1 Earnings Supplement Fourth Quarter 2025 February 12, 2026

2 Forward-Looking Statements – Cautionary Language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln’s behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements. Forward-looking statements may contain words like: “anticipate,” “believe,” “estimate,” “expect,” “project,” “shall,” “will” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln’s businesses, prospective services or products, future performance or financial results, including the statements relating to our 2026 outlook, our medium-term expectations with respect to certain business segments and other key metrics, our illustrative timeline for strategic initiatives, our 2026 seasonality considerations and our 2026 expected operating income and expense reallocations. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements are subject to risks and uncertainties. Actual results could differ materially from those expressed in or implied by such forward-looking statements due to a variety of factors, including: • Weak general economic and business conditions that may affect demand for our products, account balances, investment results, guaranteed benefit liabilities, premium levels and claims experience; • Adverse global capital and credit market conditions that may affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures; • The inability of our subsidiaries to pay dividends to the holding company in sufficient amounts, which could harm the holding company’s ability to meet its obligations; • Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries’ products; the required amount of reserves and/or surplus; our ability to conduct business; and our affiliate reinsurance arrangements; • Changes in tax law or the interpretation of or application of existing tax laws that could impact our tax costs and the products that we sell; • The impact of regulations adopted by the Securities and Exchange Commission (“SEC”), the Department of Labor or other federal or state regulators or self-regulatory organizations that could adversely affect our distribution model and sales of our products and result in additional disclosure and other requirements related to the sale and delivery of our products; • The impact of existing and emerging rules and regulations relating to privacy, cybersecurity and artificial intelligence (“AI”) that may lead to increased compliance costs, reputation risk and/or changes in business practices, and challenges with properly managing the use of AI that could result in reputational harm, competitive harm and legal liability; • Continued scrutiny and evolving expectations and regulations regarding ESG matters that may adversely affect our reputation and our investment portfolio; • Actions taken by reinsurers to raise rates on in-force business; • Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses and demand for our products; • Increasing or sustained higher interest rates that may negatively affect our profitability, value of our investment portfolio and capital position and may cause policyholders to surrender annuity and life insurance policies, thereby causing realized investment losses; • The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings; • A decline or continued volatility in the equity markets causing a reduction in the sales of our subsidiaries’ products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; and an increase in liabilities related to guaranteed benefits, including riders on certain of our annuity products and secondary guarantees on certain variable universal life insurance products; • Ineffectiveness of our risk management policies and procedures, including our various hedging strategies; A deviation in actual experience regarding future policyholder behavior, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries’ products and in establishing related insurance reserves, which may reduce future earnings; Changes in accounting principles that may affect our consolidated financial statements; • Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition; • Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention and profitability of our insurance subsidiaries and liquidity; • Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain financial assets, as well as counterparties to which we are exposed to credit risk, requiring that we realize losses on financial assets; • Interruption in or failure of the telecommunication, information technology or other operational systems of the company or the third parties on whom we rely or failure to safeguard the confidentiality or privacy of sensitive data on such systems, including from cyberattacks or other breaches in security of such systems; • The effect of acquisitions and divestitures, including the inability to realize the anticipated benefits of acquisitions and dispositions of businesses and potential operating difficulties and unforeseen liabilities relating thereto, as well as the effect of restructurings, product withdrawals and other unusual items; • The inability to realize or sustain the benefits we expect from, greater than expected investments in, and the potential impact of efforts related to, our strategic initiatives; The adequacy and collectability of reinsurance that we have obtained; • Pandemics, acts of terrorism, war or other man-made and natural catastrophes that may adversely impact liabilities for policyholder claims and adversely affect our businesses and the cost and availability of reinsurance; • Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products; • The unknown effect on our subsidiaries’ businesses resulting from evolving market preferences and the changing demographics of our client base; and • The unanticipated loss of key management or wholesalers. The risks and uncertainties included here are not exhaustive. Our most recent Form 10-K, as well as other reports that we file with the SEC, include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to correct or update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk-Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

3 2025 Fourth Quarter Summary

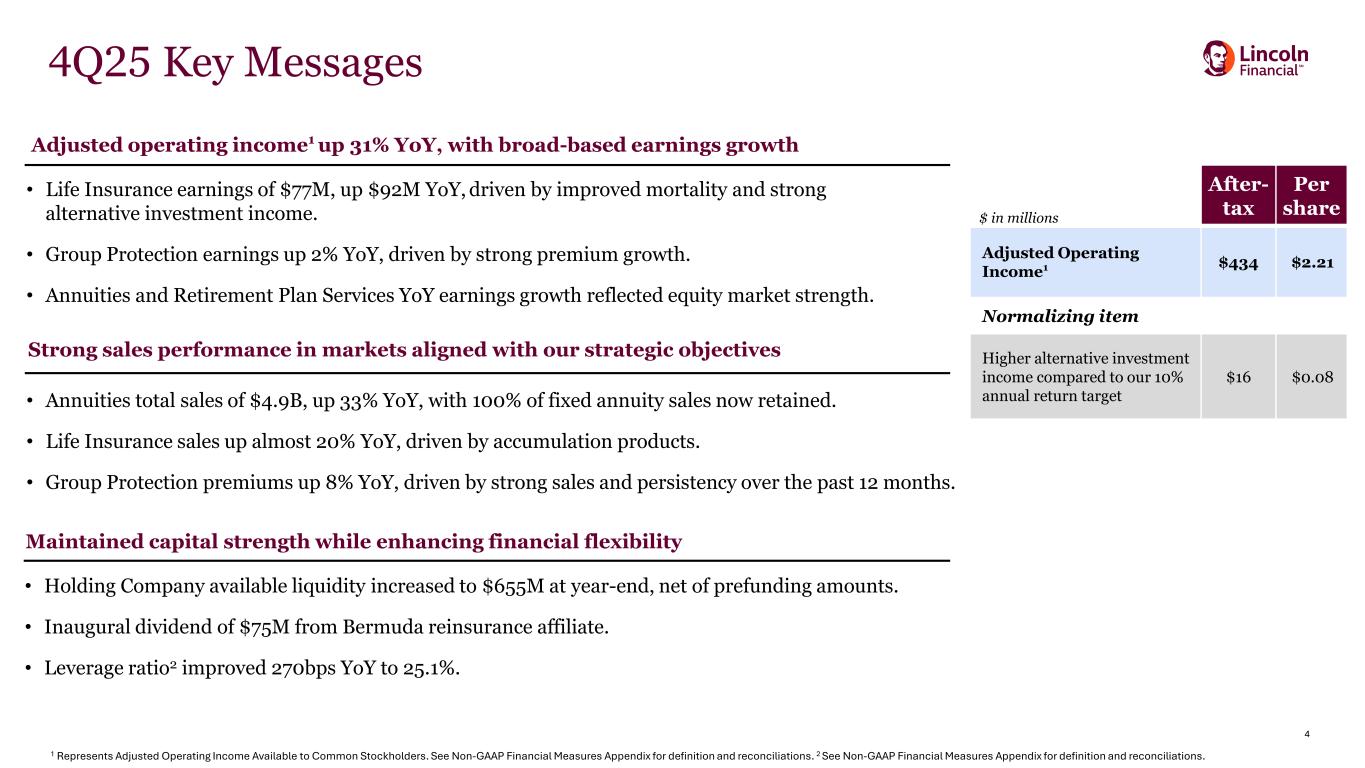

4 4Q25 Key Messages • Annuities total sales of $4.9B, up 33% YoY, with 100% of fixed annuity sales now retained. • Life Insurance sales up almost 20% YoY, driven by accumulation products. • Group Protection premiums up 8% YoY, driven by strong sales and persistency over the past 12 months. $ in millions After- tax Per share Adjusted Operating Income1 $434 $2.21 Normalizing item Higher alternative investment income compared to our 10% annual return target $16 $0.08 Adjusted operating income1 up 31% YoY, with broad-based earnings growth • Life Insurance earnings of $77M, up $92M YoY, driven by improved mortality and strong alternative investment income. • Group Protection earnings up 2% YoY, driven by strong premium growth. • Annuities and Retirement Plan Services YoY earnings growth reflected equity market strength. Strong sales performance in markets aligned with our strategic objectives Maintained capital strength while enhancing financial flexibility • Holding Company available liquidity increased to $655M at year-end, net of prefunding amounts. • Inaugural dividend of $75M from Bermuda reinsurance affiliate. • Leverage ratio2 improved 270bps YoY to 25.1%. 1 Represents Adjusted Operating Income Available to Common Stockholders. See Non-GAAP Financial Measures Appendix for definition and reconciliations. 2 See Non-GAAP Financial Measures Appendix for definition and reconciliations.

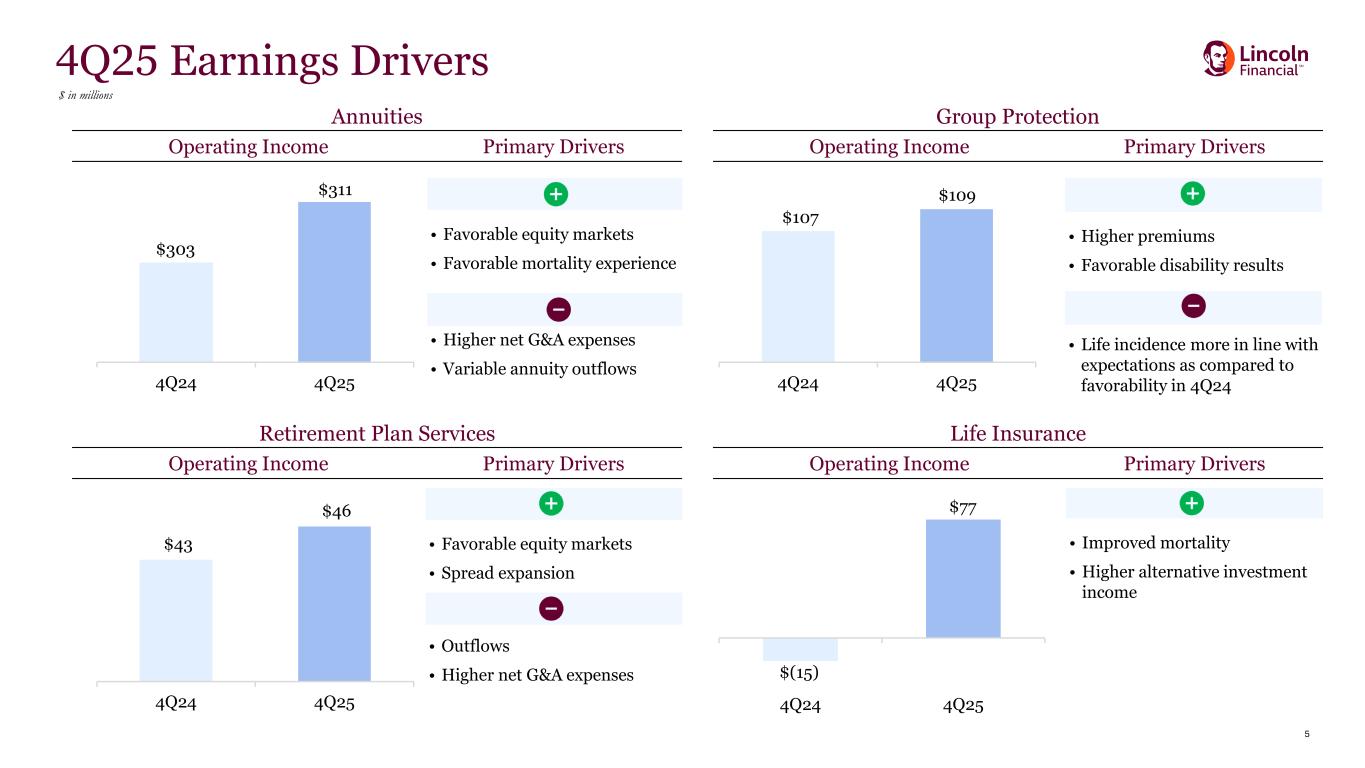

5 Annuities Group Protection Operating Income Primary Drivers Operating Income Primary Drivers Retirement Plan Services Life Insurance Operating Income Primary Drivers Operating Income Primary Drivers • Favorable equity markets • Favorable mortality experience • Higher net G&A expenses • Variable annuity outflows • Higher premiums • Favorable disability results • Life incidence more in line with expectations as compared to favorability in 4Q24 4Q25 Earnings Drivers $ in millions • Favorable equity markets • Spread expansion • Outflows • Higher net G&A expenses • Improved mortality • Higher alternative investment income $303 $311 4Q24 4Q25 $107 $109 4Q24 4Q25 $43 $46 4Q24 4Q25 $(15) $77 4Q24 4Q25

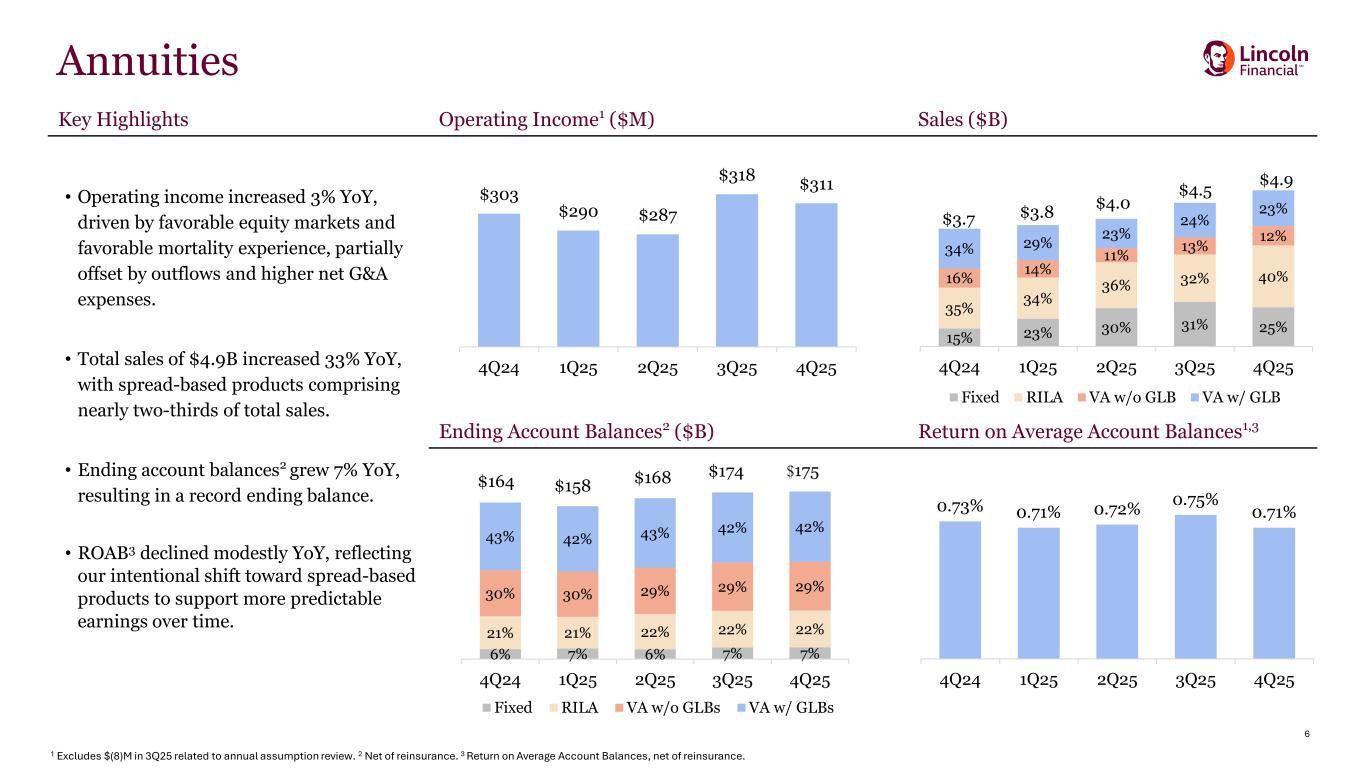

6 Key Highlights Operating Income1 ($M) Sales ($B) • Operating income increased 3% YoY, driven by favorable equity markets and favorable mortality experience, partially offset by outflows and higher net G&A expenses. • Total sales of $4.9B increased 33% YoY, with spread-based products comprising nearly two-thirds of total sales. • Ending account balances2 grew 7% YoY, resulting in a record ending balance. • ROAB3 declined modestly YoY, reflecting our intentional shift toward spread-based products to support more predictable earnings over time. Ending Account Balances2 ($B) Return on Average Account Balances1,3 15% 23% 30% 31% 25% 35% 34% 36% 32% 40%16% 14% 11% 13% 12% 34% 29% 23% 24% 23% 4Q24 1Q25 2Q25 3Q25 4Q25 Fixed RILA VA w/o GLB VA w/ GLB $164 $158 $168 $174 $175 6% 7% 6% 7% 7% 21% 21% 22% 22% 22% 30% 30% 29% 29% 29% 43% 42% 43% 42% 42% 4Q24 1Q25 2Q25 3Q25 4Q25 Fixed RILA VA w/o GLBs VA w/ GLBs Annuities 0.73% 0.71% 0.72% 0.75% 0.71% 4Q24 1Q25 2Q25 3Q25 4Q25 $303 $290 $287 $318 $311 4Q24 1Q25 2Q25 3Q25 4Q25 $4.0 $3.7 $3.8 $4.5 $4.9 1 Excludes $(8)M in 3Q25 related to annual assumption review. 2 Net of reinsurance. 3 Return on Average Account Balances, net of reinsurance.

