| Third Quarter Fiscal 2026 February 5, 2026 |

| NEIL BRINKER President and Chief Executive Officer MICK LUCARELI Executive Vice President and Chief Financial Officer KATHY POWERS Vice President, Treasurer, and Investor Relations 2 |

| Forward-Looking Statements 3 This presentation contains statements, including information about future financial performance and market conditions, accompanied by phrases such as “believes,” “estimates,” “expects,” “plans,” “anticipates,” “intends,” “projects,” and other similar “forward-looking” statements, as defined in the Private Securities Litigation Reform Act of 1995. Modine's actual results, performance or achievements may differ materially from those expressed or implied in these statements because of certain risks and uncertainties, including, but not limited to those described under “Risk Factors” in Item 1A of Part I of the Company's Annual Report on Form 10-K for the year ended March 31, 2025. Other risks and uncertainties include, but are not limited to, the following: the impact of potential adverse developments or disruptions in the global economy and financial markets, including impacts related to inflation, energy costs, government incentive or funding programs, supply chain challenges or supplier constraints, logistical disruptions, tariffs, sanctions and other trade issues or cross-border trade restrictions; the impact of other economic, social and political conditions, changes and challenges in the markets where we operate and compete, including foreign currency exchange rate fluctuations, changes in interest rates, tightening of the credit markets, recession or recovery therefrom, restrictions associated with importing and exporting and foreign ownership, public health crises, and the general uncertainties, including the impact on demand for our products and the markets we serve from regulatory and/or policy changes that have been or may be implemented in the U.S. or abroad, including those related to tax and trade, climate change, public health threats, and international political and military conflicts; the overall health and pricing focus of our customers; changes or threats to the market growth prospects for our customers; our ability to successfully realize anticipated benefits, including improved profit margins and cash flow, from our strategic initiatives and our application of 80/20 principles across our businesses; our ability to be at the forefront of technological advances and the impacts of any changes in the adoption rate of technologies that we expect to drive sales growth; our ability to accelerate growth organically and through acquisitions and successfully integrate acquired businesses; our ability to successfully exit portions of our business that do not align with our strategic plans; various risks related to the proposed Reverse Morris Trust transaction with Gentherm; our ability to effectively and efficiently manage our operations in response to sales volume changes, including maintaining adequate production capacity to meet demand in our growing businesses while also completing restructuring activities and realizing benefits thereof; our ability to fund our global liquidity requirements efficiently and comply with the financial covenants in our credit agreements; operational inefficiencies as a result of product or program launches, unexpected volume increases or decreases, product transfers and warranty claims; the impact on Modine of any significant increases in commodity prices, particularly aluminum, copper, steel and stainless steel (nickel) and other purchased components and related costs, and our ability to adjust product pricing in response to any such increases; our ability to recruit and maintain talent in managerial, leadership, operational and administrative functions and to mitigate increased labor costs; our ability to protect our proprietary information and intellectual property from theft or attack; the impact of any substantial disruption or material breach of our information technology systems; costs and other effects of environmental investigation, remediation or litigation and the increasing emphasis on environmental, social and corporate governance matters; our ability to realize the benefits of deferred tax assets; and other risks and uncertainties identified in our public filings with the U.S. Securities and Exchange Commission. Forward-looking statements are as of the date of this presentation, and we do not assume any obligation to update any forward-looking statements. |

| Performance Technologies Spin-off Announcement 4 ▪ Significant progress evolving our business portfolio by investing in high-growth, high-margin businesses and executing strategic divestitures ▪ Recently announced our plan to spin-off the Performance Technologies segment and combine with Gentherm; with Modine shareholders owning 40% of the combined company ▪ The combined business will open attractive markets for Gentherm and provide a renewed focus on investment and growth for Performance Technologies ▪ Transaction values business at $1 billion or a 6.8x multiple on trailing LTM adjusted EBITDA*, a valuation that recognizes the hard work done to improve segment margins ▪ Allows Modine shareholders to participate in future synergies and strong earnings conversion when market volumes recover ▪ Secures an ideal home for the segment while maximizing shareholder value and accelerating Modine's transformation ▪ Modine becomes a pure-play climate solutions company focused on attractive, high-growth markets * Represents LTM September 30, 2025 EBITDA, including estimated standalone costs and other adjustments |

| Performance Technologies ▪ Performance Technologies revenues increased 1%, driven by commercial execution and cost recoveries, volumes remain down ▪ Adjusted EBITDA margin increased 400 bps to 14.8% – Driven by cost containment and operational efficiencies taken over past quarters, including shifting resources to Climate Solutions ▪ Preparing the business for spin-off and combination with Gentherm along with necessary regulatory approvals ▪ Historic and pivotal time for Modine as we continue our portfolio transformation, allowing both segments to focus and grow in attractive markets in line with our strategy 5 |

| Climate Solutions 6 ▪ Delivered 51% revenue growth, including contributions from recent acquisitions –Organic growth of 36%, including a 78% increase in Data Centers ▪ Data Center capacity expansion is proceeding on schedule; supporting a sequential margin improvement – Launched chiller lines in Leeds, UK, Grenada, MS and Jefferson City, MO – Expect four additional lines in the fourth quarter – Launched production in Franklin, WI for AHUs and modular data centers ▪ New capacity is flexible, providing opportunity to change product mix in response to demand ▪ Hybrid technologies including free cooling can reduce energy consumption required to run mechanical cooling processes, including next generation chip designs ▪ Further increasing outlook for data center revenues; expect 50 to 70% annual growth over the next two years, comfortably exceeding $2 billion target for FY28 |

