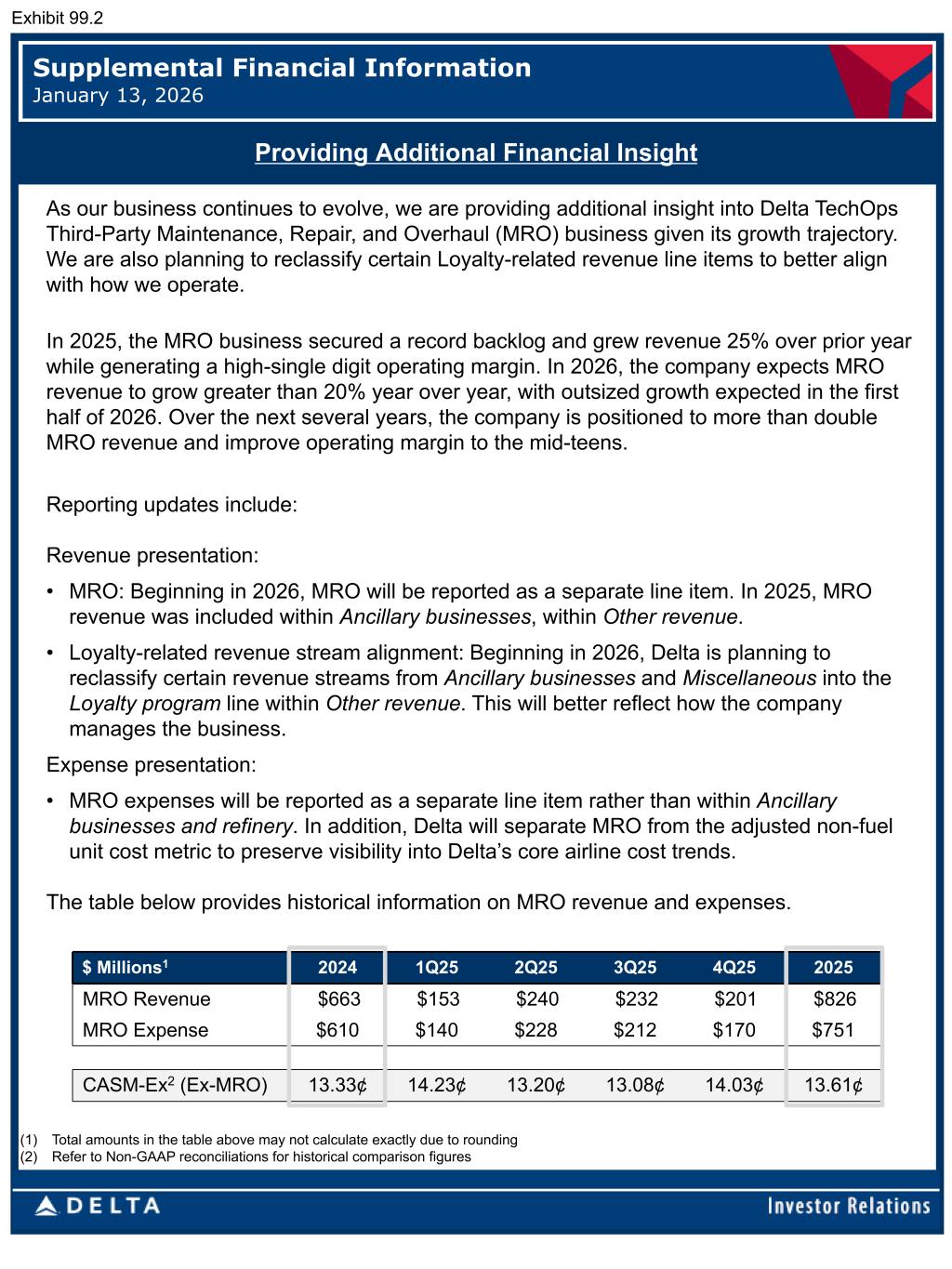

$ Millions1 2024 1Q25 2Q25 3Q25 4Q25 2025 MRO Revenue $663 $153 $240 $232 $201 $826 MRO Expense $610 $140 $228 $212 $170 $751 CASM-Ex2 (Ex-MRO) 13.33¢ 14.23¢ 13.20¢ 13.08¢ 14.03¢ 13.61¢ Providing Additional Financial Insight Supplemental Financial Information January 13, 2026 (1) Total amounts in the table above may not calculate exactly due to rounding (2) Refer to Non-GAAP reconciliations for historical comparison figures As our business continues to evolve, we are providing additional insight into Delta TechOps Third-Party Maintenance, Repair, and Overhaul (MRO) business given its growth trajectory. We are also planning to reclassify certain Loyalty-related revenue line items to better align with how we operate. In 2025, the MRO business secured a record backlog and grew revenue 25% over prior year while generating a high-single digit operating margin. In 2026, the company expects MRO revenue to grow greater than 20% year over year, with outsized growth expected in the first half of 2026. Over the next several years, the company is positioned to more than double MRO revenue and improve operating margin to the mid-teens. Reporting updates include: Revenue presentation: • MRO: Beginning in 2026, MRO will be reported as a separate line item. In 2025, MRO revenue was included within Ancillary businesses, within Other revenue. • Loyalty-related revenue stream alignment: Beginning in 2026, Delta is planning to reclassify certain revenue streams from Ancillary businesses and Miscellaneous into the Loyalty program line within Other revenue. This will better reflect how the company manages the business. Expense presentation: • MRO expenses will be reported as a separate line item rather than within Ancillary businesses and refinery. In addition, Delta will separate MRO from the adjusted non-fuel unit cost metric to preserve visibility into Delta’s core airline cost trends. The table below provides historical information on MRO revenue and expenses. .2

Forward Looking Statements Statements made in this presentation that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments or strategies for the future, should be considered “forward- looking statements” under the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements are not guarantees or promised outcomes and should not be construed as such. All forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments and strategies reflected in or suggested by the forward-looking statements. These risks and uncertainties include, but are not limited to, the possible effects of serious accidents involving our aircraft or aircraft of our airline partners; breaches or lapses in the security of technology systems we use and rely on, which could compromise the data stored within them, as well as failure to comply with evolving global privacy and security regulatory obligations or adequately address increasing customer focus on privacy issues