CTS Corporation 4th Quarter and Full-Year 2025 Earnings Call February 10, 2026

Cautionary Statement Regarding Forward-Looking Statements Readers are cautioned that the statements contained in this document regarding expectations of our performance or other matters that may affect our business, results of operations, or financial condition are, or may be deemed to be, “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this document, including statements regarding our strategy, financial position, guidance, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “continued,” “project,” “plan,” “goals,” “opportunity,” “appeal,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “might,” “could,” “intend,” “shall,” “possible,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “on track,” “poised,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are based on management’s expectations, certain assumptions, and currently available information. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties, and other factors, which could cause CTS’ actual results, performance, or achievements to differ materially from those presented in the forward-looking statements. Examples of factors that may affect future operating results and financial condition include, but are not limited to: supply chain disruptions (including, but not limited to, the availability and cost of rare earth elements, minerals and metals); changes in the economy generally, including inflationary and/or recessionary conditions and increased tariffs, and in respect to the business in which CTS operates; unanticipated issues in integrating acquisitions; the funding of contracts by the U.S. Government; the results of actions to reposition CTS’ business; rapid technological change; general market conditions in the transportation, as well as conditions in the industrial, aerospace and defense, and medical markets; reliance on key customers; unanticipated public health crises, natural disasters or other events; environmental compliance and remediation expenses; the ability to protect CTS’ intellectual property; pricing pressures and demand for CTS’ products; risks associated with CTS’ international operations, including trade and tariff barriers, exchange rates and political and geopolitical risks (including, without limitation, the impact of tariffs on China, Canada and Mexico, and other nations); the potential impact of U.S./China relations and the impact of geopolitical conflicts may have on our business, results of operations and financial condition; write offs of goodwill on our balance sheet; the amount and timing of any share repurchases; and the effect of any cybersecurity incidents on our business. Many of these, and other risks and uncertainties, are discussed in further detail in Item 1A. of CTS’ most recent Annual Report on Form 10-K and other filings made with the SEC. CTS undertakes no obligation to publicly update CTS’ forward-looking statements to reflect new information or events or circumstances that arise after the date hereof, including market or industry changes. CTS refers to the forward-looking measures of book-to-bill ratio and total booked business in this document. Book-to-bill ratio is the ratio of customer orders received to revenues recorded for the same period. Although the book-to-bill ratio reflects firm customer orders, changes such as terminations, amendments, or contract cancellations may occur which could result in a reduction to the customer orders. Total booked business reflects expected revenue from the remaining life of long-term agreements with transportation customers. Total booked business is adjusted periodically for changes in expected revenue based on market information, fluctuations in foreign currency exchange rates, information from our customers, and any other factors that may impact the expected revenue from these agreements. Book-to-bill ratio and total booked business are not defined by U.S. GAAP and our methodology for calculating these measures may not be consistent with or comparable to other similarly titled measures of other companies.

Solid growth from diversified end markets2 Revenue +9% for Q4 2025 Revenue +5% for full year 2025 59% of total revenue in Q4 2025 57% of total revenue for full year 2025 Transportation end market challenging Revenue flat for Q4 2025 Revenue (7)% for full year 2025 Lower sales of commercial vehicle products Book-to-bill ratio3 1.04 for full year 2025 Notes: All comparisons vs. same period in prior year unless otherwise noted. 1 Adj. Gross Margin and Adj. Earnings per Share are non-GAAP financial measures. Refer to the Appendix for reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. 2 Diversified end markets, previously referred as the “non-transportation” market, includes the industrial, aerospace & defense, and medical end markets. 3 Refer to slide 2 for information on book-to-bill ratio. Q4 and Full-Year 2025 – Strong Growth in Diversified Markets and Operational Execution $137M Revenue +9% Fourth Quarter 39.1% Adj. Gross Margin1 +150 bps $0.62 Adj. Diluted EPS1 +23% $541M Revenue +5% Full Year 2025 38.5% Adj. Gross Margin1 +150 bps $2.23 Adj. Diluted EPS1 +5%

Medical $85 4 Aerospace & Defense ($ Millions) Revenue $83 ($ Millions) FY 2025 Sales up 21%; book to bill 1.07 Q4 2025 Sales up 41% vs. Q4 2024 Robust growth driven by therapeutic and minimally invasive applications Multiple Q4 wins across all regions in medical ultrasound, therapeutic applications FY 2025 Sales up 20%; book to bill 0.91 Q4 2025 Sales down 4% vs. Q4 2024 SyQwest $22m in revenue in 2025 Wins across naval sonar, hydrophones, RF filters (anti‑jamming and drones) Added three new customers for underwater locator beacons and sonobuoy electronics Revenue End Markets Update

End Markets Update Industrial 1 Refer to slide 2 for information on total booked business. 5 Transportation ($ Millions) FY 2025 Sales up 12%; book to bill 1.11 Q4 Sales up 16% year-over-year Continued recovery from cyclical lows across OEM and distribution customers Multiple Q4 wins across distribution, industrial printing, EMC, temperature sensing FY 2025 down 7% year over year; Q4 sales flat $1b total booked business1 at end of Q4 2025 Added floor hinge pedal technology with a first North American OEM win Multiple platform awards for accelerator modules Continued progress on electronic brake pedal Revenue ($ Millions) Revenue

