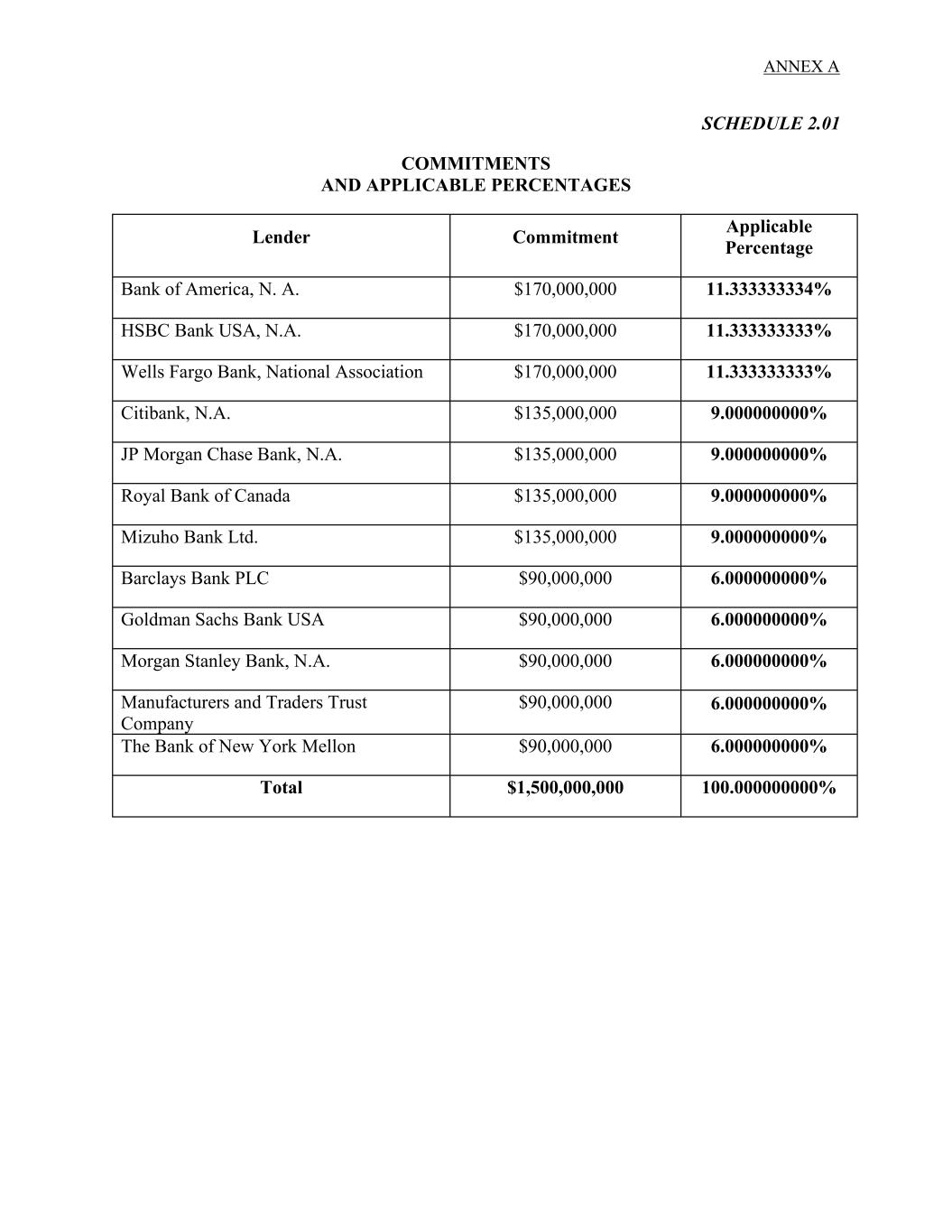

Execution Version JOINDER AND COMMITMENT INCREASE AGREEMENT This JOINDER AND COMMITMENT INCREASE AGREEMENT (this “Joinder Agreement”) is entered into as of December 11, 2025 by and among MIZUHO BANK, LTD. (“Mizuho”), ROYAL BANK OF CANADA (“RBC”) and THE BANK OF NEW YORK MELLON (“BNY”; together with Mizuho and RBC, each a “New Lender” and, collectively, the “New Lenders”), each of the other Lenders party hereto (together with the New Lenders, each an “Increasing Lender” and, collectively, the “Increasing Lenders”), BANK OF AMERICA, N.A., as Administrative Agent under the Credit Agreement (defined below) (the “Agent”), and FRANKLIN RESOURCES, INC., a Delaware corporation (the “Borrower”). RECITALS A. Reference is hereby made to that certain Amended and Restated Credit Agreement, dated April 30, 2025 (as amended, amended and restated, refinanced, supplemented, replaced or otherwise modified from time to time, the “Credit Agreement”), by and among the Borrower, the Lenders from time to time party thereto and the Agent. B. The Borrower has requested an increase in the Aggregate Commitments in an amount equal to $400,000,000 (the “Aggregate Commitment Increase”), such that the Aggregate Commitments after giving effect to this Joinder Agreement will be in an amount equal to $1,500,000,000. C. The Increasing Lenders are willing to provide the Aggregate Commitment Increase to the Borrower in an amount equal to $400,000,000 on the Increase Effective Date, subject to the terms and conditions set forth herein. D. Section 2.12 of the Credit Agreement provides that, upon the Increase Effective Date, the Credit Agreement shall be deemed amended to the extent (but only to the extent) necessary to reflect the existence of the Aggregate Commitment Increase and additional Loans evidenced thereby and the Agent, each applicable Increasing Lender and the Borrower may revise the Credit Agreement to evidence such Aggregate Commitment Increase and additional Loans (and no consent of any Lender that is not an Increasing Lender will be required to effect the revisions contemplated by Section 2.12 of the Credit Agreement). AGREEMENT Now, therefore, in consideration of the foregoing recitals and other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, and intending to be legally bound, the parties hereto agree as follows: 1. DEFINITIONS. Capitalized terms used but not defined in this Joinder Agreement shall have the meaning given such terms in the Credit Agreement. 2. AMENDMENTS TO CREDIT AGREEMENT. a. Schedule 2.01 (Commitments and Applicable Percentages) to the Credit Agreement is hereby deleted in its entirety and a new Schedule 2.01 is substituted in its stead, as attached hereto as Annex A.