and data security; disruptions in our information technology infrastructure; our dependence on technology in our operations; increases in the cost of aircraft fuel; extended disruptions in the supply of aircraft fuel, including from Monroe Energy, LLC (“Monroe”), a wholly-owned subsidiary of Delta that operates the Trainer refinery; failure to receive the expected results or returns from our commercial relationships with airlines in other parts of the world and the investments we have in certain of those airlines; the effects of a significant disruption in the operations or performance of third parties on which we rely; failure to comply with the financial and other covenants in our financing agreements; labor-related disruptions; the effects on our business of seasonality and other factors beyond our control, such as changes in value in our equity investments, severe weather conditions, natural disasters or other environmental events, including from the impact of climate change; failure or inability of insurance to cover a significant liability at Monroe’s refinery; failure to comply with existing and future environmental regulations to which Monroe’s refinery operations are subject, including costs related to compliance with renewable fuel standard regulations; significant damage to our reputation and brand, including from exposure to significant adverse publicity or inability to achieve certain sustainability goals; our ability to retain senior management and other key employees, and to maintain our company culture; disease outbreaks or other public health threats, and measures implemented to combat them; the effects of terrorist attacks, geopolitical conflict or security events; competitive conditions in the airline industry; extended interruptions or disruptions in service at major airports at which we operate or significant problems associated with types of aircraft or engines we operate; the effects of extensive regulatory and legal compliance requirements we are subject to; the impact of environmental regulation, including but not limited to regulation of hazardous substances, increased regulation to reduce emissions and other risks associated with climate change, and the cost of compliance with more stringent environmental regulations; and unfavorable economic or political conditions in the markets in which we operate or volatility in currency exchange rates. Additional information concerning risks and uncertainties that could cause differences between actual results and forward-looking statements is contained in our Securities and Exchange Commission (SEC) filings, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and other filings filed with the SEC from time to time. Caution should be taken not to place undue reliance on our forward-looking statements, which represent our views only as of the date of this presentation, and which we undertake no obligation to update except to the extent required by law.

