Lowe’s Acquisition of Foundation Building Materials (FBM) A U G U S T 2 0 , 2 0 2 5 Exhibit 99.2

This presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as "believe", "expect", "anticipate", "plan", "desire", "project", "estimate", "intend", "will", "should", "could", "would", "may", "strategy", "potential", "opportunity", "outlook", "scenario", "guidance", and similar expressions are forward-looking statements. Forward-looking statements involve, among other things, expectations, projections and assumptions about future financial and operating results (including pro forma leverage of Lowe’s and Foundation Building Materials and Lowe’s target leverage ratio), objectives (including objectives related to environmental and social matters), business outlook, priorities, sales growth, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for products and services including customer acceptance of new offerings and initiatives, macroeconomic conditions and consumer spending, share repurchases and Lowe's strategic initiatives, including those relating to acquisitions and dispositions, including Lowe’s proposed acquisition of Foundation Building Materials and the impact of such transactions on our strategic and operational plans and financial results. Such statements involve risks and uncertainties, and we can give no assurance that they will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by these forward- looking statements including, but not limited to, the occurrence of any event or other circumstance that could give rise to the right of one or both of the parties to terminate the stock purchase agreement between Lowe’s and Foundation Building Materials, the failure to obtain the regulatory approval or to satisfy the other conditions to the proposed transaction in the expected timeframe or at all, the risk of litigation and/or regulatory actions related to the proposed transaction, the potential adverse effects to the businesses of Lowe’s or Foundation Building Materials during the pendency of the transaction, the possibility that the anticipated benefits and synergies of the transaction are not realized when expected, or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of changes in general economic conditions, such as volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to Lowe's and its customers, slower rates of growth in real disposable personal income that could affect the rate of growth in consumer spending, inflation and its impacts on discretionary spending and on our costs, shortages and other disruptions in the labor supply, interest rate and currency fluctuations, home price appreciation or decreasing housing turnover, age of housing stock, the availability of consumer credit and of mortgage financing, trade policy changes or additional tariffs, outbreaks of pandemics, fluctuations in fuel and energy costs, inflation or deflation of commodity prices, natural disasters, geopolitical or armed conflicts, acts of both domestic and international terrorism, and other factors that can negatively affect our customers. Investors and others should carefully consider the foregoing factors and other uncertainties, risks and potential events including, but not limited to, those described in "Item 1A - Risk Factors" in our most recent Annual Report on Form 10-K and as may be updated from time to time in Item 1A in our quarterly reports on Form 10-Q or other subsequent filings with the SEC. All such forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update these statements other than as required by law. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements. Forward-looking statements 2

We refer to certain non-GAAP financial measures in this presentation, including: • Lease Adjusted Debt to EBITDAR (Leverage). Lowe’s believes the ratio of Lease Adjusted Debt to EBITDAR is a useful supplemental measure and provides an indication of the results generated by Lowe’s in relation to its level of indebtedness. Lowe’s defines EBITDAR as four quarters' earnings before interest, taxes, depreciation, amortization, share-based payments, rent (inclusive of interest on operating leases), and certain items as defined by Lowe’s credit facility. Lowe’s defines Lease Adjusted Debt as short-term debt, current maturities of long-term debt, long-term debt excluding current maturities, and operating lease liabilities reflected on our balance sheet. A quantitative reconciliation of the Lease Adjusted Debt to EBITDAR to the most directly comparable GAAP measure cannot be provided without unreasonable efforts because certain items may have not yet occurred or are out of Lowe’s or Foundation Building Materials’ control and/or cannot be reasonably predicted. • Pro forma Foundation Building Materials Adjusted earnings before interest, taxes, depreciation, and amortization, or adjusted EBITDA. Pro forma Foundation Building Materials adjusted EBITDA, a metric prepared by Foundation Building Materials, is calculated as operating income, presented on a pro forma basis to include the full year impact of Foundation Building Materials’ recent acquisitions of REW Materials and Unified Door & Hardware Group, and adjusted for certain items made by Foundation Building Materials in its discretion. These adjustments differ from the adjustments that Lowe’s makes in calculating EBITDAR. Pro forma Foundation Building Materials adjusted EBITDA has not been calculated in accordance with the rules governing pro forma calculations as set forth by the Securities and Exchange Commission and has not been audited. Quantitative reconciliations of Foundation Building Materials’ adjusted EBITDA cannot be provided as this metric has been calculated by Foundation Building Materials. These non-GAAP financial measures should not be considered alternatives to, or more meaningful indicators of, Lowe’s or Foundation Building Materials’ financial measures as prepared in accordance with GAAP. Lowe’s or Foundation Building Materials’ methods of determining these non-GAAP financial measures may differ from the methods used by other companies and may not be comparable. Material limitations associated with the use of such measures include that they do not reflect all period costs included in operating expenses and may not be comparable with similarly named financial measures of other companies. Furthermore, the calculations of these non-GAAP financial measures are based on subjective determinations of management of Lowe’s or Foundation Building Materials regarding the nature and classification of events and circumstances that the investor may find material and view differently. Use of Non-GAAP Information 3

