Q3 2025 Supplemental | Page 1 Table of Contents Conference Call 800-836-8184 | ID – EastGroup October 24, 2025 11:00 a.m. Eastern Time webcast available at EastGroup.net SUPPLEMENTAL INFORMATION September 30, 2025 N or th ea st T ra de C en te r, Sa n A nt on io , T ex as

Q3 2025 Supplemental | Page 2 Table of Contents Financial Information: Consolidated Balance Sheets ................................................................................ 3 Consolidated Statements of Income and Comprehensive Income ......................... 4 Reconciliations of GAAP to Non-GAAP Measures ................................................. 5 Consolidated Statements of Cash Flows ................................................................ 7 Same Property Portfolio Analysis ........................................................................... 8 Additional Financial Information ............................................................................. 9 Financial Statistics ................................................................................................. 10 Capital Deployment: Development and Value-Add Properties Summary ................................................ 11 Development and Value-Add Properties Transferred to Real Estate Properties ..... 12 Acquisitions and Dispositions ................................................................................. 13 Real Estate Improvements and Leasing Costs ....................................................... 14 Property Information: Leasing Statistics and Occupancy Summary ......................................................... 15 Core Market Operating Statistics ........................................................................... 16 Lease Expiration Summary .................................................................................... 17 Top 10 Customers by Annualized Base Rent ......................................................... 18 Capitalization: Debt and Equity Market Capitalization ................................................................... 19 Continuous Common Equity Program .................................................................... 20 Debt-to-EBITDAre Ratios ....................................................................................... 21 Other Information: Components of Net Asset Value ............................................................................ 22 Outlook for 2025 .................................................................................................... 23 Glossary of REIT Terms ........................................................................................ 24 FORWARD-LOOKING STATEMENTS The statements and certain other information contained herein, which can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “expects,” “anticipates,” “believes,” “targets,” “intends,” “should,” “estimates,” “could,” “continue,” “assume,” “projects,” “goals” “plans” or variations of such words and similar expressions or the negative of such words, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors created thereby. These forward-looking statements reflect the current views of EastGroup Properties, Inc. (the “Company” or “EastGroup”) about its plans, intentions, expectations, strategies, and prospects, which are based on the information currently available to the Company and on assumptions it has made. For instance, the amount, timing and frequency of future dividends is subject to authorization by the Company’s Board of Directors and will be based upon a variety of factors. Although the Company believes that its plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, the Company can give no assurance that such plans, intentions, expectations, or strategies will be attained or achieved. Furthermore, these forward-looking statements should be considered as subject to the many risks and uncertainties that exist in the Company’s operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to: international, national, regional and local economic conditions and conflicts; the competitive environment in which the Company operates; fluctuations of occupancy or rental rates; potential defaults (including bankruptcies or insolvency) on or non-renewal of leases by tenants, or our ability to lease space at current or anticipated rents, particularly in light of the ongoing uncertainty around interest rates, tariffs and general economic conditions; disruption in supply and delivery chains; increased construction and development costs, including as a result of tariffs or the recent inflationary environment; acquisition and development risks, including failure of such acquisitions and development projects to perform in accordance with our projections or to materialize at all; potential changes in the law or governmental regulations and interpretations of those laws and regulations, including changes in real estate laws, real estate investment trust (“REIT”) or corporate income tax laws, potential changes in zoning laws, or increases in real property tax rates, and any related increased cost of compliance; our ability to maintain our qualification as a REIT; natural disasters such as fires, floods, tornadoes, hurricanes, earthquakes, or other extreme weather events, which may or may not be caused by longer-term shifts in climate patterns, could destroy buildings and damage regional economies; the availability of financing and capital, increases in or long-term elevated interest rates, and our ability to raise equity capital on attractive terms; financing risks, including the risks that our cash flows from operations may be insufficient to meet required payments of principal and interest, and we may be unable to refinance our existing debt upon maturity or obtain new financing on attractive terms or at all; our ability to retain our credit agency ratings; our ability to comply with applicable financial covenants; credit risk in the event of non-performance by the counterparties to our interest rate swaps; how and when pending forward equity sales may settle; lack of or insufficient amounts of insurance; litigation, including costs associated with prosecuting or defending claims and any adverse outcomes; our ability to attract and retain key personnel or lack of adequate succession planning; risks related to the failure, inadequacy or interruption of our data security systems and processes, including security breaches through cyber attacks; pandemics, epidemics or other public health emergencies, such as the coronavirus pandemic; potentially catastrophic events such as acts of war, civil unrest and terrorism; and environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently owned or previously owned by us. All forward-looking statements should be read in light of the risks identified in Part I, Item 1A. Risk Factors within the Company’s most recent Annual Report on Form 10-K, as such factors may be updated from time to time in the Company’s periodic filings and current reports filed with the SEC. The Company assumes no obligation to update publicly any forward-looking statements, including its Outlook for 2025, whether as a result of new information, future events or otherwise.

Q3 2025 Supplemental | Page 3 Consolidated Balance Sheets (In thousands, except share and per share data) (Unaudited) September 30, 2025 December 31, 2024 ASSETS Real estate properties 5,950,075$ 5,503,444 Development and value-add properties 642,207 674,472 6,592,282 6,177,916 Accumulated depreciation (1,540,937) (1,415,576) 5,051,345 4,762,340 Unconsolidated investment 6,950 7,448 Cash and cash equivalents 2,981 17,529 Other assets, net 293,479 290,159 TOTAL ASSETS 5,354,755$ 5,077,476 LIABILITIES AND EQUITY LIABILITIES Unsecured bank credit facilities, net of debt issuance costs 42,159$ (3,595) Unsecured debt, net of debt issuance costs 1,437,660 1,507,157 Accounts payable and accrued expenses 230,170 147,342 Other liabilities 135,732 134,028 Total Liabilities 1,845,721 1,784,932 EQUITY Stockholders' Equity: Common shares; $0.0001 par value; 70,000,000 shares authorized; 53,348,644 shares issued and outstanding at September 30, 2025 and 51,825,798 at December 31, 2024 5 5 Excess shares; $0.0001 par value; 30,000,000 shares authorized; no shares issued - - Additional paid-in capital 3,943,700 3,673,393 Distributions in excess of earnings (443,754) (403,172) Accumulated other comprehensive income 8,751 21,953 Total Stockholders' Equity 3,508,702 3,292,179 Noncontrolling interest in joint ventures 332 365 Total Equity 3,509,034 3,292,544 TOTAL LIABILITIES AND EQUITY 5,354,755$ 5,077,476

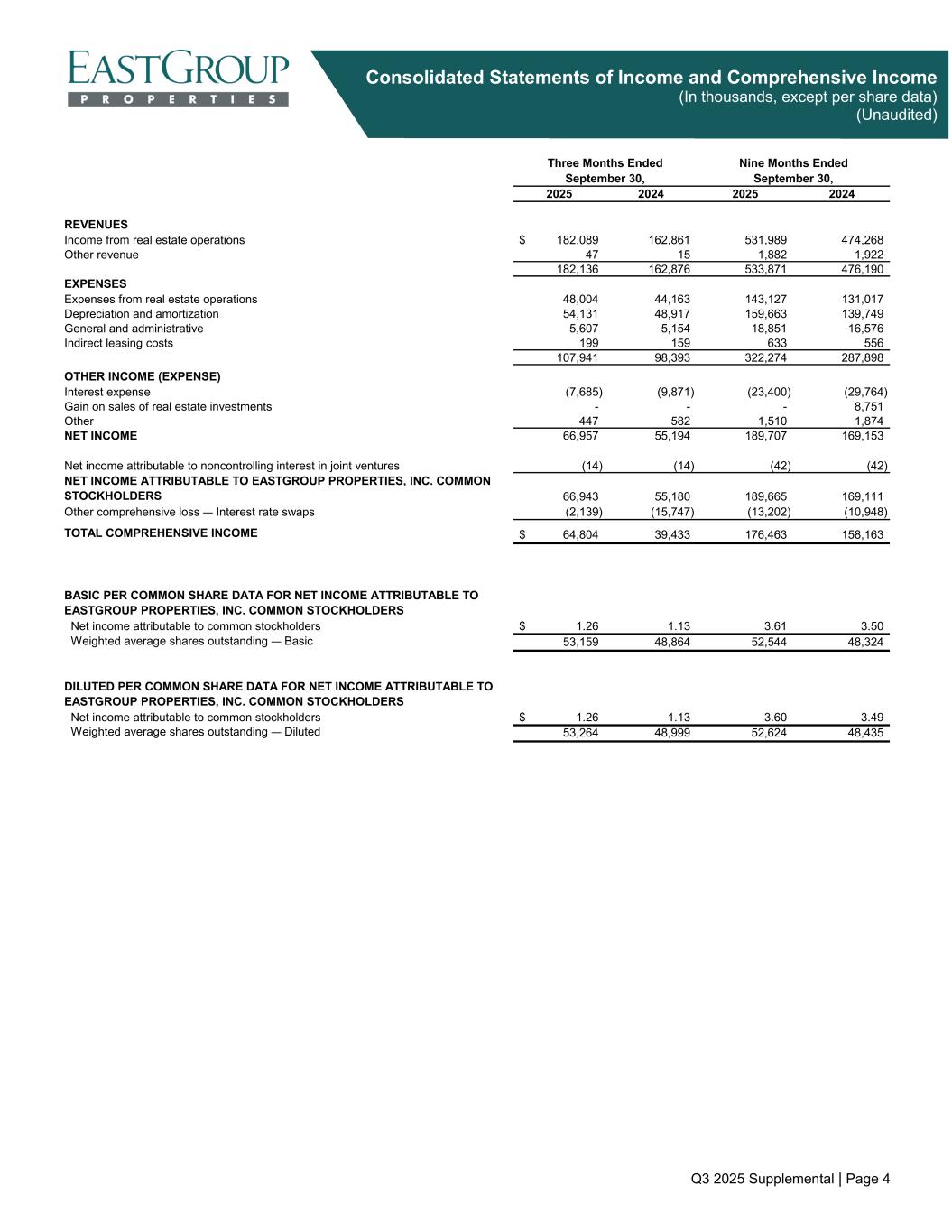

Q3 2025 Supplemental | Page 4 Consolidated Statements of Income and Comprehensive Income (In thousands, except per share data) (Unaudited) 2025 2024 2025 2024 REVENUES Income from real estate operations 182,089$ 162,861 531,989 474,268 Other revenue 47 15 1,882 1,922 182,136 162,876 533,871 476,190 EXPENSES Expenses from real estate operations 48,004 44,163 143,127 131,017 Depreciation and amortization 54,131 48,917 159,663 139,749 General and administrative 5,607 5,154 18,851 16,576 Indirect leasing costs 199 159 633 556 107,941 98,393 322,274 287,898 OTHER INCOME (EXPENSE) Interest expense (7,685) (9,871) (23,400) (29,764) Gain on sales of real estate investments - - - 8,751 Other 447 582 1,510 1,874 NET INCOME 66,957 55,194 189,707 169,153 Net income attributable to noncontrolling interest in joint ventures (14) (14) (42) (42) NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS 66,943 55,180 189,665 169,111 Other comprehensive loss — Interest rate swaps (2,139) (15,747) (13,202) (10,948) TOTAL COMPREHENSIVE INCOME 64,804$ 39,433 176,463 158,163 BASIC PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders 1.26$ 1.13 3.61 3.50 Weighted average shares outstanding — Basic 53,159 48,864 52,544 48,324 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders 1.26$ 1.13 3.60 3.49 Weighted average shares outstanding — Diluted 53,264 48,999 52,624 48,435 Nine Months Ended September 30,September 30, Three Months Ended

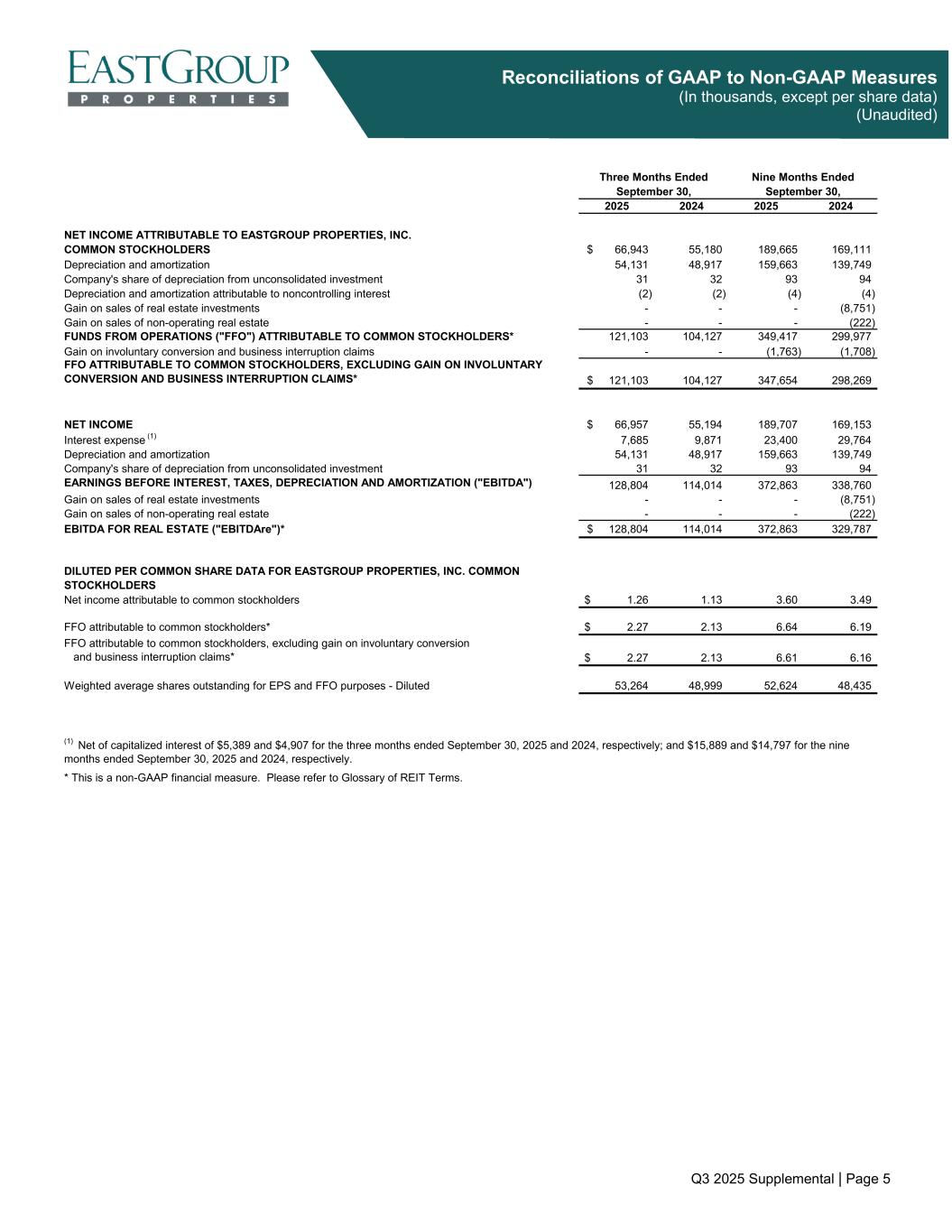

Q3 2025 Supplemental | Page 5 Reconciliations of GAAP to Non-GAAP Measures (In thousands, except per share data) (Unaudited) 2025 2024 2025 2024 NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS 66,943$ 55,180 189,665 169,111 Depreciation and amortization 54,131 48,917 159,663 139,749 Company's share of depreciation from unconsolidated investment 31 32 93 94 Depreciation and amortization attributable to noncontrolling interest (2) (2) (4) (4) Gain on sales of real estate investments - - - (8,751) Gain on sales of non-operating real estate - - - (222) FUNDS FROM OPERATIONS ("FFO") ATTRIBUTABLE TO COMMON STOCKHOLDERS* 121,103 104,127 349,417 299,977 Gain on involuntary conversion and business interruption claims - - (1,763) (1,708) FFO ATTRIBUTABLE TO COMMON STOCKHOLDERS, EXCLUDING GAIN ON INVOLUNTARY CONVERSION AND BUSINESS INTERRUPTION CLAIMS* 121,103$ 104,127 347,654 298,269 NET INCOME 66,957$ 55,194 189,707 169,153 Interest expense (1) 7,685 9,871 23,400 29,764 Depreciation and amortization 54,131 48,917 159,663 139,749 Company's share of depreciation from unconsolidated investment 31 32 93 94 EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION ("EBITDA") 128,804 114,014 372,863 338,760 Gain on sales of real estate investments - - - (8,751) Gain on sales of non-operating real estate - - - (222) EBITDA FOR REAL ESTATE ("EBITDAre")* 128,804$ 114,014 372,863 329,787 DILUTED PER COMMON SHARE DATA FOR EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders 1.26$ 1.13 3.60 3.49 FFO attributable to common stockholders* 2.27$ 2.13 6.64 6.19 FFO attributable to common stockholders, excluding gain on involuntary conversion and business interruption claims* 2.27$ 2.13 6.61 6.16 Weighted average shares outstanding for EPS and FFO purposes - Diluted 53,264 48,999 52,624 48,435 September 30, * This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. Three Months Ended September 30, Nine Months Ended (1) Net of capitalized interest of $5,389 and $4,907 for the three months ended September 30, 2025 and 2024, respectively; and $15,889 and $14,797 for the nine months ended September 30, 2025 and 2024, respectively.

