Please wait

Dana Incorporated Reports Strong 2025 Financial Results;

Reaffirms 2026 Targets Featuring New Business Growth, Increased Margins

2025 Highlights:

| |

• |

|

Adjusted EBITDA of $610 million; $10 million higher than preliminary

estimate |

| |

• |

|

8.1 percent adjusted EBITDA margin; 10 basis points higher than preliminary estimate

|

| |

• |

|

Adjusted free cash flow of $331 million; $16 million higher than

preliminary estimate |

| |

• |

|

Completed sale of the Off-Highway business |

| |

• |

|

Achieved $248 million in cost savings; in line with our preliminary estimate

|

| |

• |

|

Returned $704 million to shareholders |

| |

• |

|

Repurchased 34 million shares, representing 23% of shares outstanding

|

2026 Highlights:

| |

• |

|

Completed nearly $2 billion in debt reduction, supported by proceeds from the Off-Highway

sale |

| |

• |

|

Announced capital return program has been extended and increased from $1 billion to

$2 billion |

| |

• |

|

Repurchased $100 million in shares in January; expect repurchases of up to

$300 million in 2026 |

| |

• |

|

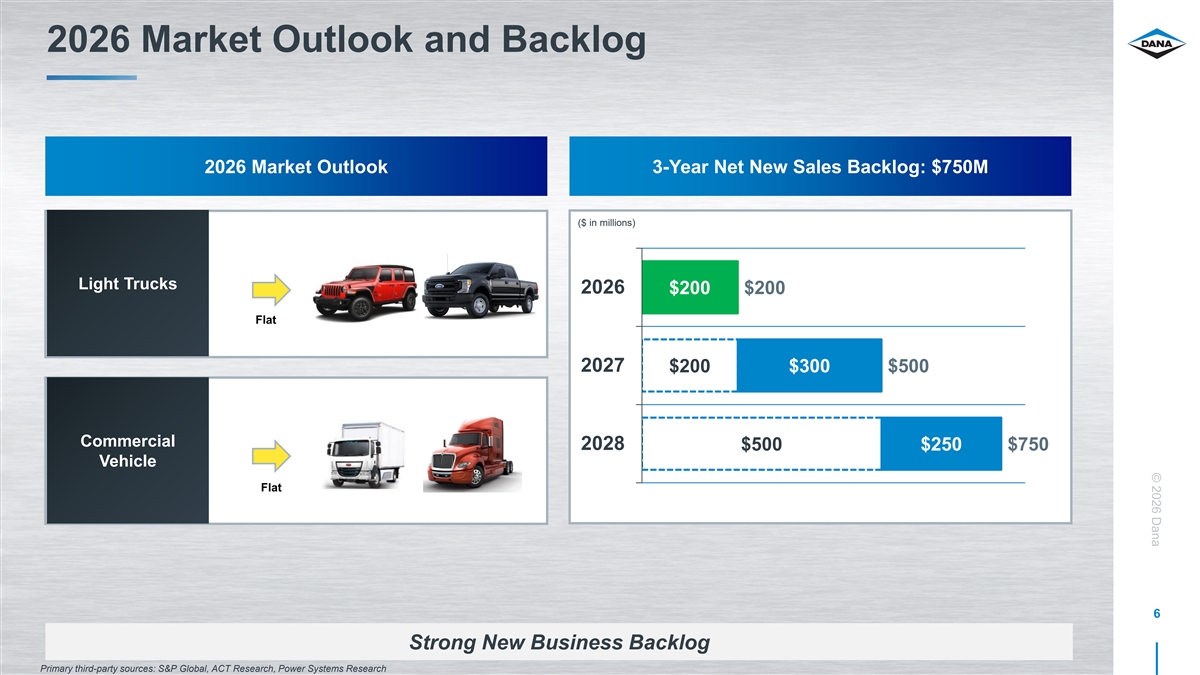

Announced $750 million three-year new business backlog; $200 million

incremental in 2026 |

| |

• |

|

2026 margin guidance range at a midpoint of 10.7 percent |

| |

• |

|

Announced new long-range targets for sales, profitability, and adjusted free cash flow

|

| |

• |

|

Will host a Capital Markets Day on March 25, 2026 |

MAUMEE, Ohio, February 18, 2026 – Dana Incorporated today announced its full-year 2025 financial results, with adjusted EBITDA and adjusted free

cash flow above the preliminary results issued in January. Dana also confirmed its outlook for 2026, highlighting stronger profitability, significant cost-reduction progress, increased capital return, and further improvements to its balance sheet.

“Over the past year, Dana made incredible progress on every one of our strategic priorities — from successfully completing the

Off-Highway separation to realizing significant cost efficiencies across the enterprise,” said R. Bruce McDonald, Chairman and Chief Executive Officer. “These actions have reshaped Dana into a more focused, more resilient organization

with improved margins and enhanced financial agility. In 2026, we remain on track to finalize the balance of our $325 million cost-reduction initiative and deliver adjusted EBITDA margins in the 10 to 11 percent range with a stronger balance sheet,

a richer mix of higher-margin programs, a continued focus on disciplined execution and an ongoing commitment to significant capital return in the years ahead.

All results are for continuing operations.

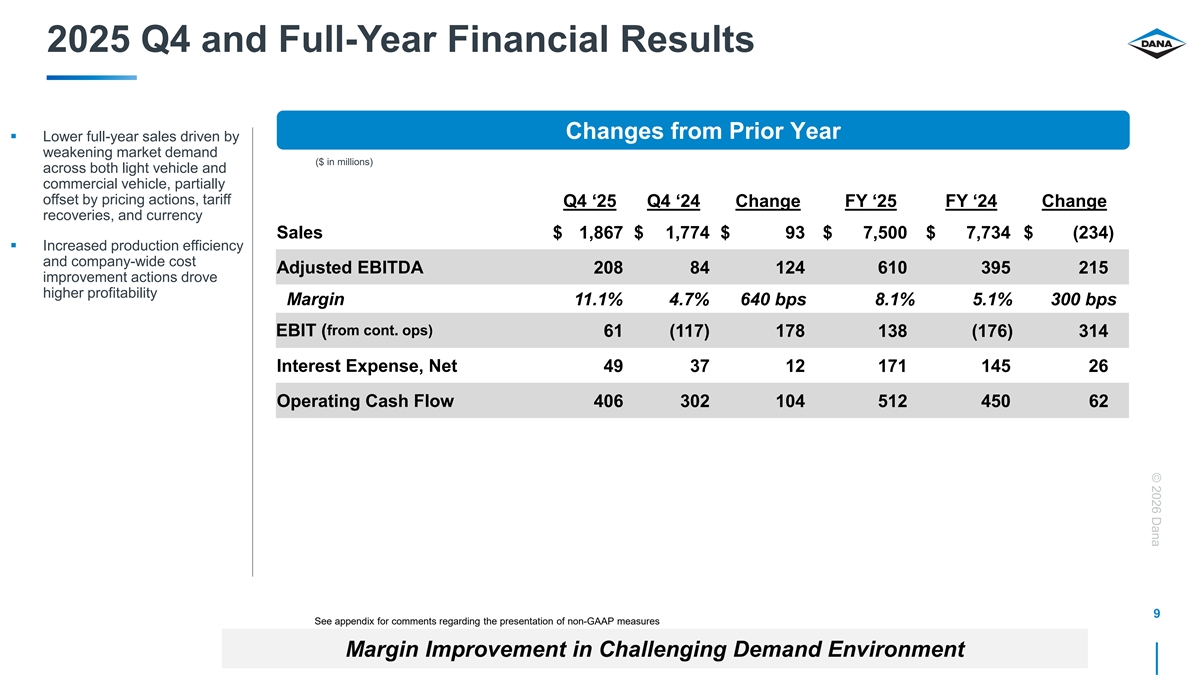

Fourth-quarter 2025 Financial Results

Sales in

the fourth quarter of 2025 totaled $1.9 billion, compared with $1.8 billion in the same period of 2023. The improvement was driven by increased demand for our key light truck programs offsetting lower market demand for commercial trucks.

Customer recovery and currency translation provided a further benefit.

Adjusted EBITDA for the fourth quarter of 2025 was $208 million

representing an 11.1 percent margin, compared with $84 million, or 4.7 percent, for the same period in 2024. Cost-savings actions and efficiency improvements were the primary drivers of the

improvement.

Operating cash flow in the fourth quarter of 2025 was $406 million, compared with $302 million in the same period of

2024. Adjusted free cash flow was $324 million, compared with $153 million in the fourth quarter of 2024.

1

Full-year 2025 Financial Results

Sales for 2025 were $7.5 billion, compared with $7.7 billion in 2024. The decrease was due to lower demand for vehicles in all end

markets partially offset by recoveries from customers and currency translation.

Adjusted EBITDA for 2025 was $610 million, compared with

$395 million in 2024, driven by cost-savings actions and performance improvements that more than offset the margin impact of lower sales and tariffs.

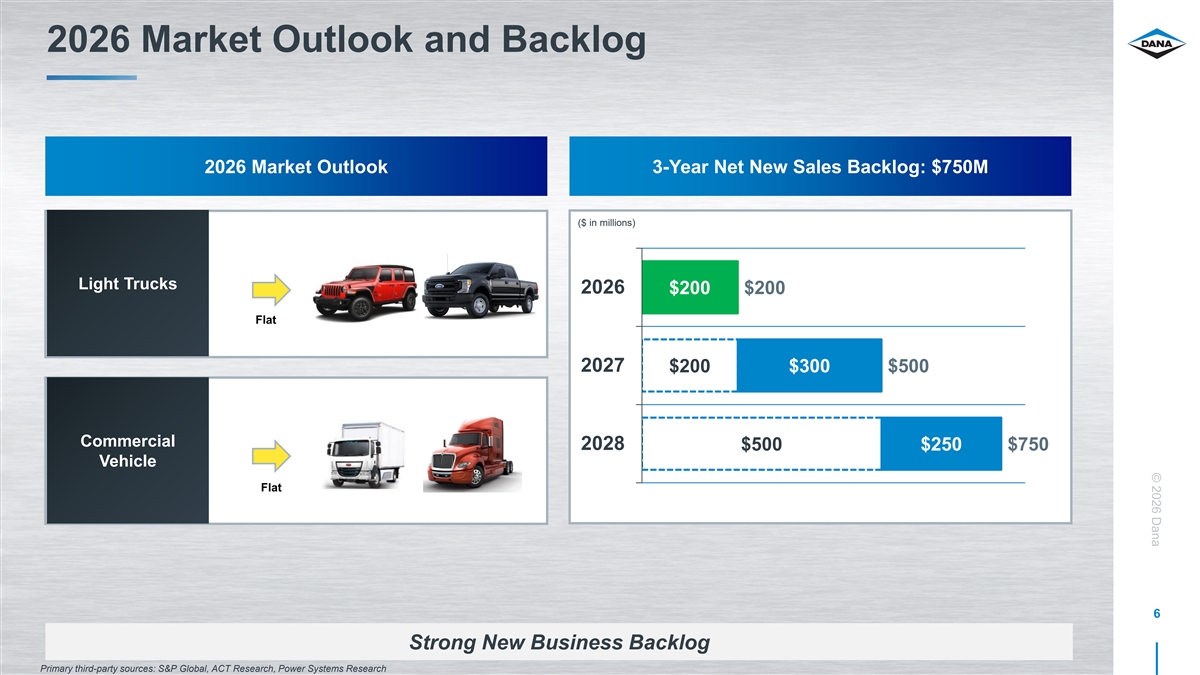

Dana’s three-year, new-business backlog totals $750 million, driven by new program awards, increased content, and expanded vehicle platforms

across both the light-vehicle and commercial-vehicle segments. The company expects $200 million in incremental new business growth in 2026 from next-generation platforms with global OEMs.

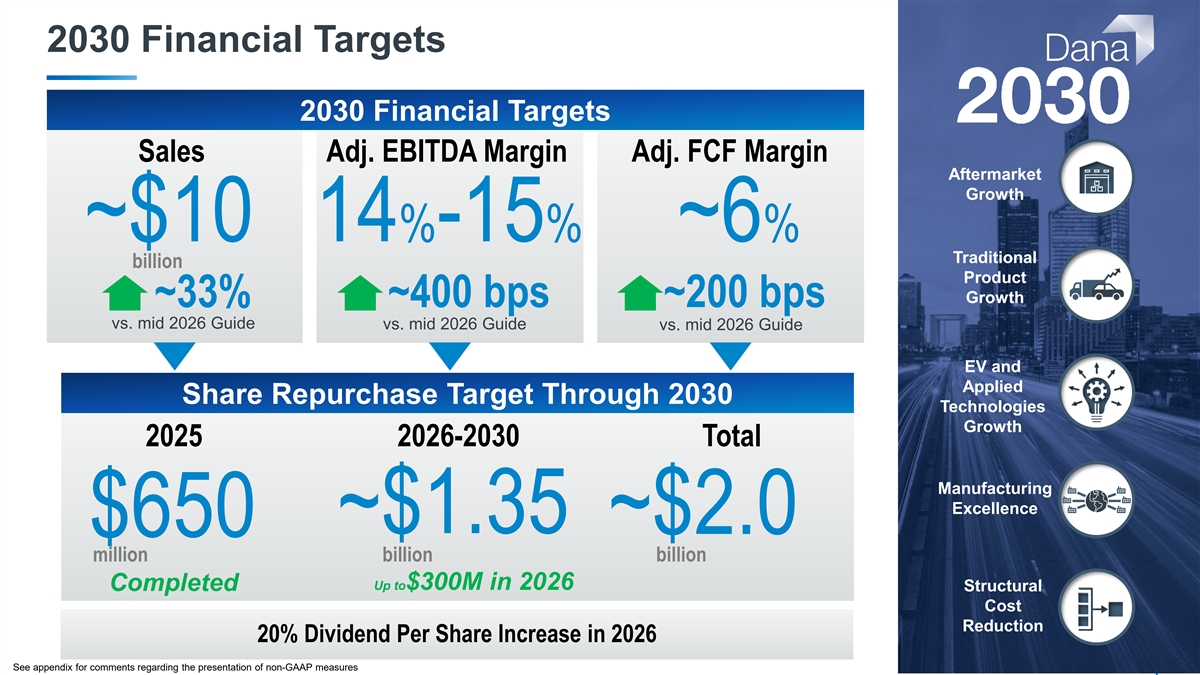

“Dana today introduced its long-term financial guidance as part of the company’s Dana 2030 strategy. In 2030, the company expects to generate

approximately $10 billion in sales, reflecting a 33 percent increase over its 2026 outlook,” said Byron Foster Senior Vice President and President, Light Vehicle Systems. “We are also targeting a significant expansion in

profitability, with adjusted EBITDA margins projected to reach 14 to 15 percent—a 45 percent improvement versus our 2026 guidance—and adjusted free cash flow margins of roughly 6 percent, representing a 50 percent

increase. Complementing these financial targets, the company announced a robust capital-return plan that includes a total of approximately $2 billion in share repurchases through 2030, reinforcing its commitment to delivering long-term shareholder

value.”

Join the company for an in-depth discussion of the Dana 2030 strategy at their Capital

Markets Day on March 25, 2026, in New York City.

2026 Financial Targets

|

|

|

| |

|

Preliminary Guidance |

| Sales |

|

$7.30 to $7.70 billion |

| Adjusted EBITDA |

|

$750 to $850 million |

| Implied adjusted EBITDA margin |

|

10.0% to 11.0% |

| Diluted Adjusted EPS |

|

$2.00 to $3.00 |

| Adjusted free cash flow |

|

$250 to $350 million |

Dana to Host Conference Call at 9 a.m. Wednesday, February 18

Dana will discuss its 2025 results and 2026 outlook in a conference call at 9:00 a.m. EST on Wednesday, February 18. The conference call can be accessed by

telephone from both domestic and international locations using the information provided below:

Conference ID: 9943139

Participant Toll-Free Dial-In Number: 1 (888) 440-5873

Participant Toll Dial-In Number: 1 (646) 960-0319

Audio streaming and slides will be available online via a link provided on the Dana investor website: www.dana.com/investors. Phone registration

will be available beginning at 8:30 a.m. EST. A webcast replay can be accessed via Dana’s investor website following the call.

2

Non-GAAP Financial Information

Adjusted EBITDA is a non-GAAP financial measure which we have defined as net income (loss) before interest, income

taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other postretirement benefit costs and other adjustments not related to our core

operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations and provide shareholder returns. We use adjusted

EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by management, we also believe adjusted EBITDA is a

measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be considered a substitute for earnings (loss) before income

taxes, net income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Adjusted net income (loss) attributable to the parent company is a non-GAAP financial measure which we have defined

as net income (loss) attributable to the parent company, excluding any discrete income tax items, restructuring charges, amortization expense and other adjustments not related to our core operations (as used in adjusted EBITDA), net of any

associated income tax effects. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an indicator of ongoing financial performance that provides enhanced comparability to net income (loss)

attributable to the parent company reported by other companies. Adjusted net income (loss) attributable to the parent company is neither intended to represent nor be an alternative measure to net income (loss) attributable to the parent company

reported in accordance with GAAP.

