| Creating a Premier Global Climate Solutions Company January 29, 2026 |

| Forward-Looking Statements and RMT Disclaimer No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law. Additional Information and Where to Find It In connection with the proposed transaction between Modine, SpinCo and Gentherm, the parties intend to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including, among other filings, a registration statement on Form S-4 to be filed by Gentherm (the “Form S-4”) that will include a preliminary proxy statement/prospectus of Gentherm and a definitive proxy statement/prospectus of Gentherm, the latter of which will be mailed to shareholders of Gentherm, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and will serve as an information statement/prospectus in connection with the spin-off of SpinCo from Modine. INVESTORS AND SECURITY HOLDERS OF GENTHERM AND MODINE ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GENTHERM, MODINE, SPINCO, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy statement/prospectus (when available) and other documents filed with the SEC by Gentherm, SpinCo or Modine through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Gentherm will be available free of charge on Gentherm’s website at gentherm.com under the tab “Investors & Media” and under the heading “Financial Info” and subheading “SEC Filings.” Copies of the documents filed with the SEC by Modine and SpinCo will be available free of charge on Modine’s website at modine.com under the tab “Investors” and under the heading “Financials” and subheading “SEC Filings.” Participants in the Solicitation Gentherm, Modine and their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies from Gentherm stockholders in connection with the proposed transaction. Information about the directors and executive officers of Gentherm is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 19, 2025, and its proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on March 27, 2025. To the extent holdings of Gentherm’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Gentherm and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction. Information about the directors and executive officers of Modine is set forth in its Annual Report on Form 10-K for the year ended March 31, 2025, which was filed with the SEC on May 21, 2025, and its proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on July 9, 2025. To the extent holdings of Modine’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov and from Gentherm’s website and Modine’s website as described above. Cautionary Statement Regarding Forward-Looking Statements This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Proposed Transaction among Gentherm, Modine and SpinCo. These forward-looking statements may be identified by the words “believe,” “feel,” “project,” “expect,” “anticipate,” “appear,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “suggest,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the Proposed Transaction, the ability of the parties to complete the Proposed Transaction, the expected 2 benefits of the Proposed Transaction, including future financial and operating results, anticipated strategic benefits of the Proposed Transaction, the amount and timing of synergies from the Proposed Transaction, the tax consequences of the Proposed Transaction, the terms and scope of the expected financing in connection with the Proposed Transaction, the aggregate amount of indebtedness of the combined company following the closing of the Proposed Transaction, the combined company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward-looking statements. These forward-looking statements are based on Gentherm’s and Modine’s current expectations and are subject to risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Gentherm’s and Modine’s control. None of Gentherm, Modine, SpinCo or any of their respective directors, executive officers, advisors or representatives make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Gentherm, Modine or the combined business. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements, including developments that could have a material adverse effect on Gentherm’s and Modine’s businesses and the ability to successfully complete the Proposed Transaction and realize its benefits. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the Proposed Transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the shareholders of Gentherm may not be obtained; (2) the risk that the Proposed Transaction may not be completed on the terms or in the time frame expected by Gentherm, Modine and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the Proposed Transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the Proposed Transaction; (5) failure to realize the anticipated benefits of the Proposed Transaction, including as a result of delay in completing the Proposed Transaction or integrating the businesses of Gentherm and SpinCo, on the expected timeframe or at all; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the Proposed Transaction; (10) the risk that shareholder litigation in connection with the Proposed Transaction or other litigation, settlements or investigations may affect the timing or occurrence of the Proposed Transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies, including those policies with respect to tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the Proposed Transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of Modine; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the Proposed Transaction, or other effects of the pendency of the Proposed Transaction on the relationship of any of the parties to the Proposed Transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Gentherm’s and Modine’s reports filed with the SEC, including Gentherm’s and Modine’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the Proposed Transaction. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. None of Gentherm, Modine or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Use of Non-GAAP Financial Measures In addition to the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this communication includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as adjusted EBITDA, adjusted EBITDA margin, net leverage ratio, and adjusted EPS. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition, Gentherm’s and Modine’s definitions of these Non-GAAP Measures may not be comparable to similarly titled non-GAAP financial measures reported by other companies. |

| • Modine has undergone a strategic and transformational journey, which was launched at our first Investor Day in 2022 • Our consistent and transparent goals have guided every step of this process, with a track record of exceeding targets • Long history of leveraging critical thermal applications to build a top-performing, diversified industrial company while continuously improving our growth rates and profit margin • We have demonstrated success over the last several years, embedding 80/20 into the company’s DNA and realigning the portfolio to capture favorable secular megatrends • Historic announcement today; transaction with Gentherm further accelerates Modine’s strategic transformation Advancing Our Consistent Strategy to Drive Value Creation 3 |