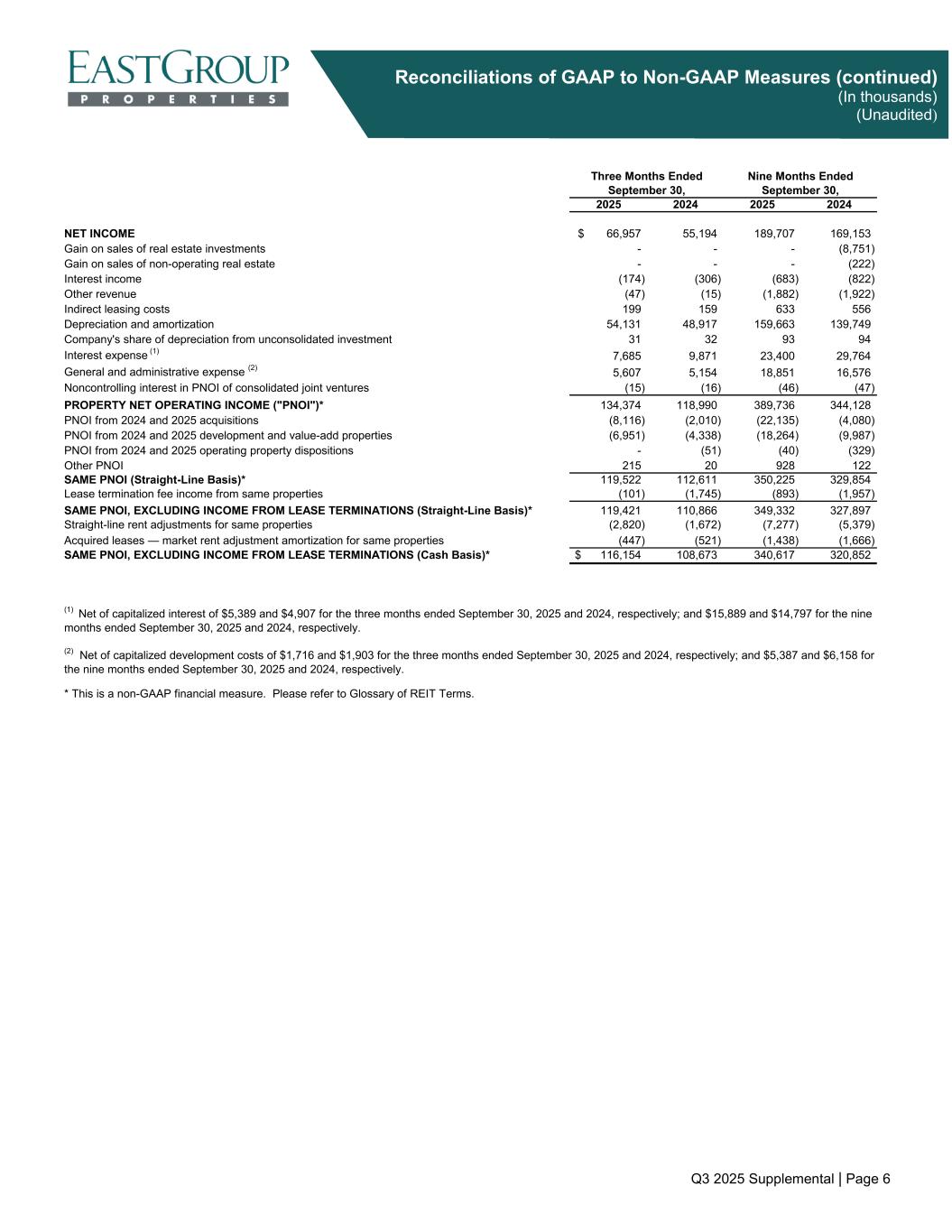

Q3 2025 Supplemental | Page 6 Reconciliations of GAAP to Non-GAAP Measures (continued) (In thousands) (Unaudited) 2025 2024 2025 2024 NET INCOME 66,957$ 55,194 189,707 169,153 Gain on sales of real estate investments - - - (8,751) Gain on sales of non-operating real estate - - - (222) Interest income (174) (306) (683) (822) Other revenue (47) (15) (1,882) (1,922) Indirect leasing costs 199 159 633 556 Depreciation and amortization 54,131 48,917 159,663 139,749 Company's share of depreciation from unconsolidated investment 31 32 93 94 Interest expense (1) 7,685 9,871 23,400 29,764 General and administrative expense (2) 5,607 5,154 18,851 16,576 Noncontrolling interest in PNOI of consolidated joint ventures (15) (16) (46) (47) PROPERTY NET OPERATING INCOME ("PNOI")* 134,374 118,990 389,736 344,128 PNOI from 2024 and 2025 acquisitions (8,116) (2,010) (22,135) (4,080) PNOI from 2024 and 2025 development and value-add properties (6,951) (4,338) (18,264) (9,987) PNOI from 2024 and 2025 operating property dispositions - (51) (40) (329) Other PNOI 215 20 928 122 SAME PNOI (Straight-Line Basis)* 119,522 112,611 350,225 329,854 Lease termination fee income from same properties (101) (1,745) (893) (1,957) SAME PNOI, EXCLUDING INCOME FROM LEASE TERMINATIONS (Straight-Line Basis)* 119,421 110,866 349,332 327,897 Straight-line rent adjustments for same properties (2,820) (1,672) (7,277) (5,379) Acquired leases — market rent adjustment amortization for same properties (447) (521) (1,438) (1,666) SAME PNOI, EXCLUDING INCOME FROM LEASE TERMINATIONS (Cash Basis)* 116,154$ 108,673 340,617 320,852 * This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. Nine Months Ended September 30, September 30, (1) Net of capitalized interest of $5,389 and $4,907 for the three months ended September 30, 2025 and 2024, respectively; and $15,889 and $14,797 for the nine months ended September 30, 2025 and 2024, respectively. (2) Net of capitalized development costs of $1,716 and $1,903 for the three months ended September 30, 2025 and 2024, respectively; and $5,387 and $6,158 for the nine months ended September 30, 2025 and 2024, respectively. Three Months Ended

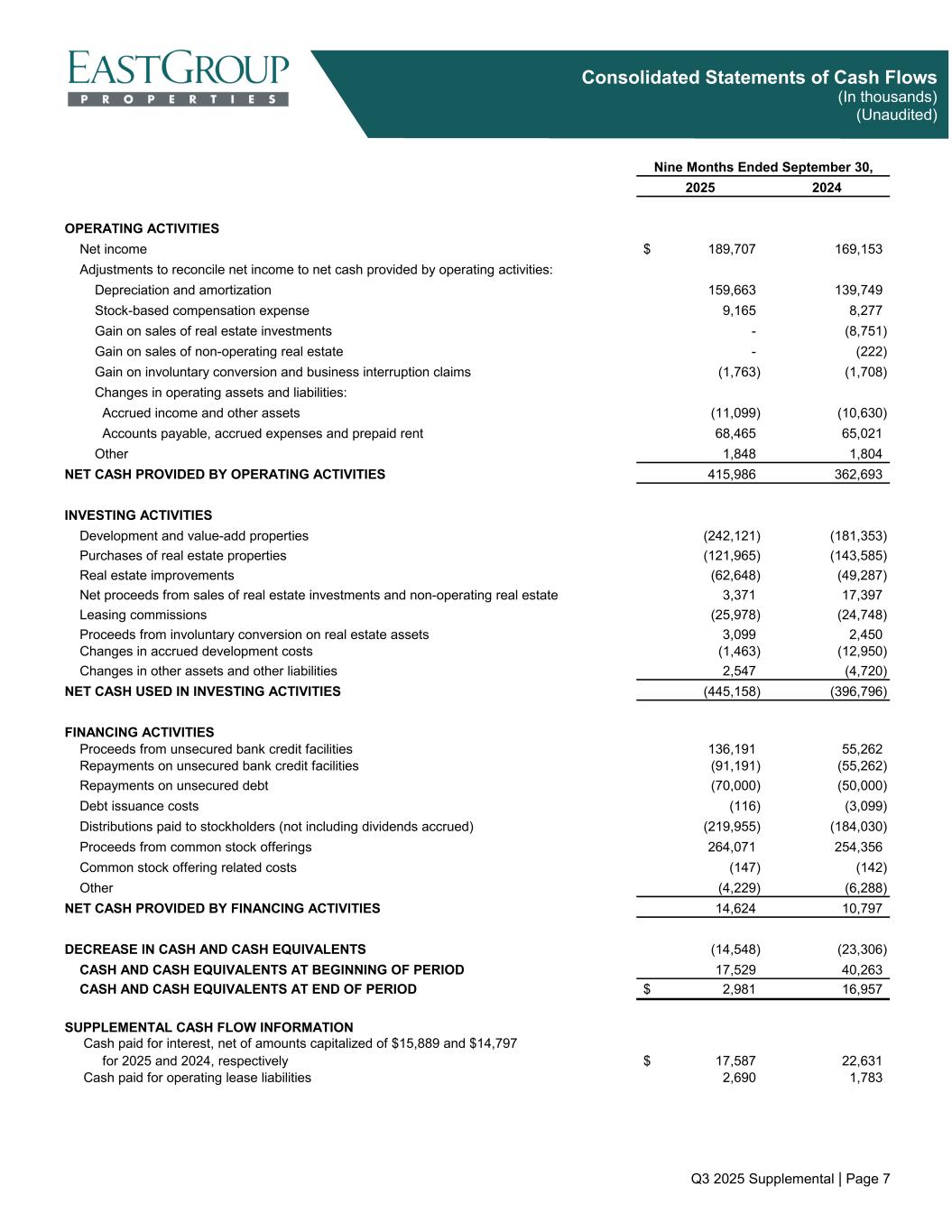

Q3 2025 Supplemental | Page 7 Consolidated Statements of Cash Flows (In thousands) (Unaudited) 2025 2024 OPERATING ACTIVITIES Net income 189,707$ 169,153 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 159,663 139,749 Stock-based compensation expense 9,165 8,277 Gain on sales of real estate investments - (8,751) Gain on sales of non-operating real estate - (222) Gain on involuntary conversion and business interruption claims (1,763) (1,708) Changes in operating assets and liabilities: Accrued income and other assets (11,099) (10,630) Accounts payable, accrued expenses and prepaid rent 68,465 65,021 Other 1,848 1,804 NET CASH PROVIDED BY OPERATING ACTIVITIES 415,986 362,693 INVESTING ACTIVITIES Development and value-add properties (242,121) (181,353) Purchases of real estate properties (121,965) (143,585) Real estate improvements (62,648) (49,287) Net proceeds from sales of real estate investments and non-operating real estate 3,371 17,397 Leasing commissions (25,978) (24,748) Proceeds from involuntary conversion on real estate assets 3,099 2,450 Changes in accrued development costs (1,463) (12,950) Changes in other assets and other liabilities 2,547 (4,720) NET CASH USED IN INVESTING ACTIVITIES (445,158) (396,796) FINANCING ACTIVITIES Proceeds from unsecured bank credit facilities 136,191 55,262 Repayments on unsecured bank credit facilities (91,191) (55,262) Repayments on unsecured debt (70,000) (50,000) Debt issuance costs (116) (3,099) Distributions paid to stockholders (not including dividends accrued) (219,955) (184,030) Proceeds from common stock offerings 264,071 254,356 Common stock offering related costs (147) (142) Other (4,229) (6,288) NET CASH PROVIDED BY FINANCING ACTIVITIES 14,624 10,797 DECREASE IN CASH AND CASH EQUIVALENTS (14,548) (23,306) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 17,529 40,263 CASH AND CASH EQUIVALENTS AT END OF PERIOD 2,981$ 16,957 SUPPLEMENTAL CASH FLOW INFORMATION Cash paid for interest, net of amounts capitalized of $15,889 and $14,797 for 2025 and 2024, respectively 17,587$ 22,631 Cash paid for operating lease liabilities 2,690 1,783 Nine Months Ended September 30,

