FOURTH QUARTER FY2025 EARNINGS NOVEMBER 26, 2025

2 SAFE HARBOR The information provided in this presentation may include forward-looking statements relating to future events or the future financial performance of the Company. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “aims”, “anticipates,” “plans,” “expects,” “intends,” “will,” “potential,” “hope” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon current expectations of the Company and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties. Detailed information regarding factors that may cause actual results to differ materially from the results expressed or implied by statements relating to the Company may be found in the Company’s periodic filings with the Commission, including the factors described in the sections entitled “Risk Factors,” copies of which may be obtained from the SEC’s website at www.sec.gov. The Company does not undertake any obligation to update forward-looking statements contained in this presentation.

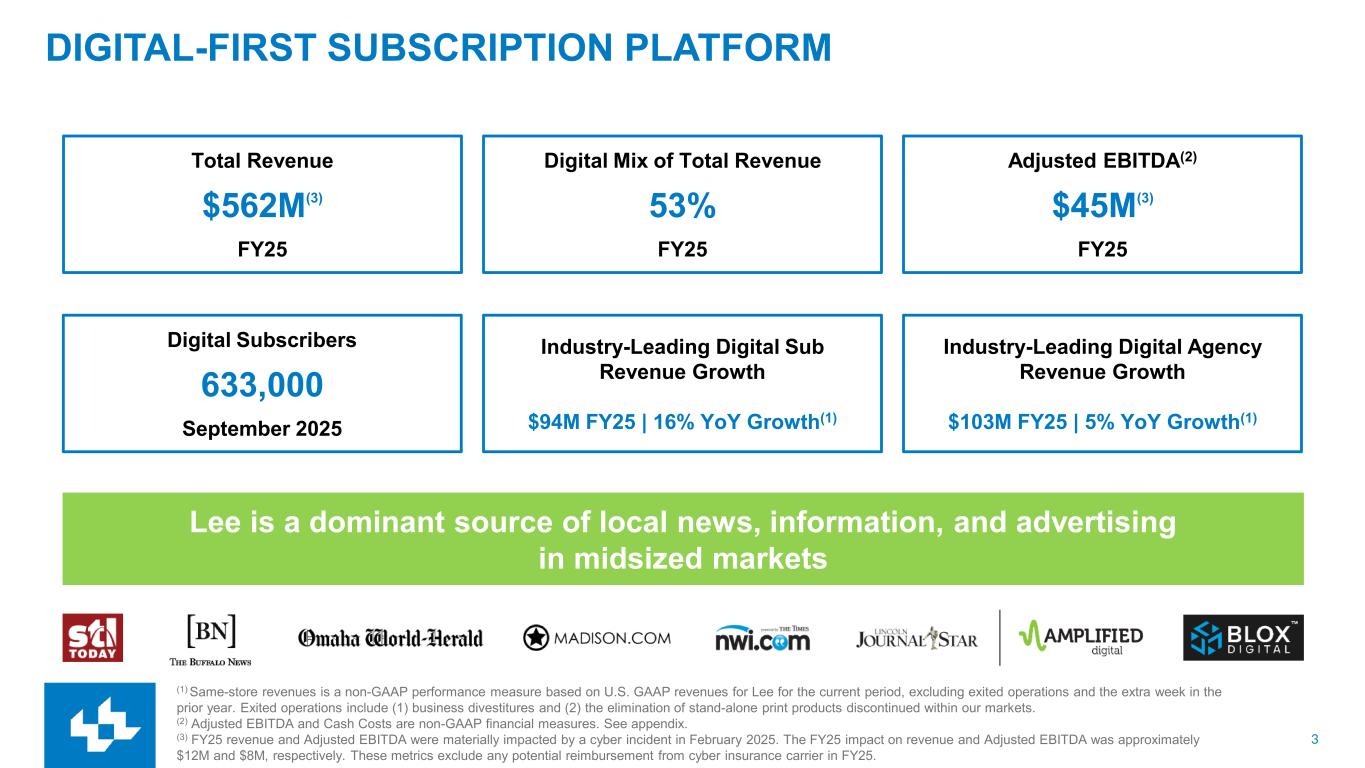

3 DIGITAL-FIRST SUBSCRIPTION PLATFORM Total Revenue $562M(3) FY25 Digital Mix of Total Revenue 53% FY25 Adjusted EBITDA(2) $45M(3) FY25 Digital Subscribers 633,000 September 2025 Industry-Leading Digital Sub Revenue Growth $94M FY25 | 16% YoY Growth(1) Lee is a dominant source of local news, information, and advertising in midsized markets Industry-Leading Digital Agency Revenue Growth $103M FY25 | 5% YoY Growth(1) (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations and the extra week in the prior year. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. (2) Adjusted EBITDA and Cash Costs are non-GAAP financial measures. See appendix. (3) FY25 revenue and Adjusted EBITDA were materially impacted by a cyber incident in February 2025. The FY25 impact on revenue and Adjusted EBITDA was approximately $12M and $8M, respectively. These metrics exclude any potential reimbursement from cyber insurance carrier in FY25.

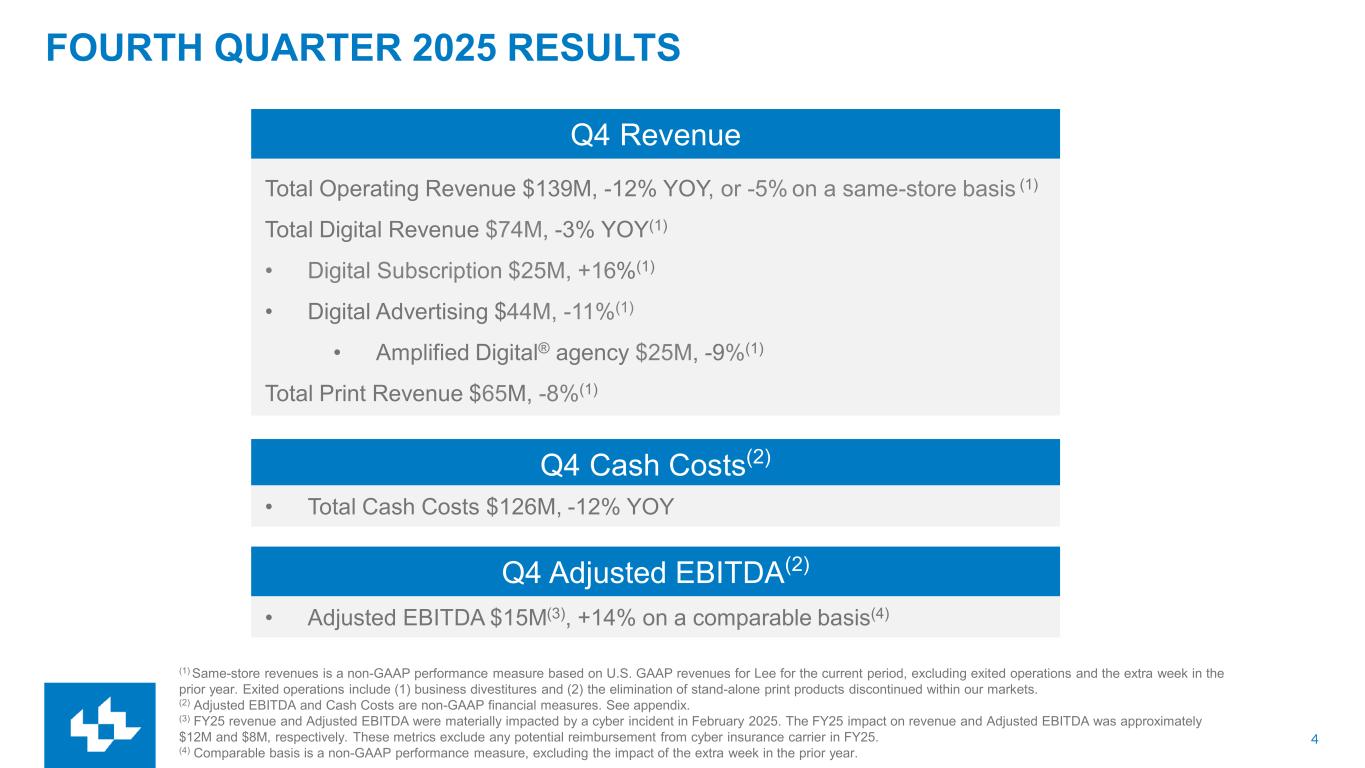

4 FOURTH QUARTER 2025 RESULTS (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations and the extra week in the prior year. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. (2) Adjusted EBITDA and Cash Costs are non-GAAP financial measures. See appendix. (3) FY25 revenue and Adjusted EBITDA were materially impacted by a cyber incident in February 2025. The FY25 impact on revenue and Adjusted EBITDA was approximately $12M and $8M, respectively. These metrics exclude any potential reimbursement from cyber insurance carrier in FY25. (4) Comparable basis is a non-GAAP performance measure, excluding the impact of the extra week in the prior year. Q4 Revenue Total Operating Revenue $139M, -12% YOY, or -5% on a same-store basis (1) Total Digital Revenue $74M, -3% YOY(1) • Digital Subscription $25M, +16%(1) • Digital Advertising $44M, -11%(1) • Amplified Digital® agency $25M, -9%(1) Total Print Revenue $65M, -8%(1) Q4 Cash Costs(2) • Total Cash Costs $126M, -12% YOY Q4 Adjusted EBITDA(2) • Adjusted EBITDA $15M(3), +14% on a comparable basis(4)

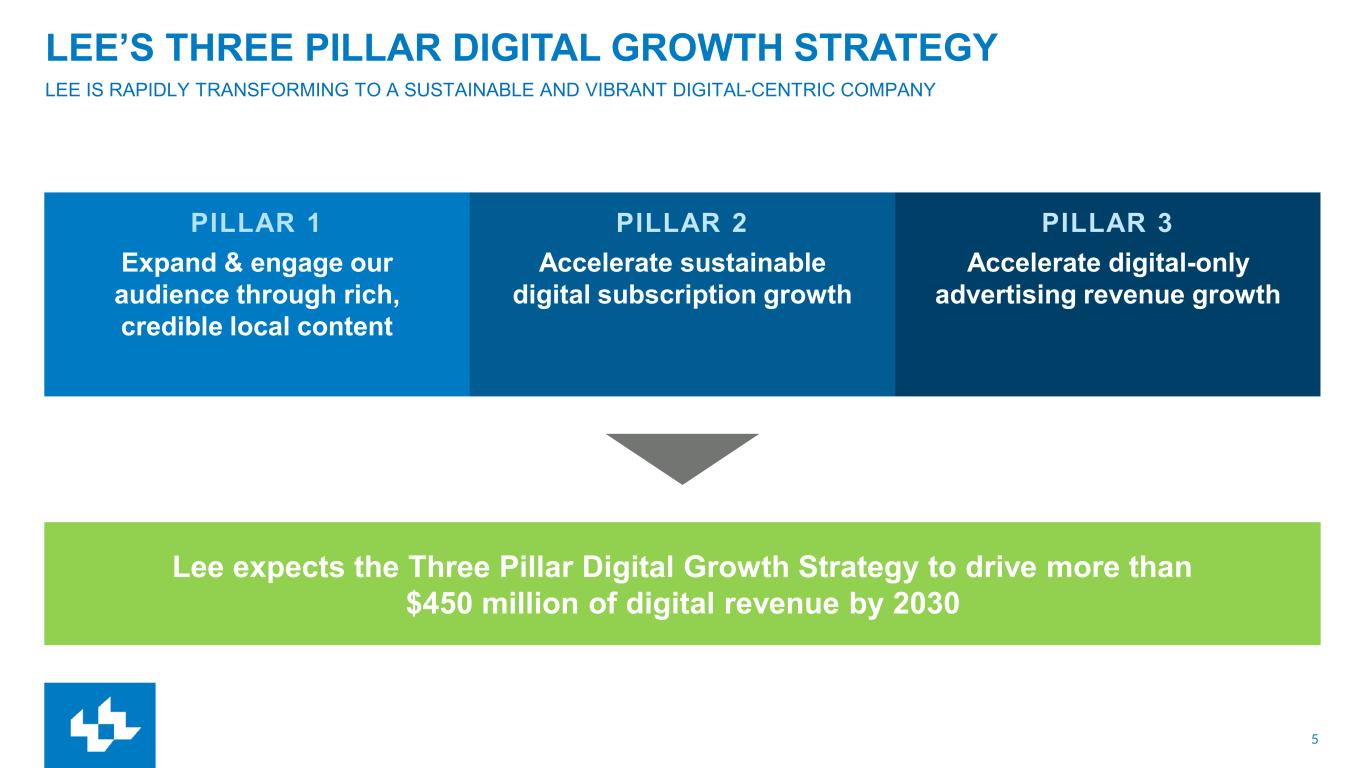

5 LEE’S THREE PILLAR DIGITAL GROWTH STRATEGY LEE IS RAPIDLY TRANSFORMING TO A SUSTAINABLE AND VIBRANT DIGITAL-CENTRIC COMPANY PILLAR 1 Expand & engage our audience through rich, credible local content PILLAR 2 Accelerate sustainable digital subscription growth PILLAR 3 Accelerate digital-only advertising revenue growth Lee expects the Three Pillar Digital Growth Strategy to drive more than $450 million of digital revenue by 2030

