| Investor Presentation February 2026 |

| Forward-Looking Statements and RMT Disclaimer No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law. Additional Information and Where to Find It In connection with the proposed transaction between Modine, SpinCo and Gentherm, the parties intend to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including, among other filings, a registration statement on Form S-4 to be filed by Gentherm (the “Form S-4”) that will include a preliminary proxy statement/prospectus of Gentherm and a definitive proxy statement/prospectus of Gentherm, the latter of which will be mailed to shareholders of Gentherm, and a registration statement on Form 10 to be filed by SpinCo that will incorporate by reference certain portions of the Form S-4 and will serve as an information statement/prospectus in connection with the spin-off of SpinCo from Modine. INVESTORS AND SECURITY HOLDERS OF GENTHERM AND MODINE ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE INFORMATION STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GENTHERM, MODINE, SPINCO, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4 and the proxy statement/prospectus (when available) and other documents filed with the SEC by Gentherm, SpinCo or Modine through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Gentherm will be available free of charge on Gentherm’s website at gentherm.com under the tab “Investors & Media” and under the heading “Financial Info” and subheading “SEC Filings.” Copies of the documents filed with the SEC by Modine and SpinCo will be available free of charge on Modine’s website at modine.com under the tab “Investors” and under the heading “Financials” and subheading “SEC Filings.” Participants in the Solicitation Gentherm, Modine and their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies from Gentherm stockholders in connection with the proposed transaction. Information about the directors and executive officers of Gentherm is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 19, 2025, and its proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on March 27, 2025. To the extent holdings of Gentherm’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and executive officers of Gentherm and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction. Information about the directors and executive officers of Modine is set forth in its Annual Report on Form 10-K for the year ended March 31, 2025, which was filed with the SEC on May 21, 2025, and its proxy statement for its 2025 annual meeting of shareholders, which was filed with the SEC on July 9, 2025. To the extent holdings of Modine’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov and from Gentherm’s website and Modine’s website as described above. Cautionary Statement Regarding Forward-Looking Statements This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Proposed Transaction among Gentherm, Modine and SpinCo. These forward-looking statements may be identified by the words “believe,” “feel,” “project,” “expect,” “anticipate,” “appear,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “suggest,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the Proposed Transaction, the ability of the parties to complete the Proposed Transaction, the expected 2 benefits of the Proposed Transaction, including future financial and operating results, anticipated strategic benefits of the Proposed Transaction, the amount and timing of synergies from the Proposed Transaction, the tax consequences of the Proposed Transaction, the terms and scope of the expected financing in connection with the Proposed Transaction, the aggregate amount of indebtedness of the combined company following the closing of the Proposed Transaction, the combined company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward-looking statements. These forward-looking statements are based on Gentherm’s and Modine’s current expectations and are subject to risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Gentherm’s and Modine’s control. None of Gentherm, Modine, SpinCo or any of their respective directors, executive officers, advisors or representatives make any representation or provide any assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Gentherm, Modine or the combined business. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements, including developments that could have a material adverse effect on Gentherm’s and Modine’s businesses and the ability to successfully complete the Proposed Transaction and realize its benefits. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the Proposed Transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Proposed Transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the shareholders of Gentherm may not be obtained; (2) the risk that the Proposed Transaction may not be completed on the terms or in the time frame expected by Gentherm, Modine and SpinCo, or at all; (3) unexpected costs, charges or expenses resulting from the Proposed Transaction; (4) uncertainty of the expected financial performance of the combined company following completion of the Proposed Transaction; (5) failure to realize the anticipated benefits of the Proposed Transaction, including as a result of delay in completing the Proposed Transaction or integrating the businesses of Gentherm and SpinCo, on the expected timeframe or at all; (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company achieving revenue and cost synergies; (8) inability of the combined company to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the Proposed Transaction; (10) the risk that shareholder litigation in connection with the Proposed Transaction or other litigation, settlements or investigations may affect the timing or occurrence of the Proposed Transaction or result in significant costs of defense, indemnification and liability; (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions or any volatility resulting from the imposition of and changing policies, including those policies with respect to tariffs; (13) actions by third parties, including government agencies; (14) the risk that the anticipated tax treatment of the Proposed Transaction is not obtained; (15) the risk of greater than expected difficulty in separating the business of SpinCo from the other businesses of Modine; (16) risks related to the disruption of management time from ongoing business operations due to the pendency of the Proposed Transaction, or other effects of the pendency of the Proposed Transaction on the relationship of any of the parties to the Proposed Transaction with their employees, customers, suppliers, or other counterparties; and (17) other risk factors detailed from time to time in Gentherm’s and Modine’s reports filed with the SEC, including Gentherm’s and Modine’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC, including documents that will be filed with the SEC in connection with the Proposed Transaction. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. None of Gentherm, Modine or SpinCo undertakes, and each party expressly disclaims, any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Use of Non-GAAP Financial Measures In addition to the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this communication includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as adjusted EBITDA, adjusted EBITDA margin, net leverage ratio, and adjusted EPS. These Non-GAAP Measures should not be used in isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition, Gentherm’s and Modine’s definitions of these Non-GAAP Measures may not be comparable to similarly titled non-GAAP financial measures reported by other companies. |

| 3 Always evolving our portfolio of products in pursuit of highly engineered, mission-critical thermal solutions Engineering A Cleaner, Healthier World Integrity Committed People Centric Technology Driven Results Oriented Team Focused Improve Indoor Air Quality Reduce Water & Energy Consumption Lower Harmful Emissions Enable Cleaner Running Vehicles Use Environmentally Friendly Refrigerants OUR VISION OUR PURPOSE OUR VALUES OUR MISSION |

