1©2025 U.S. Bank | Confidential U.S. Bancorp 4Q25 Earnings Conference Call J a n u a r y 2 0 , 2 0 2 6

2©2025 U.S. Bank | Confidential Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, future economic conditions and the anticipated future revenue, expenses, financial condition, asset quality, capital and liquidity levels, plans, prospects, targets, initiatives and operations of U.S. Bancorp. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “projects,” “forecasts,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward-looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from those set forth in forward-looking statements, including the following risks and uncertainties: deterioration in general business, political and economic conditions or turbulence in domestic or global financial markets, which could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility; changes to statutes, regulations, or regulatory policies or practices, including capital and liquidity requirements and any credit card interest rate caps, and the enforcement and interpretation of such laws and regulations, and U.S. Bancorp’s ability to address or satisfy those requirements and other requirements or conditions imposed by regulatory entities; changes in trade policy, including the imposition of tariffs or the impacts of retaliatory tariffs; changes in interest rates; increases in unemployment rates; deterioration in the credit quality of U.S. Bancorp’s loan portfolios or in the value of the collateral securing those loans; changes in commercial real estate occupancy rates; increases in Federal Deposit Insurance Corporation (FDIC) assessments, including due to bank failures; actions taken by governmental agencies to stabilize or reform the financial system and the effectiveness of such actions; turmoil and volatility in the financial services industry; risks related to originating and selling mortgages, including repurchase and indemnity demands, and related to U.S. Bancorp’s role as a loan servicer; impacts of current, pending or future litigation and governmental proceedings; increased competitive pressure; effects of climate change and related physical and transition risks; changes in customer behavior and preferences and the ability to implement technological changes to respond to customer needs and meet competitive demands; breaches in data security; failures or disruptions in or breaches of U.S. Bancorp’s operational, technology or security systems or infrastructure, or those of third parties, including as a result of cybersecurity incidents; failures to safeguard personal information; impacts of pandemics, natural disasters, terrorist activities, civil unrest, international hostilities and geopolitical events; impacts of supply chain disruptions, rising inflation, slower growth or a recession; failure to execute on strategic or operational plans; effects of mergers and acquisitions, such as the pending acquisition of Condor Trading LP and its subsidiaries, including BTIG, LLC, and related integration, including that the expected benefits may take longer than anticipated to achieve or may not be achieved in entirety or at all and the costs relating to the combination may be greater than expected; effects of critical accounting policies and judgments; effects of changes in or interpretations of tax laws and regulations; management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk and liquidity risk; and the risks and uncertainties more fully discussed in the section entitled “Risk Factors” of U.S. Bancorp’s Form 10-K for the year ended December 31, 2024, and subsequent filings with the Securities and Exchange Commission. Factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the difficulty forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of U.S. Bancorp’s control or cannot be reasonably predicted. For the same reasons, U.S. Bancorp’s management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

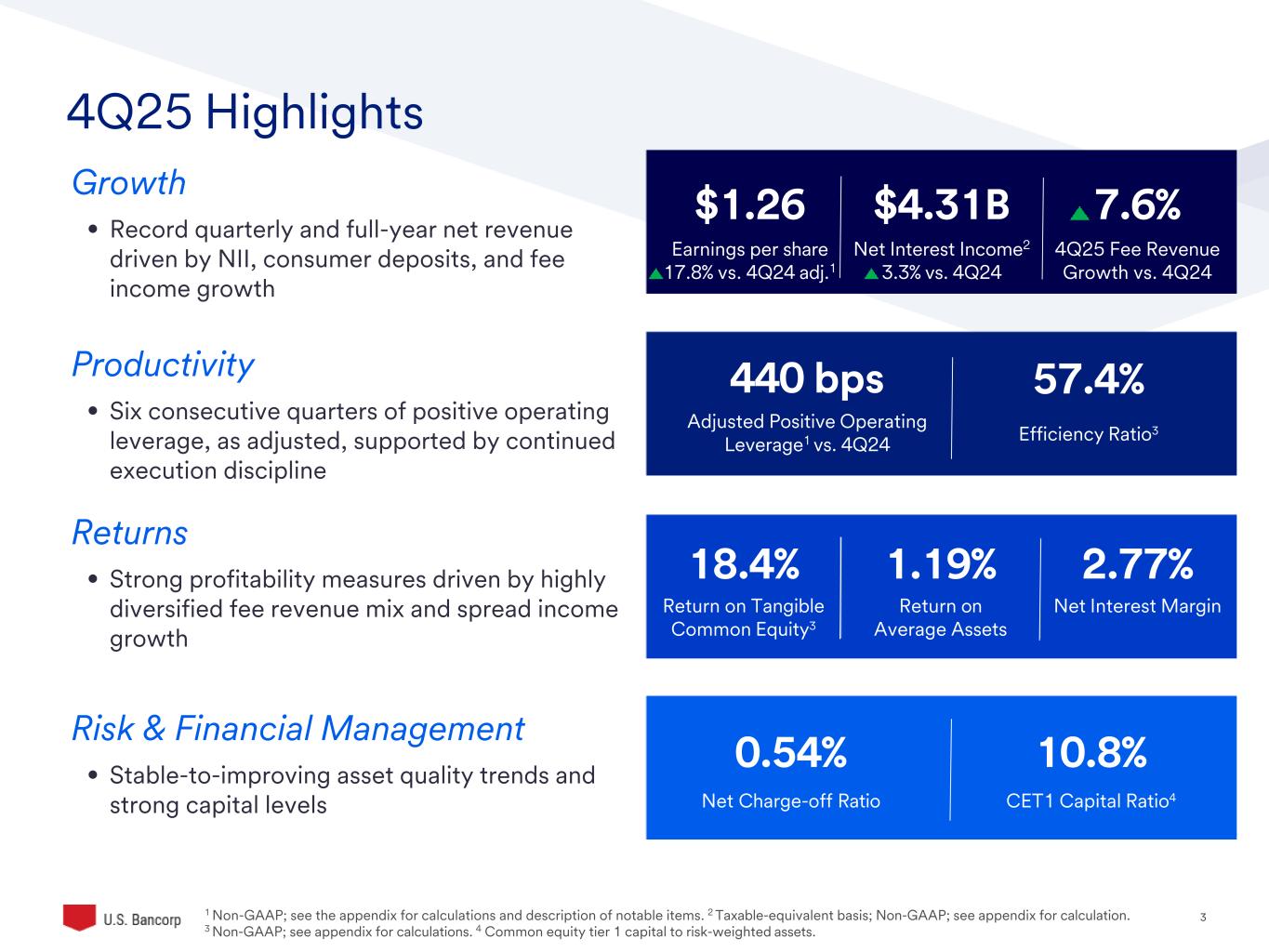

3©2025 U.S. Bank | Confidential 4Q25 Highlights Growth • Record quarterly and full-year net revenue driven by NII, consumer deposits, and fee income growth Productivity • Six consecutive quarters of positive operating leverage, as adjusted, supported by continued execution discipline Returns • Strong profitability measures driven by highly diversified fee revenue mix and spread income growth Risk & Financial Management • Stable-to-improving asset quality trends and strong capital levels 1 Non-GAAP; see the appendix for calculations and description of notable items. 2 Taxable-equivalent basis; Non-GAAP; see appendix for calculation. 3 Non-GAAP; see appendix for calculations. 4 Common equity tier 1 capital to risk-weighted assets. 0.54% Net Charge-off Ratio 10.8% CET1 Capital Ratio4 $4.31B Net Interest Income2 3.3% vs. 4Q24 7.6% 4Q25 Fee Revenue Growth vs. 4Q24 440 bps Adjusted Positive Operating Leverage1 vs. 4Q24 57.4% Efficiency Ratio3 $1.26 Earnings per share 17.8% vs. 4Q24 adj.1 18.4% Return on Tangible Common Equity3 1.19% Return on Average Assets 2.77% Net Interest Margin

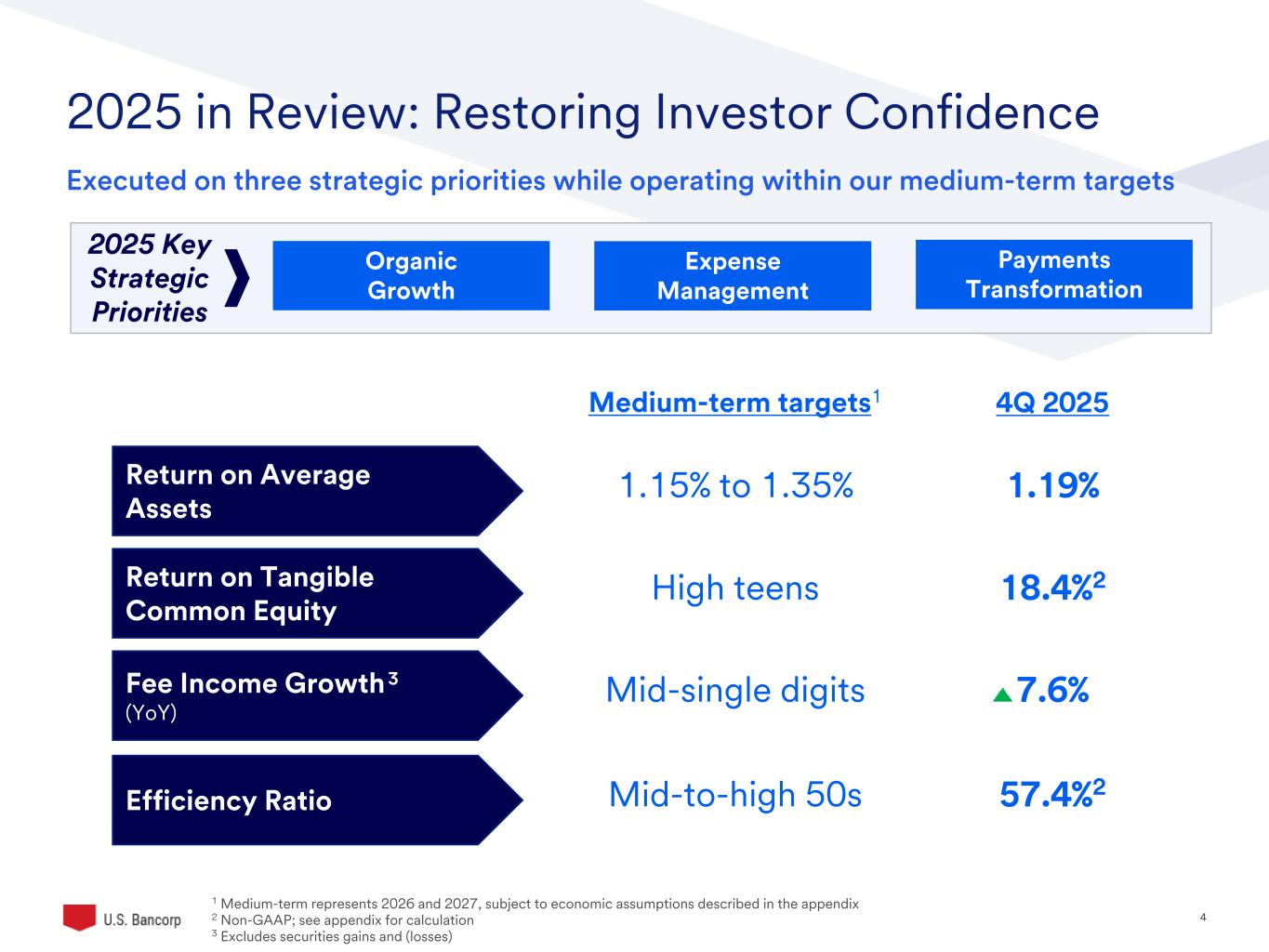

4©2025 U.S. Bank | Confidential 2025 in Review: Restoring Investor Confidence Return on Average Assets Return on Tangible Common Equity Fee Income Growth (YoY) Efficiency Ratio 1.15% to 1.35% High teens Mid-single digits Mid-to-high 50s Medium-term targets1 1 Medium-term represents 2026 and 2027, subject to economic assumptions described in the appendix 2 Non-GAAP; see appendix for calculation 3 Excludes securities gains and (losses) Executed on three strategic priorities while operating within our medium-term targets 2025 Key Strategic Priorities Organic Growth Payments Transformation Expense Management 1.19% 18.4%2 7.6% 57.4%2 4Q 2025 3

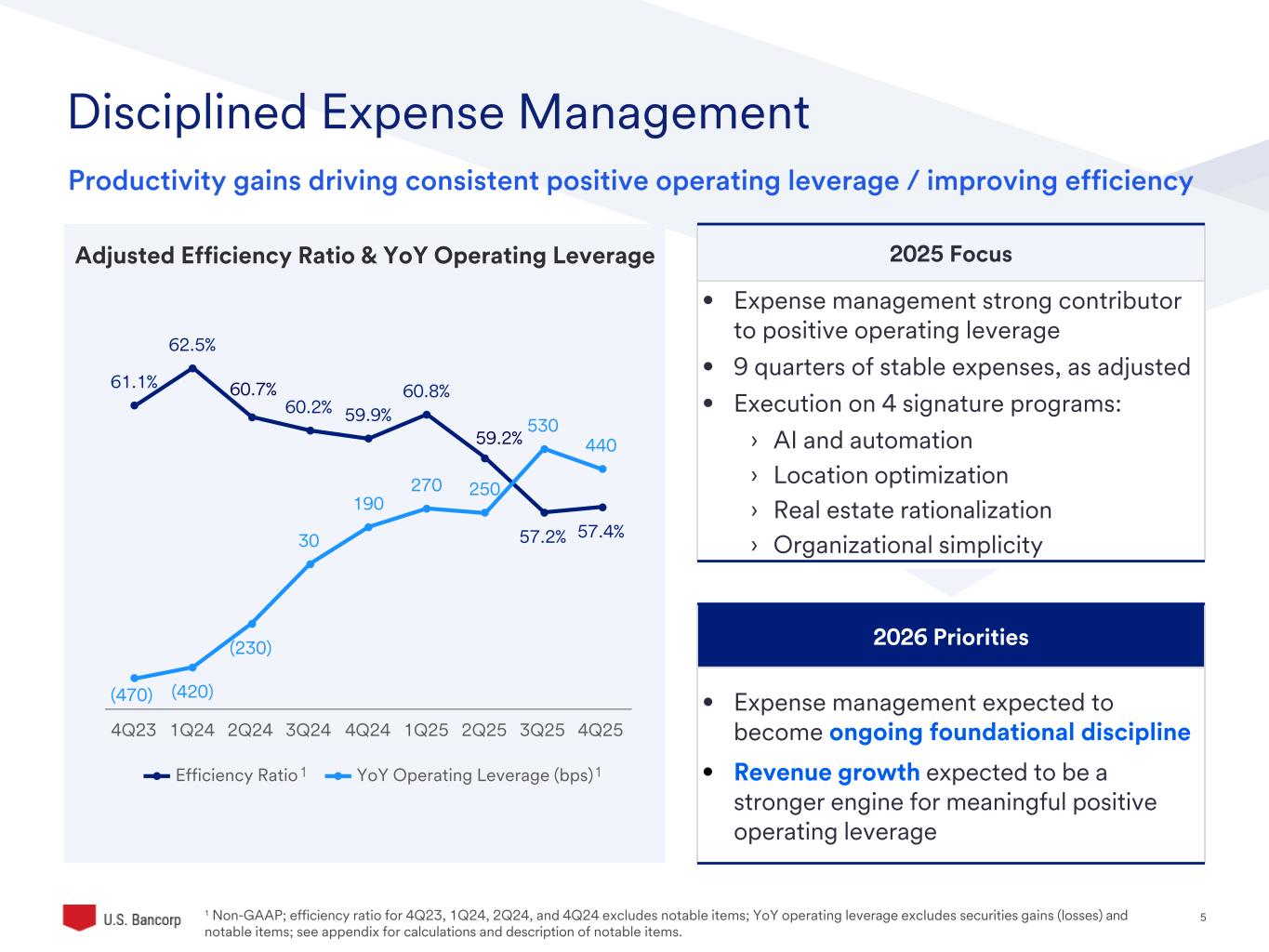

5©2025 U.S. Bank | Confidential 61.1% 62.5% 60.2% 59.9% 60.8% 57.2% 57.4% (420) (230) 30 190 270 250 530 440 Efficiency Ratio YoY Operating Leverage (bps) 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Disciplined Expense Management Productivity gains driving consistent positive operating leverage / improving efficiency 1 Non-GAAP; efficiency ratio for 4Q23, 1Q24, 2Q24, and 4Q24 excludes notable items; YoY operating leverage excludes securities gains (losses) and notable items; see appendix for calculations and description of notable items. 2025 Focus • Expense management strong contributor to positive operating leverage • 9 quarters of stable expenses, as adjusted • Execution on 4 signature programs: › AI and automation › Location optimization › Real estate rationalization › Organizational simplicity 2026 Priorities • Expense management expected to become ongoing foundational discipline • Revenue growth expected to be a stronger engine for meaningful positive operating leverage Adjusted Efficiency Ratio & YoY Operating Leverage 1 1 60.7% 59.2% (470)

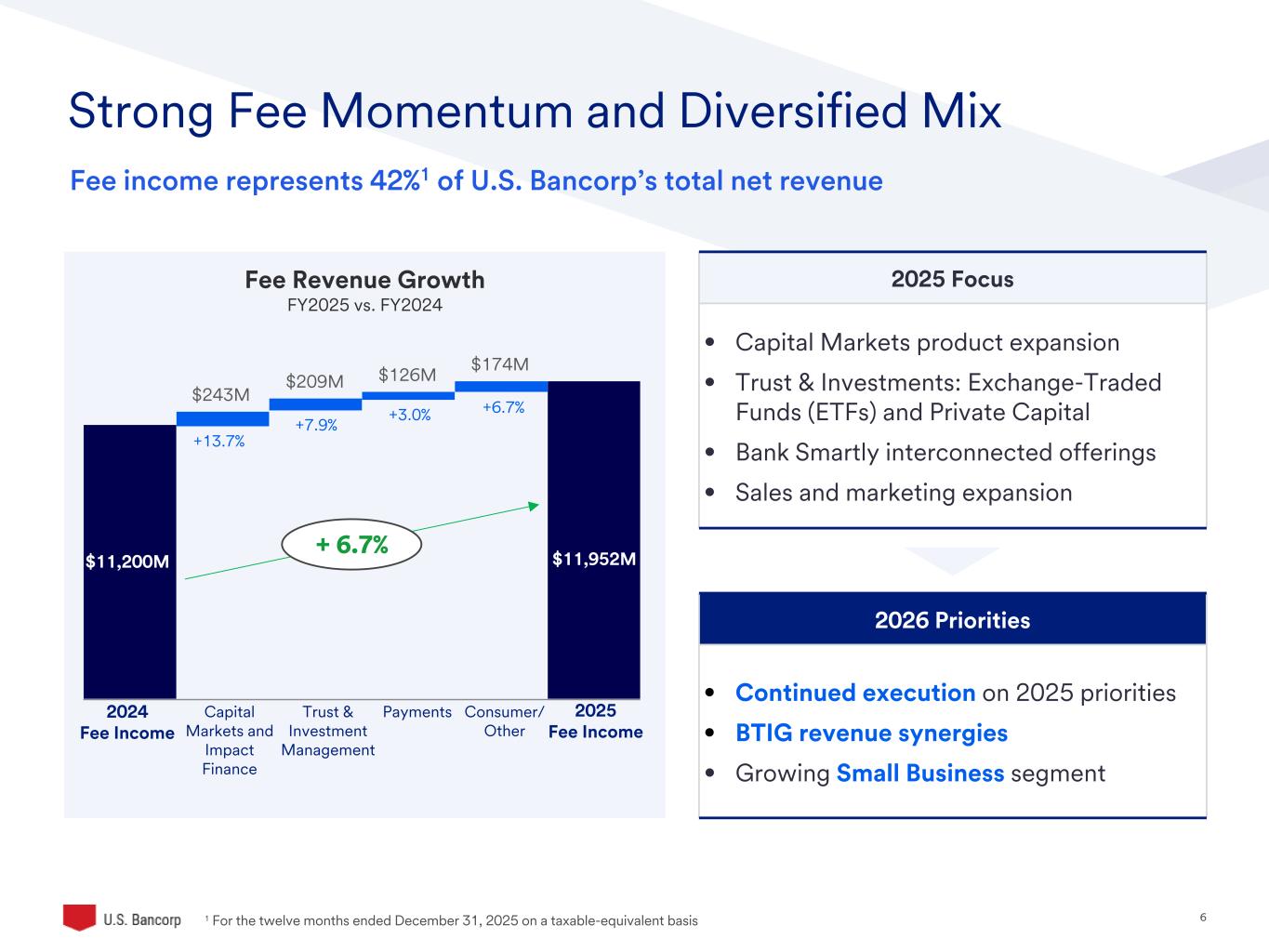

6©2025 U.S. Bank | Confidential Strong Fee Momentum and Diversified Mix Fee income represents 42%1 of U.S. Bancorp’s total net revenue Fee Revenue Growth FY2025 vs. FY2024 2024 Fee Income Capital Markets and Impact Finance PaymentsTrust & Investment Management Consumer/ Other +6.7% 2025 Focus • Capital Markets product expansion • Trust & Investments: Exchange-Traded Funds (ETFs) and Private Capital • Bank Smartly interconnected offerings • Sales and marketing expansion 2026 Priorities • Continued execution on 2025 priorities • BTIG revenue synergies • Growing Small Business segment 2025 Fee Income $243M $209M $126M $174M $11,200M $11,952M +13.7% +7.9% +3.0% +6.7% + 6. % 1 F r th twelve months ended December 31, 2025 on a taxable-equivalent basis

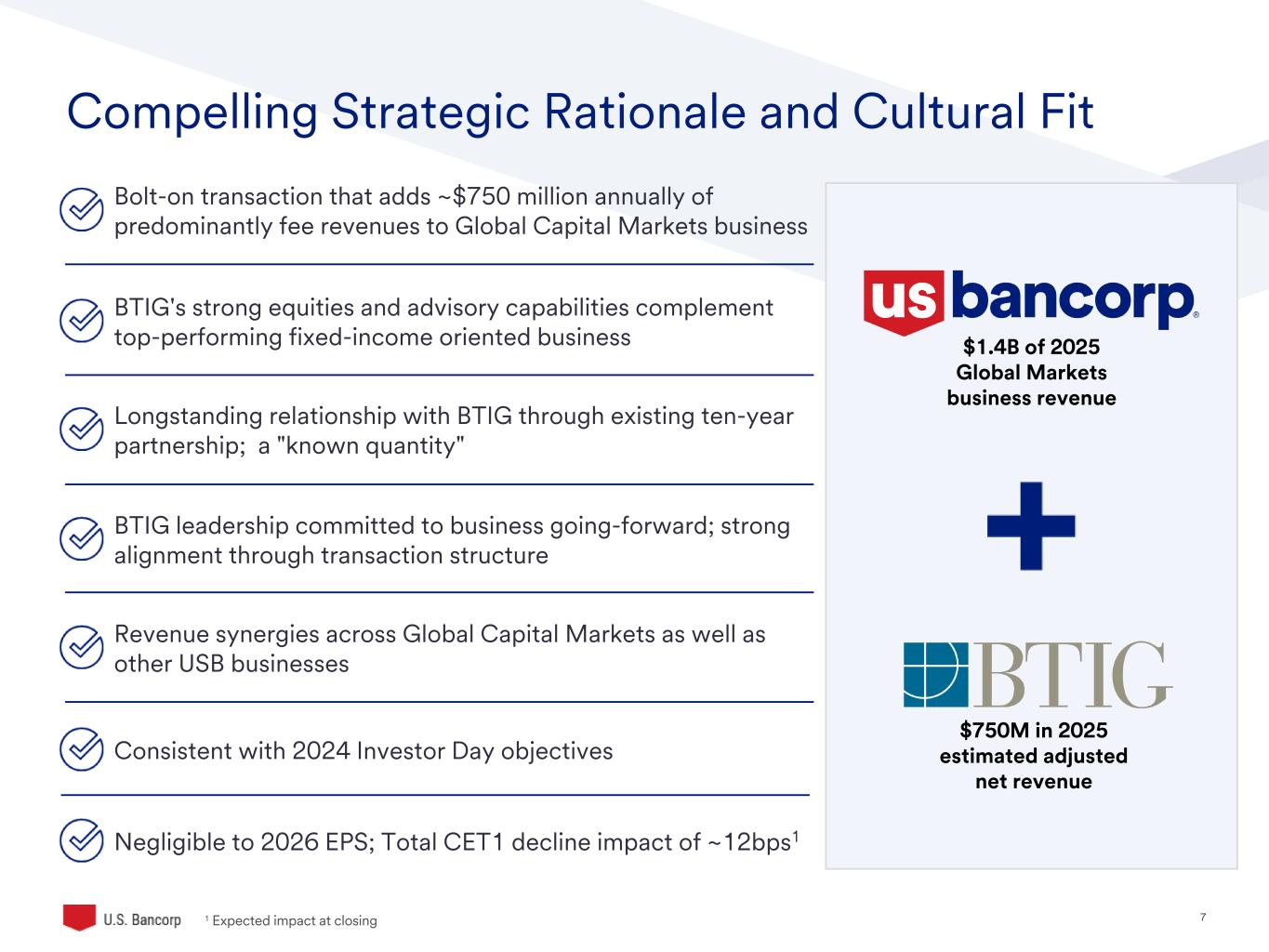

7©2025 U.S. Bank | Confidential Compelling Strategic Rationale and Cultural Fit Bolt-on transaction that adds ~$750 million annually of predominantly fee revenues to Global Capital Markets business BTIG's strong equities and advisory capabilities complement top-performing fixed-income oriented business BTIG leadership committed to business going-forward; strong alignment through transaction structure Revenue synergies across Global Capital Markets as well as other USB businesses Consistent with 2024 Investor Day objectives Longstanding relationship with BTIG through existing ten-year partnership; a "known quantity" Negligible to 2026 EPS; Total CET1 decline impact of ~12bps1 $1.4B of 2025 Global Markets business revenue $750M in 2025 estimated adjusted net revenue 1 Expected impact at closing

