Please wait

Dana Incorporated Announces Strong Preliminary 2025 Financial Results and

Provides 2026 Outlook Featuring New Business Growth and Increased Margins

2025 Highlights:

| |

• |

|

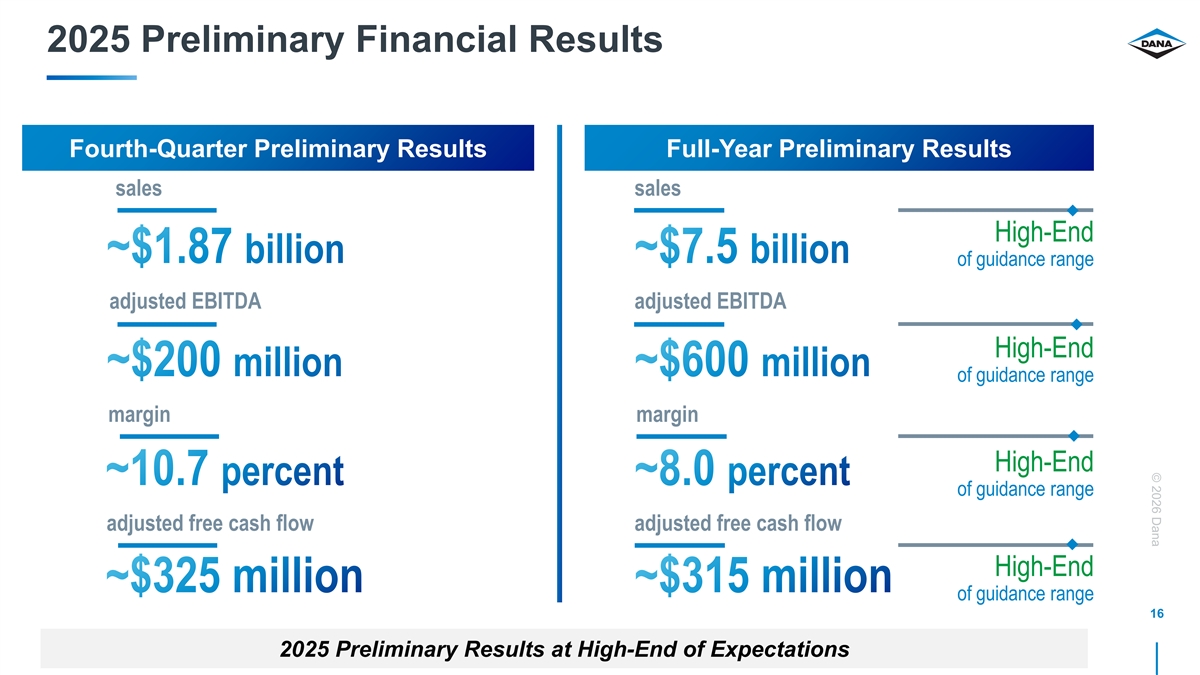

Sales of approximately $7.5 billion |

| |

• |

|

Adjusted EBITDA of approximately $600 million; 8 percent of sales

|

| |

• |

|

Adjusted free cash flow of approximately $315 million |

| |

• |

|

Completed sale of the Off-Highway business at a $2.7 billion enterprise value

|

| |

• |

|

Achieved approximately $250 million in cost savings |

| |

• |

|

Returned $704 million to shareholders |

| |

• |

|

Repurchased 34 million shares, representing 23 percent of shares

outstanding |

| |

• |

|

Shares outstanding as of December 31 were 112.3 million

|

2026 Highlights:

| |

• |

|

Completed $1.9 billion in debt reduction, supported by proceeds from the Off-Highway

sale |

| |

• |

|

Announced $750 million three-year new business backlog; $200 million

incremental in 2026 |

| |

• |

|

Raised cumulative cost savings target to $325 million |

| |

• |

|

Raises 2026 margin guidance range to a midpoint of 10.5 percent |

| |

• |

|

Completed the previously disclosed buy-out of TM4 joint venture |

| |

• |

|

Will host a Capital Markets Day on March 25, 2026 |

MAUMEE, Ohio, January 21, 2026 – Dana Incorporated today announced its preliminary full-year 2025 financial results, which came in at the high

end of the company’s expectations. Dana also issued its preliminary outlook for 2026, highlighting stronger profitability, significant cost-reduction progress, incremental capital return, and improvements to its balance sheet.

“We closed 2025 with strong momentum and executed on every major strategic commitment, from completing the Off-Highway divestiture to delivering

substantial cost savings,” said R. Bruce McDonald, Chairman and Chief Executive Officer of Dana Incorporated. “Our actions have reshaped Dana into a more streamlined, higher-margin company with greater financial flexibility. In 2026, we

expect to complete the remainder of our now $325 million cost-reduction program, continue executing our $1 billion capital return plan, and expand adjusted EBITDA margins to 10–11 percent—positioning Dana for durable, long-term

value creation. We are entering the year with a strengthened balance sheet, higher-margin new business, and an ongoing commitment to shareholder returns and operational excellence.”

Dana’s three-year new business backlog totals $750 million, driven by new program awards, increased content, and expanded vehicle platforms

across both the light- and commercial-vehicle segments. The company expects $200 million in incremental new business growth in 2026 from next-generation platforms with global OEMs.

2026 Preliminary Financial Targets

|

|

|

|

|

| |

|

Preliminary Guidance |

|

| Sales |

|

|

$7.30 to $7.70 billion |

|

| Adjusted EBITDA |

|

|

$750 to $850 million |

|

| Implied adjusted EBITDA margin |

|

|

10.0% to 11.0% |

|

| Adjusted free cash flow |

|

|

$250 to $350 million |

|

The company will host a Capital Markets Day on March 25, 2026, in New York City, with more information to follow.

1

Dana to Host Conference Call at 10 a.m. Wednesday, January 21

Dana will discuss its preliminary 2025 results and 2026 market outlook in a conference call at 10 a.m. EST on Wednesday, January 21. The conference

call can be accessed by telephone from both domestic and international locations using the information provided below:

Conference ID: 9943139

Participant Toll-Free Dial-In Number: 1 (888) 440-5873

Participant Toll Dial-In Number: 1 (646) 960-0319

Audio streaming and slides will be available online via a link provided on the Dana investor website: www.dana.com/investors. Phone registration

will be available beginning at 9:30 a.m. EST.

A webcast replay can be accessed via Dana’s investor website following the call.

Non-GAAP Financial Information

Adjusted EBITDA is a non-GAAP financial measure which we have defined as net income (loss) before interest, income

taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other postretirement benefit costs and other adjustments not related to our core

operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations and provide shareholder returns. We use adjusted

EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by management, we also believe adjusted EBITDA is a

measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be considered a substitute for earnings (loss) before income

taxes, net income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Adjusted free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in)

operating activities less purchases of property, plant and equipment plus proceeds from sale of property, plant and equipment plus cash paid for Off-Highway business divestiture related activities. We believe

adjusted free cash flow is useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Adjusted free cash flow is not intended to represent nor be an alternative to the

measure of net cash provided by (used in) operating activities reported in accordance with GAAP. Adjusted free cash flow may not be comparable to similarly titled measures reported by other companies.

Please reference the “Non-GAAP financial information” accompanying our quarterly earnings conference

call presentations on our website at www.dana.com/investors for reconciliations of adjusted EBITDA and free cash flow to the most directly comparable financial measures calculated and presented in accordance with GAAP. We have not provided a

reconciliation of our adjusted EBITDA outlook to the most comparable GAAP measures of net income. Providing net income (loss) guidance is potentially misleading and not practical given the difficulty of projecting event driven transactional and

other non-core operating items that are included in net income, including restructuring actions, asset impairments and income tax valuation adjustments. The reconciliations of these non-GAAP measures with the most comparable GAAP measures for the historical periods presented on our website are indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance.

2

Forward-Looking Statements

Certain statements and projections contained in this news release are, by their nature, forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates, and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are

subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,”

“estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” and similar expressions, and variations or

negatives of these words. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties, and assumptions that could cause our actual results to differ materially and adversely from those expressed in

any forward-looking statement.

Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on

Form 10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business,

results of operations and financial condition. The forward-looking statements in this news release speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason.

About Dana Incorporated

Dana is a

leader in the design and manufacture of highly efficient propulsion and energy-management solutions that power vehicles and machines in all mobility markets across the globe. The company is shaping sustainable progress through its conventional and

clean-energy solutions that support nearly every vehicle manufacturer with drive and motion systems; electrodynamic technologies, including software and controls; and thermal, sealing, and digital solutions.