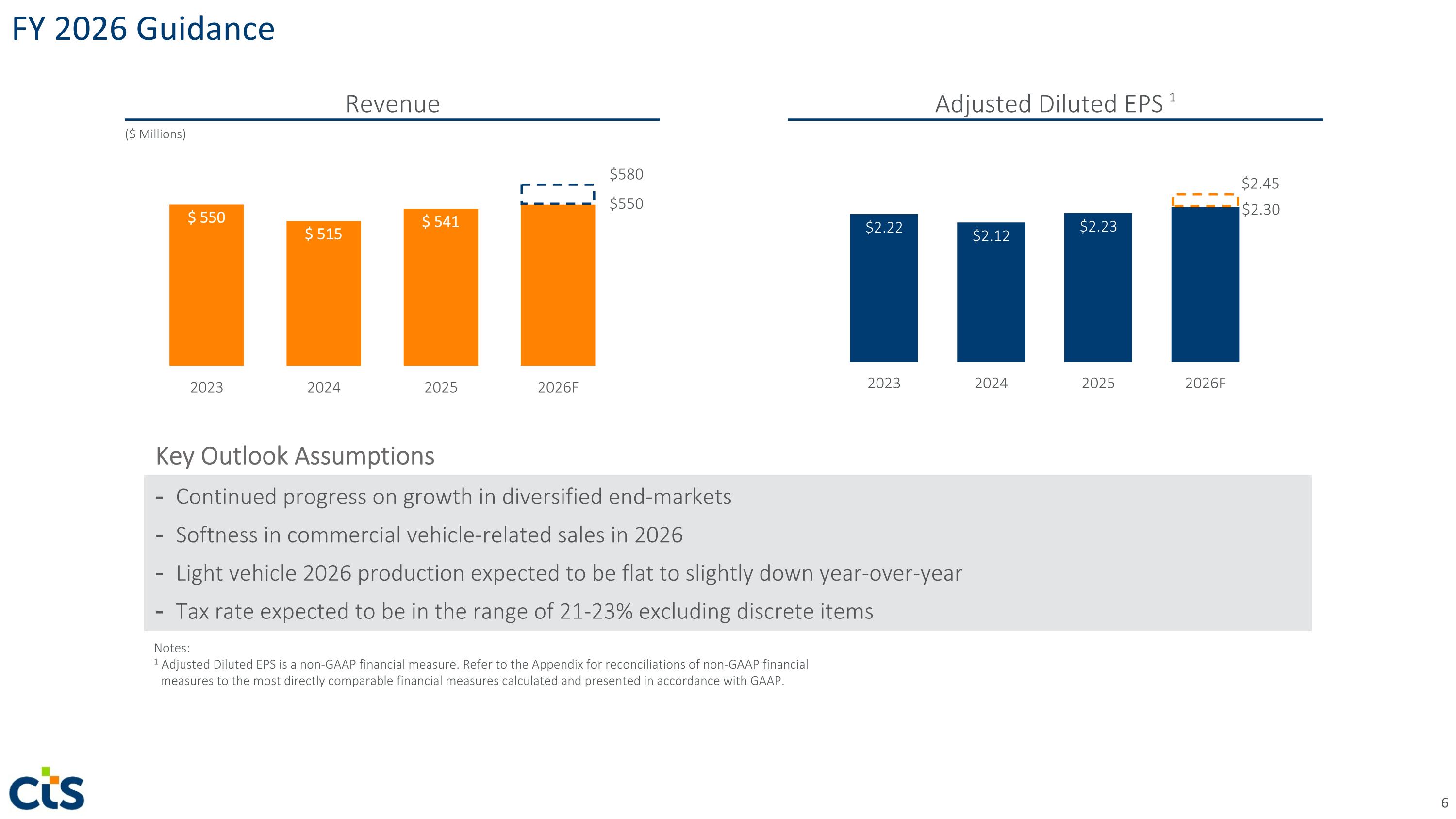

$2.45 $2.30 Notes: 1 Adjusted Diluted EPS is a non-GAAP financial measure. Refer to the Appendix for reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. FY 2026 Guidance Revenue ($ Millions) Adjusted Diluted EPS 1 $550 $580 Continued progress on growth in diversified end-markets Softness in commercial vehicle-related sales in 2026 Light vehicle 2026 production expected to be flat to slightly down year-over-year Tax rate expected to be in the range of 21-23% excluding discrete items Key Outlook Assumptions

4th Quarter and Full-Year 2025 Financial Results

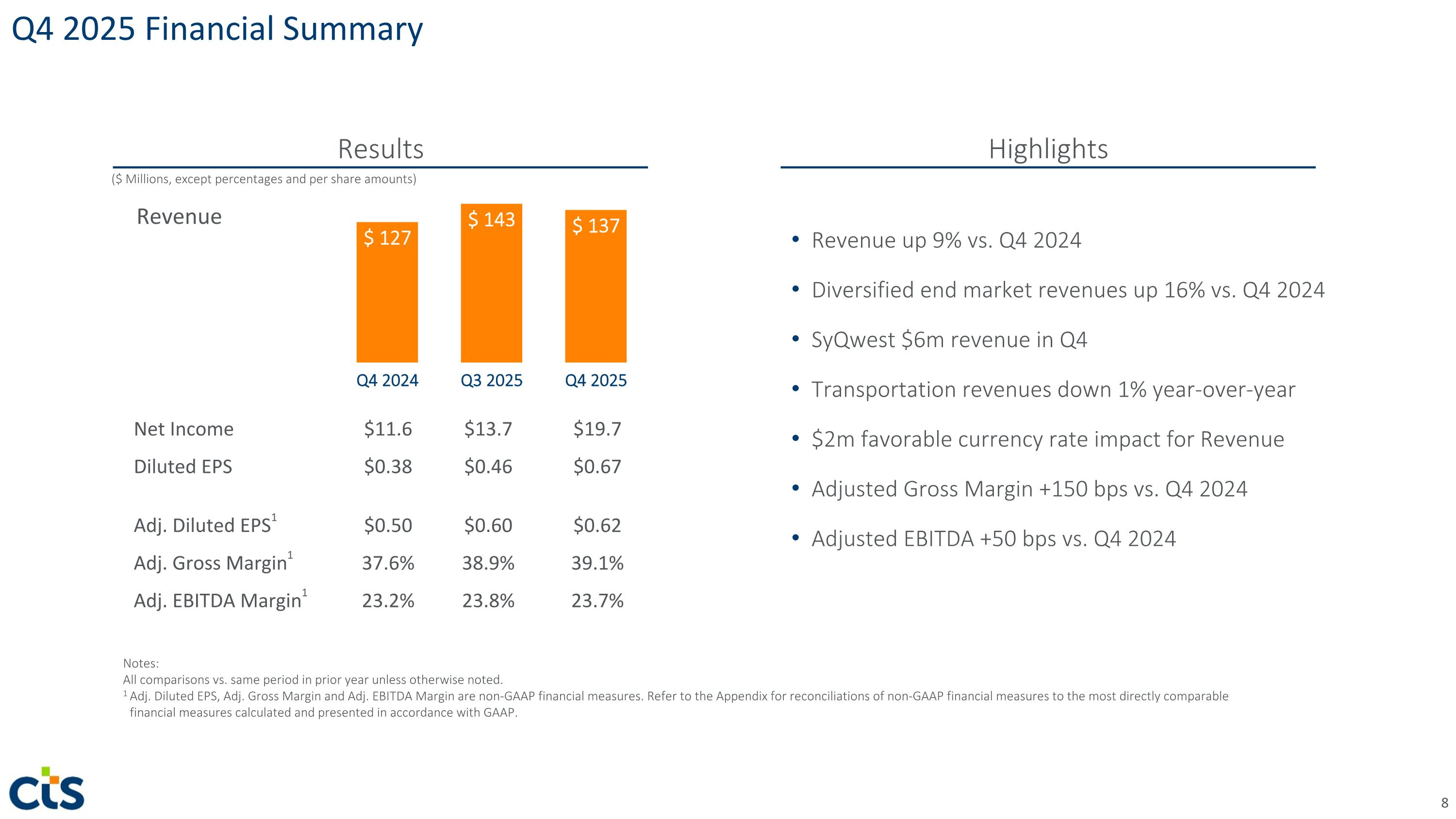

Notes: All comparisons vs. same period in prior year unless otherwise noted. 1 Adj. Diluted EPS, Adj. Gross Margin and Adj. EBITDA Margin are non-GAAP financial measures. Refer to the Appendix for reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. Revenue up 9% vs. Q4 2024 Diversified end market revenues up 16% vs. Q4 2024 SyQwest $6m revenue in Q4 Transportation revenues down 1% year-over-year $2m favorable currency rate impact for Revenue Adjusted Gross Margin +150 bps vs. Q4 2024 Adjusted EBITDA +50 bps vs. Q4 2024 Net Income $11.6 $13.7 $19.7 Diluted EPS $0.38 $0.46 $0.67 Adj. Diluted EPS1 $0.50 $0.60 $0.62 Adj. Gross Margin1 37.6% 38.9% 39.1% Adj. EBITDA Margin1 23.2% 23.8% 23.7% Revenue Q4 2025 Financial Summary Results ($ Millions, except percentages and per share amounts) Highlights