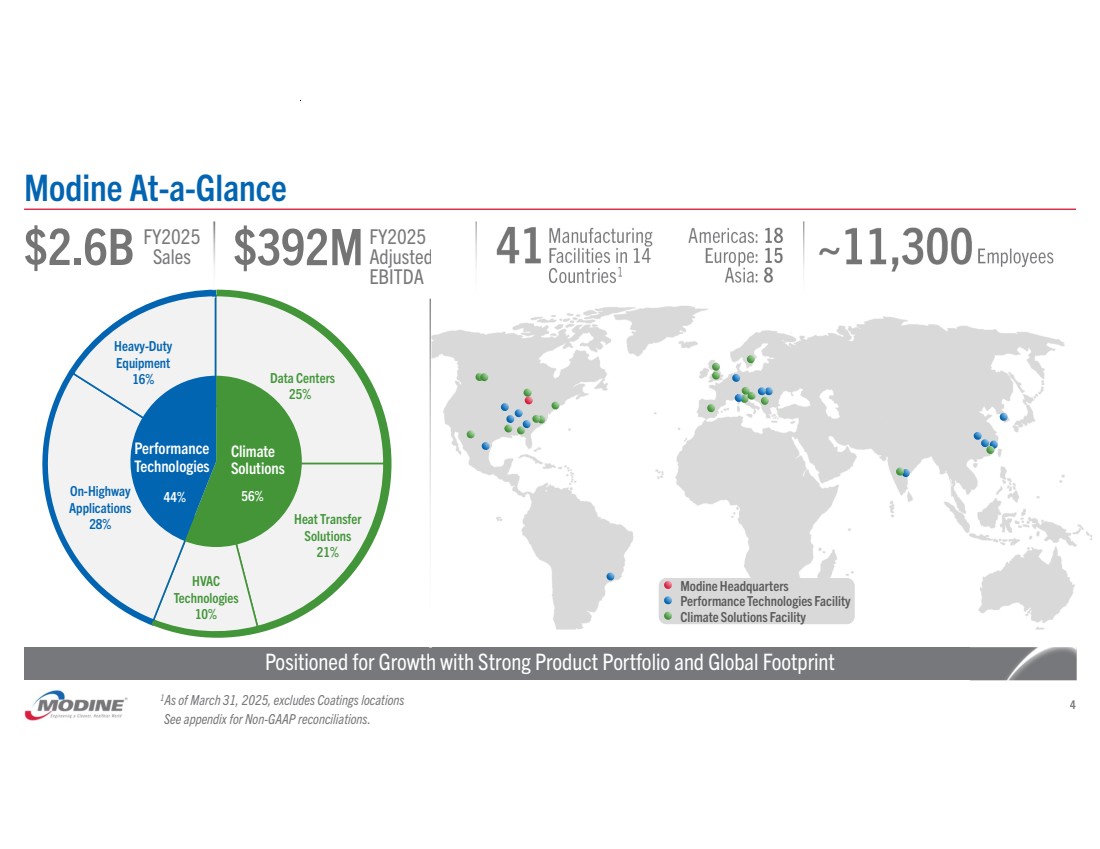

| Heat Transfer Solutions 21% HVAC Technologies 10% On-Highway Applications 28% Heavy-Duty Equipment 16% Modine At-a-Glance 4 Positioned for Growth with Strong Product Portfolio and Global Footprint Performance Technologies Climate Solutions 41 Manufacturing Facilities in 14 Countries1 Americas: Europe: Asia: $2.6B ~11,300Employees FY2025 Sales $392MFY2025 Adjusted EBITDA 18 15 8 Modine Headquarters Performance Technologies Facility Climate Solutions Facility 25% Data Centers 1As of March 31, 2025, excludes Coatings locations 44% 56% See appendix for Non-GAAP reconciliations. |

| Strategic Pillars Driving Value Creation Capitalizing on our deep expertise in thermal management to deliver differentiated solutions and sustained market leadership Leveraging our portfolio of highly engineered, mission-critical thermal solutionsto accelerate growth Entering a multi-year growth cycle powered by multiple secular mega-trends Elevating our 80/20 discipline by influencing daily decision-making and strategic resource and capital allocation Evolving our portfolio to compound shareholder value by focusing on high-growth, high-margin businesses for sustainable growth and returns 80 20 5 |

| Deep Expertise in Thermal Management 6 Over a century of leadership in thermal management Strong relationships with leading companies across many diversified industries Patent-protected, fit-for-purpose innovation meeting customers’ unique needs Advanced technical test centers and lab capabilities driving product development Proprietary technology and footprint creates ongoing value for our customers HIGHLY ENGINEERED, MISSION-CRITICAL thermal solutions to meet the needs of our customers |

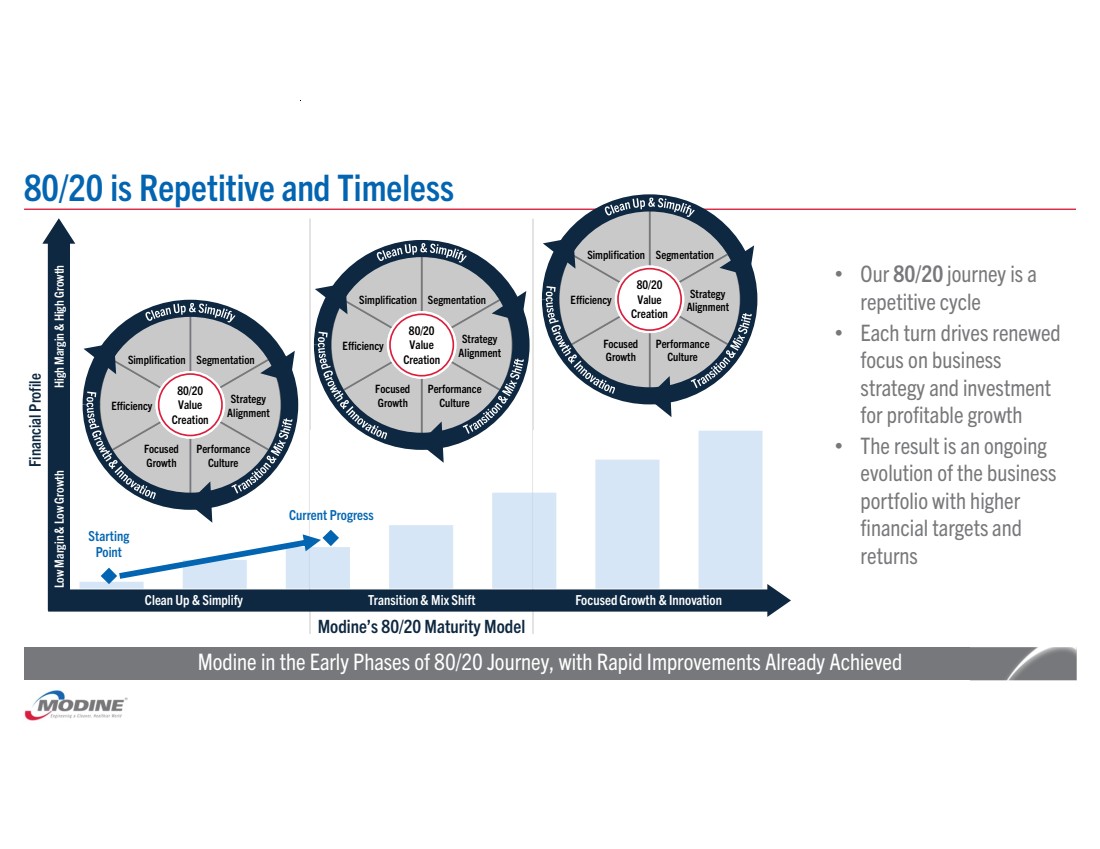

| 80/20 is Repetitive and Timeless Modine in the Early Phases of 80/20 Journey, with Rapid Improvements Already Achieved High Margin & High Growth Financial Profile Low Margin & Low Growth Modine’s 80/20 Maturity Model Starting Point Current Progress 80/20 Value Creation Simplification Segmentation Focused Growth Performance Culture Efficiency Strategy Alignment 80/20 Value Creation Simplification Segmentation Focused Growth Performance Culture Efficiency Strategy Alignment 80/20 Value Creation Simplification Segmentation Focused Growth Performance Culture Efficiency Strategy Alignment Clean Up & Simplify Transition & Mix Shift Focused Growth & Innovation • Our 80/20 journey is a repetitive cycle • Each turn drives renewed focus on business strategy and investment for profitable growth • The result is an ongoing evolution of the business portfolio with higher financial targets and returns |

