.2 ENVIRI ANNOUNCES SALE OF CLEAN EARTH FOR $3.04B AND SPIN-OFF OF HARSCO ENVIRONMENTAL AND RAIL TO SHAREHOLDERS Significant Step to Unlocking Sum-of-the-Parts Value November 21, 2025 © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 1

IMPORTANT INFORMATION Forward-Looking Statements The nature of the Company's and New Enviri’s business, together with the number of countries in which it operates, subject it to changing economic, competitive, regulatory and technological conditions, risks and uncertainties. In accordance with the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, the Company provides the following cautionary remarks regarding important factors that, among others, could cause outcomes to differ materially from those contemplated by forward-looking statements, including the expectations and assumptions expressed or implied herein. Forward-looking statements contained herein could include, among other things, statements regarding the timing of the consummation of the proposed transaction; statements about management's confidence in and strategies for performance of New Enviri; expectations for new and existing products, technologies and opportunities; and expectations regarding growth, sales, cash flows, and earnings. Forward-looking statements can be identified by the use of such terms as may, could, expect, anticipate, intend, believe, likely, estimate, outlook, plan, contemplate, project, target or other comparable terms. Factors that could cause actual outcomes to differ, perhaps materially, from those implied by forward-looking statements include, but are not limited to: (1) the occurrence of any event, change, or other circumstance that could give rise to the right of one or both of the parties to terminate the definitive agreement between the Company and Veolia; (2) the possibility that the transaction does not close when expected, or at all, because required regulatory, shareholder, or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (3) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, including those resulting from the announcement, pendency or completion of the transaction; (4) New Enviri’s ability to successfully enter into new contracts and complete new acquisitions, divestitures, or strategic ventures in the time-frame contemplated or at all; (5) New Enviri’s inability to comply with applicable environmental laws and regulations; (6) New Enviri’s inability to obtain, renew, or maintain compliance with its operating permits or license agreements; (7) New Enviri having a smaller size and more limited resources than the Company; (8) the seasonal nature of New Enviri’s business; (9) risks caused by customer concentration, the fixed price and long-term customer contracts, especially those related to complex engineered equipment, and the competitive nature of the industries in which New Enviri will operate; (10) the outcome of any disputes with customers, contractors and subcontractors; (11) the financial condition of New Enviri’s customers, including the ability of customers (especially those that may be highly leveraged or have inadequate liquidity) to maintain their credit availability; (12) higher than expected claims under New Enviri’s insurance policies, or losses that are uninsurable or that exceed existing insurance coverage; (13) market and competitive changes, including pricing pressures, market demand and acceptance for new products, services and technologies; changes in currency exchange rates, interest rates, commodity and fuel costs and capital costs; (14) New Enviri’s ability to attract and effectively retain key management and employees, including due to unanticipated changes to demand for New Enviri’s services, disruptions associated with labor disputes, and increased operating costs associated with union organizations; (15) New Enviri's inability or failure to protect its intellectual property rights from infringement in one or more of the many countries in which New Enviri will operate; (16) failure to effectively prevent, detect or recover from breaches in New Enviri's cybersecurity infrastructure; (17) changes in the worldwide business environment in which New Enviri operates, including changes in general economic and industry conditions and cyclical slowdowns impacting the steel and aluminum industries; (18) fluctuations in exchange rates between the U.S. dollar and other currencies in which New Enviri will conduct business; (19) unforeseen business disruptions in one or more of the many countries in which New Enviri will operate due to changes in economic conditions, changes in governmental laws and regulations, including environmental, occupational health and safety, tax and import tariff standards and amounts; political instability, civil disobedience, armed hostilities, public health issues or other calamities; (20) liability for and implementation of environmental remediation matters; (21) product liability and warranty claims associated with the Company’s operations; (22) New Enviri’s ability to comply with financial covenants and obligations to financial counterparties; (23) the outstanding indebtedness and exposure to derivative financial instruments to which New Enviri will be subject that may be impacted by, among other factors, changes in interest rates; (24) tax liabilities and changes in tax laws; (25) changes in the performance of equity and bond markets that could affect, among other things, the valuation of the assets in the New Enviri’s pension plans and the accounting for pension assets, liabilities and expenses; (26) risk and uncertainty associated with intangible assets; and the other risk factors listed from time to time in the Company's SEC reports. A further discussion of these, along with other potential risk factors, can be found in Part I, Item 1A, “Risk Factors” of the Company’s most recently filed Annual Report on Form 10-K, as updated by subsequent Quarterly Reports on Form 10-Q, which are filed with the Securities and Exchange Commission. The Company cautions that these factors may not be exhaustive and that many of these factors are beyond the Company's ability to control or predict. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. All forward-looking statements attributable to the Company or New Enviri, or persons acting on their behalf, are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made, and the Company and New Enviri do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If the Company or New Enviri updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 2

IMPORTANT INFORMATION (CONTINUED) Additional Information and Where to Find It In connection with the proposed transaction, the Company and New Enviri will be filing documents with the SEC, including preliminary and definitive proxy statements of the Company relating to the proposed transaction and a registration statement relating to the shares of New Enviri. The definitive proxy statement will be mailed to the Company's shareholders in connection with the proposed acquisition. This communication is not a substitute for the proxy statement, the registration statement or any other document that may be filed by the Company or New Enviri with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION. Any vote in respect of resolutions to be proposed at the Company's shareholder meeting to approve the proposed transaction should be made only on the basis of the information contained in the Company's proxy statement and documents incorporated by reference therein. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC's web site at www.sec.gov or on the Company's website at www.enviri.com. No Offer or Solicitation This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Participants in Solicitation The Company, its directors and certain of its respective executive officers may be deemed to be participants in the solicitation of proxies from shareholders of the Company in connection with the proposed transaction under the rules of the SEC. Information about the interests of the directors and executive officers of the Company and other persons who may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement to be filed with the SEC by the Company related to the proposed transaction. Information about the directors and executive officers of the Company and their ownership of shares of Company common stock and other securities of the Company can be found in the sections entitled “Non-Employee Director Compensation”, “Share Ownership of Directors, Management and Certain Beneficial Owners”, “Compensation Discussion & Analysis”, “Discussion and Analysis of 2024 Compensation”, “Termination or Change of Control Arrangements”, “Equity Compensation Plan Information as of December 31, 2024” included in the Company’s proxy statement in connection with its 2025 Annual Meeting of Stockholders, filed with the SEC on March 12, 2025; in the Form 3 and Form 4 statements of beneficial ownership and statements of changes in beneficial ownership filed with the SEC by the Company’s directors and executive officers; and in other documents subsequently filed by the Company with the SEC. Investors and security holders may obtain free copies of these documents and other related documents filed with the SEC at the SEC's web site at www.sec.gov or on the Company's website at www.enviri.com. Non-GAAP Measures Throughout this presentation, the Company refers to certain non-GAAP measures, including without limitation, Adjusted EBITDA (Earnings Before Interest Taxes Depreciation and Amortization) from continuing operations, Adjusted EBITDA margin, adjusted diluted earnings (loss) per share from continuing operations and adjusted free cash flow. For a reconciliation of non-GAAP measures to the most directly comparable GAAP financial measures and the Company’s rationale for its usage of non-GAAP measures, see the Appendix in this presentation. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 3