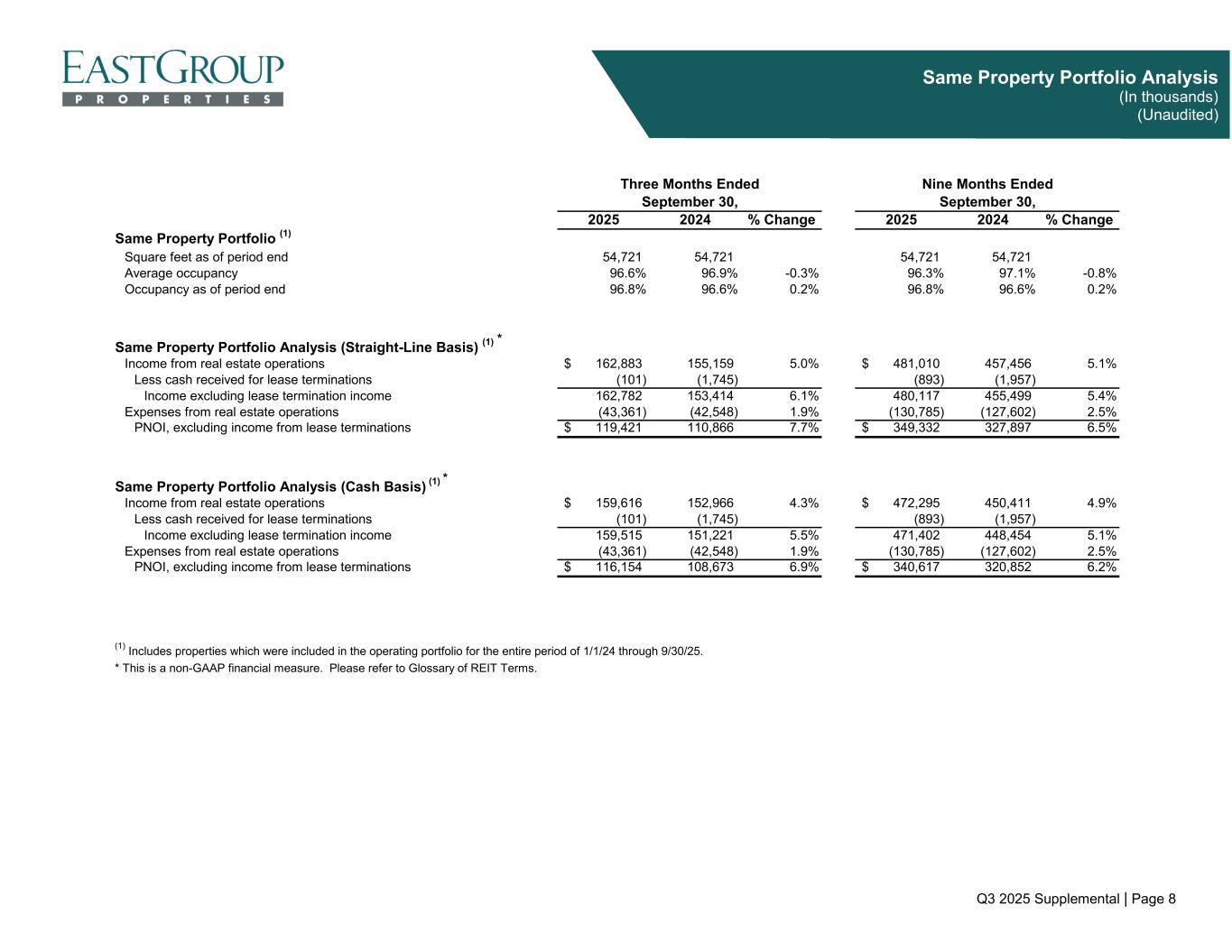

Q3 2025 Supplemental | Page 8 Same Property Portfolio Analysis (In thousands) (Unaudited) 2025 2024 % Change 2025 2024 % Change Same Property Portfolio (1) Square feet as of period end 54,721 54,721 54,721 54,721 Average occupancy 96.6% 96.9% -0.3% 96.3% 97.1% -0.8% Occupancy as of period end 96.8% 96.6% 0.2% 96.8% 96.6% 0.2% Same Property Portfolio Analysis (Straight-Line Basis) (1) * Income from real estate operations 162,883$ 155,159 5.0% 481,010$ 457,456 5.1% Less cash received for lease terminations (101) (1,745) (893) (1,957) Income excluding lease termination income 162,782 153,414 6.1% 480,117 455,499 5.4% Expenses from real estate operations (43,361) (42,548) 1.9% (130,785) (127,602) 2.5% PNOI, excluding income from lease terminations 119,421$ 110,866 7.7% 349,332$ 327,897 6.5% Same Property Portfolio Analysis (Cash Basis) (1) * Income from real estate operations 159,616$ 152,966 4.3% 472,295$ 450,411 4.9% Less cash received for lease terminations (101) (1,745) (893) (1,957) Income excluding lease termination income 159,515 151,221 5.5% 471,402 448,454 5.1% Expenses from real estate operations (43,361) (42,548) 1.9% (130,785) (127,602) 2.5% PNOI, excluding income from lease terminations 116,154$ 108,673 6.9% 340,617$ 320,852 6.2% (1) Includes properties which were included in the operating portfolio for the entire period of 1/1/24 through 9/30/25. * This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. September 30, September 30, Three Months Ended Nine Months Ended

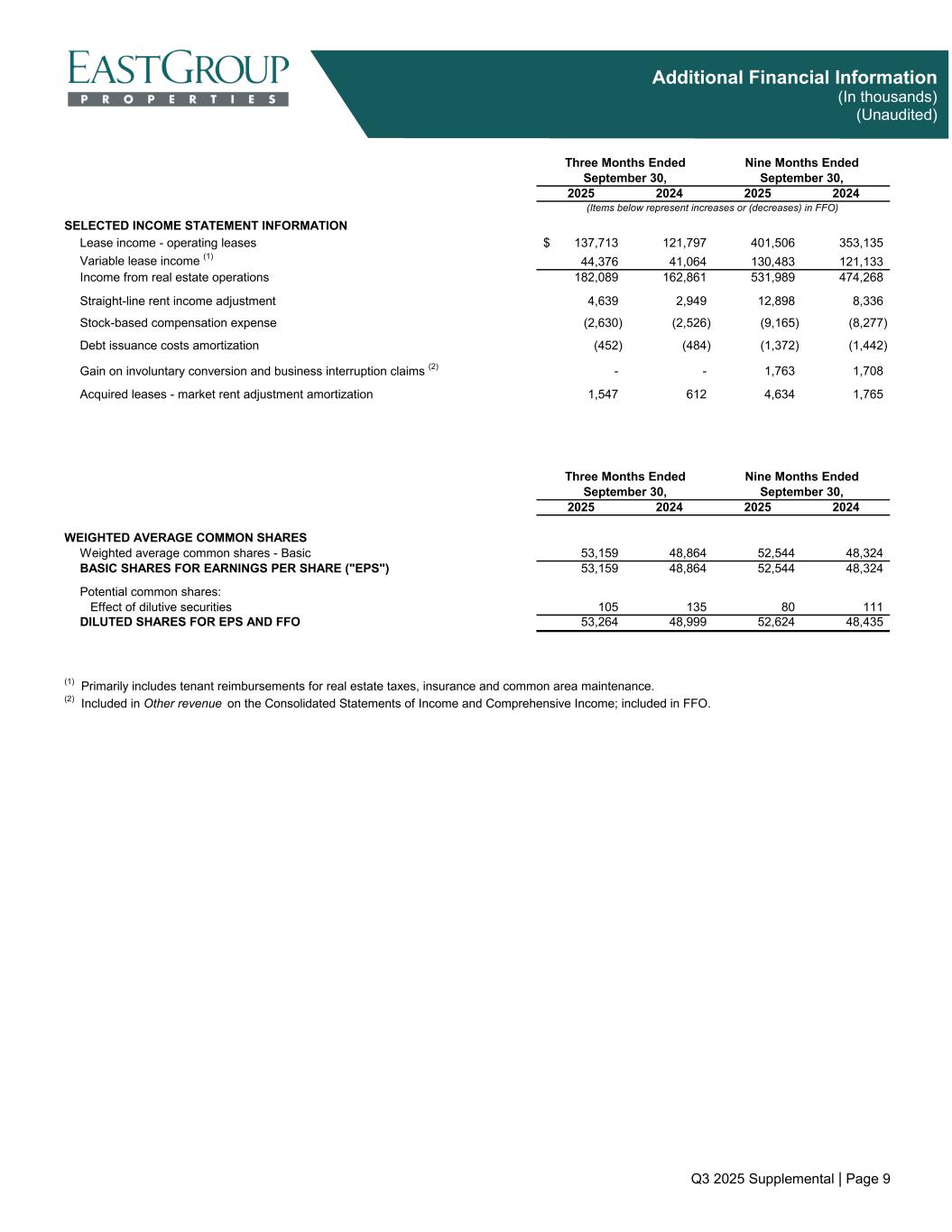

Q3 2025 Supplemental | Page 9 Additional Financial Information (In thousands) (Unaudited) 2025 2024 2025 2024 Lease income - operating leases 137,713$ 121,797 401,506 353,135 Variable lease income (1) 44,376 41,064 130,483 121,133 Income from real estate operations 182,089 162,861 531,989 474,268 Straight-line rent income adjustment 4,639 2,949 12,898 8,336 Stock-based compensation expense (2,630) (2,526) (9,165) (8,277) Debt issuance costs amortization (452) (484) (1,372) (1,442) Gain on involuntary conversion and business interruption claims (2) - - 1,763 1,708 Acquired leases - market rent adjustment amortization 1,547 612 4,634 1,765 2025 2024 2025 2024 WEIGHTED AVERAGE COMMON SHARES Weighted average common shares - Basic 53,159 48,864 52,544 48,324 BASIC SHARES FOR EARNINGS PER SHARE ("EPS") 53,159 48,864 52,544 48,324 Potential common shares: Effect of dilutive securities 105 135 80 111 DILUTED SHARES FOR EPS AND FFO 53,264 48,999 52,624 48,435 (1) Primarily includes tenant reimbursements for real estate taxes, insurance and common area maintenance. (2) Included in Other revenue on the Consolidated Statements of Income and Comprehensive Income; included in FFO. (Items below represent increases or (decreases) in FFO) September 30, Three Months Ended Three Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, SELECTED INCOME STATEMENT INFORMATION

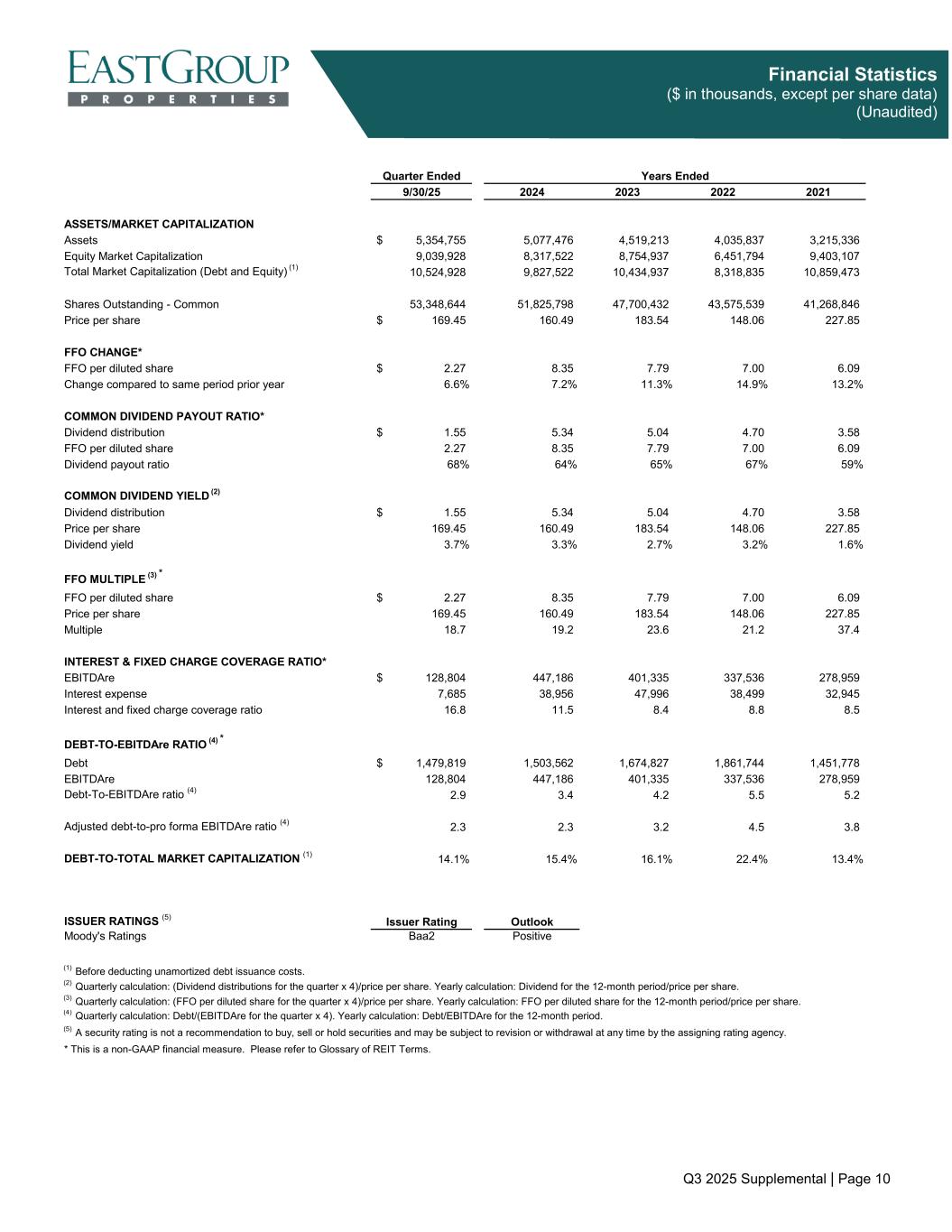

Q3 2025 Supplemental | Page 10 Financial Statistics ($ in thousands, except per share data) (Unaudited) Quarter Ended 9/30/25 2024 2023 2022 2021 ASSETS/MARKET CAPITALIZATION Assets 5,354,755$ 5,077,476 4,519,213 4,035,837 3,215,336 Equity Market Capitalization 9,039,928 8,317,522 8,754,937 6,451,794 9,403,107 Total Market Capitalization (Debt and Equity) (1) 10,524,928 9,827,522 10,434,937 8,318,835 10,859,473 Shares Outstanding - Common 53,348,644 51,825,798 47,700,432 43,575,539 41,268,846 Price per share 169.45$ 160.49 183.54 148.06 227.85 FFO CHANGE* FFO per diluted share 2.27$ 8.35 7.79 7.00 6.09 Change compared to same period prior year 6.6% 7.2% 11.3% 14.9% 13.2% COMMON DIVIDEND PAYOUT RATIO* Dividend distribution 1.55$ 5.34 5.04 4.70 3.58 FFO per diluted share 2.27 8.35 7.79 7.00 6.09 Dividend payout ratio 68% 64% 65% 67% 59% COMMON DIVIDEND YIELD (2) Dividend distribution 1.55$ 5.34 5.04 4.70 3.58 Price per share 169.45 160.49 183.54 148.06 227.85 Dividend yield 3.7% 3.3% 2.7% 3.2% 1.6% FFO MULTIPLE (3) * FFO per diluted share 2.27$ 8.35 7.79 7.00 6.09 Price per share 169.45 160.49 183.54 148.06 227.85 Multiple 18.7 19.2 23.6 21.2 37.4 INTEREST & FIXED CHARGE COVERAGE RATIO* EBITDAre 128,804$ 447,186 401,335 337,536 278,959 Interest expense 7,685 38,956 47,996 38,499 32,945 Interest and fixed charge coverage ratio 16.8 11.5 8.4 8.8 8.5 DEBT-TO-EBITDAre RATIO (4) * Debt 1,479,819$ 1,503,562 1,674,827 1,861,744 1,451,778 EBITDAre 128,804 447,186 401,335 337,536 278,959 Debt-To-EBITDAre ratio (4) 2.9 3.4 4.2 5.5 5.2 Adjusted debt-to-pro forma EBITDAre ratio (4) 2.3 2.3 3.2 4.5 3.8 DEBT-TO-TOTAL MARKET CAPITALIZATION (1) 14.1% 15.4% 16.1% 22.4% 13.4% ISSUER RATINGS (5) Issuer Rating Outlook Moody's Ratings Baa2 Positive (1) Before deducting unamortized debt issuance costs. (2) Quarterly calculation: (Dividend distributions for the quarter x 4)/price per share. Yearly calculation: Dividend for the 12-month period/price per share. (3) Quarterly calculation: (FFO per diluted share for the quarter x 4)/price per share. Yearly calculation: FFO per diluted share for the 12-month period/price per share. (4) Quarterly calculation: Debt/(EBITDAre for the quarter x 4). Yearly calculation: Debt/EBITDAre for the 12-month period. (5) A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. * This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. Years Ended

