© 2025 Kelly Services, Inc. All rights reserved. February 12, 2026 Q4 2025 .2

© 2025 Kelly Services, Inc. All rights reserved. 2 Presentation Disclosures

© 2025 Kelly Services, Inc. All rights reserved. 3 Safe Harbor Statement This presentation contains statements that are forward looking in nature and, accordingly, are subject to risks and uncertainties . These statements are made under the “safe harbor” provisions of the U.S . Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about Kelly’s financial expectations, are forward - looking statements . Factors that could cause actual results to differ materially from those contained in this release include, but are not limited to, (i) changing market and economic conditions, (ii) disruption in the labor market and weakened demand for human capital resulting from technological advances, loss of large corporate customers and government contractor requirements, (iii) the impact of laws and regulations (including federal, state and international tax laws), (iv) unexpected changes in claim trends on workers’ compensation, unemployment, disability and medical benefit plans, (v) litigation and other legal liabilities (including tax liabilities) in excess of our estimates, (vi) our ability to achieve our business’s anticipated growth strategies, (vii) our future business development, results of operations and financial condition, (viii) damage to our brands, (ix) dependency on third parties for the execution of critical functions, (x) conducting business in foreign countries, including foreign currency fluctuations, (xi) availability of temporary workers with appropriate skills required by customers, (xii) cyberattacks or other breaches of network or information technology security, and (xiii) other risks, uncertainties and factors discussed in this release and in the Company’s filings with the Securities and Exchange Commission . In some cases, forward - looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “target,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions . All information provided in this presentation is as of the date of this presentation and we undertake no duty to update any forward - looking statement, whether as a result of new information, future events, or otherwise, except as required by law .

© 2025 Kelly Services, Inc. All rights reserved. 4 Non - GAAP Measures Management uses Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortization) and Adjusted EBITDA Margin (percent of total GAAP revenue) which Management believes is useful to compare operating performance compared to prior periods and uses it in conjunction with GAAP measures to assess performance . Our calculation of Adjusted EBITDA may not be consistent with similarly titled measures of other companies and should be used in conjunction with GAAP measurements . Management believes that the non - GAAP (U .S . Generally Accepted Accounting Principles) information excluding items such as goodwill impairment charges, valuation allowances, integration and realignment costs, transaction costs, executive transition costs, gains and losses on the sale of our EMEA staffing operations and other assets, gain on forward contracts, gain on equity securities, restructuring charges and asset impairment charges are useful to understand the Company's fiscal 2025 financial performance and increases comparability . Specifically, Management believes that removing the impact of these items allows for a meaningful comparison of current period operating performance with the operating results of prior periods . Management also believes that such measures are used by those analyzing performance of companies in the staffing industry to compare current performance to prior periods and to assess future performance . These non - GAAP measures may have limitations as analytical tools because they exclude items which can have a material impact on cash flow and earnings per share . As a result, Management considers these measures, along with reported results, when it reviews and evaluates the Company's financial performance . Management believes that these measures provide greater transparency to investors and provide insight into how Management is evaluating the Company's financial performance . Non - GAAP measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP .

© 2025 Kelly Services, Inc. All rights reserved. 5 Financials

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 Takeaways 6 Revenue decline in the quarter reflects growth in more resilient markets and the Education segment, offset by discrete impacts in the ETM and SET segments • Revenue down 11.9%, down 3.9% (1) underlying which excludes the discrete impacts of U.S. federal government in the SET and ETM segments and three large customers in ETM • Underlying demand trends consistent with prior quarter for ETM and other areas Profitability reflects revenue and gross profit pressure, partially offset by notable SG&A decreases • Gross profit rate of 18.8%, down 150 bps primarily from increased employee - related costs • SG&A down 8.7% (11.1% (2) adjusted) reflecting significant progress on cost optimization efforts • Q4 Adjusted EBITDA margin of 2.0% (2) , down 170 bps primarily reflecting the lower gross profit Driving structural and volume - related expense optimalizations • Technology modernization initiative is on - track to reduce expenses associated with managing disparate and outdated systems and enable more rapid innovation within SET and ultimately across the enterprise o In Q4 2025, completed the first major phase of the technology transition, also executed an enterprise agreement with a major technology provider in support of these efforts • Aligning resources with demand as the macroeconomic environment continues to evolve Maintaining our focus on accelerating profitable growth • Further enhancing go to market approach across the enterprise to strengthen large account management and expand new customer acquisition • Capitalizing on organic growth drivers in each business and integrating legacy acquisitions to capture revenue and cost synergies Refer to the last two slides for footnotes.