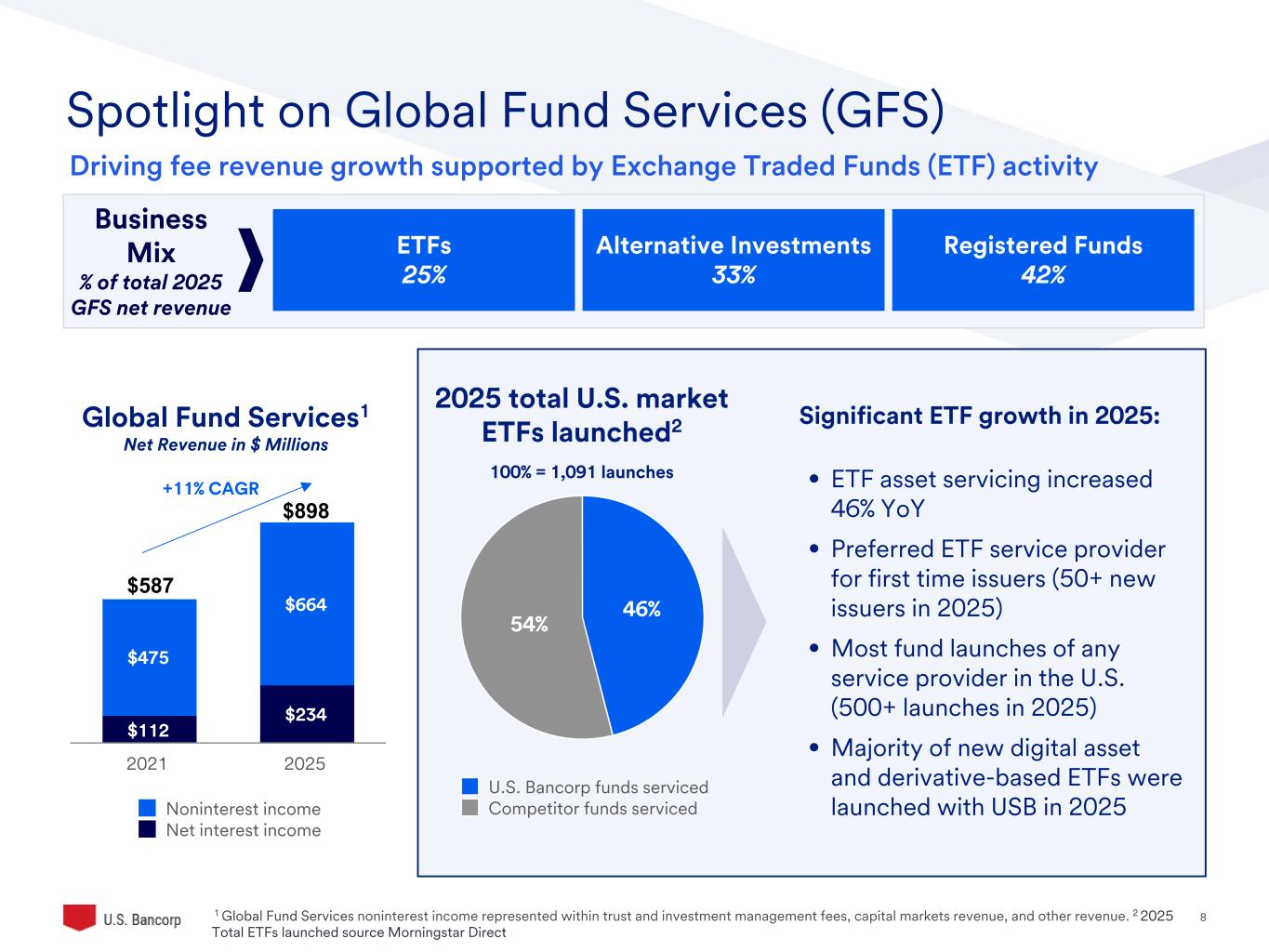

8©2025 U.S. Bank | Confidential $112 $234 $475 $664 Noninterest income Net interest income 2021 2025 Spotlight on Global Fund Services (GFS) Driving fee revenue growth supported by Exchange Traded Funds (ETF) activity Global Fund Services1 Net Revenue in $ Millions Significant ETF growth in 2025: • ETF asset servicing increased 46% YoY • Preferred ETF service provider for first time issuers (50+ new issuers in 2025) • Most fund launches of any service provider in the U.S. (500+ launches in 2025) • Majority of new digital asset and derivative-based ETFs were launched with USB in 2025 +11% CAGR Business Mix % of total 2025 GFS net revenue ETFs 25% Registered Funds 42% Alternative Investments 33% 2025 total U.S. market ETFs launched2 100% = 1,091 launches 1 Global Fund Services noninterest income represented within trust and investment management fees, capital markets revenue, and other revenue. 2 2025 Total ETFs launched source Morningstar Direct 46% 54% U.S. Bancorp funds serviced Competitor funds serviced $587 $898

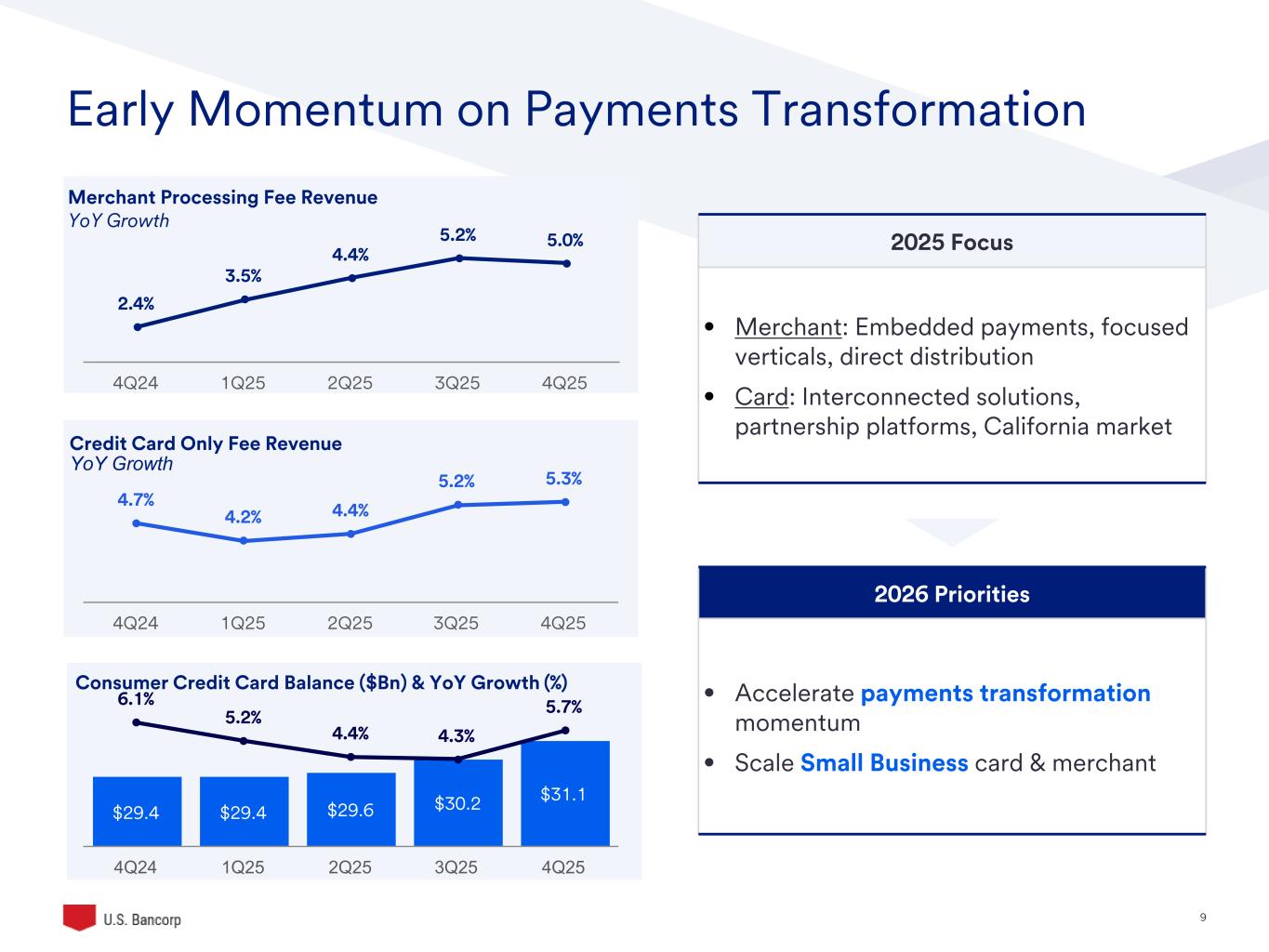

9©2025 U.S. Bank | Confidential Early Momentum on Payments Transformation 2025 Focus • Merchant: Embedded payments, focused verticals, direct distribution • Card: Interconnected solutions, partnership platforms, California market 2026 Priorities • Accelerate payments transformation momentum • Scale Small Business card & merchant Merchant Processing Fee Revenue YoY Growth Credit Card Only Fee Revenue YoY Growth Consumer Credit Card Balance ($Bn) & YoY Growth (%) 2.4% 3.5% 4.4% 5.2% 5.0% 4Q24 1Q25 2Q25 3Q25 4Q25 4.7% 4.2% 4.4% 5.2% 5.3% 4Q24 1Q25 2Q25 3Q25 4Q25 $29.4 $29.4 $29.6 $30.2 $31.1 6.1% 5.2% 4.4% 4.3% 5.7% 4Q24 1Q25 2Q25 3Q25 4Q25

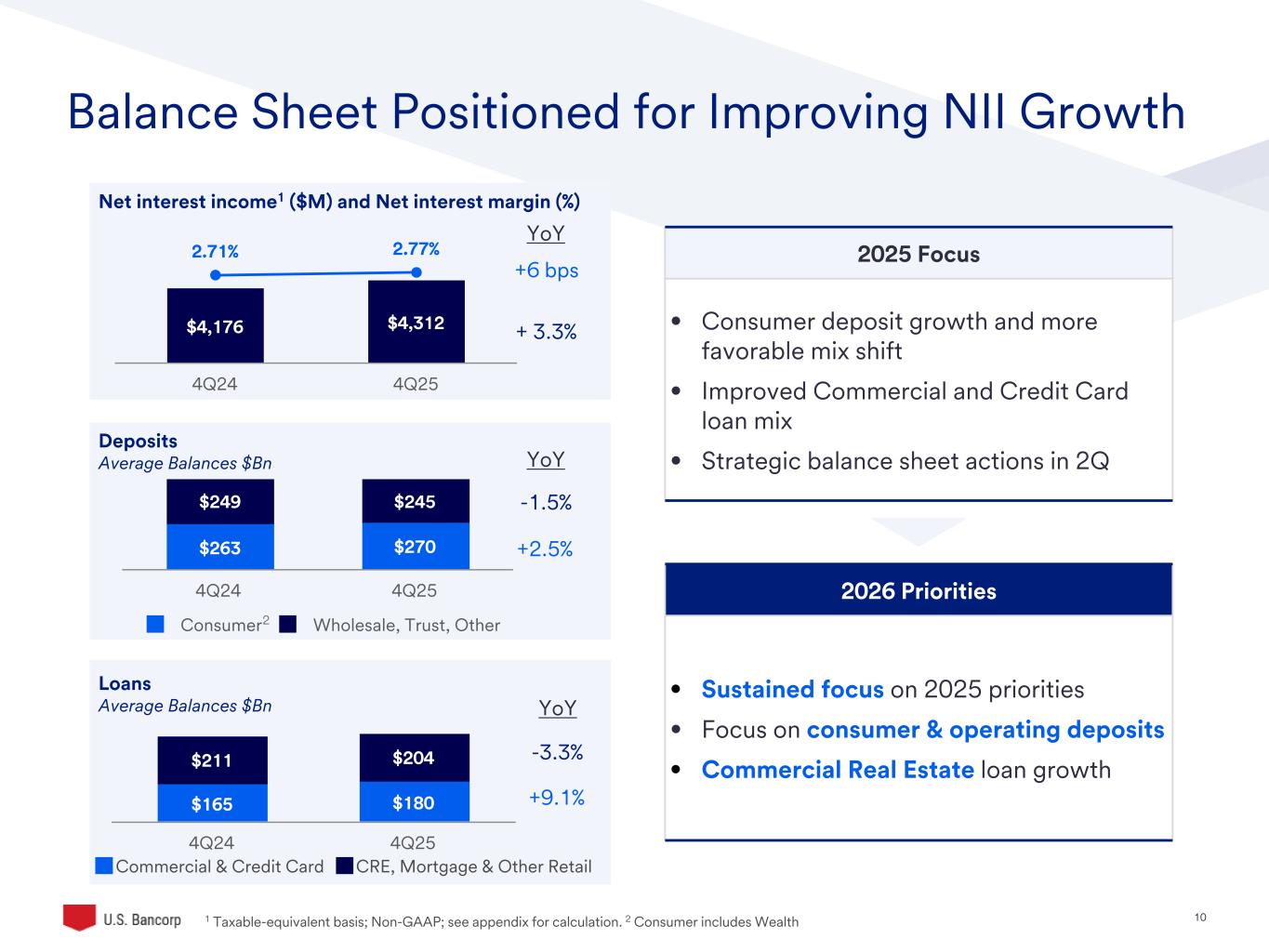

10©2025 U.S. Bank | Confidential Deposits Average Balances $Bn Balance Sheet Positioned for Improving NII Growth Net interest income1 ($M) and Net interest margin (%) Loans Average Balances $Bn 2025 Focus • Consumer deposit growth and more favorable mix shift • Improved Commercial and Credit Card loan mix • Strategic balance sheet actions in 2Q 2026 Priorities • Sustained focus on 2025 priorities • Focus on consumer & operating deposits • Commercial Real Estate loan growth 1 Taxable-equivalent basis; Non-GAAP; see appendix for calculation. 2 Consumer includes Wealth YoY -1.5% +2.5% YoY +6 bps + 3.3% $263 $270 $249 $245 Consumer Wholesale, Trust, Other 4Q24 4Q25 CRE, Mortgage & Other Retail $4,176 $4,312 2.71% 2.77% 4Q24 4Q25 2 Commercial & Credit Card YoY -3.3% +9.1%$165 $180 $211 $204 4Q24 4Q25

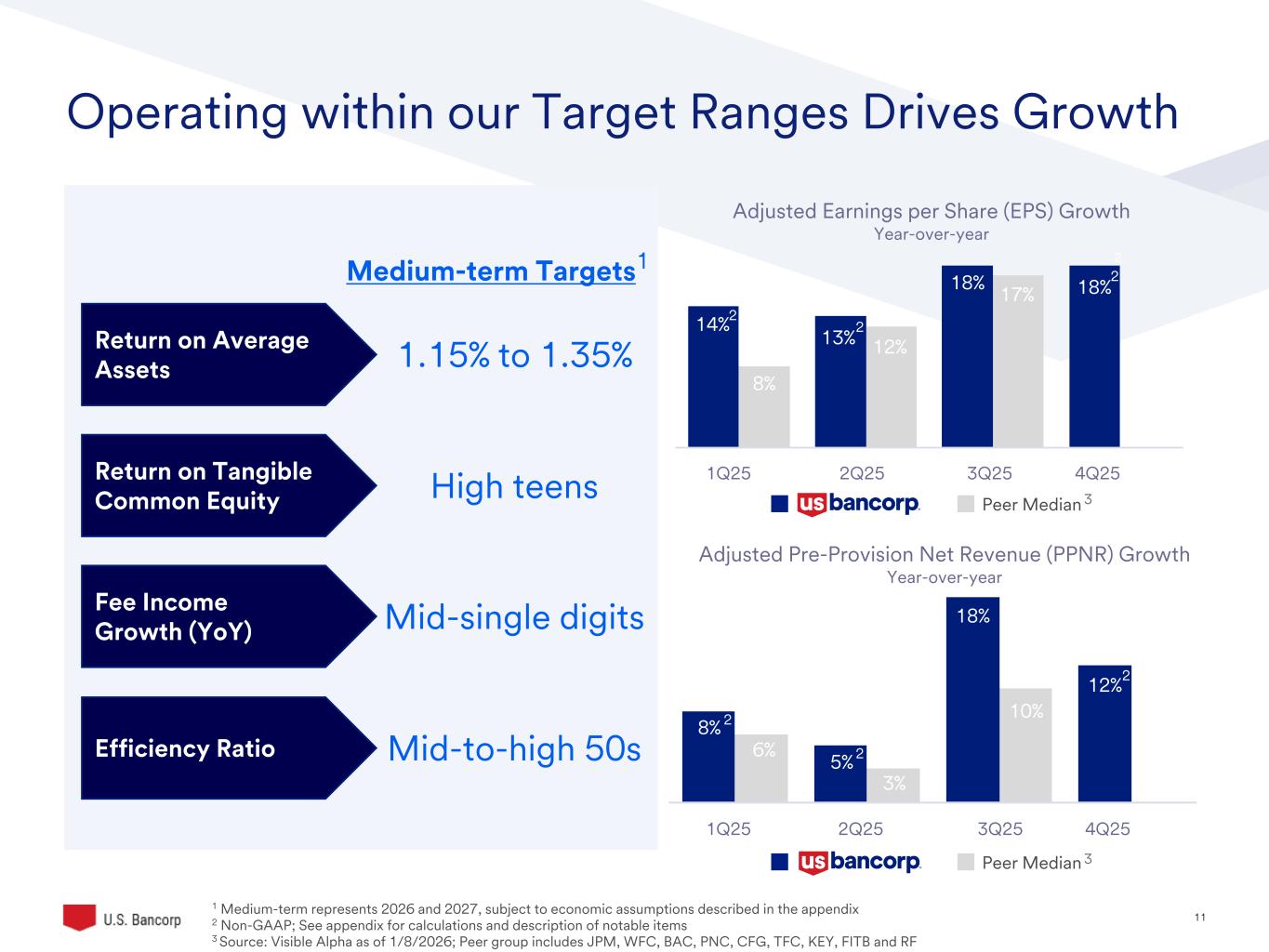

11©2025 U.S. Bank | Confidential Operating within our Target Ranges Drives Growth Return on Average Assets Return on Tangible Common Equity Fee Income Growth (YoY) Efficiency Ratio 1.15% to 1.35% High teens Mid-single digits Mid-to-high 50s Medium-term Targets1 1 Medium-term represents 2026 and 2027, subject to economic assumptions described in the appendix 2 Non-GAAP; See appendix for calculations and description of notable items 3 Source: Visible Alpha as of 1/8/2026; Peer group includes JPM, WFC, BAC, PNC, CFG, TFC, KEY, FITB and RF Adjusted Pre-Provision Net Revenue (PPNR) Growth Year-over-year 8% 6% 5% 3% 18% 10% 12% Peer Median 3 1Q25 2Q25 3Q25 4Q25 Adjusted Earnings per Share (EPS) Growth Year-over-year 2 2 2 2 Peer Median 3 1Q25 2Q25 3Q25 4Q25 14% 8% 13% 12% 18% 17% 18% 2 2 2 2 2 2

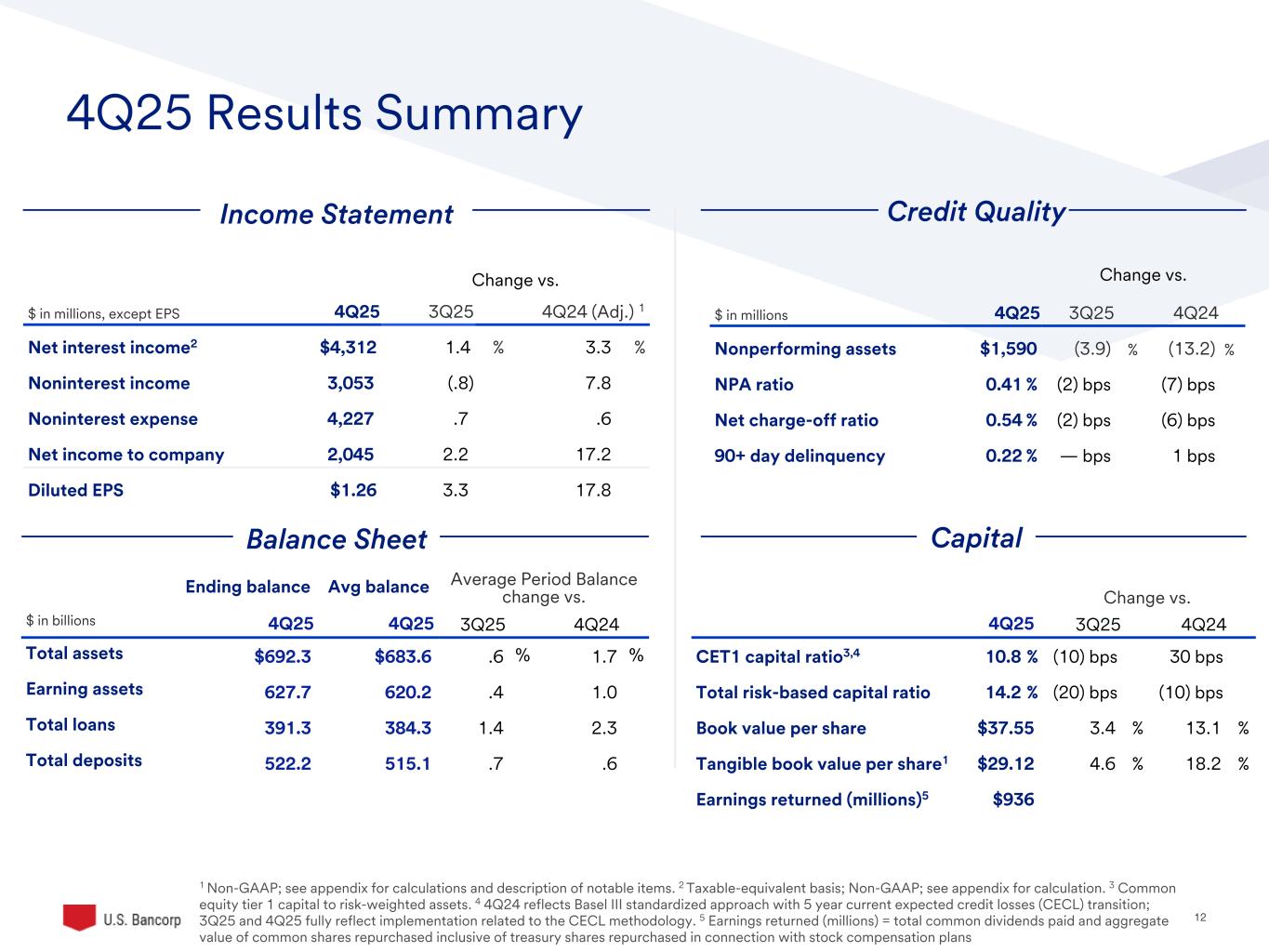

12©2025 U.S. Bank | Confidential 4Q25 Results Summary Income Statement Balance Sheet Capital 1 Non-GAAP; see appendix for calculations and description of notable items. 2 Taxable-equivalent basis; Non-GAAP; see appendix for calculation. 3 Common equity tier 1 capital to risk-weighted assets. 4 4Q24 reflects Basel III standardized approach with 5 year current expected credit losses (CECL) transition; 3Q25 and 4Q25 fully reflect implementation related to the CECL methodology. 5 Earnings returned (millions) = total common dividends paid and aggregate value of common shares repurchased inclusive of treasury shares repurchased in connection with stock compensation plans Change vs. $ in millions, except EPS 4Q25 3Q25 4Q24 (Adj.) 1 Net interest income2 $4,312 1.4 % 3.3 % Noninterest income 3,053 (.8) 7.8 Noninterest expense 4,227 .7 .6 Net income to company 2,045 2.2 17.2 Diluted EPS $1.26 3.3 17.8 Change vs. $ in millions 4Q25 3Q25 4Q24 Nonperforming assets $1,590 (3.9) % (13.2) % NPA ratio 0.41 % (2) bps (7) bps Net charge-off ratio 0.54 % (2) bps (6) bps 90+ day delinquency 0.22 % — bps 1 bps Ending balance Avg balance Average Period Balance change vs. $ in billions 4Q25 4Q25 3Q25 4Q24 Total assets $692.3 $683.6 .6 % 1.7 % Earning assets 627.7 620.2 .4 1.0 Total loans 391.3 384.3 1.4 2.3 Total deposits 522.2 515.1 .7 .6 Change vs. 4Q25 3Q25 4Q24 CET1 capital ratio3,4 10.8 % (10) bps 30 bps Total risk-based capital ratio 14.2 % (20) bps (10) bps Book value per share $37.55 3.4 % 13.1 % Tangible book value per share1 $29.12 4.6 % 18.2 % Earnings returned (millions)5 $936 Credit Quality

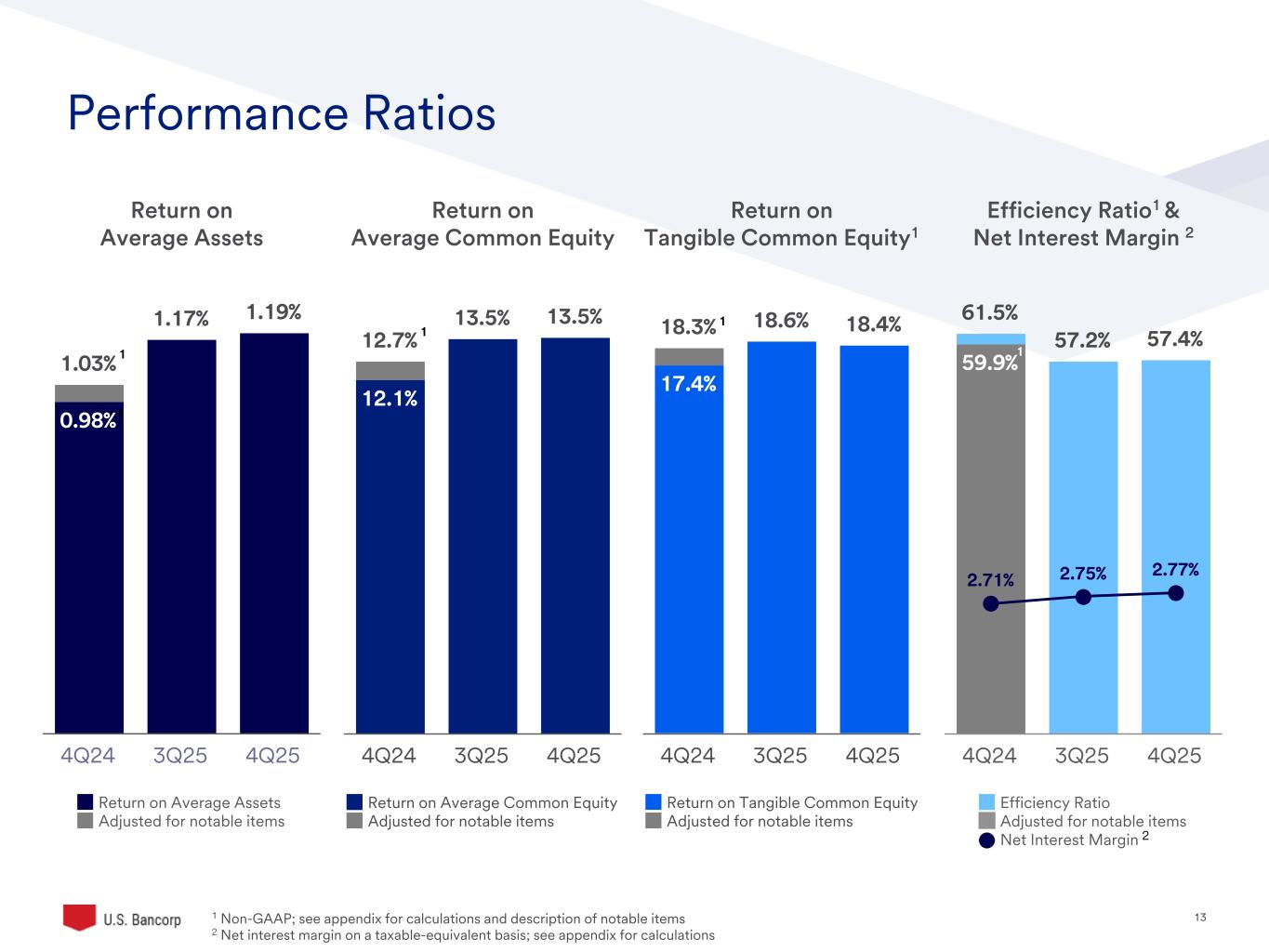

13©2025 U.S. Bank | Confidential 1.03% 1.17% 1.19% 0.98% Return on Average Assets Adjusted for notable items 4Q24 3Q25 4Q25 61.5% 57.2% 57.4% 59.9% 2.71% 2.75% 2.77% Efficiency Ratio Adjusted for notable items Net Interest Margin 4Q24 3Q25 4Q25 Performance Ratios 12.7% 13.5% 13.5% 12.1% Return on Average Common Equity Adjusted for notable items 4Q24 3Q25 4Q25 18.3% 18.6% 18.4% 17.4% Return on Tangible Common Equity Adjusted for notable items 4Q24 3Q25 4Q25 Return on Average Assets Return on Average Common Equity Return on Tangible Common Equity1 Efficiency Ratio1 & Net Interest Margin 2 2 1 Non-GAAP; see appendix for calculations and description of notable items 2 Net interest margin on a taxable-equivalent basis; see appendix for calculations 1 1 1 1 1

