Earnings Results 4th Quarter 2025 January 16, 2026 .2

2 This presentation may contain forward-looking statements regarding M&T Bank Corporation (“M&T”) within the meaning of the Private Securities Litigation Reform Act of 1995 and the rules and regulations of the Securities and Exchange Commission (“SEC”). Any statement that does not describe historical or current facts is a forward-looking statement, including statements based on current expectations, estimates and projections about M&T's business, and management's beliefs and assumptions. Statements regarding the potential effects of events or factors specific to M&T and/or the financial industry as a whole, as well as national and global events generally, on M&T's business, financial condition, liquidity and results of operations may constitute forward-looking statements. Such statements are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond M&T's control. Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "target," "estimate," "continue," or "potential," by future conditional verbs such as "will," "would," "should," "could," or "may," or by variations of such words or by similar expressions. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict and may cause actual outcomes to differ materially from what is expressed or forecasted. While there can be no assurance that any list of risks and uncertainties is complete, important factors that could cause actual outcomes and results to differ materially from those contemplated by forward-looking statements include the following, without limitation: economic conditions and growth rates, including inflation and market volatility; events, developments and current conditions in the financial services industry, including trust, brokerage and investment management businesses; changes in interest rates, spreads on earning assets and interest-bearing liabilities, and interest rate sensitivity; prepayment speeds, loan originations, loan concentrations by type and industry, credit losses and market values on loans, collateral securing loans, and other assets; sources of liquidity; levels of client deposits; ability to contain costs and expenses; changes in M&T's credit ratings; domestic or international political developments and other geopolitical events, including trade and tariff policies and international conflicts and hostilities; changes and trends in the securities markets; common shares outstanding and common stock price volatility; fair value of and number of stock-based compensation awards to be issued in future periods; the impact of changes in market values on trust-, brokerage-, and investment management-related revenues; federal, state or local legislation and/or regulations affecting the financial services industry, or M&T and its subsidiaries individually or collectively, including tax policy; regulatory supervision and oversight, including monetary policy and capital requirements; governmental and public policy changes; political conditions, either nationally or in the states in which M&T and its subsidiaries do business; the initiation and outcome of potential, pending and future litigation, investigations and governmental proceedings, including tax-related examinations and other matters; operational risk events, including loss resulting from fraud by employees or persons outside M&T and breaches in data and cybersecurity; changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board, regulatory agencies or legislation; increasing price, product and service competition by competitors, including new entrants; technological developments and changes; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; the mix of products and services; protection and validity of intellectual property rights; reliance on large customers; technological, implementation and cost/ financial risks in large, multi-year contracts; continued availability of financing; financial resources in the amounts, at the times and on the terms required to support M&T and its subsidiaries' future businesses; and material differences in the actual financial results of merger, acquisition, divestment and investment activities compared with M&T's initial expectations, including the full realization of anticipated cost savings and revenue enhancements. These are representative of the factors that could affect the outcome of the forward-looking statements. In addition, as noted, such statements could be affected by general industry and market conditions and growth rates, general economic and political conditions, either nationally or in the states in which M&T and its subsidiaries do business, and other factors. M&T provides further detail regarding these risks and uncertainties in its Form 10-K for the year ended December 31, 2024, including in the Risk Factors section of such report, as well as in other SEC filings. Forward-looking statements speak only as of the date they are made, and M&T assumes no duty and does not undertake to update forward-looking statements. Annualized, pro forma, projected, and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. This presentation also contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States ("GAAP"). Management believes investors may find these non-GAAP financial measures useful. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Please see the Appendix for reconciliation of GAAP with corresponding non- GAAP measures, as indicated in the presentation. Forward-Looking Statements and Non-GAAP Financial Measures

3 Our Customers Linking our customers to the people, capital, and ideas that empower them in the moments that matter most in their lives. Our Communities M&T is a “bank for communities,” a true engine for local economic development and relationship-building. Our Colleagues We empower our employees to be the best versions of themselves through integrity and empathy. We are committed to Our Shareholders We deliver reliable results anchored by a strong balance sheet that protects and builds investor value across economic cycles. Together, We are M&T Bank

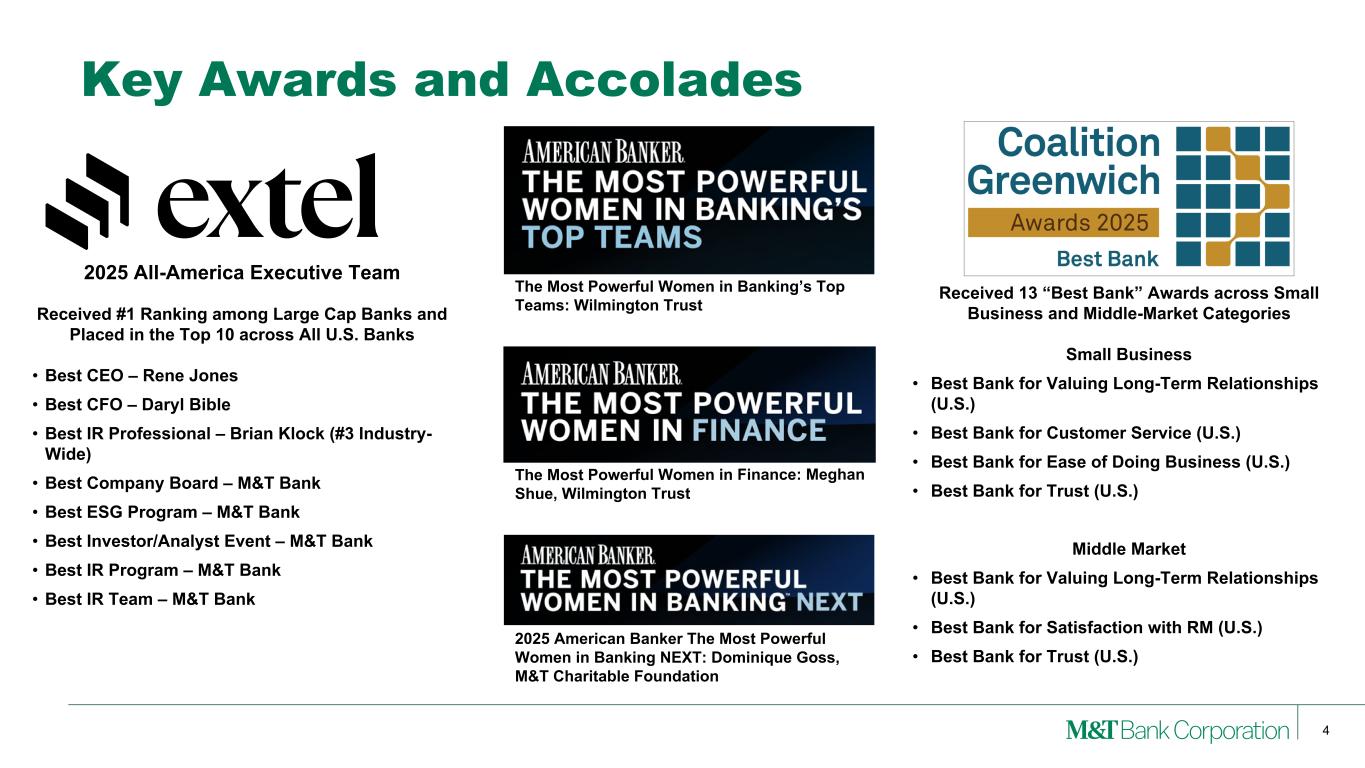

Key Awards and Accolades Received 13 “Best Bank” Awards across Small Business and Middle-Market Categories Small Business • Best Bank for Valuing Long-Term Relationships (U.S.) • Best Bank for Customer Service (U.S.) • Best Bank for Ease of Doing Business (U.S.) • Best Bank for Trust (U.S.) Middle Market • Best Bank for Valuing Long-Term Relationships (U.S.) • Best Bank for Satisfaction with RM (U.S.) • Best Bank for Trust (U.S.) The Most Powerful Women in Finance: Meghan Shue, Wilmington Trust 2025 American Banker The Most Powerful Women in Banking NEXT: Dominique Goss, M&T Charitable Foundation The Most Powerful Women in Banking’s Top Teams: Wilmington Trust 2025 All-America Executive Team Received #1 Ranking among Large Cap Banks and Placed in the Top 10 across All U.S. Banks • Best CEO – Rene Jones • Best CFO – Daryl Bible • Best IR Professional – Brian Klock (#3 Industry- Wide) • Best Company Board – M&T Bank • Best ESG Program – M&T Bank • Best Investor/Analyst Event – M&T Bank • Best IR Program – M&T Bank • Best IR Team – M&T Bank 4

5 Financial Results

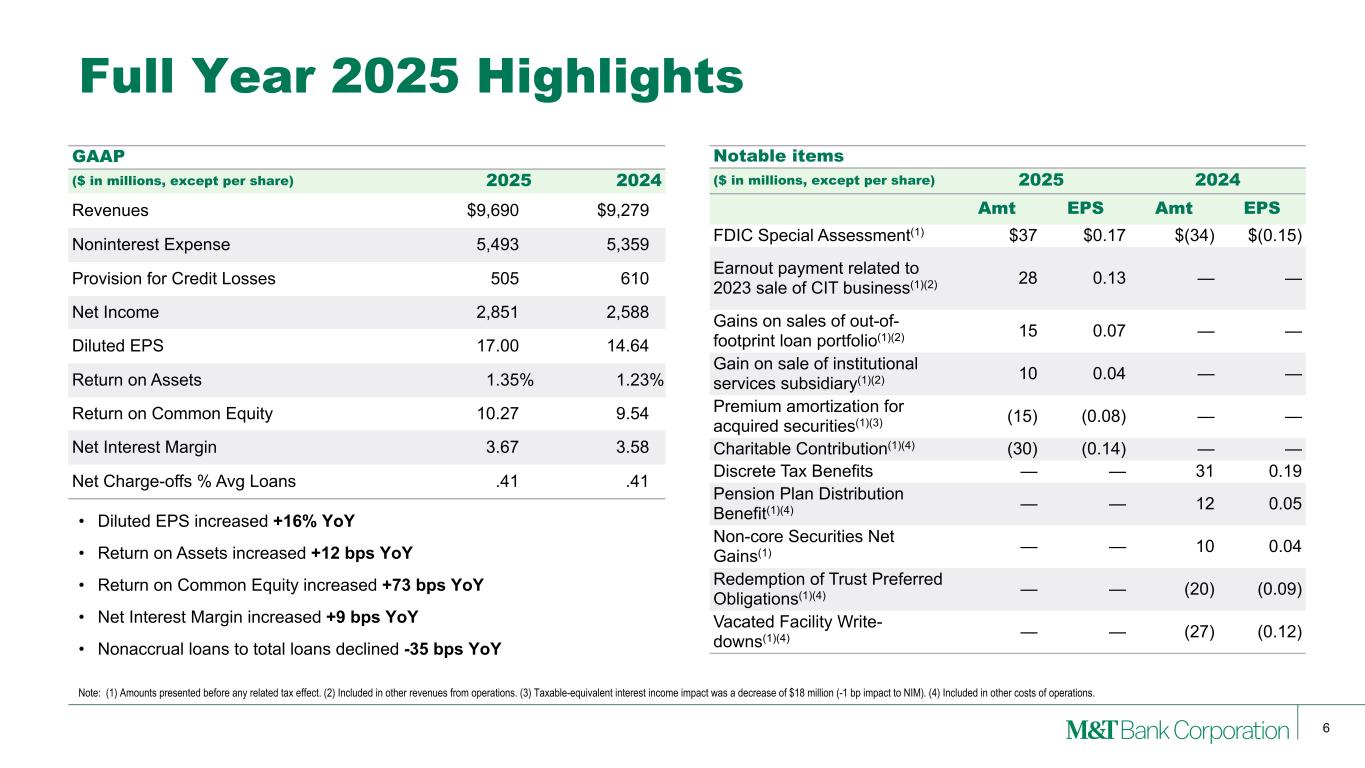

6 • Diluted EPS increased +16% YoY • Return on Assets increased +12 bps YoY • Return on Common Equity increased +73 bps YoY • Net Interest Margin increased +9 bps YoY • Nonaccrual loans to total loans declined -35 bps YoY Note: (1) Amounts presented before any related tax effect. (2) Included in other revenues from operations. (3) Taxable-equivalent interest income impact was a decrease of $18 million (-1 bp impact to NIM). (4) Included in other costs of operations. Full Year 2025 Highlights GAAP ($ in millions, except per share) 2025 2024 Revenues $9,690 $9,279 Noninterest Expense 5,493 5,359 Provision for Credit Losses 505 610 Net Income 2,851 2,588 Diluted EPS 17.00 14.64 Return on Assets 1.35% 1.23% Return on Common Equity 10.27 9.54 Net Interest Margin 3.67 3.58 Net Charge-offs % Avg Loans .41 .41 Notable items ($ in millions, except per share) 2025 2024 Amt EPS Amt EPS FDIC Special Assessment(1) $37 $0.17 $(34) $(0.15) Earnout payment related to 2023 sale of CIT business(1)(2) 28 0.13 — — Gains on sales of out-of- footprint loan portfolio(1)(2) 15 0.07 — — Gain on sale of institutional services subsidiary(1)(2) 10 0.04 — — Premium amortization for acquired securities(1)(3) (15) (0.08) — — Charitable Contribution(1)(4) (30) (0.14) — — Discrete Tax Benefits — — 31 0.19 Pension Plan Distribution Benefit(1)(4) — — 12 0.05 Non-core Securities Net Gains(1) — — 10 0.04 Redemption of Trust Preferred Obligations(1)(4) — — (20) (0.09) Vacated Facility Write- downs(1)(4) — — (27) (0.12)

