J.P. Morgan 44th Healthcare Conference Prahlad Singh Chief Executive Officer January 13, 2026

Safe Harbor 2 This presentation contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements relating to estimates and projections of future earnings per share, cash flow and revenue growth and other financial results, developments relating to the Company’s customers and end-markets, plans concerning business development opportunities, and acquisitions or divestitures. Words such as "believes," "intends," "anticipates," "plans," "expects," "projects," "forecasts," "will" and similar expressions, and references to guidance, are intended to identify forward-looking statements. Such statements are based on management's current assumptions and expectations and no assurances can be given that the Company’s assumptions or expectations will prove to be correct. A number of important risk factors could cause actual results to differ materially from the results described, implied or projected in any forward-looking statements. A detailed description of these risk factors can be found under the caption “Risk Factors” in the Company’s most recent quarterly report on Form 10-Q and in the Company’s other filings with the Securities and Exchange Commission. The Company disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this presentation. In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this presentation also includes non-GAAP financial measures. Guidance for future periods is provided on a non-GAAP basis and cannot be reconciled to the closest GAAP measures without unreasonable effort due to the unpredictability of the amounts and timing of events affecting the items the Company excludes from these non-GAAP measures. The amounts and timing of such events and items could be material to the Company’s results prepared in accordance with GAAP.

3 Financial Disclosures Estimated future results and historical growth rates presented and discussed today are based on 2025 guidance as provided on October 27, 2025 (2025E) Key Definitions: • LSD = 1-3% • MSD = 4-6% • HSD = 7-9% • LDD = 10-12% • LRP = Long-range plan

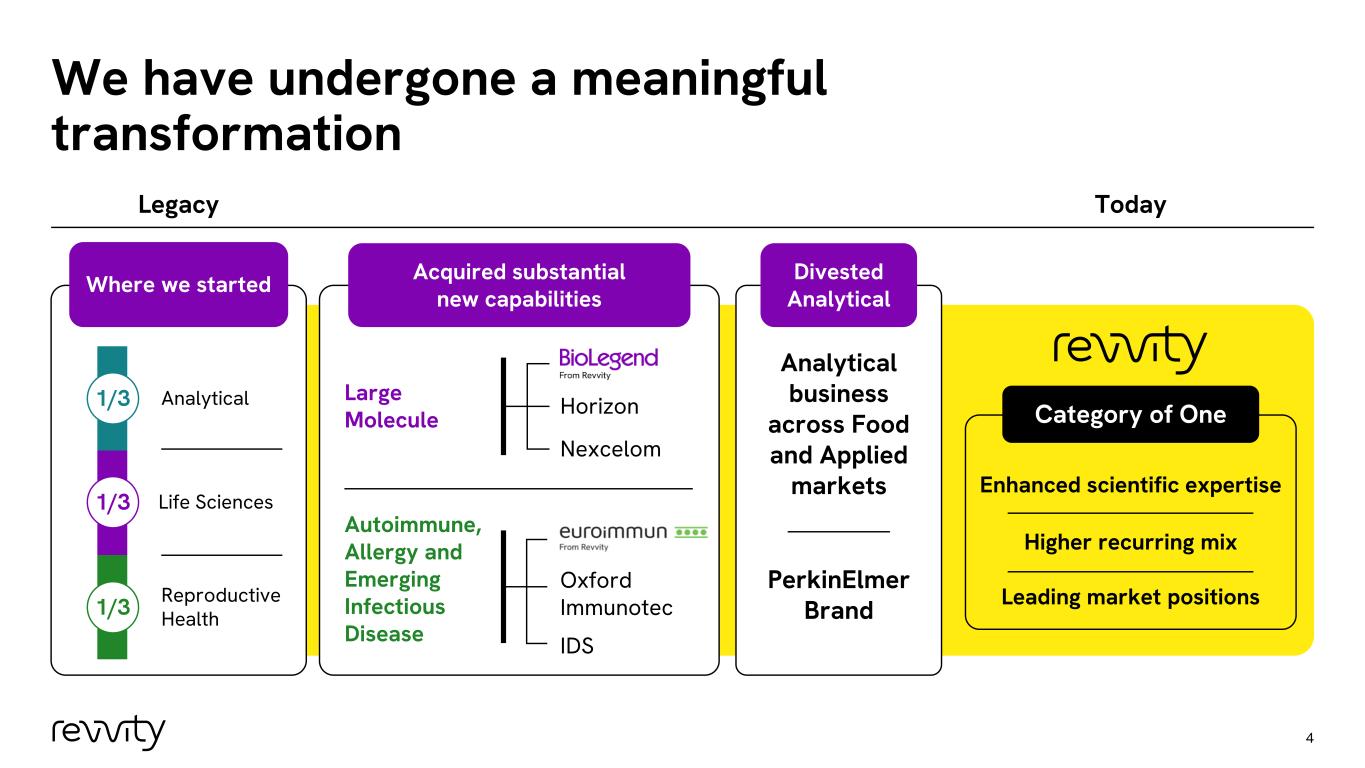

Where we started We have undergone a meaningful transformation 4 Divested Analytical Analytical business across Food and Applied markets Enhanced scientific expertise Higher recurring mix Leading market positions Analytical1/3 Life Sciences1/3 Reproductive Health1/3 Acquired substantial new capabilities Large Molecule Horizon Nexcelom Autoimmune, Allergy and Emerging Infectious Disease Oxford Immunotec IDS Category of One Legacy Today PerkinElmer Brand