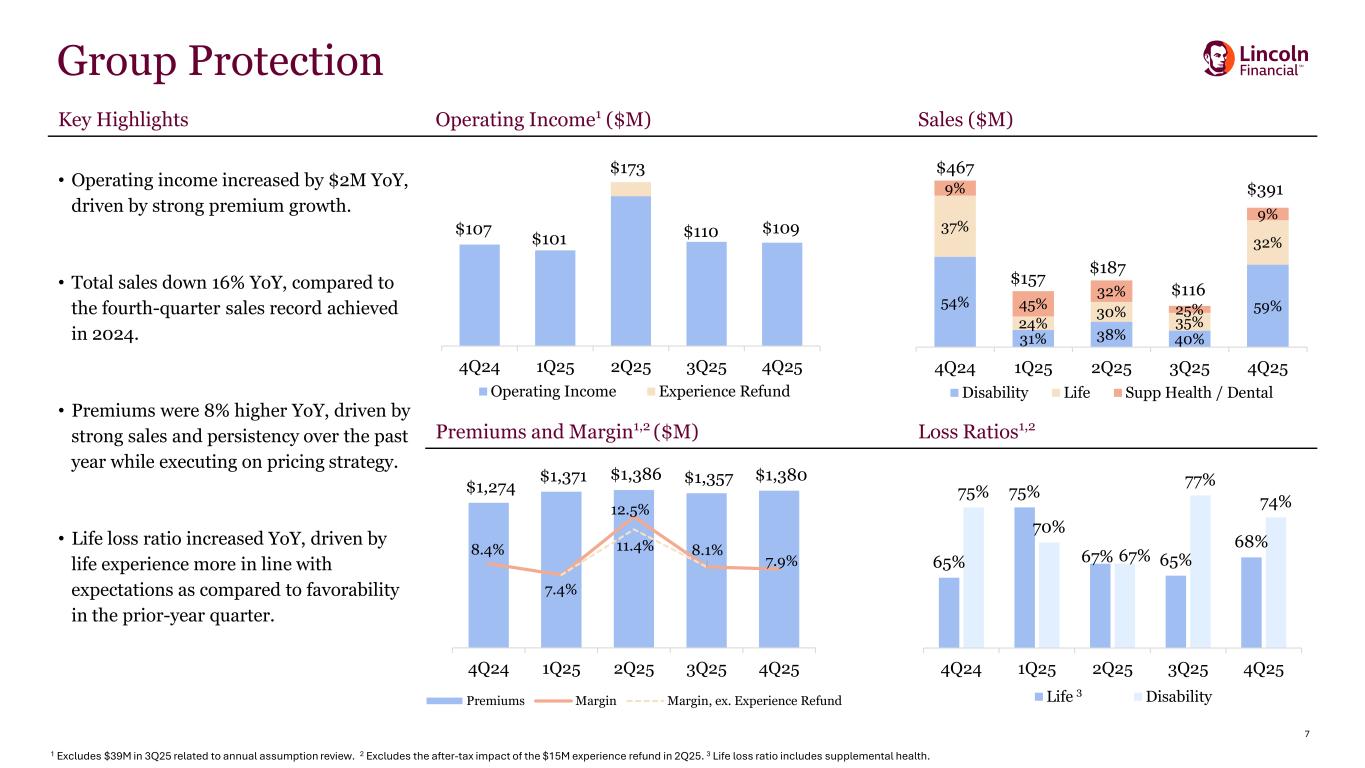

7 Key Highlights Operating Income1 ($M) Sales ($M) • Operating income increased by $2M YoY, driven by strong premium growth. • Total sales down 16% YoY, compared to the fourth-quarter sales record achieved in 2024. • Premiums were 8% higher YoY, driven by strong sales and persistency over the past year while executing on pricing strategy. • Life loss ratio increased YoY, driven by life experience more in line with expectations as compared to favorability in the prior-year quarter. Premiums and Margin1,2 ($M) Loss Ratios1,2 $1,274 $1,371 $1,386 $1,357 $1,380 8.4% 7.4% 12.5% 11.4% 8.1% 7.9% 1.0% 3.0% 5.0% 7.0% 9.0% 11.0% 13.0% 15.0% $- $200 $400 $600 $800 $1,000 $1,200 $1,400 4Q24 1Q25 2Q25 3Q25 4Q25 Premiums Margin Margin, ex. Experience Refund 54% 31% 38% 40% 59% 37% 24% 30% 35% 32% 9% 45% 32% 25% 9% 4Q24 1Q25 2Q25 3Q25 4Q25 Disability Life Supp Health / Dental 65% 75% 67% 65% 68% 75% 70% 67% 77% 74% 4Q24 1Q25 2Q25 3Q25 4Q25 Life Disability $467 3 $109 4Q24 1Q25 2Q25 3Q25 4Q25 Operating Income Experience Refund $110$107 $101 $157 $173 $187 $116 $391 Group Protection 1 Excludes $39M in 3Q25 related to annual assumption review. 2 Excludes the after-tax impact of the $15M experience refund in 2Q25. 3 Life loss ratio includes supplemental health.

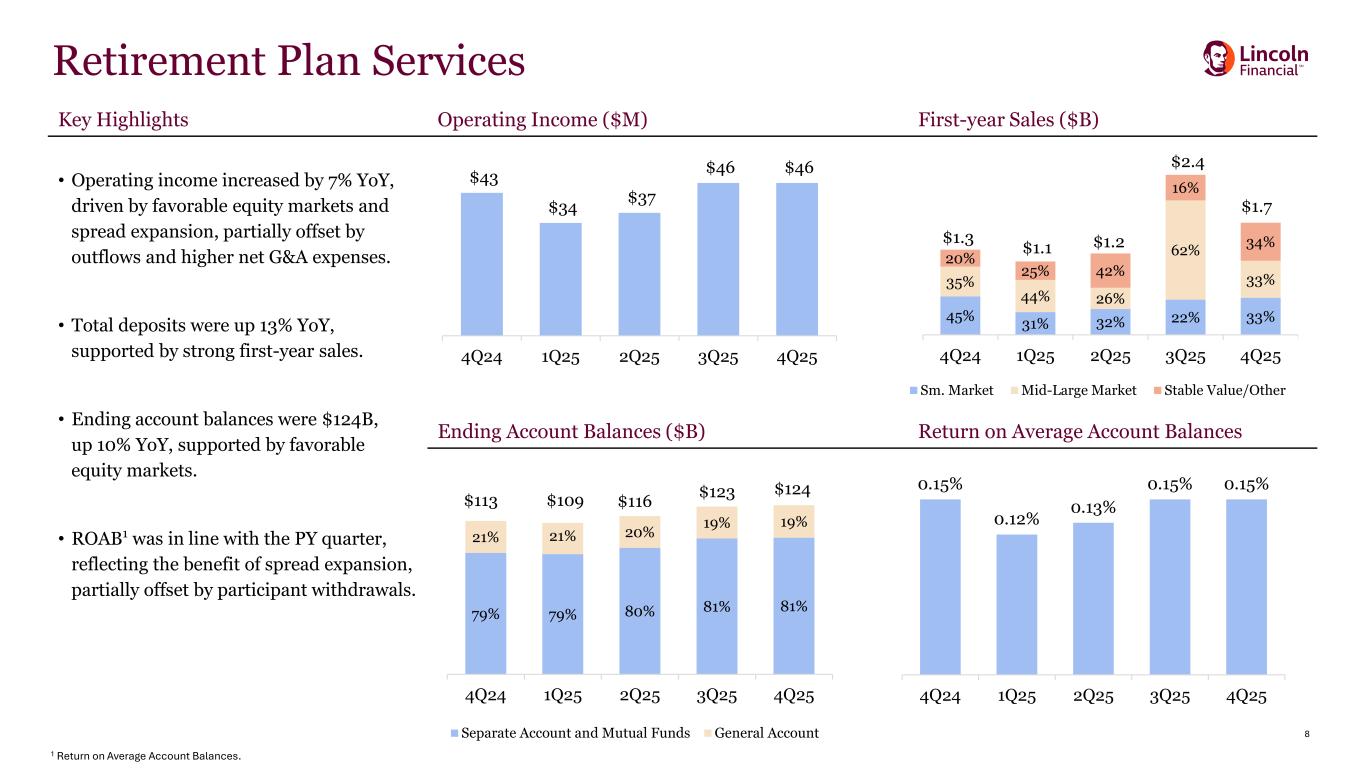

8 Retirement Plan Services Key Highlights Operating Income ($M) First-year Sales ($B) • Operating income increased by 7% YoY, driven by favorable equity markets and spread expansion, partially offset by outflows and higher net G&A expenses. • Total deposits were up 13% YoY, supported by strong first-year sales. • Ending account balances were $124B, up 10% YoY, supported by favorable equity markets. • ROAB1 was in line with the PY quarter, reflecting the benefit of spread expansion, partially offset by participant withdrawals. Ending Account Balances ($B) Return on Average Account Balances 79% 79% 80% 81% 81% 21% 21% 20% 19% 19% $113 $109 $116 $123 $124 4Q24 1Q25 2Q25 3Q25 4Q25 Separate Account and Mutual Funds General Account $43 $34 $37 $46 $46 4Q24 1Q25 2Q25 3Q25 4Q25 0.15% 0.12% 0.13% 0.15% 0.15% 4Q24 1Q25 2Q25 3Q25 4Q25 45% 31% 32% 22% 33% 35% 44% 26% 62% 33% 20% 25% 42% 16% 34% 4Q24 1Q25 2Q25 3Q25 4Q25 Sm. Market Mid-Large Market Stable Value/Other $1.3 $1.1 $1.2 $2.4 $1.7 1 Return on Average Account Balances.

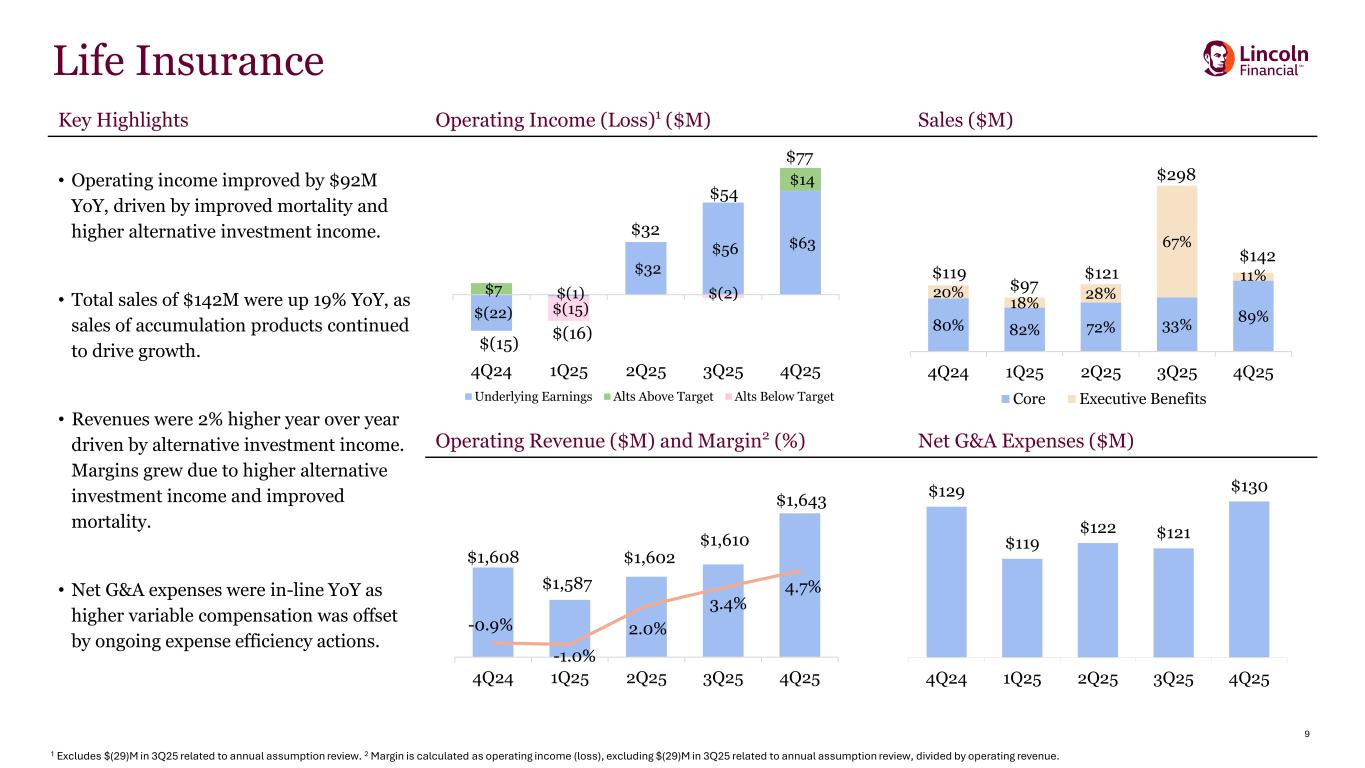

9 Key Highlights Operating Income (Loss)1 ($M) Sales ($M) • Operating income improved by $92M YoY, driven by improved mortality and higher alternative investment income. • Total sales of $142M were up 19% YoY, as sales of accumulation products continued to drive growth. • Revenues were 2% higher year over year driven by alternative investment income. Margins grew due to higher alternative investment income and improved mortality. • Net G&A expenses were in-line YoY as higher variable compensation was offset by ongoing expense efficiency actions. Operating Revenue ($M) and Margin2 (%) Net G&A Expenses ($M) 92% 91% 85% 80% 83% 8% 9% 15% 20% 17% 13% 8% 14% 19% 13% 19% 14% 1Q24 2Q24 3Q24 4Q24 1Q25 Underlying Earnings Alts Above Target Alts Below Target $(22) $(1) $32 $56 $63 $7 $(15) $(2) $14 4Q24 1Q25 2Q25 3Q25 4Q25 $(15) $(16) Life Insurance $32 80% 82% 72% 33% 89% 20% 18% 28% 67% 11%$119 $97 $121 $298 $142 4Q24 1Q25 2Q25 3Q25 4Q25 Core Executive Benefits $54 $77 $129 $119 $122 $121 $130 4Q24 1Q25 2Q25 3Q25 4Q25 1 Excludes $(29)M in 3Q25 related to annual assumption review. 2 Margin is calculated as operating income (loss), excluding $(29)M in 3Q25 related to annual assumption review, divided by operating revenue. $1,608 $1,587 $1,602 $1,610 $1,643 -0.9% -1.0% 2.0% 3.4% 4.7% -2.0% 0.0 % 2.0% 4.0% 6.0% 8.0% 10.0% 1550 1560 1570 1580 1590 1600 1610 1620 1630 1640 1650 4Q24 1Q25 2Q25 3Q25 4Q25