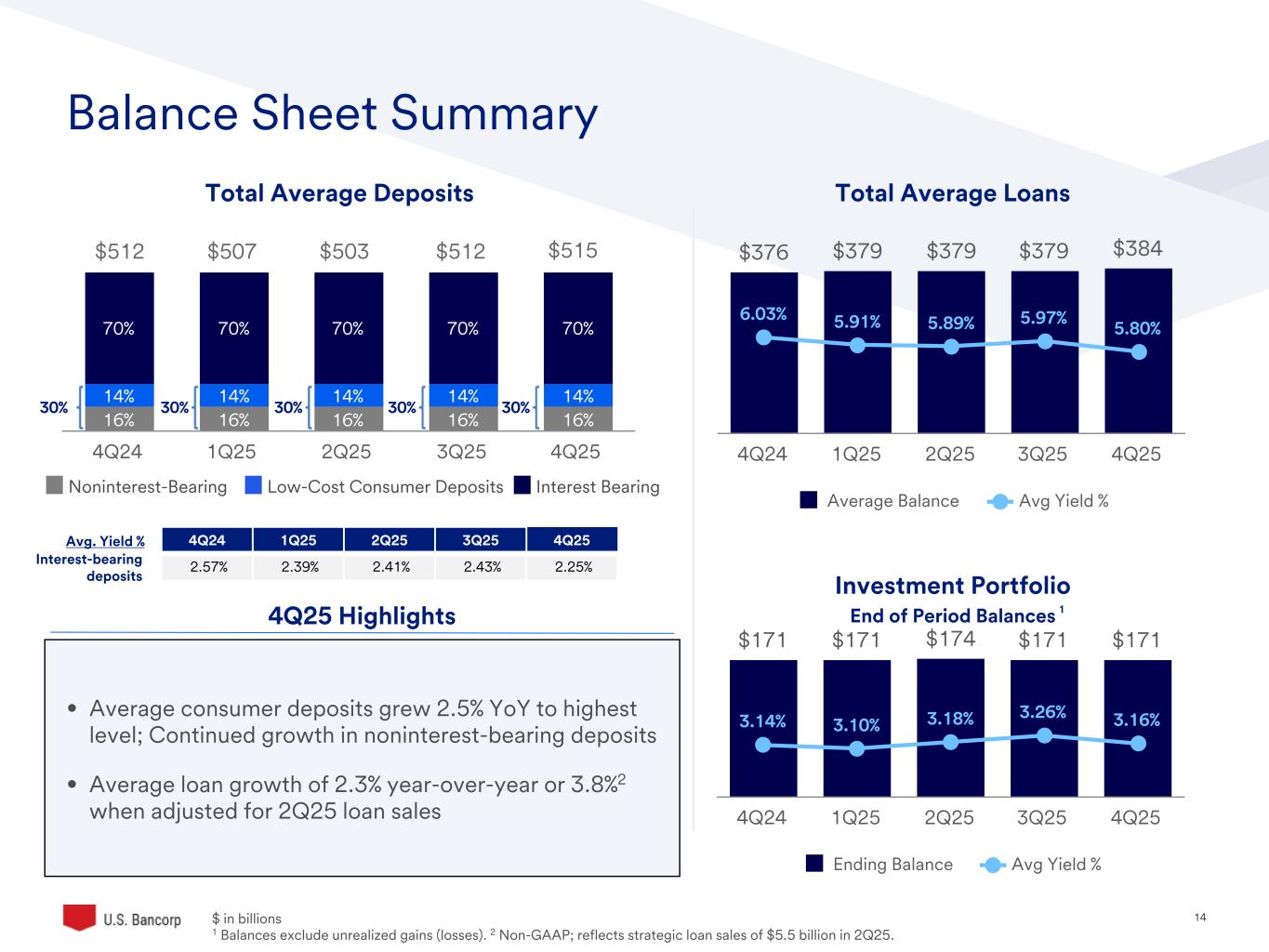

14©2025 U.S. Bank | Confidential Balance Sheet Summary 16% 16% 16% 16% 16% 14% 14% 14% 14% 14% 70% 70% 70% 70% 70% 4Q24 1Q25 2Q25 3Q25 4Q25 Total Average Deposits 4Q25 Highlights Total Average Loans $376 $379 $379 $379 $384 6.03% 5.91% 5.89% 5.97% 5.80% Average Balance Avg Yield % 4Q24 1Q25 2Q25 3Q25 4Q25 Investment Portfolio End of Period Balances $ i billions 1 Balances exclude unrealized gains (losses). 2 Non-GAAP; reflects strategic loan sales of $5.5 billion in 2Q25. $171 $171 $174 $171 $171 3.14% 3.10% 3.18% 3.26% 3.16% Ending Balance Avg Yield % 4Q24 1Q25 2Q25 3Q25 4Q25 1 $512 $507 $503 $512 30% 30% 30% 30% $515 Noninterest-Bearing Low-Cost Consumer Deposits Interest Bearing • Average consumer deposits grew 2.5% YoY to highest level; Continued growth in noninterest-bearing deposits • Average loan growth of 2.3% year-over-year or 3.8%2 when adjusted for 2Q25 loan sales Interest-bearing deposits 30% 4Q24 1Q25 2Q25 3Q25 4Q25 2.57% 2.39% 2.41% 2.43% 2.25% Avg. Yield %

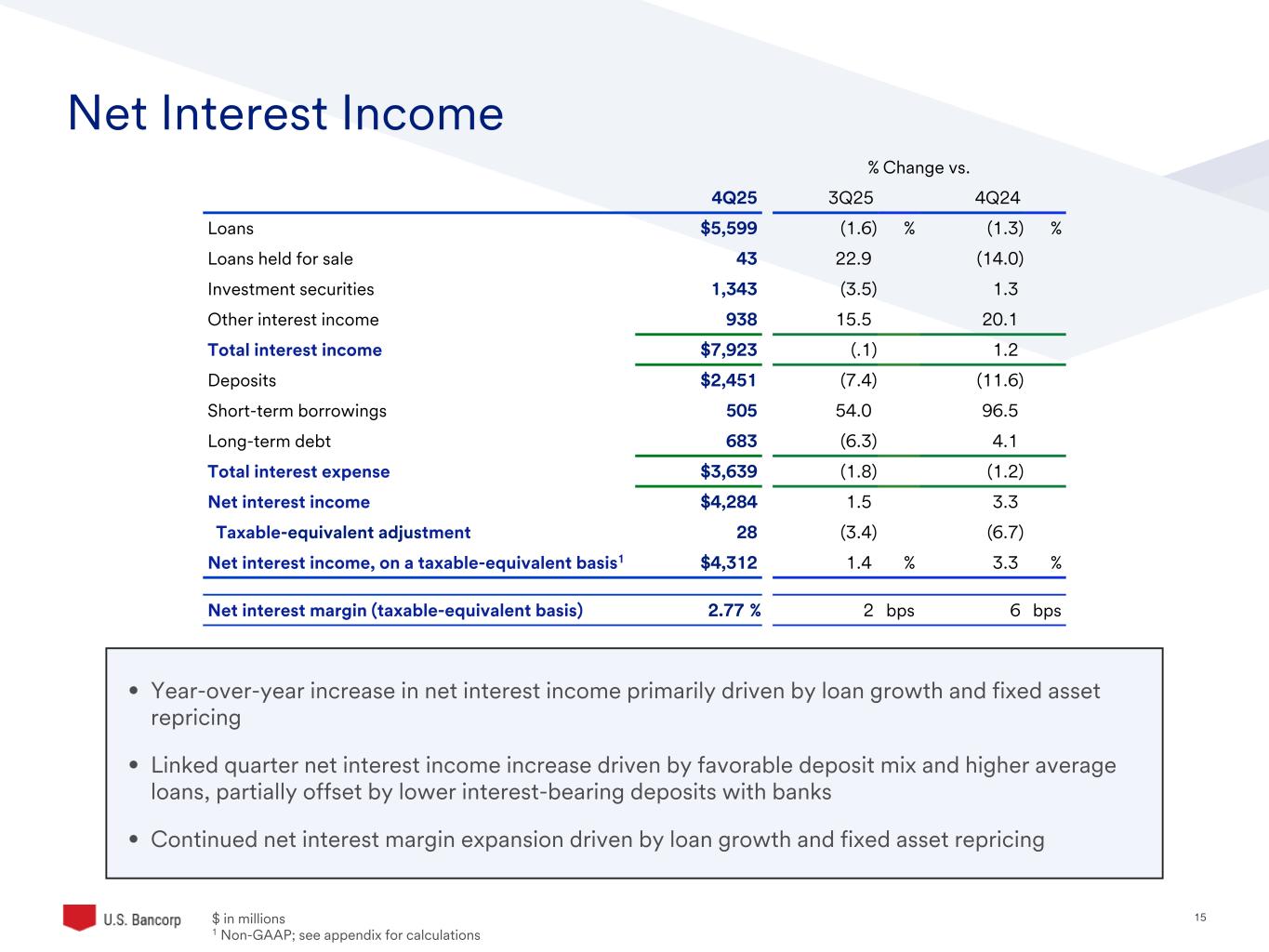

15©2025 U.S. Bank | Confidential • Year-over-year increase in net interest income primarily driven by loan growth and fixed asset repricing • Linked quarter net interest income increase driven by favorable deposit mix and higher average loans, partially offset by lower interest-bearing deposits with banks • Continued net interest margin expansion driven by loan growth and fixed asset repricing Net Interest Income % Change vs. 4Q25 3Q25 4Q24 Loans $5,599 (1.6) % (1.3) % Loans held for sale 43 22.9 (14.0) Investment securities 1,343 (3.5) 1.3 Other interest income 938 15.5 20.1 Total interest income $7,923 (.1) 1.2 Deposits $2,451 (7.4) (11.6) Short-term borrowings 505 54.0 96.5 Long-term debt 683 (6.3) 4.1 Total interest expense $3,639 (1.8) (1.2) Net interest income $4,284 1.5 3.3 Taxable-equivalent adjustment 28 (3.4) (6.7) Net interest income, on a taxable-equivalent basis1 $4,312 1.4 % 3.3 % Net interest margin (taxable-equivalent basis) 2.77 % 2 bps 6 bps $ i millions 1 Non-GAAP; see appendix for calculations

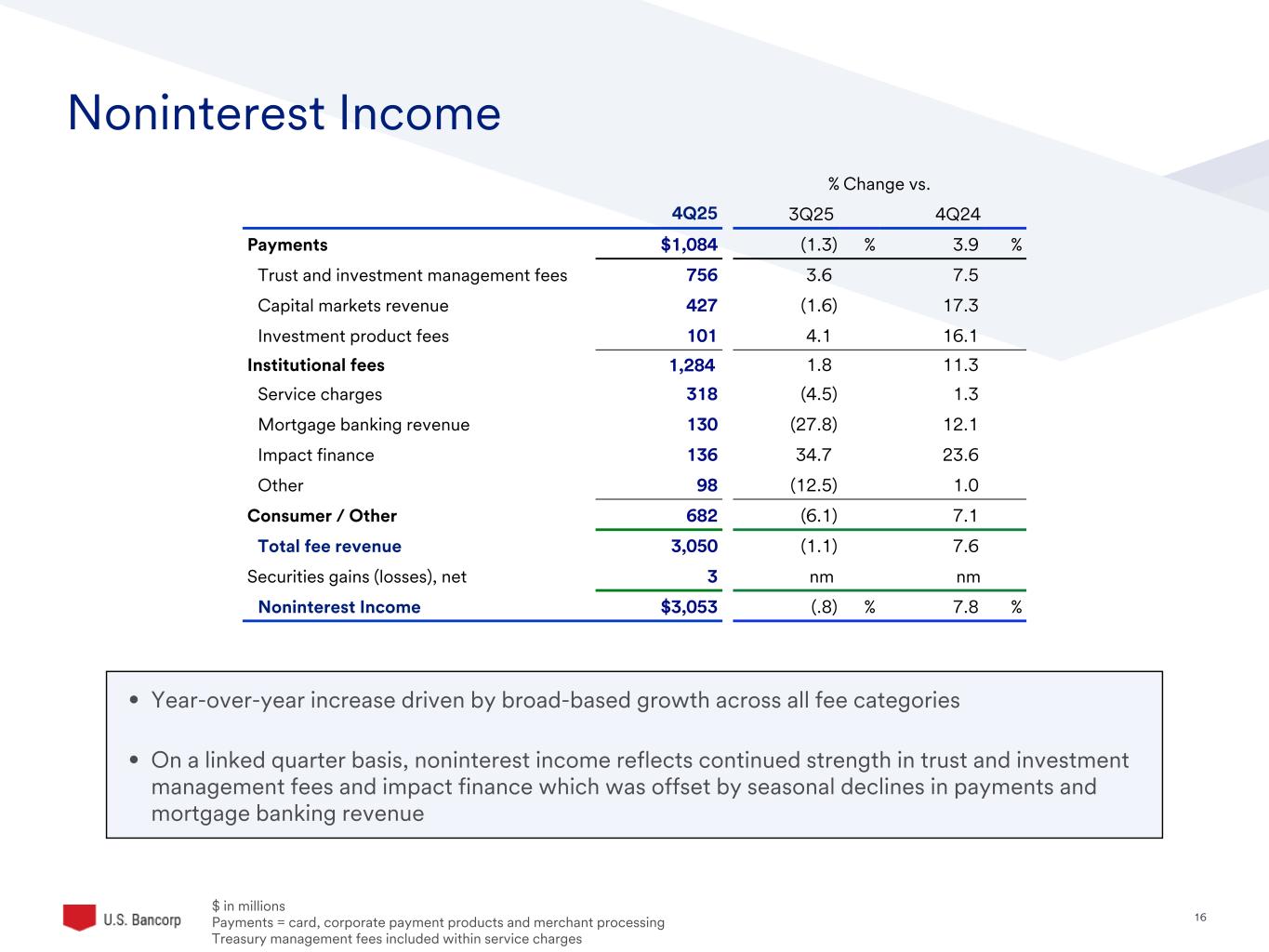

16©2025 U.S. Bank | Confidential Noninterest Income $ in millions Payments = card, corporate payment products and merchant processing Treasury management fees included within service charges % Change vs. 4Q25 3Q25 4Q24 Payments $1,084 (1.3) % 3.9 % Trust and investment management fees 756 3.6 7.5 Capital markets revenue 427 (1.6) 17.3 Investment product fees 101 4.1 16.1 Institutional fees 1,284 1.8 11.3 Service charges 318 (4.5) 1.3 Mortgage banking revenue 130 (27.8) 12.1 Impact finance 136 34.7 23.6 Other 98 (12.5) 1.0 Consumer / Other 682 (6.1) 7.1 Total fee revenue 3,050 (1.1) 7.6 Securities gains (losses), net 3 nm nm Noninterest Income $3,053 (.8) % 7.8 % • Year-over-year increase driven by broad-based growth across all fee categories • On a linked quarter basis, noninterest income reflects continued strength in trust and investment management fees and impact finance which was offset by seasonal declines in payments and mortgage banking revenue

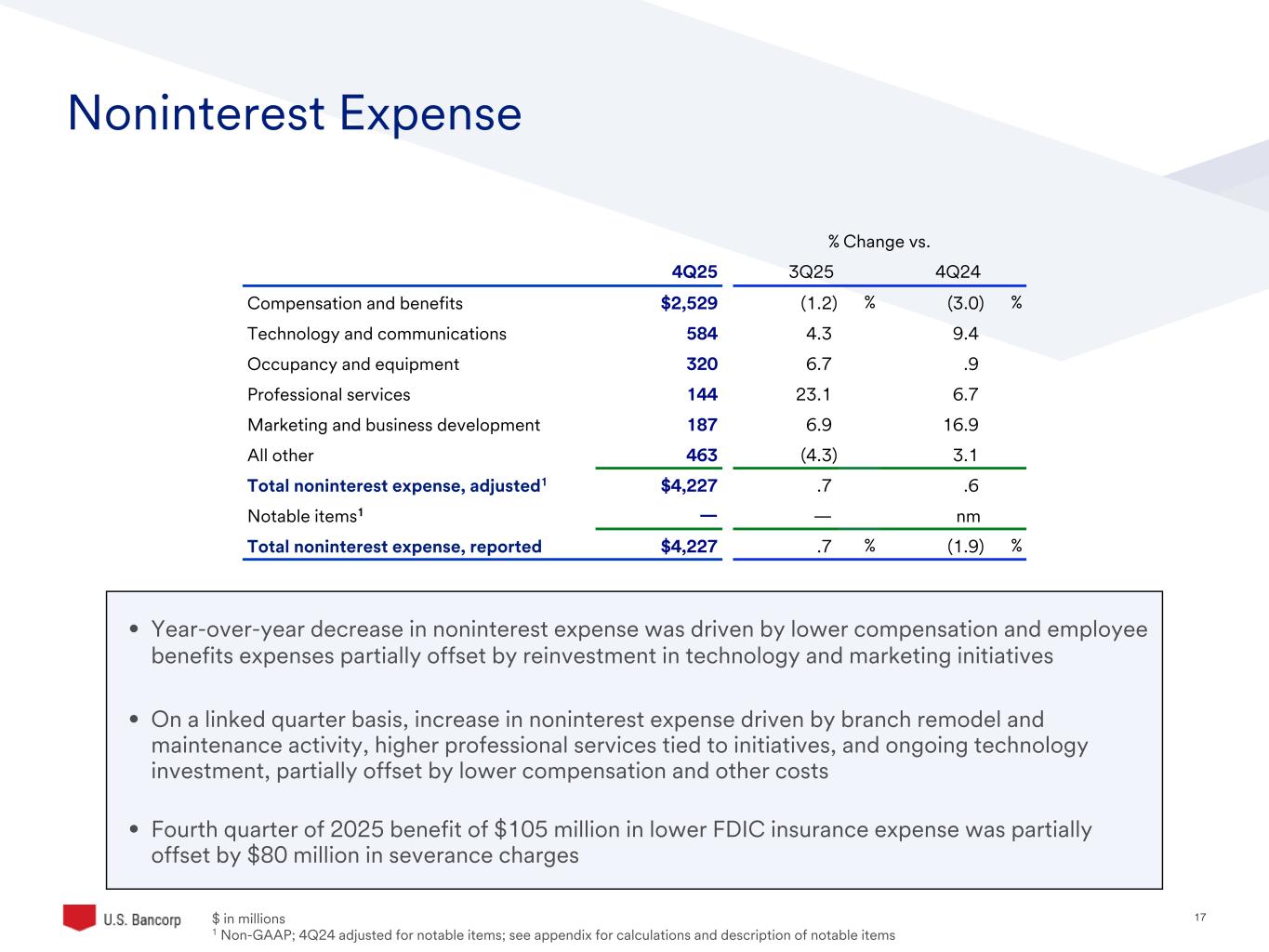

17©2025 U.S. Bank | Confidential Noninterest Expense $ i millions 1 Non-GAAP; 4Q24 adjusted for notable items; see appendix for calculations and description of notable items % Change vs. 4Q25 3Q25 4Q24 Compensation and benefits $2,529 (1.2) % (3.0) % Technology and communications 584 4.3 9.4 Occupancy and equipment 320 6.7 .9 Professional services 144 23.1 6.7 Marketing and business development 187 6.9 16.9 All other 463 (4.3) 3.1 Total noninterest expense, adjusted1 $4,227 .7 .6 Notable items1 — — nm Total noninterest expense, reported $4,227 .7 % (1.9) % • Year-over-year decrease in noninterest expense was driven by lower compensation and employee benefits expenses partially offset by reinvestment in technology and marketing initiatives • On a linked quarter basis, increase in noninterest expense driven by branch remodel and maintenance activity, higher professional services tied to initiatives, and ongoing technology investment, partially offset by lower compensation and other costs • Fourth quarter of 2025 benefit of $105 million in lower FDIC insurance expense was partially offset by $80 million in severance charges

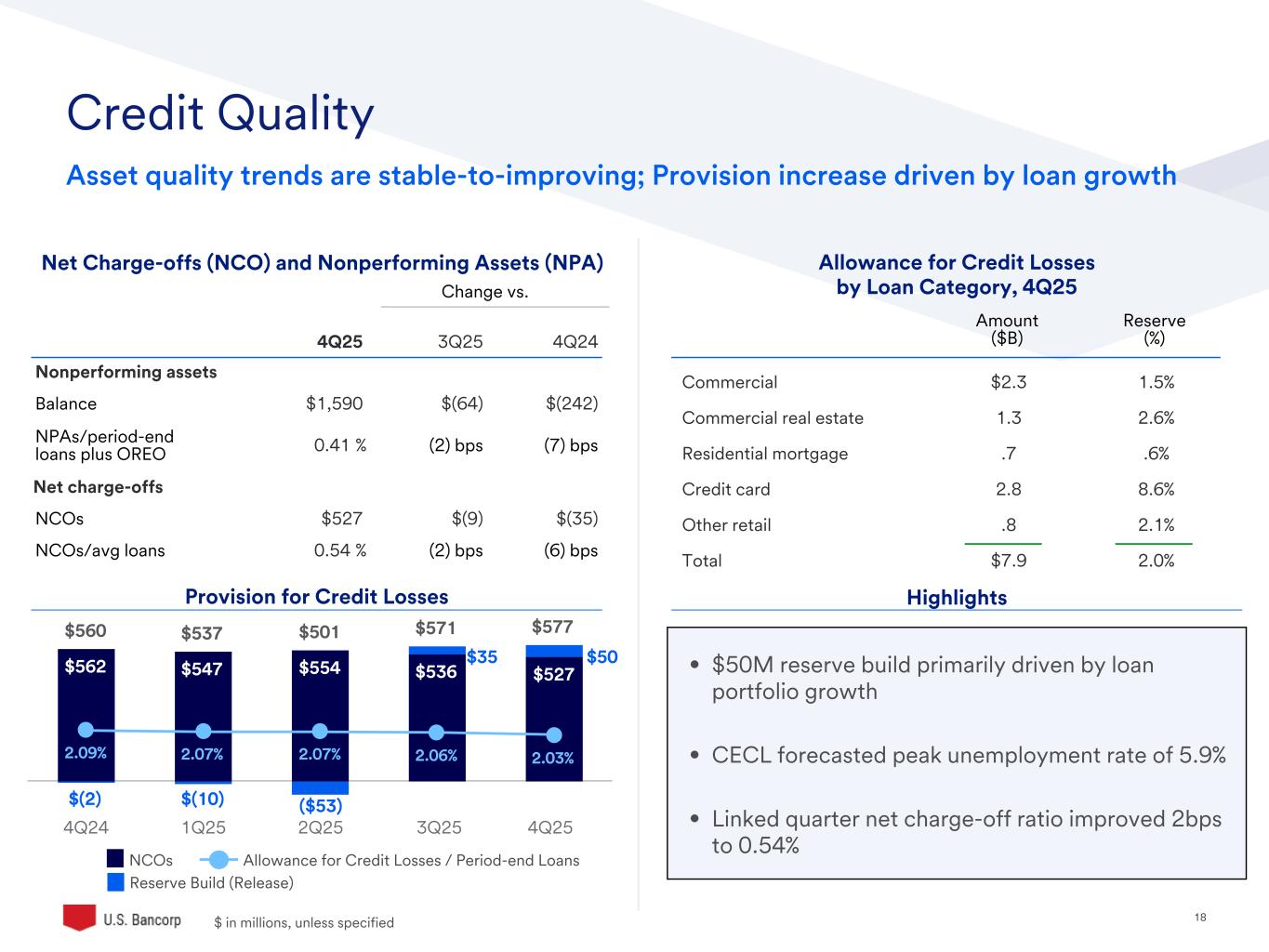

18©2025 U.S. Bank | Confidential $560 $537 $501 $571 $577 $562 $547 $554 $536 $527 $(2) $(10) 2.09% 2.07% 2.07% 2.06% 2.03% $ in millions, unless specified Credit Quality Asset quality trends are stable-to-improving; Provision increase driven by loan growth Amount ($B) Reserve (%) Commercial $2.3 1.5% Commercial real estate 1.3 2.6% Residential mortgage .7 .6% Credit card 2.8 8.6% Other retail .8 2.1% Total $7.9 2.0% Change vs. 4Q25 3Q25 4Q24 Nonperforming assets Balance $1,590 $(64) $(242) NPAs/period-end loans plus OREO 0.41 % (2) bps (7) bps Net charge-offs NCOs $527 $(9) $(35) NCOs/avg loans 0.54 % (2) bps (6) bps Provision for Credit Losses Net Charge-offs (NCO) and Nonperforming Assets (NPA) Highlights Allowance for Credit Losses by Loan Category, 4Q25 • $50M reserve build primarily driven by loan portfolio growth • CECL forecasted peak unemployment rate of 5.9% • Linked quarter net charge-off ratio improved 2bps to 0.54% NCOs Reserve Build (Release) Allowance for Credit Losses / Period-end Loans 4Q24 1Q25 2Q25 3Q25 ($53) $35 4Q25 $50

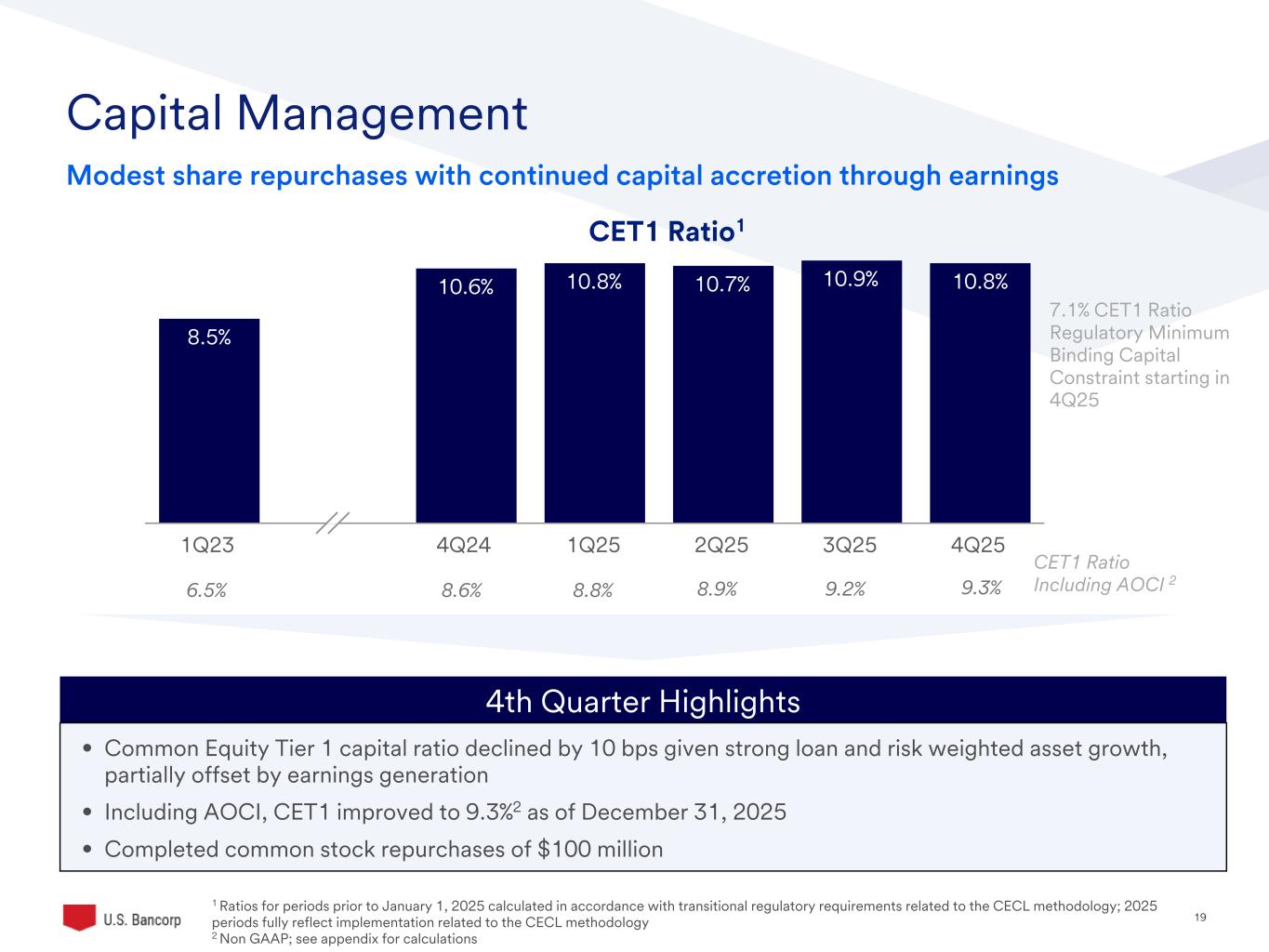

19©2025 U.S. Bank | Confidential Capital Management Modest share repurchases with continued capital accretion through earnings 1 Ratios for periods prior to January 1, 2025 calculated in accordance with transitional regulatory requirements related to the CECL methodology; 2025 periods fully reflect implementation related to the CECL methodology 2 Non GAAP; see appendix for calculations 4th Quarter Highlights CET1 Ratio Including AOCI 28.8%8.6% 8.9%6.5% 8.5% 10.6% 10.8% 10.7% 10.9% 10.8% 1Q23 4Q24 1Q25 2Q25 3Q25 4Q25 7.1% CET1 Ratio Regulatory Minimum Binding Capital Constraint starting in 4Q25 9.2% • Common Equity Tier 1 capital ratio declined by 10 bps given strong loan and risk weighted asset growth, partially offset by earnings generation • Including AOCI, CET1 improved to 9.3%2 as of December 31, 2025 • Completed common stock repurchases of $100 million CET1 Ratio1 9.3%