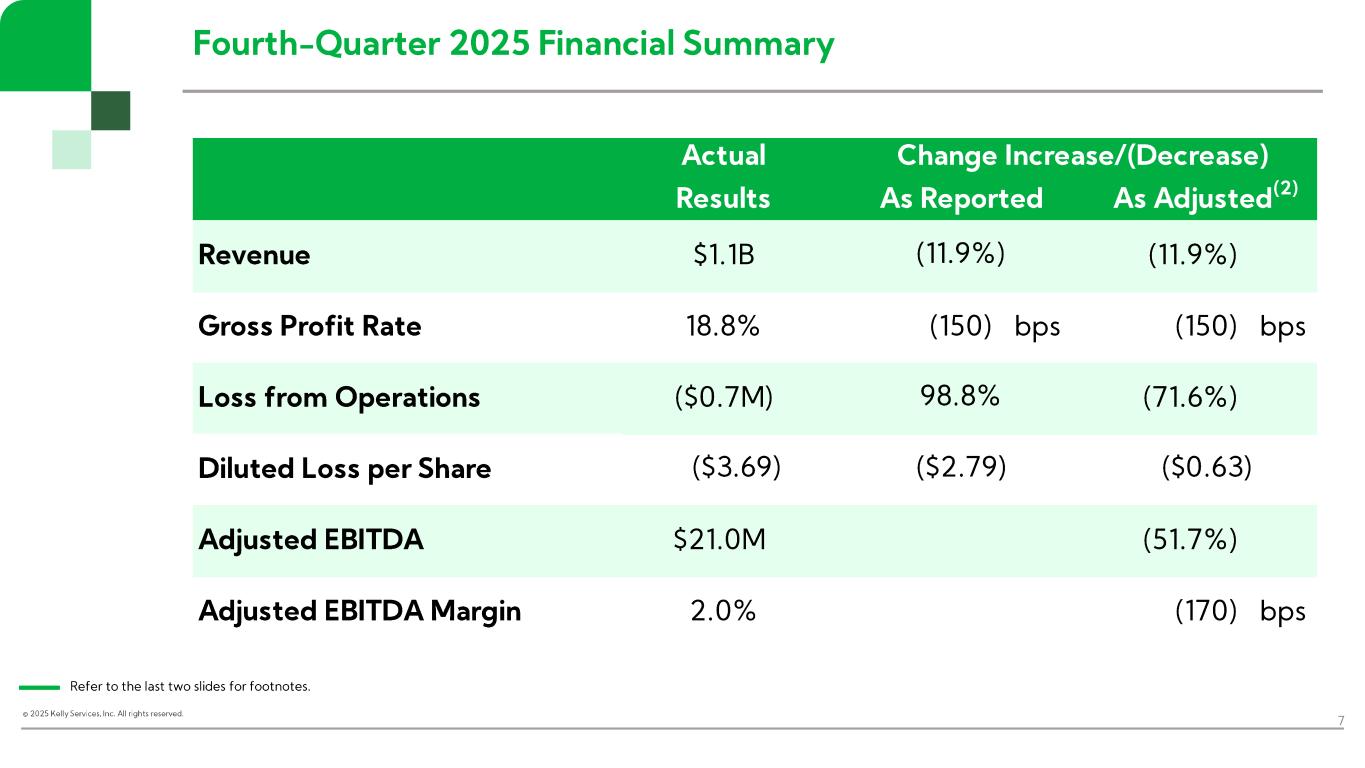

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 Financial Summary 7 Refer to the last two slides for footnotes. Actual Results Revenue $1.1B (11.9%) Gross Profit Rate 18.8% (150) bps (150) bps Loss from Operations ($0.7M) (71.6%) Diluted Loss per Share Adjusted EBITDA $21.0M (51.7%) Adjusted EBITDA Margin 2.0% (170) bps 98.8% Change Increase/(Decrease) As Reported As Adjusted (2) (11.9%) ($3.69) ($2.79) ($0.63)

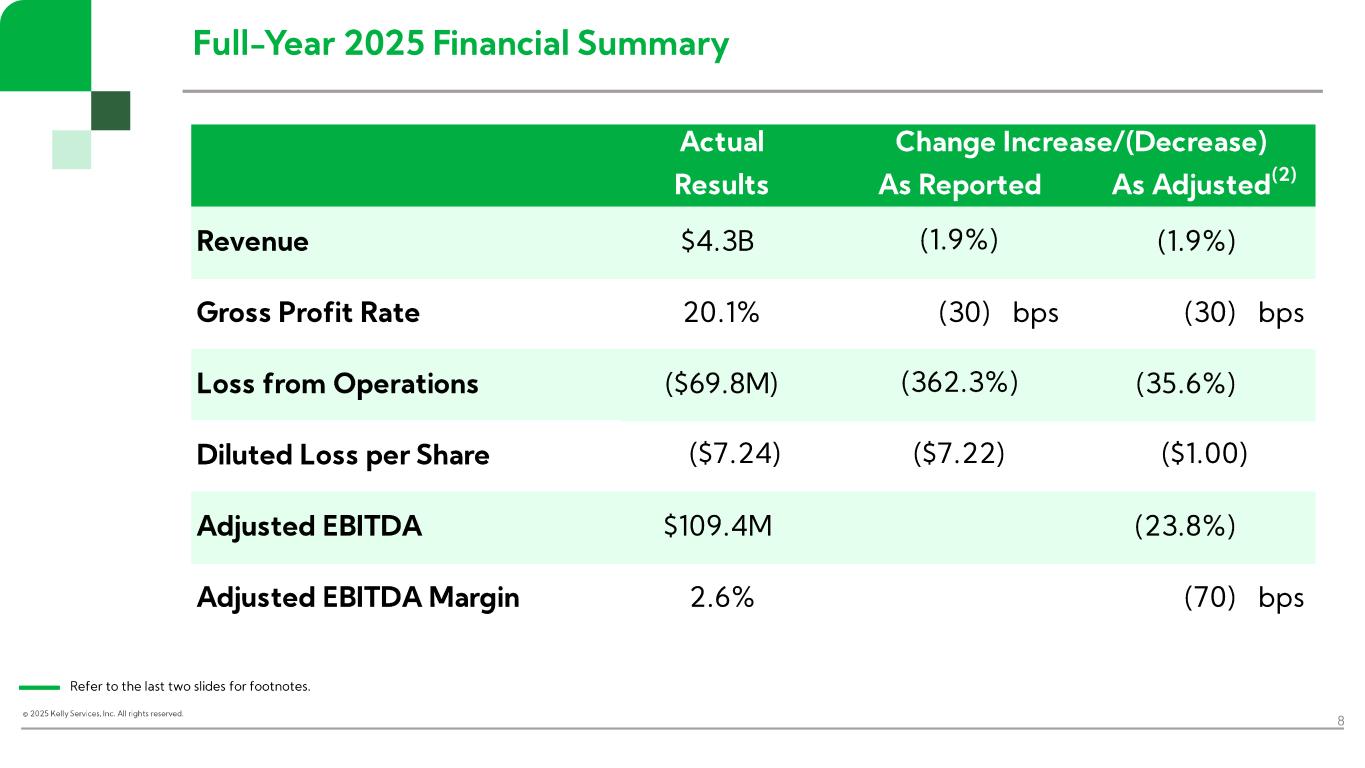

© 2025 Kelly Services, Inc. All rights reserved. Full - Year 2025 Financial Summary 8 Refer to the last two slides for footnotes. Actual Results Revenue $4.3B (1.9%) Gross Profit Rate 20.1% (30) bps (30) bps Loss from Operations ($69.8M) (35.6%) Diluted Loss per Share Adjusted EBITDA $109.4M (23.8%) Adjusted EBITDA Margin 2.6% (70) bps (362.3%) Change Increase/(Decrease) As Reported As Adjusted (2) (1.9%) ($7.24) ($7.22) ($1.00)