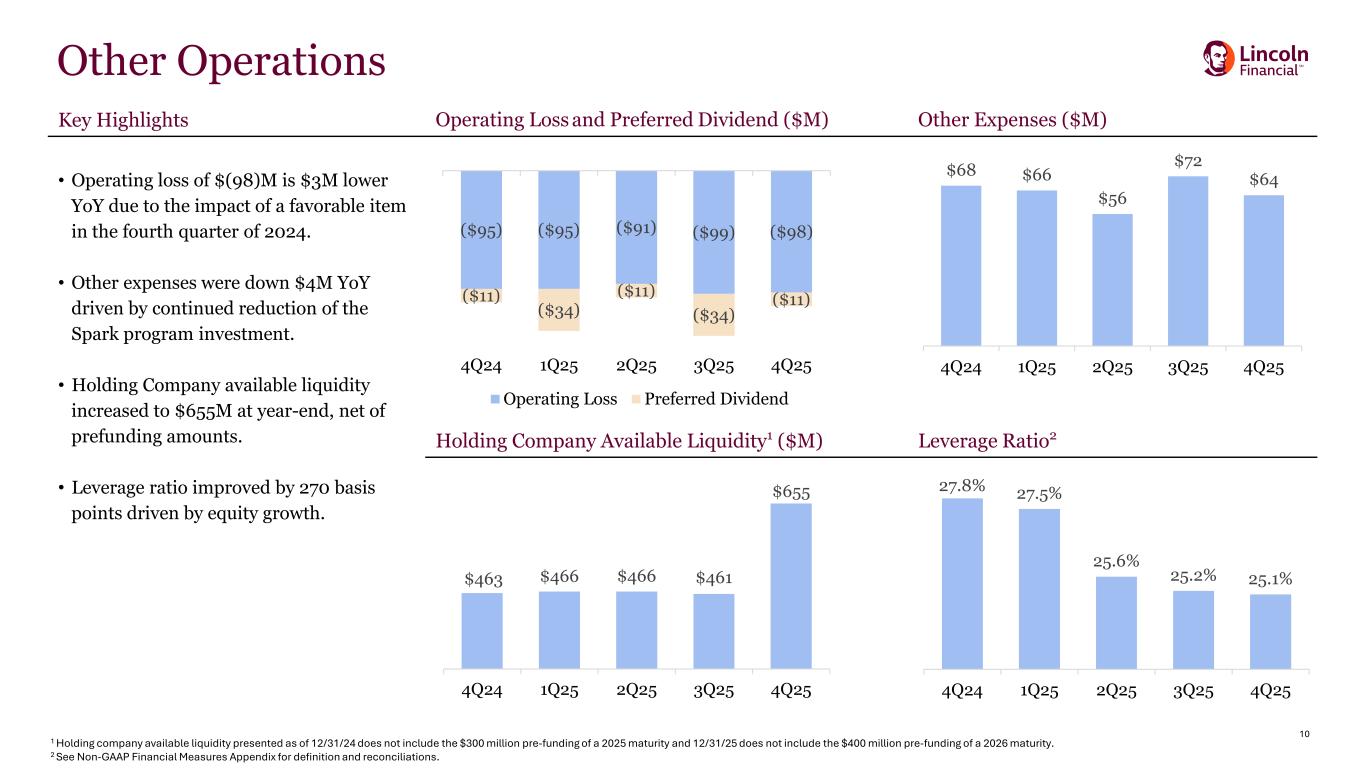

10 Other Operations ($95) ($95) ($91) ($99) ($98) ($11) ($34) ($11) ($34) ($11) 4Q24 1Q25 2Q25 3Q25 4Q25 Operating Loss Preferred Dividend $463 $466 $466 $461 $655 4Q24 1Q25 2Q25 3Q25 4Q25 27.8% 27.5% 25.6% 25.2% 25.1% 4Q24 1Q25 2Q25 3Q25 4Q25 $68 $66 $56 $72 $64 4Q24 1Q25 2Q25 3Q25 4Q25 1 Holding company available liquidity presented as of 12/31/24 does not include the $300 million pre-funding of a 2025 maturity and 12/31/25 does not include the $400 million pre-funding of a 2026 maturity. 2 See Non-GAAP Financial Measures Appendix for definition and reconciliations. Key Highlights Operating Loss and Preferred Dividend ($M) Other Expenses ($M) • Operating loss of $(98)M is $3M lower YoY due to the impact of a favorable item in the fourth quarter of 2024. • Other expenses were down $4M YoY driven by continued reduction of the Spark program investment. • Holding Company available liquidity increased to $655M at year-end, net of prefunding amounts. • Leverage ratio improved by 270 basis points driven by equity growth. Holding Company Available Liquidity1 ($M) Leverage Ratio2

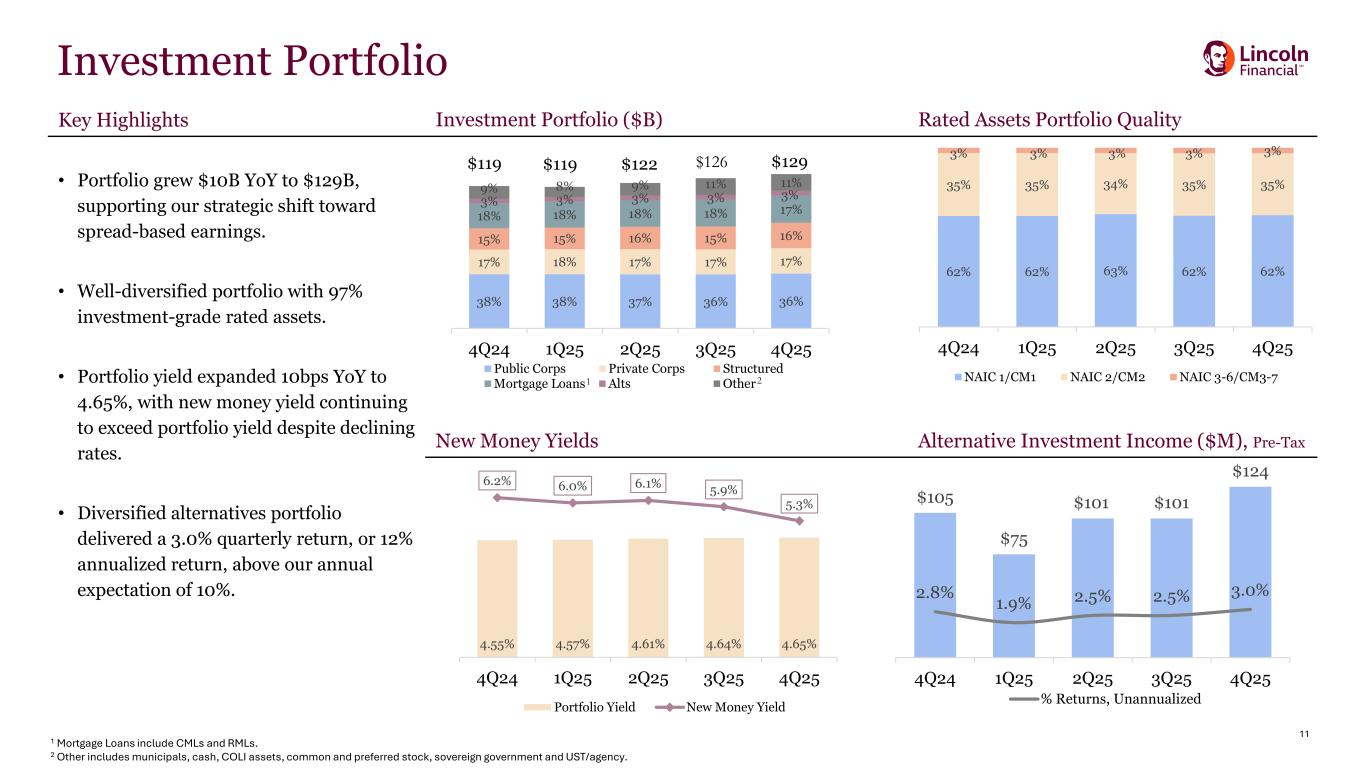

11 Key Highlights Investment Portfolio ($B) Rated Assets Portfolio Quality • Portfolio grew $10B YoY to $129B, supporting our strategic shift toward spread-based earnings. • Well-diversified portfolio with 97% investment-grade rated assets. • Portfolio yield expanded 10bps YoY to 4.65%, with new money yield continuing to exceed portfolio yield despite declining rates. • Diversified alternatives portfolio delivered a 3.0% quarterly return, or 12% annualized return, above our annual expectation of 10%. New Money Yields Alternative Investment Income ($M), Pre-Tax 38% 38% 37% 36% 36% 17% 18% 17% 17% 17% 15% 15% 16% 15% 16% 18% 18% 18% 18% 17% 3% 3% 3% 3% 3%9% 8% 9% 11% 11% 4Q24 1Q25 2Q25 3Q25 4Q25 Public Corps Private Corps Structured Mortgage Loans Alts Other Investment Portfolio 4.55% 4.57% 4.61% 4.64% 4.65% 6.2% 6.0% 6.1% 5.9% 5.3% 4Q24 1Q25 2Q25 3Q25 4Q25 Portfolio Yield New Money Yield $105 $75 $101 $101 $124 2.8% 1.9% 2.5% 2.5% 3.0% 0 20 40 60 80 100 120 140 4Q24 1Q25 2Q25 3Q25 4Q25 % Returns, Unannualized 62% 62% 63% 62% 62% 35% 35% 34% 35% 35% 3% 3% 3% 3% 3% 4Q24 1Q25 2Q25 3Q25 4Q25 NAIC 1/CM1 NAIC 2/CM2 NAIC 3-6/CM3-7 $119 $119 $122 $126 1 2 $129 1 Mortgage Loans include CMLs and RMLs. 2 Other includes municipals, cash, COLI assets, common and preferred stock, sovereign government and UST/agency.

12 Outlook

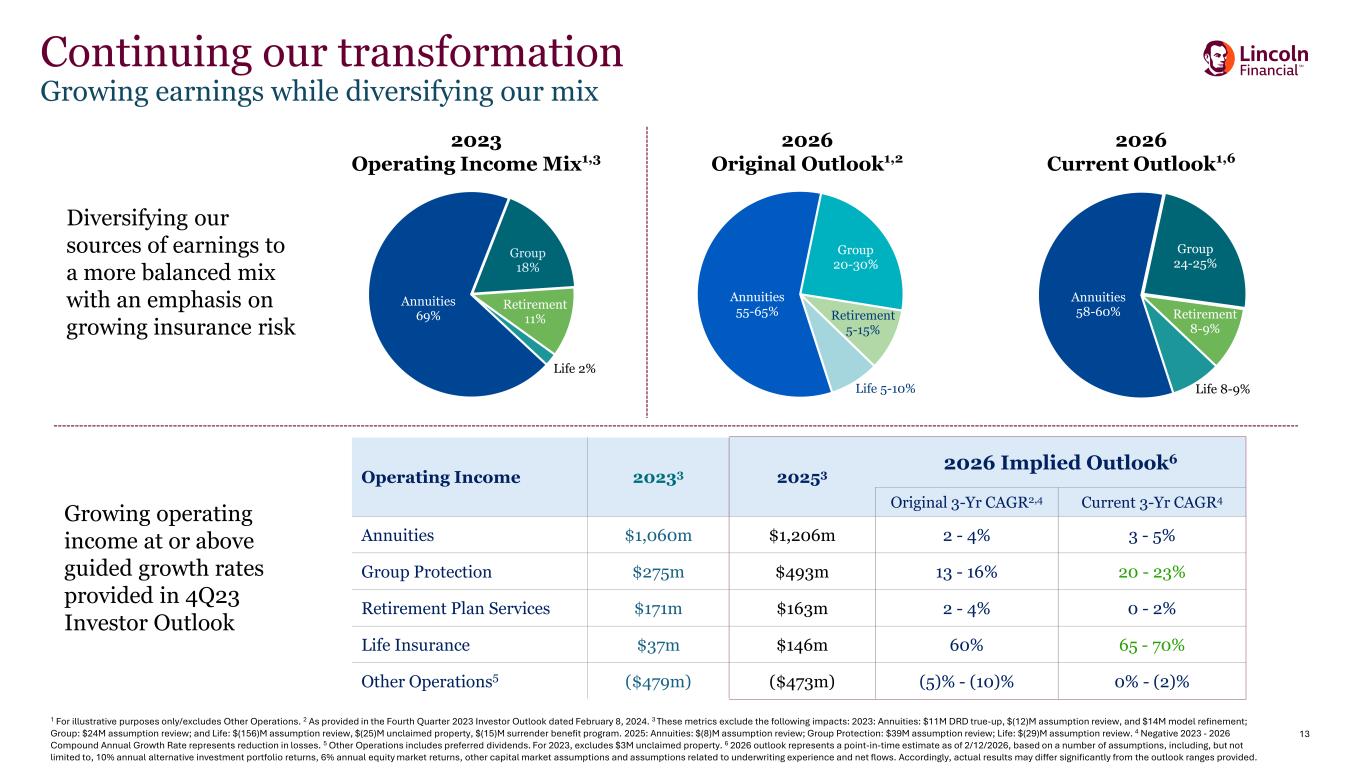

13 Continuing our transformation Growing earnings while diversifying our mix Annuities 69% Group 18% Retirement 11% Life 2% Annuities 55-65% Group 20-30% Retirement 5-15% Life 5-10% Annuities 58-60% Group 24-25% Retirement 8-9% Life 8-9% 2023 Operating Income Mix1,3 2026 Original Outlook1,2 2026 Current Outlook1,6 Diversifying our sources of earnings to a more balanced mix with an emphasis on growing insurance risk Growing operating income at or above guided growth rates provided in 4Q23 Investor Outlook Operating Income 20233 20253 2026 Implied Outlook6 Original 3-Yr CAGR2,4 Current 3-Yr CAGR4 Annuities $1,060m $1,206m 2 - 4% 3 - 5% Group Protection $275m $493m 13 - 16% 20 - 23% Retirement Plan Services $171m $163m 2 - 4% 0 - 2% Life Insurance $37m $146m 60% 65 - 70% Other Operations5 ($479m) ($473m) (5)% - (10)% 0% - (2)% 1 For illustrative purposes only/excludes Other Operations. 2 As provided in the Fourth Quarter 2023 Investor Outlook dated February 8, 2024. 3 These metrics exclude the following impacts: 2023: Annuities: $11M DRD true-up, $(12)M assumption review, and $14M model refinement; Group: $24M assumption review; and Life: $(156)M assumption review, $(25)M unclaimed property, $(15)M surrender benefit program. 2025: Annuities: $(8)M assumption review; Group Protection: $39M assumption review; Life: $(29)M assumption review. 4 Negative 2023 - 2026 Compound Annual Growth Rate represents reduction in losses. 5 Other Operations includes preferred dividends. For 2023, excludes $3M unclaimed property. 6 2026 outlook represents a point-in-time estimate as of 2/12/2026, based on a number of assumptions, including, but not limited to, 10% annual alternative investment portfolio returns, 6% annual equity market returns, other capital market assumptions and assumptions related to underwriting experience and net flows. Accordingly, actual results may differ significantly from the outlook ranges provided.