Based in Maumee, Ohio, USA, the company reported preliminary sales of $7.5 billion in 2025 with 28,000 people in 24 countries across six continents.

With a history dating to 1904, Dana was named among the “World’s Most Ethical Companies” for 2025 by Ethisphere and as one of “America’s Most Responsible Companies 2025” by Newsweek. The

company is driven by a high-performance culture that focuses on valuing others, inspiring innovation, growing responsibly, and winning together, earning it global recognition as a top employer. Learn more at dana.com.

###

Contact: Craig Barber

+1-419-887-5166

craig.barber@dana.com

3

2026 Market and Backlog January 21, 2026

© 2026 Dana Safe Harbor Statement Certain statements and

projections contained in this presentation are, by their nature, forward- looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and

projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,”

“expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,”

“could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. These forward-looking statements are not guarantees of future results and are subject to

risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward- looking statement. Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q,

recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business, results of operations and financial condition. The forward-looking statements in this

presentation speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason. 2

© 2026 Dana Agenda Craig Barber R. Bruce McDonald Byron Foster

Brian Pour Timothy Kraus Senior Director, Investor Chairman and Senior Vice President and Senior Vice President and Senior Vice President and Relations and Corporate President, Light Vehicle President, Commercial Chief Financial Officer Chief

Executive Officer Communications Systems Vehicle Systems Introduction Business Review LV Market CV Market Financial Review 3

© 2026 Dana Dana Strategy Commitment Achieved January 2025

Commitment 2025 Achievements Total 2026 cost-reduction target of $325M Focus on efficiency and generate value § Revised EV commercial strategy Focus on core on-highway end markets § Downsizing corporate overhead structure § Divest

Off-Highway business § Complexity reduction § Closing at year end § New Dana will be a more streamlined organization New Dana target adjusted EBITDA margins § 8%+ in 2025 Measured approach to EV market § Lower volume and

longer lead times allow for more § ~10.5% in 2026 efficient program management - Inclusive of $325M of cost savings less $40M of stranded cost from Off-Highway sale § Disciplined investment philosophy Strong balance sheet, targeting net

leverage Streamlined cost structure of 1x through the cycle § Actions will yield ~$300M in annual savings § Free cash flow of ~4% of sales § Moving to two business segments in new Dana - Power Technologies segment will be integrated

Three-year backlog increased to $750M 4 Generating Results: Increased Profit Margin, Top Line Growth, and Stronger Balance Sheet

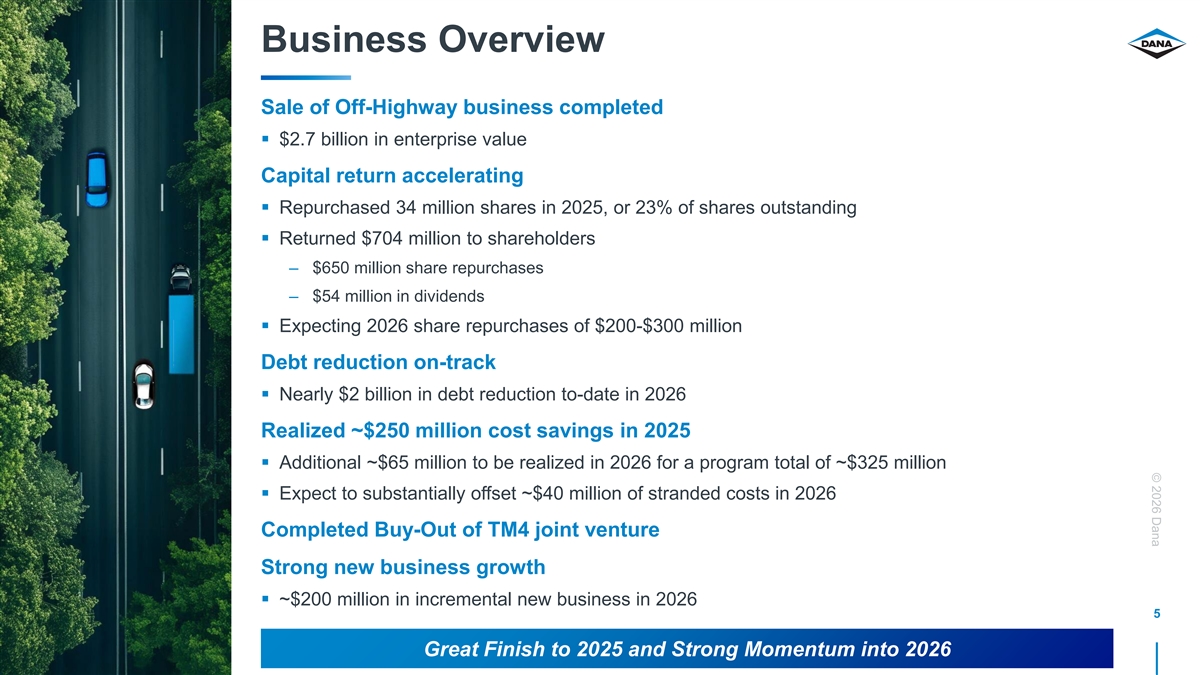

© 2026 Dana Business Overview Sale of Off-Highway business

completed § $2.7 billion in enterprise value Capital return accelerating § Repurchased 34 million shares in 2025, or 23% of shares outstanding § Returned $704 million to shareholders – $650 million share repurchases – $54

million in dividends § Expecting 2026 share repurchases of $200-$300 million Debt reduction on-track § Nearly $2 billion in debt reduction to-date in 2026 Realized ~$250 million cost savings in 2025 § Additional ~$65 million to be

realized in 2026 for a program total of ~$325 million § Expect to substantially offset ~$40 million of stranded costs in 2026 Completed Buy-Out of TM4 joint venture Strong new business growth § ~$200 million in incremental new business in

