1 https://ford.to/facebook https://x.com/ford https://ford.to/linkedin Ford Reports Second Quarter 2025 Financial Results • Second-quarter revenue reached a record $50.2 billion; incurred a net loss of $36 million as a result of special items • Adjusted EBIT was $2.1 billion, including $0.8 billion of adverse net tariff-related impacts; operating cash flow was $6.3 billion, adjusted free cash flow was $2.8 billion • Company declares a third quarter regular dividend of 15 cents per share • Reinstated full-year 2025 guidance includes adjusted EBIT of $6.5 billion to $7.5 billion, adjusted free cash flow of $3.5 billion to $4.5 billion, capital spending of about $9 billion, and a net tariff-related headwind of about $2 billion DEARBORN, Mich., July 30, 2025 – Ford Motor Co. (NYSE: F) today announced its second- quarter 2025 financial results. “Our second-quarter performance shows the power of the Ford+ plan and continued execution on cost and quality,” said Jim Farley, Ford president and CEO. “Ford Pro is a unique competitive advantage driving both top and bottom-line growth while creating new high-margin revenue streams from software and physical services. Ford Blue delivered profitable market share gains, and we continue to improve the efficiency of our Ford Model e business. We have scheduled an event on Aug. 11 in Kentucky where we will share more about our plans to design and build breakthrough electric vehicles in America.” Added Ford CFO Sherry House: “We recorded our fourth consecutive quarter of year-over-year cost improvement, excluding the impact of tariffs, building on progress we made last year when we closed roughly $1.5 billion of our competitive cost gap in material cost. Our balance sheet keeps getting stronger, further enabling our ability to invest in areas of strength. We are remaking Ford into a higher-growth, higher-margin and more durable business – and allocating capital where we can compete, win and grow.” Total Company Highlights Second Quarter First Half 2024 2025 Change 2024 2025 Change Wholesale Units (000) 1,142 1,185 4 % 2,187 2,155 (1)% GAAP Financial Measures Cash Flows from Op. Activities ($B) $ 5.5 $ 6.3 $ 0.8 $ 6.9 $ 10.0 $ 3.1 Revenue ($B) 47.8 50.2 5 % 90.6 90.8 — % Net Income / (Loss) ($B) 1.8 (0.0) (1.9) 3.2 0.4 (2.7) Net Income / (Loss) Margin (%) 3.8 % (0.1)% (3.9) ppts 3.5 % 0.5 % (3.0) ppts EPS (Diluted) $ 0.46 $ (0.01) $ (0.47) $ 0.79 $ 0.11 $ (0.68) Non-GAAP Financial Measures Company Adj. Free Cash Flow ($B) $ 3.2 $ 2.8 $ (0.4) $ 2.8 $ 1.3 $ (1.4) Company Adj. EBIT ($B) 2.8 2.1 (0.6) 5.5 3.2 (2.4) Company Adj. EBIT Margin (%) 5.8 % 4.3 % (1.5) ppts 6.1 % 3.5 % (2.6) ppts Adjusted EPS (Diluted) $ 0.47 $ 0.37 $ (0.10) $ 0.97 $ 0.51 $ (0.46) Adjusted ROIC (Trailing Four Qtrs) 11.1 % 10.1 % (1.0) ppts

2 The company reported second-quarter revenue of $50.2 billion, a 5% increase from the same period a year ago, which outpaced wholesale growth. Net loss was $36 million, which primarily includes special charges related to a field service action and expenses related to a previously announced cancellation of an electric vehicle program; adjusted earnings before interest and taxes was $2.1 billion, including $0.8 billion of adverse net tariff-related impacts. Cash flow from operations in the second quarter was $6.3 billion, and adjusted free cash flow was $2.8 billion. At quarter end, Ford had $28.4 billion in cash and $46.6 billion in liquidity. The company also declared a third-quarter regular dividend of 15 cents per share, payable on Sept. 2 to shareholders of record at the close of business on Aug. 11. Business Segment Highlights Second Quarter First Half 2024 2025 Change 2024 2025 Change Ford Blue Segment Wholesales (000) 741 696 (6)% 1,367 1,284 (6)% Revenue ($B) $ 26.7 $ 25.8 (3)% $ 48.4 $ 46.8 (3)% EBIT ($M) 1,167 661 $ (506) 2,068 757 $ (1,311) EBIT Margin (%) 4.4 % 2.6 % (1.8) ppts 4.3 % 1.6 % (2.7) ppts Ford Model e Segment Wholesales (000) 26 60 128 % 36 91 151 % Revenue ($B) $ 1.2 $ 2.4 105 % $ 1.3 $ 3.6 184 % EBIT ($M) (1,150) (1,329) $ (179) (2,477) (2,178) $ 299 EBIT Margin (%) (99.9) % (56.4) % 43.6 ppts (195.5)% (60.5) % 135.0 ppts Ford Pro Segment Wholesales (000) 375 429 15 % 783 781 (0)% Revenue ($B) $ 17.0 $ 18.8 11 % $ 35.0 $ 34.0 (3)% EBIT ($M) 2,562 2,318 $ (244) 5,568 3,627 $ (1,941) EBIT Margin (%) 15.1 % 12.3 % (2.7) ppts 15.9 % 10.7 % (5.2) ppts In the second quarter, Ford Pro generated $2.3 billion in EBIT with a margin of 12.3% on $18.8 billion in revenue. Software and physical services contributed 17% of Ford Pro’s EBIT on a trailing 12-month basis. In the quarter, Ford Pro paid subscriptions grew 24% year-over-year to 757,000. Ford Model e reported a second-quarter EBIT loss of $1.3 billion, a $179 million higher loss than the same quarter a year ago. Second quarter results reflect net tariff-related cost, strategic investments in next-generation electric vehicles and expenses related to the launch of Ford’s new battery plant in Marshall, Mich. The segment doubled revenue to $2.4 billion; EBIT performance for first-generation products, Mustang Mach-E and F-150 Lightning, was essentially flat year-over-year, excluding the impact of tariffs, underscoring gains in operating leverage and cost reduction.

