Earnings Call: Fourth Quarter 2025 January 22, 2026 (NASDAQ: IBCP)

Cautionary note regarding forward-looking statements This presentation contains forward-looking statements, which are any statements or information that are not historical facts. These forward-looking statements include statements about our anticipated future revenue and expenses and our future plans and prospects. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. For example, deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding to us, lead to a tightening of credit, and increase stock price volatility. Our results could also be adversely affected by changes in interest rates; increases in unemployment rates; deterioration in the credit quality of our loan portfolios or in the value of the collateral securing those loans; deterioration in the value of our investment securities; legal and regulatory developments; changes in customer behavior and preferences; breaches in data security; and management’s ability to effectively manage the multitude of risks facing our business. Key risk factors that could affect our future results are described in more detail in our Annual Report on Form 10-K for the year ended December 31, 2024 and the other reports we file with the SEC, including under the heading “Risk Factors.” Investors should not place undue reliance on forward-looking statements as a prediction of our future results. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2 2

• Formal Remarks − William B. (Brad) Kessel President and Chief Executive Officer − Gavin A. Mohr Executive Vice President and Chief Financial Officer − Joel F. Rahn Executive Vice President – Commercial Banking • Question and Answer session • Closing Remarks Note: This presentation is available at www.IndependentBank.com in the Investor Relations area under the “Presentations” tab. Agenda 3

4Q'25 Overview • Total loans increased 7.4% annualized while maintaining a disciplined approach to new loan production • New loan production continues to be largely focused on new commercial clients that bring deposits to the bank • Asset quality remained sound with NPAs/Total Assets at 0.44% and NCO of 0.04% of average loans in the quarter • Generated a ROAA and ROAE of 1.35% and 14.75%, respectively • Net interest margin of 3.62% compared to 3.45% in the prior year quarter • Commercial loan growth of 16.5% annualized • Net growth in total deposits, net of brokered deposits of $57.1 or 4.8% annualized • Tangible book value per share increased 13.3% annualized from end of prior quarter • An increase in tangible common equity ratio to 8.65% • Paid off $154.6 million of brokered time deposits • Net income of $18.6 million, or $0.89 per diluted share • Increase in net interest income of $3.5 million over the prior year quarter and $1.0 million over the third quarter of 2025 • Strong profitability and prudent balance sheet management results 13.4% growth in tangible book value per share compared to the prior year quarter. Healthy Capital & Liquidity Positions Positive Trends in Key Metrics Solid Loan Growth and Strong Asset Quality 4Q'25 Earnings 4 4

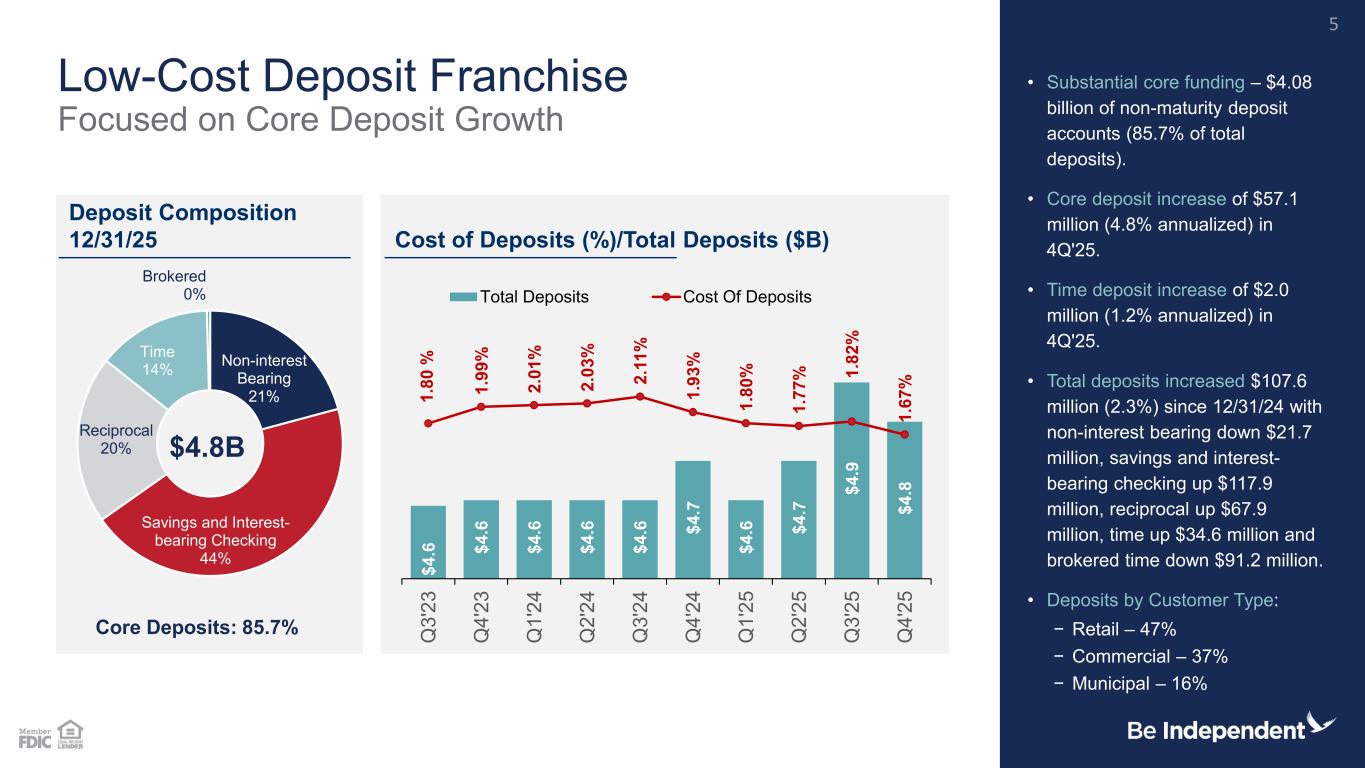

Non-interest Bearing 21% Savings and Interest- bearing Checking 44% Reciprocal 20% Time 14% Brokered 0% $ 4 .6 $ 4 .6 $ 4 .6 $ 4 .6 $ 4 .6 $ 4 .7 $ 4 .6 $ 4 .7 $ 4 .9 $ 4 .8 1 .8 0 % 1 .9 9 % 2 .0 1 % 2 .0 3 % 2 .1 1 % 1 .9 3 % 1 .8 0 % 1 .7 7 % 1 .8 2 % 1 .6 7 % Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Q 1 '2 5 Q 2 '2 5 Q 3 '2 5 Q 4 '2 5 Total Deposits Cost Of Deposits Low-Cost Deposit Franchise Focused on Core Deposit Growth • Substantial core funding – $4.08 billion of non-maturity deposit accounts (85.7% of total deposits). • Core deposit increase of $57.1 million (4.8% annualized) in 4Q'25. • Time deposit increase of $2.0 million (1.2% annualized) in 4Q'25. • Total deposits increased $107.6 million (2.3%) since 12/31/24 with non-interest bearing down $21.7 million, savings and interest- bearing checking up $117.9 million, reciprocal up $67.9 million, time up $34.6 million and brokered time down $91.2 million. • Deposits by Customer Type: − Retail – 47% − Commercial – 37% − Municipal – 16% Deposit Composition 12/31/25 Cost of Deposits (%)/Total Deposits ($B) 5 Core Deposits: 85.7% $4.8B

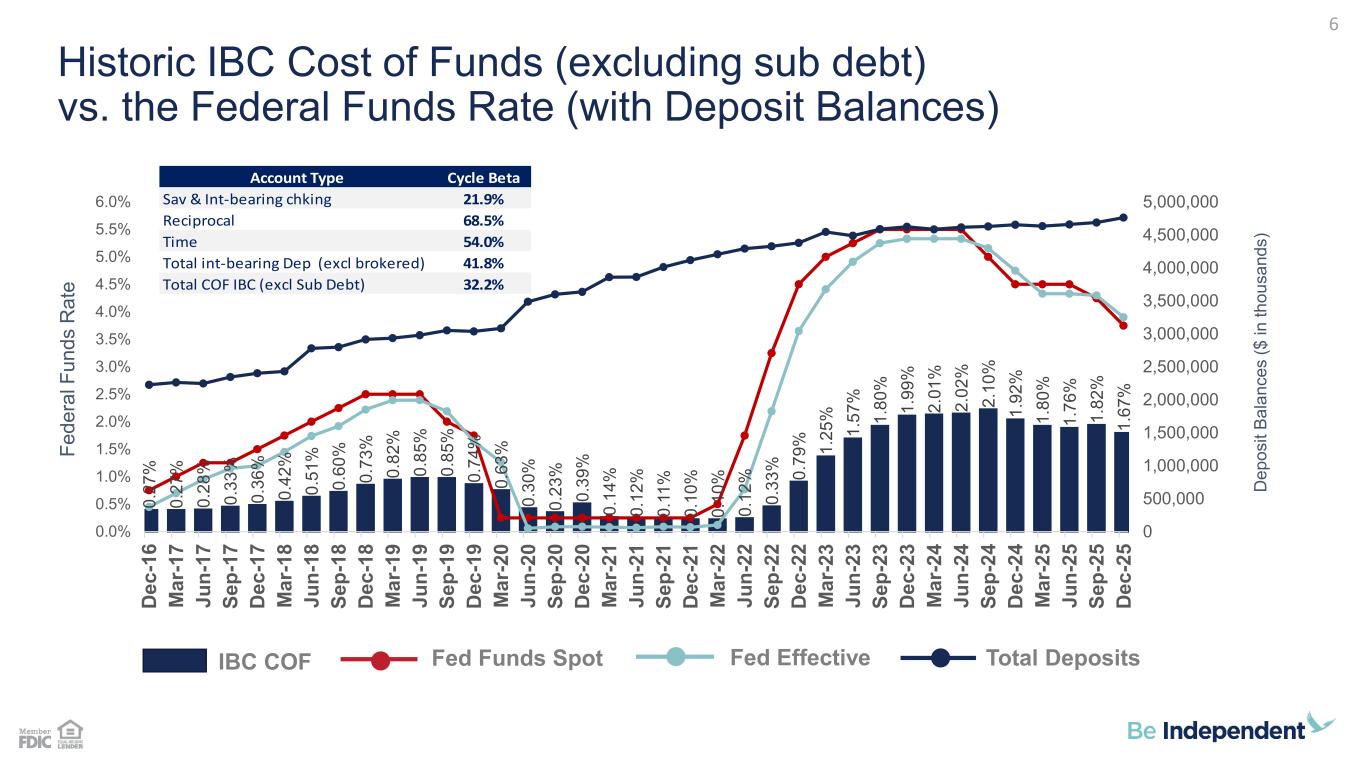

0 .2 7 % 0 .2 7 % 0 .2 8 % 0 .3 3 % 0 .3 6 % 0 .4 2 % 0 .5 1 % 0 .6 0 % 0 .7 3 % 0 .8 2 % 0 .8 5 % 0 .8 5 % 0 .7 4 % 0 .6 3 % 0 .3 0 % 0 .2 3 % 0 .3 9 % 0 .1 4 % 0 .1 2 % 0 .1 1 % 0 .1 0 % 0 .1 0 % 0 .1 2 % 0 .3 3 % 0 .7 9 % 1 .2 5 % 1 .5 7 % 1 .8 0 % 1 .9 9 % 2 .0 1 % 2 .0 2 % 2 .1 0 % 1 .9 2 % 1 .8 0 % 1 .7 6 % 1 .8 2 % 1 .6 7 % 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 5,000,000 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% D e c -1 6 M a r- 1 7 J u n -1 7 S e p -1 7 D e c -1 7 M a r- 1 8 J u n -1 8 S e p -1 8 D e c -1 8 M a r- 1 9 J u n -1 9 S e p -1 9 D e c -1 9 M a r- 2 0 J u n -2 0 S e p -2 0 D e c -2 0 M a r- 2 1 J u n -2 1 S e p -2 1 D e c -2 1 M a r- 2 2 J u n -2 2 S e p -2 2 D e c -2 2 M a r- 2 3 J u n -2 3 S e p -2 3 D e c -2 3 M a r- 2 4 J u n -2 4 S e p -2 4 D e c -2 4 M a r- 2 5 J u n -2 5 S e p -2 5 D e c -2 5 Historic IBC Cost of Funds (excluding sub debt) vs. the Federal Funds Rate (with Deposit Balances) D e p o s it B a la n c e s ( $ i n t h o u s a n d s ) 6 F e d e ra l F u n d s R a te Account Type Cycle Beta Sav & Int-bearing chking 21.9% Reciprocal 68.5% Time 54.0% Total int-bearing Dep (excl brokered) 41.8% Total COF IBC (excl Sub Debt) 32.2% IBC COF Fed Funds Spot Fed Effective Total Deposits

