Meredith to Acquire Time Inc.

Creates Premier Media and Marketing Company

Serving 200 Million American Consumers

1

November 27, 2017

2

FORWARD-LOOKING STATEMENTS & SAFE HARBOR

This presentation contains forward-looking statements. You can generally identify forward-looking statements by the use of

forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “explore,”

“evaluate,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” or “will,” or the negative

thereof or other variations thereon or comparable terminology. These forward-looking statements are only predictions and

involve known and unknown risks and uncertainties, many of which are beyond Meredith’s, purchaser’s and Time’s control.

Statements in this document regarding Meredith, purchaser, and Time Inc. that are forward-looking, including, without

limitation, projections as to the anticipated benefits of the proposed transaction, the methods that will be used to finance the

transaction, the impact of the transaction on anticipated financial results, the synergies from the proposed transaction, and the

closing date for the proposed transaction, are based on management’s estimates, assumptions and projections, and are subject

to significant uncertainties and other factors, many of which are beyond the control of Meredith, purchaser and Time Inc.

Important risk factors could cause actual future results and other future events to differ materially from those currently

estimated by management, including, but not limited to: the timing to consummate the proposed transaction; the risk that a

condition to closing of the proposed transaction may not be satisfied and the transaction may not close; any failure to obtain

equity or debt financing; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is

not obtained or is obtained subject to conditions that are not anticipated; the ability to achieve the synergies and value

creation contemplated by the proposed transaction; management’s ability to promptly and effectively integrate the businesses

of the two companies; and the diversion of management time on transaction-related issues.

For more discussion of important risk factors that may materially affect Meredith, purchaser and Time Inc, please see the risk

factors contained Meredith’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, and Time Inc.’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, both of which are on file with the SEC. Except as

specifically noted, information on, or accessible from, any website to which this website contains a hyperlink is not

incorporated by reference into this website and does not constitute a part of this website.

No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if

any of them do occur, what impact they will have on the results of operations, financial condition or cash flows of Meredith,

purchaser or Time Inc. None of Meredith, purchaser or Time Inc. assumes any duty to update or revise forward-looking

statements, whether as a result of new information, future events or otherwise, as of any future date.

3

ADDITIONAL INFORMATION

The offer has not yet commenced, and this communication is neither an offer to purchase nor a solicitation of an

offer to sell any shares of the common stock of Time Inc. or any other securities. On the commencement date of

the offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and

related documents, will be filed with the SEC by purchaser and a Solicitation/Recommendation Statement on

Schedule 14D-9 will be filed with the SEC by Time Inc. The offer to purchase shares of Time Inc.’s common

stock will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as

a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE

TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT

REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The tender offer

statement will be filed with the SEC by purchaser, and the solicitation/recommendation statement will be filed

with the SEC by Time Inc. Investors and security holders may obtain a free copy of these statements (when

available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by

directing such requests to the Information Agent for the offer, which will be named in the tender offer statement.

4

EXECUTIVE SUMMARY

Executive Summary About Meredith About Time MDP + TIME Summary

5

STRATEGIC HIGHLIGHTS

1. Creates a premier media and marketing company

• Unparalleled portfolio of national media brands with greater scale and efficiency

• Highly profitable local media brands with record financial performance

• Top 10 digital business; 170 million monthly U.S. unique visitors; and nearly $700 million of digital ad revenue