3 Ford Blue reported $661 million in EBIT, which reflected profitable market share gains, higher net pricing and cost improvement. This was more than offset by the non-recurrence of last year’s F-150 stock build following the new-model launch and tariff-related headwinds. Segment revenue declined 3% to $25.8 billion. Ford Credit reported second-quarter earnings before taxes (EBT) of $645 million, an 88% increase compared to a year ago. Full-Year 2025 Outlook Ford now anticipates full-year adjusted EBIT of $6.5 billion to $7.5 billion, which includes a net tariff-related headwind of about $2 billion, and to generate $3.5 billion to $4.5 billion in adjusted free cash flow, with capital expenditures of about $9 billion. In February, the company initially provided adjusted EBIT guidance for the year of $7.0 billion to $8.5 billion and then withdrew that guidance in May due to tariff-related uncertainty. The company’s updated guidance reflects the strong underlying first half performance across Ford Blue, Ford Model e, Ford Pro and Ford Credit, and continued improvement in cost. The net tariff-related headwind of about $2 billion reflects a $3 billion gross adverse adjusted EBIT impact, offset partially by $1 billion of recovery actions. The company is only providing Total Company outlook for the remainder of the year. Conference Call Details At 5:00 p.m. ET today, Ford and Ford Credit management will hold a conference call to discuss these financial results. For the webcast, click here. It will be available for replay for approximately one week following the call at the same link. Analysts will be able to ask questions on the call. Registration beforehand is strongly recommended to expedite access to the call. # # # About Ford Motor Company Ford Motor Company (NYSE: F) is a global company based in Dearborn, Michigan, committed to helping build a better world, where every person is free to move and pursue their dreams. The company’s Ford+ plan for growth and value creation combines existing strengths, new capabilities, and always-on relationships with customers to enrich experiences for customers and deepen their loyalty. Ford develops and delivers innovative, must-have Ford trucks, sport utility vehicles, commercial vans and cars and Lincoln luxury vehicles, along with connected services. The company offers freedom of choice through three customer-centered business segments: Ford Blue, engineering iconic gas-powered and hybrid vehicles; Ford Model e, inventing breakthrough electric vehicles (“EVs”) along with embedded software that defines always-on digital experiences for all customers; and Ford Pro, helping commercial customers transform and expand their businesses with vehicles and services tailored to their needs. Additionally, the Company provides financial services through Ford Motor Credit Company. Ford employs about

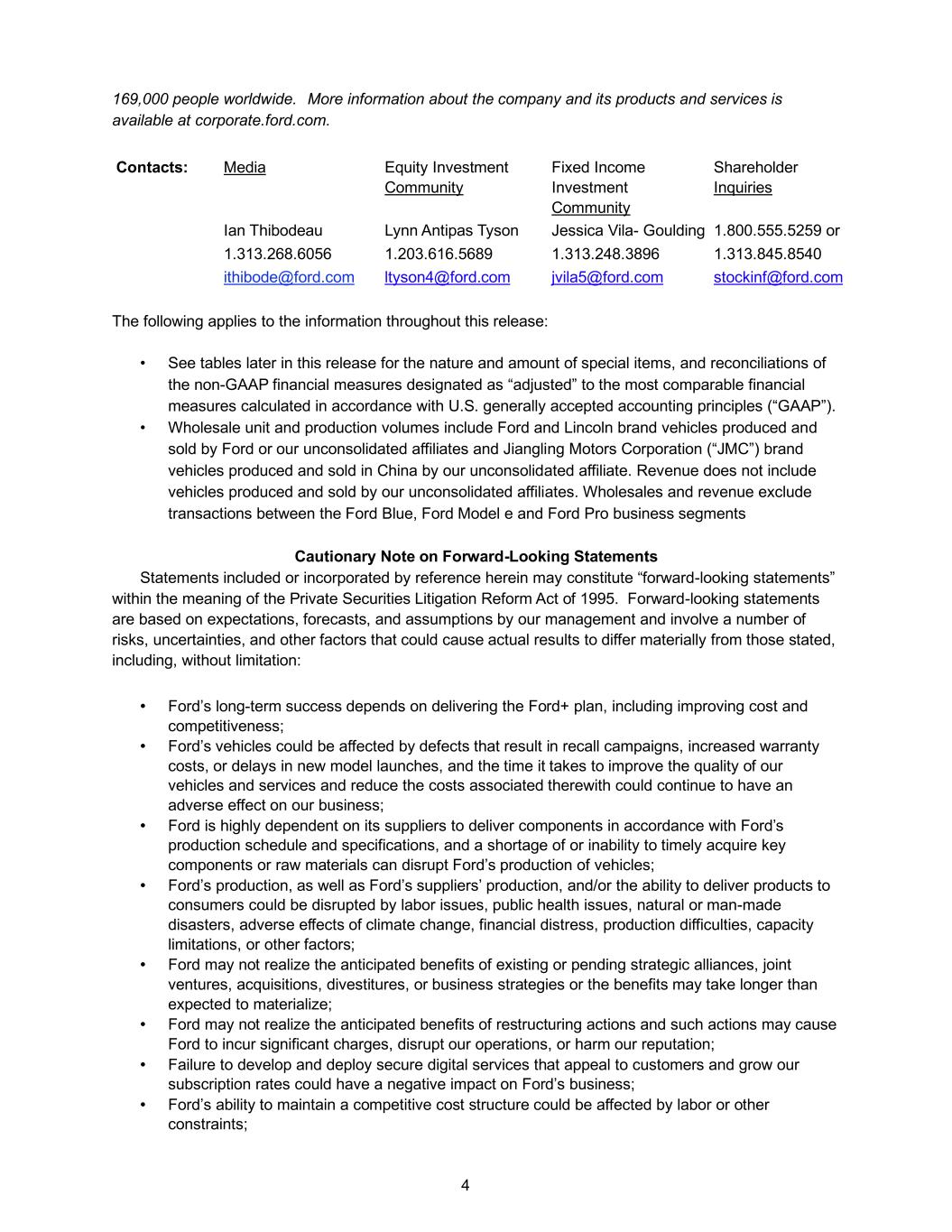

4 169,000 people worldwide. More information about the company and its products and services is available at corporate.ford.com. Contacts: Media Equity Investment Community Fixed Income Investment Community Shareholder Inquiries Ian Thibodeau Lynn Antipas Tyson Jessica Vila- Goulding 1.800.555.5259 or 1.313.268.6056 1.203.616.5689 1.313.248.3896 1.313.845.8540 ithibode@ford.com ltyson4@ford.com jvila5@ford.com stockinf@ford.com The following applies to the information throughout this release: • See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). • Wholesale unit and production volumes include Ford and Lincoln brand vehicles produced and sold by Ford or our unconsolidated affiliates and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliate. Revenue does not include vehicles produced and sold by our unconsolidated affiliates. Wholesales and revenue exclude transactions between the Ford Blue, Ford Model e and Ford Pro business segments Cautionary Note on Forward-Looking Statements Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford’s long-term success depends on delivering the Ford+ plan, including improving cost and competitiveness; • Ford’s vehicles could be affected by defects that result in recall campaigns, increased warranty costs, or delays in new model launches, and the time it takes to improve the quality of our vehicles and services and reduce the costs associated therewith could continue to have an adverse effect on our business; • Ford is highly dependent on its suppliers to deliver components in accordance with Ford’s production schedule and specifications, and a shortage of or inability to timely acquire key components or raw materials can disrupt Ford’s production of vehicles; • Ford’s production, as well as Ford’s suppliers’ production, and/or the ability to deliver products to consumers could be disrupted by labor issues, public health issues, natural or man-made disasters, adverse effects of climate change, financial distress, production difficulties, capacity limitations, or other factors; • Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, or business strategies or the benefits may take longer than expected to materialize; • Ford may not realize the anticipated benefits of restructuring actions and such actions may cause Ford to incur significant charges, disrupt our operations, or harm our reputation; • Failure to develop and deploy secure digital services that appeal to customers and grow our subscription rates could have a negative impact on Ford’s business; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints;

