The Manitowoc Company, Inc. February 2026

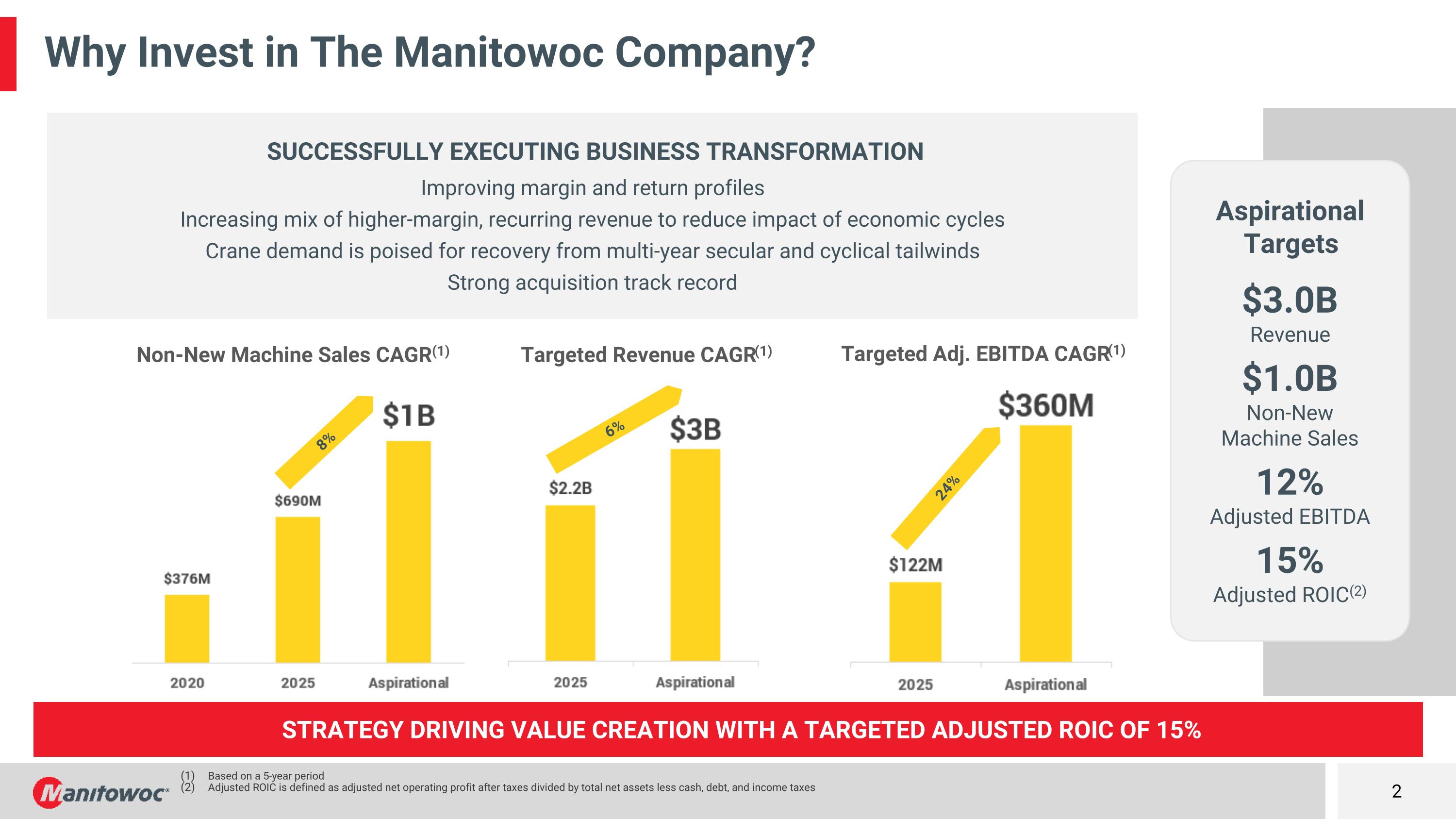

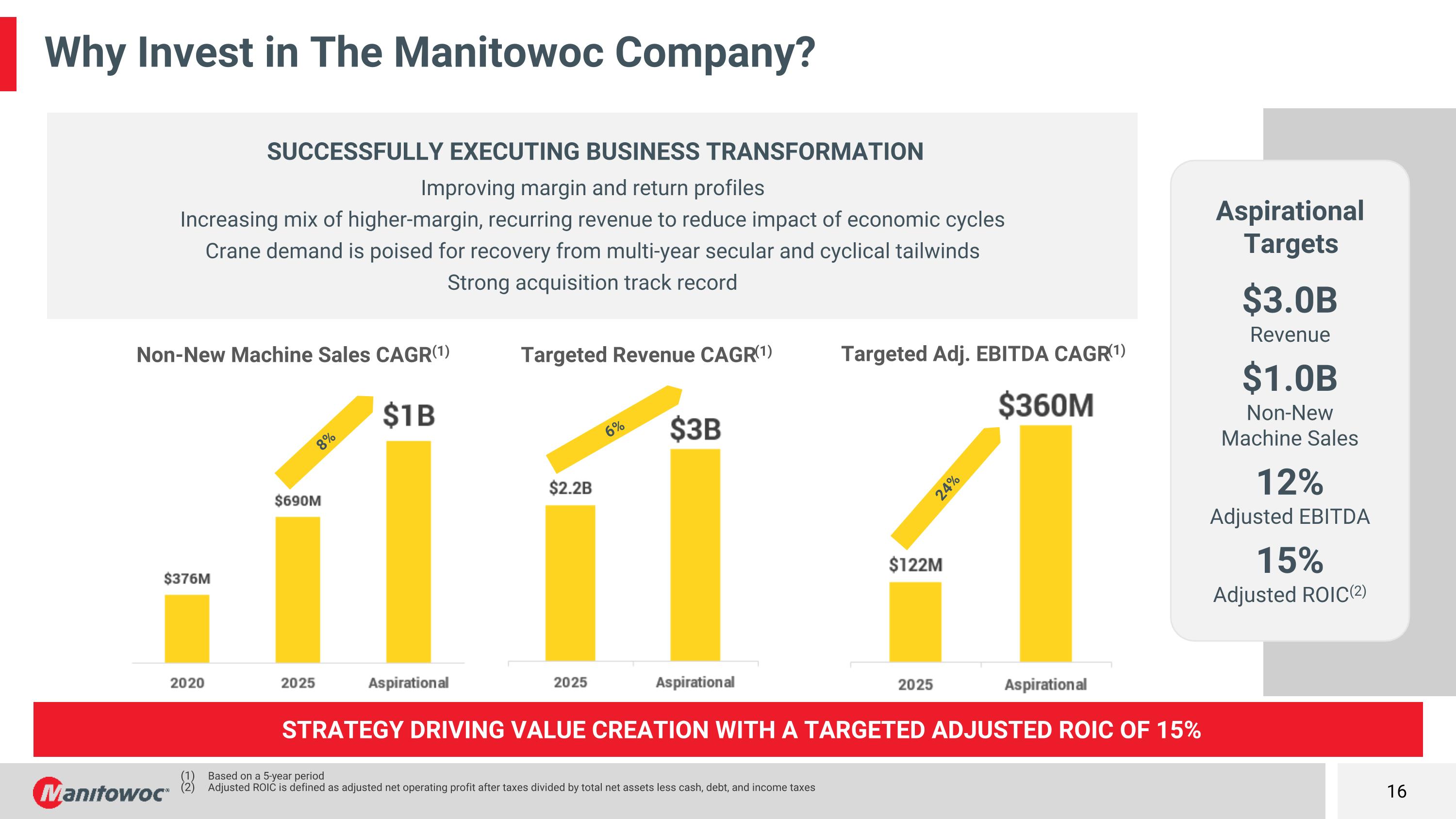

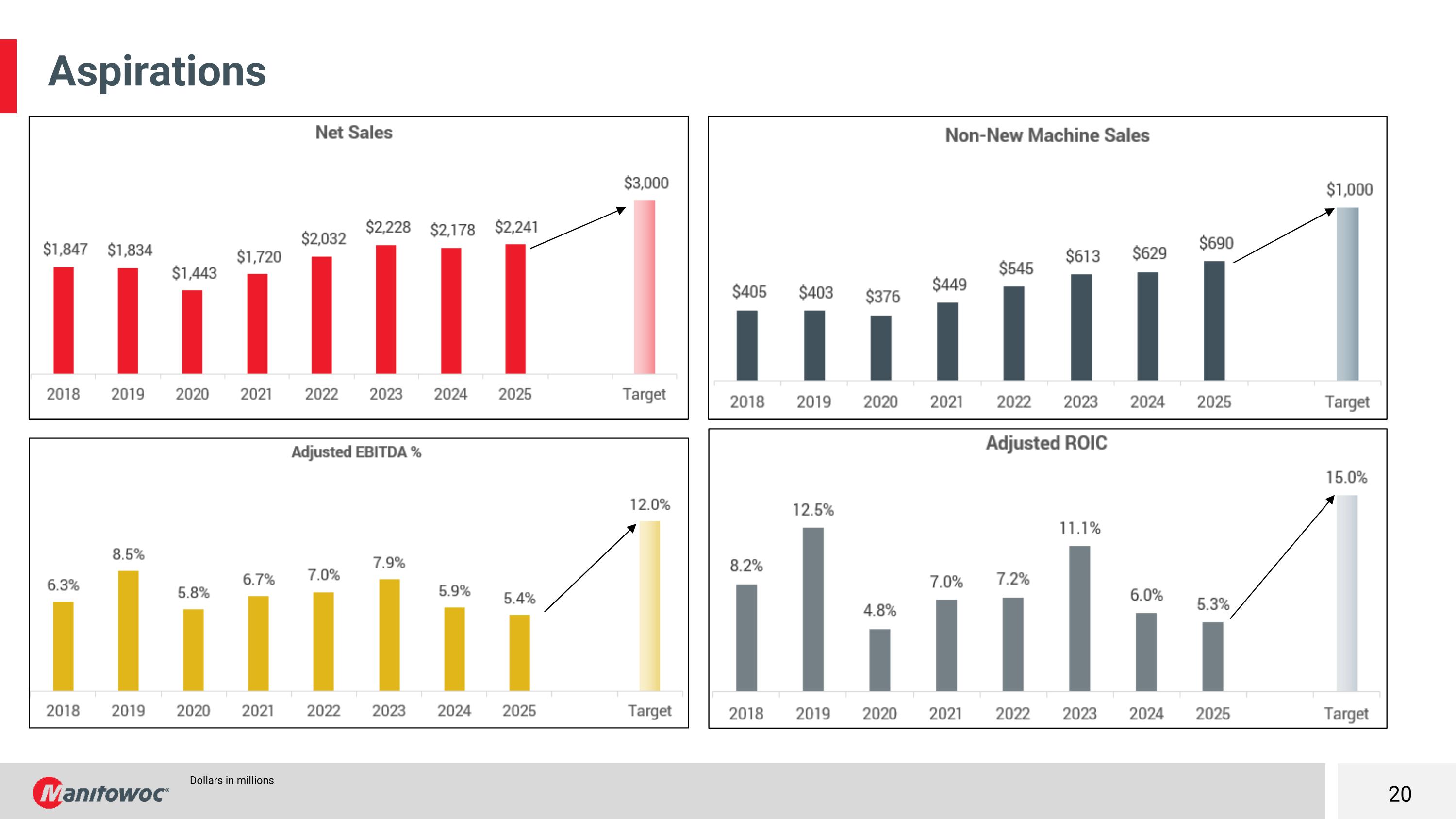

Why Invest in The Manitowoc Company? SUCCESSFULLY EXECUTING BUSINESS TRANSFORMATION Improving margin and return profiles Increasing mix of higher-margin, recurring revenue to reduce impact of economic cycles Crane demand is poised for recovery from multi-year secular and cyclical tailwinds Strong acquisition track record Aspirational Targets $3.0B Revenue $1.0B Non-New Machine Sales 12% Adjusted EBITDA 15% Adjusted ROIC(2) Based on a 5-year period Adjusted ROIC is defined as adjusted net operating profit after taxes divided by total net assets less cash, debt, and income taxes Strategy driving value creation with a targeted adjusted roic of 15% Targeted Adj. EBITDA CAGR(1) 24% Targeted Revenue CAGR(1) 6% 8% Non-New Machine Sales CAGR(1)

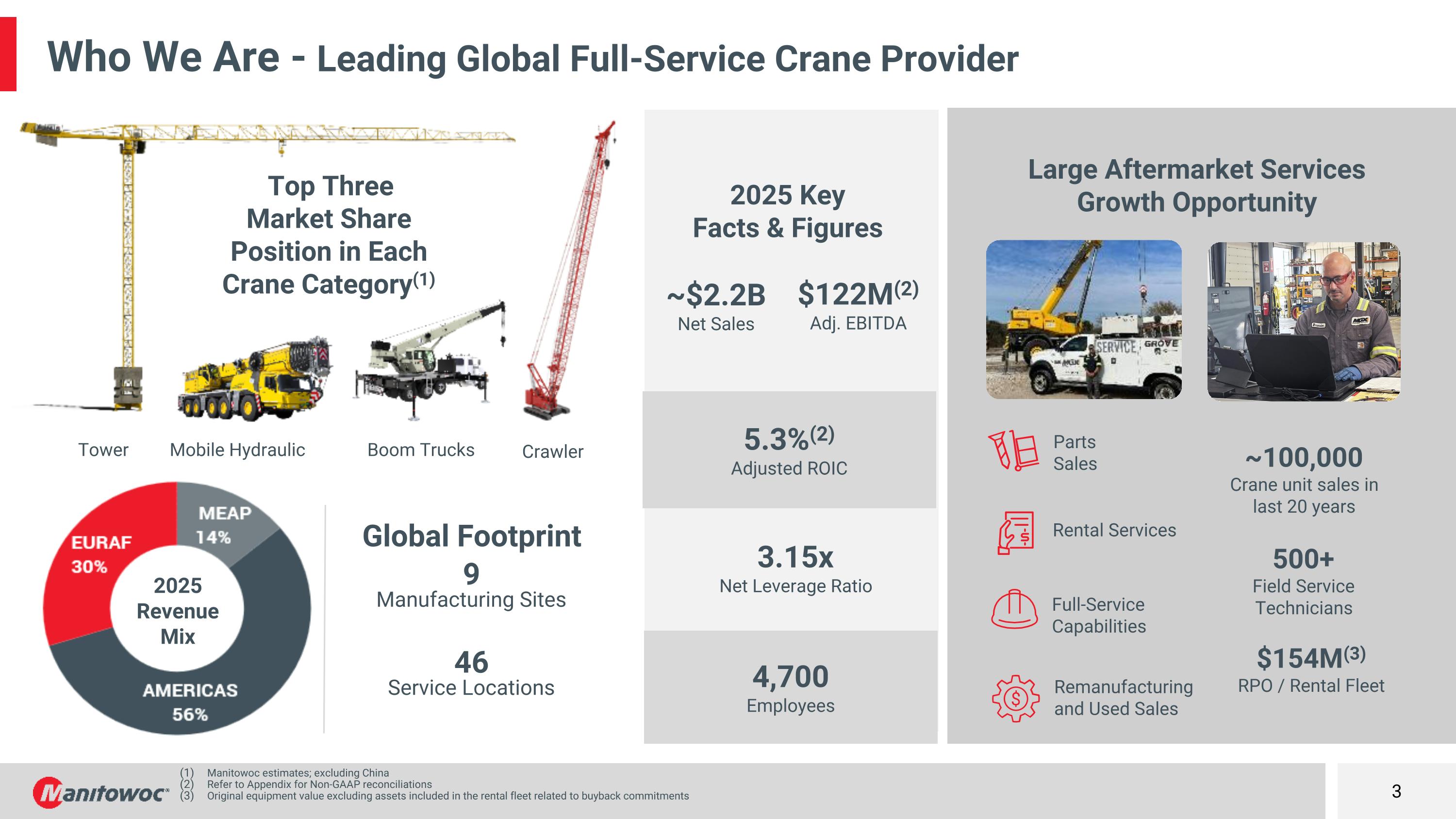

Who We Are - Leading Global Full-Service Crane Provider Top Three Market Share Position in Each Crane Category(1) Tower Boom Trucks Crawler Mobile Hydraulic Global Footprint 9 Manufacturing Sites 46 Service Locations 4,700 Employees $154M(3) RPO / Rental Fleet ~$2.2B Net Sales $122M(2) Adj. EBITDA 5.3%(2) Adjusted ROIC 3.15x Net Leverage Ratio 2025 Revenue Mix Large Aftermarket Services Growth Opportunity 2025 Key Facts & Figures Remanufacturing and Used Sales Full-Service