2 b. On the Increase Effective Date, each of the parties hereto acknowledge and agree that the Aggregate Commitments shall be increased from $1,100,000,000 to $1,500,000,000, as more fully set forth on Schedule 2.01 to the Credit Agreement set forth as Annex A. c. From and after the Increase Effective Date, all references to the Credit Agreement in any Loan Document shall be deemed to mean and refer to the Credit Agreement as amended by this Joinder Agreement. 3. CONDITIONS TO EFFECTIVENESS OF THIS JOINDER AGREEMENT. This Joinder Agreement shall become effective as of the date of this Joinder Agreement upon the satisfaction or waiver of the following conditions (such date, the “Increase Effective Date”): a. The Agent’s receipt of the following, each of which shall be originals or telecopies (if requested by the Agent, followed promptly by originals) unless otherwise specified, each properly executed by a Responsible Officer of Borrower, each dated the Increase Effective Date (or, in the case of certificates of governmental officials, a recent date before the Increase Effective Date) and each in form and substance reasonably satisfactory to the Agent: i. executed counterparts of this Joinder Agreement; ii. a Note executed by the Borrower in favor of each Lender requesting a Note (to the extent requested at least three (3) Business Days prior to the Increase Effective Date); iii. such certificates of resolutions or other action, incumbency certificates and/or other certificates of Responsible Officers of Borrower as the Agent may require evidencing the identity, authority and capacity of each Responsible Officer thereof authorized to act as a Responsible Officer in connection with this Joinder Agreement and the other Loan Documents; iv. such documents and certifications as the Agent may reasonably require to evidence that Borrower is validly existing and in good standing in its jurisdiction of incorporation or formation, as applicable; and v. a favorable opinion of Ropes & Gray LLP, New York and Delaware counsel to the Borrower, addressed to the Agent and each Increasing Lender, in customary form; b. (i) upon the reasonable request of any Increasing Lender made at least ten (10) days prior to the Increase Effective Date, the Borrower shall have provided to such Increasing Lender, and such Increasing Lender shall be reasonably satisfied with, the documentation and other information so requested in connection with applicable “know your customer” and anti- money-laundering rules and regulations, including, without limitation, the PATRIOT Act, in each case at least three (3) days prior to the Increase Effective Date and (ii) at least three (3) days prior to the Increase Effective Date, if Borrower qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, Borrower shall have delivered, to each Increasing Lender that so requests, a Beneficial Ownership Certification in relation to Borrower; c. all fees required to be paid on or before the Increase Effective Date shall have been paid on or substantially concurrently with the Increase Effective Date; provided, that the