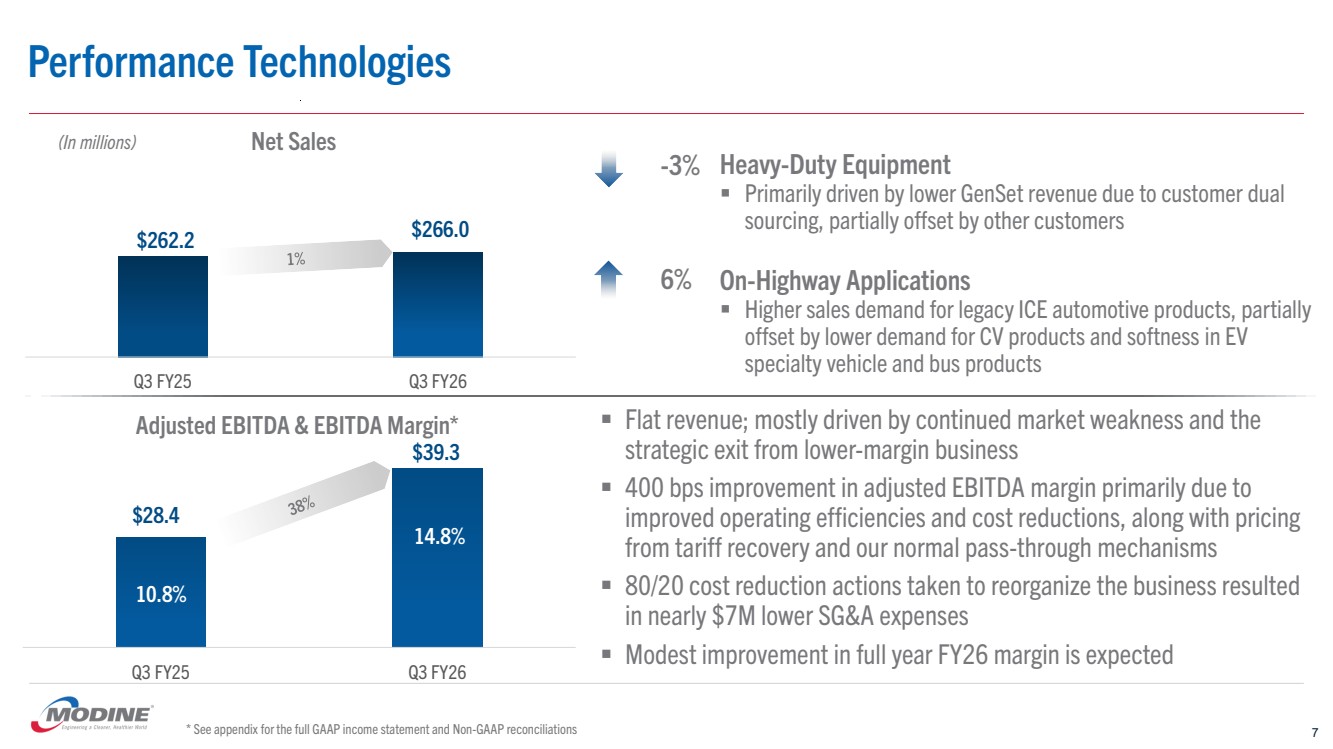

| Q3 FY25 Q3 FY26 Net Sales Q3 FY25 Q3 FY26 Adjusted EBITDA & EBITDA Margin* Performance Technologies $262.2 $266.0 $28.4 $39.3 (In millions) Heavy-Duty Equipment ▪ Primarily driven by lower GenSet revenue due to customer dual sourcing, partially offset by other customers On-Highway Applications ▪ Higher sales demand for legacy ICE automotive products, partially offset by lower demand for CV products and softness in EV specialty vehicle and bus products ▪ Flat revenue; mostly driven by continued market weakness and the strategic exit from lower-margin business ▪ 400 bps improvement in adjusted EBITDA margin primarily due to improved operating efficiencies and cost reductions, along with pricing from tariff recovery and our normal pass-through mechanisms ▪ 80/20 cost reduction actions taken to reorganize the business resulted in nearly $7M lower SG&A expenses ▪ Modest improvement in full year FY26 margin is expected 6% 10.8% 14.8% * See appendix for the full GAAP income statement and Non-GAAP reconciliations 7 -3% |