Lowe’s Total Home Strategy 2025 Drive Pro penetration Increase space productivity Accelerate online sales Expand home services Create a loyalty ecosystem FBM acquisition marks significant step forward in key Pro growth initiative 4

PRO PENETRATION UP FROM ~19% IN 2019…TO ~30% IN 20251 Lowe’s transformed Pro offering Inventory investmentsDedicated service Powerful Pro brand arsenal Robust Pro loyalty program Enhanced Pro digital offering Launching Pro Extended Aisle Acquisition of ADG 1. Reflects percentage of Lowe’s Pro sales compared to Lowe’s total sales. 5

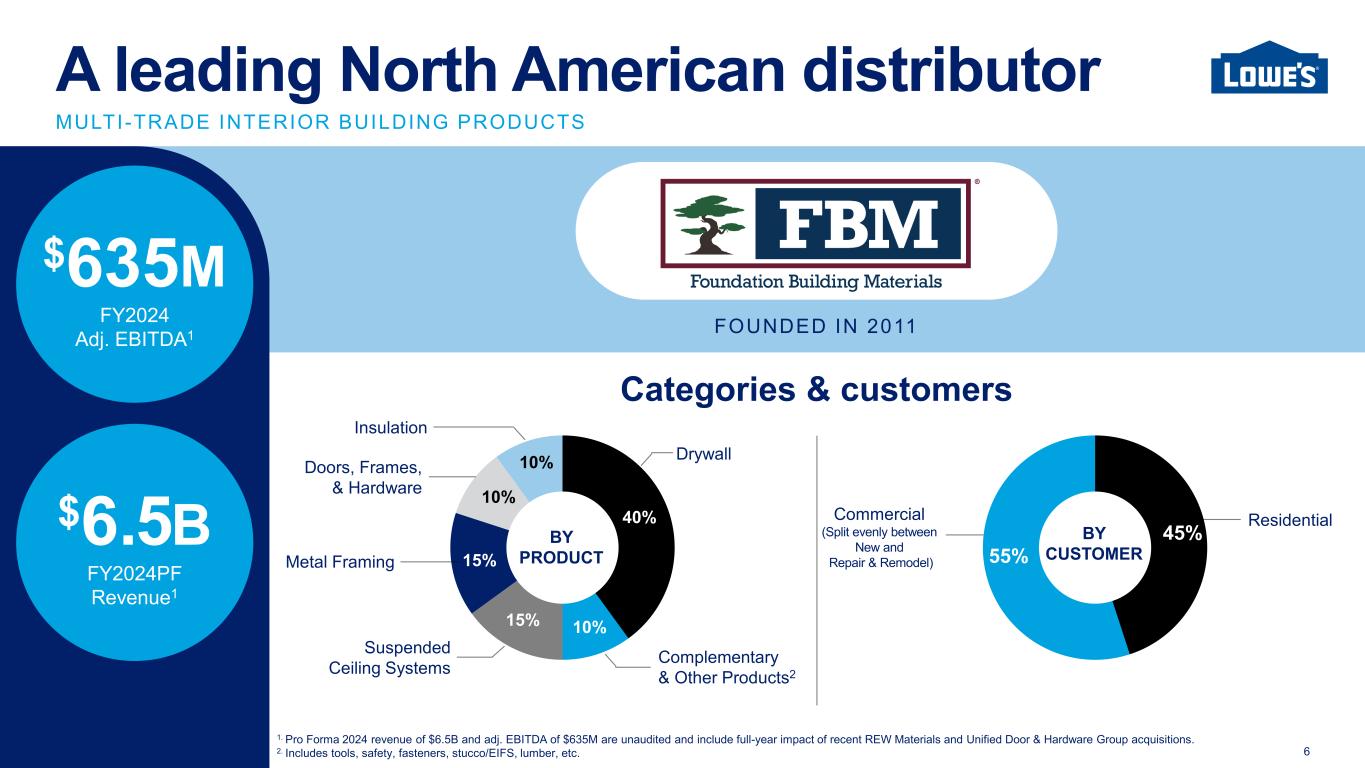

Categories & customers MULTI-TRADE INTERIOR BUILDING PRODUCTS A leading North American distributor FOUNDED IN 2011 $635M FY2024 Adj. EBITDA1 $6.5B FY2024PF Revenue1 40% 10%15% 15% 10% 10% Drywall Complementary & Other Products2 Suspended Ceiling Systems Metal Framing Doors, Frames, & Hardware BY PRODUCT 45% 55% BY CUSTOMER ResidentialCommercial (Split evenly between New and Repair & Remodel) Insulation 6 1. Pro Forma 2024 revenue of $6.5B and adj. EBITDA of $635M are unaudited and include full-year impact of recent REW Materials and Unified Door & Hardware Group acquisitions. 2. Includes tools, safety, fasteners, stucco/EIFS, lumber, etc.