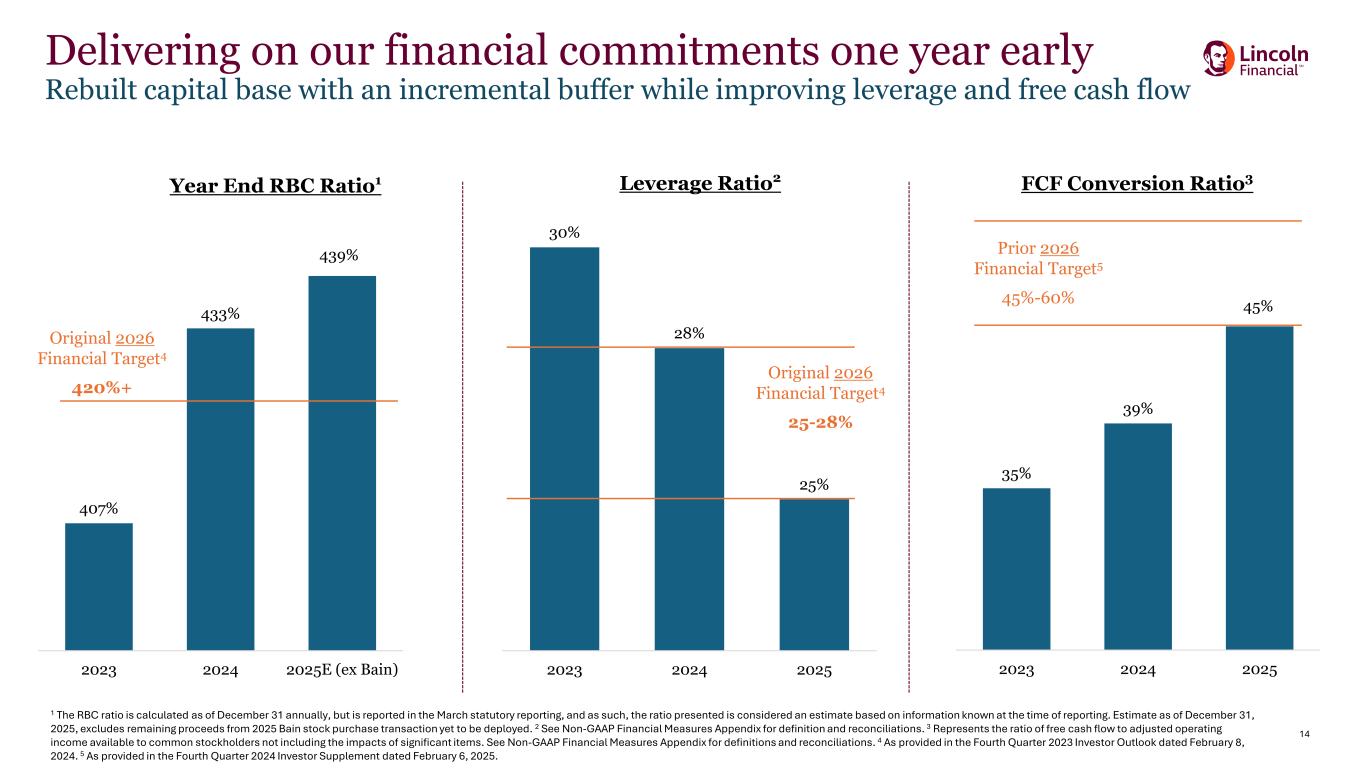

14 407% 433% 2023 2024 2025E (ex Bain) Year End RBC Ratio1 30% 28% 25% 2023 2024 2025 Leverage Ratio2 Delivering on our financial commitments one year early Rebuilt capital base with an incremental buffer while improving leverage and free cash flow Original 2026 Financial Target4 420%+ 35% 39% 2023 2024 2025 FCF Conversion Ratio3 Prior 2026 Financial Target5 45%-60% Original 2026 Financial Target4 25-28% 439% 45% 1 The RBC ratio is calculated as of December 31 annually, but is reported in the March statutory reporting, and as such, the ratio presented is considered an estimate based on information known at the time of reporting. Estimate as of December 31, 2025, excludes remaining proceeds from 2025 Bain stock purchase transaction yet to be deployed. 2 See Non-GAAP Financial Measures Appendix for definition and reconciliations. 3 Represents the ratio of free cash flow to adjusted operating income available to common stockholders not including the impacts of significant items. See Non-GAAP Financial Measures Appendix for definitions and reconciliations. 4 As provided in the Fourth Quarter 2023 Investor Outlook dated February 8, 2024. 5 As provided in the Fourth Quarter 2024 Investor Supplement dated February 6, 2025.

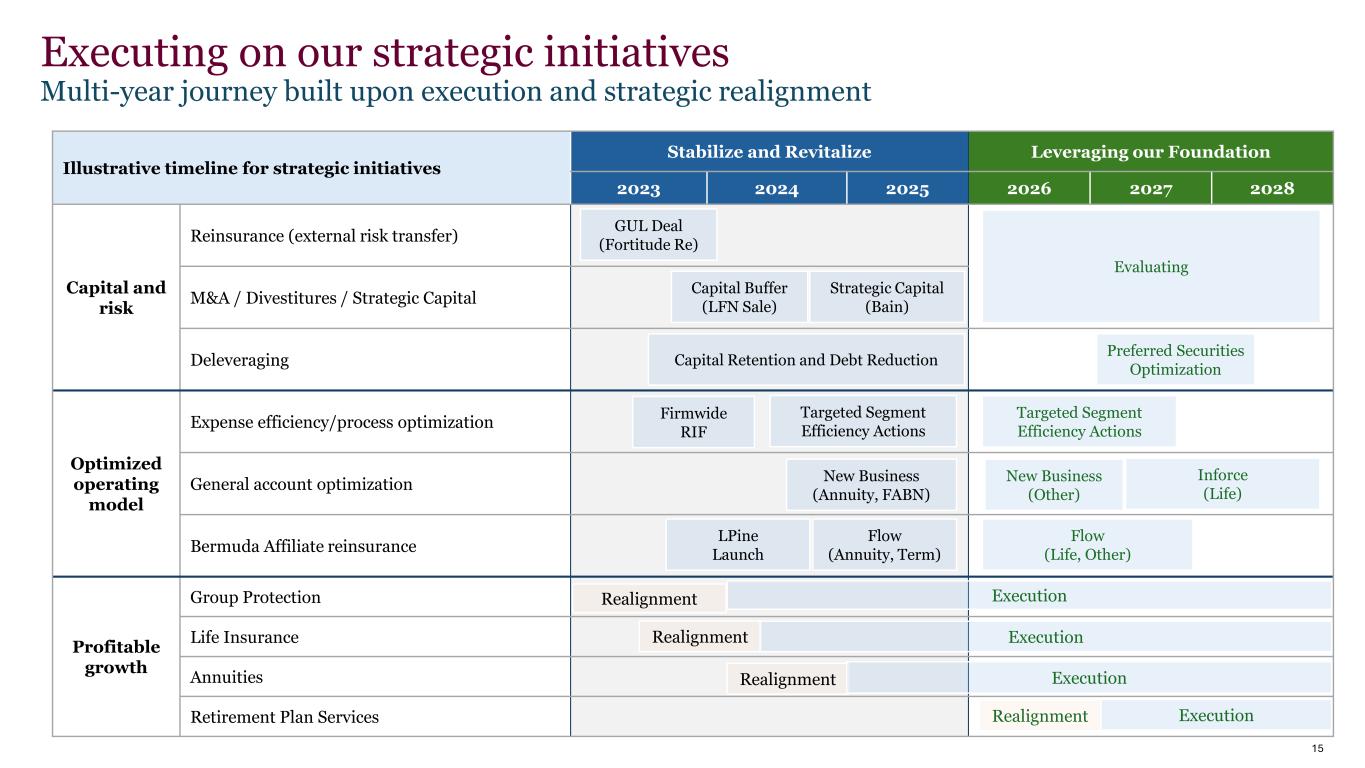

Illustrative timeline for strategic initiatives Stabilize and Revitalize Leveraging our Foundation 2023 2024 2025 2026 2027 2028 Capital and risk Reinsurance (external risk transfer) M&A / Divestitures / Strategic Capital Deleveraging Optimized operating model Expense efficiency/process optimization General account optimization Bermuda Affiliate reinsurance Profitable growth Group Protection Life Insurance Annuities Retirement Plan Services Executing on our strategic initiatives Multi-year journey built upon execution and strategic realignment Evaluating GUL Deal (Fortitude Re) Capital Buffer (LFN Sale) Strategic Capital (Bain) Firmwide RIF Targeted Segment Efficiency Actions Targeted Segment Efficiency Actions Capital Retention and Debt Reduction Preferred Securities Optimization Realignment Execution Realignment Realignment Realignment Execution Execution Execution New Business (Annuity, FABN) New Business (Other) Inforce (Life) LPine Launch Flow (Annuity, Term) Flow (Life, Other) 15

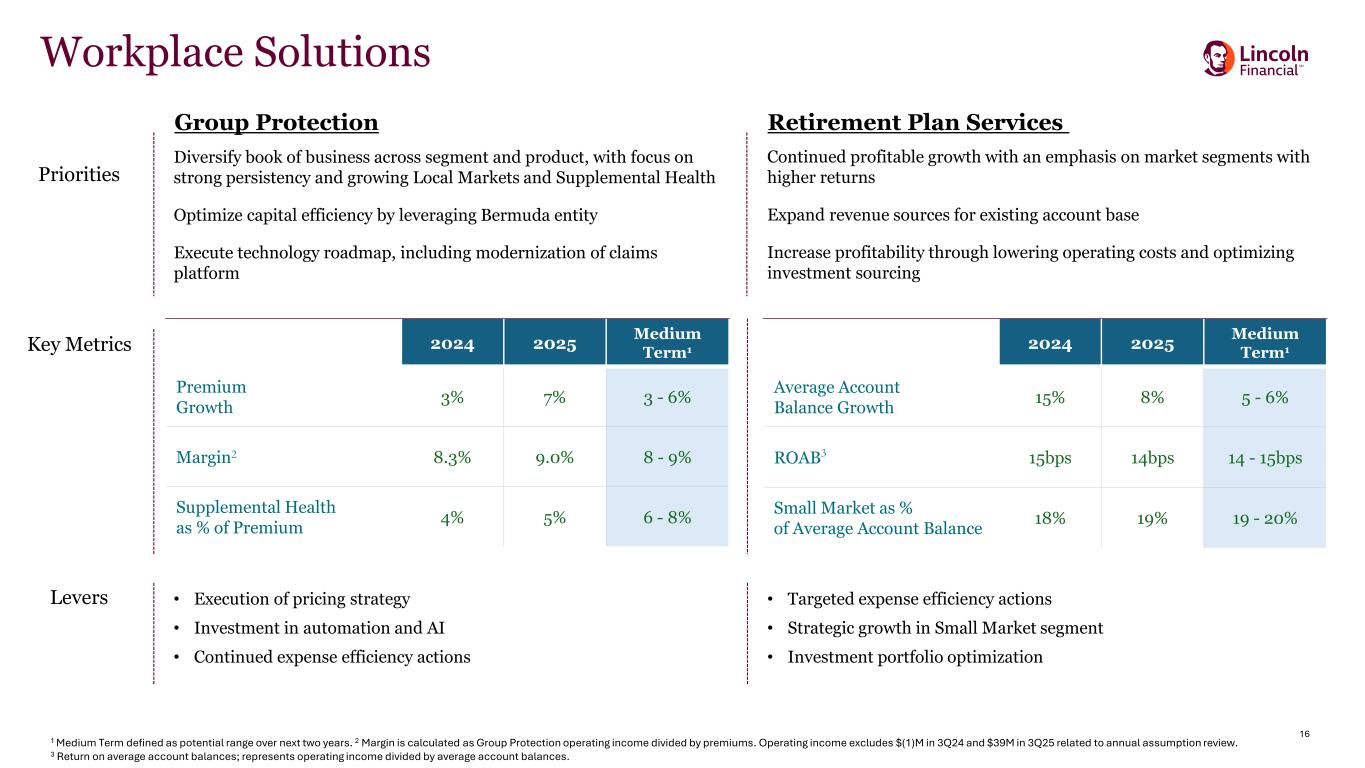

16 Workplace Solutions Priorities Key Metrics 2024 2025 Medium Term1 Premium Growth 3% 7% 3 - 6% Margin2 8.3% 9.0% 8 - 9% Supplemental Health as % of Premium 4% 5% 6 - 8% 2024 2025 Medium Term1 Average Account Balance Growth 15% 8% 5 - 6% ROAB3 15bps 14bps 14 - 15bps Small Market as % of Average Account Balance 18% 19% 19 - 20% Continued profitable growth with an emphasis on market segments with higher returns Expand revenue sources for existing account base Increase profitability through lowering operating costs and optimizing investment sourcing Levers • Execution of pricing strategy • Investment in automation and AI • Continued expense efficiency actions • Targeted expense efficiency actions • Strategic growth in Small Market segment • Investment portfolio optimization Diversify book of business across segment and product, with focus on strong persistency and growing Local Markets and Supplemental Health Optimize capital efficiency by leveraging Bermuda entity Execute technology roadmap, including modernization of claims platform Group Protection Retirement Plan Services 1 Medium Term defined as potential range over next two years. 2 Margin is calculated as Group Protection operating income divided by premiums. Operating income excludes $(1)M in 3Q24 and $39M in 3Q25 related to annual assumption review. 3 Return on average account balances; represents operating income divided by average account balances.

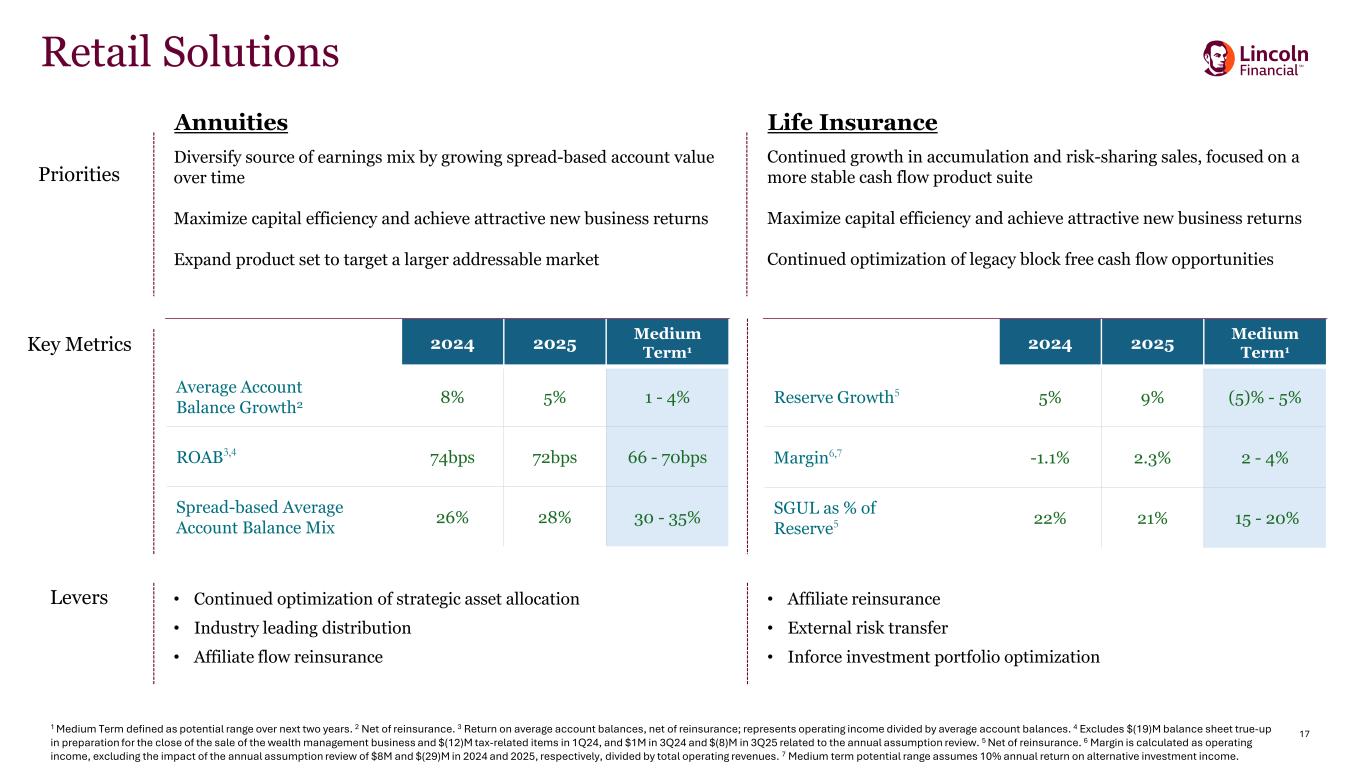

17 Retail Solutions Annuities Life Insurance 2024 2025 Medium Term1 Average Account Balance Growth2 8% 5% 1 - 4% ROAB3,4 74bps 72bps 66 - 70bps Spread-based Average Account Balance Mix 26% 28% 30 - 35% 2024 2025 Medium Term1 Reserve Growth5 5% 9% (5)% - 5% Margin6,7 -1.1% 2.3% 2 - 4% SGUL as % of Reserve5 22% 21% 15 - 20% Priorities Key Metrics Levers Continued growth in accumulation and risk-sharing sales, focused on a more stable cash flow product suite Maximize capital efficiency and achieve attractive new business returns Continued optimization of legacy block free cash flow opportunities Diversify source of earnings mix by growing spread-based account value over time Maximize capital efficiency and achieve attractive new business returns Expand product set to target a larger addressable market • Continued optimization of strategic asset allocation • Industry leading distribution • Affiliate flow reinsurance • Affiliate reinsurance • External risk transfer • Inforce investment portfolio optimization 1 Medium Term defined as potential range over next two years. 2 Net of reinsurance. 3 Return on average account balances, net of reinsurance; represents operating income divided by average account balances. 4 Excludes $(19)M balance sheet true-up in preparation for the close of the sale of the wealth management business and $(12)M tax-related items in 1Q24, and $1M in 3Q24 and $(8)M in 3Q25 related to the annual assumption review. 5 Net of reinsurance. 6 Margin is calculated as operating income, excluding the impact of the annual assumption review of $8M and $(29)M in 2024 and 2025, respectively, divided by total operating revenues. 7 Medium term potential range assumes 10% annual return on alternative investment income.