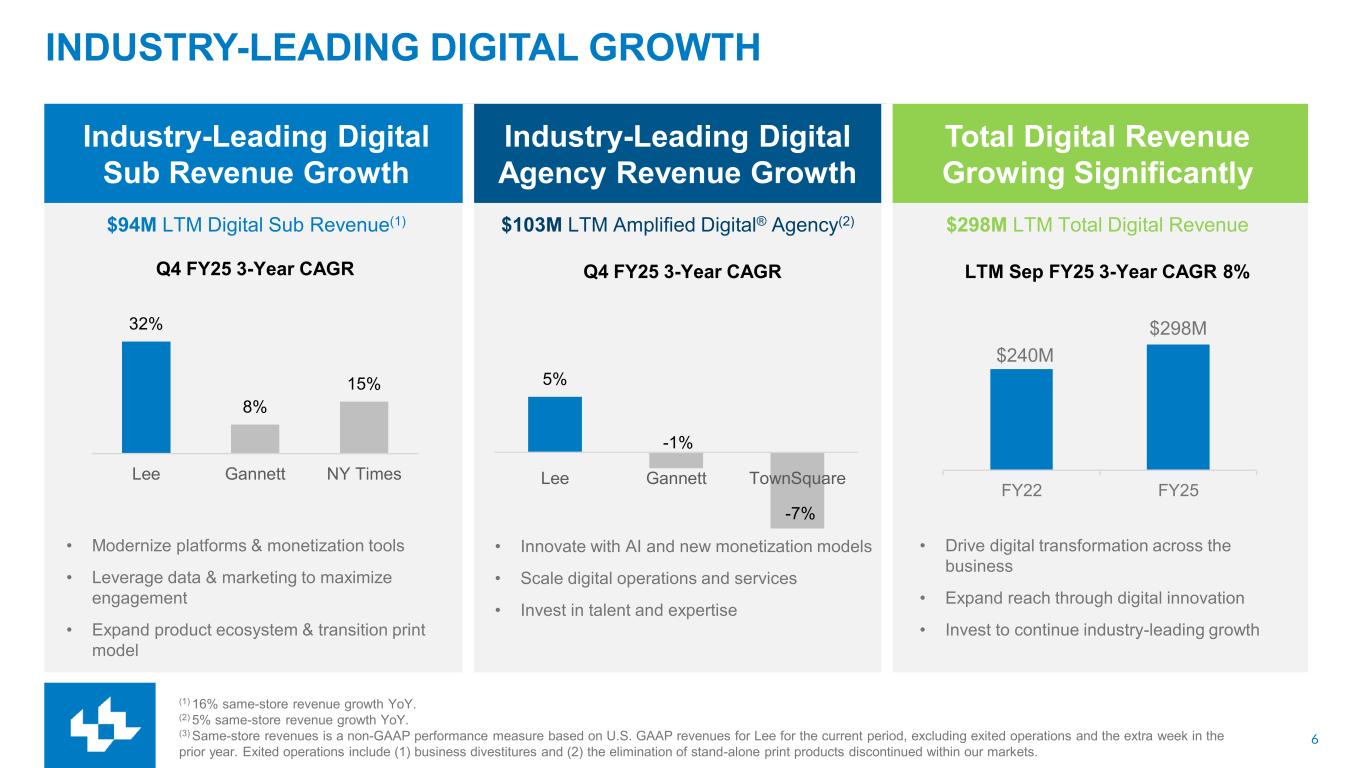

6 Industry-Leading Digital Sub Revenue Growth Industry-Leading Digital Agency Revenue Growth Total Digital Revenue Growing Significantly $94M LTM Digital Sub Revenue(1) $103M LTM Amplified Digital® Agency(2) $298M LTM Total Digital Revenue INDUSTRY-LEADING DIGITAL GROWTH (1) 16% same-store revenue growth YoY. (2) 5% same-store revenue growth YoY. (3) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations and the extra week in the prior year. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. Q4 FY25 3-Year CAGR Q4 FY25 3-Year CAGR LTM Sep FY25 3-Year CAGR 8% • Modernize platforms & monetization tools • Leverage data & marketing to maximize engagement • Expand product ecosystem & transition print model • Innovate with AI and new monetization models • Scale digital operations and services • Invest in talent and expertise • Drive digital transformation across the business • Expand reach through digital innovation • Invest to continue industry-leading growth FY22 FY25 $240M $298M32% 8% 15% Lee Gannett NY Times 5% -1% -7% Lee Gannett TownSquare

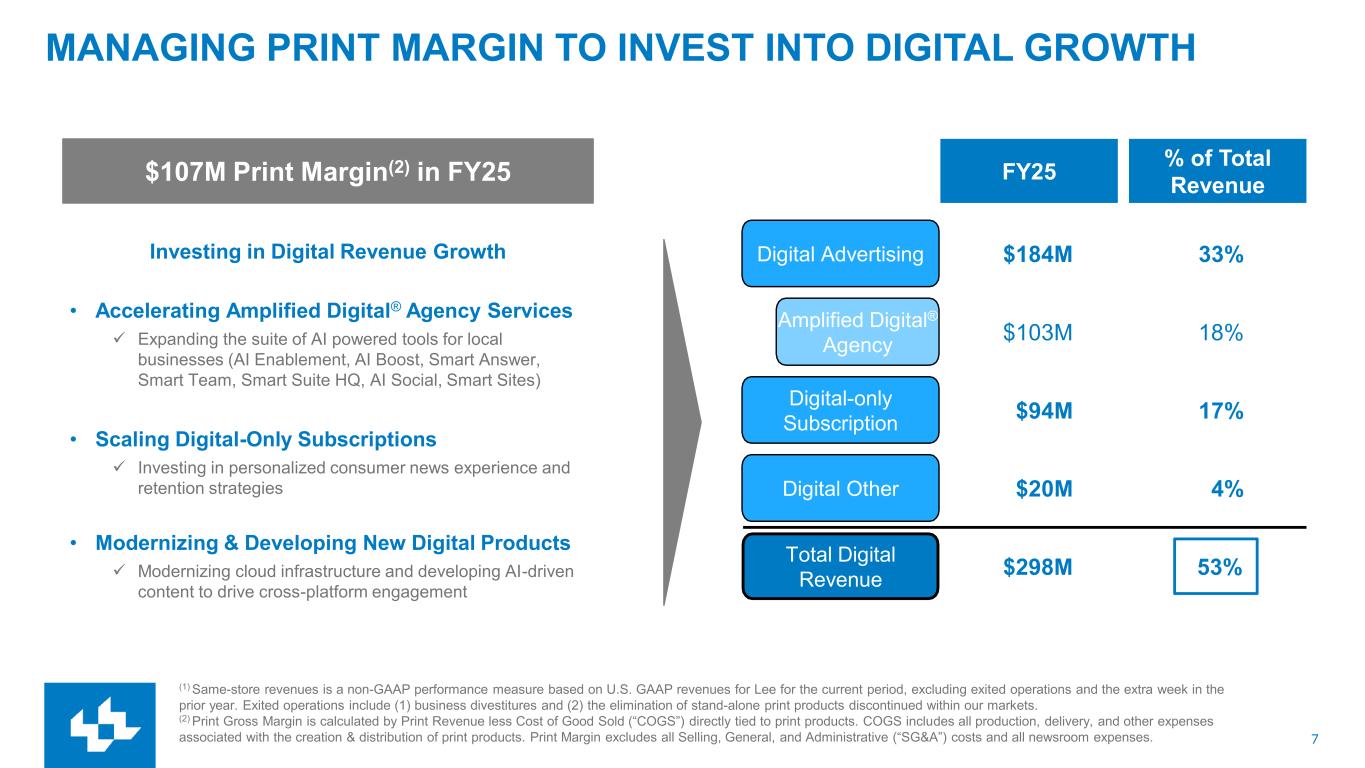

7 MANAGING PRINT MARGIN TO INVEST INTO DIGITAL GROWTH (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations and the extra week in the prior year. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. (2) Print Gross Margin is calculated by Print Revenue less Cost of Good Sold (“COGS”) directly tied to print products. COGS includes all production, delivery, and other expenses associated with the creation & distribution of print products. Print Margin excludes all Selling, General, and Administrative (“SG&A”) costs and all newsroom expenses. Digital Advertising Total Digital Revenue Amplified Digital® Agency Digital Other Digital-only Subscription $94M $103M $184M $20M $298M 17% 18% 33% 4% 53% $107M Print Margin(2) in FY25 • Accelerating Amplified Digital® Agency Services ✓ Expanding the suite of AI powered tools for local businesses (AI Enablement, AI Boost, Smart Answer, Smart Team, Smart Suite HQ, AI Social, Smart Sites) • Scaling Digital-Only Subscriptions ✓ Investing in personalized consumer news experience and retention strategies • Modernizing & Developing New Digital Products ✓ Modernizing cloud infrastructure and developing AI-driven content to drive cross-platform engagement % of Total Revenue FY25 Investing in Digital Revenue Growth