2026 5 Great Finish to 2025 and Strong Momentum into 2026

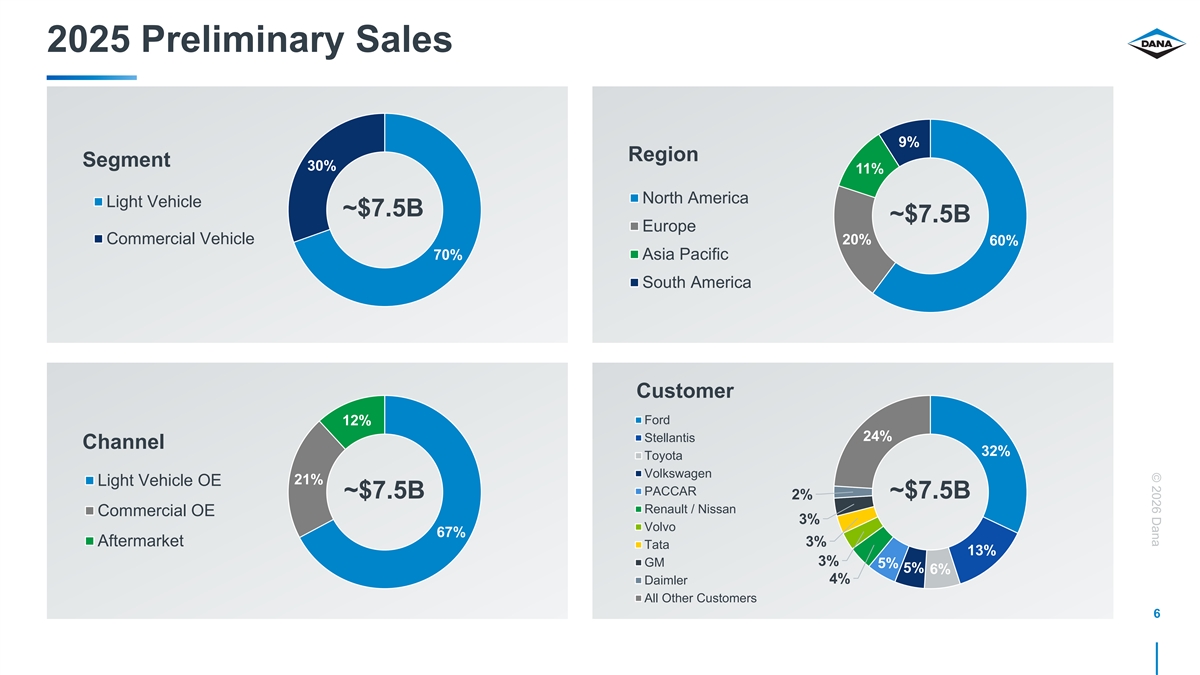

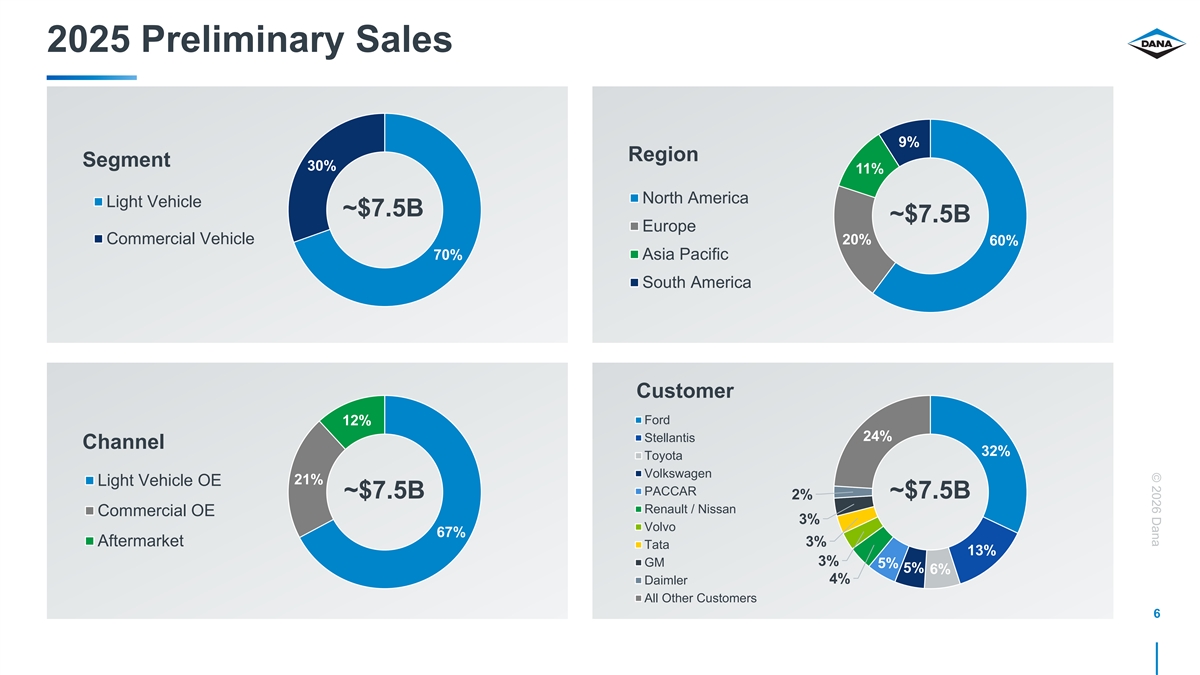

© 2026 Dana 2025 Preliminary Sales 9% Region Segment 30% 11% North

America Light Vehicle ~$7.5B ~$7.5B Europe Commercial Vehicle 20% 60% 70% Asia Pacific South America Customer Ford 12% 24% Stellantis Channel 32% Toyota Volkswagen 21% Light Vehicle OE PACCAR ~$7.5B ~$7.5B 2% Renault / Nissan Commercial OE 3% Volvo

67% Aftermarket 3% Tata 13% 3% GM 5% 5% 6% 4% Daimler All Other Customers 6

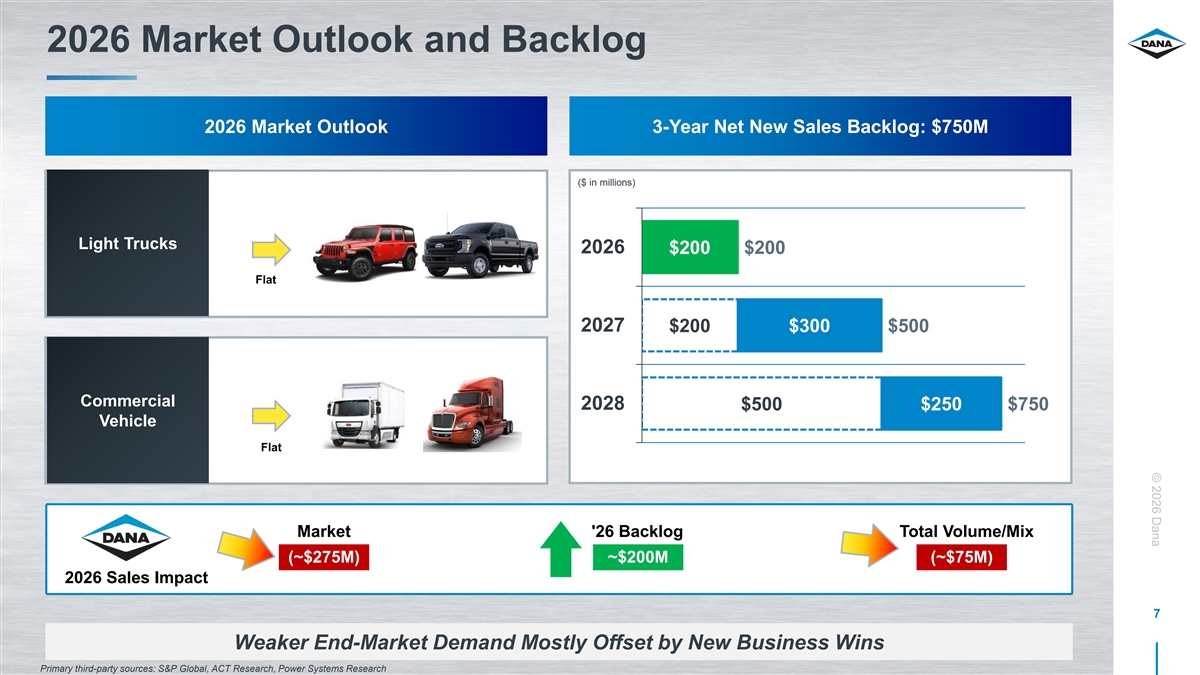

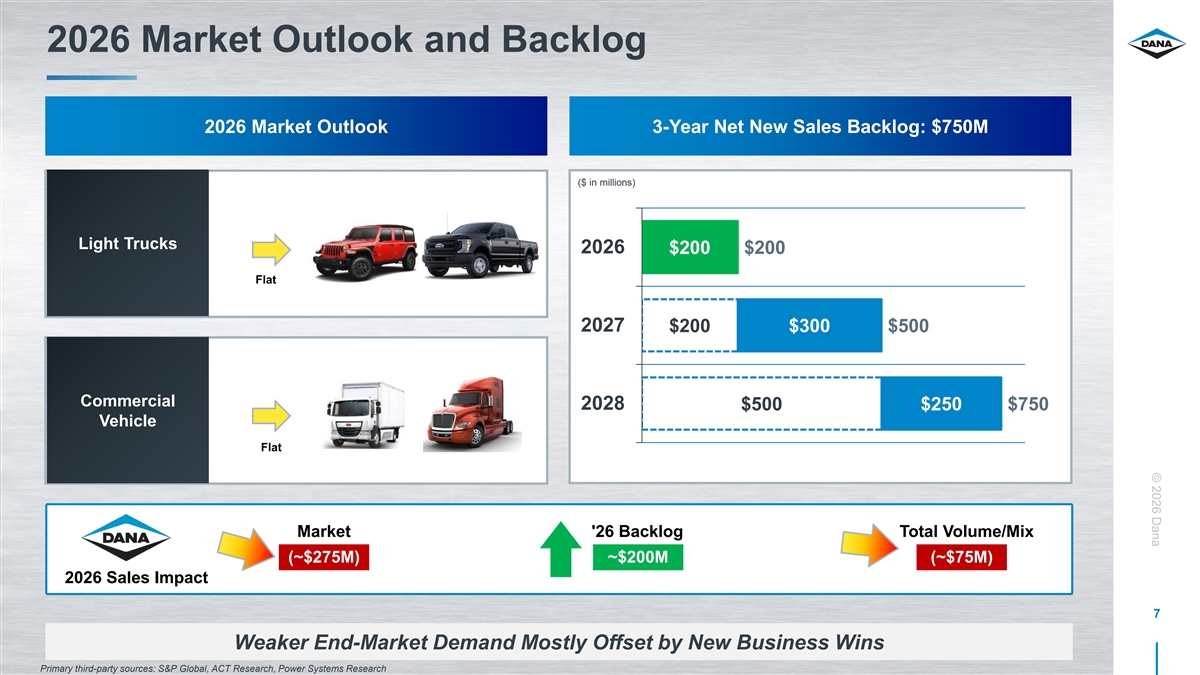

© 2026 Dana 2026 Market Outlook and Backlog 2026 Market Outlook

3-Year Net New Sales Backlog: $750M ($ in millions) Light Trucks 2026 $200 $200 Flat 2027 $200 $300 $500 Commercial 2028 $500 $250 $750 Vehicle Flat Market '26 Backlog Total Volume/Mix (~$275M) ~$200M (~$75M) 2026 Sales Impact 7 Weaker End-Market