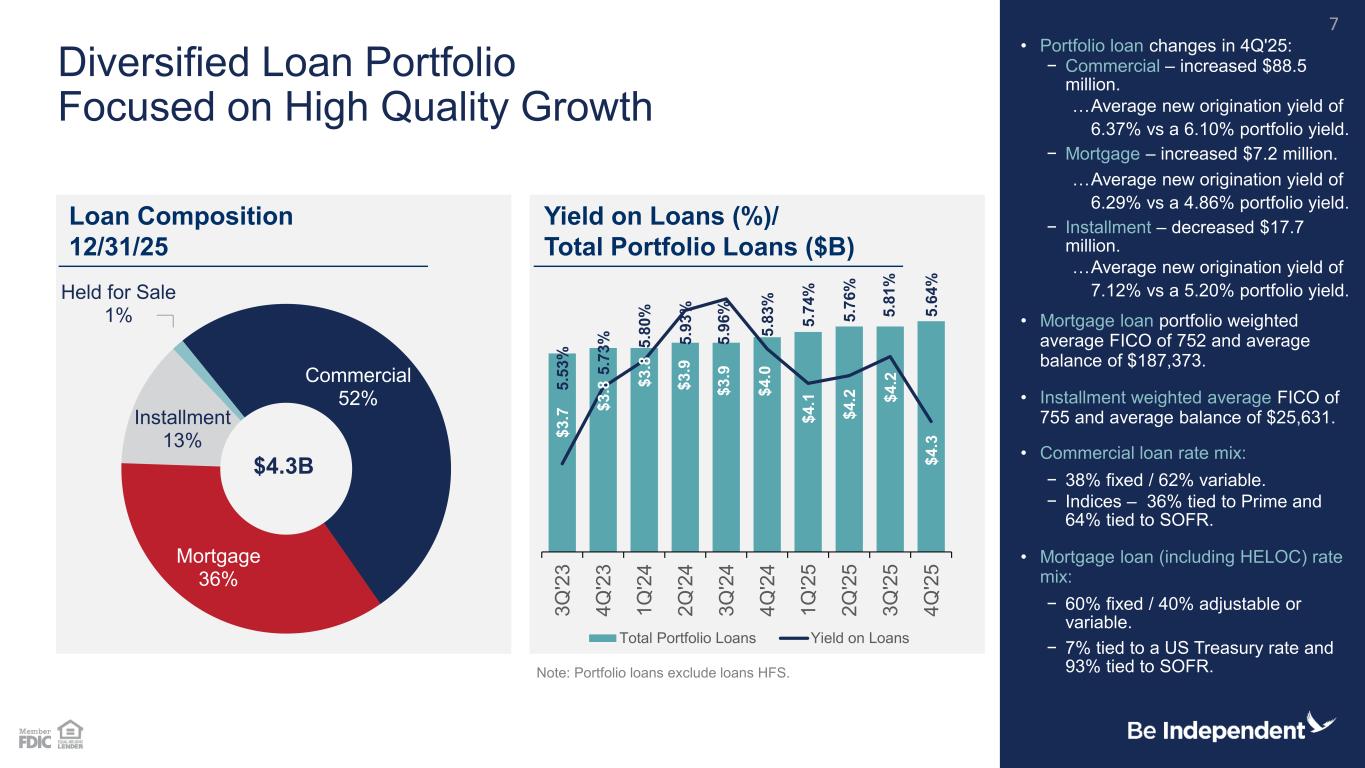

Commercial 52% Mortgage 36% Installment 13% Held for Sale 1% $ 3 .7 $ 3 .8 $ 3 .8 $ 3 .9 $ 3 .9 $ 4 .0 $ 4 .1 $ 4 .2 $ 4 .2 $ 4 .3 5 .5 3 % 5 .7 3 % 5 .8 0 % 5 .9 3 % 5 .9 6 % 5 .8 3 % 5 .7 4 % 5 .7 6 % 5 .8 1 % 5 .6 4 % 3 Q '2 3 4 Q '2 3 1 Q '2 4 2 Q '2 4 3 Q '2 4 4 Q '2 4 1 Q '2 5 2 Q '2 5 3 Q '2 5 4 Q '2 5 Total Portfolio Loans Yield on Loans Diversified Loan Portfolio Focused on High Quality Growth • Portfolio loan changes in 4Q'25: − Commercial – increased $88.5 million. …Average new origination yield of 6.37% vs a 6.10% portfolio yield. − Mortgage – increased $7.2 million. …Average new origination yield of 6.29% vs a 4.86% portfolio yield. − Installment – decreased $17.7 million. …Average new origination yield of 7.12% vs a 5.20% portfolio yield. • Mortgage loan portfolio weighted average FICO of 752 and average balance of $187,373. • Installment weighted average FICO of 755 and average balance of $25,631. • Commercial loan rate mix: − 38% fixed / 62% variable. − Indices – 36% tied to Prime and 64% tied to SOFR. • Mortgage loan (including HELOC) rate mix: − 60% fixed / 40% adjustable or variable. − 7% tied to a US Treasury rate and 93% tied to SOFR.Note: Portfolio loans exclude loans HFS. Loan Composition 12/31/25 Yield on Loans (%)/ Total Portfolio Loans ($B) 7 $4.3B

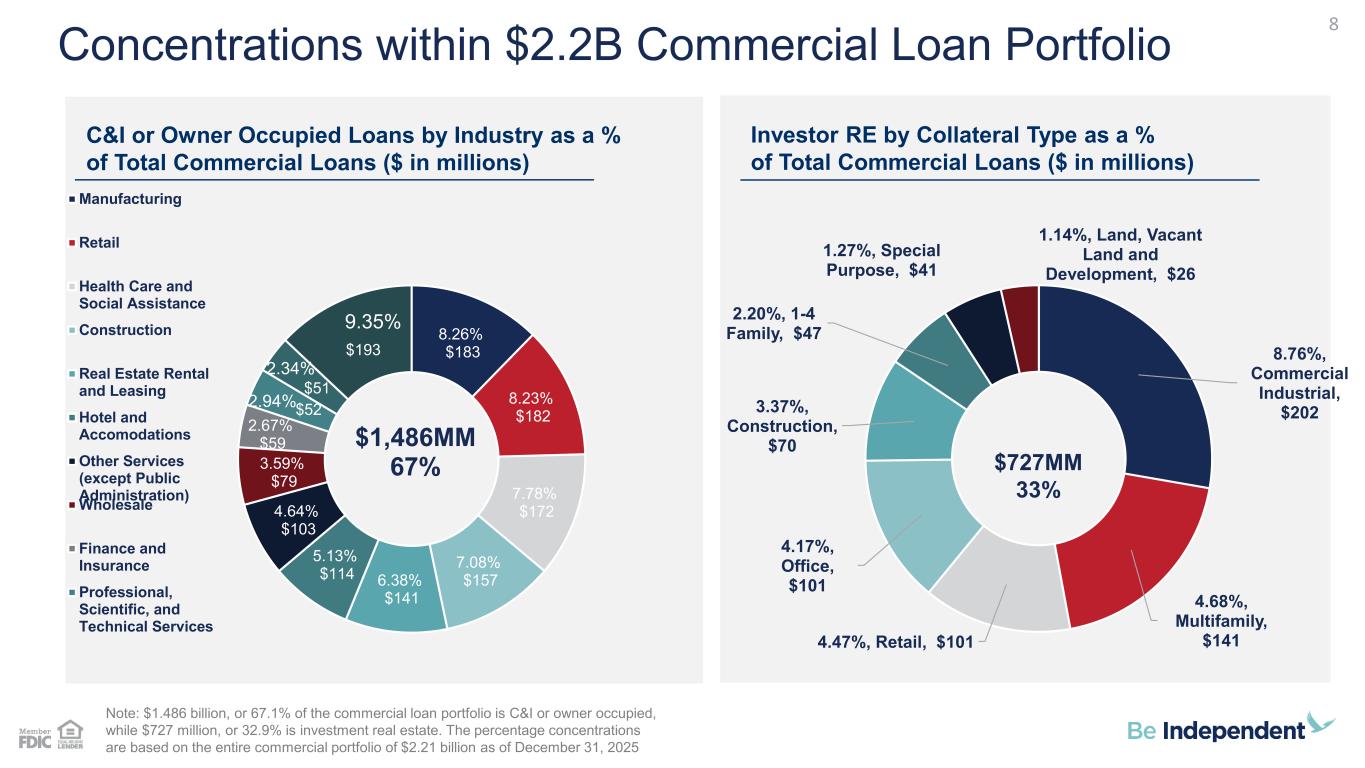

8.76%, Commercial Industrial, $202 4.68%, Multifamily, $141 4.47%, Retail, $101 4.17%, Office, $101 3.37%, Construction, $70 2.20%, 1-4 Family, $47 1.27%, Special Purpose, $41 1.14%, Land, Vacant Land and Development, $26 Concentrations within $2.2B Commercial Loan Portfolio C&I or Owner Occupied Loans by Industry as a % of Total Commercial Loans ($ in millions) Investor RE by Collateral Type as a % of Total Commercial Loans ($ in millions) Note: $1.486 billion, or 67.1% of the commercial loan portfolio is C&I or owner occupied, while $727 million, or 32.9% is investment real estate. The percentage concentrations are based on the entire commercial portfolio of $2.21 billion as of December 31, 2025 8 $727MM 33% 8.26% $183 8.23% $182 7.78% $172 7.08% $157 6.38% $141 5.13% $114 4.64% $103 3.59% $79 2.67% $59 $52 $51 $193 $1,486MM 67% Manufacturing Retail Health Care and Social Assistance Construction Real Estate Rental and Leasing Hotel and Accomodations Other Services (except Public Administration) Wholesale Finance and Insurance Professional, Scientific, and Technical Services 2.34% 9.35% 2.94%

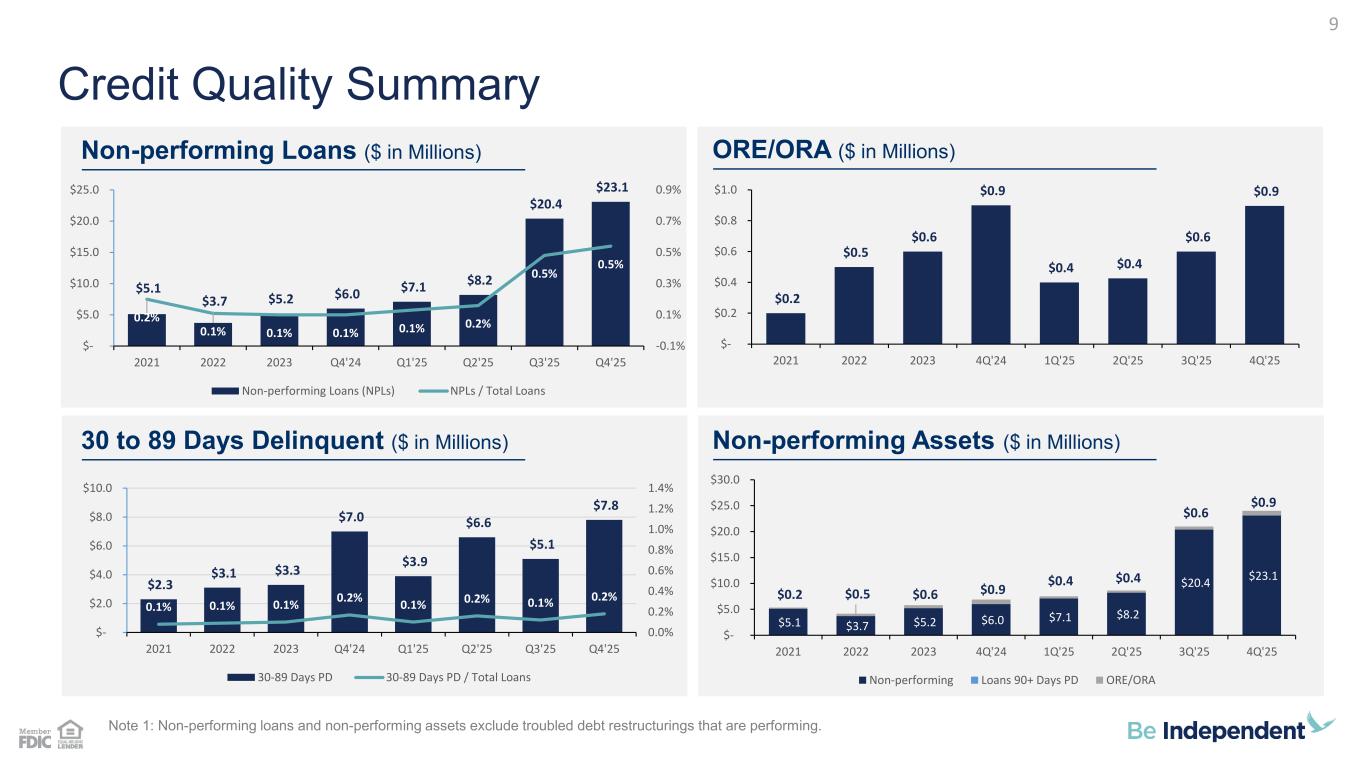

$5.1 $3.7 $5.2 $6.0 $7.1 $8.2 $20.4 $23.1 $0.2 $0.5 $0.6 $0.9 $0.4 $0.4 $0.6 $0.9 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 2021 2022 2023 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 Non-performing Loans 90+ Days PD ORE/ORA $2.3 $3.1 $3.3 $7.0 $3.9 $6.6 $5.1 $7.8 0.1% 0.1% 0.1% 0.2% 0.1% 0.2% 0.1% 0.2% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% $- $2.0 $4.0 $6.0 $8.0 $10.0 2021 2022 2023 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 30-89 Days PD 30-89 Days PD / Total Loans $0.2 $0.5 $0.6 $0.9 $0.4 $0.4 $0.6 $0.9 $- $0.2 $0.4 $0.6 $0.8 $1.0 2021 2022 2023 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 $5.1 $3.7 $5.2 $6.0 $7.1 $8.2 $20.4 $23.1 0.2% 0.1% 0.1% 0.1% 0.1% 0.2% 0.5% 0.5% -0.1% 0.1% 0.3% 0.5% 0.7% 0.9% $- $5.0 $10.0 $15.0 $20.0 $25.0 2021 2022 2023 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 Non-performing Loans (NPLs) NPLs / Total Loans Note 1: Non-performing loans and non-performing assets exclude troubled debt restructurings that are performing. Credit Quality Summary Non-performing Loans ($ in Millions) ORE/ORA ($ in Millions) 30 to 89 Days Delinquent ($ in Millions) Non-performing Assets ($ in Millions) 9

