|

|

Filed

by the Registrant x

|

|

|

Filed

by a Party other than the Registrant o

|

|

|

Check

the appropriate box:

|

|

o

|

Preliminary

Proxy Statement

|

|

o

|

Confidential,

For Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

x

|

Definitive

Proxy Statement

|

|

o

|

Definitive

Additional Materials

|

|

o

|

Soliciting

Material Pursuant to §240.14a-12

|

|

Payment

of Filing Fee (Check the appropriate box):

|

||

|

x

|

No

fee required.

|

|

|

o

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

|

(1)

|

Amount

previously paid:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

o

|

Fee

paid previously with preliminary materials.

|

|

|

o

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

party:

|

|

|

(4)

|

Date

filed:

|

|

|

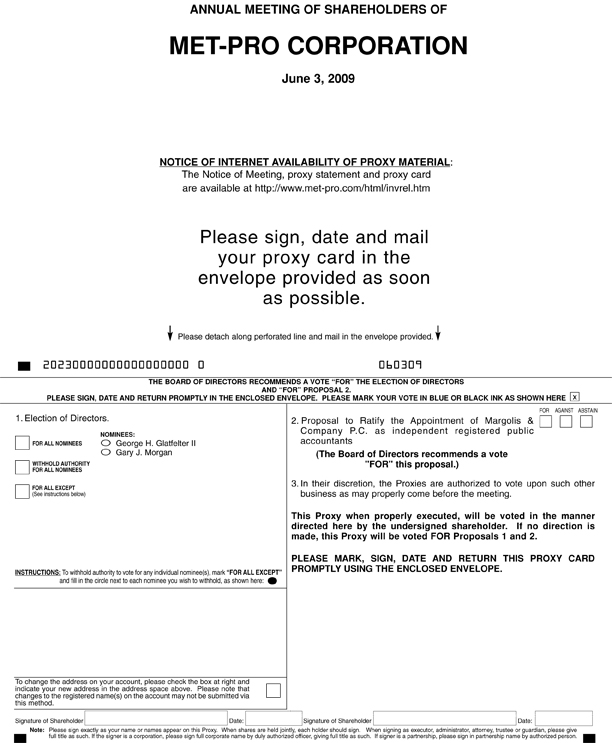

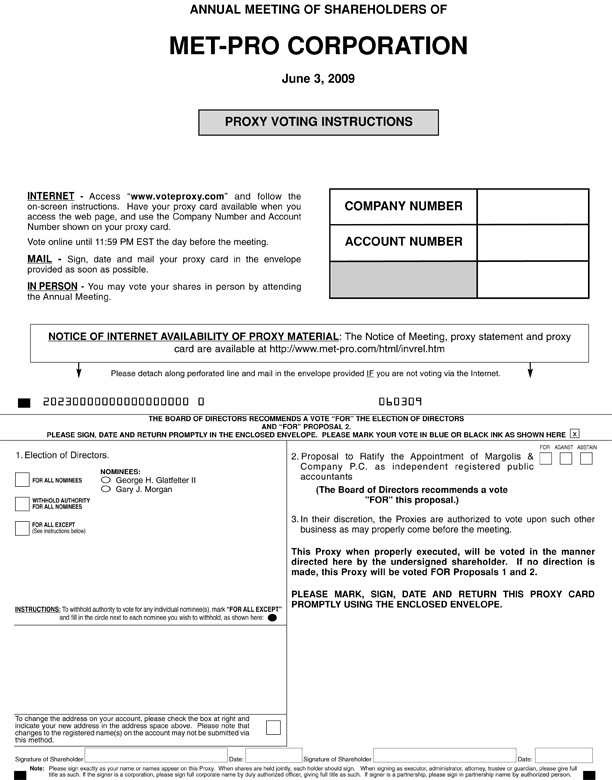

1.

|

To

elect two Directors to serve until the 2012 Annual Meeting of

Shareholders.

|

|

2.

|

To

ratify the selection of Margolis & Company P.C. as independent

registered public accountants for the Company’s fiscal year ending January

31, 2010.

|

|

3.

|

To

transact such other business as may properly come before the

meeting.

|

|

FIRST

YEAR

|

|||

|

OF

SERVICE

|

|||

|

NAME

|

AGE

|

PRINCIPAL

OCCUPATION

|

AS

A

|

|

DIRECTOR

|

|||

|

NOMINEES

FOR TERMS TO EXPIRE IN 2012

|

|||

|

George

H. Glatfelter II

|

57

|

Mr.

Glatfelter is Chairman of the Board and Chief Executive Officer of P. H.

Glatfelter Company, positions that he has held for more than five

years. P. H. Glatfelter Company, located in York, Pennsylvania,

a global manufacturer of specialty papers and engineered products, is a

public company whose shares are listed on the New York Stock Exchange (see

www.Glatfelter.com). Mr.

Glatfelter is also a Director of the National Council for Air and Stream

Improvements, and the Alliance for the Chesapeake Bay. Currently, Mr.

Glatfelter is the Chairman of the Company’s Compensation and Management

Development Committee and also serves on the Corporate Governance and

Nominating Committee.

|

2004

|

|

Gary

J. Morgan

|

54

|

Mr.

Morgan is Senior Vice President-Finance, Secretary, Treasurer, and Chief

Financial Officer of the Company. He was appointed Senior Vice

President-Finance in June 2006, prior to which, since October 1997, he was

Vice President-Finance, as well as Secretary, Treasurer and Chief

Financial Officer. He is a Certified Public

Accountant. Immediately prior to October 1997, Mr. Morgan was

the Corporate Controller of the Company. He has been employed

by the Company since 1980.

|

1998

|

|

FIRST

YEAR

|

|||

|

OF

SERVICE

|

|||

|

NAME

|

AGE

|

PRINCIPAL

OCCUPATION

|

AS

A

|

|

DIRECTOR

|

|||

|

DIRECTORS

WHOSE TERMS EXPIRE IN 2010

|

|||

|

Raymond

J. De Hont

|

55

|

Mr.