5 • Ford’s ability to attract, develop, grow, support, and reward talent is critical to its success and competitiveness; • Operational information systems, security systems, vehicles, and services could be affected by cybersecurity incidents, ransomware attacks, and other disruptions and impact Ford, Ford Credit, their suppliers, and dealers; • To facilitate access to the raw materials and other components necessary for the production of electric vehicles, Ford has entered into and may, in the future, enter into multi-year commitments to raw material and other suppliers that subject Ford to risks associated with lower future demand for such items as well as costs that fluctuate and are difficult to accurately forecast; • With a global footprint and supply chain, Ford’s results and operations could be adversely affected by economic or geopolitical developments, including protectionist trade policies such as tariffs, or other events; • Ford’s new and existing products and digital, software, and physical services are subject to market acceptance and face significant competition from existing and new entrants in the automotive and digital and software services industries, and Ford’s reputation may be harmed based on positions it takes or if it is unable to achieve the initiatives it has announced; • Ford may face increased price competition for its products and services, including pricing pressure resulting from industry excess capacity, currency fluctuations, competitive actions, or economic or other factors, particularly for electric vehicles; • Inflationary pressure and fluctuations in commodity and energy prices, foreign currency exchange rates, interest rates, and market value of Ford or Ford Credit’s investments, including marketable securities, can have a significant effect on results; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • Industry sales volume can be volatile and could decline if there is a financial crisis, recession, public health emergency, or significant geopolitical event; • The impact of government incentives on Ford’s business could be significant, and Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, asset portfolios, or other factors; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Economic and demographic experience for pension and OPEB plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Ford and Ford Credit could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, services, perceived environmental impacts, or otherwise; • Ford may need to substantially modify its product plans and facilities to comply with safety, emissions, fuel economy, autonomous driving technology, environmental, and other regulations; • Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, data protection, data access, and artificial intelligence laws and regulations as well as consumers’ heightened expectations to safeguard their personal information; and • Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward- looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake, and expressly disclaim to the extent permitted by law, any obligation to update or revise publicly any forward-looking statement, whether as a

6 result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

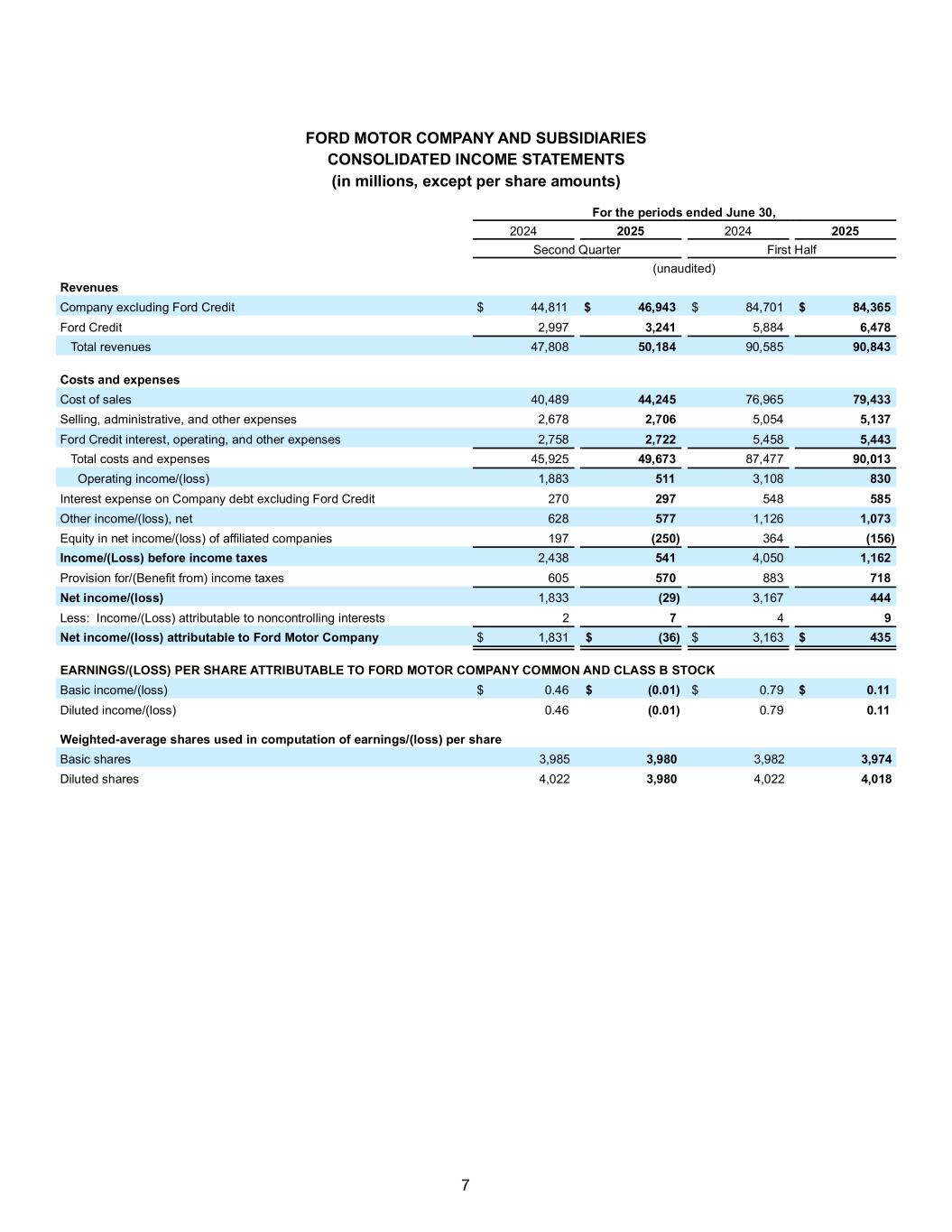

7 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions, except per share amounts) For the periods ended June 30, 2024 2025 2024 2025 Second Quarter First Half (unaudited) Revenues Company excluding Ford Credit $ 44,811 $ 46,943 $ 84,701 $ 84,365 Ford Credit 2,997 3,241 5,884 6,478 Total revenues 47,808 50,184 90,585 90,843 Costs and expenses Cost of sales 40,489 44,245 76,965 79,433 Selling, administrative, and other expenses 2,678 2,706 5,054 5,137 Ford Credit interest, operating, and other expenses 2,758 2,722 5,458 5,443 Total costs and expenses 45,925 49,673 87,477 90,013 Operating income/(loss) 1,883 511 3,108 830 Interest expense on Company debt excluding Ford Credit 270 297 548 585 Other income/(loss), net 628 577 1,126 1,073 Equity in net income/(loss) of affiliated companies 197 (250) 364 (156) Income/(Loss) before income taxes 2,438 541 4,050 1,162 Provision for/(Benefit from) income taxes 605 570 883 718 Net income/(loss) 1,833 (29) 3,167 444 Less: Income/(Loss) attributable to noncontrolling interests 2 7 4 9 Net income/(loss) attributable to Ford Motor Company $ 1,831 $ (36) $ 3,163 $ 435 EARNINGS/(LOSS) PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK Basic income/(loss) $ 0.46 $ (0.01) $ 0.79 $ 0.11 Diluted income/(loss) 0.46 (0.01) 0.79 0.11 Weighted-average shares used in computation of earnings/(loss) per share Basic shares 3,985 3,980 3,982 3,974 Diluted shares 4,022 3,980 4,022 4,018