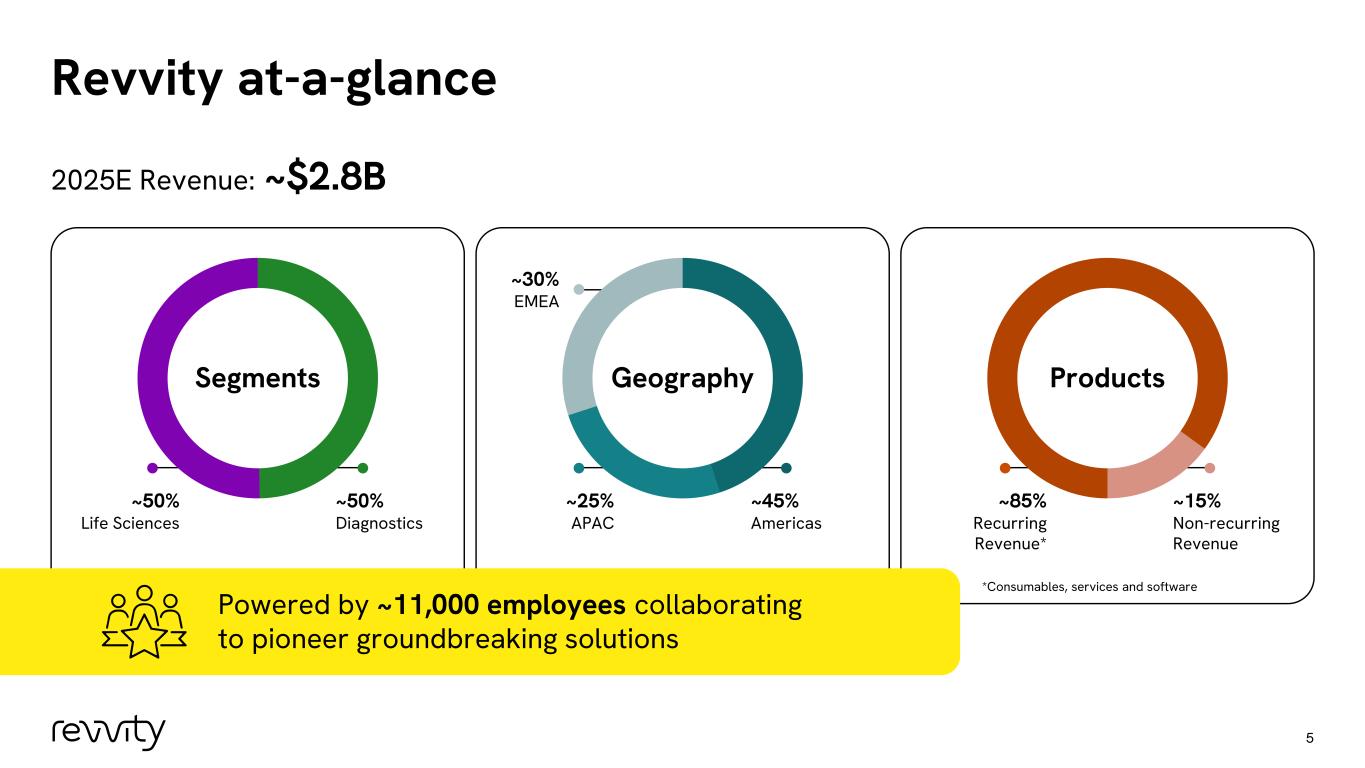

Revvity at-a-glance 5 2025E Revenue: ~$2.8B Segments Geography ~45% Americas ~25% APAC ~30% EMEA ~85% Recurring Revenue* ~15% Non-recurring Revenue ~50% Life Sciences ~50% Diagnostics Powered by ~11,000 employees collaborating to pioneer groundbreaking solutions *Consumables, services and software Products

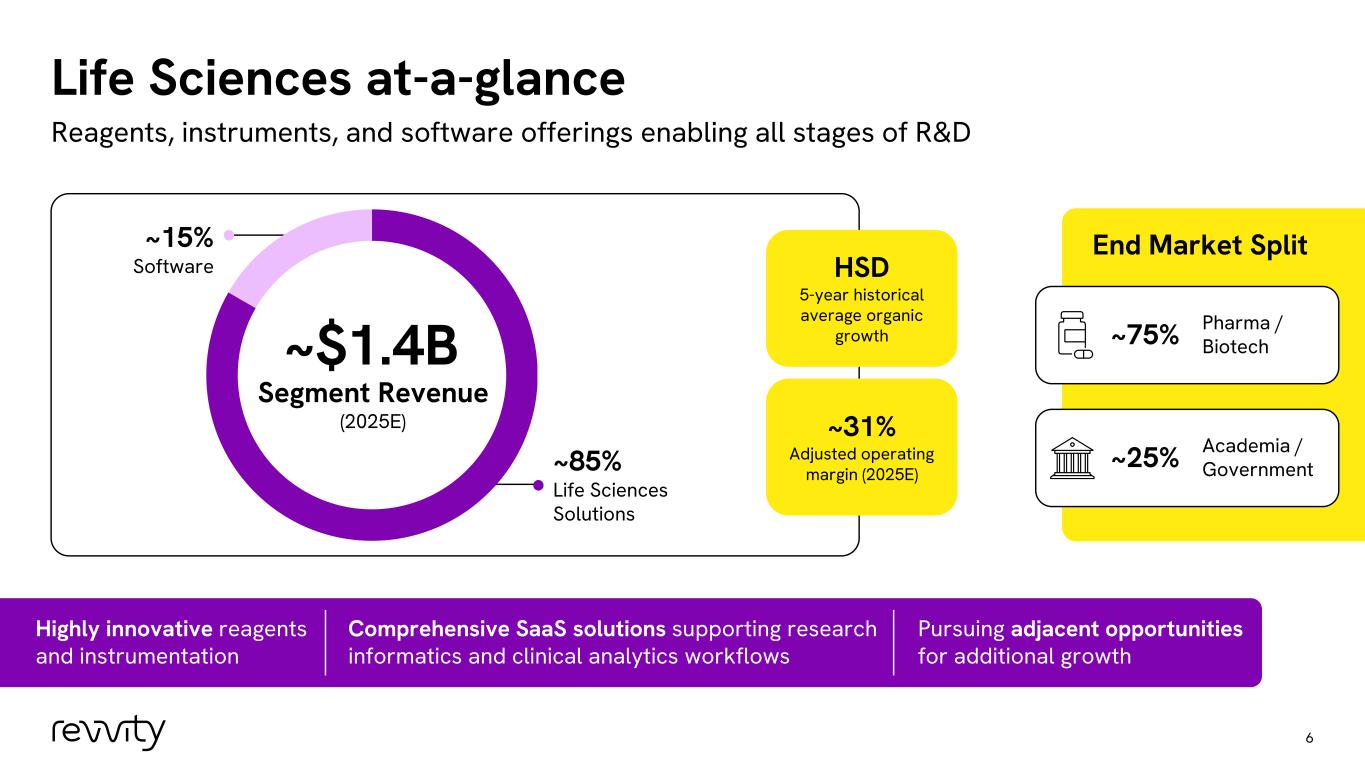

Life Sciences at-a-glance Reagents, instruments, and software offerings enabling all stages of R&D HSD 5-year historical average organic growth ~31% Adjusted operating margin (2025E) End Market Split~15% Software ~85% Life Sciences Solutions ~$1.4B Highly innovative reagents and instrumentation Comprehensive SaaS solutions supporting research informatics and clinical analytics workflows Pursuing adjacent opportunities for additional growth 6 Segment Revenue (2025E) Pharma / Biotech~75% Academia / Government~25%

