Innovation. Engagement. Performance.

Innovation. Engagement. Performance. 2 Cautionary Statement Regarding Forward-Looking Information This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that do not relate to historical facts and that are based on current assumptions, beliefs, estimates, expectations and projections, many of which, by their nature, are inherently uncertain and beyond our control. Forward-looking statements may relate to various matters, including our financial condition, results of operations, plans, objectives, future performance, business or industry, and usually can be identified by the use of forward-looking words, such as “anticipates,” “assumes,” “believes,” “can,” “continues,” “could,” ”enable,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “likely,” “may,” “might,” “objective,” “plans,” “positioned,” “potential,” “projects,” “remains,” “should,” “target,” “trend,” “will,” “would,” or similar words or expressions or variations thereof, and the negative thereof, but these terms are not the exclusive means of identifying such statements. You should not place undue reliance on forward-looking statements, as they are subject to risks and uncertainties, including, but not limited to, those described below. When considering these forward- looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. There are various important factors that could cause future results to differ materially from historical performance and any forward-looking statements. Factors that might cause such differences, include, but are not limited to: • the credit risk associated with the substantial amount of commercial loans and leases in our loan portfolio; • the volatility of the mortgage banking business; • changes in market interest rates, the U.S. federal government shutdown and the unpredictability of monetary, tax and other policies of government agencies, including tariffs or the imposition of new tariffs, trade wars, barriers or restrictions, or threats of such actions; • the impact of changes in interest rates on the value of our investment securities portfolios; • changes in our ability to obtain liquidity as and when needed to fund our obligations as they come due, including as a result of adverse changes to our credit ratings; • the risk associated with uninsured deposit account balances; • regulatory limits on our ability to receive dividends from our subsidiaries and pay dividends to our shareholders; • our ability to recruit and retain qualified banking professionals; • the financial soundness of other financial institutions and the impact of volatility in the banking sector on us; • changes and instability in economic conditions and financial markets, in the regions in which we operate or otherwise, including a contraction of economic activity, economic downturn or uncertainty and international conflict; • our ability to continue to invest in technological improvements as they become appropriate or necessary; • any interruption in or breach in security of our information systems, or other cybersecurity risks; • risks associated with reliance on third-party vendors and artificial intelligence; • risks associated with the use of models, estimations and assumptions in our business; • the effects of adverse weather events and public health emergencies; • the risks associated with acquiring other banks and financial services businesses, including integration into our existing operations; • the extensive federal and state regulations, supervision and examination governing almost every aspect of our operations, and potential expenses associated with complying with such regulations; • our ability to comply with the consent orders entered into by First National Bank of Pennsylvania with the Department of Justice and the North Carolina State Department of Justice, and related costs and potential reputational harm; • changes in federal, state or local tax rules and regulations or interpretations, or accounting policies, standards and interpretations; • the effects of climate change and related legislative and regulatory initiatives; and • any reputation, credit, interest rate, market, operational, litigation, legal, liquidity, regulatory and compliance risk resulting from developments related to any of the risks discussed above. FNB cautions that the risks identified here are not exhaustive of the types of risks that may adversely impact FNB and actual results may differ materially from those expressed or implied as a result of these risks and uncertainties, including, but not limited to, the risk factors and other uncertainties described under Item 1A. Risk Factors and the Risk Management sections of our 2024 Annual Report on Form 10-K (including the MD&A section), our subsequent 2025 Quarterly Reports on Form 10-Q (including the risk factors and risk management discussions) and our other 2025 filings with the Securities and Exchange Commission (SEC), which are available on our corporate website at https://www.fnb-online.com/about-us/investor- information/reports-and-filings or the SEC’s website at www.sec.gov. We have included our web address as an inactive textual reference only. Information on our website is not part of our SEC filings. You should treat forward-looking statements as speaking only as of the date they are made and based only on information then actually known to FNB. FNB does not undertake, and specifically disclaim any obligation to update or revise any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

