Dana Incorporated Reports Solid 2025 Third-quarter Financial Results;

Raises 2025 Full-year Profit Guidance

Highlights

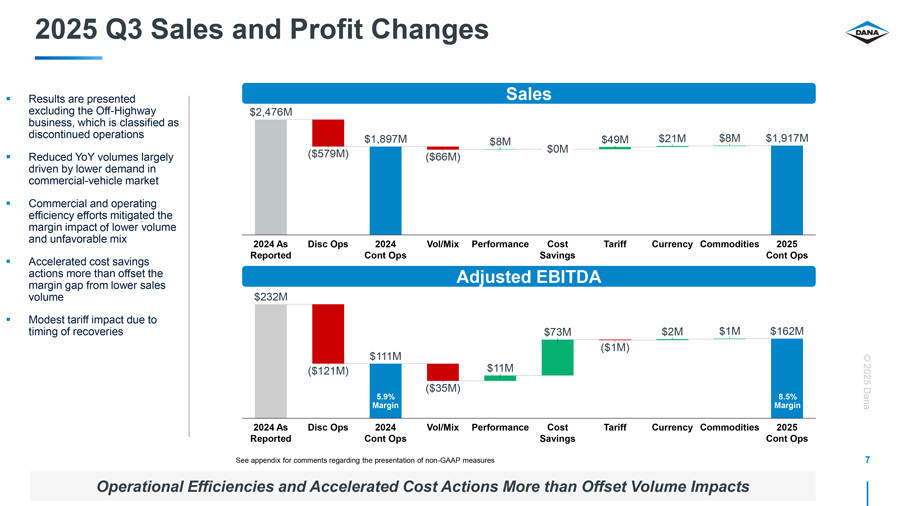

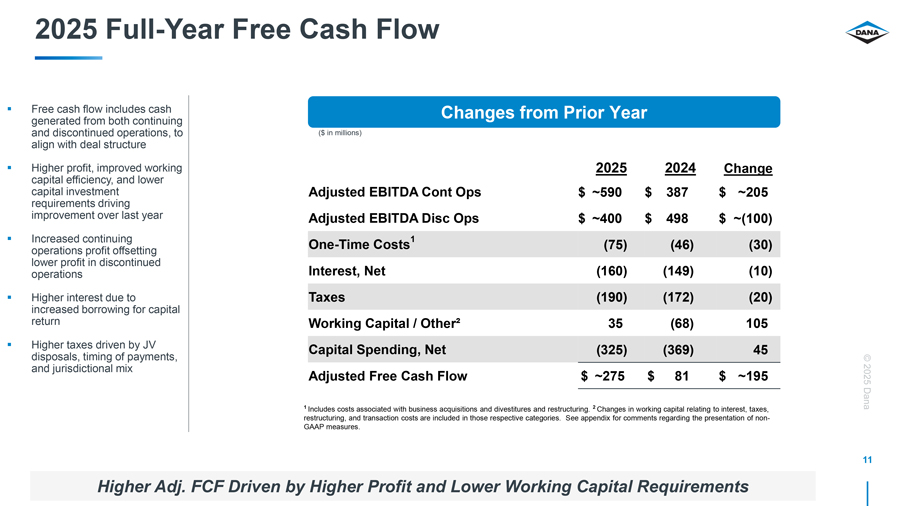

| • | Sales of $1.9 billion from continuing operations |

| • | Net income was $13 million from continuing operations, a $34 million increase compared to last year |

| • | Adjusted EBITDA of $162 million from continuing operations; 8.5 percent margin, an increase of 260 basis points compared to prior year |

| • | Operating cash flow* was $111 million, a $76 million increase compared to last year |