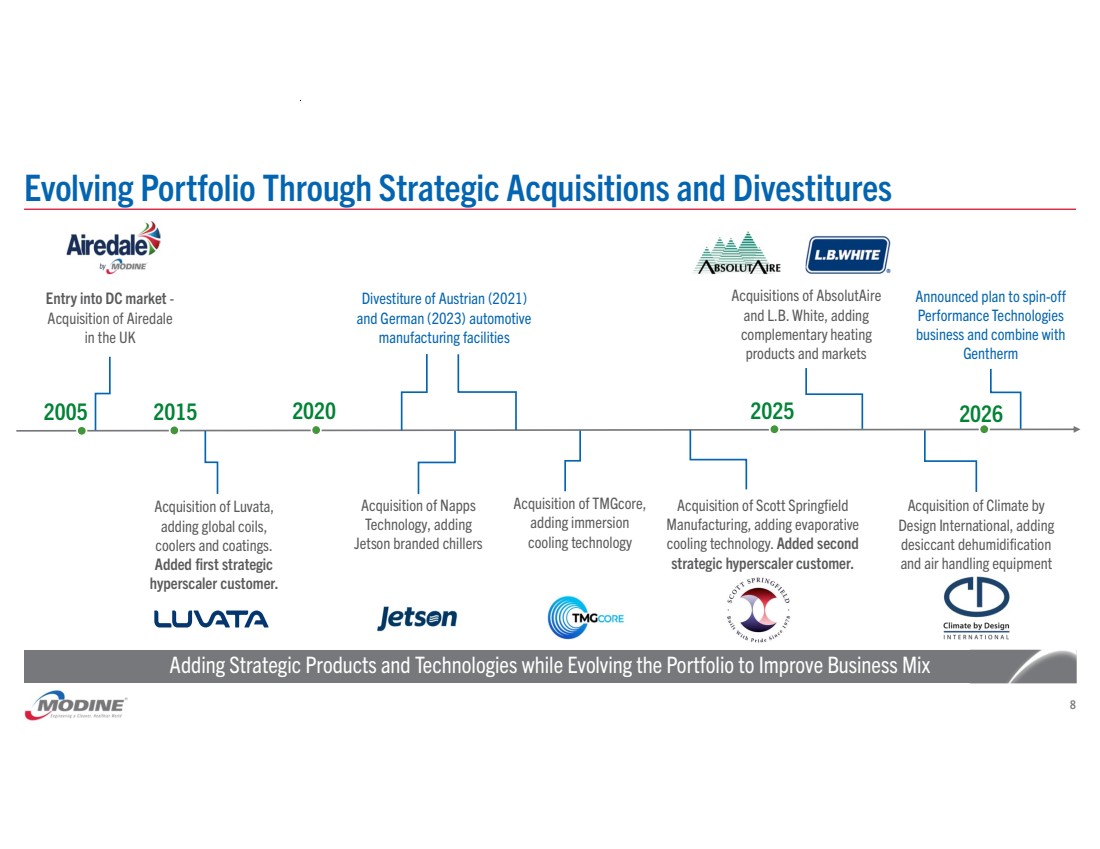

| Entry into DC market - Acquisition of Airedale in the UK Acquisition of Luvata, adding global coils, coolers and coatings. Added first strategic hyperscaler customer. Acquisition of Napps Technology, adding Jetson branded chillers 2005 2015 Evolving Portfolio Through Strategic Acquisitions and Divestitures 8 Expanding Our Thermal Management Capabilities to Serve High-Growth Markets and Accelerate Growth Acquisition of TMGcore, adding immersion cooling technology Acquisition of Scott Springfield Manufacturing, adding evaporative cooling technology. Added second strategic hyperscaler customer. 2020 2025 Acquisitions of AbsolutAire and L.B. White, adding complementary heating products and markets Divestiture of Austrian (2021) and German (2023) automotive manufacturing facilities Adding Strategic Products and Technologies while Evolving the Portfolio to Improve Business Mix Acquisition of Climate by Design International, adding desiccant dehumidification and air handling equipment Announced plan to spin-off Performance Technologies business and combine with Gentherm 2026 |

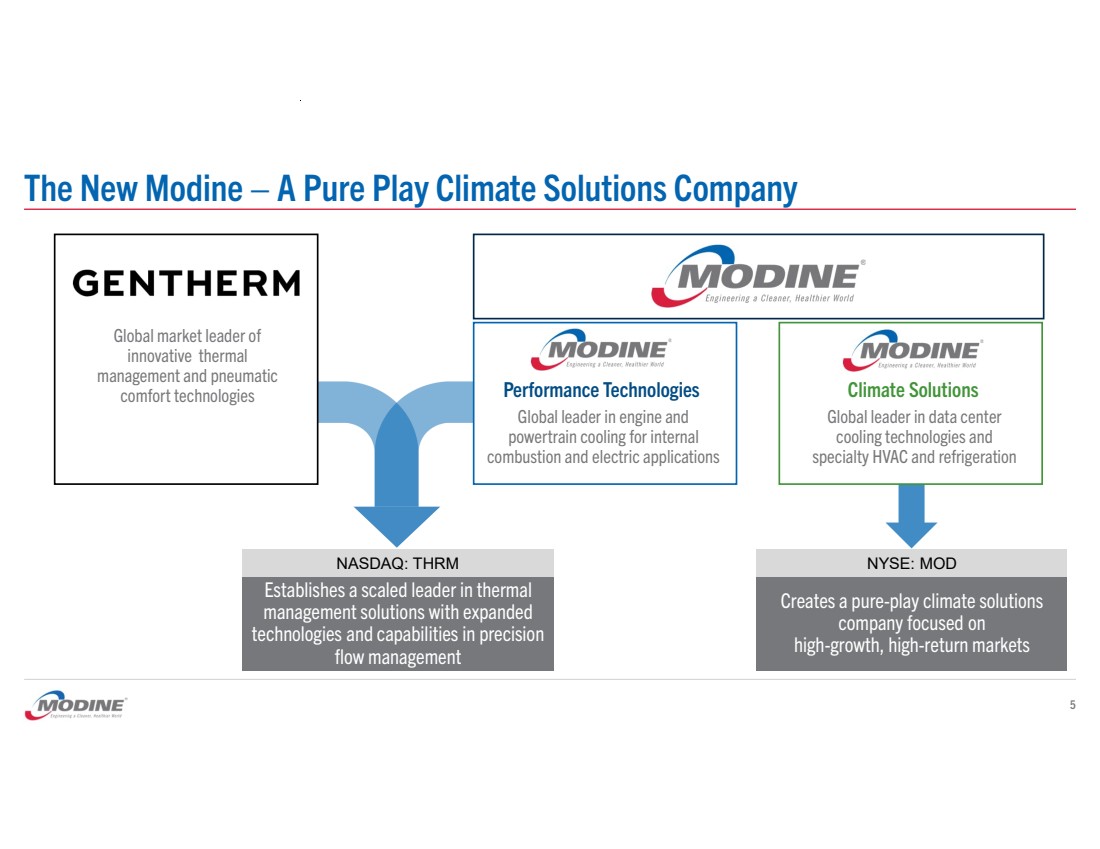

| The New Modine – A Pure Play Climate Solutions Company Establishes a scaled leader in thermal management solutions with expanded technologies and capabilities in precision flow management 5 Performance Technologies Global market leader of innovative thermal management and pneumatic comfort technologies Global leader in engine and powertrain cooling for internal combustion and electric applications Climate Solutions Global leader in data center cooling technologies and specialty HVAC and refrigeration Creates a pure-play climate solutions company focused on high-growth, high-return markets NASDAQ: THRM NYSE: MOD |