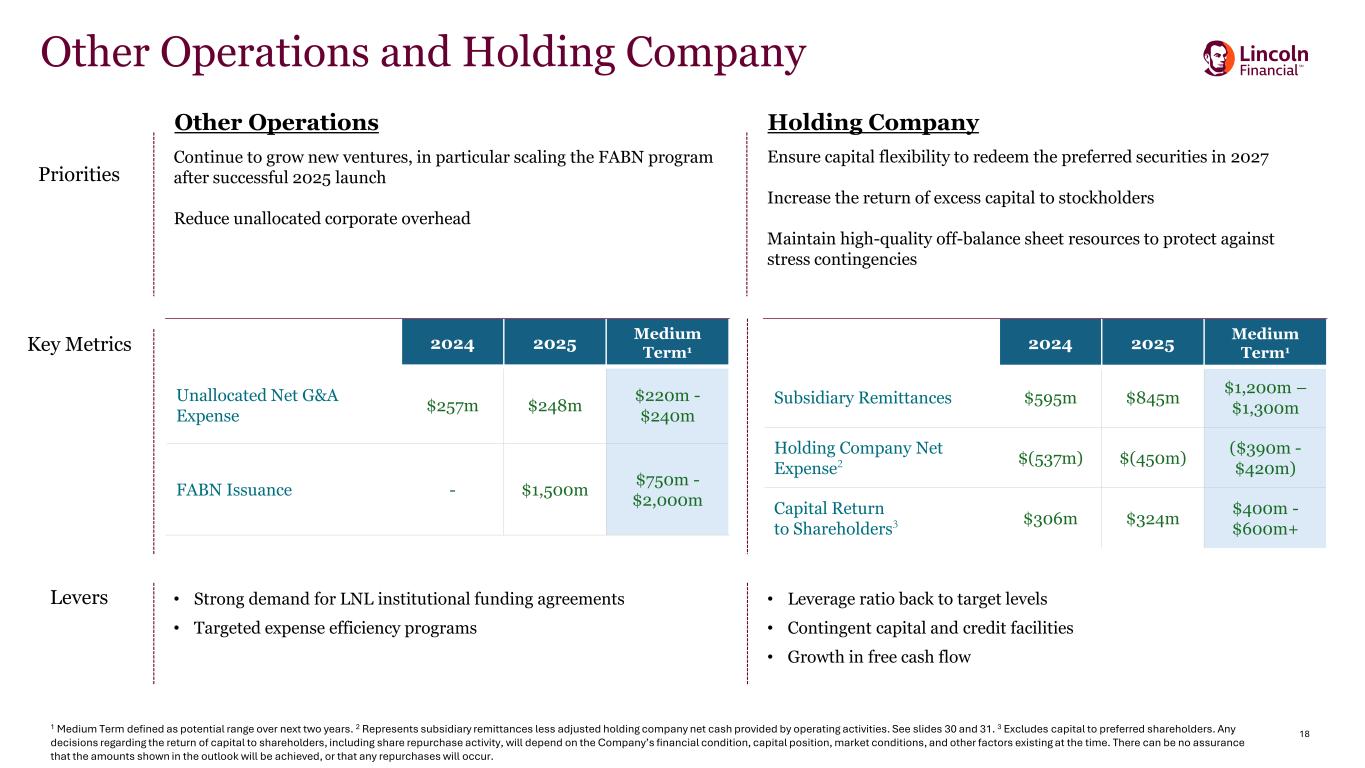

18 Other Operations and Holding Company 2024 2025 Medium Term1 Unallocated Net G&A Expense $257m $248m $220m - $240m FABN Issuance - $1,500m $750m - $2,000m 2024 2025 Medium Term1 Subsidiary Remittances $595m $845m $1,200m – $1,300m Holding Company Net Expense2 $(537m) $(450m) ($390m - $420m) Capital Return to Shareholders3 $306m $324m $400m - $600m+ Priorities Key Metrics Levers Other Operations Holding Company Ensure capital flexibility to redeem the preferred securities in 2027 Increase the return of excess capital to stockholders Maintain high-quality off-balance sheet resources to protect against stress contingencies Continue to grow new ventures, in particular scaling the FABN program after successful 2025 launch Reduce unallocated corporate overhead • Strong demand for LNL institutional funding agreements • Targeted expense efficiency programs • Leverage ratio back to target levels • Contingent capital and credit facilities • Growth in free cash flow 1 Medium Term defined as potential range over next two years. 2 Represents subsidiary remittances less adjusted holding company net cash provided by operating activities. See slides 30 and 31. 3 Excludes capital to preferred shareholders. Any decisions regarding the return of capital to shareholders, including share repurchase activity, will depend on the Company’s financial condition, capital position, market conditions, and other factors existing at the time. There can be no assurance that the amounts shown in the outlook will be achieved, or that any repurchases will occur.

19 Appendix

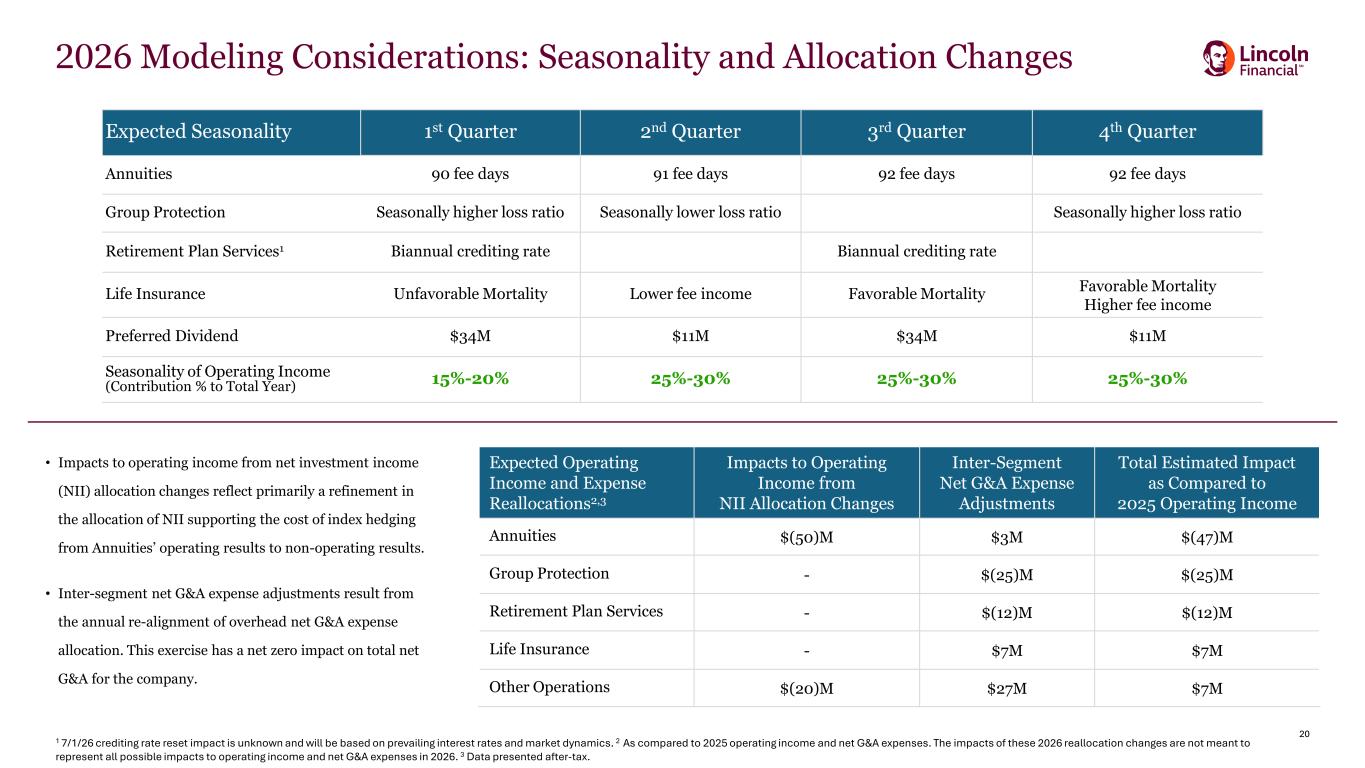

20 Expected Seasonality 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Annuities 90 fee days 91 fee days 92 fee days 92 fee days Group Protection Seasonally higher loss ratio Seasonally lower loss ratio Seasonally higher loss ratio Retirement Plan Services1 Biannual crediting rate Biannual crediting rate Life Insurance Unfavorable Mortality Lower fee income Favorable Mortality Favorable Mortality Higher fee income Preferred Dividend $34M $11M $34M $11M Seasonality of Operating Income (Contribution % to Total Year) 15%-20% 25%-30% 25%-30% 25%-30% 1 7/1/26 crediting rate reset impact is unknown and will be based on prevailing interest rates and market dynamics. 2 As compared to 2025 operating income and net G&A expenses. The impacts of these 2026 reallocation changes are not meant to represent all possible impacts to operating income and net G&A expenses in 2026. 3 Data presented after-tax. 2026 Modeling Considerations: Seasonality and Allocation Changes • Impacts to operating income from net investment income (NII) allocation changes reflect primarily a refinement in the allocation of NII supporting the cost of index hedging from Annuities’ operating results to non-operating results. • Inter-segment net G&A expense adjustments result from the annual re-alignment of overhead net G&A expense allocation. This exercise has a net zero impact on total net G&A for the company. Expected Operating Income and Expense Reallocations2,3 Impacts to Operating Income from NII Allocation Changes Inter-Segment Net G&A Expense Adjustments Total Estimated Impact as Compared to 2025 Operating Income Annuities $(50)M $3M $(47)M Group Protection - $(25)M $(25)M Retirement Plan Services - $(12)M $(12)M Life Insurance - $7M $7M Other Operations $(20)M $27M $7M

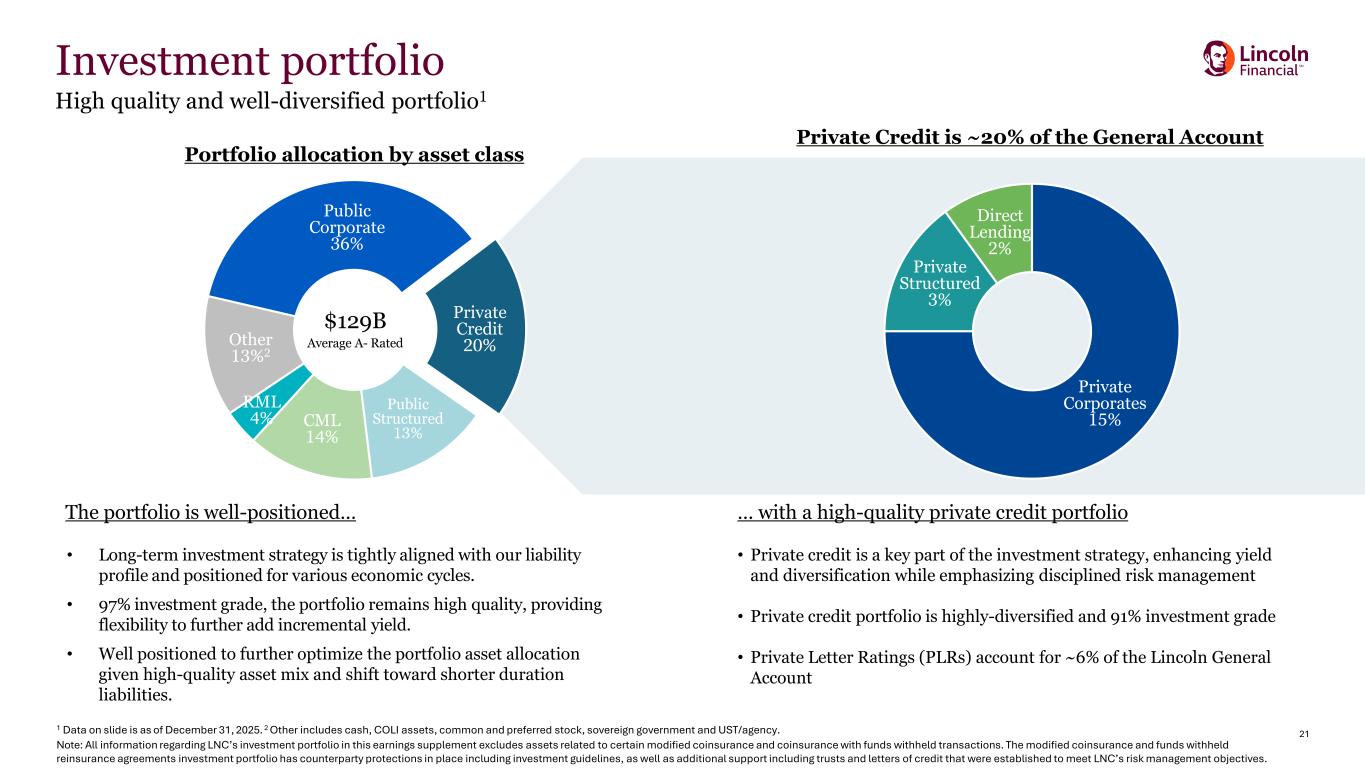

21 Investment portfolio High quality and well-diversified portfolio1 $129B Average A- Rated Portfolio allocation by asset class 1 Data on slide is as of December 31, 2025. 2 Other includes cash, COLI assets, common and preferred stock, sovereign government and UST/agency. Note: All information regarding LNC’s investment portfolio in this earnings supplement excludes assets related to certain modified coinsurance and coinsurance with funds withheld transactions. The modified coinsurance and funds withheld reinsurance agreements investment portfolio has counterparty protections in place including investment guidelines, as well as additional support including trusts and letters of credit that were established to meet LNC’s risk management objectives. … with a high-quality private credit portfolio • Private credit is a key part of the investment strategy, enhancing yield and diversification while emphasizing disciplined risk management • Private credit portfolio is highly-diversified and 91% investment grade • Private Letter Ratings (PLRs) account for ~6% of the Lincoln General Account The portfolio is well-positioned… • Long-term investment strategy is tightly aligned with our liability profile and positioned for various economic cycles. • 97% investment grade, the portfolio remains high quality, providing flexibility to further add incremental yield. • Well positioned to further optimize the portfolio asset allocation given high-quality asset mix and shift toward shorter duration liabilities. Private Credit is ~20% of the General Account Public Corporate 36% Private Credit 20% Public Structured 13% CML 14% RML 4% Other 13%2 Private Corporates 15% Private Structured 3% Direct Lending 2%

