.2

JANUARY 2026 U.S. Bancorp’s Acquisition of BTIG Bolt -on acquisition to expand markets -based product set and revenues and enhance support for institutional clients

.2

JANUARY 2026 U.S. Bancorp’s Acquisition of BTIG Bolt -on acquisition to expand markets -based product set and revenues and enhance support for institutional clients

Forward -looking statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward -looking statements about U.S. Bancorp. Statements that are not historical or current facts, i ncluding statements about beliefs and expectations, are forward -looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward -looking statements cover, among other things, any projections or expectations regarding U.S. Bancorp’s proposed acquisition of BTIG, LLC and its affiliates (collectively, “BTIG”) described herein, U.S. Bancorp’s future revenues, expenses, earnings, capital expenditures, deposits or stock price, as well as the assumptions on which such expectations are based. Forward -looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “projects,” “forecasts,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward -looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from th ose set forth in forward -looking statements, including the following risks and uncertainties: (1) the risk that the cost savings, any revenue synergies and other anticipated benefi ts of the proposed acquisition may not be realized or may take longer than anticipated to be realized, (2) disruption to the parties’ businesses as a result of the announcement and pe ndency of the proposed acquisition and diversion of management’s attention from ongoing business operations and opportunities, (3) the occurrence of any event that could give ri se to the right of one or both of the parties to terminate the definitive purchase agreement, (4) the failure to obtain required regulatory approvals or a delay in obtaining suc h approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect U.S. Bancorp or the expected benefits of the proposed acqu isition), (5) the failure of any of the closing conditions in the definitive purchase agreement to be satisfied on a timely basis or at all, (6) delays in closing the proposed acquisit ion, (7) the possibility that the proposed acquisition, including the integration of BTIG, may be more costly or difficult to complete than anticipated, (8) the dilution caused by U .S. Bancorp’s issuance of additional shares of its capital stock in connection with the proposed acquisition, and (9) other factors that may affect future results of U.S. Bancorp, incl uding changes in asset quality and credit risk, the inability to sustain revenue and earnings growth, changes in interest rates and capital markets, inflation, customer borrowing, repayme nt, investment and deposit practices, the impact, extent and timing of technological changes, capital management activities, litigation, and legislative and regulatory actions and reforms. For discussion of these and other risks and uncertainties that could cause actual results to differ materially from those set forth in forward -looking statements, see the section entitled “Risk Factors” of U.S. Bancorp’s Form 10 -K for the year ended December 31, 2024, and subsequent filings with the Securi ties and Exchange Commission. In addition, factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these r isks to be a complete set of all potential risks or uncertainties. Readers are cautioned not to place undue reliance on any forward -looking statements. Forward -looking statements s peak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events.