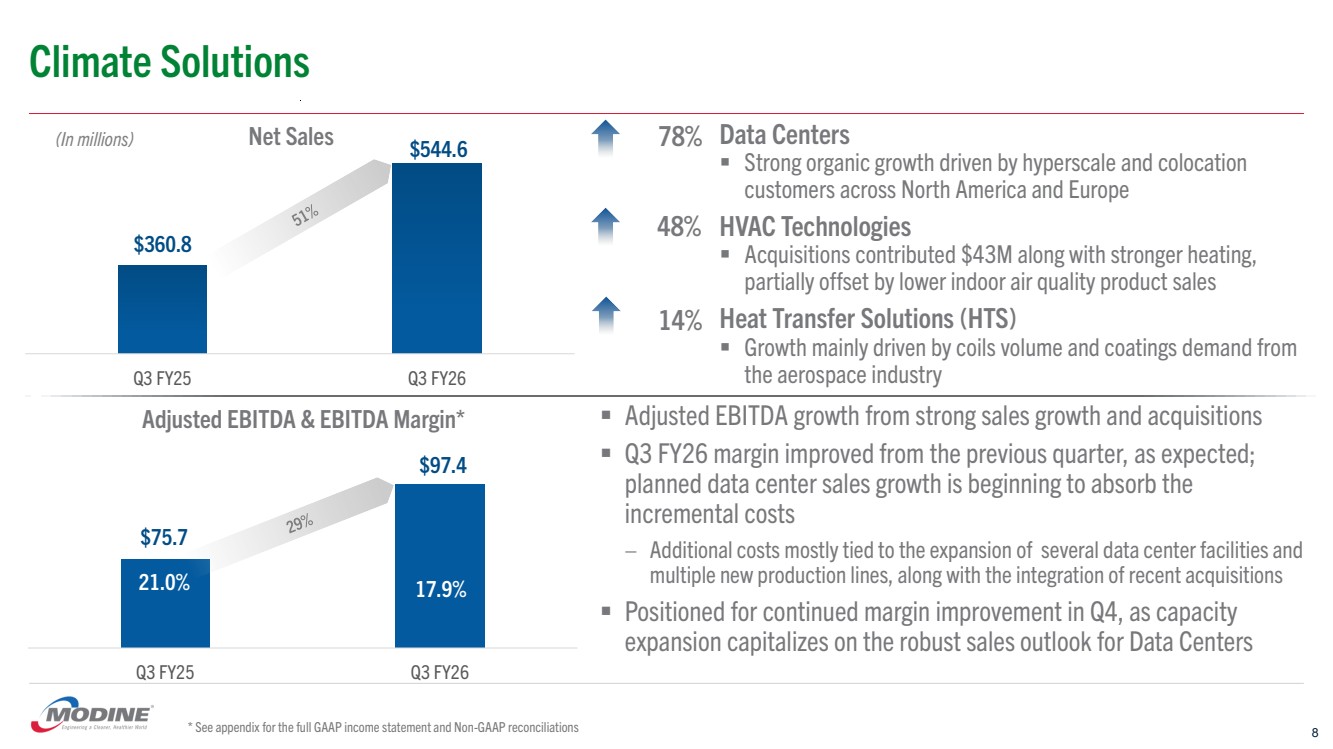

| Q3 FY25 Q3 FY26 Net Sales Climate Solutions 8 $360.8 $544.6 (In millions) Data Centers ▪ Strong organic growth driven by hyperscale and colocation customers across North America and Europe HVAC Technologies ▪ Acquisitions contributed $43M along with stronger heating, partially offset by lower indoor air quality product sales Heat Transfer Solutions (HTS) ▪ Growth mainly driven by coils volume and coatings demand from the aerospace industry 78% 48% 14% Q3 FY25 Q3 FY26 Adjusted EBITDA & EBITDA Margin* $75.7 $97.4 21.0% 17.9% ▪ Adjusted EBITDA growth from strong sales growth and acquisitions ▪ Q3 FY26 margin improved from the previous quarter, as expected; planned data center sales growth is beginning to absorb the incremental costs – Additional costs mostly tied to the expansion of several data center facilities and multiple new production lines, along with the integration of recent acquisitions ▪ Positioned for continued margin improvement in Q4, as capacity expansion capitalizes on the robust sales outlook for Data Centers * See appendix for the full GAAP income statement and Non-GAAP reconciliations |

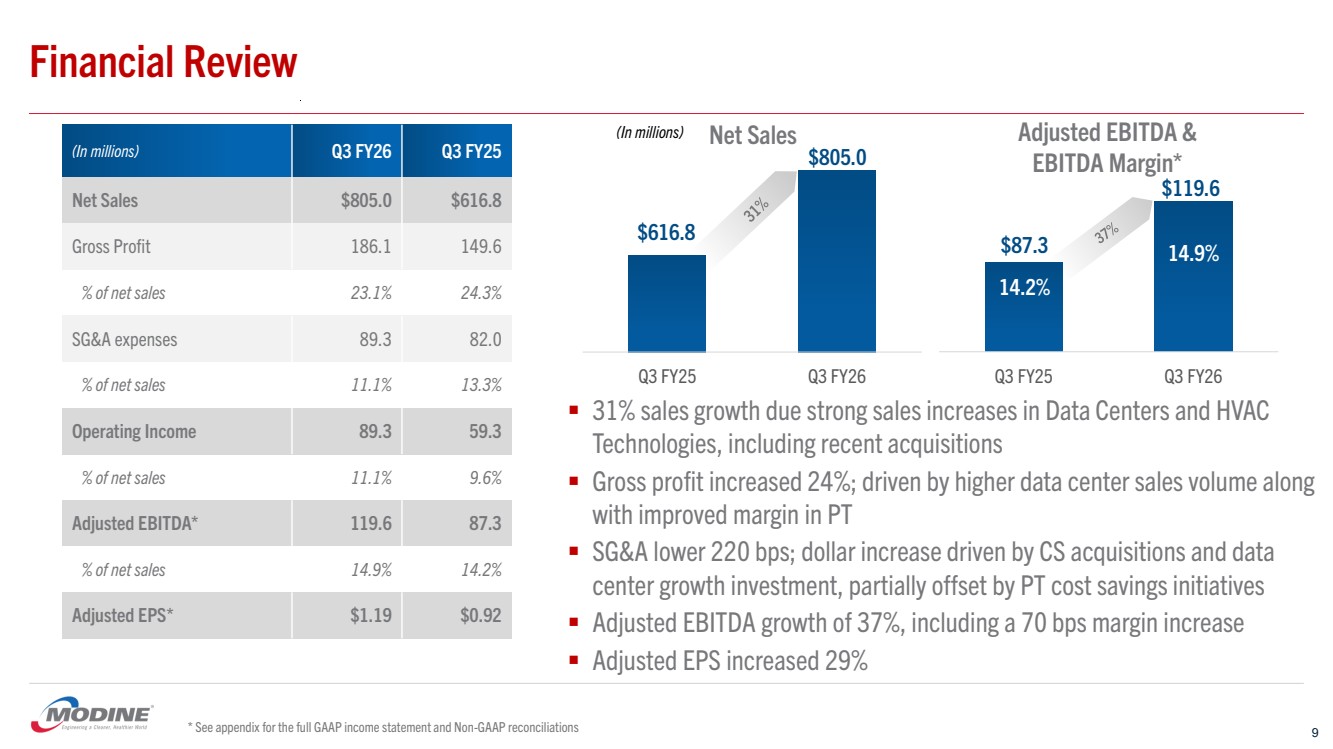

| Q3 FY25 Q3 FY26 Adjusted EBITDA & EBITDA Margin* Q3 FY25 Q3 FY26 Net Sales Financial Review (In millions) Q3 FY26 Q3 FY25 Net Sales $805.0 $616.8 Gross Profit 186.1 149.6 % of net sales 23.1% 24.3% SG&A expenses 89.3 82.0 % of net sales 11.1% 13.3% Operating Income 89.3 59.3 % of net sales 11.1% 9.6% Adjusted EBITDA* 119.6 87.3 % of net sales 14.9% 14.2% Adjusted EPS* $1.19 $0.92 (In millions) $616.8 $805.0 $87.3 $119.6 ▪ 31% sales growth due strong sales increases in Data Centers and HVAC Technologies, including recent acquisitions ▪ Gross profit increased 24%; driven by higher data center sales volume along with improved margin in PT ▪ SG&A lower 220 bps; dollar increase driven by CS acquisitions and data center growth investment, partially offset by PT cost savings initiatives ▪ Adjusted EBITDA growth of 37%, including a 70 bps margin increase ▪ Adjusted EPS increased 29% 14.2% 14.9% * See appendix for the full GAAP income statement and Non-GAAP reconciliations 9 |

