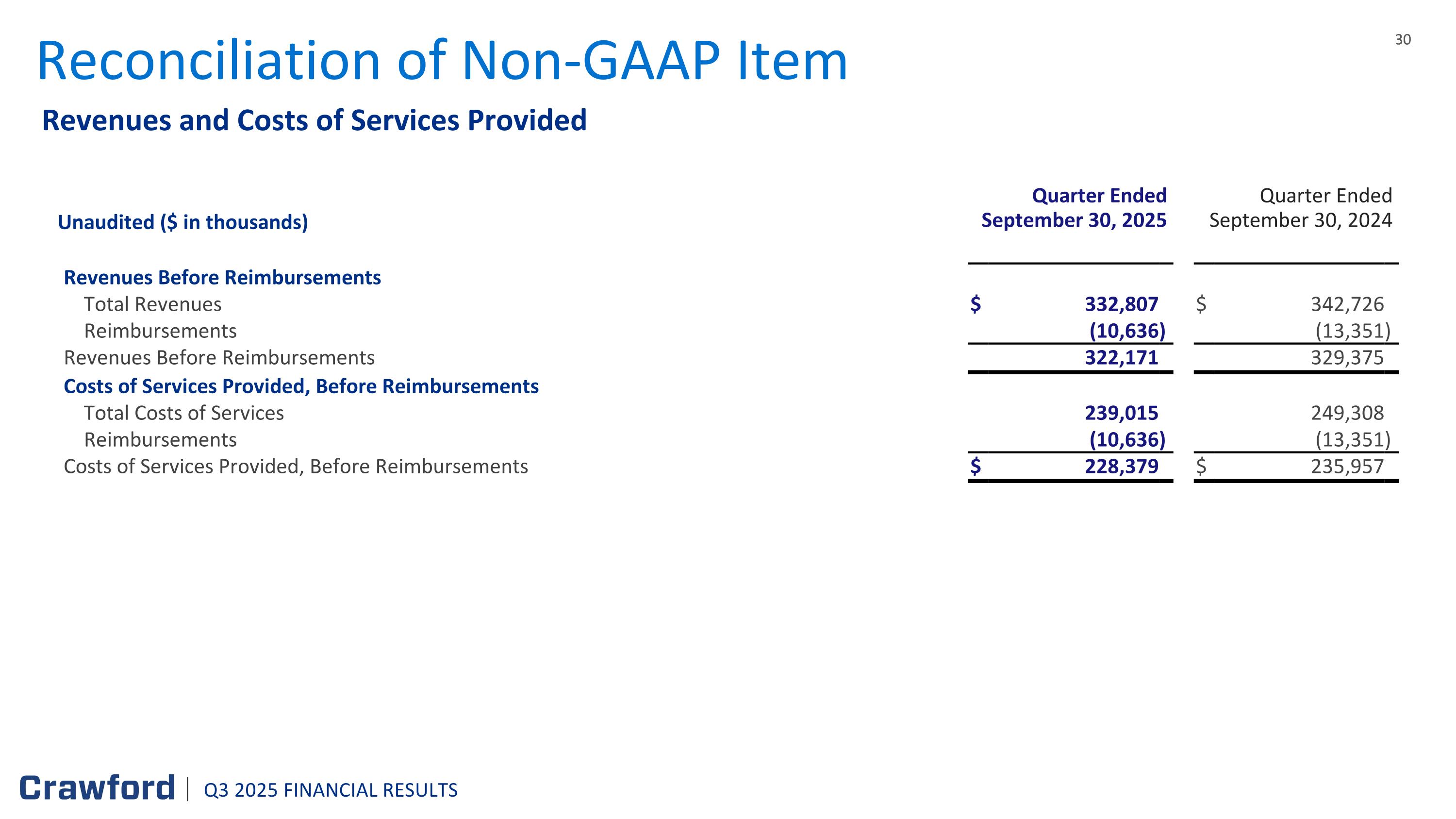

Revenues and Costs of Services Provided Reconciliation of Non-GAAP Item Quarter Ended Quarter Ended Quarter Ended Quarter Ended Unaudited ($ in thousands) September 30, 2025 December 31, September 30, 2024 December 31, 2019 2018 Revenues Before Reimbursements Total Revenues $ 332,807 $ 342,726 Reimbursements (10,636 ) (13,351 ) Revenues Before Reimbursements 322,171 329,375 Costs of Services Provided, Before Reimbursements Total Costs of Services 239,015 249,308 Reimbursements (10,636 ) (13,351 ) Costs of Services Provided, Before Reimbursements $ 228,379 $ 235,957 Q3 2025 FINANCIAL RESULTS