Demand Mostly Offset by New Business Wins Primary third-party sources: S&P Global, ACT Research, Power Systems Research

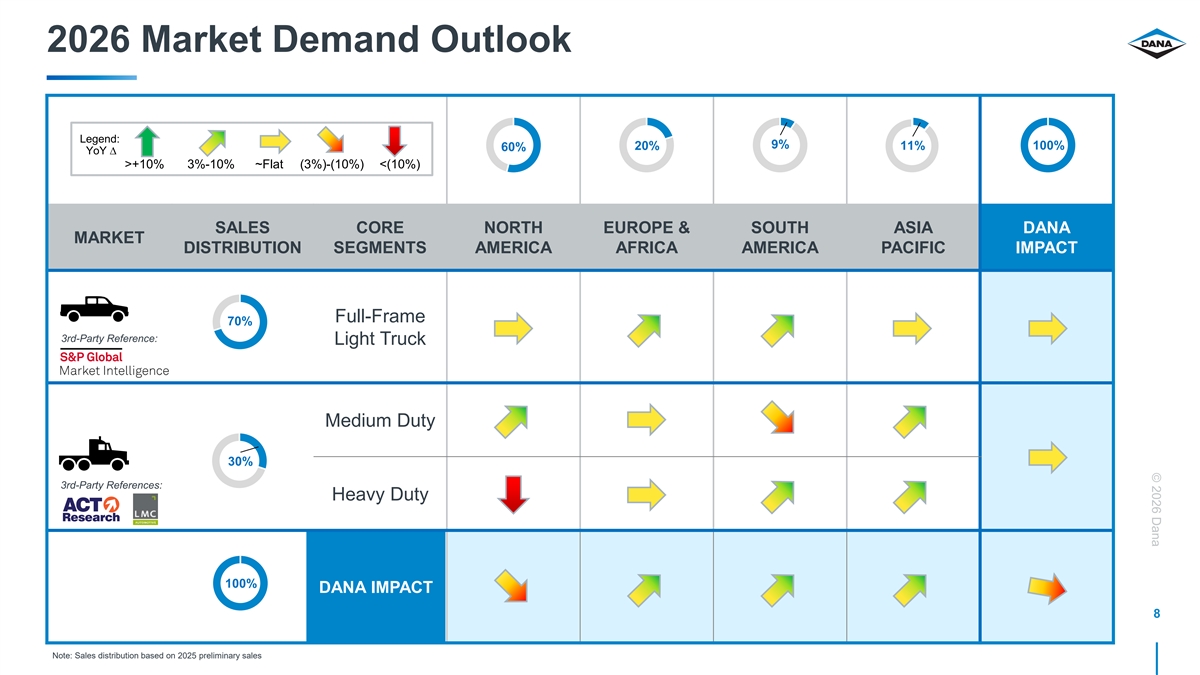

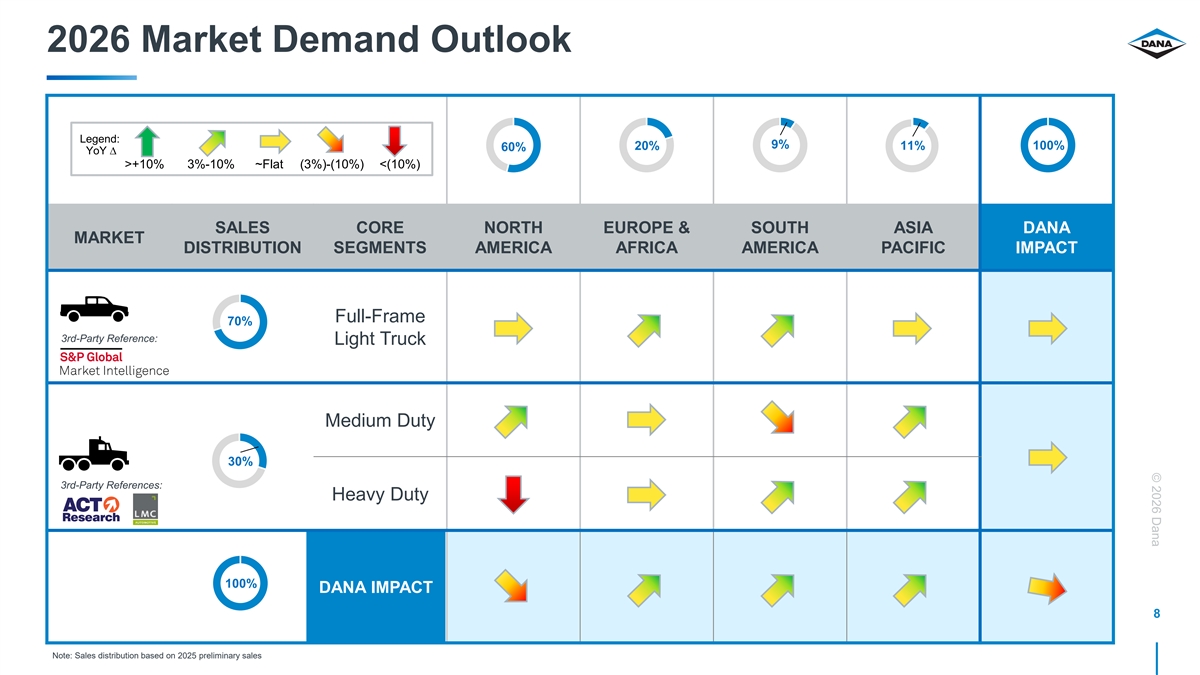

© 2026 Dana 2026 Market Demand Outlook Legend: 9% 20% 11% 100% 60%

YoY ∆ >+10% 3%-10% ~Flat (3%)-(10%) <(10%) SALES CORE NORTH EUROPE & SOUTH ASIA DANA MARKET DISTRIBUTION SEGMENTS AMERICA AFRICA AMERICA PACIFIC IMPACT Full-Frame 70% 3rd-Party Reference: Light Truck Medium Duty 30% 3rd-Party

References: Heavy Duty 100% DANA IMPACT 8 Note: Sales distribution based on 2025 preliminary sales