8 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, 2024 June 30, 2025 (unaudited) ASSETS Cash and cash equivalents $ 22,935 $ 23,020 Marketable securities 15,413 14,484 Ford Credit finance receivables, net of allowance for credit losses of $247 and $258 51,850 47,593 Trade and other receivables, less allowances of $84 and $98 14,723 19,709 Inventories 14,951 17,270 Other assets 4,602 4,536 Total current assets 124,474 126,612 Ford Credit finance receivables, net of allowance for credit losses of $617 and $632 59,786 59,867 Net investment in operating leases 22,947 25,336 Net property 41,928 43,877 Equity in net assets of affiliated companies 6,821 5,038 Deferred income taxes 16,375 17,320 Other assets 12,865 14,675 Total assets $ 285,196 $ 292,725 LIABILITIES Payables $ 24,128 $ 27,756 Other liabilities and deferred revenue 27,782 30,360 Debt payable within one year Company excluding Ford Credit 1,756 3,591 Ford Credit 53,193 53,281 Total current liabilities 106,859 114,988 Other liabilities and deferred revenue 28,832 30,242 Long-term debt Company excluding Ford Credit 18,898 16,742 Ford Credit 84,675 84,113 Deferred income taxes 1,074 1,559 Total liabilities 240,338 247,644 EQUITY Common Stock, par value $0.01 per share (4,129 million shares issued of 6 billion authorized) 41 41 Class B Stock, par value $0.01 per share (71 million shares issued of 530 million authorized) 1 1 Capital in excess of par value of stock 23,502 23,715 Retained earnings 33,740 32,352 Accumulated other comprehensive income/(loss) (9,639) (8,242) Treasury stock (2,810) (2,810) Total equity attributable to Ford Motor Company 44,835 45,057 Equity attributable to noncontrolling interests 23 24 Total equity 44,858 45,081 Total liabilities and equity $ 285,196 $ 292,725