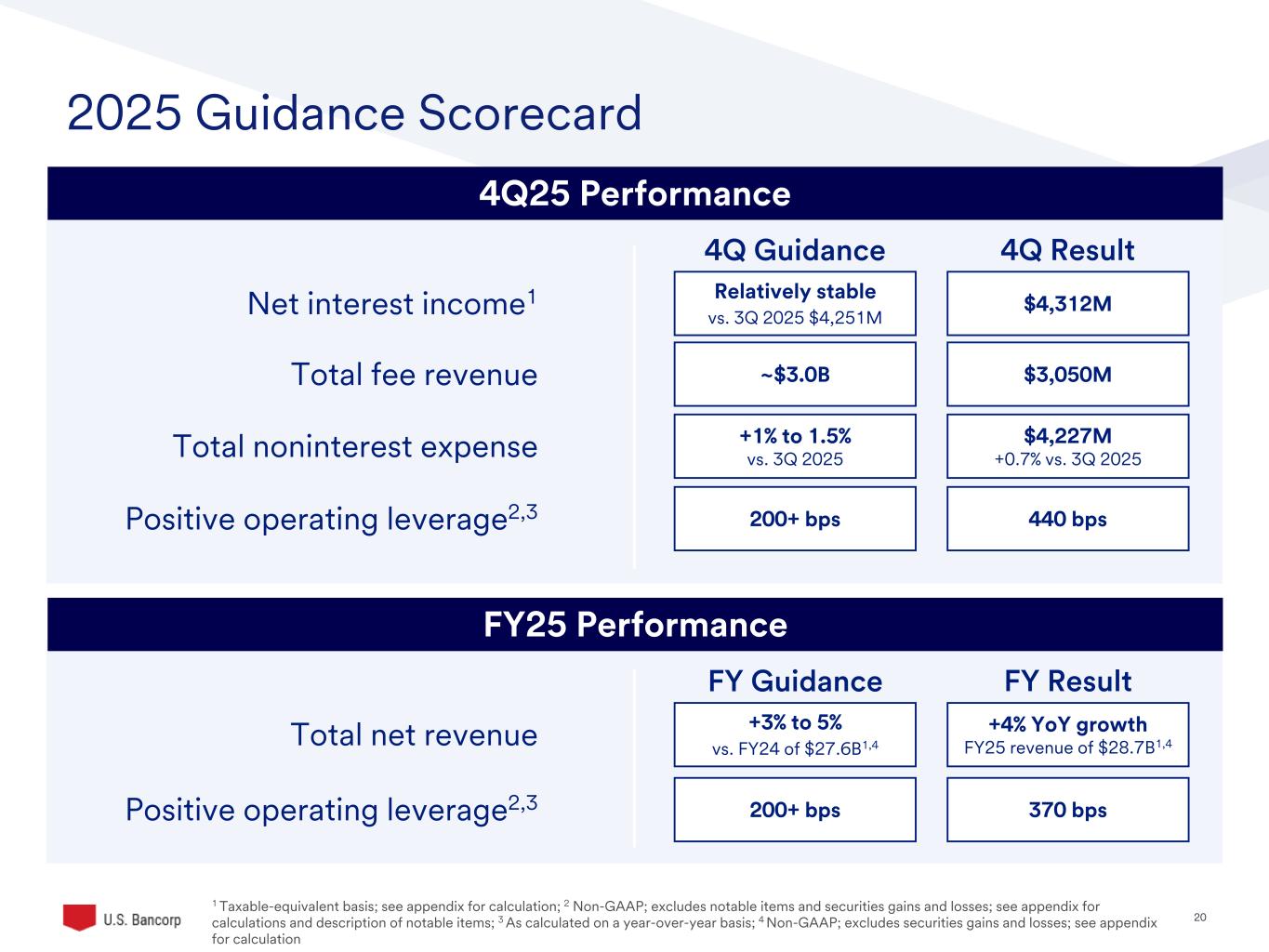

20©2025 U.S. Bank | Confidential 2025 Guidance Scorecard 1 Taxable-equivalent basis; see appendix for calculation; 2 Non-GAAP; excludes notable items and securities gains and losses; see appendix for calculations and description of notable items; 3 As calculated on a year-over-year basis; 4 Non-GAAP; excludes securities gains and losses; see appendix for calculation 4Q25 Performance Net interest income1 Total noninterest expense Positive operating leverage2,3 4Q Guidance 4Q Result Relatively stable vs. 3Q 2025 $4,251M $4,312M +1% to 1.5% vs. 3Q 2025 $4,227M +0.7% vs. 3Q 2025 200+ bps 440 bps Total fee revenue ~$3.0B $3,050M FY25 Performance Total net revenue Positive operating leverage2,3 FY Guidance FY Result +3% to 5% vs. FY24 of $27.6B1,4 +4% YoY growth FY25 revenue of $28.7B1,4 200+ bps 370 bps

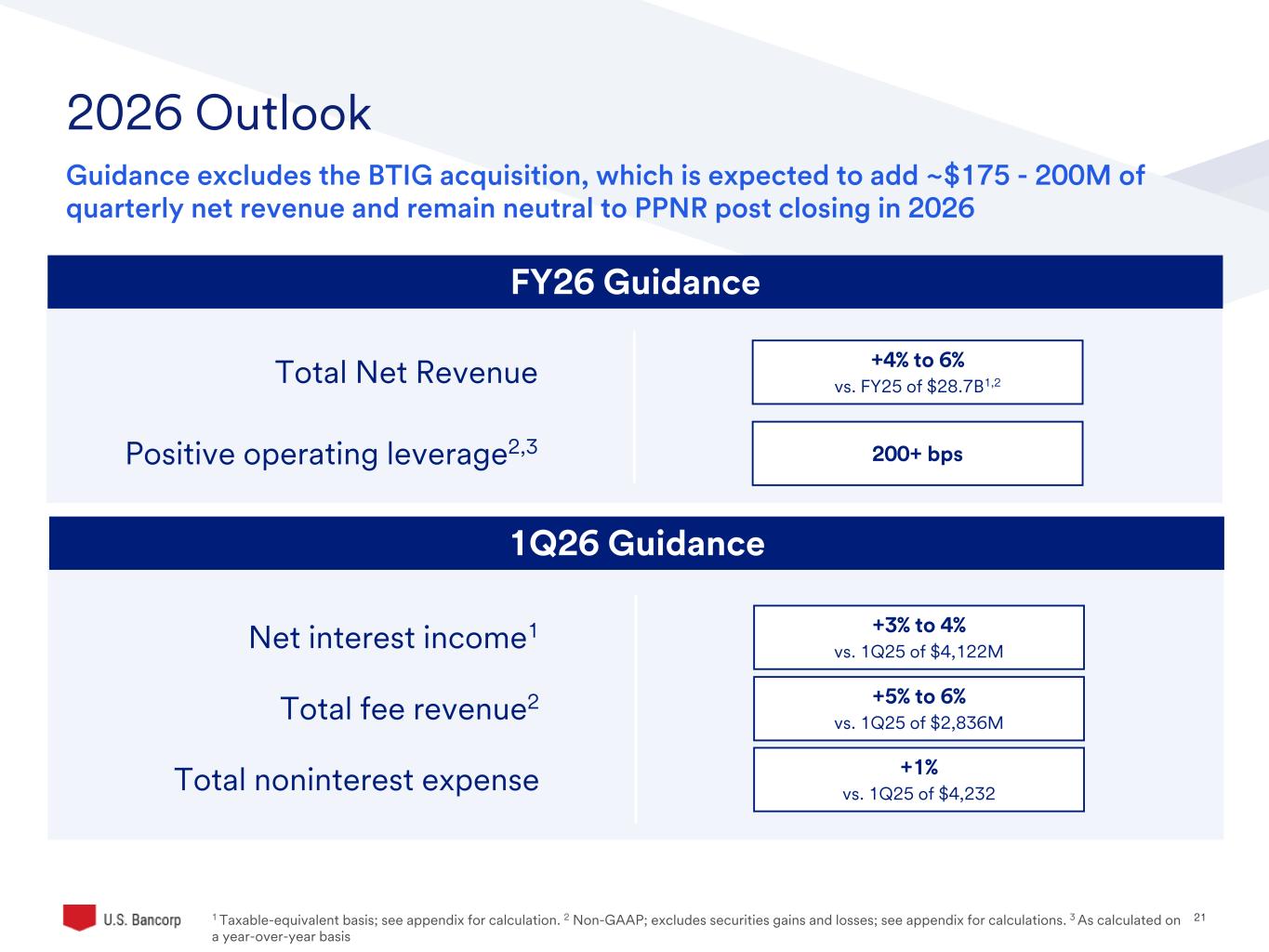

21©2025 U.S. Bank | Confidential 2026 Outlook 1 Taxable-equivalent basis; see appendix for calculation. 2 Non-GAAP; excludes securities gains and losses; see appendix for calculations. 3 As calculated on a year-over-year basis 1Q26 Guidance +3% to 4% vs. 1Q25 of $4,122M +1% vs. 1Q25 of $4,232 +5% to 6% vs. 1Q25 of $2,836M FY26 Guidance Net interest income1 Total noninterest expense Total fee revenue2 +4% to 6% vs. FY25 of $28.7B1,2 200+ bps Total Net Revenue Positive operating leverage2,3 Guidance excludes the BTIG acquisition, which is expected to add ~$175 - 200M of quarterly net revenue and remain neutral to PPNR post closing in 2026

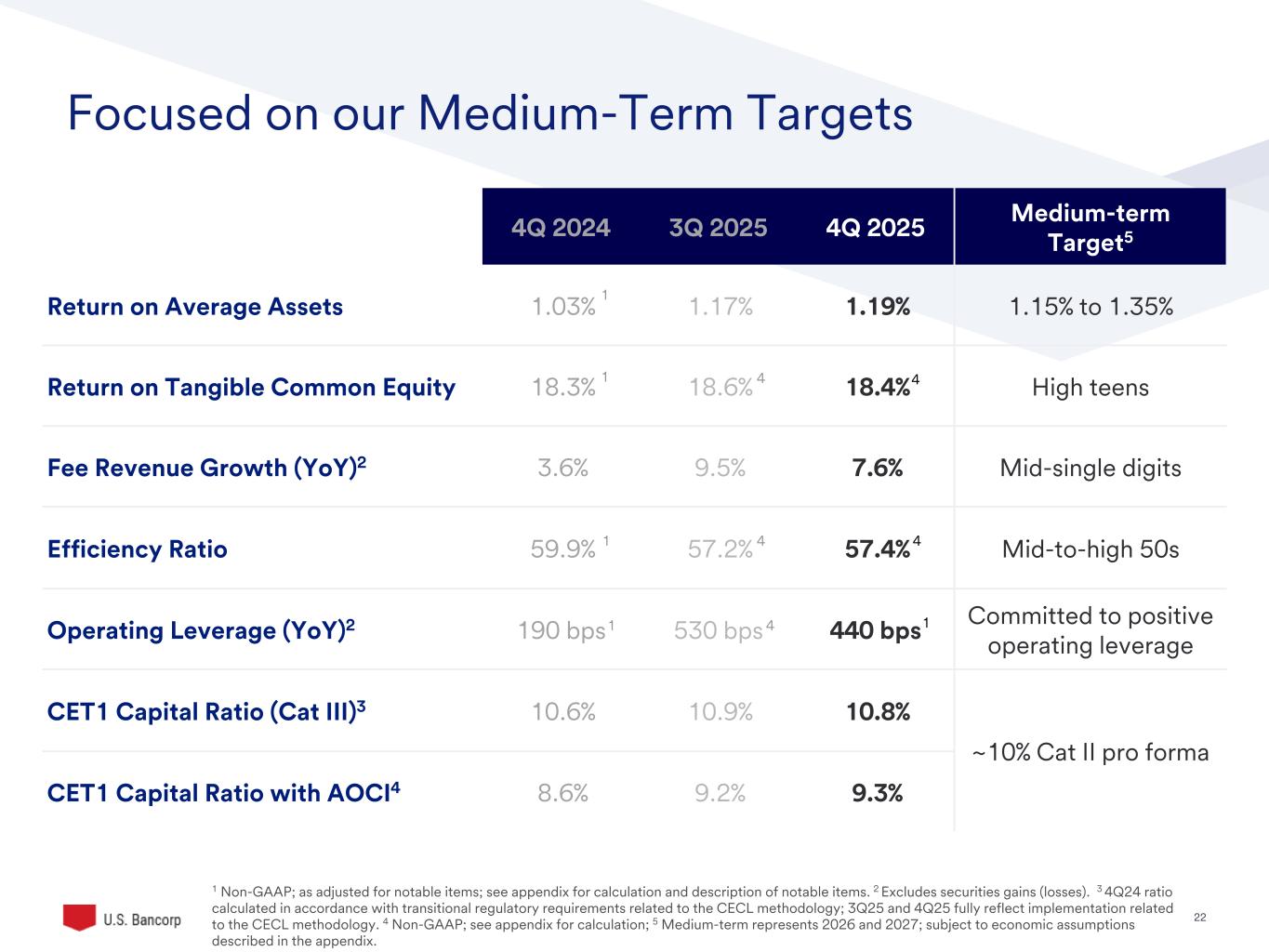

22©2025 U.S. Bank | Confidential Focused on our Medium-Term Targets 1 Non-GAAP; as adjusted for notable items; see appendix for calculation and description of notable items. 2 Excludes securities gains (losses). 3 4Q24 ratio calculated in accordance with transitional regulatory requirements related to the CECL methodology; 3Q25 and 4Q25 fully reflect implementation related to the CECL methodology. 4 Non-GAAP; see appendix for calculation; 5 Medium-term represents 2026 and 2027; subject to economic assumptions described in the appendix. 4Q 2024 3Q 2025 4Q 2025 Medium-term Target5 Return on Average Assets 1.03% 1.17% 1.19% 1.15% to 1.35% Return on Tangible Common Equity 18.3% 18.6% 18.4% High teens Fee Revenue Growth (YoY)2 3.6% 9.5% 7.6% Mid-single digits Efficiency Ratio 59.9% 57.2% 57.4% Mid-to-high 50s Operating Leverage (YoY)2 190 bps 530 bps 440 bps Committed to positive operating leverage CET1 Capital Ratio (Cat III)3 10.6% 10.9% 10.8% ~10% Cat II pro forma CET1 Capital Ratio with AOCI4 8.6% 9.2% 9.3% 1 1 4 4 1 4 4 1 4 1

23©2025 U.S. Bank | Confidential Looking ahead to 2026 • Committed to delivering consistent, strong EPS growth • Executing on organic growth and payments transformation with meaningful operating leverage and strong risk management • Investing for growth, in particular Technology, Sales and Marketing • Building towards our long-term capital distribution target of ~75% • Strongly positioned to succeed in a banking industry being transformed by regulation, digital assets, AI, and novel competitors

24©2025 U.S. Bank Appendix

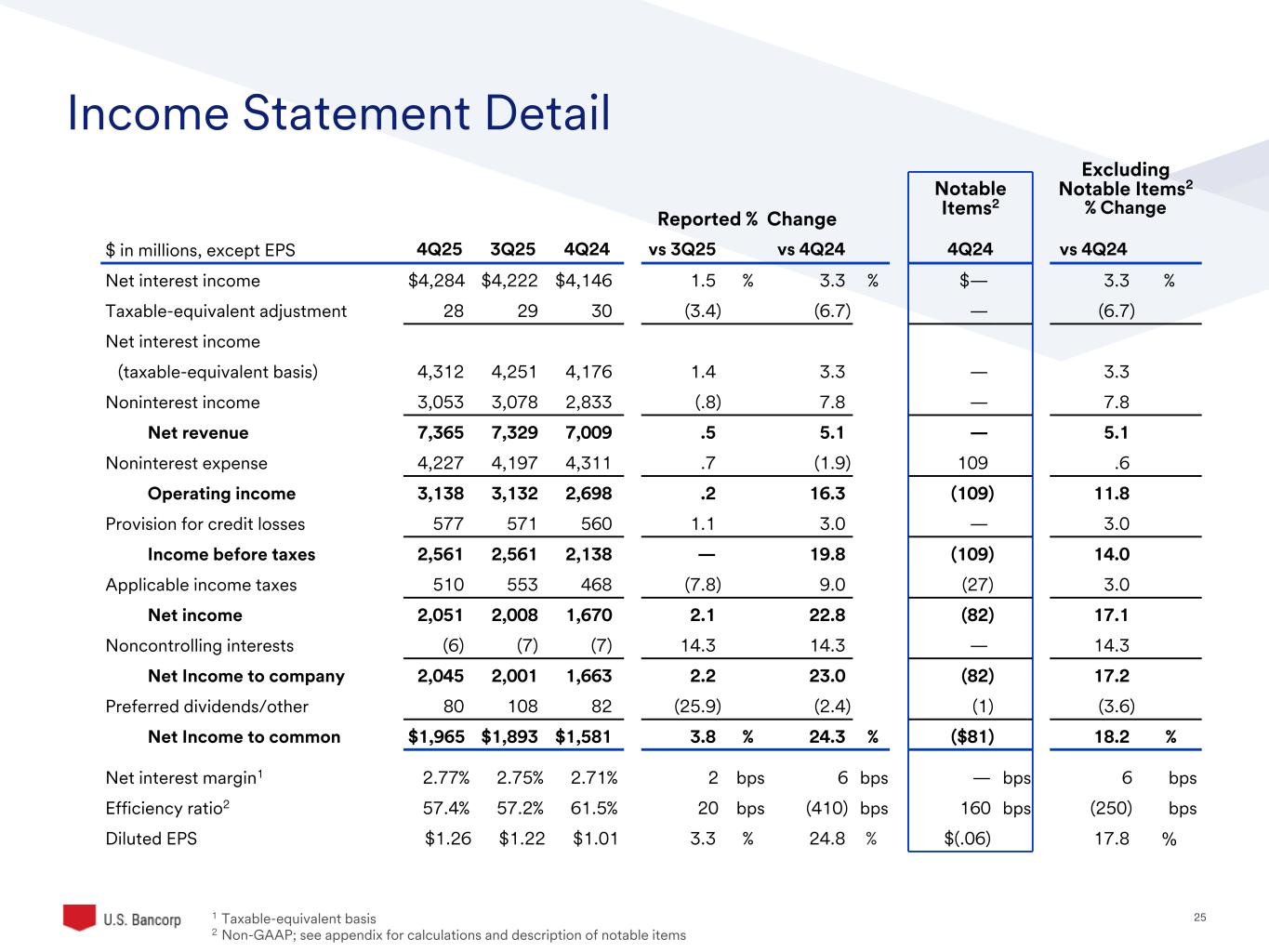

25©2025 U.S. Bank | Confidential Income Statement Detail 1 Taxable-equivalent basis 2 Non-GAAP; see appendix for calculations and description of notable items Excluding Notable Items2 % Change Notable Items2 Reported % Change $ in millions, except EPS 4Q25 3Q25 4Q24 vs 3Q25 vs 4Q24 4Q24 vs 4Q24 Net interest income $4,284 $4,222 $4,146 1.5 % 3.3 % $— 3.3 % Taxable-equivalent adjustment 28 29 30 (3.4) (6.7) — (6.7) Net interest income (taxable-equivalent basis) 4,312 4,251 4,176 1.4 3.3 — 3.3 Noninterest income 3,053 3,078 2,833 (.8) 7.8 — 7.8 Net revenue 7,365 7,329 7,009 .5 5.1 — 5.1 Noninterest expense 4,227 4,197 4,311 .7 (1.9) 109 .6 Operating income 3,138 3,132 2,698 .2 16.3 (109) 11.8 Provision for credit losses 577 571 560 1.1 3.0 — 3.0 Income before taxes 2,561 2,561 2,138 — 19.8 (109) 14.0 Applicable income taxes 510 553 468 (7.8) 9.0 (27) 3.0 Net income 2,051 2,008 1,670 2.1 22.8 (82) 17.1 Noncontrolling interests (6) (7) (7) 14.3 14.3 — 14.3 Net Income to company 2,045 2,001 1,663 2.2 23.0 (82) 17.2 Preferred dividends/other 80 108 82 (25.9) (2.4) (1) (3.6) Net Income to common $1,965 $1,893 $1,581 3.8 % 24.3 % ($81) 18.2 % Net interest margin1 2.77% 2.75% 2.71% 2 bps 6 bps — bps 6 bps Efficiency ratio2 57.4% 57.2% 61.5% 20 bps (410) bps 160 bps (250) bps Diluted EPS $1.26 $1.22 $1.01 3.3 % 24.8 % $(.06) 17.8 %

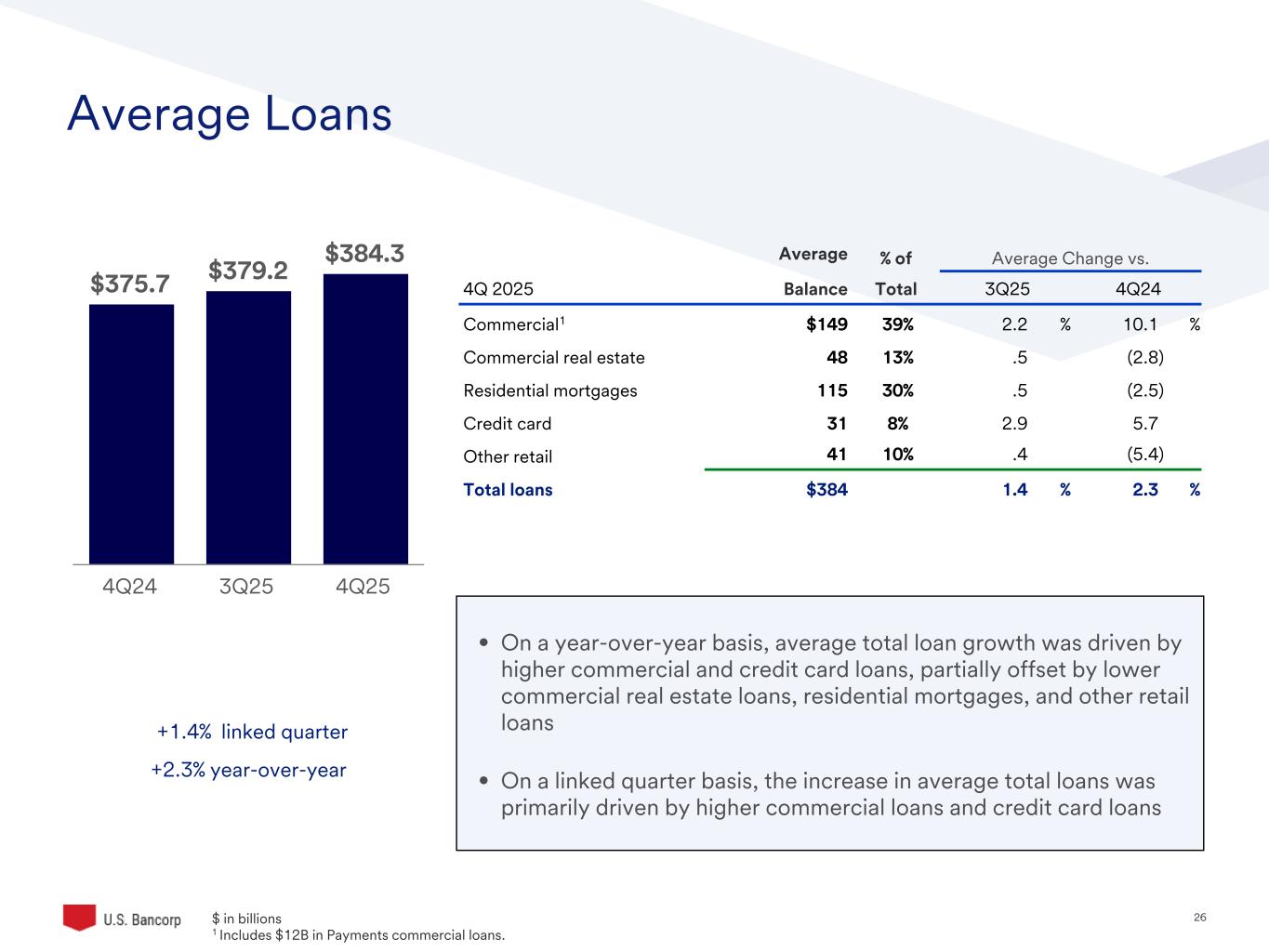

26©2025 U.S. Bank | Confidential Average Loans • On a year-over-year basis, average total loan growth was driven by higher commercial and credit card loans, partially offset by lower commercial real estate loans, residential mortgages, and other retail loans • On a linked quarter basis, the increase in average total loans was primarily driven by higher commercial loans and credit card loans Average % of Average Change vs. 4Q 2025 Balance Total 3Q25 4Q24 Commercial1 $149 39% 2.2 % 10.1 % Commercial real estate 48 13% .5 (2.8) Residential mortgages 115 30% .5 (2.5) Credit card 31 8% 2.9 5.7 Other retail 41 10% .4 (5.4) Total loans $384 1.4 % 2.3 % $375.7 $379.2 $384.3 4Q24 3Q25 4Q25 $ i billions 1 Includes $12B in Payments commercial loans. +1.4% linked quarter +2.3% year-over-year