3 payment of fees and expenses of counsel shall be subject to the receipt of an invoice with respect thereto at least two (2) Business Days prior to the Increase Effective Date; d. unless waived by the Agent, the Borrower shall have paid, on or substantially concurrently with the Increase Effective Date, all reasonable and documented out-of-pocket fees, charges and disbursements of one counsel to the Agent and the Lenders collectively (directly to such counsel if requested by the Agent) to the extent invoiced in reasonable detail at least two (2) Business Days prior to or on the Increase Effective Date; e. each of the representations and warranties contained in Article V of the Credit Agreement and the other Loan Documents shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) on and as of the Increase Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of such earlier date, and except that the representations and warranties contained in subsections (a) and (b) of Section 5.05 of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to subsections (a) and (b), respectively, of Section 6.01 of the Credit Agreement; and f. no Event of Default shall have occurred and be continuing, or would result from the consummation of the transactions contemplated herein. 4. JOINDER OF NEW LENDERS; ACKNOWLEDGMENTS OF INCREASING LENDERS. a. Each New Lender, by its signature below, confirms that it has agreed to become a “Lender” under, and as defined in, the Credit Agreement holding Commitments in the amount and percentages set forth opposite such New Lender’s name on Schedule 2.01 to the Credit Agreement set forth as Annex A, effective on the Increase Effective Date. b. Each New Lender represents and warrants that: i. it has full power and authority, and has taken all action necessary, to execute and deliver this Joinder Agreement and to consummate the transactions contemplated hereby and to become a Lender under the Credit Agreement; ii. it meets all the requirements to be an assignee under Section 10.06(b)(iii) and (v) of the Credit Agreement (subject to such consents, if any, as may be required under Section 10.06(b)(iii)); iii. from and after the Increase Effective Date, it shall be bound by the provisions of the Credit Agreement as a Lender thereunder and shall have the obligations of a Lender thereunder; iv. it is sophisticated with respect to decisions to make, acquire and/or hold commercial loans and to provide other facilities set forth in the Credit Agreement and either it, or the Person exercising discretion in making its decision to make, acquire and/or hold such commercial loans or to provide such other facilities, is