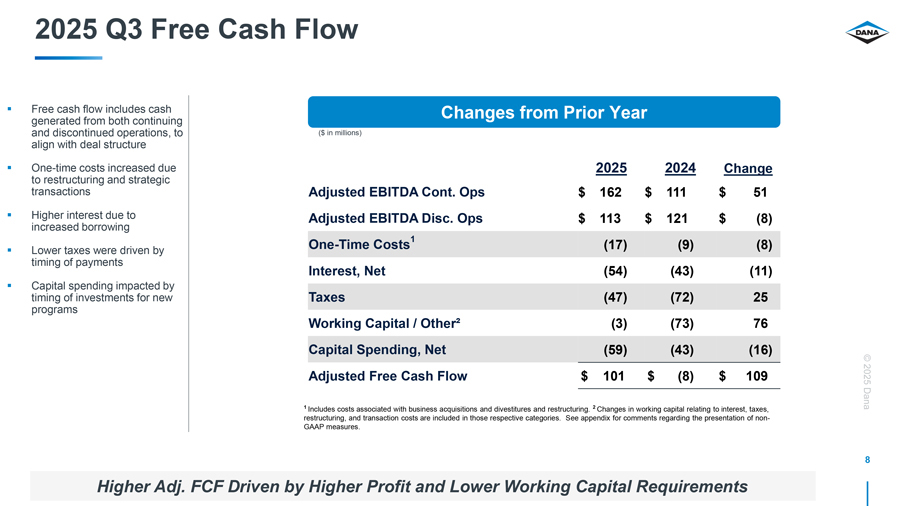

| • | Adjusted free cash flow* was $101 million, a $109 million increase compared to the prior year |

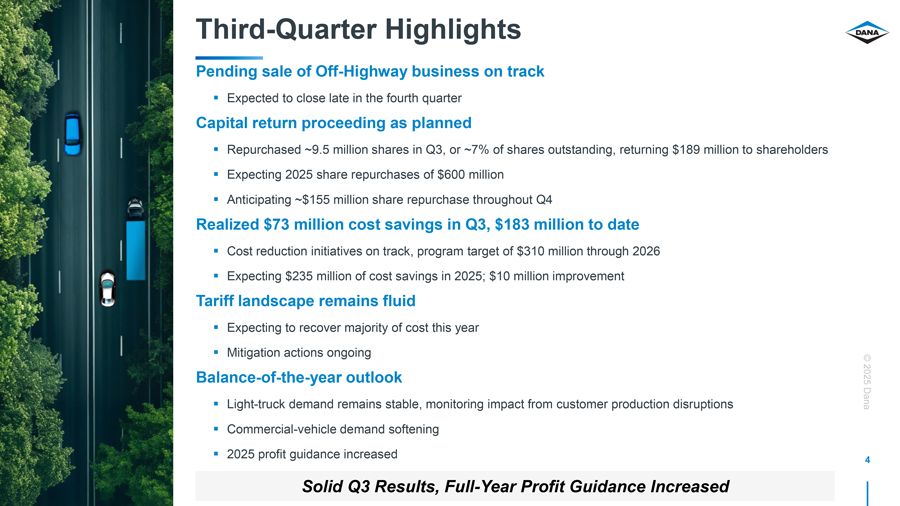

| • | Sale of Off-Highway business remains on-track for closing in late Q4 2025 |

| • | Repurchased 9.5 million shares in Q3, 24.1 million to date |

| • | Realized $73 million in cost savings in Q3, $183 million to date; expecting $235 million in 2025 |