22 Non-GAAP Financial Measures Appendix

23 Non-GAAP Financial Measures Non-GAAP Financial Measures Non-GAAP financial measures do not replace the most directly comparable GAAP measures. Reconciliations of the following non-GAAP financial measures to the most directly comparable GAAP financial measures or calculations of such measures, as applicable, are presented herein beginning on slide 25. Adjusted Income (Loss) From Operations Adjusted income (loss) from operations is GAAP net income (loss) excluding the effects of the following items, as applicable: • Items related to annuity product features, which include changes in market risk benefits (“MRBs”), changes in the fair value of the related hedge instruments inclusive of income allocated to support the cost of hedging or future benefits, and changes in the fair value of the embedded derivative liabilities and the associated index options for our indexed annuity products (collectively, “net annuity product features”); • Items related to life insurance product features, which include changes in the fair value of derivatives we hold as part of variable universal life insurance (“VUL”) hedging, changes in reserves resulting from benefit ratio unlocking associated with the impact of capital markets, and changes in the fair value of the embedded derivative liabilities of our indexed universal life insurance (“IUL”) contracts and the associated index options we hold to hedge them (collectively, “net life insurance product features”); • Credit loss-related adjustments on fixed maturity available-for-sale (“AFS”) securities, mortgage loans on real estate and reinsurance-related assets (“credit loss-related adjustments”); • Changes in the fair value of equity securities and certain other investments, the impact of certain derivatives, and realized gains (losses) on sales, disposals and impairments of financial assets (collectively, “investment gains (losses)”); • Changes in the fair value of reinsurance-related embedded derivatives, trading securities and mortgage loans on real estate electing the fair value option (“changes in the fair value of reinsurance-related embedded derivatives, trading securities and certain mortgage loans”); • Income (loss) from the initial adoption of new accounting standards, accounting policy changes and new regulations, including changes in tax law; • Income (loss) from reserve changes, net of related amortization, on business sold through reinsurance; • Losses from the impairment of intangible assets and gains (losses) on other non-financial assets; • Income (loss) from discontinued operations; • Other items, which include the following: certain legal and regulatory accruals; severance expense related to initiatives that realign the workforce; transaction, integration and other costs related to mergers and acquisitions including the acquisition or divestiture, through reinsurance or other means, of businesses or blocks of business, and certain other corporate initiatives; mark-to-market adjustment related to the LNC stock component of our deferred compensation plans (“deferred compensation mark-to-market adjustment”); gains (losses) on modification or early extinguishment of debt; and impacts from settlement or curtailment of defined benefit obligations; and • Income tax benefit (expense) related to the above pre-tax items, including the effect of tax adjustments such as changes to deferred tax valuation allowances. Adjusted income (loss) from operations available to common stockholders is defined as after-tax adjusted income (loss) from operations less preferred stock dividends.

24 Non-GAAP Financial Measures, Cont’d Management believes that the use of the non-GAAP financial measures adjusted income (loss) from operations, adjusted income (loss) from operations available to common stockholders (or adjusted operating income) and adjusted income (loss) from operations per diluted share available to common stockholders is helpful to investors in evaluating the company’s performance. Management believes that excluding the following items from adjusted income (loss) from operations enhances understanding of the underlying trends and long-term performance of the company’s business. Management excludes “net annuity product features” as this adjustment primarily represents the difference between the valuation of reserves and the valuation of derivatives utilized for hedging our variable annuity and indexed annuity products, which can fluctuate significantly from period to period based on changes in equity markets and interest rates. This difference is due to the hedge focus on managing risks to statutory capital as opposed to the GAAP reserves. Management excludes “net life insurance product features” for similar reasons. In addition, management excludes “credit loss-related adjustments” and “investment gains (losses)” as the timing of changes in allowances or sales of credit-impaired investments depends largely on market credit cycles and can vary considerably from period to period and the timing of other sales of investments that would result in gains or losses is driven by market conditions, including interest rates, and other factors. Management excludes “changes in the fair value of reinsurance-related embedded derivatives, trading securities and certain mortgage loans” as this adjustment represents the economics of investments in underlying funds withheld portfolios supporting reinsurance agreements that have been transferred to third-party reinsurers, which is not indicative of our ongoing results. Finally, management excludes from adjusted income (loss) from operations certain additional items (as set forth in the definition above) that are not necessarily indicative of current operating fundamentals or future performance of the business segments, and, in most instances, decisions regarding these items do not necessarily relate to the operations of the individual segments. Management believes excluding these items better explains the results of the company’s ongoing businesses in a manner that allows for enhanced understanding of underlying trends, company performance and business fundamentals. Adjusted Stockholders' Equity Adjusted stockholders’ equity is stockholders’ equity, excluding AOCI, preferred stock, changes in MRBs, guaranteed living benefit (“GLB”) and guaranteed death benefit (“GDB”) hedge instruments gains (losses), and the difference between amounts recognized in net income (loss) on reinsurance-related embedded derivatives and the underlying asset portfolios (“reinsurance-related embedded derivatives and portfolio gains (losses)”). Management believes this metric is useful to investors to analyze our net worth because it eliminates the effect of market movements that can fluctuate significantly from period to period, primarily related to changes in equity markets and interest rates. Stockholders’ equity is the most directly comparable GAAP measure. Leverage Ratio Leverage ratio is a measure that we use to monitor the level of our debt relative to our total capitalization. Debt used in this metric reflects total debt and preferred stock adjusted for certain items. Total capitalization reflects debt used in the numerator of this ratio and stockholders' equity adjusted for certain items. Free Cash Flow Free cash flow is holding company net cash provided by (used in) operating activities less preferred stock dividends, capital contributions to subsidiaries and certain one-time items, plus the net change in excess statutory capital in our life insurance subsidiaries, after meeting targeted levels of statutory capital and holding company obligations, excluding the impact of certain strategic transactions and certain other one-time items.

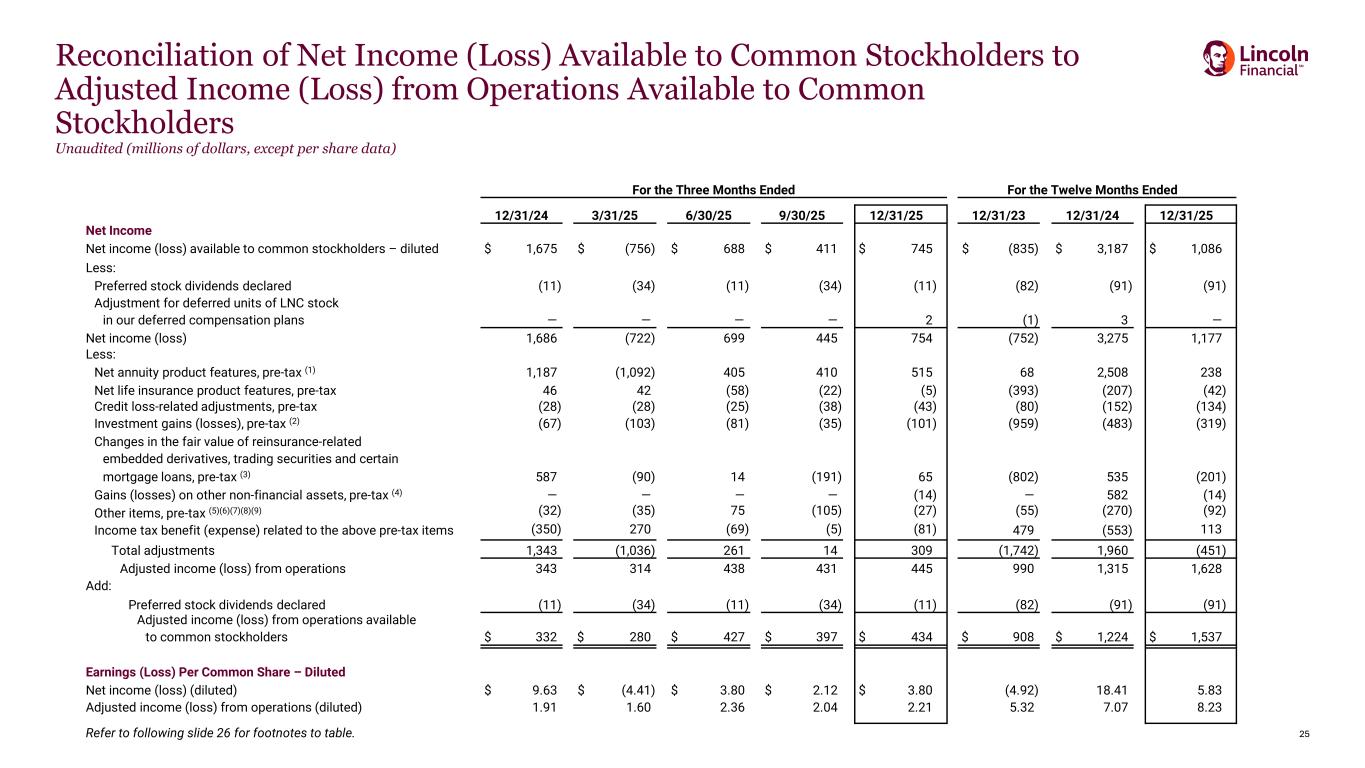

25 Reconciliation of Net Income (Loss) Available to Common Stockholders to Adjusted Income (Loss) from Operations Available to Common Stockholders Unaudited (millions of dollars, except per share data) For the Three Months Ended For the Twelve Months Ended 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 12/31/23 12/31/24 12/31/25 Net Income Net income (loss) available to common stockholders – diluted $ 1,675 $ (756) $ 688 $ 411 $ 745 $ (835) $ 3,187 $ 1,086 Less: Preferred stock dividends declared (11) (34) (11) (34) (11) (82) (91) (91) Adjustment for deferred units of LNC stock in our deferred compensation plans — — — — 2 (1) 3 — Net income (loss) 1,686 (722) 699 445 754 (752) 3,275 1,177 Less: Net annuity product features, pre-tax (1) 1,187 (1,092) 405 410 515 68 2,508 238 Net life insurance product features, pre-tax 46 42 (58) (22) (5) (393) (207) (42) Credit loss-related adjustments, pre-tax (28) (28) (25) (38) (43) (80) (152) (134) Investment gains (losses), pre-tax (2) (67) (103) (81) (35) (101) (959) (483) (319) Changes in the fair value of reinsurance-related embedded derivatives, trading securities and certain mortgage loans, pre-tax (3) 587 (90) 14 (191) 65 (802) 535 (201) Gains (losses) on other non-financial assets, pre-tax (4) — — — — (14) — 582 (14) Other items, pre-tax (5)(6)(7)(8)(9) (32) (35) 75 (105) (27) (55) (270) (92) Income tax benefit (expense) related to the above pre-tax items (350) 270 (69) (5) (81) 479 (553) 113 Total adjustments 1,343 (1,036) 261 14 309 (1,742) 1,960 (451) Adjusted income (loss) from operations 343 314 438 431 445 990 1,315 1,628 Add: Preferred stock dividends declared (11) (34) (11) (34) (11) (82) (91) (91) Adjusted income (loss) from operations available to common stockholders $ 332 $ 280 $ 427 $ 397 $ 434 $ 908 $ 1,224 $ 1,537 Earnings (Loss) Per Common Share – Diluted Net income (loss) (diluted) $ 9.63 $ (4.41) $ 3.80 $ 2.12 $ 3.80 (4.92) 18.41 5.83 Adjusted income (loss) from operations (diluted) 1.91 1.60 2.36 2.04 2.21 5.32 7.07 8.23 Refer to following slide 26 for footnotes to table.