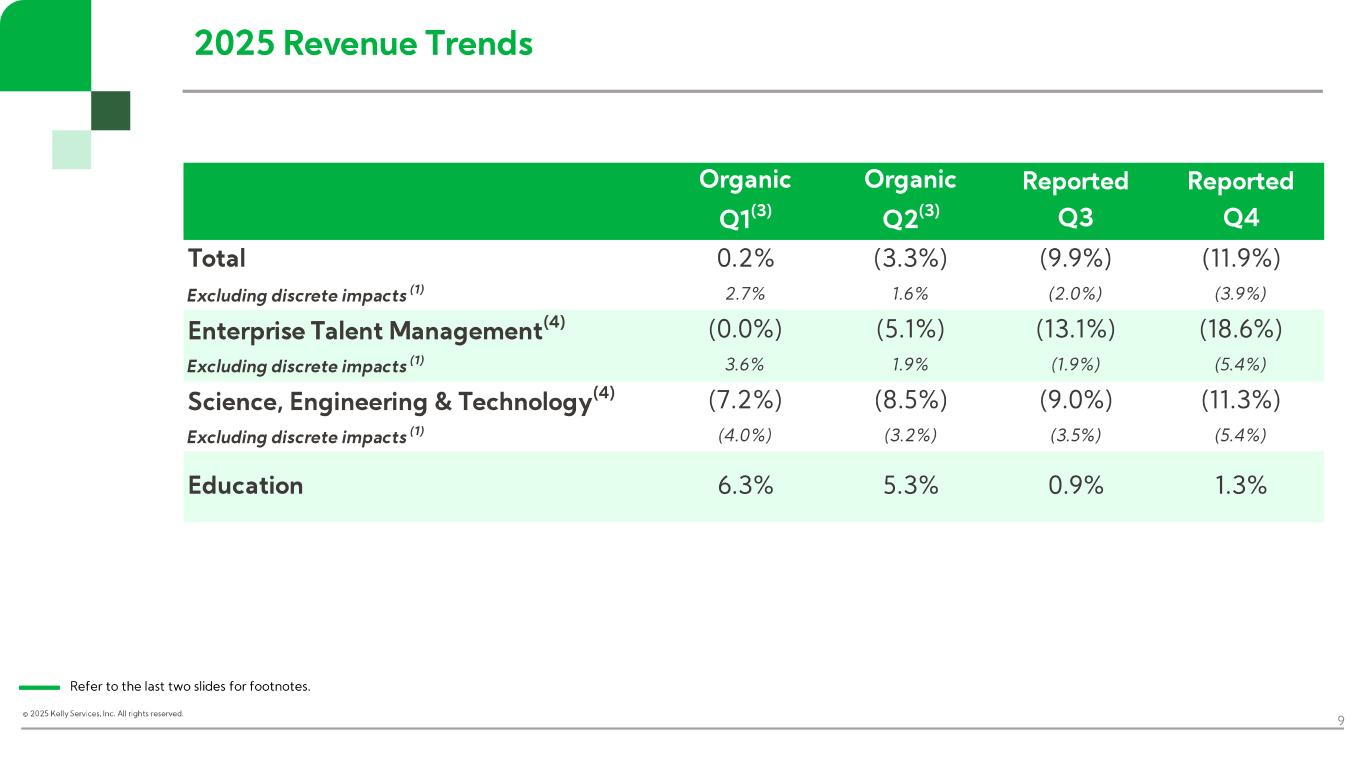

© 2025 Kelly Services, Inc. All rights reserved. 2025 Revenue Trends 9 Refer to the last two slides for footnotes. Organic Q1 (3) Organic Q2 (3) Reported Q3 Reported Q4 Total 0.2% (3.3%) (9.9%) (11.9%) Excluding discrete impacts (1) 2.7% 1.6% (2.0%) (3.9%) Enterprise Talent Management (4) (0.0%) (5.1%) (13.1%) (18.6%) Excluding discrete impacts (1) 3.6% 1.9% (1.9%) (5.4%) Science, Engineering & Technology (4) (7.2%) (8.5%) (9.0%) (11.3%) Excluding discrete impacts (1) (4.0%) (3.2%) (3.5%) (5.4%) Education 6.3% 5.3% 0.9% 1.3%