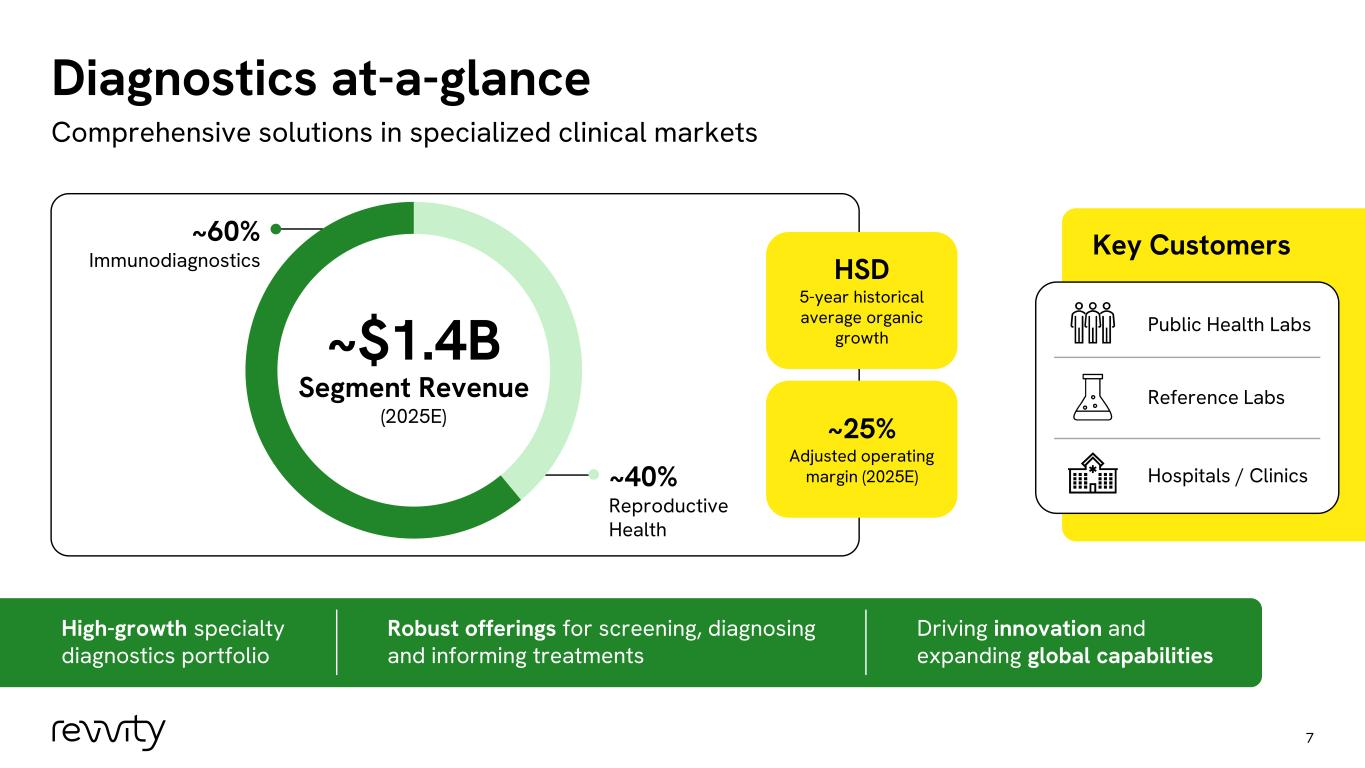

Diagnostics at-a-glance 7 Comprehensive solutions in specialized clinical markets ~60% Immunodiagnostics ~40% Reproductive Health Segment Revenue (2025E) ~$1.4B HSD 5-year historical average organic growth ~25% Adjusted operating margin (2025E) High-growth specialty diagnostics portfolio Robust offerings for screening, diagnosing and informing treatments Driving innovation and expanding global capabilities Key Customers Public Health Labs Hospitals / Clinics Reference Labs