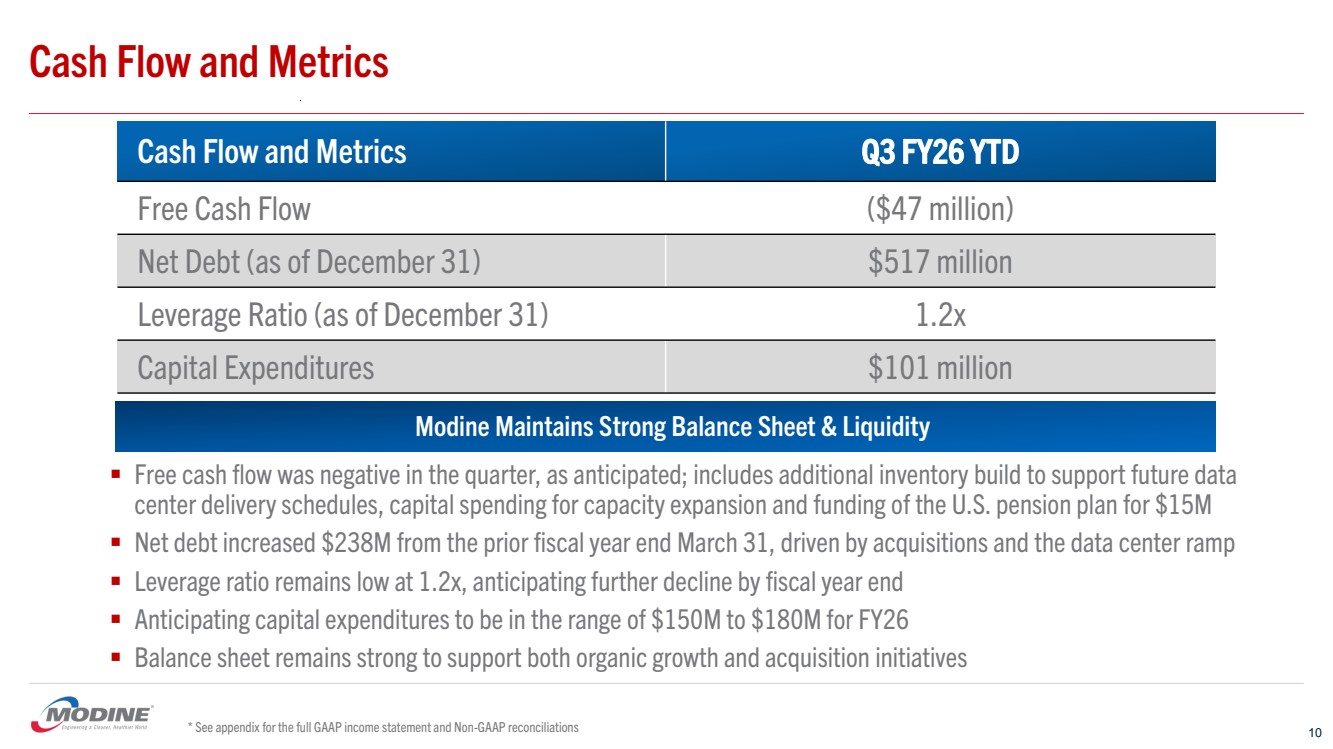

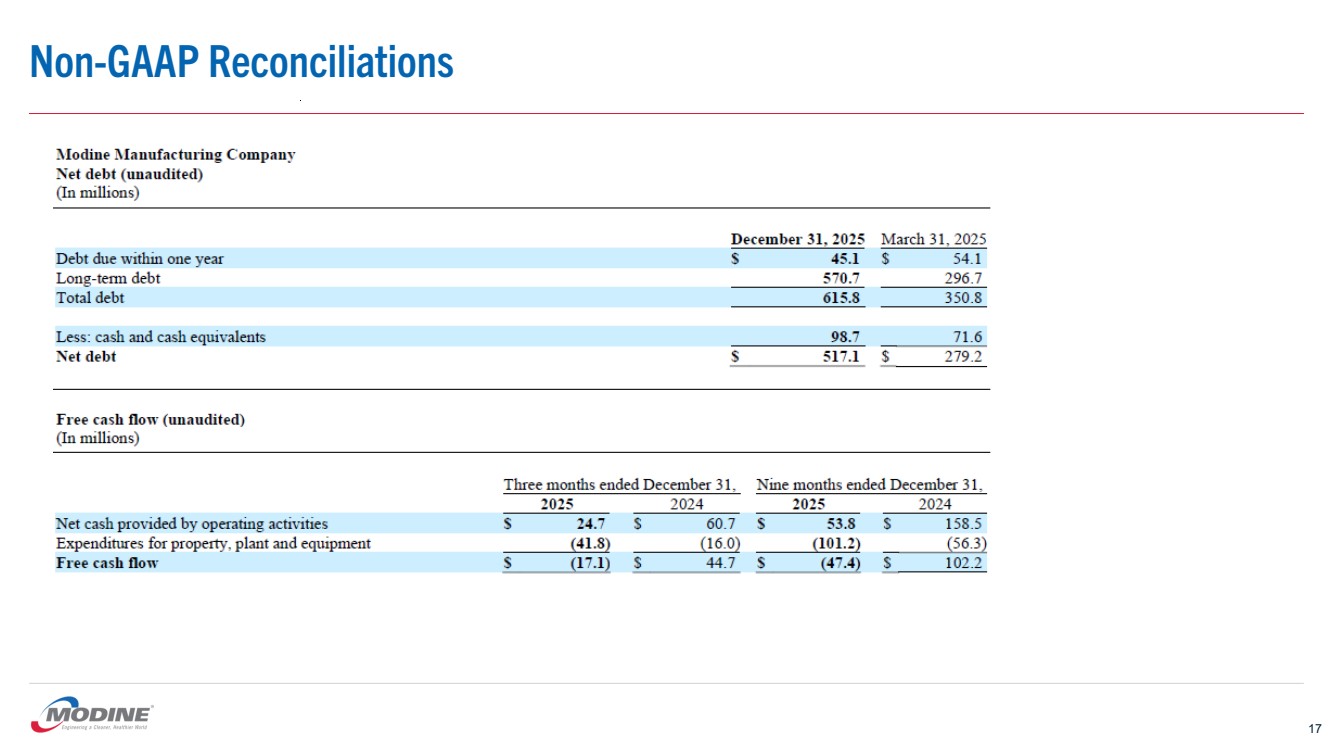

| Cash Flow and Metrics Cash Flow and Metrics Q3 FY26 YTD Free Cash Flow ($47 million) Net Debt (as of December 31) $517 million Leverage Ratio (as of December 31) 1.2x Capital Expenditures $101 million ▪ Free cash flow was negative in the quarter, as anticipated; includes additional inventory build to support future data center delivery schedules, capital spending for capacity expansion and funding of the U.S. pension plan for $15M ▪ Net debt increased $238M from the prior fiscal year end March 31, driven by acquisitions and the data center ramp ▪ Leverage ratio remains low at 1.2x, anticipating further decline by fiscal year end ▪ Anticipating capital expenditures to be in the range of $150M to $180M for FY26 ▪ Balance sheet remains strong to support both organic growth and acquisition initiatives * See appendix for the full GAAP income statement and Non-GAAP reconciliations 10 Modine Maintains Strong Balance Sheet & Liquidity |

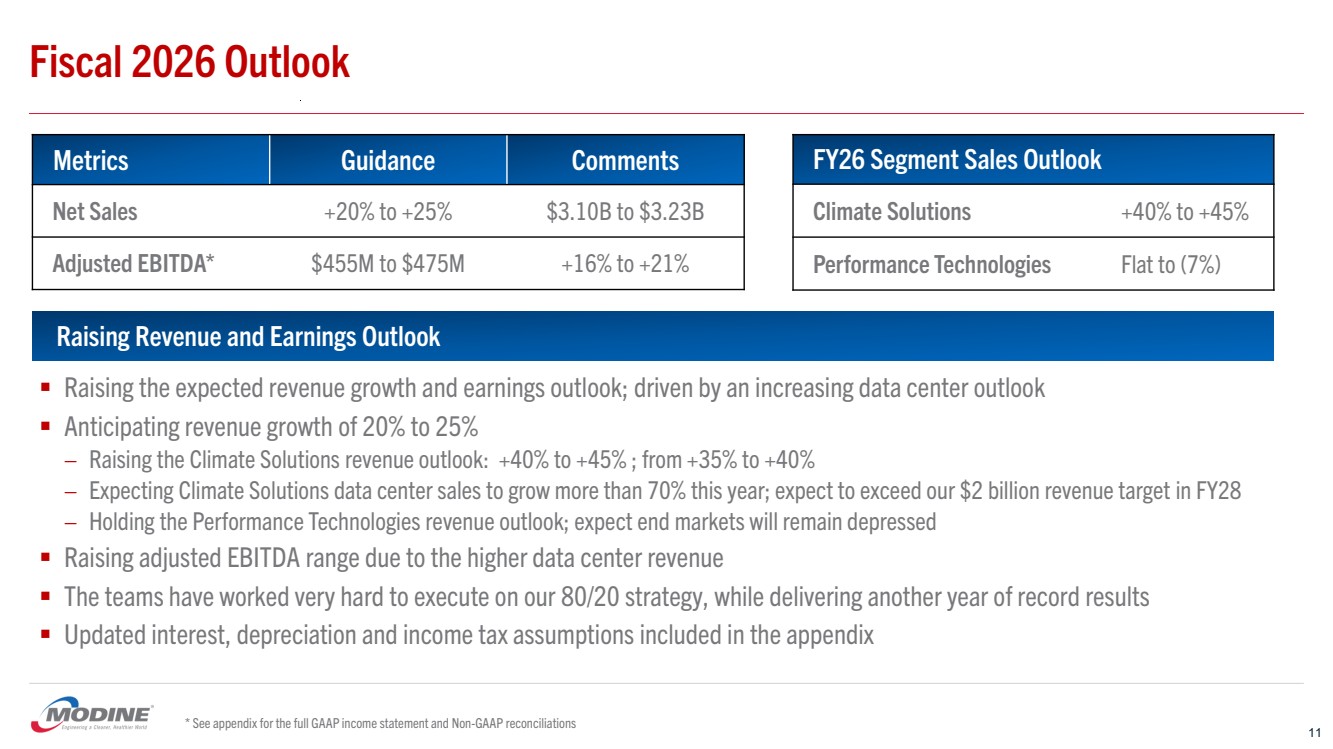

| Fiscal 2026 Outlook Metrics Guidance Comments Net Sales +20% to +25% $3.10B to $3.23B Adjusted EBITDA* $455M to $475M +16% to +21% FY26 Segment Sales Outlook Climate Solutions +40% to +45% Performance Technologies Flat to (7%) * See appendix for the full GAAP income statement and Non-GAAP reconciliations Raising Revenue and Earnings Outlook ▪ Raising the expected revenue growth and earnings outlook; driven by an increasing data center outlook ▪ Anticipating revenue growth of 20% to 25% – Raising the Climate Solutions revenue outlook: +40% to +45% ; from +35% to +40% – Expecting Climate Solutions data center sales to grow more than 70% this year; expect to exceed our $2 billion revenue target in FY28 – Holding the Performance Technologies revenue outlook; expect end markets will remain depressed ▪ Raising adjusted EBITDA range due to the higher data center revenue ▪ The teams have worked very hard to execute on our 80/20 strategy, while delivering another year of record results ▪ Updated interest, depreciation and income tax assumptions included in the appendix 11 |