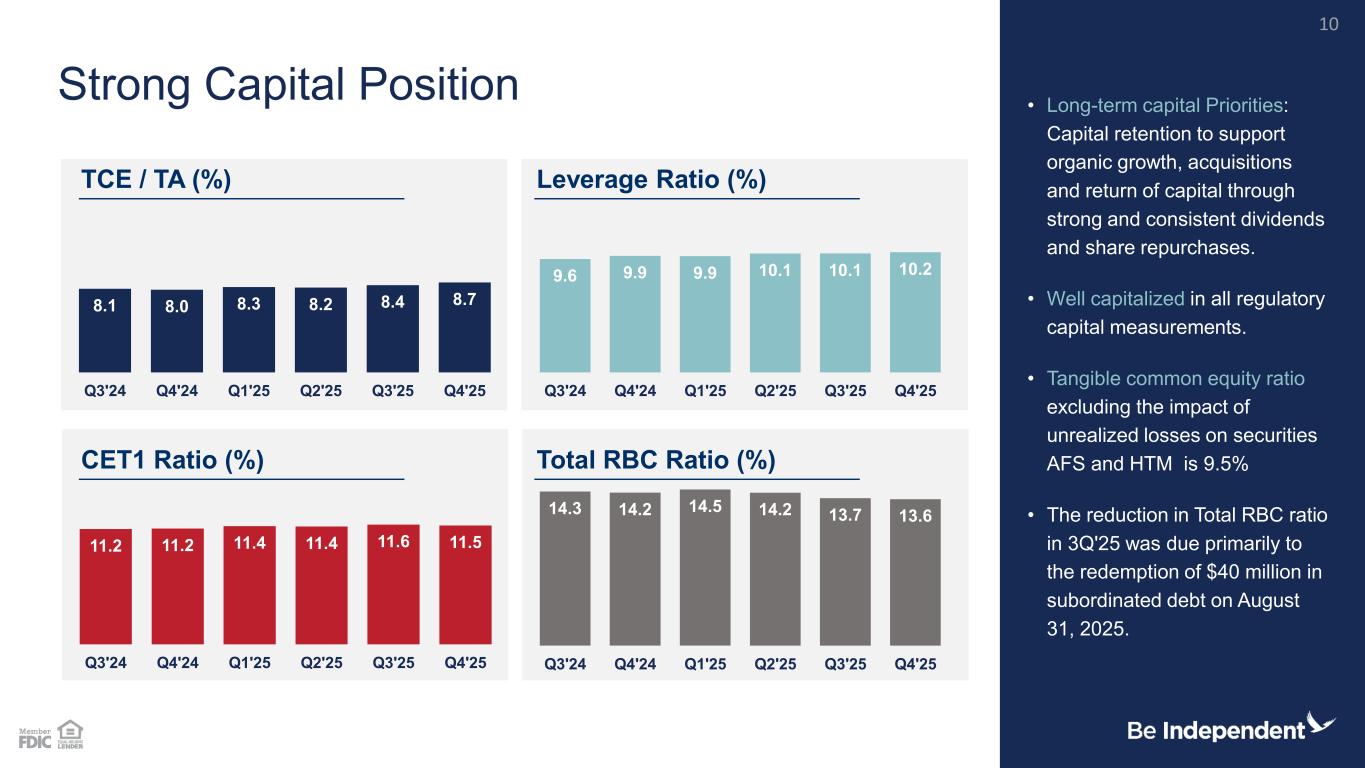

14.3 14.2 14.5 14.2 13.7 13.6 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 11.2 11.2 11.4 11.4 11.6 11.5 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 9.6 9.9 9.9 10.1 10.1 10.2 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 8.1 8.0 8.3 8.2 8.4 8.7 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 • Long-term capital Priorities: Capital retention to support organic growth, acquisitions and return of capital through strong and consistent dividends and share repurchases. • Well capitalized in all regulatory capital measurements. • Tangible common equity ratio excluding the impact of unrealized losses on securities AFS and HTM is 9.5% • The reduction in Total RBC ratio in 3Q'25 was due primarily to the redemption of $40 million in subordinated debt on August 31, 2025. Strong Capital Position TCE / TA (%) Leverage Ratio (%) CET1 Ratio (%) Total RBC Ratio (%) 10

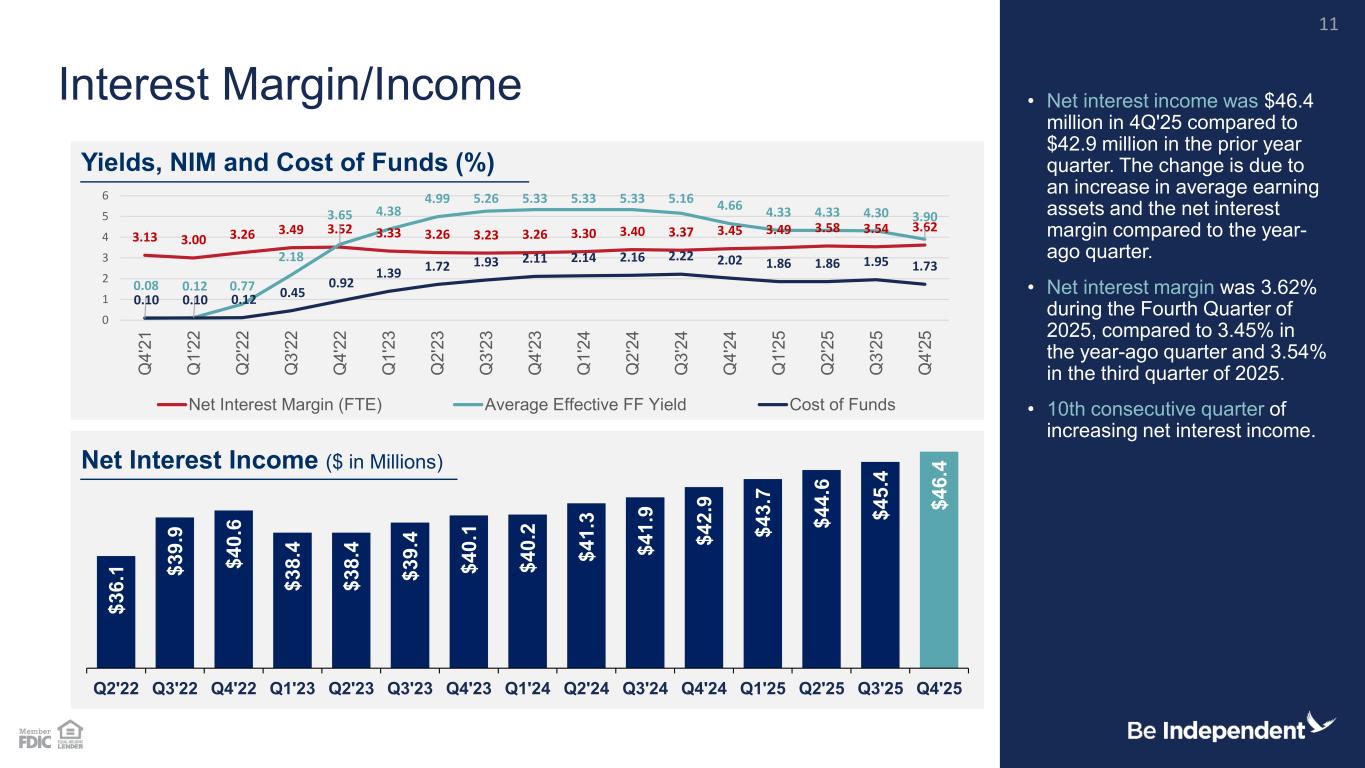

$ 3 6 .1 $ 3 9 .9 $ 4 0 .6 $ 3 8 .4 $ 3 8 .4 $ 3 9 .4 $ 4 0 .1 $ 4 0 .2 $ 4 1 .3 $ 4 1 .9 $ 4 2 .9 $ 4 3 .7 $ 4 4 .6 $ 4 5 .4 $ 4 6 .4 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 3.13 3.00 3.26 3.49 3.52 3.33 3.26 3.23 3.26 3.30 3.40 3.37 3.45 3.49 3.58 3.54 3.62 0.08 0.12 0.77 2.18 3.65 4.38 4.99 5.26 5.33 5.33 5.33 5.16 4.66 4.33 4.33 4.30 3.90 0.10 0.10 0.12 0.45 0.92 1.39 1.72 1.93 2.11 2.14 2.16 2.22 2.02 1.86 1.86 1.95 1.73 0 1 2 3 4 5 6 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Q 1 '2 5 Q 2 '2 5 Q 3 '2 5 Q 4 '2 5 Net Interest Margin (FTE) Average Effective FF Yield Cost of Funds Net Interest Margin/Income • Net interest income was $46.4 million in 4Q'25 compared to $42.9 million in the prior year quarter. The change is due to an increase in average earning assets and the net interest margin compared to the year- ago quarter. • Net interest margin was 3.62% during the Fourth Quarter of 2025, compared to 3.45% in the year-ago quarter and 3.54% in the third quarter of 2025. • 10th consecutive quarter of increasing net interest income. Yields, NIM and Cost of Funds (%) Net Interest Income ($ in Millions) 11

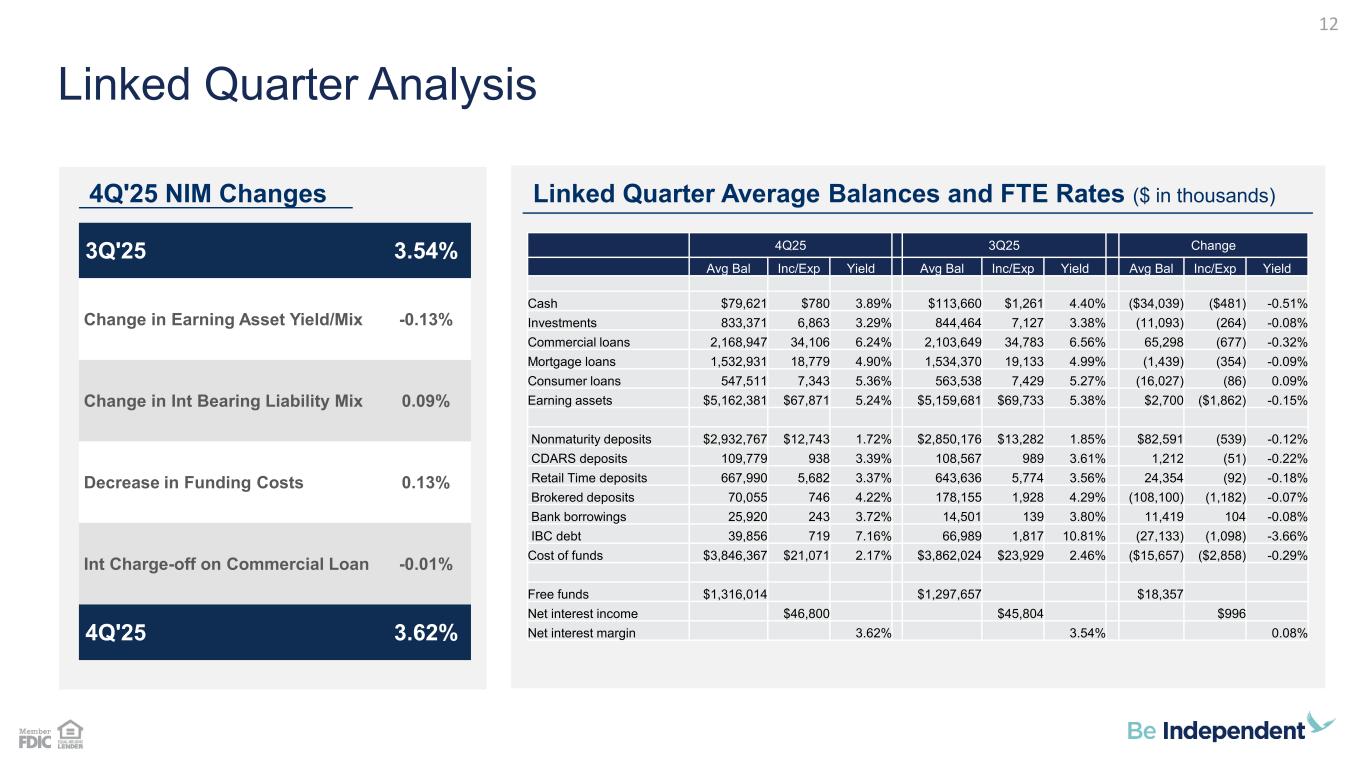

3Q'25 3.54% Change in Earning Asset Yield/Mix -0.13% Change in Int Bearing Liability Mix 0.09% Decrease in Funding Costs 0.13% Int Charge-off on Commercial Loan -0.01% 4Q'25 3.62% 4Q'25 NIM Changes Linked Quarter Average Balances and FTE Rates ($ in thousands) Linked Quarter Analysis 12 4Q25 3Q25 Change Avg Bal Inc/Exp Yield Avg Bal Inc/Exp Yield Avg Bal Inc/Exp Yield Cash $79,621 $780 3.89% $113,660 $1,261 4.40% ($34,039) ($481) -0.51% Investments 833,371 6,863 3.29% 844,464 7,127 3.38% (11,093) (264) -0.08% Commercial loans 2,168,947 34,106 6.24% 2,103,649 34,783 6.56% 65,298 (677) -0.32% Mortgage loans 1,532,931 18,779 4.90% 1,534,370 19,133 4.99% (1,439) (354) -0.09% Consumer loans 547,511 7,343 5.36% 563,538 7,429 5.27% (16,027) (86) 0.09% Earning assets $5,162,381 $67,871 5.24% $5,159,681 $69,733 5.38% $2,700 ($1,862) -0.15% Nonmaturity deposits $2,932,767 $12,743 1.72% $2,850,176 $13,282 1.85% $82,591 (539) -0.12% CDARS deposits 109,779 938 3.39% 108,567 989 3.61% 1,212 (51) -0.22% Retail Time deposits 667,990 5,682 3.37% 643,636 5,774 3.56% 24,354 (92) -0.18% Brokered deposits 70,055 746 4.22% 178,155 1,928 4.29% (108,100) (1,182) -0.07% Bank borrowings 25,920 243 3.72% 14,501 139 3.80% 11,419 104 -0.08% IBC debt 39,856 719 7.16% 66,989 1,817 10.81% (27,133) (1,098) -3.66% Cost of funds $3,846,367 $21,071 2.17% $3,862,024 $23,929 2.46% ($15,657) ($2,858) -0.29% Free funds $1,316,014 $1,297,657 $18,357 Net interest income $46,800 $45,804 $996 Net interest margin 3.62% 3.54% 0.08%