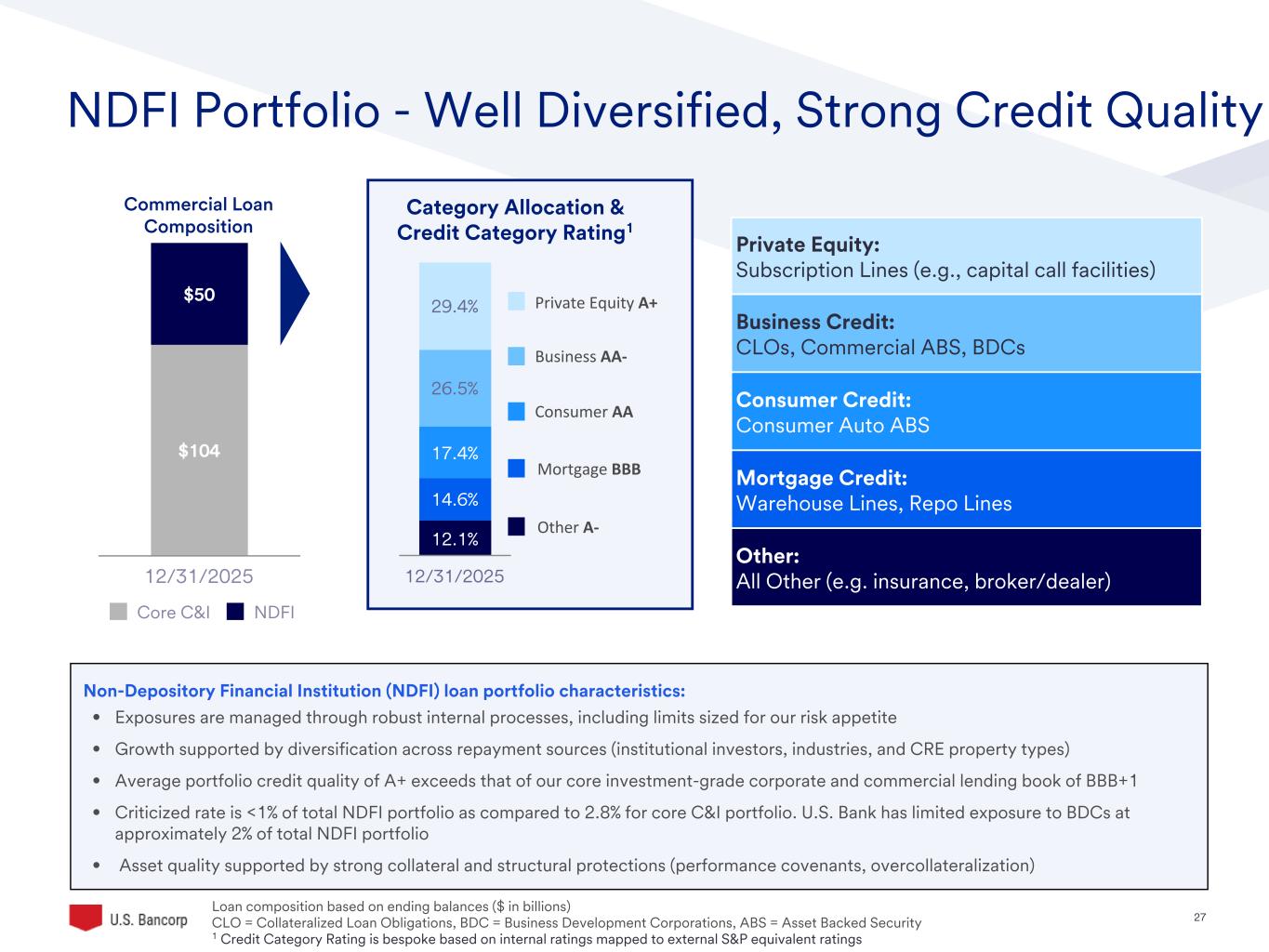

27©2025 U.S. Bank | Confidential $104 $50 Core C&I NDFI 12/31/2025 NDFI Portfolio - Well Diversified, Strong Credit Quality Loan composition based on ending balances ($ in billions) CLO = Collateralized Loan Obligations, BDC = Business Development Corporations, ABS = Asset Backed Security 1 Credit Category Rating is bespoke based on internal ratings mapped to external S&P equivalent ratings Private Equity: Subscription Lines (e.g., capital call facilities) Business Credit: CLOs, Commercial ABS, BDCs Consumer Credit: Consumer Auto ABS Mortgage Credit: Warehouse Lines, Repo Lines Other: All Other (e.g. insurance, broker/dealer) Category Allocation & Credit Category Rating1 Private Equity A+ Business AA- Consumer AA Mortgage BBB Other A- 12.1% 14.6% 17.4% 26.5% 29.4% 12/31/2025 Commercial Loan Composition Non-Depository Financial Institution (NDFI) loan portfolio characteristics: • Exposures are managed through robust internal processes, including limits sized for our risk appetite • Growth supported by diversification across repayment sources (institutional investors, industries, and CRE property types) • Average portfolio credit quality of A+ exceeds that of our core investment-grade corporate and commercial lending book of BBB+1 • Criticized rate is <1% of total NDFI portfolio as compared to 2.8% for core C&I portfolio. U.S. Bank has limited exposure to BDCs at approximately 2% of total NDFI portfolio • Asset quality supported by strong collateral and structural protections (performance covenants, overcollateralization)

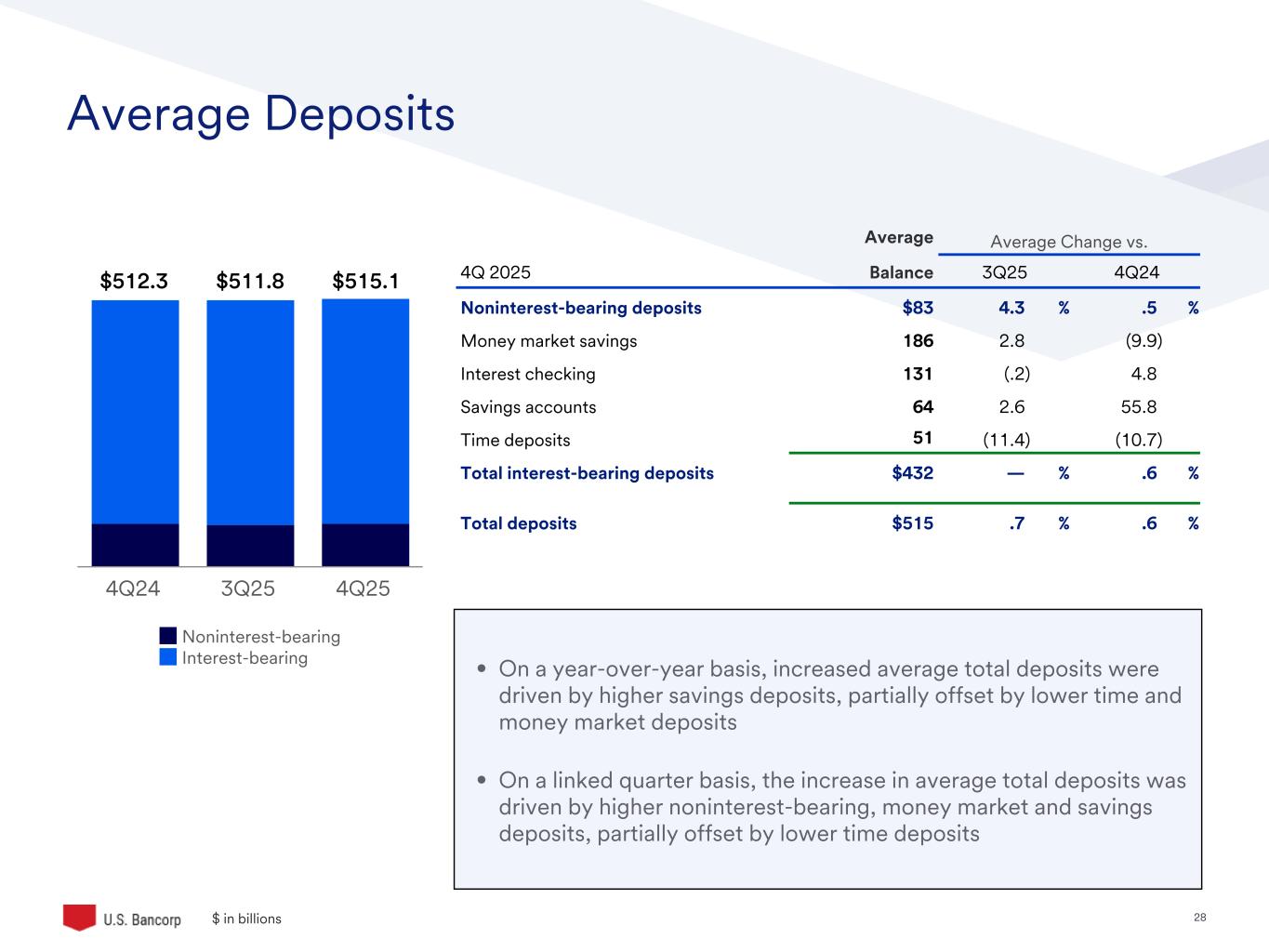

28©2025 U.S. Bank | Confidential Average Deposits • On a year-over-year basis, increased average total deposits were driven by higher savings deposits, partially offset by lower time and money market deposits • On a linked quarter basis, the increase in average total deposits was driven by higher noninterest-bearing, money market and savings deposits, partially offset by lower time deposits $ i billions Noninterest-bearing Interest-bearing 4Q24 3Q25 4Q25 Average Average Change vs. 4Q 2025 Balance 3Q25 4Q24 Noninterest-bearing deposits $83 4.3 % .5 % Money market savings 186 2.8 (9.9) Interest checking 131 (.2) 4.8 Savings accounts 64 2.6 55.8 Time deposits 51 (11.4) (10.7) Total interest-bearing deposits $432 — % .6 % Total deposits $515 .7 % .6 % $515.1$511.8$512.3

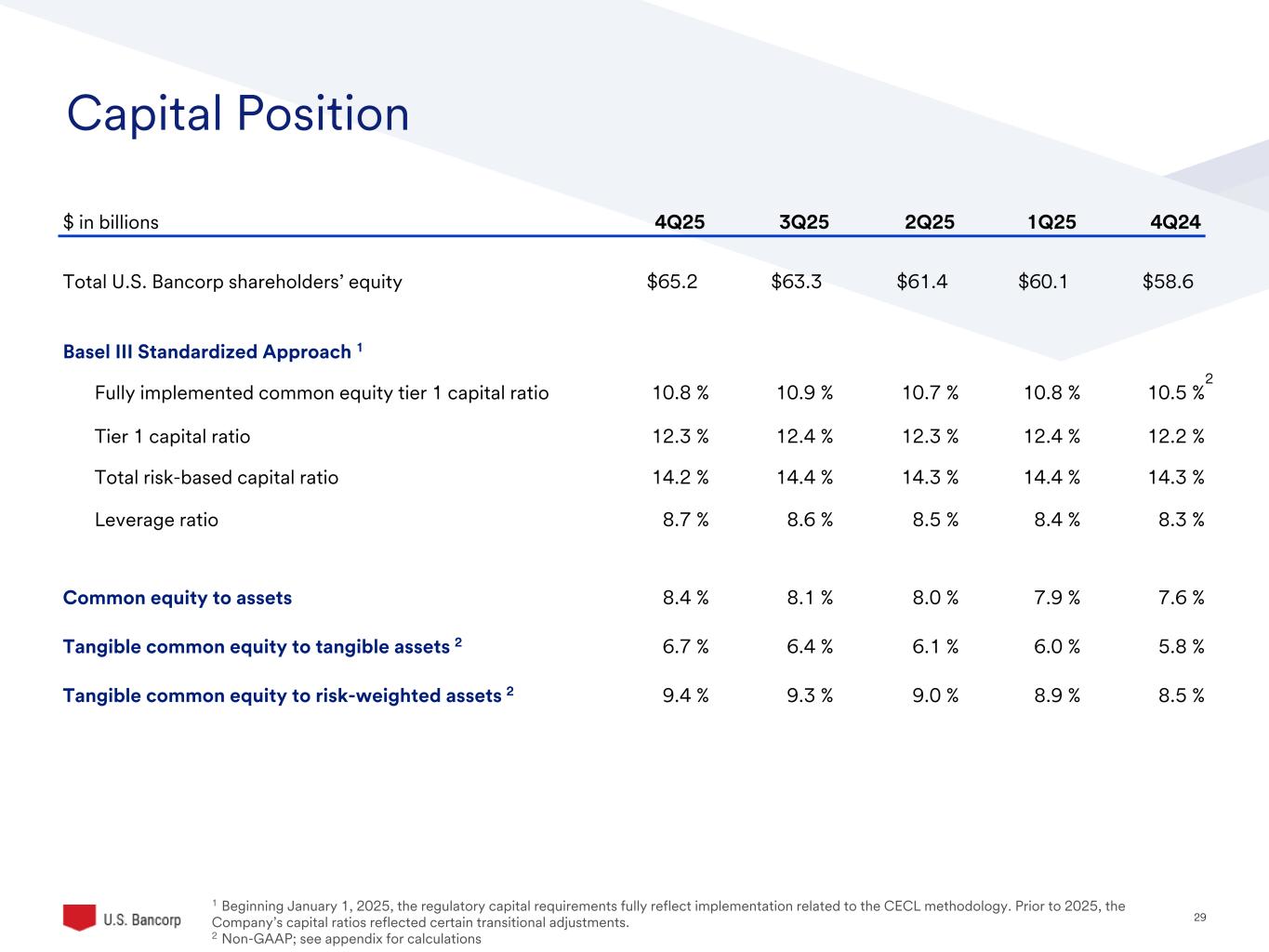

29©2025 U.S. Bank | Confidential Capital Position $ in billions 4Q25 3Q25 2Q25 1Q25 4Q24 Total U.S. Bancorp shareholders’ equity $65.2 $63.3 $61.4 $60.1 $58.6 Basel III Standardized Approach 1 Fully implemented common equity tier 1 capital ratio 10.8 % 10.9 % 10.7 % 10.8 % 10.5 % Tier 1 capital ratio 12.3 % 12.4 % 12.3 % 12.4 % 12.2 % Total risk-based capital ratio 14.2 % 14.4 % 14.3 % 14.4 % 14.3 % Leverage ratio 8.7 % 8.6 % 8.5 % 8.4 % 8.3 % Common equity to assets 8.4 % 8.1 % 8.0 % 7.9 % 7.6 % Tangible common equity to tangible assets 2 6.7 % 6.4 % 6.1 % 6.0 % 5.8 % Tangible common equity to risk-weighted assets 2 9.4 % 9.3 % 9.0 % 8.9 % 8.5 % 1 Beginning January 1, 2025, the regulatory capital requirements fully reflect implementation related to the CECL methodology. Prior to 2025, the Company’s capital ratios reflected certain transitional adjustments. 2 Non-GAAP; see appendix for calculations 2

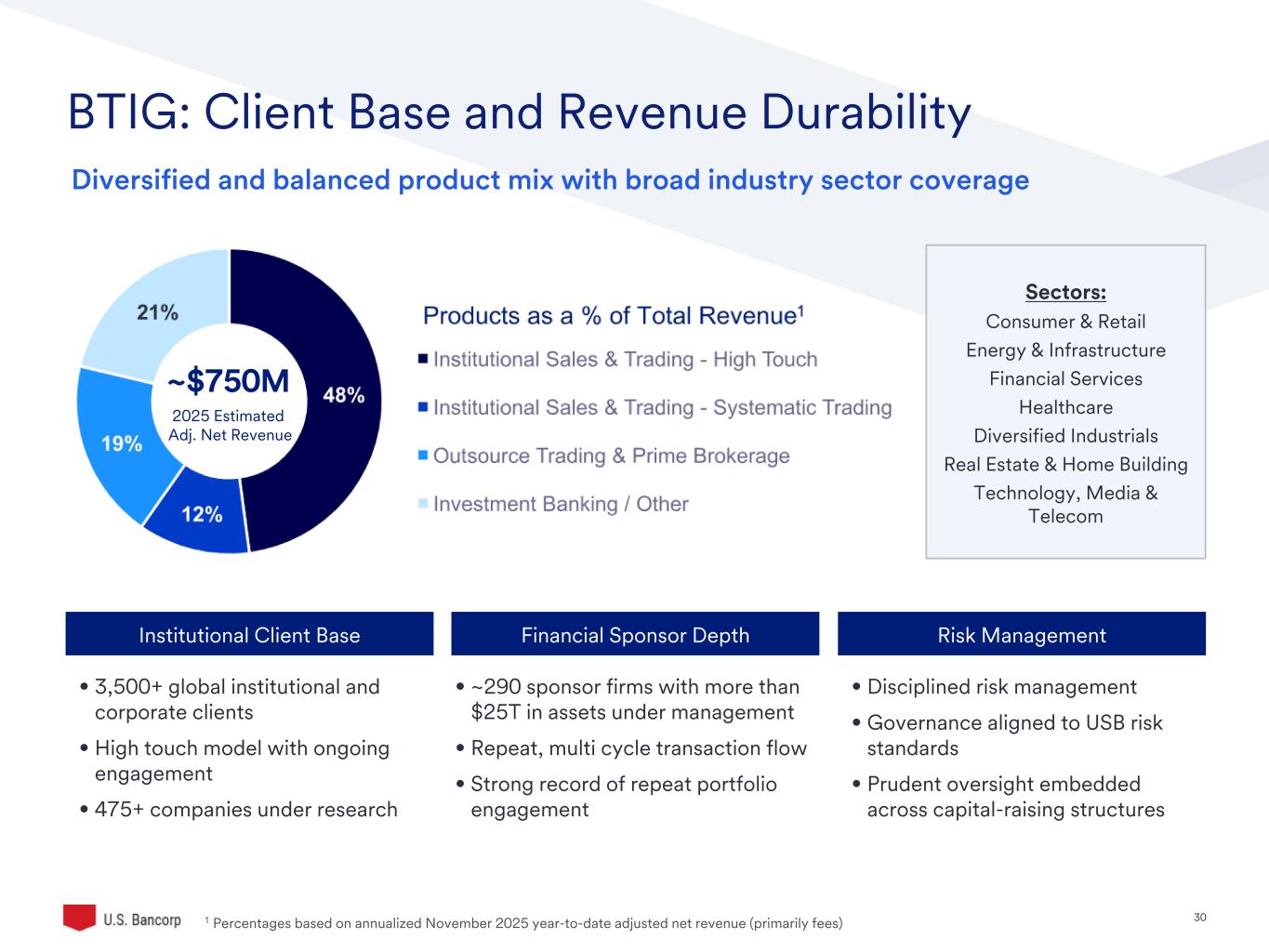

30©2025 U.S. Bank | Confidential BTIG: Client Base and Revenue Durability 1 Percentages based on annualized November 2025 year-to-date adjusted net revenue (primarily fees) Diversified and balanced product mix with broad industry sector coverage Institutional Client Base Financial Sponsor Depth Risk Management • 3,500+ global institutional and corporate clients • High touch model with ongoing engagement • 475+ companies under research • ~290 sponsor firms with more than $25T in assets under management • Repeat, multi cycle transaction flow • Strong record of repeat portfolio engagement • Disciplined risk management • Governance aligned to USB risk standards • Prudent oversight embedded across capital-raising structures Sectors: Consumer & Retail Energy & Infrastructure Financial Services Healthcare Diversified Industrials Real Estate & Home Building Technology, Media & Telecom ~$750M 2025 Estimated Adj. Net Revenue

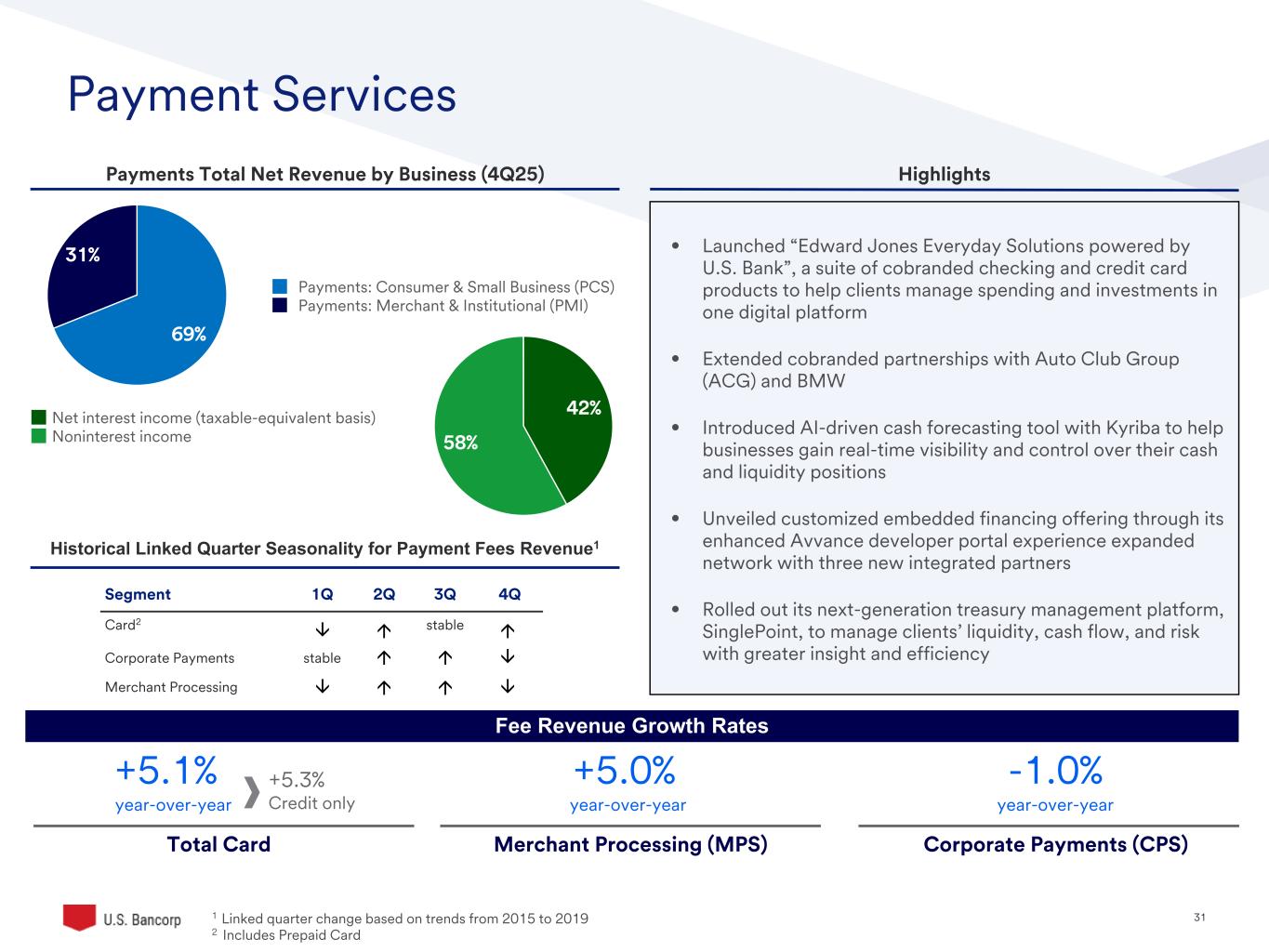

31©2025 U.S. Bank | Confidential 69% 31% Payments: Consumer & Small Business (PCS) Payments: Merchant & Institutional (PMI) • Launched “Edward Jones Everyday Solutions powered by U.S. Bank”, a suite of cobranded checking and credit card products to help clients manage spending and investments in one digital platform • Extended cobranded partnerships with Auto Club Group (ACG) and BMW • Introduced AI-driven cash forecasting tool with Kyriba to help businesses gain real-time visibility and control over their cash and liquidity positions • Unveiled customized embedded financing offering through its enhanced Avvance developer portal experience expanded network with three new integrated partners • Rolled out its next-generation treasury management platform, SinglePoint, to manage clients’ liquidity, cash flow, and risk with greater insight and efficiency Segment 1Q 2Q 3Q 4Q Card2 stable Corporate Payments stable Merchant Processing Merchant Processing (MPS) Corporate Payments (CPS)Total Card Payments Total Net Revenue by Business (4Q25) Highlights Historical Linked Quarter Seasonality for Payment Fees Revenue1 â â â á á á á á á â +5.1% year-over-year +5.0% year-over-year -1.0% year-over-year Payment Services +5.3% Credit only Fee Revenue Growth Rates 1 Link d quarter change based on trends from 2015 to 2019 2 Includes Prepaid Card 42% 58% Net interest income (taxable-equivalent basis) Noninterest income

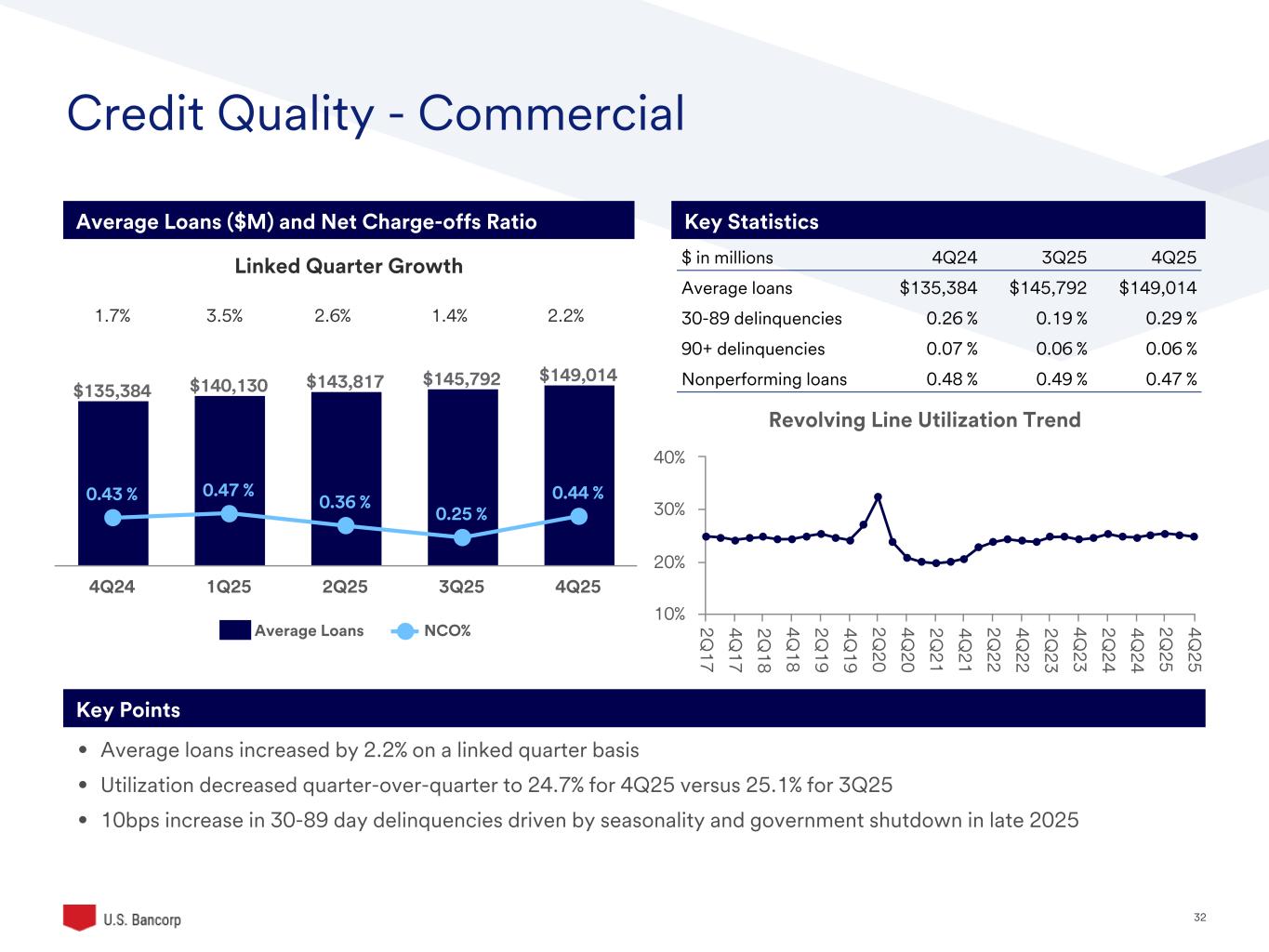

32©2025 U.S. Bank | Confidential Credit Quality - Commercial $135,384 $140,130 $143,817 $145,792 $149,014 0.43 % 0.47 % 0.36 % 0.25 % 0.44 % Average Loans NCO% 4Q24 1Q25 2Q25 3Q25 4Q25 Key StatisticsAverage Loans ($M) and Net Charge-offs Ratio 1.7% 3.5% 2.6% 1.4% 2.2% Linked Quarter Growth Key Points • Average loans increased by 2.2% on a linked quarter basis • Utilization decreased quarter-over-quarter to 24.7% for 4Q25 versus 25.1% for 3Q25 • 10bps increase in 30-89 day delinquencies driven by seasonality and government shutdown in late 2025 $ in millions 4Q24 3Q25 4Q25 Average loans $135,384 $145,792 $149,014 30-89 delinquencies 0.26 % 0.19 % 0.29 % 90+ delinquencies 0.07 % 0.06 % 0.06 % Nonperforming loans 0.48 % 0.49 % 0.47 % Revolving Line Utilization Trend 2Q 17 4Q 17 2Q 18 4Q 18 2Q 19 4Q 19 2Q 20 4Q 20 2Q 21 4Q 21 2Q 22 4Q 22 2Q 23 4Q 23 2Q 24 4Q 24 2Q 25 4Q 25 10% 20% 30% 40%