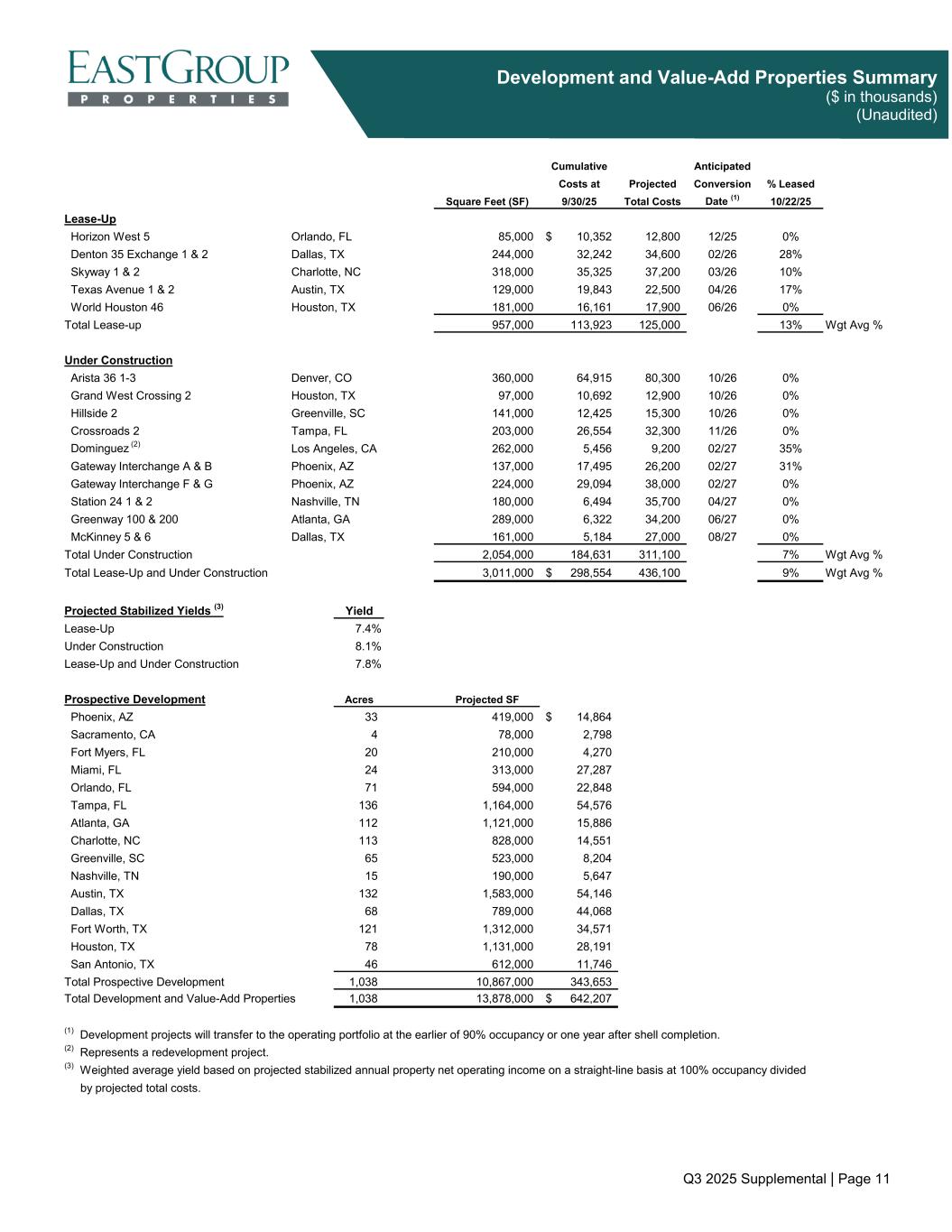

Q3 2025 Supplemental | Page 11 Development and Value-Add Properties Summary ($ in thousands) (Unaudited) Cumulative Anticipated Costs at Projected Conversion % Leased Square Feet (SF) 9/30/25 Total Costs Date (1) 10/22/25 Lease-Up Horizon West 5 Orlando, FL 85,000 10,352$ 12,800 12/25 0% Denton 35 Exchange 1 & 2 Dallas, TX 244,000 32,242 34,600 02/26 28% Skyway 1 & 2 Charlotte, NC 318,000 35,325 37,200 03/26 10% Texas Avenue 1 & 2 Austin, TX 129,000 19,843 22,500 04/26 17% World Houston 46 Houston, TX 181,000 16,161 17,900 06/26 0% Total Lease-up 957,000 113,923 125,000 13% Wgt Avg % Under Construction Arista 36 1-3 Denver, CO 360,000 64,915 80,300 10/26 0% Grand West Crossing 2 Houston, TX 97,000 10,692 12,900 10/26 0% Hillside 2 Greenville, SC 141,000 12,425 15,300 10/26 0% Crossroads 2 Tampa, FL 203,000 26,554 32,300 11/26 0% Dominguez (2) Los Angeles, CA 262,000 5,456 9,200 02/27 35% Gateway Interchange A & B Phoenix, AZ 137,000 17,495 26,200 02/27 31% Gateway Interchange F & G Phoenix, AZ 224,000 29,094 38,000 02/27 0% Station 24 1 & 2 Nashville, TN 180,000 6,494 35,700 04/27 0% Greenway 100 & 200 Atlanta, GA 289,000 6,322 34,200 06/27 0% McKinney 5 & 6 Dallas, TX 161,000 5,184 27,000 08/27 0% Total Under Construction 2,054,000 184,631 311,100 7% Wgt Avg % Total Lease-Up and Under Construction 3,011,000 298,554$ 436,100 9% Wgt Avg % Projected Stabilized Yields (3) Yield Lease-Up 7.4% Under Construction 8.1% Lease-Up and Under Construction 7.8% Prospective Development Acres Projected SF Phoenix, AZ 33 419,000 14,864$ Sacramento, CA 4 78,000 2,798 Fort Myers, FL 20 210,000 4,270 Miami, FL 24 313,000 27,287 Orlando, FL 71 594,000 22,848 Tampa, FL 136 1,164,000 54,576 Atlanta, GA 112 1,121,000 15,886 Charlotte, NC 113 828,000 14,551 Greenville, SC 65 523,000 8,204 Nashville, TN 15 190,000 5,647 Austin, TX 132 1,583,000 54,146 Dallas, TX 68 789,000 44,068 Fort Worth, TX 121 1,312,000 34,571 Houston, TX 78 1,131,000 28,191 San Antonio, TX 46 612,000 11,746 Total Prospective Development 1,038 10,867,000 343,653 Total Development and Value-Add Properties 1,038 13,878,000 642,207$ (1) Development projects will transfer to the operating portfolio at the earlier of 90% occupancy or one year after shell completion. (2) Represents a redevelopment project. (3) Weighted average yield based on projected stabilized annual property net operating income on a straight-line basis at 100% occupancy divided by projected total costs.

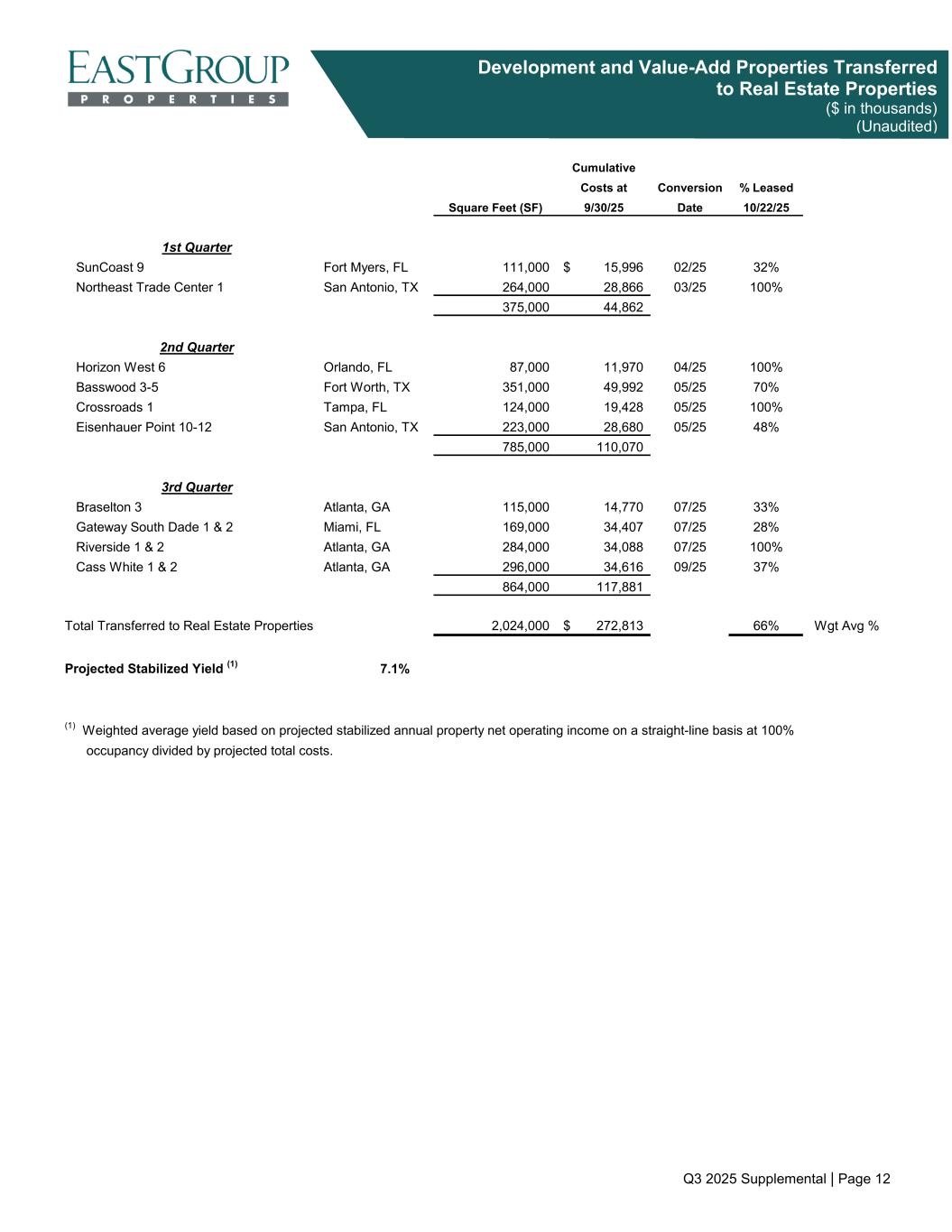

Q3 2025 Supplemental | Page 12 Development and Value-Add Properties Transferred to Real Estate Properties ($ in thousands) (Unaudited) Cumulative Costs at Conversion % Leased Square Feet (SF) 9/30/25 Date 10/22/25 1st Quarter SunCoast 9 Fort Myers, FL 111,000 15,996$ 02/25 32% Northeast Trade Center 1 San Antonio, TX 264,000 28,866 03/25 100% 375,000 44,862 2nd Quarter Horizon West 6 Orlando, FL 87,000 11,970 04/25 100% Basswood 3-5 Fort Worth, TX 351,000 49,992 05/25 70% Crossroads 1 Tampa, FL 124,000 19,428 05/25 100% Eisenhauer Point 10-12 San Antonio, TX 223,000 28,680 05/25 48% 785,000 110,070 3rd Quarter Braselton 3 Atlanta, GA 115,000 14,770 07/25 33% Gateway South Dade 1 & 2 Miami, FL 169,000 34,407 07/25 28% Riverside 1 & 2 Atlanta, GA 284,000 34,088 07/25 100% Cass White 1 & 2 Atlanta, GA 296,000 34,616 09/25 37% 864,000 117,881 Total Transferred to Real Estate Properties 2,024,000 272,813$ 66% Wgt Avg % Projected Stabilized Yield (1) 7.1% (1) Weighted average yield based on projected stabilized annual property net operating income on a straight-line basis at 100% occupancy divided by projected total costs.

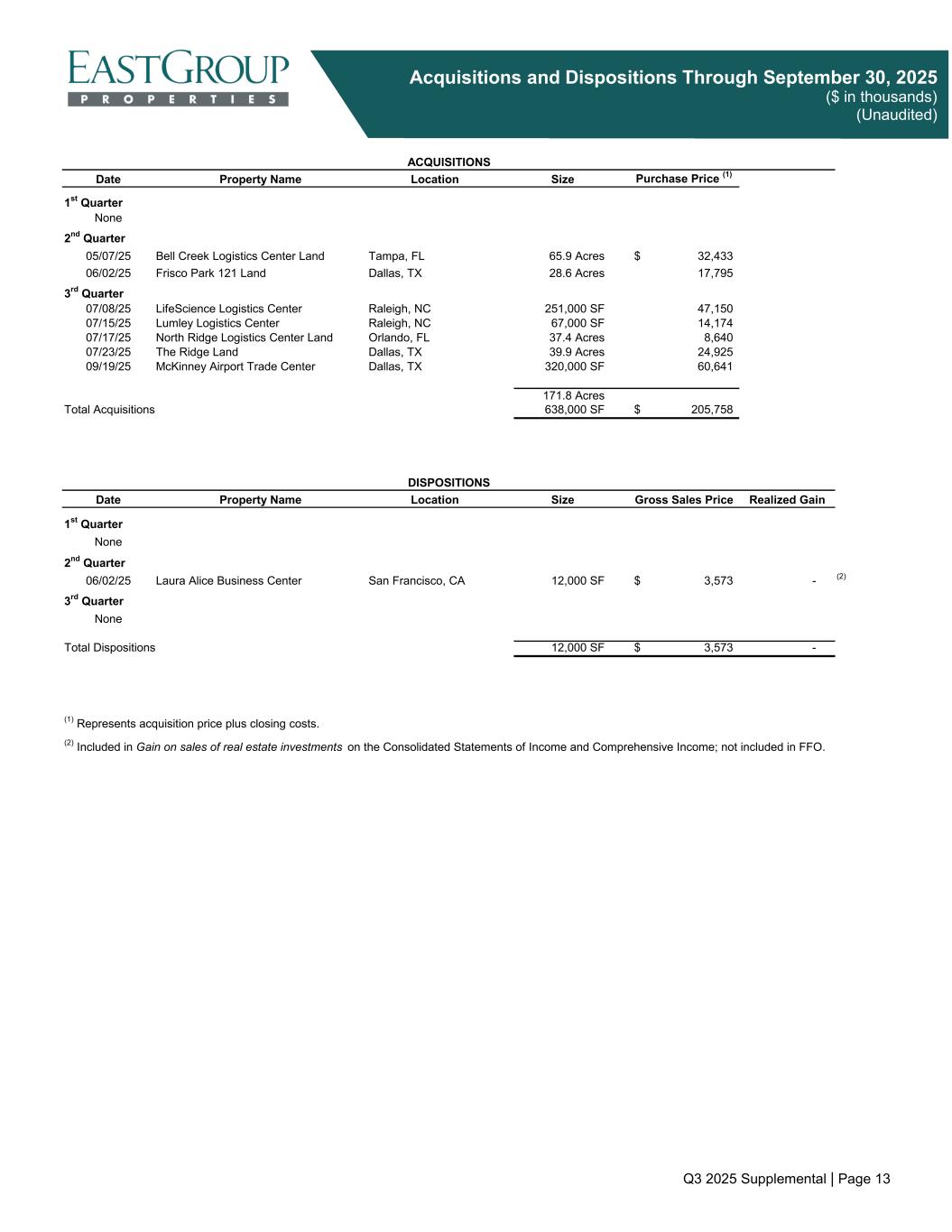

Q3 2025 Supplemental | Page 13 Acquisitions and Dispositions Through September 30, 2025 ($ in thousands) (Unaudited) Date Property Name Location Size Purchase Price (1) 1st Quarter None 2nd Quarter 05/07/25 Bell Creek Logistics Center Land Tampa, FL 65.9 Acres 32,433$ 06/02/25 Frisco Park 121 Land Dallas, TX 28.6 Acres 17,795 3rd Quarter 07/08/25 LifeScience Logistics Center Raleigh, NC 251,000 SF 47,150 07/15/25 Lumley Logistics Center Raleigh, NC 67,000 SF 14,174 07/17/25 North Ridge Logistics Center Land Orlando, FL 37.4 Acres 8,640 07/23/25 The Ridge Land Dallas, TX 39.9 Acres 24,925 09/19/25 McKinney Airport Trade Center Dallas, TX 320,000 SF 60,641 171.8 Acres Total Acquisitions 638,000 SF 205,758$ Date Property Name Location Size Gross Sales Price 1st Quarter None 2nd Quarter 06/02/25 Laura Alice Business Center San Francisco, CA 12,000 SF 3,573$ - (2) 3rd Quarter None Total Dispositions 12,000 SF 3,573$ - DISPOSITIONS ACQUISITIONS (2) Included in Gain on sales of real estate investments on the Consolidated Statements of Income and Comprehensive Income; not included in FFO. (1) Represents acquisition price plus closing costs. Realized Gain