• Delivers advertising and consumer revenue diversification and growth

• Enhances Meredith’s financial strength and flexibility

• Increases Total Shareholder Return

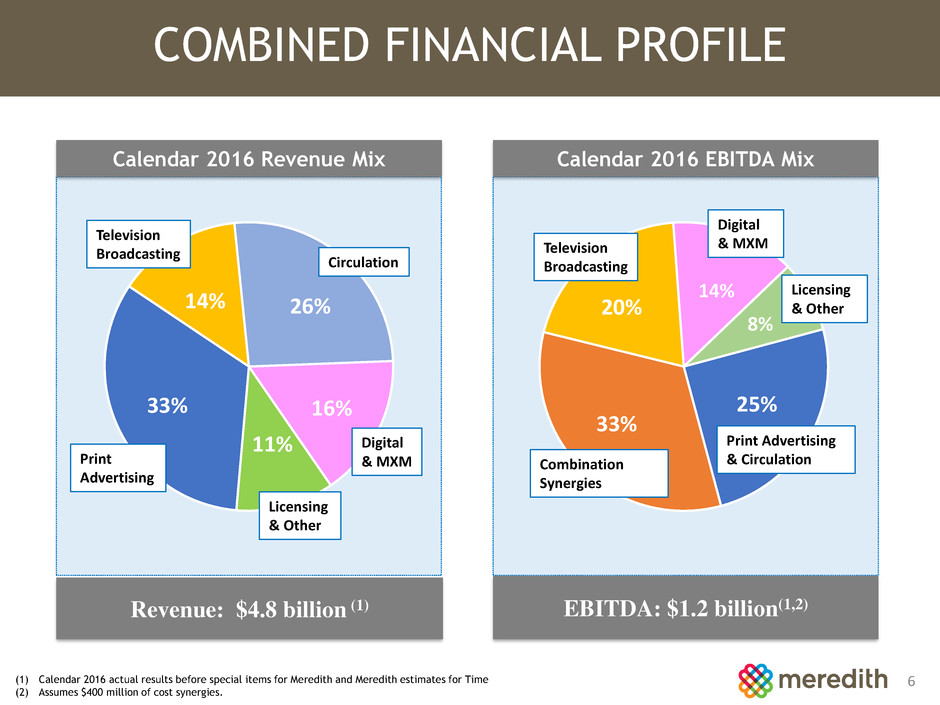

2. Combined company generates significant revenue and EBITDA

• $4.8 billion in calendar 2016 revenue, including $2.7 billion of advertising revenue

• Approximately $800 million in calendar 2016 adjusted EBITDA, before synergies

3. Unlocks meaningful value via estimated $400 to $500 million in synergies

• Fully recognized in first two years of operations

4. Financially compelling combination

• Meredith remains committed to delivering top third Total Shareholder Return

• Meredith will continue to pay its current annual dividend of $2.08 per share, and expects ongoing annual

dividend increases

• Capacity remains for additional acquisitions

5. Led by strong management team with expertise in operating multi-platform media

businesses and proven track record in growing shareholder value

Calendar 2016 Revenue Mix

6

COMBINED FINANCIAL PROFILE

(1) Calendar 2016 actual results before special items for Meredith and Meredith estimates for Time

(2) Assumes $400 million of cost synergies.

Calendar 2016 EBITDA Mix

33%

14% 26%

16%

11%

Television

Broadcasting

Revenue: $4.8 billion (1) EBITDA: $1.2 billion(1,2)

Print

Advertising

Licensing

& Other

Digital

& MXM

Circulation

25%

33%

20%

14%

8%

Print Advertising

& CirculationCombination

Synergies

Licensing

& Other

Digital

& MXMTelevision

Broadcasting

7

ABOUT MEREDITH

Executive Summary About Meredith About Time MDP + TIME Summary

8

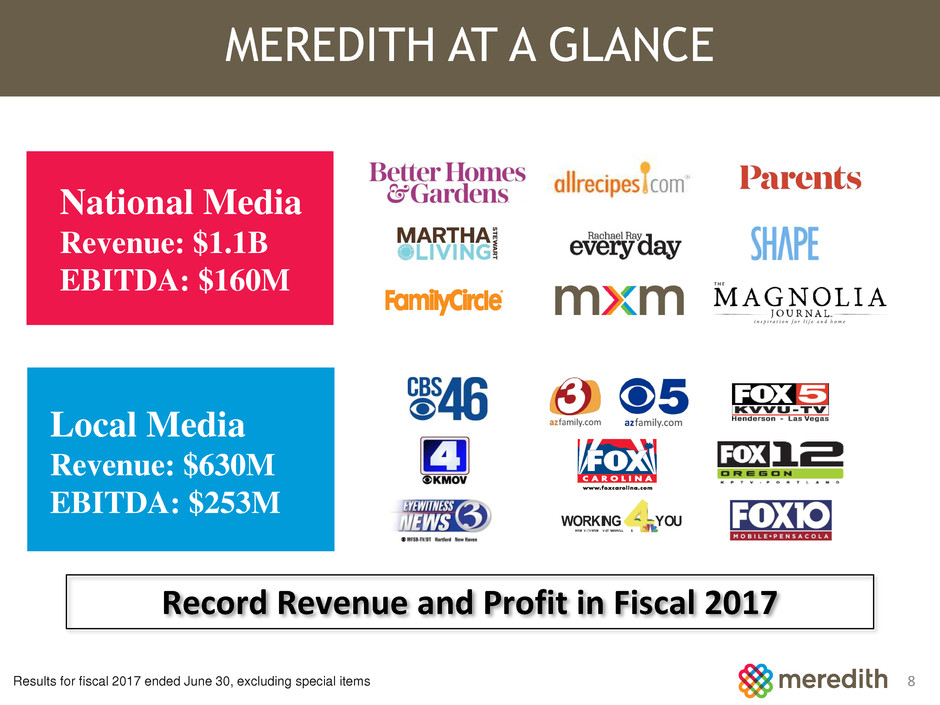

MEREDITH AT A GLANCE

National Media

Revenue: $1.1B

EBITDA: $160M

Results for fiscal 2017 ended June 30, excluding special items

Local Media

Revenue: $630M

EBITDA: $253M

WORKING YOU

WSM V -TV WSM V-DT NASHVILL E

Record Revenue and Profit in Fiscal 2017

9

NATIONAL BRANDS POSSESS STRONG CONSUMER REACH

70%

MILLION

UNIQUE

VISITORS

31%

AD REVENUES

FROM DIGITAL

SOURCES FY-17

110

MILLION

UNDUPLICATED

WOMEN

90

REACH TO

MILLENNIAL

WOMEN

9

9

10

LOCAL BRANDS IN LARGE AND GROWING MARKETS

#1 or 2

MORNING or LATE

NEWS IN 9 MARKETS

17

STATIONS IN

PORTFOLIO

13

STATIONS

IN TOP 50

MARKETS

5

EAST & SOUTHEAST:

ATLANTA: MKT 10, CBS + IND

NASHVILLE: MKT 29, NBC

HARTFORD: MKT 30, CBS

GREENVILLE: MKT 37, FOX

MOBILE: MKT 60, FOX

SPRINGFIELD: MKT 114, CBS + ABC

WEST & SOUTHWEST:

PHOENIX: MKT 12, CBS + IND

PORTLAND: MKT 25, FOX + MyTV

LAS VEGAS: MKT 40, FOX

MIDWEST:

ST. LOUIS: MKT 21, CBS

KANSAS CITY: MKT 33, CBS + MyTV

SAGINAW: MKT 72, CBS

DUOPOLY

MARKETS

11

ABOUT TIME

Executive Summary About Meredith About Time MDP + TIME Summary

12

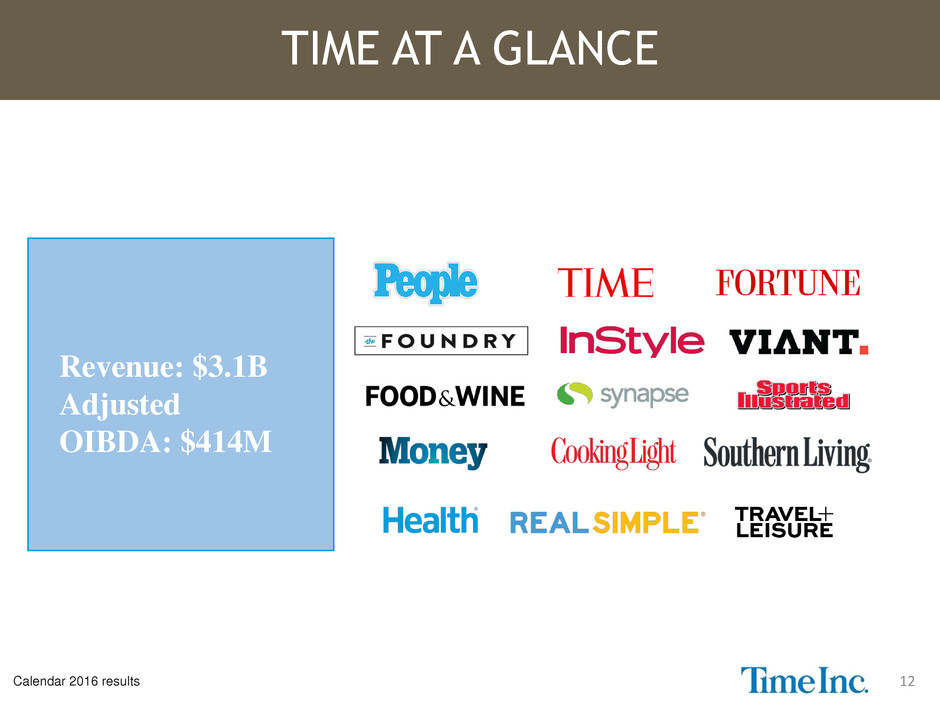

TIME AT A GLANCE

Revenue: $3.1B

Adjusted

OIBDA: $414M

Calendar 2016 results

13

TIME IS A LEADER ACROSS PLATFORMS

National

brands

• Largest reach among publishers, with readership of 100 million

• Some of the industry’s most iconic brands, including Time, Sports Illustrated

• People has No. 1 audience and No. 1 ad revenue among U.S. magazines

• InStyle is the world’s leading luxury fashion brand

• Other brands leaders in their categories

Digital

• Top digital content creator with nearly 140 million unique visitors per month

• Approximately 10 billion video views per year

• 275 million global social media reach

Key

Ancillary

Businesses

• Content Solutions: Custom content and video creation for leading

national brands

• Books: Creates and leverages editorial content across platforms

• Retail: Drives brand awareness, engagement, and retail activation

• Synapse: Leading marketer of magazine subscriptions in the U.S.