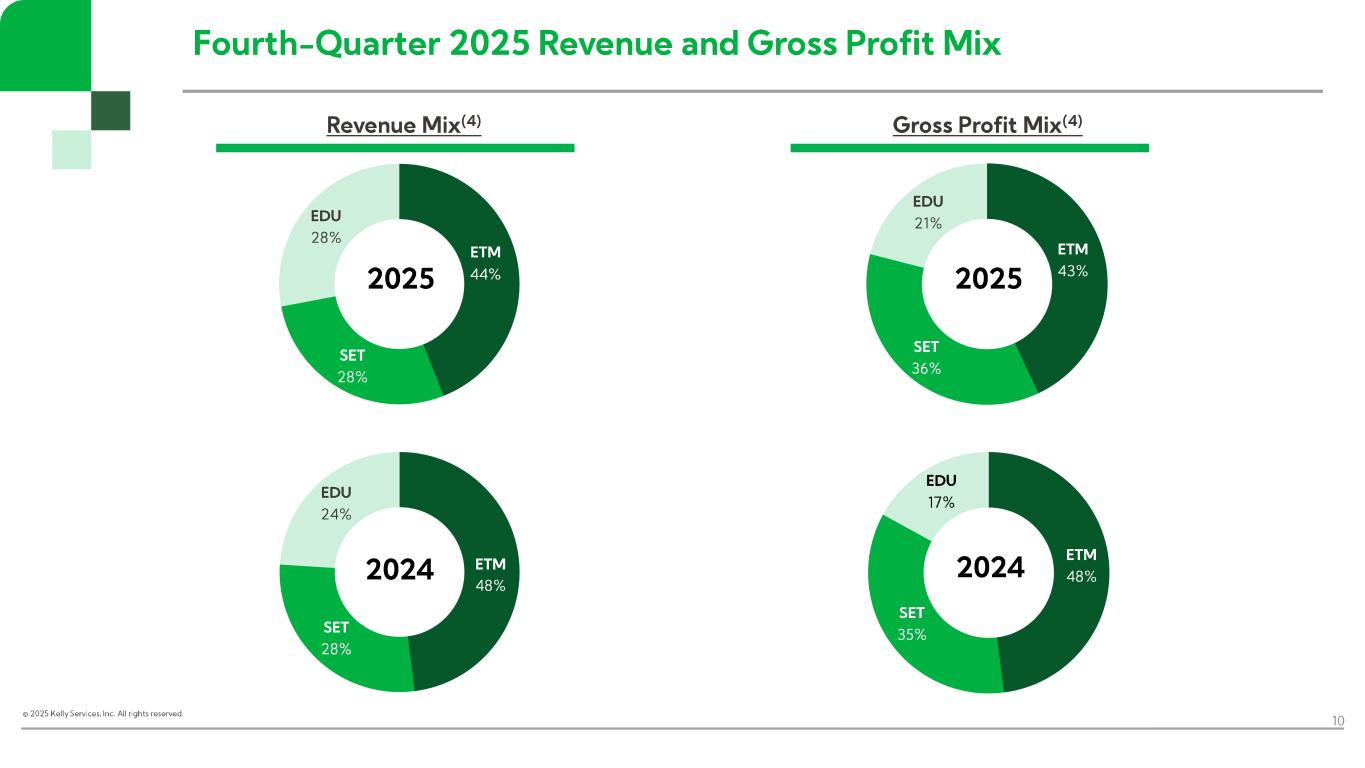

© 2025 Kelly Services, Inc. All rights reserved. ETM 48% SET 35% EDU 17% 2024 ETM 43% SET 36% EDU 21% 2025 ETM 48% SET 28% EDU 24% 2024 ETM 44% SET 28% EDU 28% 2025 Fourth - Quarter 2025 Revenue and Gross Profit Mix 10 Gross Profit Mix (4)Revenue Mix (4)

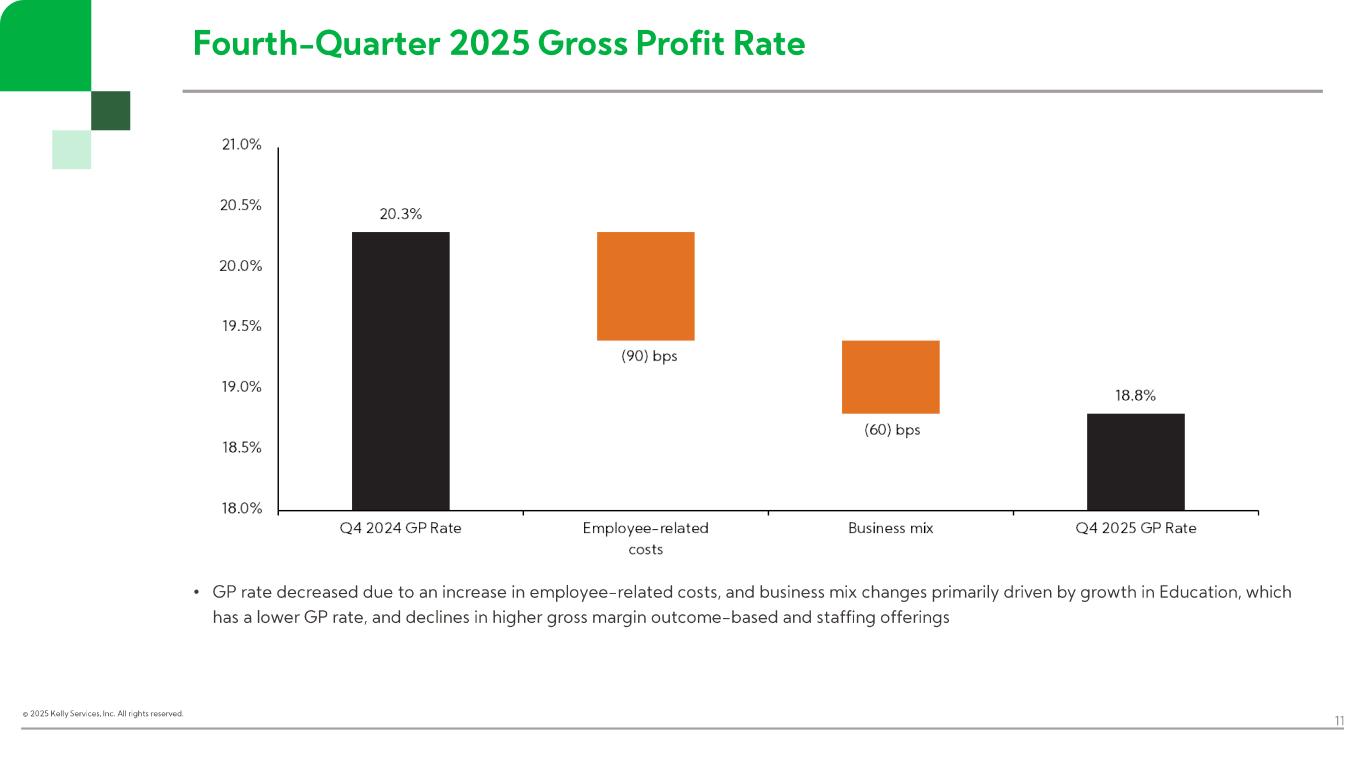

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 Gross Profit Rate 11 • GP rate decreased due to an increase in employee - related costs, and business mix changes primarily driven by growth in Education , which has a lower GP rate, and declines in higher gross margin outcome - based and staffing offerings