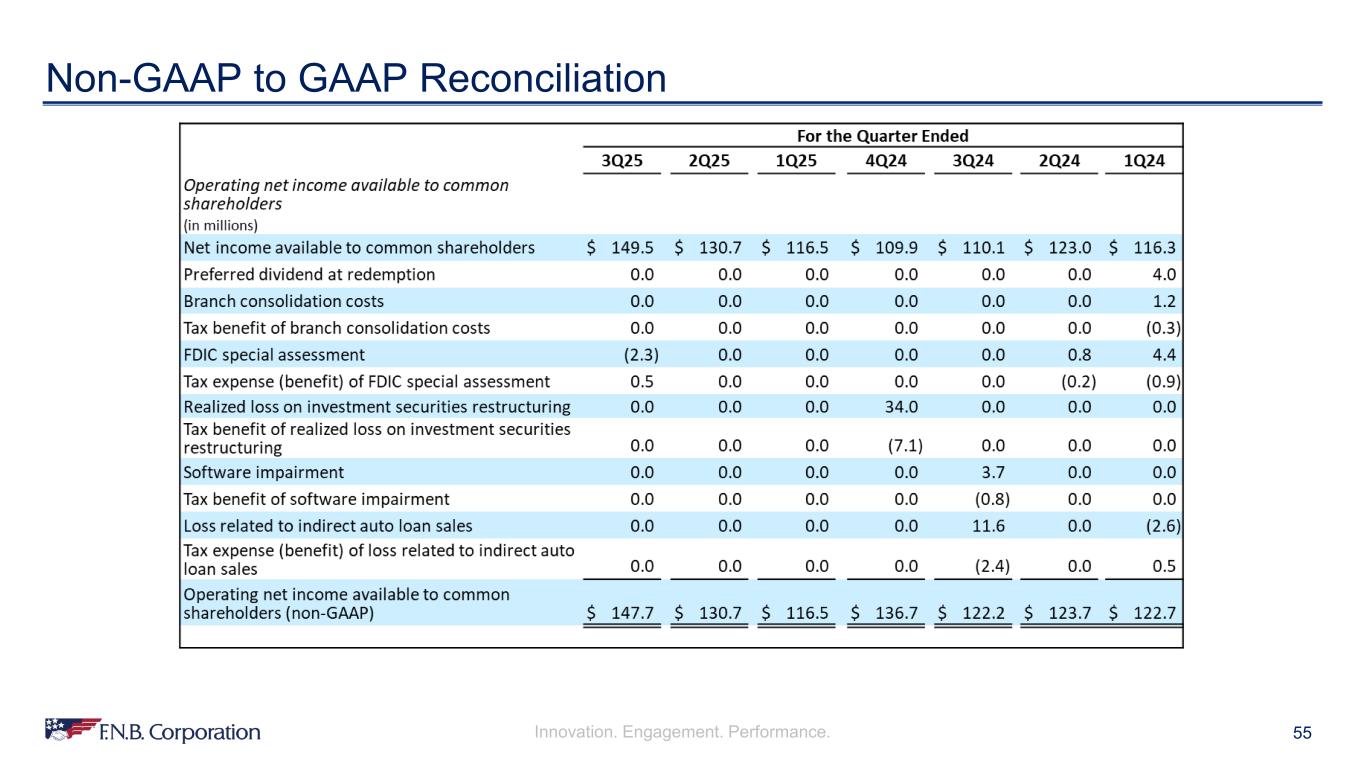

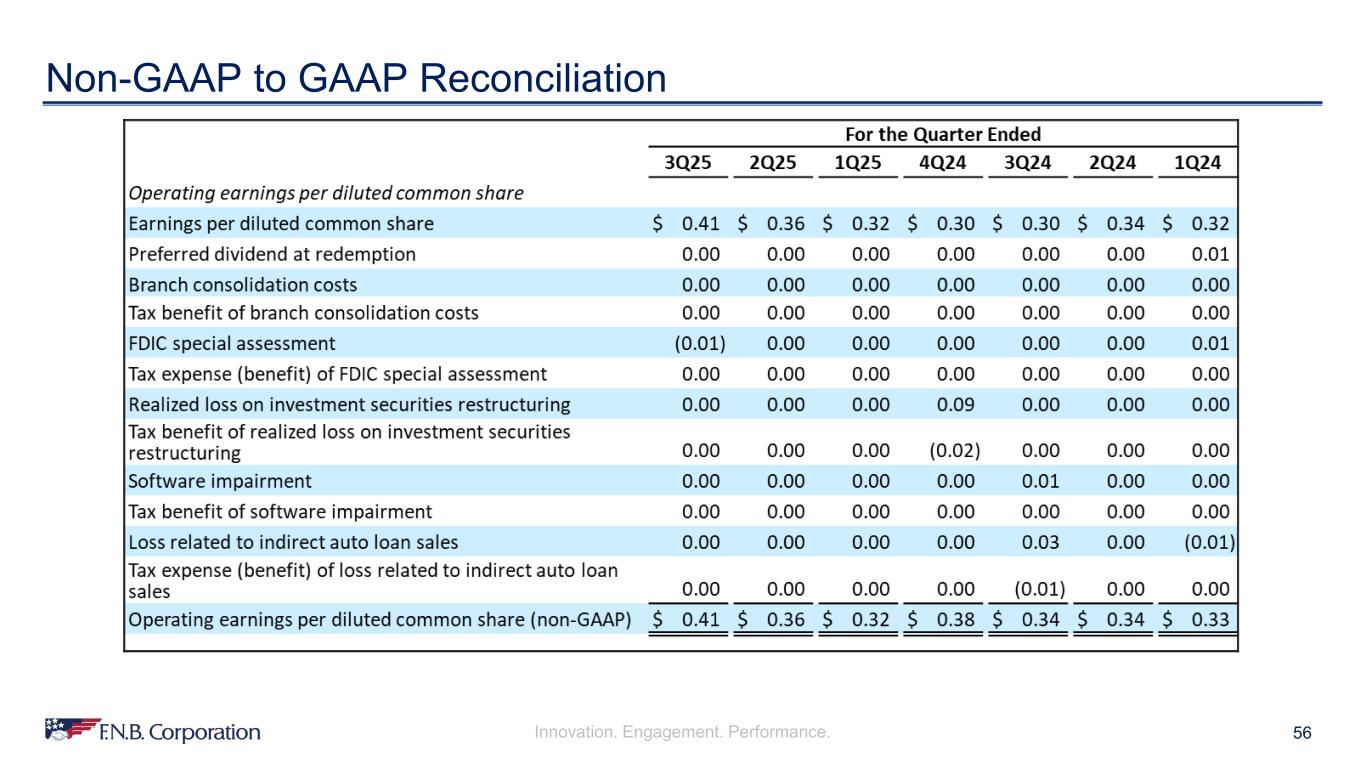

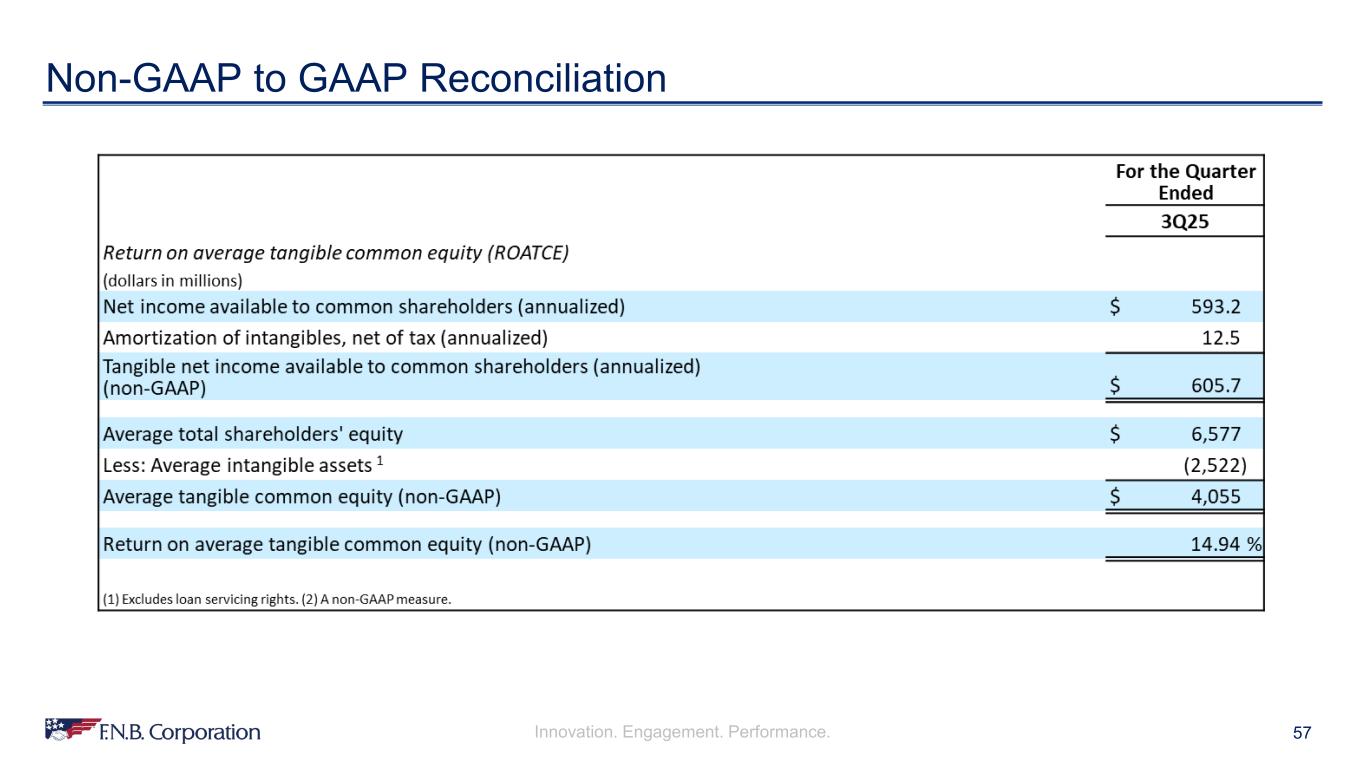

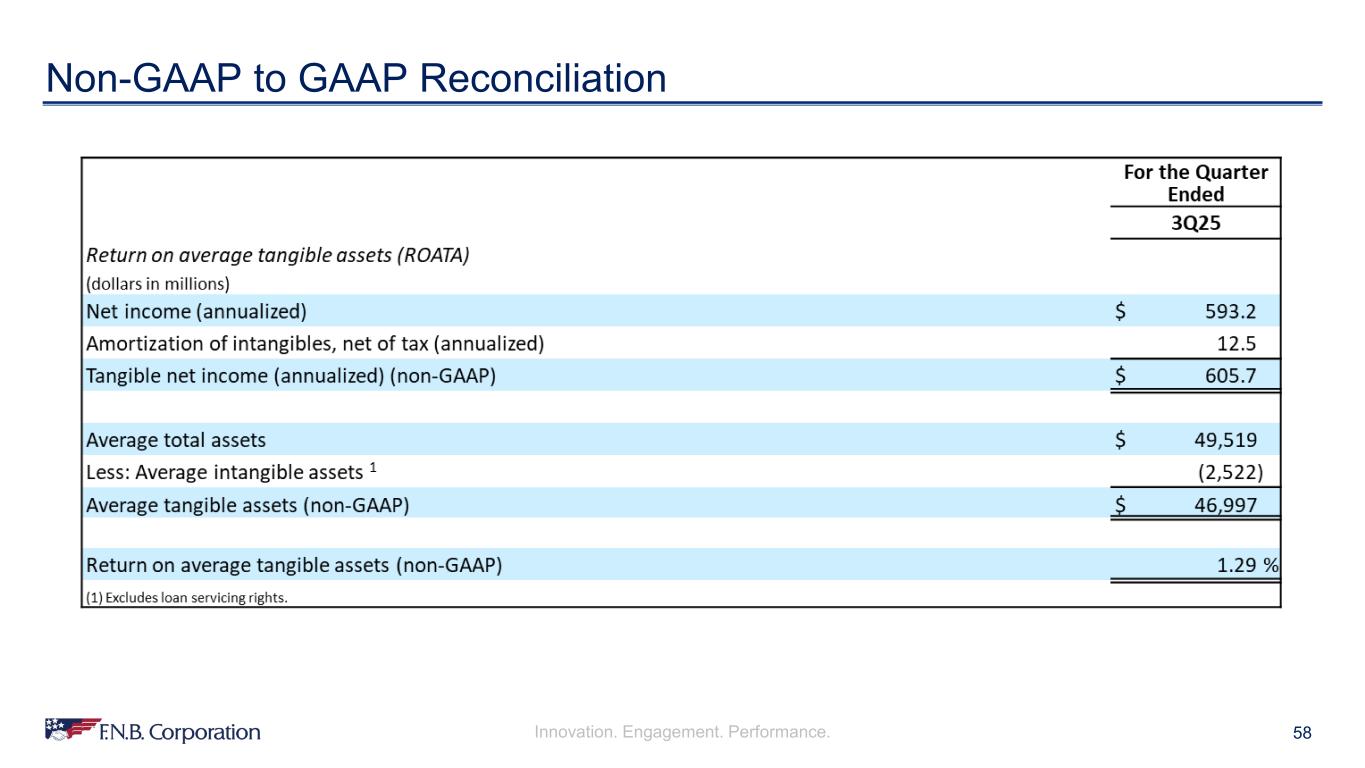

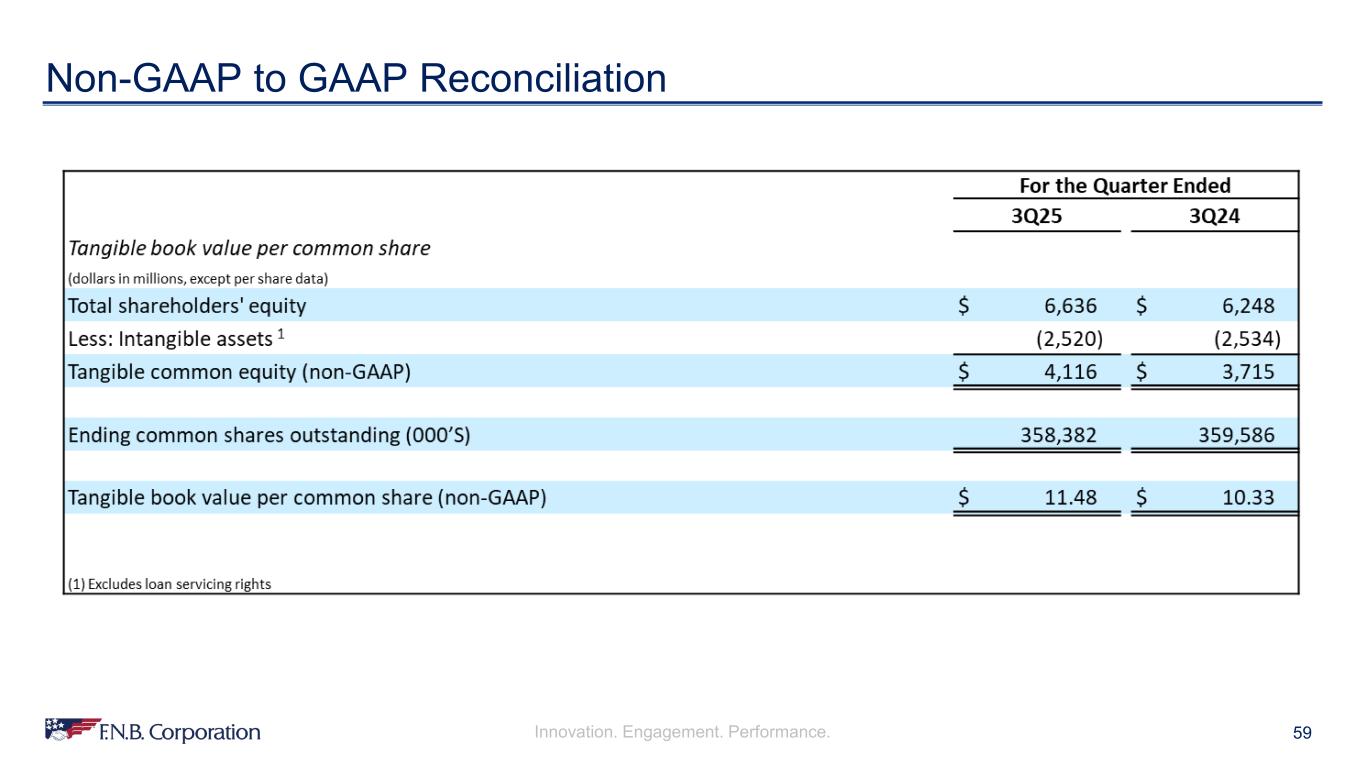

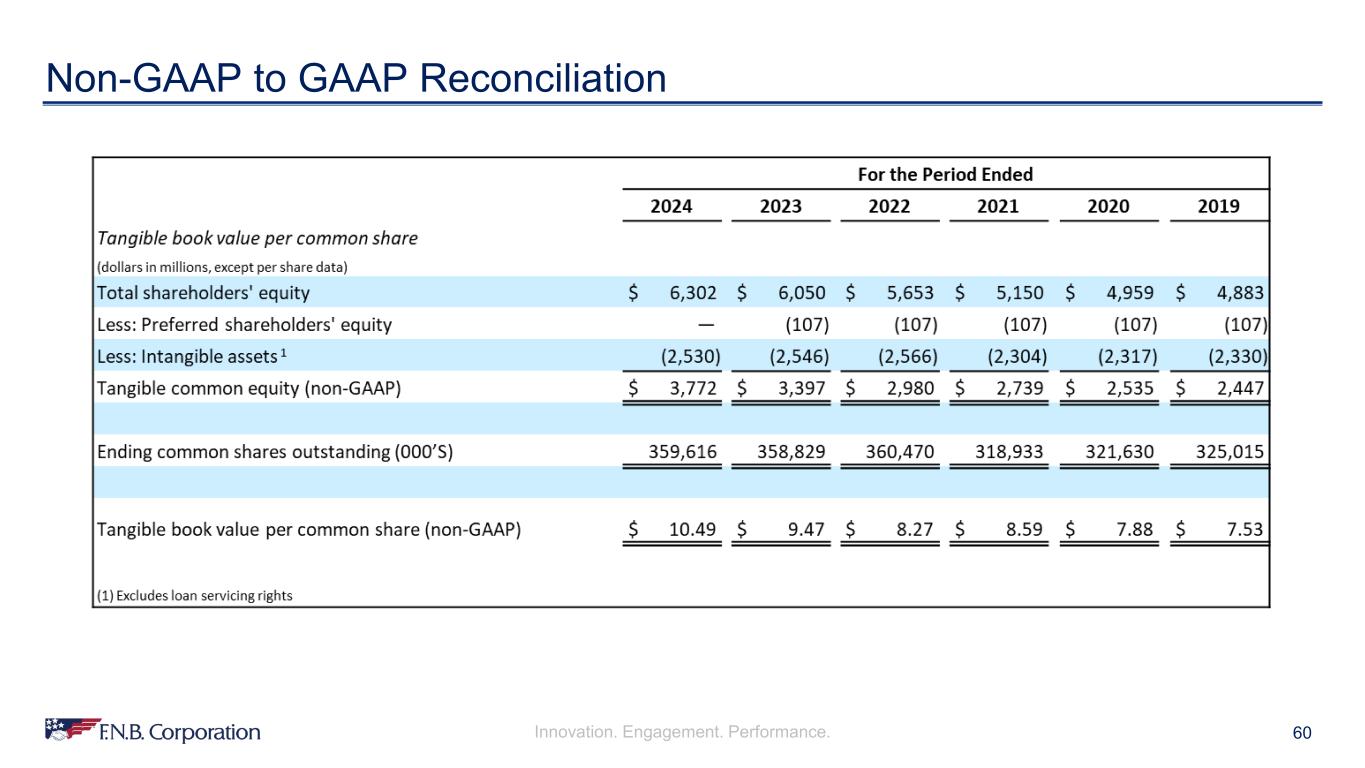

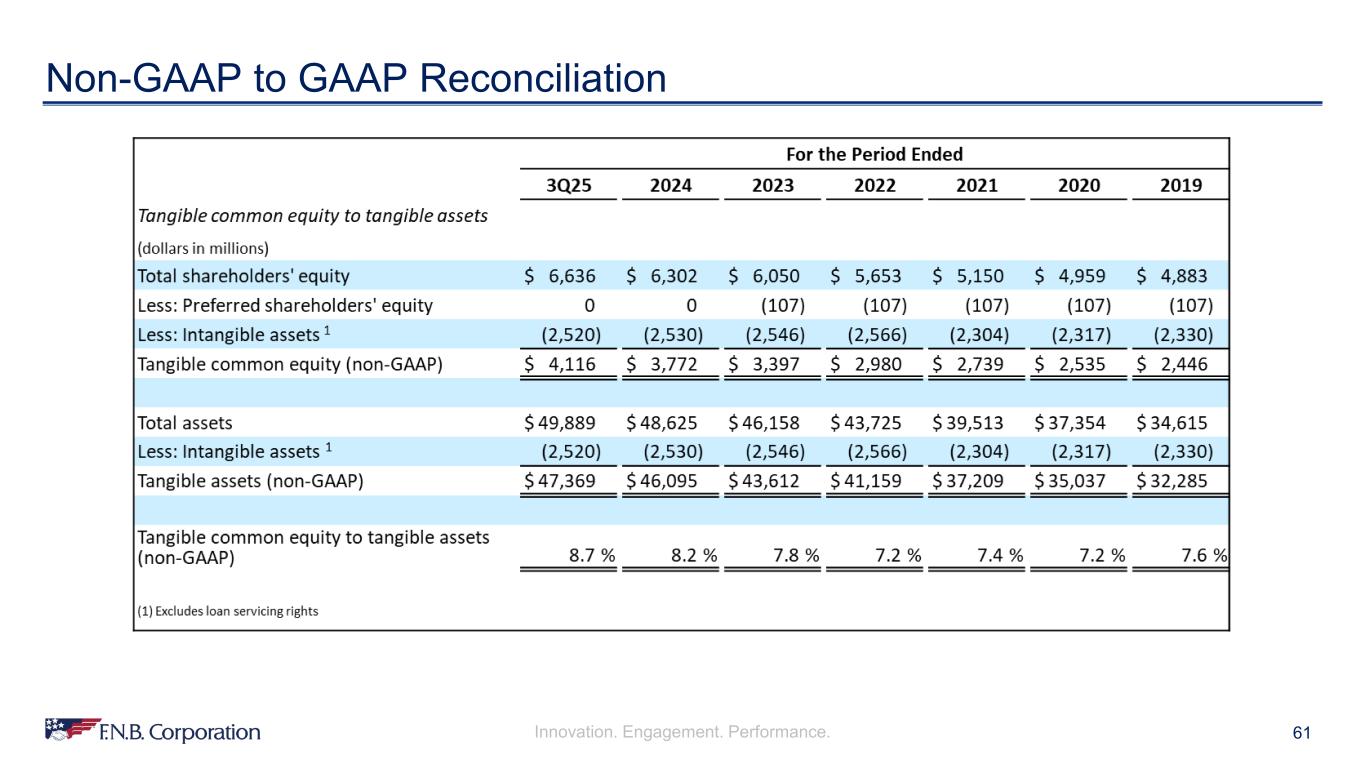

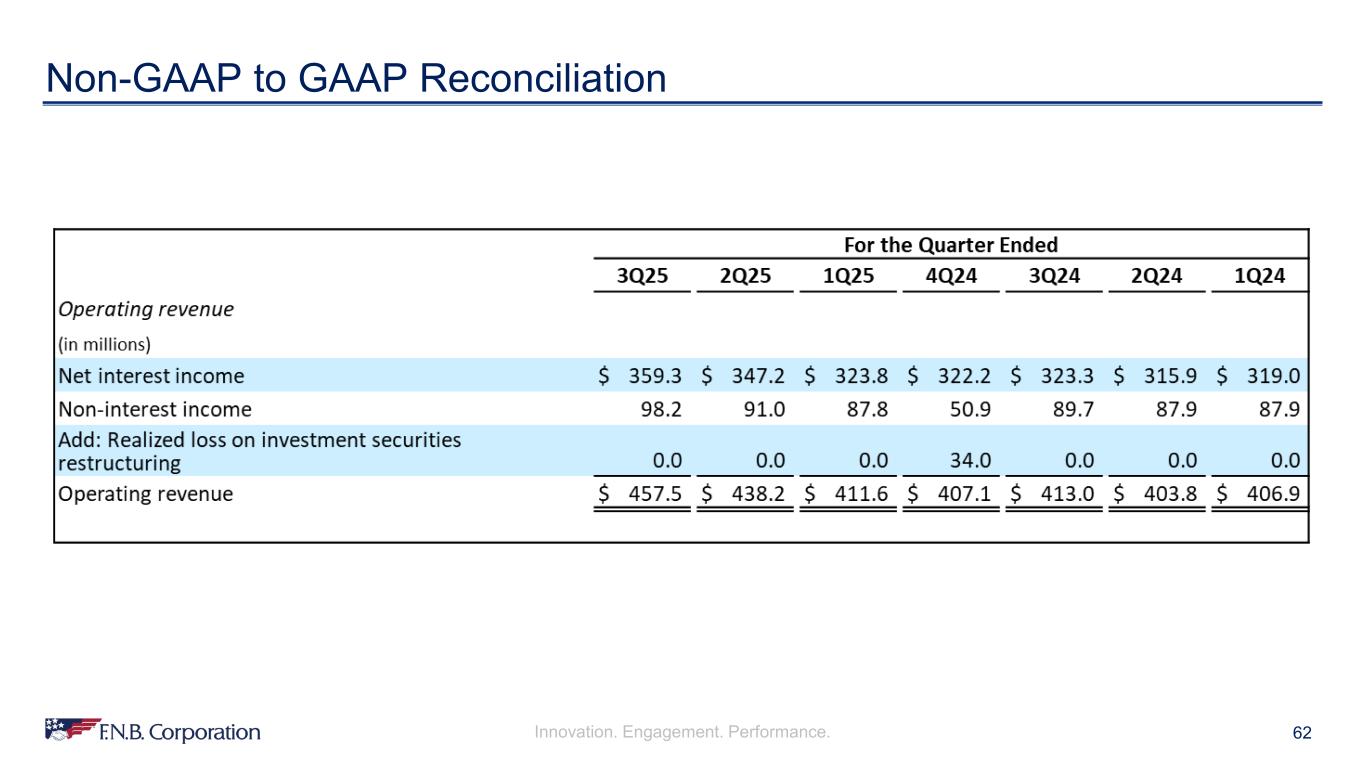

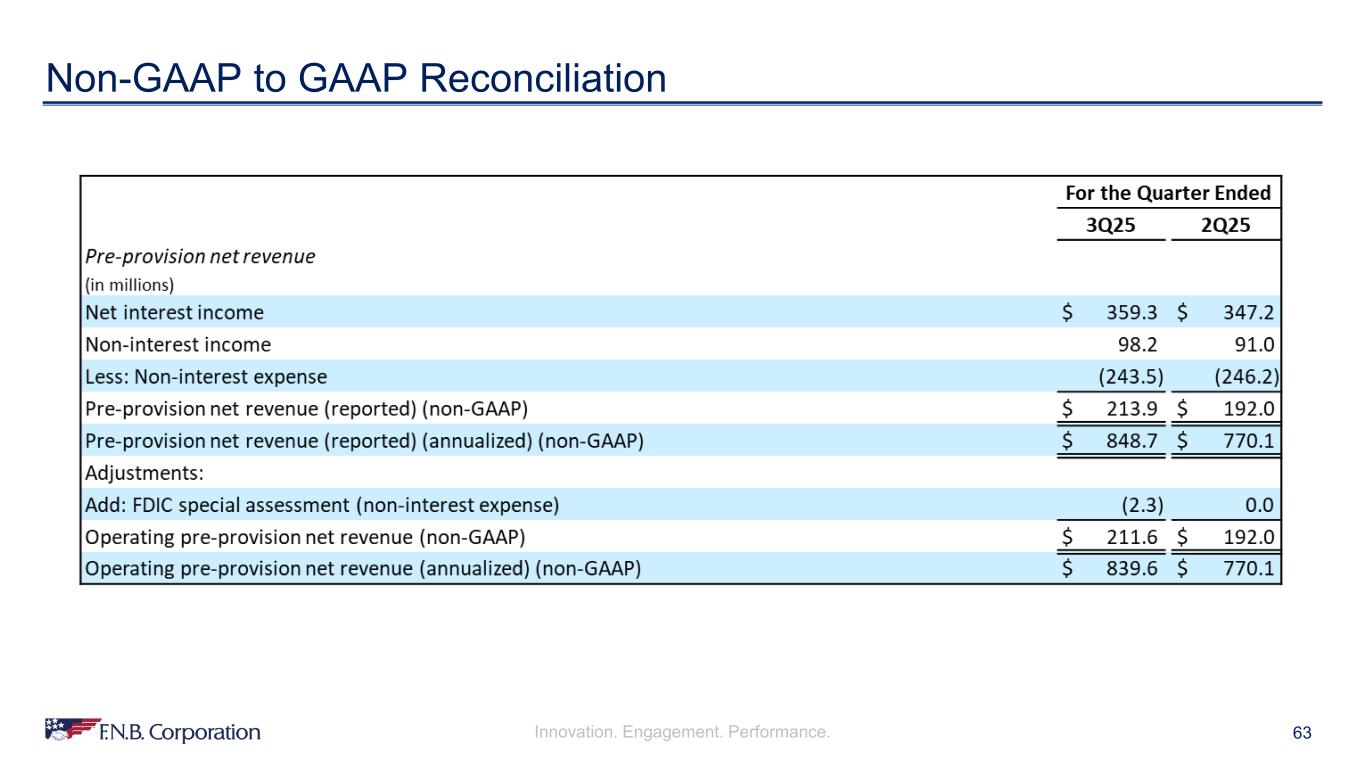

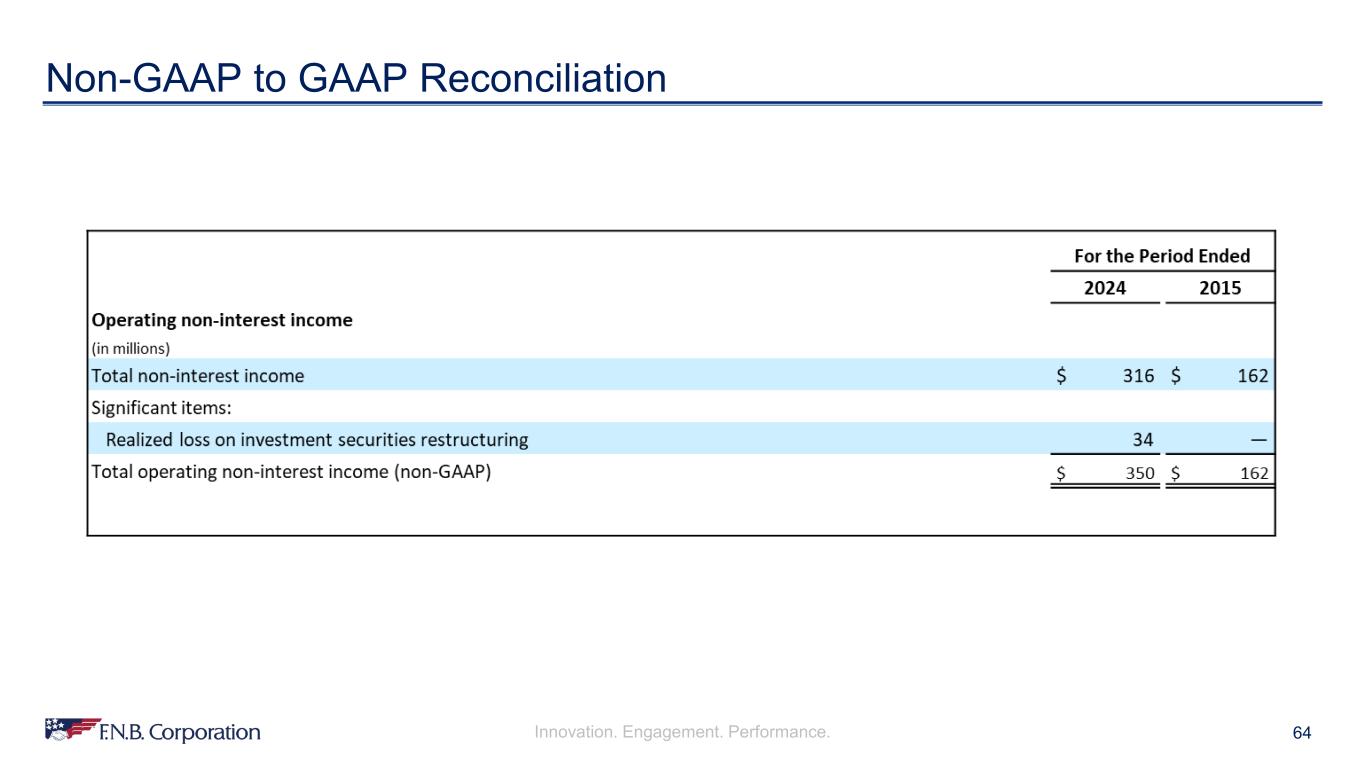

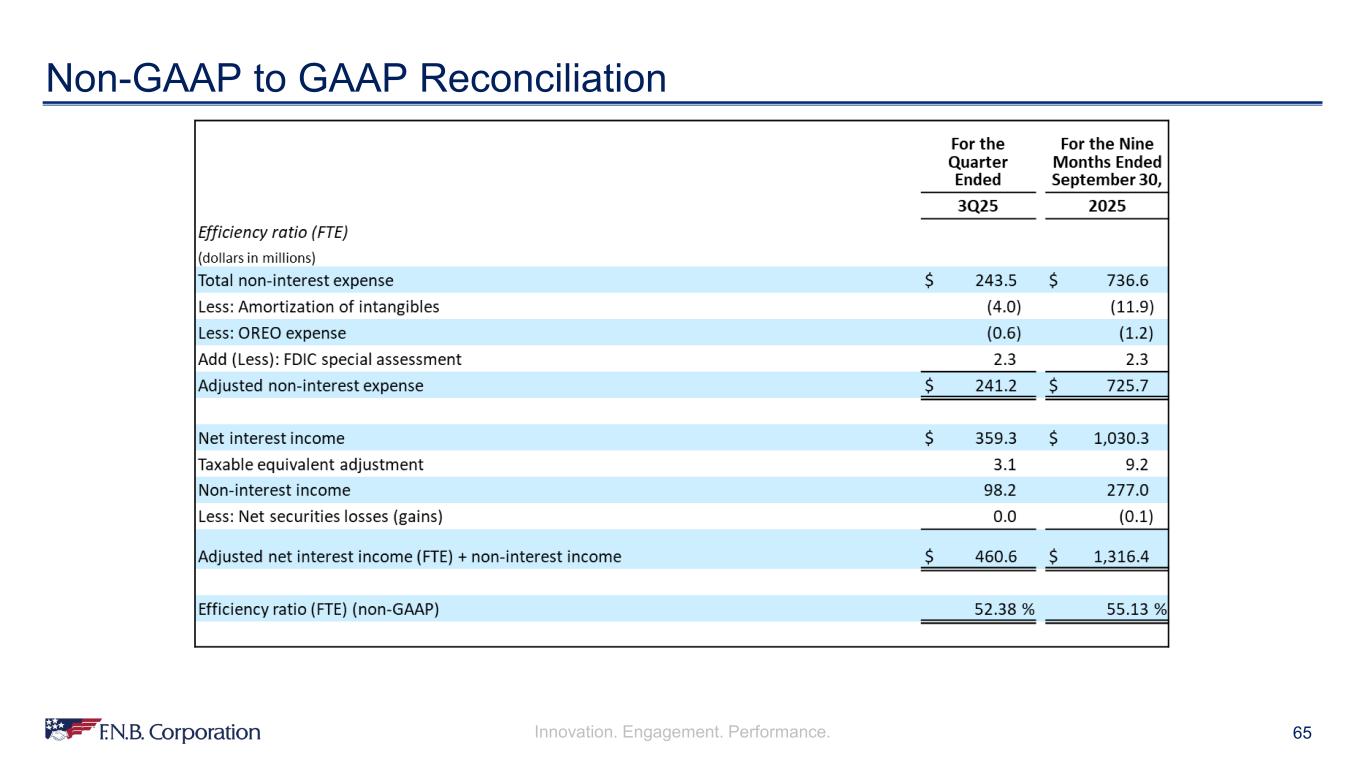

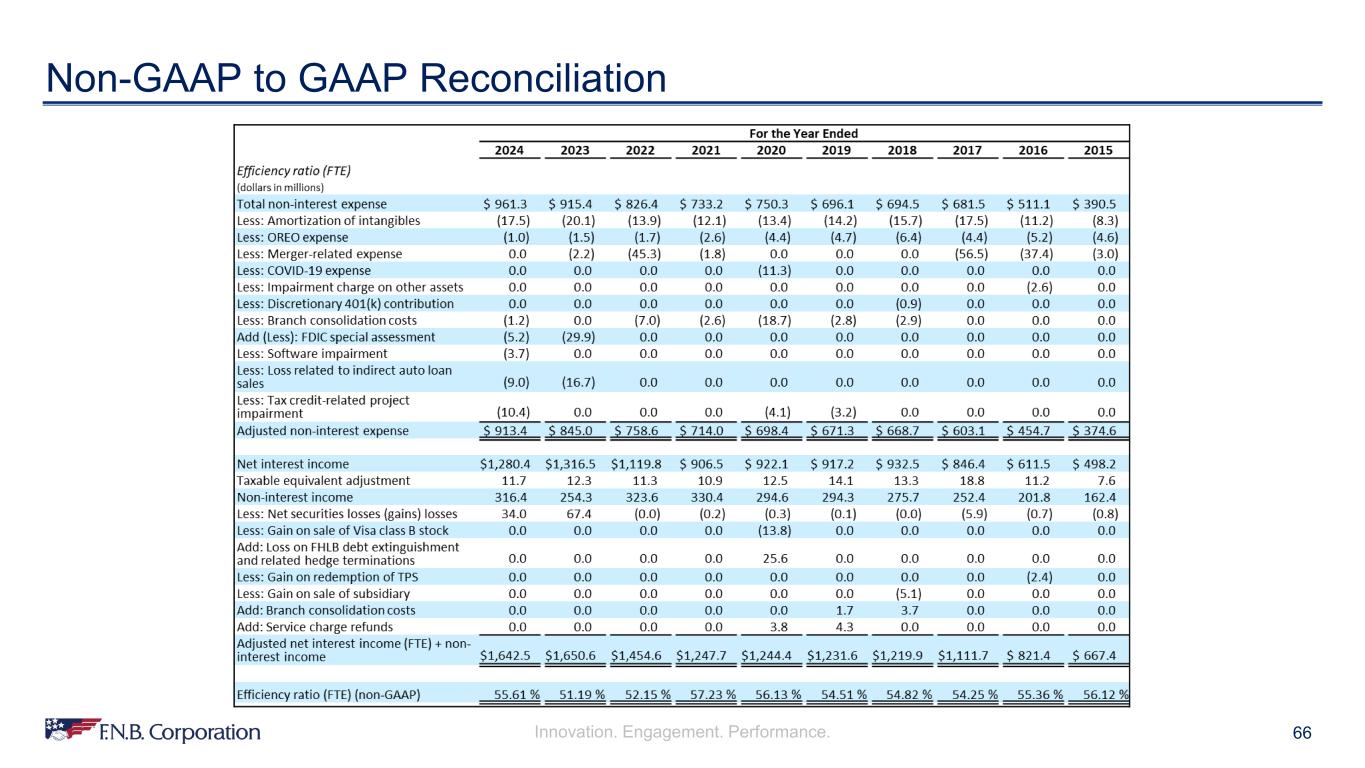

Innovation. Engagement. Performance. 3 Use of Non-GAAP Financial Measures and Key Performance Indicators To supplement our Consolidated Financial Statements presented in accordance with GAAP, we use certain non-GAAP financial measures, such as operating net income available to common shareholders, operating earnings per diluted common share, return on average tangible equity, return on average tangible common equity, return on average tangible assets, tangible book value per common share, the ratio of tangible common equity to tangible assets, pre-provision net revenue (reported), operating pre-provision net revenue, efficiency ratio, operating revenue, operating non-interest income and net interest margin (FTE) to provide information useful to investors in understanding our operating performance and trends, and to facilitate comparisons with the performance of our peers. Management uses these measures internally to assess and better understand our underlying business performance and trends related to core business activities. The non-GAAP financial measures and key performance indicators we use may differ from the non-GAAP financial measures and key performance indicators other financial institutions use to assess their performance and trends. These non-GAAP financial measures should be viewed as supplemental in nature, and not as a substitute for, or superior to, our reported results prepared in accordance with GAAP. Reconciliations of non-GAAP operating measures to the most directly comparable GAAP financial measures are included in the appendix to this presentation. Management believes certain items (e.g., FDIC special assessment) are not organic to running our operations and facilities. These items are considered significant items impacting earnings as they are deemed to be outside of ordinary banking activities. These costs are specific to each individual transaction and may vary significantly based on the size and complexity of the transaction. To facilitate peer comparisons of net interest margin and efficiency ratio, we use net interest income on a taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets (loans and investments) to make it fully equivalent to interest income earned on taxable investments (this adjustment is not permitted under GAAP). Taxable-equivalent amounts for 2025 and 2024 were calculated using a federal statutory income tax rate of 21%.