• Custom Services: Leader in magazine fulfillment 30 million

subscribers

Hundreds of

events annually

14

MEREDITH + TIME

Executive Summary About Meredith About Time MDP + TIME Summary

15

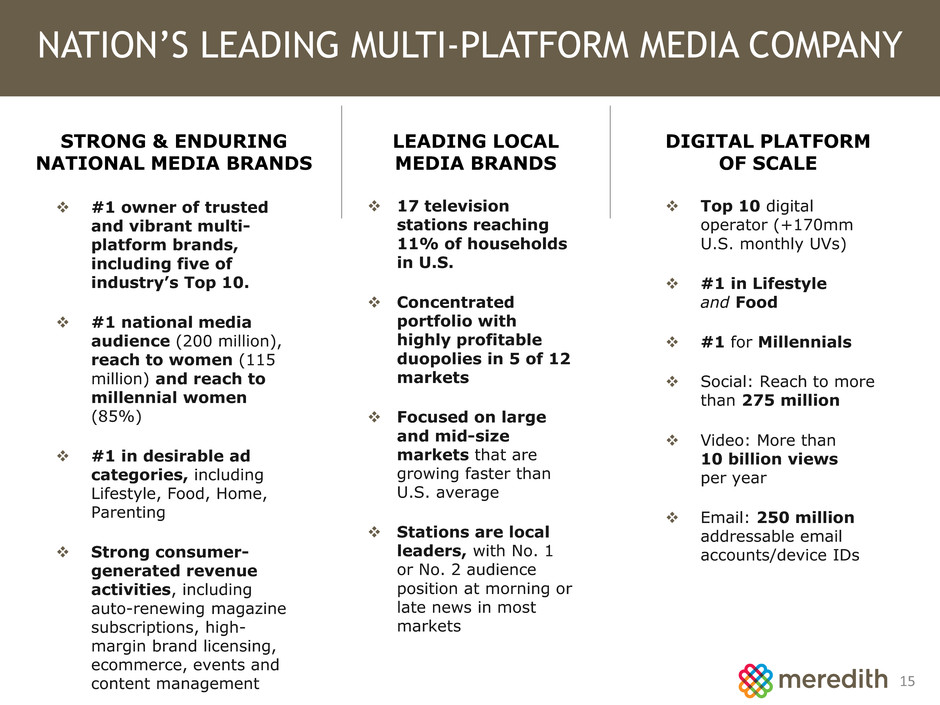

NATION’S LEADING MULTI-PLATFORM MEDIA COMPANY

STRONG & ENDURING

NATIONAL MEDIA BRANDS

❖ Top 10 digital

operator (+170mm

U.S. monthly UVs)

❖ #1 in Lifestyle

and Food

❖ #1 for Millennials

❖ Social: Reach to more

than 275 million

❖ Video: More than

10 billion views

per year

❖ Email: 250 million

addressable email

accounts/device IDs

DIGITAL PLATFORM

OF SCALE

LEADING LOCAL

MEDIA BRANDS

❖ 17 television

stations reaching

11% of households

in U.S.

❖ Concentrated

portfolio with

highly profitable

duopolies in 5 of 12

markets

❖ Focused on large

and mid-size

markets that are

growing faster than

U.S. average

❖ Stations are local

leaders, with No. 1

or No. 2 audience

position at morning or

late news in most

markets

❖ #1 owner of trusted

and vibrant multi-

platform brands,

including five of

industry’s Top 10.

❖ #1 national media

audience (200 million),

reach to women (115

million) and reach to

millennial women

(85%)