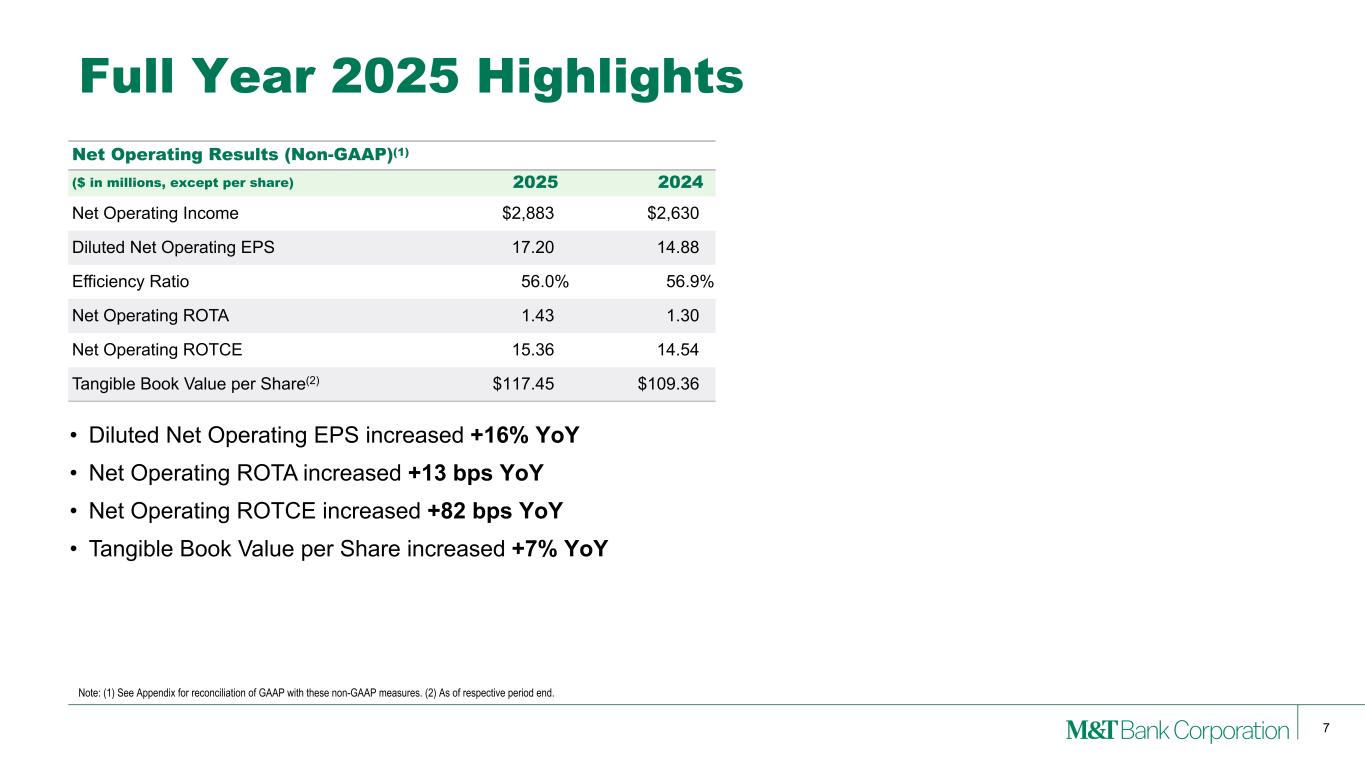

7 Note: (1) See Appendix for reconciliation of GAAP with these non-GAAP measures. (2) As of respective period end. • Diluted Net Operating EPS increased +16% YoY • Net Operating ROTA increased +13 bps YoY • Net Operating ROTCE increased +82 bps YoY • Tangible Book Value per Share increased +7% YoY Full Year 2025 Highlights Net Operating Results (Non-GAAP)(1) ($ in millions, except per share) 2025 2024 Net Operating Income $2,883 $2,630 Diluted Net Operating EPS 17.20 14.88 Efficiency Ratio 56.0% 56.9% Net Operating ROTA 1.43 1.30 Net Operating ROTCE 15.36 14.54 Tangible Book Value per Share(2) $117.45 $109.36

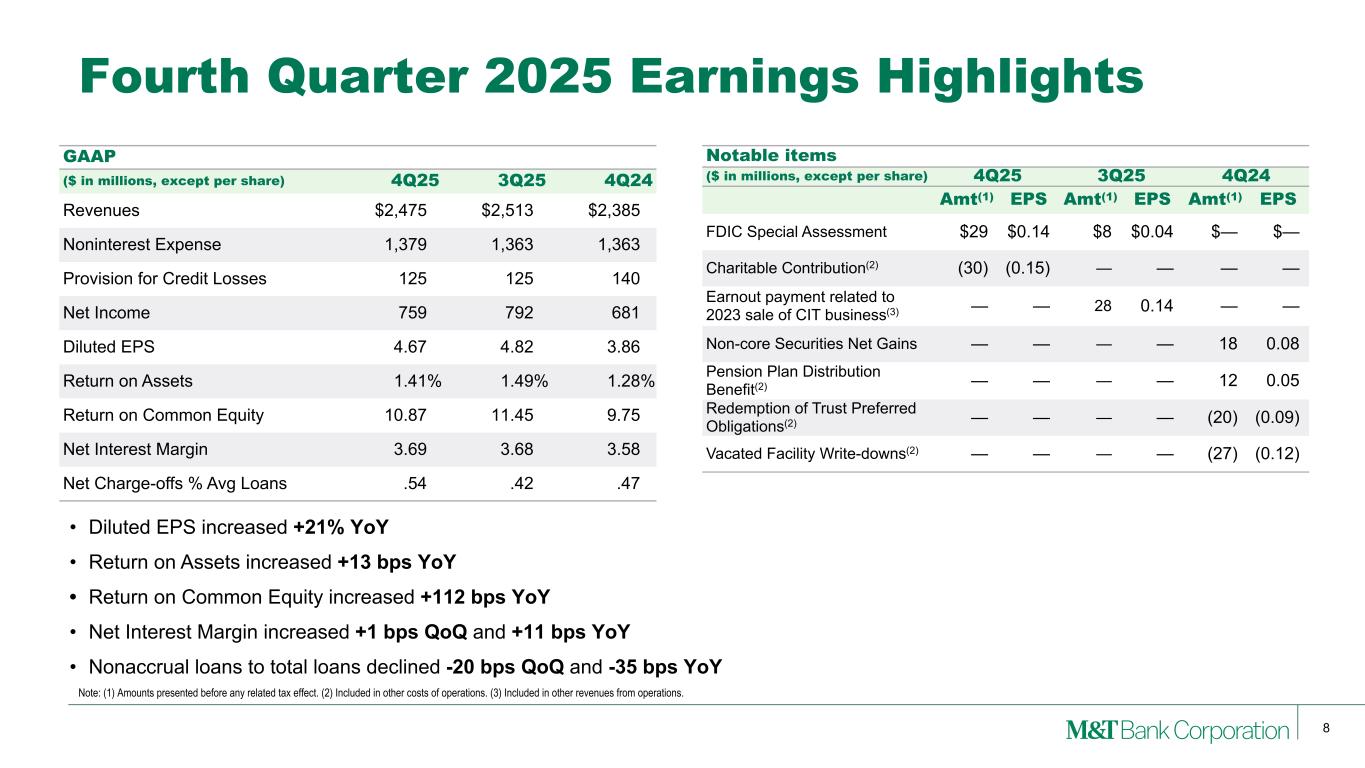

8 • Diluted EPS increased +21% YoY • Return on Assets increased +13 bps YoY • Return on Common Equity increased +112 bps YoY • Net Interest Margin increased +1 bps QoQ and +11 bps YoY • Nonaccrual loans to total loans declined -20 bps QoQ and -35 bps YoY Notable items ($ in millions, except per share) 4Q25 3Q25 4Q24 Amt(1) EPS Amt(1) EPS Amt(1) EPS FDIC Special Assessment $29 $0.14 $8 $0.04 $— $— Charitable Contribution(2) (30) (0.15) — — — — Earnout payment related to 2023 sale of CIT business(3) — — 28 0.14 — — Non-core Securities Net Gains — — — — 18 0.08 Pension Plan Distribution Benefit(2) — — — — 12 0.05 Redemption of Trust Preferred Obligations(2) — — — — (20) (0.09) Vacated Facility Write-downs(2) — — — — (27) (0.12) Fourth Quarter 2025 Earnings Highlights GAAP ($ in millions, except per share) 4Q25 3Q25 4Q24 Revenues $2,475 $2,513 $2,385 Noninterest Expense 1,379 1,363 1,363 Provision for Credit Losses 125 125 140 Net Income 759 792 681 Diluted EPS 4.67 4.82 3.86 Return on Assets 1.41% 1.49% 1.28% Return on Common Equity 10.87 11.45 9.75 Net Interest Margin 3.69 3.68 3.58 Net Charge-offs % Avg Loans .54 .42 .47 Note: (1) Amounts presented before any related tax effect. (2) Included in other costs of operations. (3) Included in other revenues from operations.

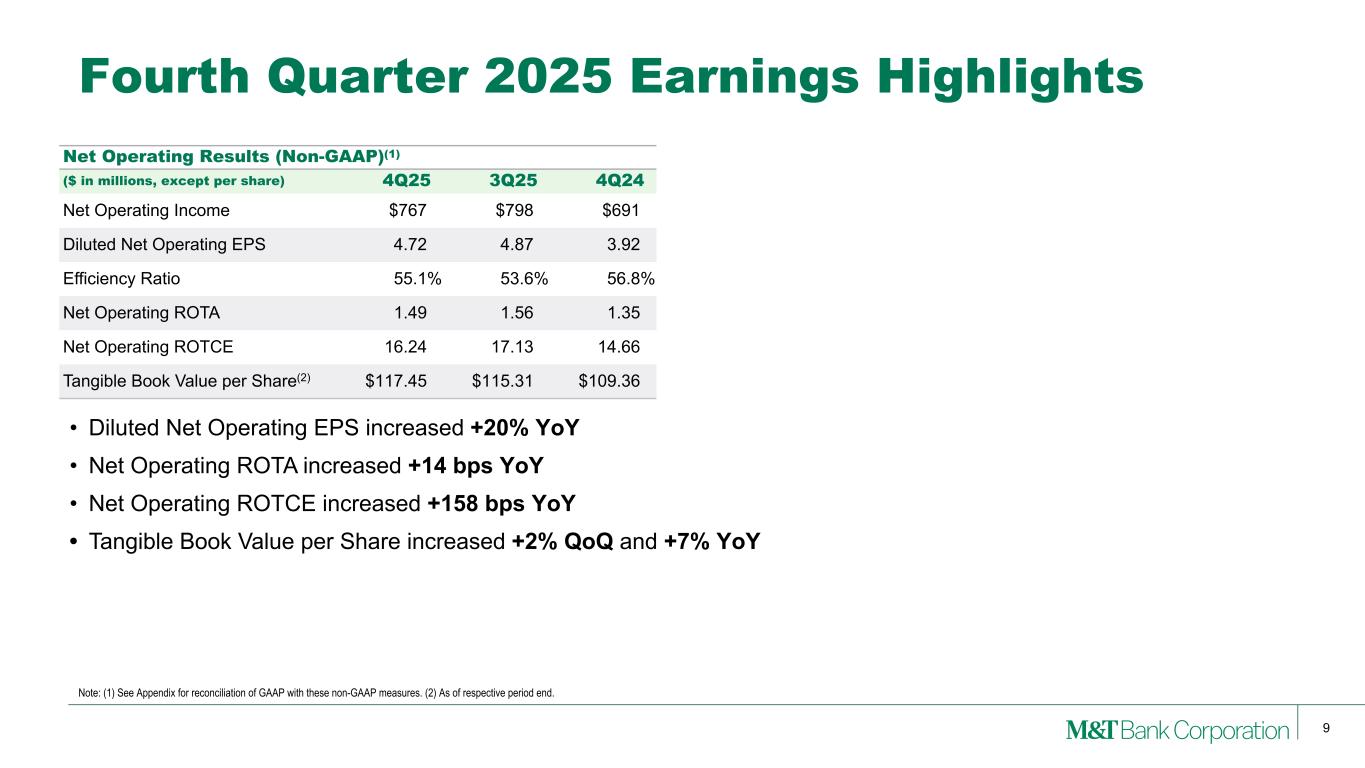

9 Note: (1) See Appendix for reconciliation of GAAP with these non-GAAP measures. (2) As of respective period end. Fourth Quarter 2025 Earnings Highlights Net Operating Results (Non-GAAP)(1) ($ in millions, except per share) 4Q25 3Q25 4Q24 Net Operating Income $767 $798 $691 Diluted Net Operating EPS 4.72 4.87 3.92 Efficiency Ratio 55.1% 53.6% 56.8% Net Operating ROTA 1.49 1.56 1.35 Net Operating ROTCE 16.24 17.13 14.66 Tangible Book Value per Share(2) $117.45 $115.31 $109.36 • Diluted Net Operating EPS increased +20% YoY • Net Operating ROTA increased +14 bps YoY • Net Operating ROTCE increased +158 bps YoY • Tangible Book Value per Share increased +2% QoQ and +7% YoY

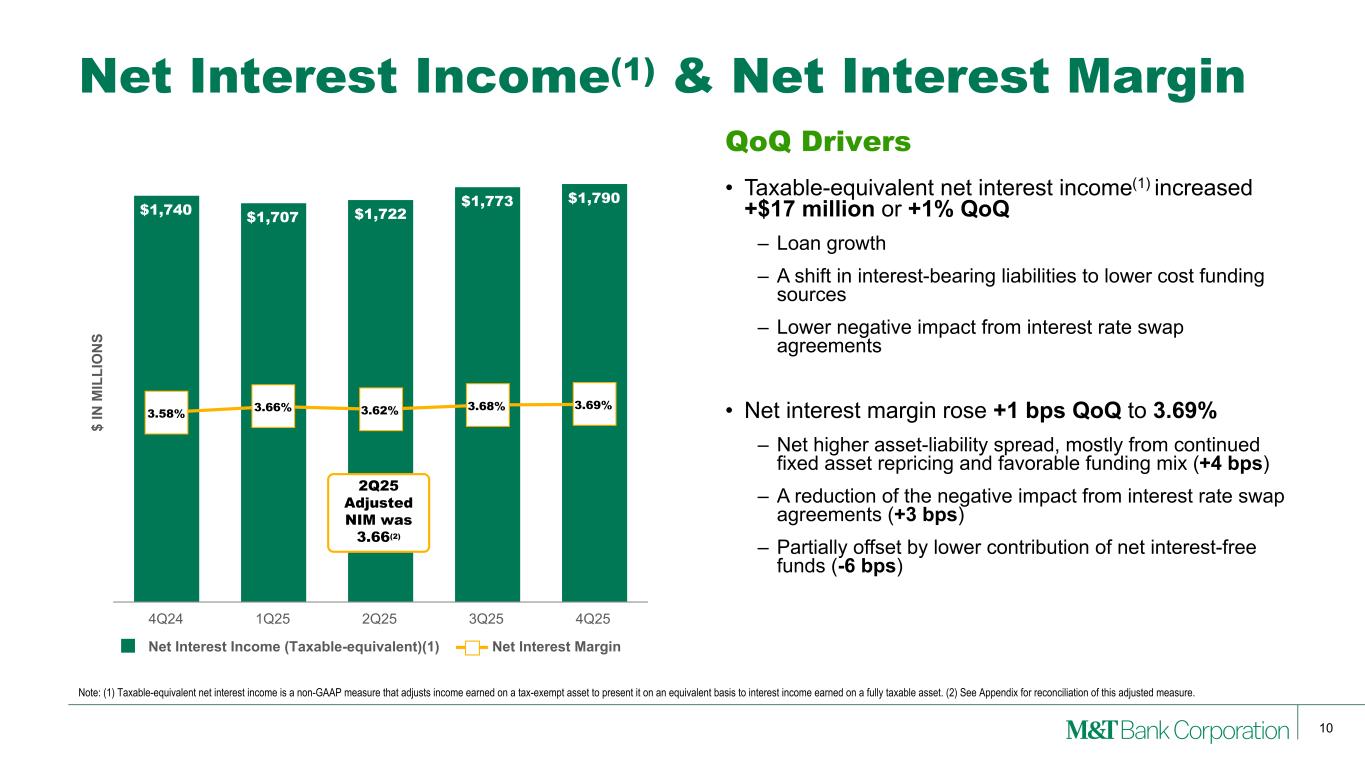

10 Net Interest Income(1) & Net Interest Margin Note: (1) Taxable-equivalent net interest income is a non-GAAP measure that adjusts income earned on a tax-exempt asset to present it on an equivalent basis to interest income earned on a fully taxable asset. (2) See Appendix for reconciliation of this adjusted measure. $ IN M IL LI O N S $1,740 $1,707 $1,722 $1,773 $1,790 3.58% 3.66% 3.62% 3.68% 3.69% Net Interest Income (Taxable-equivalent)(1) Net Interest Margin 4Q24 1Q25 2Q25 3Q25 4Q25 QoQ Drivers • Taxable-equivalent net interest income(1) increased +$17 million or +1% QoQ – Loan growth – A shift in interest-bearing liabilities to lower cost funding sources – Lower negative impact from interest rate swap agreements • Net interest margin rose +1 bps QoQ to 3.69% – Net higher asset-liability spread, mostly from continued fixed asset repricing and favorable funding mix (+4 bps) – A reduction of the negative impact from interest rate swap agreements (+3 bps) – Partially offset by lower contribution of net interest-free funds (-6 bps) 2Q25 Adjusted NIM was 3.66(2)