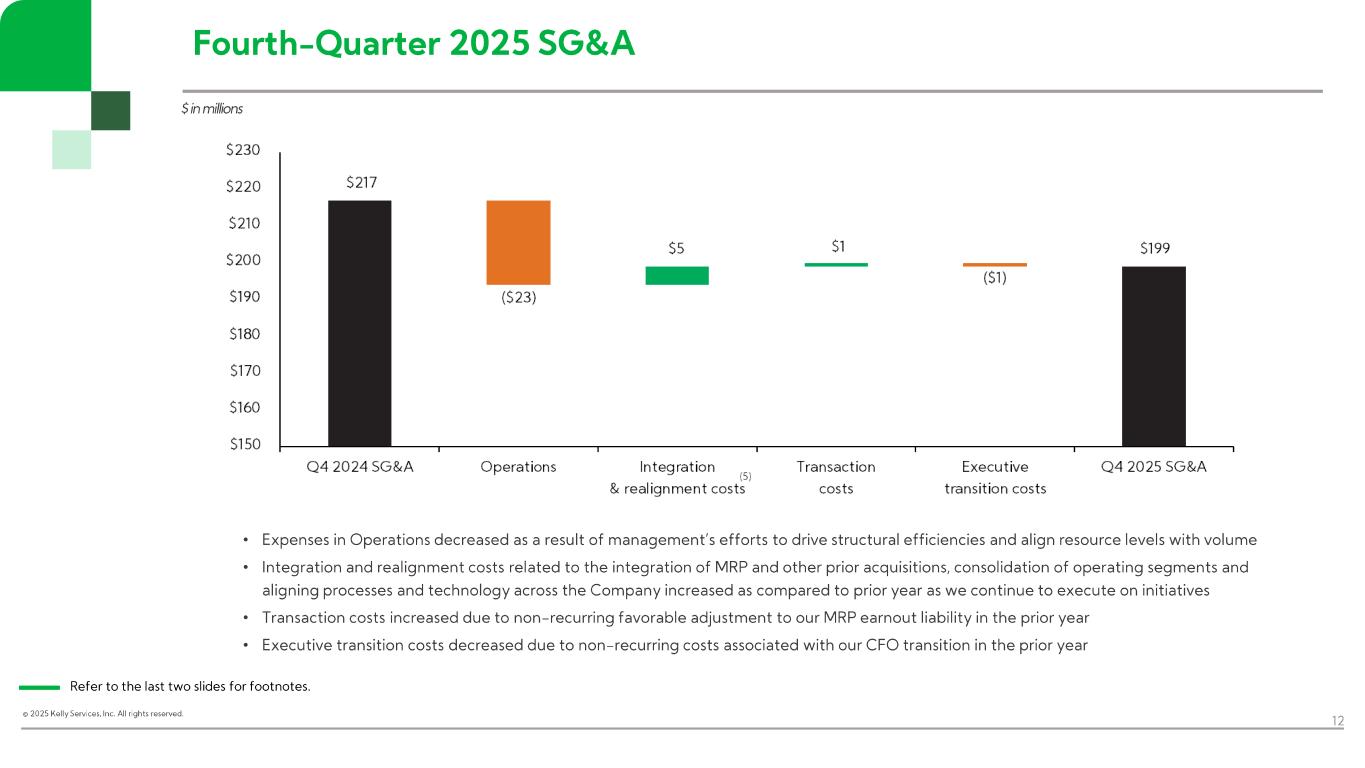

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 SG&A 12 • Expenses in Operations decreased as a result of management’s efforts to drive structural efficiencies and align resource leve ls with volume • Integration and realignment costs related to the integration of MRP and other prior acquisitions, consolidation of operating seg ments and aligning processes and technology across the Company increased as compared to prior year as we continue to execute on initiat ive s • Transaction costs increased due to non - recurring favorable adjustment to our MRP earnout liability in the prior year • Executive transition costs decreased due to non - recurring costs associated with our CFO transition in the prior year $ in millions Refer to the last two slides for footnotes.