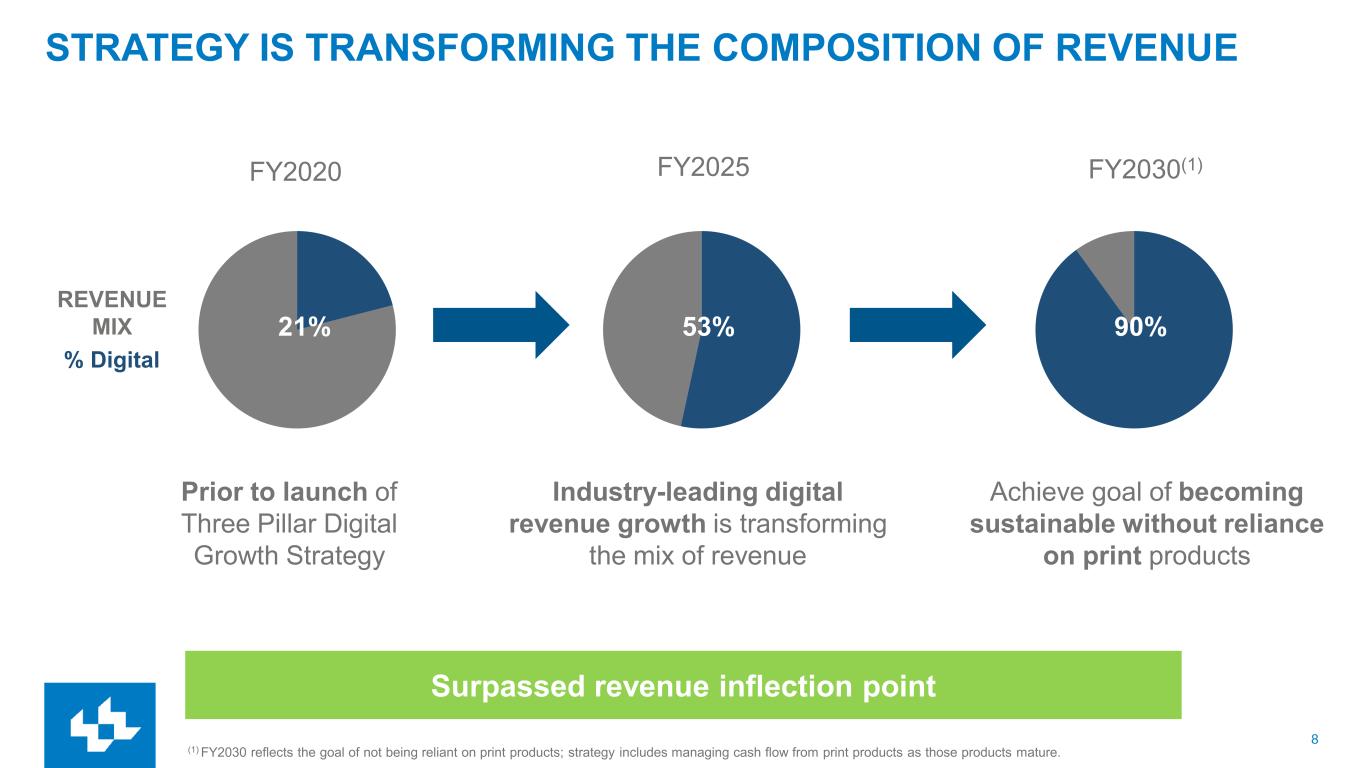

8 STRATEGY IS TRANSFORMING THE COMPOSITION OF REVENUE Prior to launch of Three Pillar Digital Growth Strategy Industry-leading digital revenue growth is transforming the mix of revenue FY2020 REVENUE MIX % Digital 7% 21% 46% FY2025 53% (1) FY2030 reflects the goal of not being reliant on print products; strategy includes managing cash flow from print products as those products mature. FY2030(1) 90% Achieve goal of becoming sustainable without reliance on print products Surpassed revenue inflection point

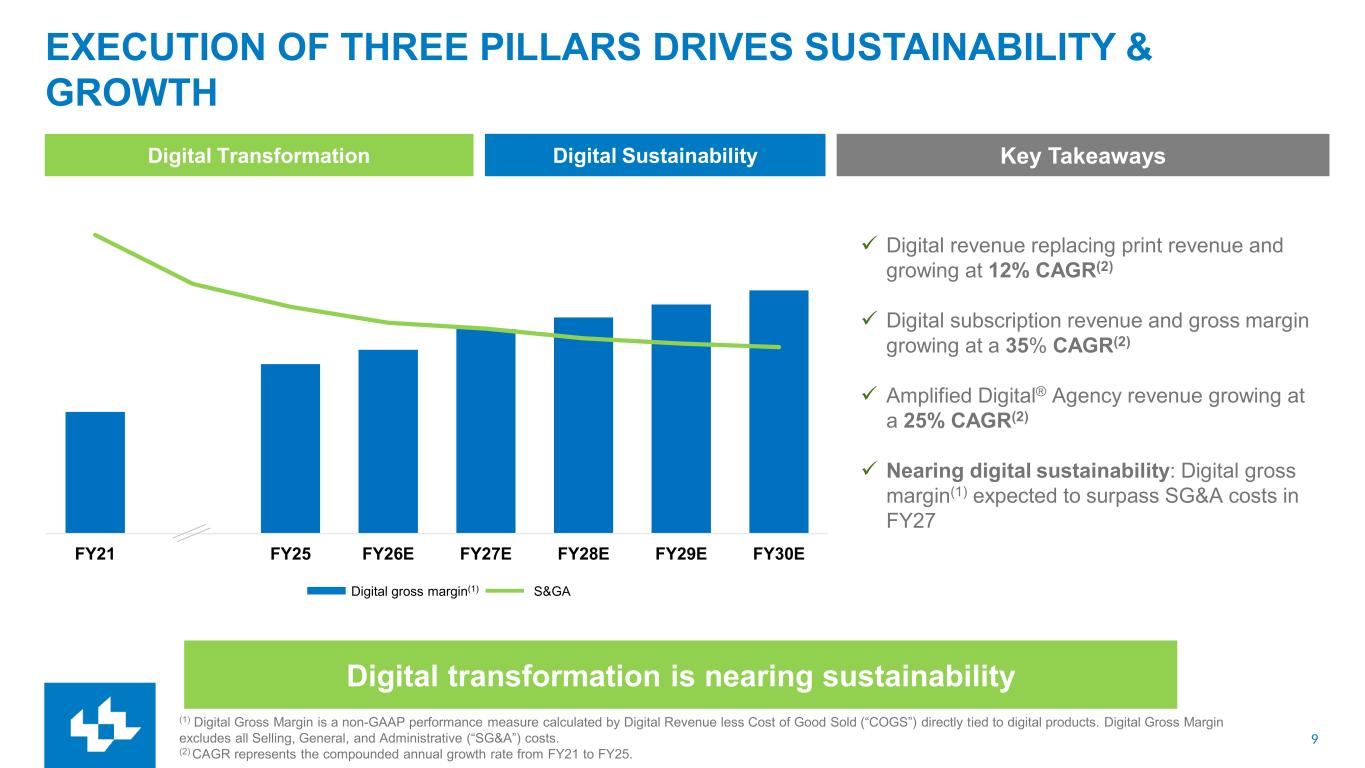

9 FY21 FY25 FY26E FY27E FY28E FY29E FY30E EXECUTION OF THREE PILLARS DRIVES SUSTAINABILITY & GROWTH Digital Transformation Digital Sustainability Digital transformation is nearing sustainability Digital gross margin(1) S&GA Key Takeaways ✓ Digital revenue replacing print revenue and growing at 12% CAGR(2) ✓ Digital subscription revenue and gross margin growing at a 35% CAGR(2) ✓ Amplified Digital® Agency revenue growing at a 25% CAGR(2) ✓ Nearing digital sustainability: Digital gross margin(1) expected to surpass SG&A costs in FY27 (1) Digital Gross Margin is a non-GAAP performance measure calculated by Digital Revenue less Cost of Good Sold (“COGS”) directly tied to digital products. Digital Gross Margin excludes all Selling, General, and Administrative (“SG&A”) costs. (2) CAGR represents the compounded annual growth rate from FY21 to FY25.

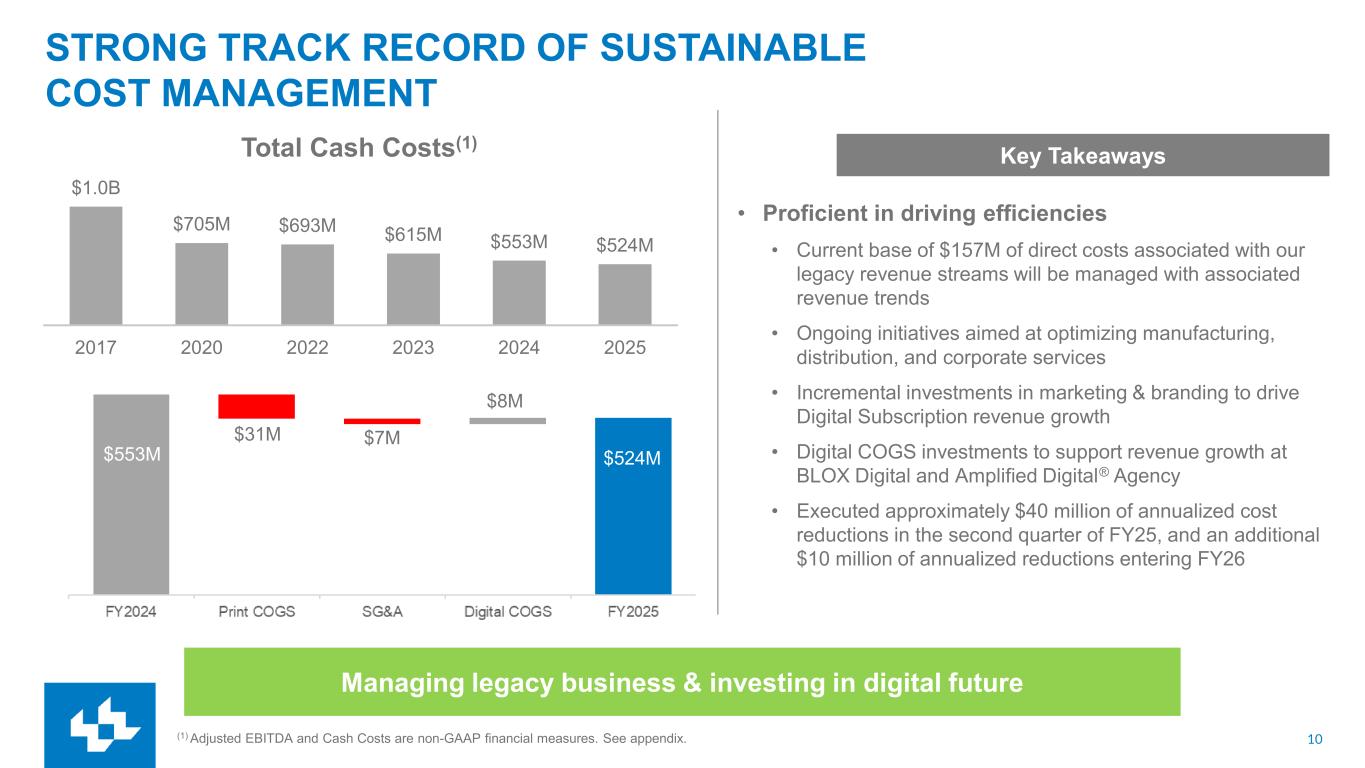

10 STRONG TRACK RECORD OF SUSTAINABLE COST MANAGEMENT • Proficient in driving efficiencies • Current base of $157M of direct costs associated with our legacy revenue streams will be managed with associated revenue trends • Ongoing initiatives aimed at optimizing manufacturing, distribution, and corporate services • Incremental investments in marketing & branding to drive Digital Subscription revenue growth • Digital COGS investments to support revenue growth at BLOX Digital and Amplified Digital® Agency • Executed approximately $40 million of annualized cost reductions in the second quarter of FY25, and an additional $10 million of annualized reductions entering FY26 $1.0B $705M $693M $615M $553M $524M 2017 2020 2022 2023 2024 2025 Total Cash Costs(1) Managing legacy business & investing in digital future (1) Adjusted EBITDA and Cash Costs are non-GAAP financial measures. See appendix. $524M $8M $31M $553M $7M Key Takeaways

