UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

☑ Filed by the Registrant |

||||

|

☐ Filed by a party other than the Registrant |

|

Check the appropriate box: |

|

|

☐ Preliminary Proxy Statement |

|

|

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☑ Definitive Proxy Statement |

|

|

☐ Definitive Additional Materials |

|

|

☐ Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

|

|

☑ No fee required |

|

|

☐ Fee paid previously with preliminary materials |

|

|

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2026

PROXY STATEMENT

Special Meeting of Shareholders

January 28, 2026, at 10:00 a.m.

Eastern Standard Time

www.virtualshareholdermeeting.com/OMC2026SM

NOTICE OF SPECIAL MEETING OF

SHAREHOLDERS

|

|

||||

|

|

|

|

|

Subject: 1. Approve the Omnicom 2026 Incentive Award Plan. The Board of Directors unanimously recommends that you vote: ■ FOR the approval of the Omnicom 2026 Incentive Award Plan. A Special Meeting of Shareholders will be held on January 28, 2026 in a virtual meeting format only, via live webcast, and there will not be a physical meeting location. You will be able to attend the Special Meeting of Shareholders online and vote your shares and submit questions electronically at the meeting. Shareholders will also transact any other business that is properly presented at the meeting. At this time, we know of no other matters that will be presented. This proxy statement is being made available to the holders of record and beneficial owners of shares of our common stock as of the close of business on the December 17, 2025 record date. Please sign and return your proxy card or vote by telephone or Internet (instructions are on your proxy card or in the proxy materials), so that your shares will be represented at the Special Meeting of Shareholders, whether or not you plan to attend. You may attend the Special Meeting of Shareholders online by visiting www.virtualshareholdermeeting.com/OMC2026SM and entering the 16-digit control number included on your proxy card or voting instruction form that accompanied your proxy materials. Additional information about the meeting is included below in the Proxy Statement in the section entitled “Information About Voting and the Meeting.” |

Meeting Date:

Time:

Online Only: www.virtualshareholdermeeting.com/OMC2026SM

Record Date: December 17, 2025 |

|

|

Louis F. Januzzi New York, New York |

PROXY STATEMENT

|

|

Dear Shareholders,

On behalf of the Board of Directors (the “Board”) of Omnicom Group Inc. (the “Company,” “Omnicom,” “we,” “us” or “our”) we are pleased to invite Omnicom shareholders as of the close of business on December 17, 2025, the record date, to virtually attend a special meeting on Wednesday, January 28, 2026, at 10:00 a.m. Eastern Standard Time (the “Special Meeting”), via live webcast at www.virtualshareholdermeeting.com/OMC2026SM.

At the Special Meeting, Omnicom shareholders will be asked to vote on a proposal to approve the Omnicom 2026 Incentive Award Plan (the “Plan”). In preparing for the acquisition of The Interpublic Group of Companies, Inc. (“IPG”), which closed on November 26, 2025, the Board carefully evaluated the equity needs of the combined company. We determined that adopting the new Plan, including an expanded share reserve relative to our existing equity program, is both necessary and appropriate to maintain sufficient shares to support retention and incentivization of our enlarged workforce for the combined go-forward company. The Plan also supports the broader objectives of our compensation program, equity usage and talent strategy by aligning the incentives of Omnicom’s employees, directors and consultants with those of our shareholders and with company performance.

Your vote is very important. To ensure your representation at the Special Meeting, please complete and return the applicable enclosed proxy card or submit your proxy by phone or the Internet. Please vote promptly, whether or not you expect to virtually attend the Special Meeting. Submitting a proxy now will not prevent you from being able to vote at the Special Meeting.

|

Sincerely,

|

The proxy statement is dated December 22, 2025 and is being made available to the holders of record and beneficial owners of shares of our common stock as of the close of business on the December 17, 2025 record date. Omnicom’s address is 280 Park Avenue, New York, New York 10017.

|

2 |

||

|

3 |

||

|

5 |

||

|

|

||

|

|

|

|

|

5 |

||

|

8 |

||

|

16 |

||

|

16 |

||

|

16 |

||

|

18 |

||

|

32 |

||

|

33 |

||

|

34 |

||

|

35 |

||

|

35 |

||

|

Potential Payments upon Termination of Employment or Change in Control |

35 |

|

|

39 |

||

|

40 |

||

|

43 |

||

|

Security Ownership of Certain Beneficial Owners and Management |

43 |

|

|

45 |

|

|

45 |

|

|

45 |

|

|

Quorum; Required Vote; Effect of Abstentions and Broker Non-Votes |

45 |

|

45 |

|

|

46 |

|

|

46 |

|

|

46 |

|

|

46 |

|

|

47 |

|

|

47 |

|

|

47 |

|

|

Shareholder Proposals and Director Nominations for the 2026 Annual Meeting of Shareholders |

47 |

|

49 |

|

|

66 |

|

PROPOSAL 1 — APPROVAL OF THE |

|

|

Overview

The information provided herein is intended to assist our shareholders in deciding how to cast their votes on the Plan. We adopted the Plan on December 9, 2025, subject to shareholder approval. Approval of the Plan requires the affirmative vote of the majority of the shares voting on the Plan at the Special Meeting.

Equity-based awards are a fundamental component of our compensation programs for a broad population of Omnicom’s employees, directors and consultants. In light of our acquisition of IPG, the Board has determined that the adoption of the Plan, including an expanded share reserve as compared to our existing equity compensation plans, is necessary and appropriate in order to have an adequate number of shares available for grant to the expanded workforce of the combined company following the acquisition. Upon approval of the new Plan, no further awards will be made under the current Omnicom or IPG equity plans.

The Plan will allow Omnicom to continue to align compensation with shareholder interests, tie compensation to company performance, and create long-term participation in Omnicom’s future. Moreover, the Plan provides the Board with tools to motivate, attract and retain excellent personnel, on whom Omnicom’s success depends.

The use of equity awards as compensation allows Omnicom to conserve cash resources for other important purposes. Additionally, our share repurchases offset the potential dilutive impact of shares issued under the Plan.

The Plan contains provisions we believe are consistent with best practices in equity compensation and which we believe further protect our shareholders’ interests, including the following:

■ The Plan prohibits any alteration or amendment that would increase the number of shares of common stock available under the Plan without shareholder approval, other than in the context of an equitable adjustment.

■ Options and stock appreciation rights have a term of no greater than ten years and may not be granted with an exercise price or base price that is less than the fair market value of our common stock on the date of grant.

■ The Plan does not have a single-trigger accelerated vesting provision for change in control where the award is assumed or an equivalent award is substituted by a successor entity.

■ The Plan provides for minimum vesting periods of at least one year on all awards granted under the Plan, with limited exceptions as described elsewhere in this proposal.

■ Underwater awards may not be repriced, replaced, cashed out or re-granted through cancellation or modification without shareholder approval if the effect would be to reduce the exercise price for the shares under the award.

■ Shares withheld from awards under the Plan to satisfy the exercise price or tax withholding amounts due upon exercise of an option or stock appreciation right will not be recycled or added back to the share limit authorized under the Plan.

■ Dividends and dividend equivalents may not be paid on awards subject to vesting conditions unless and until such conditions are met.

■ The Plan includes a non-employee director compensation limit that generally restricts the cash and stock-based compensation granted to any non-employee director in any given year.

|

www.omnicomgroup.com |

5 |

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

■ The Plan does not contain an “evergreen” feature pursuant to which the shares authorized for issuance can be automatically replenished.

■ The Plan does not provide for automatic grants to any individual.

■ The Plan does not provide for any tax gross-ups.

If the Plan is approved, it will be the sole Omnicom equity incentive plan under which equity-based incentive awards may be granted following approval. Accordingly, upon approval, the Plan will replace the Omnicom Group Inc. 2021 Incentive Award Plan (the “2021 Plan” and, together with all prior Omnicom equity compensation plans and The Interpublic Group of Companies, Inc. Amended and Restated 2019 Performance Incentive Plan, collectively, the “Prior Plans”) and no further awards will be granted thereunder. Outstanding awards under the 2021 Plan will continue to be governed by the terms of the 2021 Plan. If the Plan is not approved by shareholders, the 2021 Plan will continue in effect, and we will continue to make grants under the 2021 Plan until all shares available thereunder have been issued or the 2021 Plan expires.