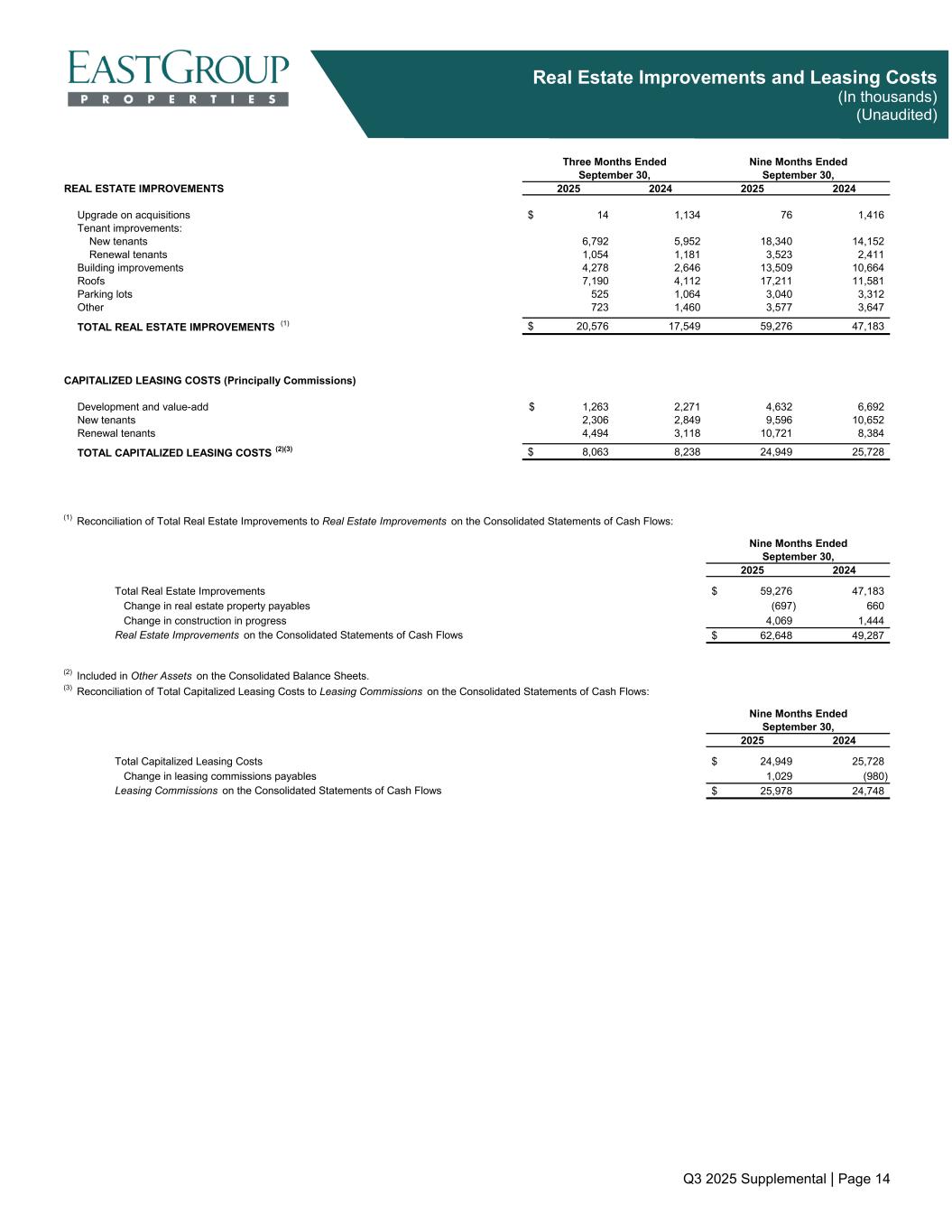

Q3 2025 Supplemental | Page 14 Real Estate Improvements and Leasing Costs (In thousands) (Unaudited) REAL ESTATE IMPROVEMENTS 2025 2024 2025 2024 Upgrade on acquisitions 14$ 1,134 76 1,416 Tenant improvements: New tenants 6,792 5,952 18,340 14,152 Renewal tenants 1,054 1,181 3,523 2,411 Building improvements 4,278 2,646 13,509 10,664 Roofs 7,190 4,112 17,211 11,581 Parking lots 525 1,064 3,040 3,312 Other 723 1,460 3,577 3,647 TOTAL REAL ESTATE IMPROVEMENTS (1) 20,576$ 17,549 59,276 47,183 CAPITALIZED LEASING COSTS (Principally Commissions) Development and value-add 1,263$ 2,271 4,632 6,692 New tenants 2,306 2,849 9,596 10,652 Renewal tenants 4,494 3,118 10,721 8,384 TOTAL CAPITALIZED LEASING COSTS (2)(3) 8,063$ 8,238 24,949 25,728 (1) Reconciliation of Total Real Estate Improvements to Real Estate Improvements on the Consolidated Statements of Cash Flows: 2025 2024 Total Real Estate Improvements 59,276$ 47,183 Change in real estate property payables (697) 660 Change in construction in progress 4,069 1,444 62,648$ 49,287 (2) Included in Other Assets on the Consolidated Balance Sheets. (3) Reconciliation of Total Capitalized Leasing Costs to Leasing Commissions on the Consolidated Statements of Cash Flows: 2025 2024 Total Capitalized Leasing Costs 24,949$ 25,728 Change in leasing commissions payables 1,029 (980) 25,978$ 24,748 Nine Months Ended September 30, Leasing Commissions on the Consolidated Statements of Cash Flows September 30, Real Estate Improvements on the Consolidated Statements of Cash Flows Nine Months Ended September 30, Nine Months EndedThree Months Ended September 30,

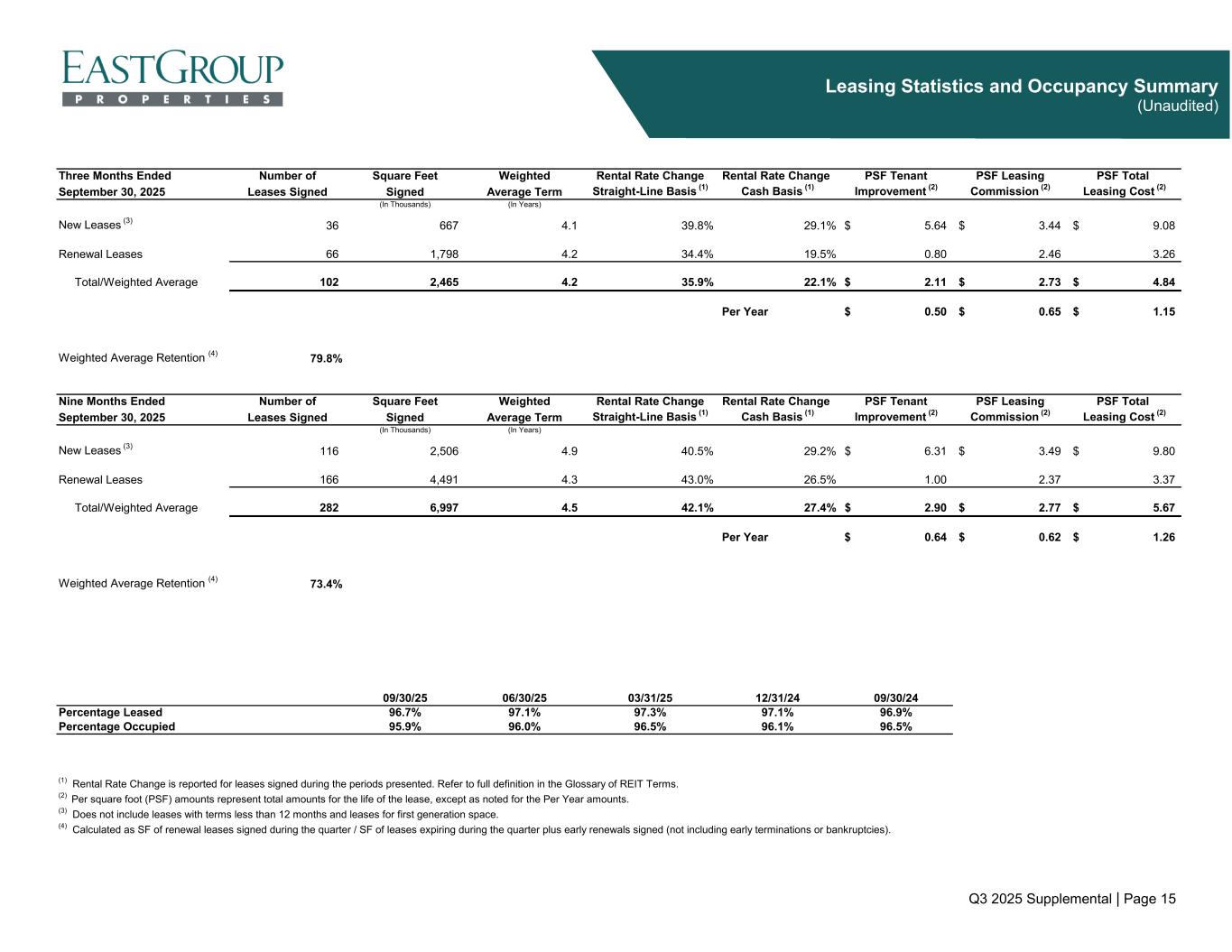

Q3 2025 Supplemental | Page 15 Leasing Statistics and Occupancy Summary (Unaudited) Three Months Ended Number of Square Feet Weighted Rental Rate Change Rental Rate Change PSF Tenant PSF Leasing PSF Total September 30, 2025 Leases Signed Signed Average Term Straight-Line Basis (1) Cash Basis (1) Improvement (2) Commission (2) Leasing Cost (2) (In Thousands) (In Years) New Leases (3) 36 667 4.1 39.8% 29.1% 5.64$ 3.44$ 9.08$ Renewal Leases 66 1,798 4.2 34.4% 19.5% 0.80 2.46 3.26 Total/Weighted Average 102 2,465 4.2 35.9% 22.1% 2.11$ 2.73$ 4.84$ Per Year 0.50$ 0.65$ 1.15$ Weighted Average Retention (4) 79.8% Nine Months Ended Number of Square Feet Weighted Rental Rate Change Rental Rate Change PSF Tenant PSF Leasing PSF Total September 30, 2025 Leases Signed Signed Average Term Straight-Line Basis (1) Cash Basis (1) Improvement (2) Commission (2) Leasing Cost (2) (In Thousands) (In Years) New Leases (3) 116 2,506 4.9 40.5% 29.2% 6.31$ 3.49$ 9.80$ Renewal Leases 166 4,491 4.3 43.0% 26.5% 1.00 2.37 3.37 Total/Weighted Average 282 6,997 4.5 42.1% 27.4% 2.90$ 2.77$ 5.67$ Per Year 0.64$ 0.62$ 1.26$ Weighted Average Retention (4) 73.4% 09/30/25 06/30/25 03/31/25 12/31/24 09/30/24 Percentage Leased 96.7% 97.1% 97.3% 97.1% 96.9% Percentage Occupied 95.9% 96.0% 96.5% 96.1% 96.5% (1) Rental Rate Change is reported for leases signed during the periods presented. Refer to full definition in the Glossary of REIT Terms. (2) Per square foot (PSF) amounts represent total amounts for the life of the lease, except as noted for the Per Year amounts. (3) Does not include leases with terms less than 12 months and leases for first generation space. (4) Calculated as SF of renewal leases signed during the quarter / SF of leases expiring during the quarter plus early renewals signed (not including early terminations or bankruptcies).

Q3 2025 Supplemental | Page 16 Core Market Operating Statistics September 30, 2025 (Unaudited) Total % of Total Square Feet Annualized % Straight-Line Cash Straight-Line Cash Straight-Line Cash Straight-Line Cash of Properties Base Rent (1) Leased 2025 (2) 2026 Basis Basis Basis Basis Basis Basis Basis Basis Texas Dallas 6,428,000 11.0% 99.2% 101,000 633,000 7.5% 10.0% 7.2% 9.4% 36.5% 22.1% 51.9% 37.0% Houston 7,108,000 9.6% 97.3% 102,000 1,184,000 6.9% 7.1% 4.3% 3.6% 44.7% 21.7% 40.5% 20.9% San Antonio 4,899,000 7.2% 95.3% 61,000 803,000 1.0% 0.4% -2.7% -2.4% 24.3% 11.8% 25.0% 12.2% Austin 1,756,000 3.5% 95.3% 38,000 224,000 6.9% 4.9% 8.3% 7.3% 58.1% 36.6% 40.4% 26.8% Fort Worth 1,459,000 2.0% 89.3% - 124,000 18.1% 6.8% 9.5% 5.3% 44.4% 26.8% 83.7% 54.9% El Paso 1,126,000 1.5% 97.1% 44,000 84,000 7.6% 10.1% 8.2% 8.8% 20.3% 9.5% 39.9% 26.6% 22,776,000 34.8% 96.7% 346,000 3,052,000 6.4% 6.4% 4.4% 4.6% 36.1% 19.2% 40.7% 24.1% Florida Orlando 4,899,000 8.5% 100.0% 152,000 617,000 15.0% 13.9% 11.3% 12.0% 19.1% 14.9% 37.0% 25.7% Tampa 4,656,000 7.4% 95.1% 34,000 1,311,000 1.8% 0.2% 2.4% 2.9% 43.6% 28.5% 53.8% 38.0% Miami/Fort Lauderdale 2,034,000 4.3% 93.0% 21,000 427,000 10.6% 12.4% 14.5% 9.8% 36.6% 21.4% 67.5% 48.9% Jacksonville 2,273,000 2.9% 94.6% 241,000 411,000 2.7% -5.0% 3.5% -1.3% 26.5% 16.4% 41.3% 27.4% Fort Myers 996,000 1.7% 90.8% - 122,000 8.1% 13.1% 5.3% 8.0% 92.9% 66.7% 77.1% 53.9% 14,858,000 24.8% 96.1% 448,000 2,888,000 7.8% 6.5% 7.4% 6.6% 36.1% 24.0% 49.8% 34.9% California San Francisco 2,463,000 5.2% 94.5% 8,000 589,000 21.3% 19.9% 11.6% 9.3% 32.9% 25.5% 24.5% 16.6% Los Angeles (4) 2,146,000 4.8% 99.0% 69,000 441,000 7.3% 14.3% 7.5% 12.5% 54.9% 48.9% 28.7% 21.7% San Diego (4) 1,933,000 4.2% 93.4% - 287,000 -3.6% -13.3% 4.8% -4.3% 18.6% 0.0% 26.4% 12.1% Sacramento 329,000 0.5% 96.9% 31,000 - -6.6% -4.0% -2.5% 0.4% 3.3% 3.0% 3.3% 3.0% Fresno 398,000 0.4% 94.7% 47,000 74,000 -1.9% 2.7% -1.4% 2.7% 24.0% 14.1% 30.2% 21.6% 7,269,000 15.1% 95.6% 155,000 1,391,000 7.4% 6.2% 7.4% 5.6% 27.1% 17.8% 25.1% 16.4% Arizona Phoenix 3,518,000 6.6% 100.0% 54,000 390,000 22.4% 14.1% 15.1% 11.1% 45.7% 31.8% 68.2% 46.3% Tucson 848,000 1.1% 100.0% - 5,000 0.2% 0.7% 1.1% 1.8% 43.3% 27.4% 43.3% 27.4% 4,366,000 7.7% 100.0% 54,000 395,000 18.2% 11.7% 12.5% 9.4% 45.4% 31.4% 67.0% 45.5% Other Core Charlotte 3,883,000 5.2% 98.0% 18,000 312,000 5.5% 3.7% 3.4% 1.2% 25.9% 11.8% 24.5% 18.0% Las Vegas 1,396,000 3.3% 100.0% 52,000 155,000 5.1% 9.2% 8.4% 13.7% 59.4% 43.6% 53.6% 38.7% Atlanta 2,941,000 3.5% 91.0% 82,000 221,000 8.7% 12.8% 11.4% 13.0% 41.1% 26.3% 46.0% 29.1% Denver 886,000 1.5% 100.0% 58,000 170,000 2.4% 2.2% 3.0% 3.6% 7.1% 1.5% 20.3% 5.9% Greenville 1,102,000 1.4% 100.0% - 220,000 7.3% 12.2% 11.2% 32.6% N/A N/A N/A N/A 10,208,000 14.9% 96.7% 210,000 1,078,000 5.7% 6.8% 6.4% 8.4% 40.2% 26.1% 34.5% 22.9% Total Core Markets 59,477,000 97.3% 96.7% 1,213,000 8,804,000 7.7% 6.8% 6.6% 6.2% 35.9% 22.2% 42.3% 27.7% Total Other Markets 1,898,000 2.7% 98.9% 1,000 95,000 10.5% 10.0% 5.3% 4.9% 7.1% 0.0% 20.7% 7.7% Total Operating Properties 61,375,000 100.0% 96.7% 1,214,000 8,899,000 7.7% 6.9% 6.5% 6.2% 35.9% 22.1% 42.1% 27.4% (1) Based on the Annualized Base Rent as of the reporting period for occupied square feet (without S/L Rent). (2) Square Feet expiring during the remainder of the year, including month-to-month leases. (3) Rental Rate Change is reported for leases signed during the periods presented. Refer to full definition in the Glossary of REIT Terms. (4) Includes the Company's share of its less-than-wholly-owned real estate investments. * This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. in Square Feet Same PNOI Change* Rental Rate Change (excluding income from lease terminations) New and Renewal Leases (3) Lease Expirations QTR YTD QTR YTD

