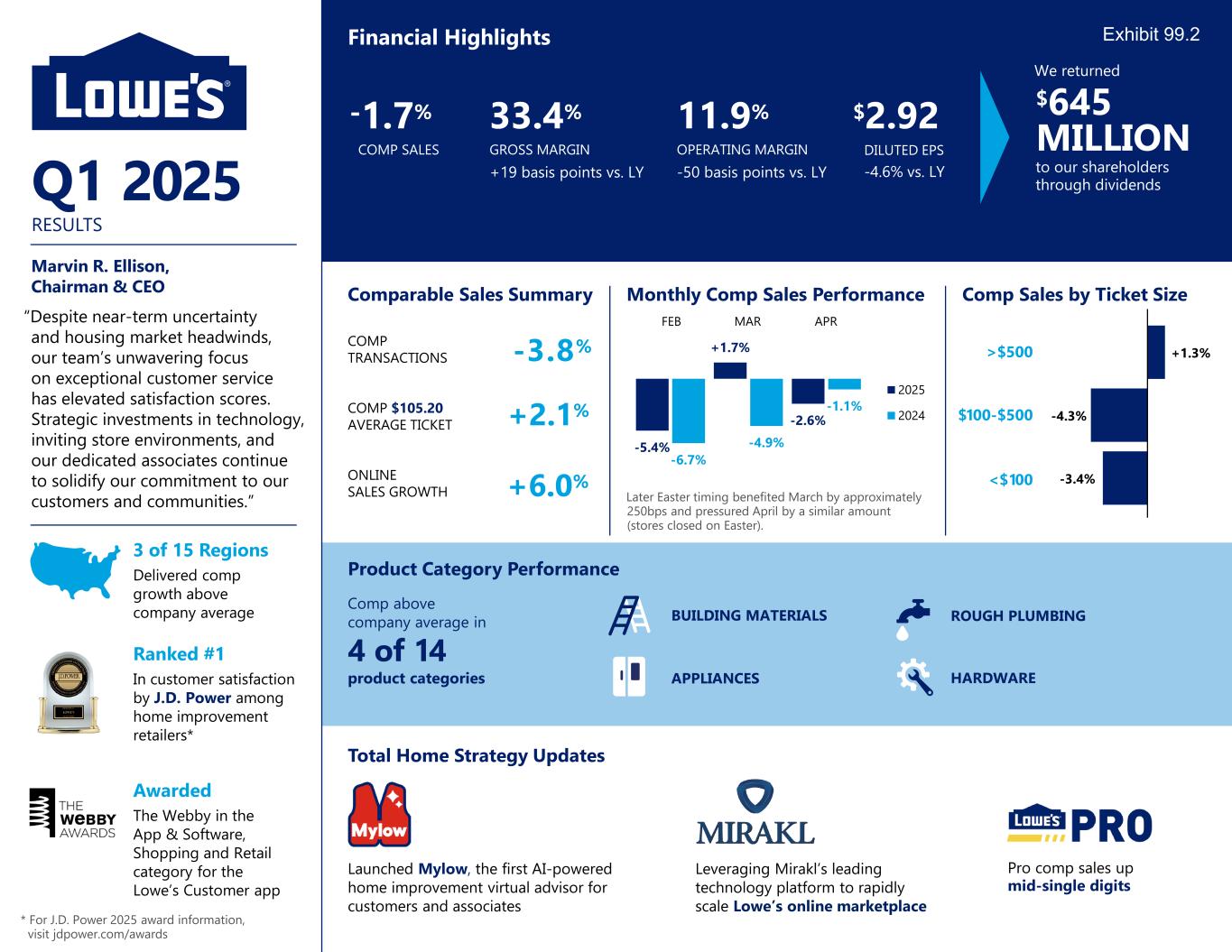

-5.4% +1.7% -2.6% -6.7% -4.9% -1.1% 2025 2024 Marvin R. Ellison, Chairman & CEO “Despite near-term uncertainty and housing market headwinds, our team’s unwavering focus on exceptional customer service has elevated satisfaction scores. Strategic investments in technology, inviting store environments, and our dedicated associates continue to solidify our commitment to our customers and communities.” Q1 2025 RESULTS Comparable Sales Summary COMP TRANSACTIONS COMP $105.20 AVERAGE TICKET ONLINE SALES GROWTH -3.8% +2.1% +6.0% -3.4% -4.3% +1.3%>$500 $100-$500 <$100 3 of 15 Regions Delivered comp growth above company average Product Category Performance Comp above company average in 4 of 14 product categories APPLIANCES BUILDING MATERIALS Monthly Comp Sales Performance Comp Sales by Ticket Size Total Home Strategy Updates FEB MAR APR ROUGH PLUMBING HARDWARE -1.7% COMP SALES We returned $645 MILLION to our shareholders through dividends 33.4% GROSS MARGIN +19 basis points vs. LY $2.92 DILUTED EPS -4.6% vs. LY 11.9% OPERATING MARGIN -50 basis points vs. LY Later Easter timing benefited March by approximately 250bps and pressured April by a similar amount (stores closed on Easter). Ranked #1 In customer satisfaction by J.D. Power among home improvement retailers* Launched Mylow, the first AI-powered home improvement virtual advisor for customers and associates Leveraging Mirakl’s leading technology platform to rapidly scale Lowe’s online marketplace Pro comp sales up mid-single digits Awarded The Webby in the App & Software, Shopping and Retail category for the Lowe’s Customer app Financial Highlights * For J.D. Power 2025 award information, visit jdpower.com/awards Exhibit 99.2

Drive Pro penetration Accelerate online sales Expand home services Create a loyalty ecosystem Increase space productivity Total Home Strategy Solving problems and fulfilling dreams for the home