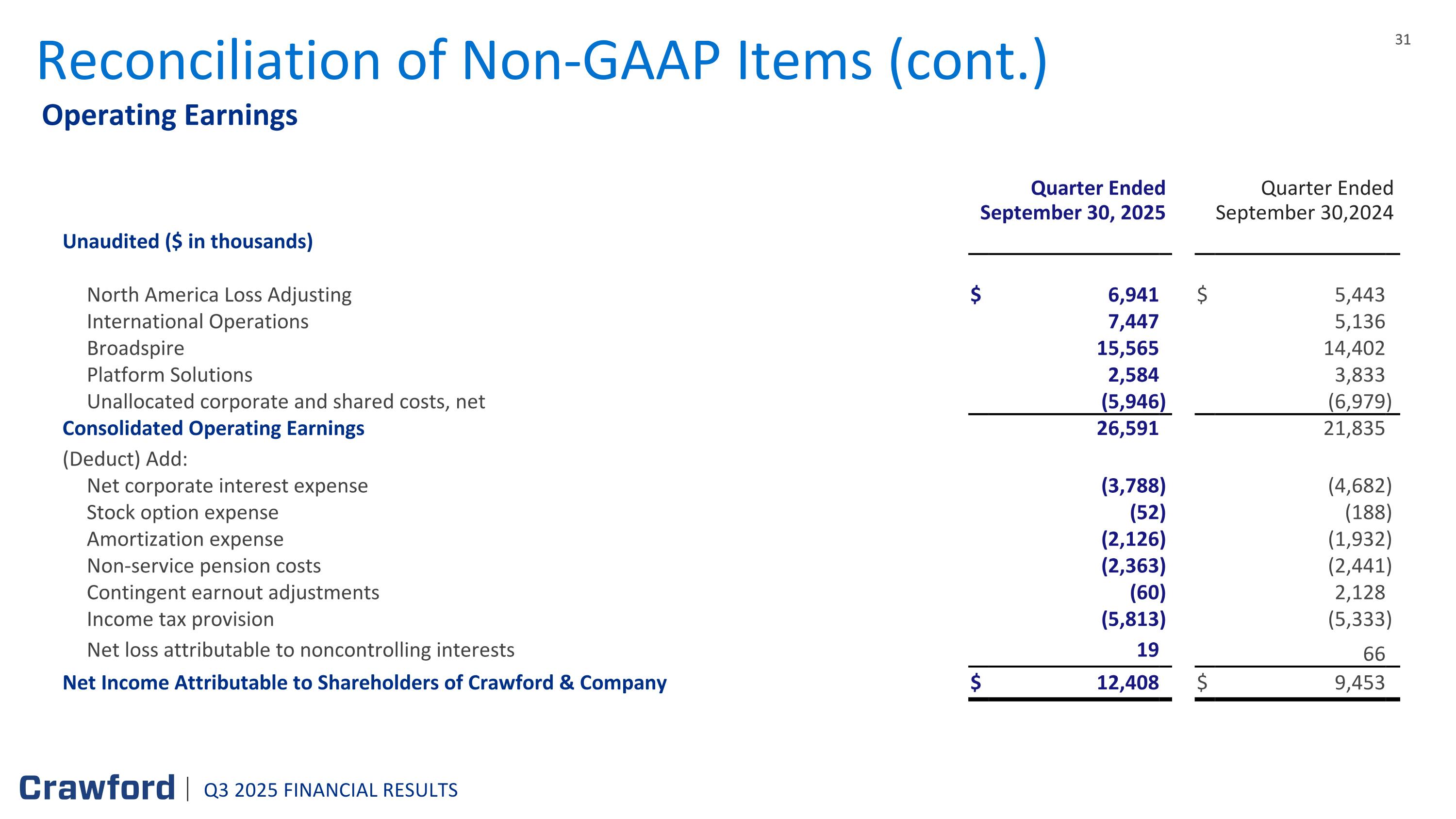

Operating Earnings Reconciliation of Non-GAAP Items (cont.) Quarter Ended Quarter Ended Quarter Ended Quarter Ended September 30, 2025 December 31, September 30,2024 December 31, Unaudited ($ in thousands) 2019 2018 North America Loss Adjusting $ 6,941 $ 5,443 International Operations 7,447 5,136 Broadspire 15,565 14,402 Platform Solutions 2,584 3,833 Unallocated corporate and shared costs, net (5,946 ) (6,979 ) Consolidated Operating Earnings 26,591 21,835 (Deduct) Add: Net corporate interest expense (3,788 ) (4,682 ) Stock option expense (52 ) (188 ) Amortization expense (2,126 ) (1,932 ) Non-service pension costs (2,363 ) (2,441 ) Contingent earnout adjustments (60 ) 2,128 Income tax provision (5,813 ) (5,333 ) Net loss attributable to noncontrolling interests 19 66 Net Income Attributable to Shareholders of Crawford & Company $ 12,408 $ 9,453 Q3 2025 FINANCIAL RESULTS