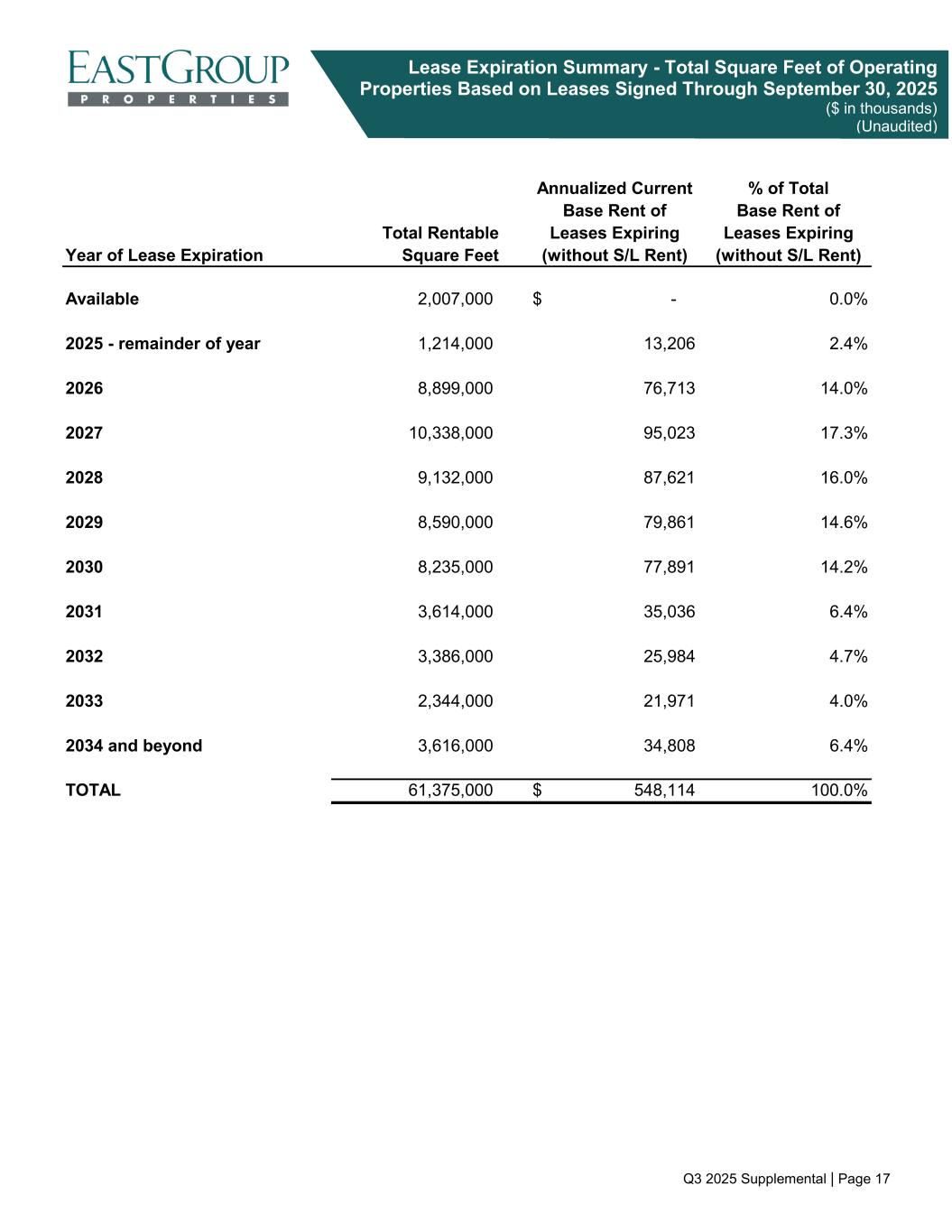

Q3 2025 Supplemental | Page 17 Lease Expiration Summary - Total Square Feet of Operating Properties Based on Leases Signed Through September 30, 2025 ($ in thousands) (Unaudited) Annualized Current % of Total Base Rent of Base Rent of Total Rentable Leases Expiring Leases Expiring Year of Lease Expiration Square Feet (without S/L Rent) (without S/L Rent) Available 2,007,000 -$ 0.0% 2025 - remainder of year 1,214,000 13,206 2.4% 2026 8,899,000 76,713 14.0% 2027 10,338,000 95,023 17.3% 2028 9,132,000 87,621 16.0% 2029 8,590,000 79,861 14.6% 2030 8,235,000 77,891 14.2% 2031 3,614,000 35,036 6.4% 2032 3,386,000 25,984 4.7% 2033 2,344,000 21,971 4.0% 2034 and beyond 3,616,000 34,808 6.4% TOTAL 61,375,000 548,114$ 100.0%

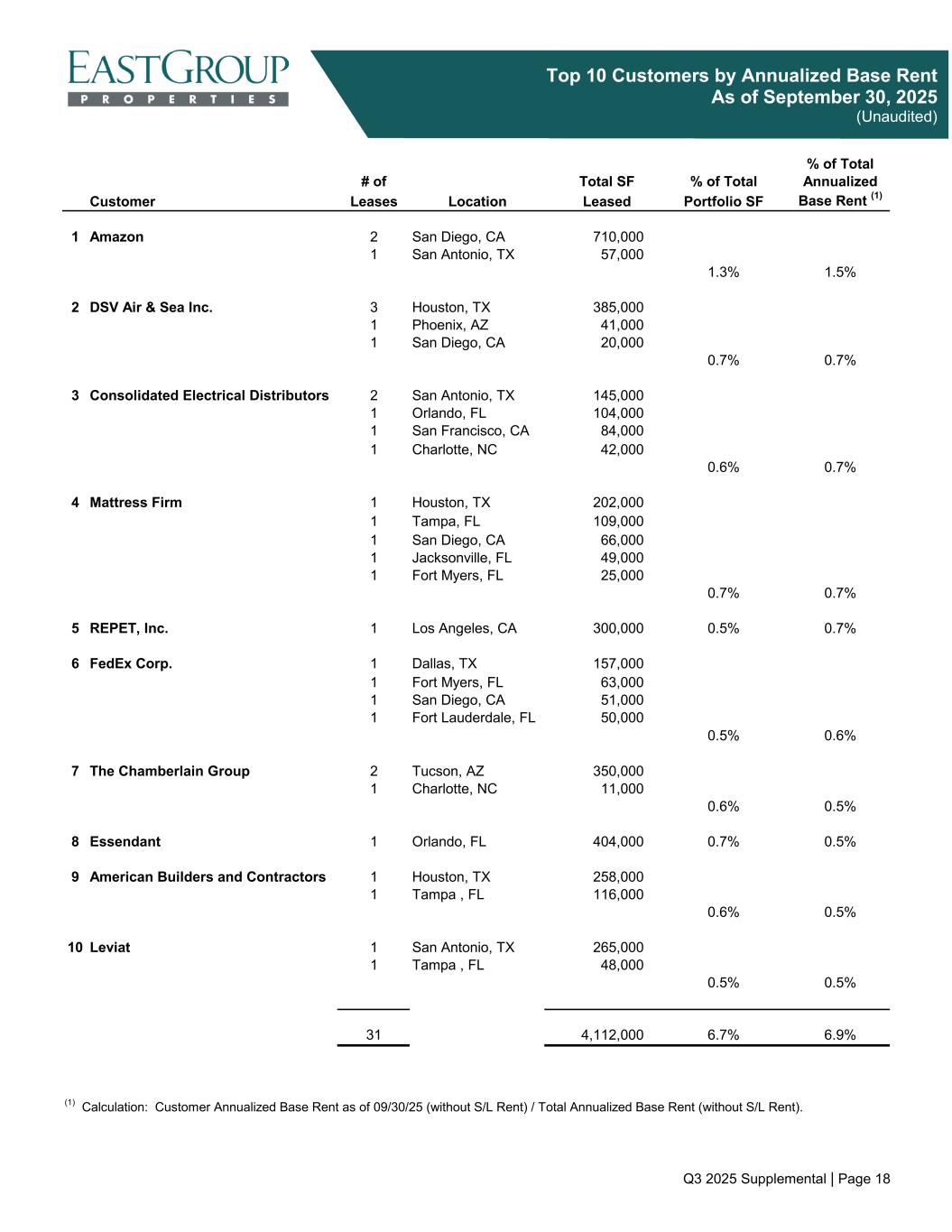

Q3 2025 Supplemental | Page 18 Top 10 Customers by Annualized Base Rent As of September 30, 2025 (Unaudited) % of Total # of % of Total Annualized Customer Leases Location Portfolio SF Base Rent (1) 1 Amazon 2 San Diego, CA 710,000 1 San Antonio, TX 57,000 1.3% 1.5% 2 DSV Air & Sea Inc. 3 Houston, TX 385,000 1 Phoenix, AZ 41,000 1 San Diego, CA 20,000 0.7% 0.7% 3 Consolidated Electrical Distributors 2 San Antonio, TX 145,000 1 Orlando, FL 104,000 1 San Francisco, CA 84,000 1 Charlotte, NC 42,000 0.6% 0.7% 4 Mattress Firm 1 Houston, TX 202,000 1 Tampa, FL 109,000 1 San Diego, CA 66,000 1 Jacksonville, FL 49,000 1 Fort Myers, FL 25,000 0.7% 0.7% 5 REPET, Inc. 1 Los Angeles, CA 300,000 0.5% 0.7% 6 FedEx Corp. 1 Dallas, TX 157,000 1 Fort Myers, FL 63,000 1 San Diego, CA 51,000 1 Fort Lauderdale, FL 50,000 0.5% 0.6% 7 The Chamberlain Group 2 Tucson, AZ 350,000 1 Charlotte, NC 11,000 0.6% 0.5% 8 Essendant 1 Orlando, FL 404,000 0.7% 0.5% 9 American Builders and Contractors 1 Houston, TX 258,000 1 Tampa , FL 116,000 0.6% 0.5% 10 Leviat 1 San Antonio, TX 265,000 1 Tampa , FL 48,000 0.5% 0.5% 31 4,112,000 6.7% 6.9% (1) Calculation: Customer Annualized Base Rent as of 09/30/25 (without S/L Rent) / Total Annualized Base Rent (without S/L Rent). Leased Total SF

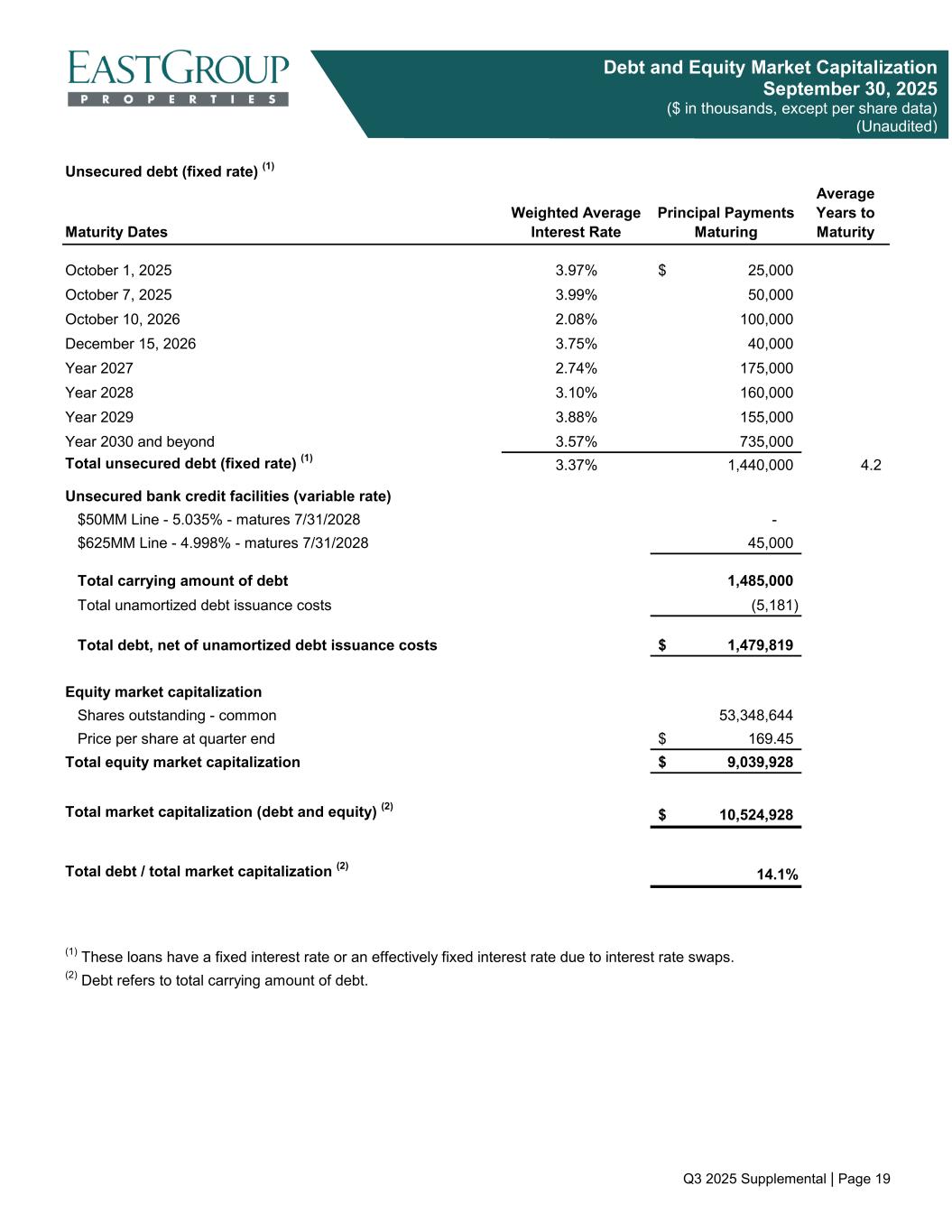

Q3 2025 Supplemental | Page 19 Debt and Equity Market Capitalization September 30, 2025 ($ in thousands, except per share data) (Unaudited) Unsecured debt (fixed rate) (1) Maturity Dates Weighted Average Interest Rate Principal Payments Maturing Average Years to Maturity October 1, 2025 3.97% 25,000$ October 7, 2025 3.99% 50,000 October 10, 2026 2.08% 100,000 December 15, 2026 3.75% 40,000 Year 2027 2.74% 175,000 Year 2028 3.10% 160,000 Year 2029 3.88% 155,000 Year 2030 and beyond 3.57% 735,000 Total unsecured debt (fixed rate) (1) 3.37% 1,440,000 4.2 Unsecured bank credit facilities (variable rate) $50MM Line - 5.035% - matures 7/31/2028 - $625MM Line - 4.998% - matures 7/31/2028 45,000 Total carrying amount of debt 1,485,000 Total unamortized debt issuance costs (5,181) Total debt, net of unamortized debt issuance costs 1,479,819$ Equity market capitalization Shares outstanding - common 53,348,644 Price per share at quarter end 169.45$ Total equity market capitalization 9,039,928$ Total market capitalization (debt and equity) (2) 10,524,928$ Total debt / total market capitalization (2) 14.1% (1) These loans have a fixed interest rate or an effectively fixed interest rate due to interest rate swaps. (2) Debt refers to total carrying amount of debt.