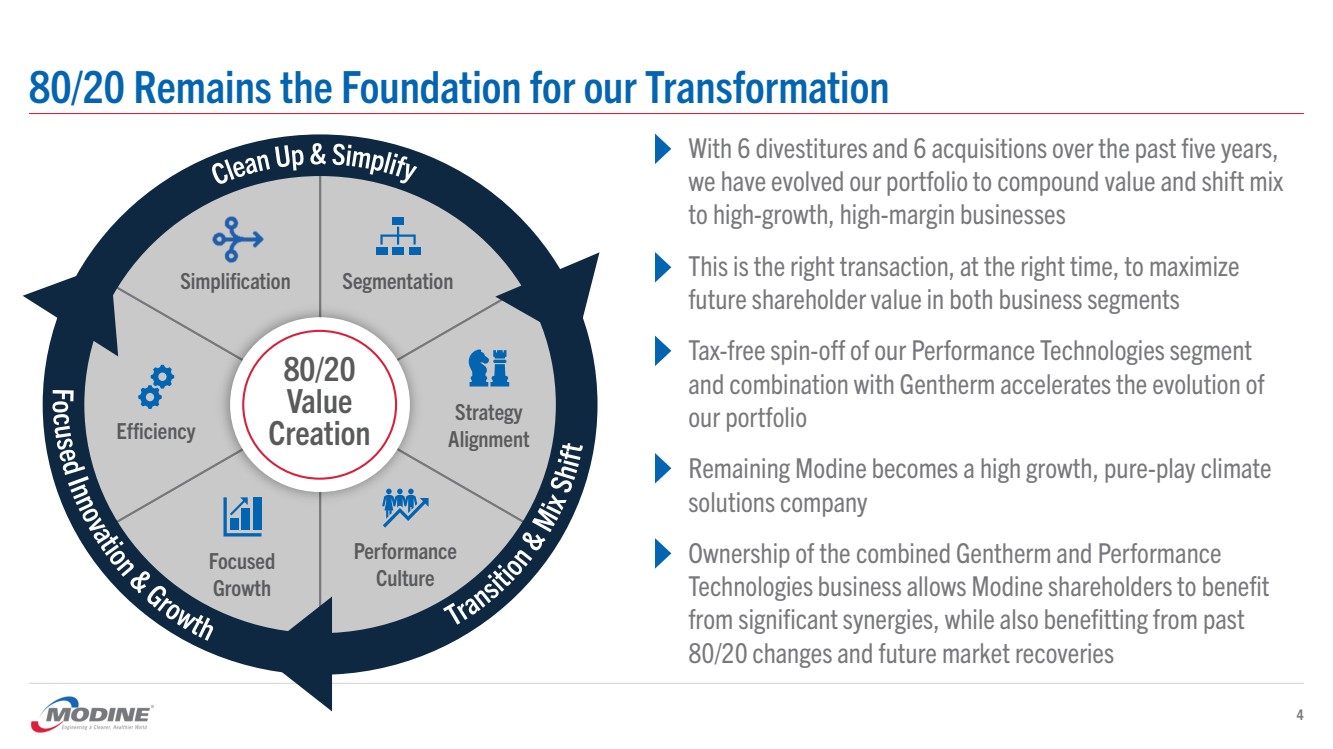

| 80/20 Remains the Foundation for our Transformation Fo c used Innovation & Growth Transition & Mix Shift Clean Up & Simplify Simplification Segmentation Focused Growth Performance Culture Efficiency Strategy Alignment 80/20 Value Creation 4 • With 6 divestitures and 6 acquisitions over the past five years, we have evolved our portfolio to compound value and shift mix to high-growth, high-margin businesses • This is the right transaction, at the right time, to maximize future shareholder value in both business segments • Tax-free spin-off of our Performance Technologies segment and combination with Gentherm accelerates the evolution of our portfolio • Remaining Modine becomes a high growth, pure-play climate solutions company • Ownership of the combined Gentherm and Performance Technologies business allows Modine shareholders to benefit from significant synergies, while also benefitting from past 80/20 changes and future market recoveries |