Capabilities Rental Services Parts Sales ~100,000 Crane unit sales in last 20 years 500+ Field Service Technicians Manitowoc estimates; excluding China Refer to Appendix for Non-GAAP reconciliations Original equipment value excluding assets included in the rental fleet related to buyback commitments

The Manitowoc Way - A Culture Built on Continuous Improvement Engage Employees on Multiple Levels Execute lean operating principles -- Kaizens Increase safety – reduced RIR(1) from 1.77 in 2016 to 0.94 in 2025 Foster employee development Innovate Our Product Offerings >50 new or refreshed models launched since January 2021 Leverage VOC process to optimize NPD spend Grow Market Presence & Market Share Develop new products to enter new segments Cross-sell lifting products to mixed fleet customers Recordable Injury Rate (RIR) is calculated based the number of recordable injuries and illnesses per 200k hours worked

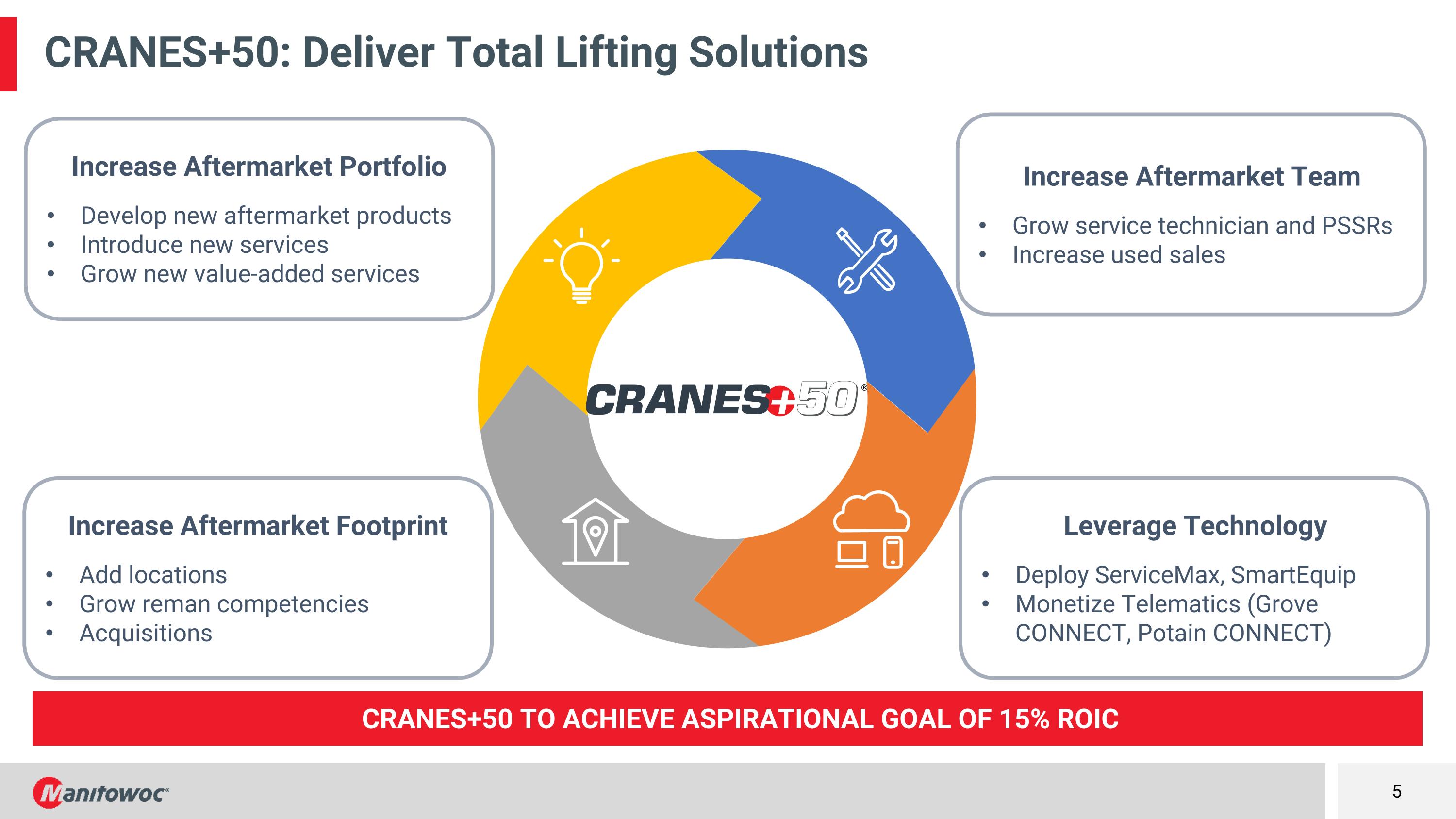

CRANES+50: Deliver Total Lifting Solutions Cranes+50 to achieve aspirational goal of 15% roic Increase Aftermarket Team Grow service technician and PSSRs Increase used sales Increase Aftermarket Portfolio Develop new aftermarket products Introduce new services Grow new value-added services Leverage Technology Deploy ServiceMax, SmartEquip Monetize Telematics (Grove CONNECT, Potain CONNECT) Increase Aftermarket Footprint Add locations Grow reman competencies Acquisitions