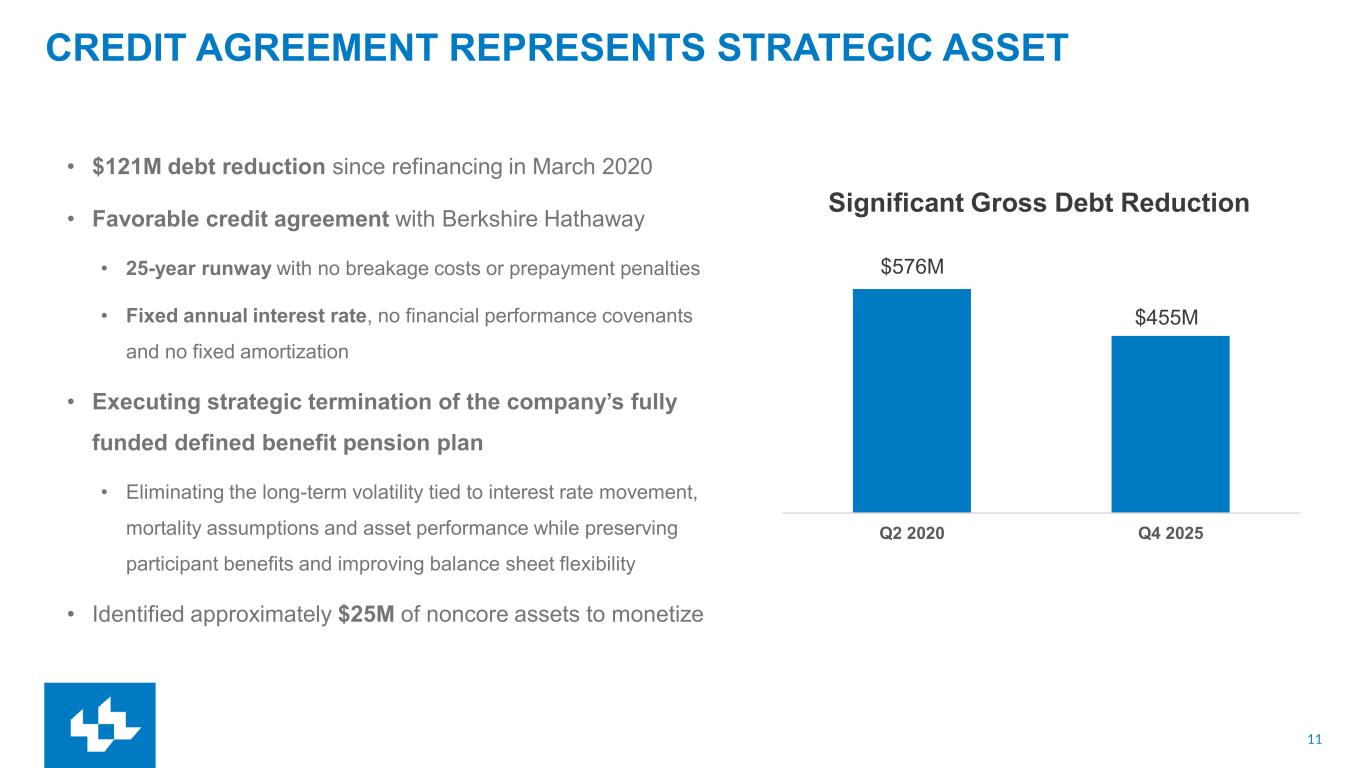

11 Q2 2020 Q4 2025 CREDIT AGREEMENT REPRESENTS STRATEGIC ASSET • $121M debt reduction since refinancing in March 2020 • Favorable credit agreement with Berkshire Hathaway • 25-year runway with no breakage costs or prepayment penalties • Fixed annual interest rate, no financial performance covenants and no fixed amortization • Executing strategic termination of the company’s fully funded defined benefit pension plan • Eliminating the long-term volatility tied to interest rate movement, mortality assumptions and asset performance while preserving participant benefits and improving balance sheet flexibility • Identified approximately $25M of noncore assets to monetize $576M $455M Significant Gross Debt Reduction

12 2026 OUTLOOK (1) Adjusted EBITDA is a non-GAAP financial measure. See appendix. Key Metric FY26 Outlook Adjusted EBITDA(1) YOY growth in the mid-single digits

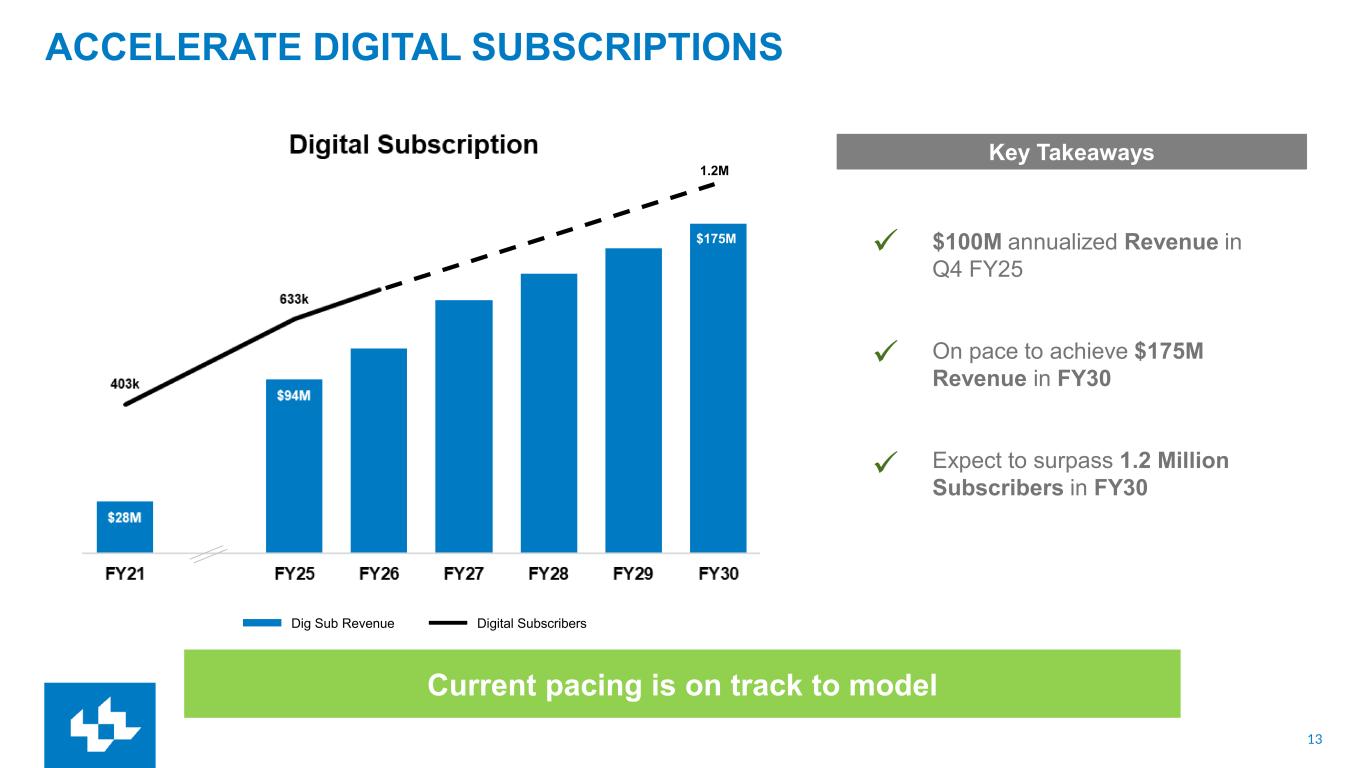

13 ACCELERATE DIGITAL SUBSCRIPTIONS Current pacing is on track to model 1.2M $100M annualized Revenue in Q4 FY25 On pace to achieve $175M Revenue in FY30 Expect to surpass 1.2 Million Subscribers in FY30 ✓ ✓ $175M Key Takeaways Dig Sub Revenue Digital Subscribers $175M ✓

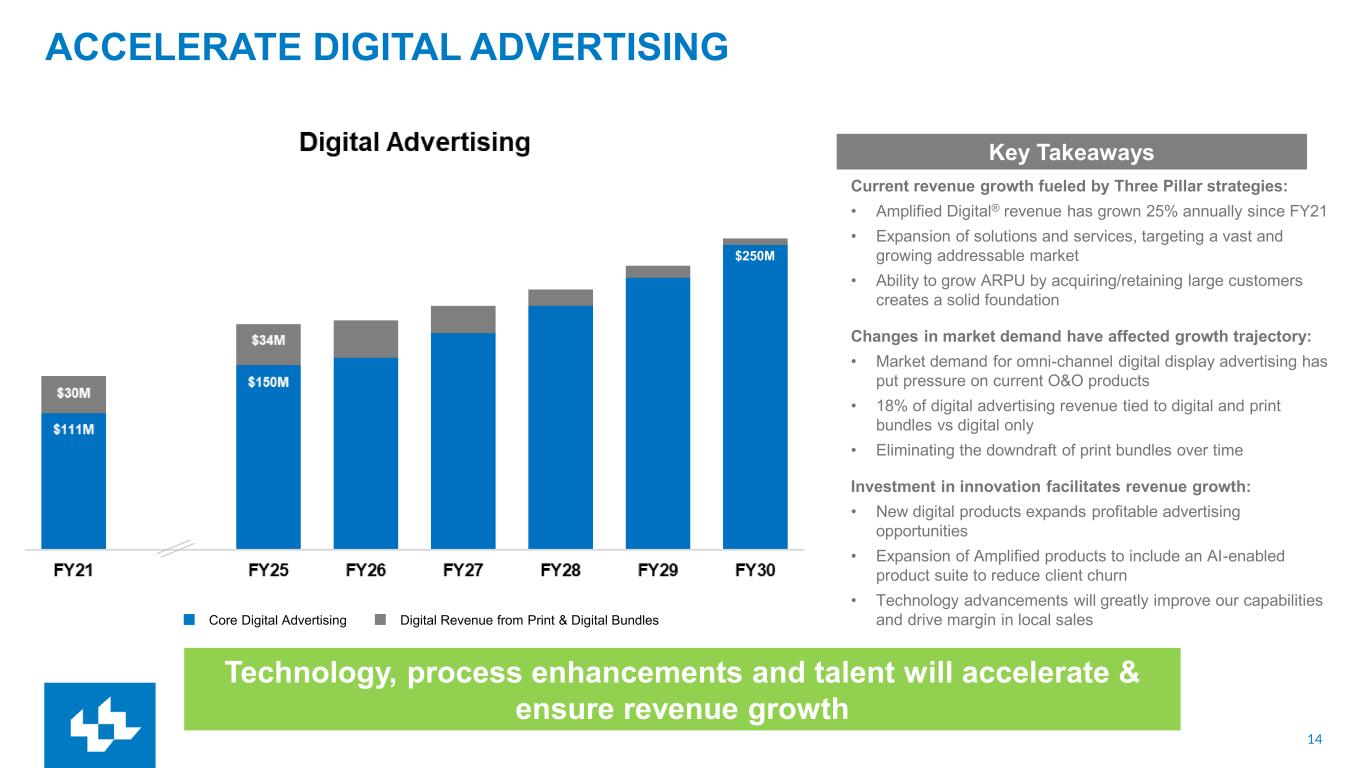

14 ACCELERATE DIGITAL ADVERTISING Technology, process enhancements and talent will accelerate & ensure revenue growth Current revenue growth fueled by Three Pillar strategies: • Amplified Digital® revenue has grown 25% annually since FY21 • Expansion of solutions and services, targeting a vast and growing addressable market • Ability to grow ARPU by acquiring/retaining large customers creates a solid foundation Changes in market demand have affected growth trajectory: • Market demand for omni-channel digital display advertising has put pressure on current O&O products • 18% of digital advertising revenue tied to digital and print bundles vs digital only • Eliminating the downdraft of print bundles over time Investment in innovation facilitates revenue growth: • New digital products expands profitable advertising opportunities • Expansion of Amplified products to include an AI-enabled product suite to reduce client churn • Technology advancements will greatly improve our capabilities and drive margin in local sales $250M $250M Core Digital Advertising Digital Revenue from Print & Digital Bundles Key Takeaways