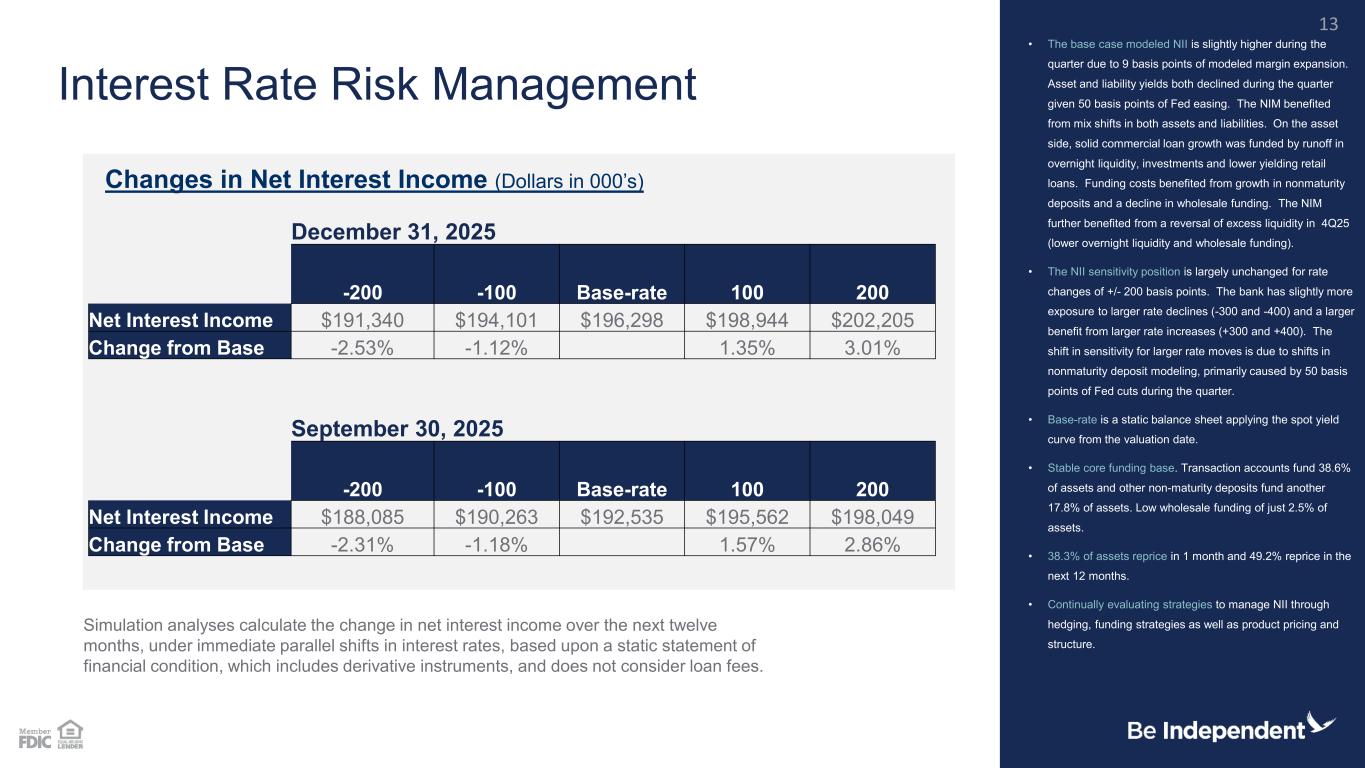

December 31, 2025 -200 -100 Base-rate 100 200 Net Interest Income $191,340 $194,101 $196,298 $198,944 $202,205 Change from Base -2.53% -1.12% 1.35% 3.01% September 30, 2025 -200 -100 Base-rate 100 200 Net Interest Income $188,085 $190,263 $192,535 $195,562 $198,049 Change from Base -2.31% -1.18% 1.57% 2.86% Interest Rate Risk Management • The base case modeled NII is slightly higher during the quarter due to 9 basis points of modeled margin expansion. Asset and liability yields both declined during the quarter given 50 basis points of Fed easing. The NIM benefited from mix shifts in both assets and liabilities. On the asset side, solid commercial loan growth was funded by runoff in overnight liquidity, investments and lower yielding retail loans. Funding costs benefited from growth in nonmaturity deposits and a decline in wholesale funding. The NIM further benefited from a reversal of excess liquidity in 4Q25 (lower overnight liquidity and wholesale funding). • The NII sensitivity position is largely unchanged for rate changes of +/- 200 basis points. The bank has slightly more exposure to larger rate declines (-300 and -400) and a larger benefit from larger rate increases (+300 and +400). The shift in sensitivity for larger rate moves is due to shifts in nonmaturity deposit modeling, primarily caused by 50 basis points of Fed cuts during the quarter. • Base-rate is a static balance sheet applying the spot yield curve from the valuation date. • Stable core funding base. Transaction accounts fund 38.6% of assets and other non-maturity deposits fund another 17.8% of assets. Low wholesale funding of just 2.5% of assets. • 38.3% of assets reprice in 1 month and 49.2% reprice in the next 12 months. • Continually evaluating strategies to manage NII through hedging, funding strategies as well as product pricing and structure. Changes in Net Interest Income (Dollars in 000’s) Simulation analyses calculate the change in net interest income over the next twelve months, under immediate parallel shifts in interest rates, based upon a static statement of financial condition, which includes derivative instruments, and does not consider loan fees. 13

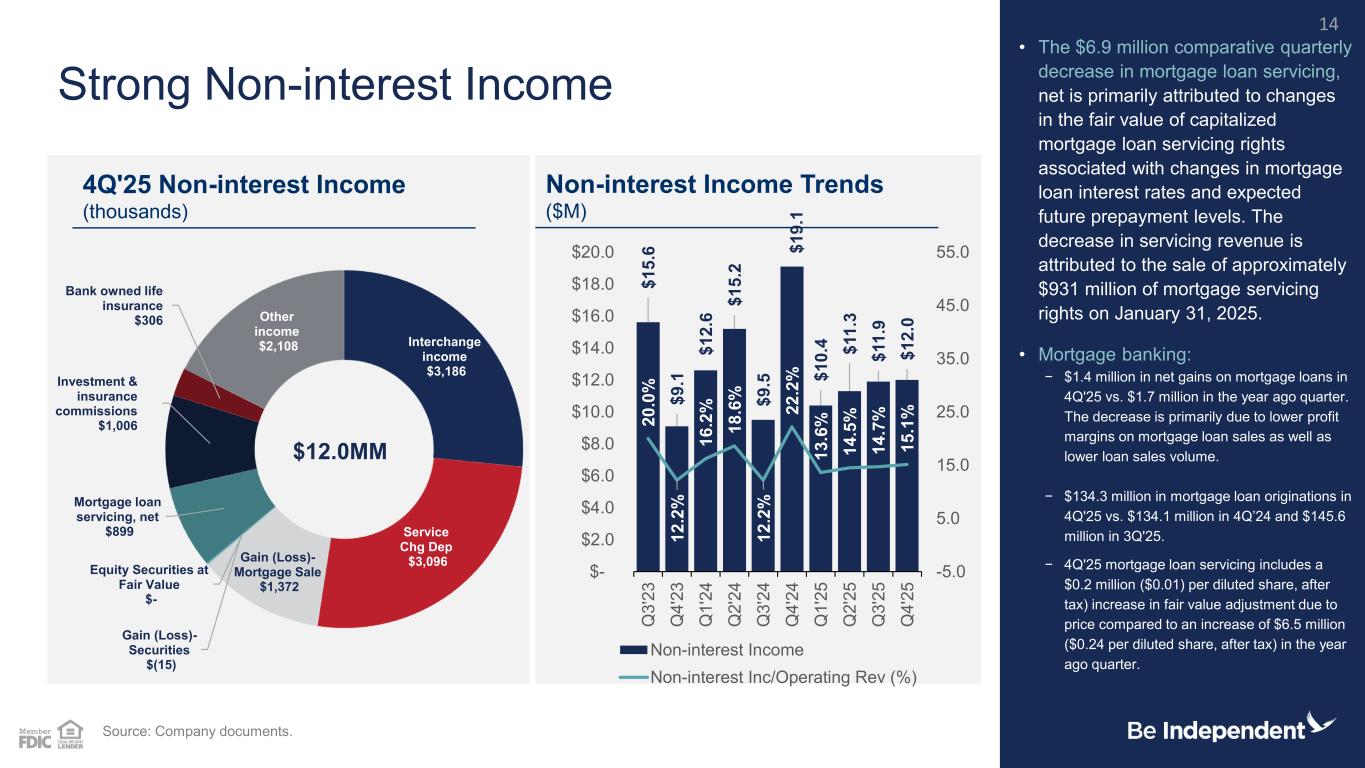

Interchange income $3,186 Service Chg Dep $3,096 Gain (Loss)- Mortgage Sale $1,372 Equity Securities at Fair Value $- Gain (Loss)- Securities $(15) Mortgage loan servicing, net $899 Investment & insurance commissions $1,006 Bank owned life insurance $306 Other income $2,108 Strong Non-interest Income • The $6.9 million comparative quarterly decrease in mortgage loan servicing, net is primarily attributed to changes in the fair value of capitalized mortgage loan servicing rights associated with changes in mortgage loan interest rates and expected future prepayment levels. The decrease in servicing revenue is attributed to the sale of approximately $931 million of mortgage servicing rights on January 31, 2025. • Mortgage banking: − $1.4 million in net gains on mortgage loans in 4Q'25 vs. $1.7 million in the year ago quarter. The decrease is primarily due to lower profit margins on mortgage loan sales as well as lower loan sales volume. − $134.3 million in mortgage loan originations in 4Q'25 vs. $134.1 million in 4Q’24 and $145.6 million in 3Q'25. − 4Q'25 mortgage loan servicing includes a $0.2 million ($0.01) per diluted share, after tax) increase in fair value adjustment due to price compared to an increase of $6.5 million ($0.24 per diluted share, after tax) in the year ago quarter. Source: Company documents. 4Q'25 Non-interest Income (thousands) Non-interest Income Trends ($M) 14 $12.0MM $ 1 5 .6 $ 9 .1 $ 1 2 .6 $ 1 5 .2 $ 9 .5 $ 1 9 .1 $ 1 0 .4 $ 1 1 .3 $ 1 1 .9 $ 1 2 .0 2 0 .0 % 1 2 .2 % 1 6 .2 % 1 8 .6 % 1 2 .2 % 2 2 .2 % 1 3 .6 % 1 4 .5 % 1 4 .7 % 1 5 .1 % -5.0 5.0 15.0 25.0 35.0 45.0 55.0 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Q 1 '2 5 Q 2 '2 5 Q 3 '2 5 Q 4 '2 5 Non-interest Income Non-interest Inc/Operating Rev (%)

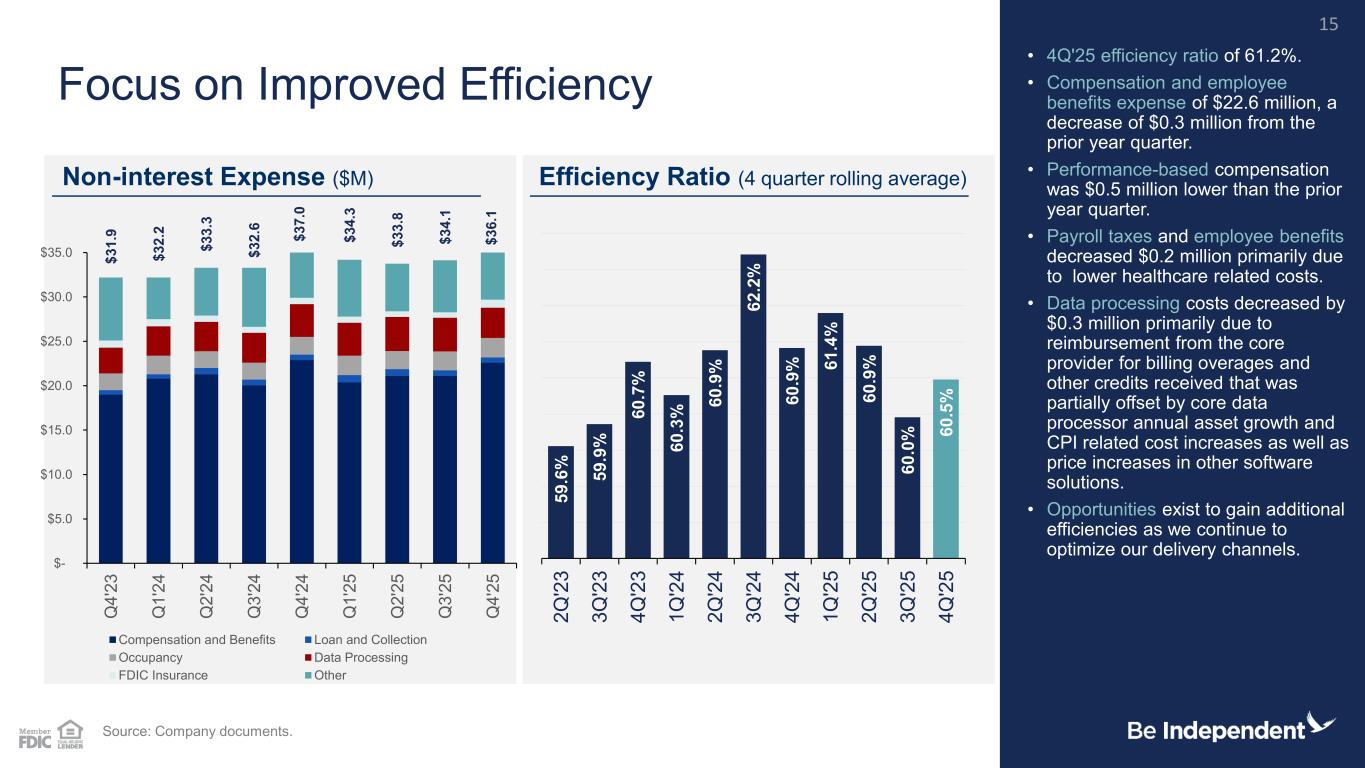

5 9 .6 % 5 9 .9 % 6 0 .7 % 6 0 .3 % 6 0 .9 % 6 2 .2 % 6 0 .9 % 6 1 .4 % 6 0 .9 % 6 0 .0 % 6 0 .5 % 2 Q '2 3 3 Q '2 3 4 Q '2 3 1 Q '2 4 2 Q '2 4 3 Q '2 4 4 Q '2 4 1 Q '2 5 2 Q '2 5 3 Q '2 5 4 Q '2 5 $ 3 1 .9 $ 3 2 .2 $ 3 3 .3 $ 3 2 .6 $ 3 4 .3 $ 3 3 .8 $ 3 4 .1 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Q 1 '2 5 Q 2 '2 5 Q 3 '2 5 Q 4 '2 5 Compensation and Benefits Loan and Collection Occupancy Data Processing FDIC Insurance Other Focus on Improved Efficiency • 4Q'25 efficiency ratio of 61.2%. • Compensation and employee benefits expense of $22.6 million, a decrease of $0.3 million from the prior year quarter. • Performance-based compensation was $0.5 million lower than the prior year quarter. • Payroll taxes and employee benefits decreased $0.2 million primarily due to lower healthcare related costs. • Data processing costs decreased by $0.3 million primarily due to reimbursement from the core provider for billing overages and other credits received that was partially offset by core data processor annual asset growth and CPI related cost increases as well as price increases in other software solutions. • Opportunities exist to gain additional efficiencies as we continue to optimize our delivery channels. Non-interest Expense ($M) Efficiency Ratio (4 quarter rolling average) Source: Company documents. 15 $ 3 7 .0 $ 3 6 .1