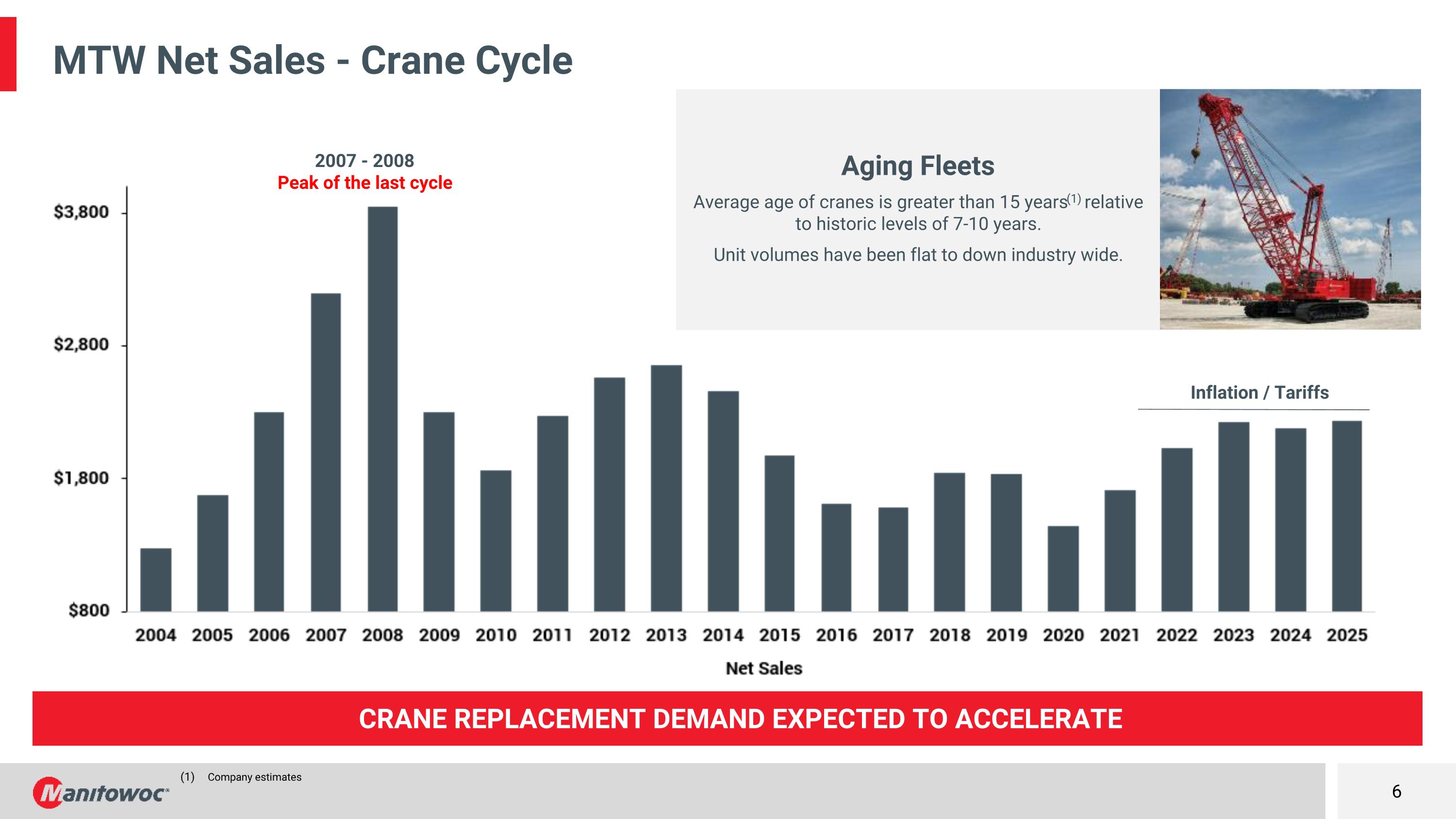

Crane replacement demand expected to accelerate MTW Net Sales - Crane Cycle Company estimates 2007 - 2008 Peak of the last cycle Aging Fleets Average age of cranes is greater than 15 years(1) relative to historic levels of 7-10 years. Unit volumes have been flat to down industry wide. Inflation / Tariffs

Crane demand expected to accelerate Crane Demand - Secular Tailwinds MANITOWOC OPPORTUNITY Power Generation Power Transmission Oil & Gas Residential Construction Mining Infrastructure Energy & Grid Modernization Chip Fabrication “Europe’s housing shortage is expected to worsen, with an estimated 9.6M new homes needed to meet demand amid falling permit levels for new construction” – CBRE, Jan 2025 “The race to energize new data center capacity remains in its early stages, with robust capacity growth poised to continue….$3T spending globally by 2023” -- Moody’s, Jan 2026 “German Parliament voted on a 500B Euro fund for infrastructure…to ramp up investment after two years of contraction”– Reuters, Mar 2025 Higher Commodity Prices Middle East Modernization Global Investments in Energy Generation and Distribution U.S. Infrastructure Investment, Jobs, Inflation Reduction, & CHIPS Acts European Housing Market Demand “There is a $3.7T gap between current planned infrastructure investments and what must be done to have the US infrastructure in good working order” -- ASCE, Mar 2025 Infrastructure Airports Waterways Stadiums Railroads

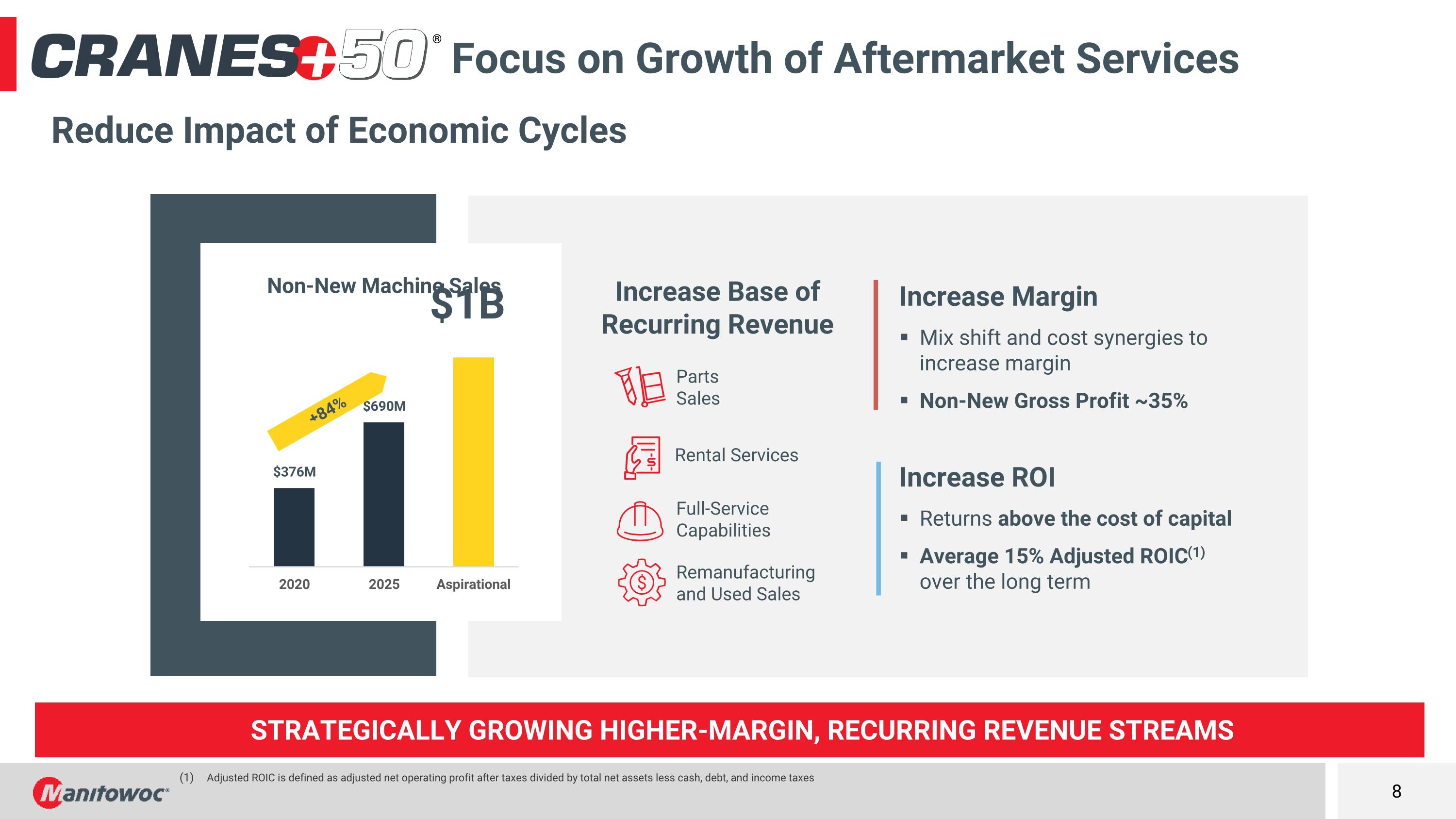

Reduce Impact of Economic Cycles Focus on Growth of Aftermarket Services Increase Margin Mix shift and cost synergies to increase margin Non-New Gross Profit ~35% Increase ROI Returns above the cost of capital Average 15% Adjusted ROIC(1) over the long term Remanufacturing and Used Sales Full-Service Capabilities Rental Services Parts Sales Increase Base of Recurring Revenue +84% Adjusted ROIC is defined as adjusted net operating profit after taxes divided by total net assets less cash, debt, and income taxes Strategically growing higher-margin, recurring revenue streams