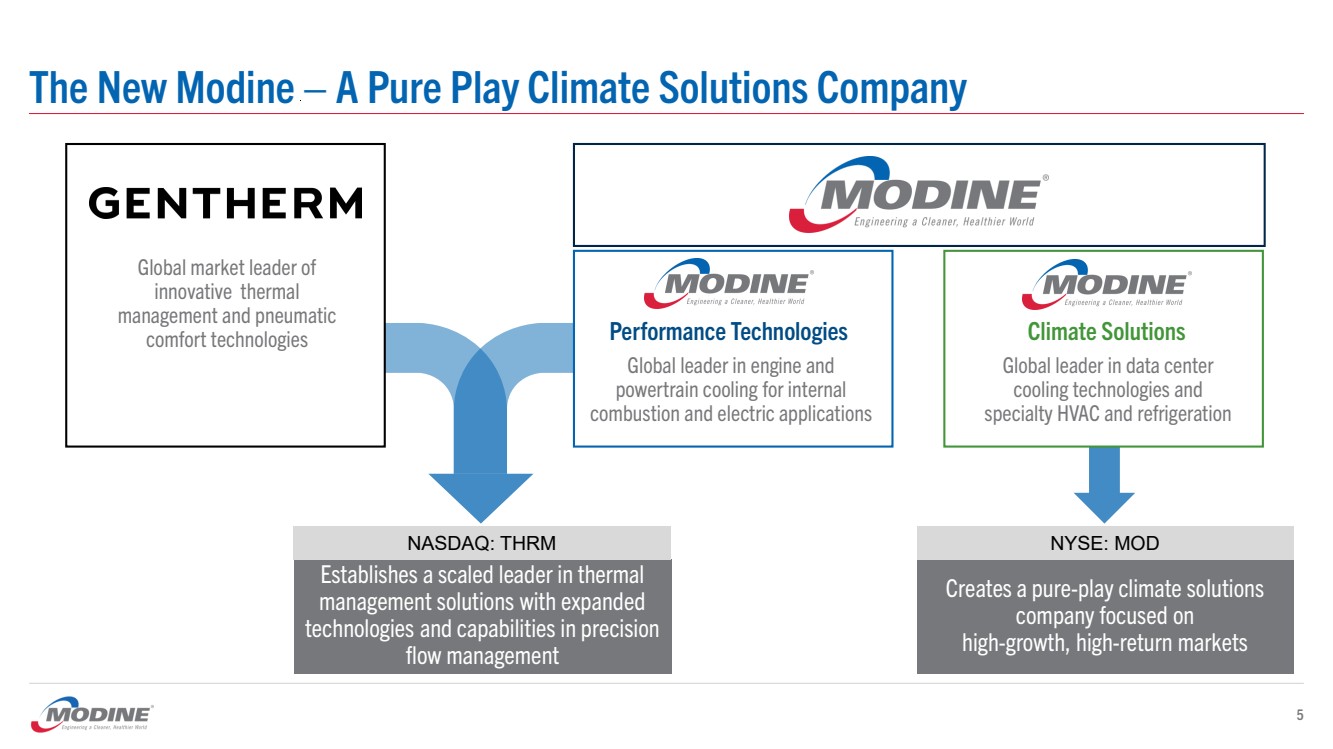

| The New Modine – A Pure Play Climate Solutions Company Establishes a scaled leader in thermal management solutions with expanded technologies and capabilities in precision flow management 5 Performance Technologies Global market leader of innovative thermal management and pneumatic comfort technologies Global leader in engine and powertrain cooling for internal combustion and electric applications Climate Solutions Global leader in data center cooling technologies and specialty HVAC and refrigeration Creates a pure-play climate solutions company focused on high-growth, high-return markets NASDAQ: THRM NYSE: MOD |

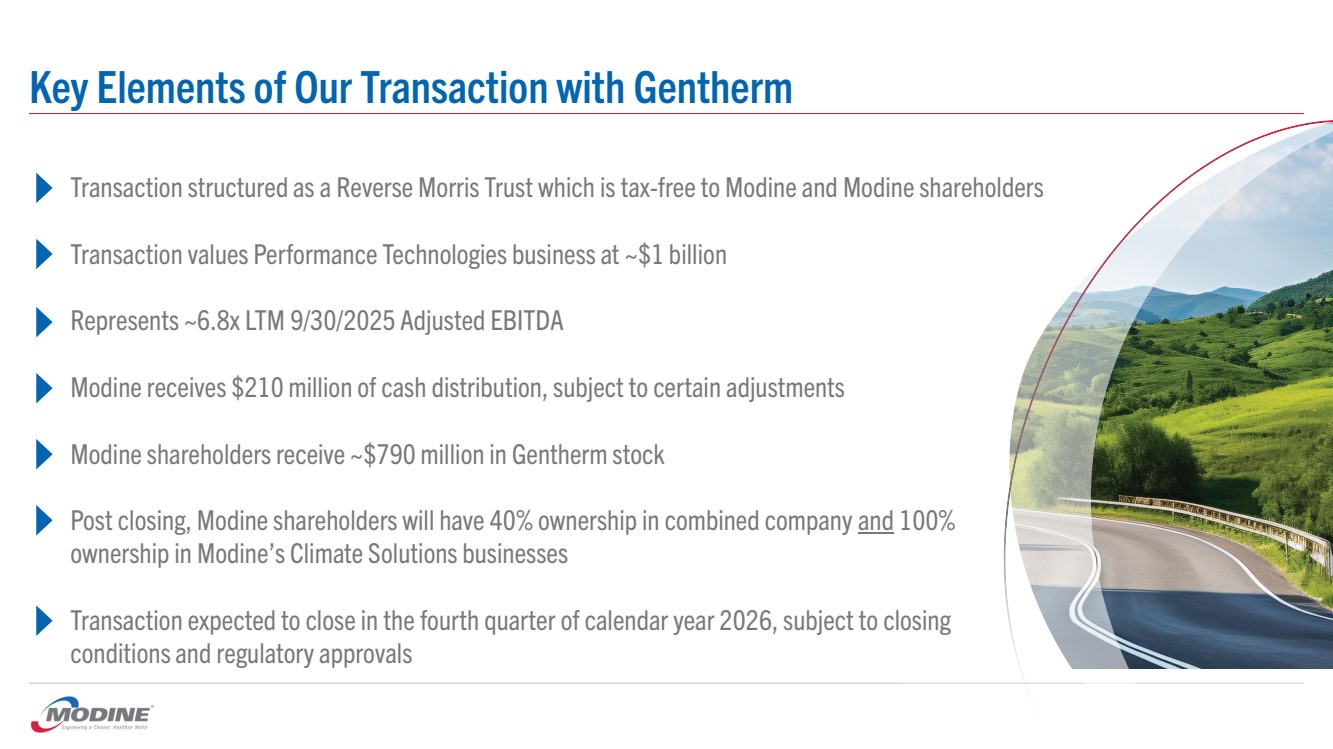

| Key Elements of Our Transaction with Gentherm 6 • Transaction structured as a Reverse Morris Trust which is tax-free to Modine and Modine shareholders • Transaction values Performance Technologies business at ~$1 billion • Represents ~6.8x LTM 9/30/2025 Adjusted EBITDA • Modine receives $210 million of cash distribution, subject to certain adjustments • Modine shareholders receive ~$790 million in Gentherm stock • Post closing, Modine shareholders will have 40% ownership in combined company and 100% ownership in Modine’s Climate Solutions businesses • Transaction expected to close in the fourth quarter of calendar year 2026, subject to closing conditions and regulatory approvals |