Diluted adjusted EPS is a non-GAAP financial measure which we have

defined as adjusted net income (loss) attributable to the parent company divided by adjusted diluted shares. We define adjusted diluted shares as diluted shares as determined in accordance with GAAP based on adjusted net income (loss) attributable

to the parent company. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an indicator of ongoing financial performance that provides enhanced comparability to EPS reported by other

companies. Diluted adjusted EPS is neither intended to represent nor be an alternative measure to diluted EPS reported in accordance with GAAP

Adjusted free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in)

operating activities less purchases of property, plant and equipment plus proceeds from sale of property, plant and equipment plus cash paid for Off-Highway business divestiture related activities. We believe

adjusted free cash flow is useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Adjusted free cash flow is not intended to represent nor be an alternative to the

measure of net cash provided by (used in) operating activities reported in accordance with GAAP. Adjusted free cash flow may not be comparable to similarly titled measures reported by other companies.

Please reference the “Non-GAAP financial information” accompanying our quarterly earnings conference

call presentations on our website at www.dana.com/investors for reconciliations of adjusted EBITDA and free cash flow to the most directly comparable financial measures calculated and presented in accordance with GAAP. We have not provided a

reconciliation of our adjusted EBITDA outlook to the most comparable GAAP measures of net income. Providing net income (loss) guidance is potentially misleading and not practical given the difficulty of projecting event driven transactional and

other non-core operating items that are included in net income, including restructuring actions, asset impairments and income tax valuation adjustments. The reconciliations of these non-GAAP measures with the most comparable GAAP measures for the historical periods presented on our website are indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance.

3

Forward-Looking Statements

Certain statements and projections contained in this news release are, by their nature, forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates, and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are

subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,”

“estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” and similar expressions, and variations or

negatives of these words. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties, and assumptions that could cause our actual results to differ materially and adversely from those expressed in

any forward-looking statement.

Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on

Form 10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business,

results of operations and financial condition. The forward-looking statements in this news release speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason.

About Dana Incorporated

Dana

Incorporated (NYSE: DAN) is a global leader in the design and manufacture of highly efficient propulsion solutions for the light- and commercial-vehicle markets. Guided by its vision to be the

world’s best powertrain company, Dana delivers advanced conventional and clean-energy technologies that help customers improve the performance, efficiency, and durability of their vehicles.

The company supplies leading vehicle manufacturers and related aftermarkets with industry-defining drive systems, electrodynamic technologies, and thermal and sealing solutions.

Headquartered in Maumee, Ohio, USA, Dana reported sales of $7.5 billion in 2025. With a history dating to 1904, the company employs 27,000 people

in 24 countries across six continents. Learn more at dana.com.

###

Contact: Craig Barber

+1-419-887-5166

craig.barber@dana.com

4

DANA INCORPORATED

Reconciliation of Net Cash Provided By Operating Activities to Adjusted Free Cash Flow (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| (In millions) |

|

December 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Net cash provided by operating activities |

|

$ |

406 |

|

|

$ |

302 |

|

| Purchases of property, plant and equipment - Continuing operations |

|

|

(61 |

) |

|

|

(114 |

) |

| Purchases of property, plant and equipment - Discontinued operations |

|

|

(23 |

) |

|

|

(39 |

) |

| Proceeds from sale of property, plant and equipment - Continuing operations |

|

|

1 |

|

|

|

4 |

|

| Proceeds from sale of property, plant and equipment - Discontinued operations |

|

|

1 |

|

|

|

— |

|

| Cash paid for Off-Highway business divestiture

related activities |

|

|

14 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Adjusted free cash flow |

|

$ |

324 |

|

|

$ |

153 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

|

| (In millions) |

|

December 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Net cash provided by operating activities |

|

$ |

512 |

|

|

$ |

450 |

|

| Purchases of property, plant and equipment - Continuing operations |

|

|

(214 |

) |

|

|

(312 |

) |

| Purchases of property, plant and equipment - Discontinued operations |

|

|

(56 |

) |

|

|

(68 |

) |

| Proceeds from sale of property, plant and equipment - Continuing operations |

|

|

13 |

|

|

|

7 |

|

| Proceeds from sale of property, plant and equipment - Discontinued operations |

|

|

1 |

|

|

|

4 |

|

| Cash paid for Off-Highway business divestiture

related activities |

|

|

75 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Adjusted free cash flow |

|

$ |

331 |

|

|

$ |

81 |

|

|

|

|

|

|

|

|

|

|

5

DANA INCORPORATED

Segment Sales and Adjusted EBITDA (Unaudited)

For the Three Months Ended December 31, 2025 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| (In millions) |

|

December 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Sales |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

1,316 |

|

|

$ |

1,201 |

|

| Commercial Vehicle |

|

|

551 |

|

|

|

573 |

|

|

|

|

|

|

|

|

|

|

| Total Sales |

|

$ |

1,867 |

|

|

$ |

1,774 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

160 |

|

|

$ |

84 |

|

| Commercial Vehicle |

|

|

60 |

|

|

|

17 |

|

| Corporate expense and other items, net |

|

|

(12 |

) |

|

|

(17 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

208 |

|

|

$ |

84 |

|

|

|

|

|

|

|

|

|

|

6

DANA INCORPORATED

Segment Sales and Adjusted EBITDA (Unaudited)

For the Year December 31, 2025 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

|

| (In millions) |

|

December 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Sales |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

5,217 |

|

|

$ |

5,250 |

|

| Commercial Vehicle |

|

|

2,283 |

|

|

|

2,484 |

|

|

|

|

|

|

|

|

|

|

| Total Sales |

|

$ |

7,500 |

|

|

$ |

7,734 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

466 |

|

|

$ |

334 |

|

| Commercial Vehicle |

|

|

199 |

|

|

|

134 |

|

| Corporate expense and other items, net |

|

|

(55 |

) |

|

|

(73 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

610 |

|

|

$ |

395 |

|

|

|

|

|

|

|

|

|

|

7

DANA INCORPORATED

Reconciliation of Loss From Continuing Operations Before Income Taxes to Adjusted EBITDA (Unaudited)

For the Year December 31, 2025 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| (In millions) |

|

December 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Income (loss) from continuing operations before income taxes |

|

$ |

12 |

|

|

$ |

(154 |

) |

| Adjustments related to continuing operations |

|

|

|

|

|

|

|

|

| Interest income |

|

|

(2 |

) |

|

|

(4 |

) |

| Interest expense |

|

|

51 |

|

|

|

41 |

|

| Depreciation |

|

|

88 |

|

|

|

84 |

|

| Amortization |

|

|

3 |

|

|

|

3 |

|

| Non-service cost components of pension and OPEB

costs |

|

|

4 |

|

|

|

5 |

|

| Restructuring charges, net |

|

|

6 |

|

|

|

34 |

|

| Stock compensation expense |

|

|

9 |

|

|

|

9 |

|

| Strategic transaction expenses |

|

|

|

|

|

|

1 |

|

| Loss on sale of property, plant and equipment |

|

|

|

|

|

|

1 |

|

| Electric vehicle program termination charges |

|

|

36 |

|

|

|

|

|

| Supplier capacity charge adjustment |

|

|

|

|

|

|

46 |

|

| Loss on divestiture of ownership interests |

|

|

2 |

|

|

|

|

|

| Amounts attributable to previously closed/divested operations |

|

|

|

|

|

|

9 |

|

| Other items |

|

|

(1 |

) |

|

|

9 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

208 |

|

|

$ |

84 |

|

|

|

|

|

|

|

|

|

|

8

DANA INCORPORATED

Reconciliation of Loss From Continuing Operations Before Income Taxes to Adjusted EBITDA (Unaudited)

For the Year December 31, 2025 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

|

| (In millions) |

|

December 31, |

|

| |

|

2025 |

|

|

2024 |

|

| Loss from continuing operations before income taxes |

|

$ |

(33 |

) |

|

$ |

(321 |

) |

| Adjustments related to continuing operations |

|

|

|

|

|

|

|

|

| Interest income |

|

|

(10 |

) |

|

|

(13 |

) |

| Interest expense |

|

|

181 |

|

|

|

158 |

|

| Depreciation |

|

|

345 |

|

|

|

337 |

|

| Amortization |

|

|

12 |

|

|

|

13 |

|

| Non-service cost components of pension and OPEB

costs |

|

|

11 |

|

|

|

17 |

|

| Restructuring charges, net |

|

|

23 |

|

|

|

70 |

|

| Stock compensation expense |

|

|

40 |

|

|

|

30 |

|

| Strategic transaction expenses |

|

|

12 |

|

|

|

3 |

|

| Loss on sale of property, plant and equipment |

|

|

|

|

|

|

1 |

|

| Electric vehicle program termination charges |

|

|

36 |

|

|

|

|

|

| Supplier capacity charge adjustment |

|

|

(21 |

) |

|

|

46 |

|

| Loss on divestiture of ownership interests |

|

|

9 |

|

|

|

|

|

| Loss on disposal group previously held for sale |

|

|

|

|

|

|

26 |

|

| Amounts attributable to previously closed/divested operations |

|

|

|

|

|

|

9 |

|

| Other items |

|

|

5 |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

610 |

|

|

$ |

395 |

|

|

|

|

|

|

|

|

|

|

9

2025 Fourth-Quarter & Full-Year Earnings Conference Call February

18, 2026

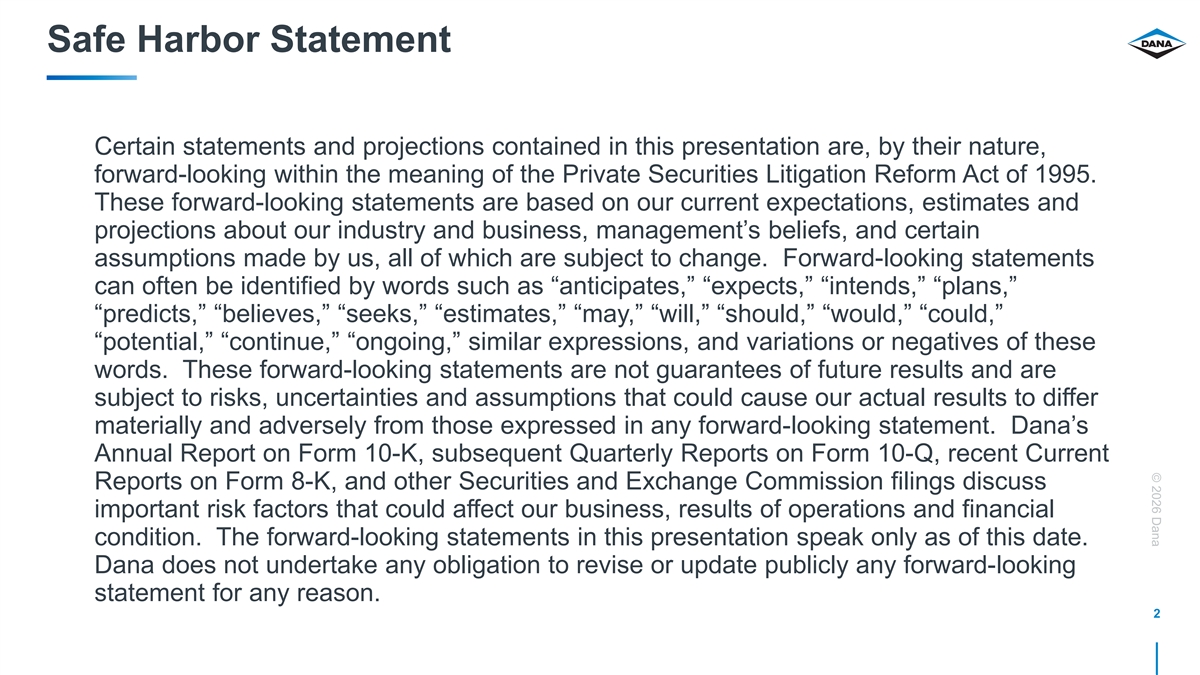

© 2026 Dana Safe Harbor Statement Certain statements and

projections contained in this presentation are, by their nature, forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and

projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,”

“expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,”

“could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. These forward-looking statements are not guarantees of future results and are subject to

risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q,

recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business, results of operations and financial condition. The forward-looking statements in this

presentation speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason. 2

© 2026 Dana Agenda Craig Barber R. Bruce McDonald Byron Foster

Timothy Kraus Senior Director, Investor Chairman and Senior Vice President and Senior Vice President and Relations and Corporate President, Light Vehicle Chief Financial Officer Chief Executive Officer Communications Systems 3

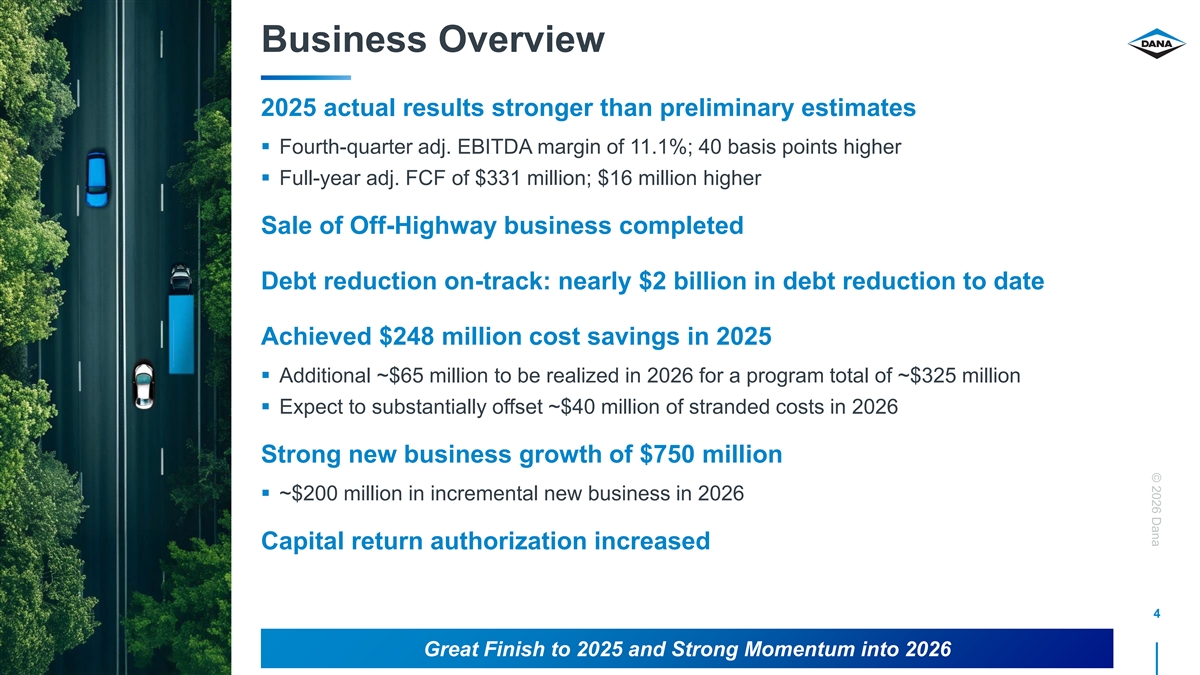

© 2026 Dana Business Overview 2025 actual results stronger than

preliminary estimates § Fourth-quarter adj. EBITDA margin of 11.1%; 40 basis points higher § Full-year adj. FCF of $331 million; $16 million higher Sale of Off-Highway business completed Debt reduction on-track: nearly $2 billion in debt

reduction to date Achieved $248 million cost savings in 2025 § Additional ~$65 million to be realized in 2026 for a program total of ~$325 million § Expect to substantially offset ~$40 million of stranded costs in 2026 Strong new business

growth of $750 million § ~$200 million in incremental new business in 2026 Capital return authorization increased 4 Great Finish to 2025 and Strong Momentum into 2026