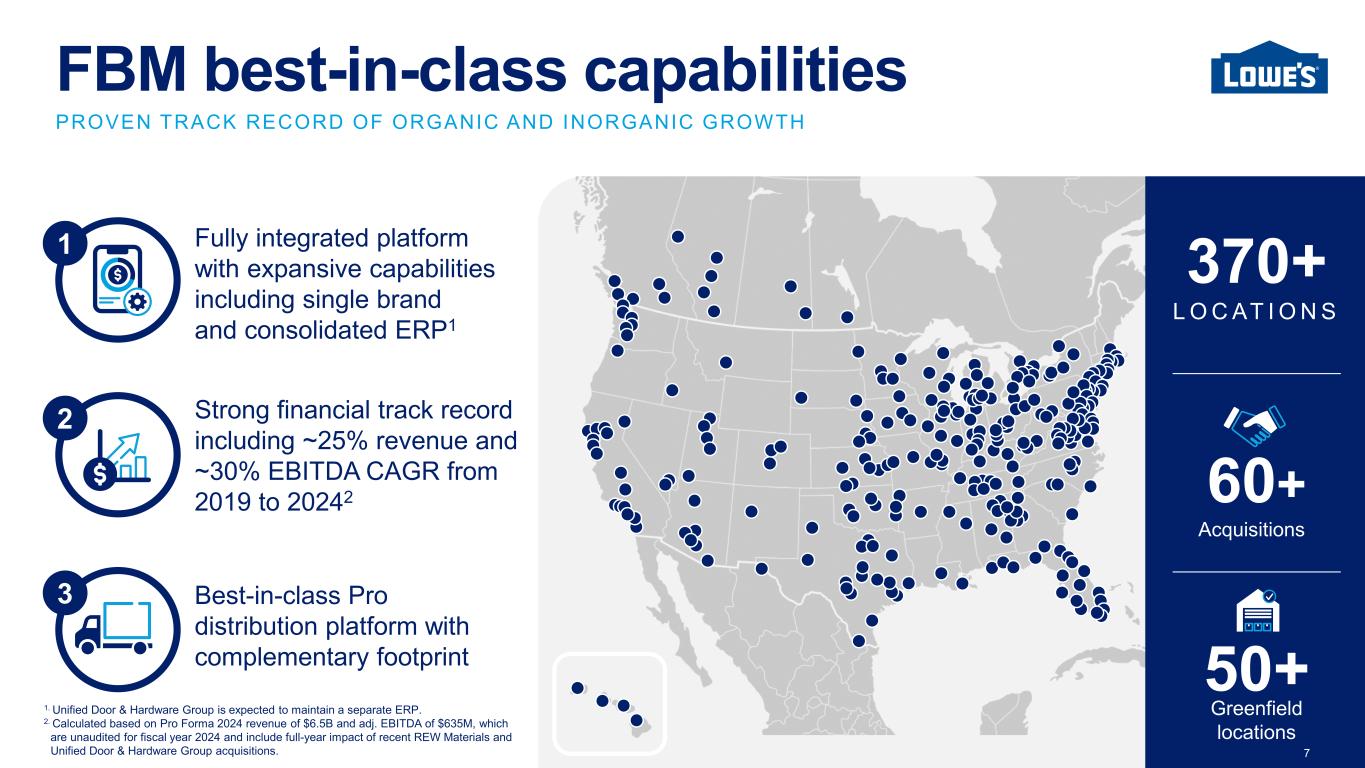

FBM best-in-class capabilities Fully integrated platform with expansive capabilities including single brand and consolidated ERP1 Strong financial track record including ~25% revenue and ~30% EBITDA CAGR from 2019 to 20242 Best-in-class Pro distribution platform with complementary footprint 1 2 3 370+ L O C AT I O N S PROVEN TRACK RECORD OF ORGANIC AND INORGANIC GROWTH 60+ Acquisitions 50+ Greenfield locations 1. Unified Door & Hardware Group is expected to maintain a separate ERP. 2. Calculated based on Pro Forma 2024 revenue of $6.5B and adj. EBITDA of $635M, which are unaudited for fiscal year 2024 and include full-year impact of recent REW Materials and Unified Door & Hardware Group acquisitions. 7

15+ Y E A R S experience Barb Bitzer Chief Accounting Officer Wasi Ahmed Chief Information Officer 10+ Y E A R S experience OVER 200 YEARS OF INDUSTRY EXPERIENCE; 9+ YEARS AVERAGE TENURE AT FBM FBM leadership team 25+ Y E A R S experience 27+ Y E A R S experience Tom Fischbeck President, Doors & Hardware 15+ Y E A R S experience Onur Demirkaya Chief Financial Officer 35+ Y E A R S experience Colin Ramsden Chief Sales Officer 20+ Y E A R S experience David Henry Chief Human Resources Officer 20+ Y E A R S experience Richard Tilley Chief Legal Officer Ruben Mendoza President & Chief Executive Officer 30+ Y E A R S experience David Opre SVP, Business Transformation 35+ Y E A R S experience Marshall Brown SVP, Operations 8