The Plan authorizes the issuance of 27,390,000 shares, less one share for each share subject to an award granted under a Prior Plan after November 26, 2025. In addition, any shares of common stock covered by an award that was granted under a Prior Plan or that is granted under the Plan and which are forfeited (including a repurchase of an unvested award upon a participant’s termination of employment at a price equal to the par value of the common stock subject to the award or the price paid by a participant (or lower price), as adjusted for corporate events), cancelled, or is settled for cash or expire, in each case, after November 26, 2025, shall be added, or added back, as applicable, to the shares of common stock authorized for issuance under the Plan and again be available. Furthermore, shares tendered for payment of or withheld after November 26, 2025 in satisfaction of the tax withholding amounts due upon vesting or settlement of any full-value award (i.e., an award which is not an option or stock appreciation right) that is granted under the Plan or a Prior Plan will be added, or added back, as applicable, to the shares of common stock authorized for issuance under the Plan and again be available for awards under the Plan. For additional information about the shares that may be added to the shares of common stock authorized for issuance under the Plan, see the discussion below under the heading “— Limitation on Awards and Shares Available.”

If this proposal is not approved, the Plan will not become effective, the 2021 Plan will remain in effect, and we will continue to grant awards thereunder until the current share reserve under the 2021 Plan is exhausted or the 2021 Plan expires. If the Plan is approved, we intend to file with the Securities and Exchange Commission a Registration Statement on Form S-8 covering the shares of our common stock issuable under the Plan.

BACKGROUND FOR THE DETERMINATION OF ADDITIONAL SHARES UNDER THE PLAN

Share Usage

The following table sets forth information regarding stock-settled, time-vested equity awards granted, and performance-based equity awards earned, under the 2021 Plan over each of the last three fiscal years.

|

|

2024 |

2023 |

2022 |

Three-Year |

|

Stock Options/SARs Granted |

0 |

0 |

853,875 |

|

|

Stock-Settled, Time-Vested Restricted Stock/Restricted Stock Units Granted |

1,459,525 |

1,010,575 |

1,147,496 |

|

|

Stock-Settled Performance Units Earned* |

165,911 |

186,197 |

181,782 |

|

|

Shares of Common Stock Outstanding |

196,400,000 |

199,400,000 |

205,600,000 |

|

|

Share Usage Rate |

0.83% |

0.60% |

1.06% |

0.83% |

* With respect to performance units in the table above, we calculate the share usage rate based on the applicable number of shares earned each year. For reference, the performance units granted during the foregoing three-year period (calculated at maximum levels of performance) were as follows: 177,059 shares in 2024, 178,998 shares in 2023 and 218,127 shares in 2022.

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

Overhang as of November 26, 2025 Following Completion of IPG Merger

The following table sets forth certain information as of November 26, 2025, with respect to the Company’s equity compensation plans (and no awards have been granted outside of any shareholder-approved plan). Amounts shown do not include awards originally granted under an IPG equity plan.

|

Stock Options/SARs Outstanding |

8,847,208 |

|

Weighted-Average Exercise Price of Outstanding Stock Options/SARs |

$75.81 |

|

Weighted-Average Remaining Term of Outstanding Stock Options/SARS |

6.34 years |

|

Total Unvested Stock-Settled Full-Value Awards Outstanding |

4,101,056 |

|

Proposed Share Reserve under the Plan(1) |

27,390,000 |

|

Shares of Common Stock Outstanding as of November 26, 2025(2) |

316,768,248 |

(1) The proposed share reserve will be reduced by one share for each share subject to any award granted under the Prior Plans after November 26, 2025. As of November 26, 2025, there were 1,062,087 total shares available for future grant under the 2021 Plan. Upon shareholder approval of the Plan, no further awards will be granted under the 2021 Plan or any Prior Plan.

(2) The number of shares of common stock outstanding is not expected to materially change from the date shown here until the Record Date.

Dilution and Expected Duration

The Board recognizes the impact of dilution on our shareholders and has evaluated the proposed share reserve under the Plan carefully in the context of our need to attract and retain talented employees, executives and directors and to motivate and reward key personnel for achieving our business objectives and strategic priorities.

The total fully-diluted overhang as of November 26, 2025, inclusive of the Plan reserve, would be 11.3%. In this context, fully-diluted overhang is calculated as the sum of grants outstanding and shares available for future awards (numerator) divided by the sum of the numerator and basic shares of common stock outstanding, with all data effective as of November 26, 2025. The Board believes that the proposed share reserve represents a reasonable amount of potential equity dilution to accommodate our long-term strategic priorities. In particular, in light of our acquisition of IPG, the Board has determined that the proposed share reserve is necessary and appropriate in order to have an adequate number of shares available for grant to the expanded workforce of the combined company following the transaction.

We expect that the proposed share reserve under the Plan will provide an adequate number of shares of common stock to fund our equity compensation needs for at least five years. Expectations regarding future share usage could be impacted by a number of factors such as award type mix, hiring and promotion activity, particularly at the executive level, the rate at which shares are returned to the Plan’s reserve under permitted addbacks, the future performance of our stock price, and other factors. While we believe that the assumptions we used are reasonable, future share usage may differ from current expectations.

The Compensation Committee retained FW Cook, its independent compensation consultant, to assist in the design of the Plan and the determination of the number of shares of common stock available for issuance under the Plan. FW Cook reviewed, among other things, the terms of the Plan, potential dilution, potential burn rate and our historical grant practices. Based on its analysis, FW Cook expressed its support for the Plan, including the number of shares of common stock available for issuance under the Plan.

As of November 26, 2025, the closing price of our common stock was $71.50.

Shareholder Approval Requirement

Shareholder approval of the Plan is necessary in order for us to meet the shareholder approval requirements of the New York Stock Exchange (“NYSE”).

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

Summary of Terms of the Plan

The following summarizes the terms of the Plan and does not purport to be a complete description. The following summary is qualified in its entirety by reference to the full text of the Plan, which is attached hereto as Annex A.

PURPOSE

The purpose of the Plan is to promote the success and enhance the value of Omnicom by linking the personal interest of participants to those of Omnicom shareholders and by providing participants with an incentive for outstanding performance to generate superior returns to Omnicom shareholders. The Plan is further intended to provide flexibility to Omnicom in its ability to motivate, attract, and retain the services of individuals upon whose judgment, interest, and special effort the successful operation of Omnicom is largely dependent.

ADMINISTRATION

The Plan is administered by a committee, which may be the Board or a committee appointed by the Board such as our Compensation Committee (collectively, the “Committee”). Until otherwise determined by the Board, the Committee consists solely of two or more Board members who are Non-Employee Directors (as defined in Rule 16b-3(b)(3) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) and “independent directors” under the rules of the NYSE. The Board or the Committee may delegate to a committee of one or more Board members or one or more Omnicom officers the authority to grant or amend awards under the Plan to participants other than (i) senior Omnicom executives who are subject to Section 16 of the Exchange Act, and (ii) Omnicom officers or directors to whom the authority to grant or amend awards under the Plan has been delegated.

The Committee has the exclusive authority to administer the Plan, including the power to (i) determine participants under the Plan, (ii) determine the types of awards granted to participants under the Plan, the number of such awards, and the number of shares of common stock of Omnicom (the “common stock”) subject to such awards, (iii) determine and interpret the terms and conditions of any awards under the Plan, including the vesting schedule, exercise price and whether to offer cash in exchange for an award, and (iv) adopt rules for the administration, interpretation and application of the Plan.

ELIGIBILITY

Persons eligible to participate in the Plan include all employees, directors, consultants and non-employee directors of Omnicom and its subsidiaries, as determined by the Committee, though only employees will be eligible to be granted incentive stock options (as defined under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”)). As of the record date, there were approximately 116,900 employees (including five executive officers) and 12 non-employee directors who were eligible to participate in the Plan pursuant to the terms of the Plan. The foregoing number of employees has not been reduced to reflect potential dispositions of businesses by Omnicom. Historically, the Company has generally only granted awards under the Prior Plans to full-time employees and non-employee directors.