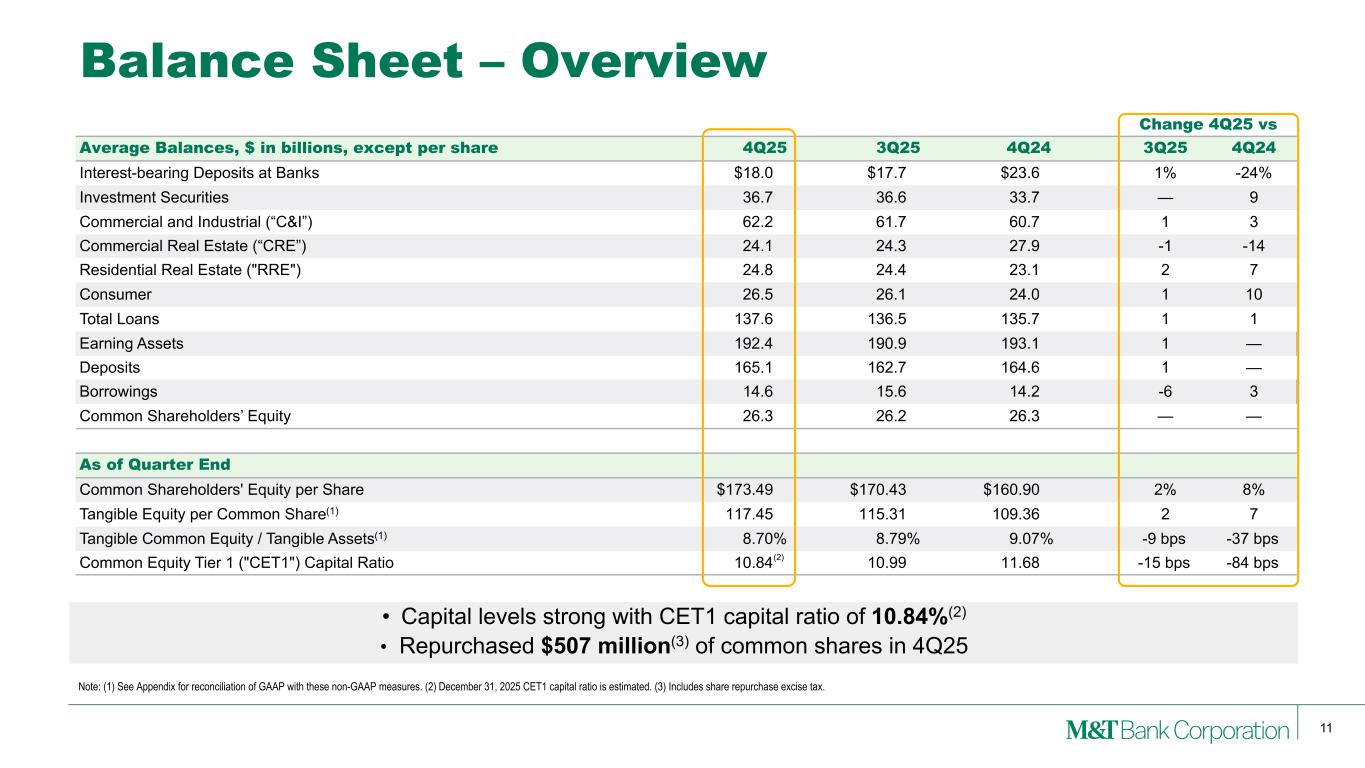

11 • Capital levels strong with CET1 capital ratio of 10.84%(2) • Repurchased $507 million(3) of common shares in 4Q25 Change 4Q25 vs Average Balances, $ in billions, except per share 4Q25 3Q25 4Q24 3Q25 4Q24 Interest-bearing Deposits at Banks $18.0 $17.7 $23.6 1% -24% Investment Securities 36.7 36.6 33.7 — 9 Commercial and Industrial (“C&I”) 62.2 61.7 60.7 1 3 Commercial Real Estate (“CRE”) 24.1 24.3 27.9 -1 -14 Residential Real Estate ("RRE") 24.8 24.4 23.1 2 7 Consumer 26.5 26.1 24.0 1 10 Total Loans 137.6 136.5 135.7 1 1 Earning Assets 192.4 190.9 193.1 1 — Deposits 165.1 162.7 164.6 1 — Borrowings 14.6 15.6 14.2 -6 3 Common Shareholders’ Equity 26.3 26.2 26.3 — — As of Quarter End Common Shareholders' Equity per Share $173.49 $170.43 $160.90 2% 8% Tangible Equity per Common Share(1) 117.45 115.31 109.36 2 7 Tangible Common Equity / Tangible Assets(1) 8.70 % 8.79 % 9.07 % -9 bps -37 bps Common Equity Tier 1 ("CET1") Capital Ratio 10.84 10.99 11.68 -15 bps -84 bps Balance Sheet – Overview Note: (1) See Appendix for reconciliation of GAAP with these non-GAAP measures. (2) December 31, 2025 CET1 capital ratio is estimated. (3) Includes share repurchase excise tax. (2)

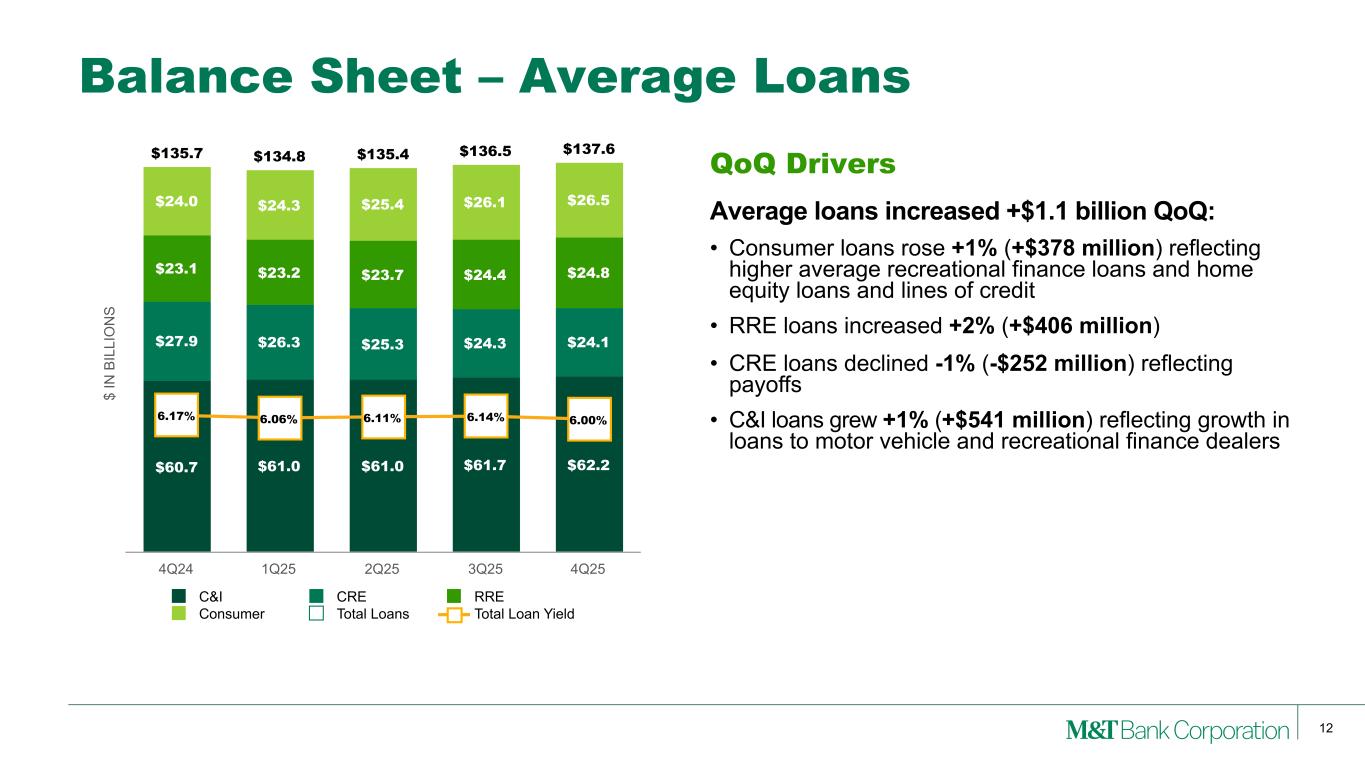

12 Balance Sheet – Average Loans QoQ Drivers Average loans increased +$1.1 billion QoQ: • Consumer loans rose +1% (+$378 million) reflecting higher average recreational finance loans and home equity loans and lines of credit • RRE loans increased +2% (+$406 million) • CRE loans declined -1% (-$252 million) reflecting payoffs • C&I loans grew +1% (+$541 million) reflecting growth in loans to motor vehicle and recreational finance dealers $ IN B IL LI O N S $60.7 $61.0 $61.0 $61.7 $62.2 $27.9 $26.3 $25.3 $24.3 $24.1 $23.1 $23.2 $23.7 $24.4 $24.8 $24.0 $24.3 $25.4 $26.1 $26.5 $135.7 $134.8 $135.4 $136.5 $137.6 6.17% 6.06% 6.11% 6.14% 6.00% C&I CRE RRE Consumer Total Loans Total Loan Yield 4Q24 1Q25 2Q25 3Q25 4Q25

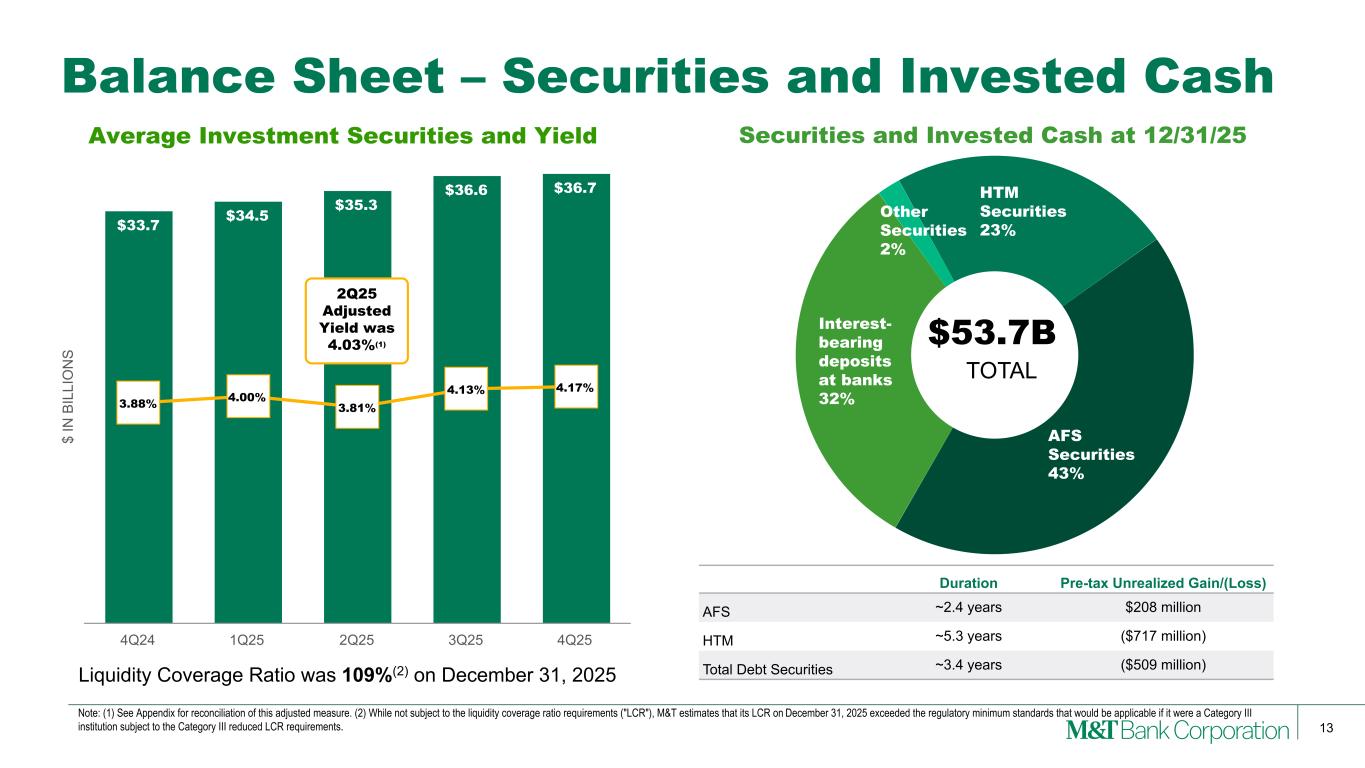

13 Balance Sheet – Securities and Invested Cash Liquidity Coverage Ratio was 109%(2) on December 31, 2025 Duration Pre-tax Unrealized Gain/(Loss) AFS ~2.4 years $208 million HTM ~5.3 years ($717 million) Total Debt Securities ~3.4 years ($509 million) $ IN B IL LI O N S Average Investment Securities and Yield $33.7 $34.5 $35.3 $36.6 $36.7 3.88% 4.00% 3.81% 4.13% 4.17% 4Q24 1Q25 2Q25 3Q25 4Q25 Interest- bearing deposits at banks 32% Other Securities 2% HTM Securities 23% AFS Securities 43% $53.7B TOTAL 2Q25 Adjusted Yield was 4.03%(1) Securities and Invested Cash at 12/31/25 Note: (1) See Appendix for reconciliation of this adjusted measure. (2) While not subject to the liquidity coverage ratio requirements ("LCR"), M&T estimates that its LCR on December 31, 2025 exceeded the regulatory minimum standards that would be applicable if it were a Category III institution subject to the Category III reduced LCR requirements.