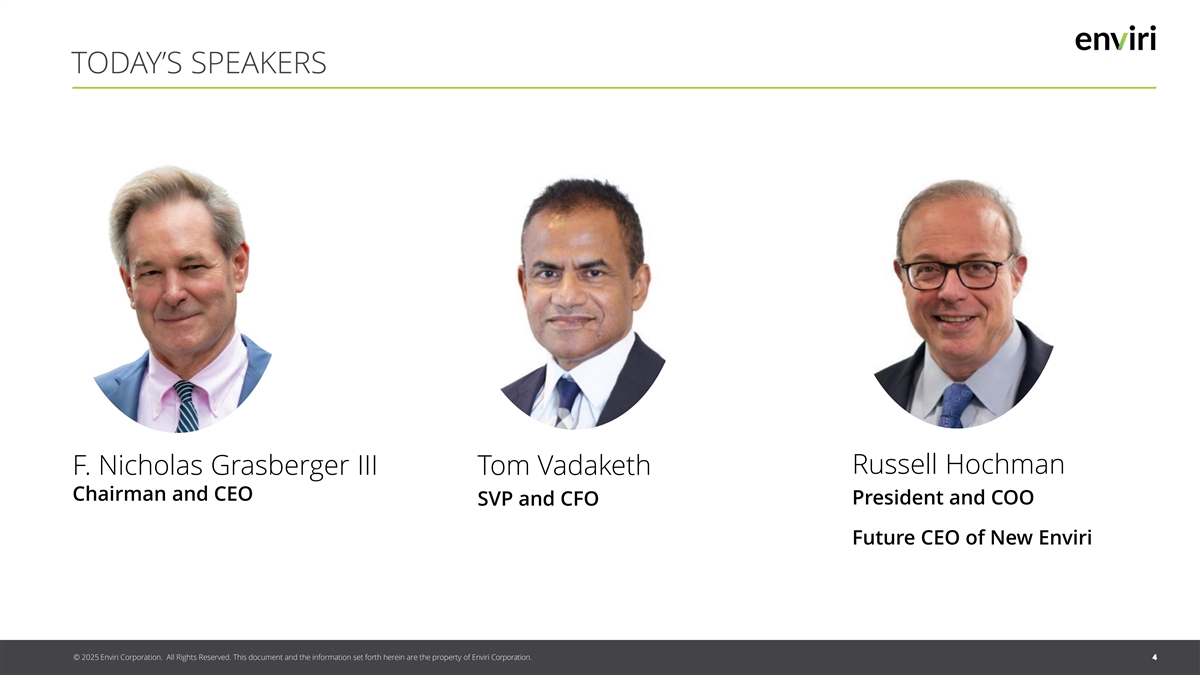

TODAY’S SPEAKERS Russell Hochman F. Nicholas Grasberger III Tom Vadaketh Chairman and CEO President and COO SVP and CFO Future CEO of New Enviri © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 4