LIMITATION ON AWARDS AND SHARES AVAILABLE

Subject to the adjustment provisions as described in more detail below, the maximum aggregate number of shares of common stock that may be subject to awards granted under the Plan is 27,390,000 shares of common stock, less one share for each share subject to an award granted under a Prior Plan after November 26, 2025. The number of shares available for issuance may be adjusted for changes in our capitalization and certain corporate transactions, as described below under the heading “Adjustments to Awards.”

The shares of common stock covered by the Plan may be treasury shares, authorized but unissued shares, or shares purchased in the open market. If, after November 26, 2025, an award or portion thereof that was previously granted under the Plan or any Prior Plans is forfeited (including a repurchase of an unvested award upon a participant’s termination of employment at a price equal to the par value of the common stock subject to the award or the price paid by a participant (or lower price), as adjusted for corporate events), cancelled, or expires or is settled for cash or, except with respect to options or stock appreciation rights, is tendered for payment of or withheld in satisfaction of the tax withholding amounts

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

due upon vesting or settlement of the award, any shares of common stock subject to such award or portion thereof will be added, or added back, as applicable, to the number of shares of common stock that may be subject to awards granted under the Plan and may be used again for new grants under the Plan.

Notwithstanding the foregoing, the following shares of common stock are not added or added back to the shares of common stock authorized for grant as described above: (i) shares of common stock tendered by the participant or withheld by Omnicom in payment of the purchase price of an option, (ii) shares of common stock tendered by the participant or withheld by Omnicom to satisfy any tax withholding obligation with respect to a stock option or stock appreciation right, (iii) shares of common stock subject to a stock appreciation right that are not issued in connection with the stock settlement of the stock appreciation right on exercise thereof, and (iv) shares purchased in the market with the proceeds from any exercise of an option.

PROVISIONS OF THE PLAN RELATED TO DIRECTOR COMPENSATION

The Plan provides that the plan administrator may establish compensation for non-employee directors from time to time subject to the Plan’s limitations. The Committee may modify non-employee director compensation from time to time in the exercise of its business judgment, taking into account factors, circumstances and considerations as it deems relevant from time to time, provided that the sum of any cash or other compensation and the grant date fair value of any equity awards granted as compensation for services as a non-employee director during any fiscal year may not exceed $1,000,000 as to any individual non-employee director. The plan administrator may make exceptions to this limit for individual non-employee directors in extraordinary circumstances, as the plan administrator may determine in its discretion, provided that the non-employee director receiving such additional compensation may not participate in the decision to award such compensation or in other contemporaneous compensation decisions involving non-employee directors.

AWARDS

The Plan provides for grants of stock options (both incentive stock options and nonqualified stock options), restricted stock, stock appreciation rights, performance shares, performance stock units, dividend equivalents, stock payments, deferred stock, and restricted stock units. No determination has been made as to the types or amounts of future awards that will be granted to specific individuals pursuant to the Plan.

Stock Options

Stock options, including incentive stock options (as defined under Section 422 of the Code) and nonqualified stock options may be granted pursuant to the Plan. The exercise price of incentive stock options and nonqualified stock options granted pursuant to the Plan will not be less than 100% of the fair market value of the common stock on the date of grant, unless incentive stock options are granted to any individual who owns, as of the date of grant, stock possessing more than ten (10) percent of the total combined voting power of all classes of Omnicom common stock (the “Ten Percent Owner”), whereupon the exercise price of such incentive stock options will not be less than 110% of the fair market value of the common stock on the date of grant. Incentive stock options and nonqualified stock options may be exercised as determined by the Committee, but in no event after (i) the fifth anniversary of the date of grant with respect to incentive stock options granted to a Ten Percent Owner, or (ii) the tenth anniversary of the date of grant with respect to incentive stock options granted to other employees and nonqualified stock options. Nonqualified stock options may be exercised as determined by the Committee. Upon the exercise of a stock option, the exercise price must be paid in full in cash, by tendering or having withheld previously-acquired or then-issuable shares of common stock with a fair market value at the time of exercise equal to the aggregate exercise price of the option or the exercised portion thereof or by tendering other property acceptable to the Committee. A maximum of 27,390,000 shares of common stock may be granted in the form of incentive stock options under the Plan.

Restricted Stock

Restricted stock awards may be granted pursuant to the Plan. A restricted stock award is the grant of shares of common stock at a price determined by the Committee (including zero), that is subject to transfer restrictions and may be subject to substantial risk of forfeiture until specific conditions are met. Conditions may be based on continuing employment or

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

achieving performance goals. During the period of restriction, participants holding shares of restricted stock may have full voting and dividend rights with respect to such shares. The restrictions will lapse in accordance with a schedule or other conditions determined by the Committee. No dividends may be paid on awards of restricted stock that are subject to vesting conditions unless and until such conditions are met.

Stock Appreciation Rights

A stock appreciation right (a “SAR”) is the right to receive payment of an amount equal to (i) the excess of (A) the fair market value of a share of common stock on the date of exercise of the SAR over (B) the fair market value of a share of common stock on the date of grant of the SAR, multiplied by (ii) the aggregate number of shares of common stock subject to the SAR. Such payment will be in the form of common stock or cash and shall satisfy all of the restrictions imposed by the Plan upon stock option grants. Each SAR must be evidenced by a written award agreement with terms and conditions consistent with the Plan. The Committee shall determine the time or times at which a SAR may be exercised in whole or in part, provided that the term of any SAR shall not exceed ten years.

Restricted Stock Units

Restricted stock units may be granted pursuant to the Plan, typically without consideration from the participant or for a nominal purchase price. Restricted stock units may be subject to vesting conditions including continued employment or achievement of performance criteria established by the Committee. Like restricted stock, except as described below, restricted stock units may not be sold or otherwise transferred or hypothecated until vesting conditions are removed or expire. Unlike restricted stock, stock underlying restricted stock units will not be issued until the restricted stock units have vested, and recipients of restricted stock units generally will have no voting or dividend rights prior to the time when vesting conditions are satisfied. No dividend equivalents may be paid on awards of restricted stock units that are subject to vesting conditions unless and until such conditions are met. Restricted stock units may be paid in shares of stock.

Other Incentive Awards

The other types of awards that may be granted under the Plan include performance shares, performance stock units, dividend equivalents, stock payments and deferred stock. Dividend equivalents may not be granted on shares of common stock subject to options or SARs. Dividend equivalents granted in connection with awards that are subject to vesting conditions will only be paid to the extent that the vesting conditions are subsequently satisfied and the related award vests.

Performance Criteria

The plan administrator may select performance criteria for an award to establish performance goals for a performance period. Performance criteria under the Plan may include, but are not limited to, the following: net earnings (either before or after interest, taxes, depreciation and amortization), profit (either before or after interest, taxes, depreciation and amortization), economic value-added, sales or revenue, net income (either before or after taxes), operating earnings, cash flow (including, but not limited to, operating cash flow and free cash flow), cash flow return on capital, return on net assets, return on shareholders’ equity, return on assets, return on capital, shareholder returns, return on sales, gross or net profit margin, productivity, expense, margins, operating efficiency, customer satisfaction, working capital, earnings per share, price per share of stock, and market share, any of which may be measured (i) either in absolute terms or as compared to any incremental increase or as compared to results of a peer group and (ii) either on a generally accepted accounting principles in the United States (“GAAP”) or adjusted GAAP or International Financial Reporting Standards (“IFRS”) or adjusted IFRS (or other accounting principles followed by Omnicom) or on any other basis. Such performance goals also may be based solely by reference to the Company’s performance or the performance of a subsidiary, division, business segment or business unit of the Company or a subsidiary, or based upon performance relative to performance of other companies or upon comparisons of any of the indicators of performance relative to performance of other companies. When determining performance goals, the plan administrator may provide for exclusion of the impact of an event or occurrence which the plan administrator determines should appropriately be excluded, including, without limitation, in the event of, or in anticipation of, any unusual or extraordinary corporate item, transaction, event, or development or in recognition of, or in anticipation of, any other unusual or nonrecurring events affecting Omnicom, or the financial statements of Omnicom, or in response to, or in anticipation of, changes in applicable laws, regulations, accounting principles, or business conditions.