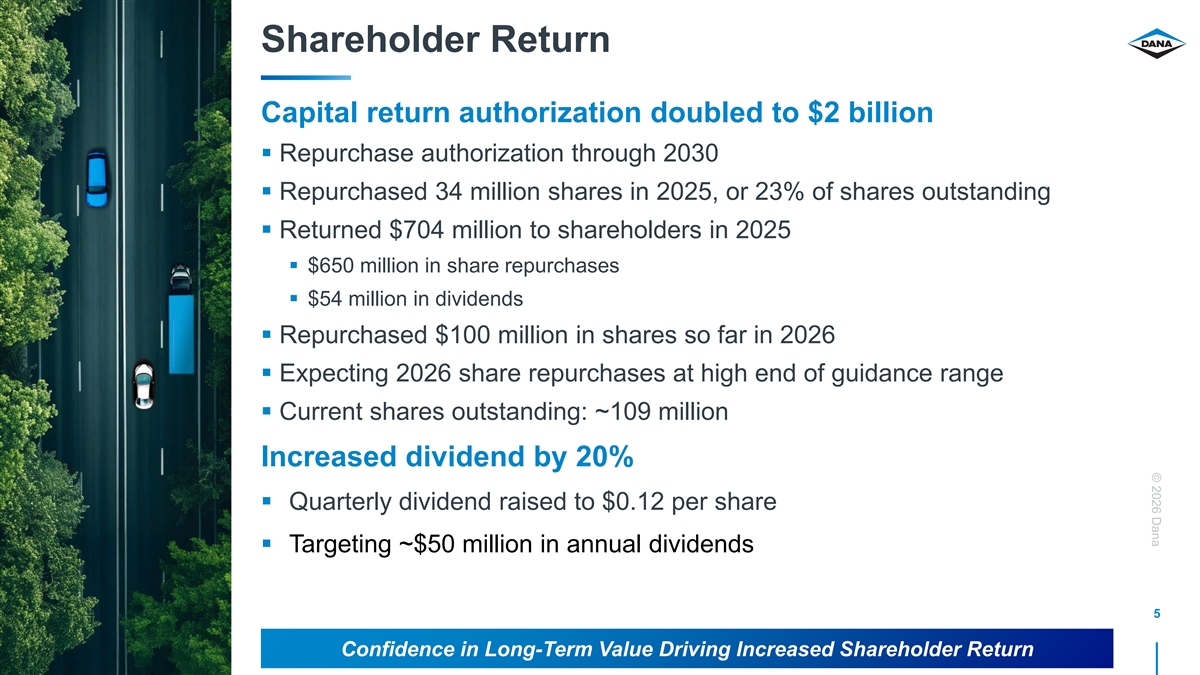

© 2026 Dana Shareholder Return Capital return authorization

doubled to $2 billion § Repurchase authorization through 2030 § Repurchased 34 million shares in 2025, or 23% of shares outstanding § Returned $704 million to shareholders in 2025 § $650 million in share repurchases § $54

million in dividends § Repurchased $100 million in shares so far in 2026 § Expecting 2026 share repurchases at high end of guidance range § Current shares outstanding: ~109 million Increased dividend by 20% § Quarterly dividend

raised to $0.12 per share § Targeting ~$50 million in annual dividends 5 Confidence in Long-Term Value Driving Increased Shareholder Return

© 2026 Dana 2026 Market Outlook and Backlog 2026 Market Outlook

3-Year Net New Sales Backlog: $750M ($ in millions) Light Trucks 2026 $200 $200 Flat 2027 $200 $300 $500 Commercial 2028 $500 $250 $750 Vehicle Flat 6 Strong New Business Backlog Primary third-party sources: S&P Global, ACT Research, Power

Systems Research

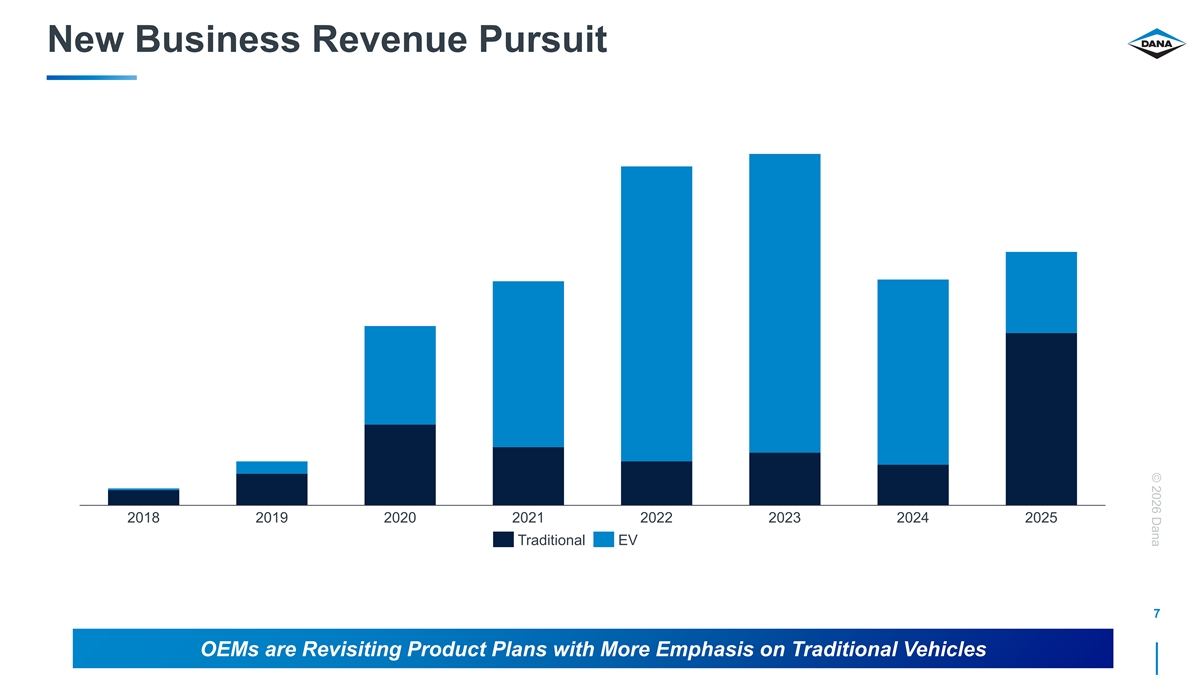

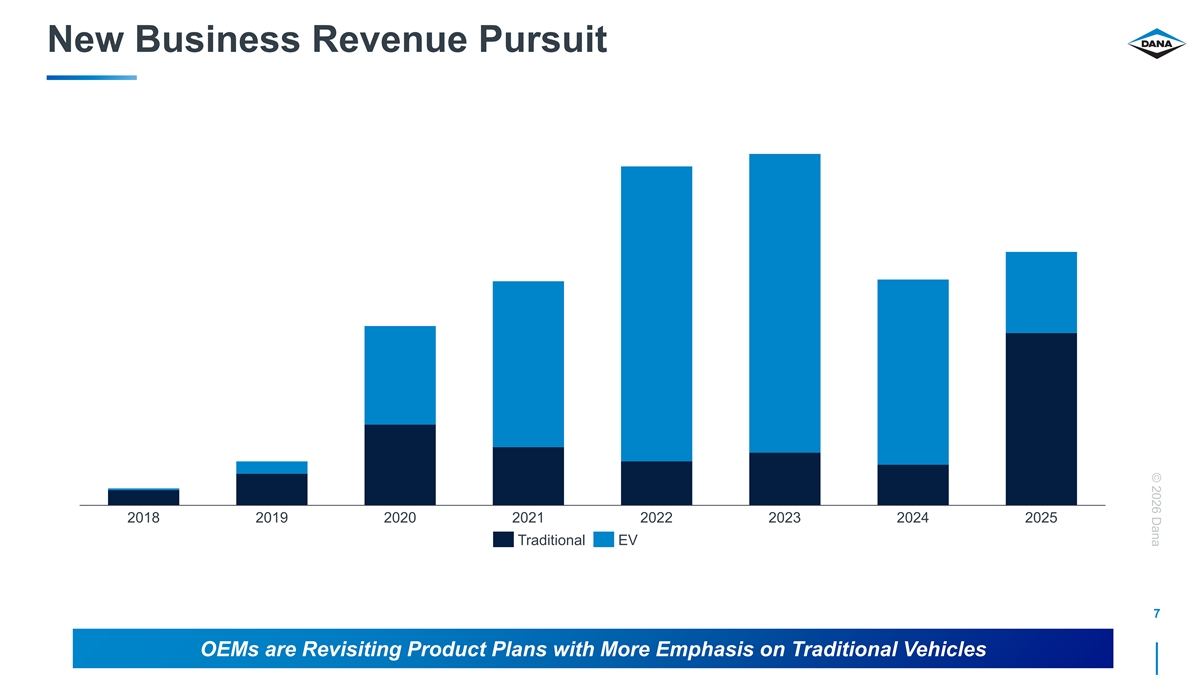

© 2026 Dana New Business Revenue Pursuit 2018 2019 2020 2021

2022 2023 2024 2025 Traditional EV 7 OEMs are Revisiting Product Plans with More Emphasis on Traditional Vehicles

© 2026 Dana Financial Review 8

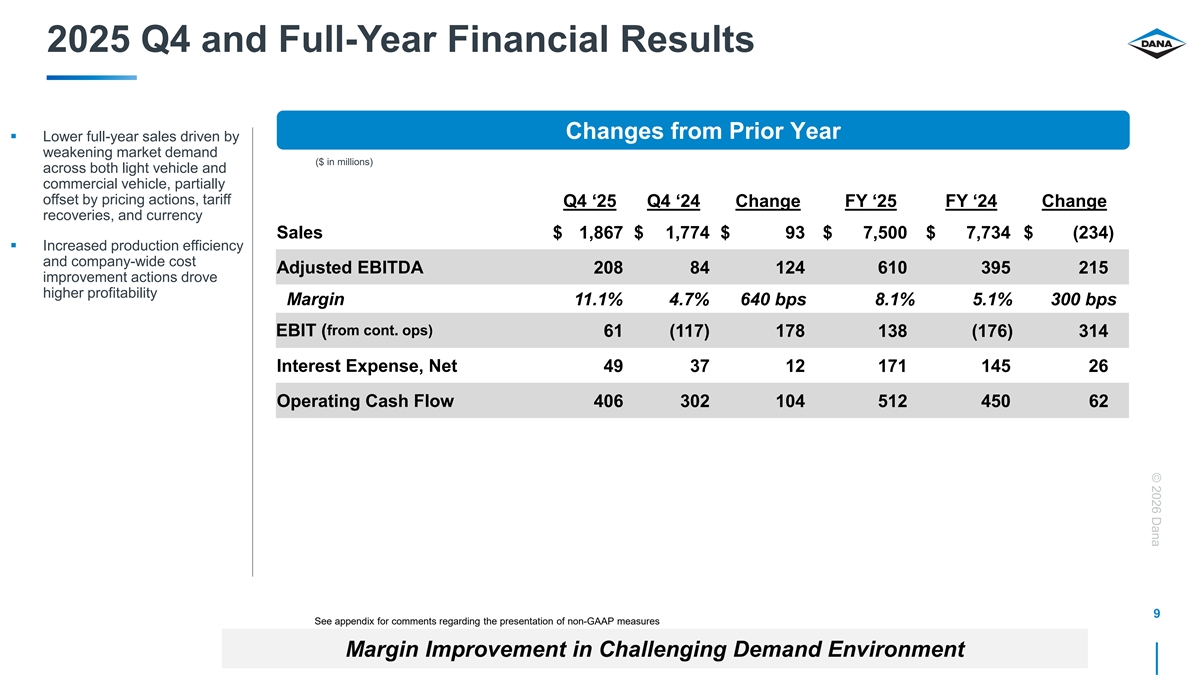

© 2026 Dana 2025 Q4 and Full-Year Financial Results Changes from

Prior Year § Lower full-year sales driven by weakening market demand ($ in millions) across both light vehicle and commercial vehicle, partially offset by pricing actions, tariff Q4 ‘25 Q4 ‘24 Change FY ‘25 FY ‘24 Change

recoveries, and currency Sales $ 1,867 $ 1,774 $ 93 $ 7,500 $ 7,734 $ (234) § Increased production efficiency and company-wide cost Adjusted EBITDA 208 84 124 610 395 215 improvement actions drove higher profitability Margin 11.1% 4.7% 640 bps

8.1% 5.1% 300 bps from cont. ops) EBIT ( 61 (117) 178 138 (176) 314 Interest Expense, Net 49 37 12 171 145 26 Operating Cash Flow 406 302 104 512 450 62 9 See appendix for comments regarding the presentation of non-GAAP measures Margin Improvement

in Challenging Demand Environment

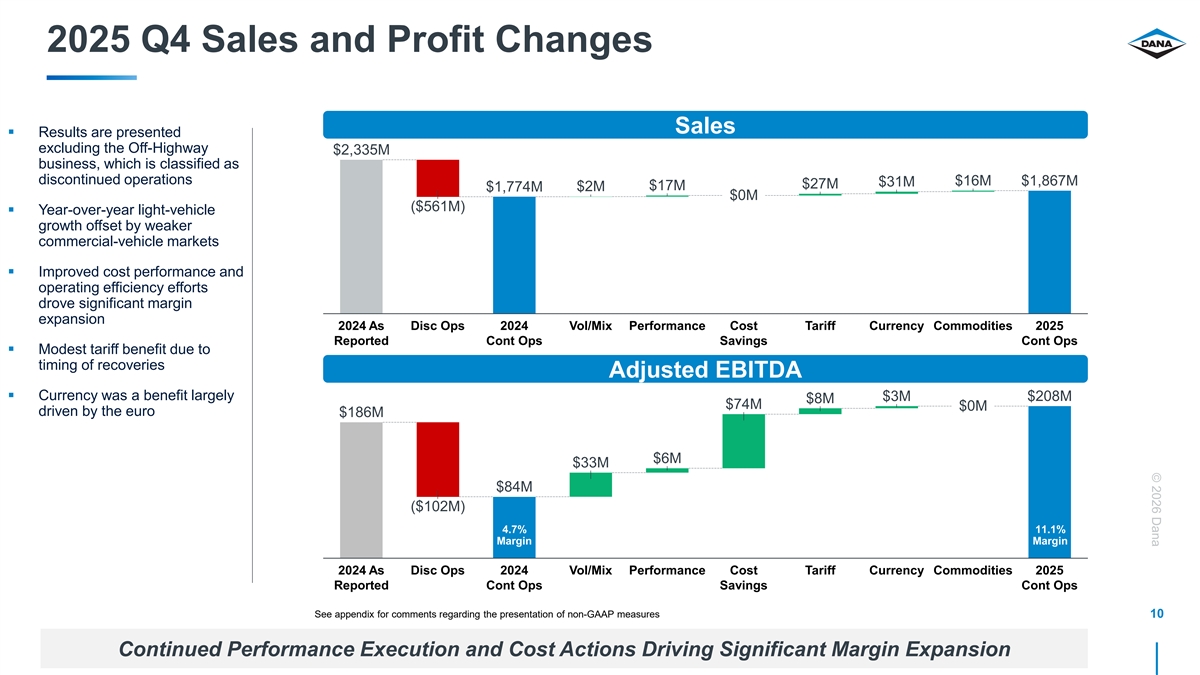

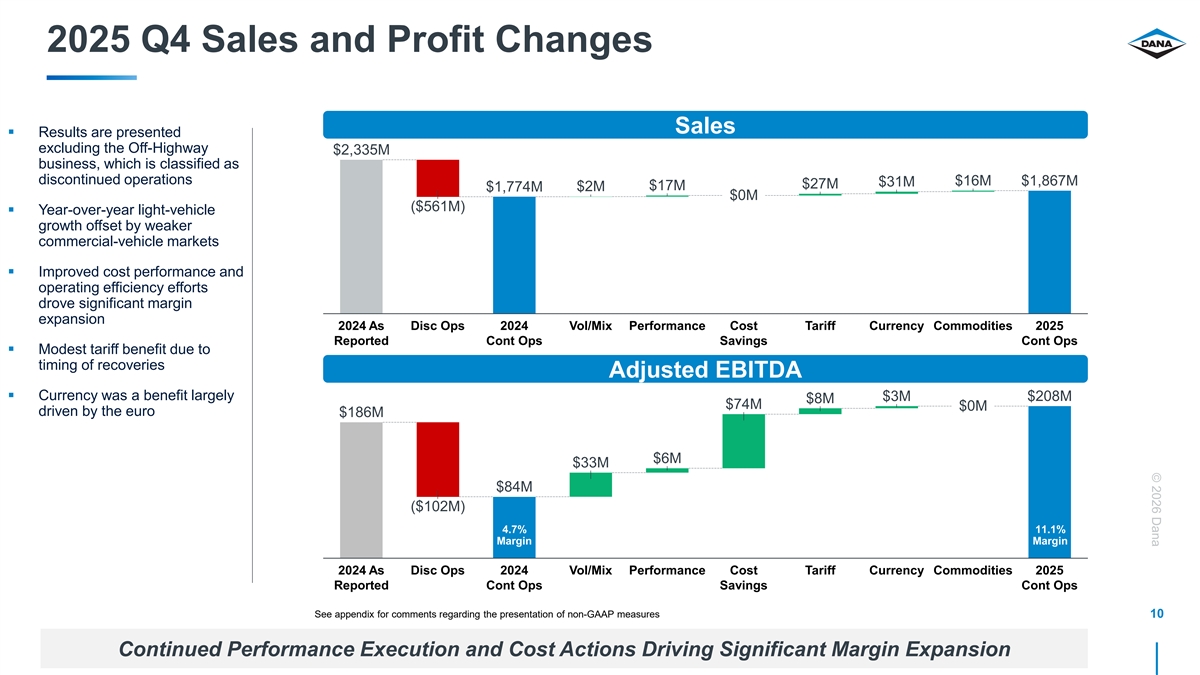

© 2026 Dana 2025 Q4 Sales and Profit Changes Sales §

Results are presented excluding the Off-Highway $2,335M business, which is classified as discontinued operations $16M $1,867M $31M $27M $17M $1,774M $2M $0M ($561M) § Year-over-year light-vehicle growth offset by weaker commercial-vehicle

markets § Improved cost performance and operating efficiency efforts drove significant margin expansion 2024 As Disc Ops 2024 Vol/Mix Performance Cost Tariff Currency Commodities 2025 Reported Cont Ops Savings Cont Ops § Modest tariff

benefit due to timing of recoveries Adjusted EBITDA § Currency was a benefit largely $3M $208M $8M $74M $0M driven by the euro $186M $6M $33M $84M ($102M) 4.7% 11.1% Margin Margin 2024 As Disc Ops 2024 Vol/Mix Performance Cost Tariff Currency