❖ #1 in desirable ad

categories, including

Lifestyle, Food, Home,

Parenting

❖ Strong consumer-

generated revenue

activities, including

auto-renewing magazine

subscriptions, high-

margin brand licensing,

ecommerce, events and

content management

16

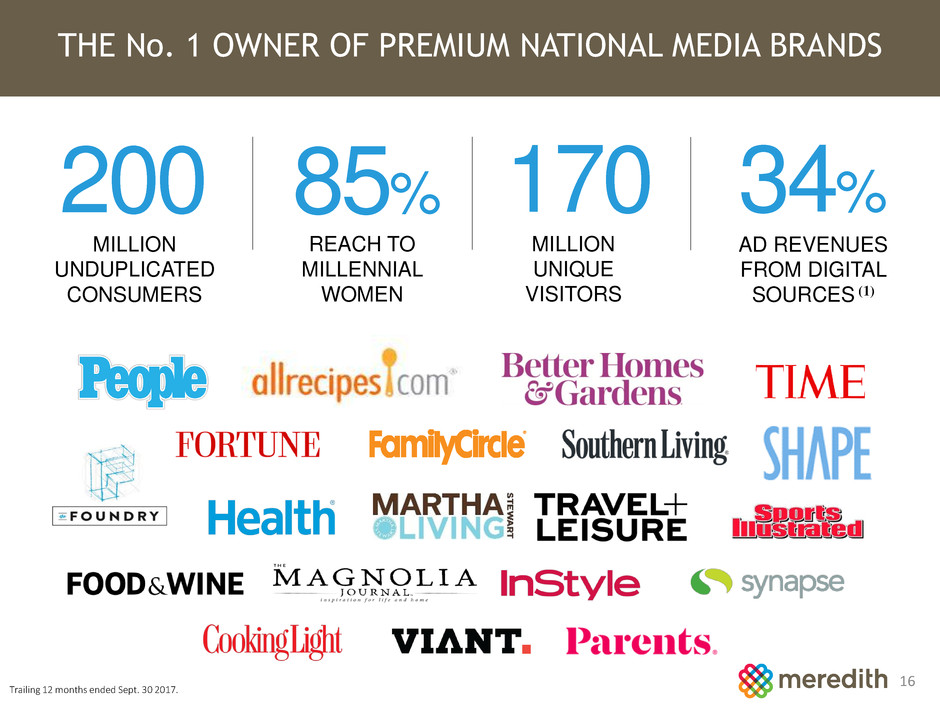

THE No. 1 OWNER OF PREMIUM NATIONAL MEDIA BRANDS

170

MILLION

UNIQUE

VISITORS

34%200

MILLION

UNDUPLICATED

CONSUMERS

85%

REACH TO

MILLENNIAL

WOMEN

AD REVENUES

FROM DIGITAL

SOURCES (1)

Trailing 12 months ended Sept. 30 2017.