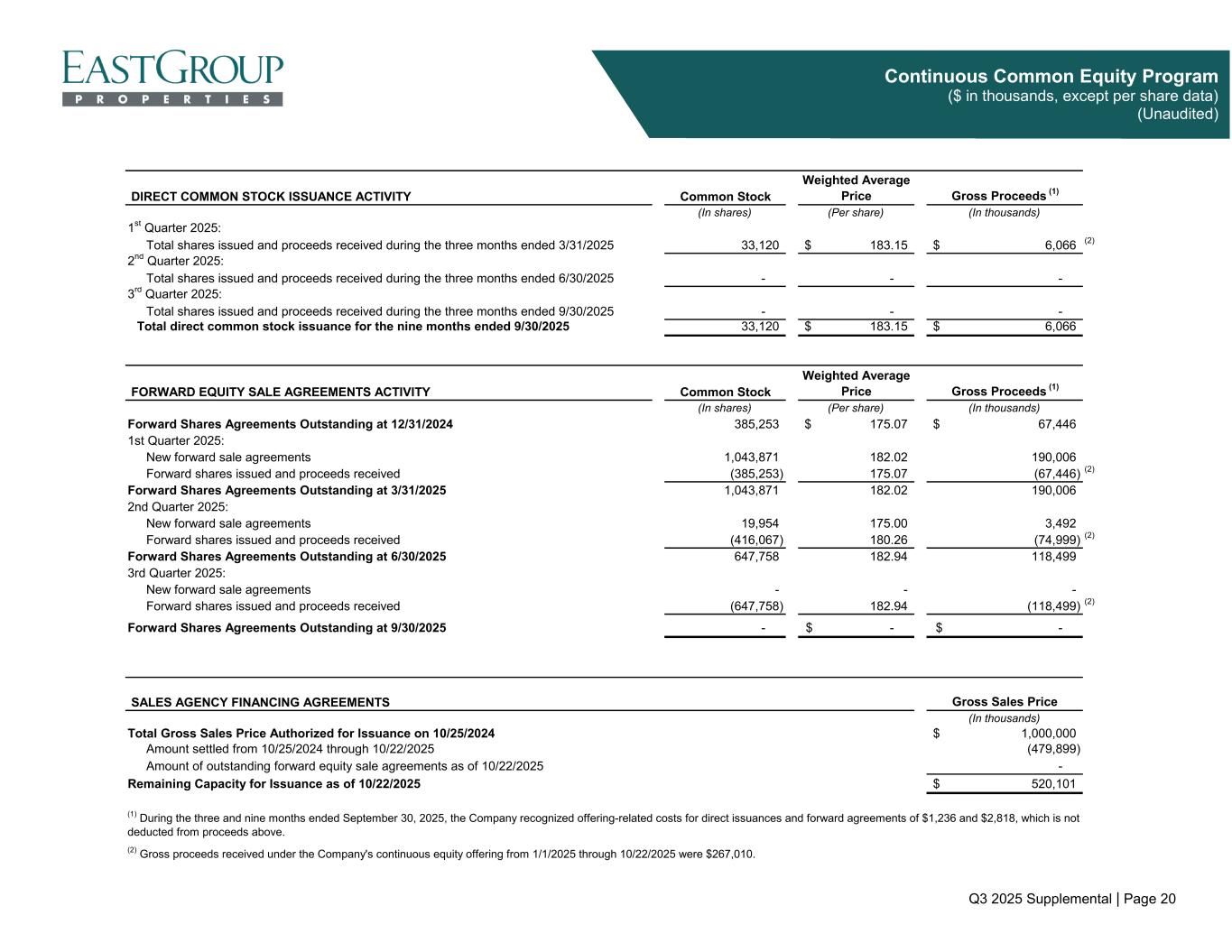

Q3 2025 Supplemental | Page 20 Continuous Common Equity Program ($ in thousands, except per share data) (Unaudited) Common Stock Weighted Average Price Gross Proceeds (1) (In shares) (Per share) (In thousands) 1st Quarter 2025: Total shares issued and proceeds received during the three months ended 3/31/2025 33,120 183.15$ 6,066$ (2) 2nd Quarter 2025: Total shares issued and proceeds received during the three months ended 6/30/2025 - - - 3rd Quarter 2025: Total shares issued and proceeds received during the three months ended 9/30/2025 - - - Total direct common stock issuance for the nine months ended 9/30/2025 33,120 183.15$ 6,066$ Common Stock Weighted Average Price Gross Proceeds (1) (In shares) (Per share) (In thousands) Forward Shares Agreements Outstanding at 12/31/2024 385,253 175.07$ 67,446$ 1st Quarter 2025: New forward sale agreements 1,043,871 182.02 190,006 Forward shares issued and proceeds received (385,253) 175.07 (67,446) (2) Forward Shares Agreements Outstanding at 3/31/2025 1,043,871 182.02 190,006 2nd Quarter 2025: New forward sale agreements 19,954 175.00 3,492 Forward shares issued and proceeds received (416,067) 180.26 (74,999) (2) Forward Shares Agreements Outstanding at 6/30/2025 647,758 182.94 118,499 3rd Quarter 2025: New forward sale agreements - - - Forward shares issued and proceeds received (647,758) 182.94 (118,499) (2) Forward Shares Agreements Outstanding at 9/30/2025 - -$ -$ Gross Sales Price (In thousands) Total Gross Sales Price Authorized for Issuance on 10/25/2024 1,000,000$ Amount settled from 10/25/2024 through 10/22/2025 (479,899) Amount of outstanding forward equity sale agreements as of 10/22/2025 - Remaining Capacity for Issuance as of 10/22/2025 520,101$ DIRECT COMMON STOCK ISSUANCE ACTIVITY FORWARD EQUITY SALE AGREEMENTS ACTIVITY (2) Gross proceeds received under the Company's continuous equity offering from 1/1/2025 through 10/22/2025 were $267,010. (1) During the three and nine months ended September 30, 2025, the Company recognized offering-related costs for direct issuances and forward agreements of $1,236 and $2,818, which is not deducted from proceeds above. SALES AGENCY FINANCING AGREEMENTS

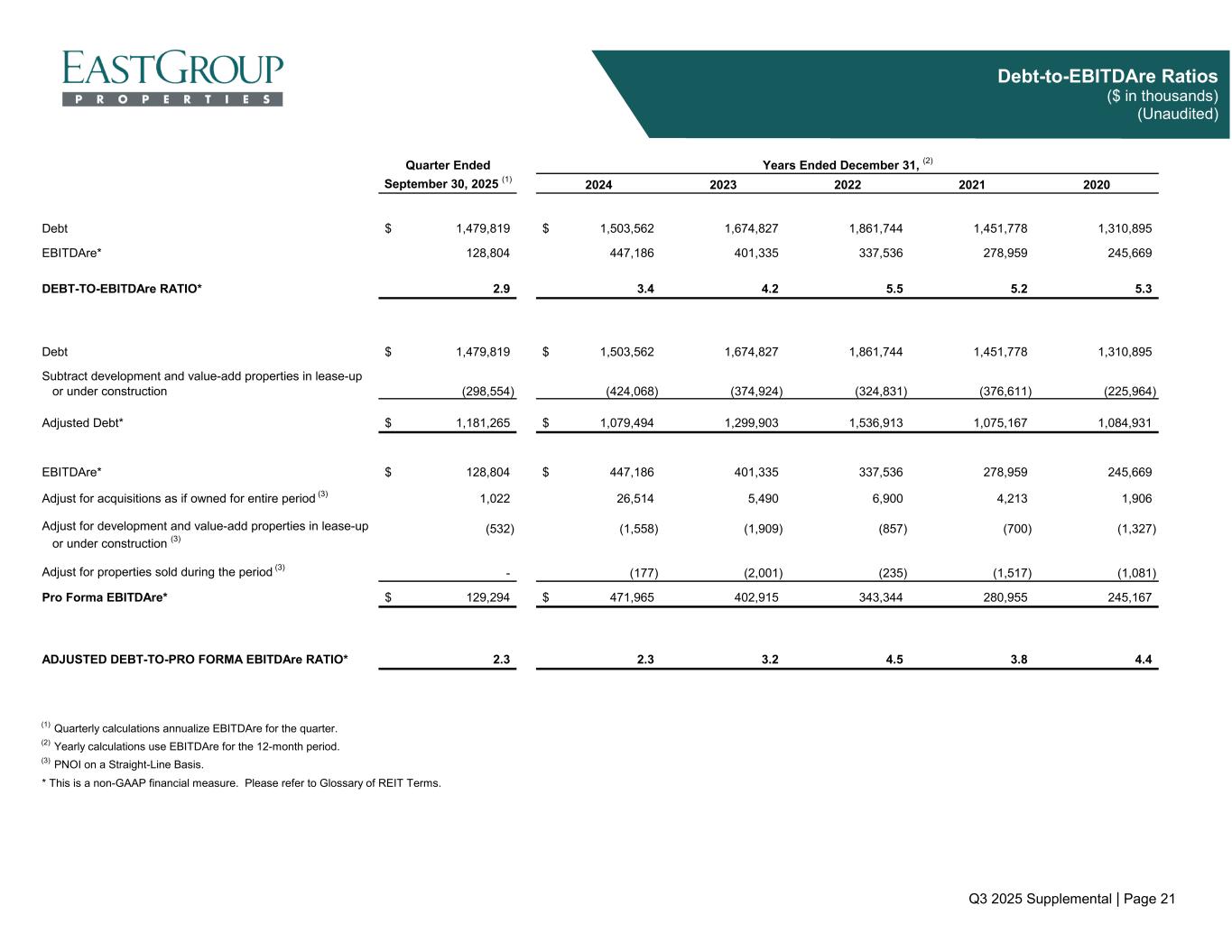

Q3 2025 Supplemental | Page 21 Debt-to-EBITDAre Ratios ($ in thousands) (Unaudited) Quarter Ended September 30, 2025 (1) 2024 2023 2022 2021 2020 Debt 1,479,819$ 1,503,562$ 1,674,827 1,861,744 1,451,778 1,310,895 EBITDAre* 128,804 447,186 401,335 337,536 278,959 245,669 DEBT-TO-EBITDAre RATIO* 2.9 3.4 4.2 5.5 5.2 5.3 Debt 1,479,819$ 1,503,562$ 1,674,827 1,861,744 1,451,778 1,310,895 Subtract development and value-add properties in lease-up or under construction (298,554) (424,068) (374,924) (324,831) (376,611) (225,964) Adjusted Debt* 1,181,265$ 1,079,494$ 1,299,903 1,536,913 1,075,167 1,084,931 EBITDAre* 128,804$ 447,186$ 401,335 337,536 278,959 245,669 Adjust for acquisitions as if owned for entire period (3) 1,022 26,514 5,490 6,900 4,213 1,906 Adjust for development and value-add properties in lease-up or under construction (3) (532) (1,558) (1,909) (857) (700) (1,327) Adjust for properties sold during the period (3) - (177) (2,001) (235) (1,517) (1,081) Pro Forma EBITDAre* 129,294$ 471,965$ 402,915 343,344 280,955 245,167 ADJUSTED DEBT-TO-PRO FORMA EBITDAre RATIO* 2.3 2.3 3.2 4.5 3.8 4.4 (1) Quarterly calculations annualize EBITDAre for the quarter. (2) Yearly calculations use EBITDAre for the 12-month period. (3) PNOI on a Straight-Line Basis. * This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. Years Ended December 31, (2)

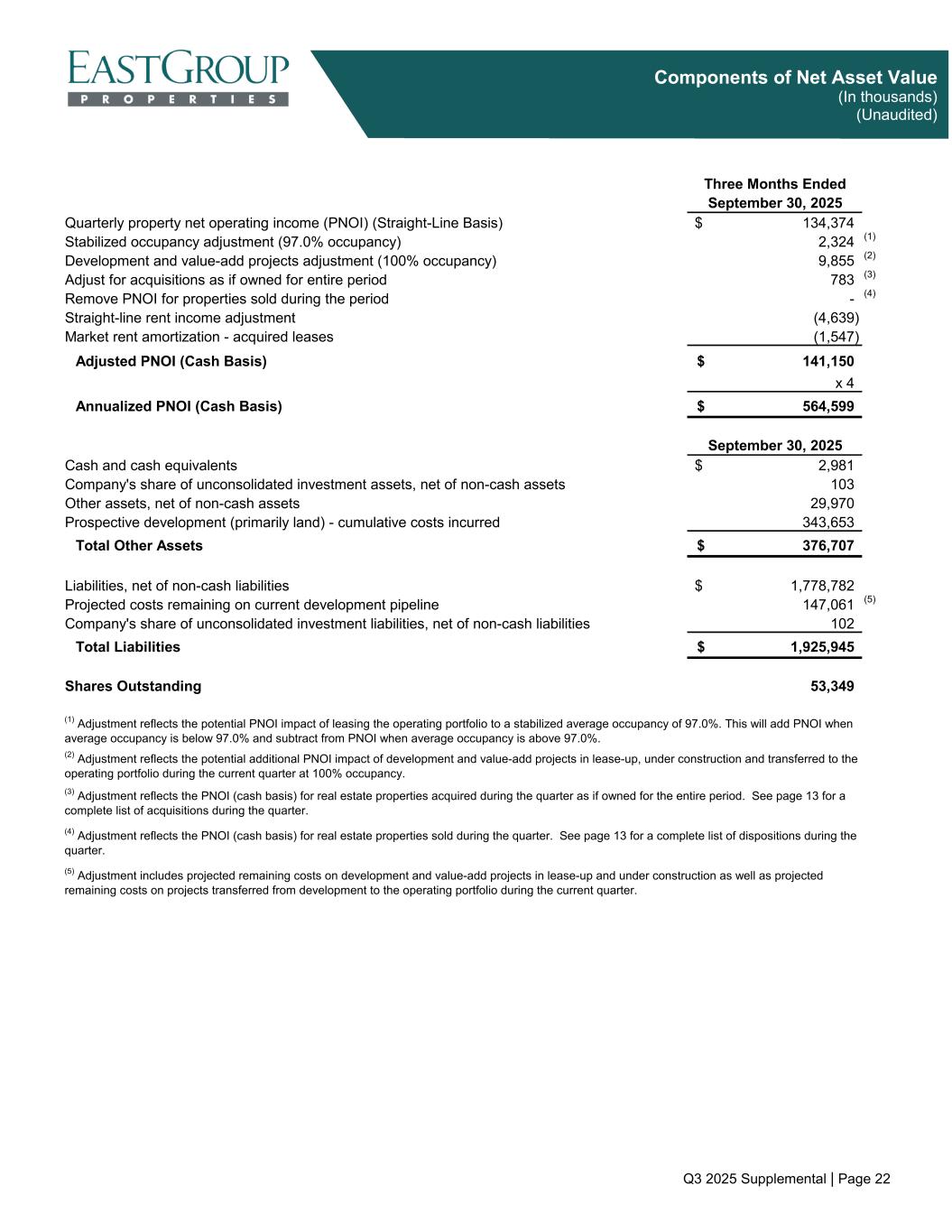

Q3 2025 Supplemental | Page 22 Components of Net Asset Value (In thousands) (Unaudited) Three Months Ended September 30, 2025 Quarterly property net operating income (PNOI) (Straight-Line Basis) 134,374$ Stabilized occupancy adjustment (97.0% occupancy) 2,324 (1) Development and value-add projects adjustment (100% occupancy) 9,855 (2) Adjust for acquisitions as if owned for entire period 783 (3) Remove PNOI for properties sold during the period - (4) Straight-line rent income adjustment (4,639) Market rent amortization - acquired leases (1,547) Adjusted PNOI (Cash Basis) 141,150$ x 4 Annualized PNOI (Cash Basis) 564,599$ September 30, 2025 Cash and cash equivalents 2,981$ Company's share of unconsolidated investment assets, net of non-cash assets 103 Other assets, net of non-cash assets 29,970 Prospective development (primarily land) - cumulative costs incurred 343,653 Total Other Assets 376,707$ Liabilities, net of non-cash liabilities 1,778,782$ Projected costs remaining on current development pipeline 147,061 (5) Company's share of unconsolidated investment liabilities, net of non-cash liabilities 102 Total Liabilities 1,925,945$ Shares Outstanding 53,349 (1) Adjustment reflects the potential PNOI impact of leasing the operating portfolio to a stabilized average occupancy of 97.0%. This will add PNOI when average occupancy is below 97.0% and subtract from PNOI when average occupancy is above 97.0%. (2) Adjustment reflects the potential additional PNOI impact of development and value-add projects in lease-up, under construction and transferred to the operating portfolio during the current quarter at 100% occupancy. (5) Adjustment includes projected remaining costs on development and value-add projects in lease-up and under construction as well as projected remaining costs on projects transferred from development to the operating portfolio during the current quarter. (3) Adjustment reflects the PNOI (cash basis) for real estate properties acquired during the quarter as if owned for the entire period. See page 13 for a complete list of acquisitions during the quarter. (4) Adjustment reflects the PNOI (cash basis) for real estate properties sold during the quarter. See page 13 for a complete list of dispositions during the quarter.