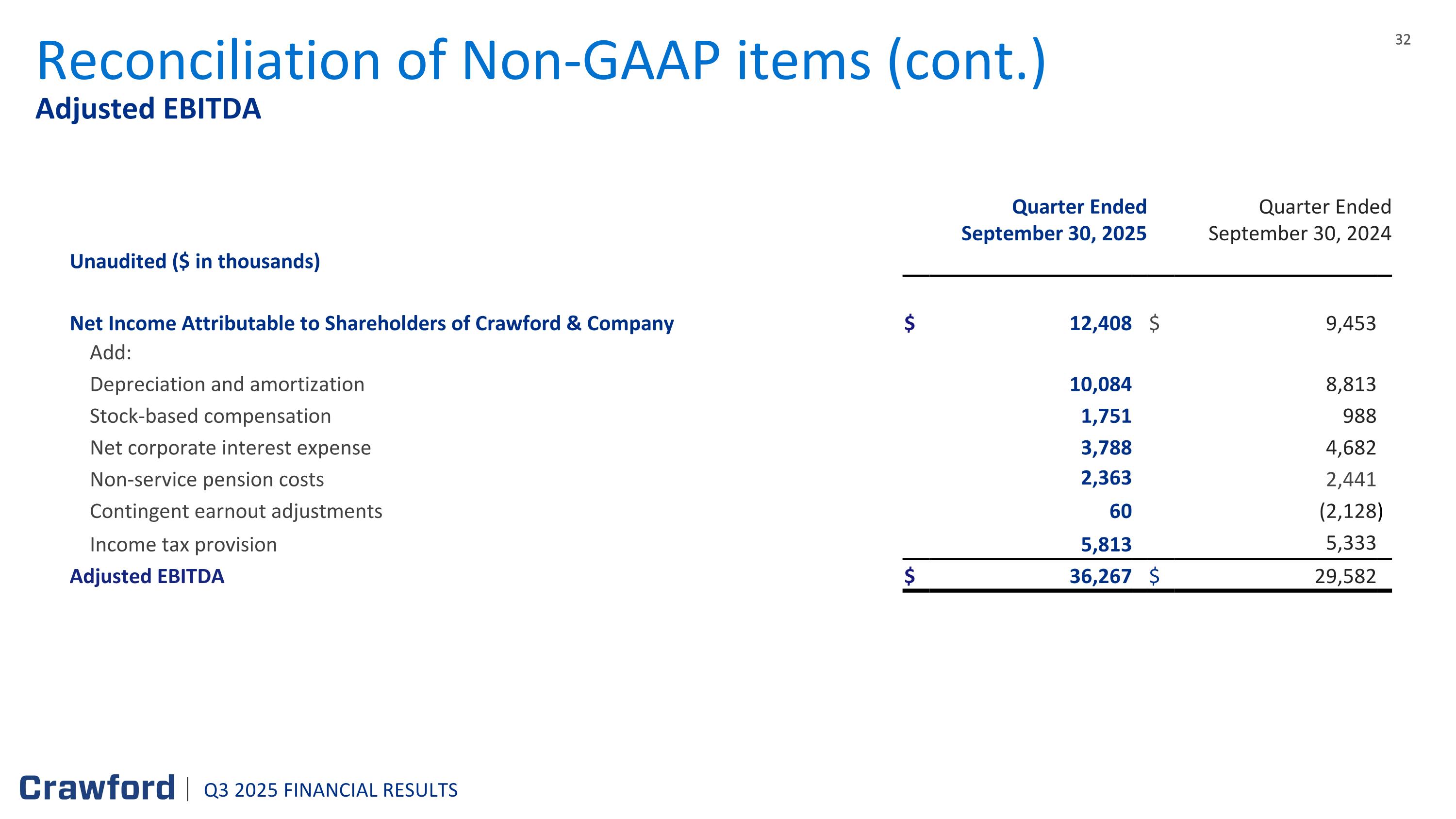

Adjusted EBITDA Reconciliation of Non-GAAP items (cont.) Quarter Ended December 31, Quarter Ended December 31, September 30, 2025 December 31, September 30, 2024 December 31, Unaudited ($ in thousands) 2019 2018 Net Income Attributable to Shareholders of Crawford & Company $ 12,408 $ 9,453 Add: Depreciation and amortization 10,084 8,813 Stock-based compensation 1,751 988 Net corporate interest expense 3,788 4,682 Non-service pension costs 2,363 2,441 Contingent earnout adjustments 60 (2,128 ) Income tax provision 5,813 5,333 Adjusted EBITDA $ 36,267 $ 29,582 Q3 2025 FINANCIAL RESULTS

