Fourth Quarter 2025 Earnings January 15, 2026

Disclaimers Non-GAAP Information Certain measures included in this document are “non-GAAP,” meaning they are not presented in accordance with generally accepted accounting principles in the U.S. and also are not codified in U.S. banking regulations currently applicable to FHN. Although other entities may use calculation methods that differ from those used by FHN for non-GAAP measures, FHN’s management believes such measures are relevant to understanding the financial condition, capital position, and financial results of FHN and its business segments. Non-GAAP measures are reported to FHN's management and Board of Directors through various internal reports. The non-GAAP measures presented in this document are listed, and are reconciled to the most comparable GAAP presentation, in the non-GAAP reconciliation table(s) appearing in the Appendix. In addition, presentation of regulatory measures, even those which are not GAAP, provides a meaningful basis for comparability to other financial institutions subject to the same regulations as FHN, as demonstrated by their use by banking regulators in reviewing capital adequacy of financial institutions. Although not GAAP terms, these regulatory measures are not considered “non-GAAP” under U.S. financial reporting rules as long as their presentation conforms to regulatory standards. Regulatory measures used in this document include: common equity tier 1 capital, generally defined as common equity less goodwill, other intangibles, and certain other required regulatory deductions; tier 1 capital, generally defined as the sum of core capital (including common equity and instruments that cannot be redeemed at the option of the holder) adjusted for certain items under risk-based capital regulations; and risk-weighted assets, which is a measure of total on- and off-balance sheet assets adjusted for credit and market risk, used to determine regulatory capital ratios. Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to FHN's beliefs, plans, goals, expectations, and estimates. Forward-looking statements are not a representation of historical information, but instead pertain to future operations, strategies, financial results, or other developments. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “should,” “is likely,” “will,” “going forward,” and other similar expressions that indicate future events and trends. Forward-looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, operational, economic, and competitive uncertainties and contingencies, many of which are beyond FHN’s control, and many of which, with respect to future business decisions and actions (including acquisitions and divestitures), are subject to change and could cause FHN’s actual future results and outcomes to differ materially from those contemplated or implied by forward-looking statements or historical performance. While there is no assurance that any list of uncertainties and contingencies is complete, examples of factors which could cause actual results to differ from those contemplated by forward-looking statements or historical performance include those mentioned: in this document; in Items 2.02 and 7.01 of FHN’s Current Report on Form 8-K to which this document has been furnished as an exhibit; in the forepart, and in Items 1, 1A, and 7, of FHN’s most recent Annual Report on Form 10-K; and in the forepart, and in Item 1A of Part II, of FHN’s Quarterly Report(s) on Form 10-Q filed after that Annual Report. Any forward-looking statements made by or on behalf of FHN speak only as of the date they are made, and FHN assumes no obligation to update or revise any forward-looking statements that are made in this document or in any other statement, release, report, or filing from time to time. Actual results could differ and expectations could change, possibly materially, because of one or more factors, including those factors listed in this document or the documents mentioned above, and other factors not listed. Throughout this document numbers may not total due to rounding, references to EPS are fully diluted, and capital ratios for the most recent quarter are estimates. 2

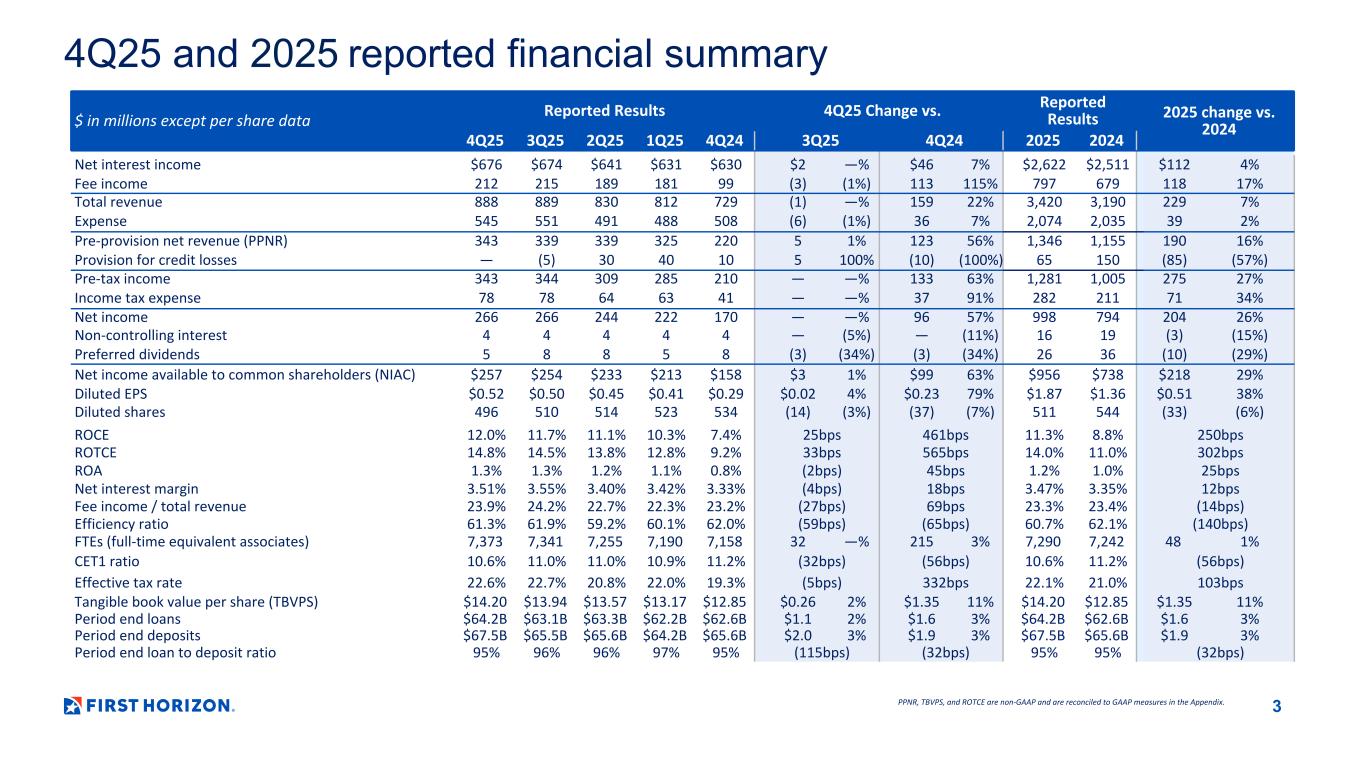

4Q25 and 2025 reported financial summary PPNR, TBVPS, and ROTCE are non-GAAP and are reconciled to GAAP measures in the Appendix. $ in millions except per share data Reported Results 4Q25 Change vs. Reported Results 2025 change vs. 2024 4Q25 3Q25 2Q25 1Q25 4Q24 3Q25 4Q24 2025 2024 Net interest income $676 $674 $641 $631 $630 $2 —% $46 7% $2,622 $2,511 $112 4% Fee income 212 215 189 181 99 (3) (1%) 113 115% 797 679 118 17% Total revenue 888 889 830 812 729 (1) —% 159 22% 3,420 3,190 229 7% Expense 545 551 491 488 508 (6) (1%) 36 7% 2,074 2,035 39 2% Pre-provision net revenue (PPNR) 343 339 339 325 220 5 1% 123 56% 1,346 1,155 190 16% Provision for credit losses — (5) 30 40 10 5 100% (10) (100%) 65 150 (85) (57%) Pre-tax income 343 344 309 285 210 — —% 133 63% 1,281 1,005 275 27% Income tax expense 78 78 64 63 41 — —% 37 91% 282 211 71 34% Net income 266 266 244 222 170 — —% 96 57% 998 794 204 26% Non-controlling interest 4 4 4 4 4 — (5%) — (11%) 16 19 (3) (15%) Preferred dividends 5 8 8 5 8 (3) (34%) (3) (34%) 26 36 (10) (29%) Net income available to common shareholders (NIAC) $257 $254 $233 $213 $158 $3 1% $99 63% $956 $738 $218 29% Diluted EPS $0.52 $0.50 $0.45 $0.41 $0.29 $0.02 4% $0.23 79% $1.87 $1.36 $0.51 38% Diluted shares 496 510 514 523 534 (14) (3%) (37) (7%) 511 544 (33) (6%) ROCE 12.0% 11.7% 11.1% 10.3% 7.4% 25bps 461bps 11.3% 8.8% 250bps ROTCE 14.8% 14.5% 13.8% 12.8% 9.2% 33bps 565bps 14.0% 11.0% 302bps ROA 1.3% 1.3% 1.2% 1.1% 0.8% (2bps) 45bps 1.2% 1.0% 25bps Net interest margin 3.51% 3.55% 3.40% 3.42% 3.33% (4bps) 18bps 3.47% 3.35% 12bps Fee income / total revenue 23.9% 24.2% 22.7% 22.3% 23.2% (27bps) 69bps 23.3% 23.4% (14bps) Efficiency ratio 61.3% 61.9% 59.2% 60.1% 62.0% (59bps) (65bps) 60.7% 62.1% (140bps) FTEs (full-time equivalent associates) 7,373 7,341 7,255 7,190 7,158 32 —% 215 3% 7,290 7,242 48 1% CET1 ratio 10.6% 11.0% 11.0% 10.9% 11.2% (32bps) (56bps) 10.6% 11.2% (56bps) Effective tax rate 22.6% 22.7% 20.8% 22.0% 19.3% (5bps) 332bps 22.1% 21.0% 103bps Tangible book value per share (TBVPS) $14.20 $13.94 $13.57 $13.17 $12.85 $0.26 2% $1.35 11% $14.20 $12.85 $1.35 11% Period end loans $64.2B $63.1B $63.3B $62.2B $62.6B $1.1 2% $1.6 3% $64.2B $62.6B $1.6 3% Period end deposits $67.5B $65.5B $65.6B $64.2B $65.6B $2.0 3% $1.9 3% $67.5B $65.6B $1.9 3% Period end loan to deposit ratio 95% 96% 96% 97% 95% (115bps) (32bps) 95% 95% (32bps) 3

2025 full year review . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 4Q25 adjusted financial results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 4Q25 notable items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 NII and NIM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Adjusted fee income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 Adjusted expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Asset quality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 2026 outlook . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Strategic focus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 Appendix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 Table of Contents 4

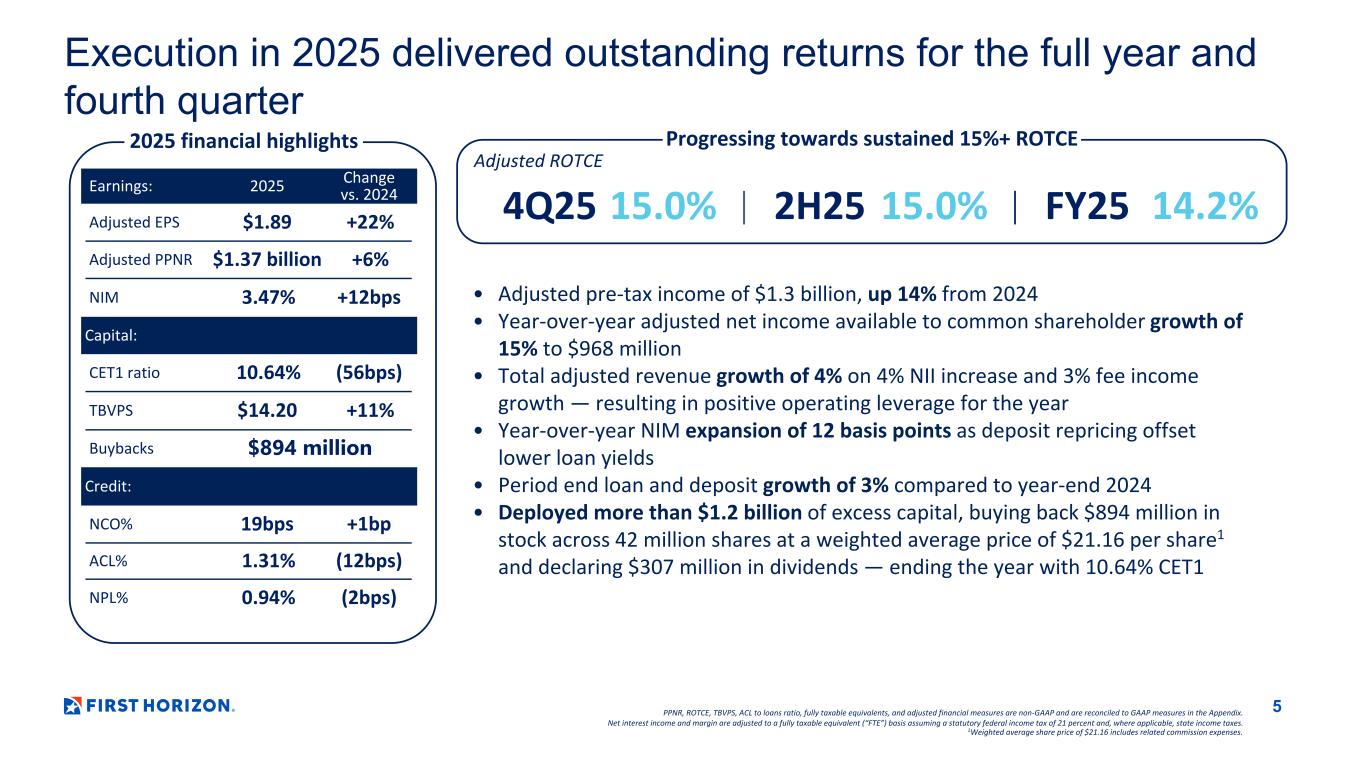

Execution in 2025 delivered outstanding returns for the full year and fourth quarter 2025 financial highlights n i n Earnings: 2025 Change vs. 2024 Adjusted EPS $1.89 +22% Adjusted PPNR $1.37 billion +6% NIM 3.47% +12bps Capital: CET1 ratio 10.64% (56bps) TBVPS $14.20 +11% Buybacks $894 million Credit: NCO% 19bps +1bp ACL% 1.31% (12bps) NPL% 0.94% (2bps) Progressing towards sustained 15%+ ROTCE Adjusted ROTCE 4Q25 15.0% 2H25 15.0% FY25 14.2% • Adjusted pre-tax income of $1.3 billion, up 14% from 2024 • Year-over-year adjusted net income available to common shareholder growth of 15% to $968 million • Total adjusted revenue growth of 4% on 4% NII increase and 3% fee income growth — resulting in positive operating leverage for the year • Year-over-year NIM expansion of 12 basis points as deposit repricing offset lower loan yields • Period end loan and deposit growth of 3% compared to year-end 2024 • Deployed more than $1.2 billion of excess capital, buying back $894 million in stock across 42 million shares at a weighted average price of $21.16 per share1 and declaring $307 million in dividends — ending the year with 10.64% CET1 5PPNR, ROTCE, TBVPS, ACL to loans ratio, fully taxable equivalents, and adjusted financial measures are non-GAAP and are reconciled to GAAP measures in the Appendix. Net interest income and margin are adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 21 percent and, where applicable, state income taxes. 1Weighted average share price of $21.16 includes related commission expenses.