4 experienced in making, acquiring or holding such commercial loans or providing such other facilities; v. it has received a copy of the Credit Agreement, and has received or has been accorded the opportunity to receive copies of the most recent financial statements delivered pursuant to Section 6.01 thereof, as applicable, and such other documents and information as it deems appropriate to make its own credit analysis and decision to enter into this Joinder Agreement and to provide its Commitment under the Credit Agreement; and vi. it has, independently and without reliance upon the Agent or any other Lender and based on such documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into this Joinder Agreement and to provide its Commitment under the Credit Agreement. c. Each New Lender agrees that: i. it will, independently and without reliance upon the Agent or any other Lender, and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Loan Documents; and ii. it will perform in accordance with their terms all of the obligations which by the terms of the Loan Documents are required to be performed by it as a Lender. d. Each Increasing Lender, by its signature below, confirms that it has agreed to an increase in its respective Commitment and, effective on the Increase Effective Date, such Increasing Lender holds Commitments in the amount and percentages set forth opposite such Increasing Lender’s name on Schedule 2.01 to the Credit Agreement set forth as Annex A. e. Each of the parties hereto acknowledges and agrees that, upon the Increase Effective Date, the Credit Agreement shall be deemed amended to the extent (but only to the extent) necessary to reflect the existence of the Aggregate Commitment Increase and the additional Loans evidenced thereby. 5. BORROWER REPRESENTATIONS AND WARRANTIES. The Borrower represents and warrants to the Agent and the Lenders as of the date hereof: a. Each of the representations and warranties contained in Article V of the Credit Agreement and the other Loan Documents is true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) on and as of the Increase Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of such earlier date, and except that the representations and warranties contained in subsections (a) and (b) of Section 5.05 of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to subsections (a) and (b), respectively, of Section 6.01 of the Credit Agreement;

5 b. no Event of Default has occurred is continuing, or will result from the consummation of the transactions contemplated herein; c. The execution, delivery and performance by Borrower of this Joinder Agreement has been duly authorized by all necessary corporate or other organizational action, and does not and will not (a) contravene the terms of Borrower’s Organization Documents; (b) conflict with or result in any breach or contravention of, or the creation of (or the requirement to create) any Lien under, or require any payment to be made under (i) any Contractual Obligation to which Borrower is a party or affecting Borrower or the properties of Borrower or any of its Subsidiaries or (ii) any order, injunction, writ or decree of any Governmental Authority or any arbitral award to which Borrower or its property is subject; or (c) violate any Applicable Law, except in each case referred to in clause (b) or (c), to the extent that such breach, contravention or violation would not reasonably be expected to have a Material Adverse Effect; d. No approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person is necessary or required in connection with the execution, delivery or performance by, or enforcement against, Borrower of this Joinder Agreement or any other Loan Document, except those that have been duly obtained, given or made or for which the failure to obtain or make would not reasonably be expected to have a Material Adverse Effect; and e. This Joinder Agreement has been duly executed and delivered by Borrower and constitutes a legal, valid and binding obligation of Borrower, enforceable against Borrower in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at law). 6. SURVIVAL OF REPRESENTATIONS AND WARRANTIES. All representations and warranties made in this Joinder Agreement or any other Loan Document shall survive the execution and delivery of this Joinder Agreement, and no investigation by the Agent or the Lenders shall affect the representations and warranties or the right of the Agent and the Lenders to rely upon them. 7. JOINDER AGREEMENT AS LOAN DOCUMENT. This Joinder Agreement constitutes a “Loan Document” under the Credit Agreement. Accordingly, it shall be an immediate Event of Default under the Credit Agreement if any representation, warranty, certification or statement of fact made by the Borrower under or in connection with this Joinder Agreement shall have been incorrect or misleading in any material respect when made or deemed made. For the avoidance of doubt, this Joinder Agreement constitutes a “Joinder Agreement” under Section 2.12 of the Credit Agreement. 8. COSTS AND EXPENSES. The Borrower shall pay all reasonable, documented and invoiced out-of-pocket expenses incurred by the Agent and its Affiliates (including the reasonable, documented and invoiced fees, charges and disbursements of counsel for the Agent) in connection with the preparation, negotiation, execution and delivery of this Joinder Agreement, in each case, in accordance with Section 10.03(a) of the Credit Agreement. 9. GOVERNING LAW, JURISDICTION, ETC.; WAIVER OF JURY TRIAL. THIS JOINDER AGREEMENT AND ANY CLAIMS, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS JOINDER AGREEMENT AND THE TRANSACTIONS CONTEMPLATED