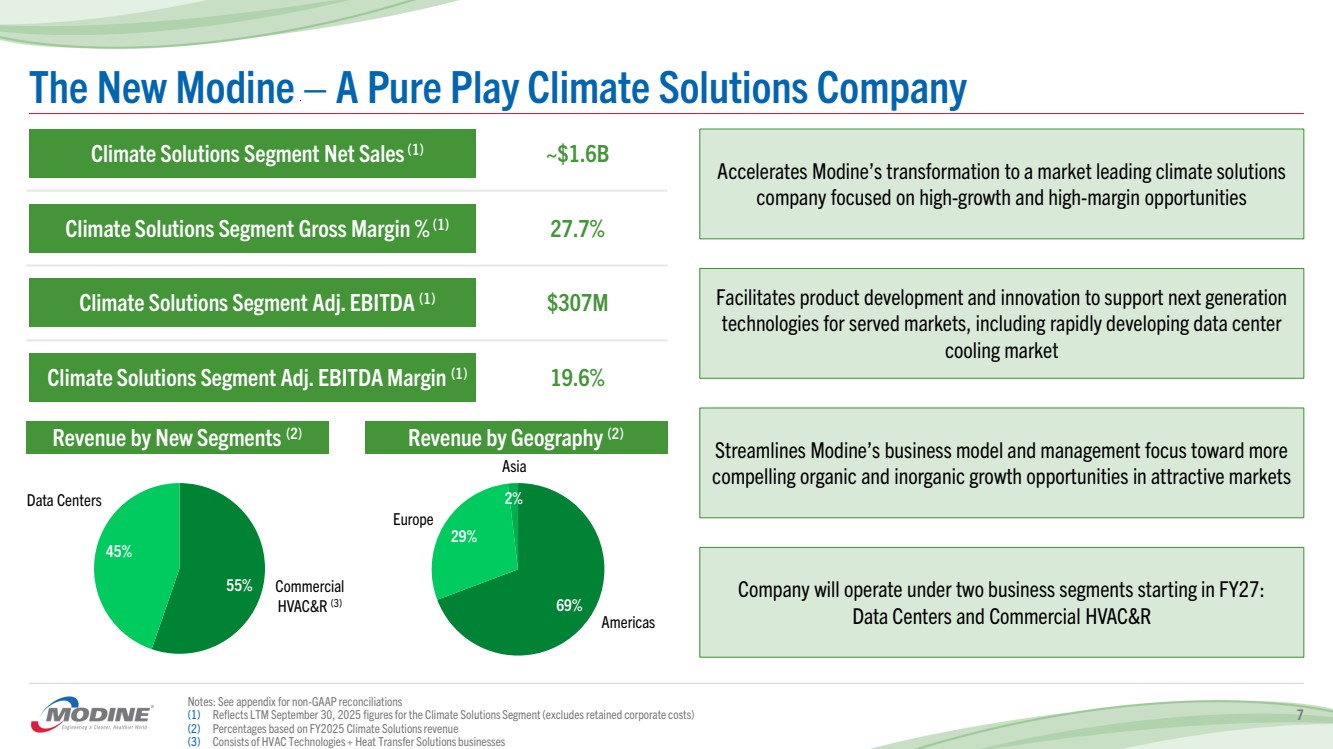

| 69% 29% 2% The New Modine – A Pure Play Climate Solutions Company Accelerates Modine’s transformation to a market leading climate solutions company focused on high-growth and high-margin opportunities Facilitates product development and innovation to support next generation technologies for served markets, including rapidly developing data center cooling market Streamlines Modine’s business model and management focus toward more compelling organic and inorganic growth opportunities in attractive markets Company will operate under two business segments starting in FY27: Data Centers and Commercial HVAC&R Medical Europe Asia Revenue by Geography (2) Revenue by New Segments (2) Climate Solutions Segment Net Sales(1) Climate Solutions Segment Gross Margin %(1) Climate Solutions Segment Adj. EBITDA (1) Climate Solutions Segment Adj. EBITDA Margin (1) Americas ~$1.6B 27.7% $307M 19.6% 7 Notes: See appendix for non-GAAP reconciliations (1) Reflects LTM September 30, 2025 figures for the Climate Solutions Segment (excludes retained corporate costs) (2) Percentages based on FY2025 Climate Solutions revenue (3) Consists of HVAC Technologies + Heat Transfer Solutions businesses 55% 45% Commercial HVAC&R (3) Data Centers |