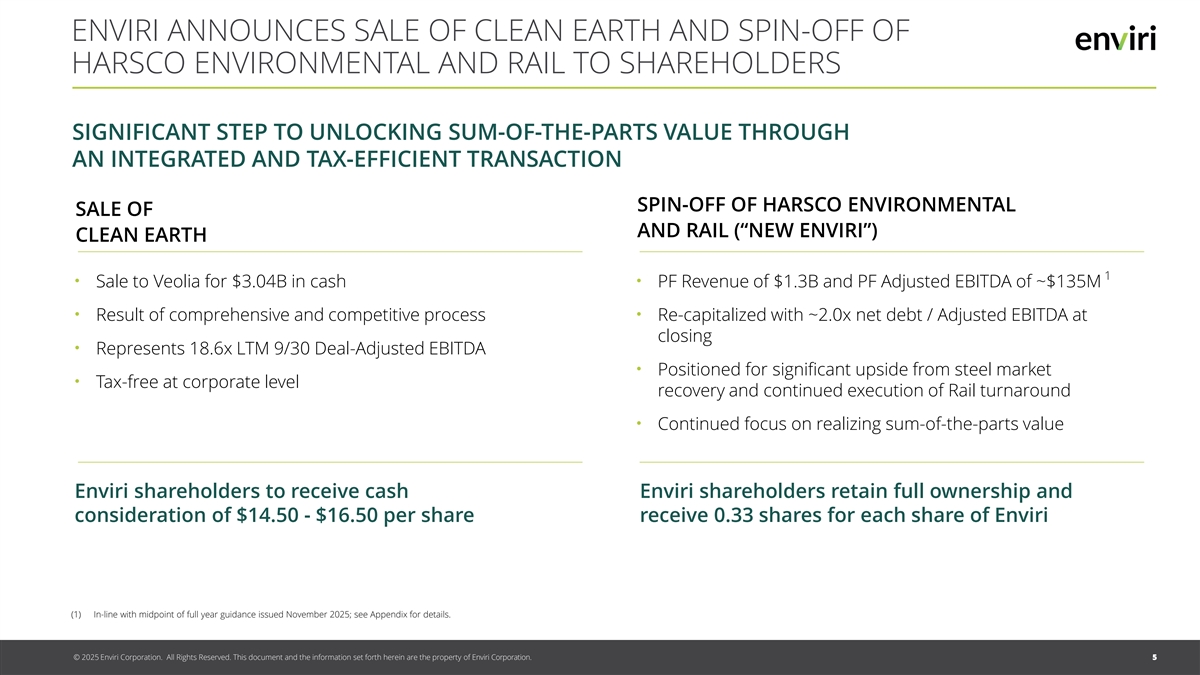

ENVIRI ANNOUNCES SALE OF CLEAN EARTH AND SPIN-OFF OF HARSCO ENVIRONMENTAL AND RAIL TO SHAREHOLDERS SIGNIFICANT STEP TO UNLOCKING SUM-OF-THE-PARTS VALUE THROUGH AN INTEGRATED AND TAX-EFFICIENT TRANSACTION SPIN-OFF OF HARSCO ENVIRONMENTAL SALE OF AND RAIL (“NEW ENVIRI”) CLEAN EARTH 1 •• Sale to Veolia for $3.04B in cash PF Revenue of $1.3B and PF Adjusted EBITDA of ~$135M •• Result of comprehensive and competitive process Re-capitalized with ~2.0x net debt / Adjusted EBITDA at closing • Represents 18.6x LTM 9/30 Deal-Adjusted EBITDA • Positioned for significant upside from steel market • Tax-free at corporate level recovery and continued execution of Rail turnaround • Continued focus on realizing sum-of-the-parts value Enviri shareholders to receive cash Enviri shareholders retain full ownership and consideration of $14.50 - $16.50 per share receive 0.33 shares for each share of Enviri (1) In-line with midpoint of full year guidance issued November 2025; see Appendix for details. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 5

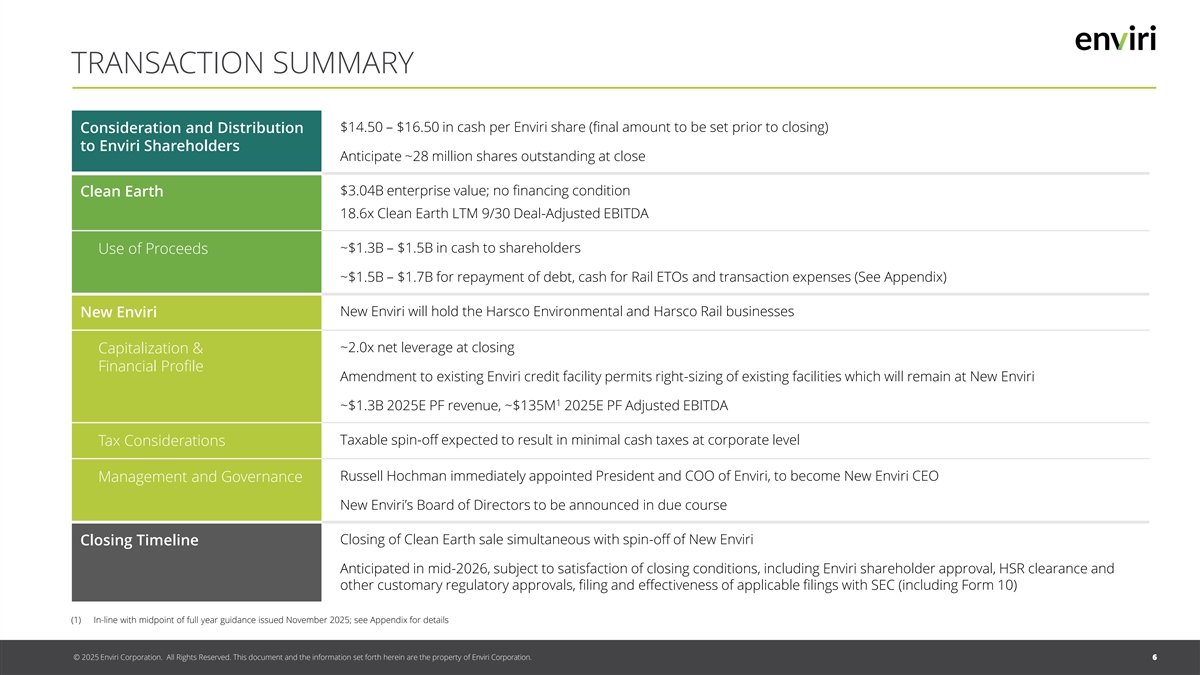

TRANSACTION SUMMARY $14.50 – $16.50 in cash per Enviri share (final amount to be set prior to closing) Consideration and Distribution to Enviri Shareholders Anticipate ~28 million shares outstanding at close $3.04B enterprise value; no financing condition Clean Earth 18.6x Clean Earth LTM 9/30 Deal-Adjusted EBITDA ~$1.3B – $1.5B in cash to shareholders Use of Proceeds ~$1.5B – $1.7B for repayment of debt, cash for Rail ETOs and transaction expenses (See Appendix) New Enviri will hold the Harsco Environmental and Harsco Rail businesses New Enviri ~2.0x net leverage at closing Capitalization & Financial Profile Amendment to existing Enviri credit facility permits right-sizing of existing facilities which will remain at New Enviri 1 ~$1.3B 2025E PF revenue, ~$135M 2025E PF Adjusted EBITDA Taxable spin-off expected to result in minimal cash taxes at corporate level Tax Considerations Russell Hochman immediately appointed President and COO of Enviri, to become New Enviri CEO Management and Governance New Enviri’s Board of Directors to be announced in due course Closing Timeline Closing of Clean Earth sale simultaneous with spin-off of New Enviri Anticipated in mid-2026, subject to satisfaction of closing conditions, including Enviri shareholder approval, HSR clearance and other customary regulatory approvals, filing and effectiveness of applicable filings with SEC (including Form 10) (1) In-line with midpoint of full year guidance issued November 2025; see Appendix for details © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 6