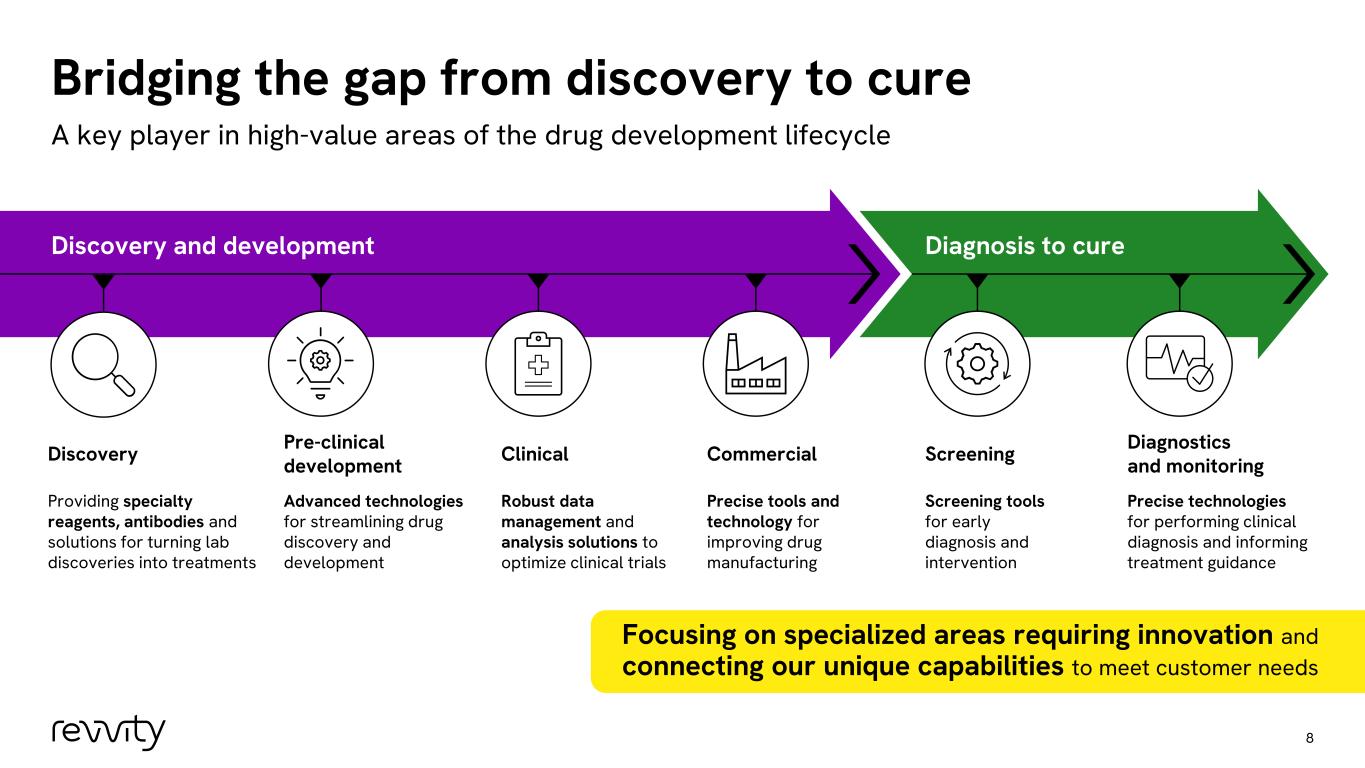

Bridging the gap from discovery to cure 8 A key player in high-value areas of the drug development lifecycle Discovery and development Diagnosis to cure Screening Screening tools for early diagnosis and intervention Discovery Providing specialty reagents, antibodies and solutions for turning lab discoveries into treatments Commercial Precise tools and technology for improving drug manufacturing Clinical Robust data management and analysis solutions to optimize clinical trials Pre-clinical development Advanced technologies for streamlining drug discovery and development Diagnostics and monitoring Precise technologies for performing clinical diagnosis and informing treatment guidance Focusing on specialized areas requiring innovation and connecting our unique capabilities to meet customer needs

9 Delivering on key growth, operational and financial priorities Strengthening operationally and financially for the future Expanding scientific and market reach Capitalizing on the potential of AI

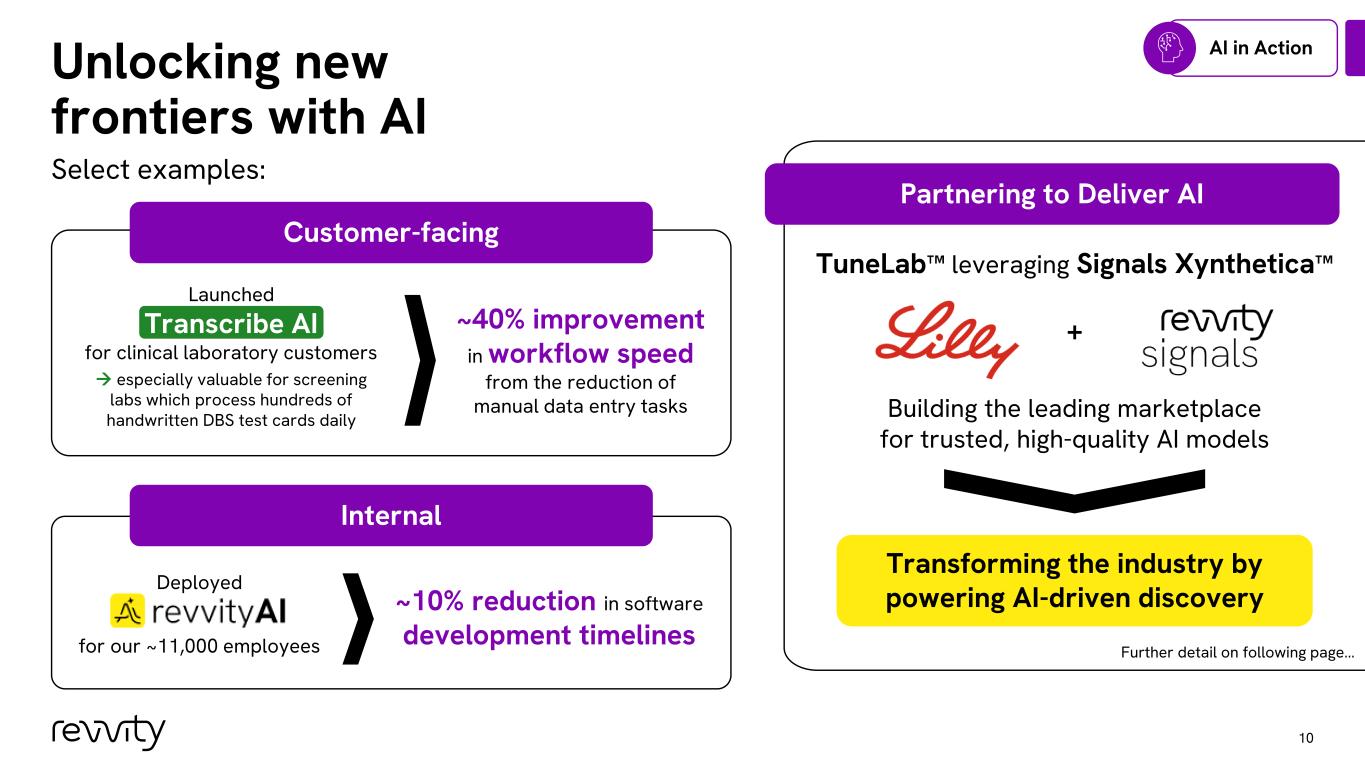

Unlocking new frontiers with AI 10 Select examples: AI in Action Customer-facing Internal ~10% reduction in software development timelines Deployed for our ~11,000 employees ~40% improvement in workflow speed from the reduction of manual data entry tasks Launched Transcribe AI for clinical laboratory customers → especially valuable for screening labs which process hundreds of handwritten DBS test cards daily Transforming the industry by powering AI-driven discovery TuneLab leveraging Signals Xynthetica + Building the leading marketplace for trusted, high-quality AI models Partnering to Deliver AI Further detail on following page…