De Hont was elected Chairman of the Board of Directors in September 2003

and appointed President and Chief Executive Officer effective March 1,

2003. In February

2003, the Board of Directors appointed Mr. De Hont a Director of

the Company. From June 2000 until March 2003, Mr. De Hont was the Chief

Operating Officer of the Company, and from June 1995 through December

2000, he was Vice President and General Manager of the Company’s Fybroc

Division. In addition, during the period October 1999 to

December 2000, Mr. De Hont also served as General Manager of the Company’s

Dean Pump business unit.

|

2003

|

|

Nicholas

DeBenedictis

|

63

|

Mr.

DeBenedictis is Chairman of the Board, Chief Executive Officer and

President of Aqua America, Inc. (formerly Philadelphia Suburban

Corporation), positions that he has held for more than five

years. Aqua America is one of nation’s largest U.S. based

publicly-traded (New York Stock Exchange) water utilities, serving

approximately 2.5 million customers (see www.aquaamerica.com).

Mr. DeBenedictis is also a Director of P.H. Glatfelter Company and Exelon

Corporation, as well as a member of the Board of Trustees of Drexel

University. Currently, Mr. DeBenedictis is the Chairman of the

Company’s Corporate Governance and Nominating Committee and also serves on

the Audit Committee. Mr. DeBenedictis is also the Presiding

Independent Director of the Executive Sessions of the

Board.

|

1997

|

|

Judith

A. Spires

|

56

|

Ms. Spires,

who was appointed to the Board in January 2009, is the

President of Acme Markets, Inc., a Pennsylvania-based retail grocery

chain, a position which she has held for three years. Prior to being named

to her current position, Ms. Spires served as President of the Dallas/Fort

Worth Division of Albertsons, Inc. for two years, after having served as

President of Albertsons, Inc.'s Denver Division. Ms. Spires'

previous experience also includes a variety of roles for Acme including:

Senior Vice President of Marketing and Merchandising, Vice President of

Integration, Vice President-Operations, Vice President-Human Resources,

Vice President-Administration, and Vice President-Advertising. Ms. Spires

currently serves on a number of civic and community Boards including:

Variety-The Children's Charity, the Greater Philadelphia Chamber of

Commerce, the National Multiple Sclerosis Society, St. Joseph's University

Academy of Food Marketing, and La Salle

University.

|

2009

|

| DIRECTORS WHOSE TERMS EXPIRE IN 2011 | |||

|

Michael

J. Morris

|

74

|

Mr.

Morris is the retired Chief Executive Officer and President of both

Transport International Pool (TIP) and GE Modular

Buildings. Mr. Morris is a Director of Beneficial Mutual

Bancorp and a Trustee of Beneficial Mutual Savings Bank where he serves as

a member of the Executive Committee and Senior Loan

Committee. Currently, Mr. Morris is the Chairman of the

Company’s Audit Committee and also serves on the Compensation and

Management Development Committee.

|

1999

|

| Constantine

N.

Papadakis,

Ph.D.

|

63

|

Dr.

Papadakis is the President of Drexel University in Philadelphia,

Pennsylvania, a position that he has held for thirteen

years. Drexel University is one of the twenty largest private

universities in the nation and is renowned for its cooperative education

program and its use of technology in the learning process (see

www.Drexel.edu). Before joining Drexel, Dr. Papadakis

was Dean of the College of Engineering at the University of

Cincinnati. Prior to returning to academia, Dr. Papadakis

served as Vice President of Tetra Tech Inc., a Honeywell subsidiary; Vice

President of STS Consultants, LTD.; and at several engineering positions

with Bechtel Power Corporation. Dr. Papadakis also serves on

the Board of Directors of Amkor Technologies, Inc., Aqua America, Inc., CDI

Corporation and MACE Security International, Inc. Currently, Dr. Papadakis

serves on the Company’s Corporate Governance and Nominating

Committee and the Compensation and Management Development

Committee.

|

2004

|

| ♦ |

the

adequacy of the Company’s internal controls and financial reporting

process and the reliability of the Company’s financial

statements;

|

| ♦ | the independence and performance of the Company’s independent auditor; and |

| ♦ |

the

Company’s compliance with designated legal and regulatory

requirements.

|

| ♦ |

To

discharge as to the Chief Executive Officer (“CEO”), and to assist the

Board in otherwise discharging, the Board’s responsibilities relating to

the compensation of the Company’s executives (consisting of the Company’s

elected officers and General Managers and such other key employees as

determined by the Committee with guidance from the CEO) and members of the

Board;

|

| ♦ |

To

review and discuss with the Company’s senior executives the Compensation

Discussion and Analysis included in the Company’s proxy statement and to

provide the Compensation and Management Development Committee Report for

inclusion in the Company’s proxy statement that complies with the rules

and regulations of the SEC; and

|

| ♦ |

To

assist the Board in ensuring that the Company has in place effective

policies and programs for senior executive succession and for the

development of its

executives.

|

| ♦ |

the

ability of the prospective nominee(s) to represent the interests of the

shareholders of the Company;

|

| ♦ |

the

prospective nominee’s standards of integrity, commitment and independence

of thought and judgment;

|

| ♦ |

the

prospective nominee’s ability to dedicate sufficient time, energy and

attention to the diligent performance of his or her duties, including the

prospective nominee’s service on other public company boards, as

specifically set out in the Company’s Corporate Governance Guidelines;

and

|

| ♦ |

the

extent to which the prospective nominee(s) contributes to the range of

talent, skill and expertise appropriate for the

Board.

|

|

Common

|

||||||||||||||

|

Shares

|

||||||||||||||

|

Underlying

|

||||||||||||||

|

Number

of

|

Options

|

|||||||||||||

|

Common

|

Exercisable

|

Percent of

|

||||||||||||

|

Name of Executive

Officers

|

|

Shares

|

Within

60

|

Shares Beneficially

|

||||||||||

|

and

Directors

|

|

Owned

|

Days (1)

|

Owned (2)

|

||||||||||

|

Raymond

J. De Hont

|

24,854

|

(3)

|

233,838

|

1.7

|

%

|

|||||||||

|

|

|

|||||||||||||

|

Nicholas

DeBenedictis

|

44,962

|

9,889

|

*

|

|||||||||||

|

|

|

|

||||||||||||

|

George

H. Glatfelter II

|

4,444

|

39,002

|

*

|

|||||||||||

|

|

|

|

||||||||||||

|

Alan

Lawley, Ph.D.