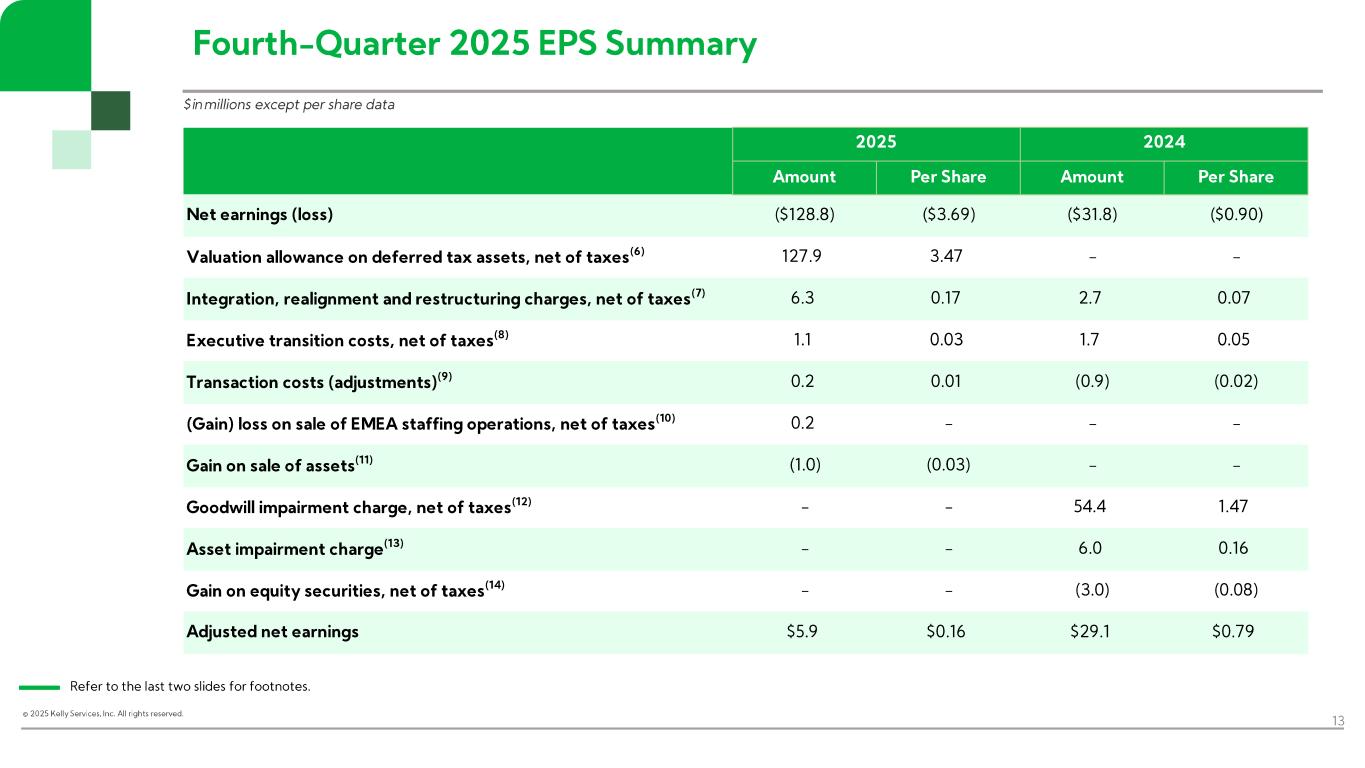

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 EPS Summary 13 Refer to the last two slides for footnotes. $ in millions except per share data Amount Per Share Amount Per Share Net earnings (loss) ($128.8) ($3.69) ($31.8) ($0.90) Valuation allowance on deferred tax assets, net of taxes (6) 127.9 3.47 - - Integration, realignment and restructuring charges, net of taxes (7) 6.3 0.17 2.7 0.07 Executive transition costs, net of taxes (8) 1.1 0.03 1.7 0.05 Transaction costs (adjustments) (9) 0.2 0.01 (0.9) (0.02) (Gain) loss on sale of EMEA staffing operations, net of taxes (10) 0.2 - - - Gain on sale of assets (11) (1.0) (0.03) - - Goodwill impairment charge, net of taxes (12) - - 54.4 1.47 Asset impairment charge (13) - - 6.0 0.16 Gain on equity securities, net of taxes (14) - - (3.0) (0.08) Adjusted net earnings $5.9 $0.16 $29.1 $0.79 2025 2024

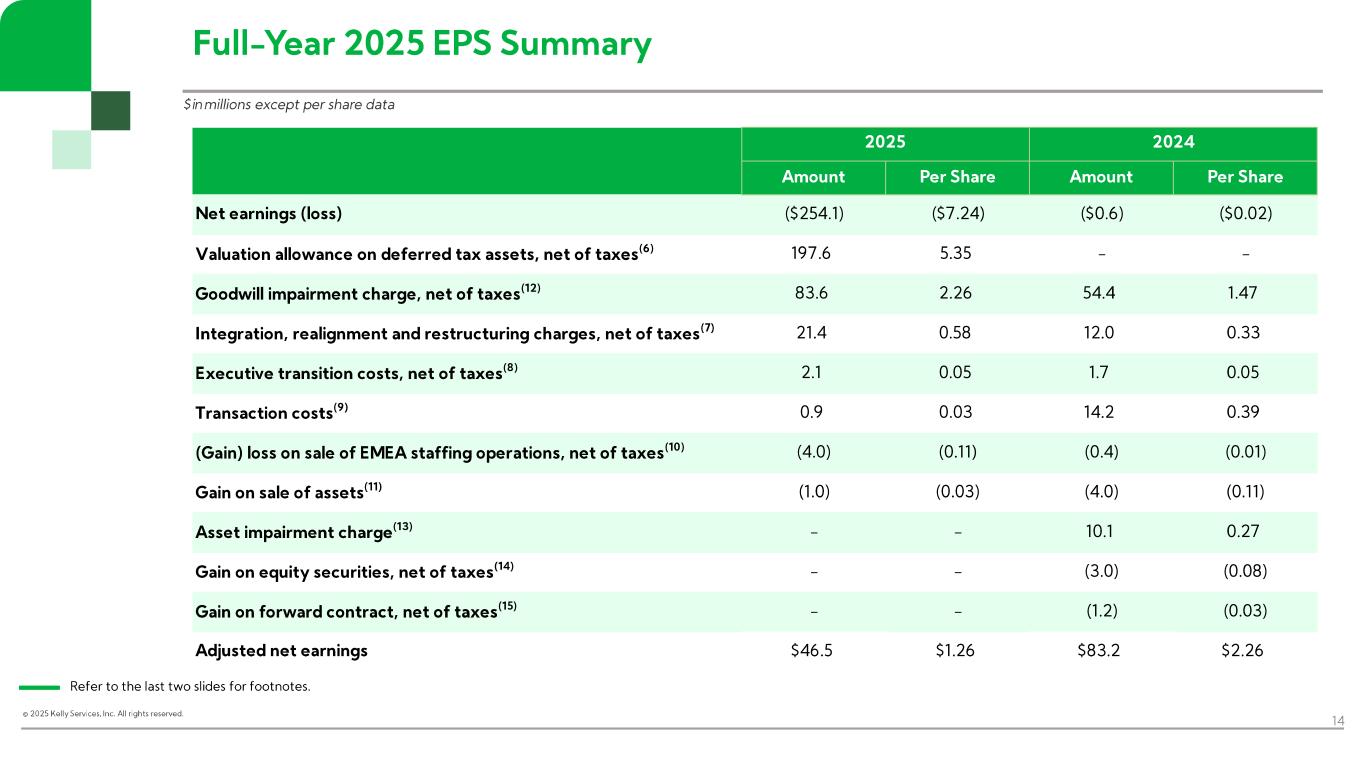

© 2025 Kelly Services, Inc. All rights reserved. Full - Year 2025 EPS Summary 14 Refer to the last two slides for footnotes. $ in millions except per share data Amount Per Share Amount Per Share Net earnings (loss) ($254.1) ($7.24) ($0.6) ($0.02) Valuation allowance on deferred tax assets, net of taxes (6) 197.6 5.35 - - Goodwill impairment charge, net of taxes (12) 83.6 2.26 54.4 1.47 Integration, realignment and restructuring charges, net of taxes (7) 21.4 0.58 12.0 0.33 Executive transition costs, net of taxes (8) 2.1 0.05 1.7 0.05 Transaction costs (9) 0.9 0.03 14.2 0.39 (Gain) loss on sale of EMEA staffing operations, net of taxes (10) (4.0) (0.11) (0.4) (0.01) Gain on sale of assets (11) (1.0) (0.03) (4.0) (0.11) Asset impairment charge (13) - - 10.1 0.27 Gain on equity securities, net of taxes (14) - - (3.0) (0.08) Gain on forward contract, net of taxes (15) - - (1.2) (0.03) Adjusted net earnings $46.5 $1.26 $83.2 $2.26 2025 2024