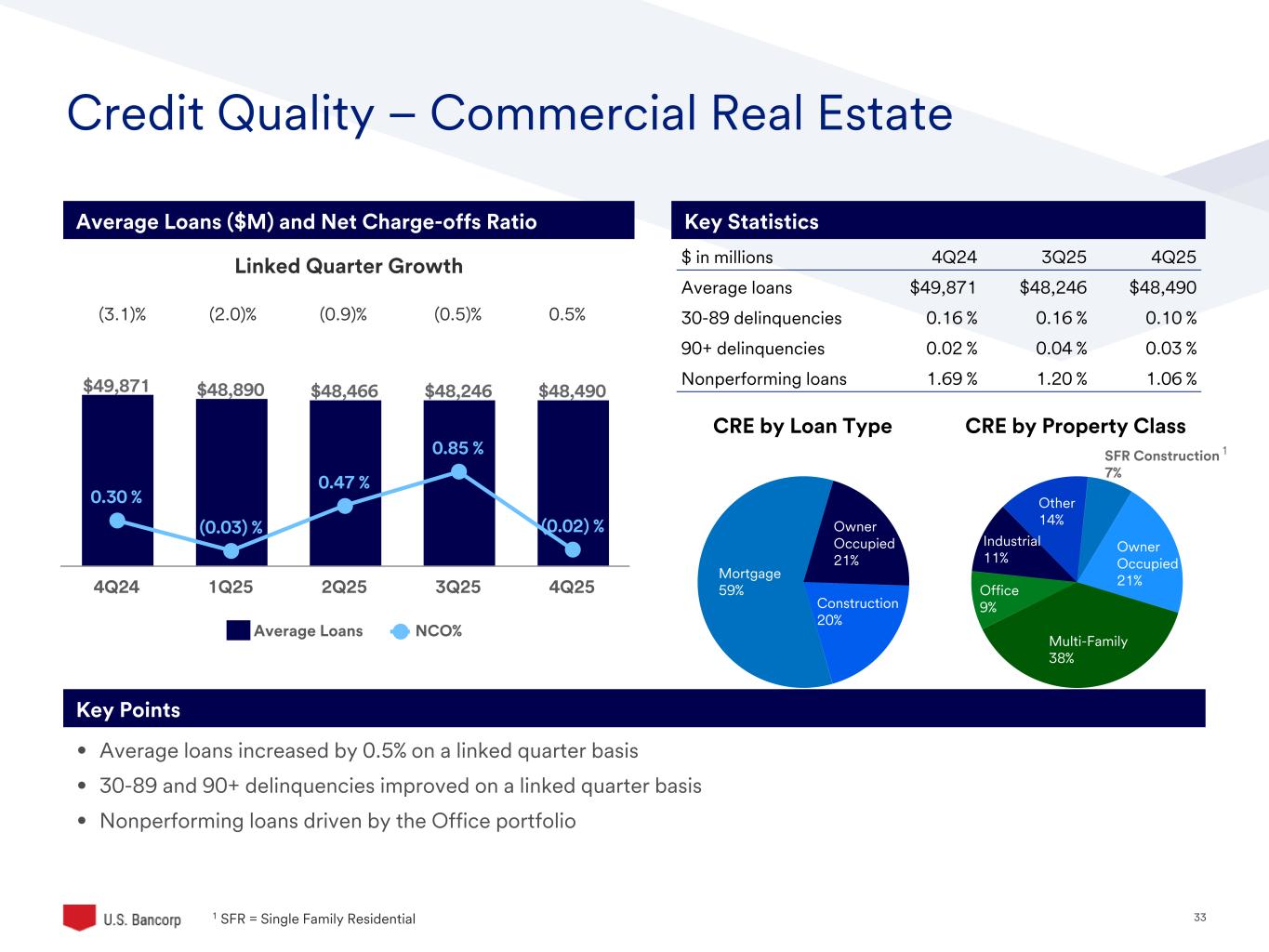

33©2025 U.S. Bank | Confidential CRE by Loan Type Mortgage 59% Owner Occupied 21% Construction 20% Credit Quality – Commercial Real Estate Key Points Average Loans ($M) and Net Charge-offs Ratio Key Statistics Linked Quarter Growth (3.1)% (2.0)% (0.9)% (0.5)% 0.5% • Average loans increased by 0.5% on a linked quarter basis • 30-89 and 90+ delinquencies improved on a linked quarter basis • Nonperforming loans driven by the Office portfolio $49,871 $48,890 $48,466 $48,246 $48,490 0.30 % (0.03) % 0.47 % 0.85 % (0.02) % Average Loans NCO% 4Q24 1Q25 2Q25 3Q25 4Q25 CRE by Property Class SFR Construction 7% Owner Occupied 21% Multi-Family 38% Office 9% Industrial 11% Other 14% $ in millions 4Q24 3Q25 4Q25 Average loans $49,871 $48,246 $48,490 30-89 delinquencies 0.16 % 0.16 % 0.10 % 90+ delinquencies 0.02 % 0.04 % 0.03 % Nonperforming loans 1.69 % 1.20 % 1.06 % 1 1 SFR = S ngle Family Residential

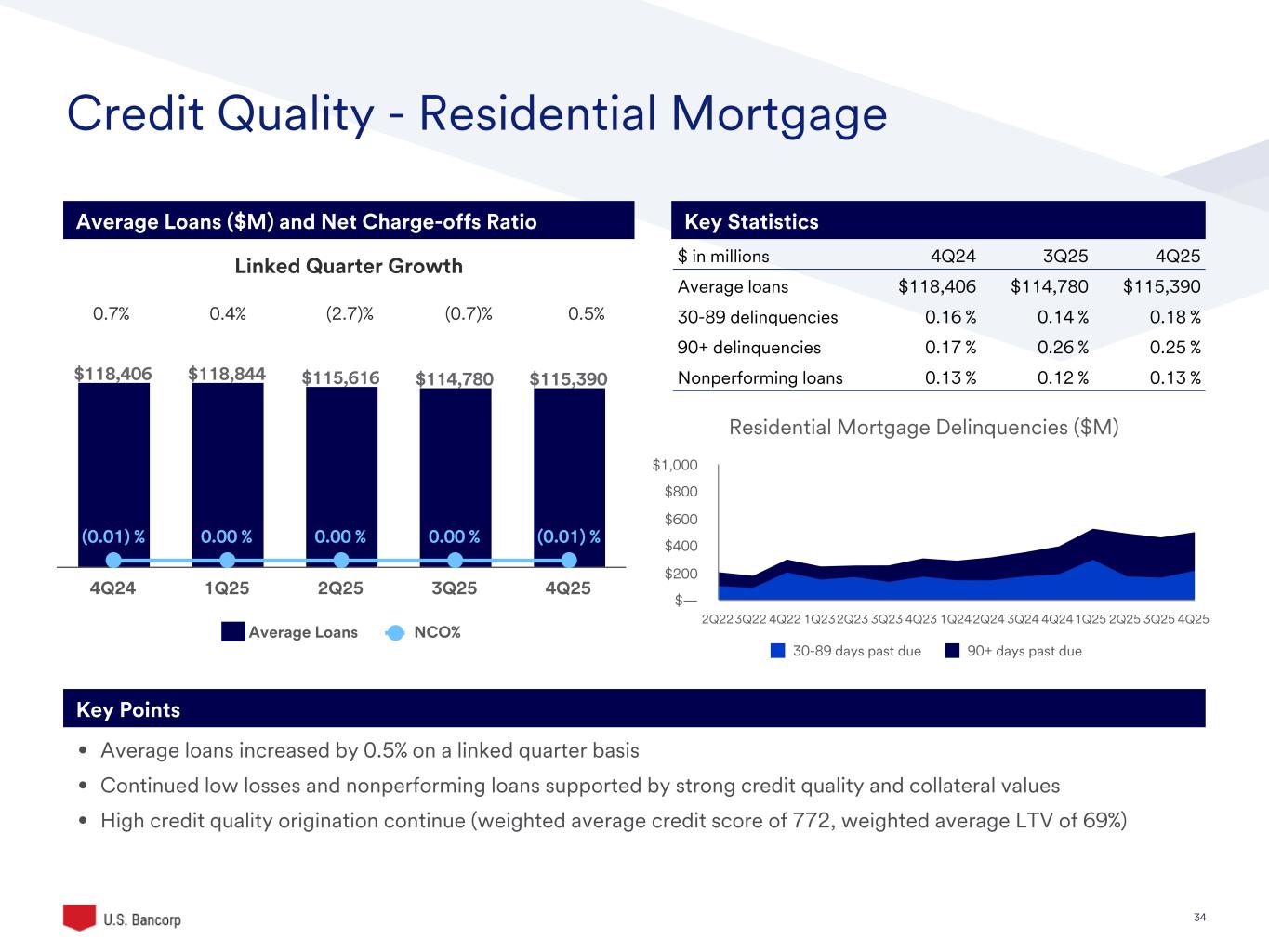

34©2025 U.S. Bank | Confidential Credit Quality - Residential Mortgage $118,406 $118,844 $115,616 $114,780 $115,390 (0.01) % 0.00 % 0.00 % 0.00 % (0.01) % Average Loans NCO% 4Q24 1Q25 2Q25 3Q25 4Q25 Key Points • Average loans increased by 0.5% on a linked quarter basis • Continued low losses and nonperforming loans supported by strong credit quality and collateral values • High credit quality origination continue (weighted average credit score of 772, weighted average LTV of 69%) Linked Quarter Growth Average Loans ($M) and Net Charge-offs Ratio Key Statistics $ in millions 4Q24 3Q25 4Q25 Average loans $118,406 $114,780 $115,390 30-89 delinquencies 0.16 % 0.14 % 0.18 % 90+ delinquencies 0.17 % 0.26 % 0.25 % Nonperforming loans 0.13 % 0.12 % 0.13 % 0.7% 0.4% (2.7)% (0.7)% 0.5% Residential Mortgage Delinquencies ($M) 30-89 days past due 90+ days past due 2Q223Q22 4Q22 1Q232Q23 3Q23 4Q23 1Q242Q24 3Q24 4Q241Q25 2Q25 3Q25 4Q25 $— $200 $400 $600 $800 $1,000

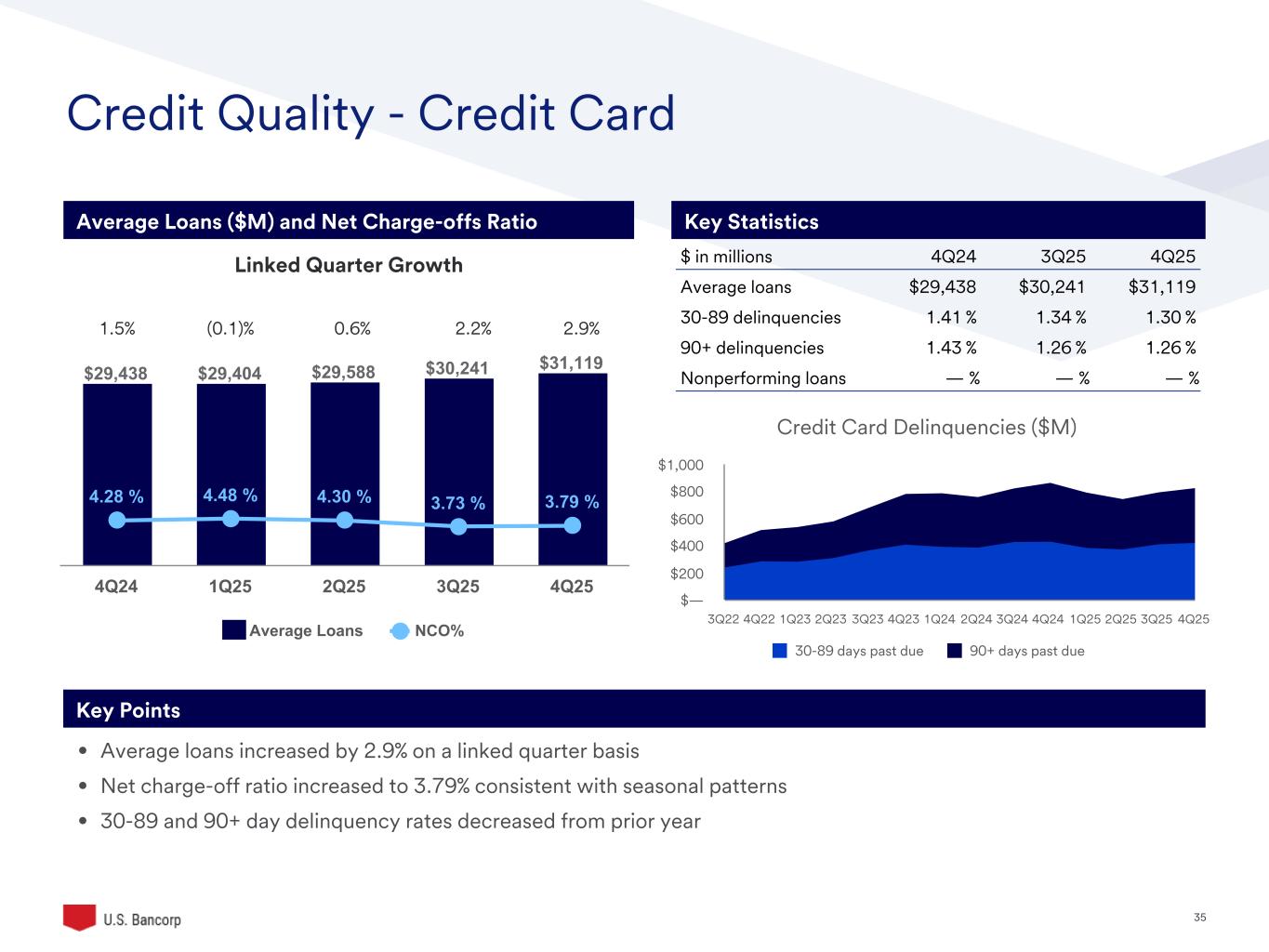

35©2025 U.S. Bank | Confidential Credit Quality - Credit Card $29,438 $29,404 $29,588 $30,241 $31,119 4.28 % 4.48 % 4.30 % 3.73 % 3.79 % Average Loans NCO% 4Q24 1Q25 2Q25 3Q25 4Q25 Key Points • Average loans increased by 2.9% on a linked quarter basis • Net charge-off ratio increased to 3.79% consistent with seasonal patterns • 30-89 and 90+ day delinquency rates decreased from prior year Average Loans ($M) and Net Charge-offs Ratio Key Statistics 1.5% (0.1)% 0.6% 2.2% 2.9% Linked Quarter Growth $ in millions 4Q24 3Q25 4Q25 Average loans $29,438 $30,241 $31,119 30-89 delinquencies 1.41 % 1.34 % 1.30 % 90+ delinquencies 1.43 % 1.26 % 1.26 % Nonperforming loans — % — % — % Credit Card Delinquencies ($M) 30-89 days past due 90+ days past due 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 $— $200 $400 $600 $800 $1,000

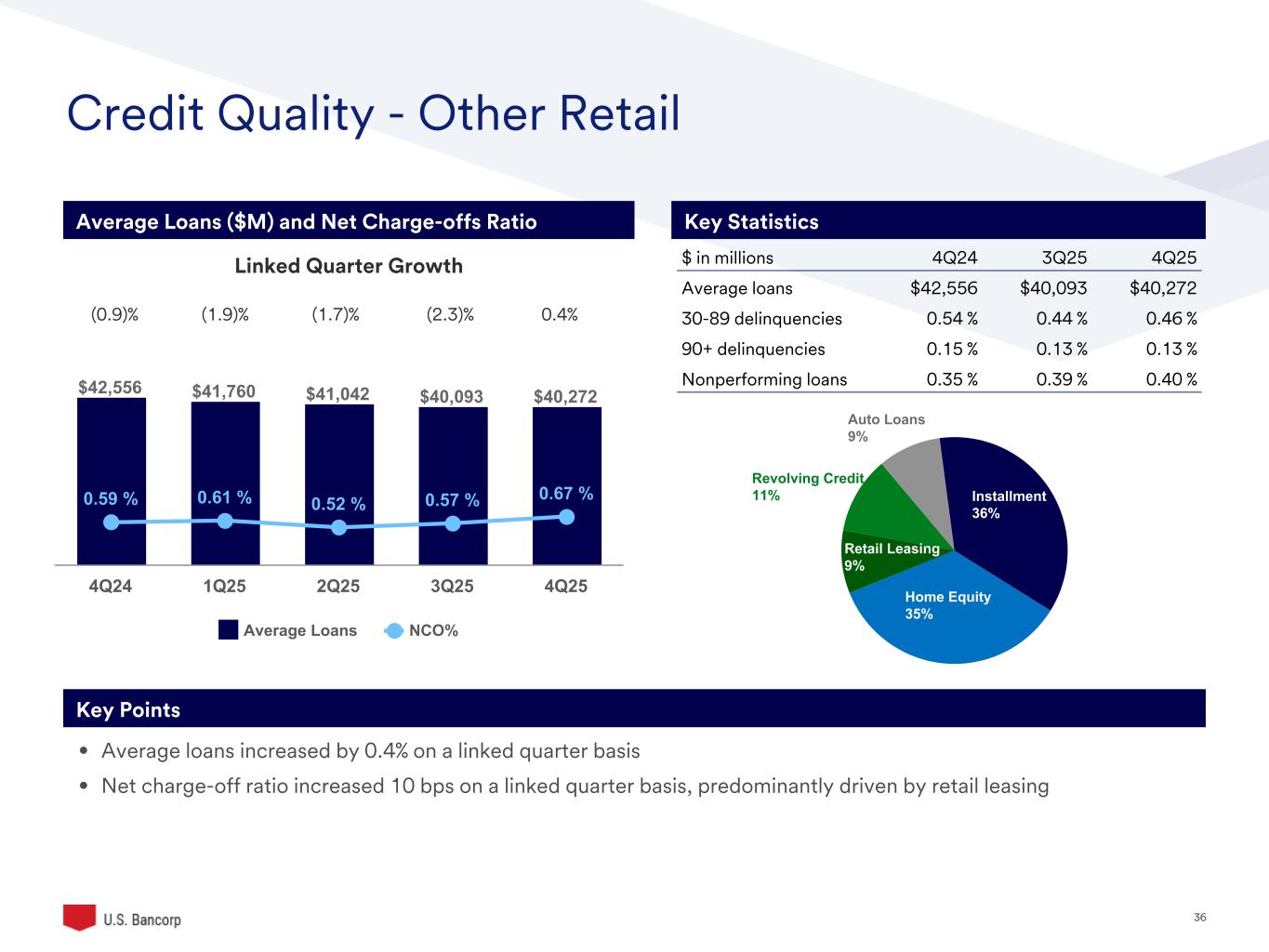

36©2025 U.S. Bank | Confidential Credit Quality - Other Retail Key Points • Average loans increased by 0.4% on a linked quarter basis • Net charge-off ratio increased 10 bps on a linked quarter basis, predominantly driven by retail leasing Average Loans ($M) and Net Charge-offs Ratio Key Statistics Linked Quarter Growth (0.9)% (1.9)% (1.7)% (2.3)% 0.4% $42,556 $41,760 $41,042 $40,093 $40,272 0.59 % 0.61 % 0.52 % 0.57 % 0.67 % Average Loans NCO% 4Q24 1Q25 2Q25 3Q25 4Q25 Auto Loans 9% Installment 36% Home Equity 35% Retail Leasing 9% Revolving Credit 11% $ in millions 4Q24 3Q25 4Q25 Average loans $42,556 $40,093 $40,272 30-89 delinquencies 0.54 % 0.44 % 0.46 % 90+ delinquencies 0.15 % 0.13 % 0.13 % Nonperforming loans 0.35 % 0.39 % 0.40 %

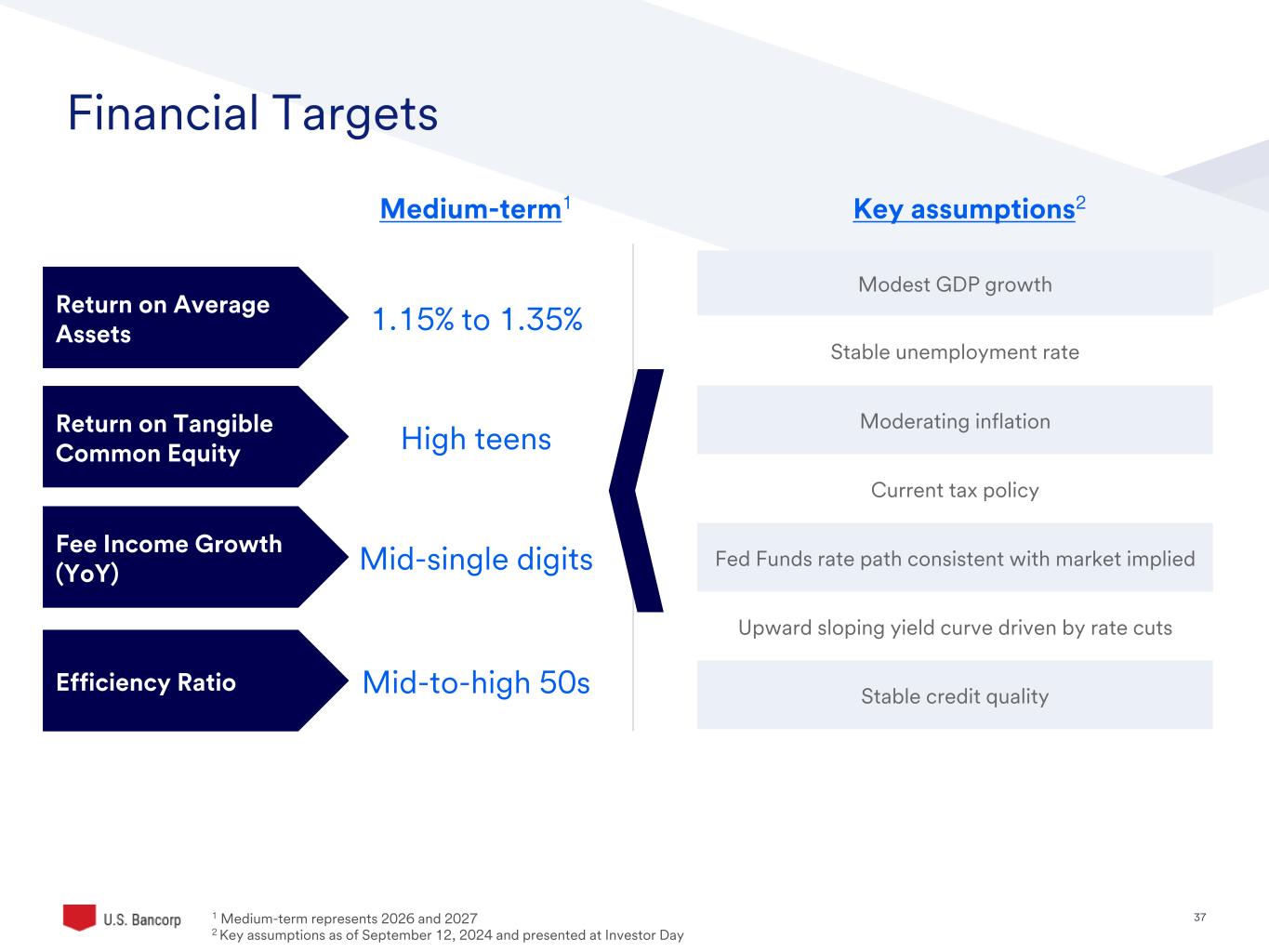

37©2025 U.S. Bank | Confidential Financial Targets Return on Average Assets Return on Tangible Common Equity Fee Income Growth (YoY) Efficiency Ratio 1.15% to 1.35% High teens Mid-single digits Mid-to-high 50s Medium-term1 Key assumptions2 Modest GDP growth Stable unemployment rate Moderating inflation Current tax policy Fed Funds rate path consistent with market implied Upward sloping yield curve driven by rate cuts Stable credit quality 1 Me ium-term represents 2026 and 2027 2 Key assumptions as of September 12, 2024 and presented at Investor Day