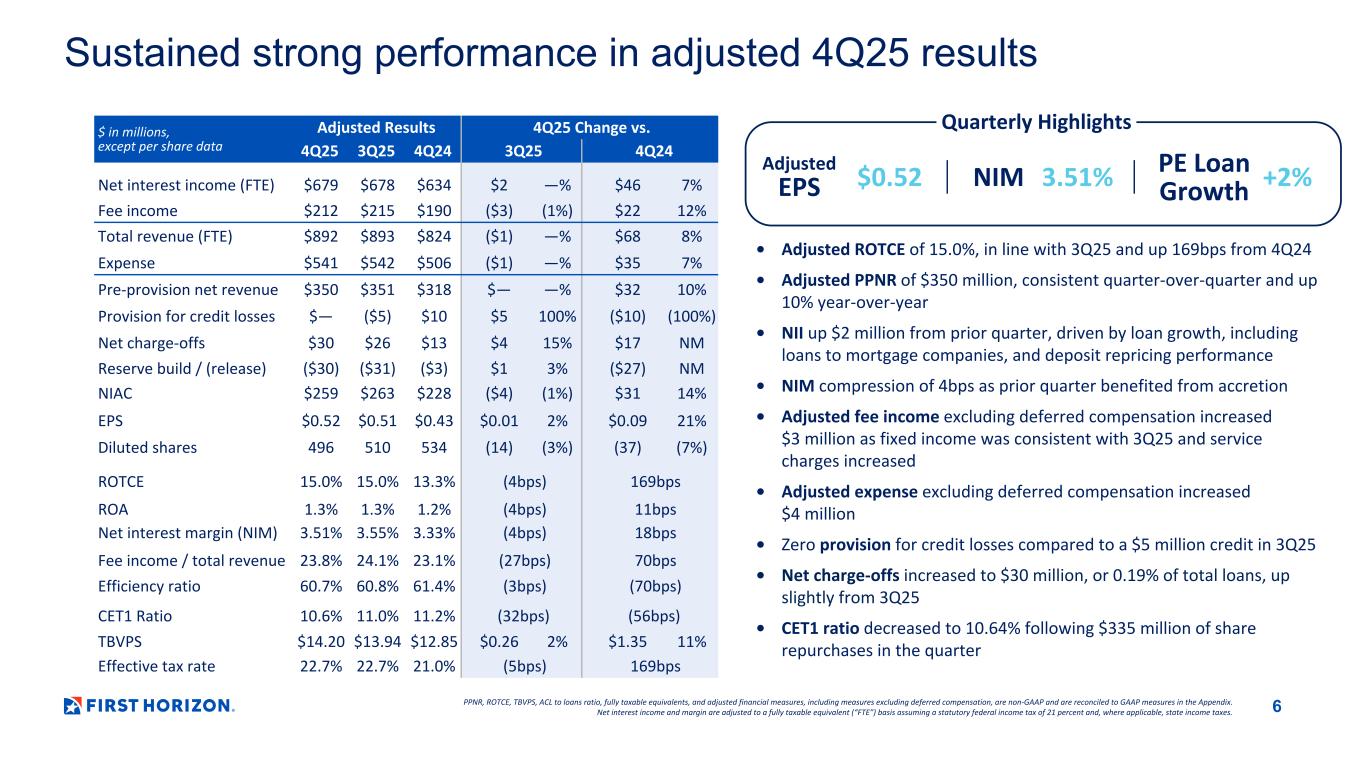

Sustained strong performance in adjusted 4Q25 results PPNR, ROTCE, TBVPS, ACL to loans ratio, fully taxable equivalents, and adjusted financial measures, including measures excluding deferred compensation, are non-GAAP and are reconciled to GAAP measures in the Appendix. Net interest income and margin are adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 21 percent and, where applicable, state income taxes. $ in millions, except per share data Adjusted Results 4Q25 Change vs. 4Q25 3Q25 4Q24 3Q25 4Q24 Net interest income (FTE) $679 $678 $634 $2 —% $46 7% Fee income $212 $215 $190 ($3) (1%) $22 12% Total revenue (FTE) $892 $893 $824 ($1) —% $68 8% Expense $541 $542 $506 ($1) —% $35 7% Pre-provision net revenue $350 $351 $318 $— —% $32 10% Provision for credit losses $— ($5) $10 $5 100% ($10) (100%) Net charge-offs $30 $26 $13 $4 15% $17 NM Reserve build / (release) ($30) ($31) ($3) $1 3% ($27) NM NIAC $259 $263 $228 ($4) (1%) $31 14% EPS $0.52 $0.51 $0.43 $0.01 2% $0.09 21% Diluted shares 496 510 534 (14) (3%) (37) (7%) ROTCE 15.0% 15.0% 13.3% (4bps) 169bps ROA 1.3% 1.3% 1.2% (4bps) 11bps Net interest margin (NIM) 3.51% 3.55% 3.33% (4bps) 18bps Fee income / total revenue 23.8% 24.1% 23.1% (27bps) 70bps Efficiency ratio 60.7% 60.8% 61.4% (3bps) (70bps) CET1 Ratio 10.6% 11.0% 11.2% (32bps) (56bps) TBVPS $14.20 $13.94 $12.85 $0.26 2% $1.35 11% Effective tax rate 22.7% 22.7% 21.0% (5bps) 169bps • Adjusted ROTCE of 15.0%, in line with 3Q25 and up 169bps from 4Q24 • Adjusted PPNR of $350 million, consistent quarter-over-quarter and up 10% year-over-year • NII up $2 million from prior quarter, driven by loan growth, including loans to mortgage companies, and deposit repricing performance • NIM compression of 4bps as prior quarter benefited from accretion • Adjusted fee income excluding deferred compensation increased $3 million as fixed income was consistent with 3Q25 and service charges increased • Adjusted expense excluding deferred compensation increased $4 million • Zero provision for credit losses compared to a $5 million credit in 3Q25 • Net charge-offs increased to $30 million, or 0.19% of total loans, up slightly from 3Q25 • CET1 ratio decreased to 10.64% following $335 million of share repurchases in the quarter 6 Quarterly Highlights NIM 3.51% PE Loan Growth +2% Adjusted EPS $0.52

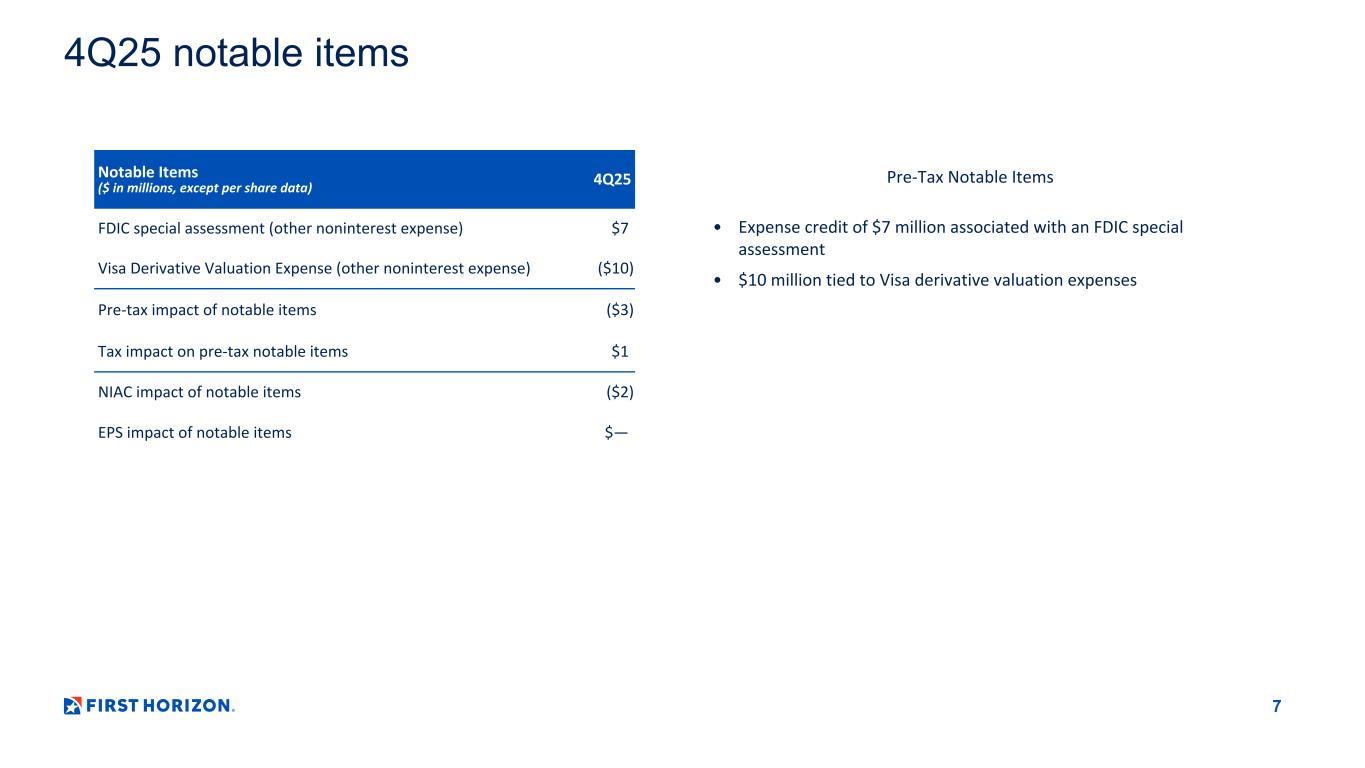

4Q25 notable items Notable Items ($ in millions, except per share data) 4Q25 FDIC special assessment (other noninterest expense) $7 Visa Derivative Valuation Expense (other noninterest expense) ($10) Pre-tax impact of notable items ($3) Tax impact on pre-tax notable items $1 NIAC impact of notable items ($2) EPS impact of notable items $— Pre-Tax Notable Items • Expense credit of $7 million associated with an FDIC special assessment • $10 million tied to Visa derivative valuation expenses 7

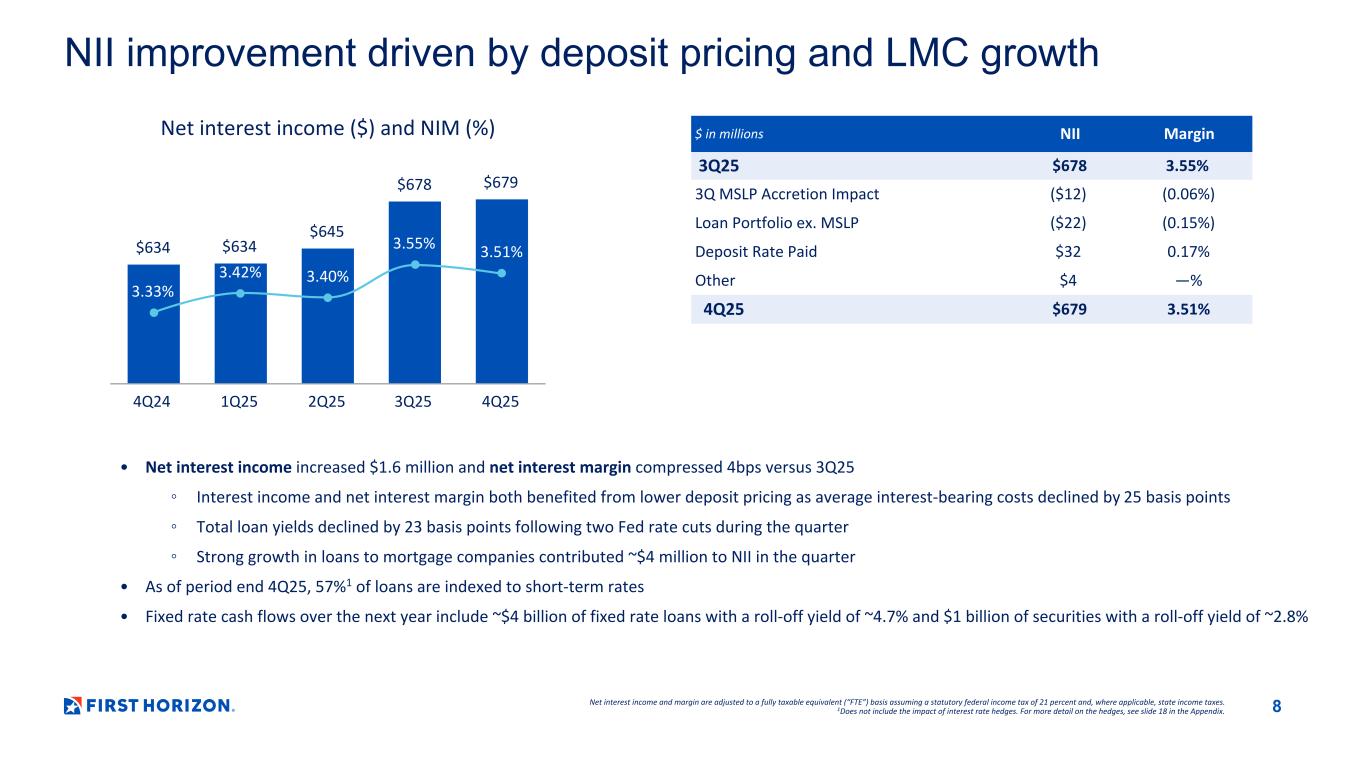

NII improvement driven by deposit pricing and LMC growth • Net interest income increased $1.6 million and net interest margin compressed 4bps versus 3Q25 ◦ Interest income and net interest margin both benefited from lower deposit pricing as average interest-bearing costs declined by 25 basis points ◦ Total loan yields declined by 23 basis points following two Fed rate cuts during the quarter ◦ Strong growth in loans to mortgage companies contributed ~$4 million to NII in the quarter • As of period end 4Q25, 57%1 of loans are indexed to short-term rates • Fixed rate cash flows over the next year include ~$4 billion of fixed rate loans with a roll-off yield of ~4.7% and $1 billion of securities with a roll-off yield of ~2.8% $634 $634 $645 $678 $679 3.33% 3.42% 3.40% 3.55% 3.51% 4Q24 1Q25 2Q25 3Q25 4Q25 Net interest income ($) and NIM (%) Net interest income and margin are adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 21 percent and, where applicable, state income taxes. 1Does not include the impact of interest rate hedges. For more detail on the hedges, see slide 18 in the Appendix. $ in millions NII Margin 3Q25 $678 3.55% 3Q MSLP Accretion Impact ($12) (0.06%) Loan Portfolio ex. MSLP ($22) (0.15%) Deposit Rate Paid $32 0.17% Other $4 —% 4Q25 $679 3.51% 8

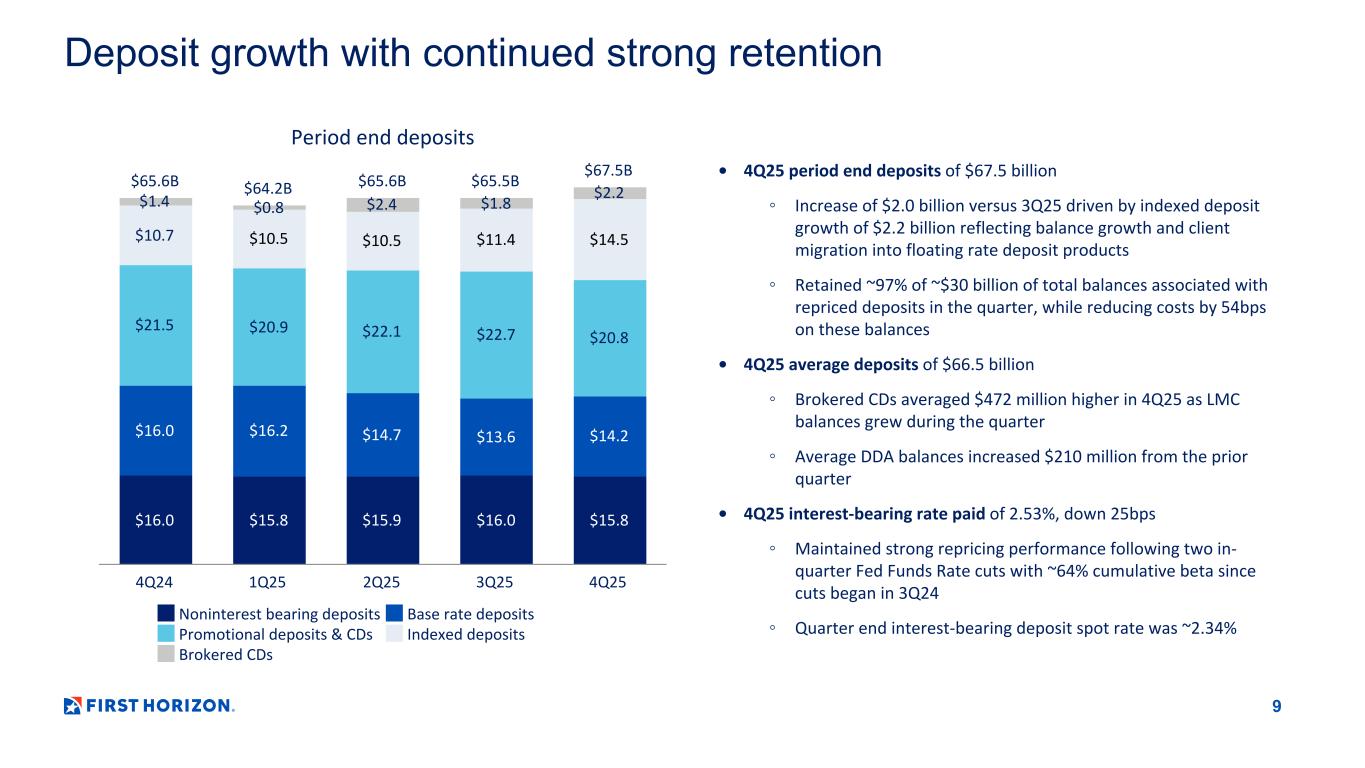

Deposit growth with continued strong retention • 4Q25 period end deposits of $67.5 billion ◦ Increase of $2.0 billion versus 3Q25 driven by indexed deposit growth of $2.2 billion reflecting balance growth and client migration into floating rate deposit products ◦ Retained ~97% of ~$30 billion of total balances associated with repriced deposits in the quarter, while reducing costs by 54bps on these balances • 4Q25 average deposits of $66.5 billion ◦ Brokered CDs averaged $472 million higher in 4Q25 as LMC balances grew during the quarter ◦ Average DDA balances increased $210 million from the prior quarter • 4Q25 interest-bearing rate paid of 2.53%, down 25bps ◦ Maintained strong repricing performance following two in- quarter Fed Funds Rate cuts with ~64% cumulative beta since cuts began in 3Q24 ◦ Quarter end interest-bearing deposit spot rate was ~2.34% Period end deposits $65.6B $64.2B $65.6B $65.5B $67.5B $16.0 $15.8 $15.9 $16.0 $15.8 $16.0 $16.2 $14.7 $13.6 $14.2 $21.5 $20.9 $22.1 $22.7 $20.8 $10.7 $10.5 $10.5 $11.4 $14.5 $1.4 $0.8 $2.4 $1.8 $2.2 Noninterest bearing deposits Base rate deposits Promotional deposits & CDs Indexed deposits Brokered CDs 4Q24 1Q25 2Q25 3Q25 4Q25 9