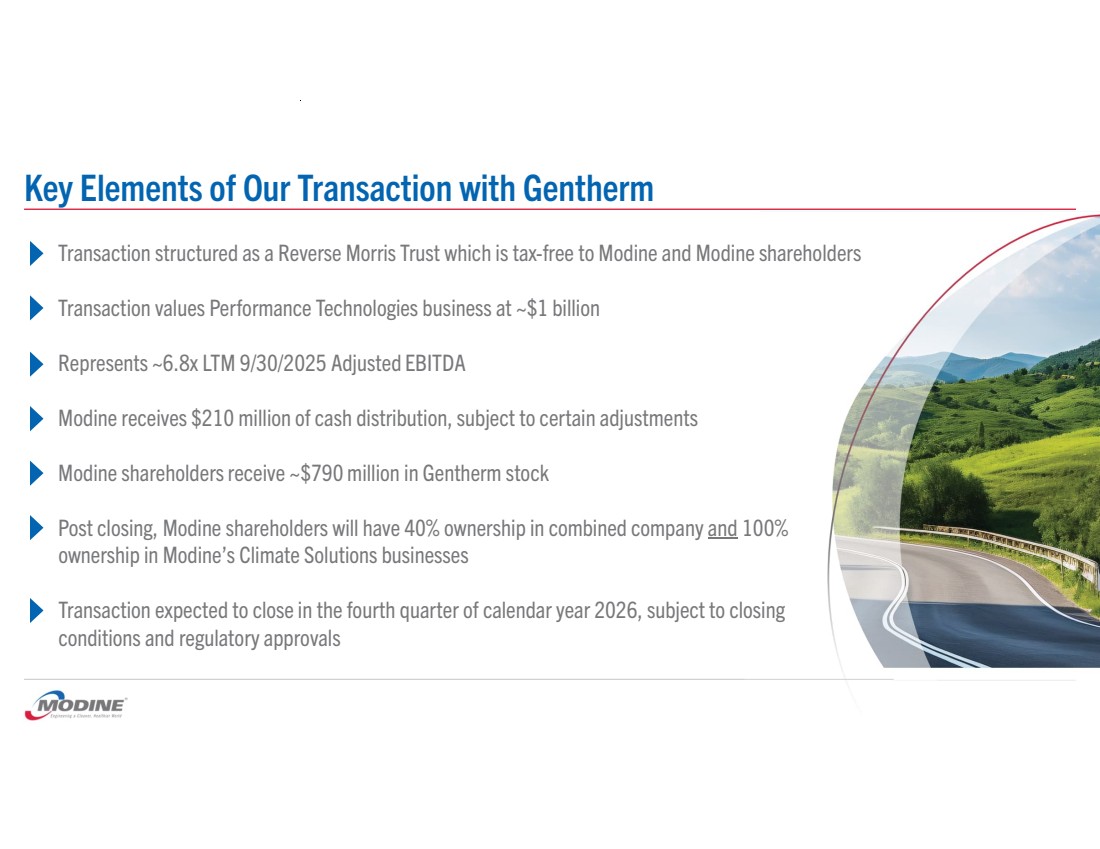

| Key Elements of Our Transaction with Gentherm 6 • Transaction structured as a Reverse Morris Trust which is tax-free to Modine and Modine shareholders • Transaction values Performance Technologies business at ~$1 billion • Represents ~6.8x LTM 9/30/2025 Adjusted EBITDA • Modine receives $210 million of cash distribution, subject to certain adjustments • Modine shareholders receive ~$790 million in Gentherm stock • Post closing, Modine shareholders will have 40% ownership in combined company and 100% ownership in Modine’s Climate Solutions businesses • Transaction expected to close in the fourth quarter of calendar year 2026, subject to closing conditions and regulatory approvals |