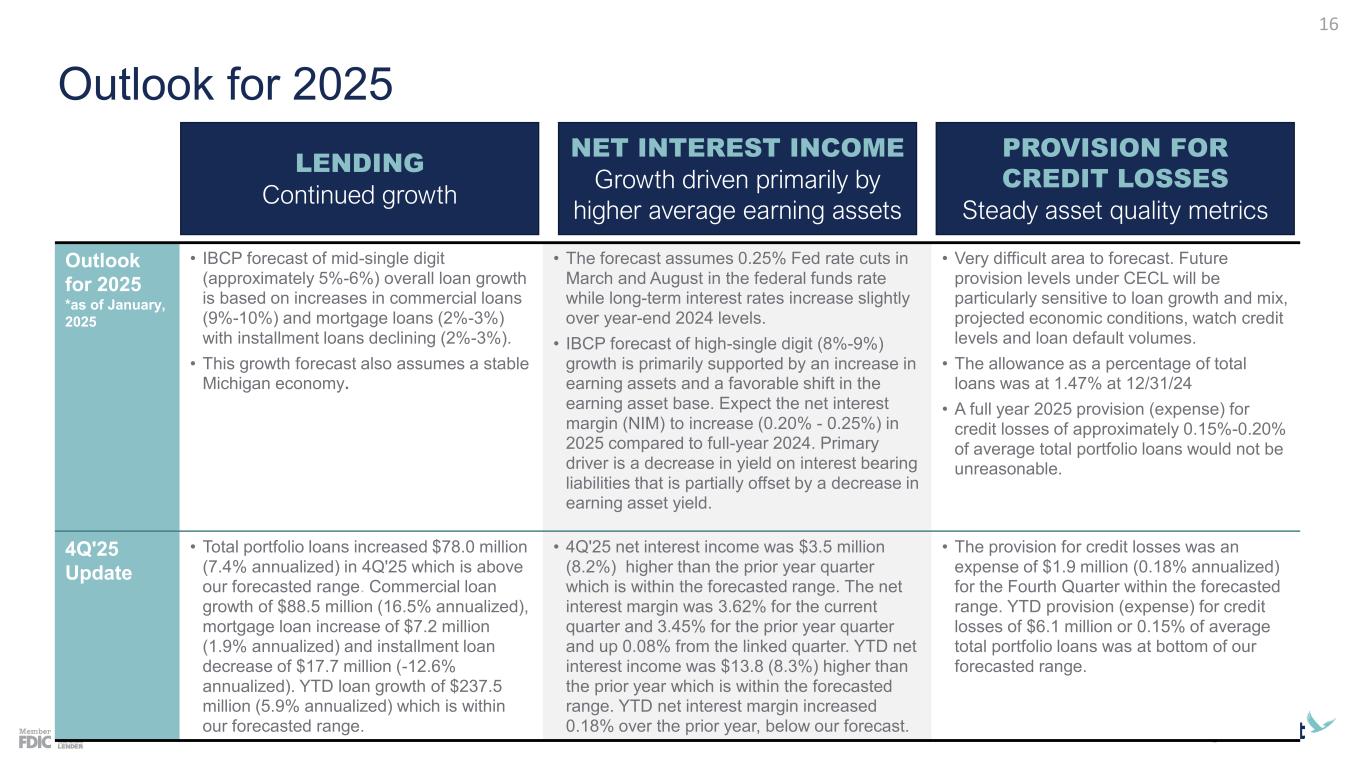

Outlook for 2025 Outlook for 2025 *as of January, 2025 • IBCP forecast of mid-single digit (approximately 5%-6%) overall loan growth is based on increases in commercial loans (9%-10%) and mortgage loans (2%-3%) with installment loans declining (2%-3%). • This growth forecast also assumes a stable Michigan economy. • The forecast assumes 0.25% Fed rate cuts in March and August in the federal funds rate while long-term interest rates increase slightly over year-end 2024 levels. • IBCP forecast of high-single digit (8%-9%) growth is primarily supported by an increase in earning assets and a favorable shift in the earning asset base. Expect the net interest margin (NIM) to increase (0.20% - 0.25%) in 2025 compared to full-year 2024. Primary driver is a decrease in yield on interest bearing liabilities that is partially offset by a decrease in earning asset yield. • Very difficult area to forecast. Future provision levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. • The allowance as a percentage of total loans was at 1.47% at 12/31/24 • A full year 2025 provision (expense) for credit losses of approximately 0.15%-0.20% of average total portfolio loans would not be unreasonable. 4Q'25 Update • Total portfolio loans increased $78.0 million (7.4% annualized) in 4Q'25 which is above our forecasted range. Commercial loan growth of $88.5 million (16.5% annualized), mortgage loan increase of $7.2 million (1.9% annualized) and installment loan decrease of $17.7 million (-12.6% annualized). YTD loan growth of $237.5 million (5.9% annualized) which is within our forecasted range. • 4Q'25 net interest income was $3.5 million (8.2%) higher than the prior year quarter which is within the forecasted range. The net interest margin was 3.62% for the current quarter and 3.45% for the prior year quarter and up 0.08% from the linked quarter. YTD net interest income was $13.8 (8.3%) higher than the prior year which is within the forecasted range. YTD net interest margin increased 0.18% over the prior year, below our forecast. • The provision for credit losses was an expense of $1.9 million (0.18% annualized) for the Fourth Quarter within the forecasted range. YTD provision (expense) for credit losses of $6.1 million or 0.15% of average total portfolio loans was at bottom of our forecasted range. LENDING Continued growth NET INTEREST INCOME Growth driven primarily by higher average earning assets PROVISION FOR CREDIT LOSSES Steady asset quality metrics 16

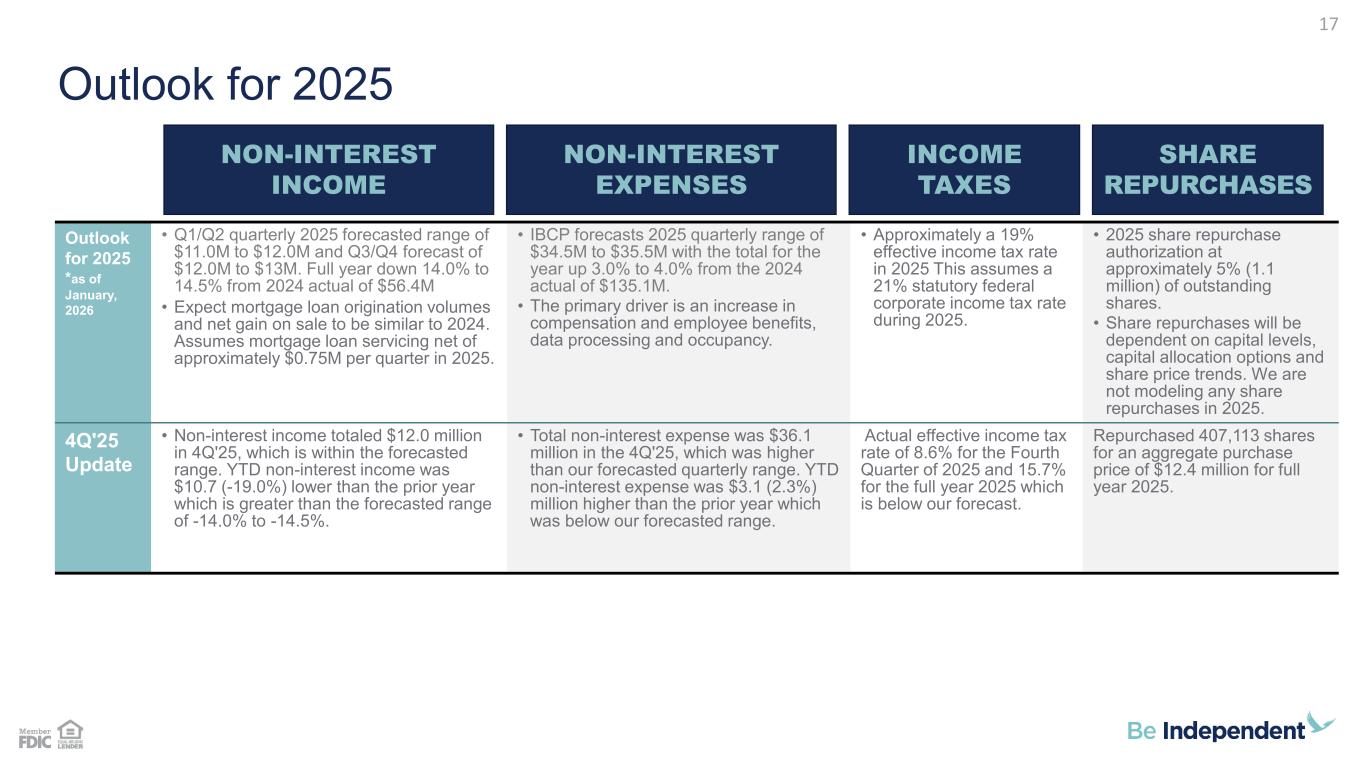

Outlook for 2025 Outlook for 2025 *as of January, 2026 • Q1/Q2 quarterly 2025 forecasted range of $11.0M to $12.0M and Q3/Q4 forecast of $12.0M to $13M. Full year down 14.0% to 14.5% from 2024 actual of $56.4M • Expect mortgage loan origination volumes and net gain on sale to be similar to 2024. Assumes mortgage loan servicing net of approximately $0.75M per quarter in 2025. • IBCP forecasts 2025 quarterly range of $34.5M to $35.5M with the total for the year up 3.0% to 4.0% from the 2024 actual of $135.1M. • The primary driver is an increase in compensation and employee benefits, data processing and occupancy. • Approximately a 19% effective income tax rate in 2025 This assumes a 21% statutory federal corporate income tax rate during 2025. • 2025 share repurchase authorization at approximately 5% (1.1 million) of outstanding shares. • Share repurchases will be dependent on capital levels, capital allocation options and share price trends. We are not modeling any share repurchases in 2025. 4Q'25 Update • Non-interest income totaled $12.0 million in 4Q'25, which is within the forecasted range. YTD non-interest income was $10.7 (-19.0%) lower than the prior year which is greater than the forecasted range of -14.0% to -14.5%. • Total non-interest expense was $36.1 million in the 4Q'25, which was higher than our forecasted quarterly range. YTD non-interest expense was $3.1 (2.3%) million higher than the prior year which was below our forecasted range. Actual effective income tax rate of 8.6% for the Fourth Quarter of 2025 and 15.7% for the full year 2025 which is below our forecast. Repurchased 407,113 shares for an aggregate purchase price of $12.4 million for full year 2025. NON-INTEREST INCOME NON-INTEREST EXPENSES INCOME TAXES SHARE REPURCHASES 17

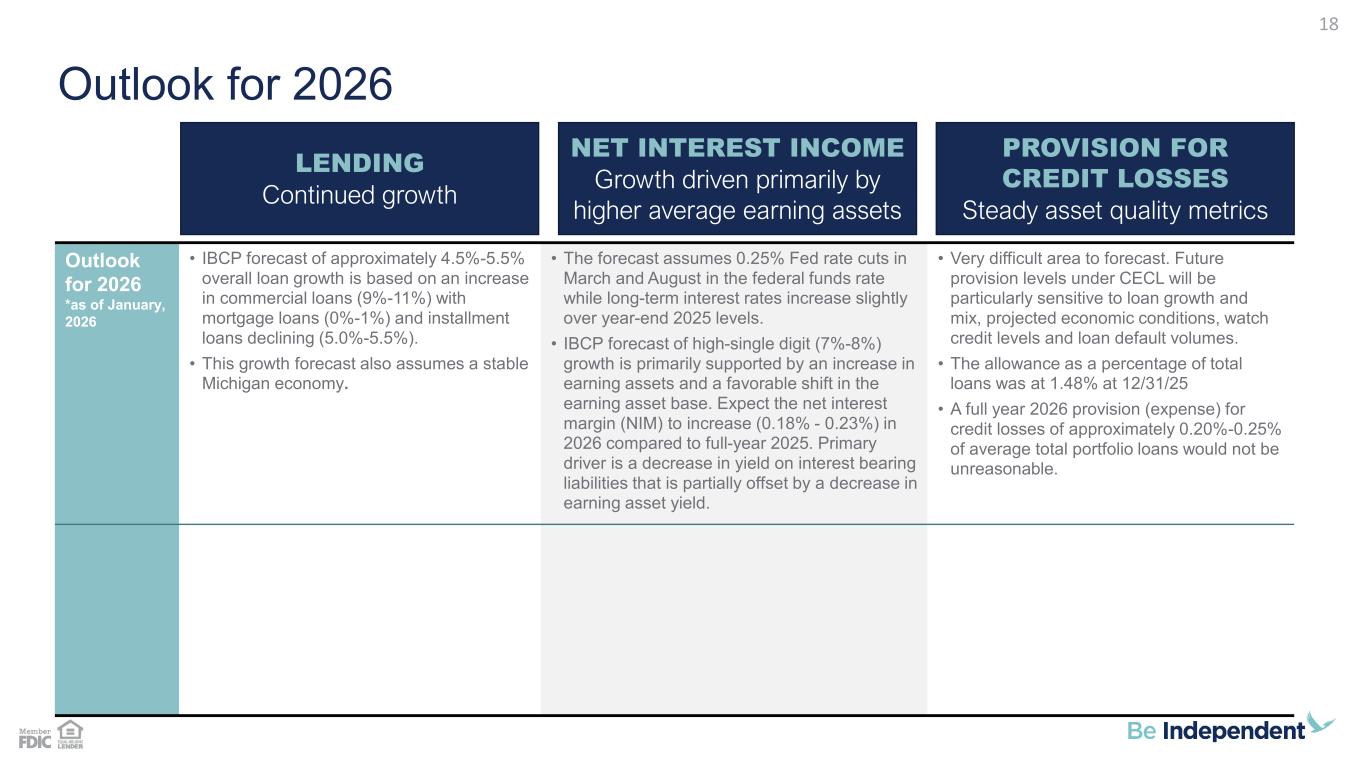

Outlook for 2026 Outlook for 2026 *as of January, 2026 • IBCP forecast of approximately 4.5%-5.5% overall loan growth is based on an increase in commercial loans (9%-11%) with mortgage loans (0%-1%) and installment loans declining (5.0%-5.5%). • This growth forecast also assumes a stable Michigan economy. • The forecast assumes 0.25% Fed rate cuts in March and August in the federal funds rate while long-term interest rates increase slightly over year-end 2025 levels. • IBCP forecast of high-single digit (7%-8%) growth is primarily supported by an increase in earning assets and a favorable shift in the earning asset base. Expect the net interest margin (NIM) to increase (0.18% - 0.23%) in 2026 compared to full-year 2025. Primary driver is a decrease in yield on interest bearing liabilities that is partially offset by a decrease in earning asset yield. • Very difficult area to forecast. Future provision levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. • The allowance as a percentage of total loans was at 1.48% at 12/31/25 • A full year 2026 provision (expense) for credit losses of approximately 0.20%-0.25% of average total portfolio loans would not be unreasonable. LENDING Continued growth NET INTEREST INCOME Growth driven primarily by higher average earning assets PROVISION FOR CREDIT LOSSES Steady asset quality metrics 18