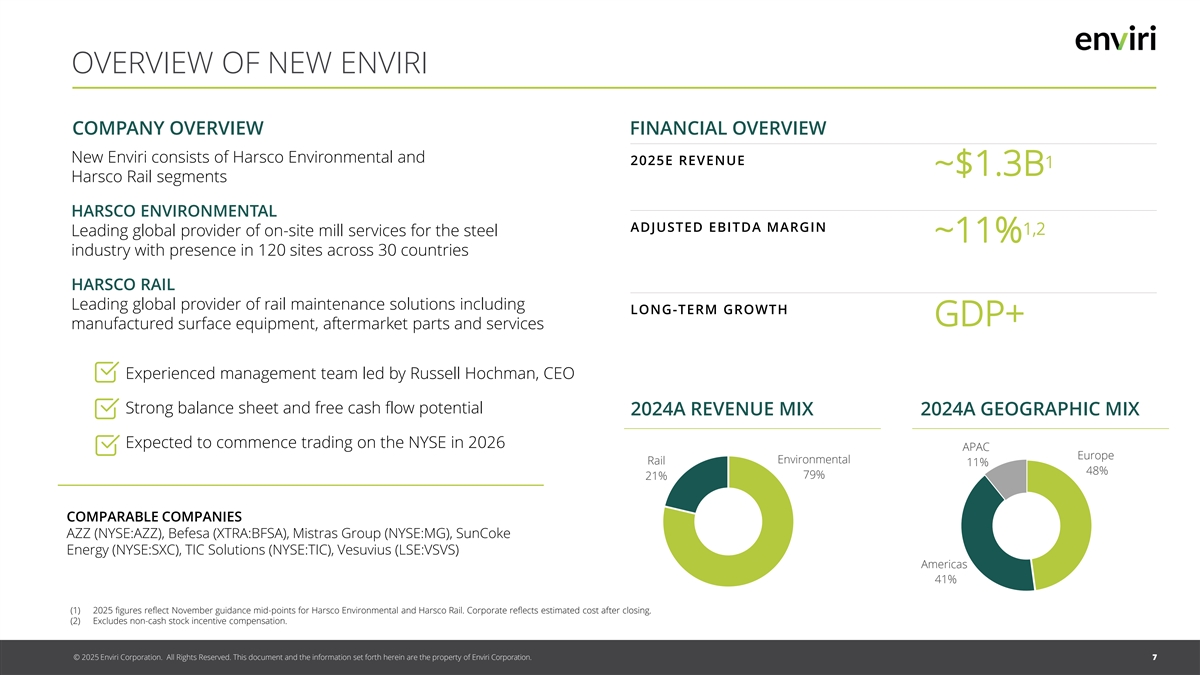

OVERVIEW OF NEW ENVIRI COMPANY OVERVIEW FINANCIAL OVERVIEW New Enviri consists of Harsco Environmental and 2025E REVENUE 1 ~$1.3B Harsco Rail segments HARSCO ENVIRONMENTAL ADJUSTED EBITDA MARGIN 1,2 Leading global provider of on-site mill services for the steel ~11% industry with presence in 120 sites across 30 countries HARSCO RAIL Leading global provider of rail maintenance solutions including LONG-TERM GROWTH GDP+ manufactured surface equipment, aftermarket parts and services Experienced management team led by Russell Hochman, CEO Strong balance sheet and free cash flow potential 2024A REVENUE MIX 2024A GEOGRAPHIC MIX Expected to commence trading on the NYSE in 2026 APAC Europe Environmental Rail 11% 48% 79% 21% COMPARABLE COMPANIES AZZ (NYSE:AZZ), Befesa (XTRA:BFSA), Mistras Group (NYSE:MG), SunCoke Energy (NYSE:SXC), TIC Solutions (NYSE:TIC), Vesuvius (LSE:VSVS) Americas 41% (1) 2025 figures reflect November guidance mid-points for Harsco Environmental and Harsco Rail. Corporate reflects estimated cost after closing. (2) Excludes non-cash stock incentive compensation. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 7