|

55,262

|

22,668

|

*

|

|||||||||||

|

|

|

|||||||||||||

|

Gary

J. Morgan

|

57,920

|

(4)

|

107,245

|

1.1

|

%

|

|||||||||

|

|

|

|

||||||||||||

|

Michael

J. Morris

|

51,359

|

39,002

|

*

|

|||||||||||

|

|

|

|

||||||||||||

|

Constantine

N. Papadakis, Ph.D.

|

-

|

39,002

|

*

|

|||||||||||

|

|

|

|

||||||||||||

|

Judith

A. Spires

|

-

|

-

|

*

|

|||||||||||

|

|

|

|

||||||||||||

|

Gennaro

A. D’Alterio

|

2,070

|

(5)

|

2,600

|

*

|

||||||||||

|

|

|

|

||||||||||||

|

Paul

A. Tetley

|

5,945

|

(6)

|

92,158

|

*

|

||||||||||

|

|

|

|

|

|||||||||||

|

Vincent

J. Verdone

|

723

|

(7)

|

23,933

|

*

|

||||||||||

|

|

|

|

|

|||||||||||

|

All

Directors, nominees and executive officers as a group (13

persons)

|

284,958

|

(8)

|

712,607

|

6.5

|

%

|

|||||||||

|

|

||||||||||||||

| * |

Less than 1% of the

Company’s outstanding Common Shares.

|

| (1) |

The number of Common

Shares beneficially owned by each person is determined under

rules promulgated by the Securities and Exchange Commission. Under

these rules, a person is deemed to have “beneficial ownership” of any

shares over which that person has or shares voting or investment power,

plus any shares that the person may acquire within 60 days, after January

31, 2009, including through the exercise of stock options. This number of

shares beneficially owned therefore includes all shares that may be

acquired within 60 days pursuant to the exercise of stock

options.

|

| (2) |

The percent

ownership for each shareholder on March 27, 2009 is calculated by

dividing (a) the total number of shares beneficially owned by the

shareholder by (b) 14,600,109 shares plus any shares acquirable

(including stock options exercisable) by that person within 60 days after

January 31, 2009.

|

| (3) |

The number of shares

held by Mr. De Hont includes 9,042 Common Shares beneficially held through

the Met-Pro Corporation Salaried Employee Stock Ownership Trust and

through the Company’s 401(k) Plan. Excludes shares owned by Mr. De Hont’s

adult children, as to which he disclaims beneficial ownership or

control.

|

| (4) |

The number of shares

held by Mr. Morgan includes 24,480 Common Shares beneficially held through

the Met-Pro Corporation Salaried Employee Stock Ownership Trust and

through the Company’s 401(k) Plan.

|

| (5) |

The number of shares

held by Mr. D’Alterio includes 1,834 Common Shares beneficially held

through the Company’s 401(k) Plan.

|

| (6) |

The number of shares

held by Mr. Tetley includes 5,945 Common Shares beneficially held through

the Met-Pro Corporation Salaried Employee Stock Ownership Trust and

through the Company’s 401(k) Plan.

|

| (7) |

The number of shares

held by Mr. Verdone includes 723 Common Shares beneficially held through

the Company’s 401(k) Plan.

|

| (8) |

The number of shares

held by all thirteen executive officers and Directors as a group include

58,501 Common Shares beneficially held through the Met-Pro Corporation

Salaried Employee Stock Ownership Trust and through the Company’s 401(k)

Plan.

|

|

♦

|

Align the interests of

executives, including the Company’s named executive officers, with those

of the shareholders. The Committee believes it is

appropriate to tie a portion of executive compensation to the value of the

Company’s stock in order to more closely align the interests of the named

executive officers and other senior managers with the interests of the

Company’s shareholders.

|

|

♦

|

Retain and develop competent

management. The Company’s executive compensation program

components are designed to attract, retain, develop and motivate highly

qualified executives critical to achieving Met-Pro’s strategic objectives

and building shareholder value.

|

|

♦

|

Relate executive compensation

to the achievement of the Company’s goals and financial performance, both

short and long-term. The Committee’s executive

compensation programs are designed to reward executives when performance

results for the Company and the executive are above stated objectives. The

Committee believes that compensation paid to executives should be closely

aligned with the performance of the Company on both a short-term and

long-term

basis.

|

|

o

|

Calgon

Carbon Corporation

|

o

|

Gorman-Rupp

Corporation

|

o

|

Fuel

Tech Inc.

|

|

o

|

CECO

Environmental Corporation

|

o

|

Graco

Inc.

|

o

|

Reunion

Industries

|

|

o

|

Environmental

Tectonics Corporation

|

o

|

K-Tron

International Inc.

|

o

|

SL

Industries Inc.

|

|

o

|

Flanders

Corporation

|

o

|

MFRI

Inc.

|

o

|

Strategic

Distribution Inc.

|

|

o

|

PMFG

Inc.

|

o

|

Misonix

Inc.

|

|

| ♦ |

The

Compensation Peer Group data and other market data for comparable

positions;

|

| ♦ |

Individual

level of responsibility, performance and contributions to the Company;

and

|

| ♦ |

The

Chief Executive Officer’s recommendations for named executive officers

(other than

himself).