Commodities 2025 Reported Cont Ops Savings Cont Ops See appendix for comments regarding the presentation of non-GAAP measures 10 Continued Performance Execution and Cost Actions Driving Significant Margin Expansion

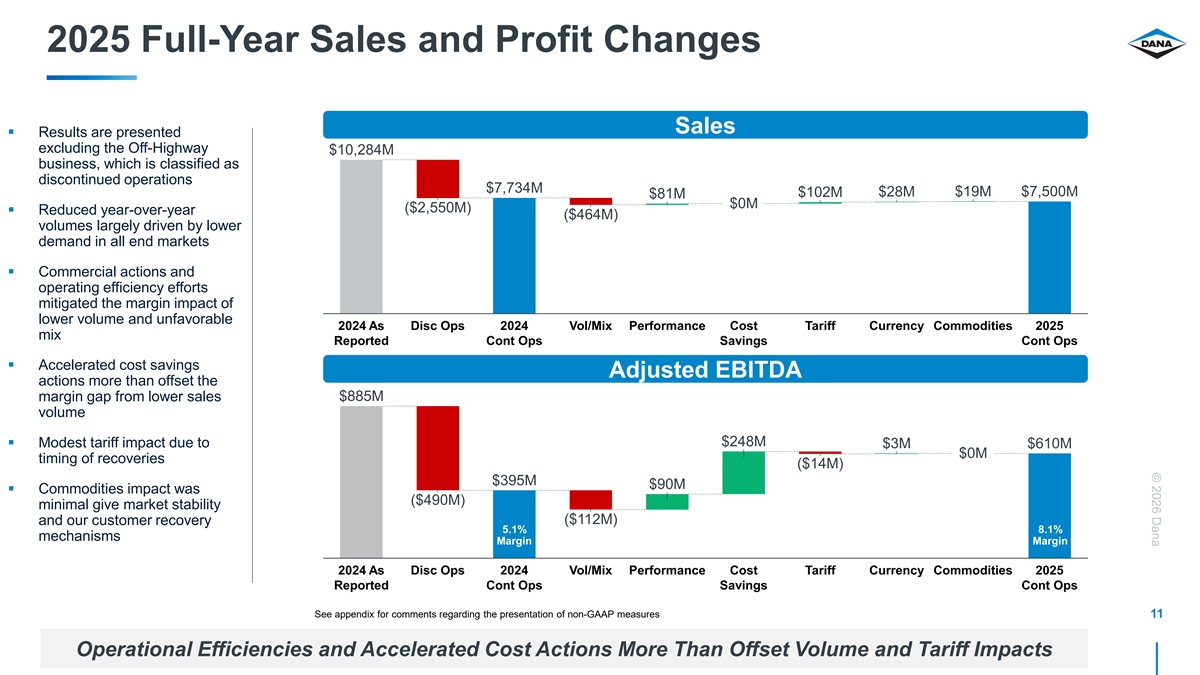

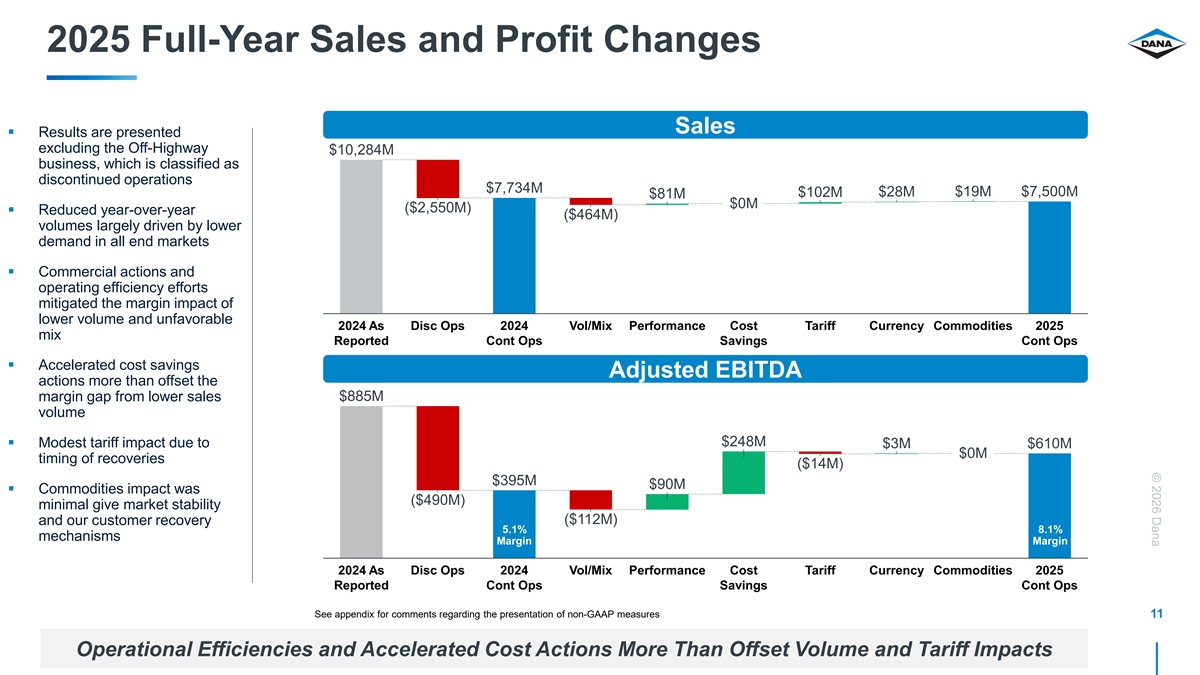

© 2026 Dana 2025 Full-Year Sales and Profit Changes Sales

§ Results are presented excluding the Off-Highway $10,284M business, which is classified as discontinued operations $7,734M $102M $28M $19M $7,500M $81M $0M ($2,550M) § Reduced year-over-year ($464M) volumes largely driven by lower demand

in all end markets § Commercial actions and operating efficiency efforts mitigated the margin impact of lower volume and unfavorable 2024 As Disc Ops 2024 Vol/Mix Performance Cost Tariff Currency Commodities 2025 mix Reported Cont Ops Savings

Cont Ops § Accelerated cost savings Adjusted EBITDA actions more than offset the margin gap from lower sales $885M volume $248M § Modest tariff impact due to $3M $610M $0M timing of recoveries ($14M) $395M $90M § Commodities impact

was ($490M) minimal give market stability ($112M) and our customer recovery 5.1% 8.1% mechanisms Margin Margin 2024 As Disc Ops 2024 Vol/Mix Performance Cost Tariff Currency Commodities 2025 Reported Cont Ops Savings Cont Ops See appendix for

comments regarding the presentation of non-GAAP measures 11 Operational Efficiencies and Accelerated Cost Actions More Than Offset Volume and Tariff Impacts

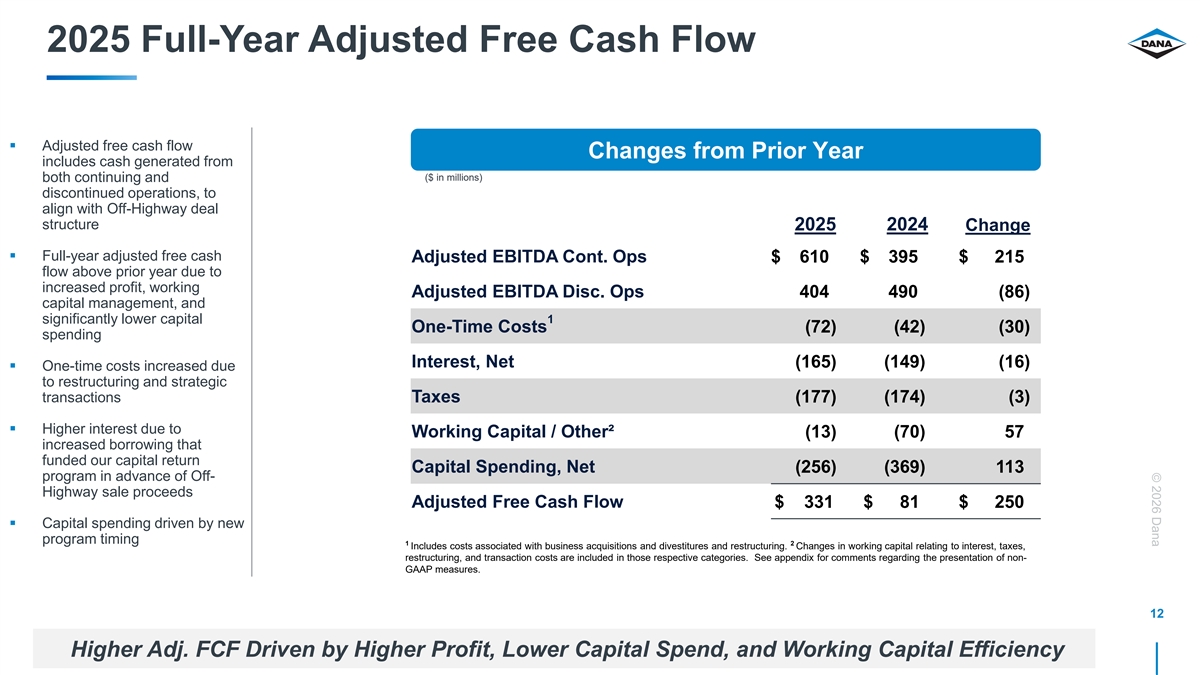

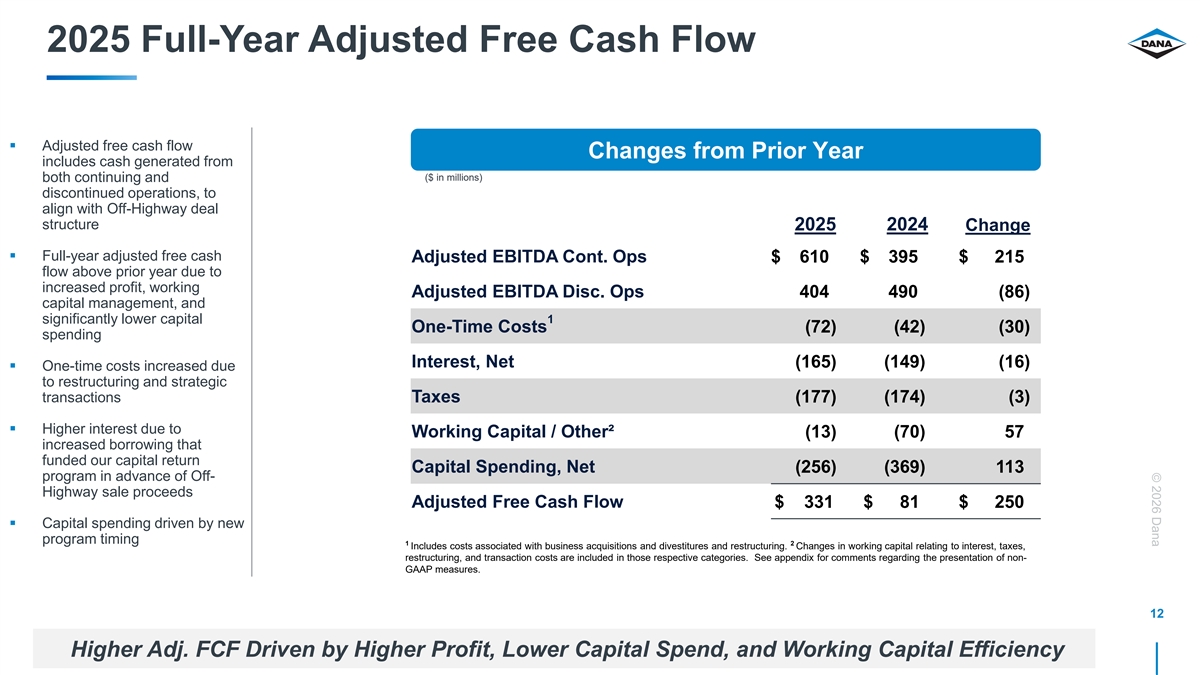

© 2026 Dana 2025 Full-Year Adjusted Free Cash Flow §

Adjusted free cash flow Changes from Prior Year includes cash generated from ($ in millions) both continuing and discontinued operations, to align with Off-Highway deal structure 2025 2024 Change § Full-year adjusted free cash Adjusted EBITDA

Cont. Ops $ 610 $ 395 $ 215 flow above prior year due to increased profit, working Adjusted EBITDA Disc. Ops 404 490 (86) capital management, and 1 significantly lower capital One-Time Costs (72) (42) (30) spending Interest, Net (165) (149) (16)

§ One-time costs increased due to restructuring and strategic transactions Taxes (177) (174) (3) § Higher interest due to Working Capital / Other² (13) (70) 57 increased borrowing that funded our capital return Capital Spending, Net

(256) (369) 113 program in advance of Off- Highway sale proceeds Adjusted Free Cash Flow $ 331 $ 81 $ 250 § Capital spending driven by new program timing 1 2 Includes costs associated with business acquisitions and divestitures and

restructuring. Changes in working capital relating to interest, taxes, restructuring, and transaction costs are included in those respective categories. See appendix for comments regarding the presentation of non- GAAP measures. 12 Higher Adj. FCF