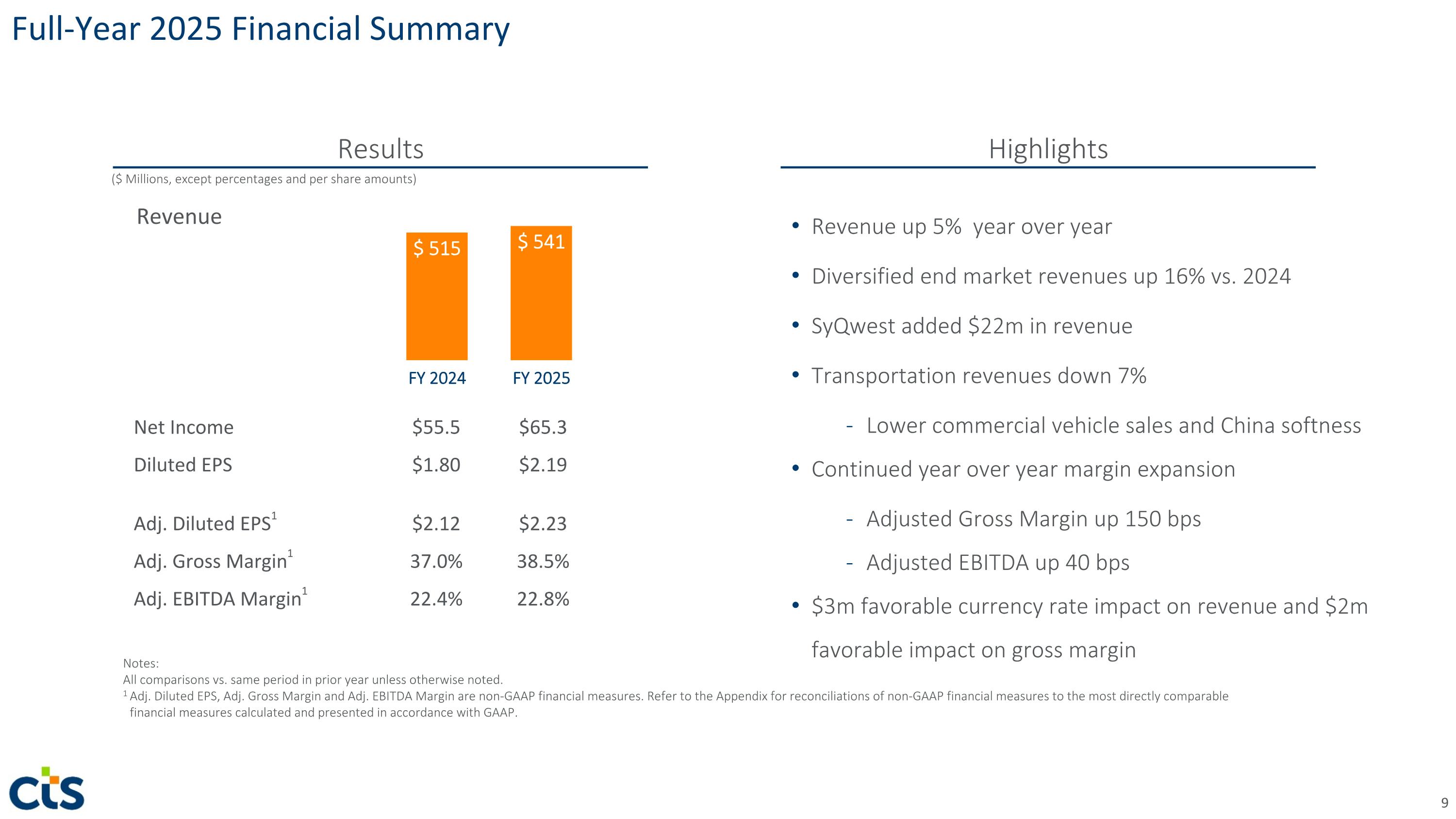

Notes: All comparisons vs. same period in prior year unless otherwise noted. 1 Adj. Diluted EPS, Adj. Gross Margin and Adj. EBITDA Margin are non-GAAP financial measures. Refer to the Appendix for reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. Net Income $55.5 $65.3 Diluted EPS $1.80 $2.19 Adj. Diluted EPS1 $2.12 $2.23 Adj. Gross Margin1 37.0% 38.5% Adj. EBITDA Margin1 22.4% 22.8% Full-Year 2025 Financial Summary Results ($ Millions, except percentages and per share amounts) Highlights Revenue up 5% year over year Diversified end market revenues up 16% vs. 2024 SyQwest added $22m in revenue Transportation revenues down 7% Lower commercial vehicle sales and China softness Continued year over year margin expansion Adjusted Gross Margin up 150 bps Adjusted EBITDA up 40 bps $3m favorable currency rate impact on revenue and $2m favorable impact on gross margin Revenue

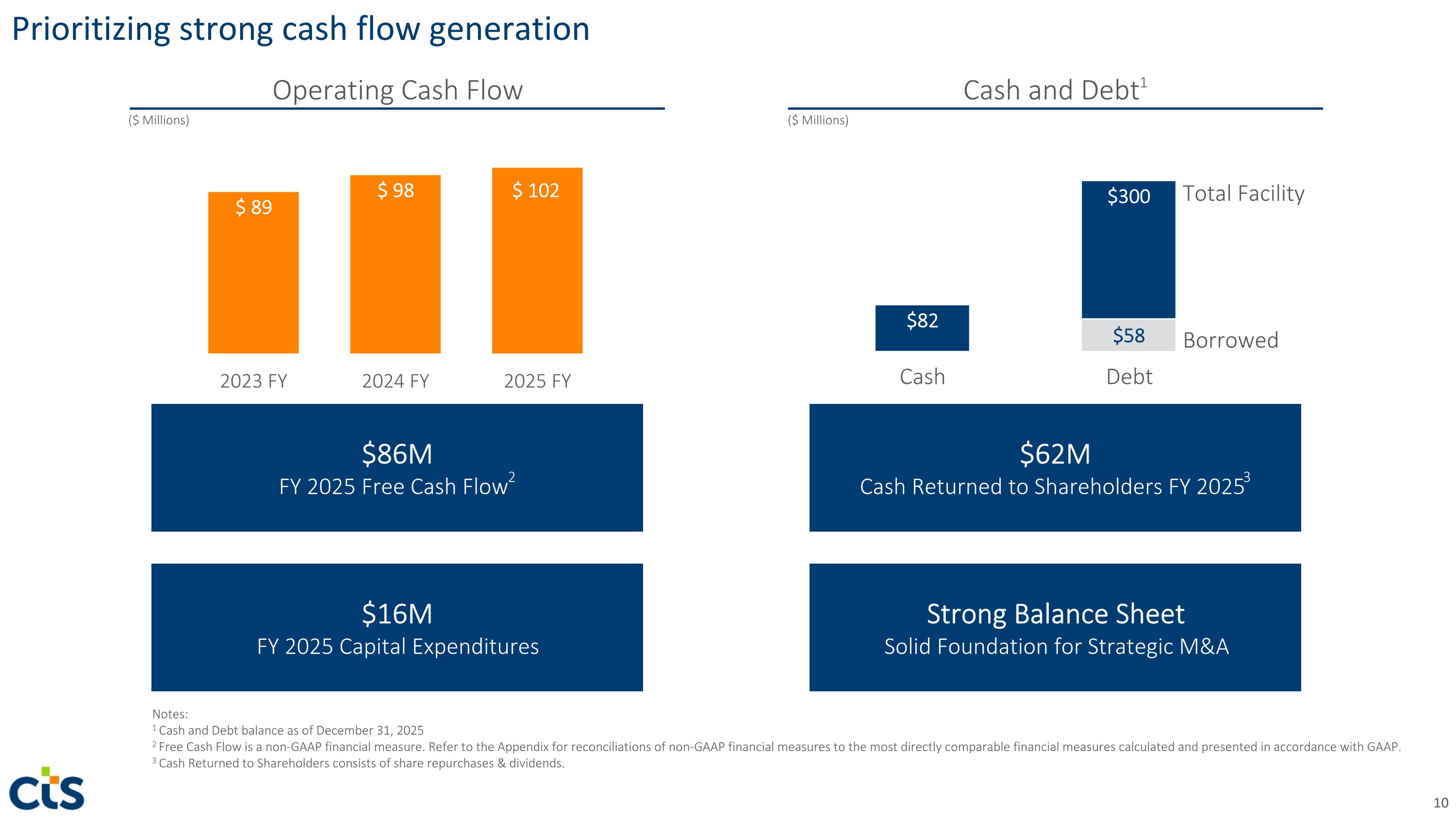

Cash and Debt1 $62M Cash Returned to Shareholders FY 20253 $86M FY 2025 Free Cash Flow2 Strong Balance Sheet Solid Foundation for Strategic M&A $16M FY 2025 Capital Expenditures Borrowed Total Facility Operating Cash Flow Prioritizing strong cash flow generation ($ Millions) ($ Millions) Notes: 1 Cash and Debt balance as of December 31, 2025 2 Free Cash Flow is a non-GAAP financial measure. Refer to the Appendix for reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. 3 Cash Returned to Shareholders consists of share repurchases & dividends.