Innovation. Engagement. Performance. Innovation. Engagement. Performance. Vincent J. Delie, Jr. Chairman, President and Chief Executive Officer F.N.B. Corporation and First National Bank

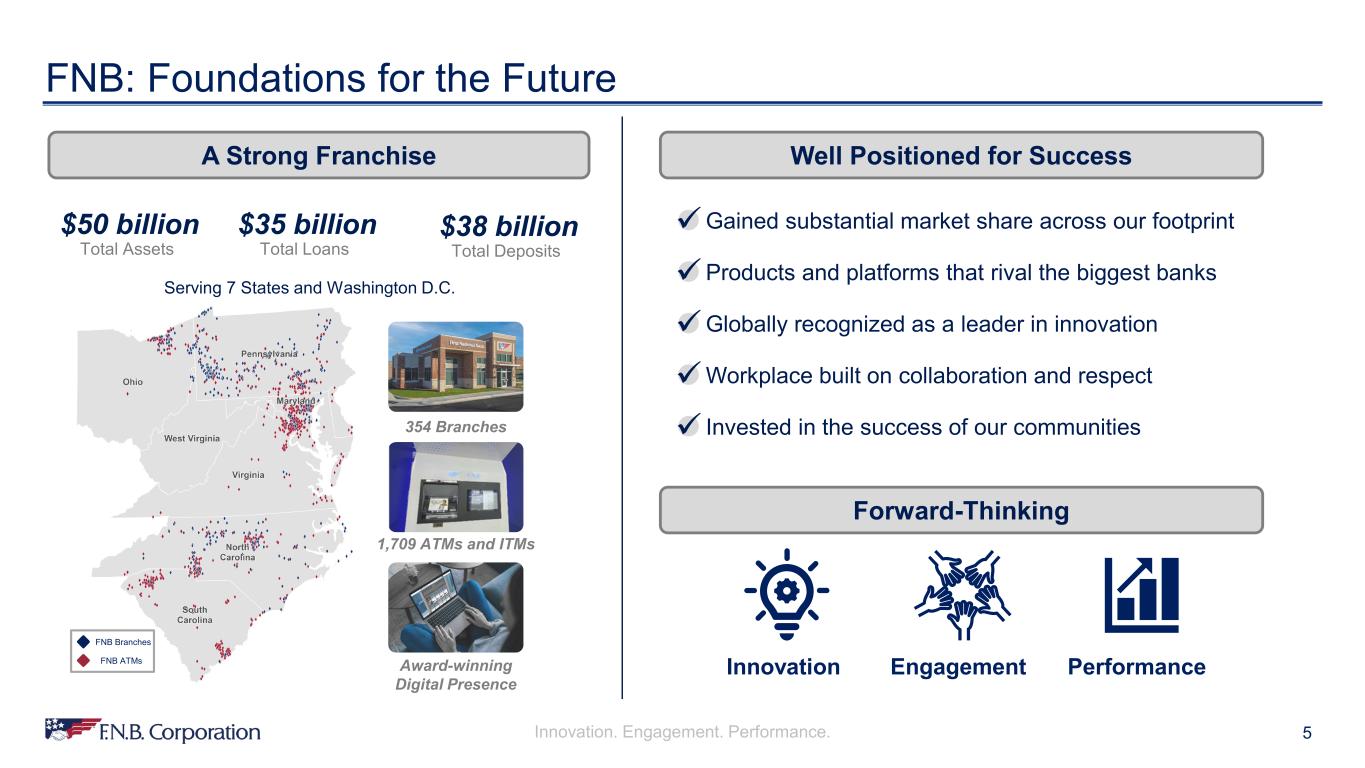

Innovation. Engagement. Performance. 5 FNB: Foundations for the Future FNB Branches FNB ATMs 354 Branches 1,709 ATMs and ITMs Award-winning Digital Presence Serving 7 States and Washington D.C. $50 billion Total Assets $35 billion Total Loans $38 billion Total Deposits Products and platforms that rival the biggest banks Globally recognized as a leader in innovation Workplace built on collaboration and respect Invested in the success of our communities Gained substantial market share across our footprint Innovation Engagement Performance A Strong Franchise Well Positioned for Success Forward-Thinking

Innovation. Engagement. Performance. 6 Can Your Bank Do That? Corporate Overview | First National Bank

Innovation. Engagement. Performance. 7 Cultivating Innovation Innovation is at the core of what we do at FNB. FNB’s digital and data strategies improve customer experience and drive revenue growth. Click-to-Bricks has transformed how customers bank. eStore® and Common App platforms have expanded features, including direct deposit and payment switching. eStore Connect, which combines the power of eStore and the convenience of an ITM, blends the latest in technology with personalized support. When we reduce time spent on manual tasks, our teams have more opportunities to: • Collaborate on strategic projects and initiatives. • Hold meaningful client conversations. • Develop innovative ideas and solutions. We are scaling AI and data usage to drive efficiency and automation, manage risk and enhance the overall customer experience. AI Innovation Team is actively reviewing and prioritizing high-impact use cases from across FNB. As we grow our AI footprint, we remain committed to strong risk management frameworks and controls to help ensure our innovation is both responsible and sustainable.

Innovation. Engagement. Performance. 8 Engaging Our Stakeholders Bringing value to all stakeholders: Can Your Bank Do That? • Omnichannel presence for a streamlined experience • Products and solutions to serve individuals and businesses throughout their lifecycle • Comprehensive financial services with expert, personalized guidance • Advantage of local leaders and teams in each region Customers • Prioritizing collaboration, professional growth and overall well being • Mentorships, leadership training programs, and internships to attract and retain high-achieving employees • Received more than 80 awards for workplace excellence based on direct employee feedback Employees • Introduced Main Street Revitalization, a new initiative to boost economic growth in rural & historic business districts • Enhanced and expanded Community Uplift, a mortgage down payment assistance program • Over 26,000 total volunteer hours completed by the FNB team in 2024 Communities • 100 shareholder engagements with investors the first three quarters of 2025 • Returned $162 million in capital to shareholders year- to-date, and $2.3 billion since 2009 • Alignment of executive compensation to long-term shareholder value Shareholders

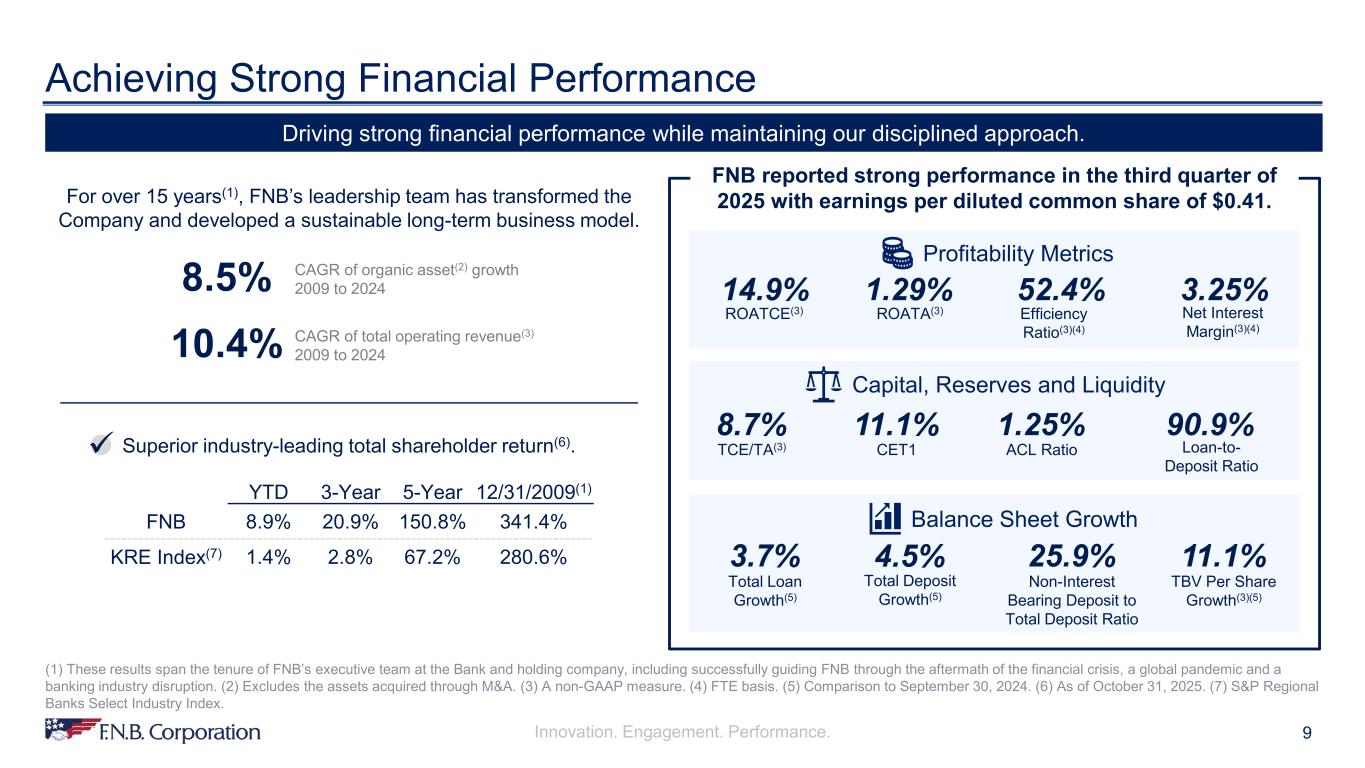

Innovation. Engagement. Performance. 9 Achieving Strong Financial Performance Driving strong financial performance while maintaining our disciplined approach. (1) These results span the tenure of FNB’s executive team at the Bank and holding company, including successfully guiding FNB through the aftermath of the financial crisis, a global pandemic and a banking industry disruption. (2) Excludes the assets acquired through M&A. (3) A non-GAAP measure. (4) FTE basis. (5) Comparison to September 30, 2024. (6) As of October 31, 2025. (7) S&P Regional Banks Select Industry Index. For over 15 years(1), FNB’s leadership team has transformed the Company and developed a sustainable long-term business model. 8.5% CAGR of organic asset(2) growth 2009 to 2024 10.4% CAGR of total operating revenue(3) 2009 to 2024 YTD 3-Year 5-Year 12/31/2009(1) FNB 8.9% 20.9% 150.8% 341.4% KRE Index(7) 1.4% 2.8% 67.2% 280.6% Superior industry-leading total shareholder return(6). 14.9% ROATCE(3) 52.4% Efficiency Ratio(3)(4) 3.25% Net Interest Margin(3)(4) 1.29% ROATA(3) Profitability Metrics TCE/TA(3) 8.7% CET1 11.1% 1.25% ACL Ratio 90.9% Loan-to- Deposit Ratio Capital, Reserves and Liquidity Total Loan Growth(5) 3.7% 4.5% Total Deposit Growth(5) 25.9% Non-Interest Bearing Deposit to Total Deposit Ratio 11.1% TBV Per Share Growth(3)(5) Balance Sheet Growth FNB reported strong performance in the third quarter of 2025 with earnings per diluted common share of $0.41.

Innovation. Engagement. Performance. 10 • Global Retail Banking Awards: CEO of the Year – United States The Digital Banker, 2025 • Global Retail Banking Awards: Excellence in Digital Innovation The Digital Banker, 2024 • Banking Tech Awards USA: Best Digital Initiative o Finalist: Best Use of Tech in Consumer Banking, Best User/Customer Experience Initiative and Top Innovation Fintech Futures, 2024 • Model Bank for Omnichannel Retail Delivery Celent, 2023 • Innovators of the Year: Vince Delie American Banker, 2023 • Most Trusted Companies in America Forbes, 2025 • America's Most Admired Workplaces Newsweek 2025-2026 • America’s Greatest Workplaces Newsweek, 2023; 2025 • Top Veteran-Friendly Employer U.S. Veterans Magazine, 2024- 2025 • World’s Best Companies TIME, 2024 • Top Places to Work in Communications Ragan, 2025 • 80+ Awards for Workplace Excellence • 17 individual awards for our CEO and leaders across our footprint (year-to-date 2025) • CEO of the Year: Vince Delie The CEO Magazine, 2024 • Top 50 CEOs in the United States; Top Banking CEOs (global): Vince Delie Brand Finance, 2025 • 115+ Best Bank Awards Crisil Coalition Greenwich, 2010-2025 • America's Best Companies; Global 2000 Forbes, 2025 • Best SME Bank (Mid-Atlantic Region) Global Finance, 2025 • Most Popular Bank in Pennsylvania Newsweek Vault, 2024 • Top 50 Bank Finance/Leasing Companies Monitor, 2024 • America's Best Loyalty & Rewards Programs USA Today, 2025 • Best Regional Banks GoBankingRates, 2022-2025 • President's "E" Award for Export Service United States Department of Commerce, 2018 Third Party Recognition FNB has received awards and recognition on a regional, national and global level.

Innovation. Engagement. Performance. Traditional Banking Reimagined: Digital and Data Analytics

Innovation. Engagement. Performance. 12 Clicks-to-Bricks: Past, Present and Future eStore & Common App Integral to Strategy • For consumers and bankers • Transforming onboarding & cross-sell • Fast, smart and scalable • 40 products across Consumer and Business lines Smart, AI-Powered Capabilities • AI-driven cross-sell (site, cart, app for customers and bankers) • Proprietary blend of 10 AI-enabled fraud tools • Data-powered identity theft and fraud controls (i.e., liveliness) • Device-based integrity checks Our Strategy in Action • Clicks-to-Bricks has been our ongoing strategy • Not here to recap the past, but focus on what’s next • We won’t walk through data entry, we’ll run a short video • We’ll cover the highlights as it runs What We’re Doing - And Why it Matters

Innovation. Engagement. Performance. Broad & Expanding Product Coverage • 31 Consumer Deposit & Lending Products • 10 Business Deposit Products (15 Lending by Q2’26) • 22 Mortgage Products (2026) 13 Focusing on the Customer Experience and Primacy Driven by Speed & Efficiency • Most products, combinations in under 7 minutes • Data pre-fill for customers and prospects • Same efficient flow for co-applicants, co-owners Relentless Focus on Primacy • Smart cross-sell puts the right products in focus • Direct deposit switch integrated into application, online/mobile • Payment switching integrated into onboarding channels • Instant card issuance and card-free cash ahead What We’re Doing - And Why it Matters

Innovation. Engagement. Performance. Expanding Ecosystem • 360 Dashboard, External Aggregation, eStore Common Application (eCA) integration • AI-driven customer support, customer-satisfaction portal • AI document management; pre-fill • More data = intelligence, engagement, cross-sell, speed 14 Continued Innovations for our Digital Strategy What’s Next • eStore in-branch – making branch apps even faster • Launching a single-device eStore Connect (university banking, workplace campus, underserved areas) • Faster eCA data entry (tax integration, AI doc review, etc.) What We’re Doing - And Why it Matters

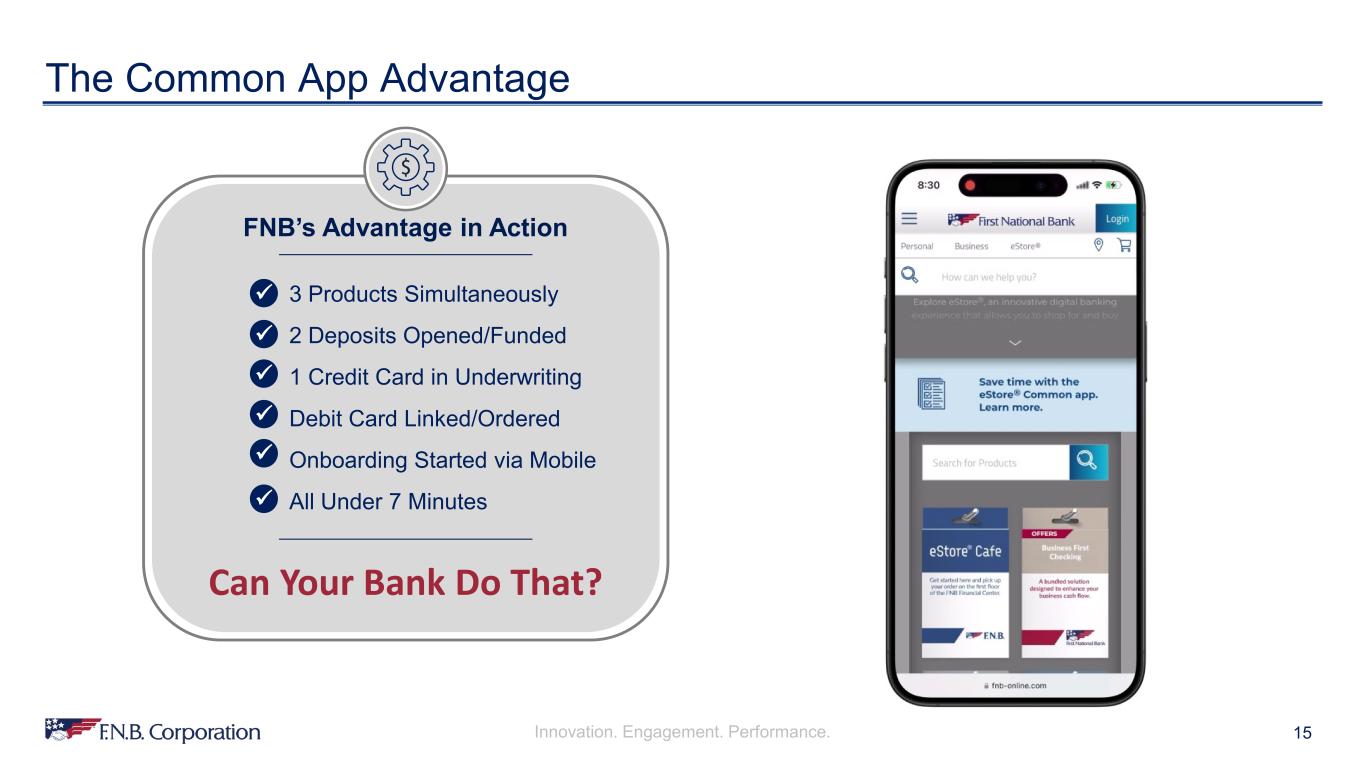

Innovation. Engagement. Performance. 15 The Common App Advantage 1 FNB’s Advantage in Action 3 Products Simultaneously 2 Deposits Opened/Funded 1 Credit Card in Underwriting Debit Card Linked/Ordered Onboarding Started via Mobile All Under 7 Minutes Can Your Bank Do That?