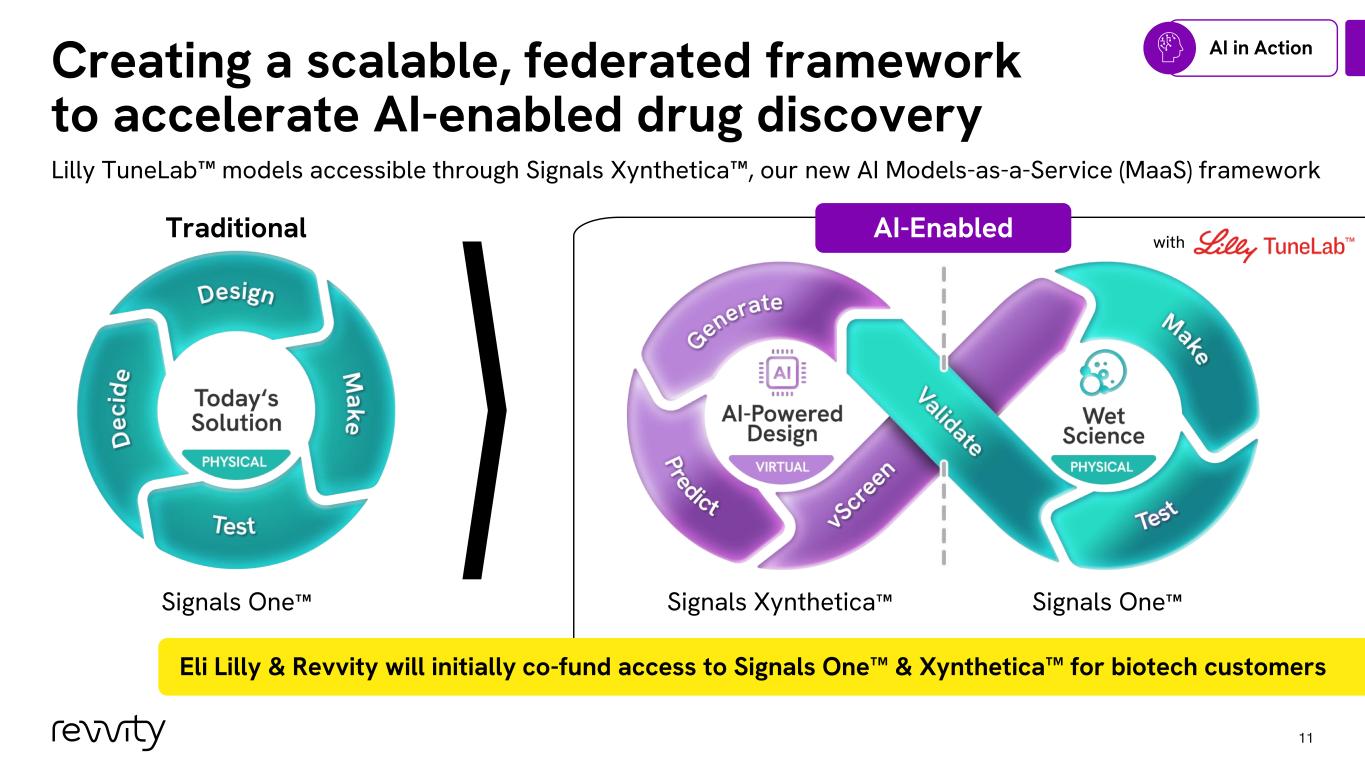

Creating a scalable, federated framework to accelerate AI-enabled drug discovery 11 Lilly TuneLab models accessible through Signals Xynthetica , our new AI Models-as-a-Service (MaaS) framework Eli Lilly & Revvity will initially co-fund access to Signals One & Xynthetica for biotech customers Signals One Signals OneSignals Xynthetica with AI in Action Traditional AI-Enabled

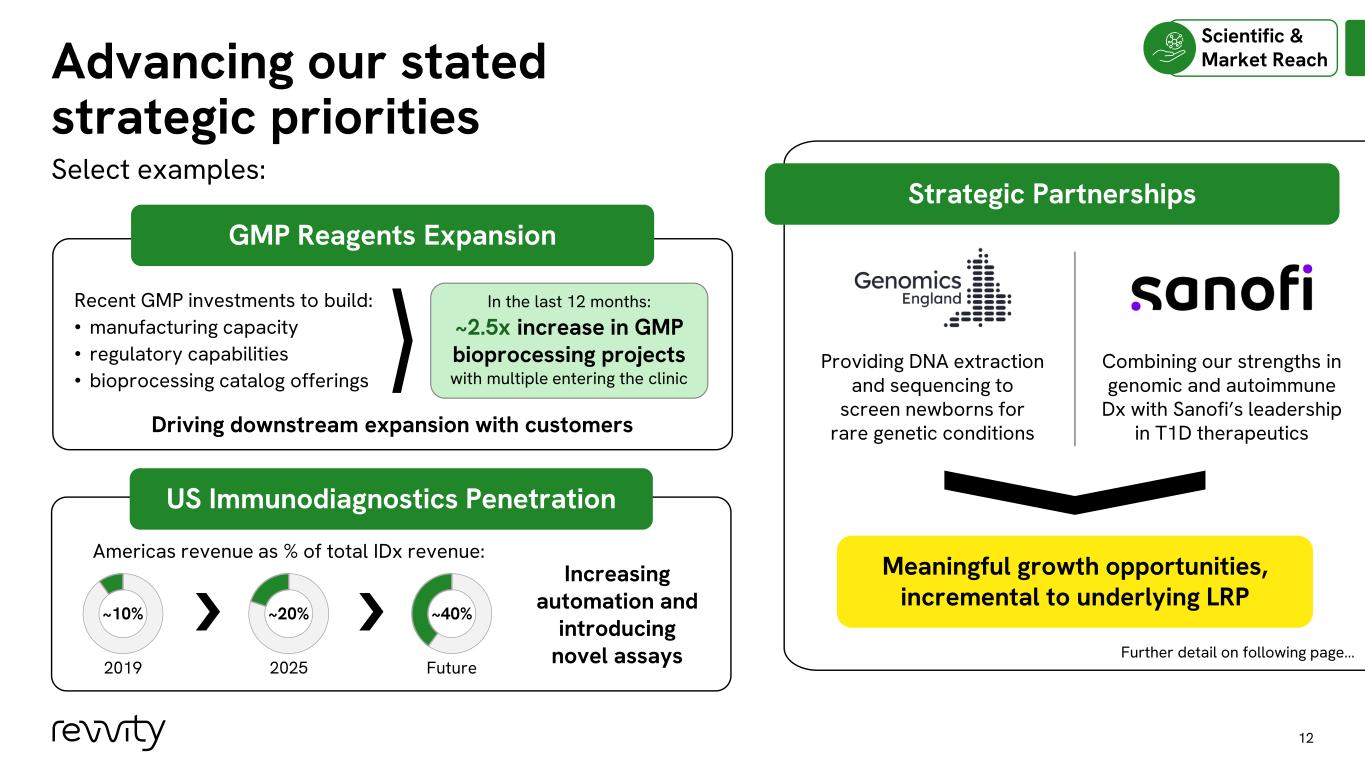

Strategic Partnerships Advancing our stated strategic priorities 12 GMP Reagents Expansion US Immunodiagnostics Penetration Increasing automation and introducing novel assays Driving downstream expansion with customers Meaningful growth opportunities, incremental to underlying LRP Providing DNA extraction and sequencing to screen newborns for rare genetic conditions Combining our strengths in genomic and autoimmune Dx with Sanofi’s leadership in T1D therapeutics Americas revenue as % of total IDx revenue: ~20% 2025 ~10% 2019 ~40% Future In the last 12 months: ~2.5x increase in GMP bioprocessing projects with multiple entering the clinic Recent GMP investments to build: • manufacturing capacity • regulatory capabilities • bioprocessing catalog offerings Select examples: Scientific & Market Reach Further detail on following page…