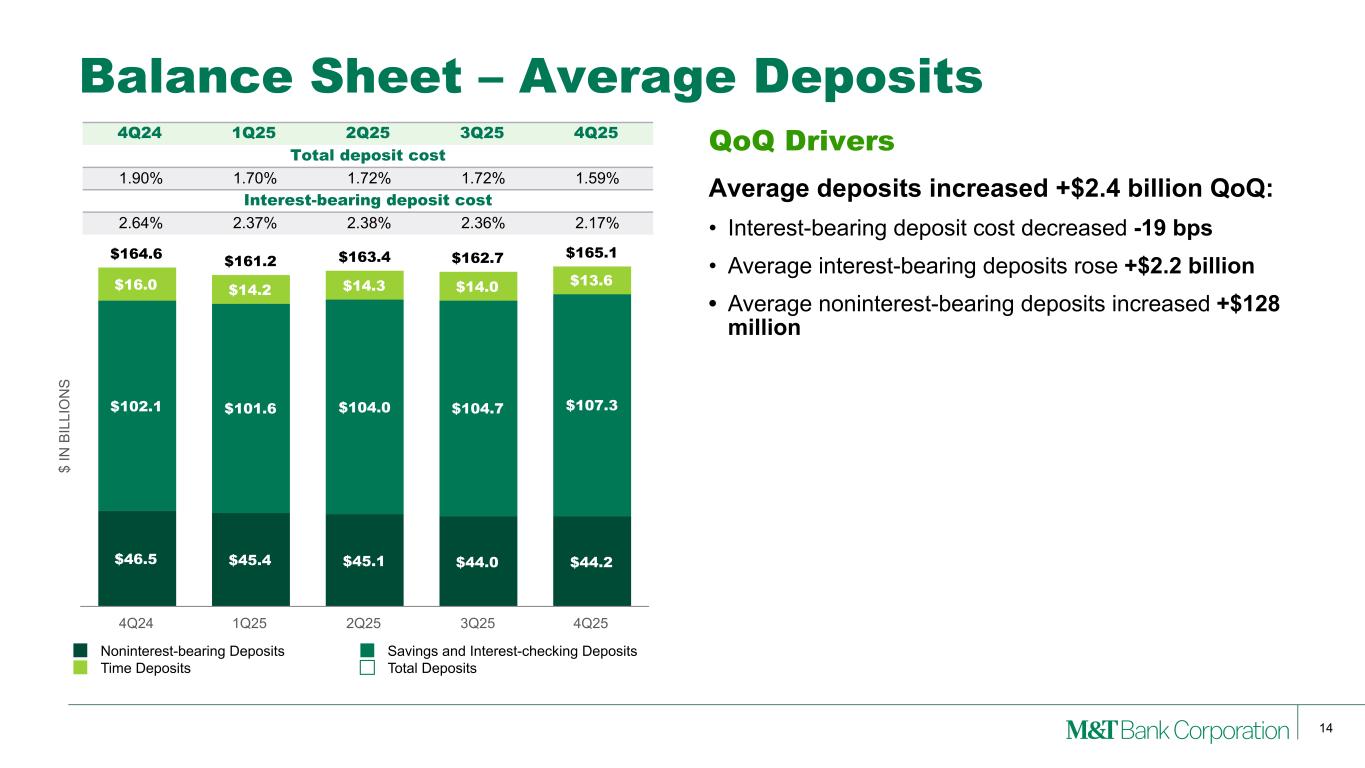

14 Balance Sheet – Average Deposits QoQ Drivers Average deposits increased +$2.4 billion QoQ: • Interest-bearing deposit cost decreased -19 bps • Average interest-bearing deposits rose +$2.2 billion • Average noninterest-bearing deposits increased +$128 million $ IN B IL LI O N S $46.5 $45.4 $45.1 $44.0 $44.2 $102.1 $101.6 $104.0 $104.7 $107.3 $16.0 $14.2 $14.3 $14.0 $13.6 $164.6 $161.2 $163.4 $162.7 $165.1 Noninterest-bearing Deposits Savings and Interest-checking Deposits Time Deposits Total Deposits 4Q24 1Q25 2Q25 3Q25 4Q25 4Q24 1Q25 2Q25 3Q25 4Q25 Total deposit cost 1.90% 1.70% 1.72% 1.72% 1.59% Interest-bearing deposit cost 2.64% 2.37% 2.38% 2.36% 2.17%

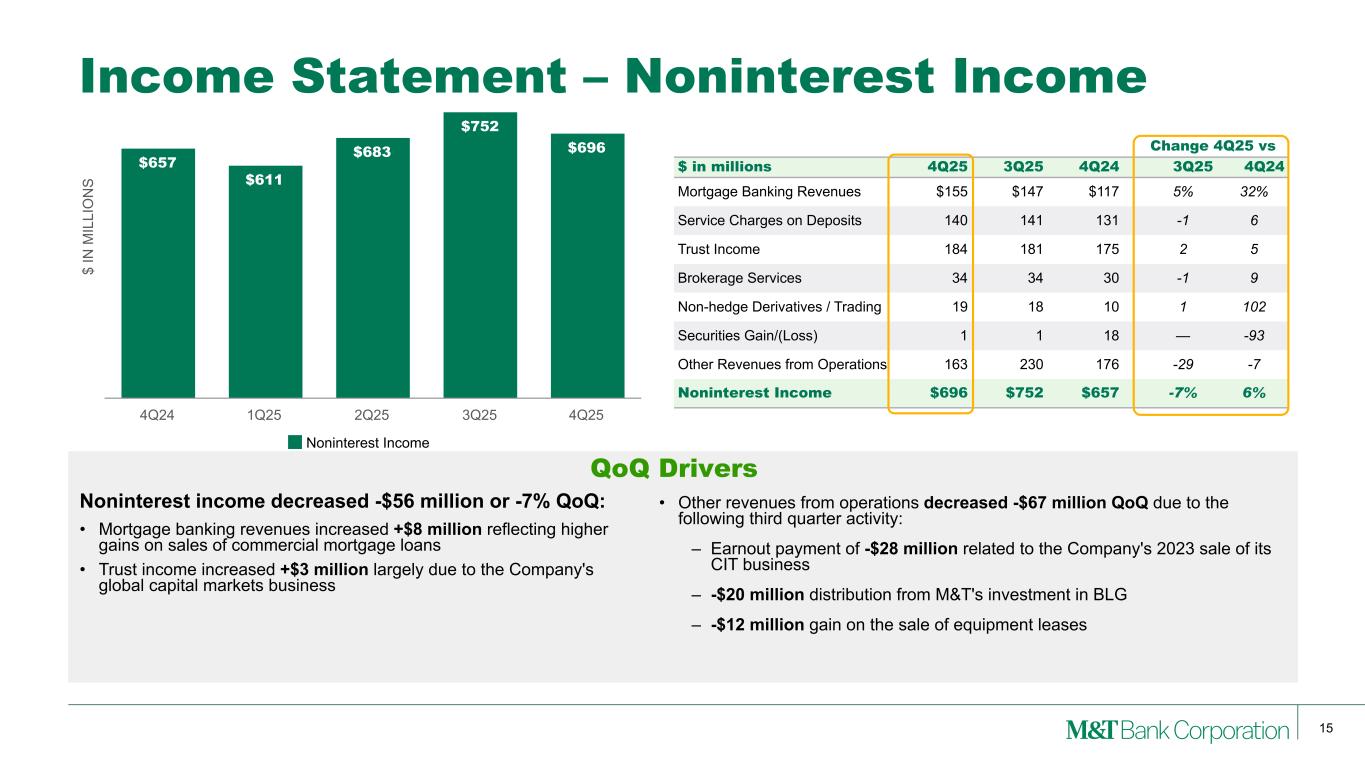

15 $ IN M IL LI O N S $657 $611 $683 $752 $696 Noninterest Income 4Q24 1Q25 2Q25 3Q25 4Q25 Change 4Q25 vs $ in millions 4Q25 3Q25 4Q24 3Q25 4Q24 Mortgage Banking Revenues $155 $147 $117 5% 32% Service Charges on Deposits 140 141 131 -1 6 Trust Income 184 181 175 2 5 Brokerage Services 34 34 30 -1 9 Non-hedge Derivatives / Trading 19 18 10 1 102 Securities Gain/(Loss) 1 1 18 — -93 Other Revenues from Operations 163 230 176 -29 -7 Noninterest Income $696 $752 $657 -7% 6% Income Statement – Noninterest Income Noninterest income decreased -$56 million or -7% QoQ: • Mortgage banking revenues increased +$8 million reflecting higher gains on sales of commercial mortgage loans • Trust income increased +$3 million largely due to the Company's global capital markets business • Other revenues from operations decreased -$67 million QoQ due to the following third quarter activity: – Earnout payment of -$28 million related to the Company's 2023 sale of its CIT business – -$20 million distribution from M&T's investment in BLG – -$12 million gain on the sale of equipment leases QoQ Drivers

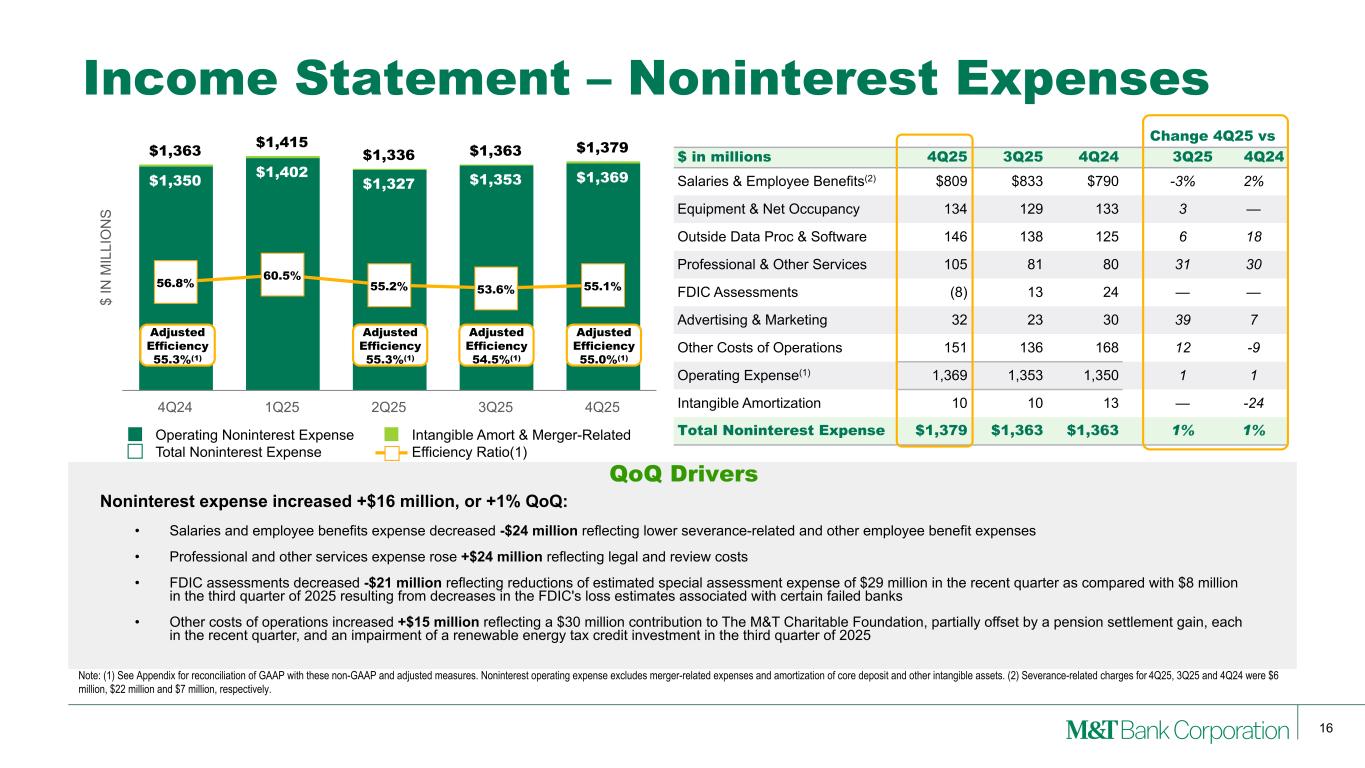

16 $ IN M IL LI O N S $1,350 $1,402 $1,327 $1,353 $1,369 $1,363 $1,415 $1,336 $1,363 $1,379 56.8% 60.5% 55.2% 53.6% 55.1% Operating Noninterest Expense Intangible Amort & Merger-Related Total Noninterest Expense Efficiency Ratio(1) 4Q24 1Q25 2Q25 3Q25 4Q25 Change 4Q25 vs $ in millions 4Q25 3Q25 4Q24 3Q25 4Q24 Salaries & Employee Benefits(2) $809 $833 $790 -3% 2% Equipment & Net Occupancy 134 129 133 3 — Outside Data Proc & Software 146 138 125 6 18 Professional & Other Services 105 81 80 31 30 FDIC Assessments (8) 13 24 — — Advertising & Marketing 32 23 30 39 7 Other Costs of Operations 151 136 168 12 -9 Operating Expense(1) 1,369 1,353 1,350 1 1 Intangible Amortization 10 10 13 — -24 Total Noninterest Expense $1,379 $1,363 $1,363 1% 1% Income Statement – Noninterest Expenses Noninterest expense increased +$16 million, or +1% QoQ: • Salaries and employee benefits expense decreased -$24 million reflecting lower severance-related and other employee benefit expenses • Professional and other services expense rose +$24 million reflecting legal and review costs • FDIC assessments decreased -$21 million reflecting reductions of estimated special assessment expense of $29 million in the recent quarter as compared with $8 million in the third quarter of 2025 resulting from decreases in the FDIC's loss estimates associated with certain failed banks • Other costs of operations increased +$15 million reflecting a $30 million contribution to The M&T Charitable Foundation, partially offset by a pension settlement gain, each in the recent quarter, and an impairment of a renewable energy tax credit investment in the third quarter of 2025 Note: (1) See Appendix for reconciliation of GAAP with these non-GAAP and adjusted measures. Noninterest operating expense excludes merger-related expenses and amortization of core deposit and other intangible assets. (2) Severance-related charges for 4Q25, 3Q25 and 4Q24 were $6 million, $22 million and $7 million, respectively. QoQ Drivers Adjusted Efficiency 55.3%(1) Adjusted Efficiency 54.5%(1) Adjusted Efficiency 55.3%(1) Adjusted Efficiency 55.0%(1)