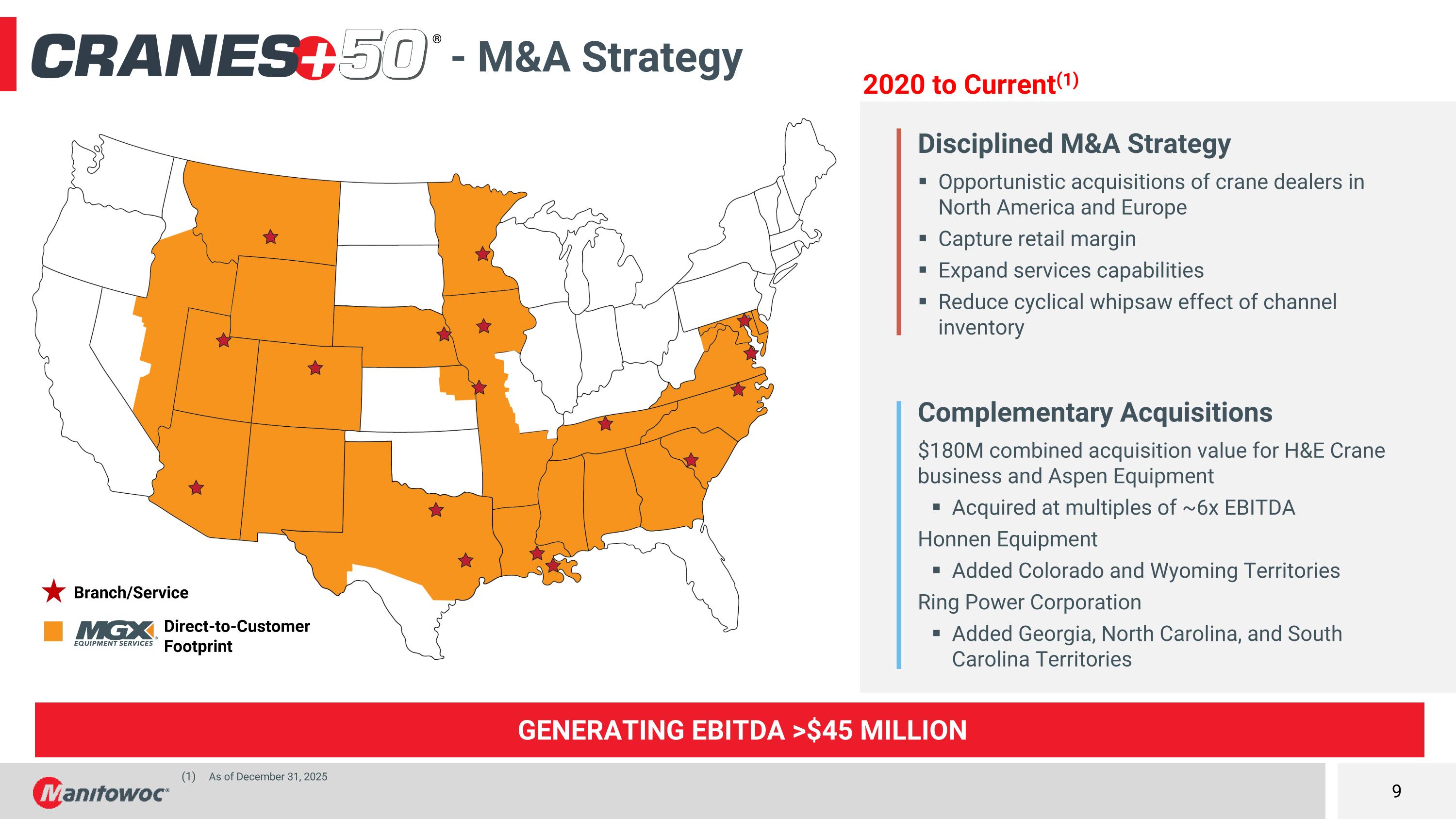

- M&A Strategy Disciplined M&A Strategy Opportunistic acquisitions of crane dealers in North America and Europe Capture retail margin Expand services capabilities Reduce cyclical whipsaw effect of channel inventory Complementary Acquisitions $180M combined acquisition value for H&E Crane business and Aspen Equipment Acquired at multiples of ~6x EBITDA Honnen Equipment Added Colorado and Wyoming Territories Ring Power Corporation Added Georgia, North Carolina, and South Carolina Territories As of December 31, 2025 2020 to Current(1) Generating ebitda >$45 million Branch/Service Direct-to-Customer Footprint

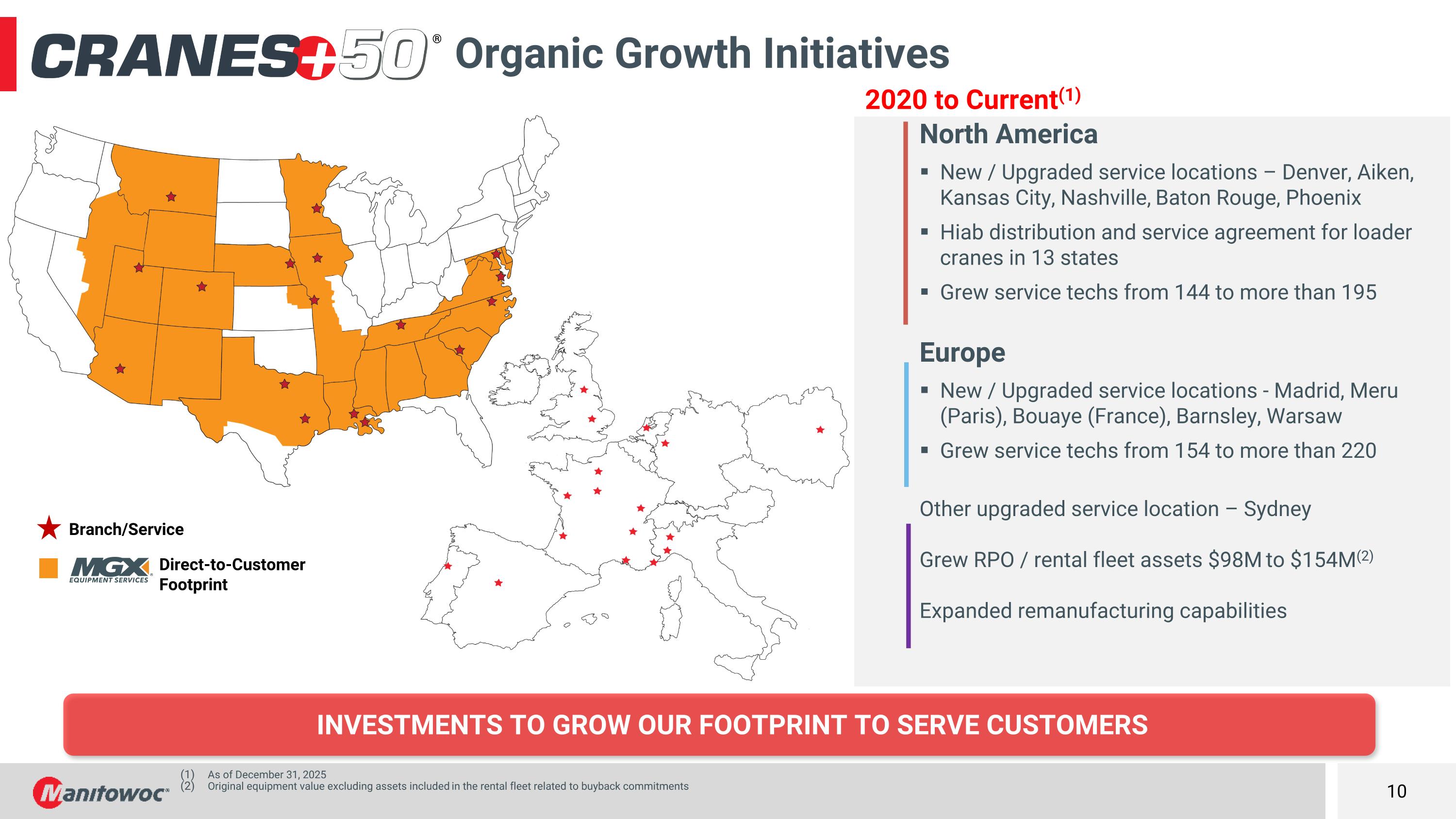

Organic Growth Initiatives North America New / Upgraded service locations – Denver, Aiken, Kansas City, Nashville, Baton Rouge, Phoenix Hiab distribution and service agreement for loader cranes in 13 states Grew service techs from 144 to more than 195 Europe New / Upgraded service locations - Madrid, Meru (Paris), Bouaye (France), Barnsley, Warsaw Grew service techs from 154 to more than 220 Other upgraded service location – Sydney Grew RPO / rental fleet assets $98M to $154M(2) Expanded remanufacturing capabilities 2020 to Current(1) As of December 31, 2025 Original equipment value excluding assets included in the rental fleet related to buyback commitments investments to grow our footprint to serve customers Branch/Service Direct-to-Customer Footprint