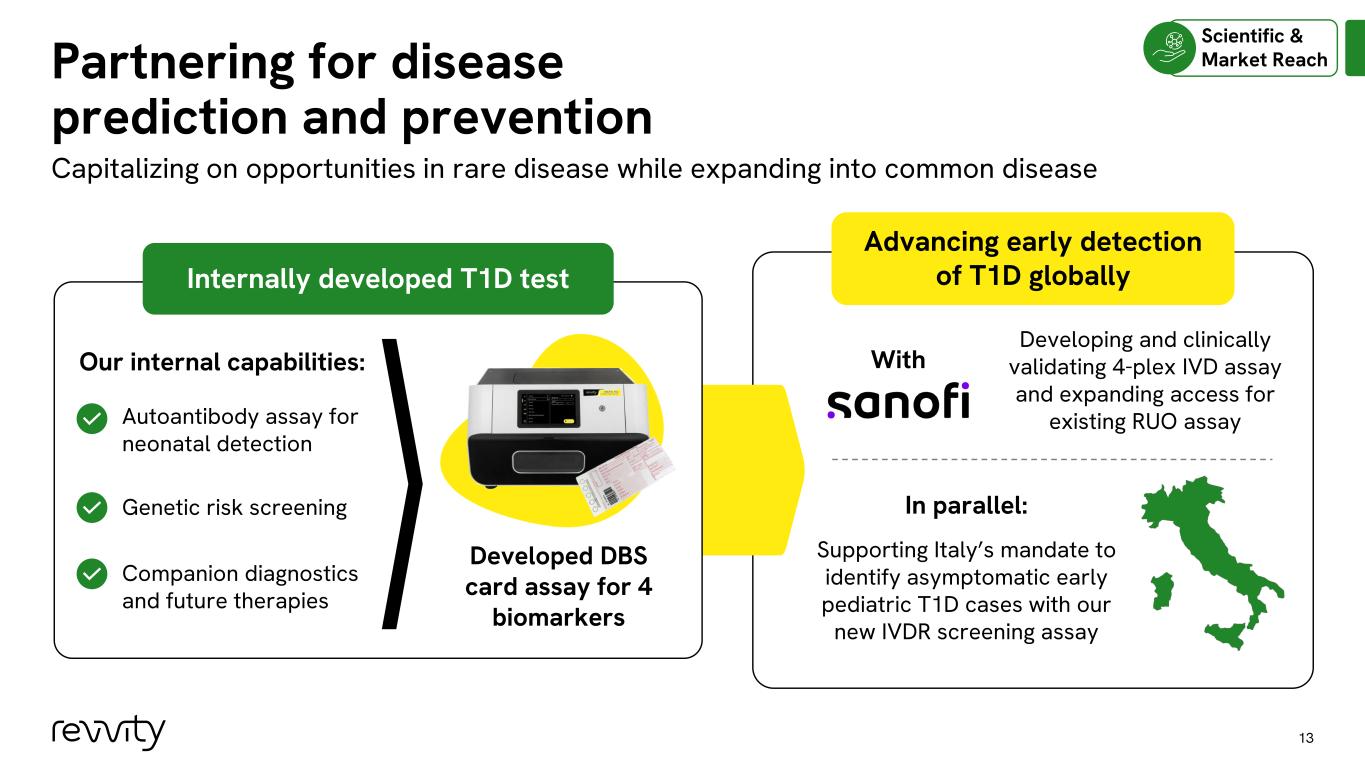

Partnering for disease prediction and prevention 13 Capitalizing on opportunities in rare disease while expanding into common disease Our internal capabilities: Genetic risk screening Companion diagnostics and future therapies Autoantibody assay for neonatal detection Developed DBS card assay for 4 biomarkers Internally developed T1D test Advancing early detection of T1D globally In parallel: Supporting Italy’s mandate to identify asymptomatic early pediatric T1D cases with our new IVDR screening assay Developing and clinically validating 4-plex IVD assay and expanding access for existing RUO assay With Scientific & Market Reach