6 HEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. THE PROVISIONS OF SECTION 10.14 AND 10.15 OF THE CREDIT AGREEMENT SHALL APPLY TO THIS JOINDER AGREEMENT, MUTATIS MUTANDIS, AS IF MORE FULLY SET FORTH HEREIN. 10. COUNTERPARTS; ELECTRONIC EXECUTION. This Joinder Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. The provisions of Section 10.17 of the Credit Agreement with regard to electronic execution and Electronic Records shall apply to this Joinder Agreement, mutatis mutandis, as if more fully set forth herein. 11. LIMITED EFFECT. This Joinder Agreement relates only to the specific matters expressly covered herein, shall not be considered to be an amendment, consent or waiver of any rights or remedies that the Agent or any Lender may have under the Credit Agreement, under any other Loan Document (except as expressly set forth herein) or under Law, and shall not be considered to create a course of dealing or to otherwise obligate in any respect the Agent or any Lender to execute similar or other amendments, consents or waivers or grant any amendments, consents or waivers under the same or similar or other circumstances in the future. 12. RATIFICATION BY BORROWER. The Borrower hereby agrees and consents to this Joinder Agreement and to the documents and agreements referred to herein and ratifies its liability for the Obligations under the Credit Agreement and the other Loan Documents. [signature pages follow]

[Signature Page to Joinder and Commitment Increase Agreement] IN WITNESS WHEREOF, the parties hereto have executed this Joinder Agreement as of the date first written above. BORROWER: FRANKLIN RESOURCES, INC. By: /s/ Leeor Avigdor Name: Leeor Avigdor Title: Executive Vice President, Global Treasurer and Head of M&A

[Signature Page to Joinder and Commitment Increase Agreement] BANK OF AMERICA, N.A., as Administrative Agent By: /s/ Aamir Saleem Name: Aamir Saleem Title: Vice President

[Signature Page to Joinder and Commitment Increase Agreement] BANK OF AMERICA, N.A., as an Increasing Lender By: /s/ Daniel Chapman Name: Daniel Chapman Title: Vice President

[Signature Page to Joinder and Commitment Increase Agreement] HSBC BANK USA, N.A., as an Increasing Lender By: /s/ Kieran Patel Name: Kieran Patel Title: Managing Director

[Signature Page to Joinder and Commitment Increase Agreement] WELLS FARGO BANK, NATIONAL ASSOCIATION, as an Increasing Lender By: /s/ Nikolas Broschofsky Name: Nikolas Broschofsky Title: Executive Director

[Signature Page to Joinder and Commitment Increase Agreement] MIZUHO BANK, LTD., as a New Lender By: /s/ Donna DeMagistris Name: Donna DeMagistris Title: Managing Director

[Signature Page to Joinder and Commitment Increase Agreement] ROYAL BANK OF CANADA, as a New Lender By: /s/ Saad Khan Name: Saad Khan Title: Authorized Signatory

[Signature Page to Joinder and Commitment Increase Agreement] THE BANK OF NEW YORK MELLON, as a New Lender By: /s/ Joanne Carey Name: Joanne Carey Title: Director

ANNEX A SCHEDULE 2.01 COMMITMENTS AND APPLICABLE PERCENTAGES Lender Commitment Applicable Percentage Bank of America, N. A. $170,000,000 11.333333334% HSBC Bank USA, N.A. $170,000,000 11.333333333% Wells Fargo Bank, National Association $170,000,000 11.333333333% Citibank, N.A. $135,000,000 9.000000000% JP Morgan Chase Bank, N.A. $135,000,000 9.000000000% Royal Bank of Canada $135,000,000 9.000000000% Mizuho Bank Ltd. $135,000,000 9.000000000% Barclays Bank PLC $90,000,000 6.000000000% Goldman Sachs Bank USA $90,000,000 6.000000000% Morgan Stanley Bank, N.A. $90,000,000 6.000000000% Manufacturers and Traders Trust Company $90,000,000 6.000000000% The Bank of New York Mellon $90,000,000 6.000000000% Total $1,500,000,000 100.000000000%