|

|

Attainment

of Threshold Financial Target

|

Threshold

Financial Multiplier

|

|

|

less

than 80%

|

0.00%

|

|

|

80%

|

50.00%

|

|

|

85%

|

62.50%

|

|

|

90%

|

75.00%

|

|

|

95%

|

87.50%

|

|

|

100%

|

100.00%

|

|

|

105%

|

110.00%

|

|

|

110%

|

120.00%

|

|

|

115%

|

130.00%

|

|

|

120%

|

140.00%

|

|

|

125%

|

150.00%

|

|

|

greater

than 125%

|

150.00%

|

|

Submitted

by the Compensation and Management Development Committee,

|

|

|

George

H. Glatfelter II (Chairman)

|

|

|

Michael

J. Morris

|

|

|

Constantine

N. Papadakis, Ph.D.

|

|

|

March

27, 2009

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

||||||||||||||||

|

Change in

|

|||||||||||||||||||||||

|

Pension

|

|||||||||||||||||||||||

|

Value and

|

|||||||||||||||||||||||

|

Non-Equity

|

Nonqualified

|

||||||||||||||||||||||

|

Incentive

|

Deferred

|

||||||||||||||||||||||

|

Option

|

Plan

|

Compensation

|

All Other

|

||||||||||||||||||||

|

Salary

|

Awards

|

Compensation |

Earnings

|

Compensation

|

Total

|

||||||||||||||||||

| Name and Principal Position |

Year

|

($) (1)

|

($)

(2)

|

($)

|

($) (3)

|

($)

(4)

|

($) (5)

|

||||||||||||||||

|

Raymond J. De

Hont

|

2009

|

$341,000

|

$87,652

|

$77,167

|

$144,741

|

$21,339

|

$671,899

|

||||||||||||||||

|

Chairman,

Chief Executive Officer and

|

2008

|

310,000

|

108,708

|

69,281

|

25,897

|

22,170

|

536,056

|

||||||||||||||||

|

President

|

2007

|

290,000

|

61,801

|

51,875

|

40,298

|

5,378

|

449,352

|

||||||||||||||||

|

Gary

J. Morgan

|

2009

|

220,000

|

37,564

|

39,828

|

88,888

|

18,157

|

404,437

|

||||||||||||||||

|

Senior

Vice President-Finance, Secretary,

|

2008

|

210,000

|

45,239

|

37,838

|

12,657

|

16,098

|

321,832

|

||||||||||||||||

|

Treasurer

and Chief Financial Officer

|

2007

|

201,000

|

33,871

|

26,920

|

42,301

|

5,049

|

309,141

|

||||||||||||||||

|

Paul

A. Tetley

|

2009

|

187,400

|

25,044

|

-

|

19,219

|

15,112

|

246,775

|

||||||||||||||||

|

Executive

Vice President-Product

|

2008

|

182,000

|

28,072

|

28,163

|

1,628

|

12,560

|

252,423

|

||||||||||||||||

|

Recovery/Pollution

Control Technologies and

|

2007

|

175,000

|

28,978

|

-

|

10,804

|

4,395

|

219,177

|

||||||||||||||||

|

General

Manager, Strobic Air Corporation

|

|||||||||||||||||||||||

|

Gennaro

A. D’Alterio

|

2009

|

157,500

|

7,467

|

36,159

|

(88

|

)

|

13,271

|

214,309

|

|||||||||||||||

|

Vice

President and General Manager,

|

2008

|

150,583

|

-

|

25,848

|

412

|

9,415

|

186,258

|

||||||||||||||||

|

Met-Pro

Pump Group

|

2007

|

125,882

|

-

|

-

|

3,402

|

2,721

|

132,005

|

||||||||||||||||

|

Vincent

J. Verdone

|

2009

|

147,500

|

15,027

|

32,782

|

1,222

|

8,853

|

205,384

|

||||||||||||||||

|

Vice

President and General Manager,

|

2008

|

144,600

|

16,352

|

-

|

1,544

|

7,827

|

170,323

|

||||||||||||||||

|

Pristine

Water Solutions Inc.

|

2007

|

144,000

|

9,802

|

-

|

9,717

|

2,450

|

165,969

|

||||||||||||||||

| (1) |

The

amounts in column (c) include base salary.

|

| (2) |

The

amounts in column (d) represent the dollar amount recognized for financial

statement reporting purposes for the fiscal years ended January 31,

2009, 2008 and 2007, in accordance with Statement of Financial Accounting

Standards (“SFAS”) No. 123(R) for stock options, which include amounts

from awards granted prior to the fiscal years 2009, 2008 and 2007 to the

extent such options became exercisable in fiscal years 2009, 2008 and

2007, respectively, as well as options granted in such fiscal years to the

extent exercisable. The fair value of these awards is based on the

Black-Scholes option pricing model on the date of grant. Assumptions

used in the calculation of these amounts are included in the “Stock-Based

Compensation” footnote to the Company’s audited financial statements for

the fiscal year ended January 31, 2009 included in the Company’s Annual

Report on Form 10-K filed with the SEC on April 10,

2009.

|

| (3) |

The

amounts in column (f) represent the actuarial increase in the present

value of the named executive officers’ benefits under the Company’s

Salaried Pension Plan, the Pension Restoration Plan (for Messrs. De Hont

and Morgan), and the contribution to the Non-Qualified Deferred

Contribution Supplemental Executive Retirement Plan. The

contributions, which are included in column (f), to the Non-Qualified

Deferred Contribution Supplemental Executive Retirement Plan for Messrs.

De Hont, Morgan, Tetley, D’Alterio and Verdone amounted to $117,372,

$65,406, $17,728, $0 and $0, respectively in the fiscal year ended January

31, 2009. The actuarial increase was calculated using the

interest rate, discount rate and form of payment assumptions consistent

with those used in the Company’s financial statements. The

calculation assumes benefit commencement is at normal retirement age (age

65), and was calculated without respect to pre-retirement death,

termination or disability.

|

| (4) |

The

amounts in column (g) “All Other Compensation” for fiscal year 2009,

consist of the

following:

|

|

401

(k)

|

401

(k)

|

Life

|

|||||

|

Match

|

Discretionary

|

Car

|

Insurance

|

Disability

|

Total

|

||

|

Name

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

|

Raymond

J. De Hont

|

$4,658

|

$9,252

|

$2,819

|

$1,620

|

$2,990

|

$21,339

|

|||||||

|

Gary

J. Morgan

|

3,159

|

9,217

|

1,955

|

1,069

|

2,757

|

18,157

|

|||||||

|

Paul

A. Tetley

|

4,272

|

6,460

|

1,007

|

911

|

2,462

|

15,112

|

|||||||

|

Gennaro

A. D’Alterio

|

3,667

|

3,667

|

3,126

|

765

|

2,046

|

13,271

|

|||||||

|

Vincent

J. Verdone

|

2,948

|

2,948

|

356

|

717

|

1,884

|

8,853

|

|

(5)

|

The

amounts in column (h) represent the total of columns (c) through

(g).