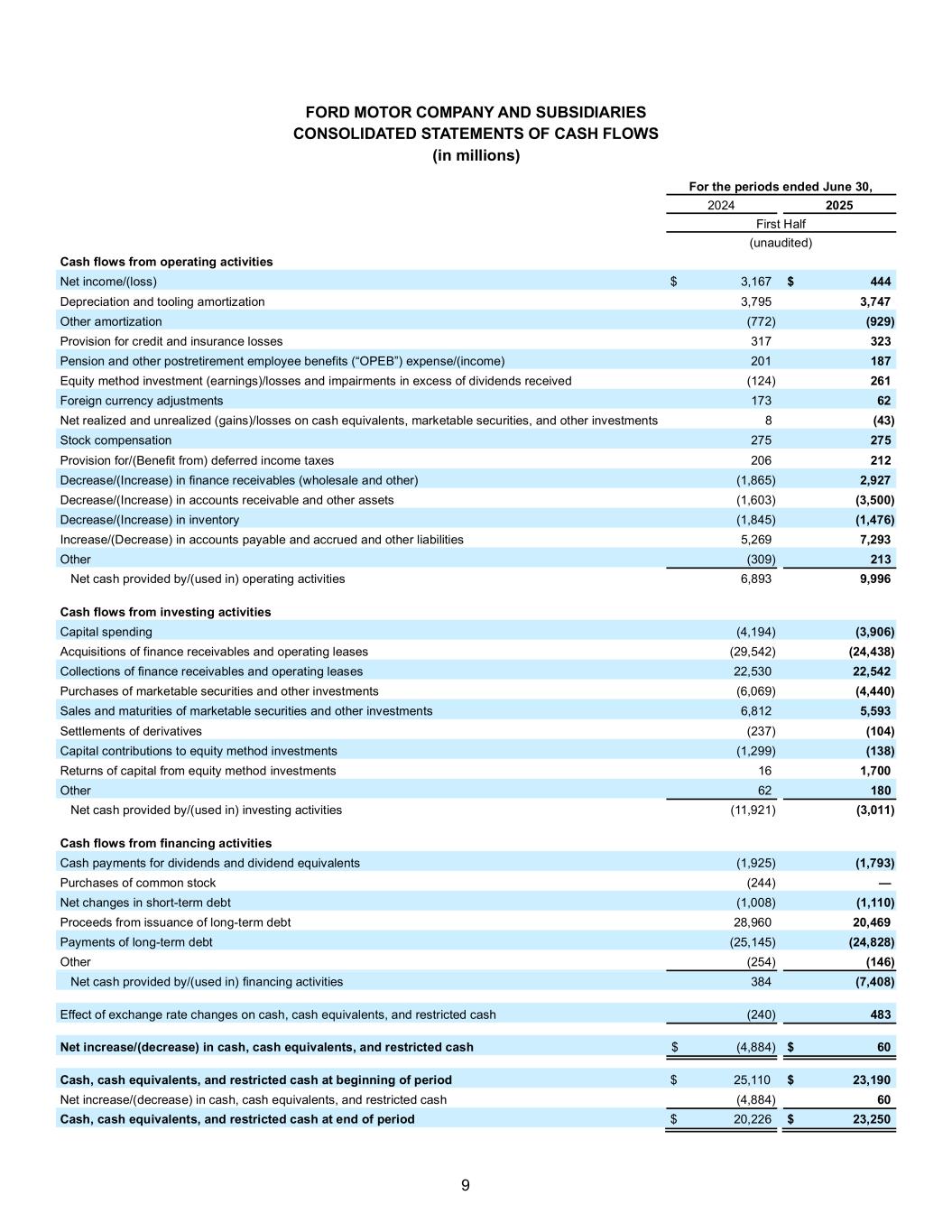

9 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) For the periods ended June 30, 2024 2025 First Half (unaudited) Cash flows from operating activities Net income/(loss) $ 3,167 $ 444 Depreciation and tooling amortization 3,795 3,747 Other amortization (772) (929) Provision for credit and insurance losses 317 323 Pension and other postretirement employee benefits (“OPEB”) expense/(income) 201 187 Equity method investment (earnings)/losses and impairments in excess of dividends received (124) 261 Foreign currency adjustments 173 62 Net realized and unrealized (gains)/losses on cash equivalents, marketable securities, and other investments 8 (43) Stock compensation 275 275 Provision for/(Benefit from) deferred income taxes 206 212 Decrease/(Increase) in finance receivables (wholesale and other) (1,865) 2,927 Decrease/(Increase) in accounts receivable and other assets (1,603) (3,500) Decrease/(Increase) in inventory (1,845) (1,476) Increase/(Decrease) in accounts payable and accrued and other liabilities 5,269 7,293 Other (309) 213 Net cash provided by/(used in) operating activities 6,893 9,996 Cash flows from investing activities Capital spending (4,194) (3,906) Acquisitions of finance receivables and operating leases (29,542) (24,438) Collections of finance receivables and operating leases 22,530 22,542 Purchases of marketable securities and other investments (6,069) (4,440) Sales and maturities of marketable securities and other investments 6,812 5,593 Settlements of derivatives (237) (104) Capital contributions to equity method investments (1,299) (138) Returns of capital from equity method investments 16 1,700 Other 62 180 Net cash provided by/(used in) investing activities (11,921) (3,011) Cash flows from financing activities Cash payments for dividends and dividend equivalents (1,925) (1,793) Purchases of common stock (244) — Net changes in short-term debt (1,008) (1,110) Proceeds from issuance of long-term debt 28,960 20,469 Payments of long-term debt (25,145) (24,828) Other (254) (146) Net cash provided by/(used in) financing activities 384 (7,408) Effect of exchange rate changes on cash, cash equivalents, and restricted cash (240) 483 Net increase/(decrease) in cash, cash equivalents, and restricted cash $ (4,884) $ 60 Cash, cash equivalents, and restricted cash at beginning of period $ 25,110 $ 23,190 Net increase/(decrease) in cash, cash equivalents, and restricted cash (4,884) 60 Cash, cash equivalents, and restricted cash at end of period $ 20,226 $ 23,250

10 SUPPLEMENTAL INFORMATION The tables below provide supplemental consolidating financial information. Company excluding Ford Credit includes our Ford Blue, Ford Model e, and Ford Pro reportable segments, Corporate Other, Interest on Debt, and Special Items. Eliminations, where presented, primarily represent eliminations of intersegment transactions and deferred tax netting. Selected Income Statement Information. The following table provides supplemental income statement information (in millions): For the period ended June 30, 2025 Second Quarter Company excluding Ford Credit Ford Credit Consolidated Revenues $ 46,943 $ 3,241 $ 50,184 Total costs and expenses 46,951 2,722 49,673 Operating income/(loss) (8) 519 511 Interest expense on Company debt excluding Ford Credit 297 — 297 Other income/(loss), net 464 113 577 Equity in net income/(loss) of affiliated companies (263) 13 (250) Income/(Loss) before income taxes (104) 645 541 Provision for/(Benefit from) income taxes 468 102 570 Net income/(loss) (572) 543 (29) Less: Income/(Loss) attributable to noncontrolling interests 7 — 7 Net income/(loss) attributable to Ford Motor Company $ (579) $ 543 $ (36) For the period ended June 30, 2025 First Half Company excluding Ford Credit Ford Credit Consolidated Revenues $ 84,365 $ 6,478 $ 90,843 Total costs and expenses 84,570 5,443 90,013 Operating income/(loss) (205) 1,035 830 Interest expense on Company debt excluding Ford Credit 585 — 585 Other income/(loss), net 906 167 1,073 Equity in net income/(loss) of affiliated companies (179) 23 (156) Income/(Loss) before income taxes (63) 1,225 1,162 Provision for/(Benefit from) income taxes 460 258 718 Net income/(loss) (523) 967 444 Less: Income/(Loss) attributable to noncontrolling interests 9 — 9 Net income/(loss) attributable to Ford Motor Company $ (532) $ 967 $ 435

11 Selected Balance Sheet Information. The following tables provide supplemental balance sheet information (in millions): June 30, 2025 Assets Company excluding Ford Credit Ford Credit Eliminations Consolidated Cash and cash equivalents $ 14,551 $ 8,469 $ — $ 23,020 Marketable securities 13,730 754 — 14,484 Ford Credit finance receivables, net — 47,593 — 47,593 Trade and other receivables, net 8,373 11,336 — 19,709 Inventories 17,270 — — 17,270 Other assets 3,331 1,205 — 4,536 Receivable from other segments 581 2,038 (2,619) — Total current assets 57,836 71,395 (2,619) 126,612 Ford Credit finance receivables, net — 59,867 — 59,867 Net investment in operating leases 1,977 23,359 — 25,336 Net property 43,550 327 — 43,877 Equity in net assets of affiliated companies 4,896 142 — 5,038 Deferred income taxes 16,944 422 (46) 17,320 Other assets 12,383 2,292 — 14,675 Receivable from other segments 82 — (82) — Total assets $ 137,668 $ 157,804 $ (2,747) $ 292,725 Liabilities Payables $ 26,795 $ 961 $ — $ 27,756 Other liabilities and deferred revenue 27,740 2,620 — 30,360 Debt payable within one year 3,591 53,281 — 56,872 Payable to other segments 2,619 — (2,619) — Total current liabilities 60,745 56,862 (2,619) 114,988 Other liabilities and deferred revenue 28,713 1,529 — 30,242 Long-term debt 16,742 84,113 — 100,855 Deferred income taxes 929 676 (46) 1,559 Payable to other segments — 82 (82) — Total liabilities $ 107,129 $ 143,262 $ (2,747) $ 247,644

12 Selected Cash Flow Information. The following tables provide supplemental cash flow information (in millions): For the period ended June 30, 2025 First Half Cash flows from operating activities Company excluding Ford Credit Ford Credit Eliminations Consolidated Net income/(loss) $ (523) $ 967 $ — $ 444 Depreciation and tooling amortization 2,514 1,233 — 3,747 Other amortization 27 (956) — (929) Provision for credit and insurance losses 5 318 — 323 Pension and OPEB expense/(income) 187 — — 187 Equity method investment (earnings)/losses and impairments in excess of dividends received 272 (11) — 261 Foreign currency adjustments 139 (77) — 62 Net realized and unrealized (gains)/losses on cash equivalents, marketable securities, and other investments (24) (19) — (43) Stock compensation 265 10 — 275 Provision for/(Benefit from) deferred income taxes 17 195 — 212 Decrease/(Increase) in finance receivables (wholesale and other) — 2,927 — 2,927 Decrease/(Increase) in intersegment receivables/payables (158) 158 — — Decrease/(Increase) in accounts receivable and other assets (3,429) (71) — (3,500) Decrease/(Increase) in inventory (1,476) — — (1,476) Increase/(Decrease) in accounts payable and accrued and other liabilities 7,122 171 — 7,293 Other 185 28 — 213 Interest supplements and residual value support to Ford Credit (1,750) 1,750 — — Net cash provided by/(used in) operating activities $ 3,373 $ 6,623 $ — $ 9,996 Cash flows from investing activities Capital spending $ (3,844) $ (62) $ — $ (3,906) Acquisitions of finance receivables and operating leases — (24,438) — (24,438) Collections of finance receivables and operating leases — 22,542 — 22,542 Purchases of marketable securities and other investments (4,238) (202) — (4,440) Sales and maturities of marketable securities and other investments 5,417 176 — 5,593 Settlements of derivatives 110 (214) — (104) Capital contributions to equity method investments (138) — — (138) Returns of capital from equity method investments 1,700 — — 1,700 Other 180 — — 180 Investing activity (to)/from other segments 700 — (700) — Net cash provided by/(used in) investing activities $ (113) $ (2,198) $ (700) $ (3,011) Cash flows from financing activities Cash payments for dividends and dividend equivalents $ (1,793) $ — $ — $ (1,793) Purchases of common stock — — — — Net changes in short-term debt 192 (1,302) — (1,110) Proceeds from issuance of long-term debt 1 20,468 — 20,469 Payments of long-term debt (926) (23,902) — (24,828) Other (94) (52) — (146) Financing activity to/(from) other segments — (700) 700 — Net cash provided by/(used in) financing activities $ (2,620) $ (5,488) $ 700 $ (7,408) Effect of exchange rate changes on cash, cash equivalents, and restricted cash $ 212 $ 271 $ — $ 483