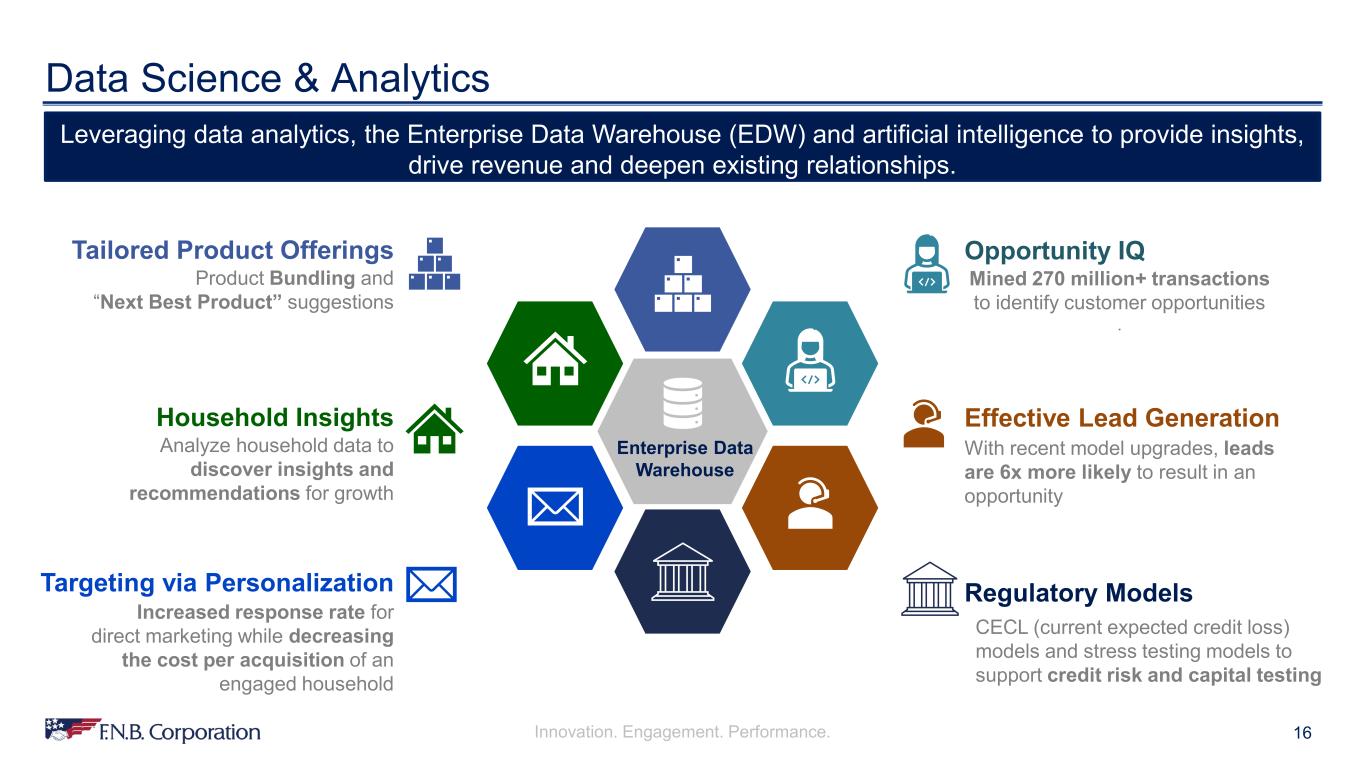

Innovation. Engagement. Performance. Data Science & Analytics Leveraging data analytics, the Enterprise Data Warehouse (EDW) and artificial intelligence to provide insights, drive revenue and deepen existing relationships. Enterprise Data Warehouse Regulatory Models Opportunity IQ Mined 270 million+ transactions to identify customer opportunities . Effective Lead Generation With recent model upgrades, leads are 6x more likely to result in an opportunity Targeting via Personalization Tailored Product Offerings Product Bundling and “Next Best Product” suggestions Household Insights Analyze household data to discover insights and recommendations for growth Increased response rate for direct marketing while decreasing the cost per acquisition of an engaged household 16 CECL (current expected credit loss) models and stress testing models to support credit risk and capital testing

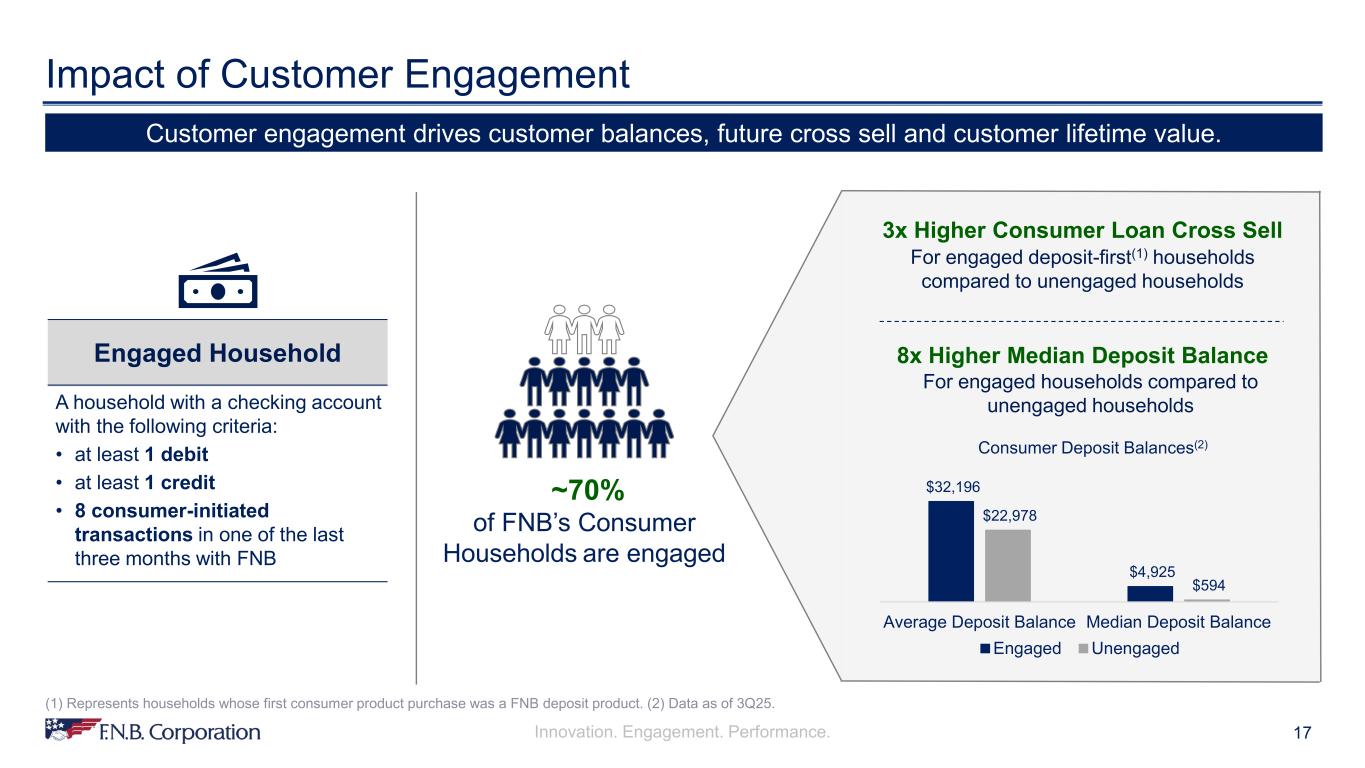

Innovation. Engagement. Performance. 17 Impact of Customer Engagement ~70% of FNB’s Consumer Households are engaged For engaged deposit-first(1) households compared to unengaged households A household with a checking account with the following criteria: • at least 1 debit • at least 1 credit • 8 consumer-initiated transactions in one of the last three months with FNB Engaged Household 3x Higher Consumer Loan Cross Sell 8x Higher Median Deposit Balance For engaged households compared to unengaged households Consumer Deposit Balances(2) (1) Represents households whose first consumer product purchase was a FNB deposit product. (2) Data as of 3Q25. $32,196 $4,925 $22,978 $594 Average Deposit Balance Median Deposit Balance Engaged Unengaged Customer engagement drives customer balances, future cross sell and customer lifetime value.

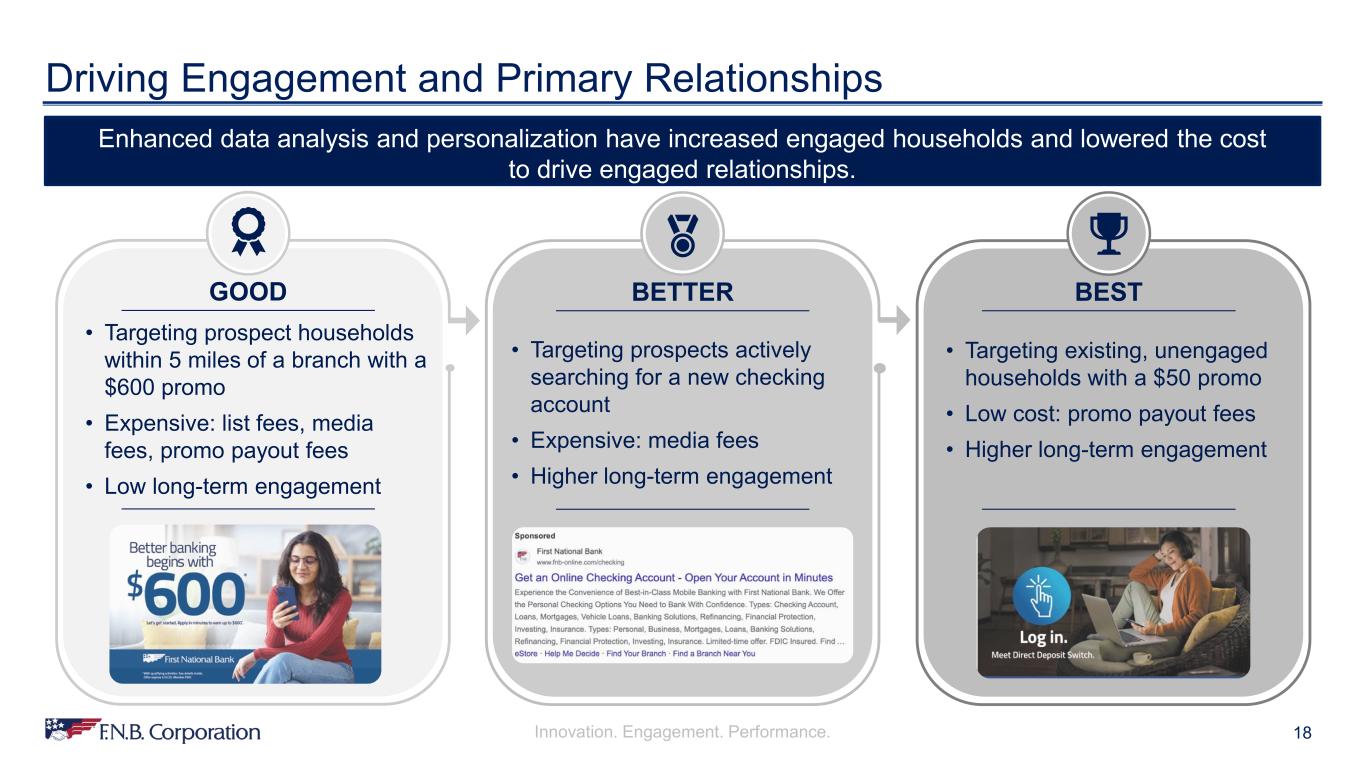

Innovation. Engagement. Performance. 18 Driving Engagement and Primary Relationships Enhanced data analysis and personalization have increased engaged households and lowered the cost to drive engaged relationships. 1 GOOD • Targeting prospect households within 5 miles of a branch with a $600 promo • Expensive: list fees, media fees, promo payout fees • Low long-term engagement 1 BETTER • Targeting prospects actively searching for a new checking account • Expensive: media fees • Higher long-term engagement 1 BEST • Targeting existing, unengaged households with a $50 promo • Low cost: promo payout fees • Higher long-term engagement

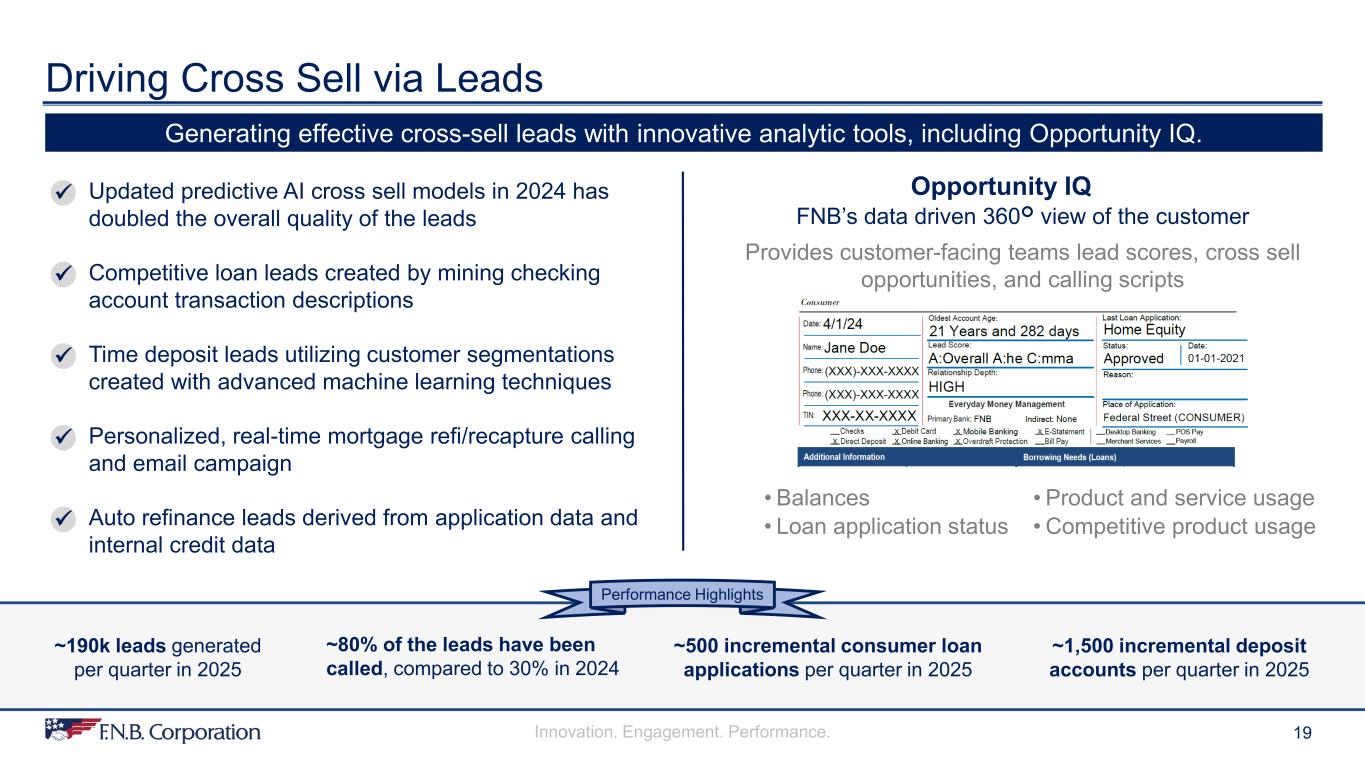

Innovation. Engagement. Performance. 19 Driving Cross Sell via Leads Generating effective cross-sell leads with innovative analytic tools, including Opportunity IQ. Performance Highlights ~190k leads generated per quarter in 2025 ~80% of the leads have been called, compared to 30% in 2024 ~500 incremental consumer loan applications per quarter in 2025 ~1,500 incremental deposit accounts per quarter in 2025 Opportunity IQ • Balances Updated predictive AI cross sell models in 2024 has doubled the overall quality of the leads Competitive loan leads created by mining checking account transaction descriptions Time deposit leads utilizing customer segmentations created with advanced machine learning techniques Personalized, real-time mortgage refi/recapture calling and email campaign Auto refinance leads derived from application data and internal credit data • Loan application status • Competitive product usage • Product and service usage FNB’s data driven 360 view of the customer Provides customer-facing teams lead scores, cross sell opportunities, and calling scripts

Innovation. Engagement. Performance. Sustainable Momentum in Consumer Banking

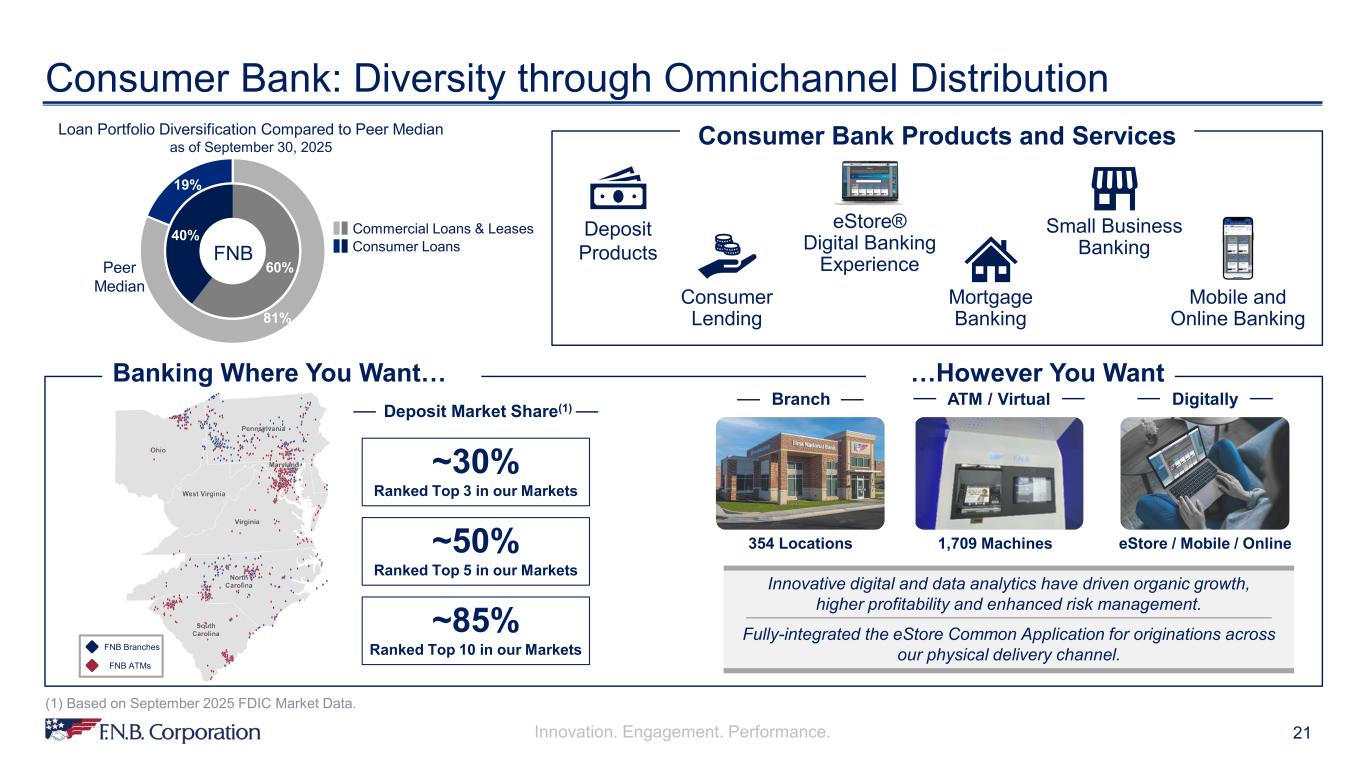

Innovation. Engagement. Performance. 81% 19% 60% 40% 21 Consumer Bank: Diversity through Omnichannel Distribution Banking Where You Want… Branch 354 Locations ATM / Virtual 1,709 Machines Digitally eStore / Mobile / Online ~85% Ranked Top 10 in our Markets Innovative digital and data analytics have driven organic growth, higher profitability and enhanced risk management. FNB Branches FNB ATMs …However You Want Deposit Products Mortgage Banking Mobile and Online Banking Consumer Bank Products and Services Small Business Banking ~50% Ranked Top 5 in our Markets ~30% Ranked Top 3 in our Markets Loan Portfolio Diversification Compared to Peer Median as of September 30, 2025 Consumer Loans Commercial Loans & Leases FNB Peer Median Consumer Lending eStore® Digital Banking Experience Deposit Market Share(1) (1) Based on September 2025 FDIC Market Data. Fully-integrated the eStore Common Application for originations across our physical delivery channel.

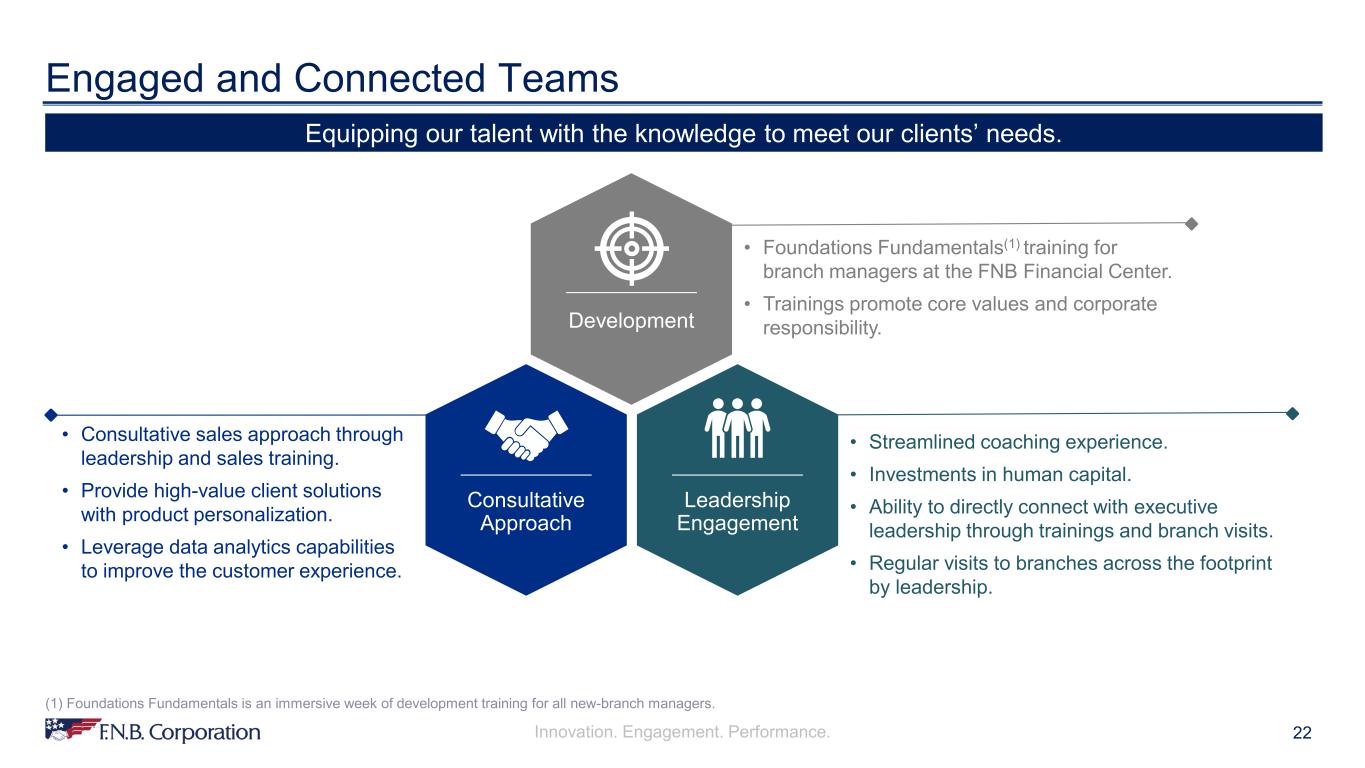

Innovation. Engagement. Performance. Consultative Approach 22 Engaged and Connected Teams Equipping our talent with the knowledge to meet our clients’ needs. • Consultative sales approach through leadership and sales training. • Provide high-value client solutions with product personalization. • Leverage data analytics capabilities to improve the customer experience. • Streamlined coaching experience. • Investments in human capital. • Ability to directly connect with executive leadership through trainings and branch visits. • Regular visits to branches across the footprint by leadership. • Foundations Fundamentals(1) training for branch managers at the FNB Financial Center. • Trainings promote core values and corporate responsibility. (1) Foundations Fundamentals is an immersive week of development training for all new-branch managers. Development Leadership Engagement