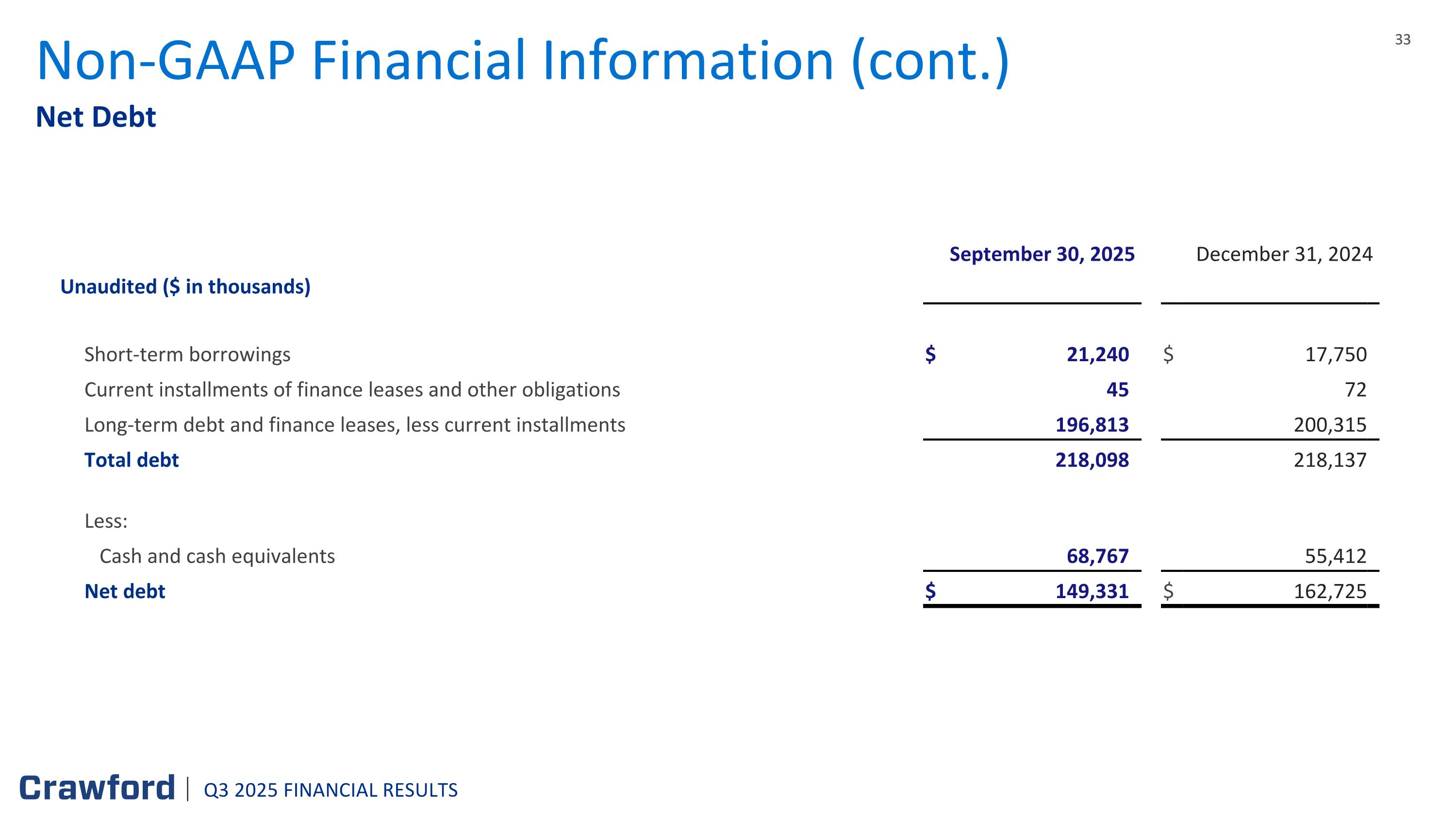

Net Debt Non-GAAP Financial Information (cont.) September 30, 2025 December 31, December 31, 2024 December 31, Unaudited ($ in thousands) 2019 2018 Short-term borrowings $ 21,240 $ 17,750 Current installments of finance leases and other obligations 45 72 Long-term debt and finance leases, less current installments 196,813 200,315 Total debt 218,098 218,137 Less: Cash and cash equivalents 68,767 55,412 Net debt $ 149,331 $ 162,725 Q3 2025 FINANCIAL RESULTS

Segment Gross Profit Non-GAAP Financial Information (cont.) Three months ended Three months ended Unaudited ($ in thousands) September 30, 2025 December 31, 2019 September 30, 2024 December 31, 2018 North America Loss Adjusting $ 16,119 $ 14,757 International Operations 22,784 18,543 Broadspire 27,480 25,600 Platform Solutions 7,223 9,751 Segment gross profit 73,606 68,651 Segment indirect costs: North America Loss Adjusting (9,178 ) (9,314 ) International Operations (15,337 ) (13,407 ) Broadspire (11,915 ) (11,198 ) Platform Solutions (4,639 ) (5,918 ) Unallocated corporate and shared costs, net (5,946 ) (6,979 ) Consolidated operating earnings 26,591 21,835 Net corporate interest expense (3,788 ) (4,682 ) Stock option expense (52 ) (188 ) Amortization expense (2,126 ) (1,932 ) Non-service pension costs (2,363 ) (2,441 ) Contingent earnout adjustments (60 ) 2,128 Income tax provision (5,813 ) (5,333 ) Net loss attributable to noncontrolling interests 19 66 Net income attributable to shareholders of Crawford & Company $ 12,408 $ 9,453 Q3 2025 FINANCIAL RESULTS