17

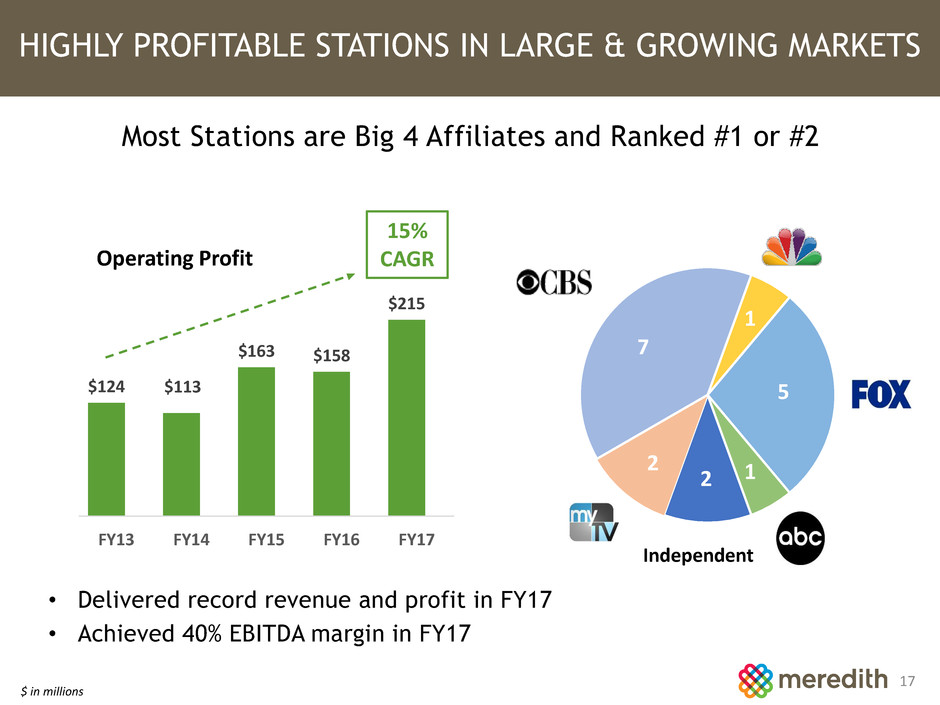

HIGHLY PROFITABLE STATIONS IN LARGE & GROWING MARKETS

Most Stations are Big 4 Affiliates and Ranked #1 or #2

7

1

1

5

Independent

2

2

$124 $113

$163 $158

$215

FY13 FY14 FY15 FY16 FY17

Operating Profit

15%

CAGR

• Delivered record revenue and profit in FY17

• Achieved 40% EBITDA margin in FY17

$ in millions

18

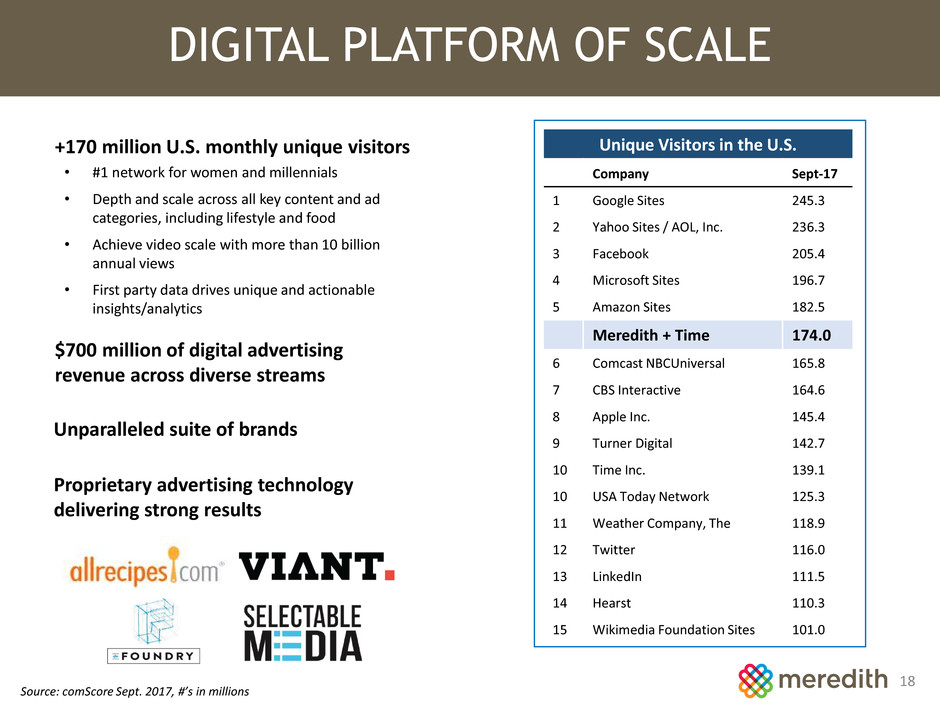

DIGITAL PLATFORM OF SCALE

Source: comScore Sept. 2017, #’s in millions

$700 million of digital advertising

revenue across diverse streams

+170 million U.S. monthly unique visitors

• #1 network for women and millennials

• Depth and scale across all key content and ad

categories, including lifestyle and food

• Achieve video scale with more than 10 billion

annual views

• First party data drives unique and actionable

insights/analytics

Unparalleled suite of brands

Proprietary advertising technology

delivering strong results

Unique Visitors in the U.S.

Company Sept-17

1 Google Sites 245.3

2 Yahoo Sites / AOL, Inc. 236.3

3 Facebook 205.4

4 Microsoft Sites 196.7

5 Amazon Sites 182.5

Meredith + Time 174.0

6 Comcast NBCUniversal 165.8

7 CBS Interactive 164.6

8 Apple Inc. 145.4

9 Turner Digital 142.7

10 Time Inc. 139.1

10 USA Today Network 125.3

11 Weather Company, The 118.9

12 Twitter 116.0

13 LinkedIn 111.5

14 Hearst 110.3

15 Wikimedia Foundation Sites 101.0

19

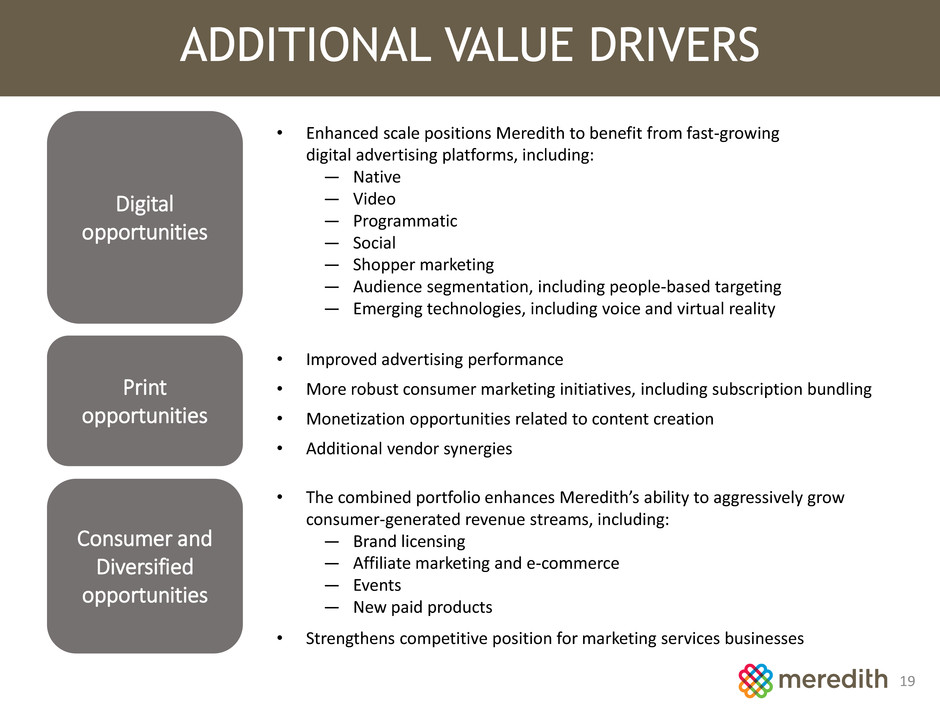

ADDITIONAL VALUE DRIVERS

Digital

opportunities

Print

opportunities

Consumer and

Diversified

opportunities

• Improved advertising performance

• More robust consumer marketing initiatives, including subscription bundling

• Monetization opportunities related to content creation

• Additional vendor synergies

• Enhanced scale positions Meredith to benefit from fast-growing

digital advertising platforms, including:

— Native

— Video

— Programmatic

— Social

— Shopper marketing

— Audience segmentation, including people-based targeting

— Emerging technologies, including voice and virtual reality

• The combined portfolio enhances Meredith’s ability to aggressively grow

consumer-generated revenue streams, including:

— Brand licensing

— Affiliate marketing and e-commerce

— Events

— New paid products

• Strengthens competitive position for marketing services businesses

20

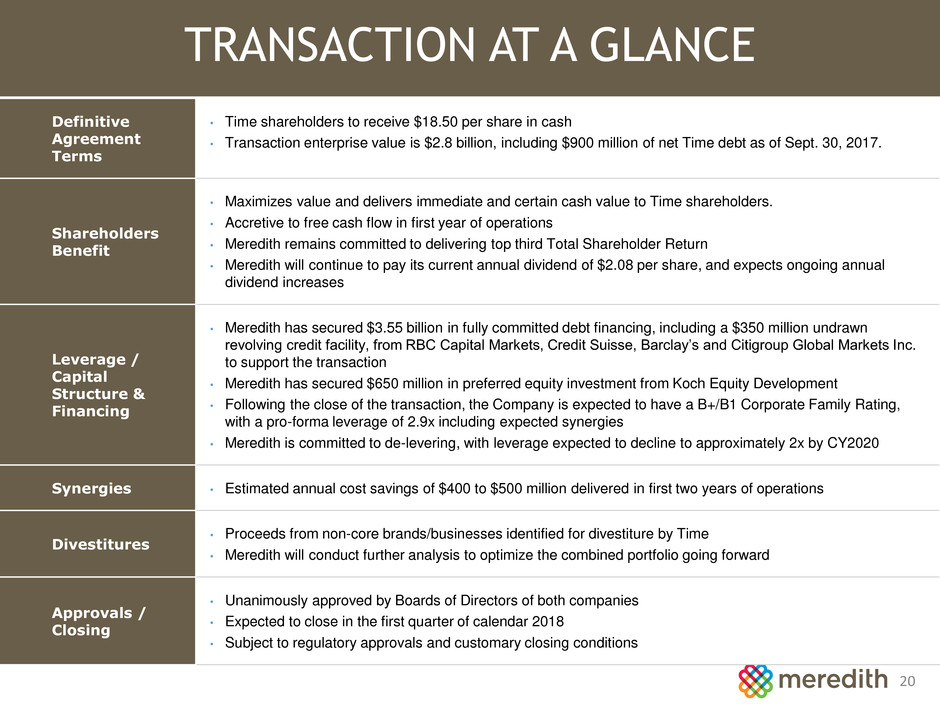

TRANSACTION AT A GLANCE

Definitive

Agreement

Terms

• Time shareholders to receive $18.50 per share in cash

• Transaction enterprise value is $2.8 billion, including $900 million of net Time debt as of Sept. 30, 2017.

Shareholders

Benefit

• Maximizes value and delivers immediate and certain cash value to Time shareholders.

• Accretive to free cash flow in first year of operations

• Meredith remains committed to delivering top third Total Shareholder Return

• Meredith will continue to pay its current annual dividend of $2.08 per share, and expects ongoing annual

dividend increases

Leverage /

Capital

Structure &

Financing

• Meredith has secured $3.55 billion in fully committed debt financing, including a $350 million undrawn

revolving credit facility, from RBC Capital Markets, Credit Suisse, Barclay’s and Citigroup Global Markets Inc.

to support the transaction

• Meredith has secured $650 million in preferred equity investment from Koch Equity Development

• Following the close of the transaction, the Company is expected to have a B+/B1 Corporate Family Rating,

with a pro-forma leverage of 2.9x including expected synergies

• Meredith is committed to de-levering, with leverage expected to decline to approximately 2x by CY2020

Synergies • Estimated annual cost savings of $400 to $500 million delivered in first two years of operations

Divestitures

• Proceeds from non-core brands/businesses identified for divestiture by Time

• Meredith will conduct further analysis to optimize the combined portfolio going forward