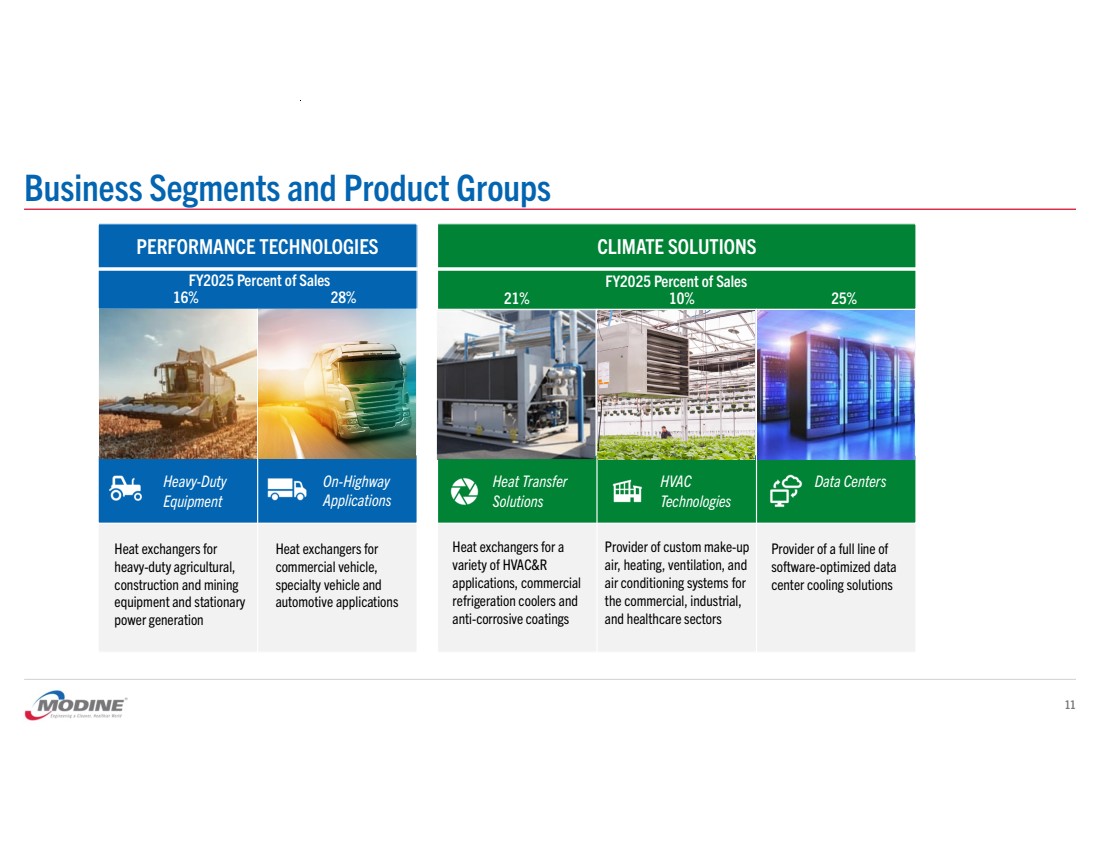

| PERFORMANCE TECHNOLOGIES Business Segments and Product Groups 11 Heat exchangers for heavy-duty agricultural, construction and mining equipment and stationary power generation Heat exchangers for commercial vehicle, specialty vehicle and automotive applications Heavy-Duty Equipment On-Highway Applications CLIMATE SOLUTIONS Heat Transfer Solutions HVAC Technologies Data Centers 21% 10% 25% Heat exchangers for a variety of HVAC&R applications, commercial refrigeration coolers and anti-corrosive coatings Provider of custom make-up air, heating, ventilation, and air conditioning systems for the commercial, industrial, and healthcare sectors Provider of a full line of software-optimized data center cooling solutions FY2025 Percent of Sales FY2025 Percent of Sales 16% 28% |

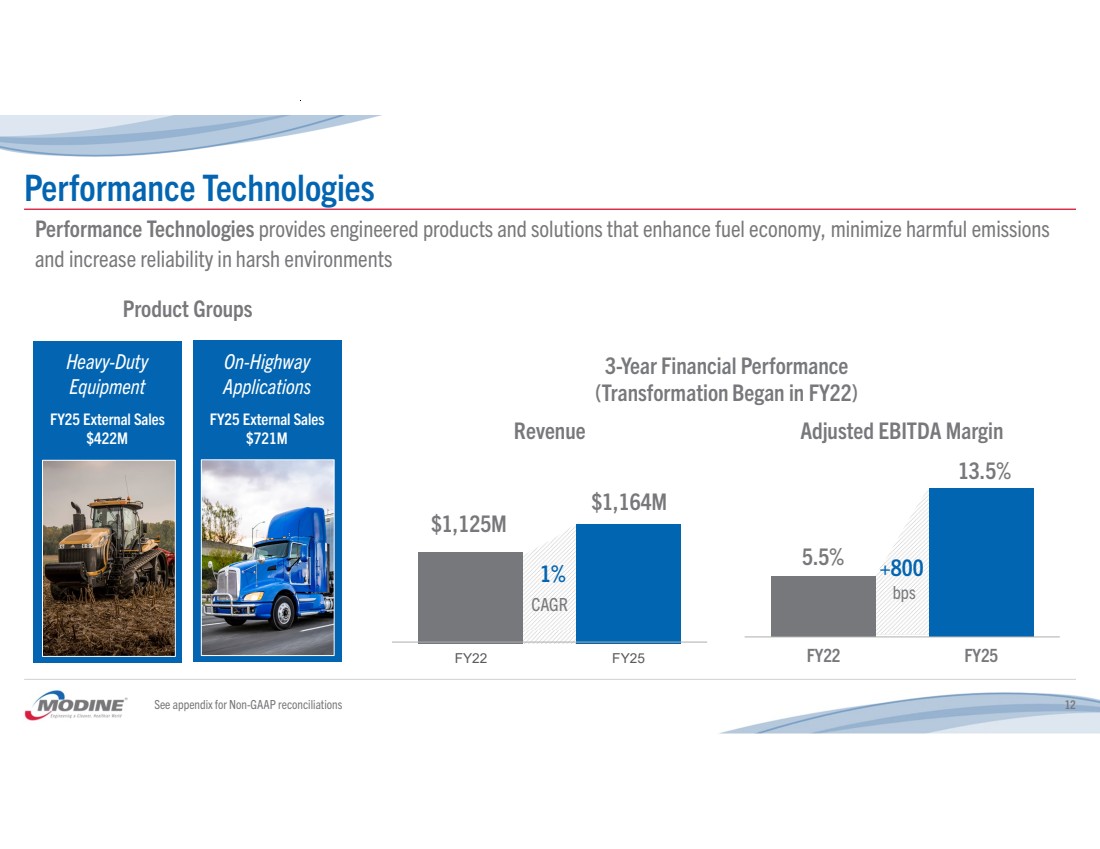

| FY22 FY25 FY22 FY25 Performance Technologies Performance Technologies provides engineered products and solutions that enhance fuel economy, minimize harmful emissions and increase reliability in harsh environments On-Highway Applications FY25 External Sales $721M Heavy-Duty Equipment FY25 External Sales $422M Product Groups See appendix for Non-GAAP reconciliations 12 Revenue 1% CAGR $1,164M $1,125M Adjusted EBITDA Margin 13.5% 5.5% +800 bps 3-Year Financial Performance (Transformation Began in FY22) |

| FY22 FY25 FY22 FY25 Climate Solutions Climate Solutions provides energy-efficient, safe, climate-controlled solutions, and components for a wide range of mission-critical applications Liquid-Cooled Applications Advanced Solutions Air-Cooled Applications Data Centers FY25 External Sales $644M Heat Transfer Solutions FY25 External Sales $539M HVAC Technologies FY25 External Sales $257M 13 $1,441M $955M 15% CAGR Revenue 21.0% 11.6% +940 bps Adjusted EBITDA Margin Product Groups 3-Year Financial Performance (Transformation Began in FY22) See appendix for Non-GAAP reconciliations |

| Climate Solutions – Leveraging Data Center Market Growth 14 • Provider of full system solutions for data center cooling with a suite of products designed to deliver flexible solutions and superior service • Key end markets include Hyperscale, Colocation, and NeoCloud data centers along with Edge and Telecom markets • Centralized smart building management systems that remotely monitor performance and energy consumption • Aim to leverage the Airedale brand to expand into telecom and edge applications, while supporting rapid growth by investing in capacity expansion and technology Air Wall Immersion Cooling Chiller CRAH/CRAC Controls Products and Solutions Cooler DEC AHU CDU Modular |