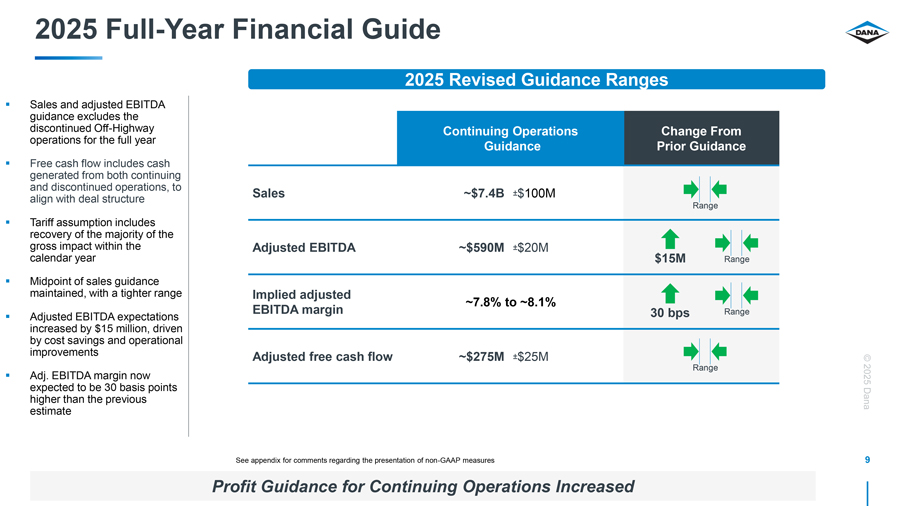

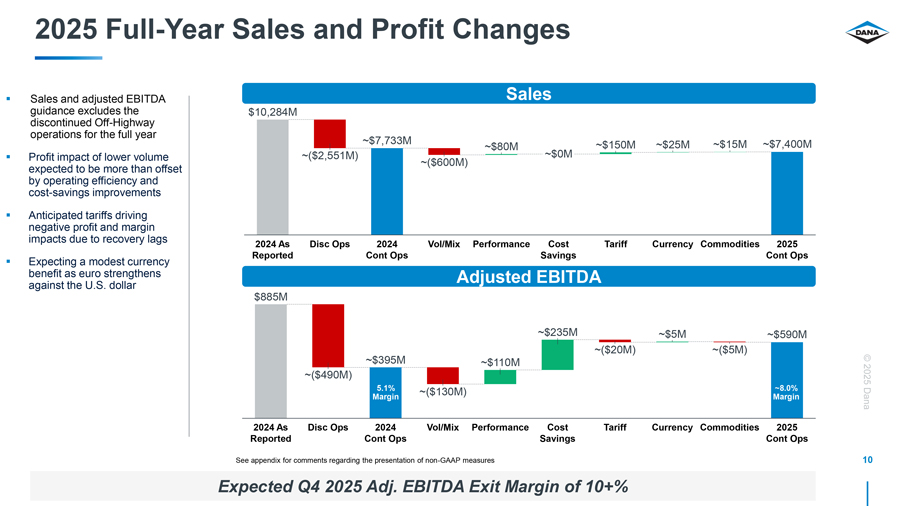

| • | Raised full-year profit guidance due to accelerated cost savings |

| * | Cash flow includes cash from both continuing and discontinued operations to align with deal structure |

MAUMEE, Ohio, October 29, 2025 – Dana Incorporated (NYSE: DAN) today announced financial results for the third quarter of 2025 reflecting the Off-Highway business as a discontinued operation for all periods.