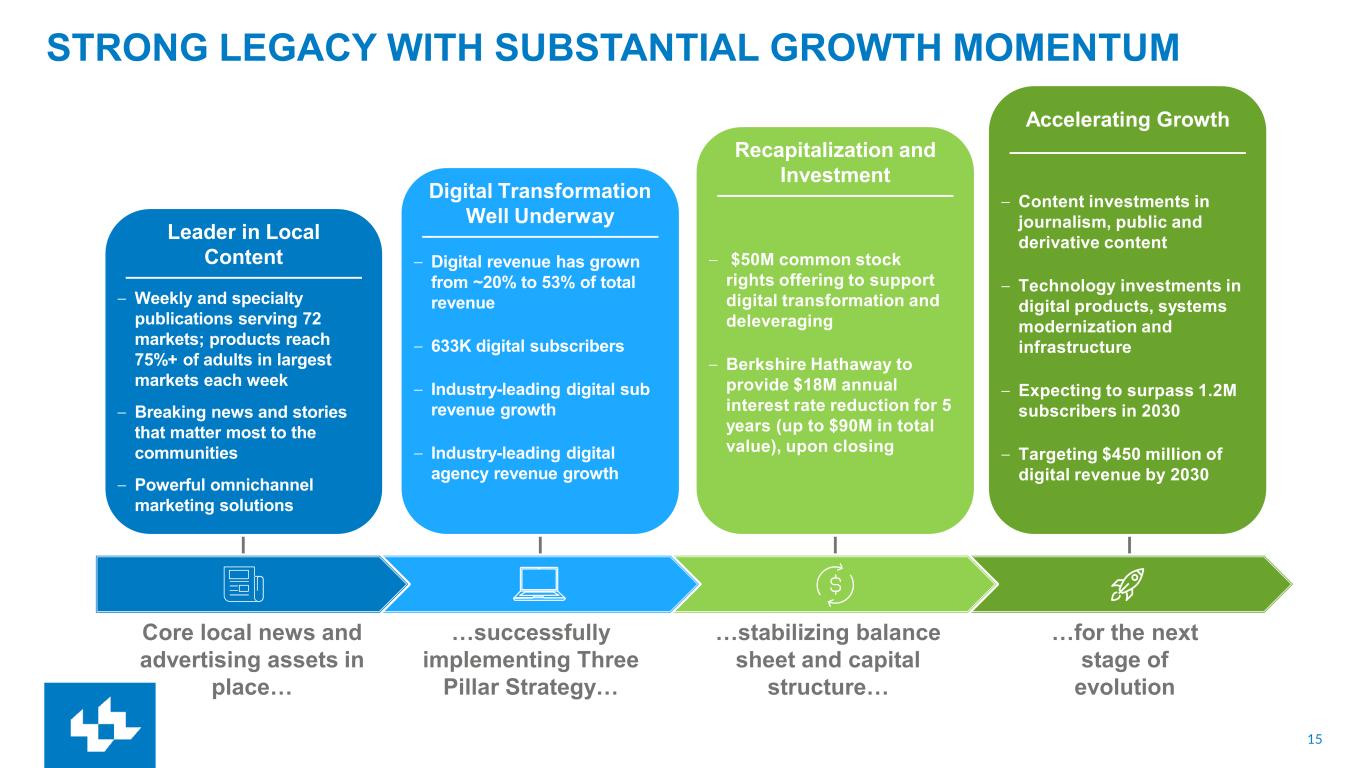

15 STRONG LEGACY WITH SUBSTANTIAL GROWTH MOMENTUM Accelerating Growth – Weekly and specialty publications serving 72 markets; products reach 75%+ of adults in largest markets each week – Breaking news and stories that matter most to the communities – Powerful omnichannel marketing solutions – Digital revenue has grown from ~20% to 53% of total revenue – 633K digital subscribers – Industry-leading digital sub revenue growth – Industry-leading digital agency revenue growth Core local news and advertising assets in place… …successfully implementing Three Pillar Strategy… …stabilizing balance sheet and capital structure… …for the next stage of evolution – $50M common stock rights offering to support digital transformation and deleveraging – Berkshire Hathaway to provide $18M annual interest rate reduction for 5 years (up to $90M in total value), upon closing – Content investments in journalism, public and derivative content – Technology investments in digital products, systems modernization and infrastructure – Expecting to surpass 1.2M subscribers in 2030 – Targeting $450 million of digital revenue by 2030 Leader in Local Content Digital Transformation Well Underway Recapitalization and Investment Accelerating Growth

17 NON-GAAP RECONCILIATION The Company uses non-GAAP financial performance measures to supplement the financial information presented on a U.S. GAAP basis. These non-GAAP financial measures, which may not be comparable to similarly titled measures reported by other companies, should not be considered in isolation from or as a substitute for the related U.S. GAAP measures and should be read together with financial information presented on a U.S. GAAP basis. The Company defines its non-GAAP measures as follows: Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non-cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one-time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI. Cash Costs represent a non-GAAP financial performance measure of operating expenses which are measured on an accrual basis and settled in cash. This measure is useful to investors in understanding the components of the Company’s cash-settled operating costs. Periodically, the Company provides forward-looking guidance of Cash Costs, which can be used by financial statement users to assess the Company's ability to manage and control its operating cost structure. Cash Costs are defined as compensation, newsprint and ink and other operating expenses. Depreciation and amortization, assets loss (gain) on sales, impairments and other, other non-cash operating expenses and other expenses are excluded. Cash Costs also exclude restructuring costs and other, which are typically paid in cash. Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. Gross Margin is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates operating costs that directly support revenue. Depreciation and amortization, assets loss (gain) on sales, impairments and other, net, other non-cash operating expenses, Selling, General, and Administrative (“SG&A”) compensation and SG&A other operating expenses are excluded from Gross Margin. Comparable basis is a non-GAAP performance measure based on U.S. GAAP trends for Lee for the current period, excluding the extra week in the prior year. TNI and MNI – TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI. Management’s Use of Non-GAAP Measures These Non-GAAP Measures are not measurements of financial performance under U.S. GAAP and should not be considered in isolation or as an alternative to income from operations, net income (loss), revenues, or any other measure of performance or liquidity derived in accordance with U.S. GAAP. We believe these non-GAAP financial measures, as we have defined them, are helpful in identifying trends in our day-to-day performance because the items excluded have little or no significance on our day-to-day operations. These measures provide an assessment of controllable expenses and afford management the ability to make decisions which are expected to facilitate meeting current financial goals as well as achieve optimal financial performance. We use these Non-GAAP measures of our day-to-day operating performance, which is evidenced by the publishing and delivery of news and other media and excludes certain expenses that may not be indicative of our day-to-day business operating results. Limitations of Non-GAAP Measures Each of our non-GAAP measures have limitations as analytical tools. They should not be viewed in isolation or as a substitute for U.S. GAAP measures of earnings. Material limitations in making the adjustments to our earnings to calculate Adjusted EBITDA using these non-GAAP financial measures as compared to U.S. GAAP net income (loss) include: the cash portion of interest / financing expense, income tax (benefit) provision, and charges related to asset impairments, which may significantly affect our financial results. Management believes these items are important in evaluating our performance, results of operations, and financial position. We use non-GAAP financial measures to supplement our U.S. GAAP results in order to provide a more complete understanding of the factors and trends affecting our business.

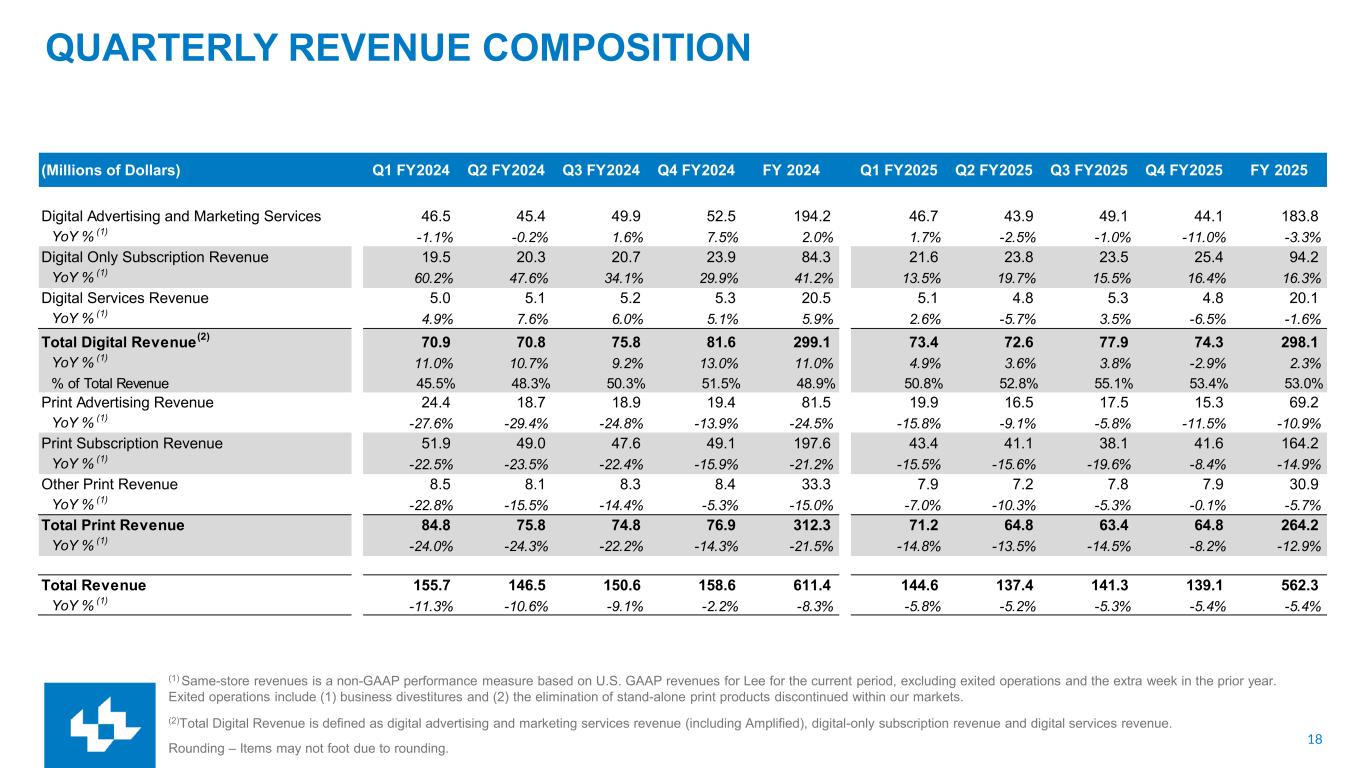

18 QUARTERLY REVENUE COMPOSITION (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations and the extra week in the prior year. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. (2)Total Digital Revenue is defined as digital advertising and marketing services revenue (including Amplified), digital-only subscription revenue and digital services revenue. Rounding – Items may not foot due to rounding. (Millions of Dollars) Q1 FY2024 Q2 FY2024 Q3 FY2024 Q4 FY2024 FY 2024 Q1 FY2025 Q2 FY2025 Q3 FY2025 Q4 FY2025 FY 2025 Digital Advertising and Marketing Services 46.5 45.4 49.9 52.5 194.2 46.7 43.9 49.1 44.1 183.8 YoY % (1) -1.1% -0.2% 1.6% 7.5% 2.0% 1.7% -2.5% -1.0% -11.0% -3.3% Digital Only Subscription Revenue 19.5 20.3 20.7 23.9 84.3 21.6 23.8 23.5 25.4 94.2 YoY % (1) 60.2% 47.6% 34.1% 29.9% 41.2% 13.5% 19.7% 15.5% 16.4% 16.3% Digital Services Revenue 5.0 5.1 5.2 5.3 20.5 5.1 4.8 5.3 4.8 20.1 YoY % (1) 4.9% 7.6% 6.0% 5.1% 5.9% 2.6% -5.7% 3.5% -6.5% -1.6% Total Digital Revenue (2) 70.9 70.8 75.8 81.6 299.1 73.4 72.6 77.9 74.3 298.1 YoY % (1) 11.0% 10.7% 9.2% 13.0% 11.0% 4.9% 3.6% 3.8% -2.9% 2.3% % of Total Revenue 45.5% 48.3% 50.3% 51.5% 48.9% 50.8% 52.8% 55.1% 53.4% 53.0% Print Advertising Revenue 24.4 18.7 18.9 19.4 81.5 19.9 16.5 17.5 15.3 69.2 YoY % (1) -27.6% -29.4% -24.8% -13.9% -24.5% -15.8% -9.1% -5.8% -11.5% -10.9% Print Subscription Revenue 51.9 49.0 47.6 49.1 197.6 43.4 41.1 38.1 41.6 164.2 YoY % (1) -22.5% -23.5% -22.4% -15.9% -21.2% -15.5% -15.6% -19.6% -8.4% -14.9% Other Print Revenue 8.5 8.1 8.3 8.4 33.3 7.9 7.2 7.8 7.9 30.9 YoY % (1) -22.8% -15.5% -14.4% -5.3% -15.0% -7.0% -10.3% -5.3% -0.1% -5.7% Total Print Revenue 84.8 75.8 74.8 76.9 312.3 71.2 64.8 63.4 64.8 264.2 YoY % (1) -24.0% -24.3% -22.2% -14.3% -21.5% -14.8% -13.5% -14.5% -8.2% -12.9% Total Revenue 155.7 146.5 150.6 158.6 611.4 144.6 137.4 141.3 139.1 562.3 YoY % (1) -11.3% -10.6% -9.1% -2.2% -8.3% -5.8% -5.2% -5.3% -5.4% -5.4%