Q & A

Appendix

Non-GAAP Financial Measures From time to time, CTS may use non-GAAP financial measures in discussing CTS’ business. These measures are intended to supplement, not replace, CTS’ presentation of its financial results in accordance with U.S. GAAP. CTS believes that the non-GAAP financial measures presented are commonly used by financial analysts and others in the industries in which CTS operates, and thus further provide useful information to investors. CTS’ definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies. Non-GAAP measures should not be used by investors or third parties as the sole basis for formulating investment decisions, as they may exclude a number of important cash and non-cash recurring items. CTS has presented these non-GAAP financial measures as it believes that the presentation of its financial results that exclude (1) restructuring charges; (2) restructuring-related charges; (3) environmental charges; (4) acquisition-related adjustments; (5) inventory fair value step-up costs; (6) foreign exchange (gains) losses; (7) non-cash pension expenses (income); and (8) certain discrete tax items are useful and assist in comparing CTS’ current operating results with past periods and with the operational performance of other companies in its industry. Included below is a description of the expenses that CTS has determined are not normal, recurring cash operating expenses necessary to operate its business and the rationale for why providing financial measures for its business with such expenses excluded or adjusted is useful to investors as a supplement to the U.S. GAAP measures. Restructuring charges – costs primarily relating to workforce reductions, building and equipment relocations, asset impairment charges and other facility closure activities in connection with our continued optimization of our organization. Restructuring-related charges – costs related to restructuring actions that do not qualify as direct restructuring charges under U.S. GAAP. These include duplicative expenses incurred due to plant consolidation related transition activities such as excess rent, utilities, personnel related and other costs incurred prior to the start of production at the new location. Environmental charges – costs associated with our non-operating facilities that are unrelated to ongoing operations. Currently, none of these costs and accruals relate to sites that provide revenue generating activities for the Company. Acquisition-related adjustments – diligence and transaction costs related to acquisitions including related contingent earnout and other adjustments. Inventory fair value step-up costs – purchase accounting-related inventory costs from acquisitions. Foreign exchange (gains) losses – remeasurement income and expenses for non-U.S. subsidiaries with the U.S. dollar as the functional currency. Non-cash pension expenses (income) – pension income and expenses relating to the non-operating U.S. pension and post-retirement life insurance plans, including historical plan settlement activities. Discrete tax items – non-recurring, infrequent, or unusual tax adjustments (e.g., valuation allowances, uncertain tax position changes, unremitted assertion changes and discrete impacts associated with pre-tax non-GAAP items or due to tax law changes, etc.). At times, the reconciliations below have been intentionally rounded to the nearest thousand, or $0.01 for EPS figures, and, therefore, may not sum. CTS does not provide reconciliations of forward-looking non-GAAP financial measures, such as estimated adjusted diluted earnings per share, to the most comparable GAAP financial measures on a forward-looking basis because CTS is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of certain items, such as, but not limited to, restructuring costs, environmental remediation costs, acquisition-related costs, foreign exchange rates and other non-routine costs. Each of such adjustments has not yet occurred, are out of CTS' control and/or cannot be reasonably predicted. For the same reasons, CTS is unable to address the probable significance of the unavailable information. The Company updated certain previously furnished 2024 amounts due to immaterial errors identified. Refer to Note 1, "Basis of Presentation" in the Annual Report on Form 10-K as of December 31, 2025 for more information.

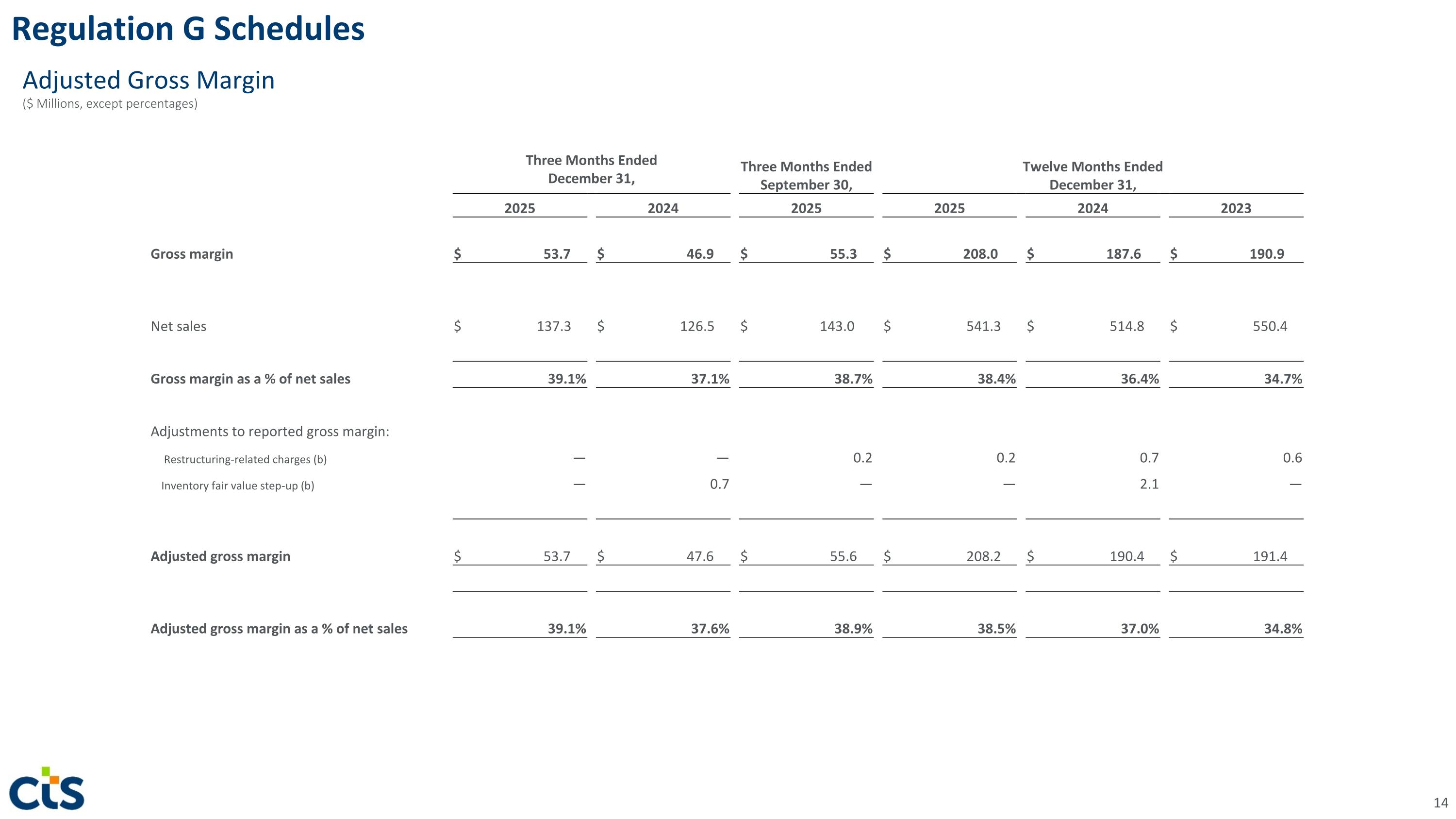

Regulation G Schedules ($ Millions, except percentages) Adjusted Gross Margin Three Months Ended December 31, Three Months Ended September 30, Twelve Months Ended December 31, 2025 2024 2025 2025 2024 2023 Gross margin $ 53.7 $ 46.9 $ 55.3 $ 208.0 $ 187.6 $ 190.9 Net sales $ 137.3 $ 126.5 $ 143.0 $ 541.3 $ 514.8 $ 550.4 Gross margin as a % of net sales 39.1% 37.1% 38.7% 38.4% 36.4% 34.7% Adjustments to reported gross margin: Restructuring-related charges (b) — — 0.2 0.2 0.7 0.6 Inventory fair value step-up (b) — 0.7 — — 2.1 — Adjusted gross margin $ 53.7 $ 47.6 $ 55.6 $ 208.2 $ 190.4 $ 191.4 Adjusted gross margin as a % of net sales 39.1% 37.6% 38.9% 38.5% 37.0% 34.8%