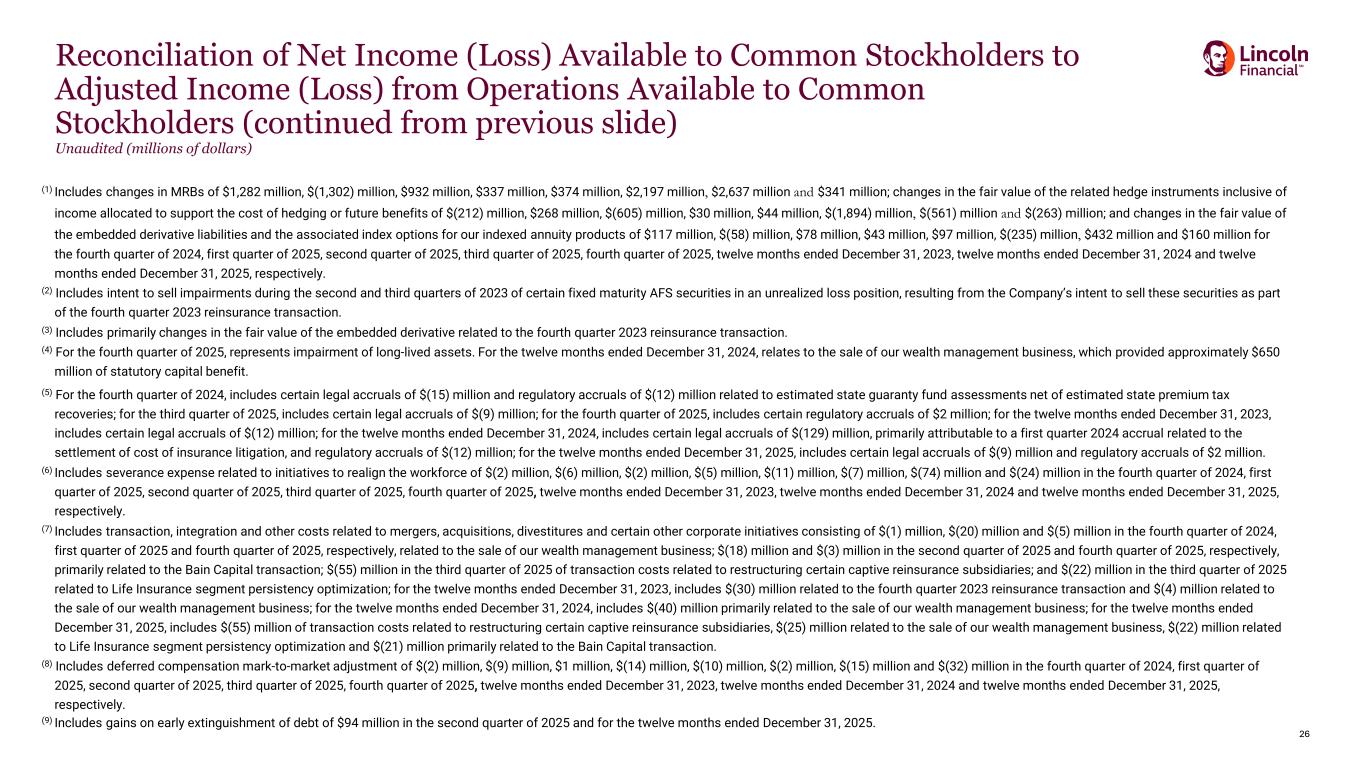

26 Reconciliation of Net Income (Loss) Available to Common Stockholders to Adjusted Income (Loss) from Operations Available to Common Stockholders (continued from previous slide) Unaudited (millions of dollars) (1) Includes changes in MRBs of $1,282 million, $(1,302) million, $932 million, $337 million, $374 million, $2,197 million, $2,637 million and $341 million; changes in the fair value of the related hedge instruments inclusive of income allocated to support the cost of hedging or future benefits of $(212) million, $268 million, $(605) million, $30 million, $44 million, $(1,894) million, $(561) million and $(263) million; and changes in the fair value of the embedded derivative liabilities and the associated index options for our indexed annuity products of $117 million, $(58) million, $78 million, $43 million, $97 million, $(235) million, $432 million and $160 million for the fourth quarter of 2024, first quarter of 2025, second quarter of 2025, third quarter of 2025, fourth quarter of 2025, twelve months ended December 31, 2023, twelve months ended December 31, 2024 and twelve months ended December 31, 2025, respectively. (2) Includes intent to sell impairments during the second and third quarters of 2023 of certain fixed maturity AFS securities in an unrealized loss position, resulting from the Company’s intent to sell these securities as part of the fourth quarter 2023 reinsurance transaction. (3) Includes primarily changes in the fair value of the embedded derivative related to the fourth quarter 2023 reinsurance transaction. (4) For the fourth quarter of 2025, represents impairment of long-lived assets. For the twelve months ended December 31, 2024, relates to the sale of our wealth management business, which provided approximately $650 million of statutory capital benefit. (5) For the fourth quarter of 2024, includes certain legal accruals of $(15) million and regulatory accruals of $(12) million related to estimated state guaranty fund assessments net of estimated state premium tax recoveries; for the third quarter of 2025, includes certain legal accruals of $(9) million; for the fourth quarter of 2025, includes certain regulatory accruals of $2 million; for the twelve months ended December 31, 2023, includes certain legal accruals of $(12) million; for the twelve months ended December 31, 2024, includes certain legal accruals of $(129) million, primarily attributable to a first quarter 2024 accrual related to the settlement of cost of insurance litigation, and regulatory accruals of $(12) million; for the twelve months ended December 31, 2025, includes certain legal accruals of $(9) million and regulatory accruals of $2 million. (6) Includes severance expense related to initiatives to realign the workforce of $(2) million, $(6) million, $(2) million, $(5) million, $(11) million, $(7) million, $(74) million and $(24) million in the fourth quarter of 2024, first quarter of 2025, second quarter of 2025, third quarter of 2025, fourth quarter of 2025, twelve months ended December 31, 2023, twelve months ended December 31, 2024 and twelve months ended December 31, 2025, respectively. (7) Includes transaction, integration and other costs related to mergers, acquisitions, divestitures and certain other corporate initiatives consisting of $(1) million, $(20) million and $(5) million in the fourth quarter of 2024, first quarter of 2025 and fourth quarter of 2025, respectively, related to the sale of our wealth management business; $(18) million and $(3) million in the second quarter of 2025 and fourth quarter of 2025, respectively, primarily related to the Bain Capital transaction; $(55) million in the third quarter of 2025 of transaction costs related to restructuring certain captive reinsurance subsidiaries; and $(22) million in the third quarter of 2025 related to Life Insurance segment persistency optimization; for the twelve months ended December 31, 2023, includes $(30) million related to the fourth quarter 2023 reinsurance transaction and $(4) million related to the sale of our wealth management business; for the twelve months ended December 31, 2024, includes $(40) million primarily related to the sale of our wealth management business; for the twelve months ended December 31, 2025, includes $(55) million of transaction costs related to restructuring certain captive reinsurance subsidiaries, $(25) million related to the sale of our wealth management business, $(22) million related to Life Insurance segment persistency optimization and $(21) million primarily related to the Bain Capital transaction. (8) Includes deferred compensation mark-to-market adjustment of $(2) million, $(9) million, $1 million, $(14) million, $(10) million, $(2) million, $(15) million and $(32) million in the fourth quarter of 2024, first quarter of 2025, second quarter of 2025, third quarter of 2025, fourth quarter of 2025, twelve months ended December 31, 2023, twelve months ended December 31, 2024 and twelve months ended December 31, 2025, respectively. (9) Includes gains on early extinguishment of debt of $94 million in the second quarter of 2025 and for the twelve months ended December 31, 2025.

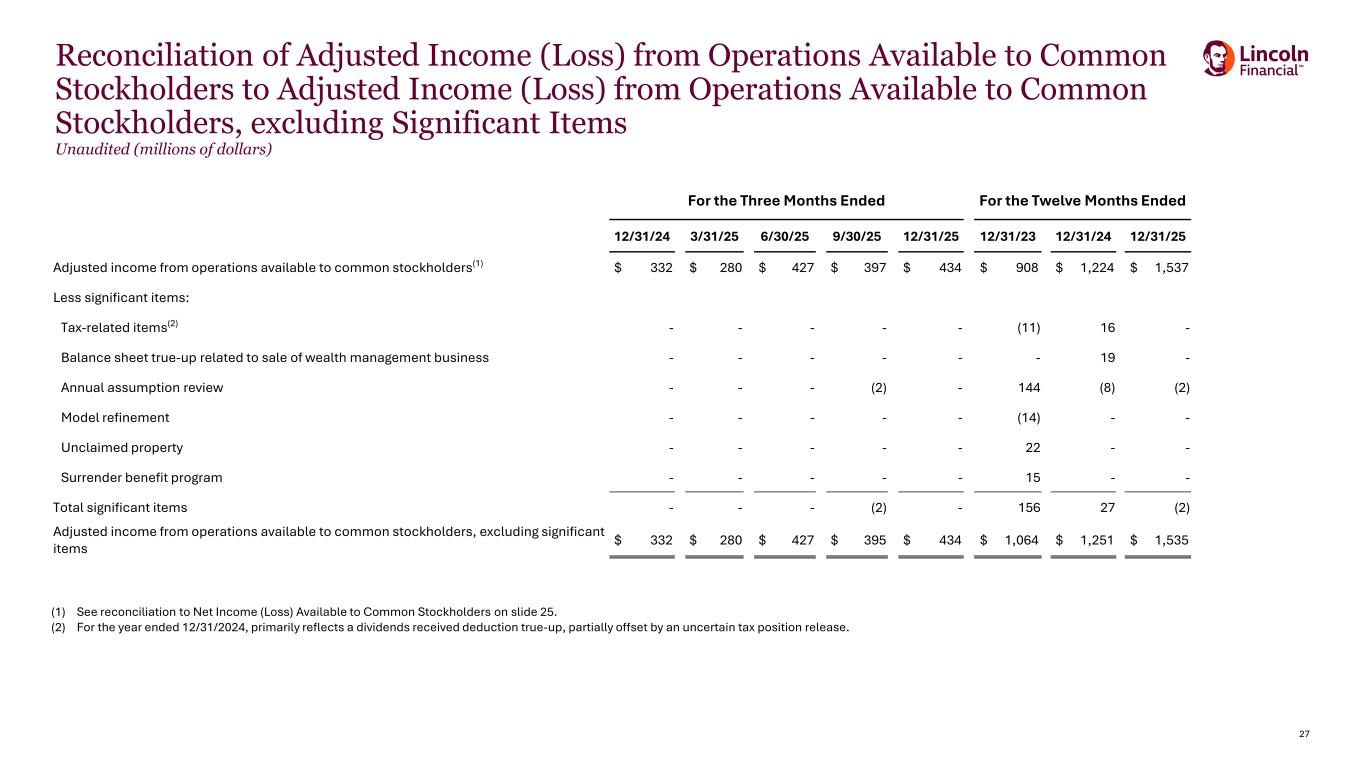

27 Reconciliation of Adjusted Income (Loss) from Operations Available to Common Stockholders to Adjusted Income (Loss) from Operations Available to Common Stockholders, excluding Significant Items Unaudited (millions of dollars) (1) See reconciliation to Net Income (Loss) Available to Common Stockholders on slide 25. (2) For the year ended 12/31/2024, primarily reflects a dividends received deduction true-up, partially offset by an uncertain tax position release. For the Three Months Ended For the Twelve Months Ended 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 12/31/23 12/31/24 12/31/25 Adjusted income from operations available to common stockholders(1) $ 332 $ 280 $ 427 $ 397 $ 434 $ 908 $ 1,224 $ 1,537 Less significant items: Tax-related items(2) - - - - - (11) 16 - Balance sheet true-up related to sale of wealth management business - - - - - - 19 - Annual assumption review - - - (2) - 144 (8) (2) Model refinement - - - - - (14) - - Unclaimed property - - - - - 22 - - Surrender benefit program - - - - - 15 - - Total significant items - - - (2) - 156 27 (2) Adjusted income from operations available to common stockholders, excluding significant items $ 332 $ 280 $ 427 $ 395 $ 434 $ 1,064 $ 1,251 $ 1,535

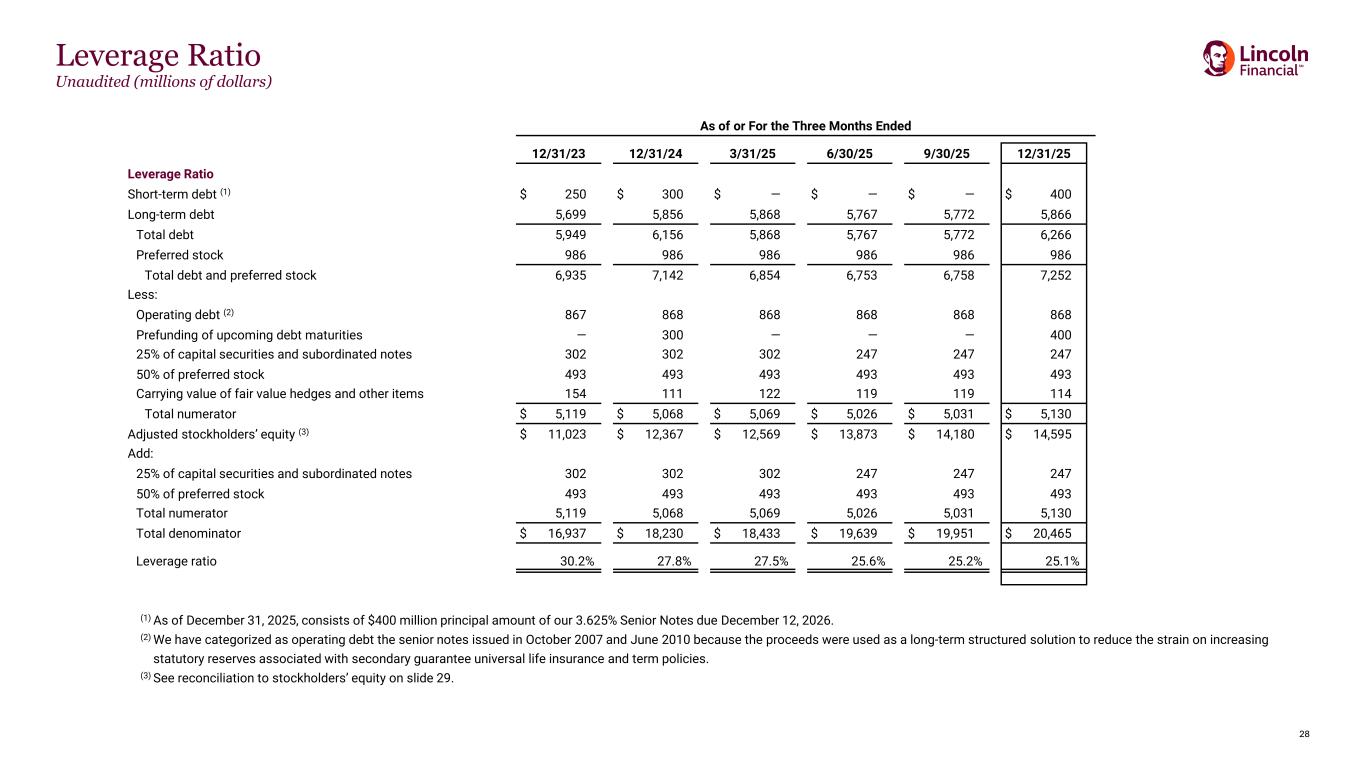

28 Leverage Ratio Unaudited (millions of dollars) As of or For the Three Months Ended 12/31/23 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Leverage Ratio Short-term debt (1) $ 250 $ 300 $ — $ — $ — $ 400 Long-term debt 5,699 5,856 5,868 5,767 5,772 5,866 Total debt 5,949 6,156 5,868 5,767 5,772 6,266 Preferred stock 986 986 986 986 986 986 Total debt and preferred stock 6,935 7,142 6,854 6,753 6,758 7,252 Less: Operating debt (2) 867 868 868 868 868 868 Prefunding of upcoming debt maturities — 300 — — — 400 25% of capital securities and subordinated notes 302 302 302 247 247 247 50% of preferred stock 493 493 493 493 493 493 Carrying value of fair value hedges and other items 154 111 122 119 119 114 Total numerator $ 5,119 $ 5,068 $ 5,069 $ 5,026 $ 5,031 $ 5,130 Adjusted stockholders’ equity (3) $ 11,023 $ 12,367 $ 12,569 $ 13,873 $ 14,180 $ 14,595 Add: 25% of capital securities and subordinated notes 302 302 302 247 247 247 50% of preferred stock 493 493 493 493 493 493 Total numerator 5,119 5,068 5,069 5,026 5,031 5,130 Total denominator $ 16,937 $ 18,230 $ 18,433 $ 19,639 $ 19,951 $ 20,465 Leverage ratio 30.2% 27.8% 27.5% 25.6% 25.2% 25.1% (1) As of December 31, 2025, consists of $400 million principal amount of our 3.625% Senior Notes due December 12, 2026. (2) We have categorized as operating debt the senior notes issued in October 2007 and June 2010 because the proceeds were used as a long-term structured solution to reduce the strain on increasing statutory reserves associated with secondary guarantee universal life insurance and term policies. (3) See reconciliation to stockholders’ equity on slide 29.