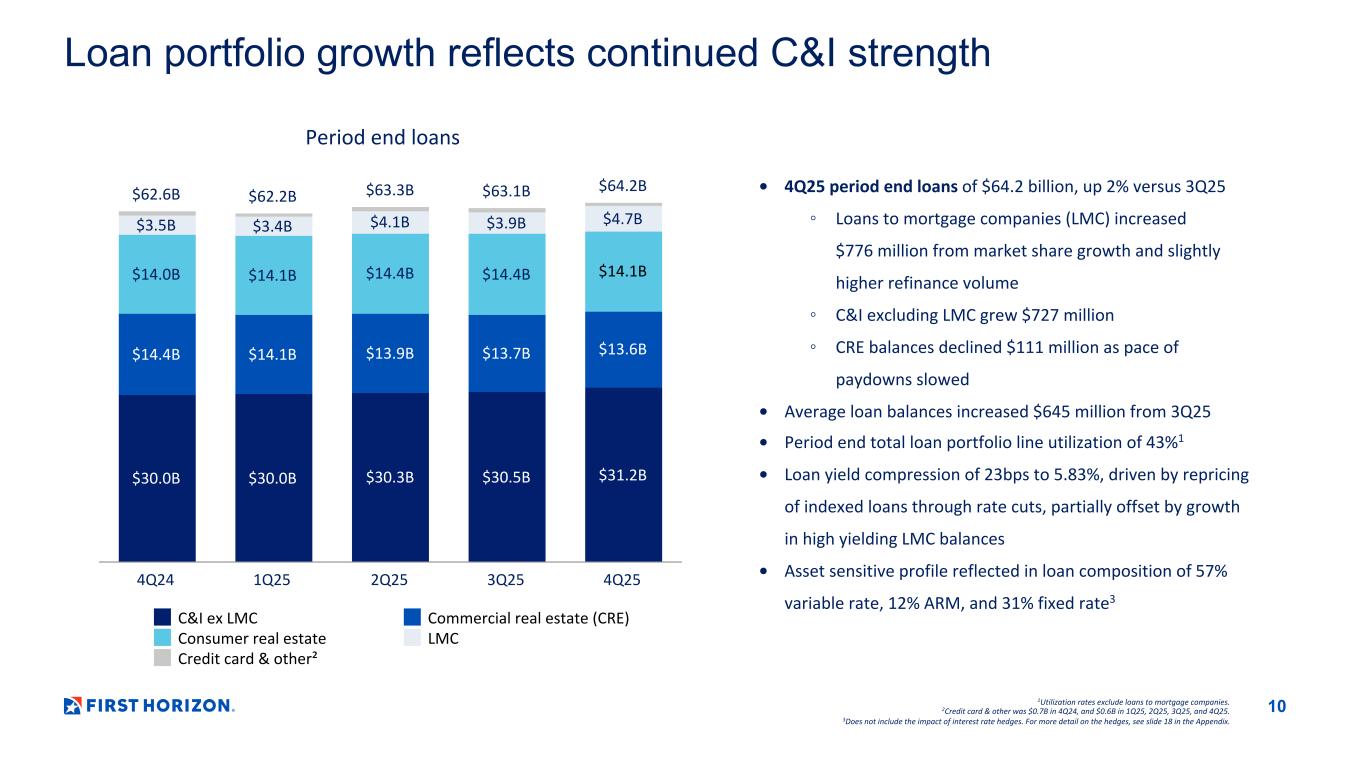

Loan portfolio growth reflects continued C&I strength Period end loans • 4Q25 period end loans of $64.2 billion, up 2% versus 3Q25 ◦ Loans to mortgage companies (LMC) increased $776 million from market share growth and slightly higher refinance volume ◦ C&I excluding LMC grew $727 million ◦ CRE balances declined $111 million as pace of paydowns slowed • Average loan balances increased $645 million from 3Q25 • Period end total loan portfolio line utilization of 43%1 • Loan yield compression of 23bps to 5.83%, driven by repricing of indexed loans through rate cuts, partially offset by growth in high yielding LMC balances • Asset sensitive profile reflected in loan composition of 57% variable rate, 12% ARM, and 31% fixed rate3 1Utilization rates exclude loans to mortgage companies. 2Credit card & other was $0.7B in 4Q24, and $0.6B in 1Q25, 2Q25, 3Q25, and 4Q25. 3Does not include the impact of interest rate hedges. For more detail on the hedges, see slide 18 in the Appendix. $62.6B $62.2B $63.3B $63.1B $64.2B $30.0B $30.0B $30.3B $30.5B $31.2B $14.4B $14.1B $13.9B $13.7B $13.6B $14.0B $14.1B $14.4B $14.4B $14.1B $3.5B $3.4B $4.1B $3.9B $4.7B C&I ex LMC Commercial real estate (CRE) Consumer real estate LMC Credit card & other² 4Q24 1Q25 2Q25 3Q25 4Q25 10

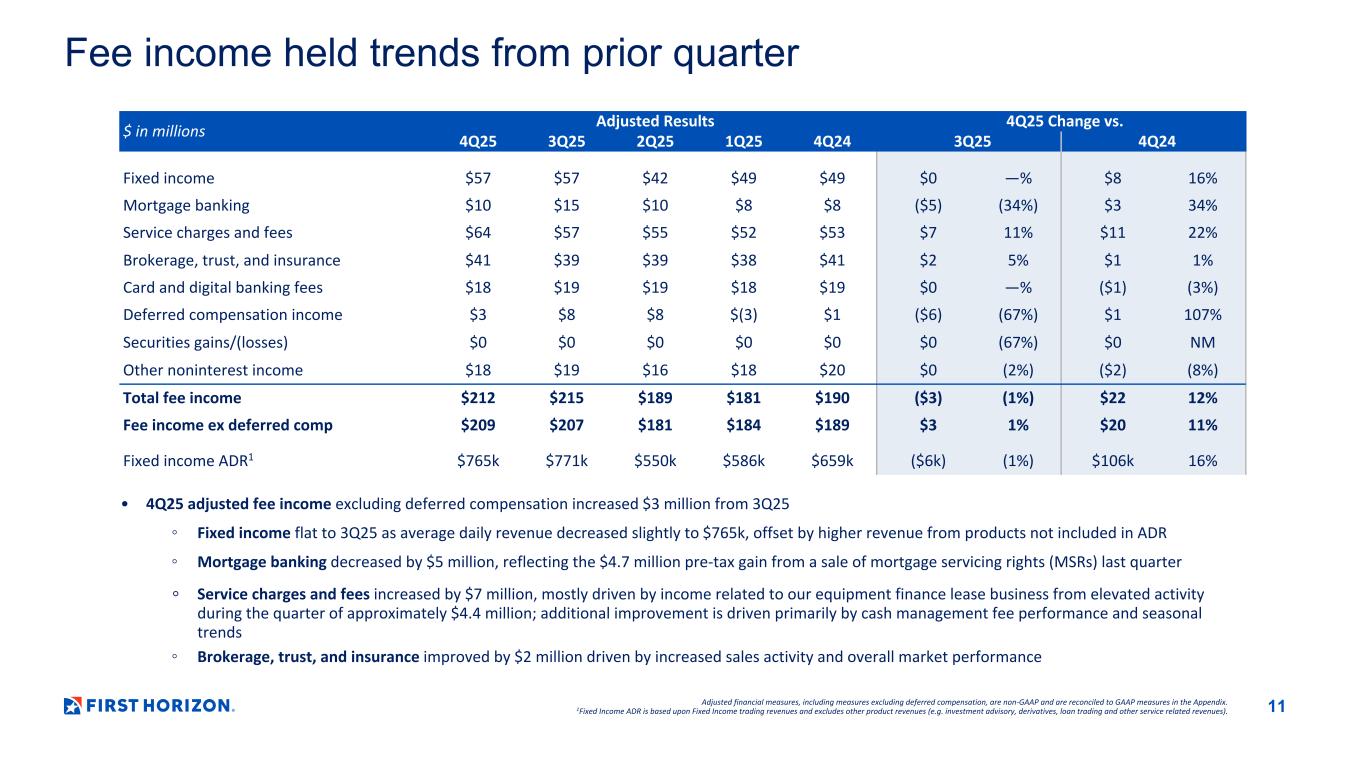

Fee income held trends from prior quarter • 4Q25 adjusted fee income excluding deferred compensation increased $3 million from 3Q25 ◦ Fixed income flat to 3Q25 as average daily revenue decreased slightly to $765k, offset by higher revenue from products not included in ADR ◦ Mortgage banking decreased by $5 million, reflecting the $4.7 million pre-tax gain from a sale of mortgage servicing rights (MSRs) last quarter ◦ Service charges and fees increased by $7 million, mostly driven by income related to our equipment finance lease business from elevated activity during the quarter of approximately $4.4 million; additional improvement is driven primarily by cash management fee performance and seasonal trends ◦ Brokerage, trust, and insurance improved by $2 million driven by increased sales activity and overall market performance Adjusted financial measures, including measures excluding deferred compensation, are non-GAAP and are reconciled to GAAP measures in the Appendix. 1Fixed Income ADR is based upon Fixed Income trading revenues and excludes other product revenues (e.g. investment advisory, derivatives, loan trading and other service related revenues). $ in millions Adjusted Results 4Q25 Change vs. 4Q25 3Q25 2Q25 1Q25 4Q24 3Q25 4Q24 Fixed income $57 $57 $42 $49 $49 $0 —% $8 16% Mortgage banking $10 $15 $10 $8 $8 ($5) (34%) $3 34% Service charges and fees $64 $57 $55 $52 $53 $7 11% $11 22% Brokerage, trust, and insurance $41 $39 $39 $38 $41 $2 5% $1 1% Card and digital banking fees $18 $19 $19 $18 $19 $0 —% ($1) (3%) Deferred compensation income $3 $8 $8 $(3) $1 ($6) (67%) $1 107% Securities gains/(losses) $0 $0 $0 $0 $0 $0 (67%) $0 NM Other noninterest income $18 $19 $16 $18 $20 $0 (2%) ($2) (8%) Total fee income $212 $215 $189 $181 $190 ($3) (1%) $22 12% Fee income ex deferred comp $209 $207 $181 $184 $189 $3 1% $20 11% Fixed income ADR1 $765k $771k $550k $586k $659k ($6k) (1%) $106k 16% 11

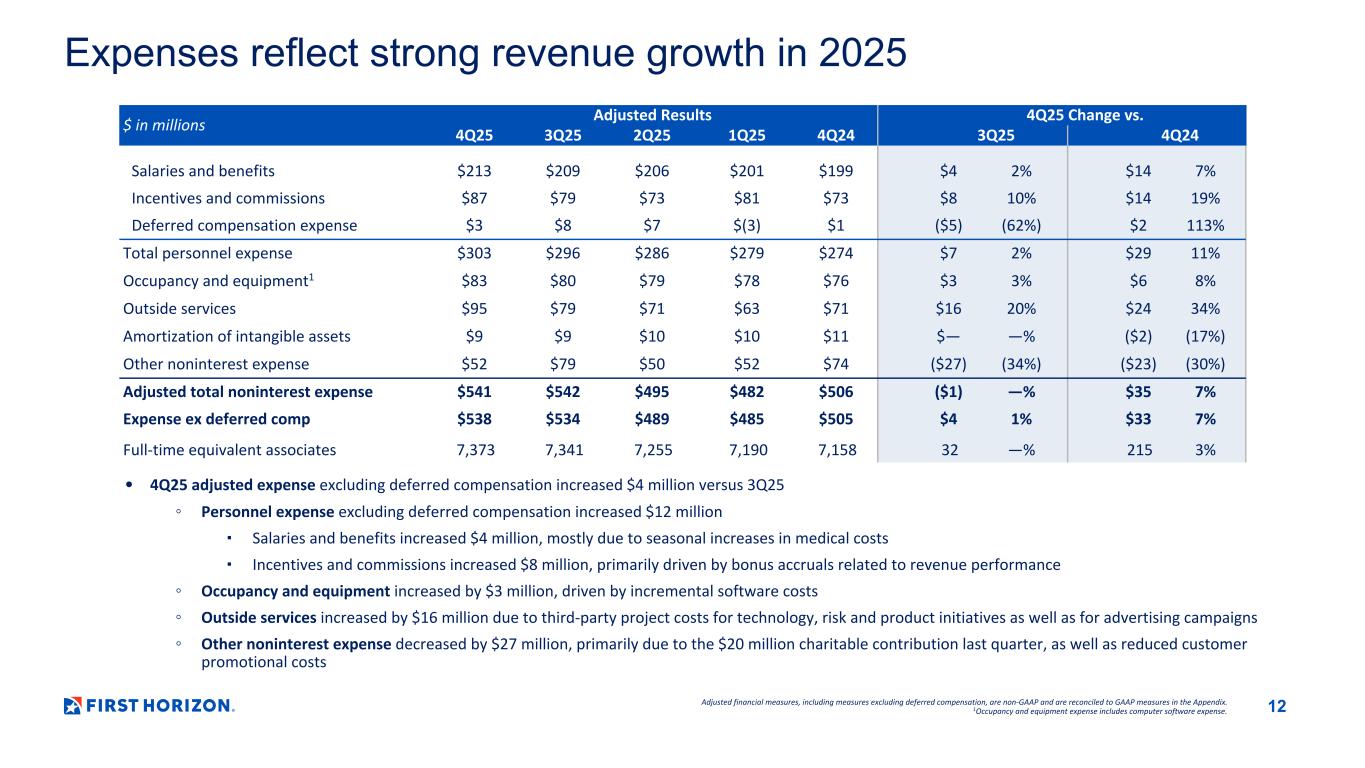

• 4Q25 adjusted expense excluding deferred compensation increased $4 million versus 3Q25 ◦ Personnel expense excluding deferred compensation increased $12 million ▪ Salaries and benefits increased $4 million, mostly due to seasonal increases in medical costs ▪ Incentives and commissions increased $8 million, primarily driven by bonus accruals related to revenue performance ◦ Occupancy and equipment increased by $3 million, driven by incremental software costs ◦ Outside services increased by $16 million due to third-party project costs for technology, risk and product initiatives as well as for advertising campaigns ◦ Other noninterest expense decreased by $27 million, primarily due to the $20 million charitable contribution last quarter, as well as reduced customer promotional costs Expenses reflect strong revenue growth in 2025 $ in millions Adjusted Results 4Q25 Change vs. 4Q25 3Q25 2Q25 1Q25 4Q24 3Q25 4Q24 Salaries and benefits $213 $209 $206 $201 $199 $4 2% $14 7% Incentives and commissions $87 $79 $73 $81 $73 $8 10% $14 19% Deferred compensation expense $3 $8 $7 $(3) $1 ($5) (62%) $2 113% Total personnel expense $303 $296 $286 $279 $274 $7 2% $29 11% Occupancy and equipment1 $83 $80 $79 $78 $76 $3 3% $6 8% Outside services $95 $79 $71 $63 $71 $16 20% $24 34% Amortization of intangible assets $9 $9 $10 $10 $11 $— —% ($2) (17%) Other noninterest expense $52 $79 $50 $52 $74 ($27) (34%) ($23) (30%) Adjusted total noninterest expense $541 $542 $495 $482 $506 ($1) —% $35 7% Expense ex deferred comp $538 $534 $489 $485 $505 $4 1% $33 7% Full-time equivalent associates 7,373 7,341 7,255 7,190 7,158 32 —% 215 3% Adjusted financial measures, including measures excluding deferred compensation, are non-GAAP and are reconciled to GAAP measures in the Appendix. 1Occupancy and equipment expense includes computer software expense. 12