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

Minimum Vesting Requirement

Awards granted under the Plan (other than cash-based awards) may not vest earlier than the first anniversary of the grant date, subject to the plan administrator’s ability to provide for acceleration of vesting, including upon a change in control, death, disability, or retirement. The following awards, however, are exempt from such minimum vesting requirement: (i) substitute awards granted in connection with awards that are assumed, converted or substituted pursuant to a merger, acquisition or similar transaction entered into by the Company or any of its subsidiaries, (ii) shares delivered in lieu of fully vested cash obligations, (iii) awards to non-employee directors that vest on the earlier of the first anniversary of the date of grant and the next annual meeting of shareholders which is at least 50 weeks after the immediately preceding year’s annual meeting, and (iv) any additional awards the Committee may grant, up to a maximum of five percent (5%) of the available share reserve authorized for issuance under the Plan.

Dividends; Dividend Equivalents

Notwithstanding anything to the contrary, if an award provides for a right to dividends or dividend equivalents, any dividends or dividend rights will be subject to the same vesting requirements as the underlying award and will only be paid at the time those vesting requirements are satisfied.

TRANSFER OF AWARDS

Awards cannot be assigned, transferred, or otherwise disposed of by a participant other than: (a) by will or the laws of descent and distribution, (b) pursuant to beneficiary designation procedures approved from time to time by the Committee, (c) to the participant’s spouse, children or grandchildren (including any adopted and step children or grandchildren), parents, grandparents or siblings, (d) to a trust for the benefit of the participant and/or one or more of the persons referred to in clause (c), (e) to a partnership, limited liability company or corporation in which the participant or the persons referred to in clause (c) are the only partners, members or shareholders or (f) for charitable donations. Such permitted transfers cannot be for monetary consideration and such permitted assignees shall be bound by and subject to all of the terms and conditions of the Plan and any applicable award agreement.

ADJUSTMENT TO AWARDS

If there is a nonreciprocal transaction between Omnicom and its shareholders such as a stock dividend, stock split, spin-off, or recapitalization through a large, nonrecurring cash dividend, then the Committee shall make equitable adjustments (if any), as the Committee in its discretion may deem appropriate, to the number and type of securities subject to each outstanding award under the Plan, the exercise price or grant price of such outstanding award (if applicable) and the aggregate number and kind of shares that may be issued under the Plan.

If there is any other distribution, merger, consolidation, combination, exchange or other corporate event affecting the common stock or the share price of the common stock (other than a nonreciprocal transaction as described above), the Committee:

■ may equitably adjust the aggregate number and type of shares of common stock subject to the Plan, the terms and conditions of any outstanding awards, and the grant or exercise price per share of outstanding awards (if applicable);

■ may provide for the termination of any award in exchange for an amount of cash and/or other property equal to the fair value of the applicable award;

■ may provide for the replacement of any award with other rights or property selected by the Committee in its sole discretion;

■ may provide that all awards shall be exercisable, payable, or fully vested as to all shares of common stock covered thereby;

■ may provide that any surviving corporation (or its parent or subsidiary) shall assume awards outstanding under the Plan or shall substitute similar awards for those outstanding under the Plan, with appropriate adjustment of the number and kind of shares and the prices of such awards; or

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

■ may make adjustments (i) in the number and type of shares of common stock (or other securities or property) subject to outstanding awards or in the number and type of shares of restricted stock or deferred stock or (ii) to the terms and conditions of (including the grant or exercise price) and the criteria included in, outstanding rights, options, and awards or future rights, options, and awards.

EFFECT OF A CHANGE IN CONTROL

In the event of a change in control of Omnicom in which an award does not remain outstanding or is not assumed or an equivalent award is not substituted by a successor entity, then, immediately prior to the change in control, the award will become fully exercisable and all forfeiture restrictions on such award shall lapse.

AMENDMENT AND TERMINATION

The Committee, subject to approval of the Board, may terminate, amend, or modify the Plan at any time; provided, however, that shareholder approval will be obtained (i) for any amendment to the extent necessary and desirable to comply with any applicable law, regulation or stock exchange rule, (ii) except as permitted by the adjustment provision described above, to increase the number of shares of common stock available under the Plan, (iii) except as permitted by the adjustment provision described above, to reduce the per share exercise price of an award, and (iv) except as permitted by the adjustment provision described above, to grant an award or cash in exchange for the cancellation or surrender of an option or a stock appreciation right when the exercise or base price exceeds the fair market value of the underlying shares.

The Plan provides that in no event may an award be granted pursuant to the Plan on or after the tenth anniversary of the date the Plan was approved by our Compensation Committee, which occurred on December 9, 2025.

FEDERAL INCOME TAX CONSEQUENCES

The following is a brief summary of certain United States federal income tax consequences generally arising with respect to awards under the Plan. This discussion does not address all aspects of the United States federal income tax consequences of participating in the Plan that may be relevant to participants in light of their personal investment or tax circumstances and does not discuss any state, local or non-United States tax consequences of participating in the Plan. Each participant is advised to consult his or her particular tax advisor concerning the application of the United States federal income tax laws to such participant’s particular situation, as well as the applicability and effect of any state, local or non-United States tax laws before taking any actions with respect to any awards.

Non-Qualified Stock Options

For federal income tax purposes, if participants are granted non-qualified stock options under the Plan, participants generally will not have taxable income on the grant of the option, nor will Omnicom be entitled to any deduction. Generally, on exercise of non-qualified stock options, participants will recognize ordinary income, and Omnicom expects that it will be entitled to a deduction, in an amount equal to the difference between the option exercise price and the fair market value of the common stock on the date of exercise. The basis that participants have in shares of common stock, for purposes of determining their gain or loss on subsequent disposition of such shares of common stock generally, will be the fair market value of the shares of common stock on the date the participants exercise their options. Any subsequent gain or loss will be generally taxable as capital gains or losses.

Incentive Stock Options

There is expected to be no taxable income to participants when participants are granted an incentive stock option or when that option is exercised. However, the amount by which the fair market value of the shares of common stock at the time of exercise exceeds the option price will be an “item of adjustment” for participants for purposes of the alternative minimum tax. Gain realized by participants on the sale of an incentive stock option is taxable at capital gains rates, and no tax deduction is available to Omnicom, unless participants dispose of the shares of common stock within (i) two years after the date of grant of the option or (ii) within one year of the date the shares of common stock were transferred to the

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

participant. If the shares of common stock are sold or otherwise disposed of before the end of the one-year and two-year periods specified above, the difference between the option exercise price and the fair market value of the shares of common stock on the date of the option’s exercise (or the date of sale, if less) will be taxed at ordinary income rates, and Omnicom expects that it will be entitled to a deduction to the extent that participants must recognize ordinary income. If such a sale or disposition takes place in the year in which participants exercise their options, the income such participants recognize upon sale or disposition of the shares of common stock will not be considered income for alternative minimum tax purposes.

Incentive stock options exercised more than three months after a participant terminates employment, other than by reason of death or disability, will be taxed as a non-qualified stock option, and the participant will have been deemed to have received income on the exercise taxable at ordinary income rates. Omnicom will be entitled to a tax deduction equal to the ordinary income, if any, realized by the participant.

Stock Appreciation Rights

Like nonqualified stock options, participants are not expected to be taxed upon grant of SARs, but will realize ordinary income in an amount equal to the sum of the amount of any cash received and the fair market value of the shares or other property received upon exercise. Omnicom expects that it will be entitled to a tax deduction equal to the ordinary income realized by the participant.