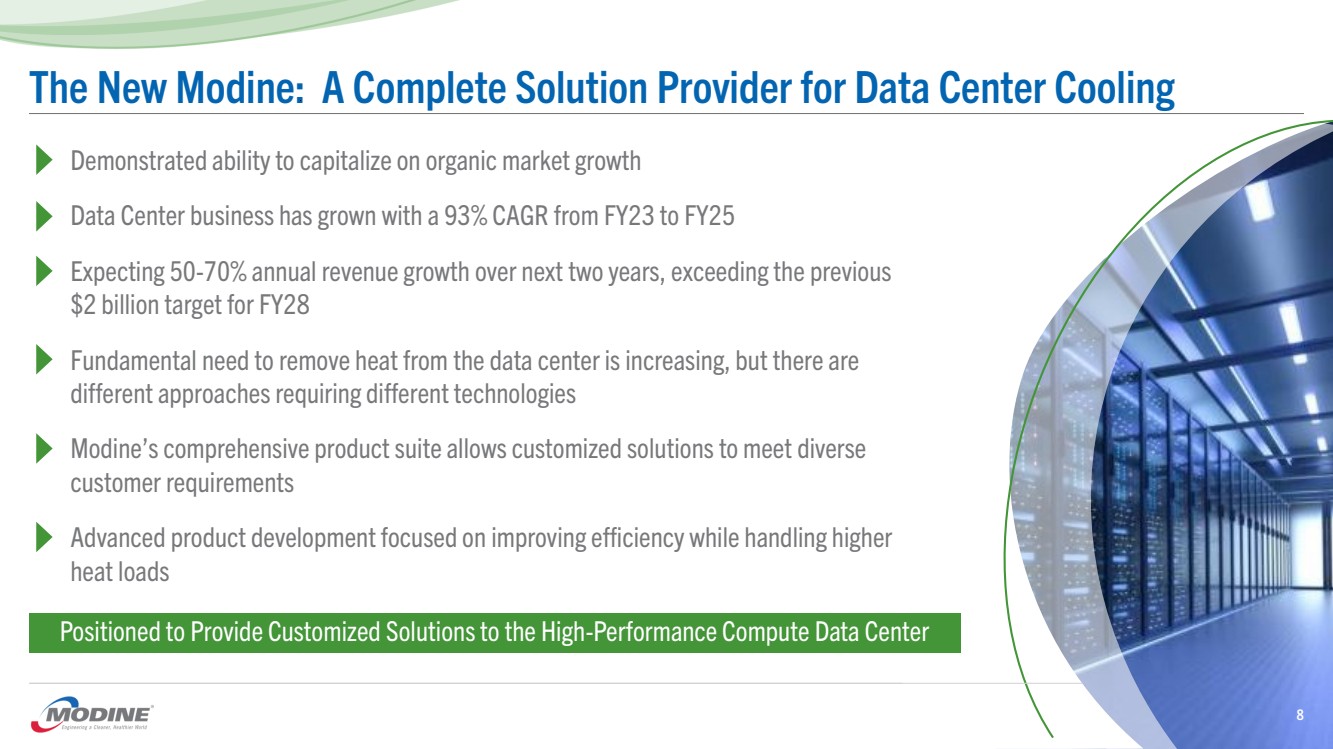

| The New Modine: A Complete Solution Provider for Data Center Cooling • Demonstrated ability to capitalize on organic market growth • Data Center business has grown with a 93% CAGR from FY23 to FY25 • Expecting 50-70% annual revenue growth over next two years, exceeding the previous $2 billion target for FY28 • Fundamental need to remove heat from the data center is increasing, but there are different approaches requiring different technologies • Modine’s comprehensive product suite allows customized solutions to meet diverse customer requirements • Advanced product development focused on improving efficiency while handling higher heat loads Positioned to Provide Customized Solutions to the High-Performance Compute Data Center 8 |

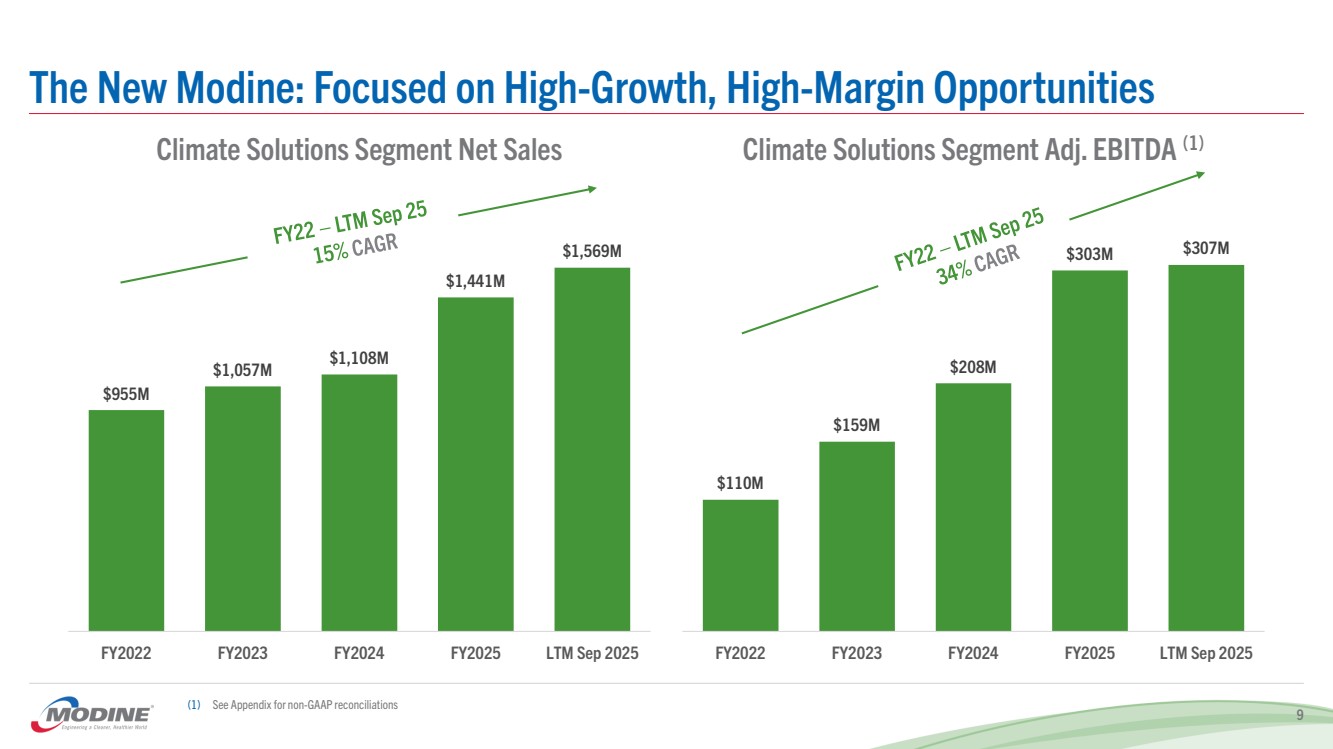

| $955M $1,057M $1,108M $1,441M $1,569M FY2022 FY2023 FY2024 FY2025 LTM Sep 2025 The New Modine: Focused on High-Growth, High-Margin Opportunities Climate Solutions Segment Net Sales Climate Solutions Segment Adj. EBITDA (1) (1) See Appendix for non-GAAP reconciliations 9 $110M $159M $208M $303M $307M FY2022 FY2023 FY2024 FY2025 LTM Sep 2025 |