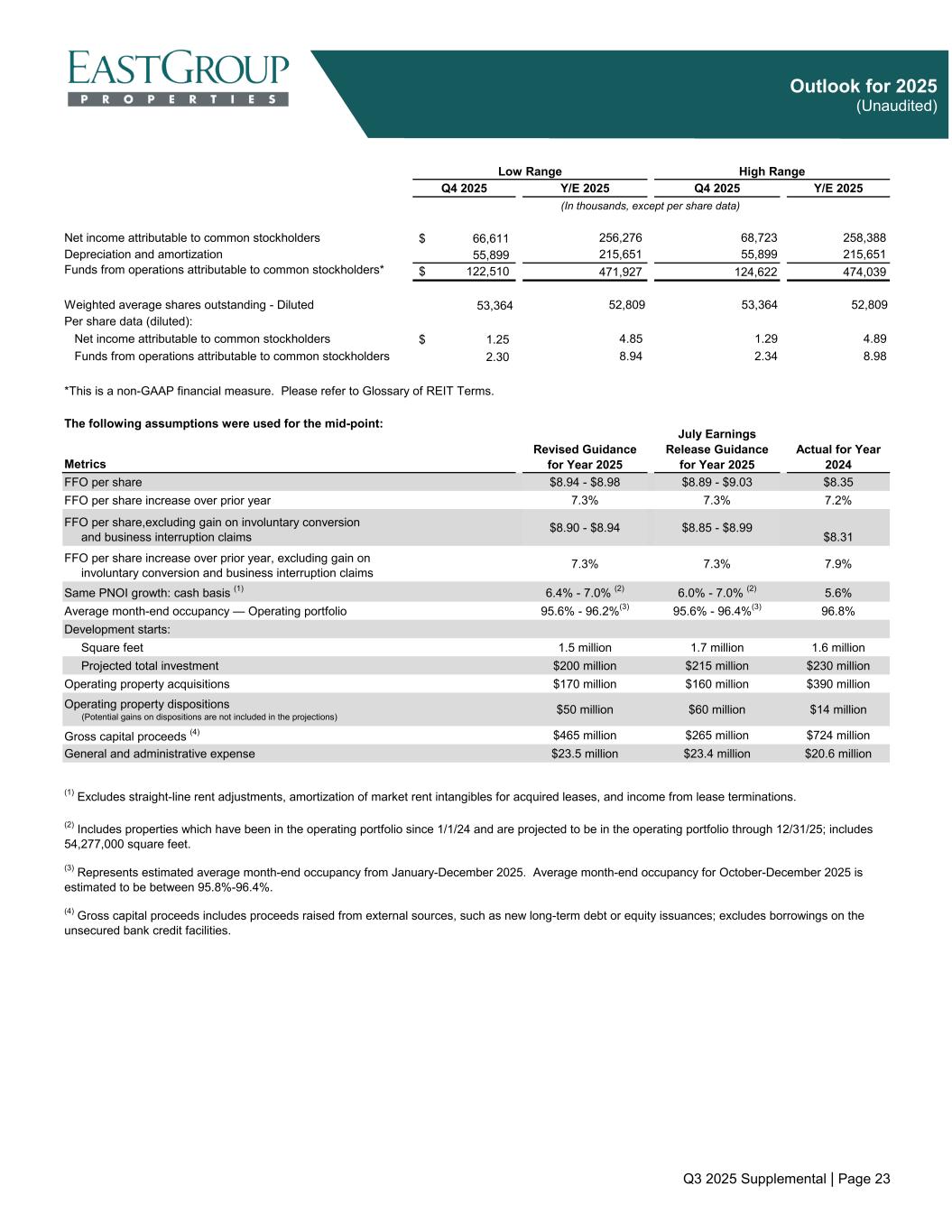

Q3 2025 Supplemental | Page 23 Outlook for 2025 (Unaudited) Q4 2025 Y/E 2025 Q4 2025 Y/E 2025 Net income attributable to common stockholders 66,611$ 256,276 68,723 258,388 Depreciation and amortization 55,899 215,651 55,899 215,651 Funds from operations attributable to common stockholders* 122,510$ 471,927 124,622 474,039 Weighted average shares outstanding - Diluted 53,364 52,809 53,364 52,809 Per share data (diluted): Net income attributable to common stockholders 1.25$ 4.85 1.29 4.89 Funds from operations attributable to common stockholders 2.30 8.94 2.34 8.98 The following assumptions were used for the mid-point: Metrics FFO per share $8.94 - $8.98 $8.89 - $9.03 $8.35 FFO per share increase over prior year 7.3% 7.3% 7.2% FFO per share,excluding gain on involuntary conversion and business interruption claims $8.90 - $8.94 $8.85 - $8.99 $8.31 FFO per share increase over prior year, excluding gain on involuntary conversion and business interruption claims 7.3% 7.3% 7.9% Same PNOI growth: cash basis (1) 6.4% - 7.0% (2) 6.0% - 7.0% (2) 5.6% Average month-end occupancy — Operating portfolio 95.6% - 96.2%(3) 95.6% - 96.4%(3) 96.8% Development starts: Square feet 1.5 million 1.7 million 1.6 million Projected total investment $200 million $215 million $230 million Operating property acquisitions $170 million $160 million $390 million Operating property dispositions (Potential gains on dispositions are not included in the projections) $50 million $60 million $14 million Gross capital proceeds (4) $465 million $265 million $724 million General and administrative expense $23.5 million $23.4 million $20.6 million (1) Excludes straight-line rent adjustments, amortization of market rent intangibles for acquired leases, and income from lease terminations. (2) Includes properties which have been in the operating portfolio since 1/1/24 and are projected to be in the operating portfolio through 12/31/25; includes 54,277,000 square feet. (4) Gross capital proceeds includes proceeds raised from external sources, such as new long-term debt or equity issuances; excludes borrowings on the unsecured bank credit facilities. (3) Represents estimated average month-end occupancy from January-December 2025. Average month-end occupancy for October-December 2025 is estimated to be between 95.8%-96.4%. Low Range (In thousands, except per share data) High Range *This is a non-GAAP financial measure. Please refer to Glossary of REIT Terms. Revised Guidance for Year 2025 July Earnings Release Guidance for Year 2025 Actual for Year 2024

Q3 2025 Supplemental | Page 24 Glossary of REIT Terms Listed below are definitions of commonly used real estate investment trust (“REIT”) industry terms. For additional information on REITs, please see the National Association of Real Estate Investment Trusts (“Nareit”) web site at www.reit.com. Adjusted Debt-to-Pro Forma EBITDAre Ratio: A ratio calculated by dividing a company’s adjusted debt by its pro forma EBITDAre. Debt is adjusted by subtracting the cost of development and value-add properties in lease-up or under construction. EBITDAre is further adjusted by adding an estimate of NOI for significant acquisitions as if the acquired properties were owned for the entire period, and by subtracting NOI from development and value-add properties in lease-up or under construction and from properties sold during the period. The Adjusted Debt-to-Pro Forma EBITDAre Ratio is a non-GAAP financial measure used to analyze the Company’s financial condition and operating performance relative to its leverage, on an adjusted basis, so as to normalize and annualize property changes during the period. Cash Basis: The Company adjusts its GAAP reporting to exclude straight-line rent adjustments and amortization of market rent intangibles for acquired leases. The cash basis is an indicator of the rents charged to customers by the Company during the periods presented and is useful in analyzing the embedded rent growth in the Company’s portfolio. Debt-to-EBITDAre Ratio: A ratio calculated by dividing a company’s debt by its EBITDAre; this non-GAAP measure is used to analyze the Company’s financial condition and operating performance relative to its leverage. Debt-to-Total Market Capitalization Ratio: A ratio calculated by dividing a company’s debt by the total amount of a company’s equity (at market value) and debt. Earnings Before Interest Taxes Depreciation and Amortization for Real Estate (“EBITDAre”): In accordance with standards established by Nareit, EBITDAre is computed as Earnings, defined as Net Income, excluding gains or losses from sales of real estate investments and non-operating real estate, plus interest, taxes, depreciation and amortization. EBITDAre is a non-GAAP financial measure used to measure the Company’s operating performance and its ability to meet interest payment obligations and pay quarterly stock dividends on an unleveraged basis. Funds From Operations (“FFO”): FFO is the most commonly accepted reporting measure of a REIT’s operating performance, and the Company computes FFO in accordance with standards established by Nareit in the Nareit Funds from Operations White Paper — 2018 Restatement. It is equal to a REIT’s net income (loss) attributable to common stockholders computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains and losses from sales of real estate property (including other assets incidental to the Company’s business) and impairment losses, adjusted for real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure used to evaluate the performance of the Company’s investments in real estate assets and its operating results. FFO, Excluding Gain on Involuntary Conversion and Business Interruption Claims: A reporting measure calculated as FFO (as defined above), adjusted to exclude gain on involuntary conversion and business interruption claims. The Company believes that this exclusion presents a more meaningful comparison of operating performance. Interest and Fixed Charge Coverage Ratio: A non-GAAP financial measure calculated by dividing the Company’s EBITDAre by its interest expense. We believe this ratio is useful to investors because it provides a basis for analysis of the Company’s leverage, operating performance and its ability to service the interest payments due on its debt. Industrial Properties: Generally consisting of one or more buildings comprised of four concrete walls tilted up on a slab of concrete. An internal office component is then added. Business uses include warehousing, distribution, light manufacturing and assembly, research and development, showroom, office, or a combination of some or all of the aforementioned. Leases Expiring and Renewal Leases Signed of Expiring Square Feet: Includes renewals during the period with terms commencing during the period and after the end of the period. Operating Land: Land with no buildings or improvements that generates income from leases with tenants; included in Real estate properties on the Consolidated Balance Sheets. Operating Properties: Stabilized real estate properties (land including buildings and improvements) in the Company’s operating portfolio; included in Real estate properties on the Consolidated Balance Sheets. Percentage Leased: The percentage of total leasable square footage for which there is a signed lease, including month-to- month leases, as of the close of the reporting period. Space is considered leased upon execution of the lease. Percentage Occupied: The percentage of total leasable square footage for which the lease term has commenced as of the close of the reporting period.

Q3 2025 Supplemental | Page 25 Glossary of REIT Terms Property Net Operating Income (“PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense) plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments. PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results. Real Estate Investment Trust (“REIT”): A company that owns and, in most cases, operates income-producing real estate such as apartments, shopping centers, offices, hotels and warehouses. Some REITs also engage in financing real estate. The shares of most REITs are freely traded, usually on a major stock exchange. To qualify as a REIT, a company must distribute at least 90 percent of its taxable income to its stockholders annually. A company that qualifies as a REIT is permitted to deduct dividends paid to its stockholders from its corporate taxable income. As a result, most REITs remit at least 100 percent of their taxable income to their stockholders and therefore owe no corporate federal income tax. Taxes are paid by stockholders on the dividends received. Most states honor this federal treatment and also do not require REITs to pay state income tax. Rental rate changes on new and renewal leases: • Cash Basis - Rental rate changes are calculated as the difference, weighted by square feet, of the annualized base rent due the first month of the new lease’s term and the annualized base rent of the rent due the last month of the former lease’s term, for leases signed during the reporting period. If free rent, discounts, or premiums are in the lease terms, then the first full rent value is used. • Straight-Line Basis - Rental rate changes are calculated as the difference, weighted by square feet, of the average rent over the life of the new lease and the average rent over the life of the former lease, for leases signed during the reporting period. • Rent amounts exclude amortization of market rent intangibles for acquired leases, hold over rent, and base stop amounts. These calculations exclude leases with terms of less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. Same Properties: Operating properties owned during the entire current and prior year reporting periods. Properties developed or acquired are excluded until held in the operating portfolio for both the current and prior year reporting periods. Properties sold during the current or prior year reporting periods are excluded. The Same Property Pool includes properties which were included in the operating portfolio for the entire period from January 1, 2024 through September 30, 2025. Same Property Net Operating Income (“Same PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense), plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments, for the same properties owned by the Company during the entire current and prior year reporting periods. Same PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results on a same property basis. Same PNOI, Excluding Income from Lease Terminations: Same PNOI (as defined above), adjusted to exclude income from lease terminations. The Company believes it is useful to evaluate Same PNOI, Excluding Income from Lease Terminations, on both a straight-line and cash basis. The straight-line basis is calculated by averaging the customers’ rent payments over the lives of the leases; GAAP requires the recognition of rental income on the straight-line basis. The cash basis excludes adjustments for straight-line rent and amortization of market rent intangibles for acquired leases; the cash basis is an indicator of the rents charged to customers by the Company during the periods presented and is useful in analyzing the embedded rent growth in the Company’s portfolio. Straight-Lining: The process of averaging the customer’s rent payments over the life of the lease. GAAP requires real estate companies to “straight-line” rents. Total Return: A stock’s dividend income plus capital appreciation/depreciation over a specified period as a percentage of the stock price at the beginning of the period. Value-Add Properties: Properties that are either acquired but not stabilized or can be converted to a higher and better use. Properties meeting either of the following two conditions are considered value-add properties: (1) Less than 75% leased as of the acquisition date (or will be less than 75% leased within one year of acquisition date based on near term lease roll), or (2) 20% or greater of the cumulative gross cost will be spent to redevelop the property. Properties qualifying under these conditions are placed into Value-Add Properties in the quarter in which (1) they are acquired, if condition 1 above is met, or (2) when construction to redevelop begins. Value-Add Properties are moved into the operating portfolio upon stabilization, meaning the earlier of achieving 90% or greater occupancy or 12 months from the acquisition date or completion of the redevelopment, as applicable.