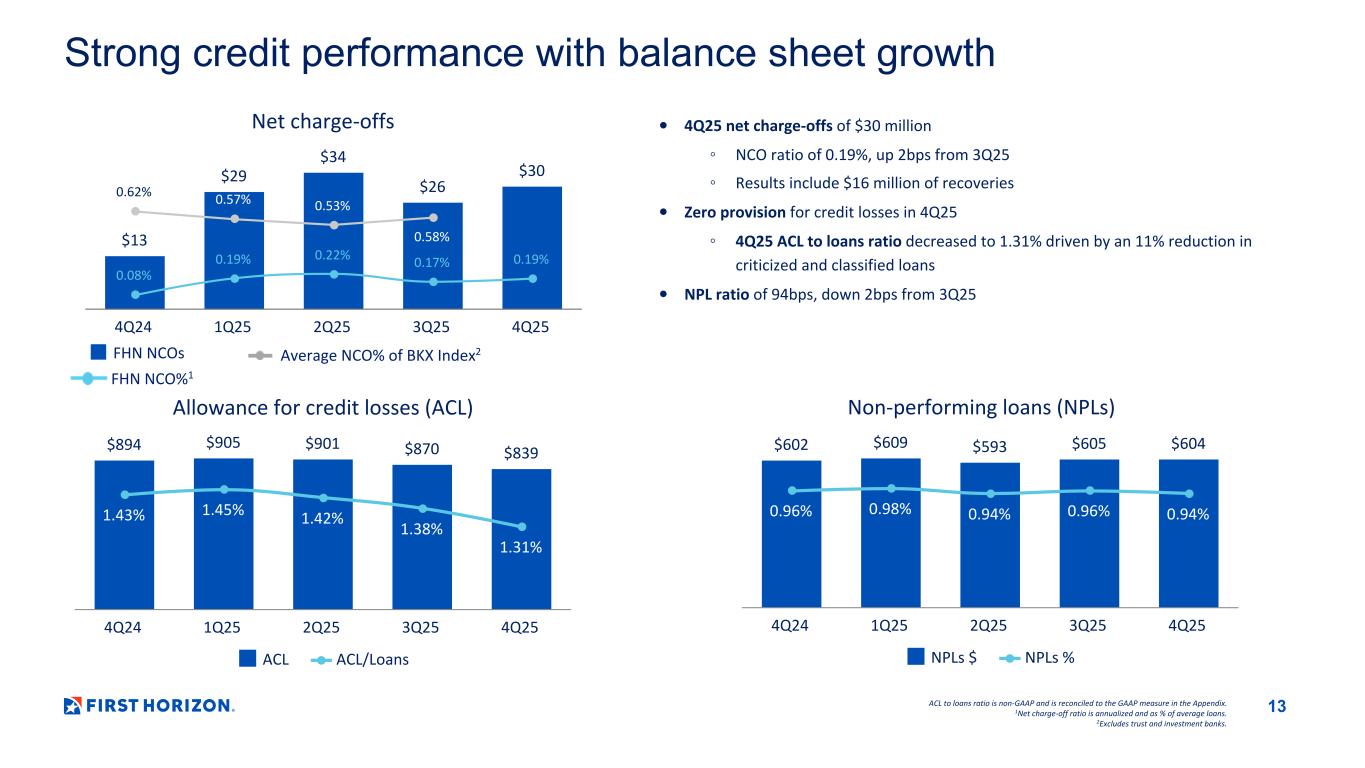

Strong credit performance with balance sheet growth Non-performing loans (NPLs)Allowance for credit losses (ACL) Net charge-offs FHN NCO%1 Average NCO% of BKX Index2 $13 $29 $34 $26 $30 0.08% 0.19% 0.22% 0.17% 0.19% 0.62% 0.57% 0.53% 0.58% 4Q24 1Q25 2Q25 3Q25 4Q25 FHN NCOs ACL to loans ratio is non-GAAP and is reconciled to the GAAP measure in the Appendix. 1Net charge-off ratio is annualized and as % of average loans. 2Excludes trust and investment banks. $894 $905 $901 $870 $839 1.43% 1.45% 1.42% 1.38% 1.31% ACL ACL/Loans 4Q24 1Q25 2Q25 3Q25 4Q25 $602 $609 $593 $605 $604 0.96% 0.98% 0.94% 0.96% 0.94% NPLs $ NPLs % 4Q24 1Q25 2Q25 3Q25 4Q25 • 4Q25 net charge-offs of $30 million ◦ NCO ratio of 0.19%, up 2bps from 3Q25 ◦ Results include $16 million of recoveries • Zero provision for credit losses in 4Q25 ◦ 4Q25 ACL to loans ratio decreased to 1.31% driven by an 11% reduction in criticized and classified loans • NPL ratio of 94bps, down 2bps from 3Q25 13

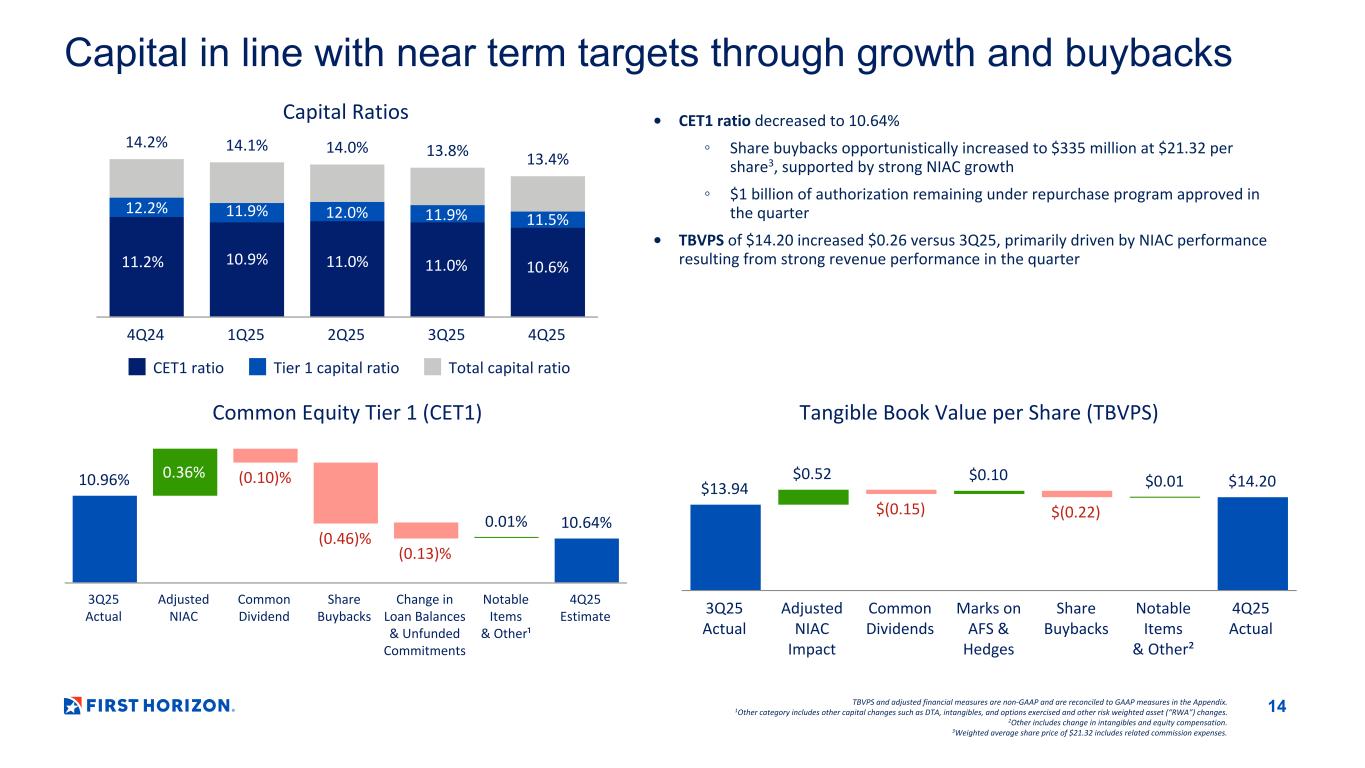

10.96% 0.36% (0.10)% (0.46)% (0.13)% 0.01% 10.64% 3Q25 Actual Adjusted NIAC Common Dividend Share Buybacks Change in Loan Balances & Unfunded Commitments Notable Items & Other¹ 4Q25 Estimate • CET1 ratio decreased to 10.64% ◦ Share buybacks opportunistically increased to $335 million at $21.32 per share3, supported by strong NIAC growth ◦ $1 billion of authorization remaining under repurchase program approved in the quarter • TBVPS of $14.20 increased $0.26 versus 3Q25, primarily driven by NIAC performance resulting from strong revenue performance in the quarter Capital in line with near term targets through growth and buybacks Capital Ratios Common Equity Tier 1 (CET1) Tangible Book Value per Share (TBVPS) 14.2% 14.1% 14.0% 13.8% 13.4% CET1 ratio Tier 1 capital ratio Total capital ratio 4Q24 1Q25 2Q25 3Q25 4Q25 $13.94 $0.52 $(0.15) $0.10 $(0.22) $0.01 $14.20 3Q25 Actual Adjusted NIAC Impact Common Dividends Marks on AFS & Hedges Share Buybacks Notable Items & Other² 4Q25 Actual TBVPS and adjusted financial measures are non-GAAP and are reconciled to GAAP measures in the Appendix. 1Other category includes other capital changes such as DTA, intangibles, and options exercised and other risk weighted asset (“RWA”) changes. 2Other includes change in intangibles and equity compensation. 3Weighted average share price of $21.32 includes related commission expenses. 11.2% 10.9% 11.0% 11.0% 10.6% 11.9%12.0%11.9%12.2% 11.5% 14

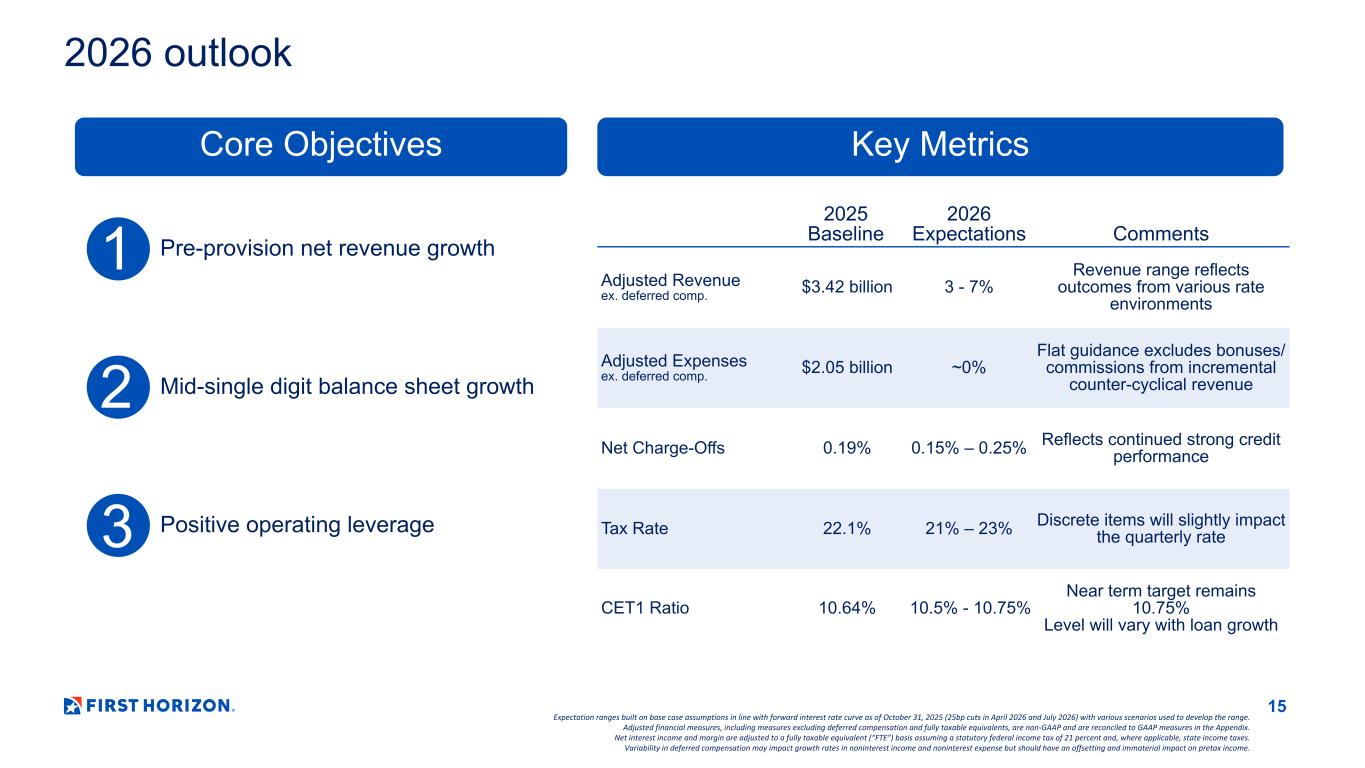

2026 outlook Expectation ranges built on base case assumptions in line with forward interest rate curve as of October 31, 2025 (25bp cuts in April 2026 and July 2026) with various scenarios used to develop the range. Adjusted financial measures, including measures excluding deferred compensation and fully taxable equivalents, are non-GAAP and are reconciled to GAAP measures in the Appendix. Net interest income and margin are adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 21 percent and, where applicable, state income taxes. Variability in deferred compensation may impact growth rates in noninterest income and noninterest expense but should have an offsetting and immaterial impact on pretax income. 15 Core Objectives Pre-provision net revenue growth1 Mid-single digit balance sheet growth Positive operating leverage Key Metrics 2025 Baseline 2026 Expectations Comments Adjusted Revenue ex. deferred comp. $3.42 billion 3 - 7% Revenue range reflects outcomes from various rate environments Adjusted Expenses ex. deferred comp. $2.05 billion ~0% Flat guidance excludes bonuses/ commissions from incremental counter-cyclical revenue Net Charge-Offs 0.19% 0.15% – 0.25% Reflects continued strong credit performance Tax Rate 22.1% 21% – 23% Discrete items will slightly impact the quarterly rate CET1 Ratio 10.64% 10.5% - 10.75% Near term target remains 10.75% Level will vary with loan growth 2 3

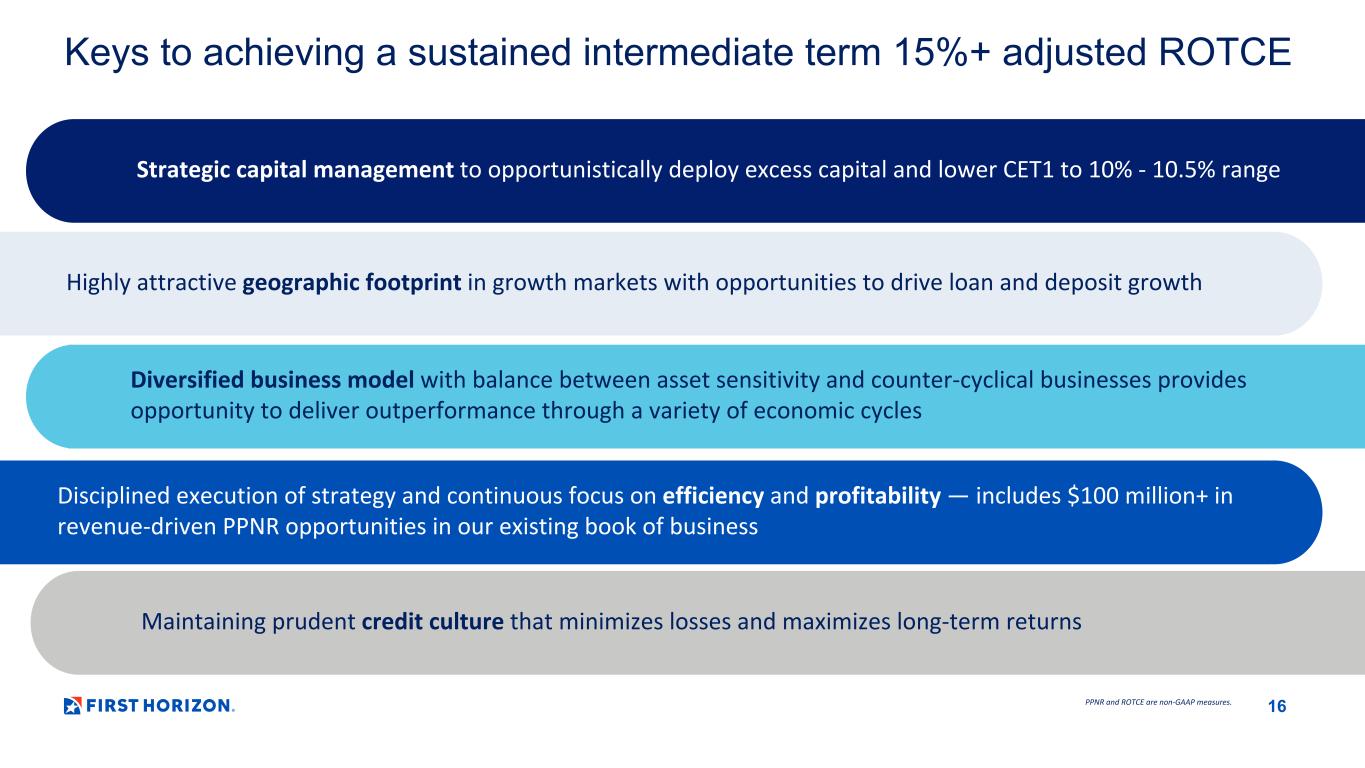

Keys to achieving a sustained intermediate term 15%+ adjusted ROTCE Strategic capital management to opportunistically deploy excess capital and lower CET1 to 10% - 10.5% range Highly attractive geographic footprint in growth markets with opportunities to drive loan and deposit growth Diversified business model with balance between asset sensitivity and counter-cyclical businesses provides opportunity to deliver outperformance through a variety of economic cycles Disciplined execution of strategy and continuous focus on efficiency and profitability — includes $100 million+ in revenue-driven PPNR opportunities in our existing book of business Maintaining prudent credit culture that minimizes losses and maximizes long-term returns 16PPNR and ROTCE are non-GAAP measures.