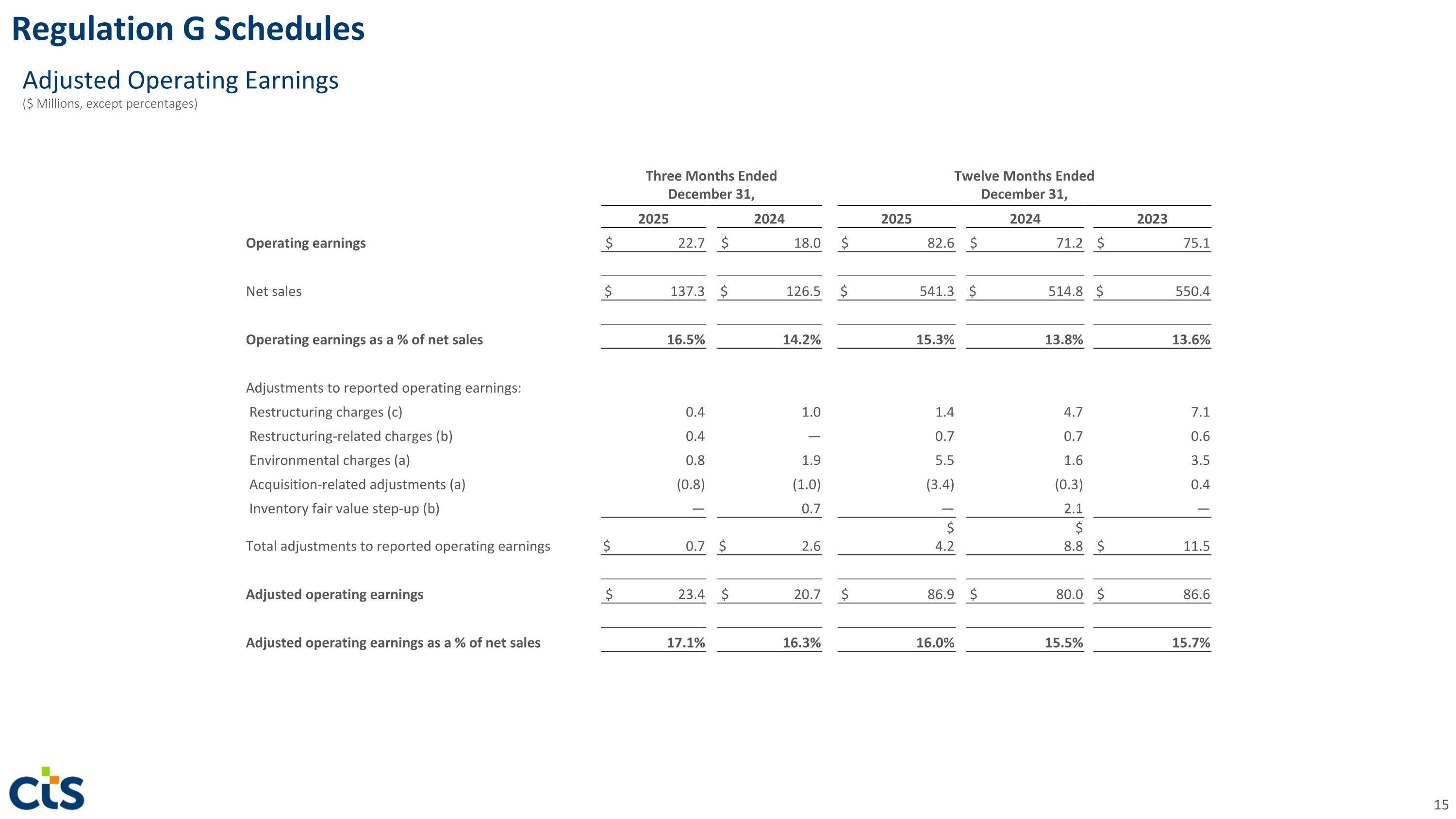

Regulation G Schedules ($ Millions, except percentages) Adjusted Operating Earnings Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 2023 Operating earnings $ 22.7 $ 18.0 $ 82.6 $ 71.2 $ 75.1 Net sales $ 137.3 $ 126.5 $ 541.3 $ 514.8 $ 550.4 Operating earnings as a % of net sales 16.5% 14.2% 15.3% 13.8% 13.6% Adjustments to reported operating earnings: Restructuring charges (c) 0.4 1.0 1.4 4.7 7.1 Restructuring-related charges (b) 0.4 — 0.7 0.7 0.6 Environmental charges (a) 0.8 1.9 5.5 1.6 3.5 Acquisition-related adjustments (a) (0.8) (1.0) (3.4) (0.3) 0.4 Inventory fair value step-up (b) — 0.7 — 2.1 — Total adjustments to reported operating earnings $ 0.7 $ 2.6 $ 4.2 $ 8.8 $ 11.5 Adjusted operating earnings $ 23.4 $ 20.7 $ 86.9 $ 80.0 $ 86.6 Adjusted operating earnings as a % of net sales 17.1% 16.3% 16.0% 15.5% 15.7%