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

||||||||||

|

All Other

|

||||||||||||||||||

|

Option

|

Grant

|

|||||||||||||||||

|

Awards:

|

Exercise

|

Date Fair

|

||||||||||||||||

|

Fiscal

|

Number of

|

or Base

|

Value of

|

Grant

|

||||||||||||||

|

Year

|

Estimated Future Payouts Under

|

Securities

|

Price of

|

Stock and

|

Date

|

|||||||||||||

|

Ended/

|

Non-Equity Incentive Plan Awards

|

Underlying

|

Option

|

Option

|

Price of

|

|||||||||||||

|

Grant

|

Threshold

|

Target

|

Maximum

|

Options

|

Awards

|

Awards

|

Options

|

|||||||||||

|

Name

|

Date

|

($)

|

($)

|

($)

|

(#)

(1)

|

($/Sh)

(2)

|

($) (3)

|

($/Sh)

(2)

|

||||||||||

|

Raymond

J. De Hont

|

01/31/2009

|

(4)

|

$0

|

$170,500

|

$255,750

|

-

|

-

|

-

|

-

|

|||||||||

|

01/31/2008

|

(4)

|

0

|

155,000

|

232,500

|

-

|

-

|

-

|

-

|

||||||||||

|

01/31/2007

|

(4)

|

0

|

116,000

|

174,000

|

-

|

-

|

-

|

-

|

||||||||||

|

12/03/2008

|

-

|

-

|

-

|

45,500

|

$11.345

|

$155,155

|

$12.100

|

|||||||||||

|

12/10/2007

|

-

|

-

|

-

|

45,500

|

11.750

|

139,230

|

11.960

|

|||||||||||

|

12/15/2006

|

-

|

-

|

-

|

46,667

|

10.900

|

141,050

|

10.910

|

|||||||||||

|

Gary

J. Morgan

|

01/31/2009

|

(4)

|

0

|

88,000

|

132,000

|

-

|

-

|

-

|

-

|

|||||||||

|

01/31/2008

|

(4)

|

0

|

84,000

|

126,000

|

-

|

-

|

-

|

-

|

||||||||||

|

01/31/2007

|

(4)

|

0

|

60,300

|

90,450

|

-

|

-

|

-

|

-

|

||||||||||

|

12/03/2008

|

-

|

-

|

-

|

19,500

|

11.345

|

66,495

|

12.100

|

|||||||||||

|

12/10/2007

|

-

|

-

|

-

|

19,500

|

11.750

|

59,670

|

11.960

|

|||||||||||

|

12/15/2006

|

-

|

-

|

-

|

20,000

|

10.900

|

60,450

|

10.910

|

|||||||||||

|

Paul

A. Tetley

|

01/31/2009

|

(4)

|

0

|

65,590

|

98,385

|

-

|

-

|

-

|

-

|

|||||||||

|

01/31/2008

|

(4)

|

0

|

63,700

|

95,550

|

-

|

-

|

-

|

-

|

||||||||||

|

01/31/2007

|

(4)

|

0

|

52,500

|

78,750

|

-

|

-

|

-

|

-

|

||||||||||

|

12/03/2008

|

-

|

-

|

-

|

13,000

|

11.345

|

44,330

|

12.100

|

|||||||||||

|

12/10/2007

|

-

|

-

|

-

|

13,000

|

11.750

|

39,780

|

11.960

|

|||||||||||

|

12/15/2006

|

-

|

-

|

-

|

13,334

|

10.900

|

40,300

|

10.910

|

|||||||||||

|

Gennaro

A. D’Alterio

|

01/31/2009

|

(4)

|

0

|

39,375

|

59,063

|

-

|

-

|

-

|

-

|

|||||||||

|

12/03/2008

|

-

|

-

|

-

|

10,000

|

11.345

|

34,100

|

12.100

|

|||||||||||

|

12/10/2007

|

-

|

-

|

-

|

7,800

|

11.750

|

23,868

|

11.960

|

|||||||||||

|

Vincent

J. Verdone

|

01/31/2009

|

(4)

|

0

|

36,875

|

55,313

|

-

|

-

|

-

|

-

|

|||||||||

|

01/31/2008

|

(4)

|

0

|

36,150

|

54,225

|

-

|

-

|

-

|

-

|

||||||||||

|

01/31/2007

|

(4)

|

0

|

35,000

|

52,500

|

-

|

-

|

-

|

-

|

||||||||||

|

12/03/2008

|

-

|

-

|

-

|

7,800

|

11.345

|

26,598

|

12.100

|

|||||||||||

|

12/10/2007

|

-

|

-

|

-

|

7,800

|

11.750

|

23,868

|

11.960

|

|||||||||||

|

12/15/2006

|

-

|

-

|

-

|

8,000

|

10.900

|

24,160

|

10.910

|

|||||||||||

| (1) |

The

amounts in column (f) represent the number of stock options granted

on December 3, 2008, December 10, 2007 and December 15, 2006, as part

of the fiscal years 2009, 2008 and 2007 long-term incentive

award.

|

| (2) |

The amounts in

column (g) represent the exercise price of the stock options, which

was the fair market value on the date of grant, calculated by taking the

average of the high and low trading values of the Company’s Common Shares

on the New York Stock Exchange on the date of grant. The closing trade

value on the Company’s Common Shares on the New York Stock Exchange on

December 3, 2008, December 10, 2007 and December 15, 2006 was $12.10,

$11.96 and $10.91, respectively, as presented in column

(i).

|

| (3) |

The amounts in

column (h) represent the fair value of the stock options granted on

December 3, 2008, December 10, 2007 and December 15, 2006 as part of

the fiscal years 2009, 2008 and 2007 long-term incentive award. The value

is computed in accordance with SFAS No. 123(R), using a Black-Scholes

option pricing model value of $3.41, $3.06 and $3.02 per option,

respectively.

|

| (4) |

Columns

(c), (d) and (e) show for each named executive officer the

potential value of the payout of their fiscal years 2009, 2008 and 2007

annual incentive award if the threshold, target and maximum performance

goals are satisfied. Annual incentive awards for fiscal years 2009, 2008

and 2007 were paid as follows, respectively, and are reported in column

(e) of the Summary Compensation Table on page 16: Mr. De Hont,

$77,167, $69,281 and $51,875; Mr. Morgan, $39,828, $37,838 and $26,920;

Mr. Tetley, $0, $28,163 and $0; Mr. D’Alterio, $36,159, $25,848 and $0;

and Mr. Verdone, $32,782, $0 and $0. The Management Incentive Plan is

described in the Compensation Discussion and Analysis on

pages 9-15.