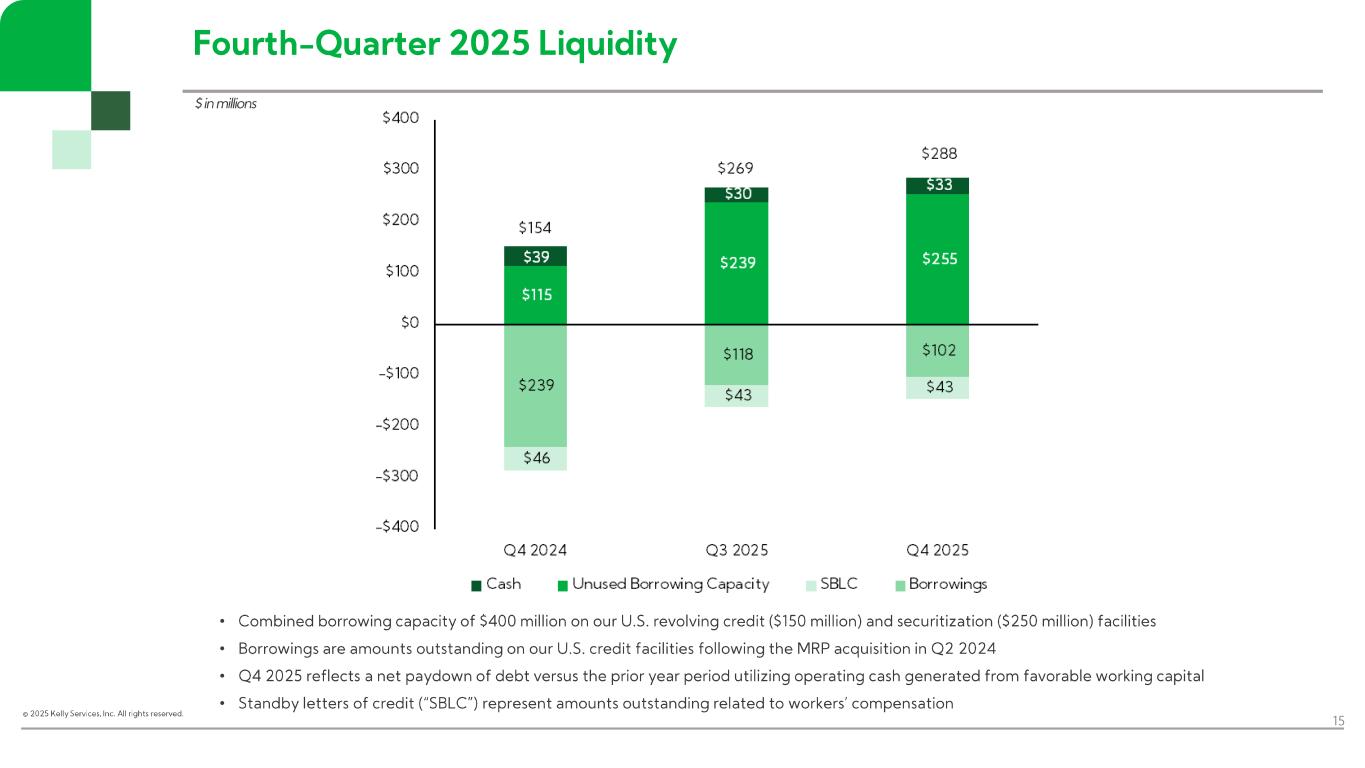

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 Liquidity 15 $ in millions • Combined borrowing capacity of $400 million on our U.S. revolving credit ($150 million) and securitization ($250 million) fac ilities • Borrowings are amounts outstanding on our U.S. credit facilities following the MRP acquisition in Q2 2024 • Q4 2025 reflects a net paydown of debt versus the prior year period utilizing operating cash generated from favorable working ca pital • Standby letters of credit (“SBLC”) represent amounts outstanding related to workers’ compensation

© 2025 Kelly Services, Inc. All rights reserved. 2026 Outlook 16 Our 2026 Outlook assumes no material change in the macroeconomic or industry dynamics relative to current trends. Through our ongoing focus on growth and efficiency, we are well prepared to navigate the evolving macroeconomic environment and capitalize when demand rebounds. First Quarter of 2026 – Consistent with Fourth Quarter of 2025 • Revenue – expect total Company year - over - year revenue decline of 11% to 13%, or 3% to 5% on an underlying basis excluding discrete customer impacts • Adjusted EBITDA margin – expect approximately 1.5%, which includes the impact of annual payroll tax resets. Remainder of Year – Assuming no new material impacts, expect relative improvement in year - over - year performance each successive quarter for both revenue and adjusted EBITDA margin resulting in modest year - over - year revenue growth and measurable adjusted EBITDA margin expansion in the second half of the year.