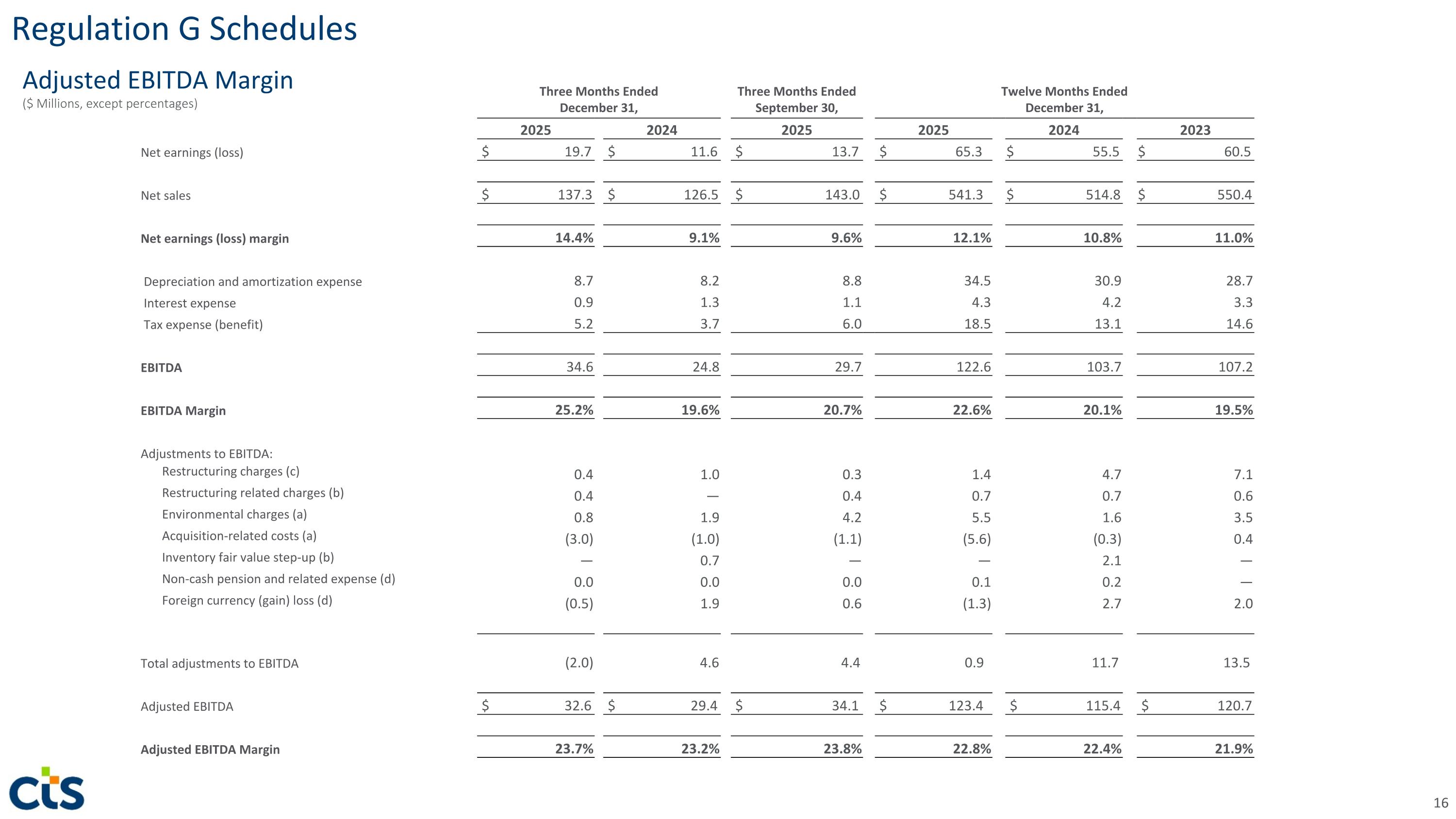

Regulation G Schedules ($ Millions, except percentages) Adjusted EBITDA Margin Three Months Ended December 31, Three Months Ended September 30, Twelve Months Ended December 31, 2025 2024 2025 2025 2024 2023 Net earnings (loss) $ 19.7 $ 11.6 $ 13.7 $ 65.3 $ 55.5 $ 60.5 Net sales $ 137.3 $ 126.5 $ 143.0 $ 541.3 $ 514.8 $ 550.4 Net earnings (loss) margin 14.4% 9.1% 9.6% 12.1% 10.8% 11.0% Depreciation and amortization expense 8.7 8.2 8.8 34.5 30.9 28.7 Interest expense 0.9 1.3 1.1 4.3 4.2 3.3 Tax expense (benefit) 5.2 3.7 6.0 18.5 13.1 14.6 EBITDA 34.6 24.8 29.7 122.6 103.7 107.2 EBITDA Margin 25.2% 19.6% 20.7% 22.6% 20.1% 19.5% Adjustments to EBITDA: Restructuring charges (c) 0.4 1.0 0.3 1.4 4.7 7.1 Restructuring related charges (b) 0.4 — 0.4 0.7 0.7 0.6 Environmental charges (a) 0.8 1.9 4.2 5.5 1.6 3.5 Acquisition-related costs (a) (3.0) (1.0) (1.1) (5.6) (0.3) 0.4 Inventory fair value step-up (b) — 0.7 — — 2.1 — Non-cash pension and related expense (d) 0.0 0.0 0.0 0.1 0.2 — Foreign currency (gain) loss (d) (0.5) 1.9 0.6 (1.3) 2.7 2.0 Total adjustments to EBITDA (2.0) 4.6 4.4 0.9 11.7 13.5 Adjusted EBITDA $ 32.6 $ 29.4 $ 34.1 $ 123.4 $ 115.4 $ 120.7 Adjusted EBITDA Margin 23.7% 23.2% 23.8% 22.8% 22.4% 21.9%