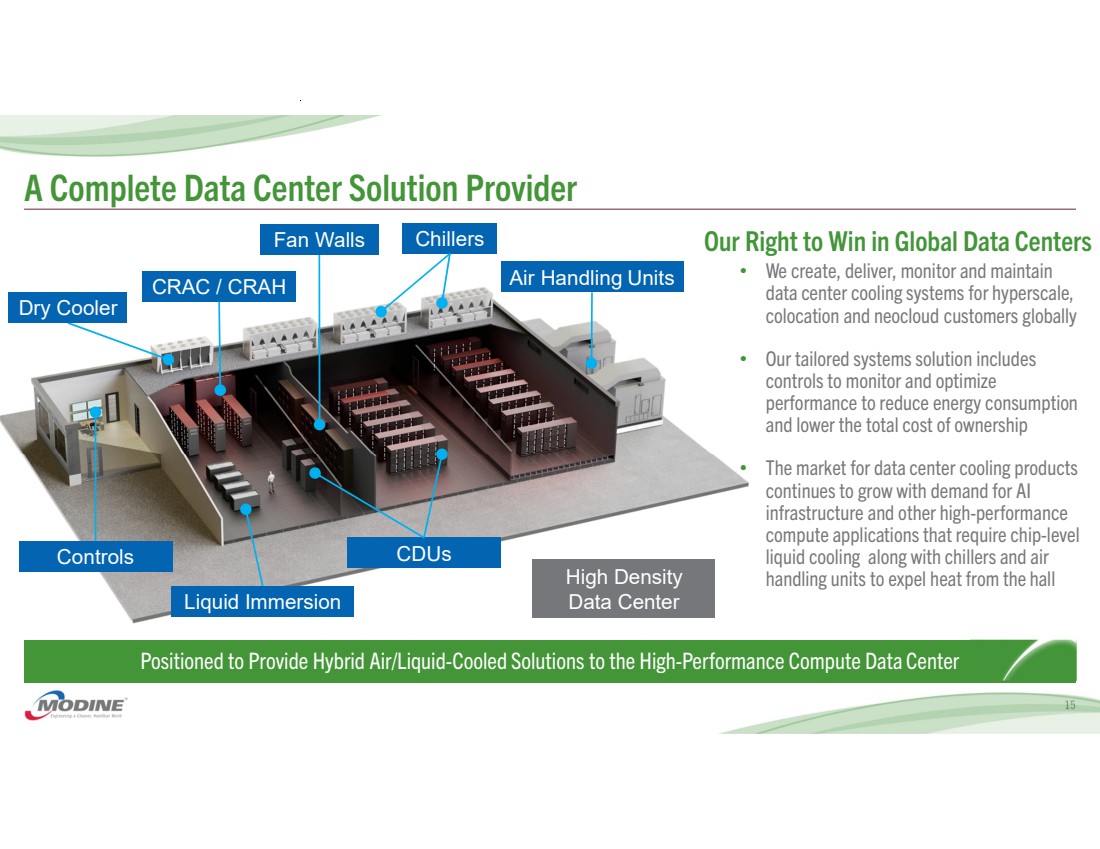

| A Complete Data Center Solution Provider 15 • We create, deliver, monitor and maintain data center cooling systems for hyperscale, colocation and neocloud customers globally • Our tailored systems solution includes controls to monitor and optimize performance to reduce energy consumption and lower the total cost of ownership • The market for data center cooling products continues to grow with demand for AI infrastructure and other high-performance compute applications that require chip-level liquid cooling along with chillers and air handling units to expel heat from the hall Our Right to Win in Global Data Centers CRAC / CRAH Fan Walls Chillers Controls CDUs Liquid Immersion Air Handling Units Positioned to Provide Hybrid Air/Liquid-Cooled Solutions to the High-Performance Compute Data Center Dry Cooler High Density Data Center |

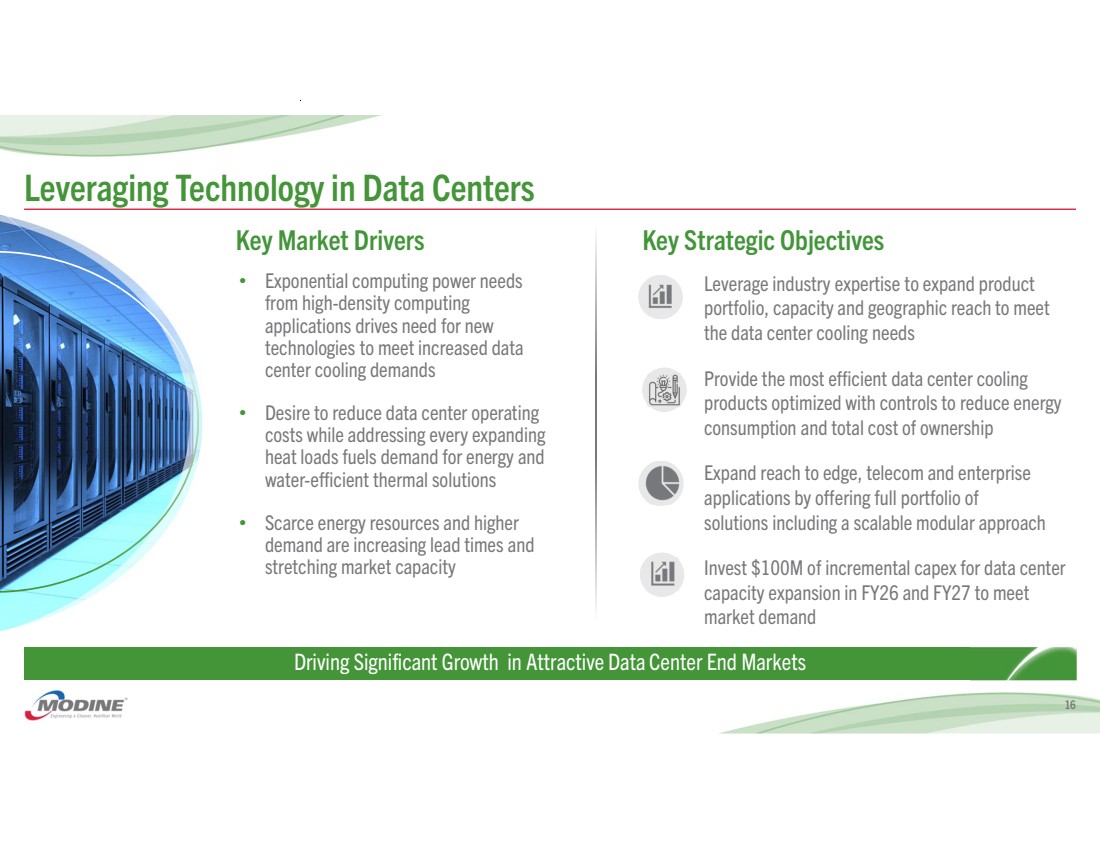

| Leveraging Technology in Data Centers 16 Driving Significant Growth in Attractive Data Center End Markets Key Market Drivers Key Strategic Objectives Leverage industry expertise to expand product portfolio, capacity and geographic reach to meet the data center cooling needs Provide the most efficient data center cooling products optimized with controls to reduce energy consumption and total cost of ownership Expand reach to edge, telecom and enterprise applications by offering full portfolio of solutions including a scalable modular approach Invest $100M of incremental capex for data center capacity expansion in FY26 and FY27 to meet market demand • Exponential computing power needs from high-density computing applications drives need for new technologies to meet increased data center cooling demands • Desire to reduce data center operating costs while addressing every expanding heat loads fuels demand for energy and water-efficient thermal solutions • Scarce energy resources and higher demand are increasing lead times and stretching market capacity |