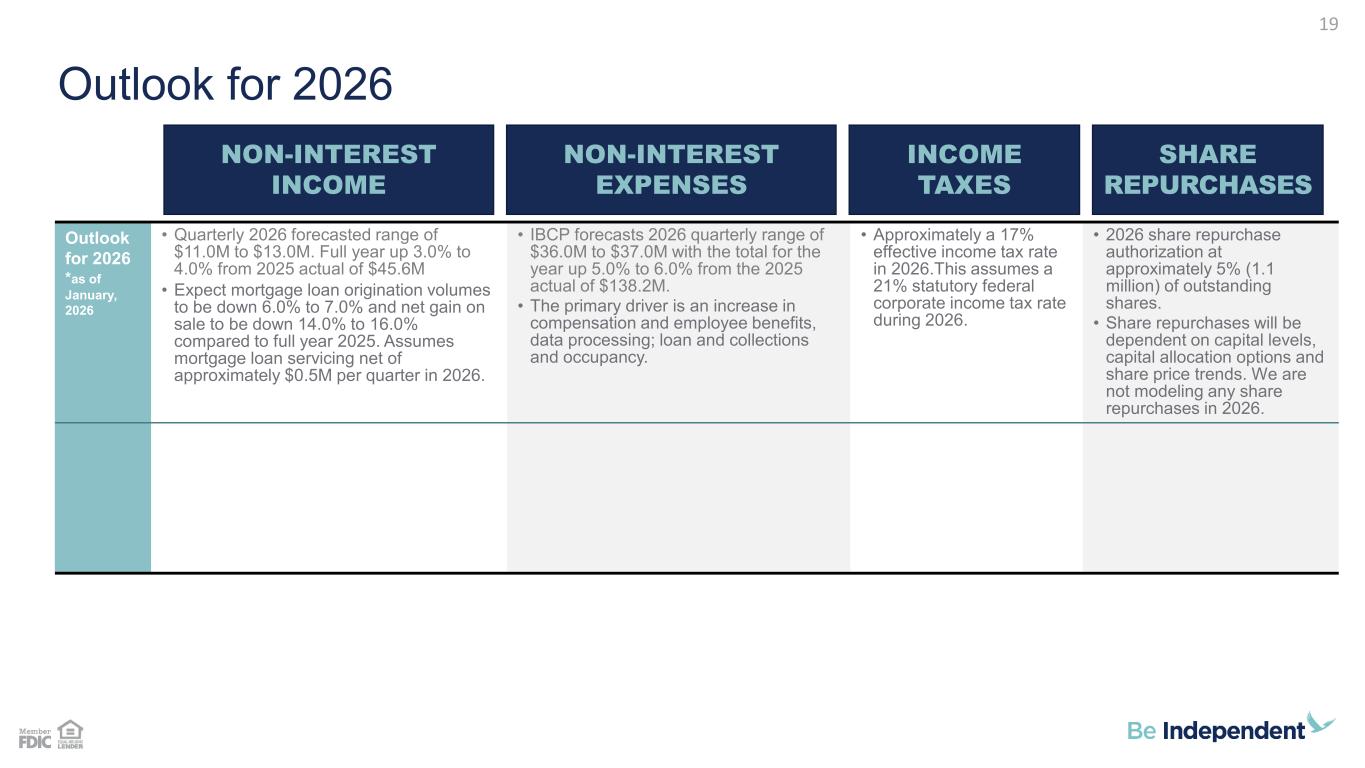

Outlook for 2026 Outlook for 2026 *as of January, 2026 • Quarterly 2026 forecasted range of $11.0M to $13.0M. Full year up 3.0% to 4.0% from 2025 actual of $45.6M • Expect mortgage loan origination volumes to be down 6.0% to 7.0% and net gain on sale to be down 14.0% to 16.0% compared to full year 2025. Assumes mortgage loan servicing net of approximately $0.5M per quarter in 2026. • IBCP forecasts 2026 quarterly range of $36.0M to $37.0M with the total for the year up 5.0% to 6.0% from the 2025 actual of $138.2M. • The primary driver is an increase in compensation and employee benefits, data processing; loan and collections and occupancy. • Approximately a 17% effective income tax rate in 2026.This assumes a 21% statutory federal corporate income tax rate during 2026. • 2026 share repurchase authorization at approximately 5% (1.1 million) of outstanding shares. • Share repurchases will be dependent on capital levels, capital allocation options and share price trends. We are not modeling any share repurchases in 2026. NON-INTEREST INCOME NON-INTEREST EXPENSES INCOME TAXES SHARE REPURCHASES 19

Strategic Initiatives • Outside Sales - Relationship banking focus thru consistent calling on prospects and COI’s. • Inside Service/Sales – high retention + high cross sales, collaboration of strategic partners. • Digital Marketing - Leverage data insights, target strategically, elevate brand image, personalize the customer experience. • Leverage Referral Network – Fintech (ReferLive); • New Products – SMB deposit product, Business digital pmts. • Market Expansion – Through existing indirect dealer network. • Selective and opportunistic bank and branch acquisitions. • Process Automation – leverage core investments + Fintech partnerships: (Blend) mortgage; (Numerated) Commercial; • Branch Optimization - including assessing existing locations, new locations, service hours, staffing, & workflow and leveraging technology. • Promotion of Self-Serve Channels - (One Wallet, Treasury One, etc.) • Leverage Banker Capacity – including on-line appointment setting. • Leverage Middleware + API’s – expediate new technology implementation. • Optimize Office Space Utilization • Invest in our Team – competitive C&B offering, skill training, leadership development, etc. • High Employee Engagement – thru fostering a culture of purpose, opportunity, continuous learning, diversity, reward + recognition. • Promote Teamwork + Alignment across all business units. • Invest in technology - to enhance the employee experience + customer experience. • Client Service Model – well defined and applied. • Utilize three layers of defense (business unit, risk management and internal audit). Independent & collaborative approach. • Consistent earnings + maintain strong capital levels. • Proactive credit quality monitoring and problem resolution. • Manage Liquidity and IRR. • Manage Operational risk, emphasizing cyber security, fraud prevention, and regulatory compliance. • Effective relationships with regulators & other outside oversight parties. Proactive, transparent and good communication. PROCESS IMPROVEMENT & COST CONTROLS RISK MANAGEMENT GROWTH TALENT MANAGEMENT 20

Question and Answer Session Closing Remarks NASDAQ: IBCP Thank you for attending 21

Appendix Additional Financial Data and Non-GAAP Reconciliations 22

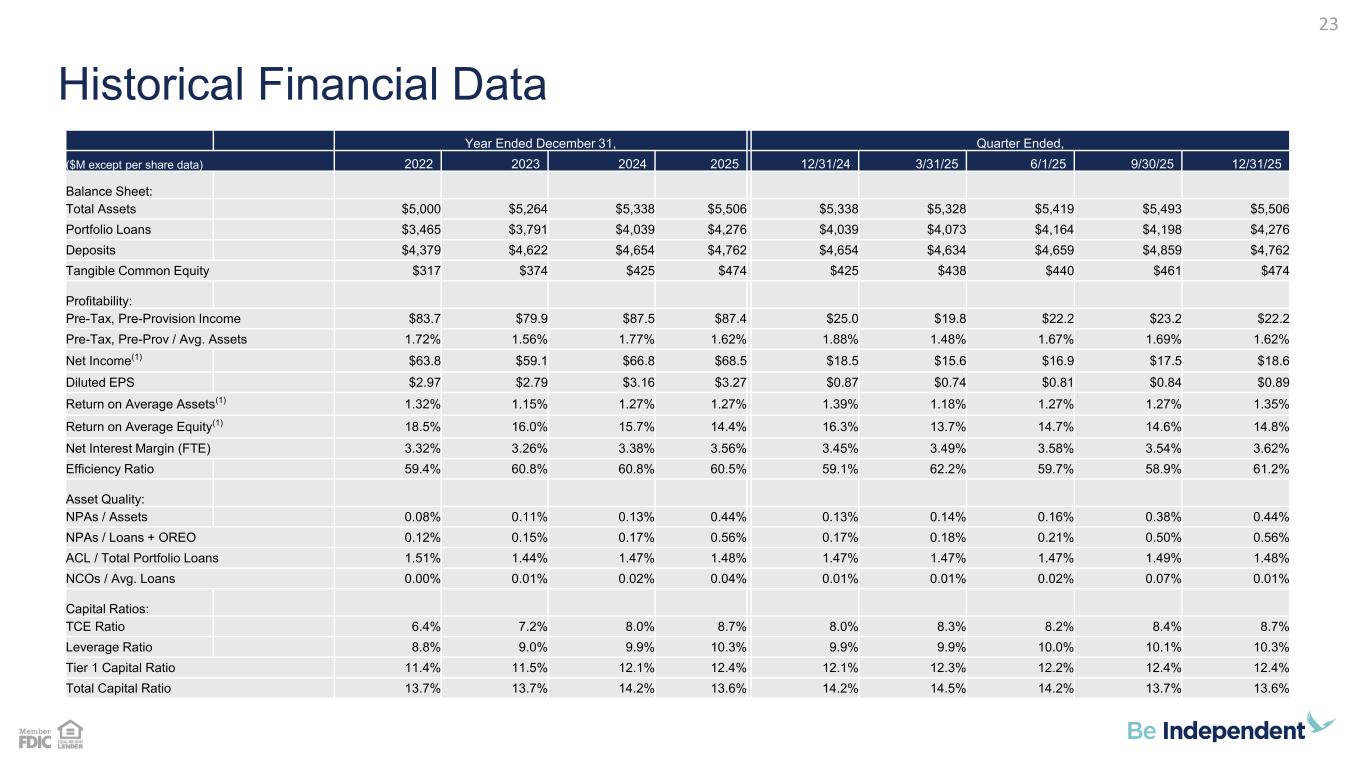

Historical Financial Data 23 Year Ended December 31, Quarter Ended, ($M except per share data) 2022 2023 2024 2025 12/31/24 3/31/25 6/1/25 9/30/25 12/31/25 Balance Sheet: Total Assets $5,000 $5,264 $5,338 $5,506 $5,338 $5,328 $5,419 $5,493 $5,506 Portfolio Loans $3,465 $3,791 $4,039 $4,276 $4,039 $4,073 $4,164 $4,198 $4,276 Deposits $4,379 $4,622 $4,654 $4,762 $4,654 $4,634 $4,659 $4,859 $4,762 Tangible Common Equity $317 $374 $425 $474 $425 $438 $440 $461 $474 Profitability: Pre-Tax, Pre-Provision Income $83.7 $79.9 $87.5 $87.4 $25.0 $19.8 $22.2 $23.2 $22.2 Pre-Tax, Pre-Prov / Avg. Assets 1.72% 1.56% 1.77% 1.62% 1.88% 1.48% 1.67% 1.69% 1.62% Net Income(1) $63.8 $59.1 $66.8 $68.5 $18.5 $15.6 $16.9 $17.5 $18.6 Diluted EPS $2.97 $2.79 $3.16 $3.27 $0.87 $0.74 $0.81 $0.84 $0.89 Return on Average Assets(1) 1.32% 1.15% 1.27% 1.27% 1.39% 1.18% 1.27% 1.27% 1.35% Return on Average Equity(1) 18.5% 16.0% 15.7% 14.4% 16.3% 13.7% 14.7% 14.6% 14.8% Net Interest Margin (FTE) 3.32% 3.26% 3.38% 3.56% 3.45% 3.49% 3.58% 3.54% 3.62% Efficiency Ratio 59.4% 60.8% 60.8% 60.5% 59.1% 62.2% 59.7% 58.9% 61.2% Asset Quality: NPAs / Assets 0.08% 0.11% 0.13% 0.44% 0.13% 0.14% 0.16% 0.38% 0.44% NPAs / Loans + OREO 0.12% 0.15% 0.17% 0.56% 0.17% 0.18% 0.21% 0.50% 0.56% ACL / Total Portfolio Loans 1.51% 1.44% 1.47% 1.48% 1.47% 1.47% 1.47% 1.49% 1.48% NCOs / Avg. Loans 0.00% 0.01% 0.02% 0.04% 0.01% 0.01% 0.02% 0.07% 0.01% Capital Ratios: TCE Ratio 6.4% 7.2% 8.0% 8.7% 8.0% 8.3% 8.2% 8.4% 8.7% Leverage Ratio 8.8% 9.0% 9.9% 10.3% 9.9% 9.9% 10.0% 10.1% 10.3% Tier 1 Capital Ratio 11.4% 11.5% 12.1% 12.4% 12.1% 12.3% 12.2% 12.4% 12.4% Total Capital Ratio 13.7% 13.7% 14.2% 13.6% 14.2% 14.5% 14.2% 13.7% 13.6%