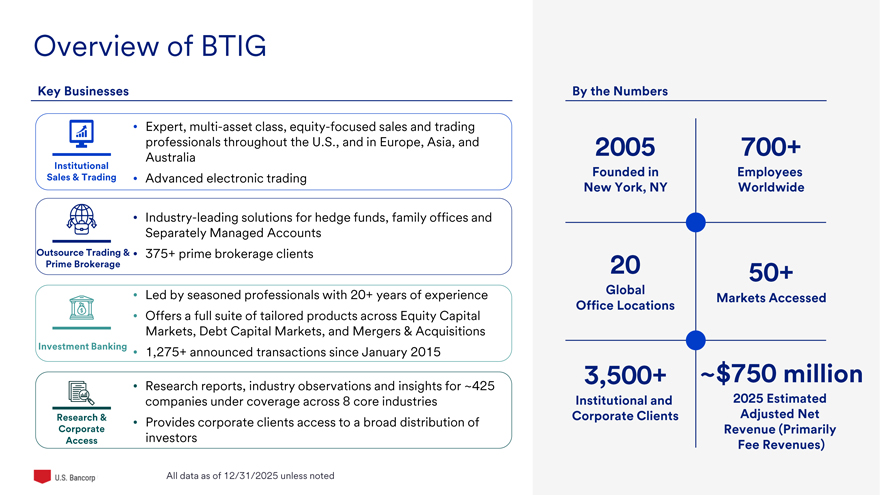

Overview of BTIG Key Businesses By the Numbers • Expert, multi -asset class, equity -focused sales and trading professionals throughout the U.S., and in Europe, Asia, and 2005 700+ Institutional Australia Founded in Employees Sales & Trading • Advanced electronic trading New York, NY Worldwide • Industry -leading solutions for hedge funds, family offices and Separately Managed Accounts Outsource Trading & • 375+ prime brokerage clients Prime Brokerage 20 50+ Global • Led by seasoned professionals with 20+ years of experience Markets Accessed Office Locations • Offers a full suite of tailored products across Equity Capital Markets, Debt Capital Markets, and Mergers & Acquisitions Investment Banking • 1,275+ announced transactions since January 2015 3,500+ ~$750 million • Research reports, industry observations and insights for ~425 companies under coverage across 8 core industries Institutional and 2025 Estimated Research & Corporate Clients Adjusted Net • Provides corporate clients access to a broad distribution of Corporate investors Revenue (Primarily Access Fee Revenues) ©2025 U.S. Bank All data as of 12/31/2025 unless noted

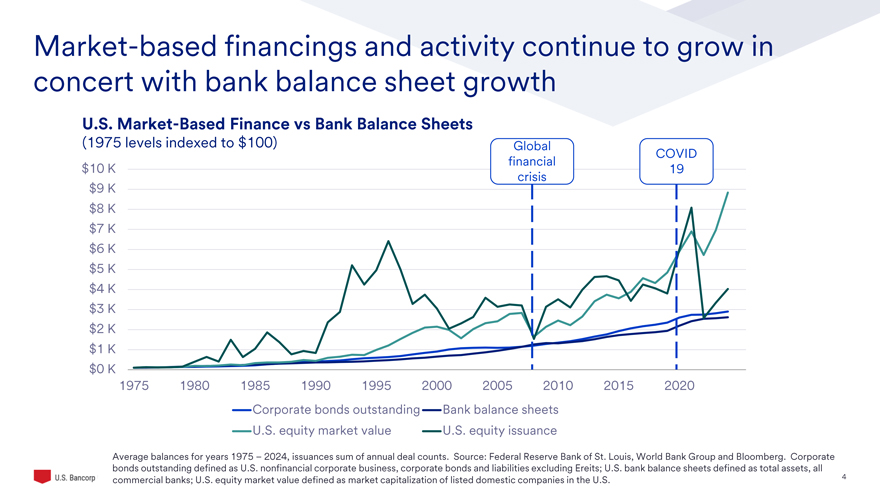

Market -based financings and activity continue to grow in concert with bank balance sheet growth U.S. Market -Based Finance vs Bank Balance Sheets (1975 levels indexed to $100) Global COVID financial $10 K 19 crisis $9 K $8 K $7 K $6 K $5 K $4 K $3 K $2 K $1 K $0 K 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 Corporate bonds outstanding Bank balance sheets U.S. equity market value U.S. equity issuance Average balances for years 1975 – 2024, issuances sum of annual deal counts. Source: Federal Reserve Bank of St. Louis, World Bank Group and Bloomberg. Corporate bonds outstanding defined as U.S. nonfinancial corporate business, corporate bonds and liabilities excluding Ereits; U.S. ban k balance sheets defined as total assets, all ©2025 U.S. Bank commercial banks; U.S. equity market value defined as market capitalization of listed domestic companies in the U.S. 4