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

||||||||||||||

|

Option Awards

|

||||||||||||||||||

|

Name

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

|

Option

Exercise

Price

($)

(1)

|

Option

Expiration

Date

(2)

|

||||||||||||||

|

Raymond

J. De Hont

|

17,779

|

-

|

$5.5476

|

2/25/2012

|

||||||||||||||

|

35,556

|

-

|

5.5181

|

2/24/2013

|

|||||||||||||||

|

44,446

|

-

|

9.6440

|

2/23/2014

|

|||||||||||||||

|

44,446

|

-

|

7.4110

|

2/22/2015

|

|||||||||||||||

|

45,334

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

31,111

|

15,556

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

15,166

|

30,334

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

45,500

|

10.3450

|

12/03/2018

|

|||||||||||||||

|

Gary

J. Morgan

|

15,408

|

-

|

5.5476

|

2/25/2012

|

||||||||||||||

|

17,779

|

-

|

5.5181

|

2/24/2013

|

|||||||||||||||

|

17,779

|

-

|

9.6440

|

2/23/2014

|

|||||||||||||||

|

17,779

|

-

|

7.4110

|

2/22/2015

|

|||||||||||||||

|

18,667

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

13,333

|

6,667

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

6,500

|

13,000

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

19,500

|

11.3450

|

12/03/2018

|

|||||||||||||||

|

Paul

A. Tetley

|

9,956

|

-

|

4.1659

|

12/16/2009

|

||||||||||||||

|

9,956

|

-

|

5.1047

|

2/26/2011

|

|||||||||||||||

|

9,956

|

-

|

5.5476

|

2/25/2012

|

|||||||||||||||

|

9,956

|

-

|

5.5181

|

2/24/2013

|

|||||||||||||||

|

17,779

|

-

|

9.6440

|

2/23/2014

|

|||||||||||||||

|

10,667

|

-

|

7.4110

|

2/22/2015

|

|||||||||||||||

|

10,667

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

8,889

|

4,445

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

4,332

|

8,668

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

13,000

|

11.3450

|

12/03/2018

|

|||||||||||||||

|

Gennaro

A. D’Alterio

|

2,600

|

5,200

|

11.7500

|

12/10/2017

|

||||||||||||||

|

-

|

10,000

|

11.3450

|

12/03/2018

|

|||||||||||||||

|

Vincent

J. Verdone

|

8,000

|

-

|

7.4110

|

2/22/2015

|

||||||||||||||

|

8,000

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

5,333

|

2,667

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

2,600

|

5,200

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

7,800

|

11.3450

|

12/03/2018

|

|||||||||||||||

| (1) |

The exercise price

of the stock options is the fair market value of the Company’s Common

Shares on the date of grant, calculated by taking the average of the high

and low price of the Company’s Common Shares on the New York Stock

Exchange on the date of grant.

|

| (2) |

Options granted

prior to fiscal year 2007 had a ten-year term and a vesting schedule of

one-third on the date of grant, one-third at the completion of year one

and one-third at the completion of year two. All options

granted during the fiscal years 2009, 2008 and 2007 have a ten-year term

and a vesting schedule of one-third per year over three years. The first

vesting date for all options granted during the fiscal years 2009, 2008

and 2007 is on the first anniversary date of the grant and is for

one-third of the options that were granted, and the options subsequently

vest at a rate of one-third of the grant per year on the following two

anniversary dates, subject to earlier termination as well as acceleration

as elsewhere described.

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

|||||||

|

Value

of Unexercised

|

|||||||||||||

|

Option Awards

|

Number

of Unexercised

|

In-The-Money

|

|||||||||||

|

Number of Shares

|

Value Realized

|

Options

at FY-End

|

Options at

FY-End

|

||||||||||

|

Acquired on Exercise

|

on Exercise

|

(#)

|

($)

(1)

|

||||||||||

|

Name

|

(#)

|

($)

|

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||||||

|

Raymond

J. De Hont

|

27,735

|

$302,717

|

233,838

|

91,390

|

$595,048

|

$972

|

|||||||

|

Gary

J. Morgan

|

28,564

|

314,751

|

107,245

|

39,167

|

303,361

|

417

|

|||||||

|

Paul

A. Tetley

|

-

|

-

|

92,158

|

26,113

|

316,320

|

278

|

|||||||

|

Gennaro

A. D’Alterio

|

-

|

-

|

2,600

|

15,200

|

-

|

-

|

|||||||

|

Vincent

J. Verdone

|

-

|

-

|

23,933

|

15,667

|

44,105

|

167

|

| (1) |

Market value of

shares covered by in-the-money options on January 31, 2009 less option

exercise price. Options are in-the-money if the

market value of the shares covered thereby is greater than the option

exercise price.