13 Non-GAAP Financial Measures That Supplement GAAP Measures We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide useful perspective on underlying operating results and trends, and a means to compare our period-over- period results. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. • Company Adjusted EBIT (Most Comparable GAAP Measure: Net income / (Loss) attributable to Ford) – Earnings Before Interest and Taxes (EBIT) excludes interest on debt (excluding Ford Credit Debt), taxes and pre-tax special items. This non-GAAP measure is useful to management and investors because it focuses on underlying operating results and trends, and improves comparability of our period-over-period results. Our management excludes special items from its review of the results of the operating segments for purposes of measuring segment profitability and allocating resources. Pre-tax special items consist of (i) pension and OPEB remeasurement gains and losses, (ii) significant personnel expenses, supplier- and dealer-related costs, and facility-related charges stemming from our efforts to match production capacity and cost structure to market demand and changing model mix, and (iii) other items that we do not generally consider to be indicative of earnings from ongoing operating activities. When we provide guidance for adjusted EBIT, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty, including gains and losses on pension and OPEB remeasurements and on investments in equity securities. • Company Adjusted EBIT Margin (Most Comparable GAAP Measure: Company Net Income / (Loss) Margin) – Company Adjusted EBIT Margin is Company Adjusted EBIT divided by Company revenue. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. • Adjusted Earnings / (Loss) Per Share (Most Comparable GAAP Measure: Earnings / (Loss) Per Share) – Measure of Company’s diluted net earnings / (loss) per share adjusted for impact of pre-tax special items (described above), tax special items and restructuring impacts in noncontrolling interests. The measure provides investors with useful information to evaluate performance of our business excluding items not indicative of earnings from ongoing operating activities. When we provide guidance for adjusted earnings / (loss) per share, we do not provide guidance on an earnings / (loss) per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Adjusted Effective Tax Rate (Most Comparable GAAP Measure: Effective Tax Rate) – Measure of Company’s tax rate excluding pre-tax special items (described above) and tax special items. The measure provides an ongoing effective rate which investors find useful for historical comparisons and for forecasting. When we provide guidance for adjusted effective tax rate, we do not provide guidance on an effective tax rate basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted Free Cash Flow (FCF) (Most Comparable GAAP Measure: Net Cash Provided By / (Used In) Operating Activities) – Measure of Company’s operating cash flow excluding Ford Credit’s operating cash flows. The measure contains elements management considers operating activities, including Company excluding Ford Credit capital spending, Ford Credit distributions to its parent, and settlement of derivatives. The measure excludes cash outflows for funded pension contributions, restructuring actions, and other items that are considered operating cash flows under GAAP. This measure is useful to management and investors because it is consistent with management’s assessment of the Company’s operating cash flow performance. When we provide guidance for Company Adjusted FCF, we do not provide guidance for net cash provided by / (used in) operating activities because the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, including cash flows related to the Company's exposures to foreign currency exchange rates and certain commodity prices (separate from any related hedges), Ford Credit's operating cash flows, and cash flows related to special items, including separation payments, each of which individually or in the aggregate could have a significant impact to our net cash provided by / (used in) our operating activities. • Adjusted ROIC – Calculated as the sum of adjusted net operating profit / (loss) after-cash tax from the last four quarters, divided by the average invested capital over the last four quarters. This calculation provides management and investors with useful information to evaluate the Company’s after-cash tax operating return on its invested capital for the period presented. Adjusted net operating profit / (loss) after-cash tax measures operating results less special items, interest on debt (excluding Ford Credit Debt), and certain pension / OPEB costs. Average invested capital is the sum of average balance sheet equity, debt (excluding Ford Credit Debt), and net pension / OPEB liability. Note: Calculated results may not sum due to rounding

14 Net Income / (Loss) Reconciliation to Adjusted EBIT ($M) Second Quarter First Half Memo: 2024 2025 2024 2025 FY 2024 Net Income / (Loss) Attributable to Ford (GAAP) $ 1,831 $ (36) $ 3,163 $ 435 $ 5,879 Income / (Loss) Attributable to Noncontrolling Interests 2 7 4 9 15 Net Income / (Loss) $ 1,833 $ (29) $ 3,167 $ 444 $ 5,894 Less: (Provision For) / Benefit From Income Taxes (605) (570) (883) (718) (1,339) Income / (Loss) Before Income Taxes $ 2,438 $ 541 $ 4,050 $ 1,162 $ 7,233 Less: Special Items Pre-Tax (49) (1,302) (922) (1,412) (1,860) Income / (Loss) Before Special Items Pre-Tax $ 2,487 $ 1,843 $ 4,972 $ 2,574 $ 9,093 Less: Interest on Debt (270) (297) (548) (585) (1,115) Adjusted EBIT (Non-GAAP) $ 2,757 $ 2,140 $ 5,520 $ 3,159 $ 10,208 Memo: Revenue ($B) $ 47.8 $ 50.2 $ 90.6 $ 90.8 $ 185.0 Net Income / (Loss) Margin (GAAP) (%) 3.8 % (0.1)% 3.5 % 0.5 % 3.2 % Adjusted EBIT Margin (Non-GAAP) (%) 5.8 % 4.3 % 6.1 % 3.5 % 5.5 % Earnings / (Loss) Per Share Reconciliation To Adjusted Earnings / (Loss) Per Share Second Quarter First Half 2024 2025 2024 2025 Diluted After-Tax Results ($M) Diluted After-Tax Results (GAAP) $ 1,831 $ (36) $ 3,163 $ 435 Less: Impact of Pre-Tax and Tax Special Items (79) (1,535) (732) (1,616) Adjusted Net Income / (Loss) – Diluted (Non-GAAP) $ 1,910 $ 1,499 $ 3,895 $ 2,051 Basic and Diluted Shares (M) Basic Shares (Average Shares Outstanding) 3,985 3,980 3,982 3,974 Net Dilutive Options, Unvested Restricted Stock Units, Unvested Restricted Stock Shares, and Convertible Debt 37 45 40 44 Diluted Shares 4,022 4,025 4,022 4,018 Earnings / (Loss) Per Share – Diluted (GAAP) (a) $ 0.46 $ (0.01) $ 0.79 $ 0.11 Less: Net Impact of Adjustments (0.01) (0.38) (0.18) (0.40) Adjusted Earnings Per Share – Diluted (Non-GAAP) $ 0.47 $ 0.37 $ 0.97 $ 0.51 a. In the second quarter of 2025, there were 45M shares excluded from the calculation of diluted earnings / (loss) per share, due to their anti- dilutive effect