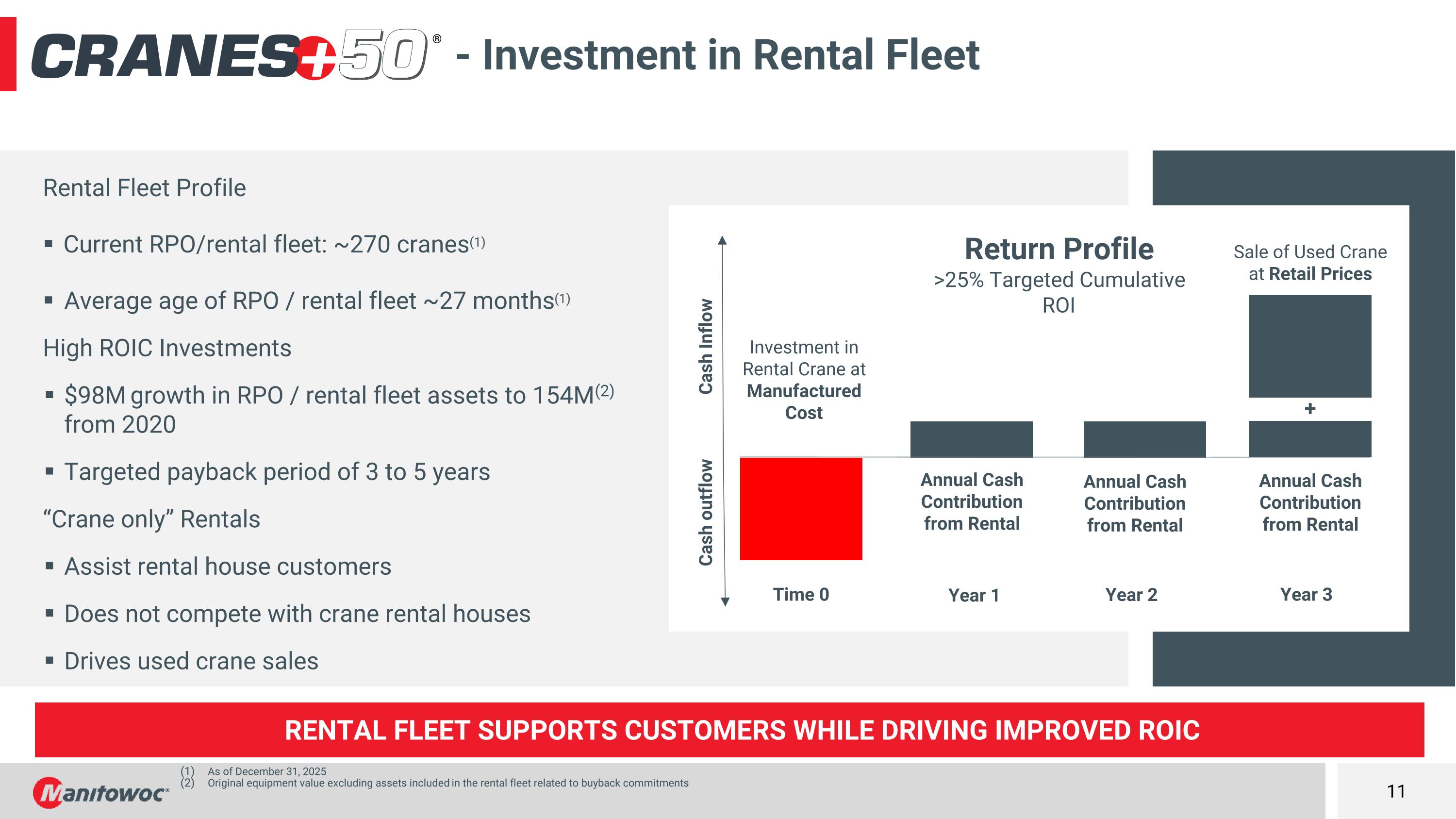

- Investment in Rental Fleet Rental Fleet Profile Current RPO/rental fleet: ~270 cranes(1) Average age of RPO / rental fleet ~27 months(1) High ROIC Investments $98M growth in RPO / rental fleet assets to 154M(2) from 2020 Targeted payback period of 3 to 5 years “Crane only” Rentals Assist rental house customers Does not compete with crane rental houses Drives used crane sales Sale of Used Crane at Retail Prices Year 3 Annual Cash Contribution from Rental Year 2 Year 1 Time 0 Investment in Rental Crane at Manufactured Cost Annual Cash Contribution from Rental Annual Cash Contribution from Rental + Return Profile >25% Targeted Cumulative ROI Cash Inflow Cash outflow Rental fleet supports customers while driving improved roic As of December 31, 2025 Original equipment value excluding assets included in the rental fleet related to buyback commitments

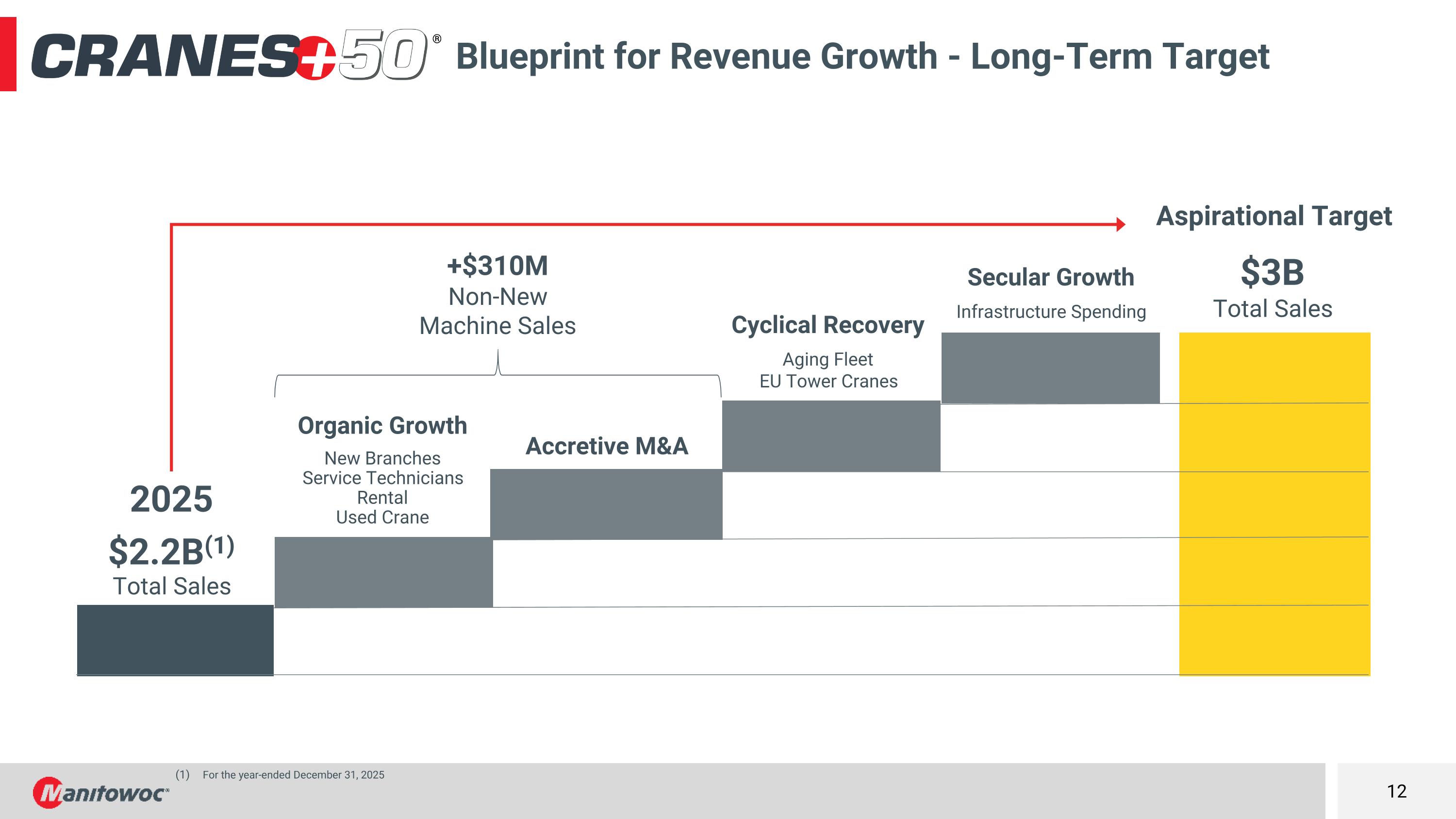

Blueprint for Revenue Growth - Long-Term Target Organic Growth New Branches Service Technicians Rental Used Crane Accretive M&A Secular Growth Infrastructure Spending Aspirational Target $3B Total Sales Cyclical Recovery Aging Fleet EU Tower Cranes 2025 $2.2B(1) Total Sales +$310M Non-New Machine Sales For the year-ended December 31, 2025

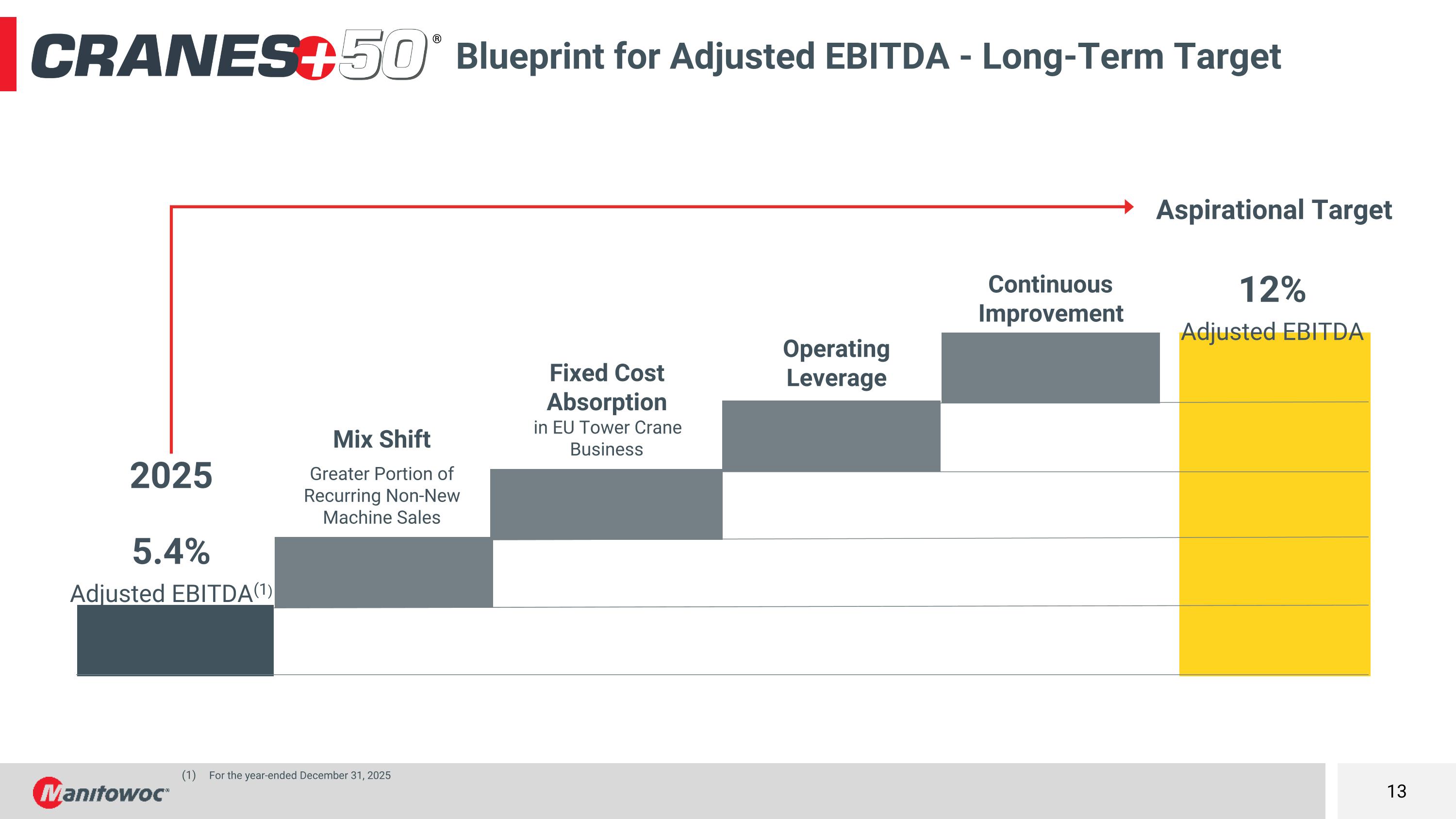

Blueprint for Adjusted EBITDA - Long-Term Target Mix Shift Greater Portion of Recurring Non-New Machine Sales Fixed Cost Absorption in EU Tower Crane Business Continuous Improvement Aspirational Target 12% Adjusted EBITDA Operating Leverage 2025 5.4% Adjusted EBITDA(1) For the year-ended December 31, 2025