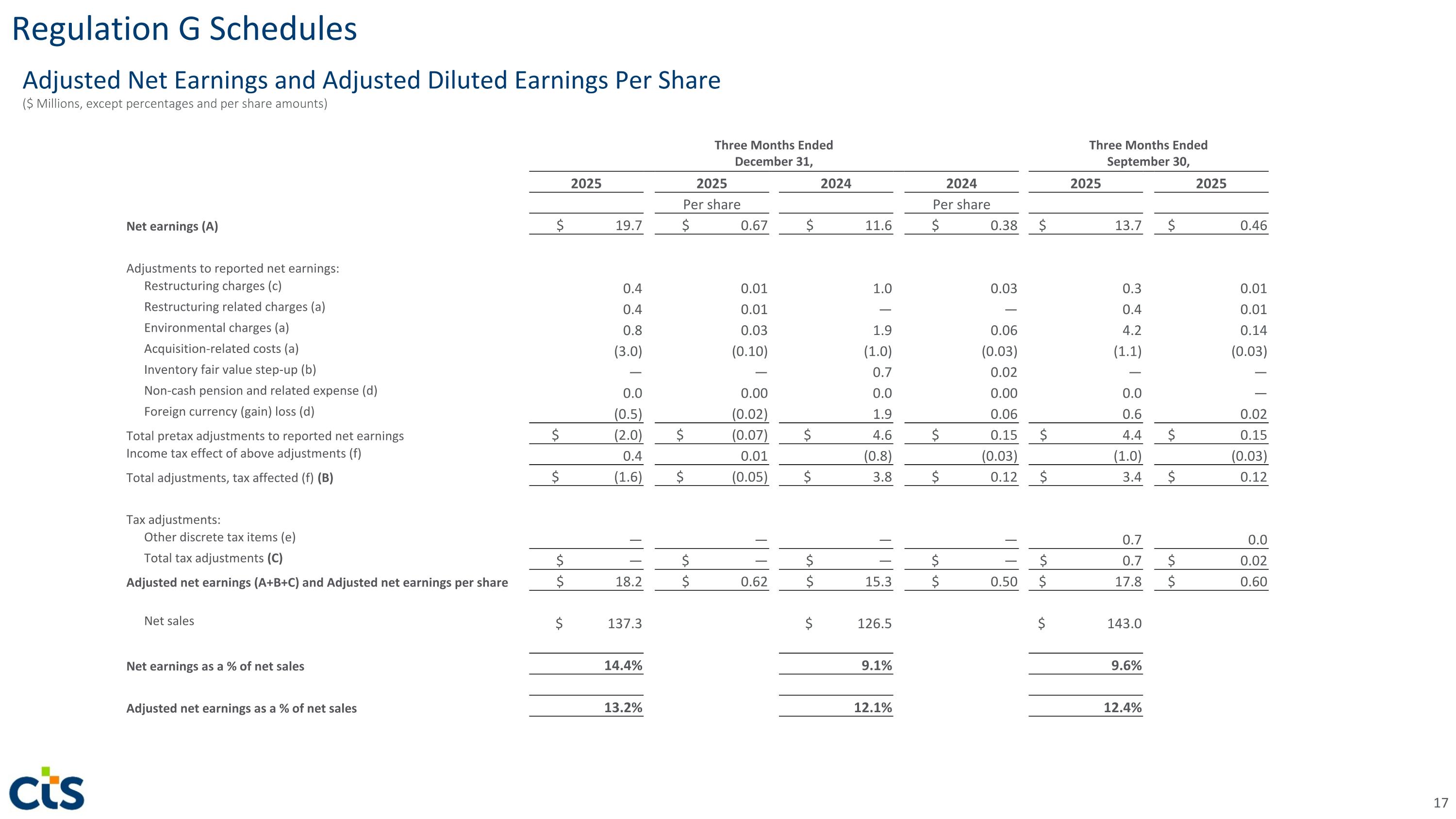

Regulation G Schedules ($ Millions, except percentages and per share amounts) Adjusted Net Earnings and Adjusted Diluted Earnings Per Share Three Months Ended December 31, Three Months Ended September 30, 2025 2025 2024 2024 2025 2025 Per share Per share Net earnings (A) $ 19.7 $ 0.67 $ 11.6 $ 0.38 $ 13.7 $ 0.46 Adjustments to reported net earnings: Restructuring charges (c) 0.4 0.01 1.0 0.03 0.3 0.01 Restructuring related charges (a) 0.4 0.01 — — 0.4 0.01 Environmental charges (a) 0.8 0.03 1.9 0.06 4.2 0.14 Acquisition-related costs (a) (3.0) (0.10) (1.0) (0.03) (1.1) (0.03) Inventory fair value step-up (b) — — 0.7 0.02 — — Non-cash pension and related expense (d) 0.0 0.00 0.0 0.00 0.0 — Foreign currency (gain) loss (d) (0.5) (0.02) 1.9 0.06 0.6 0.02 Total pretax adjustments to reported net earnings $ (2.0) $ (0.07) $ 4.6 $ 0.15 $ 4.4 $ 0.15 Income tax effect of above adjustments (f) 0.4 0.01 (0.8) (0.03) (1.0) (0.03) Total adjustments, tax affected (f) (B) $ (1.6) $ (0.05) $ 3.8 $ 0.12 $ 3.4 $ 0.12 Tax adjustments: Other discrete tax items (e) — — — — 0.7 0.0 Total tax adjustments (C) $ — $ — $ — $ — $ 0.7 $ 0.02 Adjusted net earnings (A+B+C) and Adjusted net earnings per share $ 18.2 $ 0.62 $ 15.3 $ 0.50 $ 17.8 $ 0.60 Net sales $ 137.3 $ 126.5 $ 143.0 Net earnings as a % of net sales 14.4% 9.1% 9.6% Adjusted net earnings as a % of net sales 13.2% 12.1% 12.4%

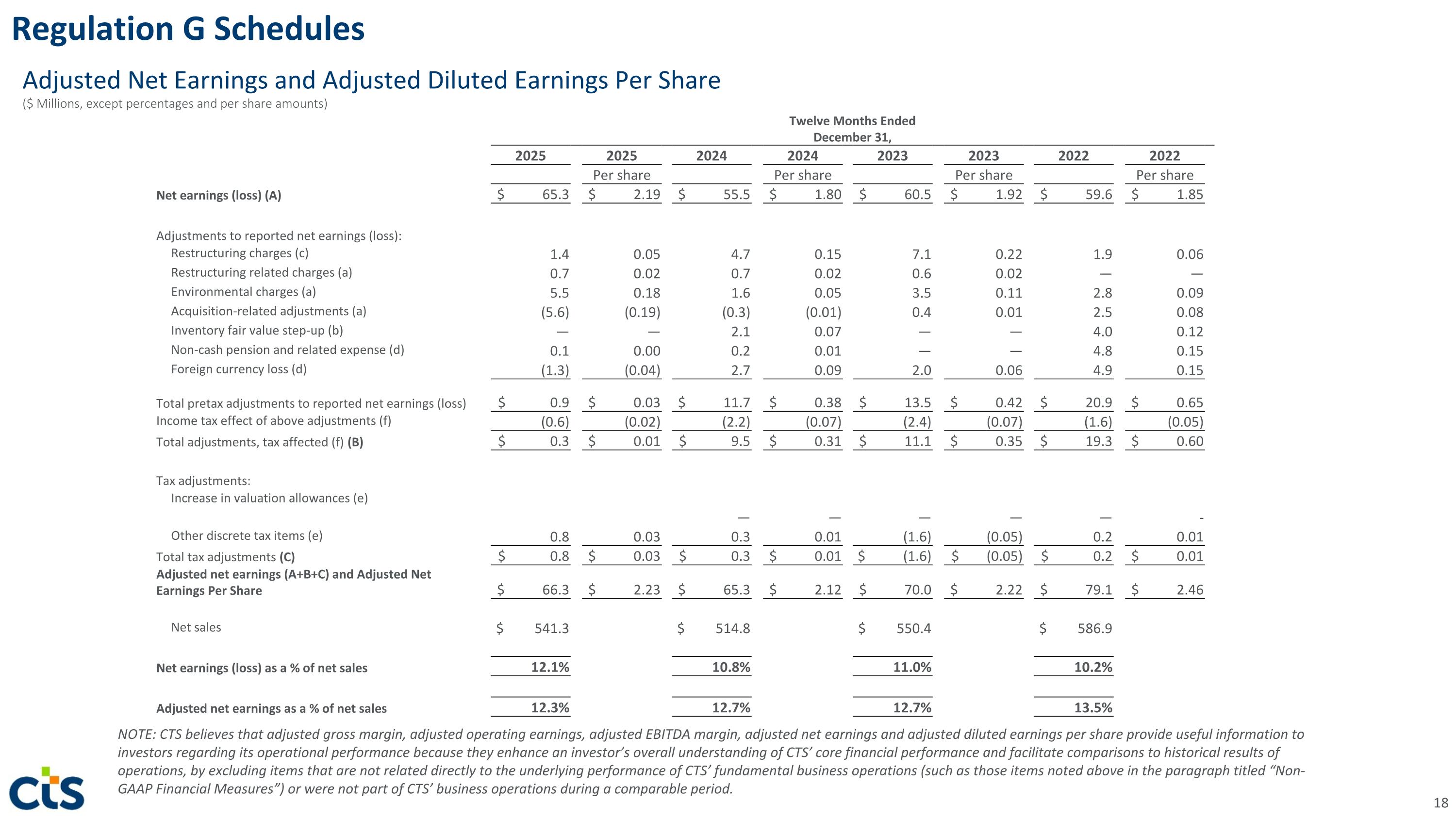

Regulation G Schedules ($ Millions, except percentages and per share amounts) Adjusted Net Earnings and Adjusted Diluted Earnings Per Share NOTE: CTS believes that adjusted gross margin, adjusted operating earnings, adjusted EBITDA margin, adjusted net earnings and adjusted diluted earnings per share provide useful information to investors regarding its operational performance because they enhance an investor’s overall understanding of CTS’ core financial performance and facilitate comparisons to historical results of operations, by excluding items that are not related directly to the underlying performance of CTS’ fundamental business operations (such as those items noted above in the paragraph titled “Non-GAAP Financial Measures”) or were not part of CTS’ business operations during a comparable period. Twelve Months Ended December 31, 2025 2025 2024 2024 2023 2023 2022 2022 Per share Per share Per share Per share Net earnings (loss) (A) $ 65.3 $ 2.19 $ 55.5 $ 1.80 $ 60.5 $ 1.92 $ 59.6 $ 1.85 Adjustments to reported net earnings (loss): Restructuring charges (c) 1.4 0.05 4.7 0.15 7.1 0.22 1.9 0.06 Restructuring related charges (a) 0.7 0.02 0.7 0.02 0.6 0.02 — — Environmental charges (a) 5.5 0.18 1.6 0.05 3.5 0.11 2.8 0.09 Acquisition-related adjustments (a) (5.6) (0.19) (0.3) (0.01) 0.4 0.01 2.5 0.08 Inventory fair value step-up (b) — — 2.1 0.07 — — 4.0 0.12 Non-cash pension and related expense (d) 0.1 0.00 0.2 0.01 — — 4.8 0.15 Foreign currency loss (d) (1.3) (0.04) 2.7 0.09 2.0 0.06 4.9 0.15 Total pretax adjustments to reported net earnings (loss) $ 0.9 $ 0.03 $ 11.7 $ 0.38 $ 13.5 $ 0.42 $ 20.9 $ 0.65 Income tax effect of above adjustments (f) (0.6) (0.02) (2.2) (0.07) (2.4) (0.07) (1.6) (0.05) Total adjustments, tax affected (f) (B) $ 0.3 $ 0.01 $ 9.5 $ 0.31 $ 11.1 $ 0.35 $ 19.3 $ 0.60 Tax adjustments: Increase in valuation allowances (e) — — — — — - Other discrete tax items (e) 0.8 0.03 0.3 0.01 (1.6) (0.05) 0.2 0.01 Total tax adjustments (C) $ 0.8 $ 0.03 $ 0.3 $ 0.01 $ (1.6) $ (0.05) $ 0.2 $ 0.01 Adjusted net earnings (A+B+C) and Adjusted Net Earnings Per Share $ 66.3 $ 2.23 $ 65.3 $ 2.12 $ 70.0 $ 2.22 $ 79.1 $ 2.46 Net sales $ 541.3 $ 514.8 $ 550.4 $ 586.9 Net earnings (loss) as a % of net sales 12.1% 10.8% 11.0% 10.2% Adjusted net earnings as a % of net sales 12.3% 12.7% 12.7% 13.5%