Restricted Stock

If the restricted stock is not freely transferable and is subject to a substantial risk of forfeiture (within the meaning of Section 83 of the Code), then the participant will not recognize any income at the time of the award until the restrictions lapse (or unless the recipient elects to accelerate the recognition as of the date of grant). Omnicom expects that it will be entitled to a tax deduction equal to the ordinary income realized by the participant. However, a Plan participant granted restricted stock that is subject to forfeiture or repurchase through a vesting schedule such that it is subject to a “risk of forfeiture” (as defined in Section 83 of the Code) may make an election under Section 83(b) of the Code to recognize taxable income at ordinary income tax rates, at the time of the grant, in an amount equal to the fair market value of the shares of common stock on the date of grant, less the amount paid, if any, for such shares. Omnicom expects that it would be entitled to a corresponding tax deduction for compensation, in the amount recognized as taxable income by the participant. If a timely Section 83(b) election is made, the participant will not recognize any additional ordinary income on the termination of restrictions on restricted stock, and we will not be entitled to any additional tax deduction.

Restricted Stock Units

Generally there is no income tax consequence to the participant or Omnicom upon the grant of performance or restricted stock units. The participant will realize ordinary income upon payment and Omnicom expects that it will be entitled to a tax deduction equal to the ordinary income realized by the participant.

Section 280G of the Code

Section 280G of the Code limits the deduction that the employer may take for otherwise deductible compensation payable to certain individuals if the compensation constitutes an “excess parachute payment.” Excess parachute payments arise from payments made to disqualified individuals that are in the nature of compensation and are contingent on changes in ownership or control of the employer or certain affiliates. Accelerated vesting or payment of awards under the Plan upon a change in ownership or control of the employer or its affiliates could result in excess parachute payments. In addition to the deduction limitation applicable to the employer, a disqualified individual receiving an excess parachute payment is subject to a 20% excise tax on the amount thereof. Omnicom expects that it will generally have a corresponding deduction at the time the participant recognizes income provided that the income is not an “excess parachute payment” within the meaning of Section 280G of the Code.

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

Section 409A of the Code

Generally, to the extent that deferrals of awards fail to meet certain requirements under Section 409A of the Code, such awards will be subject to immediate taxation and tax penalties in the year they vest unless the requirements of Section 409A of the Code are satisfied. It is our intent that awards under the Plan will be structured and administered in a manner that complies with or is exempt from the requirements of Section 409A of the Code.

Section 162(m) of the Internal Revenue Code

Under Section 162(m) of the Code, income tax deductions of publicly-traded companies may be limited to the extent total compensation (including, without limitation, base salary, annual bonus, stock option exercises, and restricted stock vesting) for certain current or former executive officers exceeds $1 million in any one taxable year. Although the Committee may take action to limit the impact of Section 162(m) of the Code, it also believes that deductibility of executive compensation is only one of several important considerations in setting compensation and reserves the right to approve executive compensation arrangements that are not fully tax deductible if it believes that doing so is in the best interests of Omnicom or our shareholders.

State, local and non-U.S. tax consequences may in some cases differ from the U.S. federal tax consequences. The foregoing summary of the income tax consequences in respect of the Plan is for general information only. Interested parties should consult their own advisors as to specific tax consequences of their awards.

NEW PLAN BENEFITS

Other than grants of fully vested common stock to our non-employee directors pursuant to our Director Compensation and Deferred Stock Program, awards under the Plan are subject to the discretion of the plan administrator, and no determinations have been made by the plan administrator as to any future awards that may be granted pursuant to the Plan. Therefore, it is not possible to determine the benefits that will be received in the future by other participants in the Plan.

In accordance with our Director Compensation and Deferred Stock Program initially adopted by our Board on December 4, 2008 and as amended from time to time, non-employee directors automatically receive fully-vested common stock each fiscal quarter in a dollar amount equal to $51,250 for their service on our board of directors. The table below shows, as to each of our outside directors, the number of shares of fully-vested common stock that would be received or allocated to each such director during 2025, assuming a per share value of our common stock of $71.50, which was the closing price of our common stock on November 26, 2025.

|

Name of Non-Employee Director |

Number of Shares |

|

Mary C. Choksi |

2,867 |

|

Leonard S. Coleman, Jr. |

2,867 |

|

Mark D. Gerstein(1) |

4,125 |

|

Ronnie S. Hawkins |

2,867 |

|

Deborah J. Kissire |

2,867 |

|

Gracia C. Martore |

2,867 |

|

Patricia Salas Pineda |

2,867 |

|

Linda Johnson Rice |

2,867 |

|

Cassandra Santos |

2,867 |

|

Valerie M. Williams |

2,867 |

|

Patrick Q. Moore(2) |

238 |

|

E. Lee Wyatt Jr.(2) |

238 |

(1) In addition to the quarterly awards of fully-vested common stock described above, amount also includes shares of common stock that the director has elected to receive in lieu of his annual cash retainer of $90,000 for 2025.

(2) Messrs. Moore and Wyatt served on our Board for a portion of 2025 and were eligible to receive a pro-rated grant in respect of their service during 2025.

PROPOSAL 1 — APPROVAL OF THE OMNICOM 2026 INCENTIVE AWARD PLAN

INTEREST OF CERTAIN PERSONS IN THE PLAN

Shareholders should understand that our executive officers and non-employee directors may be considered to have an interest in the approval of the Plan because they may in the future receive awards under the Plan. Nevertheless, the Board believes that it is important to provide incentives and rewards for superior performance and the retention of experienced officers and directors by adopting the Plan.

|

The Board UNANIMOUSLY recommends a vote FOR the approval of the Plan. |

Adoption of the Plan requires the favorable vote of the holders of a majority of the shares voting on the proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

EQUITY COMPENSATION PLANS

The following table provides information about our current equity compensation plans as of December 31, 2024.

|

Plan Category |

Number of securities |

Weighted-average |

Number of |

|

Equity compensation plans approved by security holders: 2021 Incentive Award Plan and previously adopted equity incentive plans (other than our ESPP) |

3,085,287 |

$71.65 |

7,781,173(1) |

|

Equity compensation plans approved by security holders: ESPP Shares |

— |

— |

8,174,023(2) |

|

Equity compensation plans not approved by security holders |

— |

— |

— |

|

Total |

3,085,287 |

$71.65 |

15,955,196 |

(1) The maximum number of shares that may be issued under our 2021 Plan is 14,700,000, less one share for each share subject to an award granted by Omnicom under a Prior Plan after December 31, 2020. This number is subject to upward adjustment since awards granted by Omnicom under Prior Plans that are forfeited or expire after December 31, 2020, may be used again under the 2021 Plan. Furthermore, shares tendered for payment of or withheld after December 31, 2020 in satisfaction of the tax withholding amounts due upon vesting or settlement of any award that is not an option or stock appreciation right that is granted by Omnicom under the 2021 Plan or a Prior Plan may be used under the 2021 Plan. The figure above includes 7,781,173 shares that may be issued under our 2021 Plan. As of December 31, 2024, there were 3,085,287 stock options outstanding under our equity compensation plans (other than our Employee Stock Purchase Plan (the “ESPP”)) with a weighted-average exercise price of $71.65 and a weighted-average term of 7.08 years and 3,151,514 shares of restricted stock or restricted stock units (“RSUs”) outstanding under our equity compensation plans (other than our ESPP).

(2) The ESPP is a tax-qualified plan in which all eligible full-time and part-time domestic employees may participate.

|

Fiscal Year 2024 Compensation Information |

|

|

Compensation Committee Interlocks and Insider Participation

The following directors served as members of our Compensation Committee during all or a portion of 2024: Mary C. Choksi, Leonard S. Coleman, Jr., Ronnie S. Hawkins, Gracia C. Martore and Linda Johnson Rice. None of the Compensation Committee members who served during 2024 is a current or former employee or officer of Omnicom or its subsidiaries. None of the Compensation Committee members who served during 2024 has ever had any relationship requiring disclosure by Omnicom under Item 404 of Regulation S-K. During 2024, none of our executive officers served as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any other company that had an executive officer serving as a member of our Board or its Compensation Committee.