Reconciliation of Third Quarter Non-GAAP Results Three Months Ended September 30, 2025 Unaudited ($ in thousands) Pretax Earnings Pretax (Loss) Earnings Net Income Attributable to Crawford & Company Net (Loss) Income Attributable to Crawford & Company Diluted Earnings per CRD-A Share(1) Diluted (Loss) Earnings per CRD-A Share Diluted Earnings per CRD-B Share(1) Diluted (Loss) Earnings per CRD-B Share GAAP $ 18,202 $ 12,408 $ 0.25 $ 0.25 Adjustments: Amortization of intangible assets 2,126 1,814 0.04 0.04 Non-service-related pension costs 2,363 1,831 0.04 0.04 Contingent earnout adjustments 60 60 — — Non-GAAP Adjusted $ 22,751 $ 16,113 $ 0.32 $ 0.32 Three Months Ended September 30, 2024 Unaudited ($ in thousands) Pretax Earnings Pretax Earnings Net Income Attributable to Crawford & Company Net Income Attributable to Crawford & Company Diluted Earnings per CRD-A Share Diluted Earnings per CRD-A Share Diluted Earnings per CRD-B Share Diluted Earnings per CRD-B Share GAAP $ 14,720 $ 9,453 $ 0.19 $ 0.19 Adjustments: Amortization of intangible assets 1,932 1,668 0.03 0.03 Non-service-related pension costs 2,441 1,910 0.04 0.04 Contingent earnout adjustments (2,128 ) (2,179 ) (0.04 ) (0.04 ) Non-GAAP Adjusted $ 16,965 $ 10,852 $ 0.22 $ 0.22 Q3 2025 FINANCIAL RESULTS (1) Sum of reconciling items may differ from total due to rounding of individual components