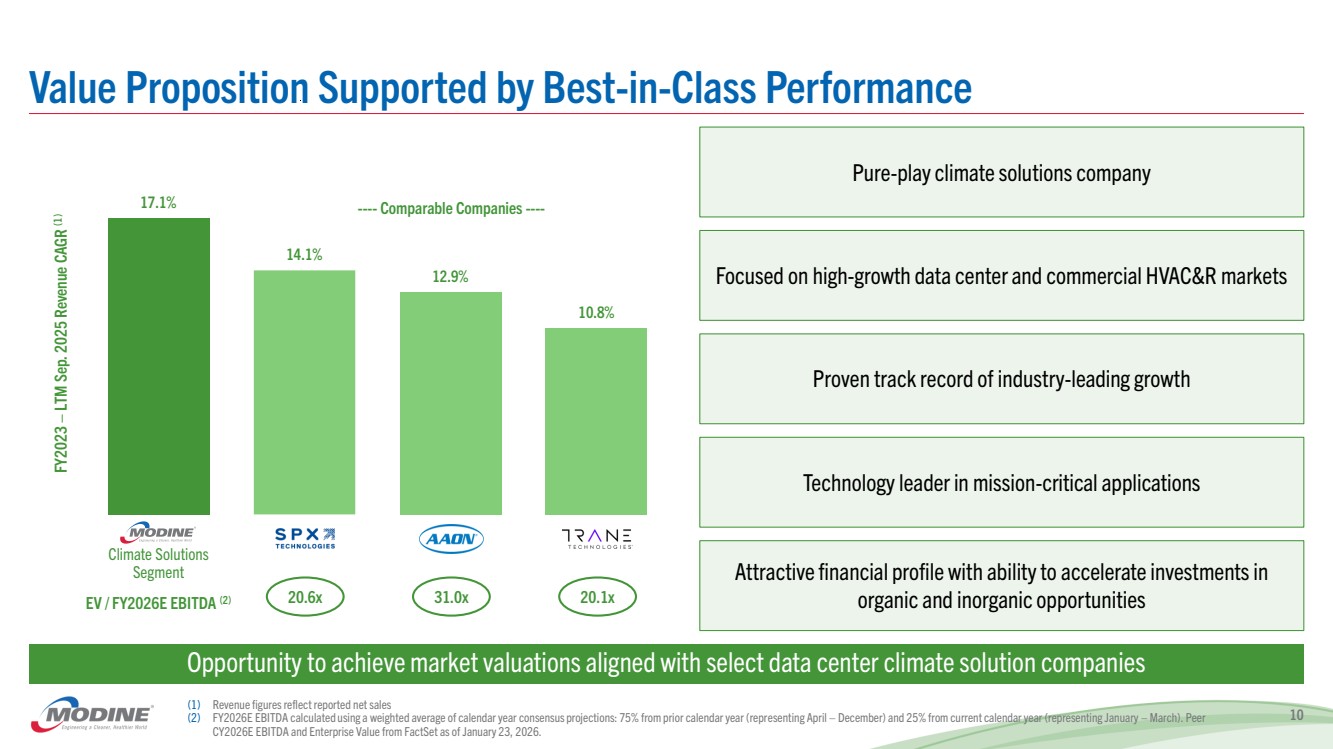

| Value Proposition Supported by Best-in-Class Performance Opportunity to achieve market valuations aligned with select data center climate solution companies (1) Revenue figures reflect reported net sales (2) FY2026E EBITDA calculated using a weighted average of calendar year consensus projections: 75% from prior calendar year (representing April – December) and 25% from current calendar year (representing January – March). Peer CY2026E EBITDA and Enterprise Value from FactSet as of January 23, 2026. 10 Pure-play climate solutions company Proven track record of industry-leading growth Technology leader in mission-critical applications Focused on high-growth data center and commercial HVAC&R markets Attractive financial profile with ability to accelerate investments in organic and inorganic opportunities Climate Solutions Segment FY2023 – LTM Sep. 2025 Revenue CAGR (1) 20.6x 31.0x 20.1x EV / FY2026E EBITDA (2) 17.1% 14.1% 12.9% 10.8% ---- Comparable Companies ---- |

| Accelerating Our Transformation to Drive Shareholder Value Delivering top line growth and margin expansion through 80/20 discipline focused on product innovation and customer focus 80 20 Delivering highly specialized, mission-critical thermal management solutions for key end-markets Capitalizing on our deep expertise in thermal management to deliver superior service, differentiated solutions and market leadership Well-positioned to accelerate growth driven by megatrends in high-density computing and indoor air quality Proactively enhancing returns by allocating capital and resources to high-growth markets 11 Led by an Experienced Leadership Team with Proven Track Record of Success |