Driven by Higher Profit, Lower Capital Spend, and Working Capital Efficiency

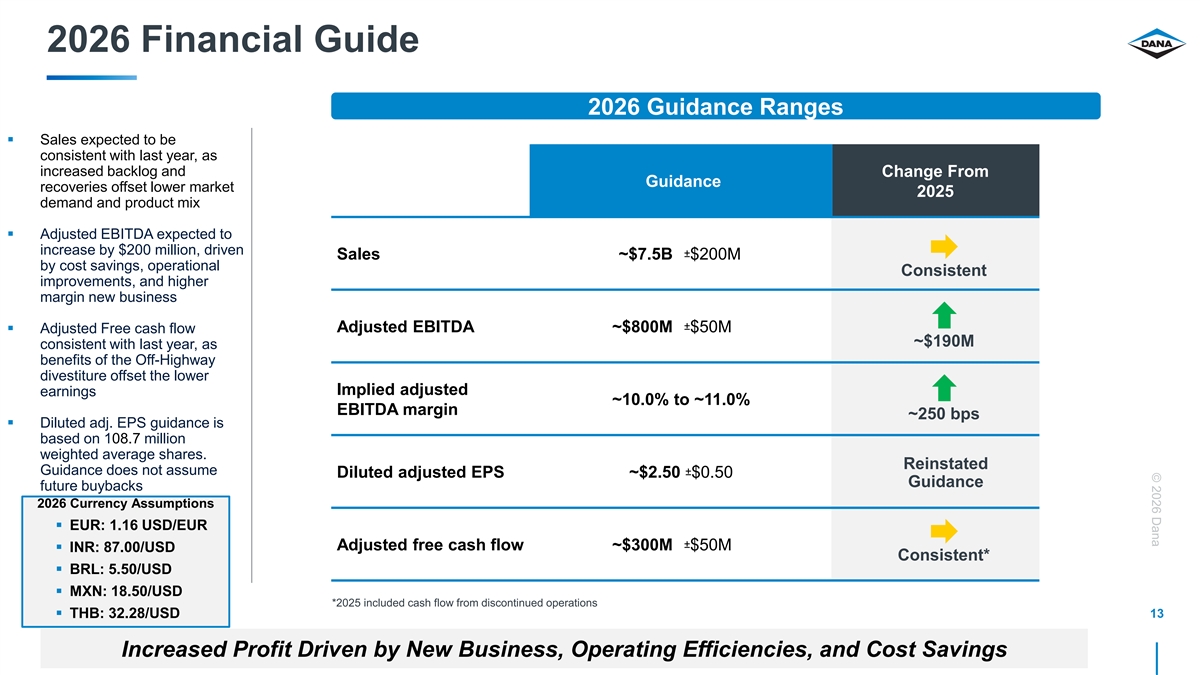

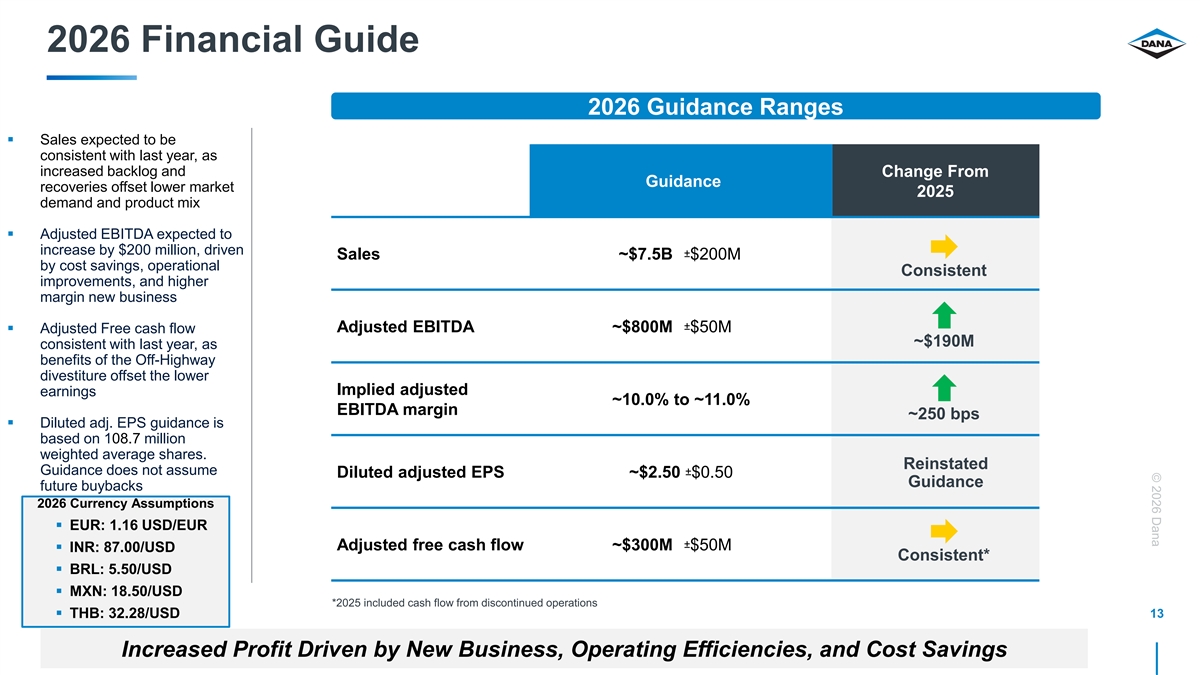

© 2026 Dana 2026 Financial Guide 2026 Guidance Ranges §

Sales expected to be consistent with last year, as increased backlog and Change From Guidance recoveries offset lower market 2025 demand and product mix § Adjusted EBITDA expected to increase by $200 million, driven ± Sales ~$7.5B $200M by

cost savings, operational Consistent improvements, and higher margin new business ± Adjusted EBITDA ~$800M $50M § Adjusted Free cash flow ~$190M consistent with last year, as benefits of the Off-Highway divestiture offset the lower Implied

adjusted earnings ~10.0% to ~11.0% EBITDA margin ~250 bps § Diluted adj. EPS guidance is based on 108.7 million weighted average shares. Reinstated Guidance does not assume ± Diluted adjusted EPS ~$2.50 $0.50 Guidance future buybacks 2026

Currency Assumptions § EUR: 1.16 USD/EUR ± Adjusted free cash flow ~$300M $50M § INR: 87.00/USD Consistent* § BRL: 5.50/USD § MXN: 18.50/USD *2025 included cash flow from discontinued operations § THB: 32.28/USD 13

Increased Profit Driven by New Business, Operating Efficiencies, and Cost Savings

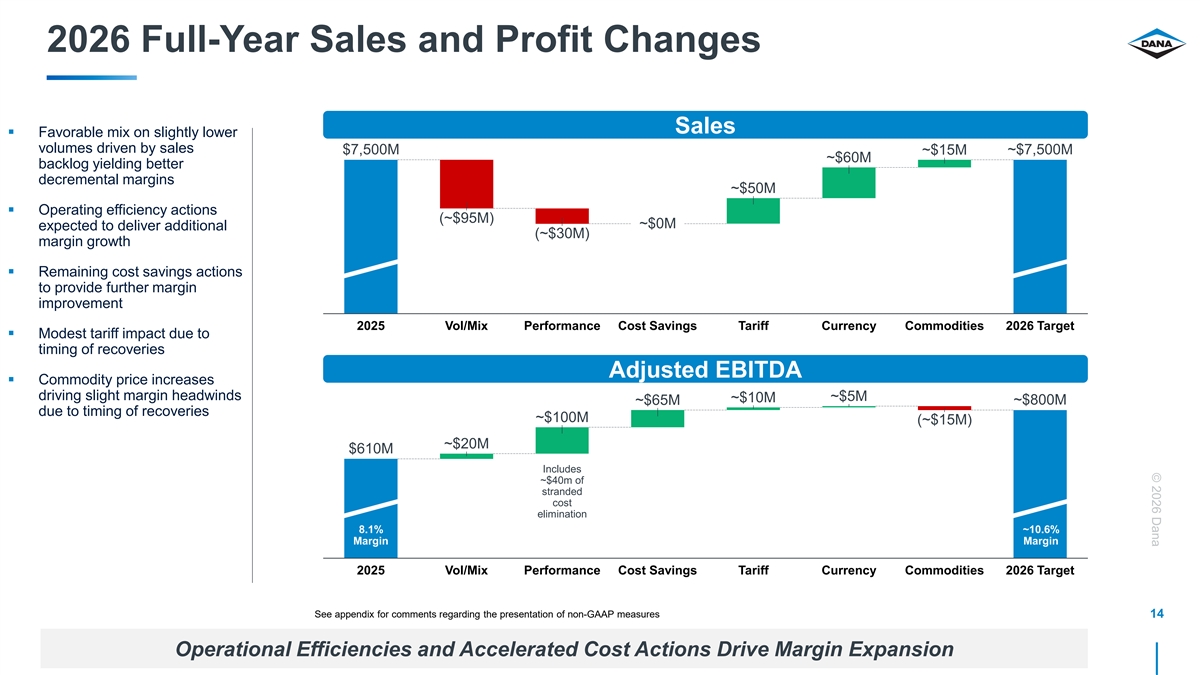

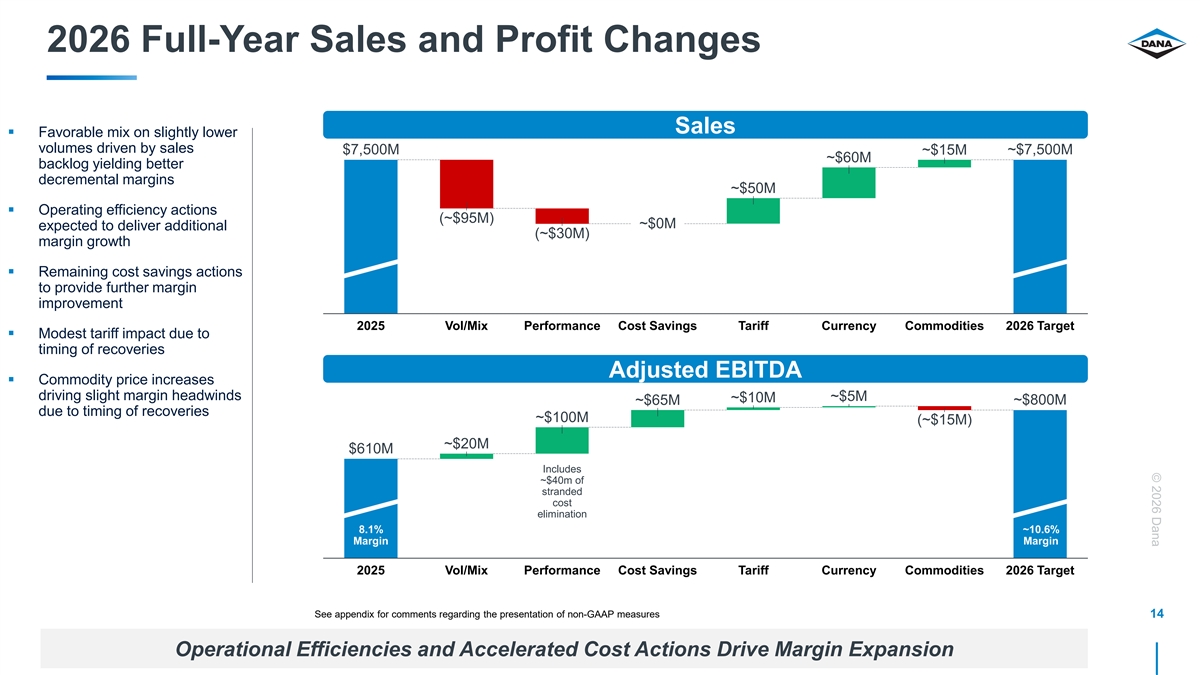

© 2026 Dana 2026 Full-Year Sales and Profit Changes Sales

§ Favorable mix on slightly lower volumes driven by sales $7,500M ~$7,500M ~$15M ~$60M backlog yielding better decremental margins ~$50M § Operating efficiency actions (~$95M) ~$0M expected to deliver additional (~$30M) margin growth

§ Remaining cost savings actions to provide further margin improvement 2025 Vol/Mix Performance Cost Savings Tariff Currency Commodities 2026 Target § Modest tariff impact due to timing of recoveries Adjusted EBITDA § Commodity price

increases driving slight margin headwinds ~$5M ~$10M ~$65M ~$800M due to timing of recoveries ~$100M (~$15M) ~$20M $610M Includes ~$40m of stranded cost elimination 8.1% ~10.6% Margin Margin 2025 Vol/Mix Performance Cost Savings Tariff Currency

Commodities 2026 Target See appendix for comments regarding the presentation of non-GAAP measures 14 Operational Efficiencies and Accelerated Cost Actions Drive Margin Expansion

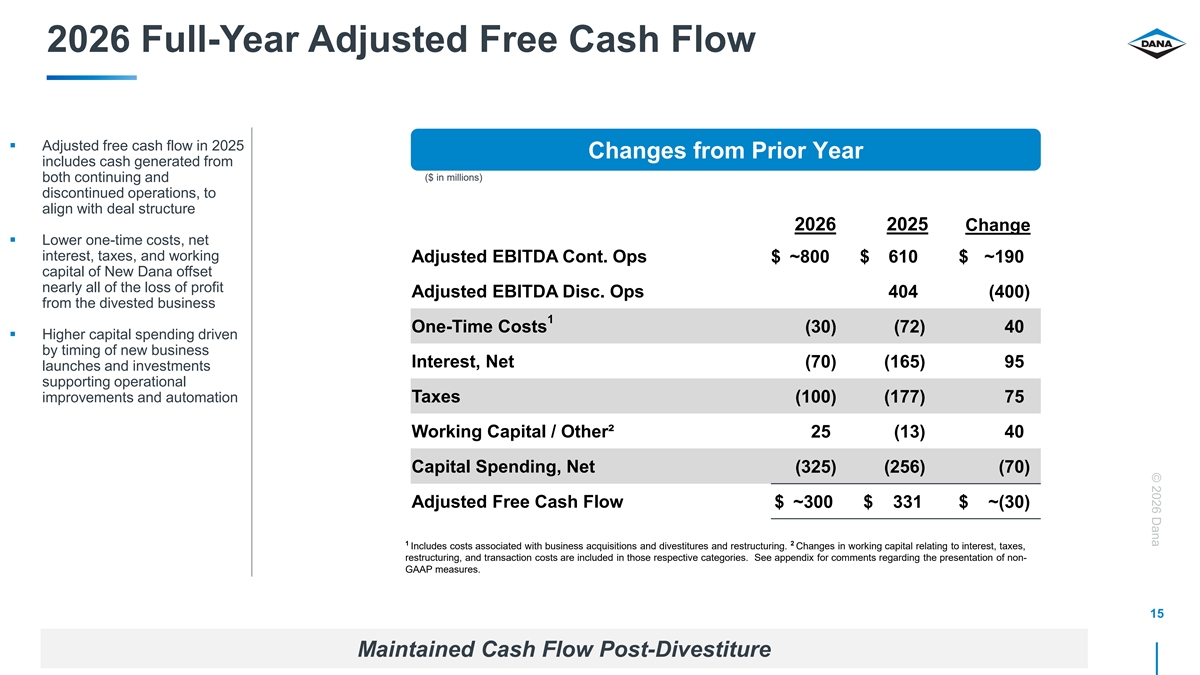

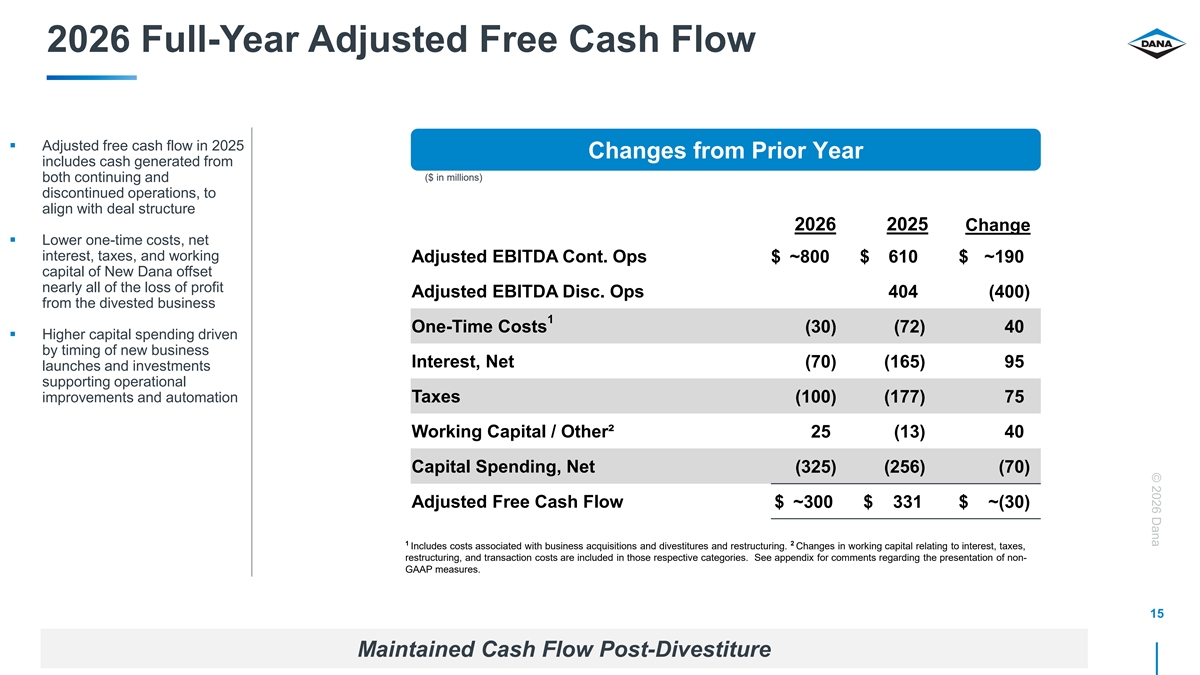

© 2026 Dana 2026 Full-Year Adjusted Free Cash Flow §

Adjusted free cash flow in 2025 Changes from Prior Year includes cash generated from ($ in millions) both continuing and discontinued operations, to align with deal structure 2026 2025 Change § Lower one-time costs, net interest, taxes, and

working Adjusted EBITDA Cont. Ops $ ~800 $ 610 $ ~190 capital of New Dana offset nearly all of the loss of profit Adjusted EBITDA Disc. Ops 404 (400) from the divested business 1 One-Time Costs (30) (72) 40 § Higher capital spending driven by

timing of new business Interest, Net (70) (165) 95 launches and investments supporting operational improvements and automation Taxes (100) (177) 75 Working Capital / Other² 25 (13) 40 Capital Spending, Net (325) (256) (70) Adjusted Free Cash