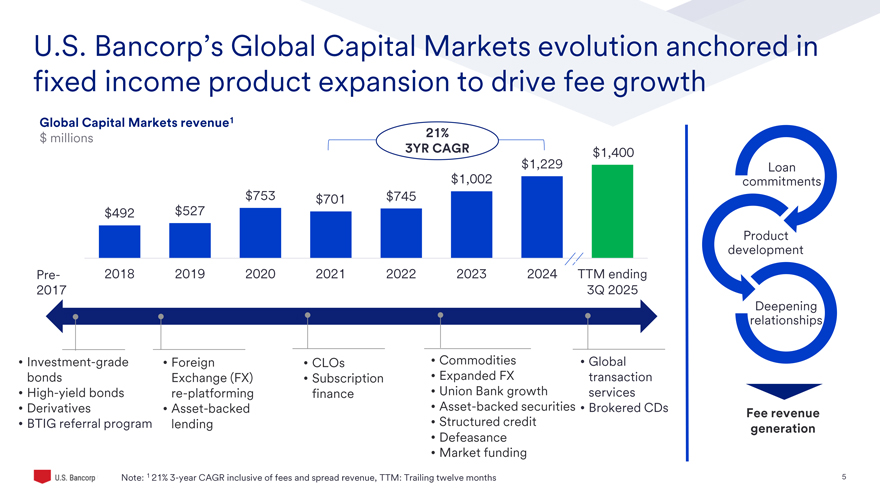

U.S. Bancorp’s Global Capital Markets evolution anchored in fixed income product expansion to drive fee growth Global Capital Markets revenue 1 21% $ millions 3YR CAGR $1,400 $1,229 Loan $1,002 commitments $753 $701 $745 $492 $527 Product development Pre- 2018 2019 2020 2021 2022 2023 2024 TTM ending 2017 3Q 2025 Deepening relationships • Investment -grade • Foreign • CLOs • Commodities • Global bonds Exchange (FX) • Subscription • Expanded FX transaction • High -yield bonds re-platforming finance • Union Bank growth services • Derivatives • Asset -backed • Asset -backed securities • Brokered CDs Fee revenue • BTIG referral program lending • Structured credit generation • Defeasance • Market funding ©2025 U.S. Bank Note: 1 21% 3 -year CAGR inclusive of fees and spread revenue, TTM: Trailing twelve months 5

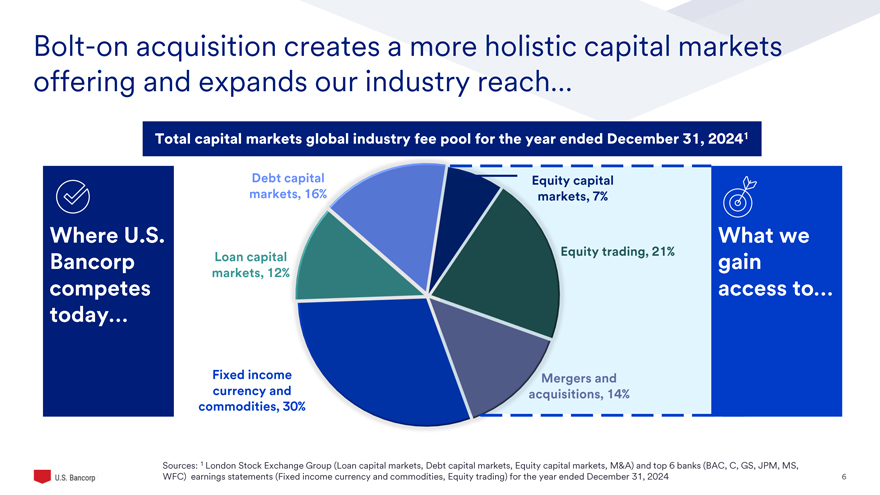

Bolt -on acquisition creates a more holistic capital markets offering and expands our industry reach… Total capital markets global industry fee pool for the year ended December 31, 2024 1 Debt capital Equity capital markets , 16% markets , 7% Where U.S. What we Equity trading , 21% Bancorp Loan capital gain markets , 12% competes access to… today… Fixed income Mergers and currency and acquisitions , 14% commodities , 30% Sources: 1 London Stock Exchange Group (Loan capital markets, Debt capital markets, Equity capital markets, M&A) and top 6 banks (BAC, C , G S, JPM , MS, ©2025 U.S. Bank WFC ) earnings statements (Fixed income currency and commodities, Equity trading) for the year ended December 31, 2024 6

…Closing product gaps to better serve clients Equity capital markets Equity sales, trading and execution M&A advisory New capabilities Prime brokerage Equity derivatives Equity research Leveraged finance Structured credit Investment grade debt capital markets & trading Shared / existing Loan syndications capabilities Interest rate derivatives Commodities Foreign exchange Repo ©2025 U.S. Bank 7