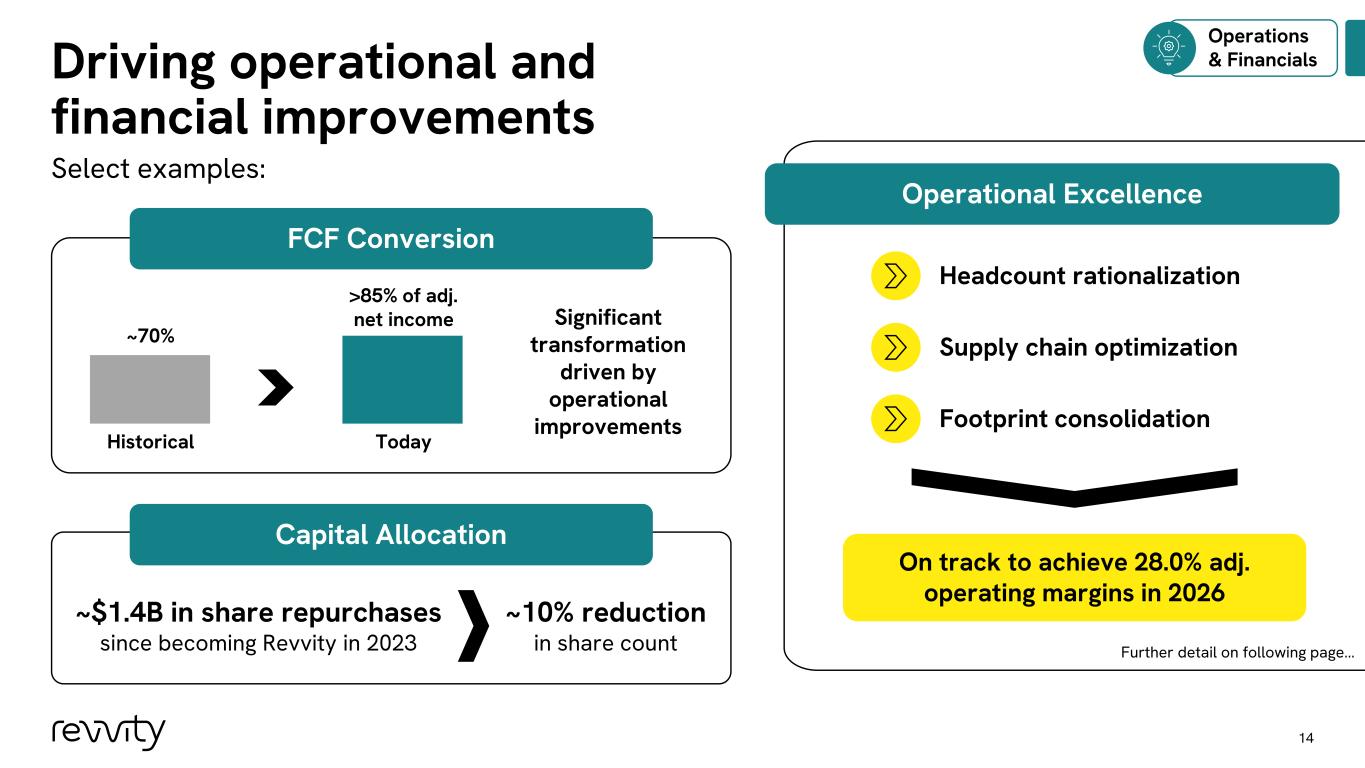

Operational Excellence Driving operational and financial improvements 14 Operations & Financials FCF Conversion Capital Allocation Significant transformation driven by operational improvements On track to achieve 28.0% adj. operating margins in 2026 Headcount rationalization Supply chain optimization Footprint consolidation ~$1.4B in share repurchases since becoming Revvity in 2023 ~10% reduction in share count Today >85% of adj. net income Historical ~70% Select examples: Further detail on following page…

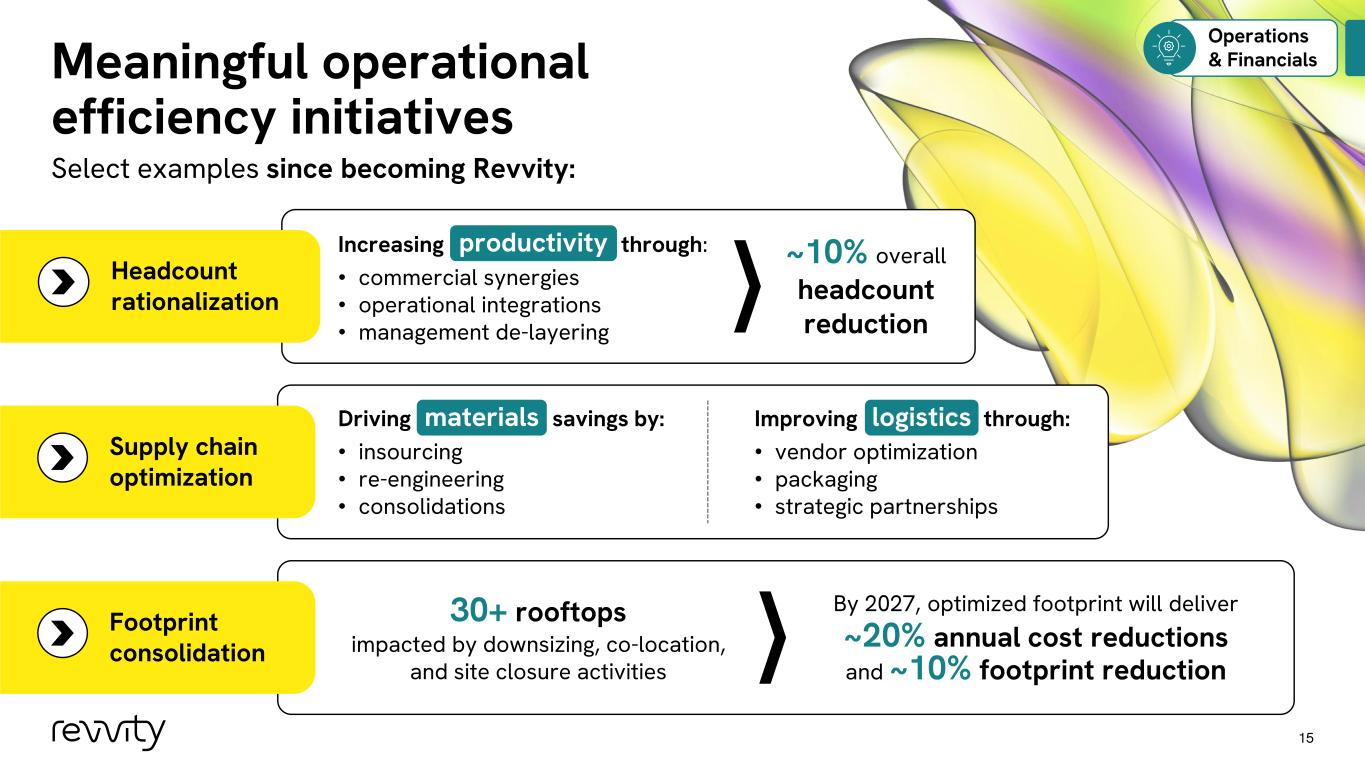

Meaningful operational efficiency initiatives 15 Select examples since becoming Revvity: Footprint consolidation By 2027, optimized footprint will deliver ~20% annual cost reductions and ~10% footprint reduction 30+ rooftops impacted by downsizing, co-location, and site closure activities Supply chain optimization Improving logistics through: • vendor optimization • packaging • strategic partnerships Driving materials savings by: • insourcing • re-engineering • consolidations Headcount rationalization ~10% overall headcount reduction Increasing productivity through: • commercial synergies • operational integrations • management de-layering r ductivity Operations & Financials