Flow $ ~300 $ 331 $ ~(30) 1 2 Includes costs associated with business acquisitions and divestitures and restructuring. Changes in working capital relating to interest, taxes, restructuring, and transaction costs are included in those respective

categories. See appendix for comments regarding the presentation of non- GAAP measures. 15 Maintained Cash Flow Post-Divestiture

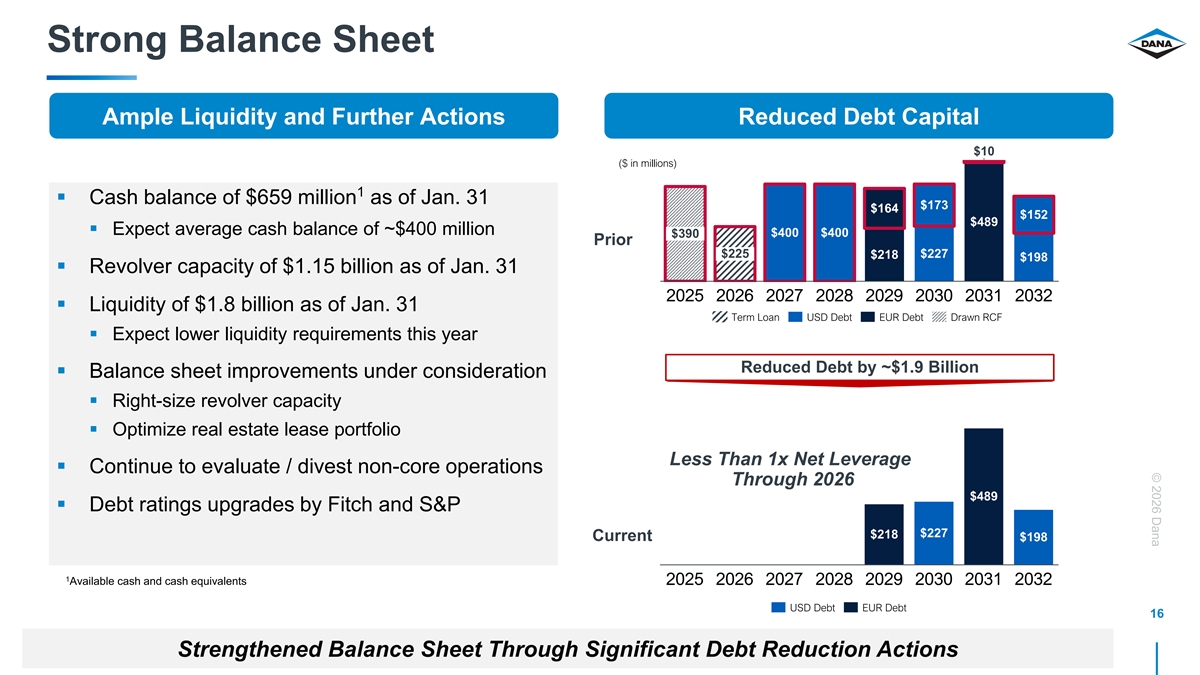

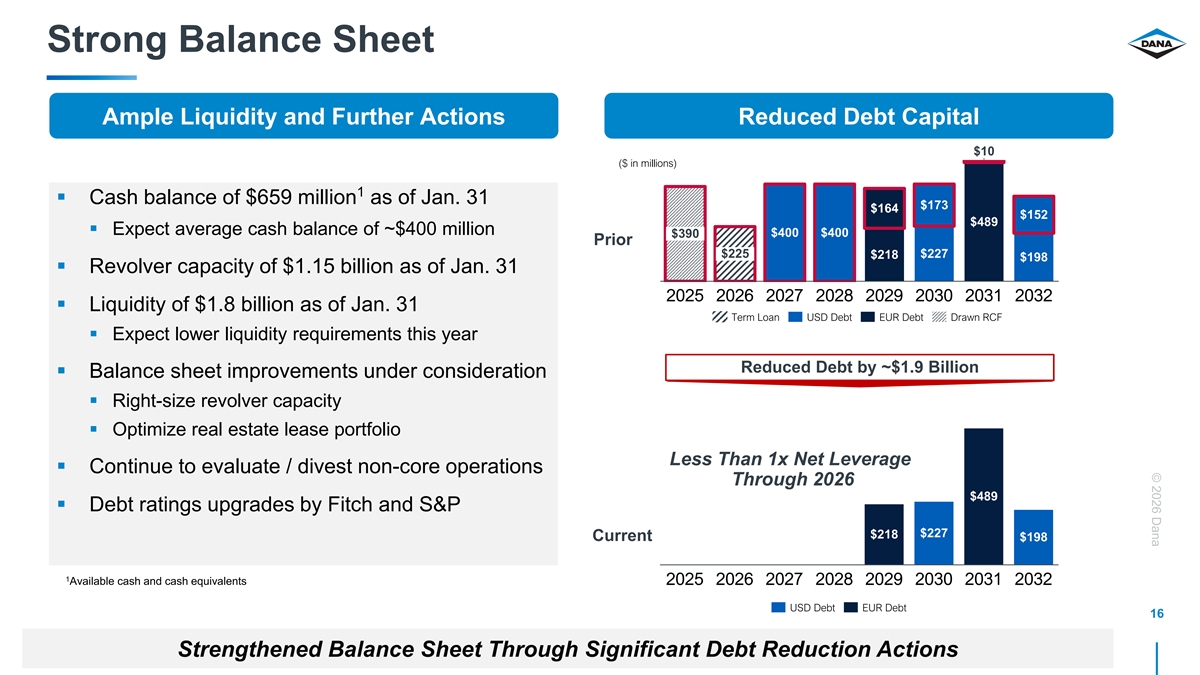

© 2026 Dana Strong Balance Sheet Ample Liquidity and Further

Actions Reduced Debt Capital $10 ($ in millions) 1 § Cash balance of $659 million as of Jan. 31 $173 $164 $152 $489 § Expect average cash balance of ~$400 million $400 $400 $390 Prior $225 $227 $218 $198 § Revolver capacity of $1.15

billion as of Jan. 31 2025 2026 2027 2028 2029 2030 2031 2032 § Liquidity of $1.8 billion as of Jan. 31 Term Loan USD Debt EUR Debt Drawn RCF § Expect lower liquidity requirements this year Reduced Debt by ~$1.9 Billion § Balance

sheet improvements under consideration § Right-size revolver capacity § Optimize real estate lease portfolio Less Than 1x Net Leverage § Continue to evaluate / divest non-core operations Through 2026 $489 § Debt ratings upgrades

by Fitch and S&P $227 $218 Current $198 1 2025 2026 2027 2028 2029 2030 2031 2032 Available cash and cash equivalents USD Debt EUR Debt 16 Strengthened Balance Sheet Through Significant Debt Reduction Actions Source: Dana

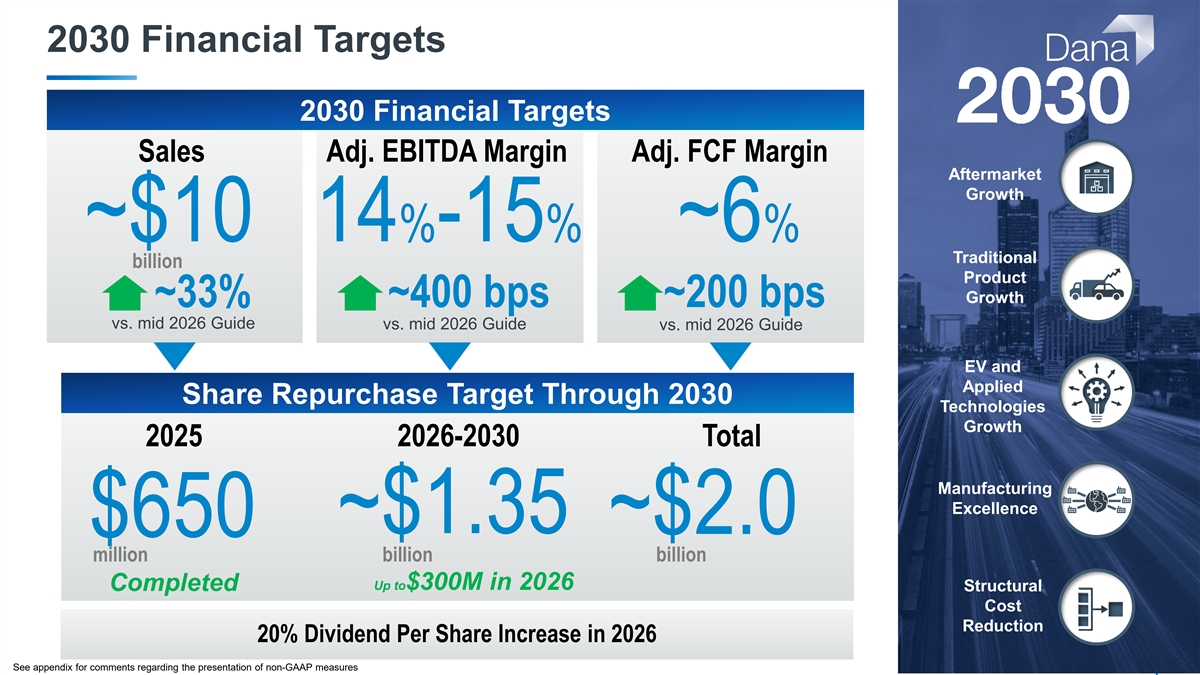

© 2026 Dana 2030 Financial Targets 2030 Financial Targets Sales

Adj. EBITDA Margin Adj. FCF Margin Aftermarket Growth ~$10 14%-15% ~6% Traditional billion Product Growth ~33% ~400 bps ~200 bps vs. mid 2026 Guide vs. mid 2026 Guide vs. mid 2026 Guide EV and Applied Share Repurchase Target Through 2030

Technologies Growth 2025 2026-2030 Total Manufacturing Excellence ~$1.35 ~$2.0 $650 million billion billion Up to$300M in 2026 Completed Structural Cost 17 Reduction 20% Dividend Per Share Increase in 2026 See appendix for comments regarding the

presentation of non-GAAP measures

© 2026 Dana SAVE THE DATE 2026 Capital Markets Day MARCH 25,

2026 9:00 am ET For an invitation to join in-person, please send a request to: InvestorRelations@dana.com NEW YORK CITY 18

© 2026 Dana Appendix 19

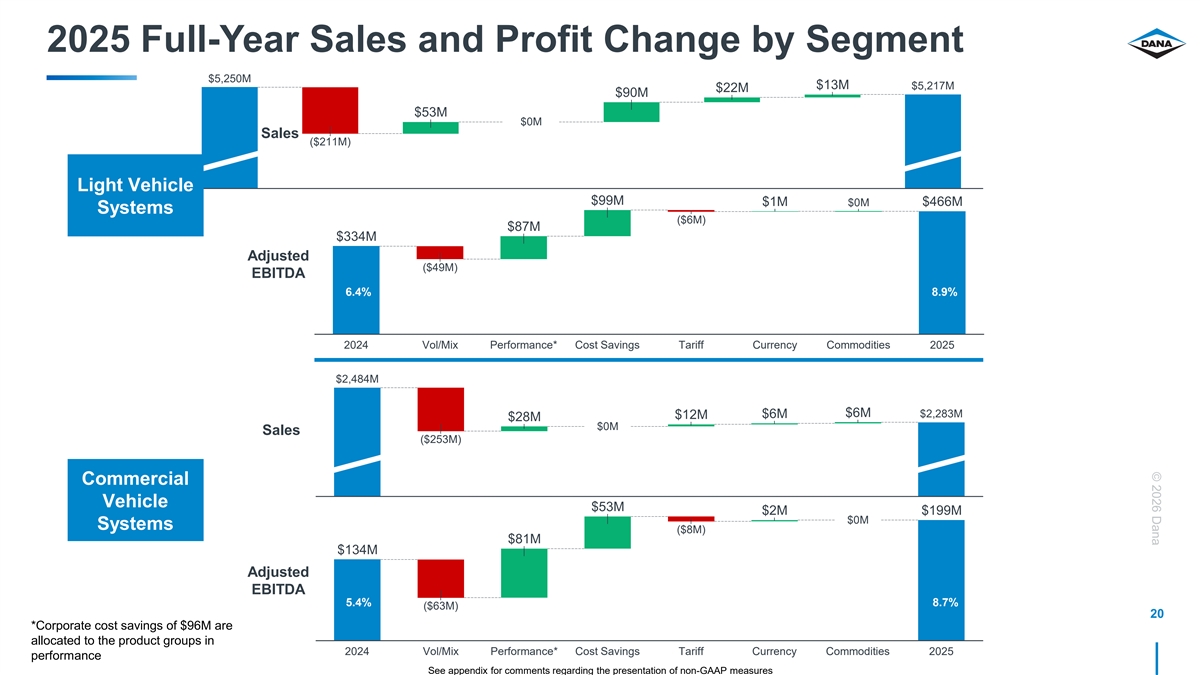

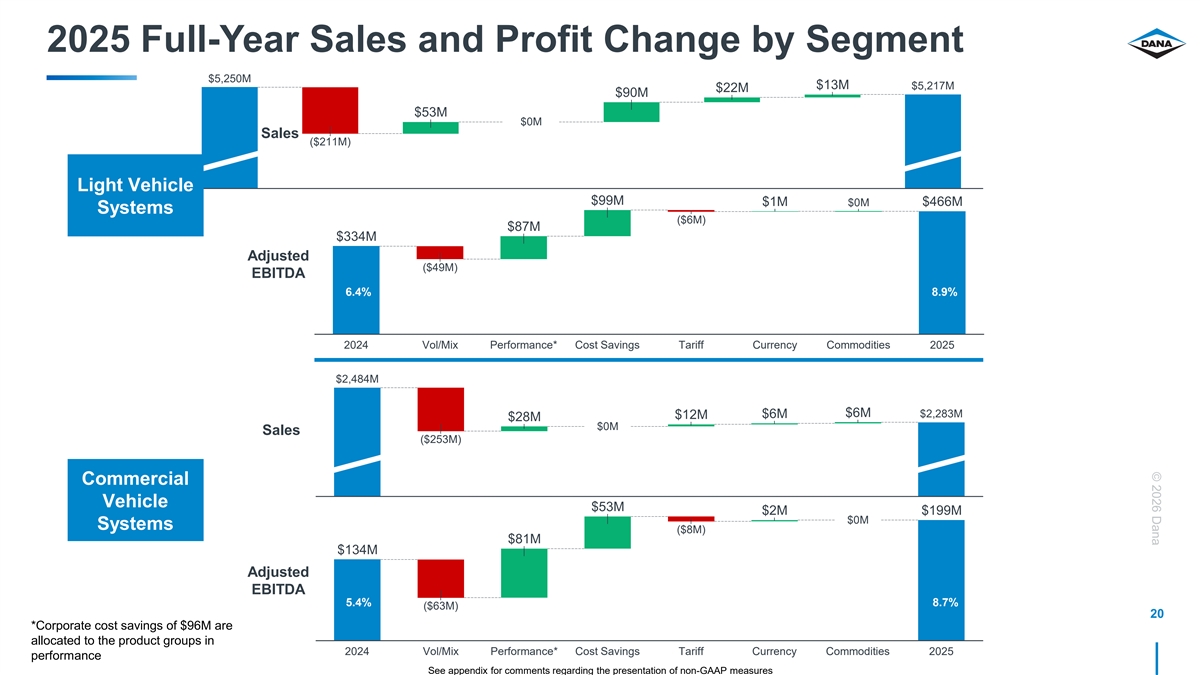

© 2026 Dana 2025 Full-Year Sales and Profit Change by Segment

$5,250M $13M $5,217M $22M $90M $53M $0M Sales ($211M) Light Vehicle $99M $1M $0M $466M Systems ($6M) $87M $334M Adjusted ($49M) EBITDA 6.4% 5.9% 8.9% 2024 Vol/Mix Performance* Cost Savings Tariff Currency Commodities 2025 $2,484M $6M $2,283M $12M

$6M $28M $0M Sales ($253M) Commercial Vehicle $53M $2M $199M $0M Systems 3.2% ($8M) $81M $134M Adjusted EBITDA 5.4% 8.7% ($63M) 20 *Corporate cost savings of $96M are allocated to the product groups in 2024 Vol/Mix Performance* Cost Savings Tariff

Currency Commodities 2025 performance See appendix for comments regarding the presentation of non-GAAP measures