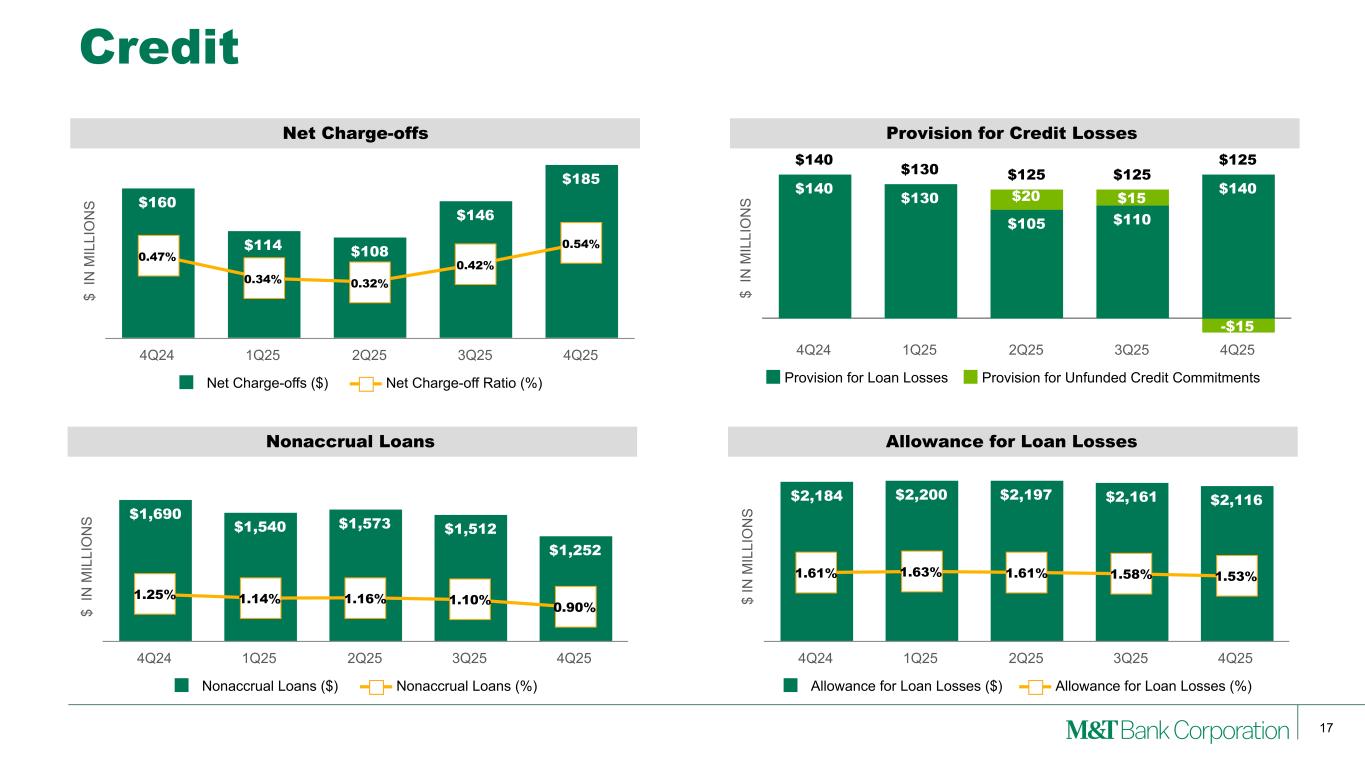

17 $ IN M IL LI O N S Nonaccrual Loans $1,690 $1,540 $1,573 $1,512 $1,252 1.25% 1.14% 1.16% 1.10% 0.90% Nonaccrual Loans ($) Nonaccrual Loans (%) 4Q24 1Q25 2Q25 3Q25 4Q25 $ IN M IL LI O N S Net Charge-offs $160 $114 $108 $146 $185 0.47% 0.34% 0.32% 0.42% 0.54% Net Charge-offs ($) Net Charge-off Ratio (%) 4Q24 1Q25 2Q25 3Q25 4Q25 Credit $ IN M IL LI O N S Allowance for Loan Losses $2,184 $2,200 $2,197 $2,161 $2,116 1.61% 1.63% 1.61% 1.58% 1.53% Allowance for Loan Losses ($) Allowance for Loan Losses (%) 4Q24 1Q25 2Q25 3Q25 4Q25 $ IN M IL LI O N S Provision for Credit Losses $140 $130 $125 $125 $125 $140 $130 $105 $110 $140$20 $15 -$15 Provision for Loan Losses Provision for Unfunded Credit Commitments 4Q24 1Q25 2Q25 3Q25 4Q25

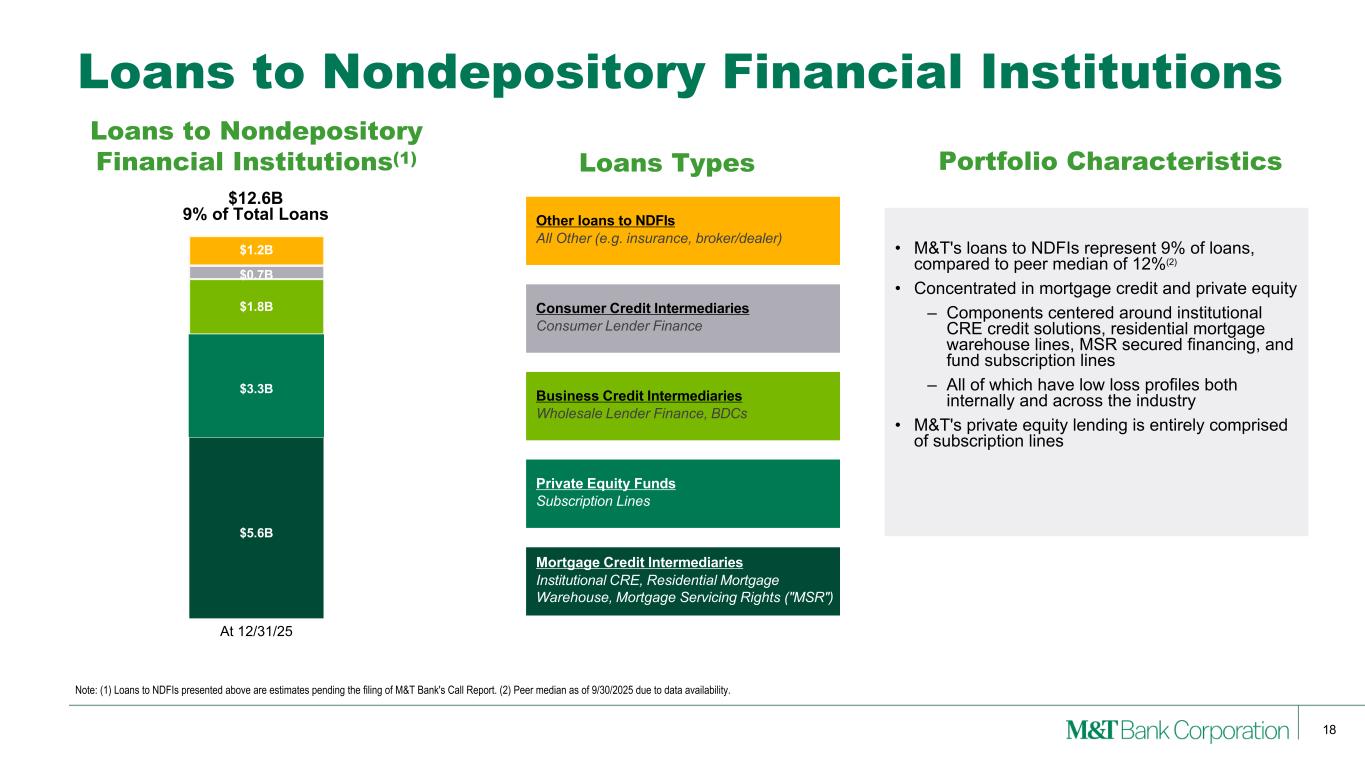

Loans to Nondepository Financial Institutions 18 Mortgage Credit Intermediaries Institutional CRE, Residential Mortgage Warehouse, Mortgage Servicing Rights ("MSR") Private Equity Funds Subscription Lines Business Credit Intermediaries Wholesale Lender Finance, BDCs Consumer Credit Intermediaries Consumer Lender Finance Other loans to NDFIs All Other (e.g. insurance, broker/dealer) $5.6B $3.3B $1.8B $0.7B $1.2B Loans to Nondepository Financial Institutions(1) Loans Types Portfolio Characteristics Note: (1) Loans to NDFIs presented above are estimates pending the filing of M&T Bank's Call Report. (2) Peer median as of 9/30/2025 due to data availability. At 12/31/25 • M&T's loans to NDFIs represent 9% of loans, compared to peer median of 12%(2) • Concentrated in mortgage credit and private equity – Components centered around institutional CRE credit solutions, residential mortgage warehouse lines, MSR secured financing, and fund subscription lines – All of which have low loss profiles both internally and across the industry • M&T's private equity lending is entirely comprised of subscription lines $12.6B 9% of Total Loans

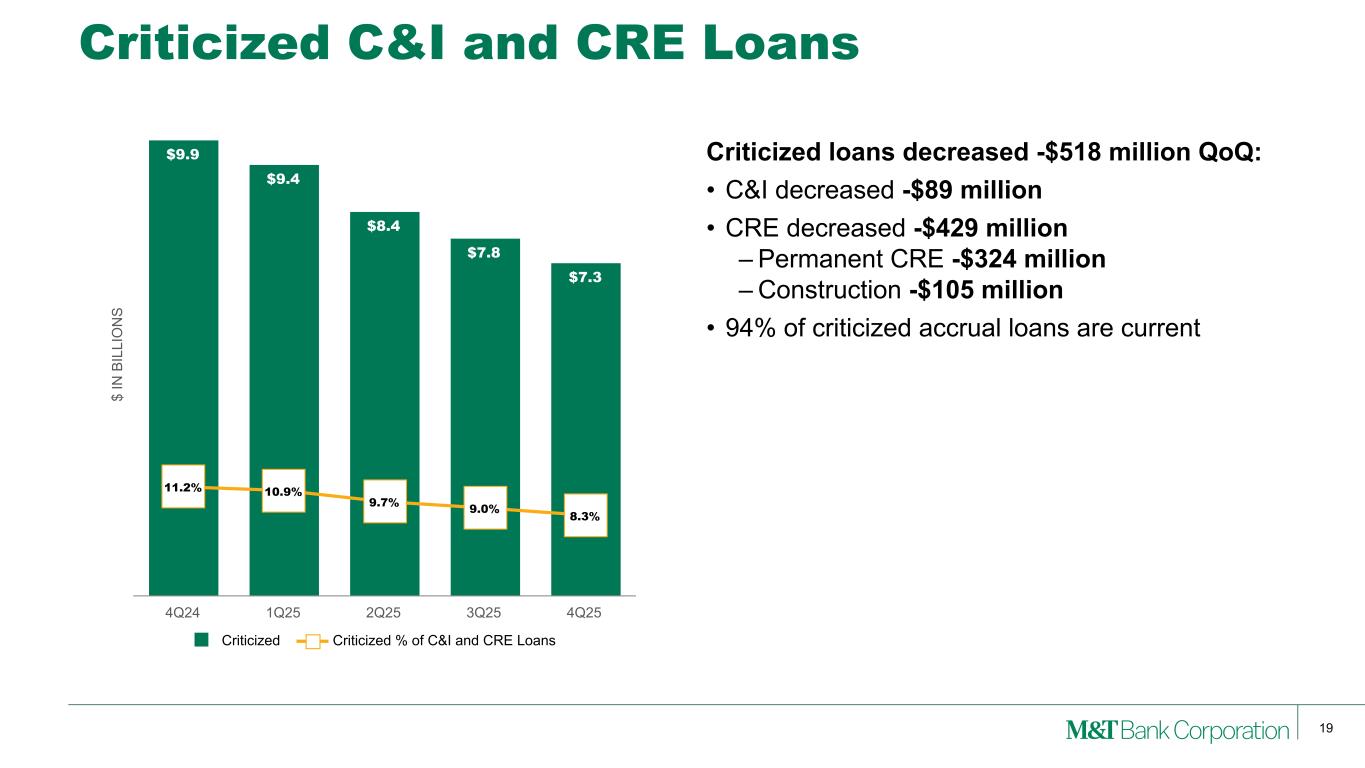

19 Criticized C&I and CRE Loans Criticized loans decreased -$518 million QoQ: • C&I decreased -$89 million • CRE decreased -$429 million – Permanent CRE -$324 million – Construction -$105 million • 94% of criticized accrual loans are current $ IN B IL LI O N S $9.9 $9.4 $8.4 $7.8 $7.3 11.2% 10.9% 9.7% 9.0% 8.3% Criticized Criticized % of C&I and CRE Loans 4Q24 1Q25 2Q25 3Q25 4Q25

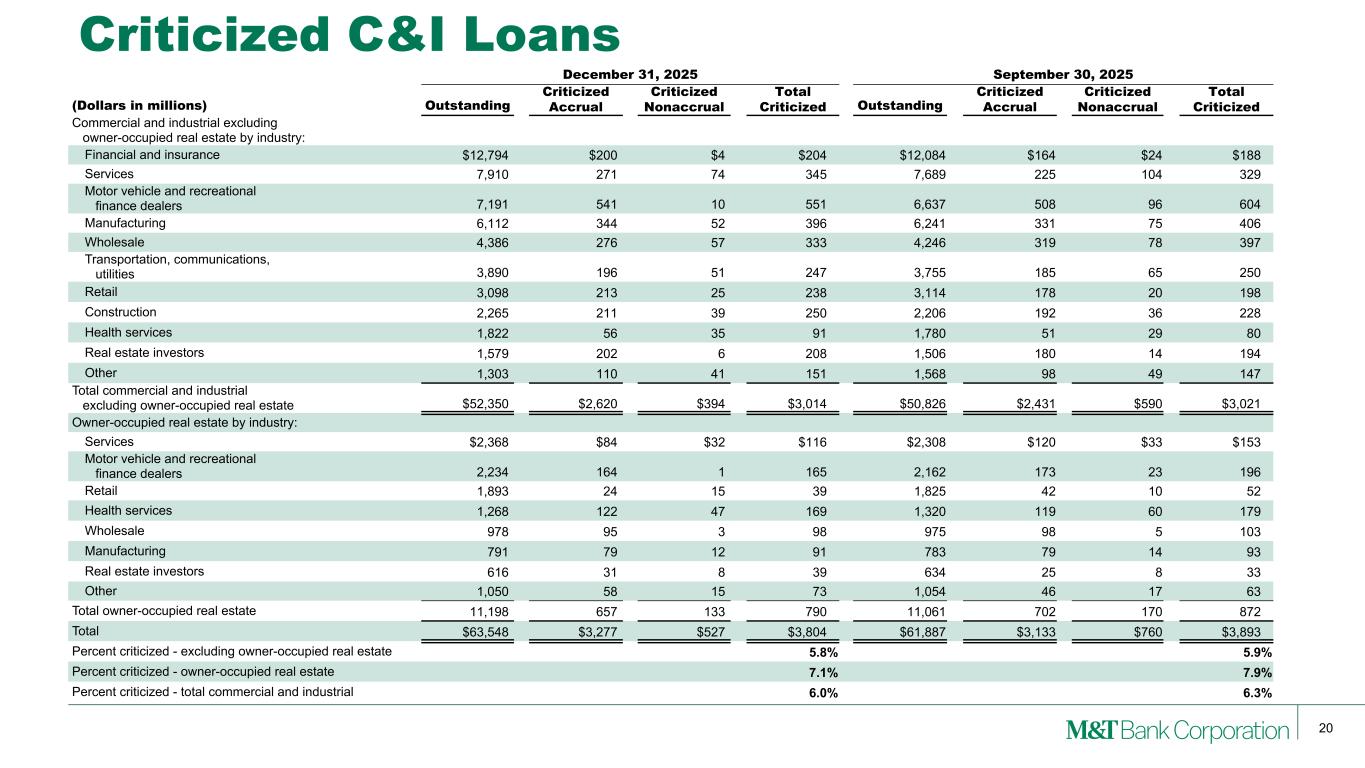

20 Criticized C&I Loans December 31, 2025 September 30, 2025 (Dollars in millions) Outstanding Criticized Accrual Criticized Nonaccrual Total Criticized Outstanding Criticized Accrual Criticized Nonaccrual Total Criticized Commercial and industrial excluding owner-occupied real estate by industry: Financial and insurance $12,794 $200 $4 $204 $12,084 $164 $24 $188 Services 7,910 271 74 345 7,689 225 104 329 Motor vehicle and recreational finance dealers 7,191 541 10 551 6,637 508 96 604 Manufacturing 6,112 344 52 396 6,241 331 75 406 Wholesale 4,386 276 57 333 4,246 319 78 397 Transportation, communications, utilities 3,890 196 51 247 3,755 185 65 250 Retail 3,098 213 25 238 3,114 178 20 198 Construction 2,265 211 39 250 2,206 192 36 228 Health services 1,822 56 35 91 1,780 51 29 80 Real estate investors 1,579 202 6 208 1,506 180 14 194 Other 1,303 110 41 151 1,568 98 49 147 Total commercial and industrial excluding owner-occupied real estate $52,350 $2,620 $394 $3,014 $50,826 $2,431 $590 $3,021 Owner-occupied real estate by industry: Services $2,368 $84 $32 $116 $2,308 $120 $33 $153 Motor vehicle and recreational finance dealers 2,234 164 1 165 2,162 173 23 196 Retail 1,893 24 15 39 1,825 42 10 52 Health services 1,268 122 47 169 1,320 119 60 179 Wholesale 978 95 3 98 975 98 5 103 Manufacturing 791 79 12 91 783 79 14 93 Real estate investors 616 31 8 39 634 25 8 33 Other 1,050 58 15 73 1,054 46 17 63 Total owner-occupied real estate 11,198 657 133 790 11,061 702 170 872 Total $63,548 $3,277 $527 $3,804 $61,887 $3,133 $760 $3,893 Percent criticized - excluding owner-occupied real estate 5.8 % 5.9 % Percent criticized - owner-occupied real estate 7.1 % 7.9 % Percent criticized - total commercial and industrial 6.0 % 6.3 %