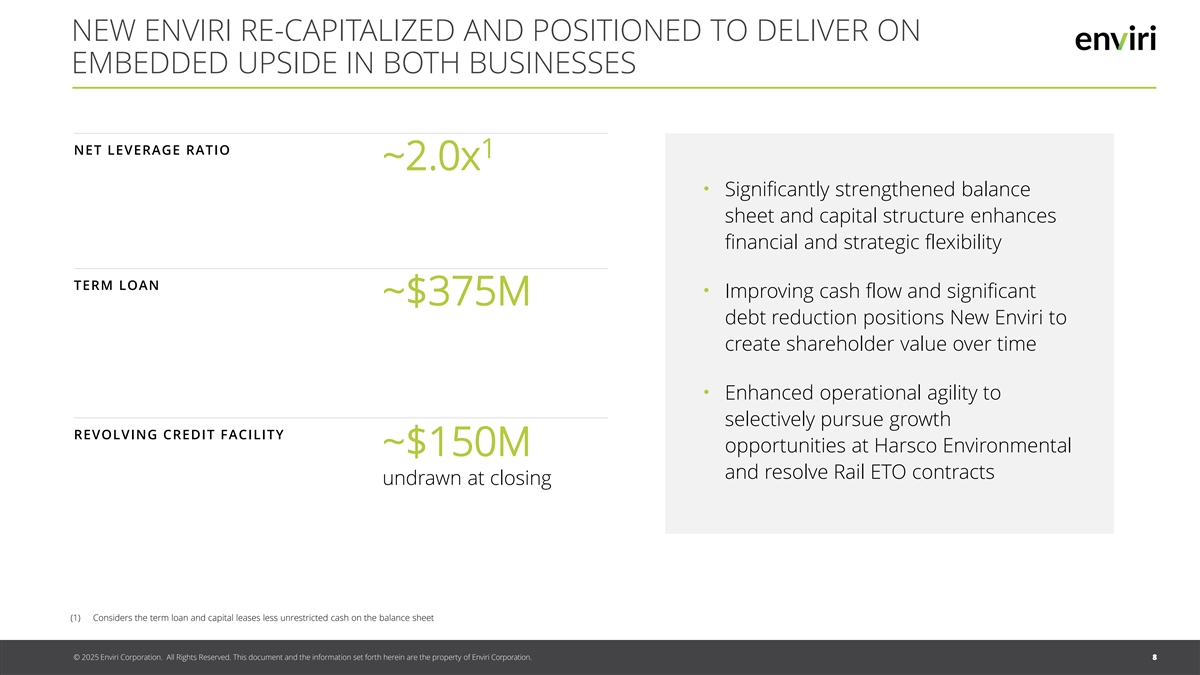

NEW ENVIRI RE-CAPITALIZED AND POSITIONED TO DELIVER ON EMBEDDED UPSIDE IN BOTH BUSINESSES NET LEVERAGE RATIO 1 ~2.0x • Significantly strengthened balance sheet and capital structure enhances financial and strategic flexibility TERM LOAN • Improving cash flow and significant ~$375M debt reduction positions New Enviri to create shareholder value over time • Enhanced operational agility to selectively pursue growth REVOLVING CREDIT FACILITY opportunities at Harsco Environmental ~$150M and resolve Rail ETO contracts undrawn at closing (1) Considers the term loan and capital leases less unrestricted cash on the balance sheet © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 8

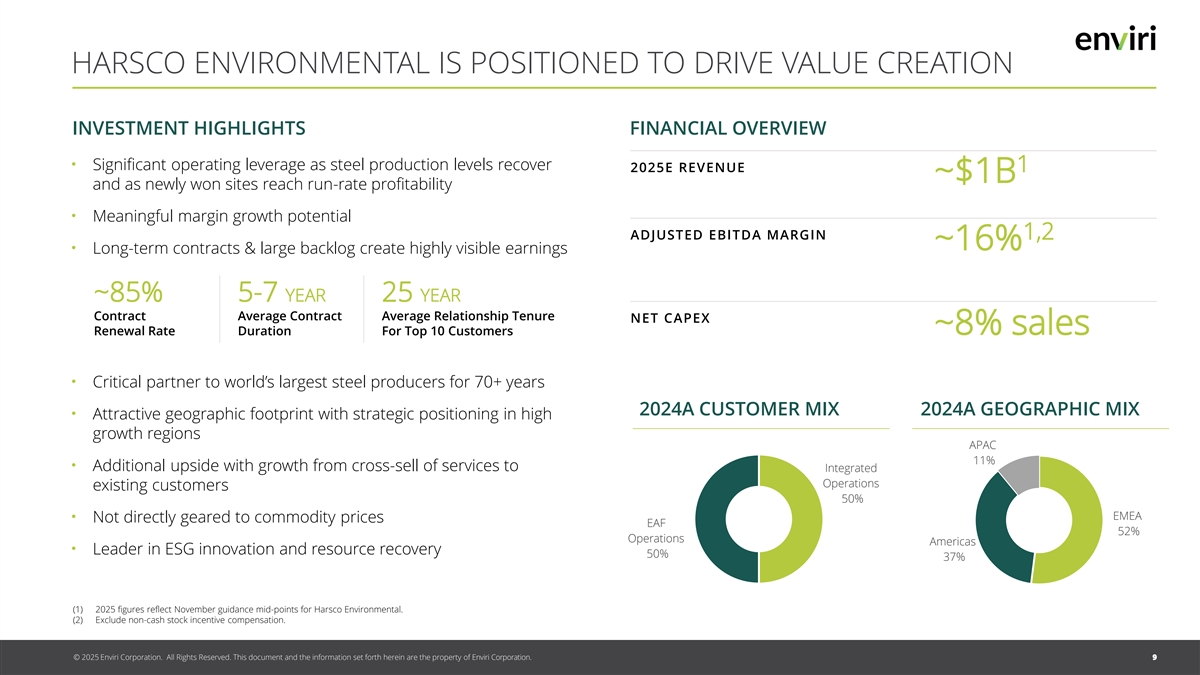

HARSCO ENVIRONMENTAL IS POSITIONED TO DRIVE VALUE CREATION INVESTMENT HIGHLIGHTS FINANCIAL OVERVIEW • Significant operating leverage as steel production levels recover 2025E REVENUE 1 ~$1B and as newly won sites reach run-rate profitability • Meaningful margin growth potential ADJUSTED EBITDA MARGIN 1,2 ~16% • Long-term contracts & large backlog create highly visible earnings ~85% 5-7 YEAR 25 YEAR Contract Average Contract Average Relationship Tenure NET CAPEX Renewal Rate Duration For Top 10 Customers ~8% sales • Critical partner to world’s largest steel producers for 70+ years 2024A CUSTOMER MIX 2024A GEOGRAPHIC MIX • Attractive geographic footprint with strategic positioning in high growth regions APAC 11% • Additional upside with growth from cross-sell of services to Integrated Operations existing customers 50% EMEA • Not directly geared to commodity prices EAF 52% Operations Americas • Leader in ESG innovation and resource recovery 50% 37% (1) 2025 figures reflect November guidance mid-points for Harsco Environmental. (2) Exclude non-cash stock incentive compensation. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 9