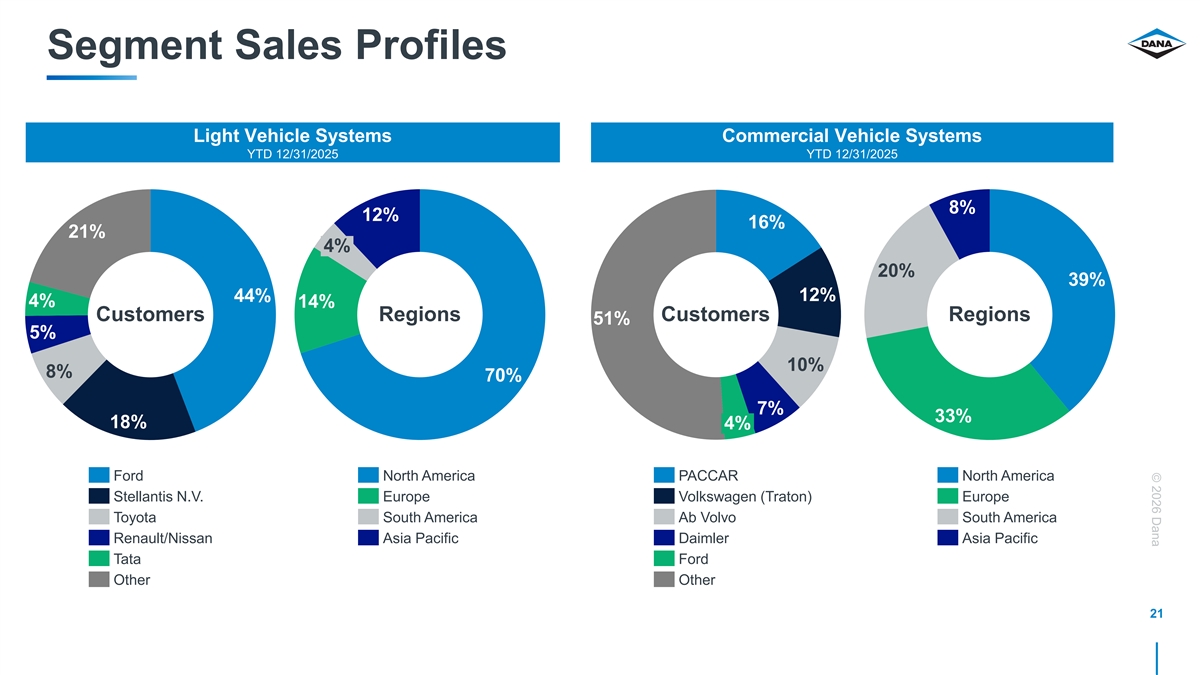

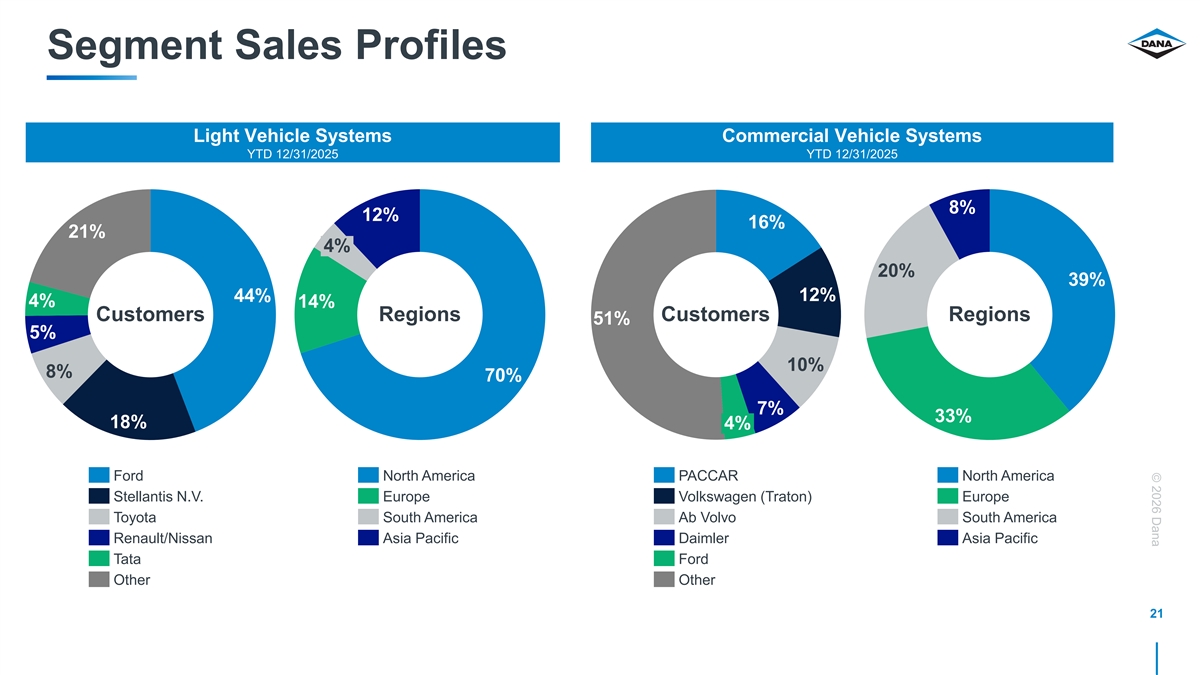

© 2026 Dana Segment Sales Profiles Light Vehicle Systems

Commercial Vehicle Systems YTD 12/31/2025 YTD 12/31/2025 8% 12% 16% 21% 4% 20% 39% 12% 44% 4% 14% Customers Regions Customers Regions 51% 5% 10% 8% 70% 7% 33% 18% 4% Ford North America PACCAR North America Stellantis N.V. Europe Volkswagen (Traton)

Europe Toyota South America Ab Volvo South America Renault/Nissan Asia Pacific Daimler Asia Pacific Tata Ford Other Other 21

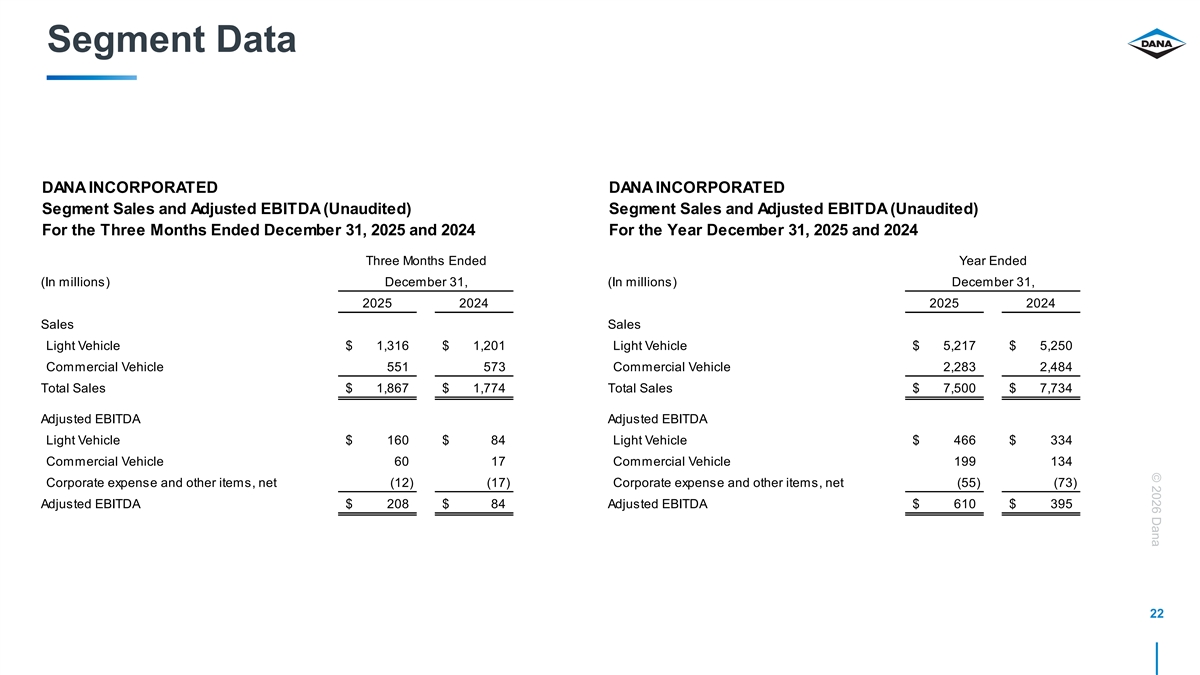

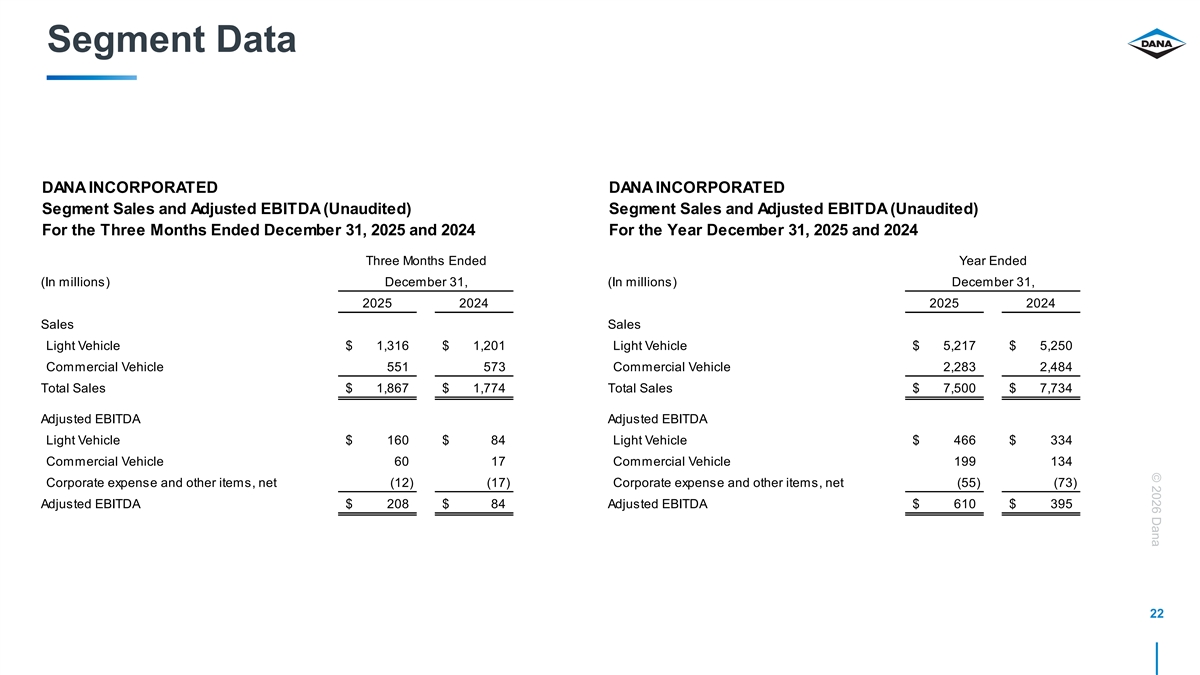

© 2026 Dana Segment Data DANA INCORPORATED DANA INCORPORATED

Segment Sales and Adjusted EBITDA (Unaudited) Segment Sales and Adjusted EBITDA (Unaudited) For the Three Months Ended December 31, 2025 and 2024 For the Year December 31, 2025 and 2024 Three Months Ended Year Ended (In millions) December 31, (In

millions) December 31, 2025 2024 2025 2024 Sales Sales Light Vehicle $ 1,316 $ 1,201 Light Vehicle $ 5,217 $ 5,250 Commercial Vehicle 551 573 Commercial Vehicle 2,283 2,484 Total Sales $ 1,867 $ 1,774 Total Sales $ 7,500 $ 7,734 Adjusted EBITDA

Adjusted EBITDA Light Vehicle $ 160 $ 84 Light Vehicle $ 466 $ 334 Commercial Vehicle 60 17 Commercial Vehicle 199 134 Corporate expense and other items, net (12) ( 17) Corporate expense and other items, net (55) ( 73) Adjusted EBITDA $ 208 $ 84

Adjusted EBITDA $ 610 $ 395 22

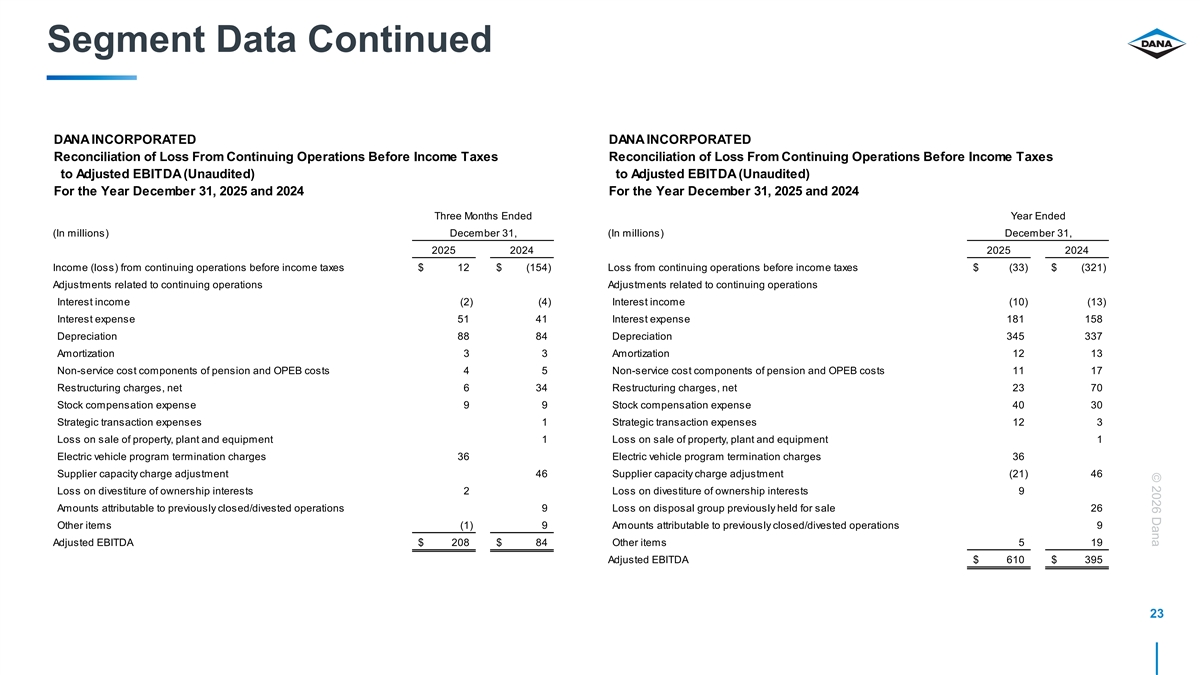

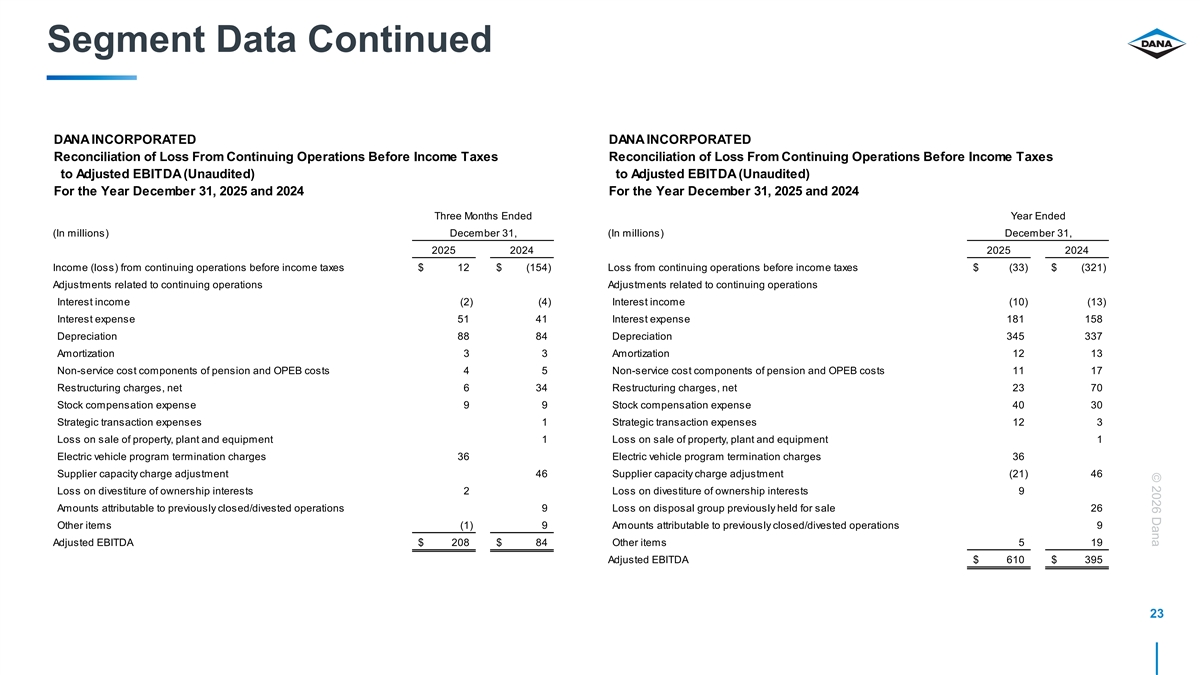

© 2026 Dana Segment Data Continued DANA INCORPORATED DANA

INCORPORATED Reconciliation of Loss From Continuing Operations Before Income Taxes Reconciliation of Loss From Continuing Operations Before Income Taxes to Adjusted EBITDA (Unaudited) to Adjusted EBITDA (Unaudited) For the Year December 31, 2025 and