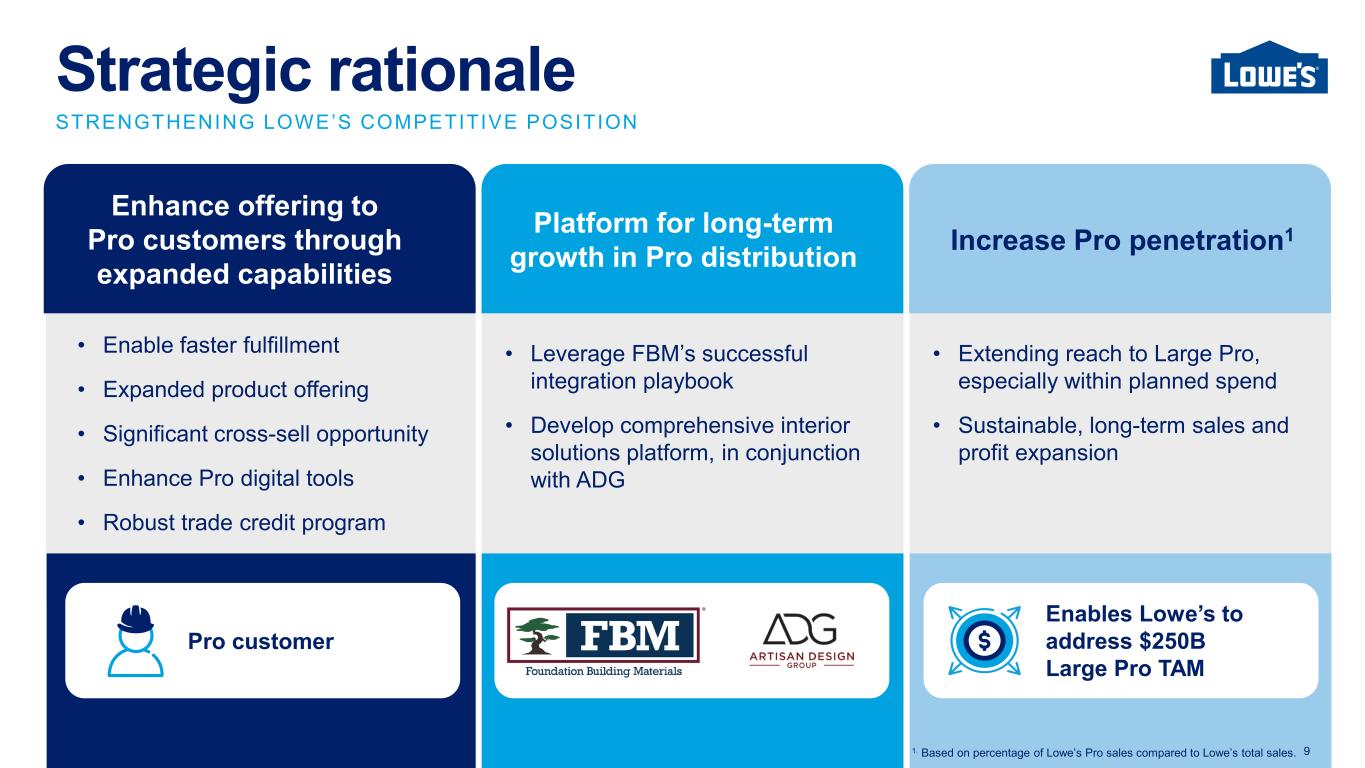

STRENGTHENING LOWE’S COMPETITIVE POSITION Strategic rationale Enhance offering to Pro customers through expanded capabilities Platform for long-term growth in Pro distribution Increase Pro penetration1 • Enable faster fulfillment • Expanded product offering • Significant cross-sell opportunity • Enhance Pro digital tools • Robust trade credit program • Leverage FBM’s successful integration playbook • Develop comprehensive interior solutions platform, in conjunction with ADG • Extending reach to Large Pro, especially within planned spend • Sustainable, long-term sales and profit expansion Enables Lowe’s to address $250B Large Pro TAM Pro customer 1. Based on percentage of Lowe’s Pro sales compared to Lowe’s total sales. 9