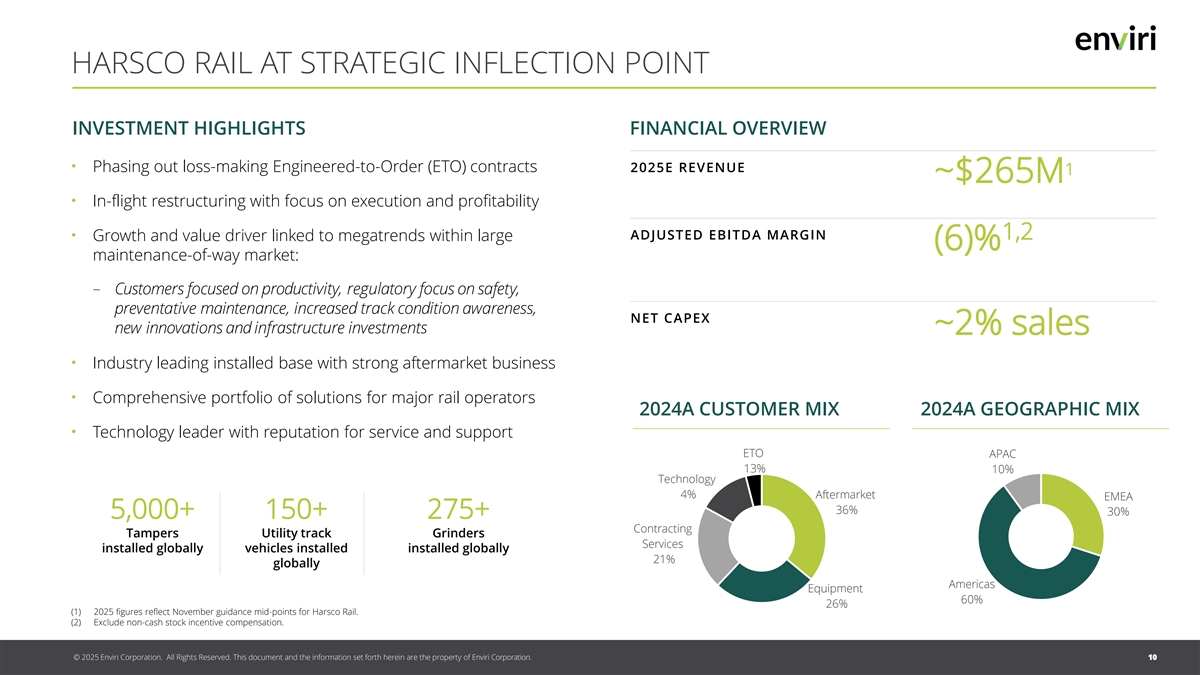

HARSCO RAIL AT STRATEGIC INFLECTION POINT INVESTMENT HIGHLIGHTS FINANCIAL OVERVIEW • Phasing out loss-making Engineered-to-Order (ETO) contracts 2025E REVENUE 1 ~$265M • In-flight restructuring with focus on execution and profitability • ADJUSTED EBITDA MARGIN 1,2 Growth and value driver linked to megatrends within large (6)% maintenance-of-way market: − Customers focused on productivity, regulatory focus on safety, preventative maintenance, increased track condition awareness, NET CAPEX new innovations and infrastructure investments ~2% sales • Industry leading installed base with strong aftermarket business • Comprehensive portfolio of solutions for major rail operators 2024A CUSTOMER MIX 2024A GEOGRAPHIC MIX • Technology leader with reputation for service and support ETO APAC 13% 10% Technology 4% Aftermarket EMEA 36% 30% 5,000+ 150+ 275+ Contracting Tampers Utility track Grinders Services installed globally vehicles installed installed globally 21% globally Americas Equipment 60% 26% (1) 2025 figures reflect November guidance mid-points for Harsco Rail. (2) Exclude non-cash stock incentive compensation. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 10

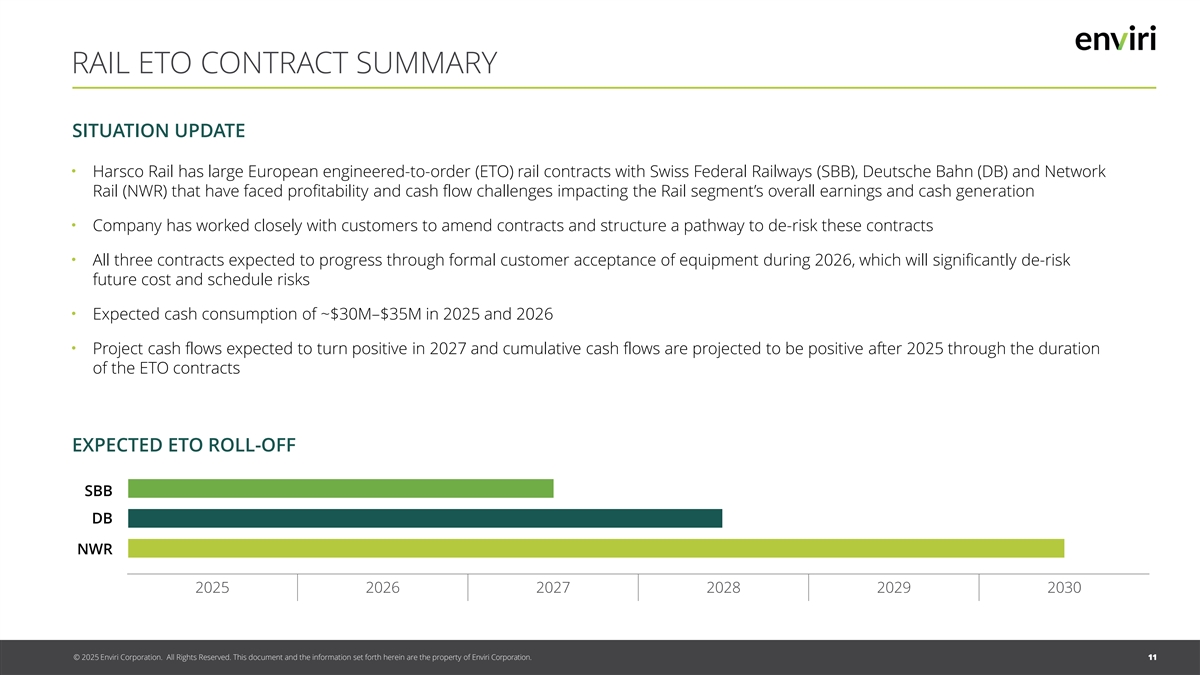

RAIL ETO CONTRACT SUMMARY SITUATION UPDATE • Harsco Rail has large European engineered-to-order (ETO) rail contracts with Swiss Federal Railways (SBB), Deutsche Bahn (DB) and Network Rail (NWR) that have faced profitability and cash flow challenges impacting the Rail segment’s overall earnings and cash generation • Company has worked closely with customers to amend contracts and structure a pathway to de-risk these contracts • All three contracts expected to progress through formal customer acceptance of equipment during 2026, which will significantly de-risk future cost and schedule risks • Expected cash consumption of ~$30M–$35M in 2025 and 2026 • Project cash flows expected to turn positive in 2027 and cumulative cash flows are projected to be positive after 2025 through the duration of the ETO contracts EXPECTED ETO ROLL-OFF SBB DB NWR 2025 2026 2027 2028 2029 2030 © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 11