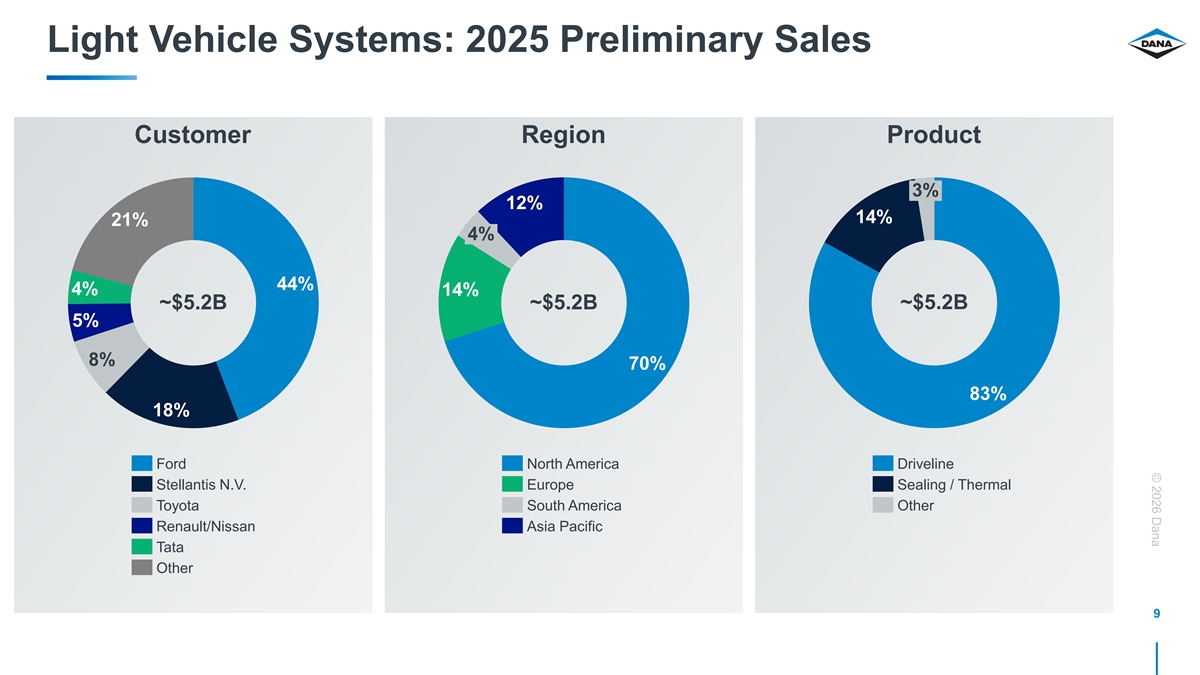

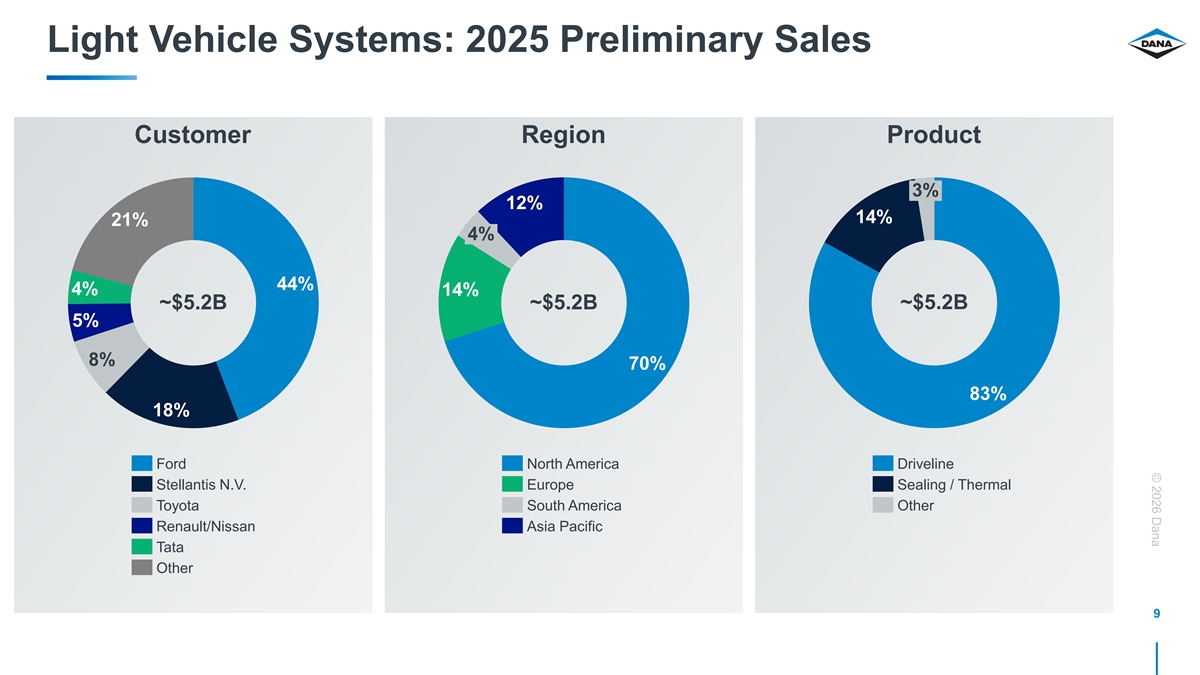

© 2026 Dana Light Vehicle Systems: 2025 Preliminary Sales Customer

Region Product 3% 12% 14% 21% 4% 44% 4% 14% ~$5.2B ~$5.2B ~$5.2B 5% 8% 70% 83% 18% Ford North America Driveline Stellantis N.V. Europe Sealing / Thermal Toyota South America Other Renault/Nissan Asia Pacific Tata Other 9

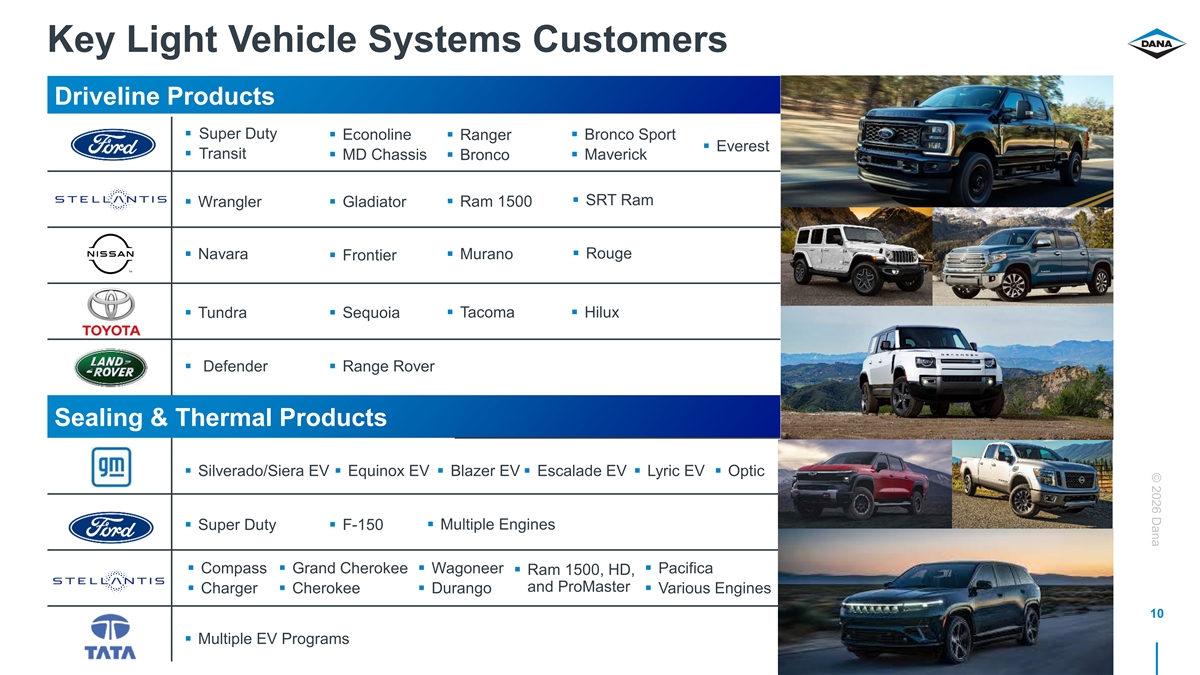

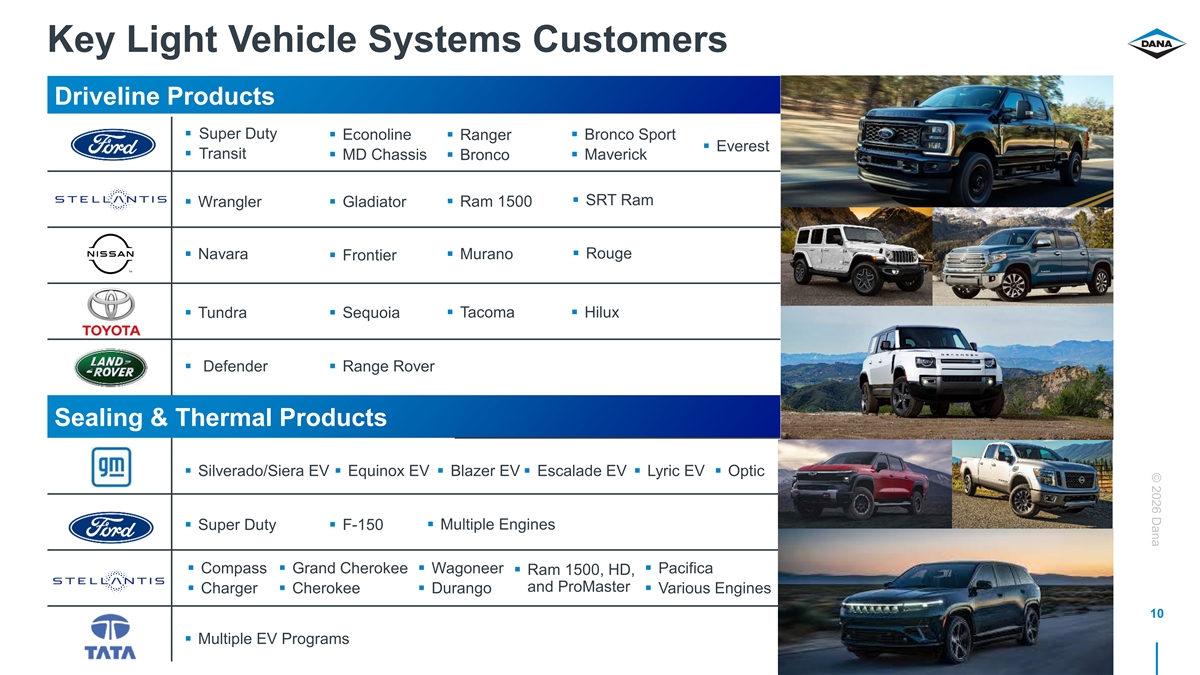

© 2026 Dana Key Light Vehicle Systems Customers Driveline Products

§ Super Duty § Econoline§ Bronco Sport § Ranger § Everest § Transit§ Maverick § MD Chassis§ Bronco § SRT Ram § Wrangler§ Gladiator§ Ram 1500 § Rouge § Navara§ Murano