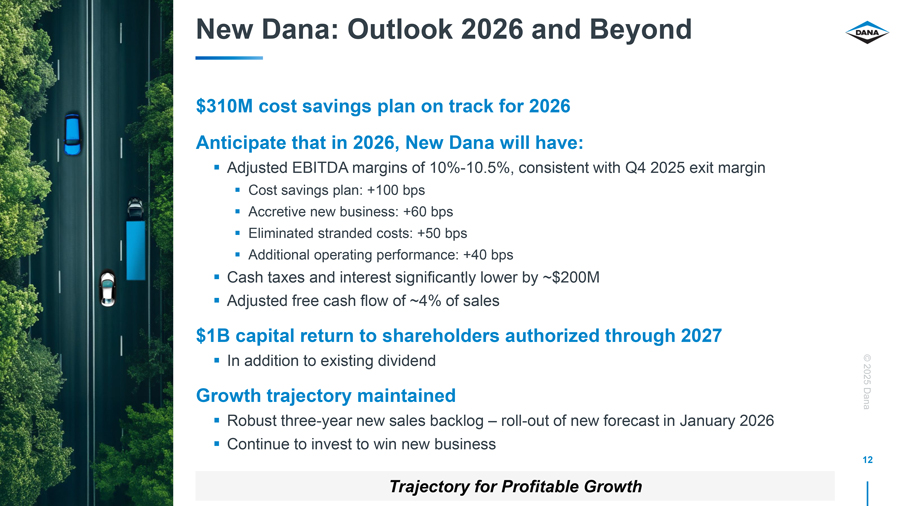

“Our business is performing very well, and we are experiencing minimal impact from market fluctuations and customer production disruptions,” said R. Bruce McDonald, Dana chairman and chief executive officer. “Our $310 million cost-savings initiative is on track, with over $70 million in savings in the third quarter we are exceeding our expectations. We now expect our fourth-quarter adjusted EBITDA margin to be consistent with our forecasted 2026 margin of 10-10.5 percent. We expect to complete the Off-Highway divestiture in the fourth quarter of this year. The benefits of this transaction are already being realized as we execute our $1 billion capital return program, including $189 million in share repurchases during the quarter. We expect to repurchase an additional $155 million in the fourth quarter, bringing the total to $600 million for the year.”