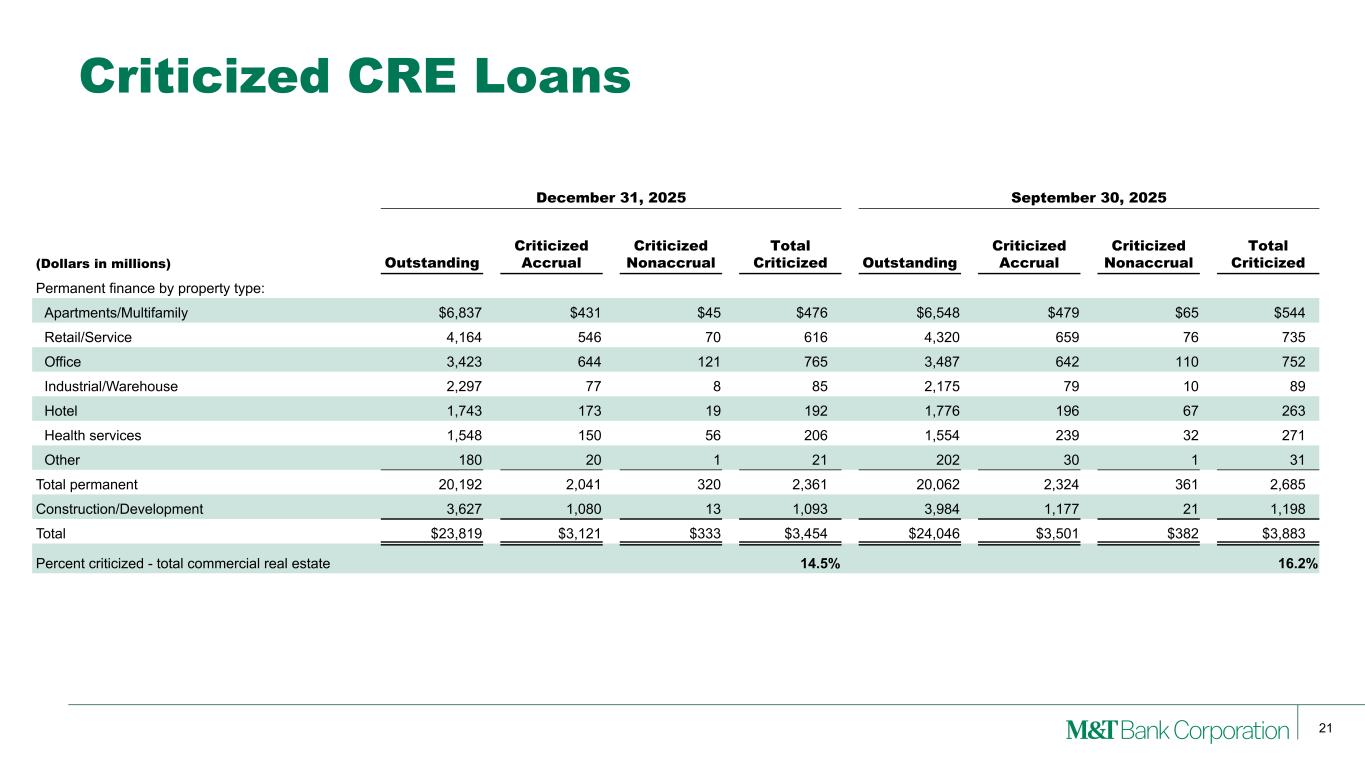

21 Criticized CRE Loans December 31, 2025 September 30, 2025 (Dollars in millions) Outstanding Criticized Accrual Criticized Nonaccrual Total Criticized Outstanding Criticized Accrual Criticized Nonaccrual Total Criticized Permanent finance by property type: Apartments/Multifamily $6,837 $431 $45 $476 $6,548 $479 $65 $544 Retail/Service 4,164 546 70 616 4,320 659 76 735 Office 3,423 644 121 765 3,487 642 110 752 Industrial/Warehouse 2,297 77 8 85 2,175 79 10 89 Hotel 1,743 173 19 192 1,776 196 67 263 Health services 1,548 150 56 206 1,554 239 32 271 Other 180 20 1 21 202 30 1 31 Total permanent 20,192 2,041 320 2,361 20,062 2,324 361 2,685 Construction/Development 3,627 1,080 13 1,093 3,984 1,177 21 1,198 Total $23,819 $3,121 $333 $3,454 $24,046 $3,501 $382 $3,883 Percent criticized - total commercial real estate 14.5 % 16.2 %

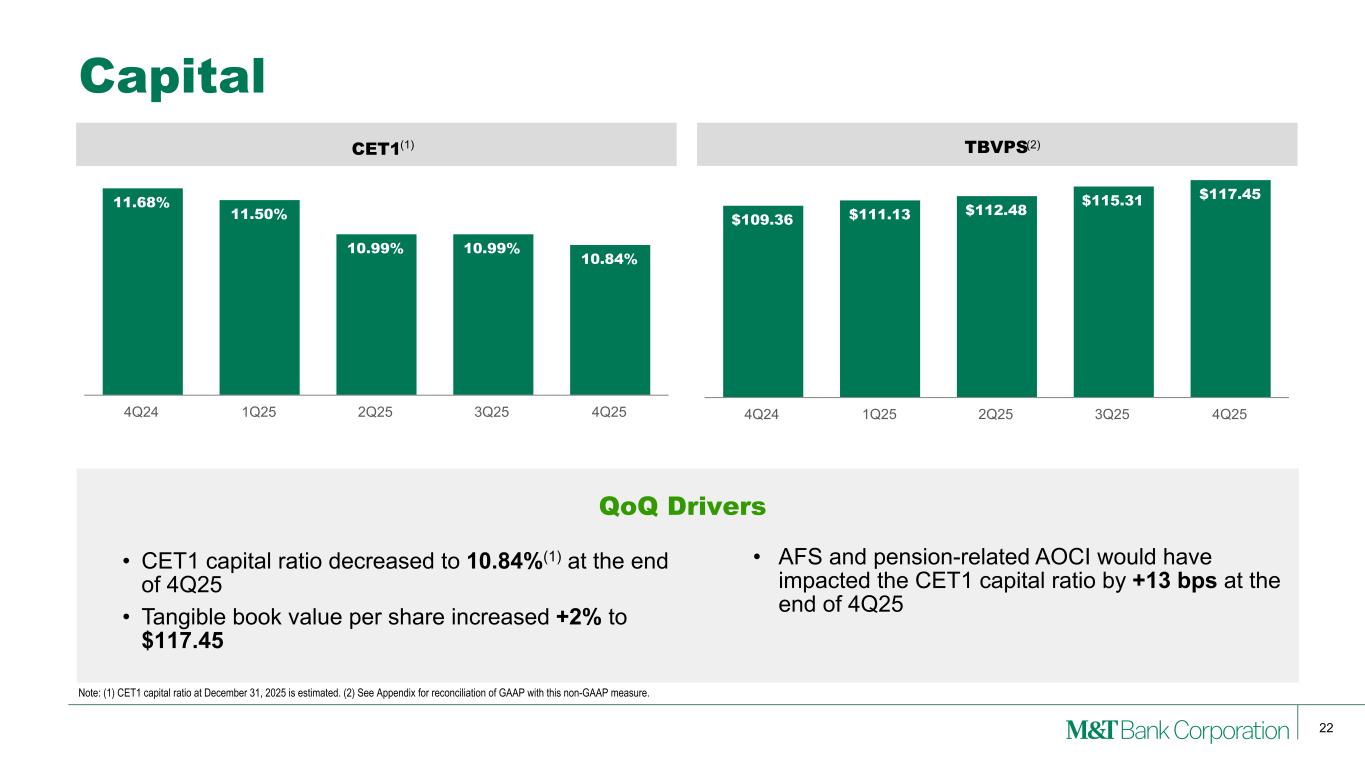

22 CET1 11.68% 11.50% 10.99% 10.99% 10.84% 4Q24 1Q25 2Q25 3Q25 4Q25 TBVPS $109.36 $111.13 $112.48 $115.31 $117.45 4Q24 1Q25 2Q25 3Q25 4Q25 Capital • CET1 capital ratio decreased to 10.84%(1) at the end of 4Q25 • Tangible book value per share increased +2% to $117.45 Note: (1) CET1 capital ratio at December 31, 2025 is estimated. (2) See Appendix for reconciliation of GAAP with this non-GAAP measure. QoQ Drivers • AFS and pension-related AOCI would have impacted the CET1 capital ratio by +13 bps at the end of 4Q25 (1) (2)

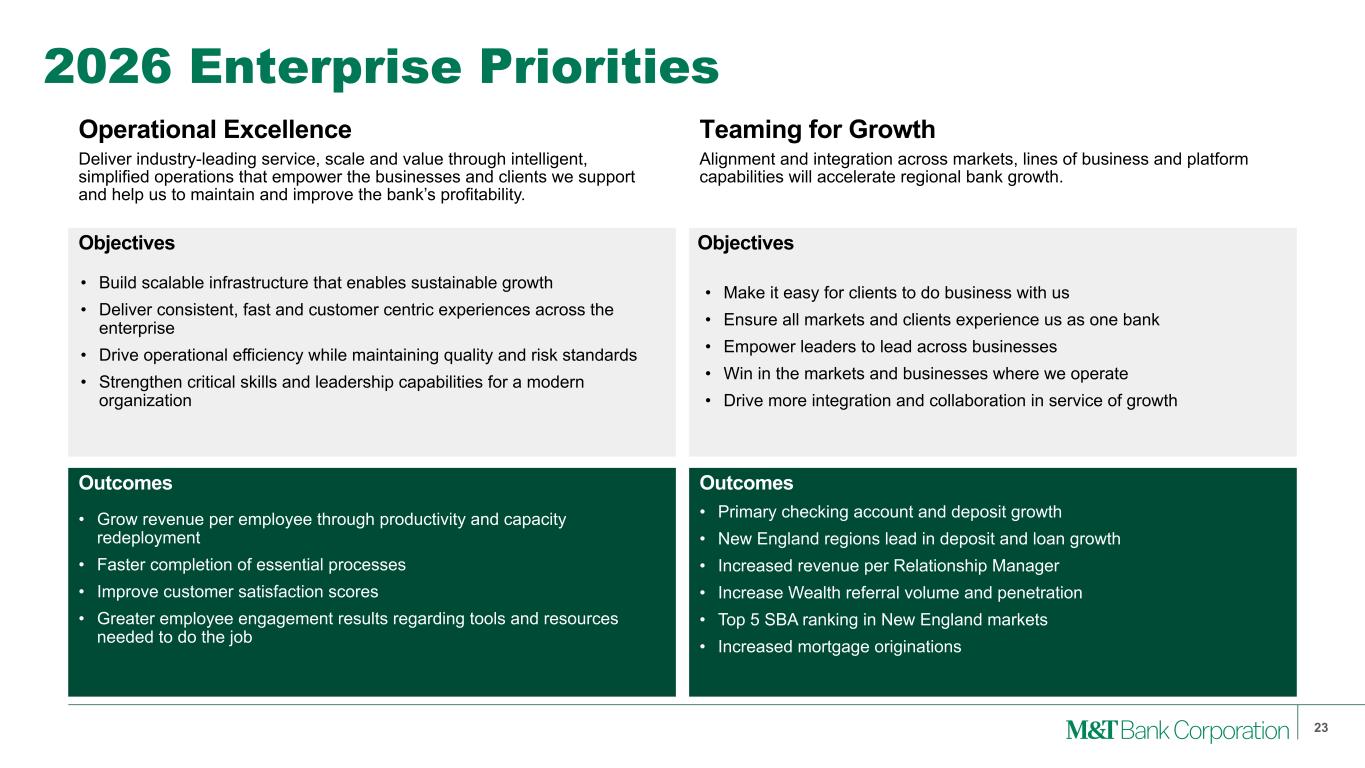

Operational Excellence Alignment and integration across markets, lines of business and platform capabilities will accelerate regional bank growth. 23 2026 Enterprise Priorities Teaming for Growth • Make it easy for clients to do business with us • Ensure all markets and clients experience us as one bank • Empower leaders to lead across businesses • Win in the markets and businesses where we operate • Drive more integration and collaboration in service of growth Deliver industry-leading service, scale and value through intelligent, simplified operations that empower the businesses and clients we support and help us to maintain and improve the bank’s profitability. • Build scalable infrastructure that enables sustainable growth • Deliver consistent, fast and customer centric experiences across the enterprise • Drive operational efficiency while maintaining quality and risk standards • Strengthen critical skills and leadership capabilities for a modern organization • Grow revenue per employee through productivity and capacity redeployment • Faster completion of essential processes • Improve customer satisfaction scores • Greater employee engagement results regarding tools and resources needed to do the job • Primary checking account and deposit growth • New England regions lead in deposit and loan growth • Increased revenue per Relationship Manager • Increase Wealth referral volume and penetration • Top 5 SBA ranking in New England markets • Increased mortgage originations Objectives Objectives Outcomes Outcomes