§ Frontier § Tundra§ Sequoia§ Tacoma§ Hilux § Defender§ Range Rover Sealing & Thermal Products § Silverado/Siera EV§ Equinox EV§ Blazer EV§ Escalade EV§ Lyric EV§ Optic §

Super Duty§ F-150§ Multiple Engines § Compass§ Grand Cherokee§ Wagoneer§ Pacifica § Ram 1500, HD, and ProMaster § Charger§ Cherokee§ Durango§ Various Engines 10 § Multiple EV

Programs

© 2026 Dana 2026 Truck of the Year: Ford Maverick Lobo

Disconnecting AWD Rear Drive Unit and Sealing Solutions 11

© 2026 Dana Light Vehicle Systems: New Business Backlog Next Gen

Platforms Expansion / Content Super-Duty Jeep Wrangler (MY ‘26) Bronco Sport New Global Programs W1 Jaguar Master Defender Sport New Sealing & Thermal Programs 12 HD Truck / Duramax Range Rover Sport Dodge/Ram Hellcat Next-Gen

V8

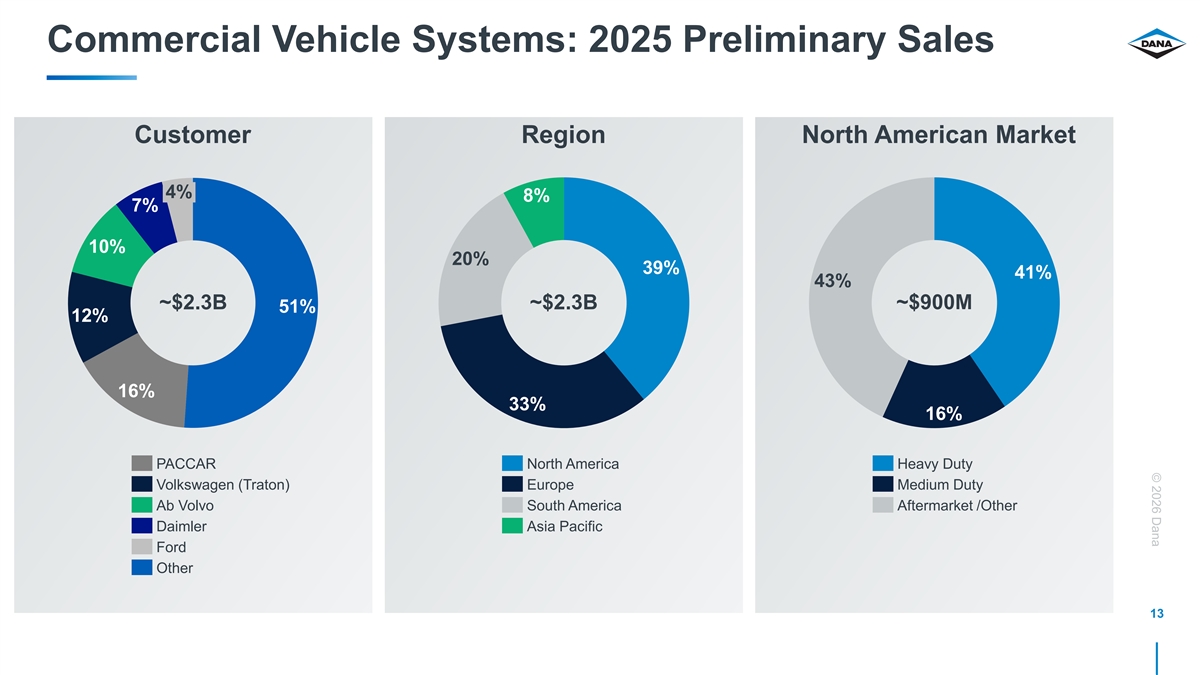

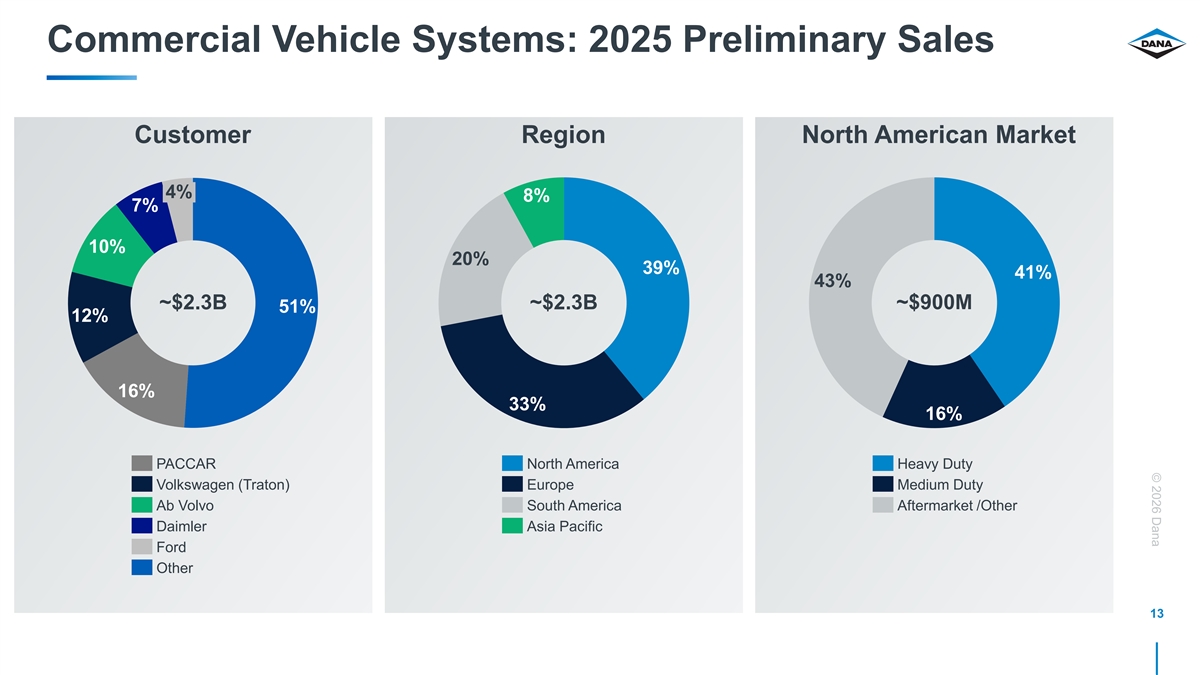

© 2026 Dana Commercial Vehicle Systems: 2025 Preliminary Sales

Customer Region North American Market 4% 8% 7% 10% 20% 39% 41% 43% ~$2.3B ~$2.3B ~$900M 51% 12% 16% 33% 16% PACCAR North America Heavy Duty Volkswagen (Traton) Europe Medium Duty Ab Volvo South America Aftermarket /Other Daimler Asia Pacific Ford