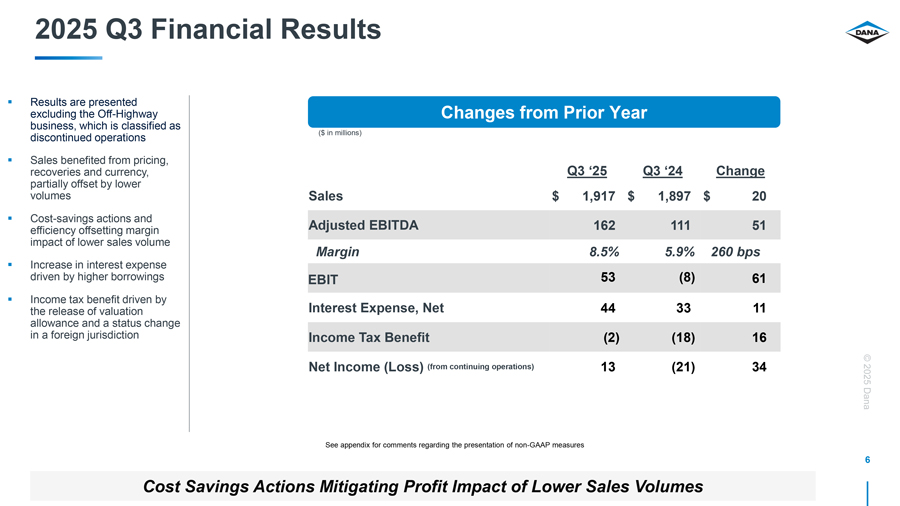

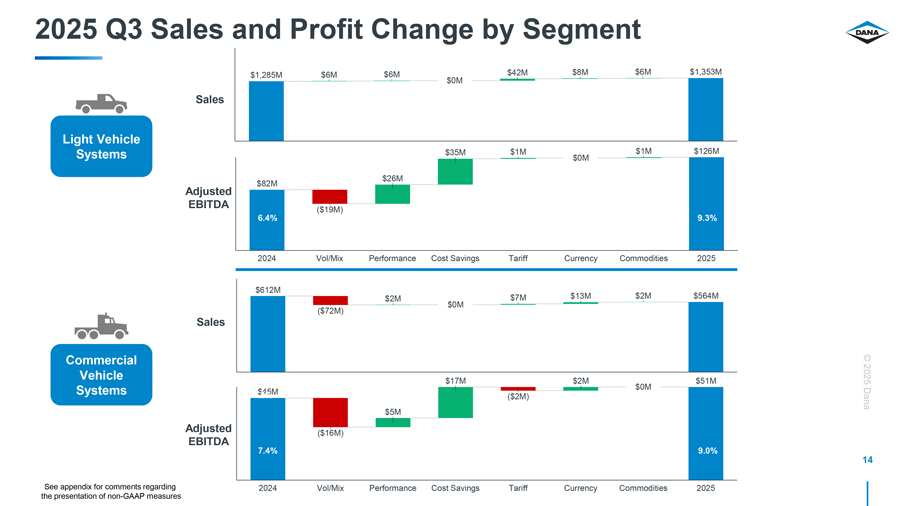

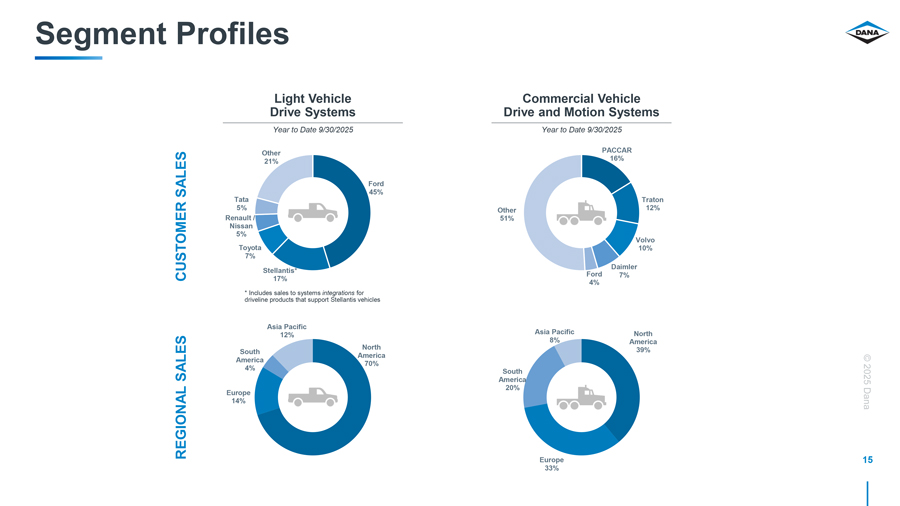

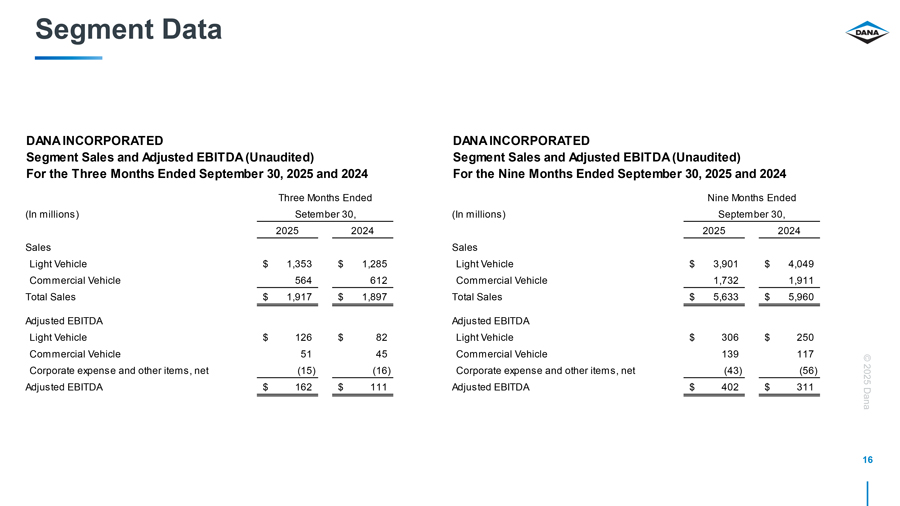

Sales for continuing operations in the third quarter of 2025 totaled $1.92 billion, compared with $1.90 billion in the same period of 2024.