2024 For the Year December 31, 2025 and 2024 Three Months Ended Year Ended (In millions) December 31, (In millions) December 31, 2025 2024 2025 2024 Income (loss) from continuing operations before income taxes $ 12 $ (154) Loss from continuing

operations before income taxes $ (33) $ (321) Adjustments related to continuing operations Adjustments related to continuing operations Interest income (2) (4) Interest income (10) ( 13) Interest expense 51 41 Interest expense 181 158 Depreciation

88 84 Depreciation 345 337 Amortization 3 3 Amortization 12 13 Non-service cost components of pension and OPEB costs 4 5 Non-service cost components of pension and OPEB costs 11 17 Restructuring charges, net 6 34 Restructuring charges, net 23 70

Stock compensation expense 9 9 Stock compensation expense 40 30 Strategic transaction expenses 1 Strategic transaction expenses 12 3 Loss on sale of property, plant and equipment 1 Loss on sale of property, plant and equipment 1 Electric vehicle

program termination charges 36 Electric vehicle program termination charges 36 Supplier capacity charge adjustment 46 Supplier capacity charge adjustment ( 21) 46 Loss on divestiture of ownership interests 2 Loss on divestiture of ownership

interests 9 Amounts attributable to previously closed/divested operations 9 Loss on disposal group previously held for sale 26 Other items (1) 9 Amounts attributable to previously closed/divested operations 9 Adjusted EBITDA $ 208 $ 84 Other items 5

19 Adjusted EBITDA $ 610 $ 395 23

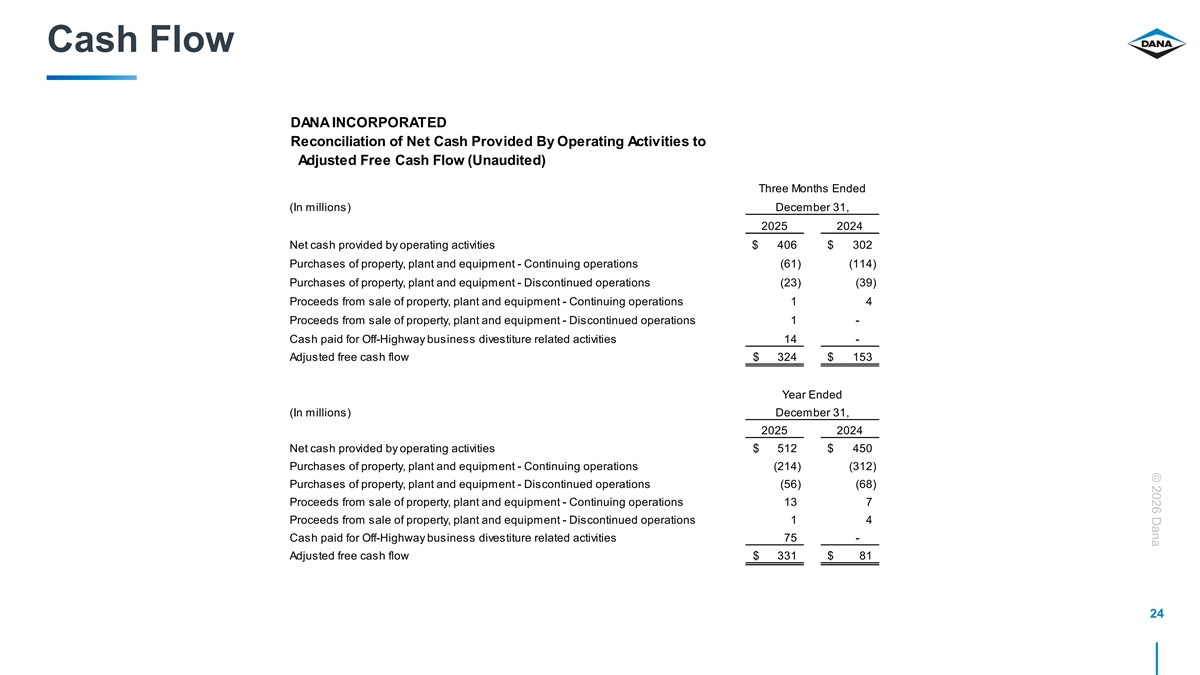

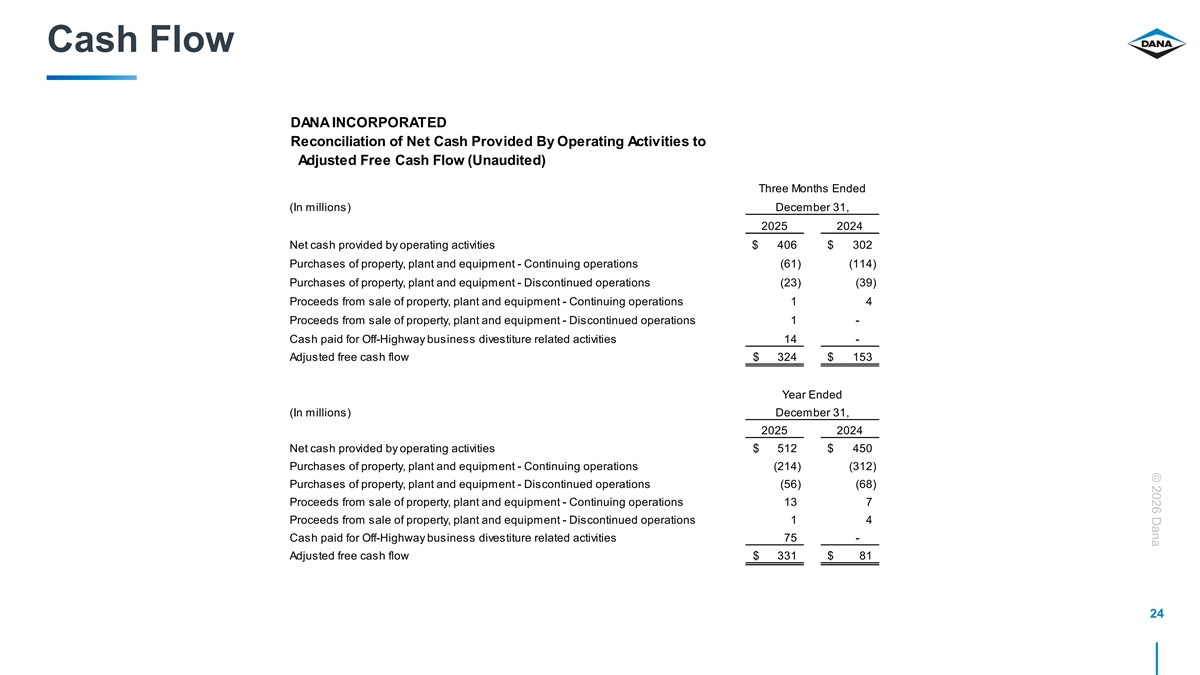

© 2026 Dana Cash Flow DANA INCORPORATED Reconciliation of Net

Cash Provided By Operating Activities to Adjusted Free Cash Flow (Unaudited) Three Months Ended (In millions) December 31, 2025 2024 Net cash provided by operating activities $ 406 $ 302 Purchases of property, plant and equipment - Continuing

operations ( 61) (114) Purchases of property, plant and equipment - Discontinued operations ( 23) (39) Proceeds from sale of property, plant and equipment - Continuing operations 1 4 Proceeds from sale of property, plant and equipment - Discontinued

operations 1 - Cash paid for Off-Highway business divestiture related activities 14 - Adjusted free cash flow $ 324 $ 153 Year Ended (In millions) December 31, 2025 2024 Net cash provided by operating activities $ 512 $ 450 Purchases of property,

plant and equipment - Continuing operations (214) (312) Purchases of property, plant and equipment - Discontinued operations ( 56) (68) Proceeds from sale of property, plant and equipment - Continuing operations 13 7 Proceeds from sale of property,

plant and equipment - Discontinued operations 1 4 Cash paid for Off-Highway business divestiture related activities 75 - Adjusted free cash flow $ 331 $ 81 24

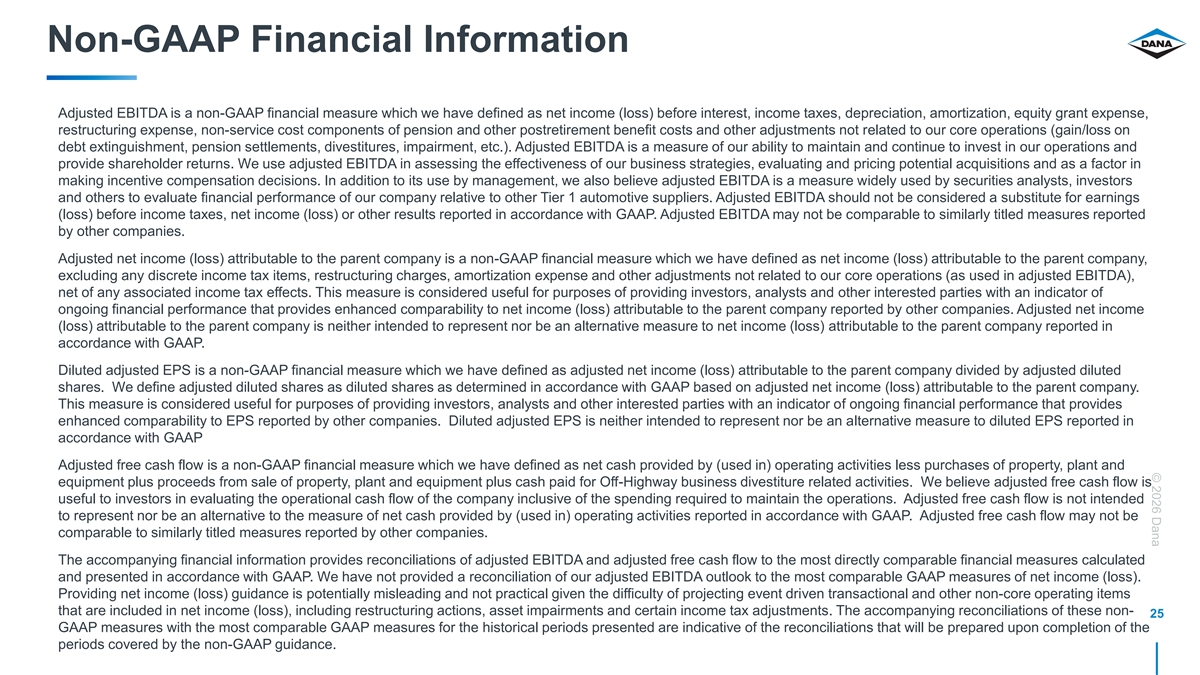

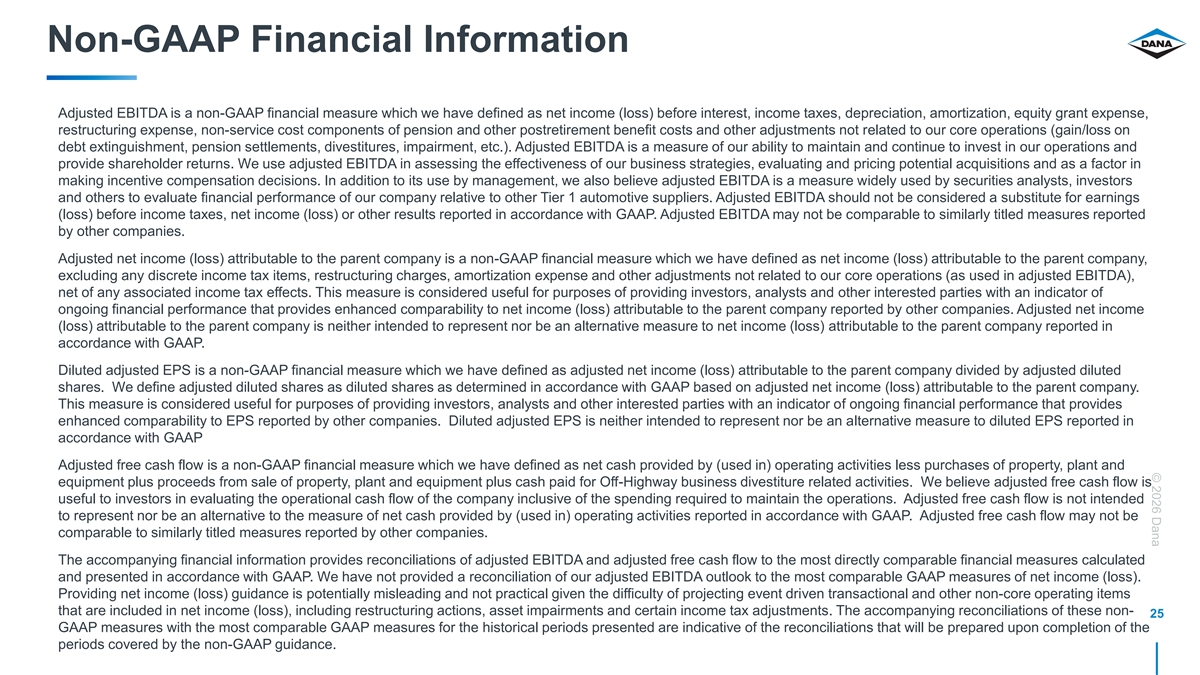

© 2026 Dana Non-GAAP Financial Information Adjusted EBITDA is a

non-GAAP financial measure which we have defined as net income (loss) before interest, income taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other postretirement benefit

costs and other adjustments not related to our core operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations

and provide shareholder returns. We use adjusted EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by

management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be

considered a substitute for earnings (loss) before income taxes, net income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Adjusted net income

(loss) attributable to the parent company is a non-GAAP financial measure which we have defined as net income (loss) attributable to the parent company, excluding any discrete income tax items, restructuring charges, amortization expense and other

adjustments not related to our core operations (as used in adjusted EBITDA), net of any associated income tax effects. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an indicator of

ongoing financial performance that provides enhanced comparability to net income (loss) attributable to the parent company reported by other companies. Adjusted net income (loss) attributable to the parent company is neither intended to represent

nor be an alternative measure to net income (loss) attributable to the parent company reported in accordance with GAAP. Diluted adjusted EPS is a non-GAAP financial measure which we have defined as adjusted net income (loss) attributable to the

parent company divided by adjusted diluted shares. We define adjusted diluted shares as diluted shares as determined in accordance with GAAP based on adjusted net income (loss) attributable to the parent company. This measure is considered useful

for purposes of providing investors, analysts and other interested parties with an indicator of ongoing financial performance that provides enhanced comparability to EPS reported by other companies. Diluted adjusted EPS is neither intended to

represent nor be an alternative measure to diluted EPS reported in accordance with GAAP Adjusted free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in) operating activities less purchases of property,

plant and equipment plus proceeds from sale of property, plant and equipment plus cash paid for Off-Highway business divestiture related activities. We believe adjusted free cash flow is useful to investors in evaluating the operational cash flow of

the company inclusive of the spending required to maintain the operations. Adjusted free cash flow is not intended to represent nor be an alternative to the measure of net cash provided by (used in) operating activities reported in accordance with

GAAP. Adjusted free cash flow may not be comparable to similarly titled measures reported by other companies. The accompanying financial information provides reconciliations of adjusted EBITDA and adjusted free cash flow to the most directly

comparable financial measures calculated and presented in accordance with GAAP. We have not provided a reconciliation of our adjusted EBITDA outlook to the most comparable GAAP measures of net income (loss). Providing net income (loss) guidance is

potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items that are included in net income (loss), including restructuring actions, asset impairments and certain income

tax adjustments. The accompanying reconciliations of these non- 25 GAAP measures with the most comparable GAAP measures for the historical periods presented are indicative of the reconciliations that will be prepared upon completion of the periods

covered by the non-GAAP guidance.