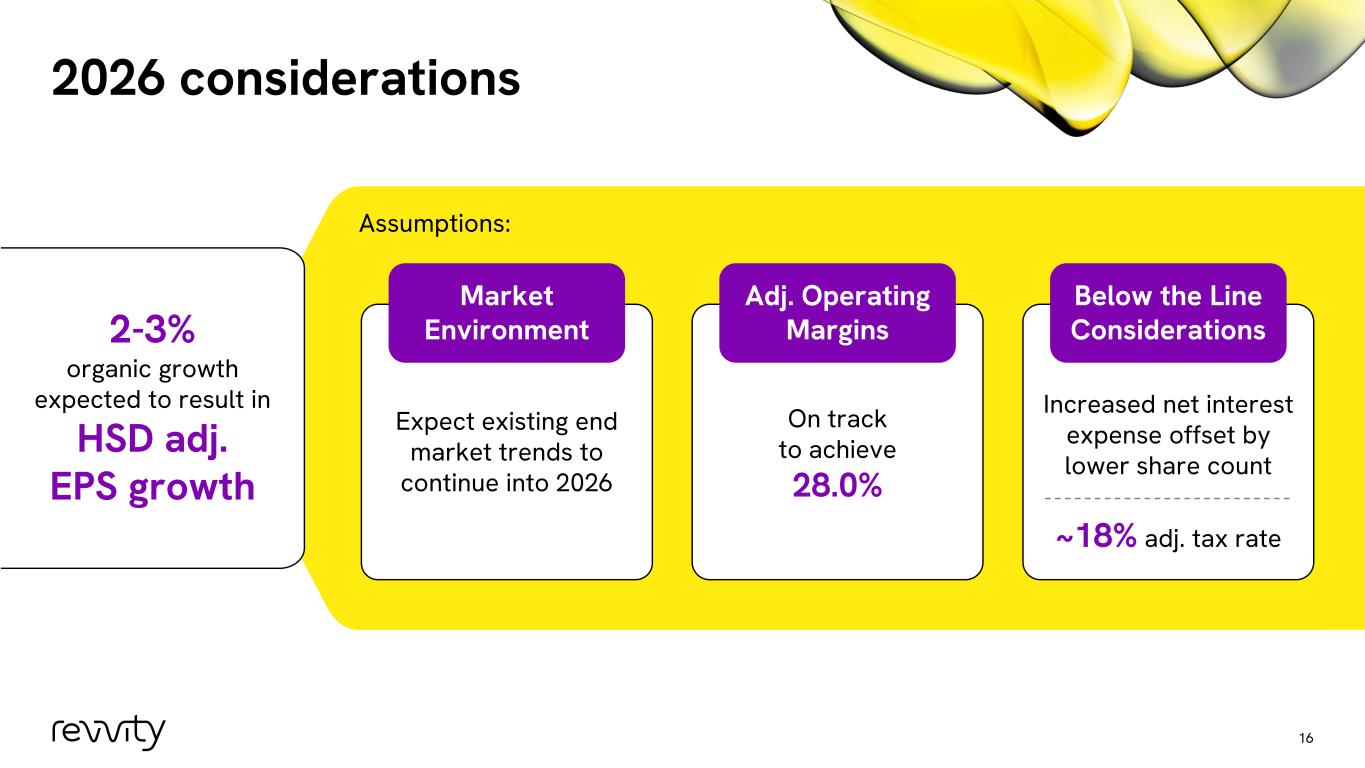

2026 considerations 16 Expect existing end market trends to continue into 2026 Market Environment On track to achieve 28.0% Adj. Operating Margins Increased net interest expense offset by lower share count ~18% adj. tax rate Below the Line Considerations2-3% organic growth expected to result in HSD adj. EPS growth Assumptions:

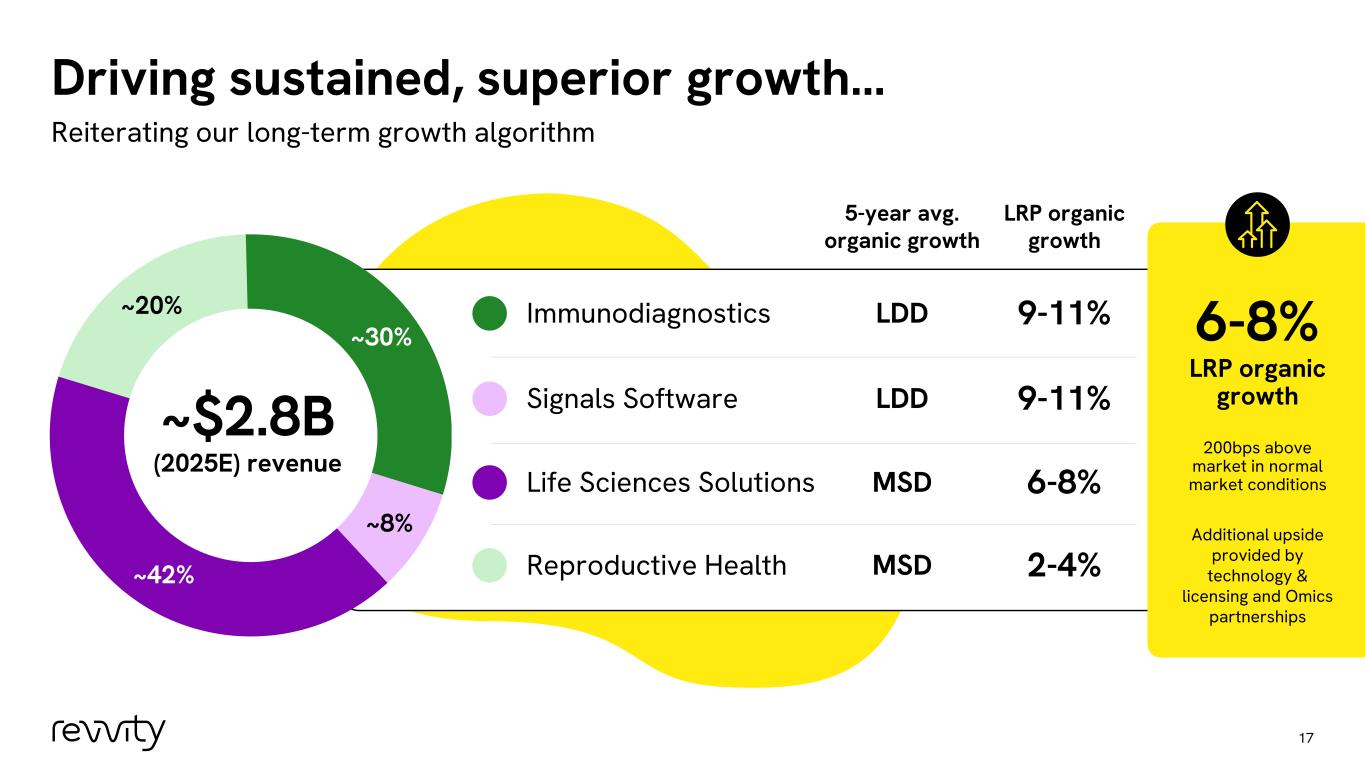

Driving sustained, superior growth… 17 LRP organic growth Life Sciences Solutions Immunodiagnostics Signals Software 5-year avg. organic growth Reproductive Health 6-8% 9-11% 9-11% 2-4% ~20% ~30% ~8% ~42% ~$2.8B (2025E) revenue LDD LDD MSD MSD 6-8% LRP organic growth 200bps above market in normal market conditions Additional upside provided by technology & licensing and Omics partnerships Reiterating our long-term growth algorithm

…and achieving top-tier margins… 18 …while delivering DD adj. EPS growth over the long term, with capital deployment providing additional upside ~27% Gross margin expansion Future SG&A operating leverage and cost efficiencies 25bps per year 50bps per year Mid-30s% Defined roadmap for continued margin expansion driven by industry-leading incremental margins 2025E

Bringing it all together 19 A Category of One An innovative Life Sciences and Diagnostics company with a unique portfolio and leading positions in high-growth end- markets Well-positioned with high recurring revenue along with compelling growth opportunities and resilient returns A strategic partner to customers bridging the gap from pre-clinical to clinical stages A company with a transformed portfolio that is execution focused A differentiated financial profile with attractive margin expansion potential and capital deployment opportunities