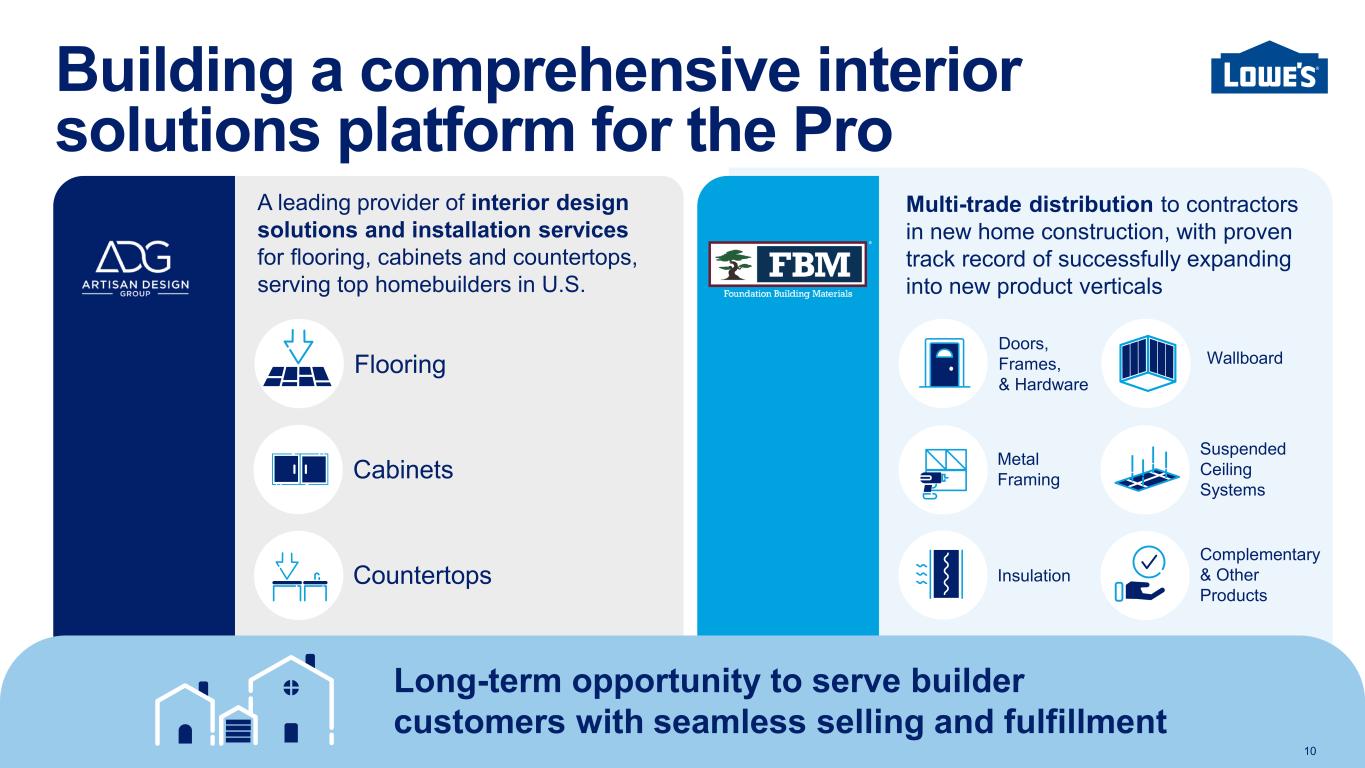

Building a comprehensive interior solutions platform for the Pro A leading provider of interior design solutions and installation services for flooring, cabinets and countertops, serving top homebuilders in U.S. Multi-trade distribution to contractors in new home construction, with proven track record of successfully expanding into new product verticals Cabinets Countertops Flooring Long-term opportunity to serve builder customers with seamless selling and fulfillment Metal Framing Complementary & Other Products Doors, Frames, & Hardware Suspended Ceiling Systems Wallboard Insulation 10

RELEVANT FIGURES AND TIMELINE Transaction details & financial overview • $8.8B purchase price reflects multiple of 13.4x Adj. EBITDA1 • FBM senior leadership fully committed to leading next chapter of growth • Transaction is subject to customary closing conditions, including regulatory approvals, and is expected to close in the fourth quarter of 2025 • Expected to be accretive to adjusted diluted EPS in the first full year, post- closing, excluding synergies • Increase Pro penetration, resulting in long-term sustainable sales and profit expansion2 • Financed with combination of short-term and long-term debt • Expected leverage3 of 3.4x - 3.5x at time of closing • Intend to maintain investment grade credit ratings of BBB+ and Baa1 • Expect to de-lever to 2.75x3 by end of Q2 2027, while pausing share repurchases Transaction Details FBM’s Impact Capital Structure 3. Lease Adjusted Debt to EBITDAR. 11 1. Pro Forma 2024 adj. EBITDA of $635M is unaudited and include full-year impact of recent REW Materials and Unified Door & Hardware Group acquisitions. Multiple calculated based on purchase price, net of expected tax benefits of ~$300M. 2. Based on percentage of Lowe’s Pro sales compared to Lowe’s total sales.