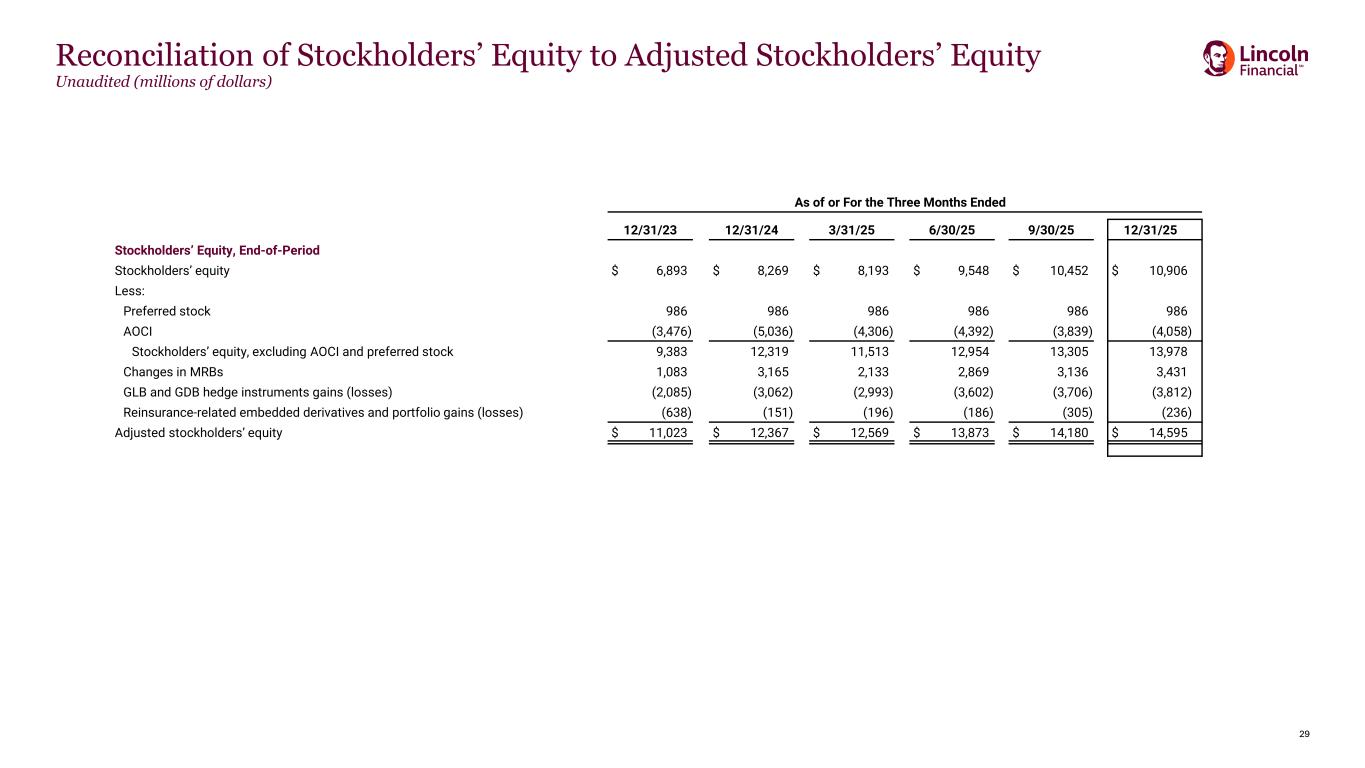

29 Reconciliation of Stockholders’ Equity to Adjusted Stockholders’ Equity Unaudited (millions of dollars) As of or For the Three Months Ended 12/31/23 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Stockholders’ Equity, End-of-Period Stockholders’ equity $ 6,893 $ 8,269 $ 8,193 $ 9,548 $ 10,452 $ 10,906 Less: Preferred stock 986 986 986 986 986 986 AOCI (3,476) (5,036) (4,306) (4,392) (3,839) (4,058) Stockholders’ equity, excluding AOCI and preferred stock 9,383 12,319 11,513 12,954 13,305 13,978 Changes in MRBs 1,083 3,165 2,133 2,869 3,136 3,431 GLB and GDB hedge instruments gains (losses) (2,085) (3,062) (2,993) (3,602) (3,706) (3,812) Reinsurance-related embedded derivatives and portfolio gains (losses) (638) (151) (196) (186) (305) (236) Adjusted stockholders’ equity $ 11,023 $ 12,367 $ 12,569 $ 13,873 $ 14,180 $ 14,595

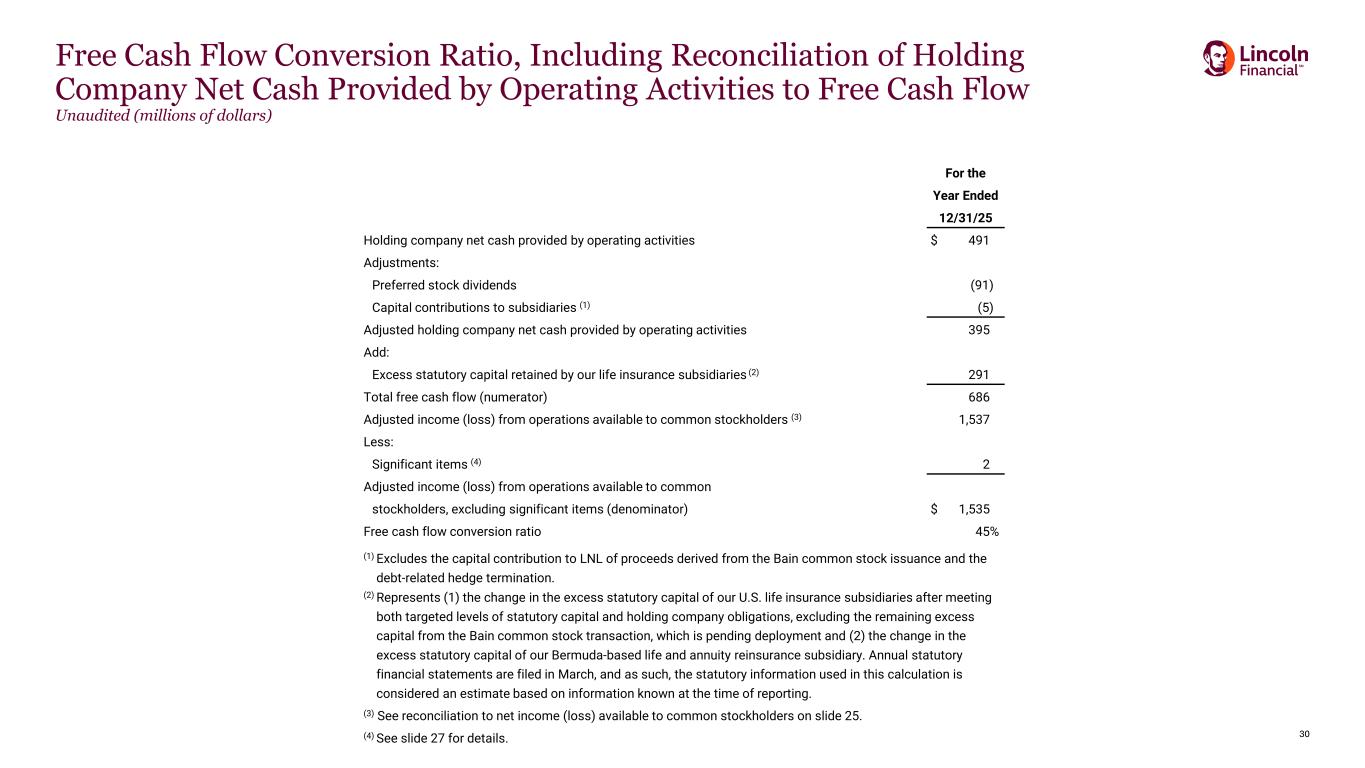

30 Free Cash Flow Conversion Ratio, Including Reconciliation of Holding Company Net Cash Provided by Operating Activities to Free Cash Flow Unaudited (millions of dollars) For the Year Ended 12/31/25 Holding company net cash provided by operating activities $ 491 Adjustments: Preferred stock dividends (91) Capital contributions to subsidiaries (1) (5) Adjusted holding company net cash provided by operating activities 395 Add: Excess statutory capital retained by our life insurance subsidiaries (2) 291 Total free cash flow (numerator) 686 Adjusted income (loss) from operations available to common stockholders (3) 1,537 Less: Significant items (4) 2 Adjusted income (loss) from operations available to common stockholders, excluding significant items (denominator) $ 1,535 Free cash flow conversion ratio 45% (1) Excludes the capital contribution to LNL of proceeds derived from the Bain common stock issuance and the debt-related hedge termination. (2) Represents (1) the change in the excess statutory capital of our U.S. life insurance subsidiaries after meeting both targeted levels of statutory capital and holding company obligations, excluding the remaining excess capital from the Bain common stock transaction, which is pending deployment and (2) the change in the excess statutory capital of our Bermuda-based life and annuity reinsurance subsidiary. Annual statutory financial statements are filed in March, and as such, the statutory information used in this calculation is considered an estimate based on information known at the time of reporting. (3) See reconciliation to net income (loss) available to common stockholders on slide 25. (4) See slide 27 for details.

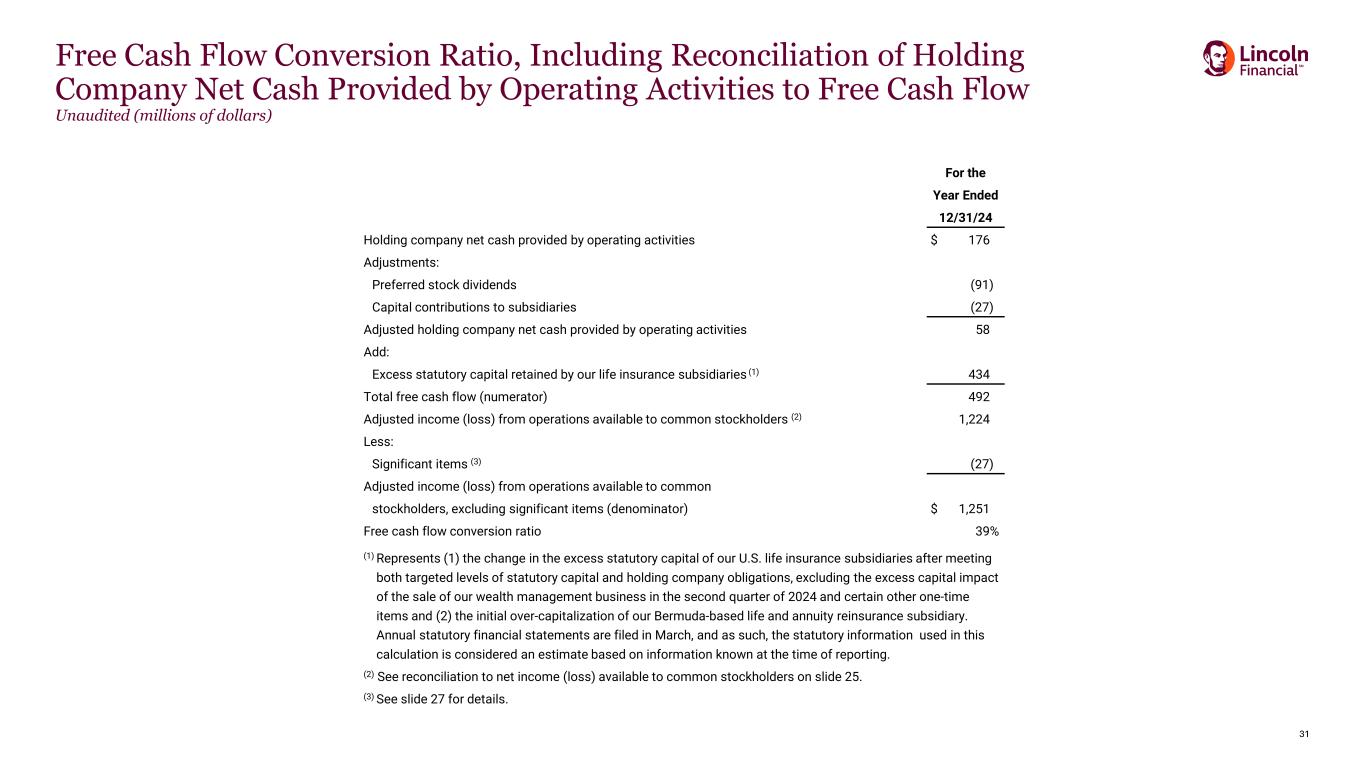

31 Free Cash Flow Conversion Ratio, Including Reconciliation of Holding Company Net Cash Provided by Operating Activities to Free Cash Flow Unaudited (millions of dollars) For the Year Ended 12/31/24 Holding company net cash provided by operating activities $ 176 Adjustments: Preferred stock dividends (91) Capital contributions to subsidiaries (27) Adjusted holding company net cash provided by operating activities 58 Add: Excess statutory capital retained by our life insurance subsidiaries (1) 434 Total free cash flow (numerator) 492 Adjusted income (loss) from operations available to common stockholders (2) 1,224 Less: Significant items (3) (27) Adjusted income (loss) from operations available to common stockholders, excluding significant items (denominator) $ 1,251 Free cash flow conversion ratio 39% (1) Represents (1) the change in the excess statutory capital of our U.S. life insurance subsidiaries after meeting both targeted levels of statutory capital and holding company obligations, excluding the excess capital impact of the sale of our wealth management business in the second quarter of 2024 and certain other one-time items and (2) the initial over-capitalization of our Bermuda-based life and annuity reinsurance subsidiary. Annual statutory financial statements are filed in March, and as such, the statutory information used in this calculation is considered an estimate based on information known at the time of reporting. (2) See reconciliation to net income (loss) available to common stockholders on slide 25. (3) See slide 27 for details.

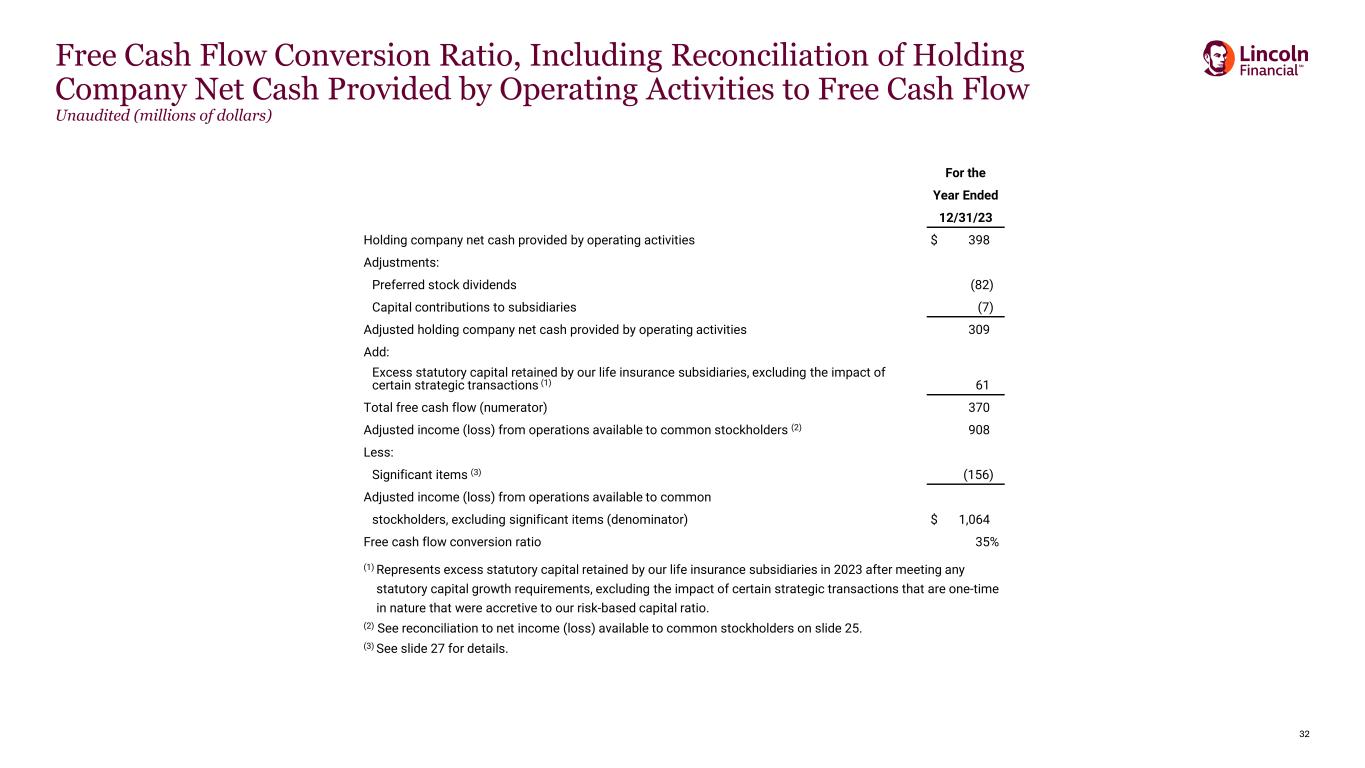

32 Free Cash Flow Conversion Ratio, Including Reconciliation of Holding Company Net Cash Provided by Operating Activities to Free Cash Flow Unaudited (millions of dollars) For the Year Ended 12/31/23 Holding company net cash provided by operating activities $ 398 Adjustments: Preferred stock dividends (82) Capital contributions to subsidiaries (7) Adjusted holding company net cash provided by operating activities 309 Add: Excess statutory capital retained by our life insurance subsidiaries, excluding the impact of certain strategic transactions (1) 61 Total free cash flow (numerator) 370 Adjusted income (loss) from operations available to common stockholders (2) 908 Less: Significant items (3) (156) Adjusted income (loss) from operations available to common stockholders, excluding significant items (denominator) $ 1,064 Free cash flow conversion ratio 35% (1) Represents excess statutory capital retained by our life insurance subsidiaries in 2023 after meeting any statutory capital growth requirements, excluding the impact of certain strategic transactions that are one-time in nature that were accretive to our risk-based capital ratio. (2) See reconciliation to net income (loss) available to common stockholders on slide 25. (3) See slide 27 for details.