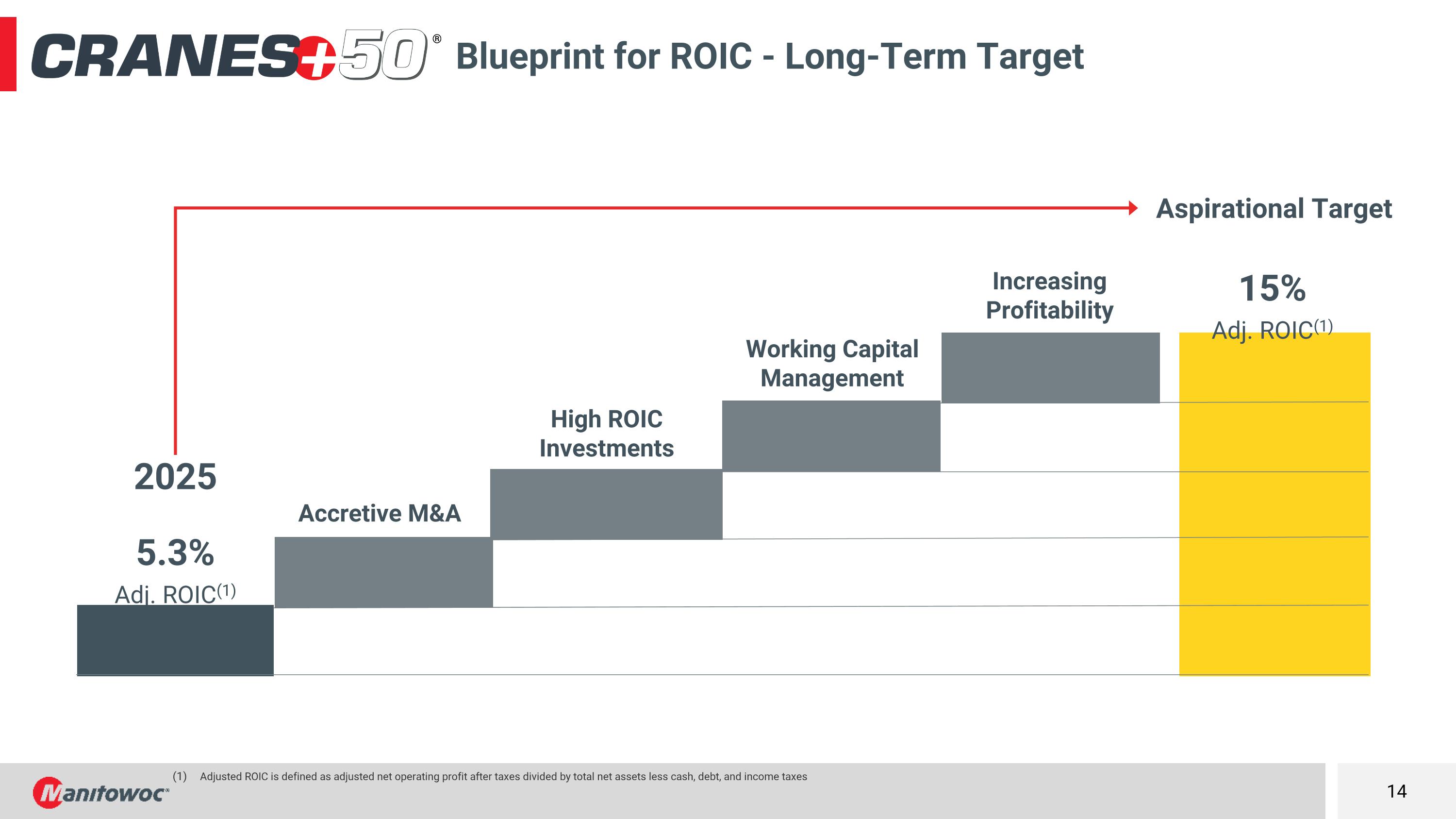

Blueprint for ROIC - Long-Term Target Accretive M&A High ROIC Investments Increasing Profitability Aspirational Target 15% Adj. ROIC(1) Working Capital Management 2025 5.3% Adj. ROIC(1) Adjusted ROIC is defined as adjusted net operating profit after taxes divided by total net assets less cash, debt, and income taxes

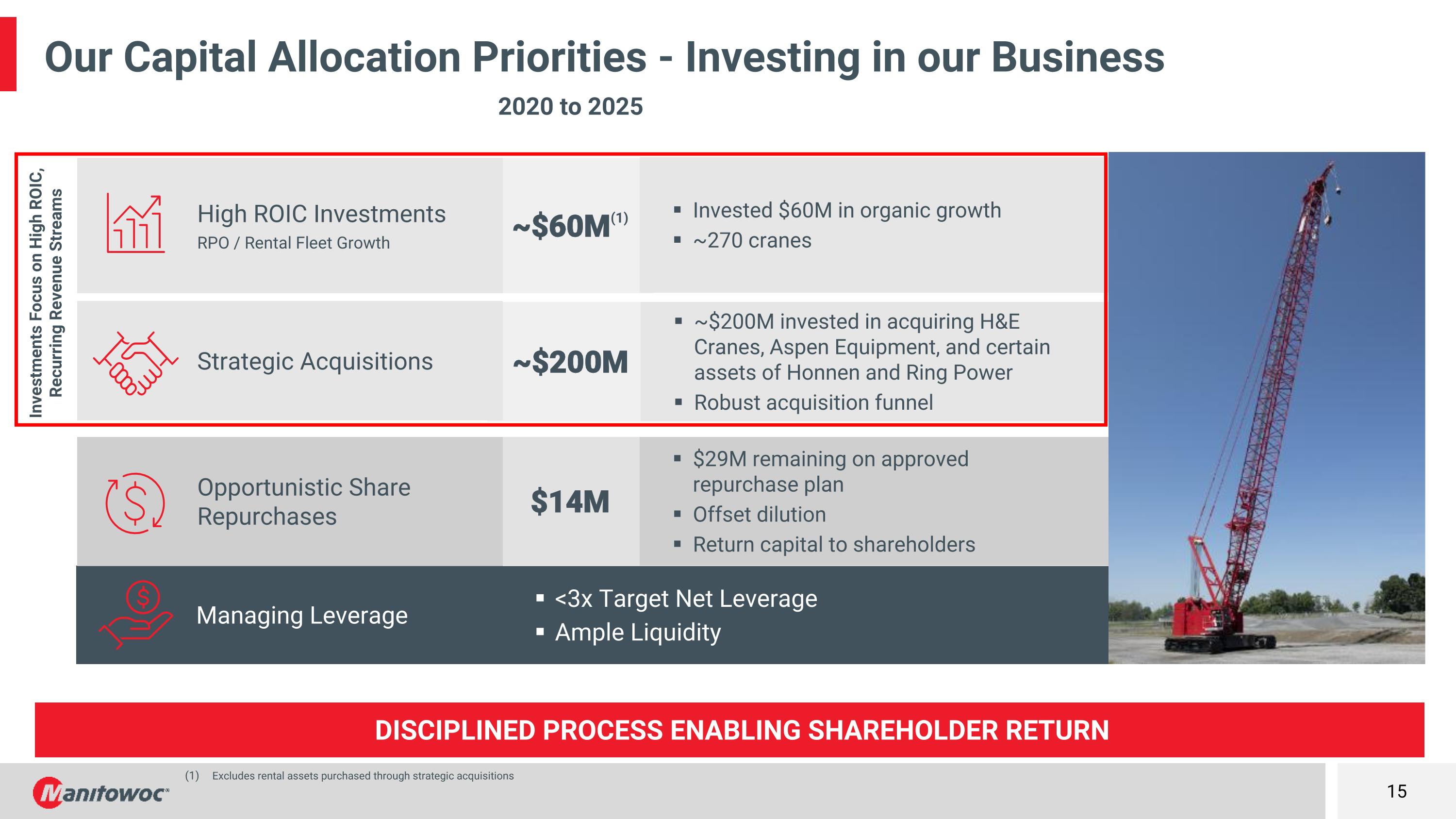

Our Capital Allocation Priorities - Investing in our Business Excludes rental assets purchased through strategic acquisitions Investments Focus on High ROIC, Recurring Revenue Streams <3x Target Net Leverage Ample Liquidity $29M remaining on approved repurchase plan Offset dilution Return capital to shareholders ~$200M invested in acquiring H&E Cranes, Aspen Equipment, and certain assets of Honnen and Ring Power Robust acquisition funnel $14M Managing Leverage Opportunistic Share Repurchases Strategic Acquisitions High ROIC Investments RPO / Rental Fleet Growth ~$60M(1) 2020 to 2025 ~$200M Invested $60M in organic growth ~270 cranes Disciplined process enabling shareholder return

Why Invest in The Manitowoc Company? SUCCESSFULLY EXECUTING BUSINESS TRANSFORMATION Improving margin and return profiles Increasing mix of higher-margin, recurring revenue to reduce impact of economic cycles Crane demand is poised for recovery from multi-year secular and cyclical tailwinds Strong acquisition track record Aspirational Targets $3.0B Revenue $1.0B Non-New Machine Sales 12% Adjusted EBITDA 15% Adjusted ROIC(2) Based on a 5-year period Adjusted ROIC is defined as adjusted net operating profit after taxes divided by total net assets less cash, debt, and income taxes Strategy driving value creation with a targeted adjusted roic of 15% Targeted Adj. EBITDA CAGR(1) 24% Targeted Revenue CAGR(1) 6% 8% Non-New Machine Sales CAGR(1)