Approvals /

Closing

• Unanimously approved by Boards of Directors of both companies

• Expected to close in the first quarter of calendar 2018

• Subject to regulatory approvals and customary closing conditions

21

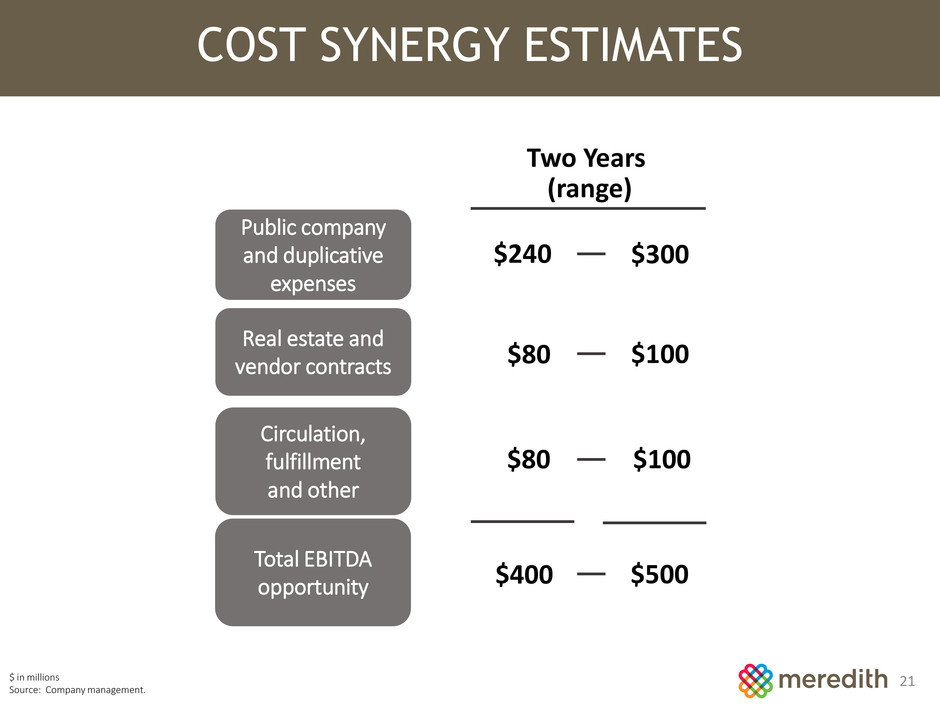

COST SYNERGY ESTIMATES

$ in millions

Source: Company management.

Public company

and duplicative

expenses

Real estate and

vendor contracts

Circulation,

fulfillment

and other

$240

Two Years

$300

$80 $100

$80 $100

Total EBITDA

opportunity $400 $500

(range)

22

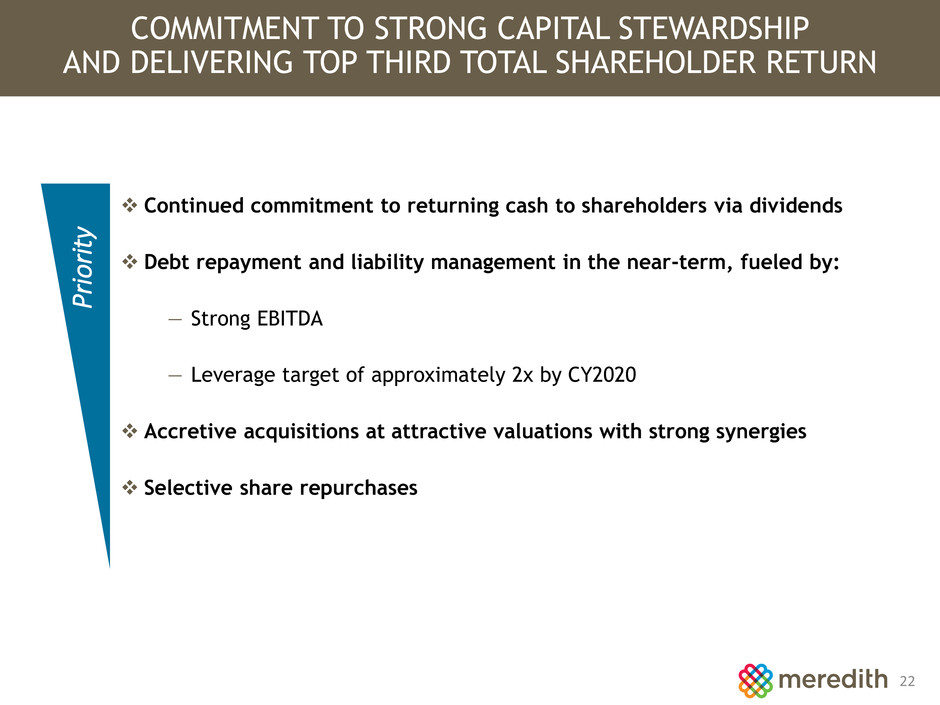

COMMITMENT TO STRONG CAPITAL STEWARDSHIP

AND DELIVERING TOP THIRD TOTAL SHAREHOLDER RETURN

❖ Continued commitment to returning cash to shareholders via dividends

❖ Debt repayment and liability management in the near-term, fueled by:

— Strong EBITDA

— Leverage target of approximately 2x by CY2020

❖ Accretive acquisitions at attractive valuations with strong synergies

❖ Selective share repurchases

P

ri

or

it

y

23

SUMMARY

Executive Summary About Meredith About Time MDP + TIME Summary

24

SUMMARY

1. Creates a premier media and marketing company with leading national brands

and strong local media properties that generate significant and consistent

cash flow

2. Unlocks significant value via estimated $400 to $500 million in synergies

3. Generates significant Revenue, EBITDA and Total Shareholder Return

4. Strengthens platform to continue industry consolidation

5. Led by strong management team with expertise at operating multi-platform

media businesses and proven track record at creating shareholder value

Meredith to Acquire Time Inc.

Creates Premier Media and Marketing Company

Serving 200 Million American Consumers

25

November 27, 2017