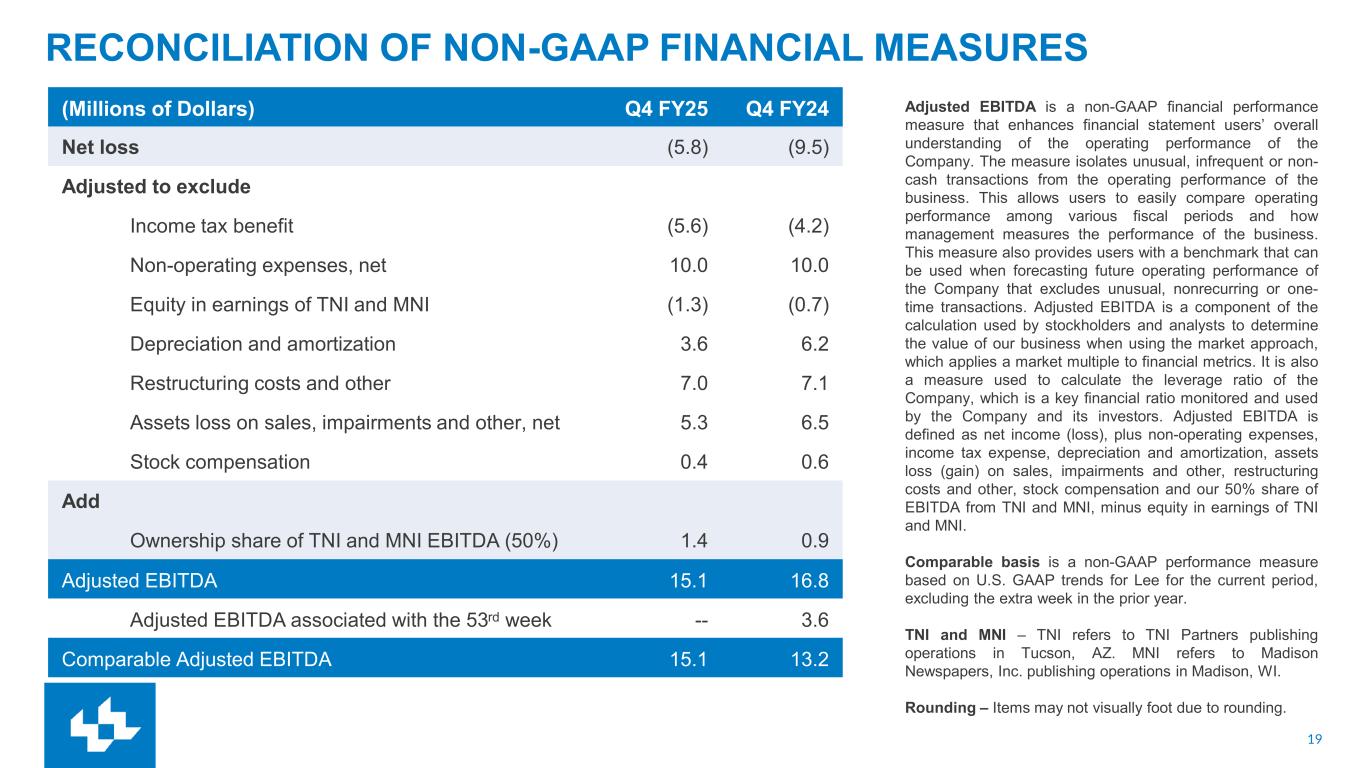

19 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (Millions of Dollars) Q4 FY25 Q4 FY24 Net loss (5.8) (9.5) Adjusted to exclude Income tax benefit (5.6) (4.2) Non-operating expenses, net 10.0 10.0 Equity in earnings of TNI and MNI (1.3) (0.7) Depreciation and amortization 3.6 6.2 Restructuring costs and other 7.0 7.1 Assets loss on sales, impairments and other, net 5.3 6.5 Stock compensation 0.4 0.6 Add Ownership share of TNI and MNI EBITDA (50%) 1.4 0.9 Adjusted EBITDA 15.1 16.8 Adjusted EBITDA associated with the 53rd week -- 3.6 Comparable Adjusted EBITDA 15.1 13.2 Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users’ overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non- cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one- time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI. Comparable basis is a non-GAAP performance measure based on U.S. GAAP trends for Lee for the current period, excluding the extra week in the prior year. TNI and MNI – TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI. Rounding – Items may not visually foot due to rounding.

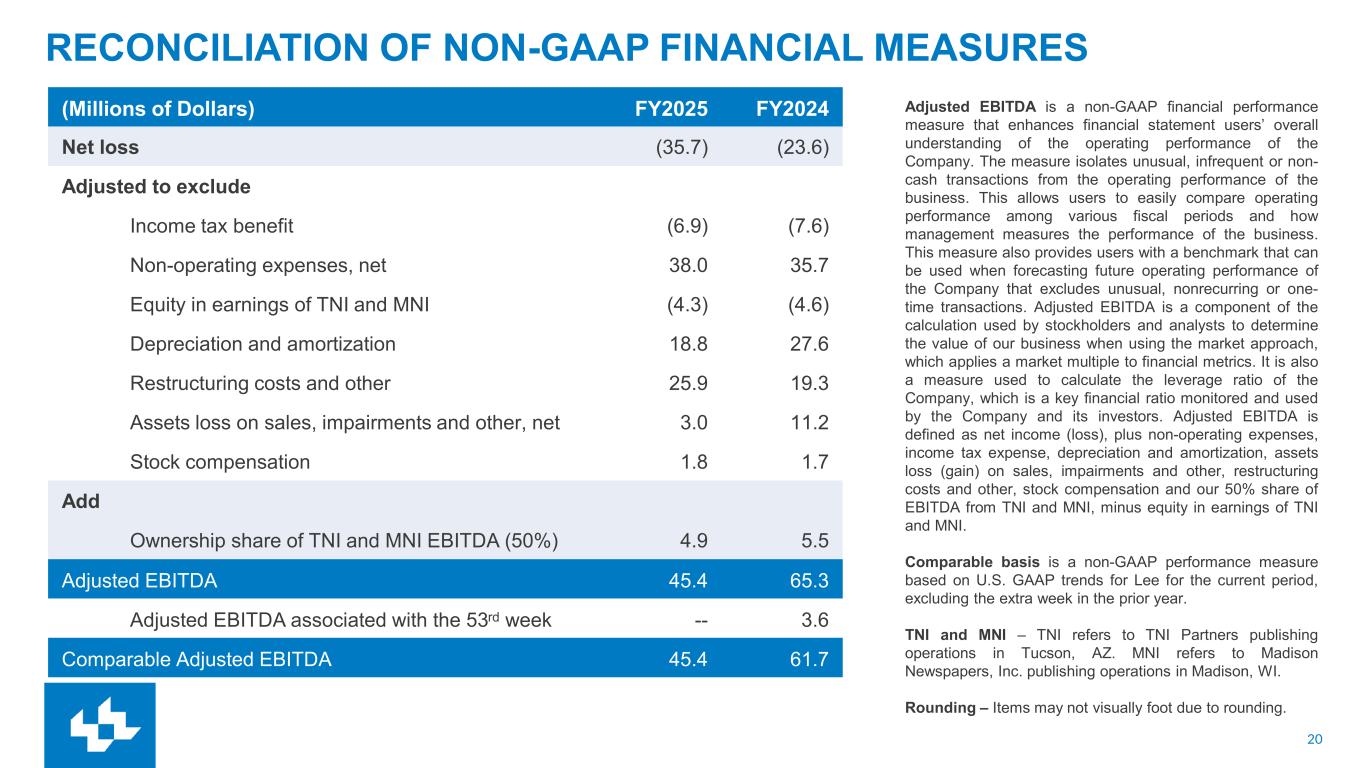

20 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users’ overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non- cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one- time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI. Comparable basis is a non-GAAP performance measure based on U.S. GAAP trends for Lee for the current period, excluding the extra week in the prior year. TNI and MNI – TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) FY2025 FY2024 Net loss (35.7) (23.6) Adjusted to exclude Income tax benefit (6.9) (7.6) Non-operating expenses, net 38.0 35.7 Equity in earnings of TNI and MNI (4.3) (4.6) Depreciation and amortization 18.8 27.6 Restructuring costs and other 25.9 19.3 Assets loss on sales, impairments and other, net 3.0 11.2 Stock compensation 1.8 1.7 Add Ownership share of TNI and MNI EBITDA (50%) 4.9 5.5 Adjusted EBITDA 45.4 65.3 Adjusted EBITDA associated with the 53rd week -- 3.6 Comparable Adjusted EBITDA 45.4 61.7