|

|

Years

of Service

|

||||||||||||

|

Five

Year Average Earnings

|

15

|

20

|

25

|

30

|

35

|

|||||||

|

$100,000

|

$15,000

|

$20,000

|

$25,000

|

$30,000

|

$35,000

|

|||||||

|

125,000

|

18,750

|

25,000

|

31,250

|

37,500

|

43,750

|

|||||||

|

150,000

|

22,500

|

30,000

|

37,500

|

45,000

|

52,500

|

|||||||

|

170,000

|

25,500

|

34,000

|

42,500

|

51,000

|

59,500

|

|||||||

|

175,000

|

26,250

|

35,000

|

43,750

|

52,500

|

61,250

|

|||||||

|

200,000

|

30,000

|

40,000

|

50,000

|

60,000

|

70,000

|

|||||||

|

230,000

|

(1)

|

|

34,500

|

46,000

|

57,500

|

69,000

|

80,500

|

|||||

|

250,000

|

37,500

|

50,000

|

62,500

|

75,000

|

87,500

|

|||||||

|

300,000

|

45,000

|

60,000

|

75,000

|

90,000

|

105,000

|

|||||||

|

350,000

|

52,500

|

70,000

|

87,500

|

105,000

|

122,500

|

|||||||

|

400,000

|

60,000

|

80,000

|

100,000

|

120,000

|

140,000

|

|||||||

|

450,000

|

67,500

|

90,000

|

112,500

|

135,000

|

157,500

|

|||||||

|

500,000

|

75,000

|

100,000

|

125,000

|

150,000

|

175,000

|

|||||||

| (1) |

Internal

Revenue Code Section 401(a)(17) limits on earnings used to calculate the

Retirement Plan benefits amounted to $230,000, $225,000 and $220,000 for

fiscal years 2009, 2008 and 2007,

respectively.

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

||||||||||

|

Number of Years

|

Present

Value of

|

Payments During

|

||||||||||||

|

Credited Service

|

Accumulated Benefit

|

Last

Fiscal Year

|

||||||||||||

|

Name

|

Plan Name

|

(#) (1)

|

($) (2)

|

($)

|

||||||||||

|

Raymond

J. De Hont

|

Retirement Plan

|

11.50

|

$108,958

|

$0

|

||||||||||

|

Pension

Restoration Plan

|

12.83

|

99,572

|

0

|

|||||||||||

|

Gary

J. Morgan

|

Retirement

Plan

|

26.75

|

222,674

|

0

|

||||||||||

|

Pension

Restoration Plan

|

28.08

|

64,737

|

0

|

|||||||||||

|

Paul

A. Tetley

|

Retirement

Plan

|

9.92

|

54,993

|

0

|

||||||||||

|

Gennaro

A. D’Alterio

|

Retirement

Plan

|

11.42

|

16,745

|

0

|

||||||||||

|

Vincent

J. Verdone

|

Retirement

Plan

|

1.92

|

19,193

|

0

|

||||||||||

| (1) |

Based

upon the pension plans’ measurement date of January 31,

2009.

|

| (2) |

The amounts in

column (d) represent the present value of accumulated benefits for

the period ended January 31, 2009. The actuarial values were based on

the mortality table and discount rate assumptions used in the calculation

in the “Employee Benefit Plans” footnote in the Company’s audited

financial statements for the fiscal year ended January 31, 2009 included

in the Company’s Annual Report on Form 10-K filed with the SEC on April

10, 2009.

|

|

|

Key

|

Accelerated

|

|

|

Employee

|

Vesting

of

|

Total

|

|

|

Name

|

Severance

|

Options

|

($)

|

|

Raymond

J. De Hont

|

$750,000

|

$0

|

$750,000

|

|

Gary

J. Morgan

|

341,550

|

-

|

341,550

|

|

Paul

A. Tetley

|

-

|

-

|

-

|

|

Gennaro

A. D’Alterio

|

-

|

-

|

-

|

|

Vincent

J. Verdone

|

-

|

-

|

-

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

||||||||

|

Change

in

|

||||||||||||

|

Pension

Value

|

||||||||||||

|

Nonqualified

|

||||||||||||

|

Deferred

|

||||||||||||

|

Fees Earned or

|

Option

|

Compensation

|

||||||||||

|

Paid in Cash

|

Awards

|

and Earnings

|

Total

|

|||||||||

|

|

($)

(1)

|

($)

(2)

|

($)

(3)

|

($)

(1)

|

||||||||

|

George

H. Glatfelter II

|

$29,550

|

$25,044

|

$0

|

$54,594

|

||||||||

|

Alan

Lawley, Ph.D. (5)

|

25,700

|

25,044

|

6,664

|

57,408

|

||||||||

|

Nicholas

DeBenedictis

|

29,225

|

25,044

|

0

|

54,269

|

||||||||

|

Michael

J. Morris

|

37,200

|

25,044

|

0

|

62,244

|

||||||||

|

Constantine

N. Papadakis, Ph.D.

|

28,850

|

25,044

|

0

|

53,894

|

||||||||

|

Judith

A. Spires (6)

|

0

|

0

|

0

|

0

|

||||||||

| (1) |

The

amounts in column (b) represent fees paid for board retainers,

committee retainers, board meetings and committee

meetings.

|

| (2) |

The amounts in

column (c) represent the dollar amount recognized for financial statement

reporting purposes for the fiscal year ended January 31, 2009, in

accordance with SFAS No. 123(R) for stock options, regardless of when the

options were granted, and include amounts from awards granted prior to the

fiscal year 2009. The fair value of these awards is based on the

Black-Scholes option pricing model on the date of grant. Assumptions

used in the calculation of these amounts are included in the “Stock-Based

Compensation” footnote to the Company’s audited financial statements for

the fiscal year ended January 31, 2009 included in the Company’s Annual

Report on Form 10-K filed with the SEC on April 10,

2009.

|

| (3) |

The amounts in

column (d) represent the actuarial increase in the present value of

benefits under the Directors’ Retirement Plan for Dr. Lawley as described

in the Directors’ Retirement Plan section on page 22. No other Director is vested in this

plan.

|

| (4) | The amounts in column (e) represent the total of columns (b), (c) and (d). |

| (5) |

Dr. Lawley will be

retiring as a Director on June 3, 2009. Reported compensation reflects

amounts earned or accrued during fiscal year 2009.

|

| (6) | Ms. Spires was appointed a Director in January 2009. |

| (7) |

The

following table provides information on the holdings of stock options by

each Director at January 31,

2009.