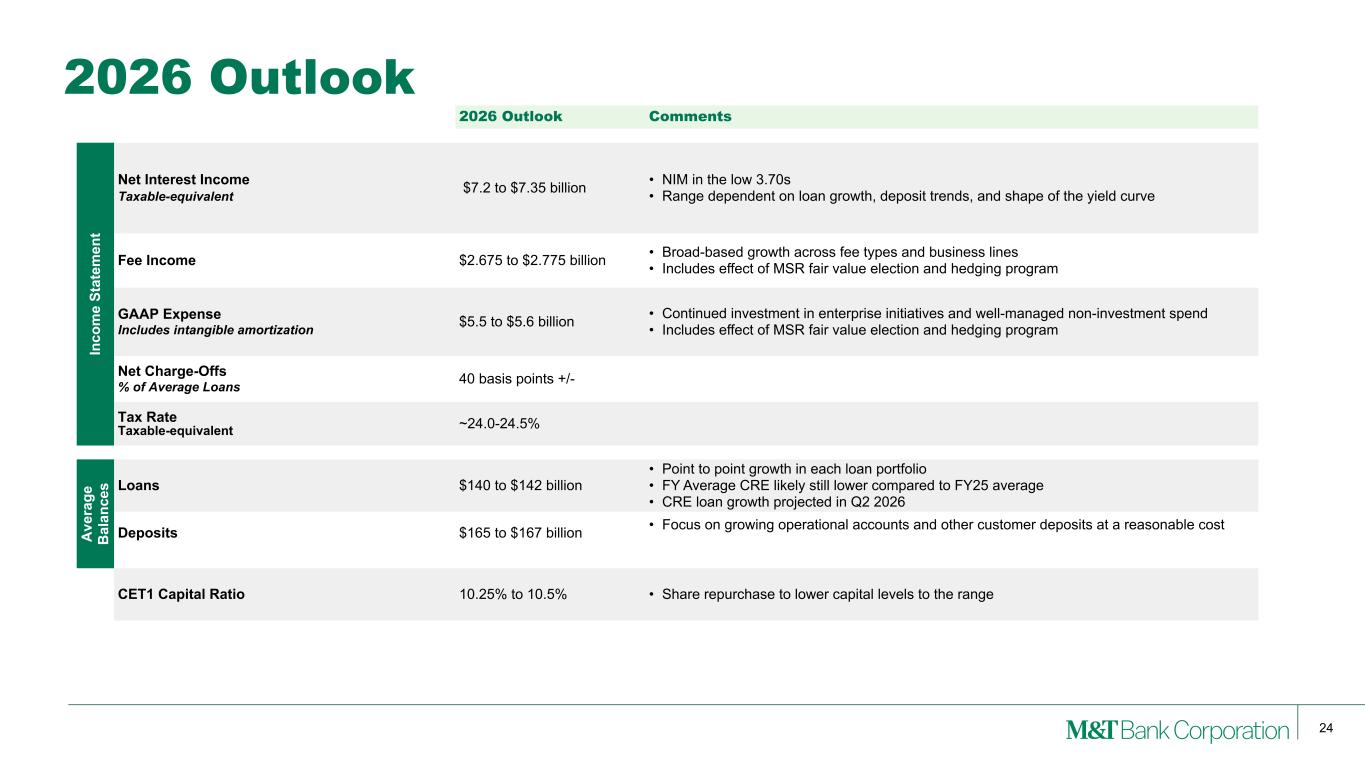

24 2026 Outlook 2026 Outlook Comments In co m e St at em en t Net Interest Income Taxable-equivalent $7.2 to $7.35 billion • NIM in the low 3.70s • Range dependent on loan growth, deposit trends, and shape of the yield curve Fee Income $2.675 to $2.775 billion • Broad-based growth across fee types and business lines • Includes effect of MSR fair value election and hedging program GAAP Expense Includes intangible amortization $5.5 to $5.6 billion • Continued investment in enterprise initiatives and well-managed non-investment spend • Includes effect of MSR fair value election and hedging program Net Charge-Offs % of Average Loans 40 basis points +/- Tax Rate Taxable-equivalent ~24.0-24.5% A ve ra ge B al an ce s Loans $140 to $142 billion • Point to point growth in each loan portfolio • FY Average CRE likely still lower compared to FY25 average • CRE loan growth projected in Q2 2026 Deposits $165 to $167 billion • Focus on growing operational accounts and other customer deposits at a reasonable cost CET1 Capital Ratio 10.25% to 10.5% • Share repurchase to lower capital levels to the range

25 Why invest in M&T? • Long term focused with deeply embedded culture • Business operated to represent the best interests of all key stakeholders • Energized colleagues consistently serving our customers and communities • A safe haven for our clients as proven during turbulent times and crisis • Experienced and seasoned management team • Strong risk controls with long track record of credit outperformance through cycles • Leading position in core markets • 15-17% ROTCE(1) • Robust dividend growth • 8% TBV per share growth(2) Source: FactSet, S&P Global, Company Filings. Note: (1) ROTCE range comprises 5 years of the trailing 3-year ROTCE from 2020-2025, consistent with M&T's measurement of ROTCE for performance-based stock compensation. (2) TBV per share growth represents CAGR from 2020-2025. Purpose-Driven Successful and Sustainable Business Model that Produces Strong Shareholder Returns Purpose Driven Organization Successful and Sustainable Business Model Strong Shareholder Returns

26 Appendix

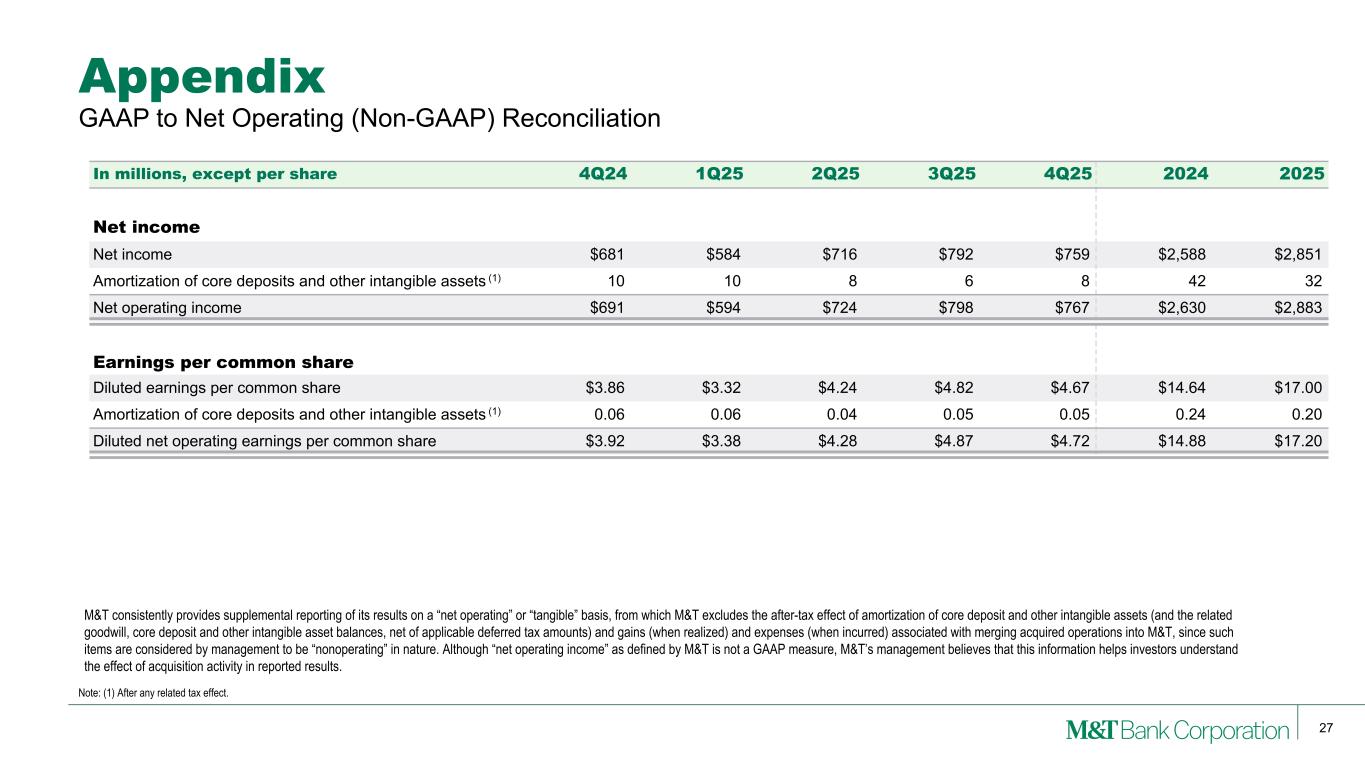

27 M&T consistently provides supplemental reporting of its results on a “net operating” or “tangible” basis, from which M&T excludes the after-tax effect of amortization of core deposit and other intangible assets (and the related goodwill, core deposit and other intangible asset balances, net of applicable deferred tax amounts) and gains (when realized) and expenses (when incurred) associated with merging acquired operations into M&T, since such items are considered by management to be “nonoperating” in nature. Although “net operating income” as defined by M&T is not a GAAP measure, M&T’s management believes that this information helps investors understand the effect of acquisition activity in reported results. Appendix Note: (1) After any related tax effect. GAAP to Net Operating (Non-GAAP) Reconciliation In millions, except per share 4Q24 1Q25 2Q25 3Q25 4Q25 2024 2025 Net income Net income $681 $584 $716 $792 $759 $2,588 $2,851 Amortization of core deposits and other intangible assets (1) 10 10 8 6 8 42 32 Net operating income $691 $594 $724 $798 $767 $2,630 $2,883 Earnings per common share Diluted earnings per common share $3.86 $3.32 $4.24 $4.82 $4.67 $14.64 $17.00 Amortization of core deposits and other intangible assets (1) 0.06 0.06 0.04 0.05 0.05 0.24 0.20 Diluted net operating earnings per common share $3.92 $3.38 $4.28 $4.87 $4.72 $14.88 $17.20

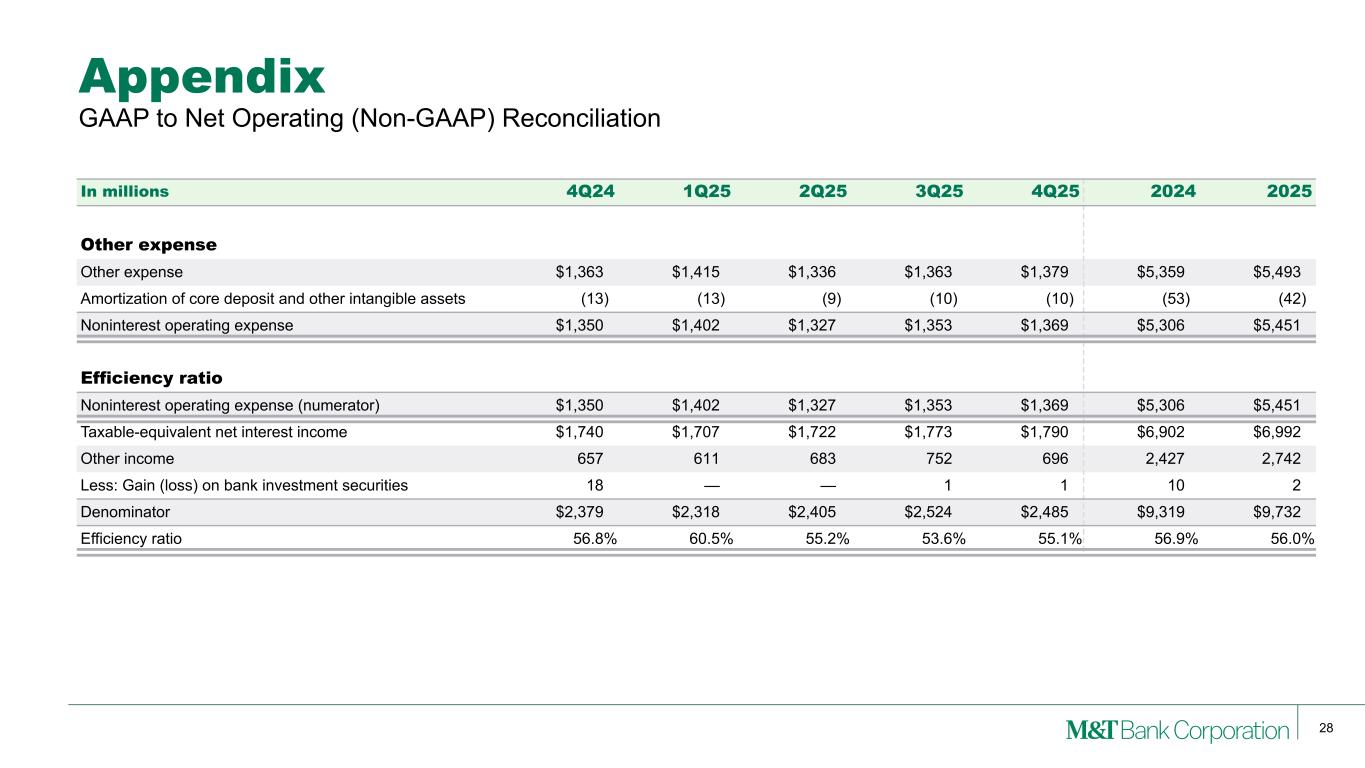

28 Appendix GAAP to Net Operating (Non-GAAP) Reconciliation In millions 4Q24 1Q25 2Q25 3Q25 4Q25 2024 2025 Other expense Other expense $1,363 $1,415 $1,336 $1,363 $1,379 $5,359 $5,493 Amortization of core deposit and other intangible assets (13) (13) (9) (10) (10) (53) (42) Noninterest operating expense $1,350 $1,402 $1,327 $1,353 $1,369 $5,306 $5,451 Efficiency ratio Noninterest operating expense (numerator) $1,350 $1,402 $1,327 $1,353 $1,369 $5,306 $5,451 Taxable-equivalent net interest income $1,740 $1,707 $1,722 $1,773 $1,790 $6,902 $6,992 Other income 657 611 683 752 696 2,427 2,742 Less: Gain (loss) on bank investment securities 18 — — 1 1 10 2 Denominator $2,379 $2,318 $2,405 $2,524 $2,485 $9,319 $9,732 Efficiency ratio 56.8 % 60.5 % 55.2 % 53.6 % 55.1 % 56.9 % 56.0 %

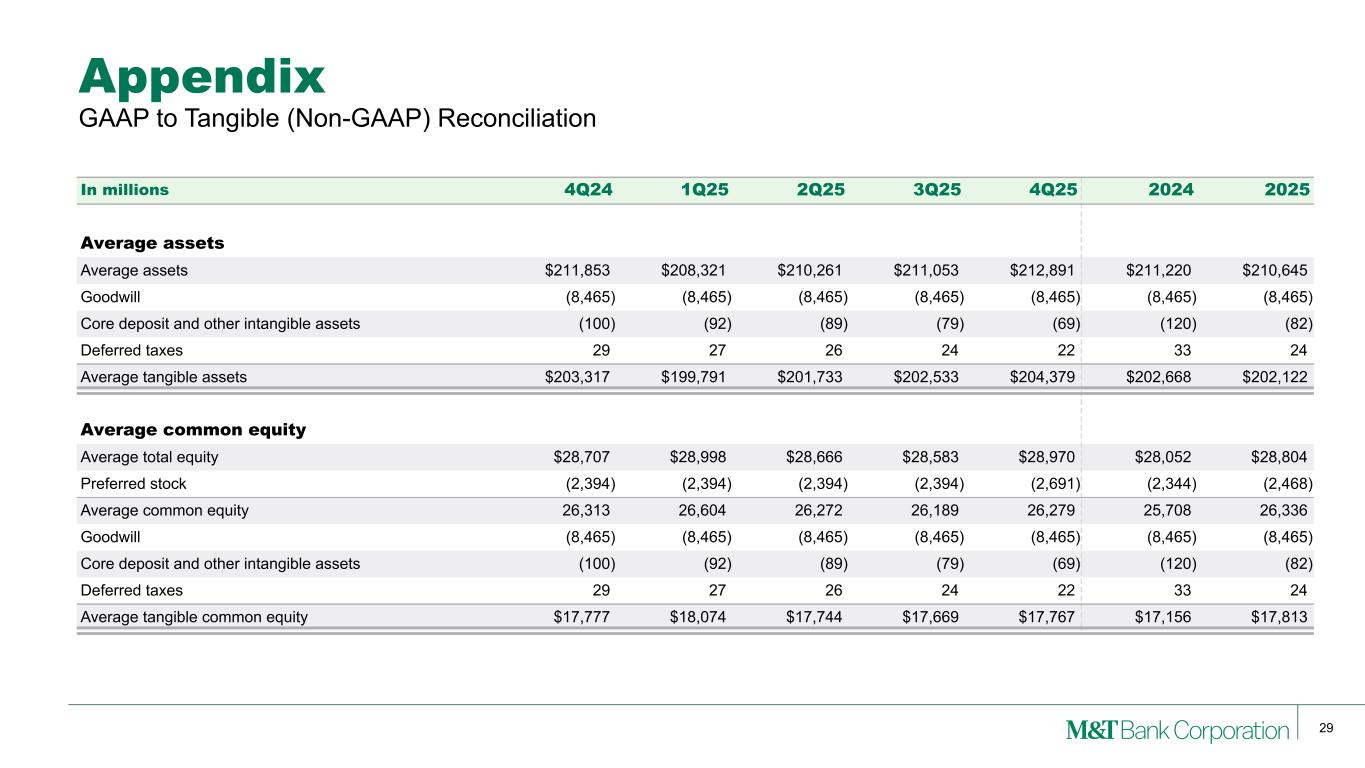

29 Appendix In millions 4Q24 1Q25 2Q25 3Q25 4Q25 2024 2025 Average assets Average assets $211,853 $208,321 $210,261 $211,053 $212,891 $211,220 $210,645 Goodwill (8,465) (8,465) (8,465) (8,465) (8,465) (8,465) (8,465) Core deposit and other intangible assets (100) (92) (89) (79) (69) (120) (82) Deferred taxes 29 27 26 24 22 33 24 Average tangible assets $203,317 $199,791 $201,733 $202,533 $204,379 $202,668 $202,122 Average common equity Average total equity $28,707 $28,998 $28,666 $28,583 $28,970 $28,052 $28,804 Preferred stock (2,394) (2,394) (2,394) (2,394) (2,691) (2,344) (2,468) Average common equity 26,313 26,604 26,272 26,189 26,279 25,708 26,336 Goodwill (8,465) (8,465) (8,465) (8,465) (8,465) (8,465) (8,465) Core deposit and other intangible assets (100) (92) (89) (79) (69) (120) (82) Deferred taxes 29 27 26 24 22 33 24 Average tangible common equity $17,777 $18,074 $17,744 $17,669 $17,767 $17,156 $17,813 GAAP to Tangible (Non-GAAP) Reconciliation