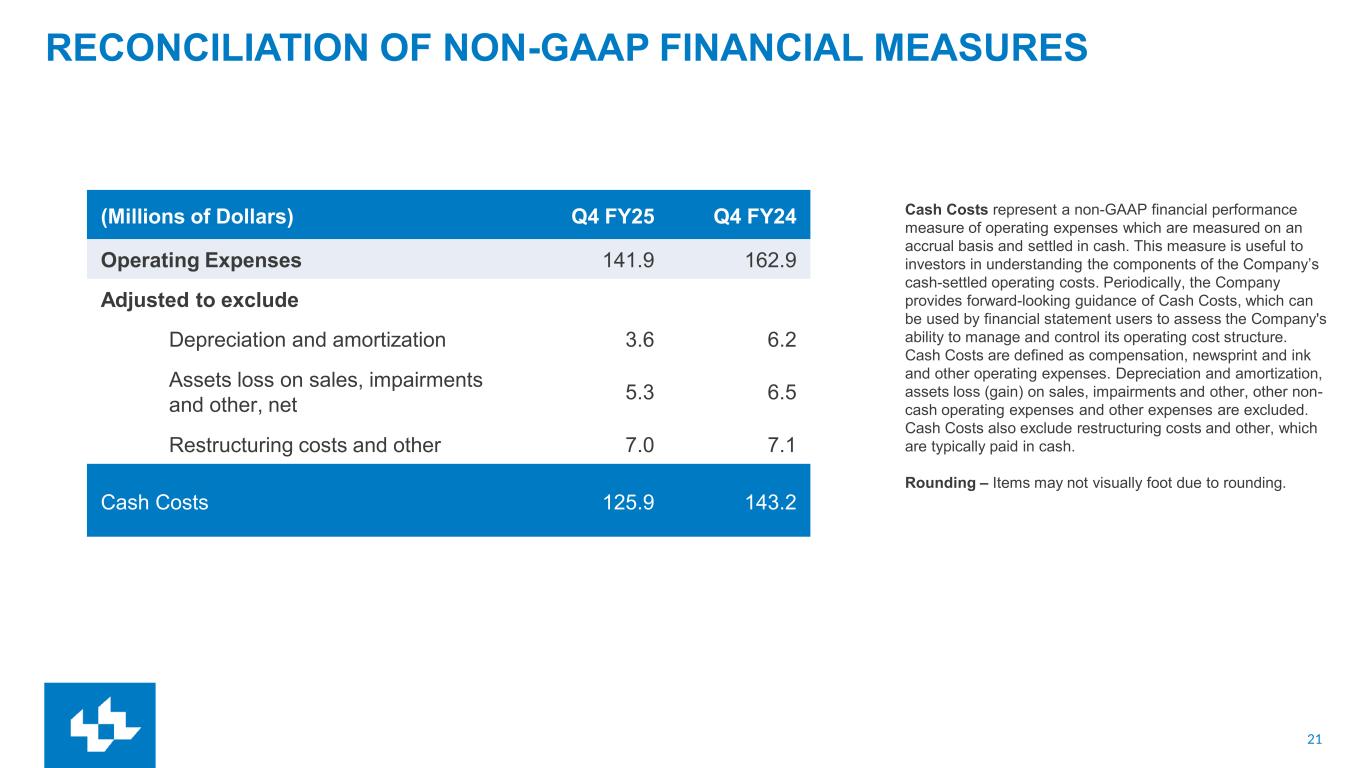

21 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Cash Costs represent a non-GAAP financial performance measure of operating expenses which are measured on an accrual basis and settled in cash. This measure is useful to investors in understanding the components of the Company’s cash-settled operating costs. Periodically, the Company provides forward-looking guidance of Cash Costs, which can be used by financial statement users to assess the Company's ability to manage and control its operating cost structure. Cash Costs are defined as compensation, newsprint and ink and other operating expenses. Depreciation and amortization, assets loss (gain) on sales, impairments and other, other non- cash operating expenses and other expenses are excluded. Cash Costs also exclude restructuring costs and other, which are typically paid in cash. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) Q4 FY25 Q4 FY24 Operating Expenses 141.9 162.9 Adjusted to exclude Depreciation and amortization 3.6 6.2 Assets loss on sales, impairments and other, net 5.3 6.5 Restructuring costs and other 7.0 7.1 Cash Costs 125.9 143.2

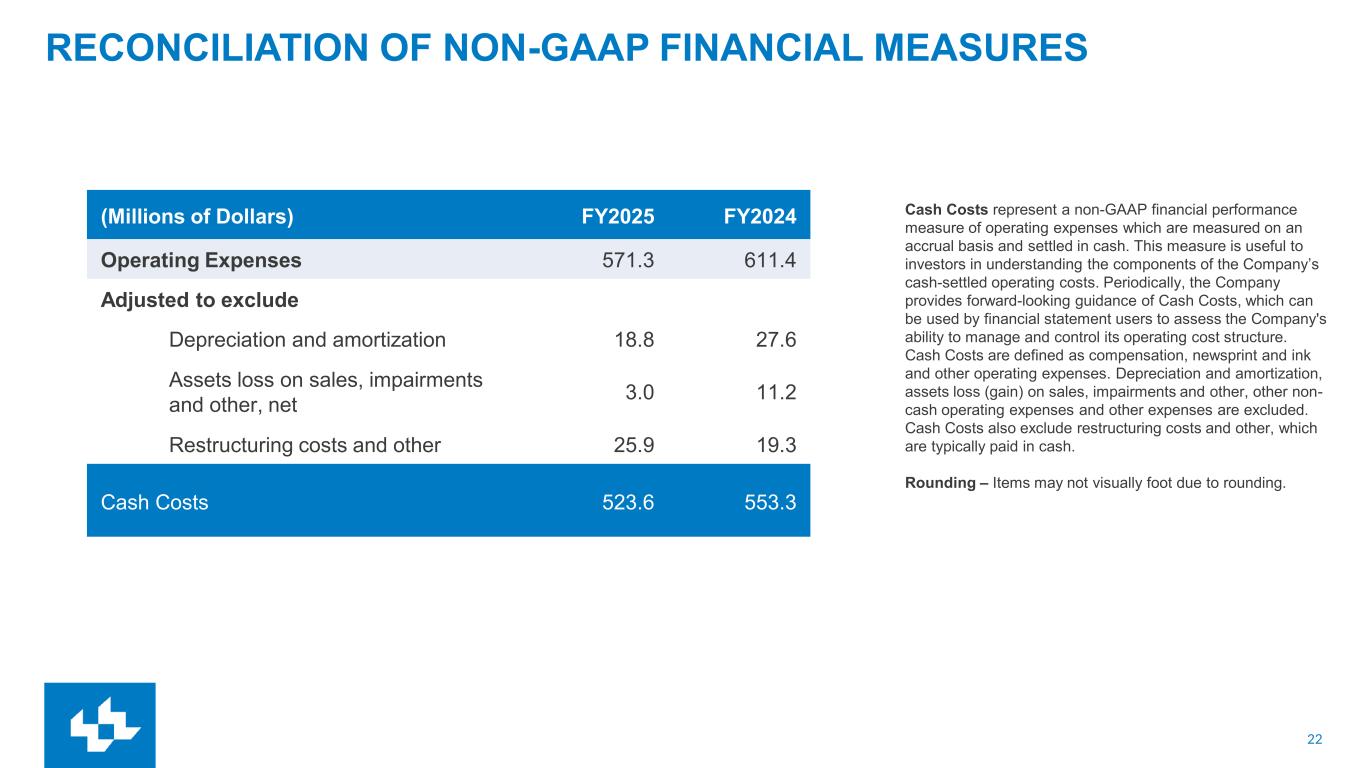

22 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Cash Costs represent a non-GAAP financial performance measure of operating expenses which are measured on an accrual basis and settled in cash. This measure is useful to investors in understanding the components of the Company’s cash-settled operating costs. Periodically, the Company provides forward-looking guidance of Cash Costs, which can be used by financial statement users to assess the Company's ability to manage and control its operating cost structure. Cash Costs are defined as compensation, newsprint and ink and other operating expenses. Depreciation and amortization, assets loss (gain) on sales, impairments and other, other non- cash operating expenses and other expenses are excluded. Cash Costs also exclude restructuring costs and other, which are typically paid in cash. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) FY2025 FY2024 Operating Expenses 571.3 611.4 Adjusted to exclude Depreciation and amortization 18.8 27.6 Assets loss on sales, impairments and other, net 3.0 11.2 Restructuring costs and other 25.9 19.3 Cash Costs 523.6 553.3

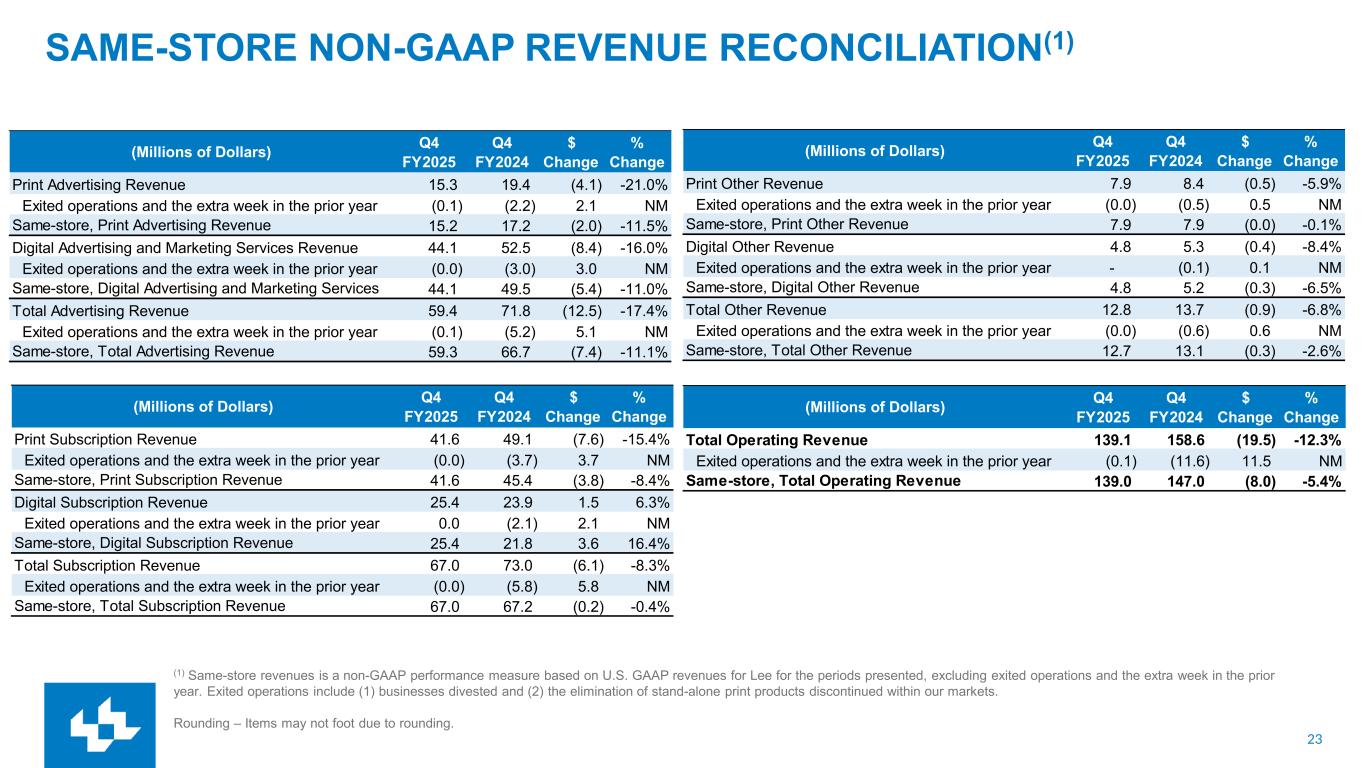

23 SAME-STORE NON-GAAP REVENUE RECONCILIATION(1) (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the periods presented, excluding exited operations and the extra week in the prior year. Exited operations include (1) businesses divested and (2) the elimination of stand-alone print products discontinued within our markets. Rounding – Items may not foot due to rounding. (Millions of Dollars) Q4 FY2025 Q4 FY2024 $ Change % Change Print Advertising Revenue 15.3 19.4 (4.1) -21.0% Exited operations and the extra week in the prior year (0.1) (2.2) 2.1 NM Same-store, Print Advertising Revenue 15.2 17.2 (2.0) -11.5% Digital Advertising and Marketing Services Revenue 44.1 52.5 (8.4) -16.0% Exited operations and the extra week in the prior year (0.0) (3.0) 3.0 NM Same-store, Digital Advertising and Marketing Services 44.1 49.5 (5.4) -11.0% Total Advertising Revenue 59.4 71.8 (12.5) -17.4% Exited operations and the extra week in the prior year (0.1) (5.2) 5.1 NM Same-store, Total Advertising Revenue 59.3 66.7 (7.4) -11.1% (Millions of Dollars) Q4 FY2025 Q4 FY2024 $ Change % Change Print Subscription Revenue 41.6 49.1 (7.6) -15.4% Exited operations and the extra week in the prior year (0.0) (3.7) 3.7 NM Same-store, Print Subscription Revenue 41.6 45.4 (3.8) -8.4% Digital Subscription Revenue 25.4 23.9 1.5 6.3% Exited operations and the extra week in the prior year 0.0 (2.1) 2.1 NM Same-store, Digital Subscription Revenue 25.4 21.8 3.6 16.4% Total Subscription Revenue 67.0 73.0 (6.1) -8.3% Exited operations and the extra week in the prior year (0.0) (5.8) 5.8 NM Same-store, Total Subscription Revenue 67.0 67.2 (0.2) -0.4% (Millions of Dollars) Q4 FY2025 Q4 FY2024 $ Change % Change Print Other Revenue 7.9 8.4 (0.5) -5.9% Exited operations and the extra week in the prior year (0.0) (0.5) 0.5 NM Same-store, Print Other Revenue 7.9 7.9 (0.0) -0.1% Digital Other Revenue 4.8 5.3 (0.4) -8.4% Exited operations and the extra week in the prior year - (0.1) 0.1 NM Same-store, Digital Other Revenue 4.8 5.2 (0.3) -6.5% Total Other Revenue 12.8 13.7 (0.9) -6.8% Exited operations and the extra week in the prior year (0.0) (0.6) 0.6 NM Same-store, Total Other Revenue 12.7 13.1 (0.3) -2.6% (Millions of Dollars) Q4 FY2025 Q4 FY2024 $ Change % Change Total Operating Revenue 139.1 158.6 (19.5) -12.3% Exited operations and the extra week in the prior year (0.1) (11.6) 11.5 NM Same-store, Total Operating Revenue 139.0 147.0 (8.0) -5.4%