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

||||||||||||||

|

Option Awards

|

||||||||||||||||||

|

Number of

|

Number of

|

|||||||||||||||||

|

Securities

|

Securities

|

|||||||||||||||||

|

Underlying

|

Underlying

|

|||||||||||||||||

|

Unexercised

|

Unexercised

|

Option

|

||||||||||||||||

|

Options

|

Options

|

Exercise

|

Option

|

|||||||||||||||

|

(#)

|

(#)

|

Price

|

Expiration

|

|||||||||||||||

|

Name

|

Exercisable

|

Unexercisable

|

($) (8)

|

Date

(9)

|

||||||||||||||

|

George

H. Glatfelter II

|

12,446

|

-

|

$7.4110

|

2/22/2015

|

||||||||||||||

|

13,334

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

8,889

|

4,445

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

4,333

|

8,667

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

13,000

|

11.3450

|

12/03/2018

|

|||||||||||||||

|

Alan

Lawley, Ph.D.

|

4,446

|

-

|

9.0375

|

12/15/2015

|

||||||||||||||

|

8,889

|

4,445

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

4,333

|

8,667

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

Nicholas

DeBenedictis

|

5,556

|

4,445

|

10.8975

|

12/15/2016

|

||||||||||||||

|

4,333

|

8,667

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

13,000

|

11.3450

|

12/03/2018

|

|||||||||||||||

|

Michael

J. Morris

|

12,446

|

-

|

9.6440

|

2/23/2014

|

||||||||||||||

|

13,334

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

8,889

|

4,445

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

4,333

|

8,667

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

13,000

|

11.3450

|

12/03/2018

|

|||||||||||||||

|

Constantine

N. Papadakis, Ph.D.

|

12,446

|

-

|

7.4110

|

2/22/2015

|

||||||||||||||

|

13,334

|

-

|

9.0375

|

12/15/2015

|

|||||||||||||||

|

8,889

|

4,445

|

10.8975

|

12/15/2016

|

|||||||||||||||

|

4,333

|

8,667

|

11.7500

|

12/10/2017

|

|||||||||||||||

|

-

|

13,000

|

11.3450

|

12/03/2018

|

|||||||||||||||

| (8) |

The

exercise price of the stock options is the fair market value of the

Company’s Common Shares on the date of grant, calculated by taking the

average of the high and low price of the Company’s Common Shares on the

New York Stock Exchange on the date of grant.

|

| (9) |

Options granted

prior to fiscal year 2007 had a ten-year term and a vesting schedule of

one-third on the date of grant, one-third at the completion of year one

and one-third at the completion of year two. All options granted during

the fiscal years 2009, 2008 and 2007 have a ten-year term and a vesting

schedule of one-third per year over three years. The first vesting date

for all options granted during the fiscal years 2009, 2008 and 2007 is on

the first anniversary date of the grant and is for one-third of the

options that were granted, and the options subsequently vest at a rate of

one-third of the grant per year on the following two anniversary dates,

subject to earlier termination as well as acceleration as elsewhere

described.

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

||||||||||

|

Number of Years

|

Present

Value of

|

Payments

During

|

||||||||||||

|

Credited Service

|

Accumulated

Benefit

|

Last

Fiscal Year

|

||||||||||||

|

Name

|

Plan Name

|

(#) (1)

|

($) (2)

|

($)

|

||||||||||

|

Alan

Lawley, Ph.D.

|

Directors’

Retirement Plan

|

9.00

|

$59,774

|

$0

|

||||||||||

| (1) |

Based

upon the pension plans’ measurement date of January 31,

2009.

|

| (2) |

The amount in column

(d) represents the present value of accumulated benefits for the

period ended January 31, 2009. The actuarial values were based on the

mortality table and discount rate assumptions used in the calculation in

the “Employee Benefit Plans” footnote in the Company’s audited financial

statements for the fiscal year ended January 31, 2009 included in the

Company’s Annual Report on Form 10-K filed with the SEC on April 10,

2009.

|

| ♦ |

the

integrity of the Company’s financial statements and internal

controls;

|

| ♦ |

the

Company’s compliance with legal and regulatory

requirements;

|

| ♦ |

the

qualifications and independence of the Company’s independent registered

public accountants; and

|

| ♦ |

the

performance of the Company’s internal audit function and the

independent registered public

accountants.

|

|

Submitted

by the Audit Committee,

|

|

|

Michael

J. Morris (Chairman)

|

|

|

Nicholas

DeBenedictis

|

|

|

Alan

Lawley, Ph.D.

|

|

|

March

27, 2009

|

|

2009

|

2008

|

||||

|

Audit

fees (1)

|

$195,940

|

$213,750

|

|||

|

Audit

related fees (2)

|

20,080

|

22,000

|

|||

|

Tax

fees (3)

|

50,280

|

65,000

|

|||

|

All

other fees (4)

|

25,700

|

-

|

|||

|

Total

|

$292,000

|

$300,750

|

| (1) |

Audit

fees consisted of audit work performed on the Company’s annual

consolidated financial statements and the reviews of Quarterly Reports on

Form 10-Q, as well as work generally only the independent auditor can

reasonably be expected to provide, such as statutory audits. In the

fiscal year ended January 31, 2009, audit fees also include fees for the

audits of the effectiveness of internal control over financial reporting.

In the fiscal year ended January 31, 2008, audit fees also include fees

for the audit of (i) the effectiveness of internal control over financial

reporting and Form 10-K and 10-K/A for the fiscal year ended January 31,

2007 and reviews of Form

|

|

10-Q/A

for the quarters ended October 31, July 31, April 30, 2007 and October 31,

2006, and (ii) management’s assessment of the effectiveness of internal

control over financial reporting.

|

||

| (2) | Audit related fees consisted of audit work performed on employee benefit plans. | |

| (3) |

Tax

fees consisted principally for services related to the preparation of the

corporate income tax returns and assistance with Internal Revenue Service

examinations.

|

|

| (4) |

The

Company’s Audit Committee engaged Margolis & Company P.C. for due diligence services in connection with a potential acquisition during

the fiscal year ended January 31,

2009.

|

|

Gary

J. Morgan

|

|

|

Secretary

|

|

|

|

|

| Harleysville, Pennsylvania | |

|

April

17, 2009

|