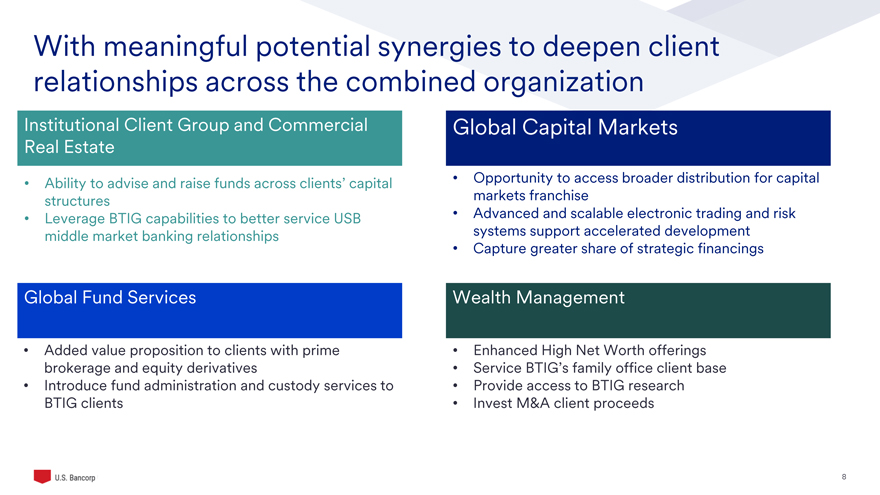

With meaningful potential synergies to deepen client relationships across the combined organization Institutional Client Group and Commercial Global Capital Markets Real Estate • Ability to advise and raise funds across clients’ capital • Opportunity to access broader distribution for capital structures markets franchise • Leverage BTIG capabilities to better service USB • Advanced and scalable electronic trading and risk middle market banking relationships systems support accelerated development • Capture greater share of strategic financings Global Fund Services Wealth Management • Added value proposition to clients with prime • Enhanced High Net Worth offerings brokerage and equity derivatives • Service BTIG’s family office client base • Introduce fund administration and custody services to • Provide access to BTIG research BTIG clients • Invest M&A client proceeds

Supported by our 10 -year partnership and aligned cultures to drive a successful integration Strong 10+ year established relationship… …with shared values and culture & Client -first culture Focused high performance BTIG became U.S. Bancorp’s equity 2014 capital markets referral partner Driven product innovation BTIG & USB began M&A advisory 2023 referral program Outstanding reputations

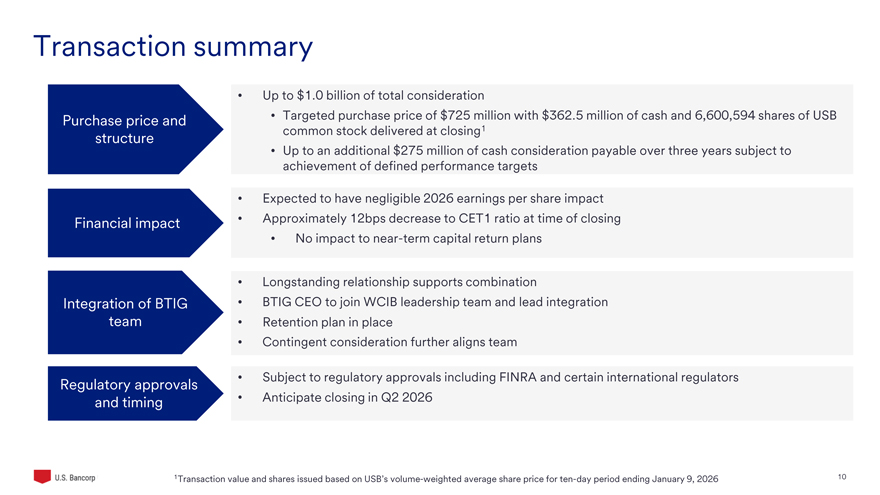

Transaction summary • Up to $1.0 billion of total consideration Purchase price and • Targeted purchase price of $725 million with $362.5 million of cash and 6,600,59 4 shares of USB common stock delivered at closing 1 structure • Up to an additional $275 million of cash consideration payable over three years subject to achievement of defined performance targets • Expected to have negligible 2026 earnings per share impact Financial impact • Approximately 12bps decrease to CET1 ratio at time of closing • No impact to near -term capital return plans • Longstanding relationship supports combination Integration of BTIG • BTIG CEO to join WCIB leadership team and lead integration team • Retention plan in place • Contingent consideration further aligns team • Subject to regulatory approvals including FINRA and certain international regulators Regulatory approvals and timing • Anticipate closing in Q2 2026 ©2025 U.S. Bank 1Transaction value and shares issued based on USB’s volume -weighted average share price for ten -day period ending January 9, 2026 10

Compelling Strategic Rationale Bolt-on transaction that adds ~$750 million annually of predominantly fee revenues to G lobal Capital Markets business BTIG’s strong equities and advisory capabilities complement top -performing fixed -income oriented business Longstanding relationship with BTIG through existing ten -year partnership; a “known quantity” BTIG leadership committed to business going -forward; strong alignment through transaction structure Revenue synergies across Global Capital Markets as well as other USB businesses Consistent with 2024 Investor Day objectives ©2025 U.S. Bank 11