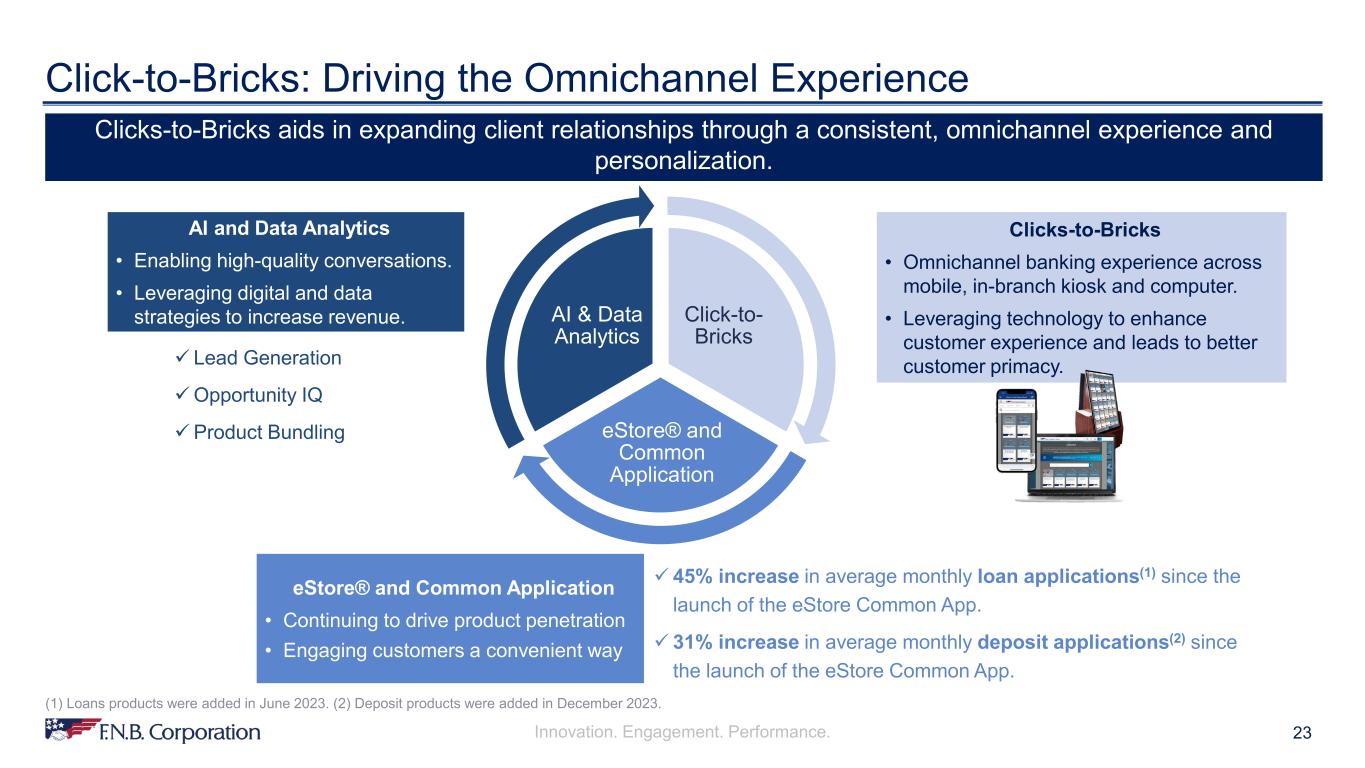

Innovation. Engagement. Performance. 23 Click-to-Bricks: Driving the Omnichannel Experience Clicks-to-Bricks aids in expanding client relationships through a consistent, omnichannel experience and personalization. AI and Data Analytics • Enabling high-quality conversations. • Leveraging digital and data strategies to increase revenue. Click-to- Bricks eStore® and Common Application AI & Data Analytics eStore® and Common Application • Continuing to drive product penetration • Engaging customers a convenient way Clicks-to-Bricks • Omnichannel banking experience across mobile, in-branch kiosk and computer. • Leveraging technology to enhance customer experience and leads to better customer primacy. Lead Generation Opportunity IQ Product Bundling 45% increase in average monthly loan applications(1) since the launch of the eStore Common App. 31% increase in average monthly deposit applications(2) since the launch of the eStore Common App. (1) Loans products were added in June 2023. (2) Deposit products were added in December 2023.

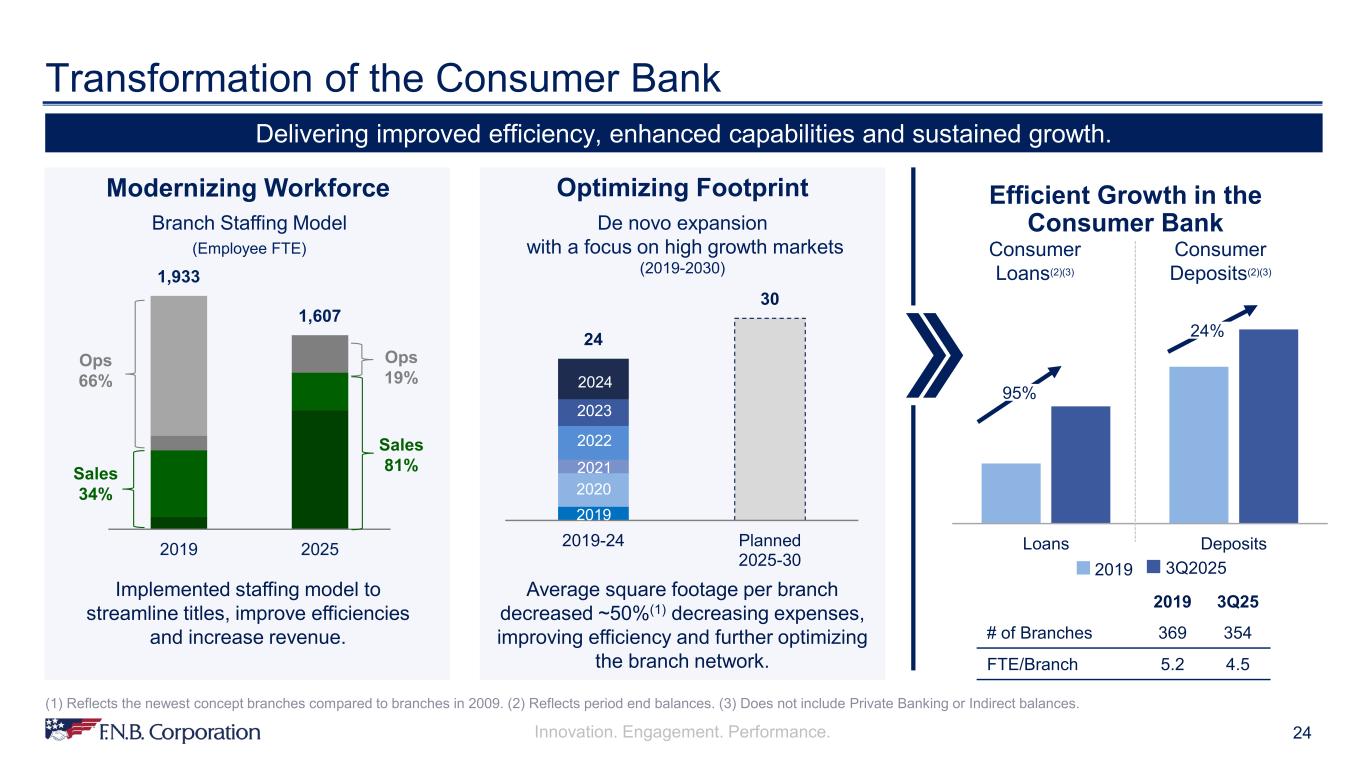

Innovation. Engagement. Performance. 24 Transformation of the Consumer Bank Delivering improved efficiency, enhanced capabilities and sustained growth. Modernizing Workforce Efficient Growth in the Consumer Bank Implemented staffing model to streamline titles, improve efficiencies and increase revenue. 1,933 1,607 2019 2025 Sales 34% Sales 81% Ops 66% Ops 19% Branch Staffing Model (Employee FTE) Loans Deposits 95% 24% Consumer Loans(2)(3) 2019 3Q25 # of Branches 369 354 FTE/Branch 5.2 4.5 3Q20252019 Optimizing Footprint Average square footage per branch decreased ~50%(1) decreasing expenses, improving efficiency and further optimizing the branch network. De novo expansion with a focus on high growth markets (2019-2030) 24 30 2019-24 Planned 2025-30 2024 2023 2022 2021 2020 2019 (1) Reflects the newest concept branches compared to branches in 2009. (2) Reflects period end balances. (3) Does not include Private Banking or Indirect balances. Consumer Deposits(2)(3)

Innovation. Engagement. Performance. 25 FNB Small Business: Positioned for Future Growth Small Business is positioned to improve household penetration and customer engagement. ~90,000 FNB Small Business Customers ~2.7 million Small Businesses(1) across FNB’s footprint Significant Opportunity to Grow Small Business Households Small Business deposits are 3x loan balances, providing a low-cost net funding source for the Bank. Business Checking Business Savings and Money Market Lines of Credit Term Loans Commercial Real Estate Loans Equipment Financing SBA Loans Business Credit Cards Treasury Management Merchant Services A comprehensive suite of products and services to meet our customer needs. Product Offerings (1) Represents businesses with revenue between $100K and $10 million.

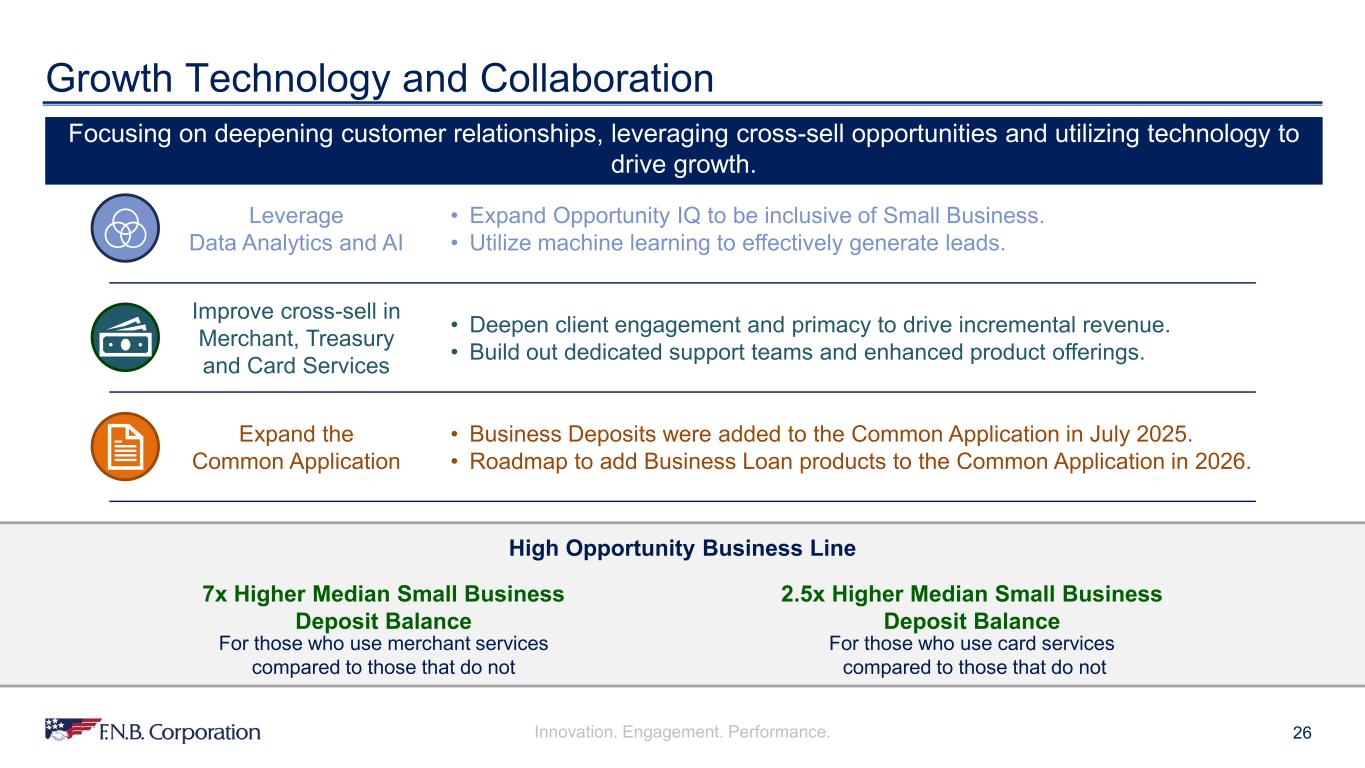

Innovation. Engagement. Performance. 26 Growth Technology and Collaboration Improve cross-sell in Merchant, Treasury and Card Services • Deepen client engagement and primacy to drive incremental revenue. • Build out dedicated support teams and enhanced product offerings. Expand the Common Application • Business Deposits were added to the Common Application in July 2025. • Roadmap to add Business Loan products to the Common Application in 2026. Leverage Data Analytics and AI • Expand Opportunity IQ to be inclusive of Small Business. • Utilize machine learning to effectively generate leads. Focusing on deepening customer relationships, leveraging cross-sell opportunities and utilizing technology to drive growth. 2.5x Higher Median Small Business Deposit Balance For those who use card services compared to those that do not 7x Higher Median Small Business Deposit Balance For those who use merchant services compared to those that do not High Opportunity Business Line

Innovation. Engagement. Performance. Differentiated Small Business Products and Capabilities FNB Small Business has created unique products and services tailored to our customers’ needs. • Small Business products and services for Physicians First private practices. • Accelerating Small Business portfolio growth through high-value client engagement, brand initiatives, digital optimization and cross- functional collaboration. Healthcare Solutions Offers Expertise for Customers Grows the Balance Sheet Cross-sell Opportunity • Designed to acquire new highly- engaged households. • Strategically engineered to include integrated reporting, fraud prevention, and enhanced cash flow. Bundled Product Offerings Customer Primacy Mitigates Risk Cross-sell Opportunity • Data and technology-driven portfolio analytics provide insight on client needs, enabling cross-sell and up-sell opportunities. • Proactive portfolio oversight to manage risk, identify growth opportunities and drive client engagement. Portfolio Management Mitigates Risk Grows Revenue Enhances Customer Experience 27

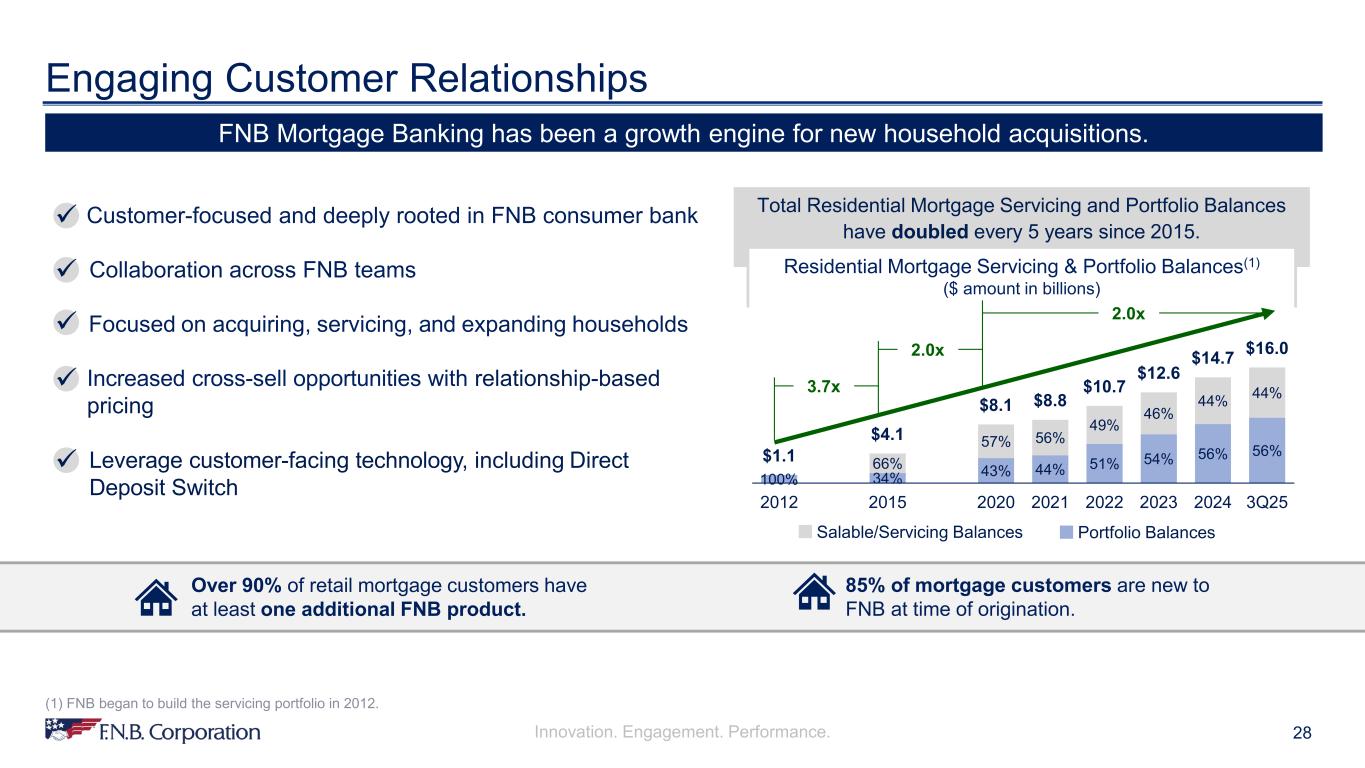

Innovation. Engagement. Performance. 28 Engaging Customer Relationships Customer-focused and deeply rooted in FNB consumer bank Focused on acquiring, servicing, and expanding households Collaboration across FNB teams Increased cross-sell opportunities with relationship-based pricing Leverage customer-facing technology, including Direct Deposit Switch Over 90% of retail mortgage customers have at least one additional FNB product. 85% of mortgage customers are new to FNB at time of origination. Total Residential Mortgage Servicing and Portfolio Balances have doubled every 5 years since 2015. Portfolio BalancesSalable/Servicing Balances Residential Mortgage Servicing & Portfolio Balances(1) ($ amount in billions) 100% 34% 43% 44% 51% 54% 56% 56% 66% 57% 56% 49% 46% 44% 44% $1.1 $4.1 $8.1 $8.8 $10.7 $12.6 $14.7 $16.0 2012 2015 2020 2021 2022 2023 2024 3Q25 FNB Mortgage Banking has been a growth engine for new household acquisitions. 3.7x 2.0x 2.0x (1) FNB began to build the servicing portfolio in 2012.

Innovation. Engagement. Performance. Superior Customer Experience 29 Innovative Customer Experience Customer Surveys Advisory Councils End-to-End Omnichannel Experience Data Analytics and A.I. Ability to complete customer journey both in- branch and digitally. Tailored products and services to optimize customer acquisition-to- retention path. Sales and Operations Advisory Councils regularly gain valuable internal feedback to implement enhancements. Continuous improvements based on customer surveys throughout lifecycle. Highly experienced team High-touch service delivery by our experienced mortgage sales team. Building a differentiated experience based on a customer-centered approach.

Innovation. Engagement. Performance. 30 Delivering Sustainable Growth FNB Mortgage Banking is strategically positioned to capture customer relationships, deepen cross-sell opportunities and expand growth. (1) Includes offerings for physicians, first-time homebuyers, low-to-moderate income consumers and those buying in minority communities. • Sustainable growth throughout economic cycles. • Business model not interest rate-sensitive nor dependent upon the refinance market. • Diversified revenue stream for non-interest income and net interest income for FNB. Secondary market programs and specialty portfolio products Tailored offerings for financing needs(1) Network of relationship-based partners across the footprint High-performing sales force Commitment to the purchase mortgage market 1 2 3 4 5 Capabilities and Relationships… …Drive Performance Performance Highlights Top 3 Financial Institution Mortgage Originator in 9 of FNB’s largest markets. High-performing sales force originating an average of $30 million annually per originator. Consistent 8-10% annual net new mortgage household growth.