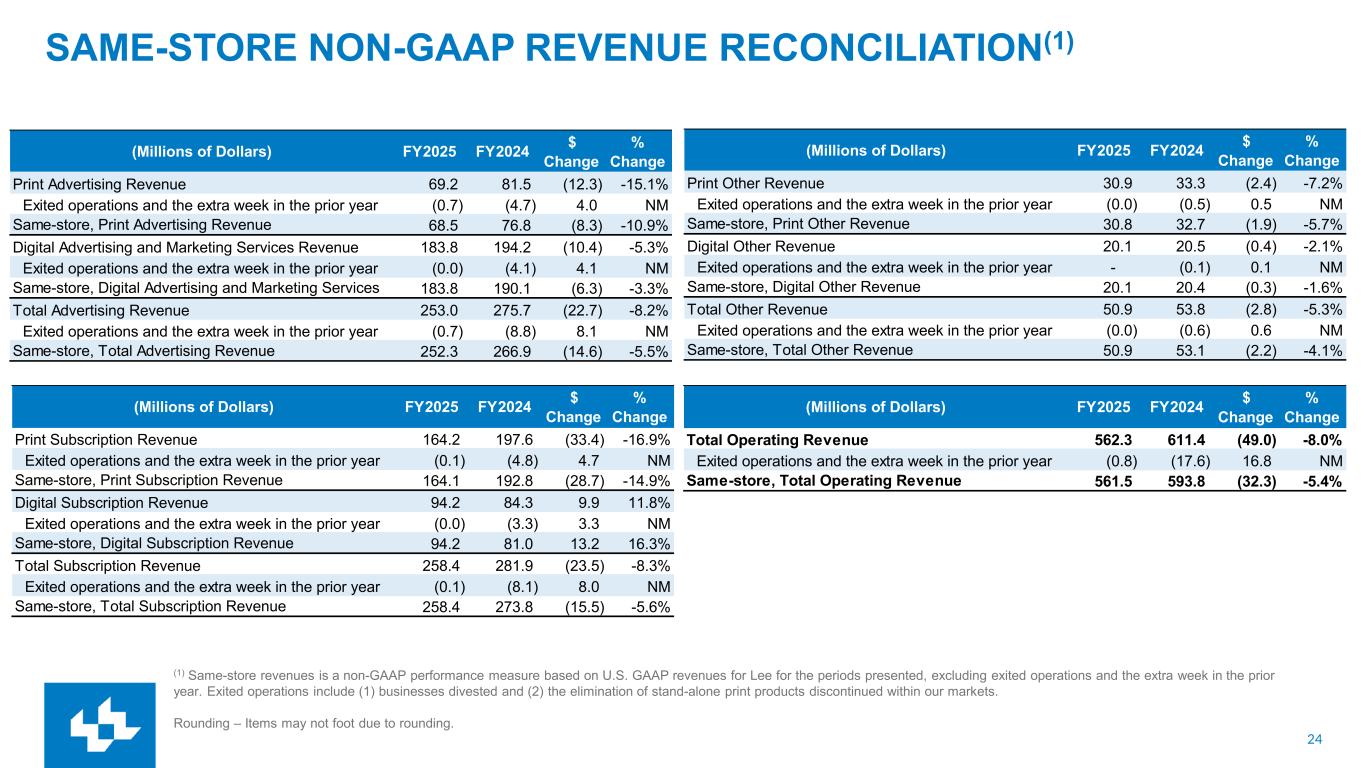

24 SAME-STORE NON-GAAP REVENUE RECONCILIATION(1) (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the periods presented, excluding exited operations and the extra week in the prior year. Exited operations include (1) businesses divested and (2) the elimination of stand-alone print products discontinued within our markets. Rounding – Items may not foot due to rounding. (Millions of Dollars) FY2025 FY2024 $ Change % Change Print Advertising Revenue 69.2 81.5 (12.3) -15.1% Exited operations and the extra week in the prior year (0.7) (4.7) 4.0 NM Same-store, Print Advertising Revenue 68.5 76.8 (8.3) -10.9% Digital Advertising and Marketing Services Revenue 183.8 194.2 (10.4) -5.3% Exited operations and the extra week in the prior year (0.0) (4.1) 4.1 NM Same-store, Digital Advertising and Marketing Services 183.8 190.1 (6.3) -3.3% Total Advertising Revenue 253.0 275.7 (22.7) -8.2% Exited operations and the extra week in the prior year (0.7) (8.8) 8.1 NM Same-store, Total Advertising Revenue 252.3 266.9 (14.6) -5.5% (Millions of Dollars) FY2025 FY2024 $ Change % Change Print Subscription Revenue 164.2 197.6 (33.4) -16.9% Exited operations and the extra week in the prior year (0.1) (4.8) 4.7 NM Same-store, Print Subscription Revenue 164.1 192.8 (28.7) -14.9% Digital Subscription Revenue 94.2 84.3 9.9 11.8% Exited operations and the extra week in the prior year (0.0) (3.3) 3.3 NM Same-store, Digital Subscription Revenue 94.2 81.0 13.2 16.3% Total Subscription Revenue 258.4 281.9 (23.5) -8.3% Exited operations and the extra week in the prior year (0.1) (8.1) 8.0 NM Same-store, Total Subscription Revenue 258.4 273.8 (15.5) -5.6% (Millions of Dollars) FY2025 FY2024 $ Change % Change Print Other Revenue 30.9 33.3 (2.4) -7.2% Exited operations and the extra week in the prior year (0.0) (0.5) 0.5 NM Same-store, Print Other Revenue 30.8 32.7 (1.9) -5.7% Digital Other Revenue 20.1 20.5 (0.4) -2.1% Exited operations and the extra week in the prior year - (0.1) 0.1 NM Same-store, Digital Other Revenue 20.1 20.4 (0.3) -1.6% Total Other Revenue 50.9 53.8 (2.8) -5.3% Exited operations and the extra week in the prior year (0.0) (0.6) 0.6 NM Same-store, Total Other Revenue 50.9 53.1 (2.2) -4.1% (Millions of Dollars) FY2025 FY2024 $ Change % Change Total Operating Revenue 562.3 611.4 (49.0) -8.0% Exited operations and the extra week in the prior year (0.8) (17.6) 16.8 NM Same-store, Total Operating Revenue 561.5 593.8 (32.3) -5.4%

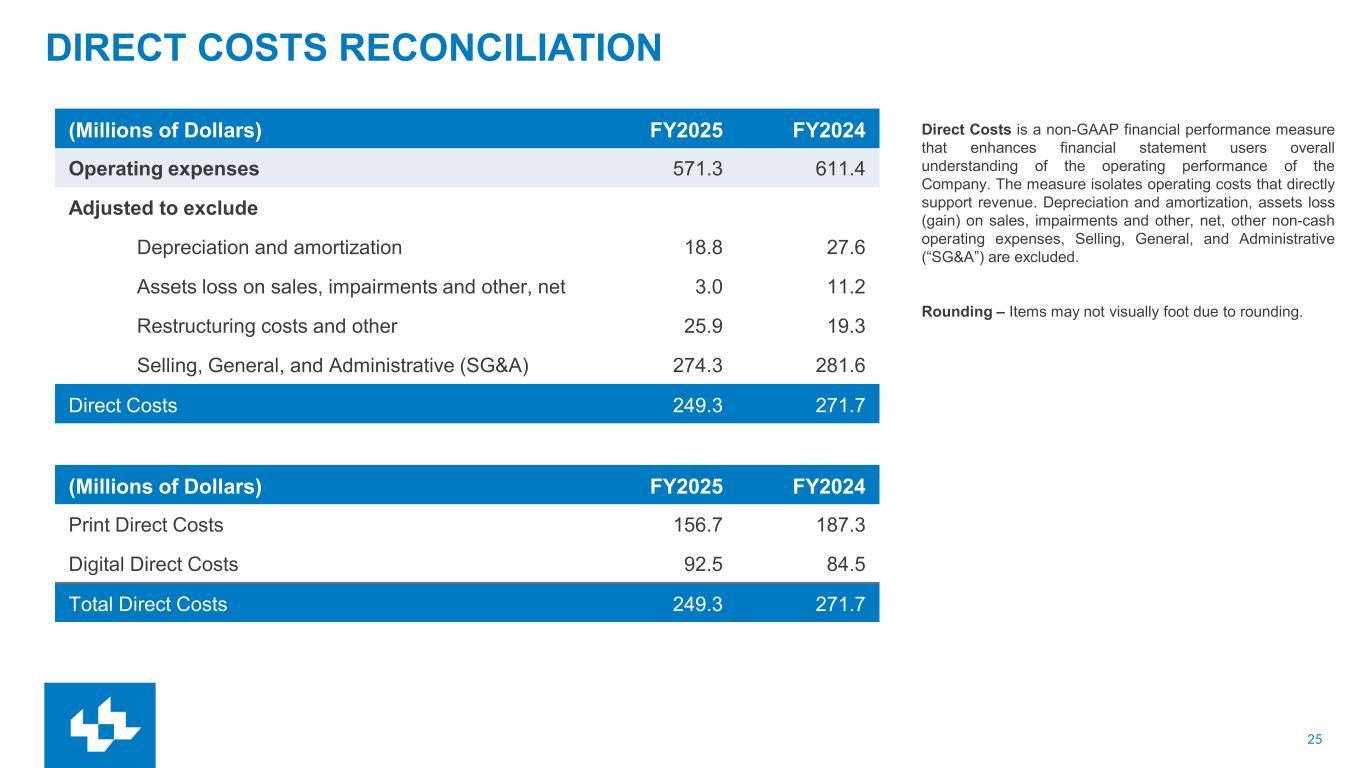

25 DIRECT COSTS RECONCILIATION (Millions of Dollars) FY2025 FY2024 Operating expenses 571.3 611.4 Adjusted to exclude Depreciation and amortization 18.8 27.6 Assets loss on sales, impairments and other, net 3.0 11.2 Restructuring costs and other 25.9 19.3 Selling, General, and Administrative (SG&A) 274.3 281.6 Direct Costs 249.3 271.7 Direct Costs is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates operating costs that directly support revenue. Depreciation and amortization, assets loss (gain) on sales, impairments and other, net, other non-cash operating expenses, Selling, General, and Administrative (“SG&A”) are excluded. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) FY2025 FY2024 Print Direct Costs 156.7 187.3 Digital Direct Costs 92.5 84.5 Total Direct Costs 249.3 271.7