Other 13

© 2026 Dana Commercial Vehicle Systems: New Business Backlog Share

Gains at Key Customers New Medium-Duty and Bus Programs Aftermarket 14

© 2026 Dana Financial Review 15

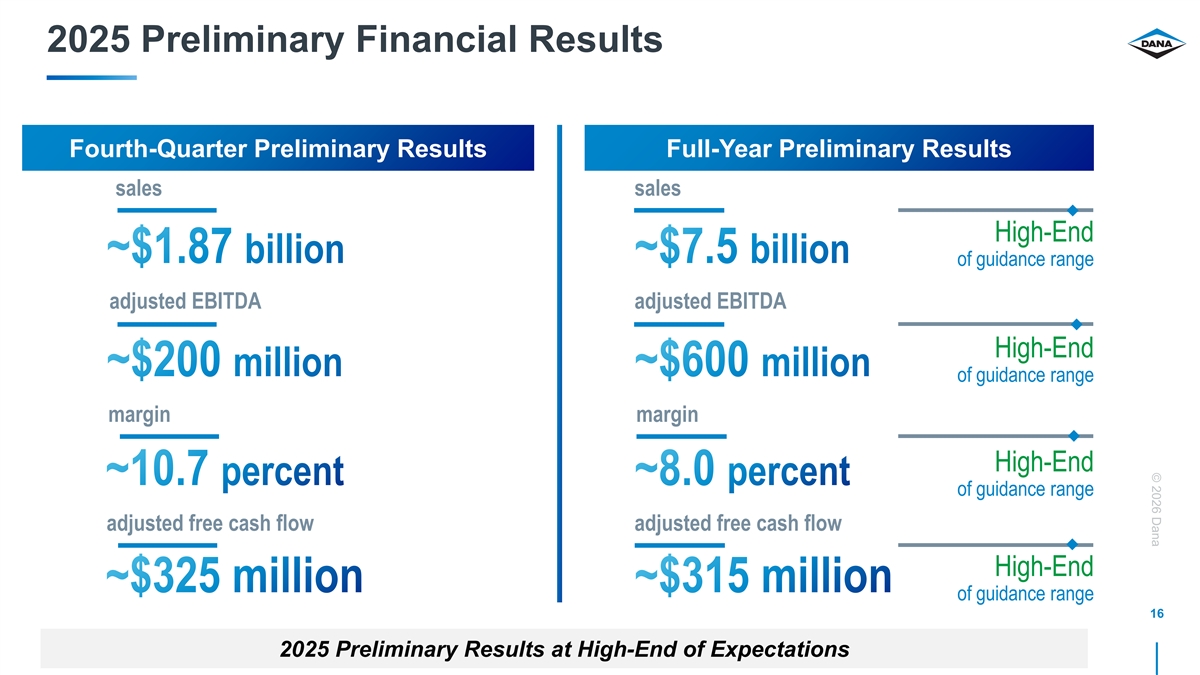

© 2026 Dana 2025 Preliminary Financial Results Fourth-Quarter

Preliminary Results Full-Year Preliminary Results sales sales High-End of guidance range adjusted EBITDA adjusted EBITDA High-End of guidance range margin margin High-End of guidance range adjusted free cash flow adjusted free cash flow High-End of

guidance range 16 2025 Preliminary Results at High-End of Expectations

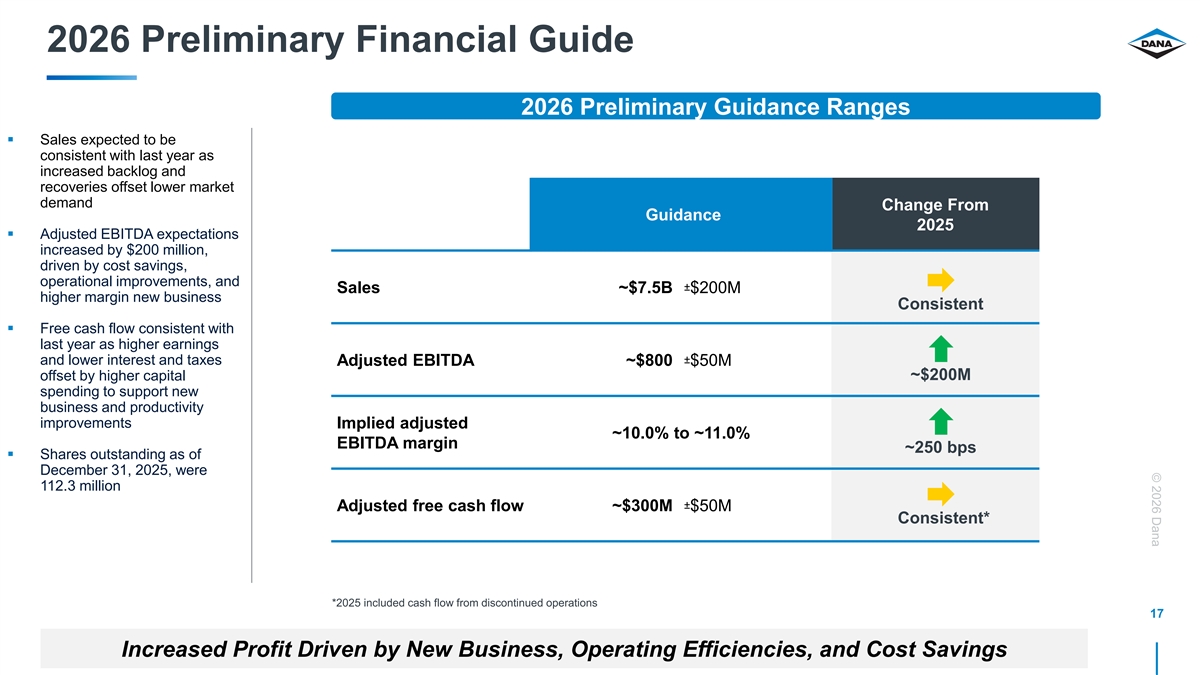

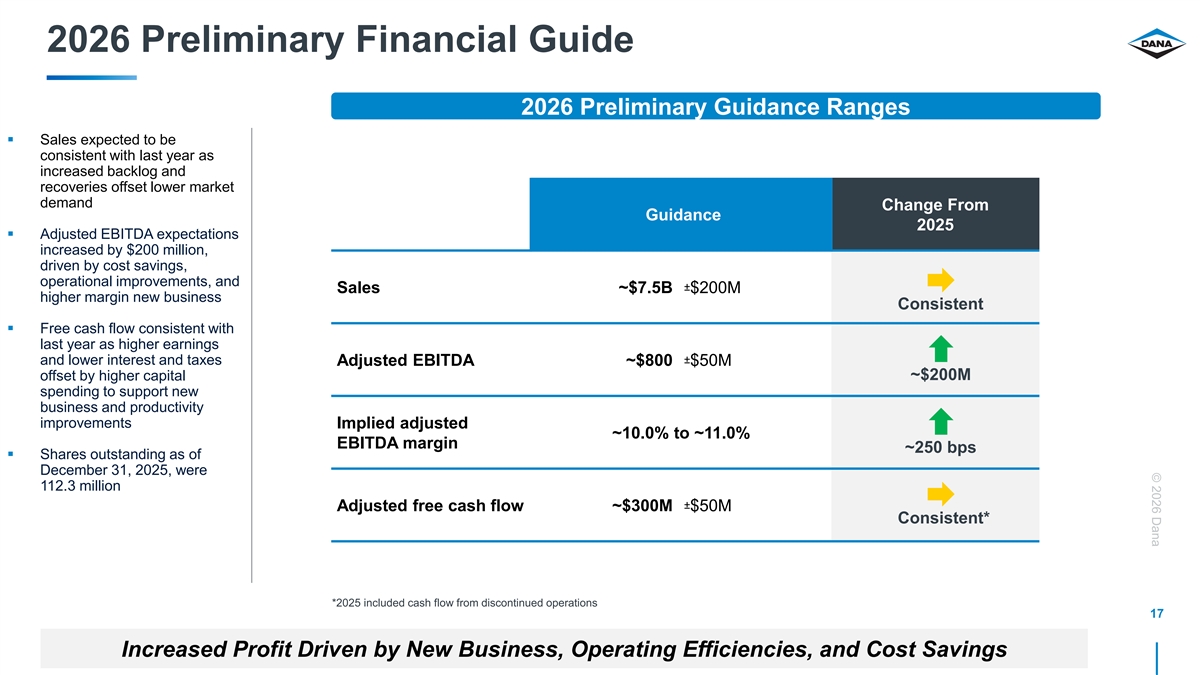

© 2026 Dana 2026 Preliminary Financial Guide 2026 Preliminary

Guidance Ranges § Sales expected to be consistent with last year as increased backlog and recoveries offset lower market demand Change From Guidance 2025 § Adjusted EBITDA expectations increased by $200 million, driven by cost savings,

operational improvements, and ± Sales ~$7.5B $200M higher margin new business Consistent § Free cash flow consistent with last year as higher earnings ± and lower interest and taxes Adjusted EBITDA ~$800 $50M offset by higher capital