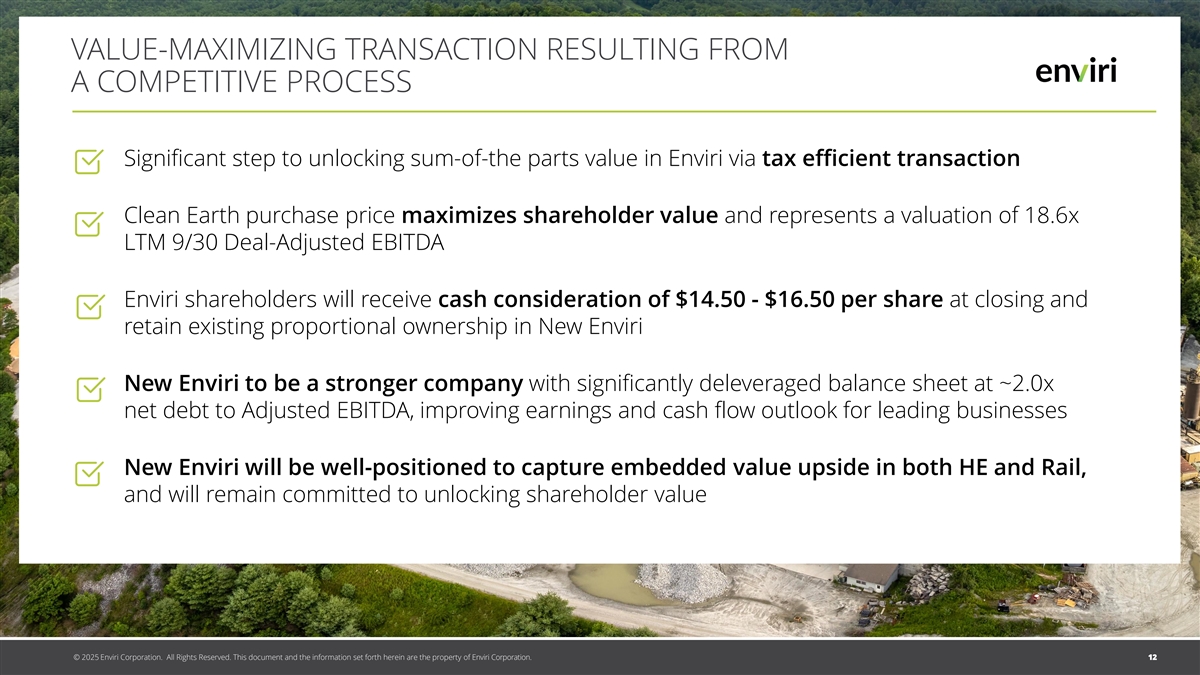

VALUE-MAXIMIZING TRANSACTION RESULTING FROM A COMPETITIVE PROCESS Significant step to unlocking sum-of-the parts value in Enviri via tax efficient transaction Clean Earth purchase price maximizes shareholder value and represents a valuation of 18.6x LTM 9/30 Deal-Adjusted EBITDA Enviri shareholders will receive cash consideration of $14.50 - $16.50 per share at closing and retain existing proportional ownership in New Enviri New Enviri to be a stronger company with significantly deleveraged balance sheet at ~2.0x net debt to Adjusted EBITDA, improving earnings and cash flow outlook for leading businesses New Enviri will be well-positioned to capture embedded value upside in both HE and Rail, and will remain committed to unlocking shareholder value © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 12

APPENDIX © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. Any disclosure or copying of this document and its contents without the prior written approval of Enviri Corporation is prohibited. All Rights Reserved.