Appendix

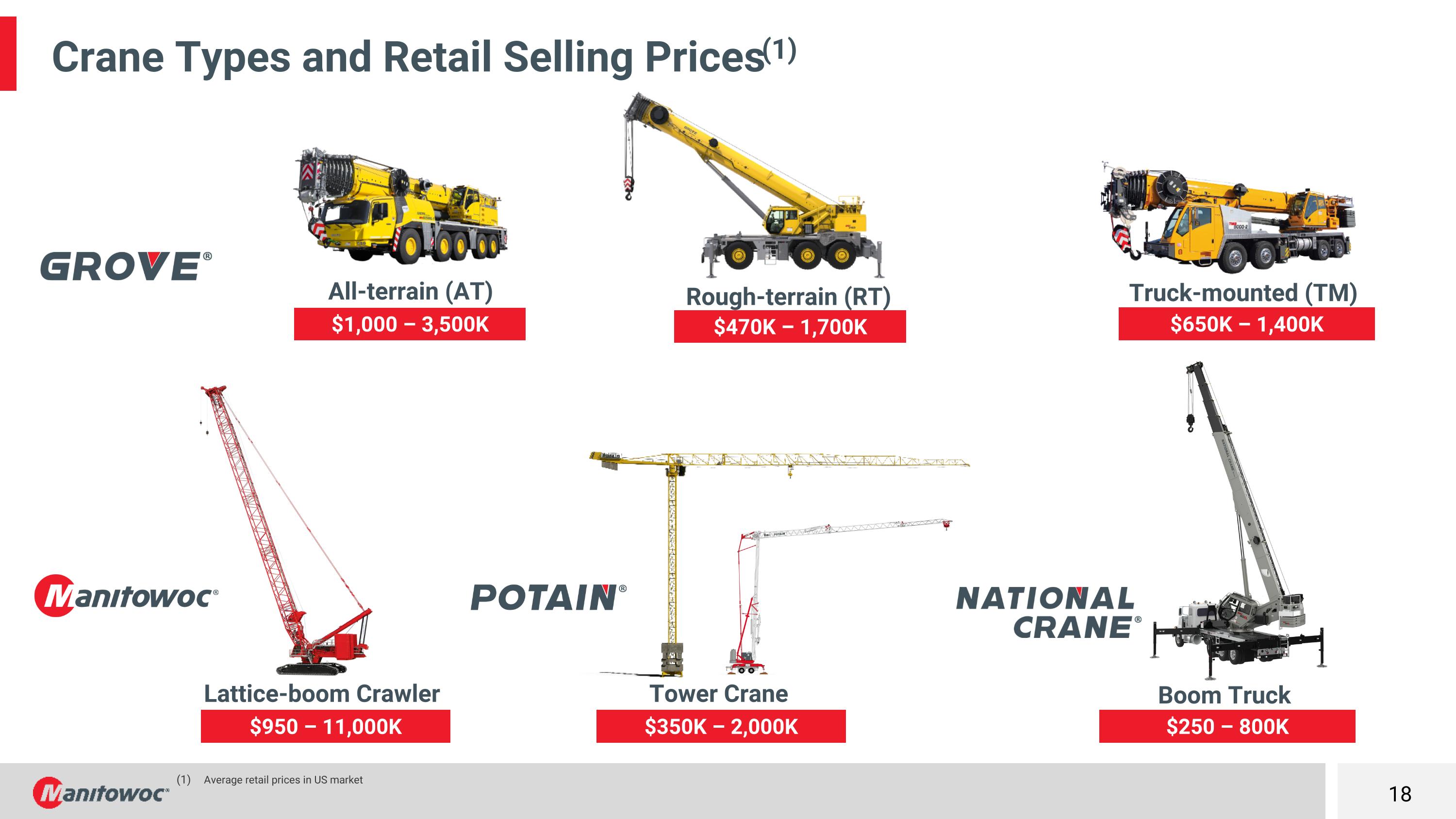

Crane Types and Retail Selling Prices(1) Average retail prices in US market $1,000 – 3,500K All-terrain (AT) $470K – 1,700K Rough-terrain (RT) $650K – 1,400K Truck-mounted (TM) $950 – 11,000K Lattice-boom Crawler $350K – 2,000K Tower Crane $250 – 800K Boom Truck

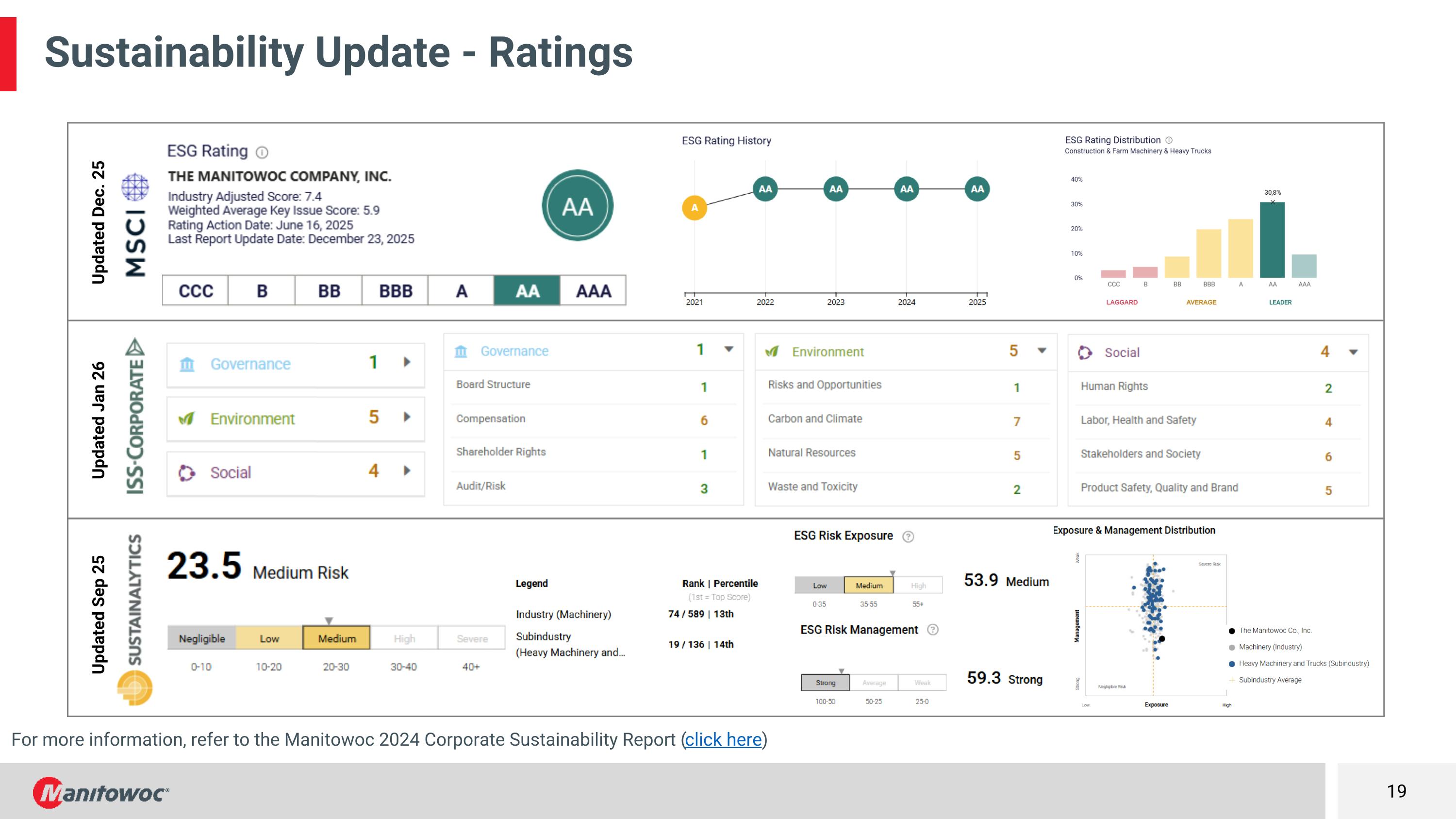

Sustainability Update - Ratings ç Updated Jan 26 Updated Sep 25 Updated Dec. 25 For more information, refer to the Manitowoc 2024 Corporate Sustainability Report (click here)