~$200M spending to support new business and productivity improvements Implied adjusted ~10.0% to ~11.0% EBITDA margin ~250 bps § Shares outstanding as of December 31, 2025, were 112.3 million ± Adjusted free cash flow ~$300M $50M

Consistent* *2025 included cash flow from discontinued operations 17 Increased Profit Driven by New Business, Operating Efficiencies, and Cost Savings

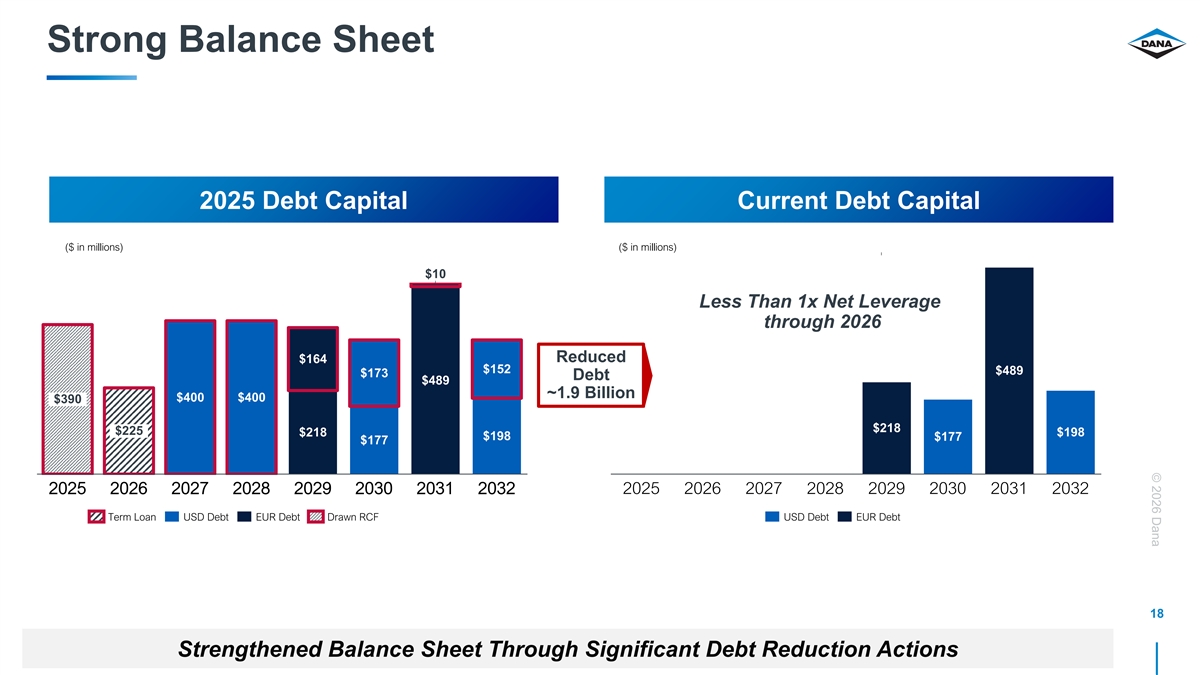

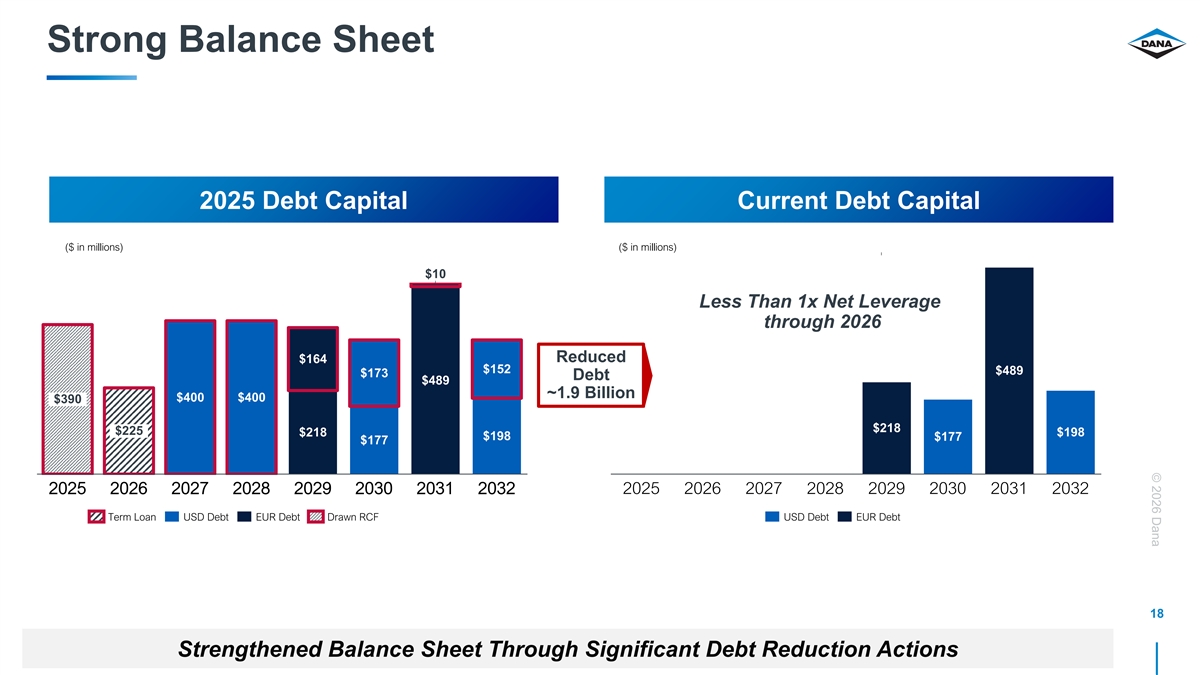

© 2026 Dana Strong Balance Sheet 2025 Debt Capital Current Debt

Capital ($ in millions) ($ in millions) $10 Less Than 1x Net Leverage through 2026 Reduced $164 $152 $489 $173 Debt $489 ~1.9 Billion $400 $400 $390 $218 $225 $218 $198 $198 $177 $177 2025 2026 2027 2028 2029 2030 2031 2032 2025 2026 2027 2028 2029

2030 2031 2032 Term Loan USD Debt EUR Debt Drawn RCF USD Debt EUR Debt 18 Strengthened Balance Sheet Through Significant Debt Reduction Actions Source: Dana

© 2026 Dana Investment Highlights Delivering Commitments

üRealization of aggressive cost reduction targets üSale of Off-Highway business § Shareholder value creation § Strengthen balance sheet § Significant capital return to shareholders New Dana positioned to win üStrong

backlog supports top-line growth ü10-11% Adjusted EBITDA margins in 2026 üAdjusted free cash flow of ~4% of sales § Invest and grow § Ongoing capital return to shareholders through $1B return authorization 19

© 2026 Dana SAVE THE DATE 2026 Capital Markets Day MARCH 25, 2026

NEW YORK CITY 20

© 2026 Dana Non-GAAP Financial Information Adjusted EBITDA is a

non-GAAP financial measure which we have defined as net income (loss) before interest, income taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other postretirement benefit

costs and other adjustments not related to our core operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations

and provide shareholder returns. We use adjusted EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by

management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be

considered a substitute for earnings (loss) before income taxes, net income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Adjusted free cash

flow is a non-GAAP financial measure which we have defined as net cash provided by (used in) operating activities less purchases of property, plant and equipment plus proceeds from sale of property, plant and equipment plus cash paid for Off-Highway

business divestiture related activities. We believe adjusted free cash flow is useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Adjusted free cash flow is not

intended to represent nor be an alternative to the measure of net cash provided by (used in) operating activities reported in accordance with GAAP. Adjusted free cash flow may not be comparable to similarly titled measures reported by other

companies. Please reference the Non-GAAP financial information accompanying our quarterly earnings conference call presentations on our website at www.dana.com/investors for reconciliations of adjusted EBITDA and free cash flow to the most directly

comparable financial measures calculated and presented in accordance with GAAP. We have not provided a reconciliation of our adjusted EBITDA outlook to the most comparable GAAP measures of net income. Providing net income (loss) guidance is

potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items that are included in net income, including restructuring actions, asset impairments and income tax valuation

adjustments. The reconciliations of these non-GAAP measures with the most comparable GAAP measures for the historical periods presented on our website are indicative of the reconciliations that will be prepared upon completion of the periods covered

by the non-GAAP guidance. 21