Directors’ Compensation for Fiscal Year 2024

Due to the fact that the proposal to approve the Plan relates to a compensation plan in which executive officers and directors of the Company will participate, the Company is required under applicable disclosure rules to provide certain executive compensation information related to our last completed fiscal year. As such, this section is based on the information and related compensation tables that were included in the Company’s Definitive Proxy Statement on Schedule 14A relating to the Company’s 2025 Annual Meeting of Shareholders, filed on March 27, 2025.

Directors who are also current or former employees of Omnicom or its subsidiaries receive no compensation for serving as directors. The compensation program for directors who are not current or former employees of Omnicom or its subsidiaries is designed to compensate directors in a manner that reflects the work required for a company of Omnicom’s size and composition and to align directors’ interests with the long-term interests of shareholders. The table below includes the following compensation elements with respect to non-employee directors:

Annual Compensation. For 2024, non-employee directors were paid an annual cash retainer of $90,000 and $2,000 for attendance at each Board and Committee meeting. Non-employee directors are also paid $10,000 for attendance in person at a Board meeting held outside of the U.S. that requires international travel from his or her residence, but no such international meetings were held in 2024, and, therefore, this additional fee was not paid. In addition, directors receive reimbursement for customary travel expenses.

In accordance with our 2021 Plan, and our Director Compensation and Deferred Stock Program initially adopted by our Board on December 4, 2008 (as amended), non-employee directors also receive fully vested common stock each fiscal quarter. For each of the four quarters in 2024, such directors received common stock with a grant date fair value of $43,750 based on the per share closing price of our common stock on the first trading day immediately prior to grant. Effective January 1, 2025, the amount of common stock to be received by non-employee directors each quarter was increased to $51,250.

Our Director Compensation and Deferred Stock Program and 2021 Plan provide that each director may elect to receive all or a portion of his or her annual cash retainer for the following year’s service in common stock. Mr. Gerstein elected to receive all of his 2024 annual cash retainer in common stock.

|

16 |

|

Fiscal Year 2024 Compensation Information

Directors may also elect to defer any shares of common stock payable to them, which will be credited to a bookkeeping account in the directors’ names. These elections must be made prior to the start of the calendar year for which the common stock would be payable to them. The number of shares of common stock delivered or credited to a director’s account is based on the fair market value of our common stock on the first trading day immediately preceding the date the shares would have been paid to the director. Each director other than Ms. Rice elected to defer all of the shares of common stock payable to them in 2024.

Lead Independent Director and Committee Chair Fees. The Chairs of our committees and our Lead Independent Director receive additional annual fees in cash due to the workload and the additional responsibilities of their positions. Our Lead Independent Director receives an additional fee of $35,000. The Chairs of our Audit, Compensation, Governance and Finance Committees receive an additional fee of $20,000 each year, as long as such Chair is not also an executive officer of Omnicom. Effective January 1, 2025, the annual Lead Independent Director fee was increased to $50,000, and the annual fee for the Chairs of our Audit, Compensation, Governance and Finance Committees was increased to $30,000.

|

Name of Director |

Fees Earned |

Stock |

Total |

|

Mary C. Choksi |

$225,000 |

$175,000 |

$400,000 |

|

Leonard S. Coleman, Jr. |

$176,000 |

$175,000 |

$351,000 |

|

Mark D. Gerstein |

$152,000 |

$175,000 |

$327,000 |

|

Ronnie S. Hawkins |

$140,000 |

$175,000 |

$315,000 |

|

Deborah J. Kissire |

$188,000 |

$175,000 |

$363,000 |

|

Gracia C. Martore |

$190,000 |

$175,000 |

$365,000 |

|

Patricia Salas Pineda |

$138,000 |

$175,000 |

$313,000 |

|

Linda Johnson Rice |

$140,000 |

$175,000 |

$315,000 |

|

Cassandra Santos |

$126,000 |

$175,000 |

$301,000 |

|

Valerie M. Williams |

$152,000 |

$175,000 |

$327,000 |

(1) This column reports the amount of cash compensation earned in 2024 for Board and Committee service. The amounts shown include $90,000 in an annual retainer for Board membership, which Mr. Gerstein elected to receive in common stock.

(2) The amount reported in the “Stock Awards” column for each director reflects the aggregate grant date fair value of the stock granted in 2024, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC Topic 718”). For a discussion of the assumptions used to calculate the fair value of stock awards, refer to Notes 2 and 10 to the consolidated financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 10-K”). The grant date fair market value for each quarterly stock award was $43,750 for each individual reported in the table above. All stock awards held by directors were fully vested as of December 31, 2024.

No Other Compensation. Directors received no compensation in 2024 other than that described above. We do not have a retirement plan for directors, and they receive no pension benefits.

Stock Ownership Requirement. The Board encourages stock ownership by directors and has adopted stock ownership guidelines for our directors. The director guidelines provide, in general, that our directors must own Omnicom stock equal to or greater than five times their annual cash retainer within five years of their joining the Board. As of December 31, 2024, each member of our Board that has served on the Board five years or more was in compliance with these guidelines.

Fiscal Year 2024 Compensation Information

Compensation Discussion & Analysis

Due to the fact that the proposal to approve the Plan relates to a compensation plan in which executive officers and directors of the Company will participate, the Company is required under applicable disclosure rules to provide certain executive compensation information related to our last completed fiscal year. As such, this section is based on the Compensation Discussion and Analysis information and related compensation tables that were included in the Company’s Definitive Proxy Statement on Schedule 14A relating to the Company’s 2025 Annual Meeting of Shareholders, filed on March 27, 2025.

OBJECTIVES

Compensation Decision Process

The Compensation Committee annually reviews and approves the compensation of the named executive officers (the “NEOs”). To aid the Compensation Committee in making its compensation determinations, the Chief Executive Officer annually reviews the performance of each other NEO by evaluating the performance factors described in this Compensation Discussion and Analysis and presents his conclusions and recommendations to the Compensation Committee. The Compensation Committee considers the Chief Executive Officer’s recommendations, but ultimately makes the final decision as to compensation determinations. With respect to 2024 compensation, the Compensation Committee did not deviate materially from our Chief Executive Officer’s recommendations.

Our NEOs for fiscal year 2024 were:

■ John D. Wren, Chairman and Chief Executive Officer

■ Daryl D. Simm, President and Chief Operating Officer

■ Philip J. Angelastro, Executive Vice President and Chief Financial Officer

■ Louis F. Januzzi, Senior Vice President, General Counsel and Secretary

■ Rochelle M. Tarlowe, Senior Vice President and Treasurer

Fiscal Year 2024 Compensation Information

Process for Determination of our Executive Compensation: Step-By-Step

|

STEP |

|

|

Base Salary |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Setting Performance Measures for 2024 |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Determining Multipliers Based on Performance Range |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Setting Target and Maximum Annual Incentive Award Dollar Amounts |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Calculation of Annual Incentive Award |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Adjustments Determined |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Long-Term Incentive Compensation: Three-Year Performance Restricted Stock Unit (“PRSU”) Awards |

|

|

|

|

|

|

|

|

||

|

STEP |

|

|

Long-Term Incentive Compensation: Time-Based Equity Awards |

|

|

|

||

Fiscal Year 2024 Compensation Information

ELEMENTS OF OMNICOM COMPENSATION AND

FISCAL YEAR 2024 DECISIONS

For Messrs. Wren, Simm and Angelastro, our principal components of pay for performance in 2024 were a base salary, an Annual Incentive Award based on 2024 performance, and an award of PRSUs that is contingent upon the long-term performance of the Company.

For Messrs. Januzzi and Tarlowe, our principal components of pay for performance in 2024 were a base salary, an Annual Incentive Award based on 2024 performance and an award of RSUs that vests pro-rata annually over a five-year period.

Although NEOs are eligible to receive an Annual Incentive Award if their achievements so merit, the granting of an Annual Incentive Award to any NEO is entirely at the discretion of the Compensation Committee. The Compensation Committee may choose not to award an Annual Incentive Award to a NEO or to adjust the amount of the award that results from the application of the measures described in this Compensation Discussion & Analysis, in each case, in light of all factors deemed relevant by the Compensation Committee. In addition, to the extent achievement of the performance criteria may be impacted by changes in accounting principles and extraordinary, unusual or infrequently occurring events reported in Omnicom’s public filings, the Compensation Committee exercises its judgment whether to reflect or exclude their impact.