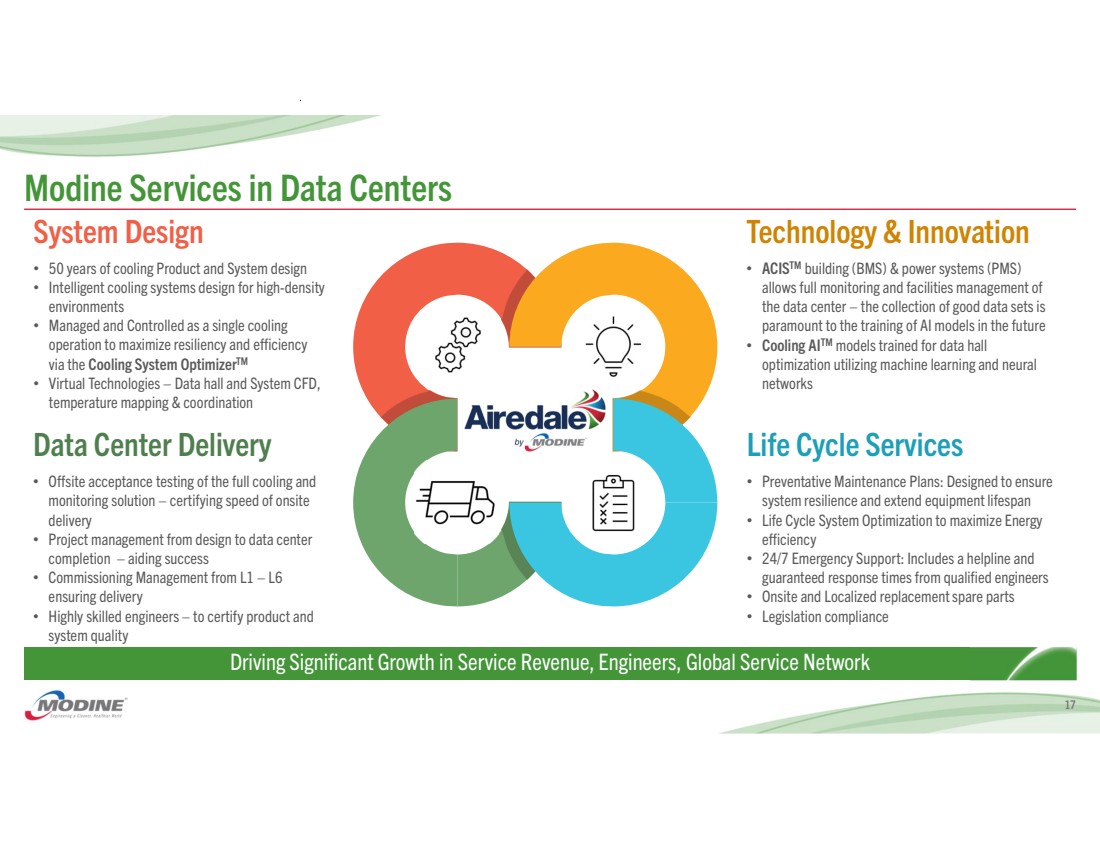

| Modine Services in Data Centers 17 Driving Significant Growth in Service Revenue, Engineers, Global Service Network Life Cycle Services • Preventative Maintenance Plans: Designed to ensure system resilience and extend equipment lifespan • Life Cycle System Optimization to maximize Energy efficiency • 24/7 Emergency Support: Includes a helpline and guaranteed response times from qualified engineers • Onsite and Localized replacement spare parts • Legislation compliance Data Center Delivery • Offsite acceptance testing of the full cooling and monitoring solution – certifying speed of onsite delivery • Project management from design to data center completion – aiding success • Commissioning Management from L1 – L6 ensuring delivery • Highly skilled engineers – to certify product and system quality Technology & Innovation • ACISTM building (BMS) & power systems (PMS) allows full monitoring and facilities management of the data center – the collection of good data sets is paramount to the training of AI models in the future • Cooling AITM models trained for data hall optimization utilizing machine learning and neural networks System Design • 50 years of cooling Product and System design • Intelligent cooling systems design for high-density environments • Managed and Controlled as a single cooling operation to maximize resiliency and efficiency via the Cooling System OptimizerTM • Virtual Technologies – Data hall and System CFD, temperature mapping & coordination |