Appendix

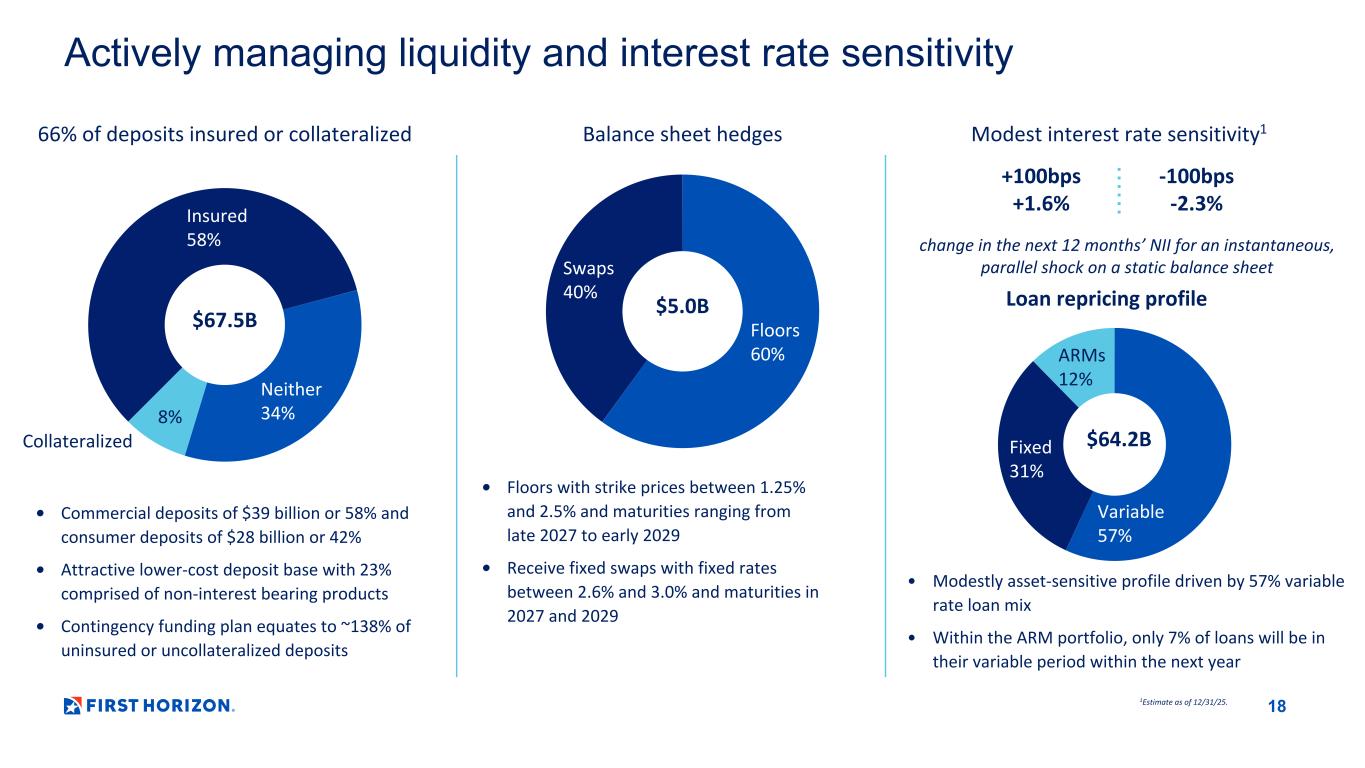

Actively managing liquidity and interest rate sensitivity Variable 57% Fixed 31% ARMs 12% $64.2B Floors 60% Swaps 40% $5.0B Loan repricing profile Balance sheet hedges Modest interest rate sensitivity1 +100bps +1.6% -100bps -2.3% • Modestly asset-sensitive profile driven by 57% variable rate loan mix • Within the ARM portfolio, only 7% of loans will be in their variable period within the next year • Floors with strike prices between 1.25% and 2.5% and maturities ranging from late 2027 to early 2029 • Receive fixed swaps with fixed rates between 2.6% and 3.0% and maturities in 2027 and 2029 1Estimate as of 12/31/25. change in the next 12 months’ NII for an instantaneous, parallel shock on a static balance sheet Insured 58% Neither 34%8% $67.5B 66% of deposits insured or collateralized Collateralized • Commercial deposits of $39 billion or 58% and consumer deposits of $28 billion or 42% • Attractive lower-cost deposit base with 23% comprised of non-interest bearing products • Contingency funding plan equates to ~138% of uninsured or uncollateralized deposits 18

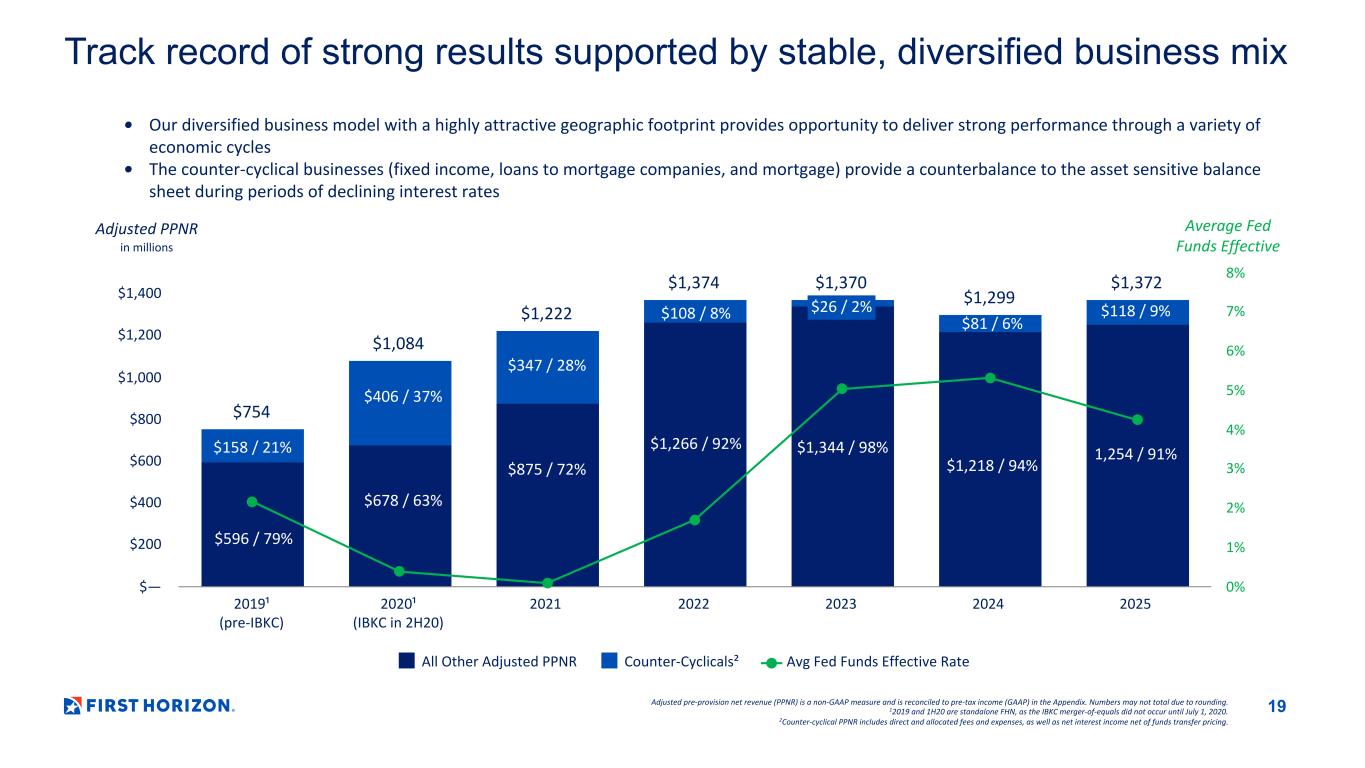

Track record of strong results supported by stable, diversified business mix • Our diversified business model with a highly attractive geographic footprint provides opportunity to deliver strong performance through a variety of economic cycles • The counter-cyclical businesses (fixed income, loans to mortgage companies, and mortgage) provide a counterbalance to the asset sensitive balance sheet during periods of declining interest rates Adjusted pre-provision net revenue (PPNR) is a non-GAAP measure and is reconciled to pre-tax income (GAAP) in the Appendix. Numbers may not total due to rounding. 12019 and 1H20 are standalone FHN, as the IBKC merger-of-equals did not occur until July 1, 2020. 2Counter-cyclical PPNR includes direct and allocated fees and expenses, as well as net interest income net of funds transfer pricing. $754 $1,084 $1,222 $1,374 $1,370 $1,299 $1,372 All Other Adjusted PPNR Counter-Cyclicals² Avg Fed Funds Effective Rate 2019¹ (pre-IBKC) 2020¹ (IBKC in 2H20) 2021 2022 2023 2024 2025 $— $200 $400 $600 $800 $1,000 $1,200 $1,400 0% 1% 2% 3% 4% 5% 6% 7% 8% $158 / 21% $406 / 37% $347 / 28% $81 / 6% $26 / 2% $108 / 8% $596 / 79% $678 / 63% $875 / 72% $1,266 / 92% $1,344 / 98% $1,218 / 94% Adjusted PPNR in millions Average Fed Funds Effective $118 / 9% 1,254 / 91% 19

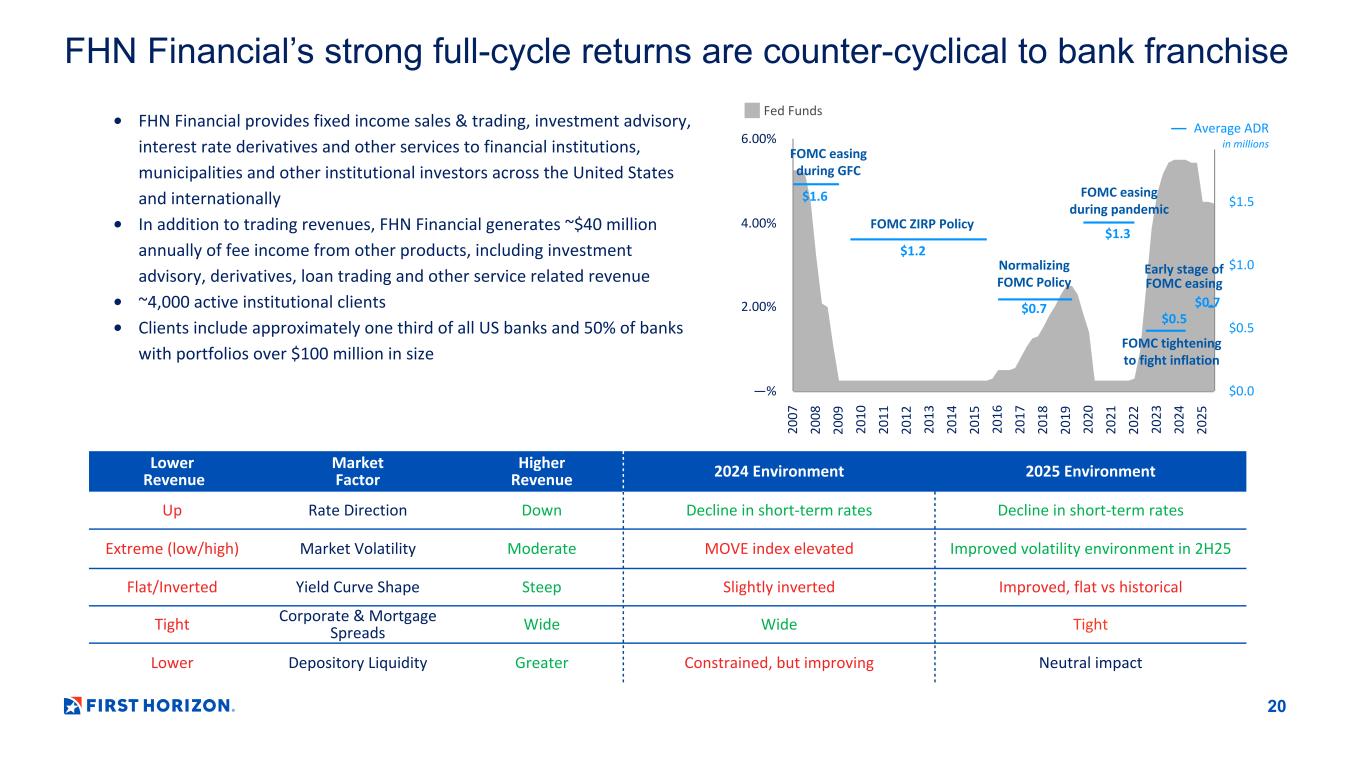

FHN Financial’s strong full-cycle returns are counter-cyclical to bank franchise 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 —% 2.00% 4.00% 6.00% $0.0 $0.5 $1.0 $1.5 $2.0 Lower Revenue Market Factor Higher Revenue 2024 Environment 2025 Environment Up Rate Direction Down Decline in short-term rates Decline in short-term rates Extreme (low/high) Market Volatility Moderate MOVE index elevated Improved volatility environment in 2H25 Flat/Inverted Yield Curve Shape Steep Slightly inverted Improved, flat vs historical Tight Corporate & Mortgage Spreads Wide Wide Tight Lower Depository Liquidity Greater Constrained, but improving Neutral impact • FHN Financial provides fixed income sales & trading, investment advisory, interest rate derivatives and other services to financial institutions, municipalities and other institutional investors across the United States and internationally • In addition to trading revenues, FHN Financial generates ~$40 million annually of fee income from other products, including investment advisory, derivatives, loan trading and other service related revenue • ~4,000 active institutional clients • Clients include approximately one third of all US banks and 50% of banks with portfolios over $100 million in size FOMC easing during GFC FOMC ZIRP Policy Normalizing FOMC Policy FOMC easing during pandemic FOMC tightening to fight inflation Fed Funds Average ADR in millions $1.6 $1.2 $0.7 $1.3 $0.5 Early stage of FOMC easing $0.7 20

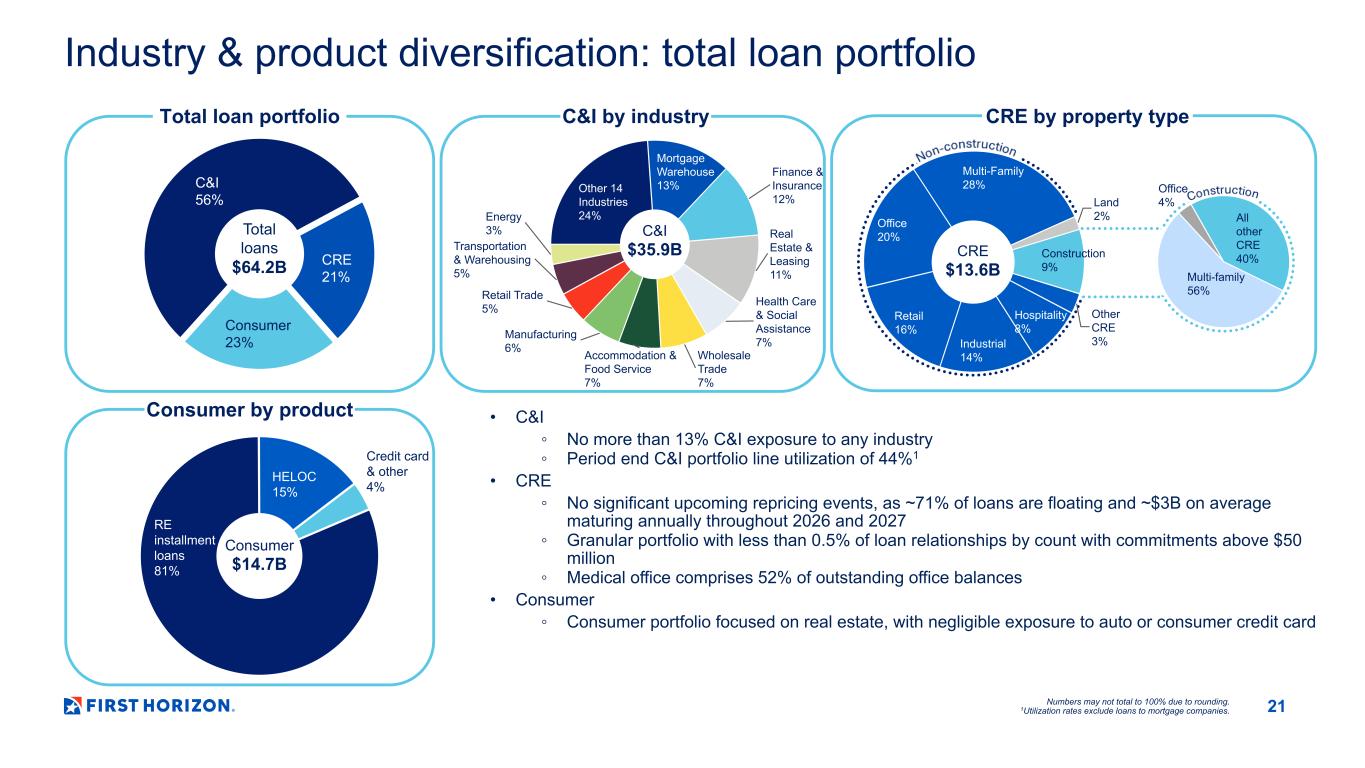

Multi-family 56% Office 4% All other CRE 40% Total loan portfolio Industry & product diversification: total loan portfolio RE installment loans 81% HELOC 15% Credit card & other 4% Total loans $64.2B Consumer $14.7B C&I $35.9B Consumer by product CRE $13.6B • C&I ◦ No more than 13% C&I exposure to any industry ◦ Period end C&I portfolio line utilization of 44%1 • CRE ◦ No significant upcoming repricing events, as ~71% of loans are floating and ~$3B on average maturing annually throughout 2026 and 2027 ◦ Granular portfolio with less than 0.5% of loan relationships by count with commitments above $50 million ◦ Medical office comprises 52% of outstanding office balances • Consumer ◦ Consumer portfolio focused on real estate, with negligible exposure to auto or consumer credit card Numbers may not total to 100% due to rounding. 1Utilization rates exclude loans to mortgage companies. C&I by industry 21 Land 2% Construction 9% Other CRE 3% Hospitality 8% Industrial 14% Retail 16% Office 20% Multi-Family 28% CRE by property type $ . C&I 56% CRE 21% Consumer 23% Other 14 Industries 24% Mortgage Warehouse 13% Finance & Insurance 12% Real Estate & Leasing 11% Health Care & Social Assistance 7% Wholesale Trade 7% Accommodation & Food Service 7% Manufacturing 6% Retail Trade 5% Transportation & Warehousing 5% Energy 3%