Each of these components and the manner in which decisions for 2024 were made for each NEO are more fully discussed in the sections that follow.

|

STEP |

|

|

Base Salary |

|

|

|

|

|

|

|

|

||

|

NEO Base Salaries: |

|

|

John Wren Chairman and Chief Executive Officer |

|

|

Daryl Simm President and Chief Operating Officer |

|

|

Philip Angelastro Executive Vice President and Chief Financial Officer |

|

|

Louis Januzzi Senior Vice President, General Counsel and Secretary |

|

|

Rochelle Tarlowe Senior Vice President and Treasurer |

|

The objective of base salary is to provide a portion of compensation to the NEO that is not “at risk,” such as incentive bonuses or equity awards, and is generally unaffected by fluctuations in company performance or the market in general. The base salaries for the NEOs are determined by the Compensation Committee.

Adjustments in base salary for NEOs are not automatic or formulaic, and are ultimately made by the Compensation Committee in the exercise of its business judgment. Omnicom considers a number of factors when determining whether to make base salary adjustments, which factors may include advice from our compensation consultant, the general knowledge of our Chief Executive Officer and Compensation Committee of base salaries paid to similarly positioned executives, salaries paid historically, tax and accounting changes that may affect the Company, as well as personal performance as assessed by the Compensation Committee and the Chief Executive Officer. Normally, base salary adjustments are generally considered no more frequently than every 24 months. Effective March 1, 2024, Mr. Januzzi’s base salary was increased from $500,000 to $650,000 to reflect his performance in his role as General Counsel of the Company.

Based on our Chief Executive Officer’s and the Compensation Committee’s general knowledge of base salaries paid to similarly positioned executives at companies of comparable size and profitability, and the Compensation Committee’s emphasis on performance-based compensation, no NEO’s base salary, other than Mr. Januzzi’s as described above, was adjusted in 2024.

Fiscal Year 2024 Compensation Information

Performance-Based Compensation Awards

Under Omnicom’s Senior Management Incentive Plan, eligible executive officers may receive an Annual Incentive Award, except as the Compensation Committee may otherwise determine in the exercise of its business judgment. The Annual Incentive Award earned by each eligible NEO is payable at the election of the Compensation Committee in cash and/or equity-based awards. The following table summarizes the combination of quantitative and qualitative performance measures the Compensation Committee considered for the Annual Incentive Awards awarded for performance in fiscal year 2024, each of which is discussed in greater detail below.

Determination of Annual Incentive Award:

|

STEP |

|

|

Setting Performance Measures for 2024 |

|

|

|

|

|

|

|

|

||

|

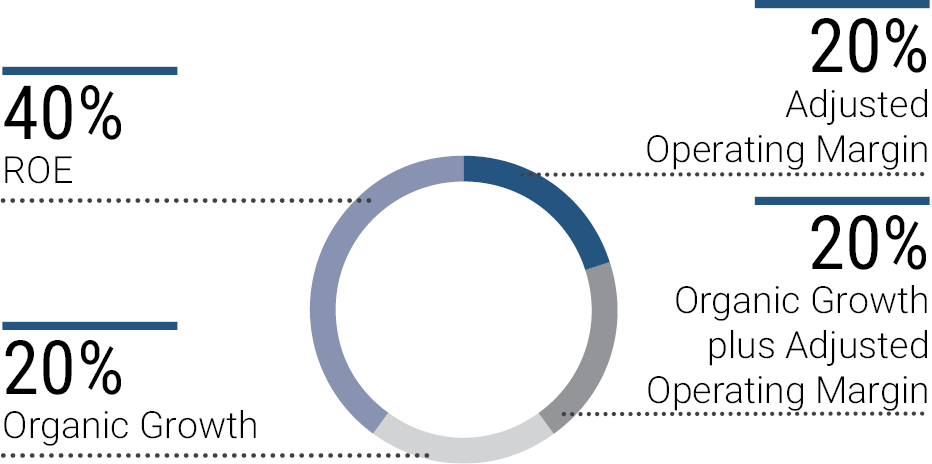

Component |

Weighting |

Performance Measures |

Rationale for Selection of Performance Metric |

|

Peer Metric |

40% |

■ Return on equity (40%) ■ Organic growth (20%) ■ Adjusted operating margin (20%) ■ Organic growth plus adjusted operating margin (20%) |

■ Comprehensively evaluates various financial metrics directly tied to the return to our common shareholders over time ■ Measures ability to drive revenue growth from existing operations, exclusive of the impact of acquisitions, dispositions and foreign currency translation ■ Focuses the Company on operating at sustainable, profitable levels ■ Balances the contribution of each of these important metrics |

|

Performance Metric |

40% |

■ Adjusted diluted EPS growth (331/3%) ■ Adjusted EBITA margin (331/3%) ■ Organic growth (331/3%) |

■ Measures Company’s profitability ■ Focuses the Company on operating at sustainable, profitable levels ■ Measures ability to drive revenue growth from existing operations, exclusive of the impact of acquisitions, dispositions and foreign currency translation |

|

Qualitative Metric |

20% |

■ Assessment of executive performance in furtherance of our business strategy, as described below |

■ Focuses on executive performance |

We believe our goals are meaningful and challenging, the achievement of which is designed to drive shareholder value.

Fiscal Year 2024 Compensation Information

|

STEP |

|

|

Determining Multipliers Based on Performance Range |

|

|

|

|

|

|

|

|

||

PEER METRIC (FINANCIAL PERFORMANCE VS. INDUSTRY PEER GROUP) – 40% OF TARGET ANNUAL INCENTIVE AWARD

|

Performance Measure |

Weight |

Rank |

Peer Multiplier |

|

Return On Equity |

40% |

1 – 4 |

0.4 – 2.0 |

|

Organic Growth |

20% |

1 – 4 |

0.4 – 2.0 |

|

Adjusted Operating Margin |

20% |

1 – 4 |

0.4 – 2.0 |

|

Organic Growth + Adjusted Operating Margin |

20% |

1 – 4 |

0.4 – 2.0 |

The “Peer Metric” is based on Omnicom’s financial performance as compared to an industry peer group. The Compensation Committee considered the following performance measures for fiscal year 2024 as compared to that of an industry peer group, which included WPP plc, Publicis Groupe SA and The Interpublic Group of Companies, Inc. (the “Peer Metric Group”), with each measure weighted as indicated:

■ return on equity (ROE) (40%)

■ organic growth (20%)

■ adjusted operating margin (20%)

■ organic growth plus adjusted operating margin (20%)

Peer Metric

(40% of Target Incentive Award)

A predetermined multiplier of between 0.4 and 2.0 (the “Peer Multiplier”) was ascribed based on Omnicom’s ranking relative to the Peer Metric Group for each metric. The Peer Multiplier was applied to each metric’s weighting within the category based on the results achieved to arrive at a weighted score (the “Peer Weighted Score”).