Innovation. Engagement. Performance. 31 Our Competitive Advantage in Consumer Banking Benefiting from our collaboration, client engagement and diverse footprint. Broad Reach and Depth Scale across our markets Customer Primacy Serve our clients how they want to be served Collaboration Work better together

Innovation. Engagement. Performance. Commercial Banking: Scale and Service that Outpace the Competition

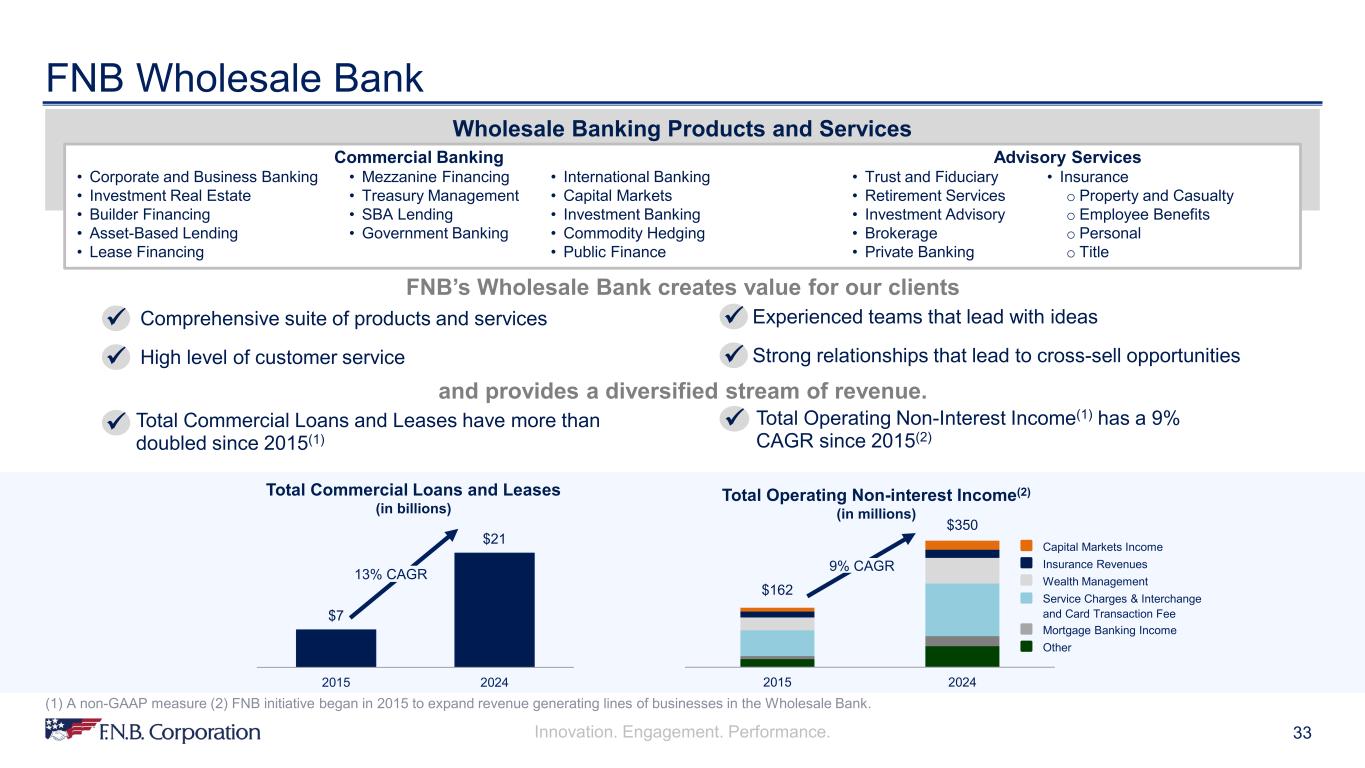

Innovation. Engagement. Performance. 33 FNB Wholesale Bank Wholesale Banking Products and Services Commercial Banking Advisory Services • Corporate and Business Banking • Mezzanine Financing • International Banking • Trust and Fiduciary • Insurance • Investment Real Estate • Treasury Management • Capital Markets • Retirement Services o Property and Casualty • Builder Financing • SBA Lending • Investment Banking • Investment Advisory o Employee Benefits • Asset-Based Lending • Government Banking • Commodity Hedging • Brokerage o Personal • Lease Financing • Public Finance • Private Banking o Title FNB’s Wholesale Bank creates value for our clients and provides a diversified stream of revenue. Total Commercial Loans and Leases (in billions) $7 $21 2015 2024 13% CAGR $162 $350 2015 2024 9% CAGR Total Operating Non-interest Income(2) (in millions) Capital Markets Income Insurance Revenues Wealth Management Service Charges & Interchange and Card Transaction Fee Mortgage Banking Income Other Comprehensive suite of products and services Experienced teams that lead with ideas High level of customer service Strong relationships that lead to cross-sell opportunities Total Operating Non-Interest Income(1) has a 9% CAGR since 2015(2) Total Commercial Loans and Leases have more than doubled since 2015(1) (1) A non-GAAP measure (2) FNB initiative began in 2015 to expand revenue generating lines of businesses in the Wholesale Bank.

Innovation. Engagement. Performance. Commercial Bank Strategy Commercial Bank Value Proposition: Carolina Markets Equipment Finance Added new FNB team members in the markets with rich knowledge Expanded Capital Markets and Treasury Management solutions Commercial loan and deposit CAGR of 16.7% and 11.2%, respectively, in the Carolina markets over the last five years CAGR of 11.8% over last five years Unique projects that help in the communities we serve Products well-positioned for the tax credit and bonus depreciation legislation Performance Highlights • Offer strategic ideas that are not balance sheet centric • Focus on client needs and long-term relationship planning • Broad Capital Market products and services • Investments in Treasury Management capabilities • Advisory Service offerings • Scale that provides the ability to compete with larger institutions • Collaborative team approach • Locally positioned credit teams that provide deep industry expertise • Received 115 Greenwich Awards recognizing FNB for award winning service to middle market business clients • Ongoing investments in talent, including the expansion of the corporate training program • Digital and data analytic capabilities which deliver enhanced solutions and insights for clients Lead with Innovative Ideas Strong Product Set High Touch Service for Client Engagement “Out Big the Smalls and Out Small the Bigs” 34

Innovation. Engagement. Performance. FNB Capital Markets: Serving Our Clients Through the Business Life Cycle

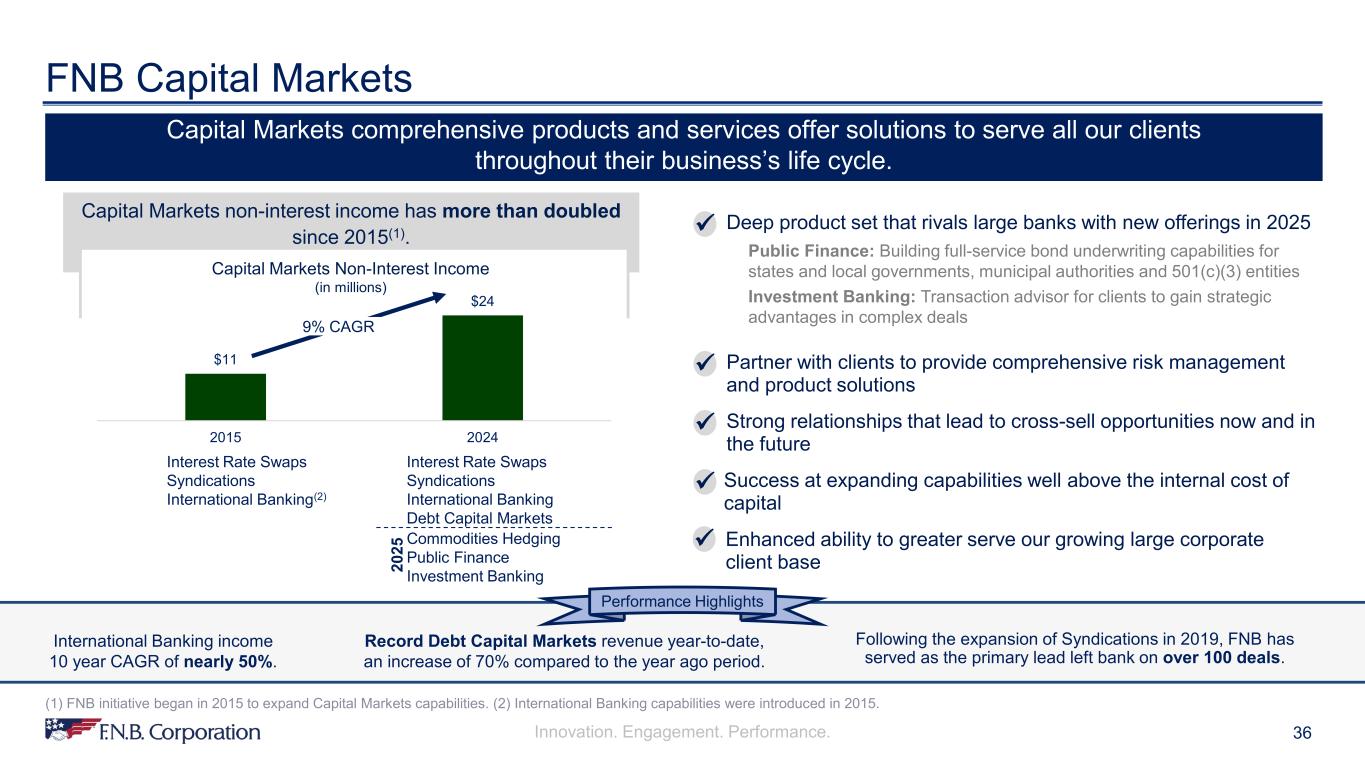

Innovation. Engagement. Performance. 36 FNB Capital Markets (1) FNB initiative began in 2015 to expand Capital Markets capabilities. (2) International Banking capabilities were introduced in 2015. Record revenue for Debt Capital Markets year-to-date Capital Markets comprehensive products and services offer solutions to serve all our clients throughout their business’s life cycle. Capital Markets non-interest income has more than doubled since 2015(1). Deep product set that rivals large banks with new offerings in 2025 Public Finance: Building full-service bond underwriting capabilities for states and local governments, municipal authorities and 501(c)(3) entities Investment Banking: Transaction advisor for clients to gain strategic advantages in complex deals Partner with clients to provide comprehensive risk management and product solutions Strong relationships that lead to cross-sell opportunities now and in the future Success at expanding capabilities well above the internal cost of capital Capital Markets Non-Interest Income (in millions) Performance Highlights International Banking income 10 year CAGR of nearly 50%. Record Debt Capital Mark ts revenue year-to-date, an increase of 70% compared to the year ago period. Interest Rate Swaps Syndications International Banking(2) Interest Rate Swaps Syndications International Banking Debt Capital Markets Commodities Hedging Public Finance Investment Banking20 25 Following the expansion of Syndications in 2019, FNB has served as the primary lead left bank on over 100 deals. Enhanced ability to greater serve our growing large corporate client base $11 $24 2015 2024 9% CAGR

Innovation. Engagement. Performance. FNB Advisory Services: Client-Focused, Growth Driven

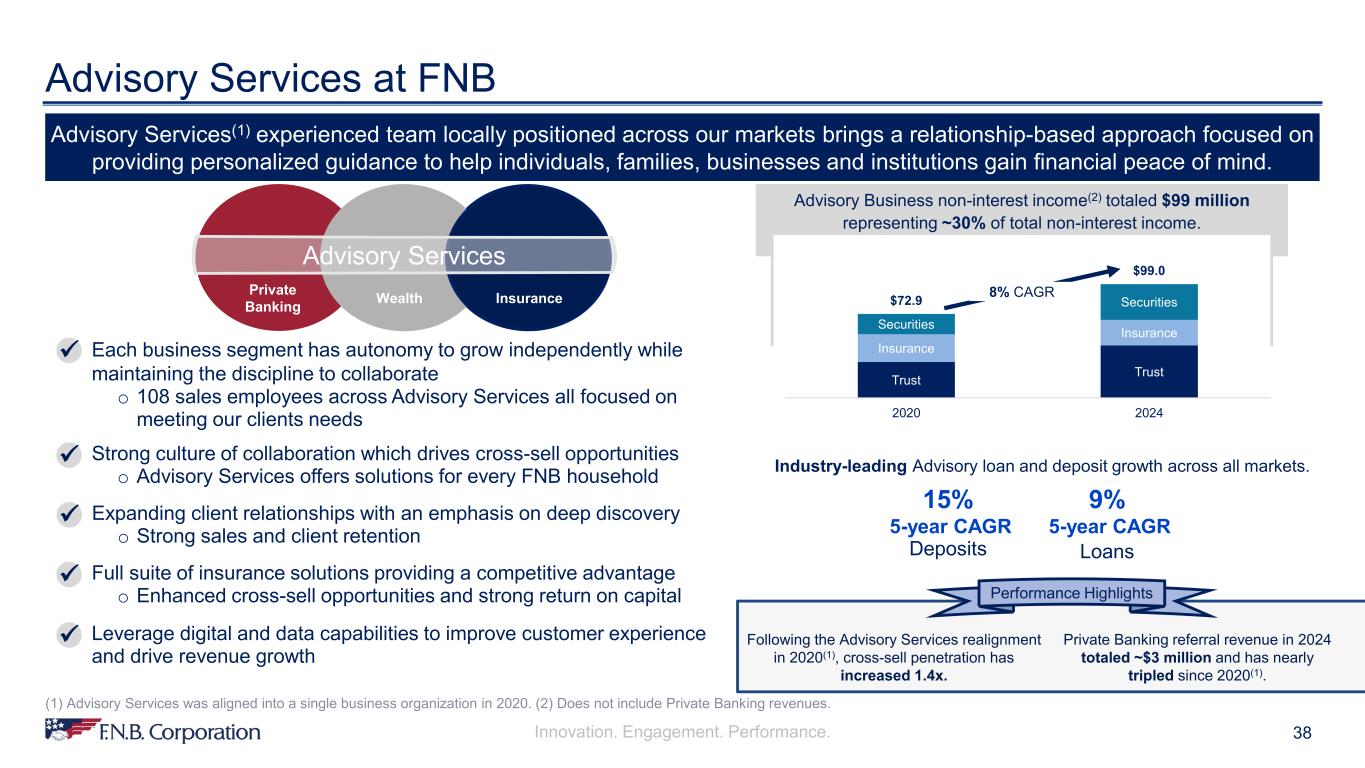

Innovation. Engagement. Performance. 38 Advisory Services at FNB Advisory Services(1) experienced team locally positioned across our markets brings a relationship-based approach focused on providing personalized guidance to help individuals, families, businesses and institutions gain financial peace of mind. Advisory Business non-interest income(2) totaled $99 million representing ~30% of total non-interest income. Private Banking referral revenue in 2024 totaled ~$3 million and has nearly tripled since 2020(1). Wealth Insurance Advisory Services ealthPrivate Banking Insurance Industry-leading Advisory loan and deposit growth across all markets. Deposits 15% 5-year CAGR Loans 9% 5-year CAGR Following the Advisory Services realignment in 2020(1), cross-sell penetration has increased 1.4x. Each business segment has autonomy to grow independently while maintaining the discipline to collaborate o 108 sales employees across Advisory Services all focused on meeting our clients needs Strong culture of collaboration which drives cross-sell opportunities o Advisory Services offers solutions for every FNB household Expanding client relationships with an emphasis on deep discovery o Strong sales and client retention Full suite of insurance solutions providing a competitive advantage o Enhanced cross-sell opportunities and strong return on capital Leverage digital and data capabilities to improve customer experience and drive revenue growth Trust Trust Insurance Insurance Securities Securities $72.9 $99.0 2020 2024 8% CAGR (1) Advisory Services was aligned into a single business organization in 2020. (2) Does not include Private Banking revenues. Performance Highlights

Innovation. Engagement. Performance. FNB Treasury Management: Expanding Capabilities and Deepening Customer Relationships

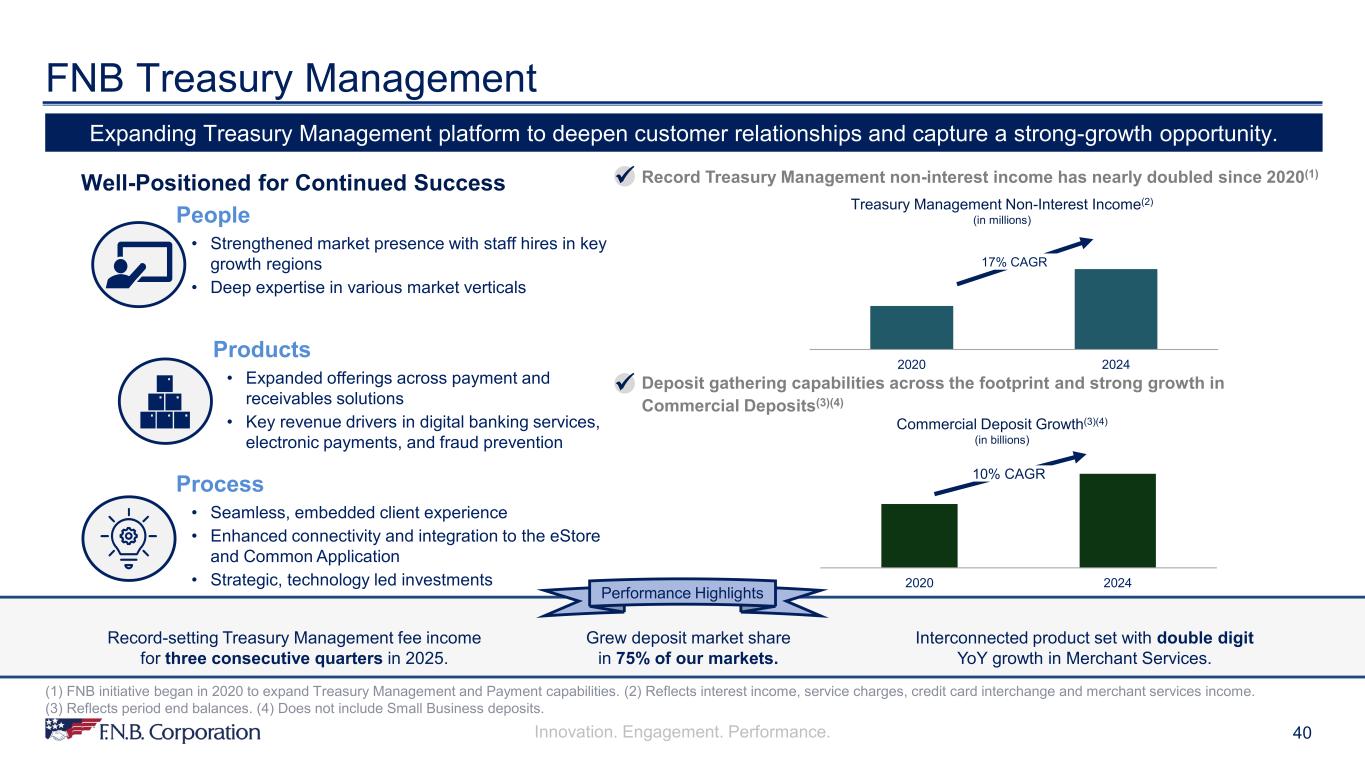

Innovation. Engagement. Performance. 2020 2024 40 FNB Treasury Management (1) FNB initiative began in 2020 to expand Treasury Management and Payment capabilities. (2) Reflects interest income, service charges, credit card interchange and merchant services income. (3) Reflects period end balances. (4) Does not include Small Business deposits. Well-Positioned for Continued Success Interconnected product set with double digit YoY growth in Merchant Services. Treasury Management Non-Interest Income(2) (in millions) Commercial Deposit Growth(3)(4) (in billions) Record Treasury Management non-interest income has nearly doubled since 2020(1) Deposit gathering capabilities across the footprint and strong growth in Commercial Deposits(3)(4) 17% CAGR 2020 2024 10% CAGR Record-setting Treasury Management fee income for three consecutive quarters in 2025. Grew deposit market share in 75% of our markets. People • Strengthened market presence with staff hires in key growth regions • Deep expertise in various market verticals Products • Expanded offerings across payment and receivables solutions • Key revenue drivers in digital banking services, electronic payments, and fraud prevention Process • Seamless, embedded client experience • Enhanced connectivity and integration to the eStore and Common Application • Strategic, technology led investments Performance Highlights Expanding Treasury Management platform to deepen customer relationships and capture a strong-growth opportunity.

Innovation. Engagement. Performance. Strong Foundations, Strategic Momentum

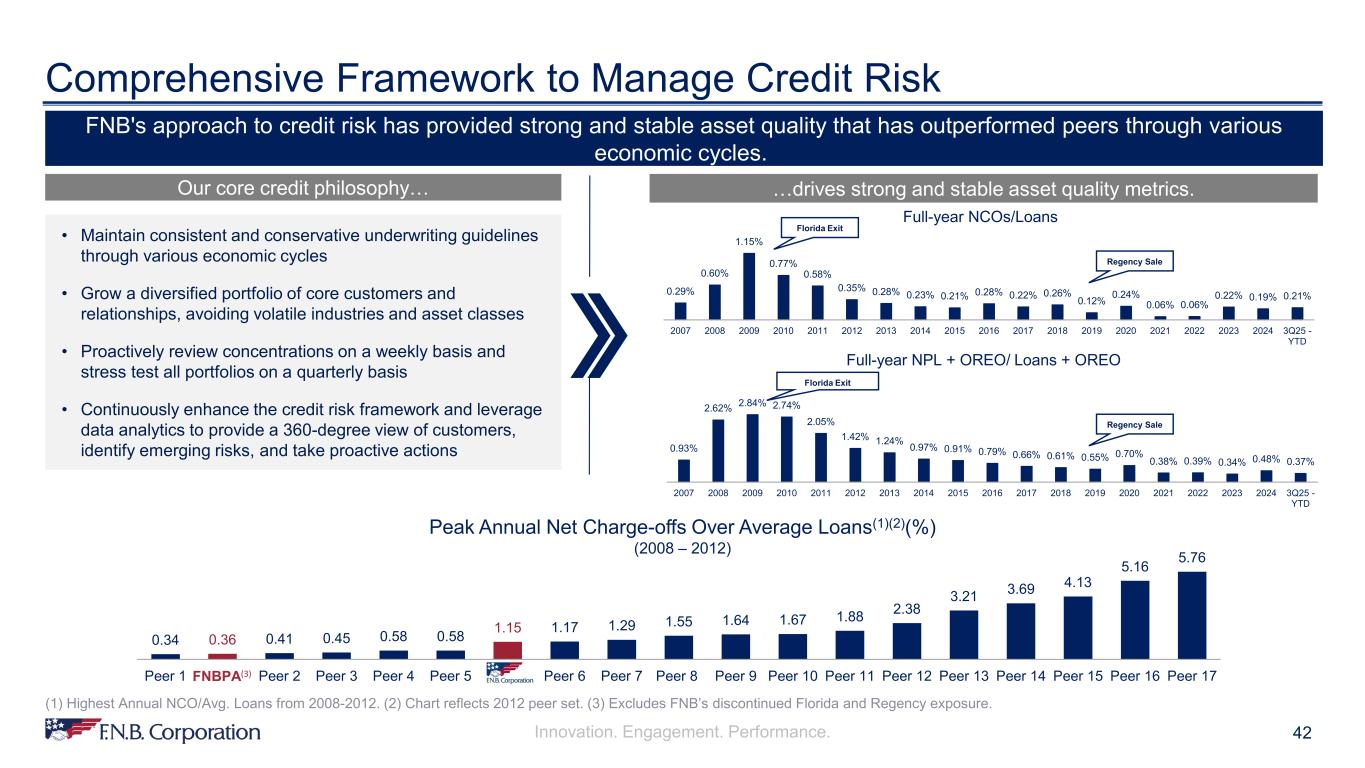

Innovation. Engagement. Performance. 0.34 0.36 0.41 0.45 0.58 0.58 1.15 1.17 1.29 1.55 1.64 1.67 1.88 2.38 3.21 3.69 4.13 5.16 5.76 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17FNBPA(3) 42 Comprehensive Framework to Manage Credit Risk FNB's approach to credit risk has provided strong and stable asset quality that has outperformed peers through various economic cycles. Our core credit philosophy… • Maintain consistent and conservative underwriting guidelines through various economic cycles • Grow a diversified portfolio of core customers and relationships, avoiding volatile industries and asset classes • Proactively review concentrations on a weekly basis and stress test all portfolios on a quarterly basis • Continuously enhance the credit risk framework and leverage data analytics to provide a 360-degree view of customers, identify emerging risks, and take proactive actions Peak Annual Net Charge-offs Over Average Loans(1)(2)(%) (2008 – 2012) (1) Highest Annual NCO/Avg. Loans from 2008-2012. (2) Chart reflects 2012 peer set. (3) Excludes FNB’s discontinued Florida and Regency exposure. …drives strong and stable asset quality metrics. 0.29% 0.60% 1.15% 0.77% 0.58% 0.35% 0.28% 0.23% 0.21% 0.28% 0.22% 0.26% 0.12% 0.24% 0.06% 0.06% 0.22% 0.19% 0.21% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 - YTD 0.93% 2.62% 2.84% 2.74% 2.05% 1.42% 1.24% 0.97% 0.91% 0.79% 0.66% 0.61% 0.55% 0.70% 0.38% 0.39% 0.34% 0.48% 0.37% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 - YTD Florida Exit Regency Sale Regency Sale Florida Exit Full-year NCOs/Loans Full-year NPL + OREO/ Loans + OREO