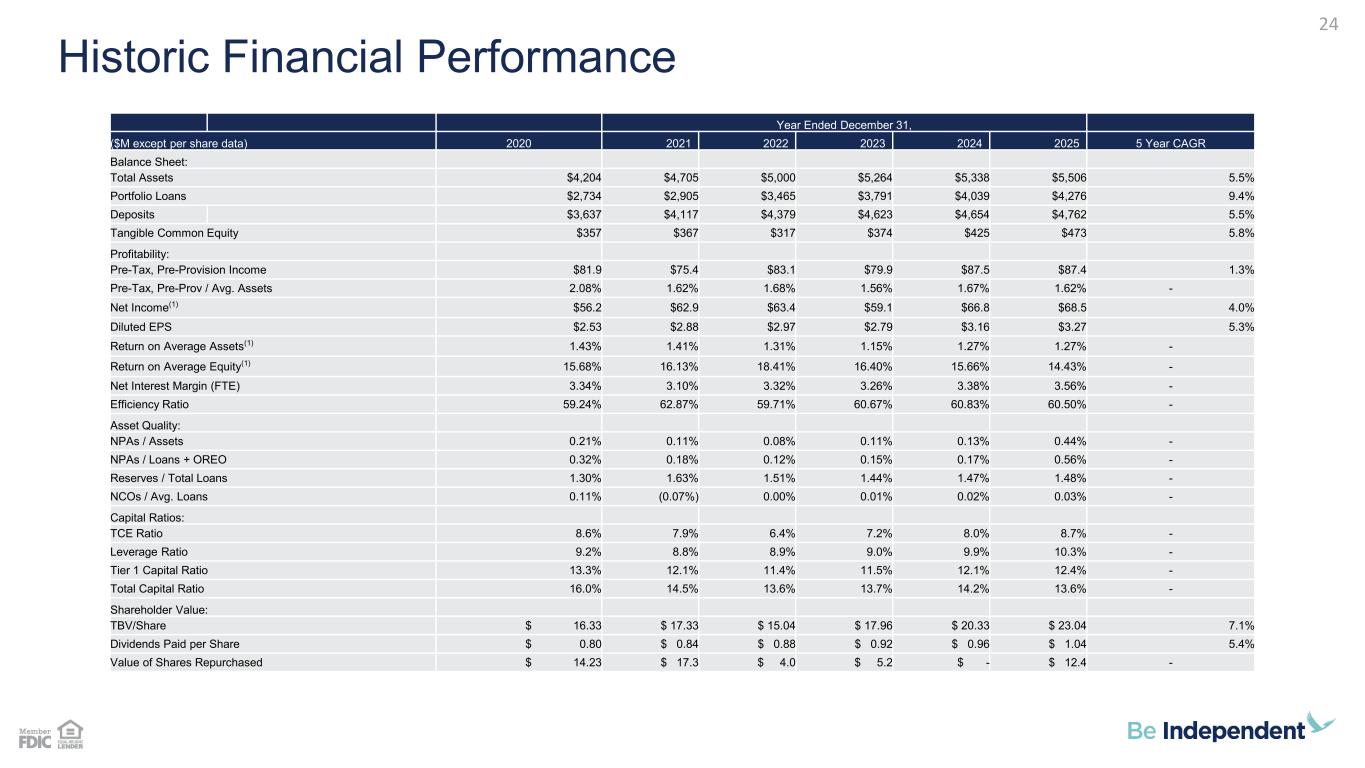

24 Historic Financial Performance Year Ended December 31, ($M except per share data) 2020 2021 2022 2023 2024 2025 5 Year CAGR Balance Sheet: Total Assets $4,204 $4,705 $5,000 $5,264 $5,338 $5,506 5.5% Portfolio Loans $2,734 $2,905 $3,465 $3,791 $4,039 $4,276 9.4% Deposits $3,637 $4,117 $4,379 $4,623 $4,654 $4,762 5.5% Tangible Common Equity $357 $367 $317 $374 $425 $473 5.8% Profitability: Pre-Tax, Pre-Provision Income $81.9 $75.4 $83.1 $79.9 $87.5 $87.4 1.3% Pre-Tax, Pre-Prov / Avg. Assets 2.08% 1.62% 1.68% 1.56% 1.67% 1.62% - Net Income(1) $56.2 $62.9 $63.4 $59.1 $66.8 $68.5 4.0% Diluted EPS $2.53 $2.88 $2.97 $2.79 $3.16 $3.27 5.3% Return on Average Assets(1) 1.43% 1.41% 1.31% 1.15% 1.27% 1.27% - Return on Average Equity(1) 15.68% 16.13% 18.41% 16.40% 15.66% 14.43% - Net Interest Margin (FTE) 3.34% 3.10% 3.32% 3.26% 3.38% 3.56% - Efficiency Ratio 59.24% 62.87% 59.71% 60.67% 60.83% 60.50% - Asset Quality: NPAs / Assets 0.21% 0.11% 0.08% 0.11% 0.13% 0.44% - NPAs / Loans + OREO 0.32% 0.18% 0.12% 0.15% 0.17% 0.56% - Reserves / Total Loans 1.30% 1.63% 1.51% 1.44% 1.47% 1.48% - NCOs / Avg. Loans 0.11% (0.07%) 0.00% 0.01% 0.02% 0.03% - Capital Ratios: TCE Ratio 8.6% 7.9% 6.4% 7.2% 8.0% 8.7% - Leverage Ratio 9.2% 8.8% 8.9% 9.0% 9.9% 10.3% - Tier 1 Capital Ratio 13.3% 12.1% 11.4% 11.5% 12.1% 12.4% - Total Capital Ratio 16.0% 14.5% 13.6% 13.7% 14.2% 13.6% - Shareholder Value: TBV/Share $ 16.33 $ 17.33 $ 15.04 $ 17.96 $ 20.33 $ 23.04 7.1% Dividends Paid per Share $ 0.80 $ 0.84 $ 0.88 $ 0.92 $ 0.96 $ 1.04 5.4% Value of Shares Repurchased $ 14.23 $ 17.3 $ 4.0 $ 5.2 $ - $ 12.4 -

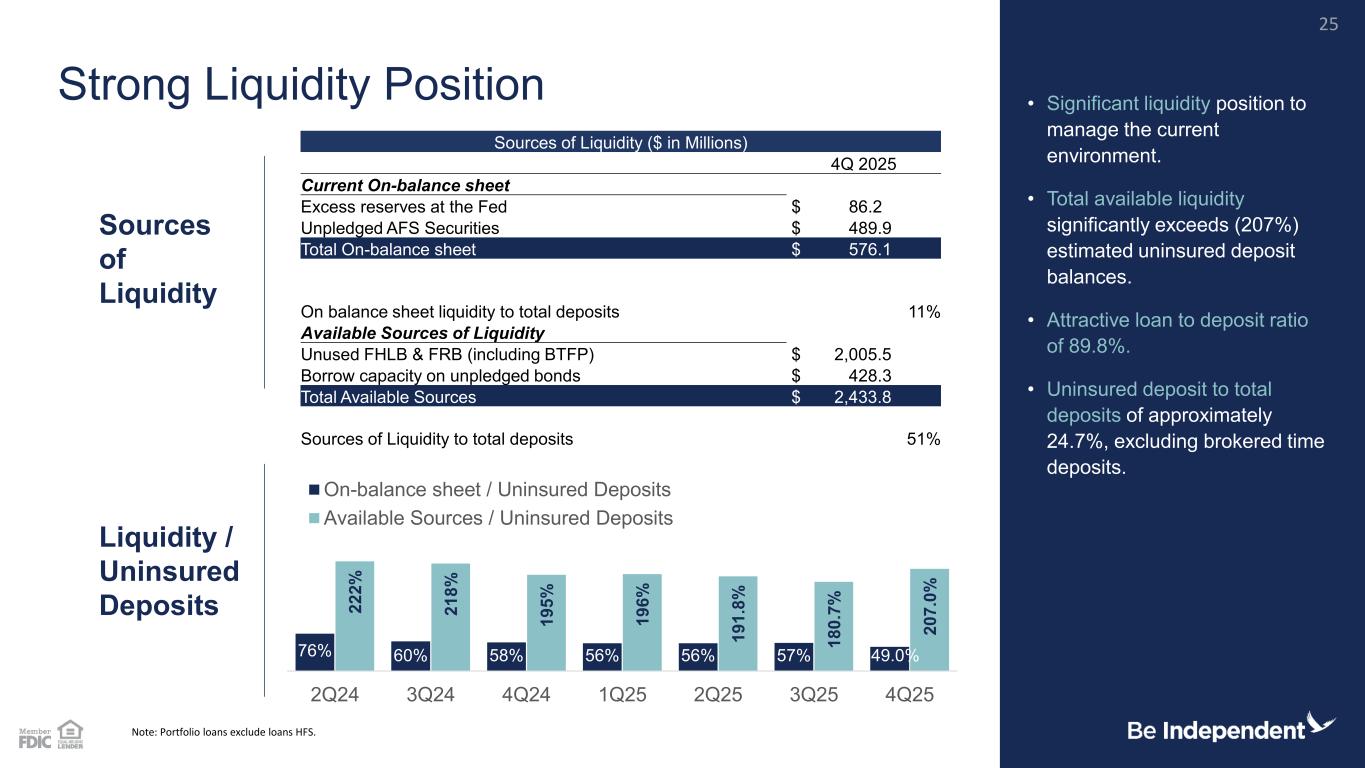

Sources of Liquidity ($ in Millions) 4Q 2025 Current On-balance sheet Excess reserves at the Fed $ 86.2 Unpledged AFS Securities $ 489.9 Total On-balance sheet $ 576.1 On balance sheet liquidity to total deposits 11% Available Sources of Liquidity Unused FHLB & FRB (including BTFP) $ 2,005.5 Borrow capacity on unpledged bonds $ 428.3 Total Available Sources $ 2,433.8 Sources of Liquidity to total deposits 51% 76% 60% 58% 56% 56% 57% 49.0% 2 2 2 % 2 1 8 % 1 9 5 % 1 9 6 % 1 9 1 .8 % 1 8 0 .7 % 2 0 7 .0 % 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 On-balance sheet / Uninsured Deposits Available Sources / Uninsured Deposits Note: Portfolio loans exclude loans HFS. Liquidity / Uninsured Deposits Strong Liquidity Position • Significant liquidity position to manage the current environment. • Total available liquidity significantly exceeds (207%) estimated uninsured deposit balances. • Attractive loan to deposit ratio of 89.8%. • Uninsured deposit to total deposits of approximately 24.7%, excluding brokered time deposits. Sources of Liquidity 25

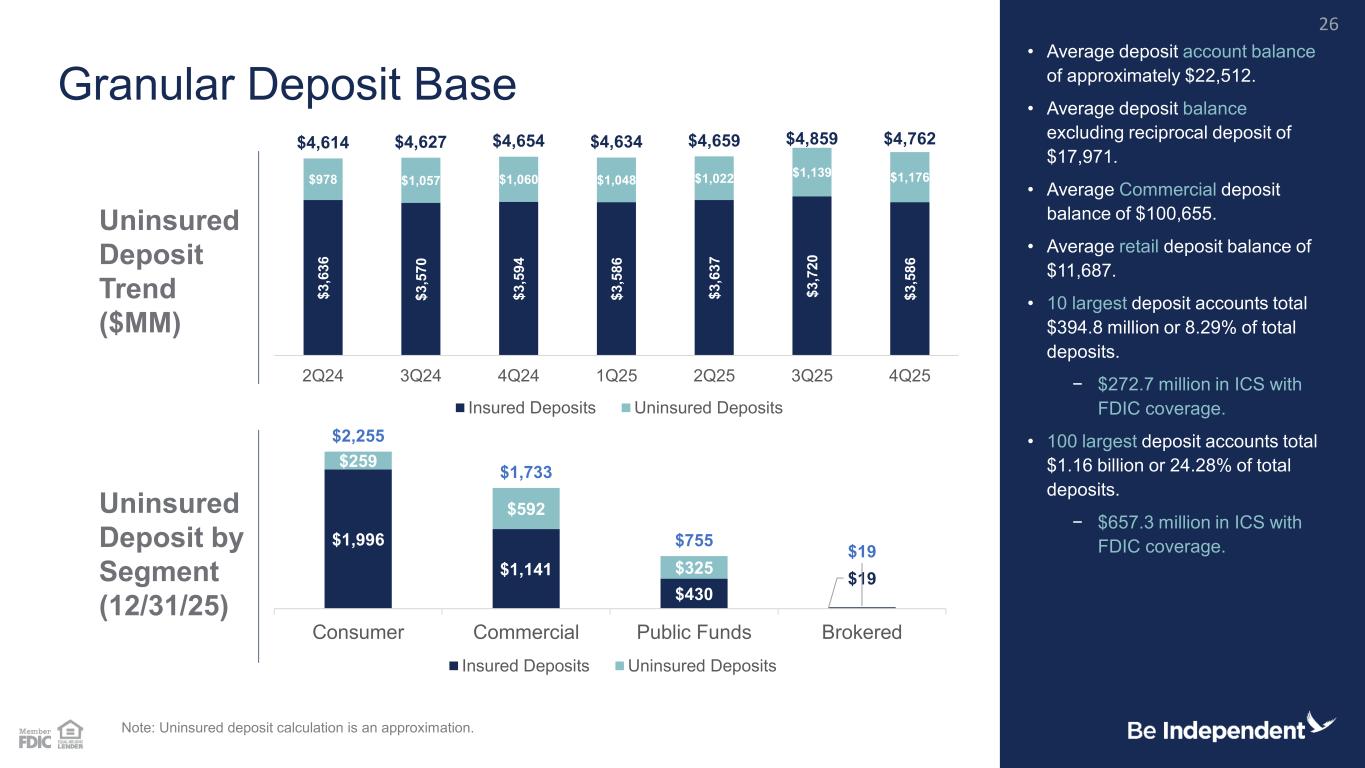

$1,996 $1,141 $430 $19 $259 $592 $325 $2,255 $1,733 $755 $19 Consumer Commercial Public Funds Brokered Insured Deposits Uninsured Deposits $ 3 ,6 3 6 $ 3 ,5 7 0 $ 3 ,5 9 4 $ 3 ,5 8 6 $ 3 ,6 3 7 $ 3 ,7 2 0 $ 3 ,5 8 6 $978 $1,057 $1,060 $1,048 $1,022 $1,139 $1,176 $4,614 $4,627 $4,654 $4,634 $4,659 $4,859 $4,762 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Insured Deposits Uninsured Deposits Granular Deposit Base • Average deposit account balance of approximately $22,512. • Average deposit balance excluding reciprocal deposit of $17,971. • Average Commercial deposit balance of $100,655. • Average retail deposit balance of $11,687. • 10 largest deposit accounts total $394.8 million or 8.29% of total deposits. − $272.7 million in ICS with FDIC coverage. • 100 largest deposit accounts total $1.16 billion or 24.28% of total deposits. − $657.3 million in ICS with FDIC coverage. Note: Uninsured deposit calculation is an approximation. Uninsured Deposit by Segment (12/31/25) Uninsured Deposit Trend ($MM) 26