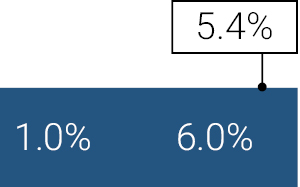

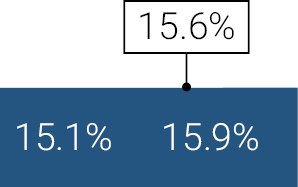

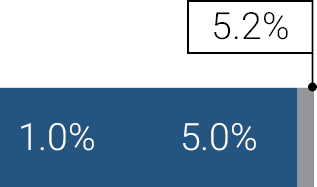

PERFORMANCE METRIC (FINANCIAL PERFORMANCE VS. ANNUAL COMPANY TARGET) – 40% OF TARGET ANNUAL INCENTIVE AWARD

|

Performance Measure |

Weight |

Performance Range |

Performance Multiplier |

|

Adjusted Diluted EPS Growth |

331/3% |

1.0% – 6.0% |

0.0 – 2.0 |

|

Adjusted EBITA Margin |

331/3% |

15.1% – 15.9% |

0.0 – 2.0 |

|

Organic Growth |

331/3% |

1.0% – 5.0% |

0.0 – 2.0 |

Fiscal Year 2024 Compensation Information

The “Performance Metric” is based on Omnicom’s financial performance as compared to annual Company targets. The Compensation Committee considered the following performance measures for fiscal year 2024, with each measure weighted as indicated:

■ Adjusted diluted earnings per share growth (Adjusted Diluted EPS Growth) (331/3%)

■ Adjusted earnings before interest, taxes and amortization (Adjusted EBITA) margin (331/3%)

■ Organic growth (331/3%)

Performance Metric

(40% of Target Incentive Award)

Organic growth is total revenue growth less the change in revenue attributable to foreign currency translation and the impact of revenue from businesses acquired net of the revenue from businesses that were disposed. A predetermined multiplier of between 0.0 and 2.0 (the “Performance Multiplier”) was ascribed based on the range of Omnicom performance with respect to each performance measure as shown above. The Performance Multiplier was applied to each metric’s weighting within the category based on the results achieved to arrive at a weighted score (the “Performance Weighted Score”).

|

STEP |

|

|

Setting Target and Maximum Annual Incentive Award Dollar Amounts |

|

|

|

|

|

|

|

|

||

|

Name of Executive |

Threshold |

Target |

Maximum |

|

John Wren |

$ 0 |

$8,300,000 |

$16,600,000 |

|

Daryl Simm |

$ 0 |

$3,700,000 |

$ 7,400,000 |

|

Philip Angelastro |

$ 0 |

$3,500,000 |

$ 7,000,000 |

|

Louis Januzzi |

$ 0 |

$ 530,000 |

$ 1,060,000 |

|

Rochelle Tarlowe |

$ 0 |

$ 325,000 |

$ 650,000 |

For performance in fiscal year 2024, we established a maximum incentive compensation level and a target incentive compensation level set at a percentage of the maximum incentive compensation level, which are shown above and in the “Grants of Plan-Based Awards in 2024” table. As described below, the Compensation Committee periodically consults with its compensation consultant to determine the range of total compensation for similarly positioned executives at peer group companies. The Compensation Committee takes the information provided by its compensation consultant into consideration when determining the Incentive Award target for our NEOs.

Fiscal Year 2024 Compensation Information

|

STEP |

|

|

Calculation of Annual Incentive Award |

|

|

|

|

|

|

|

|

||

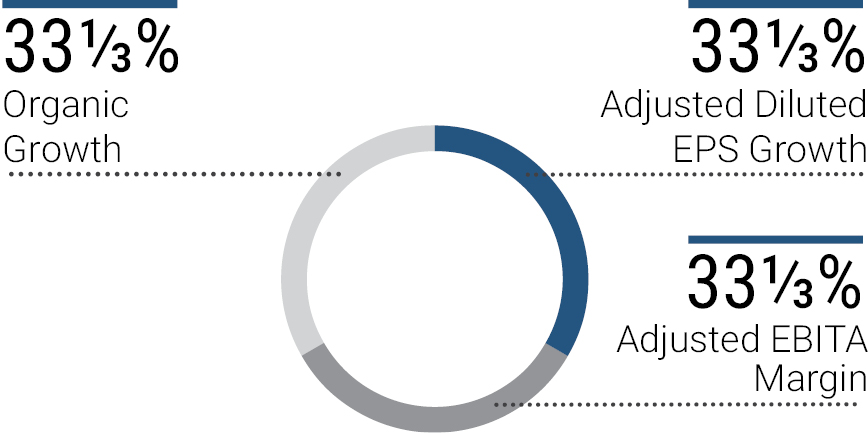

CALCULATION OF METRICS RESULTS – COMPANY PERFORMANCE VS. INDUSTRY PEER GROUP

When calculating the Adjusted Operating Margin for our performance metric, we made adjustments to Operating Income to (i) add back real estate and other repositioning costs, (ii) add back acquisition transaction costs and (iii) exclude a gain on a disposition of a subsidiary. To the extent achievement of the performance criteria may be impacted by changes in accounting principles and extraordinary, unusual or infrequently occurring events reported in Omnicom’s public filings, the Compensation Committee exercises its judgment whether to reflect or exclude their impact. The tables in Annex B show the adjustments made to Omnicom Group Inc.’s Operating Income.

|

|

2024 |

Peer Metric |

Weight |

Peer |

Weighted |

|

Return On Equity |

37.9% |

1 |

40% |

2.00 |

0.800 |

|

Organic Growth |

5.2% |

2 |

20% |

1.50 |

0.300 |

|

Adjusted Operating Margin |

15.0% |

1 |

20% |

2.00 |

0.400 |

|

Organic Growth + Adjusted Operating Margin |

20.2% |

1 |

20% |

2.00 |

0.400 |

|

Total |

1.900 |

||||

|

Peer Weighted Score of 1.900 x metric weighting of 40% |

76.0% |

||||

CALCULATION OF METRICS RESULTS – COMPANY TARGETS

When calculating our Adjusted EBITA Margin for our performance metric, we made adjustments to EBITA to (i) add back amortization of other purchased and internally developed software, (ii) add back real estate and other repositioning costs and (iii) add back acquisition transaction costs. When calculating our Adjusted Diluted EPS Growth for our performance metric, we made adjustments to Net Income – Omnicom Group Inc. to (i) add back amortization of acquired intangible assets and internally developed strategic platform assets, (ii) add back amortization of other purchased and internally developed software, (iii) add back after-tax real estate and other repositioning costs in 2023 and 2024, (iv) add back after-tax acquisition transaction costs incurred in the fourth quarters of 2023 and 2024 and (v) exclude an after-tax gain on a disposition of a subsidiary in the second quarter of 2023. To the extent achievement of the performance criteria may be impacted by changes in accounting principles and extraordinary, unusual or infrequently occurring events reported in Omnicom’s public filings, the Compensation Committee exercises its judgment whether to reflect or exclude their impact. The tables in Annex B show these adjustments to EBITA and Net Income – Omnicom Group Inc.

|

|

Target Range and 2024 |

Performance |

Relative |

Weighted |

|

Adjusted Diluted EPS growth |

|

1.80 |

331/3% |

0.600 |

|

Adjusted EBITA margin |

|

1.25 |

331/3% |

0.417 |

|

Organic growth |

|

2.00 |

331/3% |

0.667 |

|

Total |

1.683 |

|||

|

Performance Weighted Score of 1.683 x metric weighting of 40% |

67.3% |

|||

Fiscal Year 2024 Compensation Information

CALCULATION OF METRICS RESULTS – QUALITATIVE METRIC DETERMINATIONS

The use of qualitative metrics was implemented to assess individual performance. While the Compensation Committee originally planned to assess performance based on internal human capital management, corporate social responsibility and sustainability goals, for performance in fiscal year 2024, the Committee decided that an assessment of individual performance relative to their job function was more appropriate in order to tie a substantial portion of each NEO’s performance-based pay more closely to their actual performance in 2024 and to their specific areas of responsibility. In consultation with Mr. Wren (except with respect to himself), the Compensation Committee reviewed each NEO’s performance in his or her position and the extent to which they adequately carried out the functions of their role. The Compensation Committee determined that, during 2024, each NEO exceeded expectations with respect to the NEO’s performance for fiscal year 2024 and successfully executed the functions of their particular position during 2024 and, as a result, the Compensation Committee determined that the qualitative metrics should be deemed achieved at target for each individual.

Fiscal Year 2024 Calculation of Annual Incentive Award

|

Name |

Target Incentive |

Peer |

Performance |

Qualitative |

Combined |

Total Annual |

|

John Wren |

$8,300,000 |

76.0% |

67.3% |

20.0% |

163.3% |

$13,557,000 |

|

Daryl Simm |

$3,700,000 |

76.0% |

67.3% |

20.0% |

163.3% |

$ 6,043,000 |

|

Philip Angelastro |

$3,500,000 |

76.0% |