| Appendix 12 |

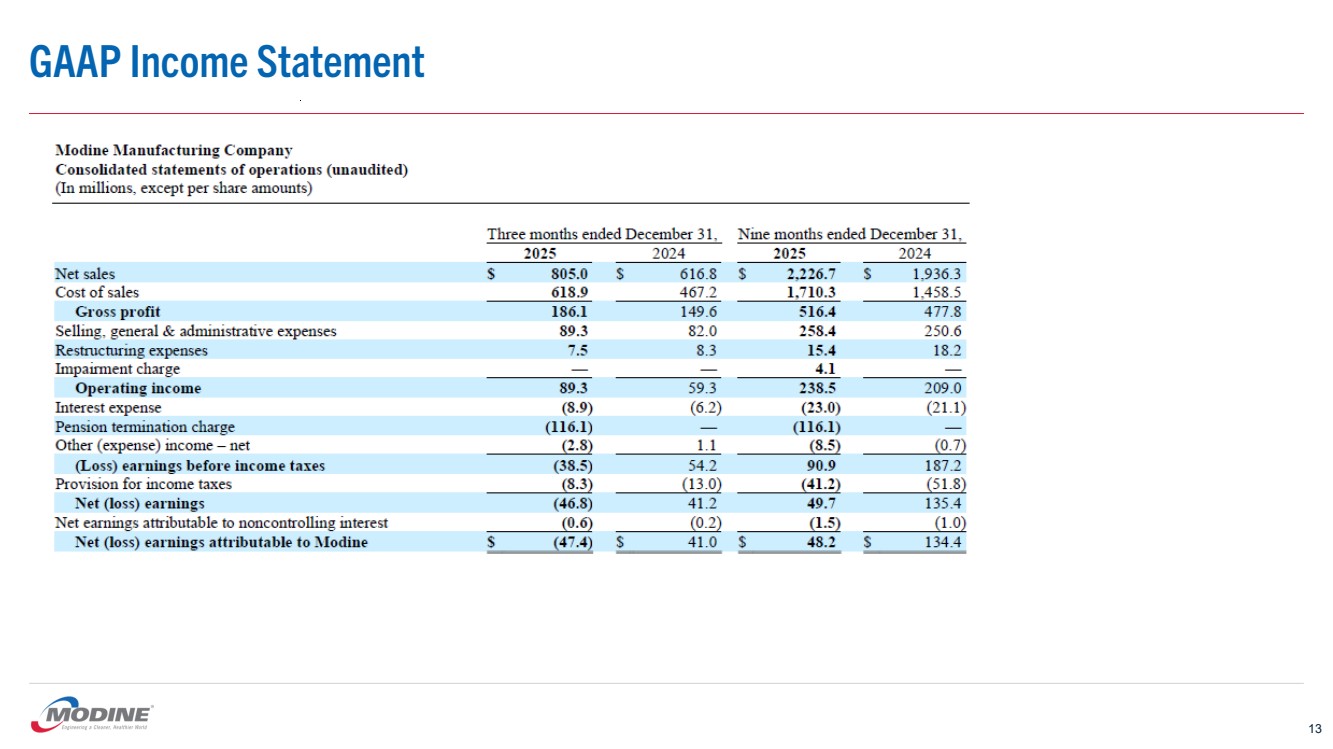

| GAAP Income Statement 13 |

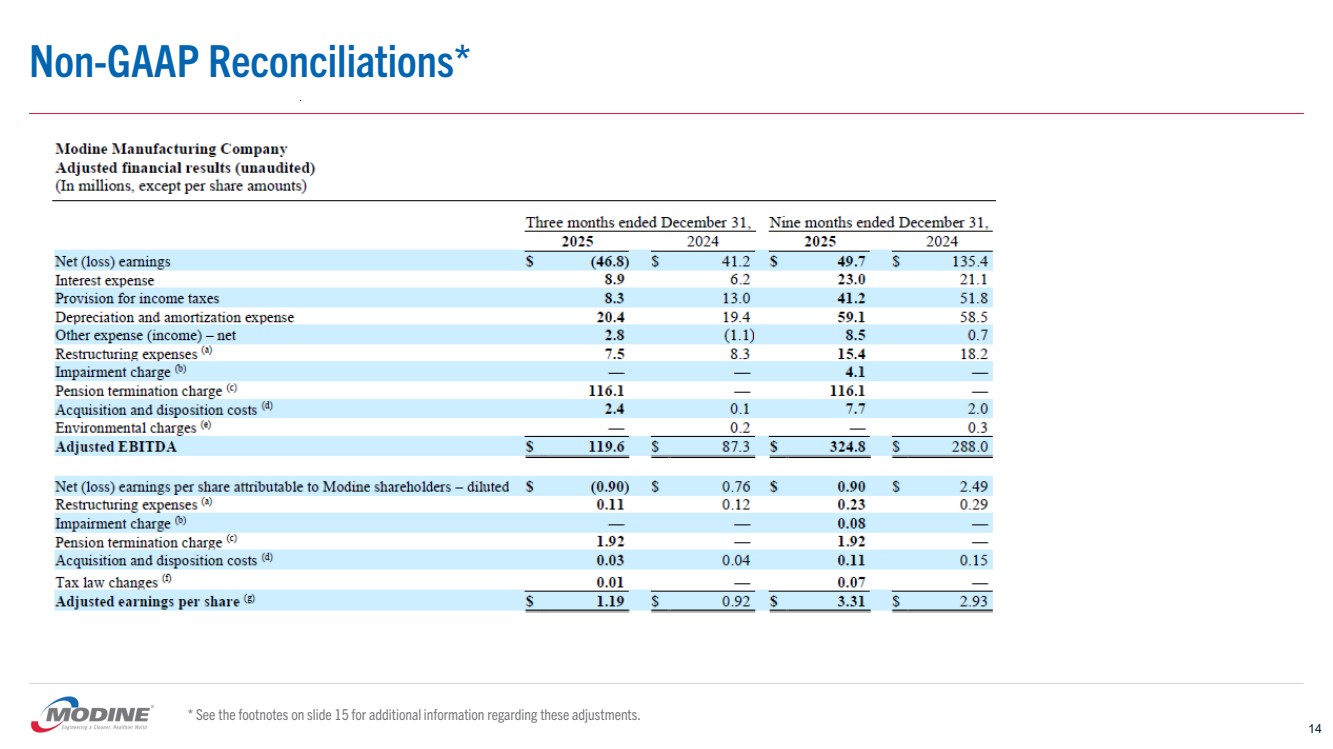

| Non-GAAP Reconciliations* 14 * See the footnotes on slide 15 for additional information regarding these adjustments. |