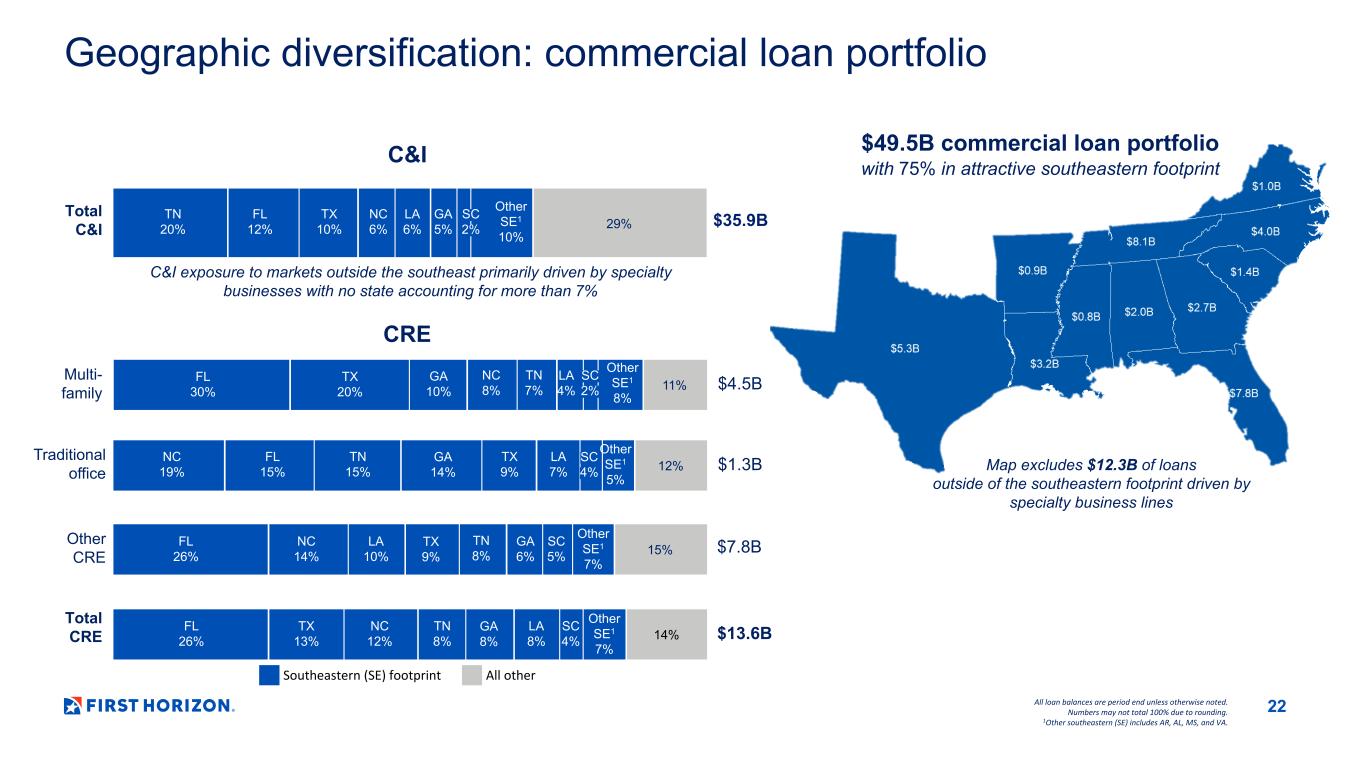

Geographic diversification: commercial loan portfolio 29% $35.9B 11% FL 30% TX 20% GA 10% NC 8% TN 7% LA 4% Other SE1 8% 12% 15% 14% SC 2% Total C&I Multi- family Traditional office Other CRE Total CRE $4.5B $1.3B $7.8B $13.6B C&I CRE C&I exposure to markets outside the southeast primarily driven by specialty businesses with no state accounting for more than 7% $49.5B commercial loan portfolio with 75% in attractive southeastern footprint All loan balances are period end unless otherwise noted. Numbers may not total 100% due to rounding. 1Other southeastern (SE) includes AR, AL, MS, and VA. Map excludes $12.3B of loans outside of the southeastern footprint driven by specialty business lines Southeastern (SE) footprint All other 22 NC 19% FL 15% TN 15% GA 14% TX 9% LA 7% SC 4% Other SE1 5% FL 26% NC 14% LA 10% TN 8% TX 9% GA 6% SC 5% Other SE1 7% FL 26% TX 13% NC 12% TN 8% GA 8% LA 8% SC 4% Other SE1 7% TN 20% FL 12% TX 10% NC 6% LA 6% GA 5% SC 2% Other SE1 10%

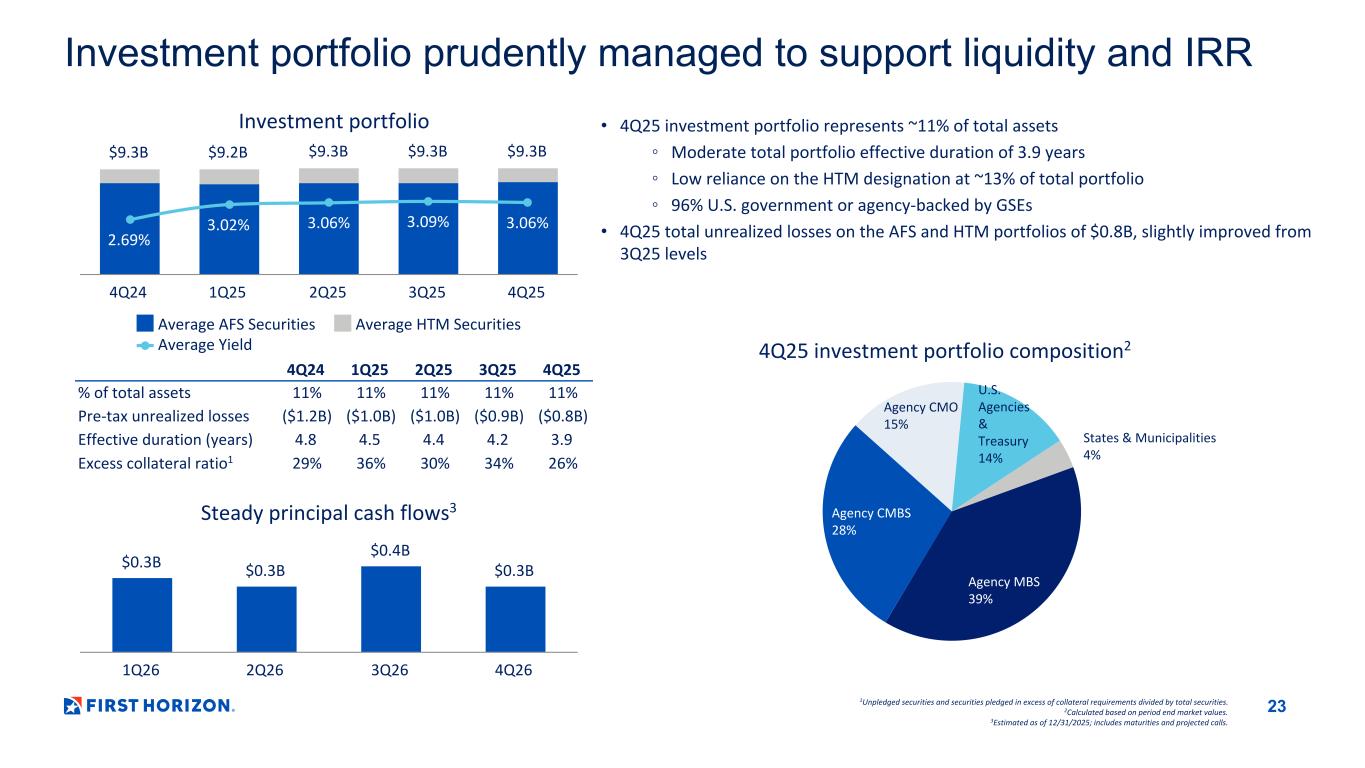

4Q25 investment portfolio composition2 Steady principal cash flows3 Investment portfolio $0.3B $0.3B $0.4B $0.3B 1Q26 2Q26 3Q26 4Q26 Agency MBS 39% Agency CMBS 28% Agency CMO 15% U.S. Agencies & Treasury 14% States & Municipalities 4% $9.3B $9.2B $9.3B $9.3B $9.3B 2.69% 3.02% 3.06% 3.09% 3.06% Average AFS Securities Average HTM Securities Average Yield 4Q24 1Q25 2Q25 3Q25 4Q25 • 4Q25 investment portfolio represents ~11% of total assets ◦ Moderate total portfolio effective duration of 3.9 years ◦ Low reliance on the HTM designation at ~13% of total portfolio ◦ 96% U.S. government or agency-backed by GSEs • 4Q25 total unrealized losses on the AFS and HTM portfolios of $0.8B, slightly improved from 3Q25 levels 1Unpledged securities and securities pledged in excess of collateral requirements divided by total securities. 2Calculated based on period end market values. 3Estimated as of 12/31/2025; includes maturities and projected calls. 4Q24 1Q25 2Q25 3Q25 4Q25 % of total assets 11% 11% 11% 11% 11% Pre-tax unrealized losses ($1.2B) ($1.0B) ($1.0B) ($0.9B) ($0.8B) Effective duration (years) 4.8 4.5 4.4 4.2 3.9 Excess collateral ratio1 29% 36% 30% 34% 26% 23 Investment portfolio prudently managed to support liquidity and IRR

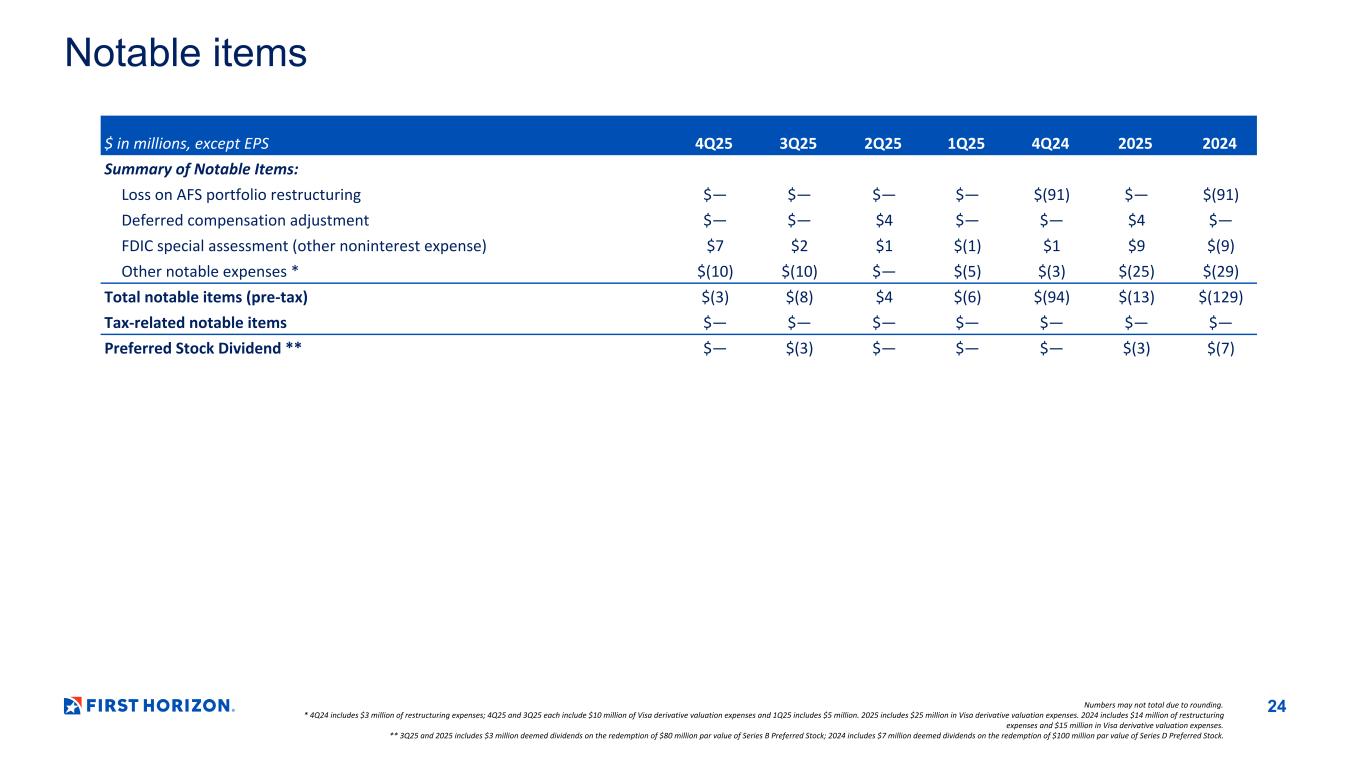

Notable items Numbers may not total due to rounding. * 4Q24 includes $3 million of restructuring expenses; 4Q25 and 3Q25 each include $10 million of Visa derivative valuation expenses and 1Q25 includes $5 million. 2025 includes $25 million in Visa derivative valuation expenses. 2024 includes $14 million of restructuring expenses and $15 million in Visa derivative valuation expenses. ** 3Q25 and 2025 includes $3 million deemed dividends on the redemption of $80 million par value of Series B Preferred Stock; 2024 includes $7 million deemed dividends on the redemption of $100 million par value of Series D Preferred Stock. $ in millions, except EPS 4Q25 3Q25 2Q25 1Q25 4Q24 2025 2024 Summary of Notable Items: Loss on AFS portfolio restructuring $— $— $— $— $(91) $— $(91) Deferred compensation adjustment $— $— $4 $— $— $4 $— FDIC special assessment (other noninterest expense) $7 $2 $1 $(1) $1 $9 $(9) Other notable expenses * $(10) $(10) $— $(5) $(3) $(25) $(29) Total notable items (pre-tax) $(3) $(8) $4 $(6) $(94) $(13) $(129) Tax-related notable items $— $— $— $— $— $— $— Preferred Stock Dividend ** $— $(3) $— $— $— $(3) $(7) 24