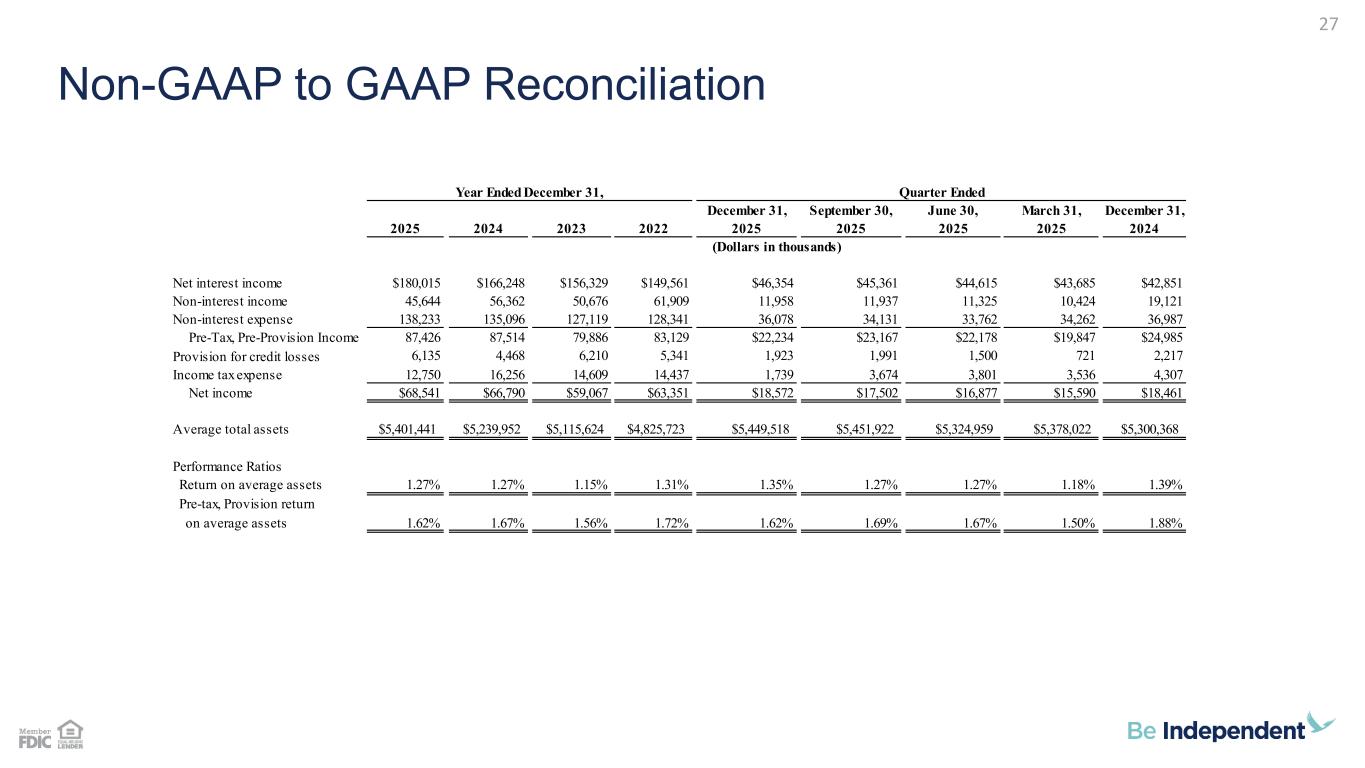

Non-GAAP to GAAP Reconciliation 27 December 31, September 30, June 30, March 31, December 31, 2025 2024 2023 2022 2025 2025 2025 2025 2024 Net interest income $180,015 $166,248 $156,329 $149,561 $46,354 $45,361 $44,615 $43,685 $42,851 Non-interest income 45,644 56,362 50,676 61,909 11,958 11,937 11,325 10,424 19,121 Non-interest expense 138,233 135,096 127,119 128,341 36,078 34,131 33,762 34,262 36,987 Pre-Tax, Pre-Provision Income 87,426 87,514 79,886 83,129 $22,234 $23,167 $22,178 $19,847 $24,985 Provision for credit losses 6,135 4,468 6,210 5,341 1,923 1,991 1,500 721 2,217 Income tax expense 12,750 16,256 14,609 14,437 1,739 3,674 3,801 3,536 4,307 Net income $68,541 $66,790 $59,067 $63,351 $18,572 $17,502 $16,877 $15,590 $18,461 Average total assets $5,401,441 $5,239,952 $5,115,624 $4,825,723 $5,449,518 $5,451,922 $5,324,959 $5,378,022 $5,300,368 Performance Ratios Return on average assets 1.27% 1.27% 1.15% 1.31% 1.35% 1.27% 1.27% 1.18% 1.39% Pre-tax, Provision return on average assets 1.62% 1.67% 1.56% 1.72% 1.62% 1.69% 1.67% 1.50% 1.88% Year Ended December 31, Quarter Ended (Dollars in thousands)

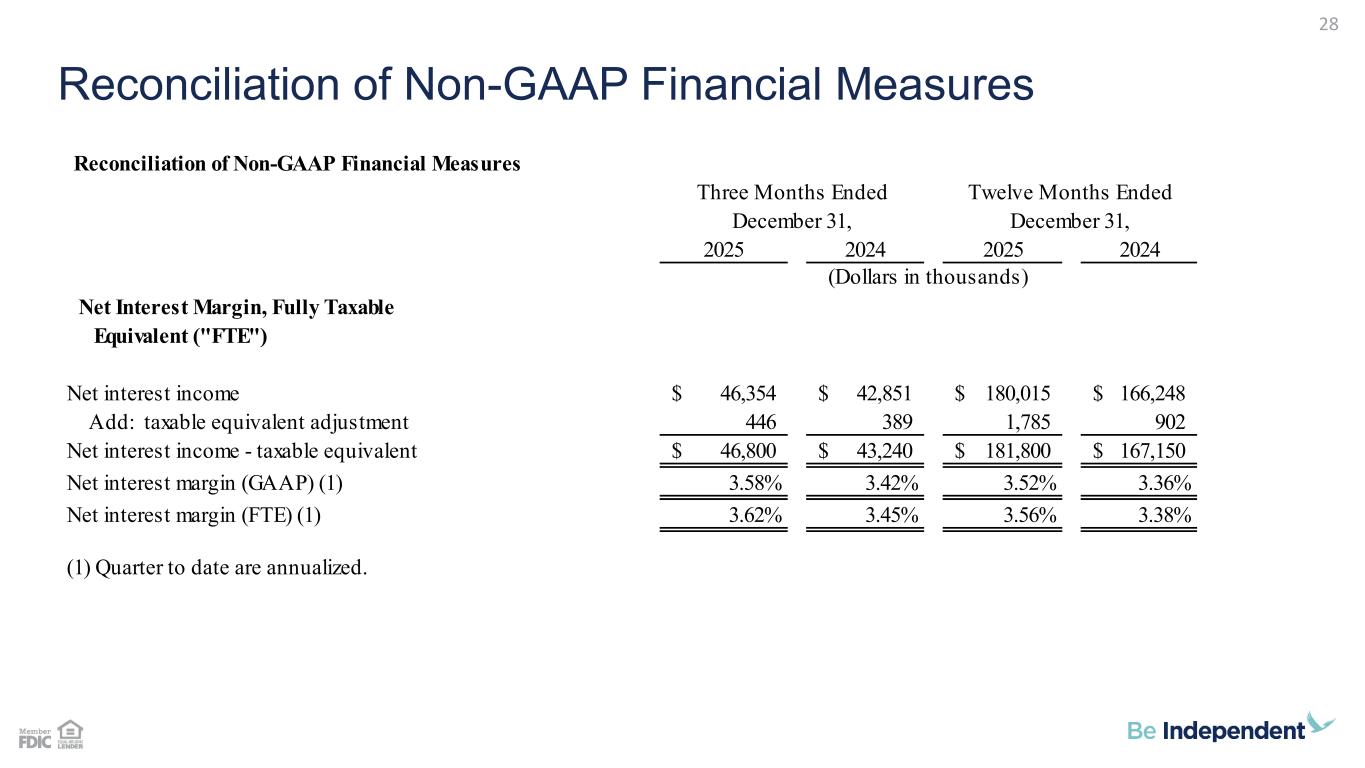

Reconciliation of Non-GAAP Financial Measures 28 Reconciliation of Non-GAAP Financial Measures 2025 2024 2025 2024 Net Interest Margin, Fully Taxable Equivalent ("FTE") Net interest income 46,354$ 42,851$ 180,015$ 166,248$ Add: taxable equivalent adjustment 446 389 1,785 902 Net interest income - taxable equivalent 46,800$ 43,240$ 181,800$ 167,150$ Net interest margin (GAAP) (1) 3.58% 3.42% 3.52% 3.36% Net interest margin (FTE) (1) 3.62% 3.45% 3.56% 3.38% (1) Quarter to date are annualized. Three Months Ended Twelve Months Ended December 31, December 31, (Dollars in thousands)

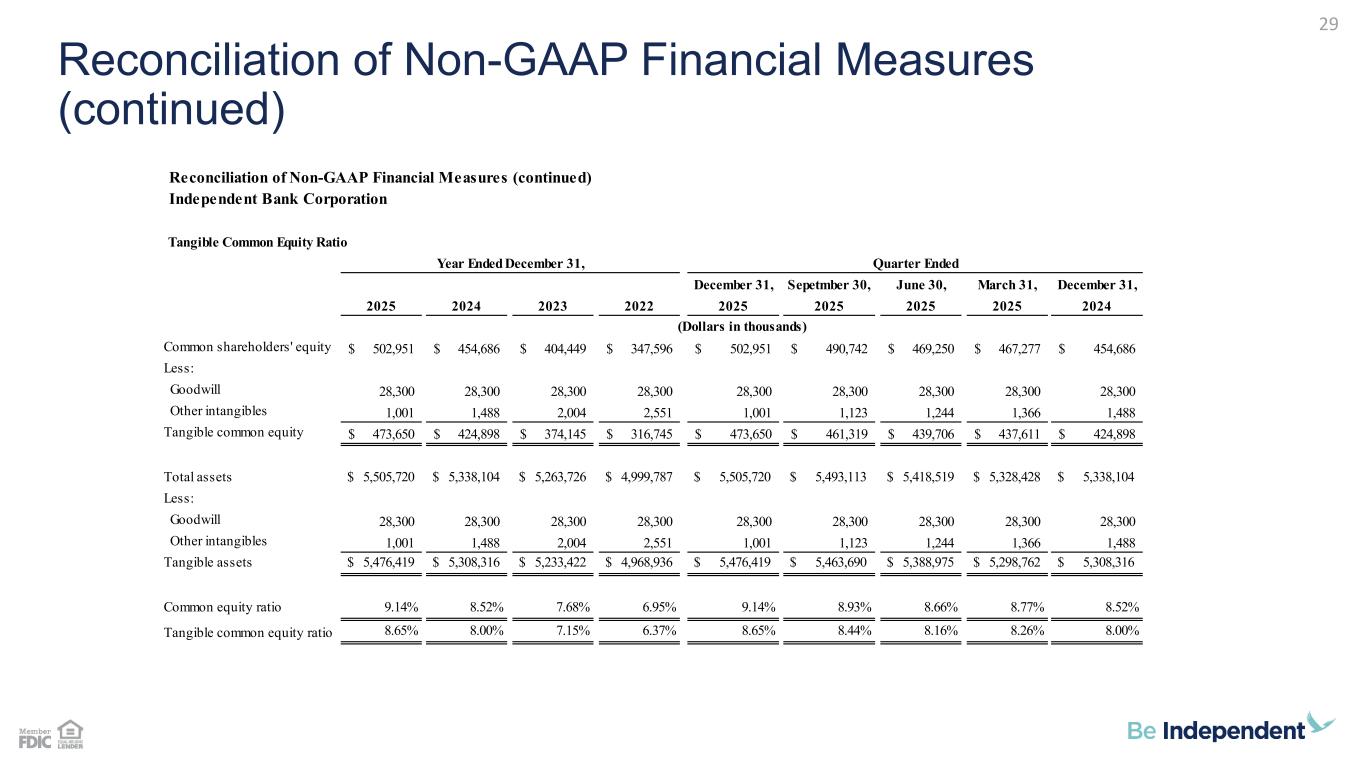

Reconciliation of Non-GAAP Financial Measures (continued) 29 Reconciliation of Non-GAAP Financial Measures (continued) Independent Bank Corporation Tangible Common Equity Ratio December 31, Sepetmber 30, June 30, March 31, December 31, 2025 2024 2023 2022 2025 2025 2025 2025 2024 Common shareholders' equity 502,951$ 454,686$ 404,449$ 347,596$ 502,951$ 490,742$ 469,250$ 467,277$ 454,686$ Less: Goodwill 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 Other intangibles 1,001 1,488 2,004 2,551 1,001 1,123 1,244 1,366 1,488 Tangible common equity 473,650$ 424,898$ 374,145$ 316,745$ 473,650$ 461,319$ 439,706$ 437,611$ 424,898$ Total assets $ 5,505,720 $ 5,338,104 $ 5,263,726 $ 4,999,787 $ 5,505,720 $ 5,493,113 $ 5,418,519 $ 5,328,428 $ 5,338,104 Less: Goodwill 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 Other intangibles 1,001 1,488 2,004 2,551 1,001 1,123 1,244 1,366 1,488 Tangible assets $ 5,476,419 $ 5,308,316 $ 5,233,422 $ 4,968,936 $ 5,476,419 $ 5,463,690 $ 5,388,975 $ 5,298,762 $ 5,308,316 Common equity ratio 9.14% 8.52% 7.68% 6.95% 9.14% 8.93% 8.66% 8.77% 8.52% Tangible common equity ratio 8.65% 8.00% 7.15% 6.37% 8.65% 8.44% 8.16% 8.26% 8.00% Year Ended December 31, Quarter Ended (Dollars in thousands)