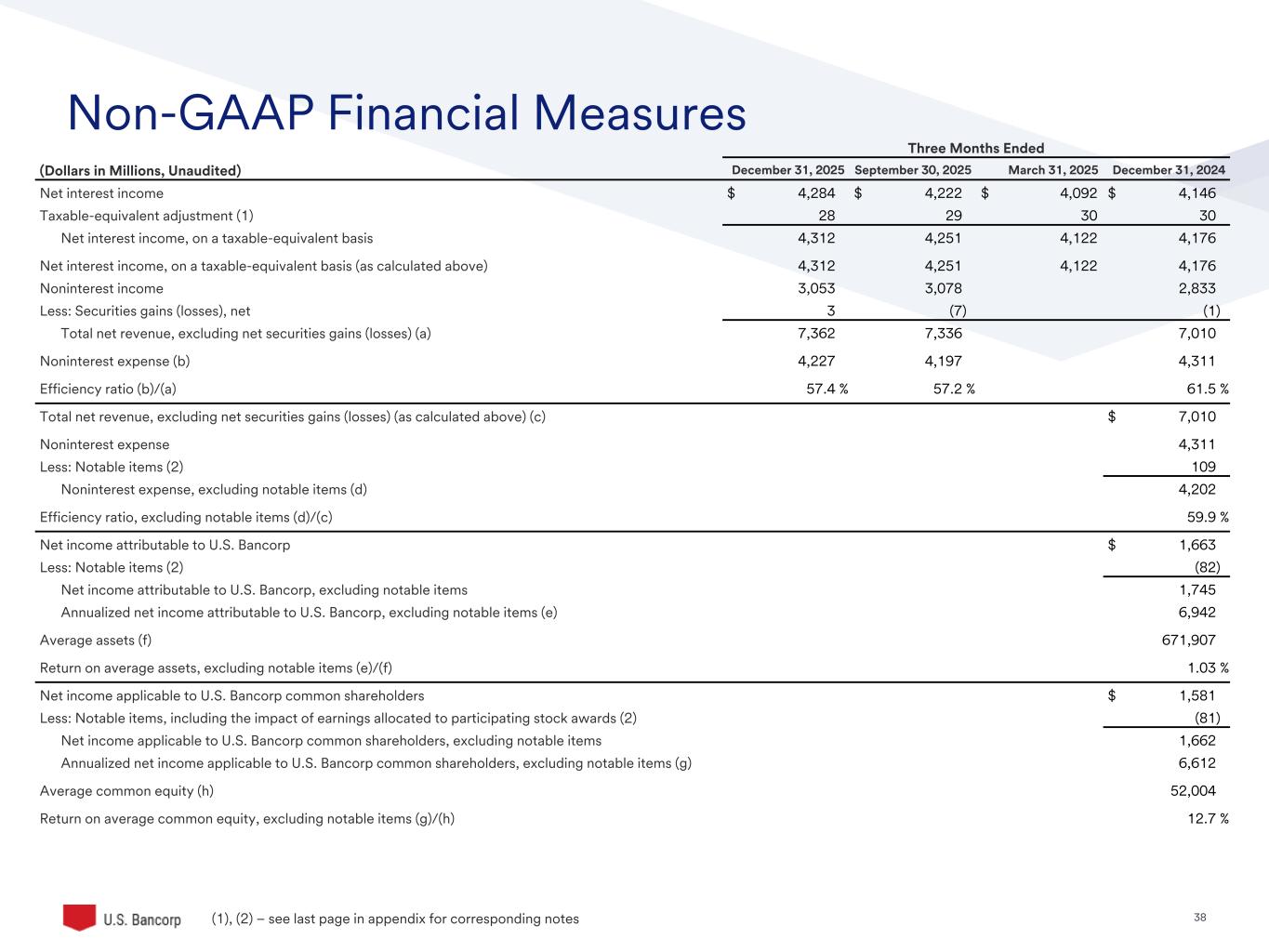

38©2025 U.S. Bank | Confidential Non-GAAP Financial Measures (1), (2) – see last page in appendix for corresponding notes Three Months Ended (Dollars in Millions, Unaudited) December 31, 2025 September 30, 2025 March 31, 2025 December 31, 2024 Net interest income $ 4,284 $ 4,222 $ 4,092 $ 4,146 Taxable-equivalent adjustment (1) 28 29 30 30 Net interest income, on a taxable-equivalent basis 4,312 4,251 4,122 4,176 Net interest income, on a taxable-equivalent basis (as calculated above) 4,312 4,251 4,122 4,176 Noninterest income 3,053 3,078 2,833 Less: Securities gains (losses), net 3 (7) (1) Total net revenue, excluding net securities gains (losses) (a) 7,362 7,336 7,010 Noninterest expense (b) 4,227 4,197 4,311 Efficiency ratio (b)/(a) 57.4 % 57.2 % 61.5 % Total net revenue, excluding net securities gains (losses) (as calculated above) (c) $ 7,010 Noninterest expense 4,311 Less: Notable items (2) 109 Noninterest expense, excluding notable items (d) 4,202 Efficiency ratio, excluding notable items (d)/(c) 59.9 % Net income attributable to U.S. Bancorp $ 1,663 Less: Notable items (2) (82) Net income attributable to U.S. Bancorp, excluding notable items 1,745 Annualized net income attributable to U.S. Bancorp, excluding notable items (e) 6,942 Average assets (f) 671,907 Return on average assets, excluding notable items (e)/(f) 1.03 % Net income applicable to U.S. Bancorp common shareholders $ 1,581 Less: Notable items, including the impact of earnings allocated to participating stock awards (2) (81) Net income applicable to U.S. Bancorp common shareholders, excluding notable items 1,662 Annualized net income applicable to U.S. Bancorp common shareholders, excluding notable items (g) 6,612 Average common equity (h) 52,004 Return on average common equity, excluding notable items (g)/(h) 12.7 %

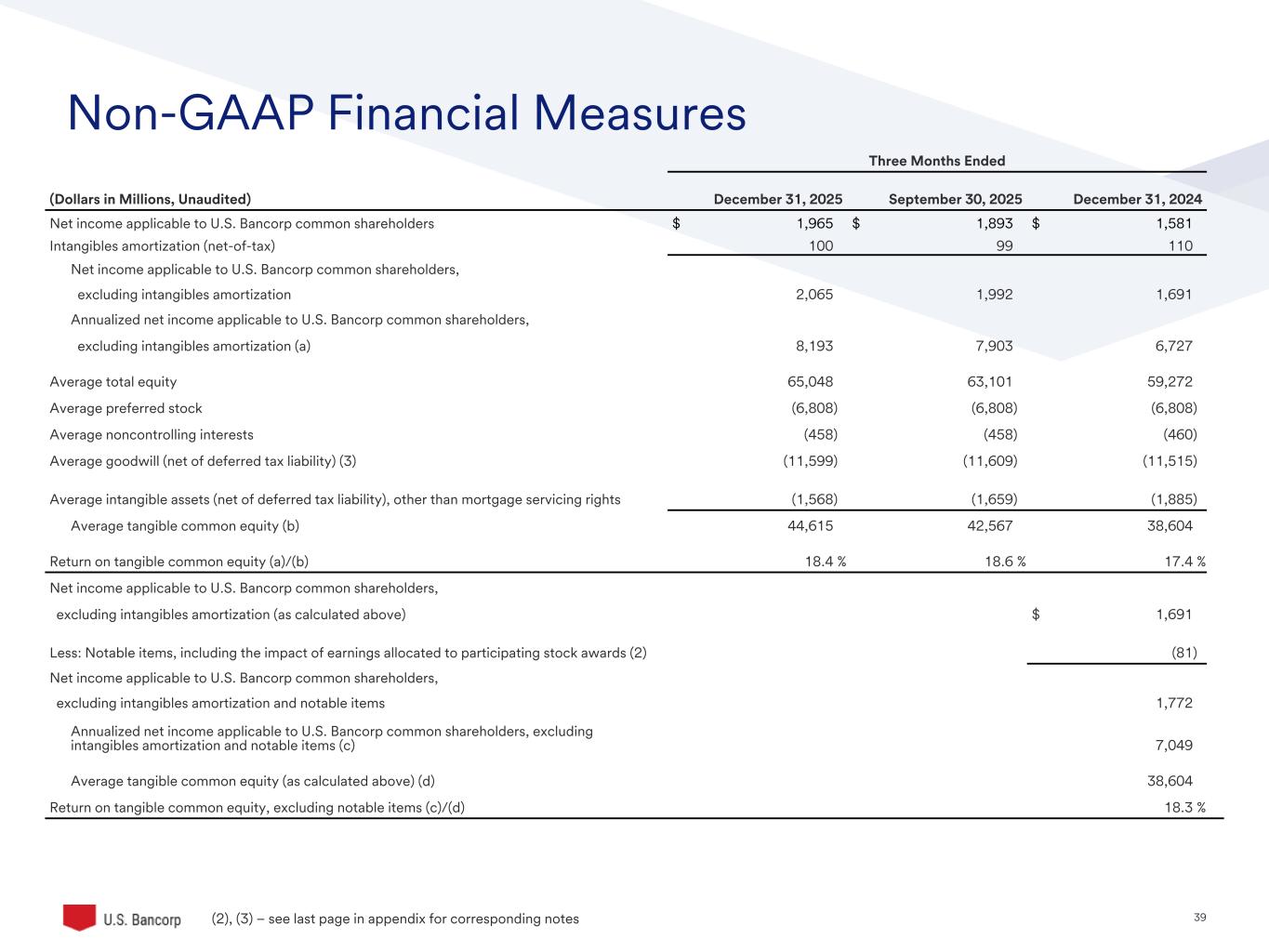

39©2025 U.S. Bank | Confidential Non-GAAP Financial Measures Three Months Ended (Dollars in Millions, Unaudited) December 31, 2025 September 30, 2025 December 31, 2024 Net income applicable to U.S. Bancorp common shareholders $ 1,965 $ 1,893 $ 1,581 Intangibles amortization (net-of-tax) 100 99 110 Net income applicable to U.S. Bancorp common shareholders, excluding intangibles amortization 2,065 1,992 1,691 Annualized net income applicable to U.S. Bancorp common shareholders, excluding intangibles amortization (a) 8,193 7,903 6,727 Average total equity 65,048 63,101 59,272 Average preferred stock (6,808) (6,808) (6,808) Average noncontrolling interests (458) (458) (460) Average goodwill (net of deferred tax liability) (3) (11,599) (11,609) (11,515) Average intangible assets (net of deferred tax liability), other than mortgage servicing rights (1,568) (1,659) (1,885) Average tangible common equity (b) 44,615 42,567 38,604 Return on tangible common equity (a)/(b) 18.4 % 18.6 % 17.4 % Net income applicable to U.S. Bancorp common shareholders, excluding intangibles amortization (as calculated above) $ 1,691 Less: Notable items, including the impact of earnings allocated to participating stock awards (2) (81) Net income applicable to U.S. Bancorp common shareholders, excluding intangibles amortization and notable items 1,772 Annualized net income applicable to U.S. Bancorp common shareholders, excluding intangibles amortization and notable items (c) 7,049 Average tangible common equity (as calculated above) (d) 38,604 Return on tangible common equity, excluding notable items (c)/(d) 18.3 % (2), (3) – see last page in appendix for corresponding notes

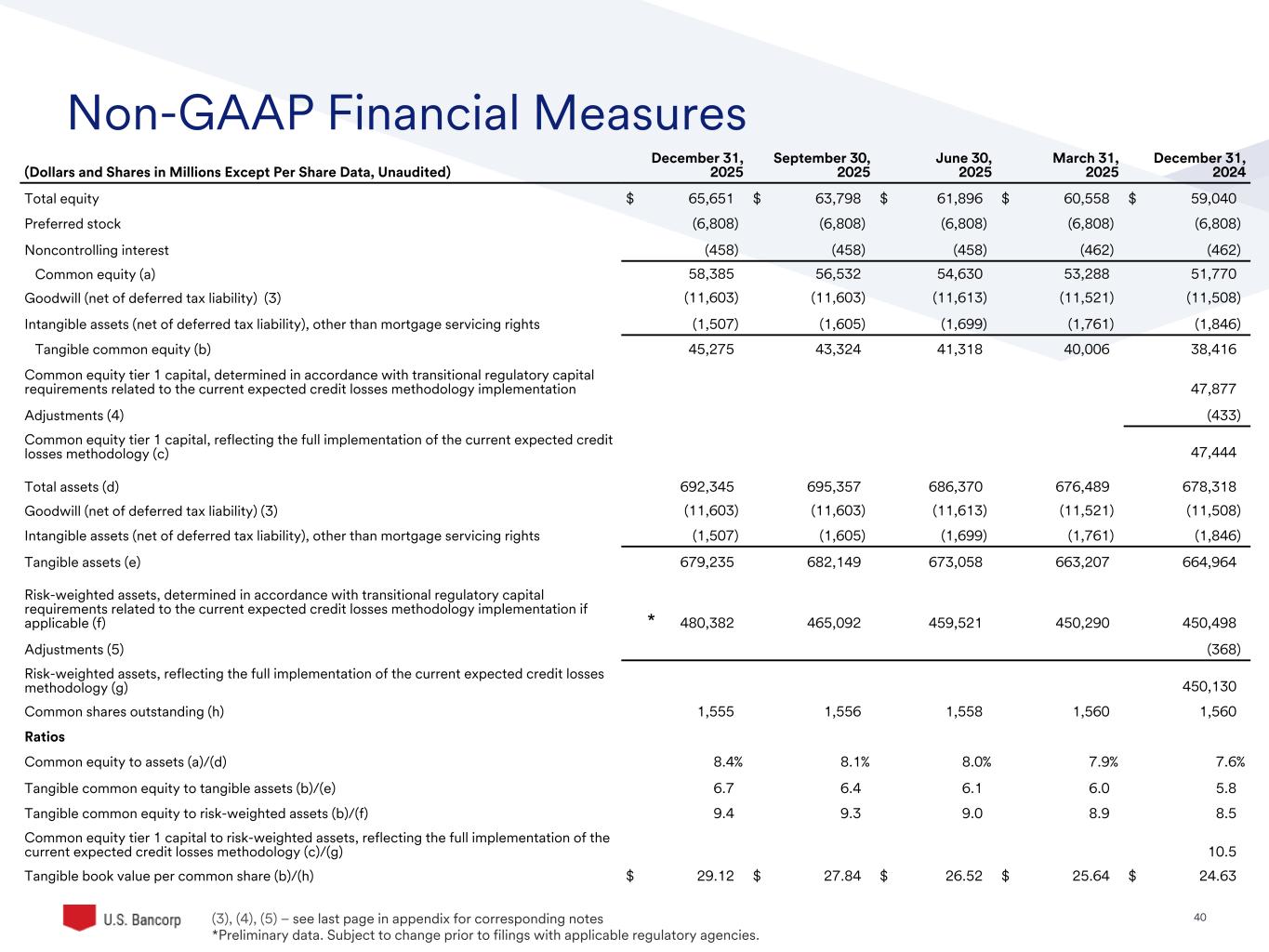

40©2025 U.S. Bank | Confidential Non-GAAP Financial Measures (Dollars and Shares in Millions Except Per Share Data, Unaudited) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 Total equity $ 65,651 $ 63,798 $ 61,896 $ 60,558 $ 59,040 Preferred stock (6,808) (6,808) (6,808) (6,808) (6,808) Noncontrolling interest (458) (458) (458) (462) (462) Common equity (a) 58,385 56,532 54,630 53,288 51,770 Goodwill (net of deferred tax liability) (3) (11,603) (11,603) (11,613) (11,521) (11,508) Intangible assets (net of deferred tax liability), other than mortgage servicing rights (1,507) (1,605) (1,699) (1,761) (1,846) Tangible common equity (b) 45,275 43,324 41,318 40,006 38,416 Common equity tier 1 capital, determined in accordance with transitional regulatory capital requirements related to the current expected credit losses methodology implementation 47,877 Adjustments (4) (433) Common equity tier 1 capital, reflecting the full implementation of the current expected credit losses methodology (c) 47,444 Total assets (d) 692,345 695,357 686,370 676,489 678,318 Goodwill (net of deferred tax liability) (3) (11,603) (11,603) (11,613) (11,521) (11,508) Intangible assets (net of deferred tax liability), other than mortgage servicing rights (1,507) (1,605) (1,699) (1,761) (1,846) Tangible assets (e) 679,235 682,149 673,058 663,207 664,964 Risk-weighted assets, determined in accordance with transitional regulatory capital requirements related to the current expected credit losses methodology implementation if applicable (f) 480,382 465,092 459,521 450,290 450,498 Adjustments (5) (368) Risk-weighted assets, reflecting the full implementation of the current expected credit losses methodology (g) 450,130 Common shares outstanding (h) 1,555 1,556 1,558 1,560 1,560 Ratios Common equity to assets (a)/(d) 8.4% 8.1% 8.0% 7.9% 7.6% Tangible common equity to tangible assets (b)/(e) 6.7 6.4 6.1 6.0 5.8 Tangible common equity to risk-weighted assets (b)/(f) 9.4 9.3 9.0 8.9 8.5 Common equity tier 1 capital to risk-weighted assets, reflecting the full implementation of the current expected credit losses methodology (c)/(g) 10.5 Tangible book value per common share (b)/(h) $ 29.12 $ 27.84 $ 26.52 $ 25.64 $ 24.63 * (3), (4), (5) – see last page in appendix for corresponding notes *Preliminary data. Subject to change prior to filings with applicable regulatory agencies.

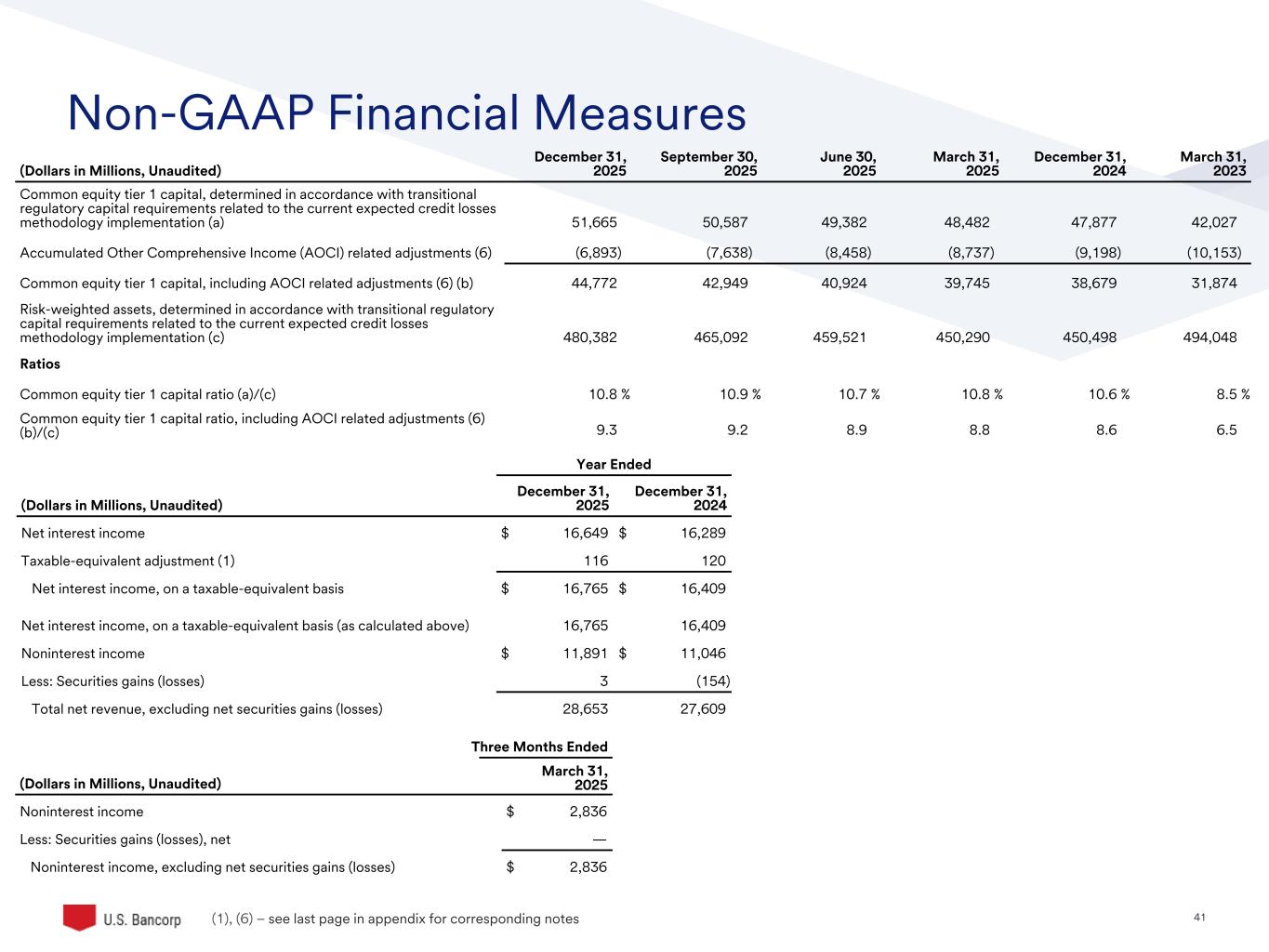

41©2025 U.S. Bank | Confidential Non-GAAP Financial Measures (Dollars in Millions, Unaudited) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 March 31, 2023 Common equity tier 1 capital, determined in accordance with transitional regulatory capital requirements related to the current expected credit losses methodology implementation (a) 51,665 50,587 49,382 48,482 47,877 42,027 Accumulated Other Comprehensive Income (AOCI) related adjustments (6) (6,893) (7,638) (8,458) (8,737) (9,198) (10,153) Common equity tier 1 capital, including AOCI related adjustments (6) (b) 44,772 42,949 40,924 39,745 38,679 31,874 Risk-weighted assets, determined in accordance with transitional regulatory capital requirements related to the current expected credit losses methodology implementation (c) 480,382 465,092 459,521 450,290 450,498 494,048 Ratios Common equity tier 1 capital ratio (a)/(c) 10.8 % 10.9 % 10.7 % 10.8 % 10.6 % 8.5 % Common equity tier 1 capital ratio, including AOCI related adjustments (6) (b)/(c) 9.3 9.2 8.9 8.8 8.6 6.5 (1), (6) – see last page in appendix for corresponding notes Year Ended (Dollars in Millions, Unaudited) December 31, 2025 December 31, 2024 Net interest income $ 16,649 $ 16,289 Taxable-equivalent adjustment (1) 116 120 Net interest income, on a taxable-equivalent basis $ 16,765 $ 16,409 Net interest income, on a taxable-equivalent basis (as calculated above) 16,765 16,409 Noninterest income $ 11,891 $ 11,046 Less: Securities gains (losses) 3 (154) Total net revenue, excluding net securities gains (losses) 28,653 27,609 Three Months Ended (Dollars in Millions, Unaudited) March 31, 2025 Noninterest income $ 2,836 Less: Securities gains (losses), net — Noninterest income, excluding net securities gains (losses) $ 2,836

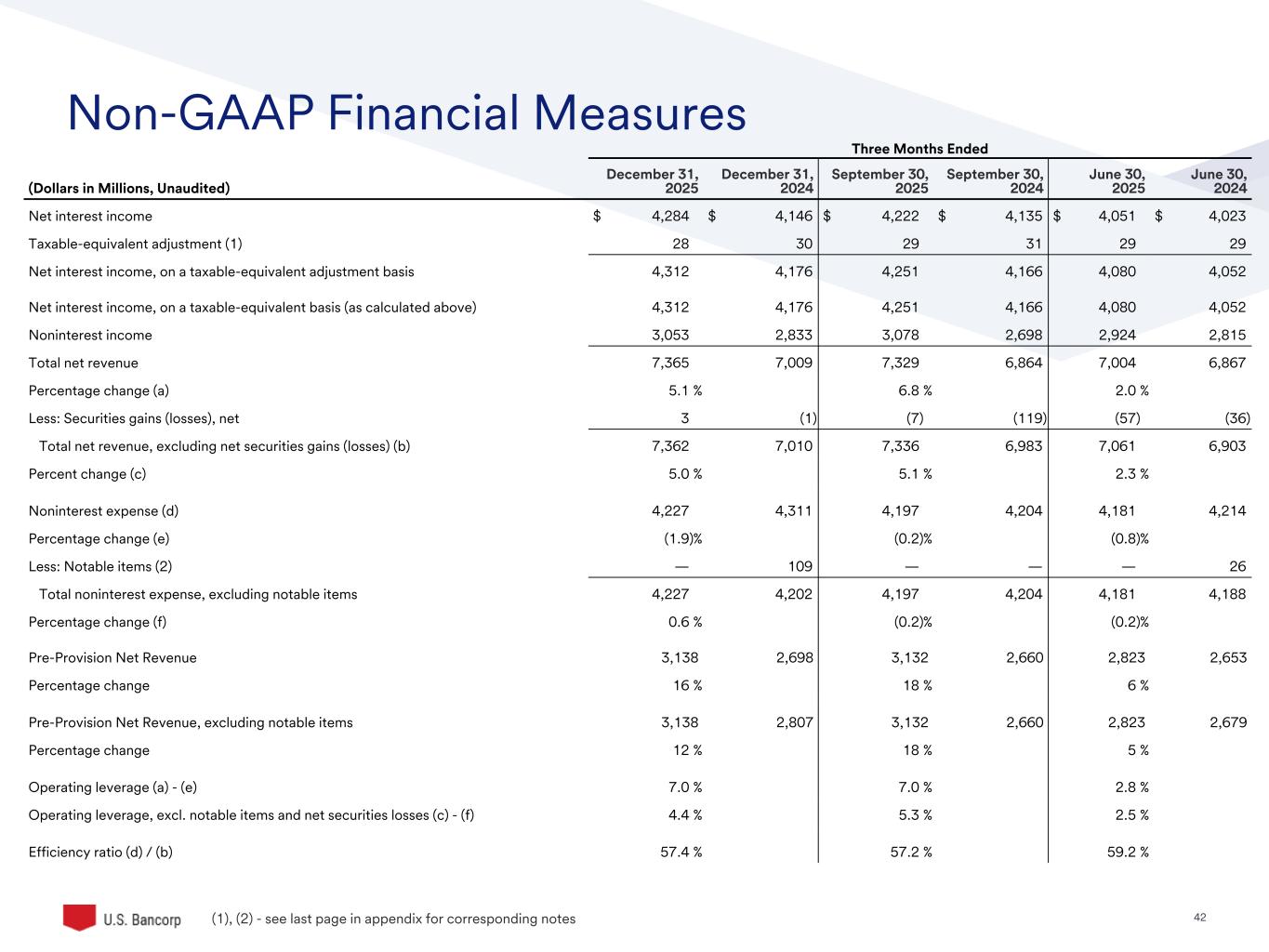

42©2025 U.S. Bank | Confidential Non-GAAP Financial Measures (1), (2) - see last page in appendix for corresponding notes Three Months Ended (Dollars in Millions, Unaudited) December 31, 2025 December 31, 2024 September 30, 2025 September 30, 2024 June 30, 2025 June 30, 2024 Net interest income $ 4,284 $ 4,146 $ 4,222 $ 4,135 $ 4,051 $ 4,023 Taxable-equivalent adjustment (1) 28 30 29 31 29 29 Net interest income, on a taxable-equivalent adjustment basis 4,312 4,176 4,251 4,166 4,080 4,052 Net interest income, on a taxable-equivalent basis (as calculated above) 4,312 4,176 4,251 4,166 4,080 4,052 Noninterest income 3,053 2,833 3,078 2,698 2,924 2,815 Total net revenue 7,365 7,009 7,329 6,864 7,004 6,867 Percentage change (a) 5.1 % 6.8 % 2.0 % Less: Securities gains (losses), net 3 (1) (7) (119) (57) (36) Total net revenue, excluding net securities gains (losses) (b) 7,362 7,010 7,336 6,983 7,061 6,903 Percent change (c) 5.0 % 5.1 % 2.3 % Noninterest expense (d) 4,227 4,311 4,197 4,204 4,181 4,214 Percentage change (e) (1.9) % (0.2) % (0.8) % Less: Notable items (2) — 109 — — — 26 Total noninterest expense, excluding notable items 4,227 4,202 4,197 4,204 4,181 4,188 Percentage change (f) 0.6 % (0.2) % (0.2) % Pre-Provision Net Revenue 3,138 2,698 3,132 2,660 2,823 2,653 Percentage change 16 % 18 % 6 % Pre-Provision Net Revenue, excluding notable items 3,138 2,807 3,132 2,660 2,823 2,679 Percentage change 12 % 18 % 5 % Operating leverage (a) - (e) 7.0 % 7.0 % 2.8 % Operating leverage, excl. notable items and net securities losses (c) - (f) 4.4 % 5.3 % 2.5 % Efficiency ratio (d) / (b) 57.4 % 57.2 % 59.2 %