Reflected in Selling, general and administrative and other income (expense), net. Reflected in Cost of goods sold. Reflected in Restructuring charges. Reflected in Other income (expense), net. Reflected in Income tax expense. For 2023, discrete tax items include adjusting for tax benefits resulting from $0.6 million for research and development tax credits from prior years, $0.8 million in foreign tax credits related to prior years from a 2023 tax law change, as well as $0.2 million from the release of uncertain tax benefits. For 2024, the discrete tax items relate to items we deemed outside normal cash-generating operations including the addition of a valuation allowance for a foreign subsidiary. For 2025, the discrete tax items relate to items we deemed outside normal cash-generating operations including the addition of a valuation allowance for research and developmental credits, the tax impacts of an immaterial correction of a prior period error, the tax impacts related to cost associated with the environmental contamination liability. We determine the tax effect of non-GAAP adjustments by considering the tax laws and statutory income tax rates applicable in the tax jurisdictions of the underlying non-GAAP adjustments. For all periods presented, we applied the statutory income tax rates to the taxable portion of all of our adjustments. Our acquisition costs and foreign currency gains and losses included in our non-GAAP adjustments were not deductible for income tax purposes; therefore, no statutory income tax rate was applied to such costs. Regulation G Schedules

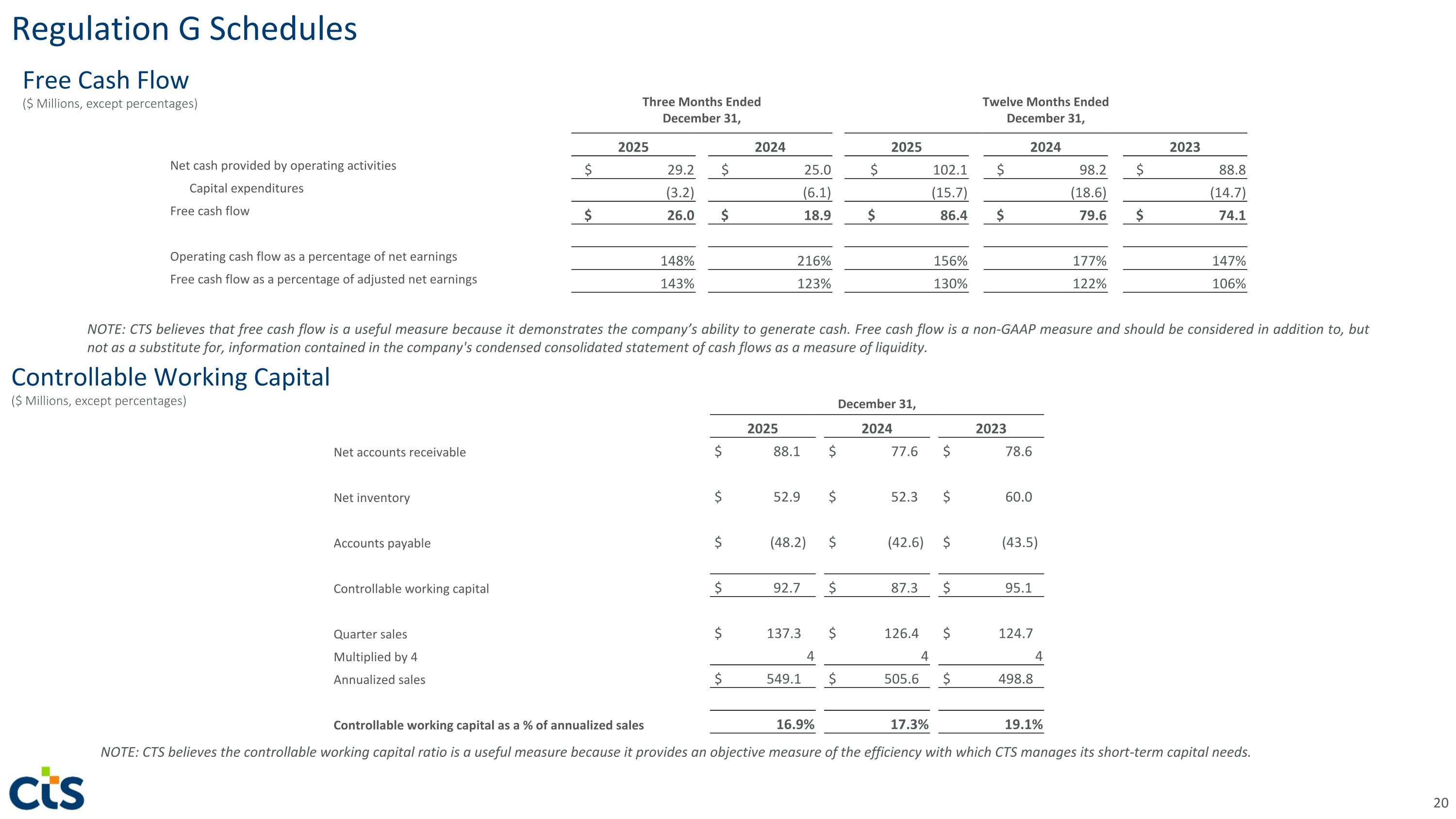

($ Millions, except percentages) Free Cash Flow ($ Millions, except percentages) Controllable Working Capital NOTE: CTS believes the controllable working capital ratio is a useful measure because it provides an objective measure of the efficiency with which CTS manages its short-term capital needs. NOTE: CTS believes that free cash flow is a useful measure because it demonstrates the company’s ability to generate cash. Free cash flow is a non-GAAP measure and should be considered in addition to, but not as a substitute for, information contained in the company's condensed consolidated statement of cash flows as a measure of liquidity. Regulation G Schedules December 31, 2025 2024 2023 Net accounts receivable $ 88.1 $ 77.6 $ 78.6 Net inventory $ 52.9 $ 52.3 $ 60.0 Accounts payable $ (48.2) $ (42.6) $ (43.5) Controllable working capital $ 92.7 $ 87.3 $ 95.1 Quarter sales $ 137.3 $ 126.4 $ 124.7 Multiplied by 4 4 4 4 Annualized sales $ 549.1 $ 505.6 $ 498.8 Controllable working capital as a % of annualized sales 16.9% 17.3% 19.1% Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 2023 Net cash provided by operating activities $ 29.2 $ 25.0 $ 102.1 $ 98.2 $ 88.8 Capital expenditures (3.2) (6.1) (15.7) (18.6) (14.7) Free cash flow $ 26.0 $ 18.9 $ 86.4 $ 79.6 $ 74.1 Operating cash flow as a percentage of net earnings 148% 216% 156% 177% 147% Free cash flow as a percentage of adjusted net earnings 143% 123% 130% 122% 106%