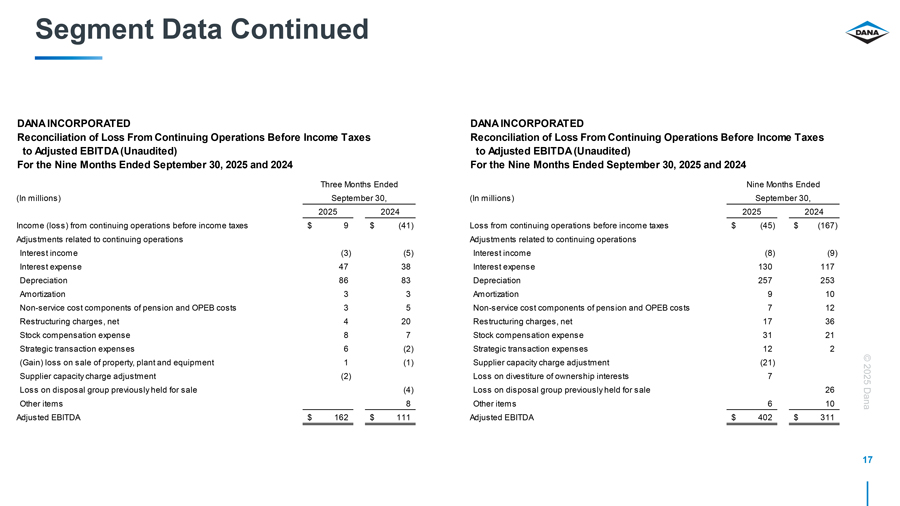

Net income from continuing operations was $13 million compared with a net loss of $21 million in the third quarter of 2024.

Adjusted EBITDA for the third quarter of 2025 was $162 million or 8.5 percent of sales, compared with $111 million or 5.9 percent of sales for the same period in 2024. The company’s cost-savings program has mitigated the margin impact of lower volumes and cost inflation.

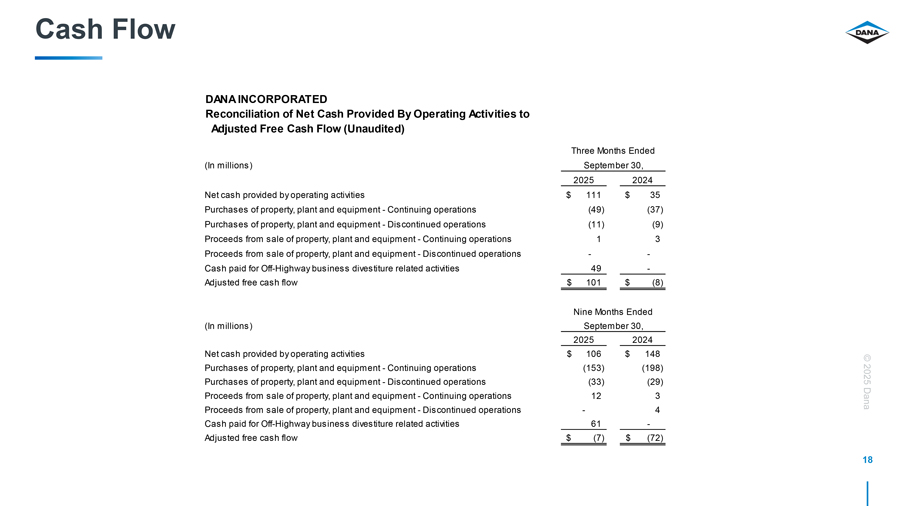

Operating cash flow in the third quarter of 2025 was $111 million, compared with $35 million in the same period of 2024. Adjusted free cash flow was $101 million, compared with a use of $8 million in the third quarter of 2024. The improvement was driven by higher profit, lower taxes and working capital requirements.

“The continued execution of our cost-saving plan and operating efficiency improvements are driving our higher profit expectations for this year,” said Timothy Kraus, Dana’s senior vice president and chief financial officer. “Additionally, the tariff recovery mechanisms we have in place are functioning well and we expect to recover the majority of these costs within the year.”

1