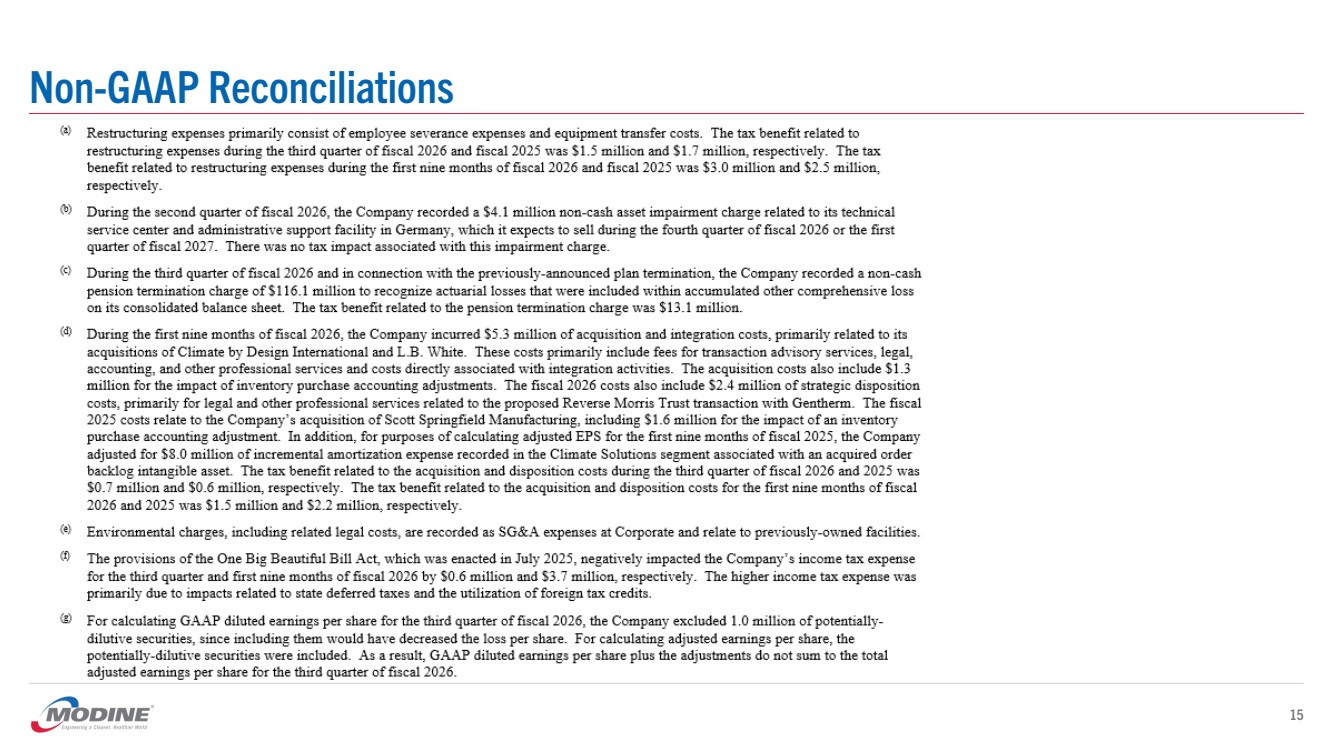

| Non-GAAP Reconciliations 15 |

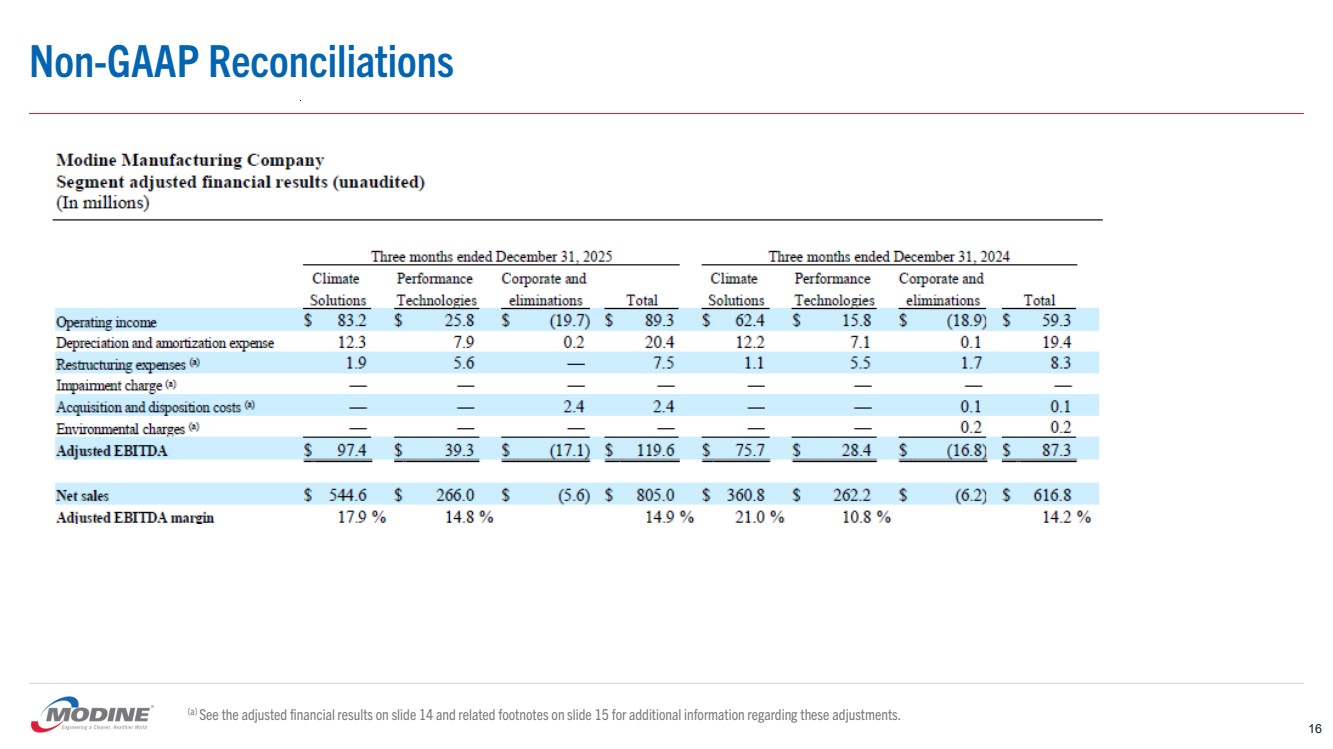

| Non-GAAP Reconciliations 16 (a) See the adjusted financial results on slide 14 and related footnotes on slide 15 for additional information regarding these adjustments. |

| Non-GAAP Reconciliations 17 |

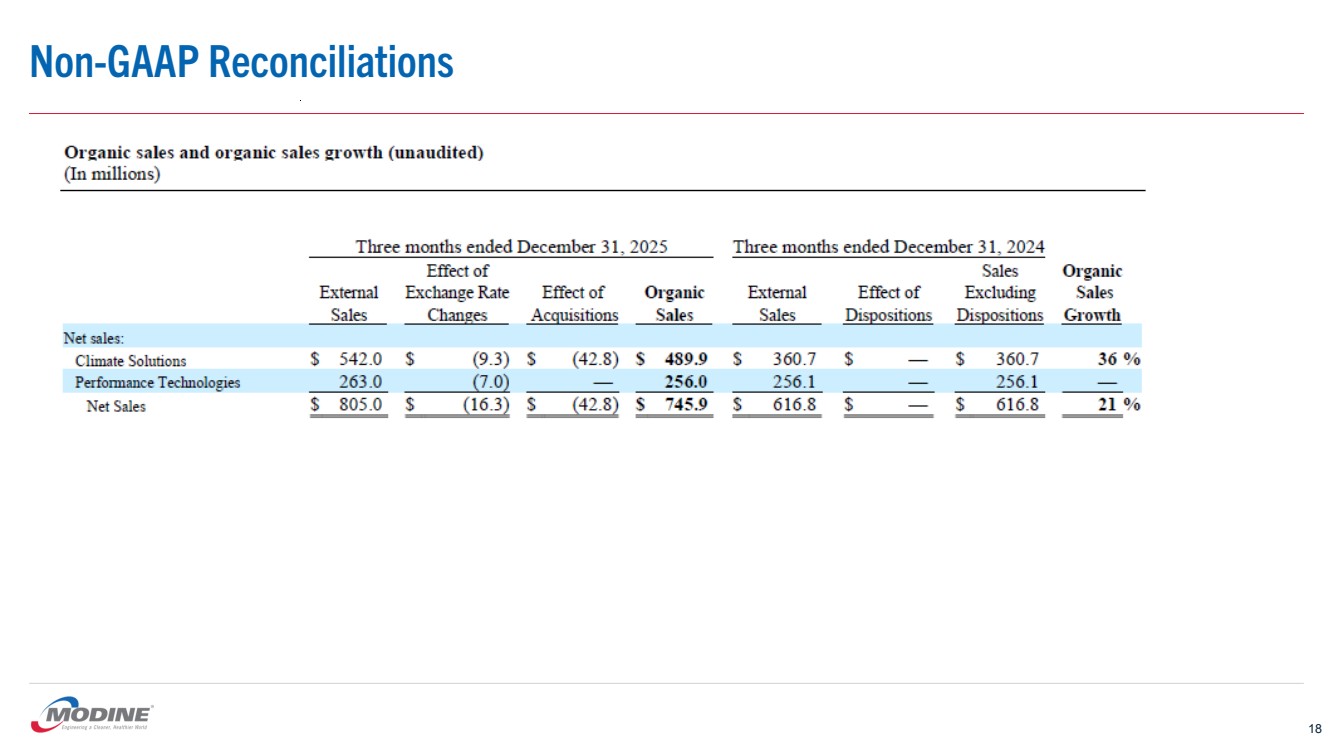

| Non-GAAP Reconciliations 18 |

| Forward-Looking Non-GAAP Financial Measure 19 The Company’s fiscal 2026 guidance includes adjusted EBITDA, which is a non-GAAP financial measure. The full-year fiscal 2026 guidance includes the Company’s estimates for interest expense of approximately $30 to $34 million, a provision for income taxes of approximately $72 to $76 million, and depreciation and amortization expense of approximately $77 to $82 million. The non-GAAP financial measure also excludes certain cash and non-cash expenses or gains. These expenses and gains may be significant and include items such as restructuring expenses (including severance and equipment transfer costs), impairment charges, pension termination charges, acquisition and disposition costs, and certain other items. These expenses for the first nine months of fiscal 2026 are presented on slide 14. Estimates of other expenses and gains for the remainder of fiscal 2026 that will be excluded for the non-GAAP financial measure are not available due to the low visibility and unpredictability of these items. |