© 2025 Kelly Services, Inc. All rights reserved. 17 Appendix

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 Footnotes 18 1) Reflects the combined negative discrete impacts from reduced demand for U.S. federal government contractors in Science, Engin eer ing & Technology ("SET") and Enterprise Talent Management ("ETM") and from three large private sector customers in ETM; 2) See Reconciliation of Non - GAAP Measures included in Form 8 - K dated February 12, 2026; 3) Organic excludes the 2025 results of MRP, which was acquired as of May 31, 2024 and was included in the reported results of o per ations in SET, from the date of acquisition and a portion in ETM starting in 2025, and the 2025 results of Children's Therapy Center ("CTC"), which was acqui red as of November 13, 2024 and was included in the reported results of operations in Education, from the date of acquisition; 4) The Company combined its former P&I and OCG segments into the ETM segment in Q1 2025. The Company also realigned certain cust ome rs as well as MRP's Sevenstep business from the SET segment to the ETM segment to support our integrated strategy and the broader integration of MRP. The 2 02 4 ETM and SET segment information has been recast to conform to the new structure; 5) Integration and realignment costs in Q4 2025 reflect various initiatives aimed at integrating MRP and other prior acquisition s, consolidating operating segments and further aligning processes and technology across the Company, and include severance of $3.6 million, IT - related charges of $2.4 million and fees and other costs of $2.4 million; 6) Valuation allowance on deferred tax assets of $127.9 million or $3.47 per share in Q4 2025 and $197.6 million or $5.35 per sh are in 2025 was established against a portion of our work opportunity credit carryforwards due to cumulative losses in recent years; 7) Integration, realignment and restructuring charges of $8.4 million, $6.3 million net of tax or $0.17 per share in Q4 2025 and $2 8.7 million, $21.4 million net of tax or $0.58 per share in 2025 as compared to $3.6 million, $2.7 million net of tax or $0.07 per share in Q4 2024 and $16.1 million, $12.0 million net of tax or $0.33 per share in 2024 reflect various initiatives aimed at integrating Motion Recruitment Partners ("MRP") and other prior acquisitions, co nso lidating operating segments, and further aligning processes and technology across the Company. Included in total integration and realignment costs is $0.4 mil lion and $0.9 million of accelerated amortization within depreciation and amortization for Q4 2025 and 2025, respectively. In 2024, $6.1 million of severance and tra nsformation costs related to a continuation of the comprehensive transformation initiative that started in Q2 2023 to further streamline the Company's opera tin g model to enhance organizational efficiency and effectiveness and $10.0 million of integration and realignment costs related to various initiat ive s aimed at integrating MRP and other prior acquisitions, consolidating operating segments, and further aligning processes and technology across the Company; 8) Executive transition costs of $1.4 million, $1.1 million net of tax or $0.03 per share in Q4 2025 and $2.7 million, $2.1 mill ion net of tax or $0.05 per share in 2025 related to non - recurring expenses associated with our CEO transition in Q3 2025. Executive transition costs of $2.3 million, $1. 7 million net of tax or $0.05 per share in Q4 2024 and 2024 related to non - recurring expenses associated with our CFO transition in Q4 2024;

© 2025 Kelly Services, Inc. All rights reserved. Fourth - Quarter 2025 Footnotes (continued) 19 9) Transaction costs of $0.3 million, $0.2 million net of tax or $0.01 per share in Q4 2025 and $1.2 million, $0.9 million net o f t ax or $0.03 per share in 2025 primarily related to costs incurred directly related to the sale of the EMEA staffing operations, which includes employee termination c ost s and transition costs, and other projects. Transaction adjustments of $0.3 million, $0.9 million net of tax or $0.02 per share in Q4 2024 was made - up of the foll owing: $2.7 million gain related to the $3.4 million write - off of the MRP earnout liability, net of transaction costs of $0.7 million related to the acquisition of MRP and CTC; $0.7 million favorable adjustment to the indemnification related to our former Brazil operations, partially offset by $3.1 million of empl oye e termination and transition costs directly related to the sale of the EMEA staffing operations in Q4 2024. Transaction costs of $17.9 million, $14.2 million ne t o f tax or $0.39 per share in 2024 for employee termination costs and transition costs directly related to the sale of the EMEA staffing operations of $12.0 million an d transaction costs related to the acquisitions of MRP and CTC of $6.6 million, which is net of the $3.4 million earnout liability write - off, partially offset by a n adjustment to the indemnification related to our former Brazil operations of $0.7 million; 10) Loss on sale of EMEA staffing operations of $0.2 million, $0.2 million net of tax or $0.00 per share in Q4 2025 and gain on s ale of EMEA staffing operations $4.1 million, $4.0 million net of tax or $0.11 per share in 2025. Gain on sale of EMEA staffing operations of $1.6 million, $0.4 m illion net of tax or $0.01 per share in 2024. The gains and losses in each period are a result of the sale in January 2024, and includes adjustments to the indemnifi cat ion related to the sale; 11) Gain on sale of assets of $1.0 million, $1.0 million net of tax or $0.03 per share in Q4 2025 and 2025 represents the sale of a property in Q4 2025. Gain on sale of assets of $5.4 million, $4.0 million net of tax or $0.11 per share in 2024 represents the sale of Ayers Group in Q2 2024; 12) Goodwill impairment charge of $102.0 million, $83.6 million net of tax or $2.26 per share in 2025 related to reduced demand, int egration of the MRP and Softworld acquisitions and realignment of reporting units in the SET segment. Goodwill impairment charge of $72.8 million, $5 4.4 million net of tax or $1.47 per share in Q4 2024 and 2024 related to changes in market conditions and the result of the Company's annual impairment test rela ted to Softworld; 13) Asset impairment charge of $8.0 million, $6.0 million net of tax or $0.16 per share in Q4 2024 and $13.5 million, $10.1 milli on net of tax or $0.27 per share in 2024 for certain right - of - use assets related to our leased headquarters facility reflects adjustments to how we are utilizing the bui lding as part of our ongoing transformation efforts; 14) Gain on equity securities of $3.8 million, $3.0 million net of tax or $0.08 per share in Q4 2024 and 2024, includes a $0.6 mi llion realized gain from the partial sale of our securities and a $3.2 million unrealized gain from the mark - to - market adjustment on our remaining shares; 15) Gain on forward contract of $1.2 million, $1.2 million net of tax or $0.03 per share in 2024 represents the settlement of the fo reign currency forward contact in January 2024 related to the sale of our EMEA staffing operations.