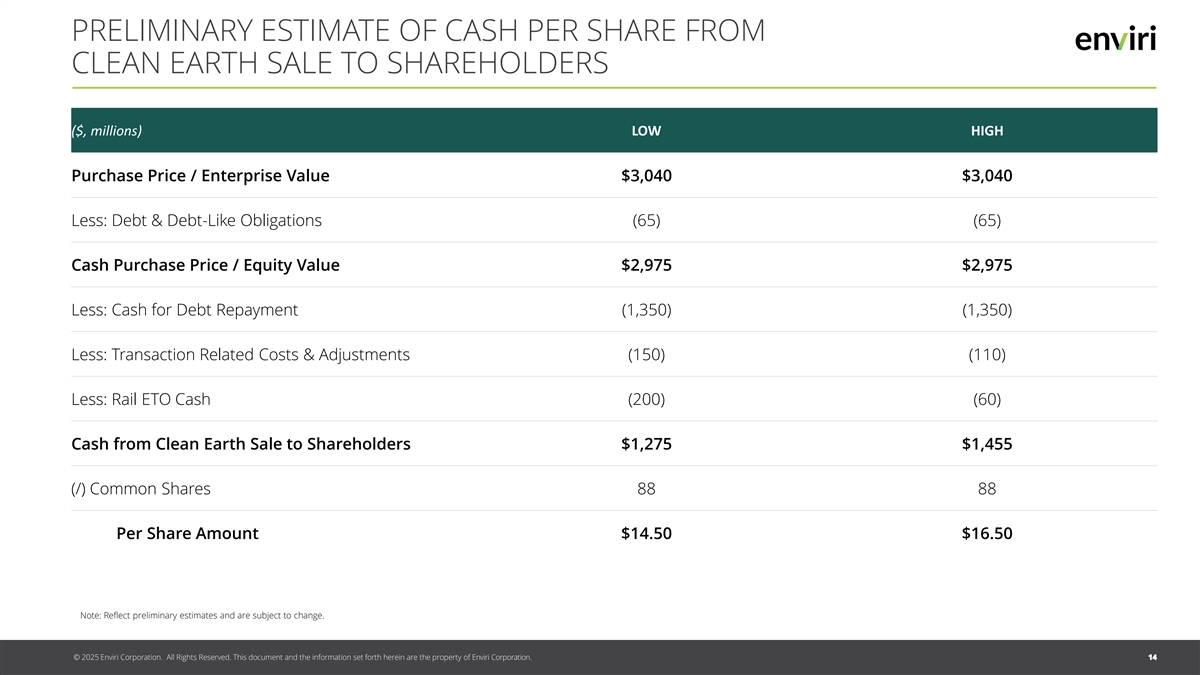

PRELIMINARY ESTIMATE OF CASH PER SHARE FROM CLEAN EARTH SALE TO SHAREHOLDERS ($, millions) LOW HIGH Purchase Price / Enterprise Value $3,040 $3,040 Less: Debt & Debt-Like Obligations (65) (65) Cash Purchase Price / Equity Value $2,975 $2,975 Less: Cash for Debt Repayment (1,350) (1,350) Less: Transaction Related Costs & Adjustments (150) (110) Less: Rail ETO Cash (200) (60) Cash from Clean Earth Sale to Shareholders $1,275 $1,455 (/) Common Shares 88 88 Per Share Amount $14.50 $16.50 Note: Reflect preliminary estimates and are subject to change. © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. 14

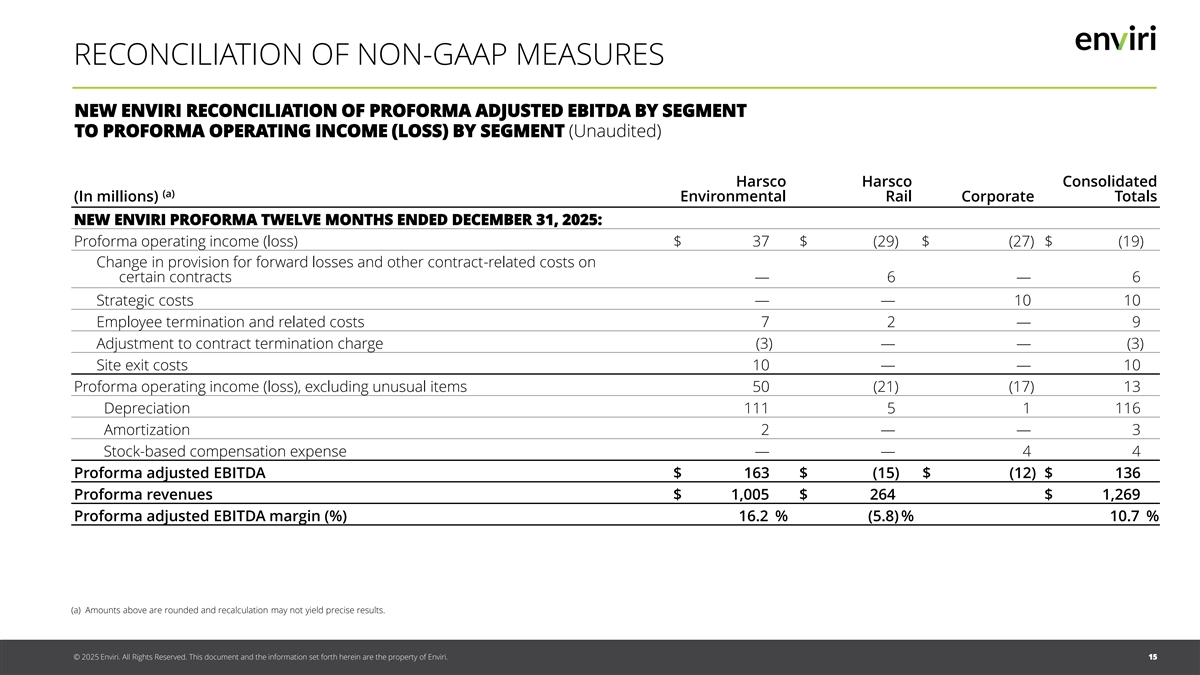

RECONCILIATION OF NON-GAAP MEASURES NEW ENVIRI RECONCILIATION OF PROFORMA ADJUSTED EBITDA BY SEGMENT TO PROFORMA OPERATING INCOME (LOSS) BY SEGMENT (Unaudited) Harsco Harsco Consolidated (a) (In millions) Environmental Rail Corporate Totals NEW ENVIRI PROFORMA TWELVE MONTHS ENDED DECEMBER 31, 2025: Proforma operating income (loss) $ 37 $ (29) $ (27) $ (19) Change in provision for forward losses and other contract-related costs on certain contracts — 6 — 6 Strategic costs — — 10 10 Employee termination and related costs 7 2 — 9 Adjustment to contract termination charge (3) — — (3) Site exit costs 10 — — 10 Proforma operating income (loss), excluding unusual items 50 (21) (17) 13 Depreciation 111 5 1 116 Amortization 2 — — 3 Stock-based compensation expense — — 4 4 Proforma adjusted EBITDA $ 163 $ (15) $ (12) $ 136 Proforma revenues $ 1,005 $ 264 $ 1,269 Proforma adjusted EBITDA margin (%) 16.2 % (5.8) % 10.7 % (a) Amounts above are rounded and recalculation may not yield precise results. © © 2 20 02 25 5 E En nvi vir rii Co . Allr R pio grh atts io R ne . se Al rlve Rid g. Th hts R is d eso ec ru ve m de . n Tth a is n d do tc hu em in efo nt r a mn ad ti t oh ne s ie ntfo fo rr m th a h tio en re s in e ta fo rer tth h e h e prre oip ne a rr te y t oh f E e n pvi ro rp i.erty of Enviri Corporation. 15 15

THANK YOU © 2025 Enviri Corporation. All Rights Reserved. This document and the information set forth herein are the property of Enviri Corporation. Any disclosure or copying of this document and its contents without the prior written approval of Enviri Corporation is prohibited. All Rights Reserved.