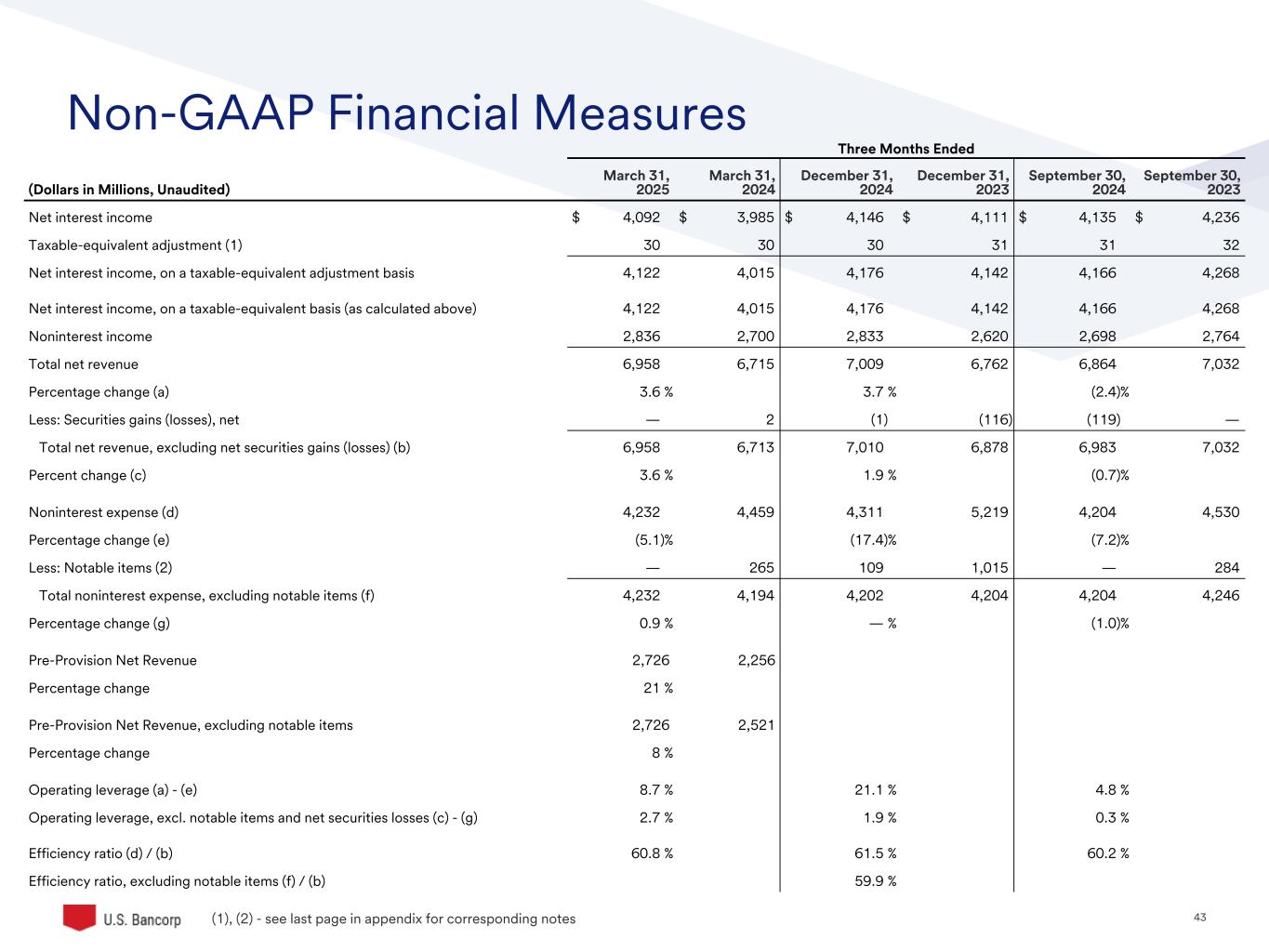

43©2025 U.S. Bank | Confidential Non-GAAP Financial Measures Three Months Ended (Dollars in Millions, Unaudited) March 31, 2025 March 31, 2024 December 31, 2024 December 31, 2023 September 30, 2024 September 30, 2023 Net interest income $ 4,092 $ 3,985 $ 4,146 $ 4,111 $ 4,135 $ 4,236 Taxable-equivalent adjustment (1) 30 30 30 31 31 32 Net interest income, on a taxable-equivalent adjustment basis 4,122 4,015 4,176 4,142 4,166 4,268 Net interest income, on a taxable-equivalent basis (as calculated above) 4,122 4,015 4,176 4,142 4,166 4,268 Noninterest income 2,836 2,700 2,833 2,620 2,698 2,764 Total net revenue 6,958 6,715 7,009 6,762 6,864 7,032 Percentage change (a) 3.6 % 3.7 % (2.4) % Less: Securities gains (losses), net — 2 (1) (116) (119) — Total net revenue, excluding net securities gains (losses) (b) 6,958 6,713 7,010 6,878 6,983 7,032 Percent change (c) 3.6 % 1.9 % (0.7) % Noninterest expense (d) 4,232 4,459 4,311 5,219 4,204 4,530 Percentage change (e) (5.1) % (17.4) % (7.2) % Less: Notable items (2) — 265 109 1,015 — 284 Total noninterest expense, excluding notable items (f) 4,232 4,194 4,202 4,204 4,204 4,246 Percentage change (g) 0.9 % — % (1.0) % Pre-Provision Net Revenue 2,726 2,256 Percentage change 21 % Pre-Provision Net Revenue, excluding notable items 2,726 2,521 Percentage change 8 % Operating leverage (a) - (e) 8.7 % 21.1 % 4.8 % Operating leverage, excl. notable items and net securities losses (c) - (g) 2.7 % 1.9 % 0.3 % Efficiency ratio (d) / (b) 60.8 % 61.5 % 60.2 % Efficiency ratio, excluding notable items (f) / (b) 59.9 % (1), (2) - see last page in appendix for corresponding notes

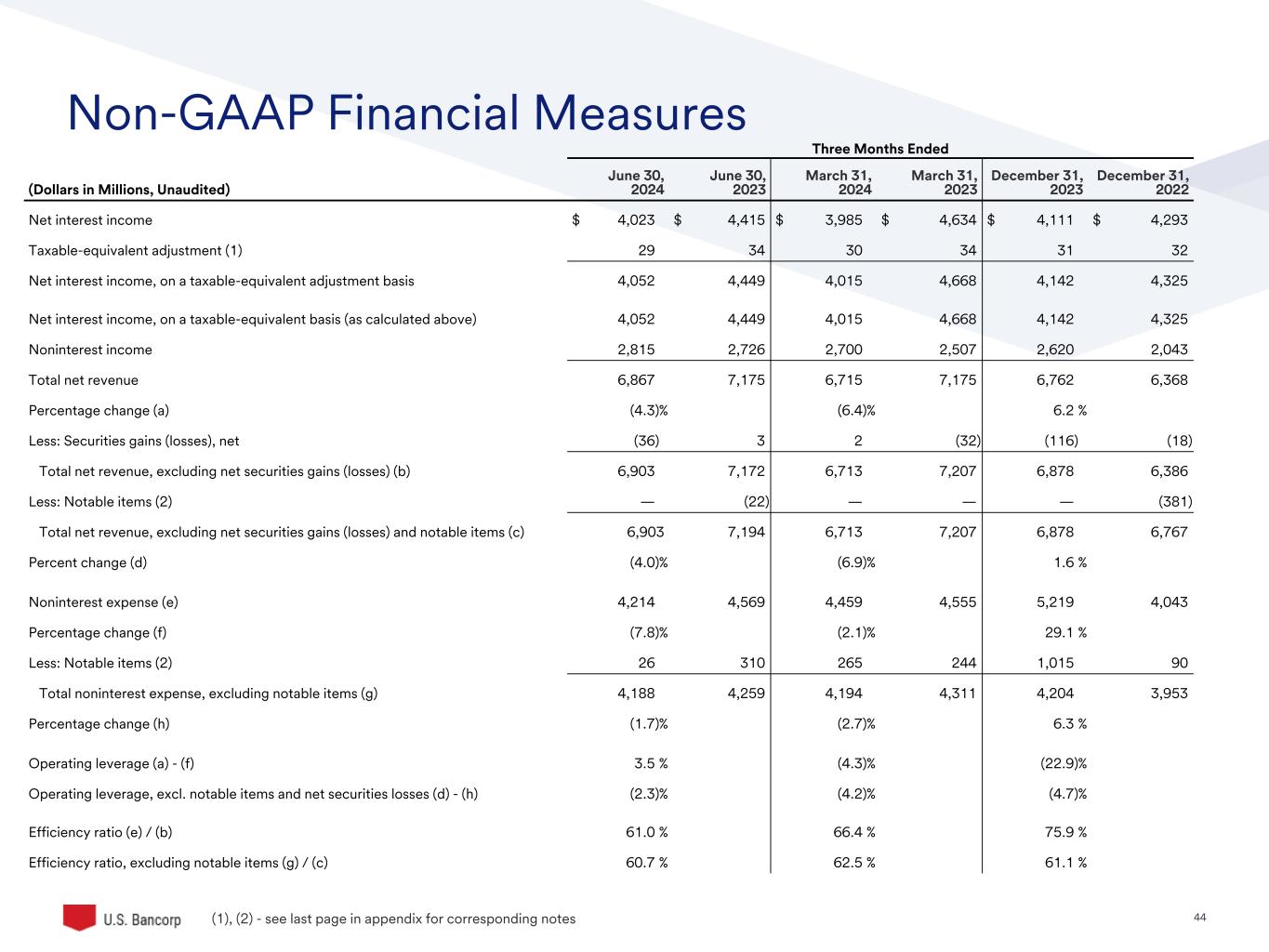

44©2025 U.S. Bank | Confidential Non-GAAP Financial Measures (1), (2) - see last page in appendix for corresponding notes Three Months Ended (Dollars in Millions, Unaudited) June 30, 2024 June 30, 2023 March 31, 2024 March 31, 2023 December 31, 2023 December 31, 2022 Net interest income $ 4,023 $ 4,415 $ 3,985 $ 4,634 $ 4,111 $ 4,293 Taxable-equivalent adjustment (1) 29 34 30 34 31 32 Net interest income, on a taxable-equivalent adjustment basis 4,052 4,449 4,015 4,668 4,142 4,325 Net interest income, on a taxable-equivalent basis (as calculated above) 4,052 4,449 4,015 4,668 4,142 4,325 Noninterest income 2,815 2,726 2,700 2,507 2,620 2,043 Total net revenue 6,867 7,175 6,715 7,175 6,762 6,368 Percentage change (a) (4.3) % (6.4) % 6.2 % Less: Securities gains (losses), net (36) 3 2 (32) (116) (18) Total net revenue, excluding net securities gains (losses) (b) 6,903 7,172 6,713 7,207 6,878 6,386 Less: Notable items (2) — (22) — — — (381) Total net revenue, excluding net securities gains (losses) and notable items (c) 6,903 7,194 6,713 7,207 6,878 6,767 Percent change (d) (4.0) % (6.9) % 1.6 % Noninterest expense (e) 4,214 4,569 4,459 4,555 5,219 4,043 Percentage change (f) (7.8) % (2.1) % 29.1 % Less: Notable items (2) 26 310 265 244 1,015 90 Total noninterest expense, excluding notable items (g) 4,188 4,259 4,194 4,311 4,204 3,953 Percentage change (h) (1.7) % (2.7) % 6.3 % Operating leverage (a) - (f) 3.5 % (4.3) % (22.9) % Operating leverage, excl. notable items and net securities losses (d) - (h) (2.3) % (4.2) % (4.7) % Efficiency ratio (e) / (b) 61.0 % 66.4 % 75.9 % Efficiency ratio, excluding notable items (g) / (c) 60.7 % 62.5 % 61.1 %

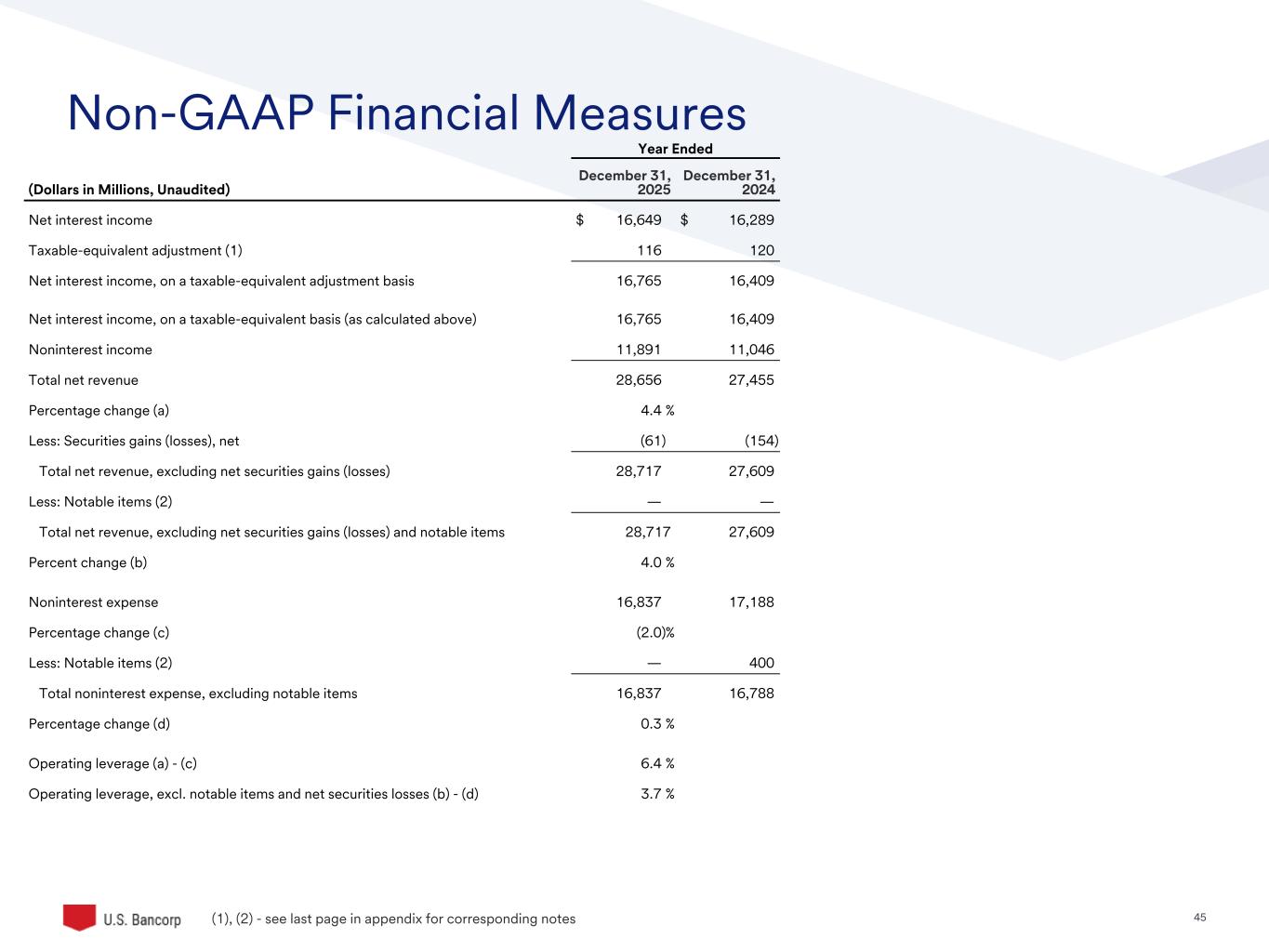

45©2025 U.S. Bank | Confidential Non-GAAP Financial Measures (1), (2) - see last page in appendix for corresponding notes Year Ended (Dollars in Millions, Unaudited) December 31, 2025 December 31, 2024 Net interest income $ 16,649 $ 16,289 Taxable-equivalent adjustment (1) 116 120 Net interest income, on a taxable-equivalent adjustment basis 16,765 16,409 Net interest income, on a taxable-equivalent basis (as calculated above) 16,765 16,409 Noninterest income 11,891 11,046 Total net revenue 28,656 27,455 Percentage change (a) 4.4 % Less: Securities gains (losses), net (61) (154) Total net revenue, excluding net securities gains (losses) 28,717 27,609 Less: Notable items (2) — — Total net revenue, excluding net securities gains (losses) and notable items 28,717 27,609 Percent change (b) 4.0 % Noninterest expense 16,837 17,188 Percentage change (c) (2.0) % Less: Notable items (2) — 400 Total noninterest expense, excluding notable items 16,837 16,788 Percentage change (d) 0.3 % Operating leverage (a) - (c) 6.4 % Operating leverage, excl. notable items and net securities losses (b) - (d) 3.7 %

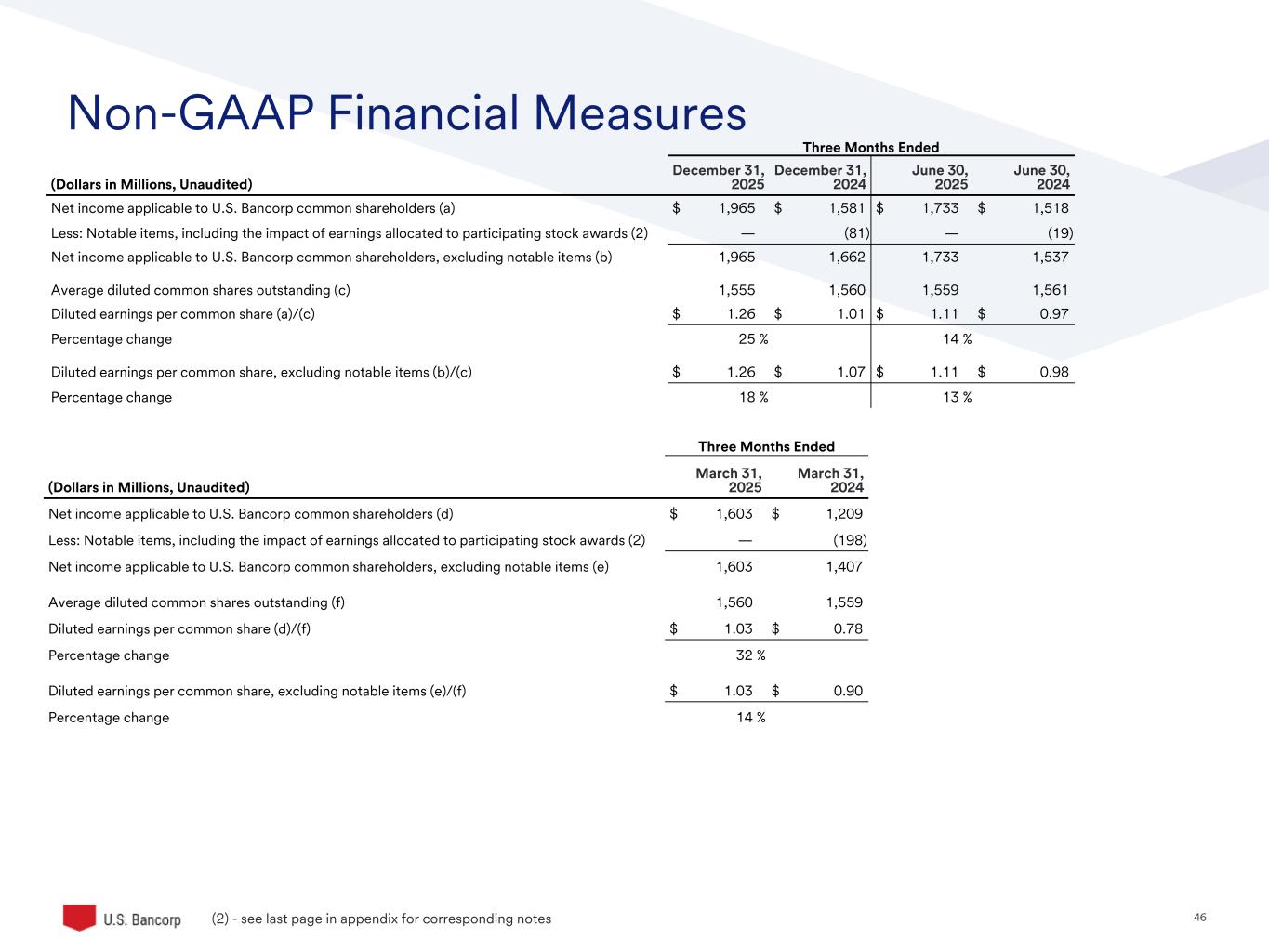

46©2025 U.S. Bank | Confidential Non-GAAP Financial Measures Three Months Ended (Dollars in Millions, Unaudited) December 31, 2025 December 31, 2024 June 30, 2025 June 30, 2024 Net income applicable to U.S. Bancorp common shareholders (a) $ 1,965 $ 1,581 $ 1,733 $ 1,518 Less: Notable items, including the impact of earnings allocated to participating stock awards (2) — (81) — (19) Net income applicable to U.S. Bancorp common shareholders, excluding notable items (b) 1,965 1,662 1,733 1,537 Average diluted common shares outstanding (c) 1,555 1,560 1,559 1,561 Diluted earnings per common share (a)/(c) $ 1.26 $ 1.01 $ 1.11 $ 0.97 Percentage change 25 % 14 % Diluted earnings per common share, excluding notable items (b)/(c) $ 1.26 $ 1.07 $ 1.11 $ 0.98 Percentage change 18 % 13 % Three Months Ended (Dollars in Millions, Unaudited) March 31, 2025 March 31, 2024 Net income applicable to U.S. Bancorp common shareholders (d) $ 1,603 $ 1,209 Less: Notable items, including the impact of earnings allocated to participating stock awards (2) — (198) Net income applicable to U.S. Bancorp common shareholders, excluding notable items (e) 1,603 1,407 Average diluted common shares outstanding (f) 1,560 1,559 Diluted earnings per common share (d)/(f) $ 1.03 $ 0.78 Percentage change 32 % Diluted earnings per common share, excluding notable items (e)/(f) $ 1.03 $ 0.90 Percentage change 14 % (2) - s e last page in appendix for corresponding notes

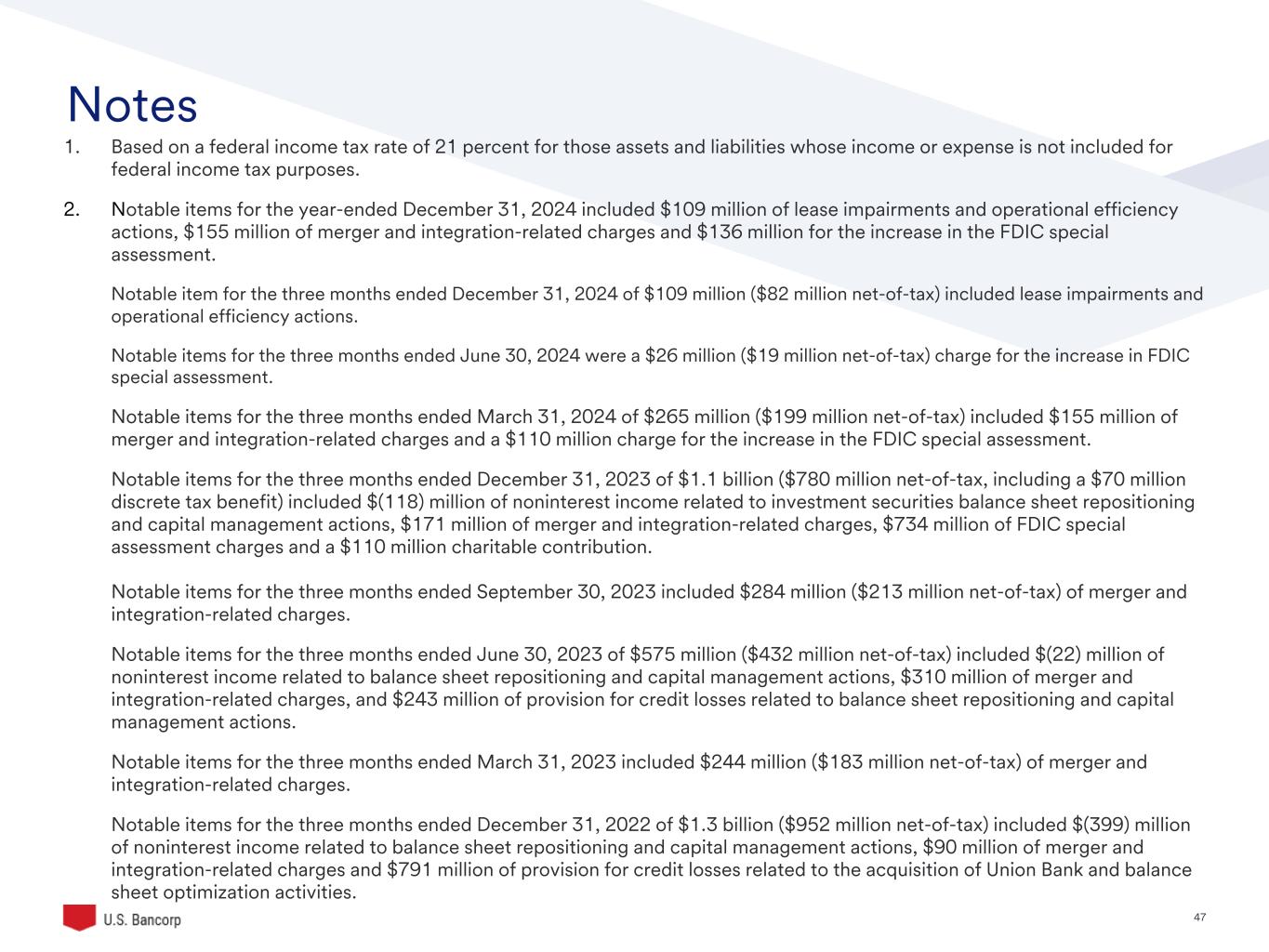

47©2025 U.S. Bank | Confidential Notes 1. Based on a federal income tax rate of 21 percent for those assets and liabilities whose income or expense is not included for federal income tax purposes. 2. Notable items for the year-ended December 31, 2024 included $109 million of lease impairments and operational efficiency actions, $155 million of merger and integration-related charges and $136 million for the increase in the FDIC special assessment. Notable item for the three months ended December 31, 2024 of $109 million ($82 million net-of-tax) included lease impairments and operational efficiency actions. Notable items for the three months ended June 30, 2024 were a $26 million ($19 million net-of-tax) charge for the increase in FDIC special assessment. Notable items for the three months ended March 31, 2024 of $265 million ($199 million net-of-tax) included $155 million of merger and integration-related charges and a $110 million charge for the increase in the FDIC special assessment. Notable items for the three months ended December 31, 2023 of $1.1 billion ($780 million net-of-tax, including a $70 million discrete tax benefit) included $(118) million of noninterest income related to investment securities balance sheet repositioning and capital management actions, $171 million of merger and integration-related charges, $734 million of FDIC special assessment charges and a $110 million charitable contribution. Notable items for the three months ended September 30, 2023 included $284 million ($213 million net-of-tax) of merger and integration-related charges. Notable items for the three months ended June 30, 2023 of $575 million ($432 million net-of-tax) included $(22) million of noninterest income related to balance sheet repositioning and capital management actions, $310 million of merger and integration-related charges, and $243 million of provision for credit losses related to balance sheet repositioning and capital management actions. Notable items for the three months ended March 31, 2023 included $244 million ($183 million net-of-tax) of merger and integration-related charges. Notable items for the three months ended December 31, 2022 of $1.3 billion ($952 million net-of-tax) included $(399) million of noninterest income related to balance sheet repositioning and capital management actions, $90 million of merger and integration-related charges and $791 million of provision for credit losses related to the acquisition of Union Bank and balance sheet optimization activities.

48©2025 U.S. Bank | Confidential Notes1. 2. 3. Includes goodwill related to certain investments in unconsolidated financial institutions per prescribed regulatory requirements. 4. Includes the estimated increase in the allowance for credit losses related to the adoption of the current expected credit losses methodology net of deferred taxes. 5. Includes the impact of the estimated increase in the allowance for credit losses related to the adoption of the current expected credit losses methodology. 6. Includes Accumulated Other Comprehensive Income (AOCI) related to available for sale securities, pension plans, and available for sale to held to maturity transfers.

49©2025 U.S. Bank | Confidential Thank you