Aspirations Dollars in millions

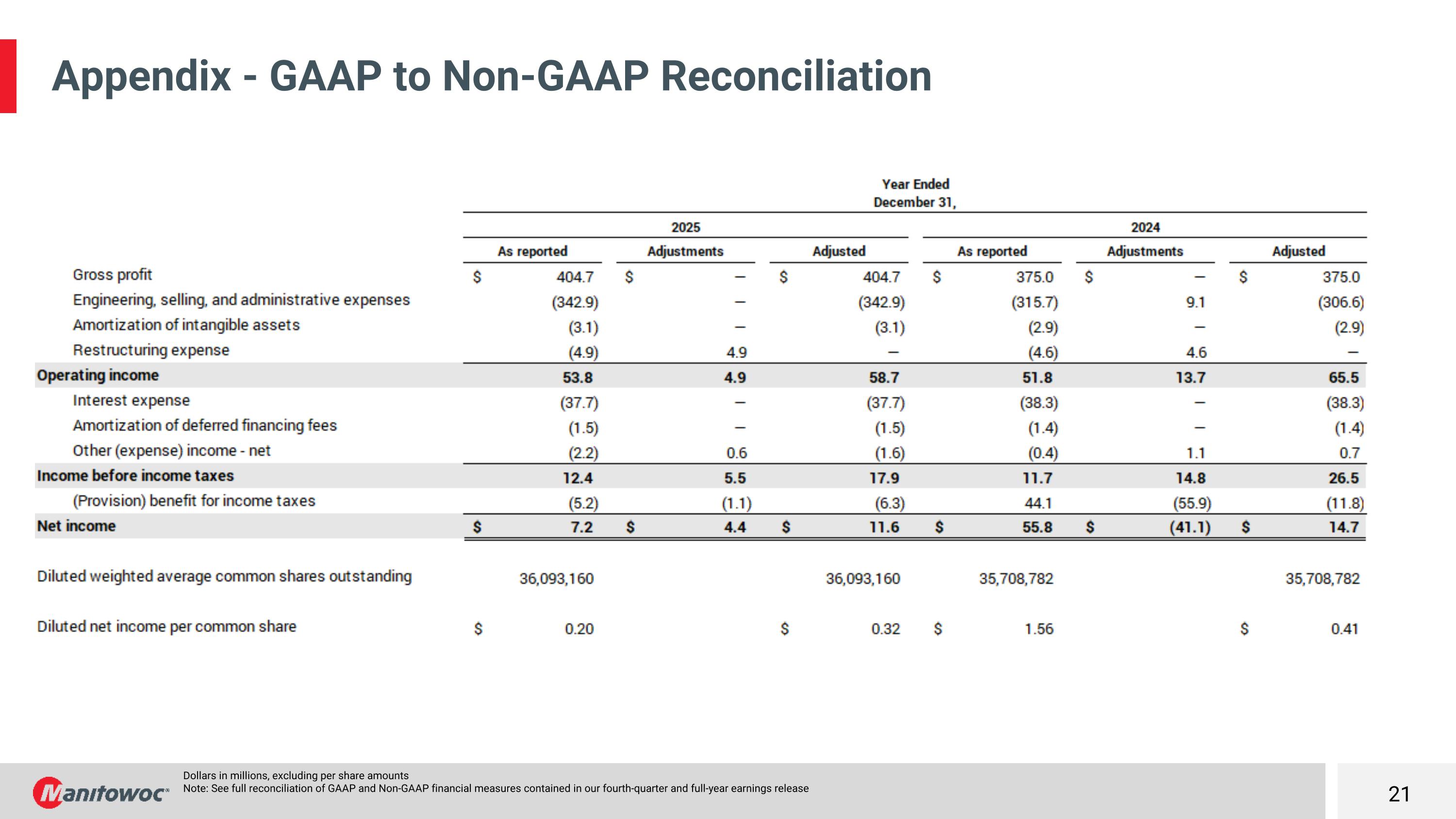

Appendix - GAAP to Non-GAAP Reconciliation Dollars in millions, excluding per share amounts Note: See full reconciliation of GAAP and Non-GAAP financial measures contained in our fourth-quarter and full-year earnings release

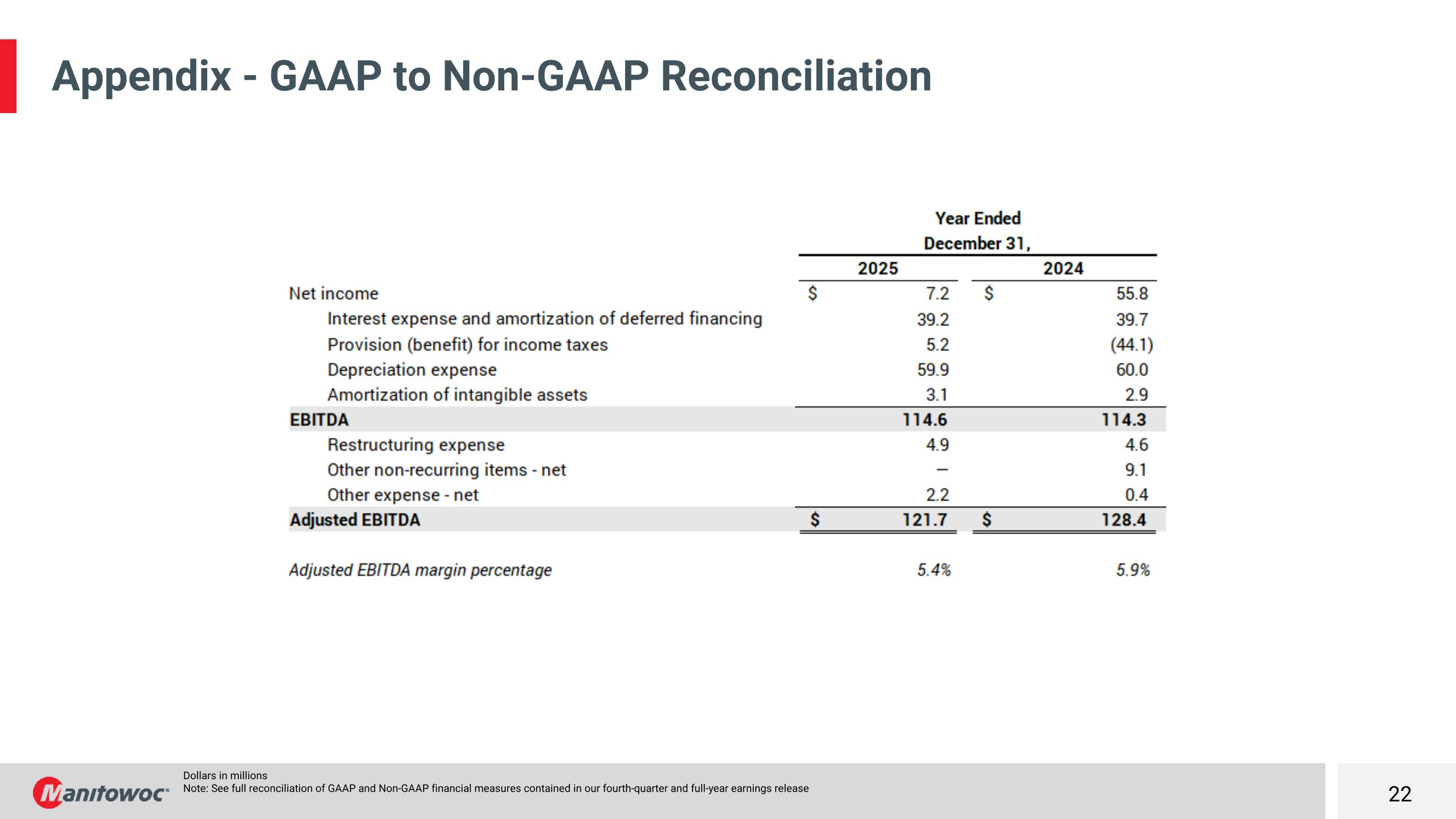

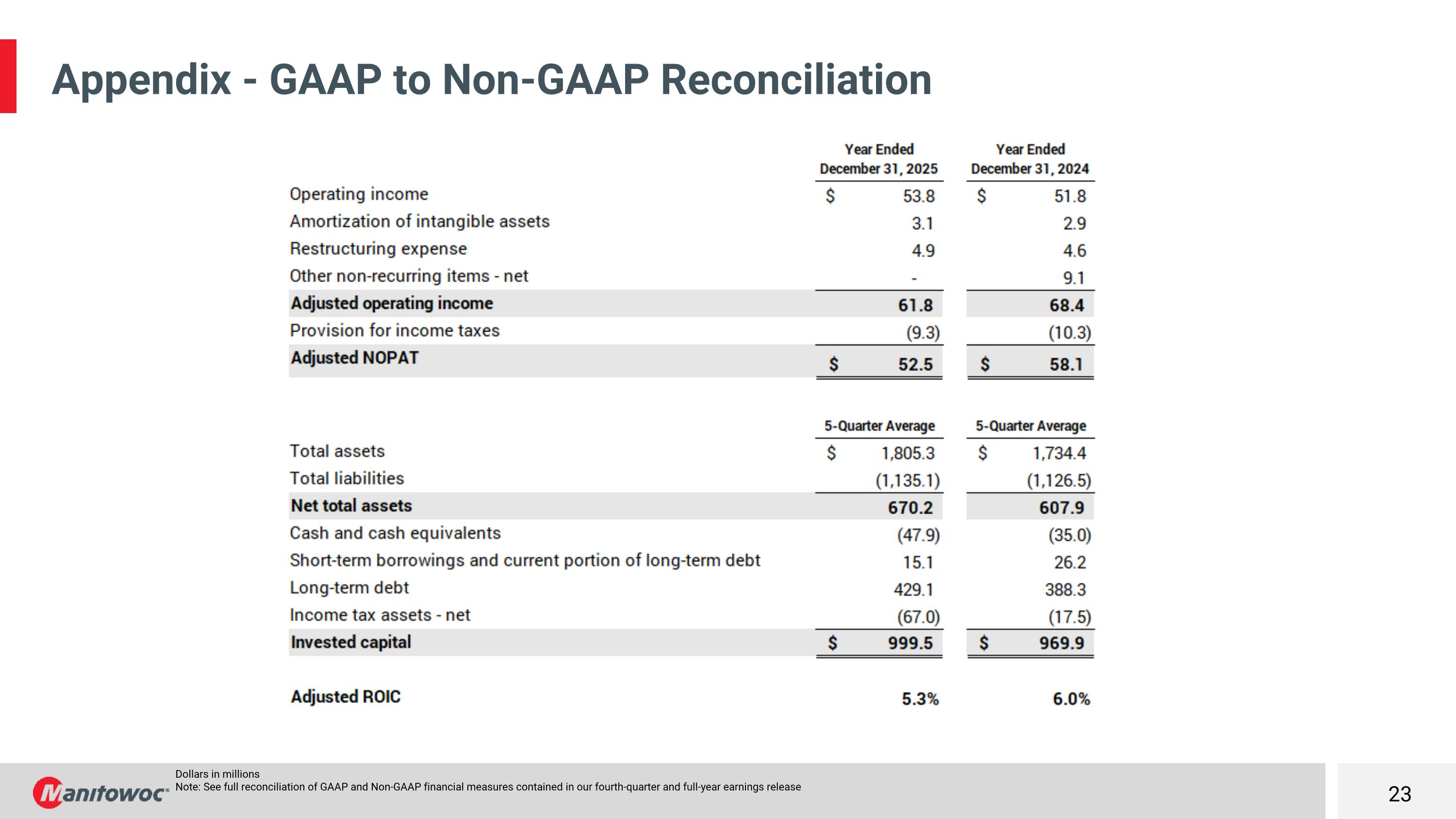

Appendix - GAAP to Non-GAAP Reconciliation Dollars in millions Note: See full reconciliation of GAAP and Non-GAAP financial measures contained in our fourth-quarter and full-year earnings release

Appendix - GAAP to Non-GAAP Reconciliation Dollars in millions Note: See full reconciliation of GAAP and Non-GAAP financial measures contained in our fourth-quarter and full-year earnings release

Additional information: Ion Warner – SVP Marketing & Investor Relations O +1 414-760-4805 M +1 717-414-1813 ion.warner@manitowoc.com www.manitowoc.com