Innovation. Engagement. Performance. 43 Consistent and Conservative Underwriting FNB credit policy provides consistent and prudent underwriting standards footprint wide for all products and delivery channels. Maintain consistent underwriting standards throughout economic cycles • Underwriting process proactively addresses dynamic risks such as tariffs, emerging economic trends, and fiscal changes • Interest rate and prepayment sensitivity analysis for CRE and C&I credits, with underwriting and shock rates updated after each Federal Reserve decision • Local decisioning authority for moderate exposures, supported by a corporate credit framework to ensure consistency and sound credit selection • Strong credit performance through cycles and periods of uncertainty reflects disciplined risk appetite, robust concentration management, and a 360 comprehensive view of customer activity Tenured team with Regional Credit Officers averaging 30+ years of experience Ongoing enhancements for driving efficiency, data quality and growth • Products delivered across all channels with one single platform developed internally to maintain consistency • Streamlined structure enhanced in 2025: o Improved efficiency enabling quicker turnaround while maintaining consistent credit standards o Channel-based delivery model built on specialized expertise • Investment in credit risk management data systems and expanded credit risk curriculum support ongoing improvements in risk identification Strong consumer loan portfolio highly concentrated in high quality prime and super-prime borrowers Performance Highlights

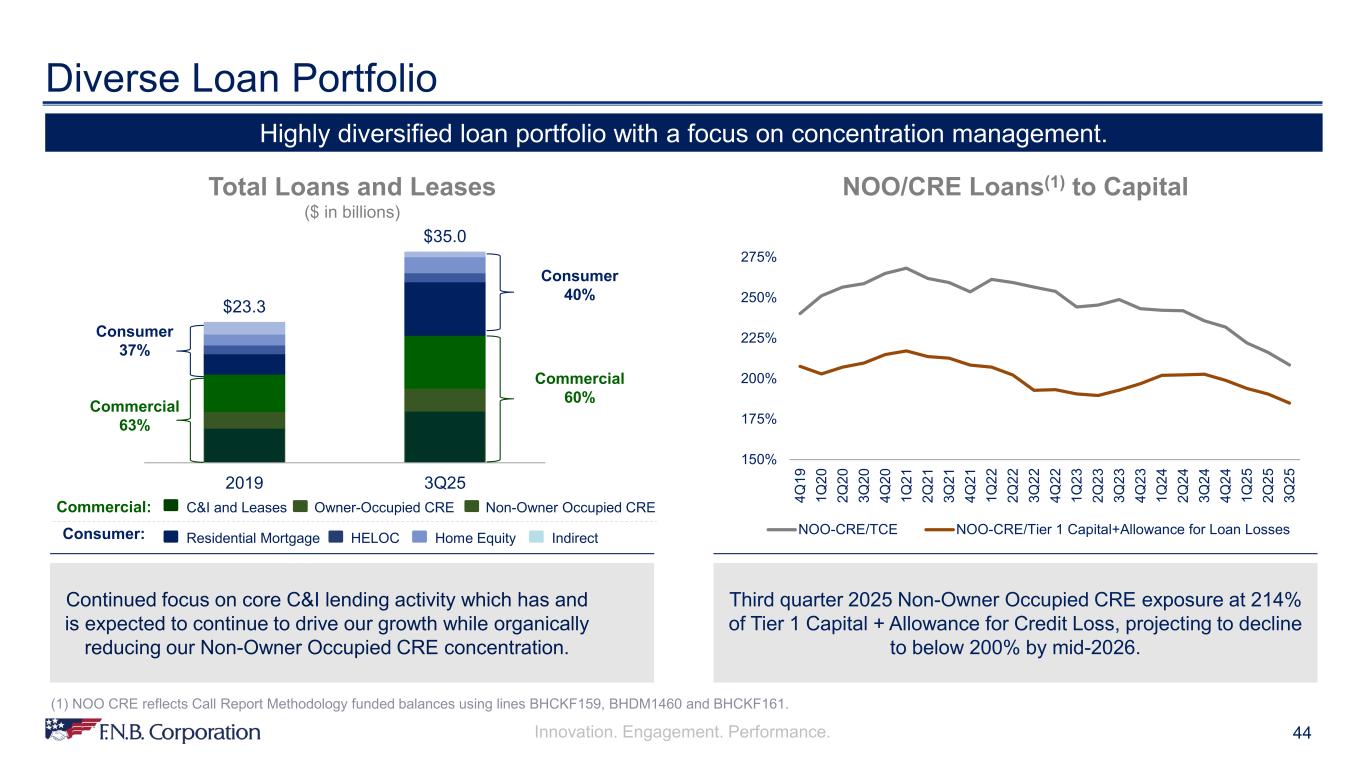

Innovation. Engagement. Performance. $23.3 $35.0 2019 3Q25 44 Diverse Loan Portfolio (1) NOO CRE reflects Call Report Methodology funded balances using lines BHCKF159, BHDM1460 and BHCKF161. Highly diversified loan portfolio with a focus on concentration management. 150% 175% 200% 225% 250% 275% 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 NOO-CRE/TCE NOO-CRE/Tier 1 Capital+Allowance for Loan Losses Total Loans and Leases ($ in billions) Continued focus on core C&I lending activity which has and is expected to continue to drive our growth while organically reducing our Non-Owner Occupied CRE concentration. Consumer 40% Commercial 60% Consumer 37% Commercial 63% Third quarter 2025 Non-Owner Occupied CRE exposure at 214% of Tier 1 Capital + Allowance for Credit Loss, projecting to decline to below 200% by mid-2026. IndirectResidential Mortgage HELOC Home Equity C&I and Leases Owner-Occupied CRE Non-Owner Occupied CRECommercial: Consumer: NOO/CRE Loans(1) to Capital

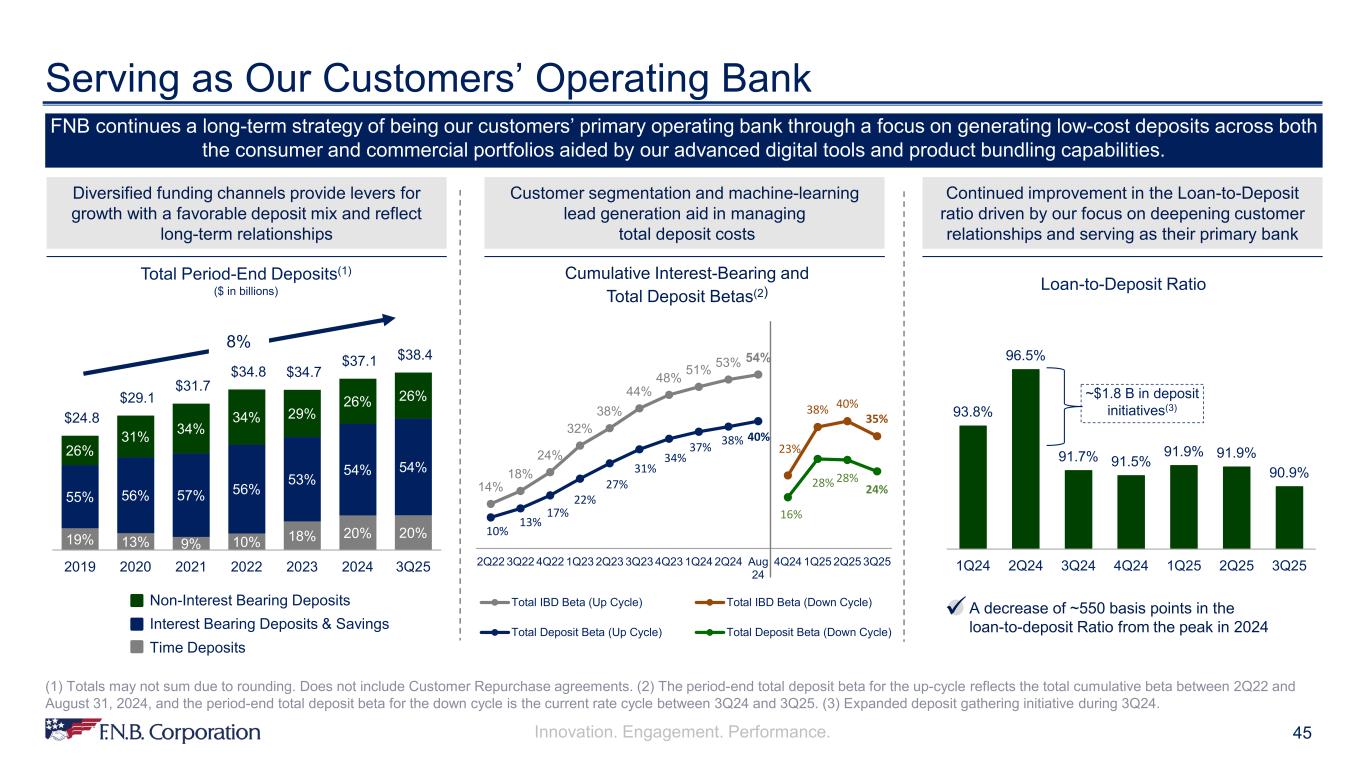

Innovation. Engagement. Performance. 93.8% 96.5% 91.7% 91.5% 91.9% 91.9% 90.9% 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 45 Serving as Our Customers’ Operating Bank FNB continues a long-term strategy of being our customers’ primary operating bank through a focus on generating low-cost deposits across both the consumer and commercial portfolios aided by our advanced digital tools and product bundling capabilities. (1) Totals may not sum due to rounding. Does not include Customer Repurchase agreements. (2) The period-end total deposit beta for the up-cycle reflects the total cumulative beta between 2Q22 and August 31, 2024, and the period-end total deposit beta for the down cycle is the current rate cycle between 3Q24 and 3Q25. (3) Expanded deposit gathering initiative during 3Q24. 19% 13% 9% 10% 18% 20% 20% 55% 56% 57% 56% 53% 54% 54% 26% 31% 34% 34% 29% 26% 26% $24.8 $29.1 $31.7 $34.8 $34.7 $37.1 $38.4 2019 2020 2021 2022 2023 2024 3Q25 Total Period-End Deposits(1) ($ in billions) Diversified funding channels provide levers for growth with a favorable deposit mix and reflect long-term relationships Loan-to-Deposit Ratio Customer segmentation and machine-learning lead generation aid in managing total deposit costs Continued improvement in the Loan-to-Deposit ratio driven by our focus on deepening customer relationships and serving as their primary bank 14% 18% 24% 32% 38% 44% 48% 51% 53% 54% 23% 38% 40% 35% 10% 13% 17% 22% 27% 31% 34% 37% 38% 40% 16% 28% 28% 24% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30% 31% 32% 33% 34% 35% 36% 37% 38% 39% 40% 41% 42% 43% 44% 45% 46% 47% 48% 49% 50% 51% 52% 53% 54% 55% 56% 57% 58% 59% 60% 61% 62% 63% 64% 65% 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Aug 24 4Q24 1Q25 2Q25 3Q25 Total IBD Beta (Up Cycle) Total IBD Beta (Down Cycle) Total Deposit Beta (Up Cycle) Total Deposit Beta (Down Cycle) Cumulative Interest-Bearing and Total Deposit Betas(2) 8% Non-Interest Bearing Deposits Interest Bearing Deposits & Savings Time Deposits ~$1.8 B in deposit initiatives(3) A decrease of ~550 basis points in the loan-to-deposit Ratio from the peak in 2024

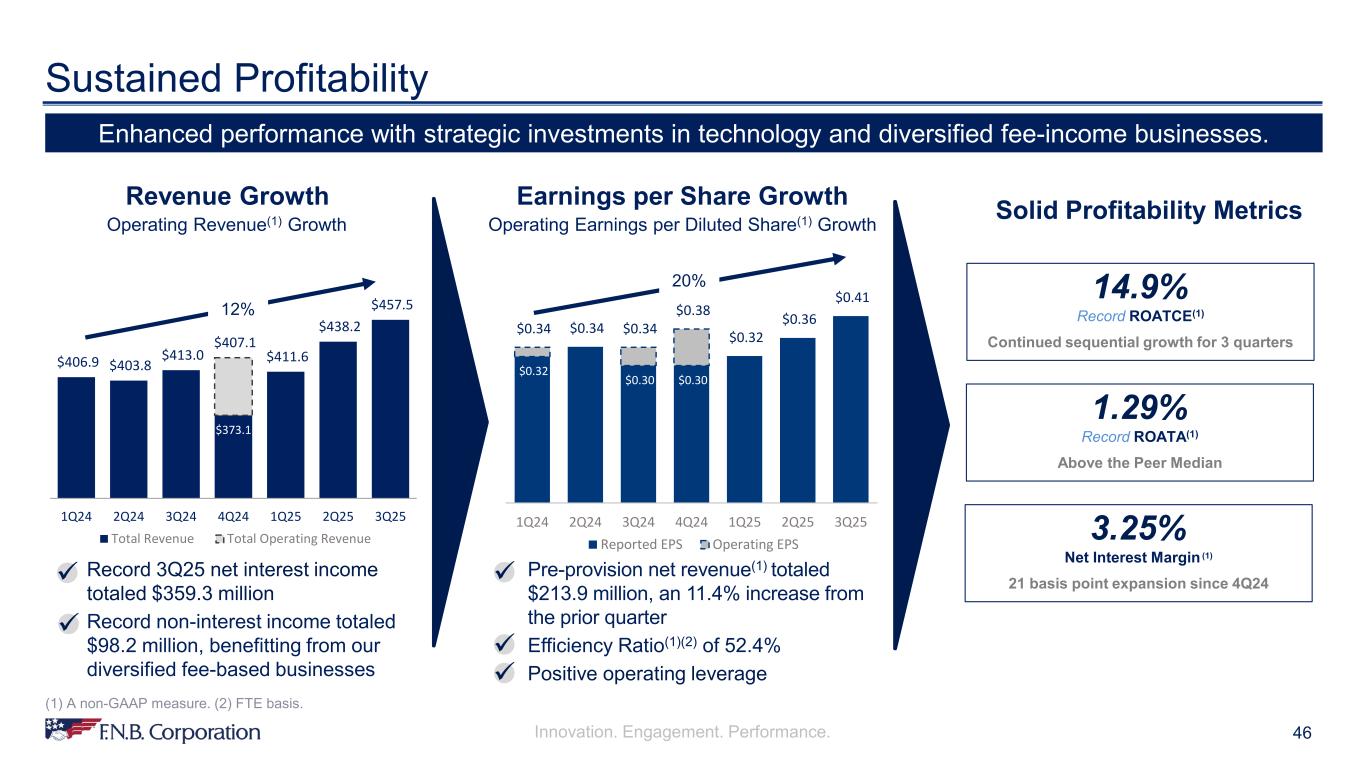

Innovation. Engagement. Performance. $373.1 $406.9 $403.8 $413.0 $407.1 $411.6 $438.2 $457.5 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Total Revenue Total Operating Revenue 46 Sustained Profitability Enhanced performance with strategic investments in technology and diversified fee-income businesses. Record 3Q25 net interest income totaled $359.3 million Record non-interest income totaled $98.2 million, benefitting from our diversified fee-based businesses Earnings per Share Growth Operating Earnings per Diluted Share(1) Growth Solid Profitability Metrics 1.29% Record ROATA(1) Above the Peer Median 14.9% Record ROATCE(1) Continued sequential growth for 3 quarters 3.25% Net Interest Margin (1) 21 basis point expansion since 4Q24 20% 12% Revenue Growth Operating Revenue(1) Growth Pre-provision net revenue(1) totaled $213.9 million, an 11.4% increase from the prior quarter Efficiency Ratio(1)(2) of 52.4% Positive operating leverage (1) A non-GAAP measure. (2) FTE basis. $0.32 $0.30 $0.30 $0.34 $0.34 $0.34 $0.38 $0.32 $0.36 $0.41 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Reported EPS Operating EPS

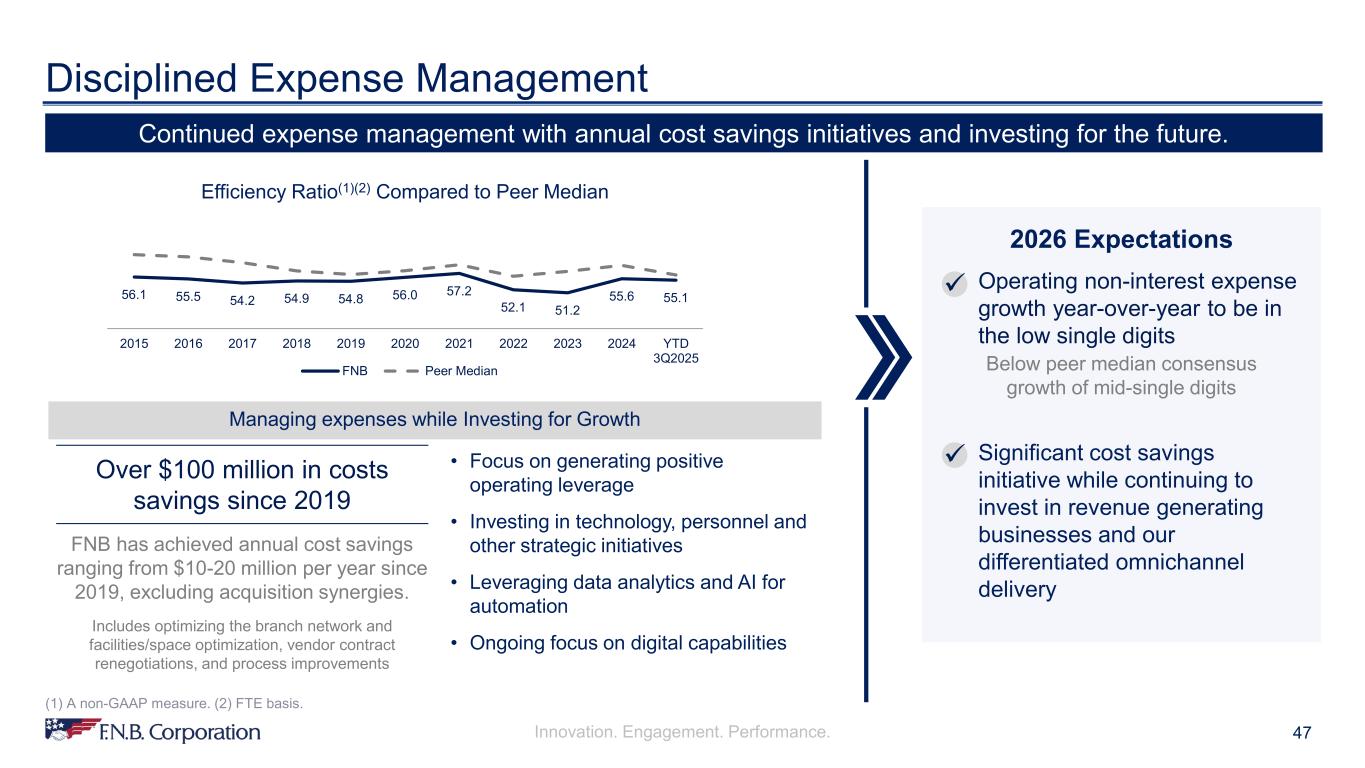

Innovation. Engagement. Performance. 47 Disciplined Expense Management Continued expense management with annual cost savings initiatives and investing for the future. 2026 Expectations Operating non-interest expense growth year-over-year to be in the low single digits Significant cost savings initiative while continuing to invest in revenue generating businesses and our differentiated omnichannel delivery Efficiency Ratio(1)(2) Compared to Peer Median FNB has achieved annual cost savings ranging from $10-20 million per year since 2019, excluding acquisition synergies. Includes optimizing the branch network and facilities/space optimization, vendor contract renegotiations, and process improvements Managing expenses while Investing for Growth Over $100 million in costs savings since 2019 • Focus on generating positive operating leverage • Investing in technology, personnel and other strategic initiatives • Leveraging data analytics and AI for automation • Ongoing focus on digital capabilities Below peer median consensus growth of mid-single digits (1) A non-GAAP measure. (2) FTE basis. 56.1 55.5 54.2 54.9 54.8 56.0 57.2 52.1 51.2 55.6 55.1 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD 3Q2025 FNB Peer Median