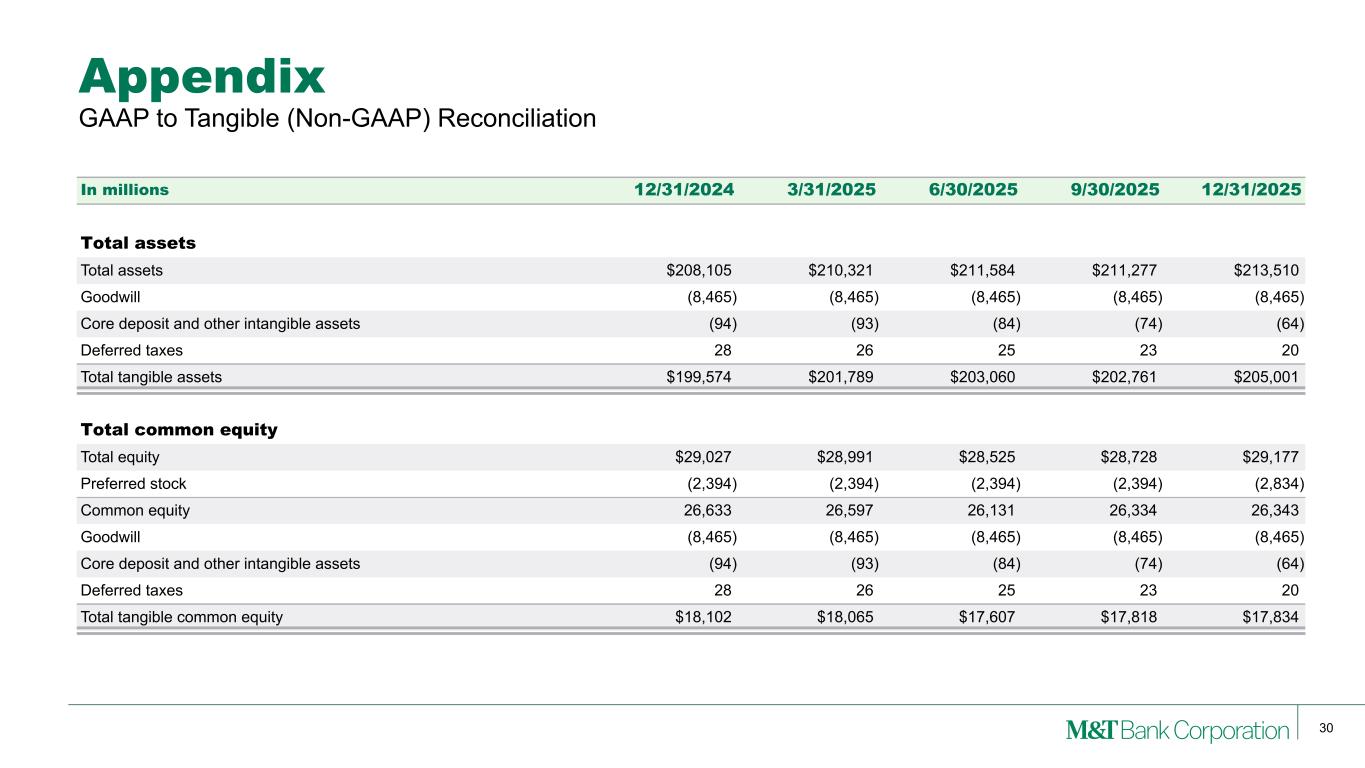

30 Appendix In millions 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 Total assets Total assets $208,105 $210,321 $211,584 $211,277 $213,510 Goodwill (8,465) (8,465) (8,465) (8,465) (8,465) Core deposit and other intangible assets (94) (93) (84) (74) (64) Deferred taxes 28 26 25 23 20 Total tangible assets $199,574 $201,789 $203,060 $202,761 $205,001 Total common equity Total equity $29,027 $28,991 $28,525 $28,728 $29,177 Preferred stock (2,394) (2,394) (2,394) (2,394) (2,834) Common equity 26,633 26,597 26,131 26,334 26,343 Goodwill (8,465) (8,465) (8,465) (8,465) (8,465) Core deposit and other intangible assets (94) (93) (84) (74) (64) Deferred taxes 28 26 25 23 20 Total tangible common equity $18,102 $18,065 $17,607 $17,818 $17,834 GAAP to Tangible (Non-GAAP) Reconciliation

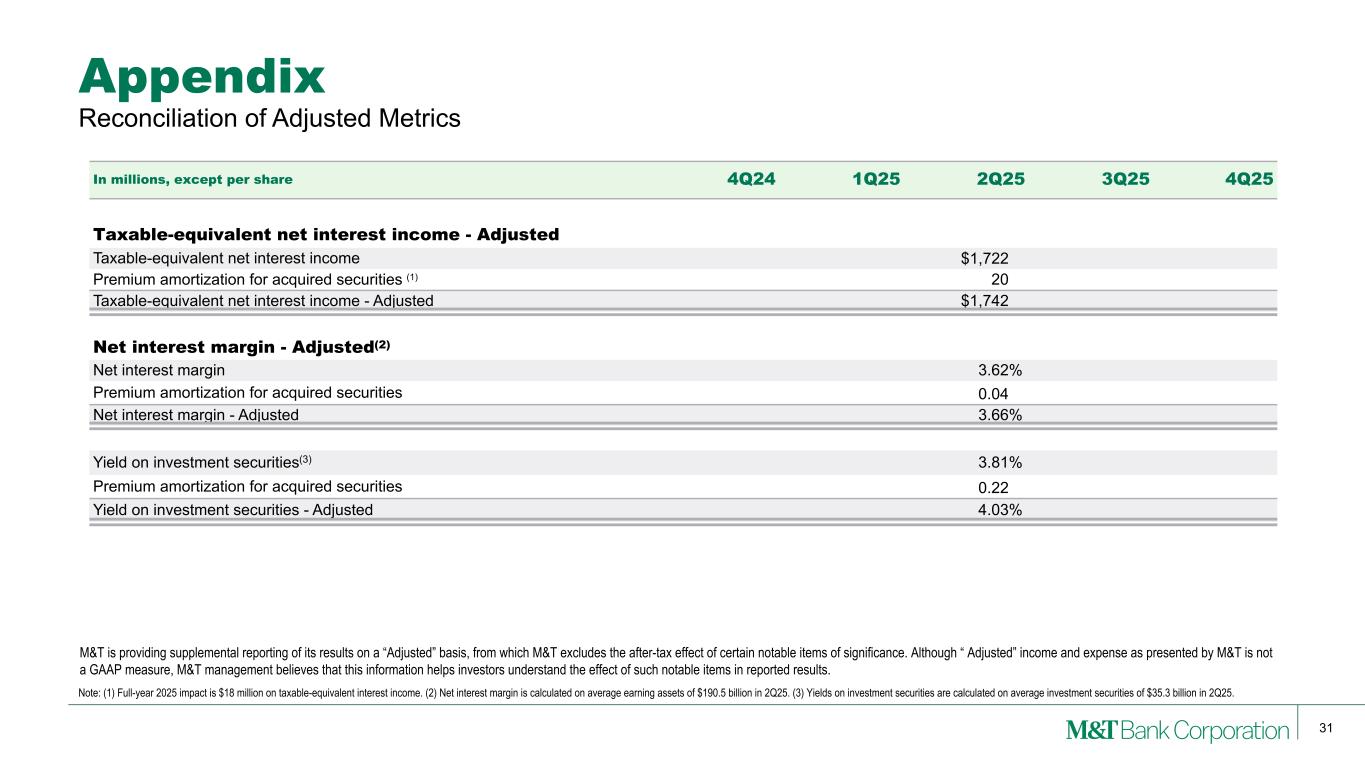

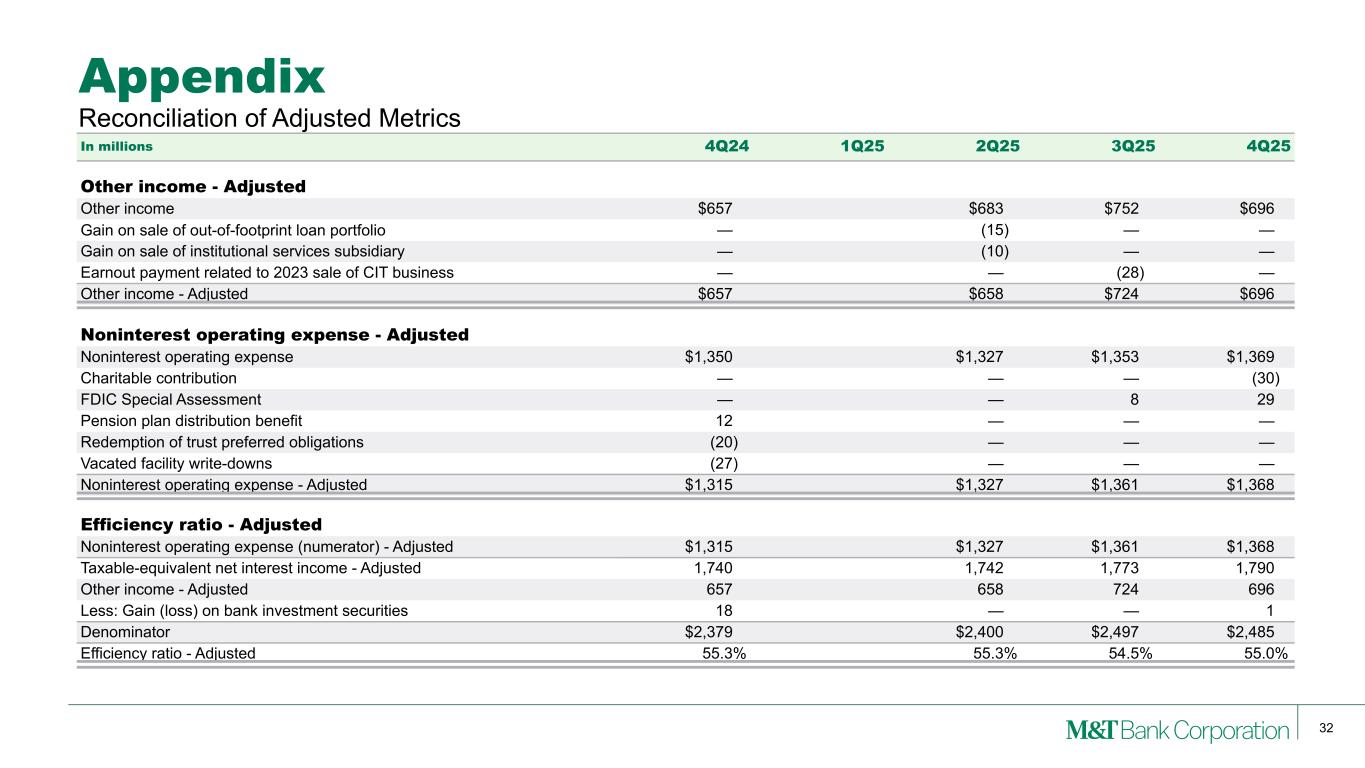

31 Appendix Reconciliation of Adjusted Metrics In millions, except per share 4Q24 1Q25 2Q25 3Q25 4Q25 Taxable-equivalent net interest income - Adjusted Taxable-equivalent net interest income $1,722 Premium amortization for acquired securities (1) 20 Taxable-equivalent net interest income - Adjusted $1,742 Net interest margin - Adjusted(2) Net interest margin 3.62% Premium amortization for acquired securities 0.04 Net interest margin - Adjusted 3.66% Yield on investment securities(3) 3.81% Premium amortization for acquired securities 0.22 Yield on investment securities - Adjusted 4.03% Note: (1) Full-year 2025 impact is $18 million on taxable-equivalent interest income. (2) Net interest margin is calculated on average earning assets of $190.5 billion in 2Q25. (3) Yields on investment securities are calculated on average investment securities of $35.3 billion in 2Q25. M&T is providing supplemental reporting of its results on a “Adjusted” basis, from which M&T excludes the after-tax effect of certain notable items of significance. Although “ Adjusted” income and expense as presented by M&T is not a GAAP measure, M&T management believes that this information helps investors understand the effect of such notable items in reported results.

32 Appendix Reconciliation of Adjusted Metrics In millions 4Q24 1Q25 2Q25 3Q25 4Q25 Other income - Adjusted Other income $657 $683 $752 $696 Gain on sale of out-of-footprint loan portfolio — (15) — — Gain on sale of institutional services subsidiary — (10) — — Earnout payment related to 2023 sale of CIT business — — (28) — Other income - Adjusted $657 $658 $724 $696 Noninterest operating expense - Adjusted Noninterest operating expense $1,350 $1,327 $1,353 $1,369 Charitable contribution — — — (30) FDIC Special Assessment — — 8 29 Pension plan distribution benefit 12 — — — Redemption of trust preferred obligations (20) — — — Vacated facility write-downs (27) — — — Noninterest operating expense - Adjusted $1,315 $1,327 $1,361 $1,368 Efficiency ratio - Adjusted Noninterest operating expense (numerator) - Adjusted $1,315 $1,327 $1,361 $1,368 Taxable-equivalent net interest income - Adjusted 1,740 1,742 1,773 1,790 Other income - Adjusted 657 658 724 696 Less: Gain (loss) on bank investment securities 18 — — 1 Denominator $2,379 $2,400 $2,497 $2,485 Efficiency ratio - Adjusted 55.3% 55.3% 54.5% 55.0%