| . Appendix |

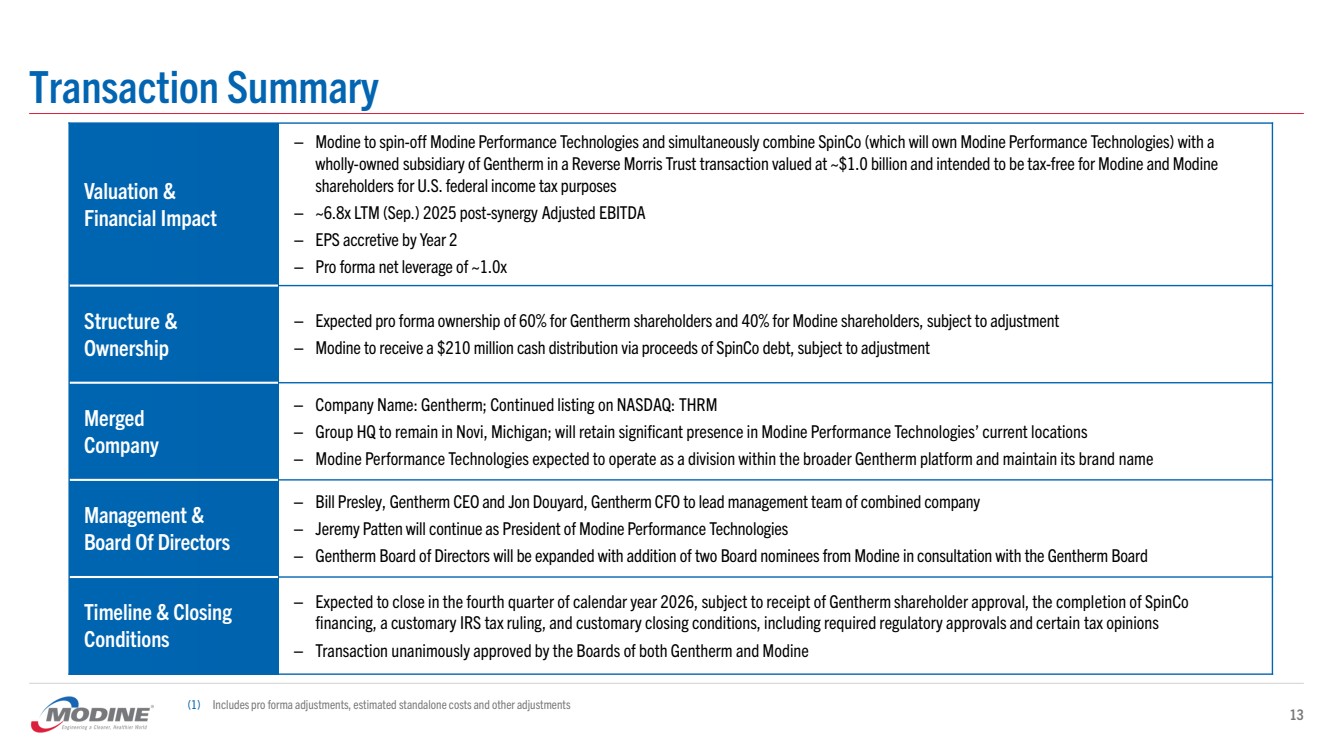

| Transaction Summary 13 Valuation & Financial Impact – Modine to spin-off Modine Performance Technologies and simultaneously combine SpinCo (which will own Modine Performance Technologies) with a wholly-owned subsidiary of Gentherm in a Reverse Morris Trust transaction valued at ~$1.0 billion and intended to be tax-free for Modine and Modine shareholders for U.S. federal income tax purposes – ~6.8x LTM (Sep.) 2025 post-synergy Adjusted EBITDA – EPS accretive by Year 2 – Pro forma net leverage of ~1.0x Structure & Ownership – Expected pro forma ownership of 60% for Gentherm shareholders and 40% for Modine shareholders, subject to adjustment – Modine to receive a $210 million cash distribution via proceeds of SpinCo debt, subject to adjustment Merged Company – Company Name: Gentherm; Continued listing on NASDAQ: THRM – Group HQ to remain in Novi, Michigan; will retain significant presence in Modine Performance Technologies’ current locations – Modine Performance Technologies expected to operate as a division within the broader Gentherm platform and maintain its brand name Management & Board Of Directors – Bill Presley, Gentherm CEO and Jon Douyard, Gentherm CFO to lead management team of combined company – Jeremy Patten will continue as President of Modine Performance Technologies – Gentherm Board of Directors will be expanded with addition of two Board nomineesfrom Modine in consultation with the Gentherm Board Timeline & Closing Conditions – Expected to close in the fourth quarter of calendar year 2026, subject to receipt of Gentherm shareholder approval, the completion of SpinCo financing, a customary IRS tax ruling, and customary closing conditions, including required regulatory approvals and certain tax opinions – Transaction unanimously approved by the Boards of both Gentherm and Modine (1) Includes pro forma adjustments, estimated standalone costs and other adjustments |