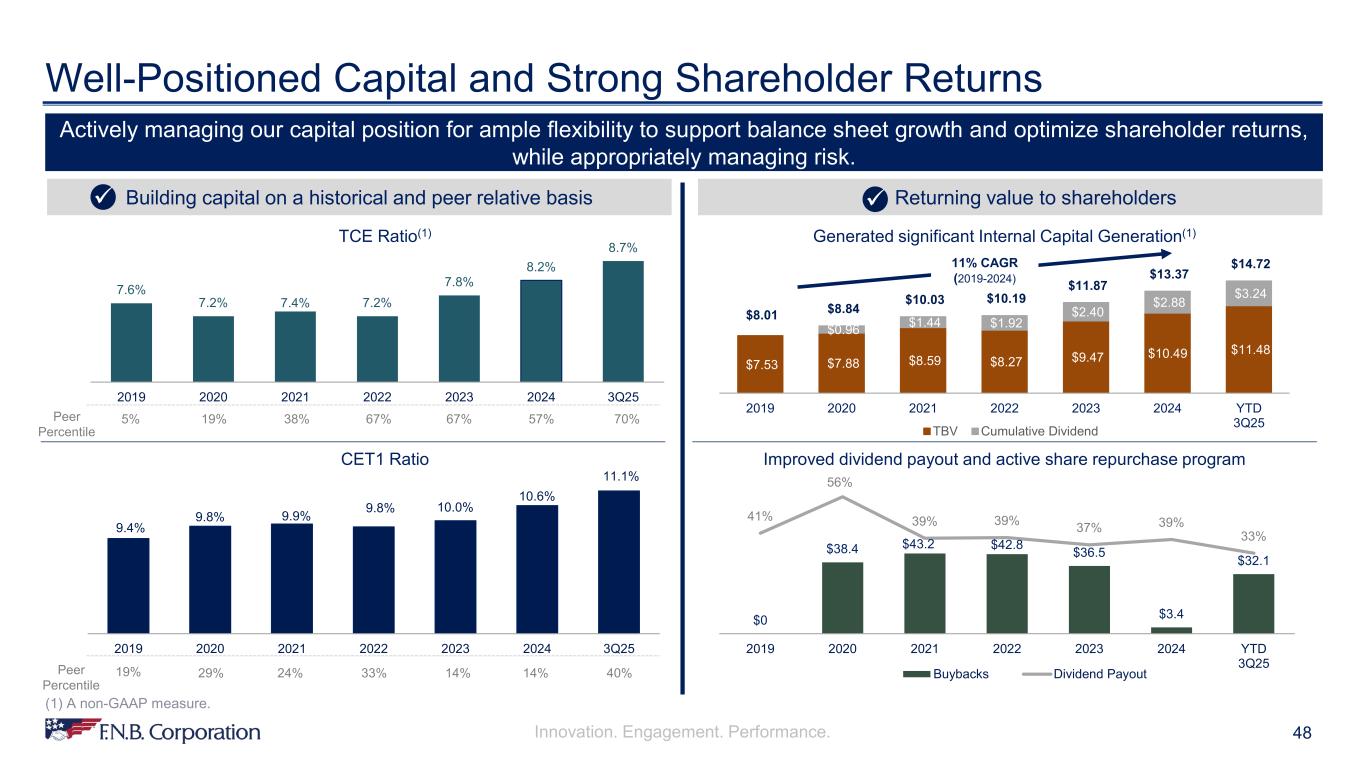

Innovation. Engagement. Performance. 9.4% 9.8% 9.9% 9.8% 10.0% 10.6% 11.1% 2019 2020 2021 2022 2023 2024 3Q25 19% 29% 14% 14% 40%24% 33%Peer Percentile 7.6% 7.2% 7.4% 7.2% 7.8% 8.2% 8.7% 2019 2020 2021 2022 2023 2024 3Q25 5% 19% 67% 57% 70%38% 67%Peer Percentile $7.53 $7.88 $8.59 $8.27 $9.47 $10.49 $11.48 $0.96 $1.44 $1.92 $2.40 $2.88 $3.24 $8.01 $8.84 $10.03 $10.19 $11.87 $13.37 $14.72 2019 2020 2021 2022 2023 2024 YTD 3Q25TBV Cumulative Dividend 11% CAGR (2019-2024) 48 Well-Positioned Capital and Strong Shareholder Returns Actively managing our capital position for ample flexibility to support balance sheet growth and optimize shareholder returns, while appropriately managing risk. Building capital on a historical and peer relative basis Generated significant Internal Capital Generation(1) Improved dividend payout and active share repurchase programCET1 Ratio TCE Ratio(1) $0 $38.4 $43.2 $42.8 $36.5 $3.4 $32.1 41% 56% 39% 39% 37% 39% 33% 0 10 20 30 40 50 60 70 80 0% 10% 20% 30% 40% 50% 60% 2019 2020 2021 2022 2023 2024 YTD 3Q25 Buybacks Dividend Payout Returning value to shareholders (1) A non-GAAP measure.

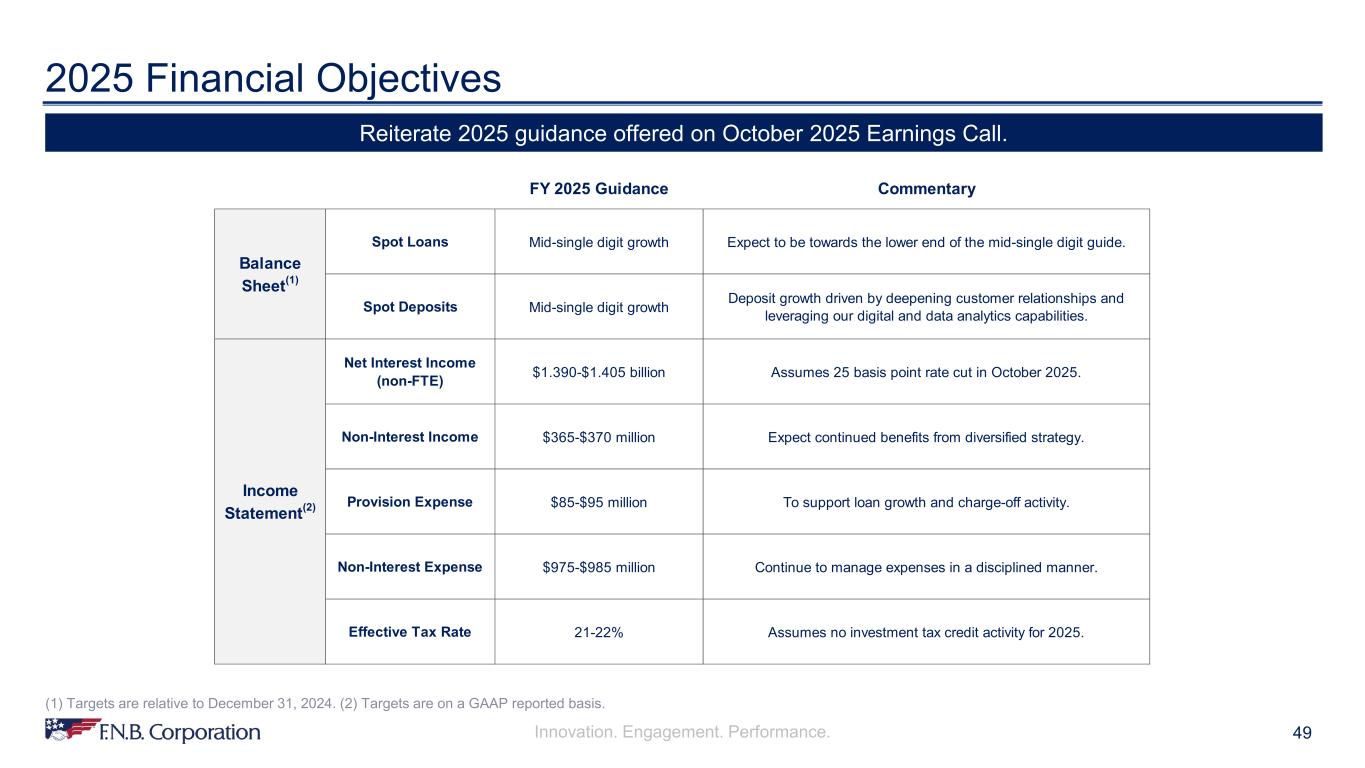

Innovation. Engagement. Performance. 49 2025 Financial Objectives Reiterate 2025 guidance offered on October 2025 Earnings Call. (1) Targets are relative to December 31, 2024. (2) Targets are on a GAAP reported basis. FY 2025 Guidance Commentary Spot Loans Mid-single digit growth Expect to be towards the lower end of the mid-single digit guide. Spot Deposits Mid-single digit growth Deposit growth driven by deepening customer relationships and leveraging our digital and data analytics capabilities. Net Interest Income (non-FTE) $1.390-$1.405 billion Assumes 25 basis point rate cut in October 2025. Non-Interest Income $365-$370 million Expect continued benefits from diversified strategy. Provision Expense $85-$95 million To support loan growth and charge-off activity. Non-Interest Expense $975-$985 million Continue to manage expenses in a disciplined manner. Effective Tax Rate 21-22% Assumes no investment tax credit activity for 2025. Income Statement(2) Balance Sheet(1)

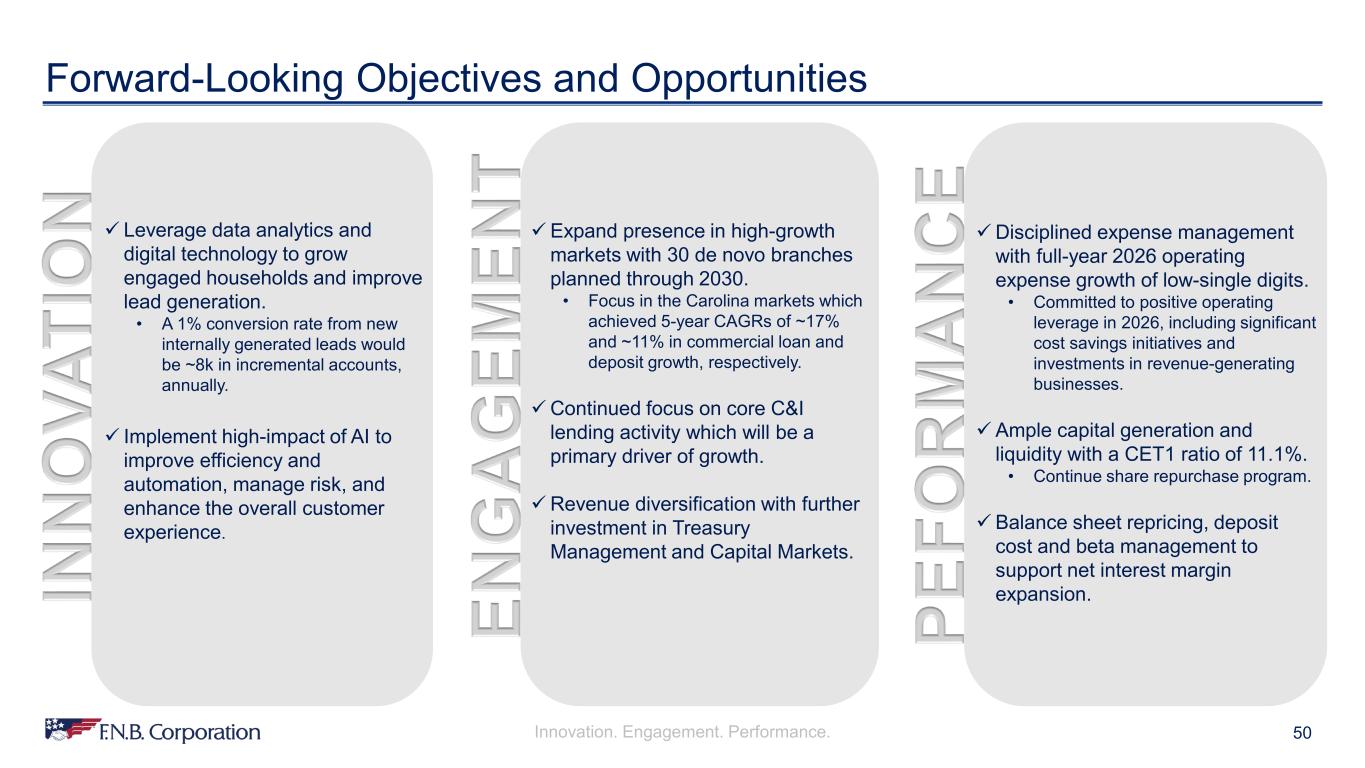

Innovation. Engagement. Performance. 50 Forward-Looking Objectives and Opportunities Leverage data analytics and digital technology to grow engaged households and improve lead generation. • A 1% conversion rate from new internally generated leads would be ~8k in incremental accounts, annually. Implement high-impact of AI to improve efficiency and automation, manage risk, and enhance the overall customer experience. Expand presence in high-growth markets with 30 de novo branches planned through 2030. • Focus in the Carolina markets which achieved 5-year CAGRs of ~17% and ~11% in commercial loan and deposit growth, respectively. Continued focus on core C&I lending activity which will be a primary driver of growth. Revenue diversification with further investment in Treasury Management and Capital Markets. Disciplined expense management with full-year 2026 operating expense growth of low-single digits. • Committed to positive operating leverage in 2026, including significant cost savings initiatives and investments in revenue-generating businesses. Ample capital generation and liquidity with a CET1 ratio of 11.1%. • Continue share repurchase program. Balance sheet repricing, deposit cost and beta management to support net interest margin expansion.

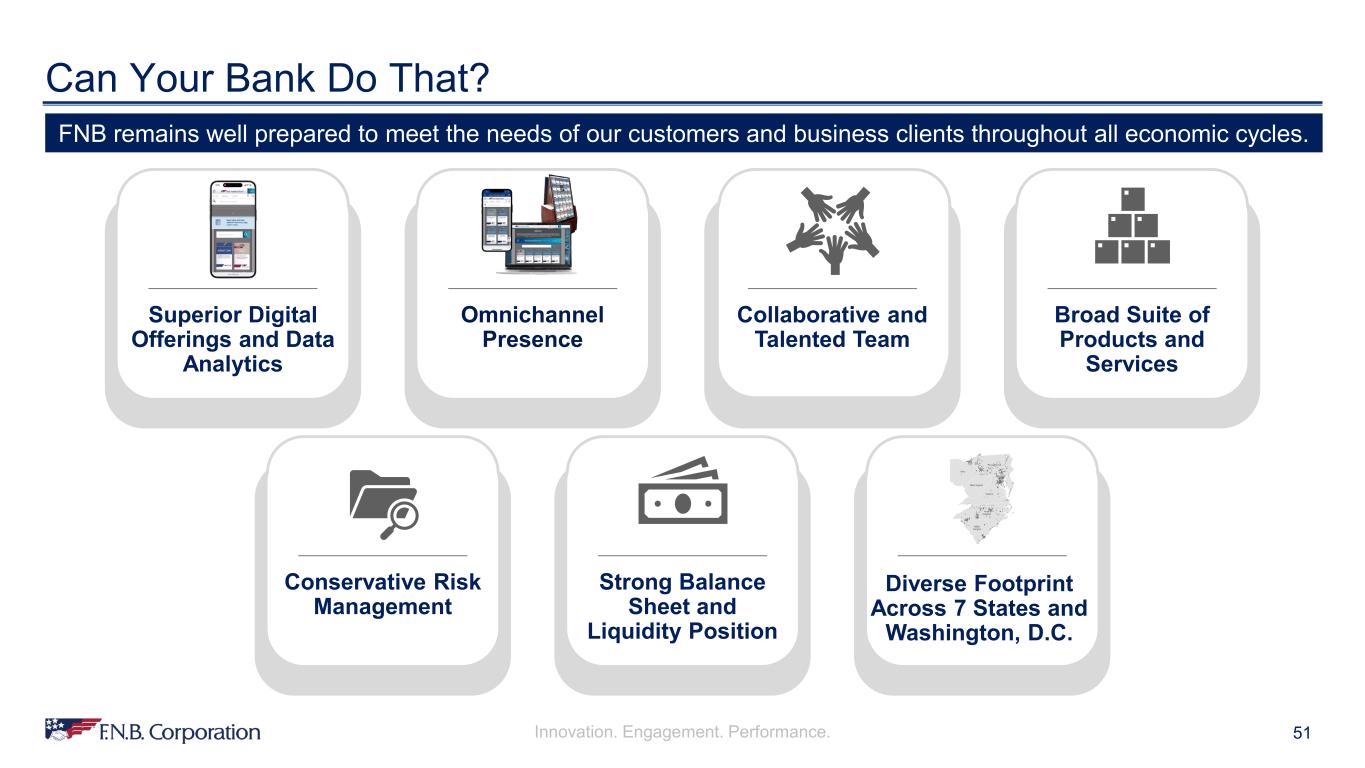

Innovation. Engagement. Performance. 51 Can Your Bank Do That? FNB remains well prepared to meet the needs of our customers and business clients throughout all economic cycles. Superior Digital Offerings and Data Analytics Collaborative and Talented Team Conservative Risk Management Broad Suite of Products and Services Diverse Footprint Across 7 States and Washington, D.C. Omnichannel Presence Strong Balance Sheet and Liquidity Position

Innovation. Engagement. Performance. Appendix

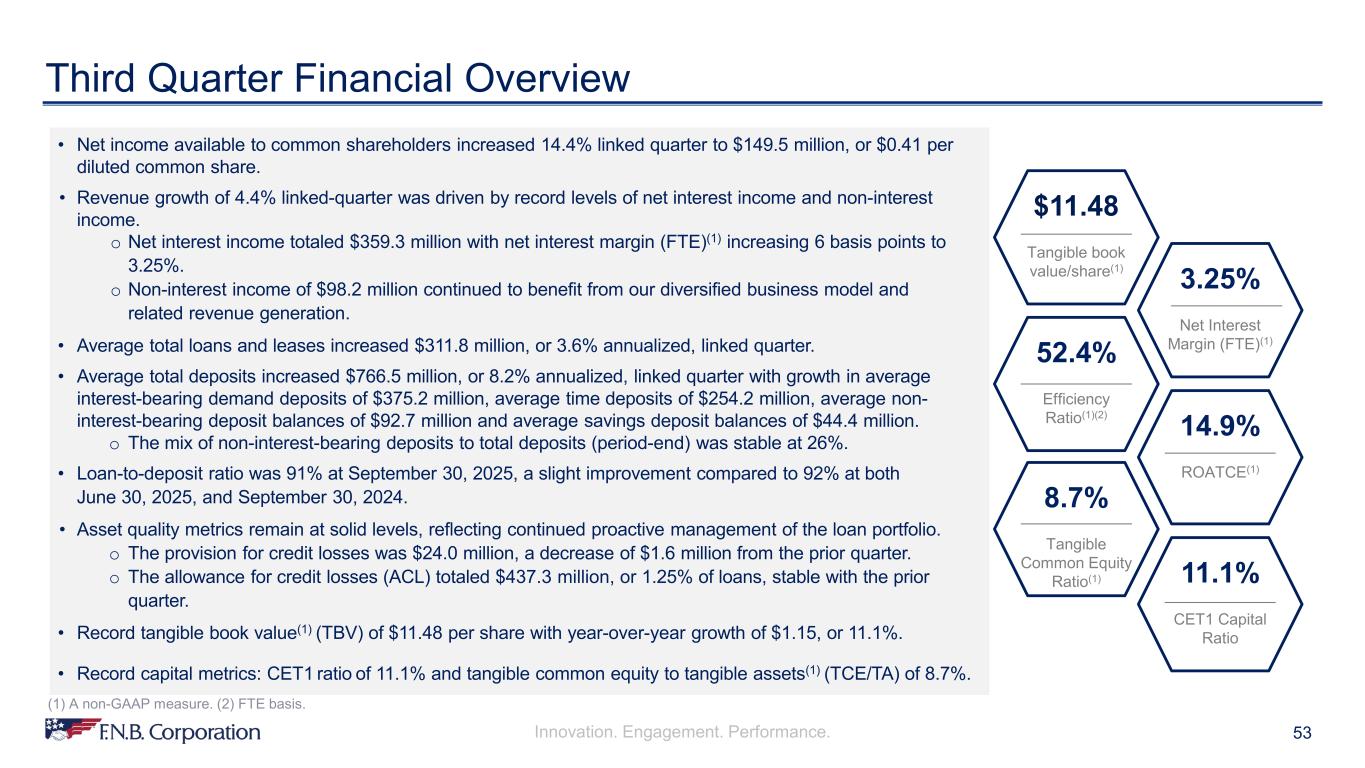

Innovation. Engagement. Performance. 53 Third Quarter Financial Overview (1) A non-GAAP measure. (2) FTE basis. • Net income available to common shareholders increased 14.4% linked quarter to $149.5 million, or $0.41 per diluted common share. • Revenue growth of 4.4% linked-quarter was driven by record levels of net interest income and non-interest income. o Net interest income totaled $359.3 million with net interest margin (FTE)(1) increasing 6 basis points to 3.25%. o Non-interest income of $98.2 million continued to benefit from our diversified business model and related revenue generation. • Average total loans and leases increased $311.8 million, or 3.6% annualized, linked quarter. • Average total deposits increased $766.5 million, or 8.2% annualized, linked quarter with growth in average interest-bearing demand deposits of $375.2 million, average time deposits of $254.2 million, average non- interest-bearing deposit balances of $92.7 million and average savings deposit balances of $44.4 million. o The mix of non-interest-bearing deposits to total deposits (period-end) was stable at 26%. • Loan-to-deposit ratio was 91% at September 30, 2025, a slight improvement compared to 92% at both June 30, 2025, and September 30, 2024. • Asset quality metrics remain at solid levels, reflecting continued proactive management of the loan portfolio. o The provision for credit losses was $24.0 million, a decrease of $1.6 million from the prior quarter. o The allowance for credit losses (ACL) totaled $437.3 million, or 1.25% of loans, stable with the prior quarter. • Record tangible book value(1) (TBV) of $11.48 per share with year-over-year growth of $1.15, or 11.1%. • Record capital metrics: CET1 ratio of 11.1% and tangible common equity to tangible assets(1) (TCE/TA) of 8.7%. 52.4% Efficiency Ratio(1)(2) $11.48 Tangible book value/share(1) 8.7% Tangible Common Equity Ratio(1) 3.25% Net Interest Margin (FTE)(1) 14.9% ROATCE(1) 11.1% CET1 Capital Ratio

Innovation. Engagement. Performance. 54 2025 Peer Group Listing Ticker Institution Ticker Institution ASB Associated Banc-Corp. RF Regions Financial Corp. BKU BankUnited, Inc. SFNC Simmons First National Corp. BOKF BOK Financial Corp. SNV Synovus Financial Corp. CBSH Commerce Bancshares, Inc. SSB SouthState Corp. CFR Cullen/Frost Bankers, Inc. TCBI Texas Capital Bancshares, Inc. CMA Comerica Inc. UMBF UMB Financial Corp. FHN First Horizon Corp. VLY Valley National Bancorp. FULT Fulton Financial Corp. WBS Webster Financial Corp. HBAN Huntington Bancshares, Inc. WTFC Wintrust Financial Corp. HWC Hancock Whitney Corp. ZION Zions Bancorp. PNFP Pinnacle Financial Partners

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 55

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 56

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 57

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 58

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 59

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 60

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 61

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 62

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 63

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 64

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 65

Innovation. Engagement. Performance. Non-GAAP to GAAP Reconciliation 66