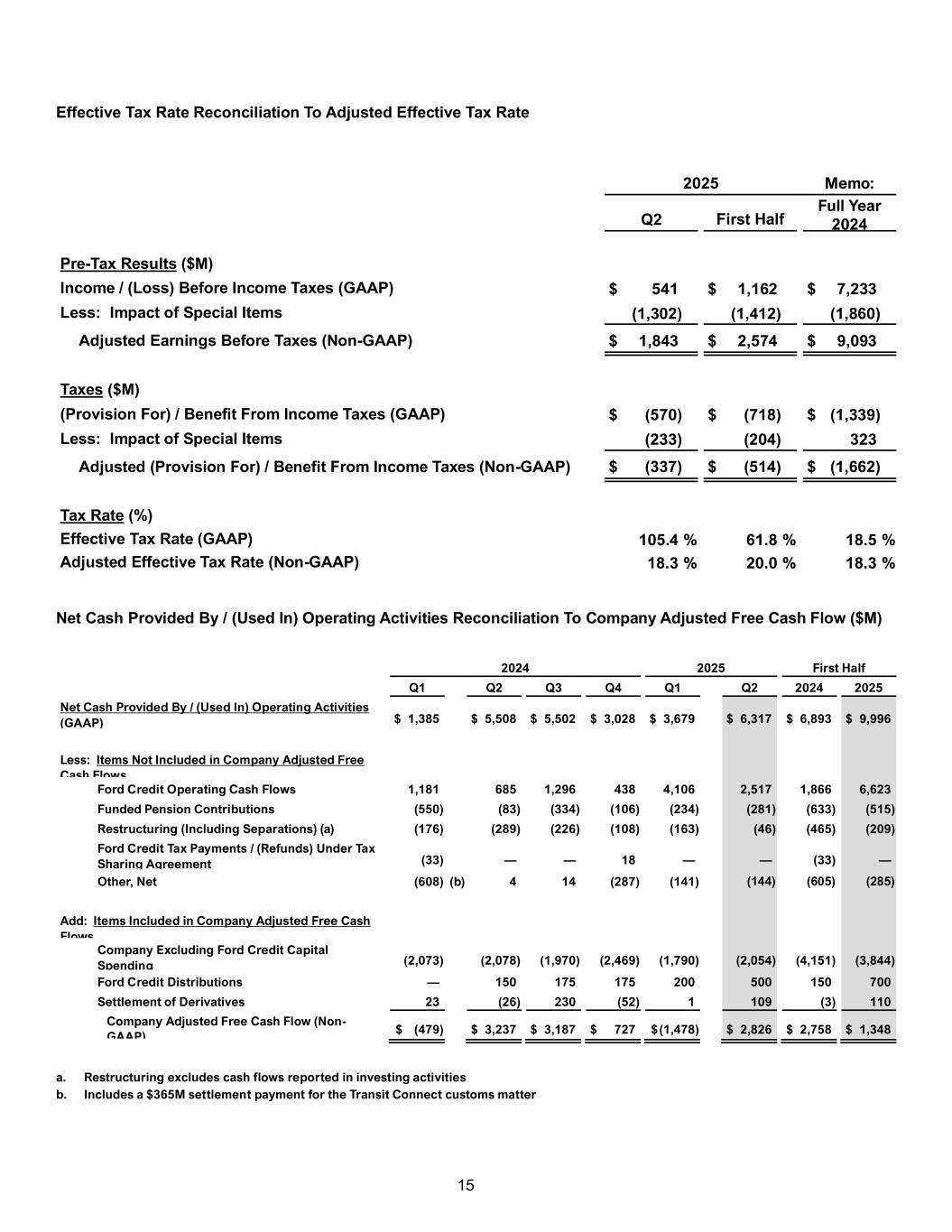

15 Effective Tax Rate Reconciliation To Adjusted Effective Tax Rate 2025 Memo: Q2 First Half Full Year 2024 Pre-Tax Results ($M) Income / (Loss) Before Income Taxes (GAAP) $ 541 $ 1,162 $ 7,233 Less: Impact of Special Items (1,302) (1,412) (1,860) Adjusted Earnings Before Taxes (Non-GAAP) $ 1,843 $ 2,574 $ 9,093 Taxes ($M) (Provision For) / Benefit From Income Taxes (GAAP) $ (570) $ (718) $ (1,339) Less: Impact of Special Items (233) (204) 323 Adjusted (Provision For) / Benefit From Income Taxes (Non-GAAP) $ (337) $ (514) $ (1,662) Tax Rate (%) Effective Tax Rate (GAAP) 105.4 % 61.8 % 18.5 % Adjusted Effective Tax Rate (Non-GAAP) 18.3 % 20.0 % 18.3 % Net Cash Provided By / (Used In) Operating Activities Reconciliation To Company Adjusted Free Cash Flow ($M) 2024 2025 First Half Q1 Q2 Q3 Q4 Q1 Q2 2024 2025 Net Cash Provided By / (Used In) Operating Activities (GAAP) $ 1,385 $ 5,508 $ 5,502 $ 3,028 $ 3,679 $ 6,317 $ 6,893 $ 9,996 Less: Items Not Included in Company Adjusted Free Cash Flows Ford Credit Operating Cash Flows 1,181 685 1,296 438 4,106 2,517 1,866 6,623 Funded Pension Contributions (550) (83) (334) (106) (234) (281) (633) (515) Restructuring (Including Separations) (a) (176) (289) (226) (108) (163) (46) (465) (209) Ford Credit Tax Payments / (Refunds) Under Tax Sharing Agreement (33) — — 18 — — (33) — Other, Net (608) (b) 4 14 (287) (141) (144) (605) (285) Add: Items Included in Company Adjusted Free Cash Flows Company Excluding Ford Credit Capital Spending (2,073) (2,078) (1,970) (2,469) (1,790) (2,054) (4,151) (3,844) Ford Credit Distributions — 150 175 175 200 500 150 700 Settlement of Derivatives 23 (26) 230 (52) 1 109 (3) 110 Company Adjusted Free Cash Flow (Non- GAAP) $ (479) $ 3,237 $ 3,187 $ 727 $ (1,478) $ 2,826 $ 2,758 $ 1,348 a. Restructuring excludes cash flows reported in investing activities b. Includes a $365M settlement payment for the Transit Connect customs matter