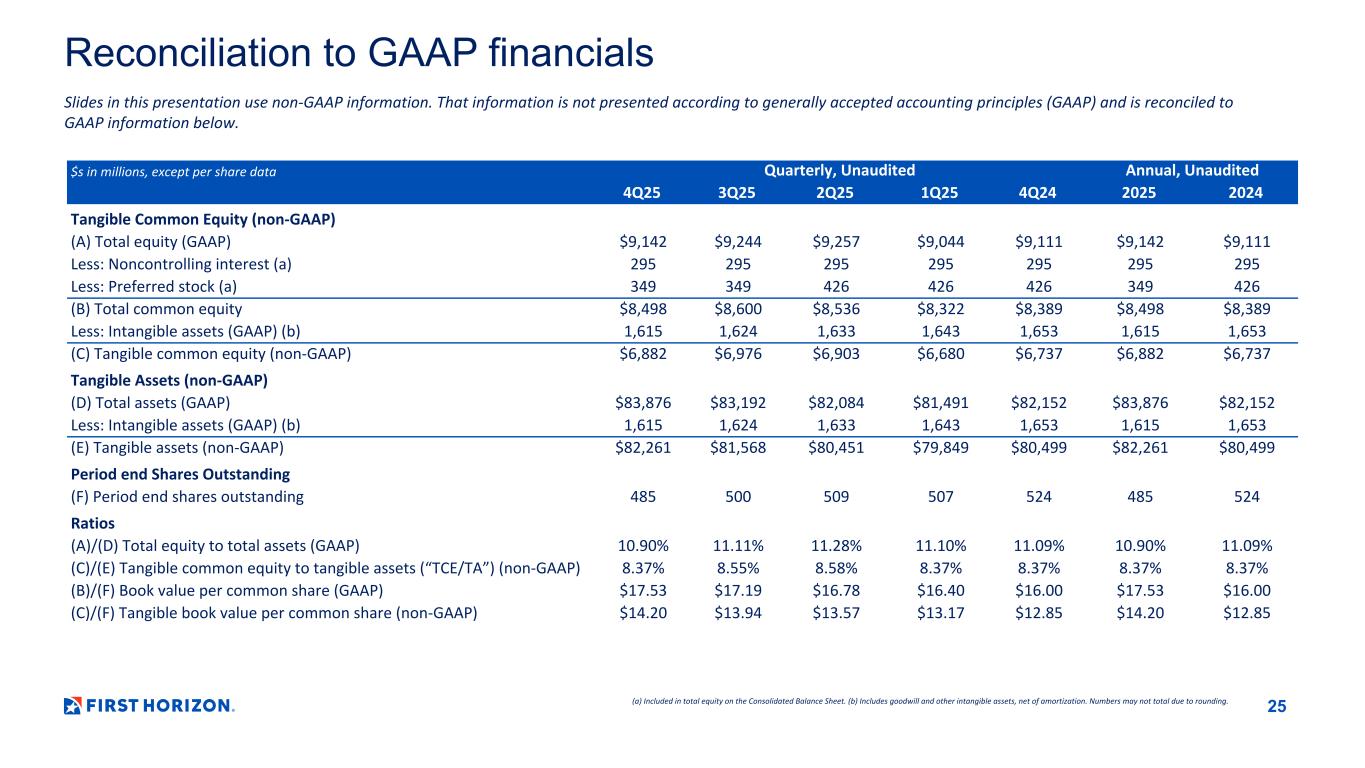

Reconciliation to GAAP financials Slides in this presentation use non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. (a) Included in total equity on the Consolidated Balance Sheet. (b) Includes goodwill and other intangible assets, net of amortization. Numbers may not total due to rounding. $s in millions, except per share data Quarterly, Unaudited Annual, Unaudited 4Q25 3Q25 2Q25 1Q25 4Q24 2025 2024 Tangible Common Equity (non-GAAP) (A) Total equity (GAAP) $9,142 $9,244 $9,257 $9,044 $9,111 $9,142 $9,111 Less: Noncontrolling interest (a) 295 295 295 295 295 295 295 Less: Preferred stock (a) 349 349 426 426 426 349 426 (B) Total common equity $8,498 $8,600 $8,536 $8,322 $8,389 $8,498 $8,389 Less: Intangible assets (GAAP) (b) 1,615 1,624 1,633 1,643 1,653 1,615 1,653 (C) Tangible common equity (non-GAAP) $6,882 $6,976 $6,903 $6,680 $6,737 $6,882 $6,737 Tangible Assets (non-GAAP) (D) Total assets (GAAP) $83,876 $83,192 $82,084 $81,491 $82,152 $83,876 $82,152 Less: Intangible assets (GAAP) (b) 1,615 1,624 1,633 1,643 1,653 1,615 1,653 (E) Tangible assets (non-GAAP) $82,261 $81,568 $80,451 $79,849 $80,499 $82,261 $80,499 Period end Shares Outstanding (F) Period end shares outstanding 485 500 509 507 524 485 524 Ratios (A)/(D) Total equity to total assets (GAAP) 10.90% 11.11% 11.28% 11.10% 11.09% 10.90% 11.09% (C)/(E) Tangible common equity to tangible assets (“TCE/TA”) (non-GAAP) 8.37% 8.55% 8.58% 8.37% 8.37% 8.37% 8.37% (B)/(F) Book value per common share (GAAP) $17.53 $17.19 $16.78 $16.40 $16.00 $17.53 $16.00 (C)/(F) Tangible book value per common share (non-GAAP) $14.20 $13.94 $13.57 $13.17 $12.85 $14.20 $12.85 25

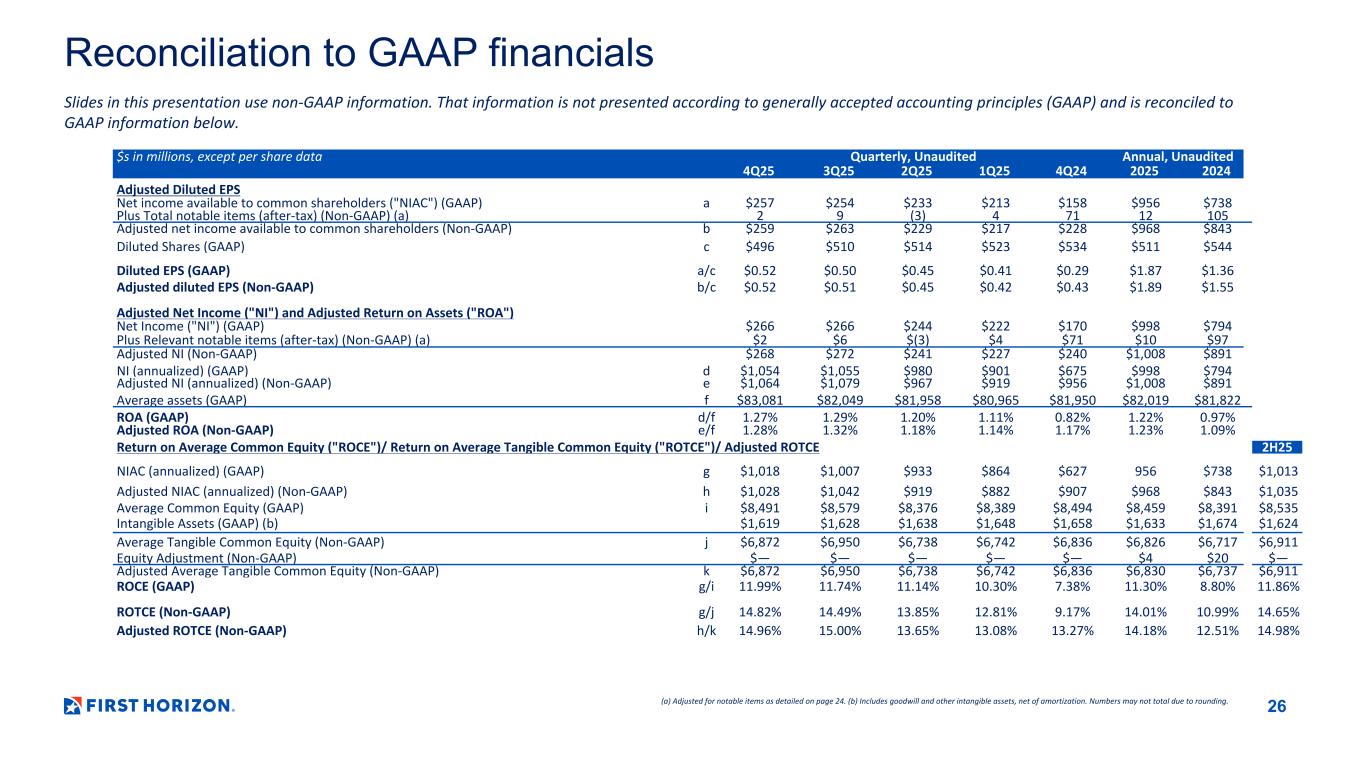

$s in millions, except per share data Quarterly, Unaudited Annual, Unaudited 4Q25 3Q25 2Q25 1Q25 4Q24 2025 2024 Adjusted Diluted EPS Net income available to common shareholders ("NIAC") (GAAP) a $257 $254 $233 $213 $158 $956 $738 Plus Total notable items (after-tax) (Non-GAAP) (a) 2 9 (3) 4 71 12 105 Adjusted net income available to common shareholders (Non-GAAP) b $259 $263 $229 $217 $228 $968 $843 Diluted Shares (GAAP) c $496 $510 $514 $523 $534 $511 $544 Diluted EPS (GAAP) a/c $0.52 $0.50 $0.45 $0.41 $0.29 $1.87 $1.36 Adjusted diluted EPS (Non-GAAP) b/c $0.52 $0.51 $0.45 $0.42 $0.43 $1.89 $1.55 Adjusted Net Income ("NI") and Adjusted Return on Assets ("ROA") Net Income ("NI") (GAAP) $266 $266 $244 $222 $170 $998 $794 Plus Relevant notable items (after-tax) (Non-GAAP) (a) $2 $6 $(3) $4 $71 $10 $97 Adjusted NI (Non-GAAP) $268 $272 $241 $227 $240 $1,008 $891 NI (annualized) (GAAP) d $1,054 $1,055 $980 $901 $675 $998 $794 Adjusted NI (annualized) (Non-GAAP) e $1,064 $1,079 $967 $919 $956 $1,008 $891 Average assets (GAAP) f $83,081 $82,049 $81,958 $80,965 $81,950 $82,019 $81,822 ROA (GAAP) d/f 1.27% 1.29% 1.20% 1.11% 0.82% 1.22% 0.97% Adjusted ROA (Non-GAAP) e/f 1.28% 1.32% 1.18% 1.14% 1.17% 1.23% 1.09% Return on Average Common Equity ("ROCE")/ Return on Average Tangible Common Equity ("ROTCE")/ Adjusted ROTCE 2H25 NIAC (annualized) (GAAP) g $1,018 $1,007 $933 $864 $627 956 $738 $1,013 Adjusted NIAC (annualized) (Non-GAAP) h $1,028 $1,042 $919 $882 $907 $968 $843 $1,035 Average Common Equity (GAAP) i $8,491 $8,579 $8,376 $8,389 $8,494 $8,459 $8,391 $8,535 Intangible Assets (GAAP) (b) $1,619 $1,628 $1,638 $1,648 $1,658 $1,633 $1,674 $1,624 Average Tangible Common Equity (Non-GAAP) j $6,872 $6,950 $6,738 $6,742 $6,836 $6,826 $6,717 $6,911 Equity Adjustment (Non-GAAP) $— $— $— $— $— $4 $20 $— Adjusted Average Tangible Common Equity (Non-GAAP) k $6,872 $6,950 $6,738 $6,742 $6,836 $6,830 $6,737 $6,911 ROCE (GAAP) g/i 11.99% 11.74% 11.14% 10.30% 7.38% 11.30% 8.80% 11.86% ROTCE (Non-GAAP) g/j 14.82% 14.49% 13.85% 12.81% 9.17% 14.01% 10.99% 14.65% Adjusted ROTCE (Non-GAAP) h/k 14.96% 15.00% 13.65% 13.08% 13.27% 14.18% 12.51% 14.98% (a) Adjusted for notable items as detailed on page 24. (b) Includes goodwill and other intangible assets, net of amortization. Numbers may not total due to rounding. 26 Reconciliation to GAAP financials Slides in this presentation use non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below.

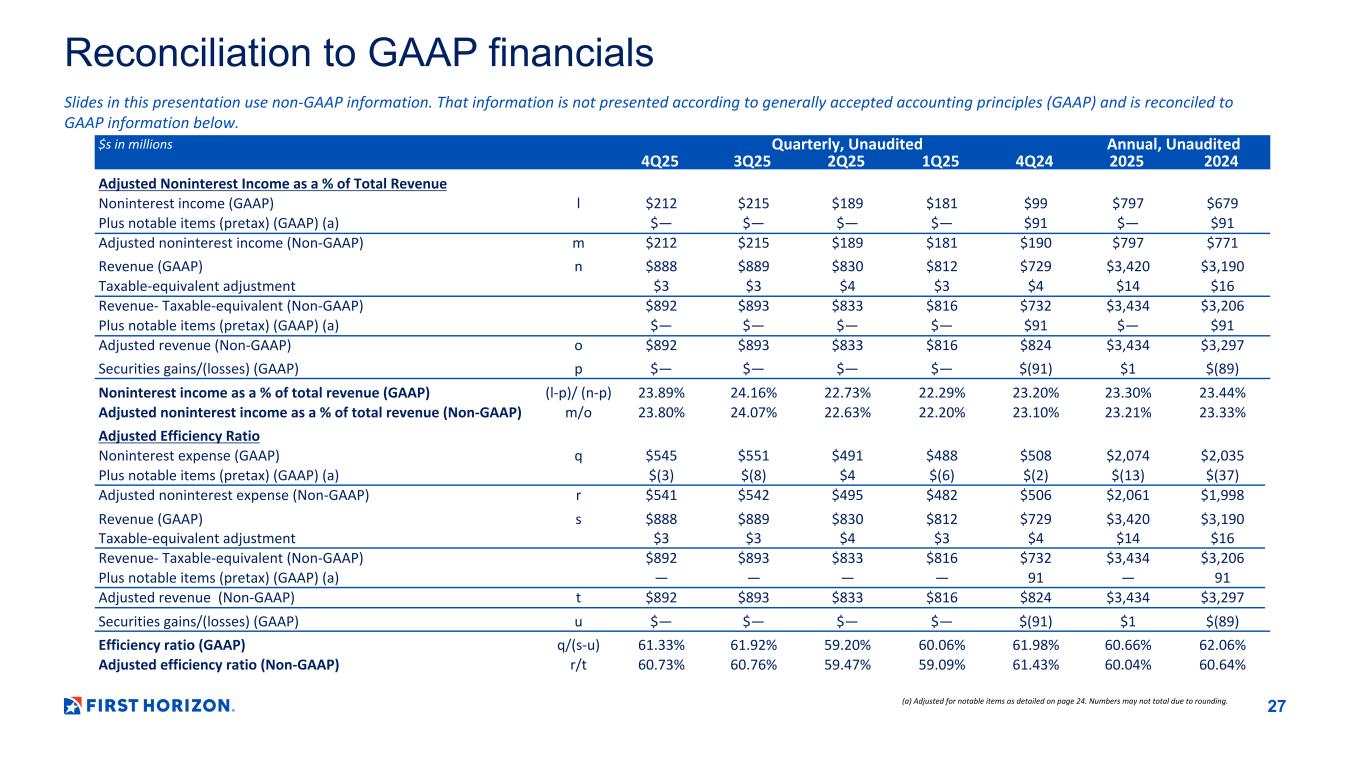

$s in millions Quarterly, Unaudited Annual, Unaudited 4Q25 3Q25 2Q25 1Q25 4Q24 2025 2024 Adjusted Noninterest Income as a % of Total Revenue Noninterest income (GAAP) l $212 $215 $189 $181 $99 $797 $679 Plus notable items (pretax) (GAAP) (a) $— $— $— $— $91 $— $91 Adjusted noninterest income (Non-GAAP) m $212 $215 $189 $181 $190 $797 $771 Revenue (GAAP) n $888 $889 $830 $812 $729 $3,420 $3,190 Taxable-equivalent adjustment $3 $3 $4 $3 $4 $14 $16 Revenue- Taxable-equivalent (Non-GAAP) $892 $893 $833 $816 $732 $3,434 $3,206 Plus notable items (pretax) (GAAP) (a) $— $— $— $— $91 $— $91 Adjusted revenue (Non-GAAP) o $892 $893 $833 $816 $824 $3,434 $3,297 Securities gains/(losses) (GAAP) p $— $— $— $— $(91) $1 $(89) Noninterest income as a % of total revenue (GAAP) (l-p)/ (n-p) 23.89% 24.16% 22.73% 22.29% 23.20% 23.30% 23.44% Adjusted noninterest income as a % of total revenue (Non-GAAP) m/o 23.80% 24.07% 22.63% 22.20% 23.10% 23.21% 23.33% Adjusted Efficiency Ratio Noninterest expense (GAAP) q $545 $551 $491 $488 $508 $2,074 $2,035 Plus notable items (pretax) (GAAP) (a) $(3) $(8) $4 $(6) $(2) $(13) $(37) Adjusted noninterest expense (Non-GAAP) r $541 $542 $495 $482 $506 $2,061 $1,998 Revenue (GAAP) s $888 $889 $830 $812 $729 $3,420 $3,190 Taxable-equivalent adjustment $3 $3 $4 $3 $4 $14 $16 Revenue- Taxable-equivalent (Non-GAAP) $892 $893 $833 $816 $732 $3,434 $3,206 Plus notable items (pretax) (GAAP) (a) — — — — 91 — 91 Adjusted revenue (Non-GAAP) t $892 $893 $833 $816 $824 $3,434 $3,297 Securities gains/(losses) (GAAP) u $— $— $— $— $(91) $1 $(89) Efficiency ratio (GAAP) q/(s-u) 61.33% 61.92% 59.20% 60.06% 61.98% 60.66% 62.06% Adjusted efficiency ratio (Non-GAAP) r/t 60.73% 60.76% 59.47% 59.09% 61.43% 60.04% 60.64% (a) Adjusted for notable items as detailed on page 24. Numbers may not total due to rounding. 27 Reconciliation to GAAP financials Slides in this presentation use non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below.