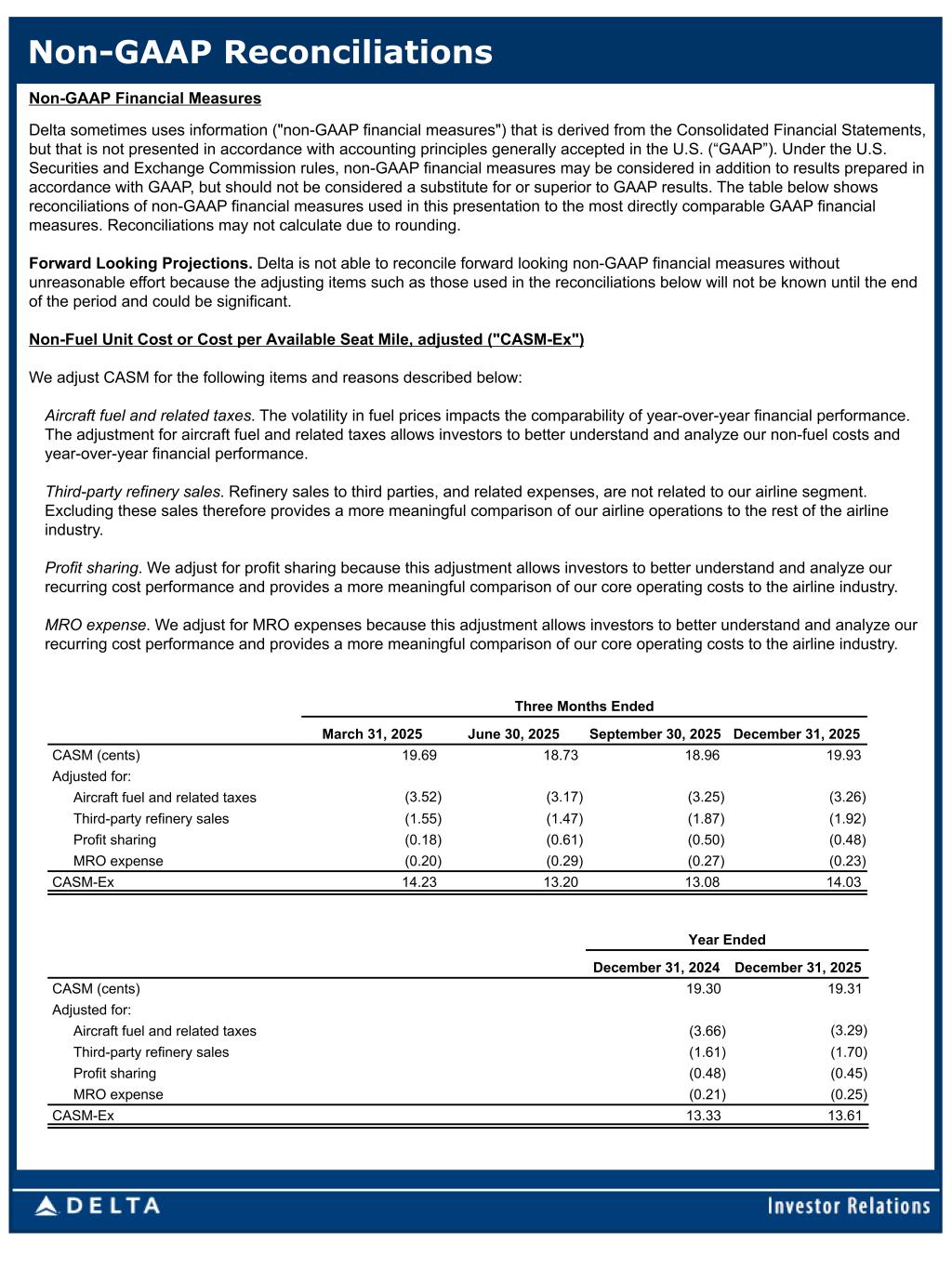

Non-GAAP Reconciliations Non-GAAP Financial Measures Delta sometimes uses information ("non-GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The table below shows reconciliations of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures. Reconciliations may not calculate due to rounding. Forward Looking Projections. Delta is not able to reconcile forward looking non-GAAP financial measures without unreasonable effort because the adjusting items such as those used in the reconciliations below will not be known until the end of the period and could be significant. Non-Fuel Unit Cost or Cost per Available Seat Mile, adjusted ("CASM-Ex") We adjust CASM for the following items and reasons described below: Aircraft fuel and related taxes. The volatility in fuel prices impacts the comparability of year-over-year financial performance. The adjustment for aircraft fuel and related taxes allows investors to better understand and analyze our non-fuel costs and year-over-year financial performance. Third-party refinery sales. Refinery sales to third parties, and related expenses, are not related to our airline segment. Excluding these sales therefore provides a more meaningful comparison of our airline operations to the rest of the airline industry. Profit sharing. We adjust for profit sharing because this adjustment allows investors to better understand and analyze our recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry. MRO expense. We adjust for MRO expenses because this adjustment allows investors to better understand and analyze our recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry. Three Months Ended March 31, 2025 June 30, 2025 September 30, 2025 December 31, 2025 CASM (cents) 19.69 18.73 18.96 19.93 Adjusted for: Aircraft fuel and related taxes (3.52) (3.17) (3.25) (3.26) Third-party refinery sales (1.55) (1.47) (1.87) (1.92) Profit sharing (0.18) (0.61) (0.50) (0.48) MRO expense (0.20) (0.29) (0.27) (0.23) CASM-Ex 14.23 13.20 13.08 14.03 Year Ended December 31, 2024 December 31, 2025 CASM (cents) 19.30 19.31 Adjusted for: Aircraft fuel and related taxes (3.66) (3.29) Third-party refinery sales (1.61) (1.70) Profit sharing (0.48) (0.45) MRO expense (0.21) (0.25) CASM-Ex 13.33 13.61