16 Adjusted ROIC ($B) Four Quarters Ending Q2 2024 Four Quarters Ending Q2 2025 Adjusted Net Operating Profit / (Loss) After Cash Tax Net Income / (Loss) Attributable to Ford $ 3.8 $ 3.2 Add: Noncontrolling Interest (0.0) 0.0 Less: Income Tax 0.2 (1.2) Add: Cash Tax (1.2) (0.7) Less: Interest on Debt (1.2) (1.2) Less: Total Pension / OPEB Income / (Cost) (2.6) (0.1) Add: Pension / OPEB Service Costs (0.6) (0.5) Net Operating Profit / (Loss) After Cash Tax $ 5.7 $ 4.4 Less: Special Items (excl. Pension / OPEB) Pre-Tax (2.0) (2.7) Adj. Net Operating Profit / (Loss) After Cash Tax $ 7.7 $ 7.1 Invested Capital Equity $ 43.6 $ 45.1 Debt (excl. Ford Credit) 20.4 20.3 Net Pension and OPEB Liability 6.0 4.3 Invested Capital (End of Period) $ 70.0 $ 69.7 Average Invested Capital $ 69.1 $ 70.2 ROIC (a) 8.2 % 6.3 % Adjusted ROIC (Non-GAAP) (b) 11.1 % 10.1 % a. Calculated as the sum of net operating profit / (loss) after cash tax from the last four quarters, divided by the average invested capital over the last four quarters b. Calculated as the sum of adjusted net operating profit / (loss) after cash tax from the last four quarters, divided by the average invested capital over the last four quarters

17 Special Items ($B) Second Quarter First Half 2024 2025 2024 2025 Restructuring (by Geography) Europe $ (0.2) $ (0.0) $ (0.5) $ (0.1) North America Hourly Buyouts — — (0.3) 0.0 Subtotal Restructuring $ (0.2) $ (0.0) $ (0.8) $ (0.1) Other Items Fuel Injector Field Service Action $ — $ (0.6) $ — $ (0.6) EV Program Cancellation — (0.3) — (0.4) Ford Share of Equity Method Investment’s Asset Impairments — (0.2) — (0.2) Ford Share of BlueOval SK’s Asset Write Down / Other — (0.2) — (0.2) Extended Oakville Assembly Plant Changeover 0.0 — (0.2) — Other 0.0 — 0.0 0.0 Subtotal Other Items $ 0.1 $ (1.3) $ (0.2) $ (1.3) Pension and OPEB Gain / (Loss) Pension and OPEB Remeasurement $ 0.2 $ — $ 0.2 $ 0.0 Pension Settlements, Curtailments and Separations Costs (0.0) (0.0) (0.1) (0.0) Subtotal Pension and OPEB Gain / (Loss) $ 0.1 $ (0.0) $ 0.1 $ (0.0) Total EBIT Special Items $ (0.0) $ (1.3) $ (0.9) $ (1.4)

18 FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENTS (in millions) For the periods ended June 30, 2024 2025 2024 2025 Second Quarter First Half (unaudited) Financing revenue Operating leases $ 1,030 $ 1,176 $ 2,047 $ 2,307 Retail financing 1,364 1,539 2,655 3,049 Dealer financing 750 661 1,446 1,330 Other financing 43 45 83 83 Total financing revenue 3,187 3,421 6,231 6,769 Depreciation on vehicles subject to operating leases (613) (603) (1,223) (1,208) Interest expense (1,897) (1,759) (3,745) (3,549) Net financing margin 677 1,059 1,263 2,012 Other revenue Insurance premiums earned 42 42 78 90 Fee based revenue and other 54 23 80 47 Total financing margin and other revenue 773 1,124 1,421 2,149 Expenses Operating expenses 343 443 686 796 Provision for credit losses 95 114 183 254 Insurance expenses 97 47 127 64 Total expenses 535 604 996 1,114 Other income/(loss), net 105 125 244 190 Income before income taxes 343 645 669 1,225 Provision for/(Benefit from) income taxes 88 102 180 258 Net income $ 255 $ 543 $ 489 $ 967

19 FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions) December 31, 2024 June 30, 2025 (unaudited) ASSETS Cash and cash equivalents $ 9,272 $ 8,469 Marketable securities 706 754 Finance receivables, net Retail installment contracts, dealer financing, and other financing 114,069 111,518 Finance leases 7,881 8,846 Total finance receivables, net of allowance for credit losses of $864 and $890 121,950 120,364 Net investment in operating leases 21,689 23,359 Notes and accounts receivable from affiliated companies 836 657 Derivative financial instruments 784 1,642 Other assets 3,055 3,497 Total assets $ 158,292 $ 158,742 LIABILITIES Accounts payable Customer deposits, dealer reserves, and other $ 961 $ 961 Affiliated companies 723 969 Total accounts payable 1,684 1,930 Debt 137,868 137,394 Deferred income taxes 364 676 Derivative financial instruments 1,992 1,312 Other liabilities and deferred revenue 2,627 2,886 Total liabilities 144,535 144,198 SHAREHOLDER’S INTEREST Shareholder’s interest 5,166 5,166 Accumulated other comprehensive income/(loss) (1,217) (697) Retained earnings 9,808 10,075 Total shareholder’s interest 13,757 14,544 Total liabilities and shareholder’s interest $ 158,292 $ 158,742

20 FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) For the periods ended June 30, 2024 2025 First Half (unaudited) Cash flows from operating activities Net income $ 489 $ 967 Provision for credit losses 183 254 Depreciation and amortization 1,530 1,541 Amortization of upfront interest supplements (1,126) (1,287) Net change in deferred income taxes 49 195 Net change in other assets (460) (56) Net change in other liabilities 203 379 All other operating activities 145 13 Net cash provided by/(used in) operating activities 1,013 2,006 Cash flows from investing activities Purchases of finance receivables (21,808) (17,705) Principal collections of finance receivables 18,900 20,025 Purchases of operating lease vehicles (5,317) (5,793) Proceeds from termination of operating lease vehicles 3,918 3,193 Net change in wholesale receivables and other short-duration receivables (1,853) 3,001 Purchases of marketable securities and other investments (95) (202) Proceeds from sales and maturities of marketable securities and other investments 200 176 Settlements of derivatives (234) (214) All other investing activities (38) (62) Net cash provided by/(used in) investing activities (6,327) 2,419 Cash flows from financing activities Proceeds from issuances of long-term debt 28,960 20,468 Payments of long-term debt (25,066) (23,902) Net change in short-term debt (1,429) (1,302) Cash distributions to parent (150) (700) All other financing activities (93) (52) Net cash provided by/(used in) financing activities 2,222 (5,488) Effect of exchange rate changes on cash, cash equivalents, and restricted cash (150) 271 Net increase/(decrease) in cash, cash equivalents and restricted cash $ (3,242) $ (792) Cash, cash equivalents, and restricted cash at beginning of period $ 10,795 $ 9,360 Net increase/(decrease) in cash, cash equivalents, and restricted cash (3,242) (792) Cash, cash equivalents, and restricted cash at end of period $ 7,553 $ 8,568