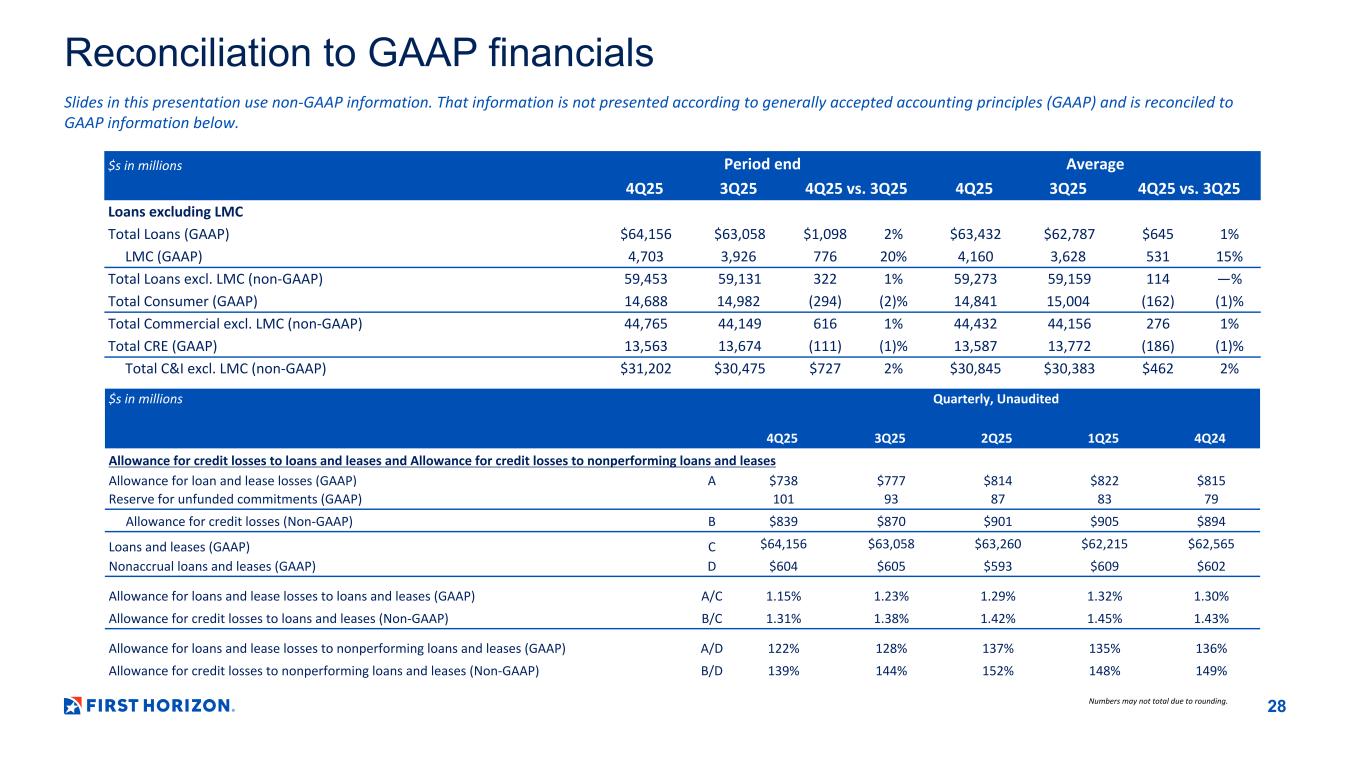

$s in millions Period end Average 4Q25 3Q25 4Q25 vs. 3Q25 4Q25 3Q25 4Q25 vs. 3Q25 Loans excluding LMC Total Loans (GAAP) $64,156 $63,058 $1,098 2% $63,432 $62,787 $645 1% LMC (GAAP) 4,703 3,926 776 20% 4,160 3,628 531 15% Total Loans excl. LMC (non-GAAP) 59,453 59,131 322 1% 59,273 59,159 114 —% Total Consumer (GAAP) 14,688 14,982 (294) (2)% 14,841 15,004 (162) (1)% Total Commercial excl. LMC (non-GAAP) 44,765 44,149 616 1% 44,432 44,156 276 1% Total CRE (GAAP) 13,563 13,674 (111) (1)% 13,587 13,772 (186) (1)% Total C&I excl. LMC (non-GAAP) $31,202 $30,475 $727 2% $30,845 $30,383 $462 2% $s in millions Quarterly, Unaudited 4Q25 3Q25 2Q25 1Q25 4Q24 Allowance for credit losses to loans and leases and Allowance for credit losses to nonperforming loans and leases Allowance for loan and lease losses (GAAP) A $738 $777 $814 $822 $815 Reserve for unfunded commitments (GAAP) 101 93 87 83 79 Allowance for credit losses (Non-GAAP) B $839 $870 $901 $905 $894 Loans and leases (GAAP) C $64,156 $63,058 $63,260 $62,215 $62,565 Nonaccrual loans and leases (GAAP) D $604 $605 $593 $609 $602 Allowance for loans and lease losses to loans and leases (GAAP) A/C 1.15% 1.23% 1.29% 1.32% 1.30% Allowance for credit losses to loans and leases (Non-GAAP) B/C 1.31% 1.38% 1.42% 1.45% 1.43% Allowance for loans and lease losses to nonperforming loans and leases (GAAP) A/D 122% 128% 137% 135% 136% Allowance for credit losses to nonperforming loans and leases (Non-GAAP) B/D 139% 144% 152% 148% 149% Numbers may not total due to rounding. 28 Reconciliation to GAAP financials Slides in this presentation use non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below.

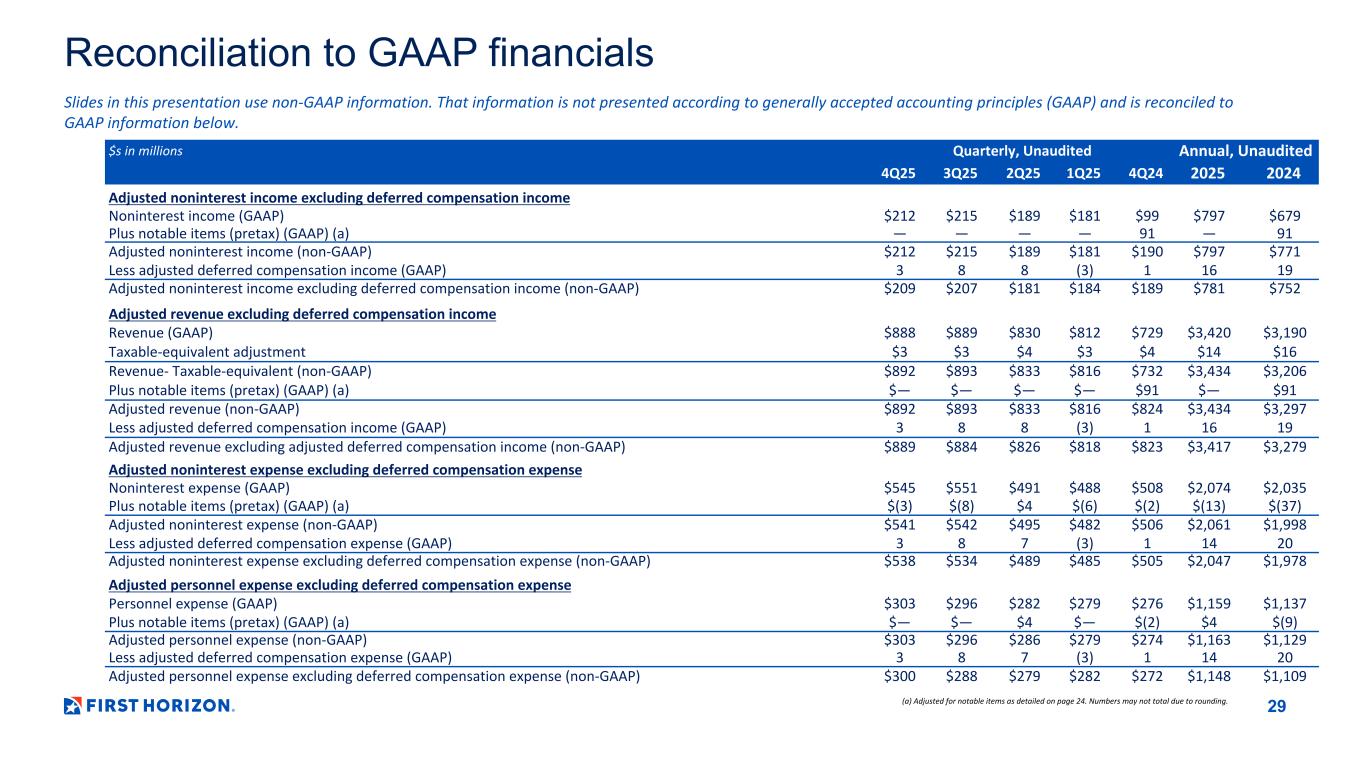

(a) Adjusted for notable items as detailed on page 24. Numbers may not total due to rounding. $s in millions Quarterly, Unaudited Annual, Unaudited 4Q25 3Q25 2Q25 1Q25 4Q24 2025 2024 Adjusted noninterest income excluding deferred compensation income Noninterest income (GAAP) $212 $215 $189 $181 $99 $797 $679 Plus notable items (pretax) (GAAP) (a) — — — — 91 — 91 Adjusted noninterest income (non-GAAP) $212 $215 $189 $181 $190 $797 $771 Less adjusted deferred compensation income (GAAP) 3 8 8 (3) 1 16 19 Adjusted noninterest income excluding deferred compensation income (non-GAAP) $209 $207 $181 $184 $189 $781 $752 Adjusted revenue excluding deferred compensation income Revenue (GAAP) $888 $889 $830 $812 $729 $3,420 $3,190 Taxable-equivalent adjustment $3 $3 $4 $3 $4 $14 $16 Revenue- Taxable-equivalent (non-GAAP) $892 $893 $833 $816 $732 $3,434 $3,206 Plus notable items (pretax) (GAAP) (a) $— $— $— $— $91 $— $91 Adjusted revenue (non-GAAP) $892 $893 $833 $816 $824 $3,434 $3,297 Less adjusted deferred compensation income (GAAP) 3 8 8 (3) 1 16 19 Adjusted revenue excluding adjusted deferred compensation income (non-GAAP) $889 $884 $826 $818 $823 $3,417 $3,279 Adjusted noninterest expense excluding deferred compensation expense Noninterest expense (GAAP) $545 $551 $491 $488 $508 $2,074 $2,035 Plus notable items (pretax) (GAAP) (a) $(3) $(8) $4 $(6) $(2) $(13) $(37) Adjusted noninterest expense (non-GAAP) $541 $542 $495 $482 $506 $2,061 $1,998 Less adjusted deferred compensation expense (GAAP) 3 8 7 (3) 1 14 20 Adjusted noninterest expense excluding deferred compensation expense (non-GAAP) $538 $534 $489 $485 $505 $2,047 $1,978 Adjusted personnel expense excluding deferred compensation expense Personnel expense (GAAP) $303 $296 $282 $279 $276 $1,159 $1,137 Plus notable items (pretax) (GAAP) (a) $— $— $4 $— $(2) $4 $(9) Adjusted personnel expense (non-GAAP) $303 $296 $286 $279 $274 $1,163 $1,129 Less adjusted deferred compensation expense (GAAP) 3 8 7 (3) 1 14 20 Adjusted personnel expense excluding deferred compensation expense (non-GAAP) $300 $288 $279 $282 $272 $1,148 $1,109 29 Reconciliation to GAAP financials Slides in this presentation use non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below.

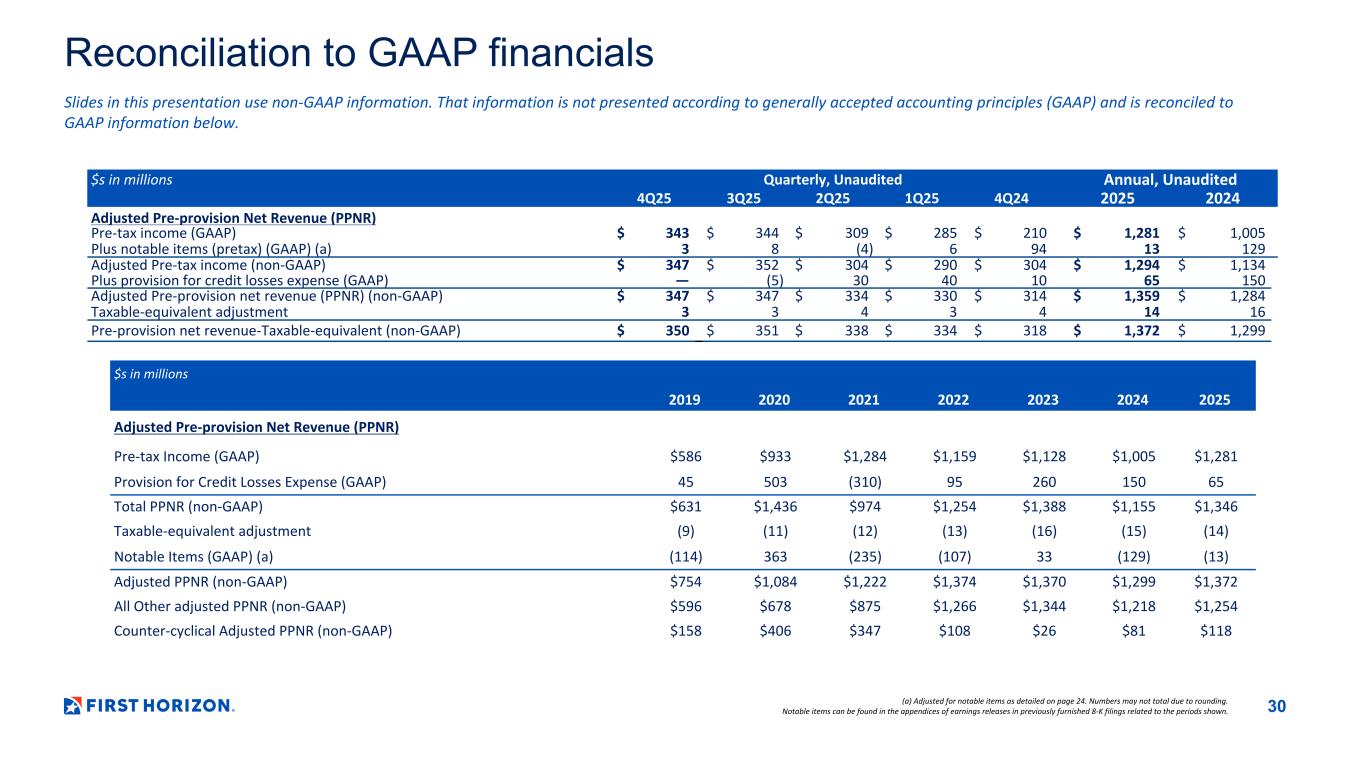

(a) Adjusted for notable items as detailed on page 24. Numbers may not total due to rounding. Notable items can be found in the appendices of earnings releases in previously furnished 8-K filings related to the periods shown. $s in millions Quarterly, Unaudited Annual, Unaudited 4Q25 3Q25 2Q25 1Q25 4Q24 2025 2024 Adjusted Pre-provision Net Revenue (PPNR) Pre-tax income (GAAP) $ 343 $ 344 $ 309 $ 285 $ 210 $ 1,281 $ 1,005 Plus notable items (pretax) (GAAP) (a) 3 8 (4) 6 94 13 129 Adjusted Pre-tax income (non-GAAP) $ 347 $ 352 $ 304 $ 290 $ 304 $ 1,294 $ 1,134 Plus provision for credit losses expense (GAAP) — (5) 30 40 10 65 150 Adjusted Pre-provision net revenue (PPNR) (non-GAAP) $ 347 $ 347 $ 334 $ 330 $ 314 $ 1,359 $ 1,284 Taxable-equivalent adjustment 3 3 4 3 4 14 16 Pre-provision net revenue-Taxable-equivalent (non-GAAP) $ 350 $ 351 $ 338 $ 334 $ 318 $ 1,372 $ 1,299 $s in millions 2024 20252019 2020 2021 2022 2023 Adjusted Pre-provision Net Revenue (PPNR) Pre-tax Income (GAAP) $586 $933 $1,284 $1,159 $1,128 $1,005 $1,281 Provision for Credit Losses Expense (GAAP) 45 503 (310) 95 260 150 65 Total PPNR (non-GAAP) $631 $1,436 $974 $1,254 $1,388 $1,155 $1,346 Taxable-equivalent adjustment (9) (11) (12) (13) (16) (15) (14) Notable Items (GAAP) (a) (114) 363 (235) (107) 33 (129) (13) Adjusted PPNR (non-GAAP) $754 $1,084 $1,222 $1,374 $1,370 $1,299 $1,372 All Other adjusted PPNR (non-GAAP) $596 $678 $875 $1,266 $1,344 $1,218 $1,254 Counter-cyclical Adjusted PPNR (non-GAAP) $158 $406 $347 $108 $26 $81 $118 30 Reconciliation to GAAP financials Slides in this presentation use non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below.