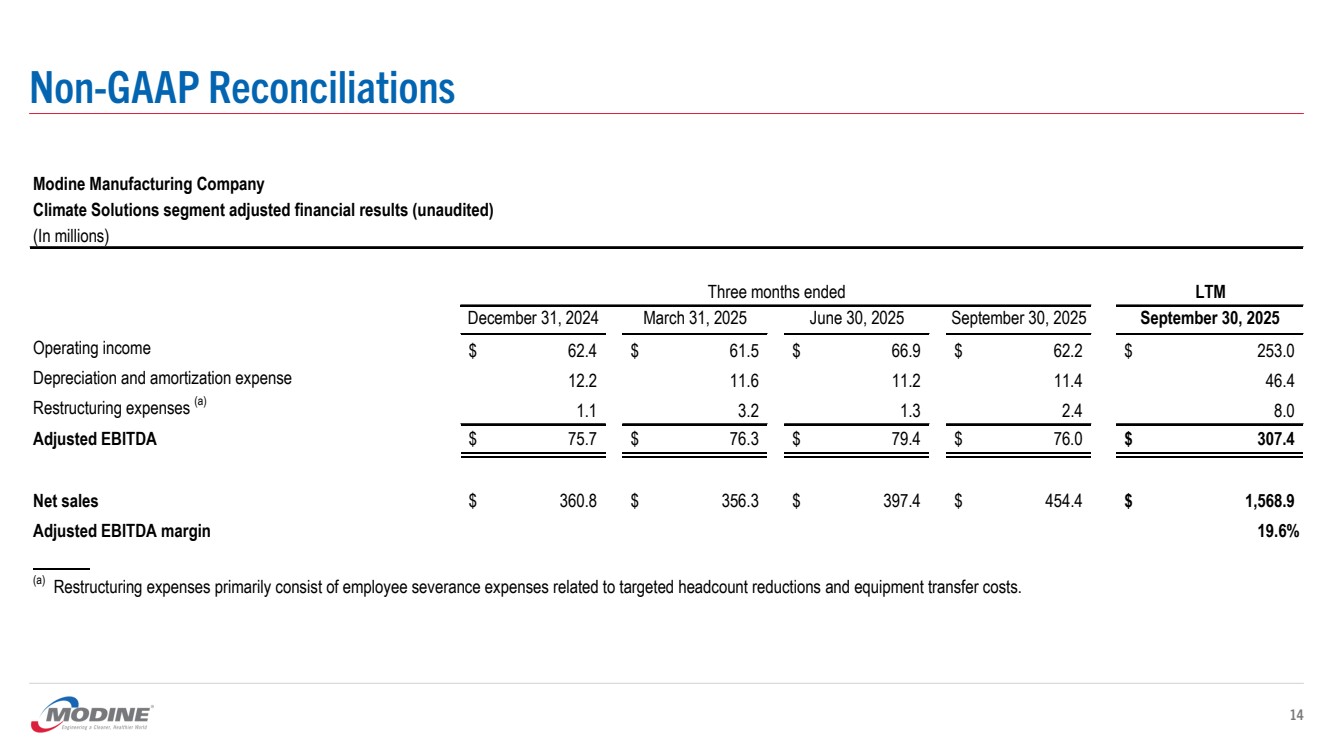

| Non-GAAP Reconciliations 14 Modine Manufacturing Company Climate Solutions segment adjusted financial results (unaudited) (In millions) LTM December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 Operating income $ 62.4 $ 61.5 $ 66.9 $ 62.2 $ 253.0 Depreciation and amortization expense 12.2 11.6 11.2 11.4 46.4 Restructuring expenses (a) 1.1 3.2 1.3 2.4 8.0 Adjusted EBITDA $ 75.7 $ 76.3 $ 79.4 $ 76.0 $ 307.4 Net sales $ 360.8 $ 356.3 $ 397.4 $ 454.4 $ 1,568.9 Adjusted EBITDA margin 19.6% (a) Restructuring expenses primarily consist of employee severance expenses related to targeted headcount reductions and equipment transfer costs. Three months ended |

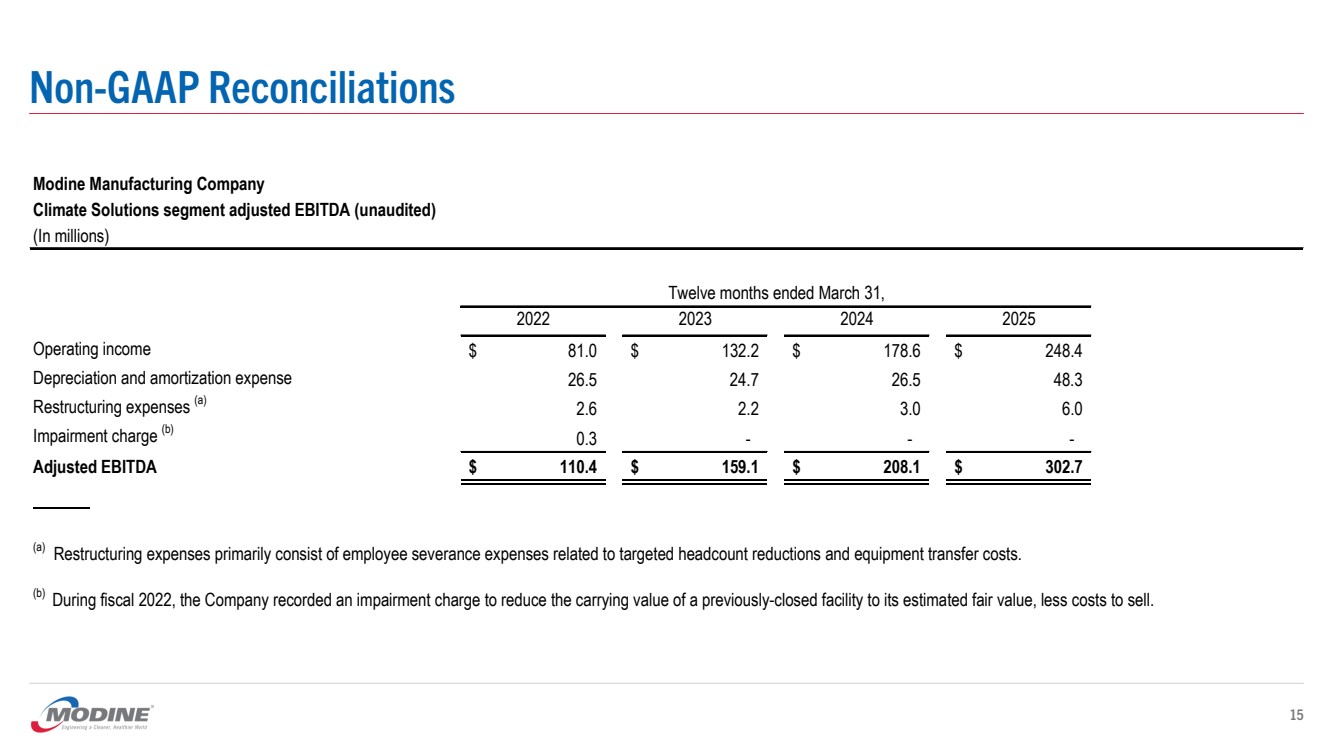

| Non-GAAP Reconciliations 15 Modine Manufacturing Company Climate Solutions segment adjusted EBITDA (unaudited) (In millions) 2022 2023 2024 2025 Operating income $ 81.0 $ 132.2 $ 178.6 $ 248.4 Depreciation and amortization expense 26.5 24.7 26.5 48.3 Restructuring expenses (a) 2.6 2.2 3.0 6.0 Impairment charge (b) 0.3 - - - Adjusted EBITDA $ 110.4 $ 159.1 $ 208.1 $ 302.7 (a) Restructuring expenses primarily consist of employee severance expenses related to targeted headcount reductions and equipment transfer costs. Twelve months ended March 31, (b) During fiscal 2022, the Company recorded an impairment charge to reduce the carrying value of a previously-closed facility to its estimated fair value, less costs to sell. |