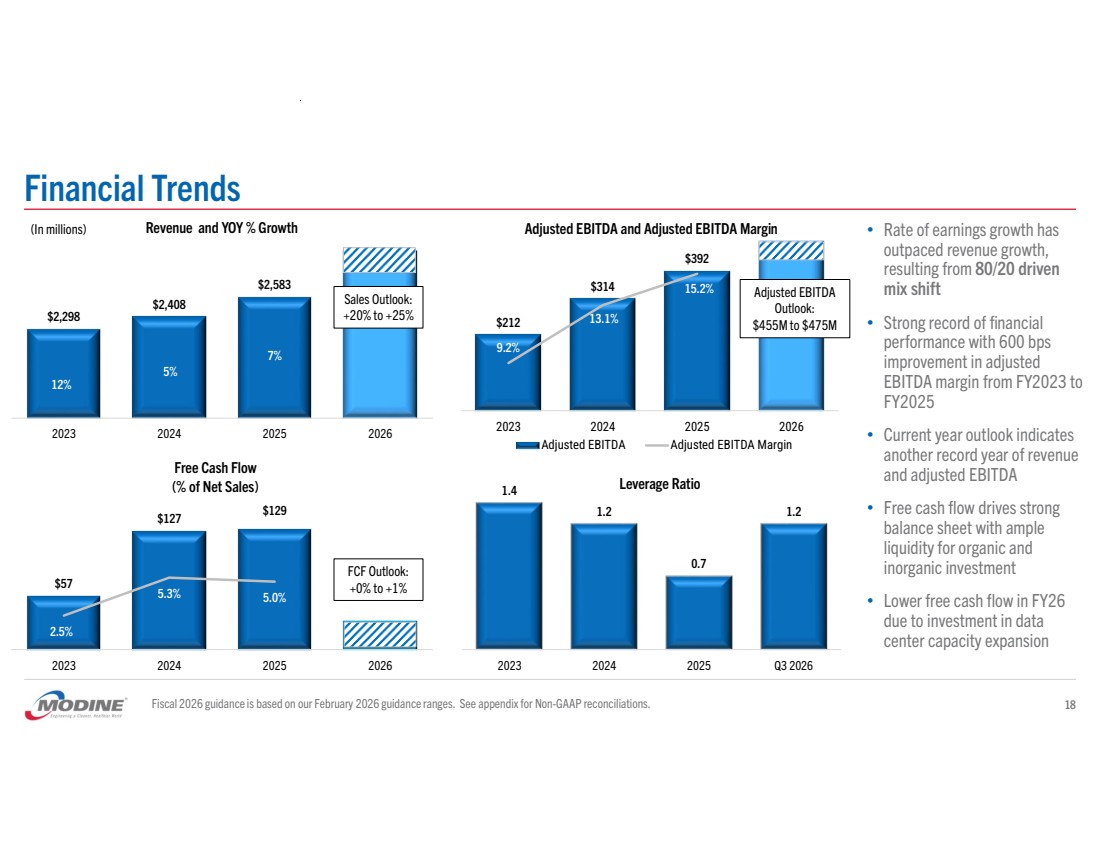

| 1.4 1.2 0.7 1.2 2023 2024 2025 Q3 2026 Leverage Ratio Financial Trends $2,298 $2,408 $2,583 12% 5% 7% 2023 2024 2025 2026 Revenue and YOY % Growth $57 $127 $129 2.5% 5.3% 5.0% 2023 2024 2025 2026 Free Cash Flow (% of Net Sales) $212 $314 $392 9.2% 13.1% 15.2% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% $0 $100 $200 $300 $400 $500 2023 2024 2025 2026 Adjusted EBITDA and Adjusted EBITDA Margin Adjusted EBITDA Adjusted EBITDA Margin Sales Outlook: +20% to +25% Adjusted EBITDA Outlook: $455M to $475M (In millions) Fiscal 2026 guidance is based on our February 2026 guidance ranges. See appendix for Non-GAAP reconciliations. FCF Outlook: +0% to +1% • Rate of earnings growth has outpaced revenue growth, resulting from 80/20 driven mix shift • Strong record of financial performance with 600 bps improvement in adjusted EBITDA margin from FY2023 to FY2025 • Current year outlook indicates another record year of revenue and adjusted EBITDA • Free cash flow drives strong balance sheet with ample liquidity for organic and inorganic investment • Lower free cash flow in FY26 due to investment in data center capacity expansion 18 |

| Capital Allocation Priorities 19 Well-positioned to Support Future Acquisitions and Investments in Organic Growth 1 Investment in Organic Growth • Allocate capital to growth businesses, particularly data center capacity expansion • Target capital spending of 3% to 6% of sales 2 Portfolio Transformation • Announced plan to spin-off Performance Technologies business and combine with Gentherm accelerates the portfolio evolution • Remaining Modine becomes a high growth, pure-play climate solutions company 3 Strategic Acquisitions • Adequate balance sheet flexibility to execute strategic M&A 4 Share Repurchase • Evaluate additional repurchases based on cash flow, macro climate, and other cash needs |

| Well-Positioned for Success Delivering end-market diversification for business resiliency through economic cycles Providing strategic flexibility through strong free cash flow and balance sheet Furthering focus on organic and inorganic investment to achieve revenue and EBITDA growth Leveraging 80/20 to deliver growth and improve business mix through operational and commercial excellence Allocating capital to optimize the business portfolio to achieve long-term financial goals and compound shareholder value 20 80/20 Maturity Supporting Our Financial Targets, Resulting in Significant Annual Earnings Growth 80 20 |

| Appendix |

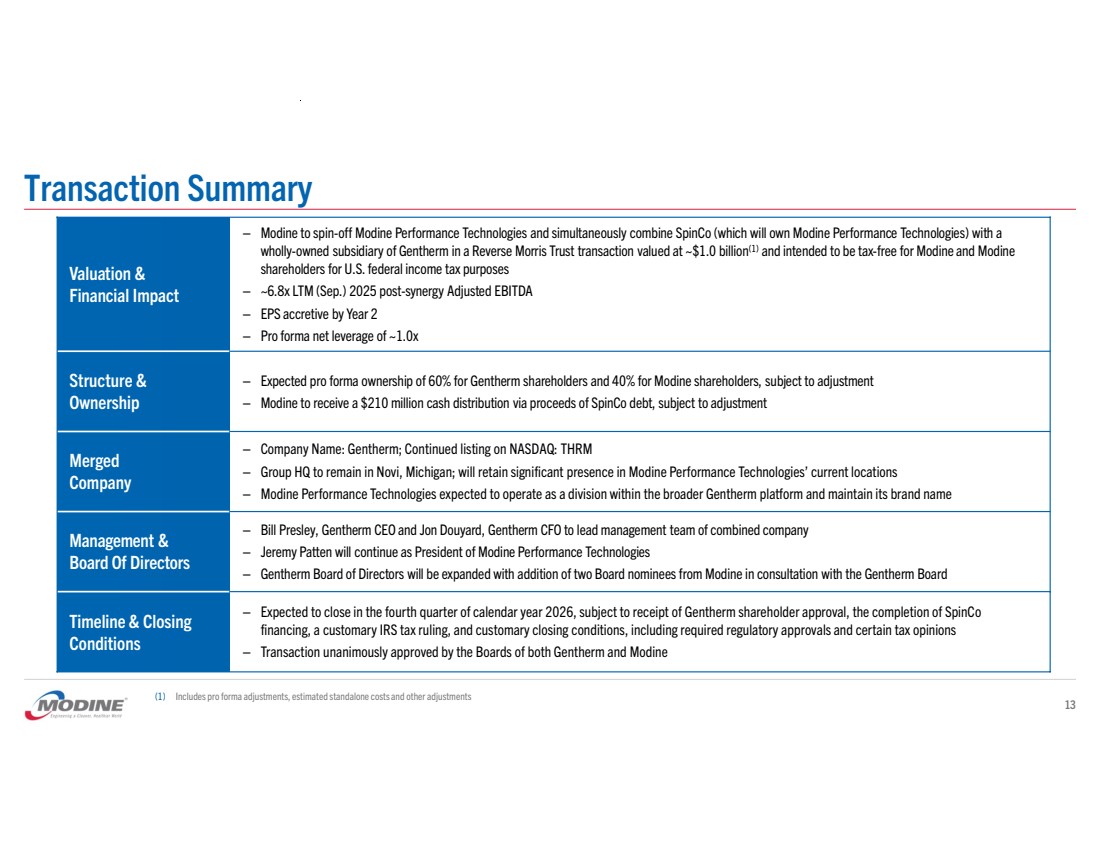

| Transaction Summary 13 – Modine to spin-off Modine Performance Technologies and simultaneously combine SpinCo (which will own Modine Performance Technologies) with a wholly-owned subsidiary of Gentherm in a Reverse Morris Trust transaction valued at ~$1.0 billion(1) and intended to be tax-free for Modine and Modine shareholders for U.S. federal income tax purposes – ~6.8x LTM (Sep.) 2025 post-synergy Adjusted EBITDA – EPS accretive by Year 2 – Pro forma net leverage of ~1.0x Valuation & Financial Impact – Expected pro forma ownership of 60% for Gentherm shareholders and 40% for Modine shareholders, subject to adjustment – Modine to receive a $210 million cash distribution via proceeds of SpinCo debt, subject to adjustment Structure & Ownership – Company Name: Gentherm; Continued listing on NASDAQ: THRM – Group HQ to remain in Novi, Michigan; will retain significant presence in Modine Performance Technologies’ current locations – Modine Performance Technologies expected to operate as a division within the broader Gentherm platform and maintain its brand name Merged Company – Bill Presley, Gentherm CEO and Jon Douyard, Gentherm CFO to lead management team of combined company – Jeremy Patten will continue as President of Modine Performance Technologies – Gentherm Board of Directors will be expanded with addition of two Board nominees from Modine in consultation with the Gentherm Board Management & Board Of Directors – Expected to close in the fourth quarter of calendar year 2026, subject to receipt of Gentherm shareholder approval, the completion of SpinCo financing, a customary IRS tax ruling, and customary closing conditions, including required regulatory approvals and certain tax opinions – Transaction unanimously approved by the Boards of both Gentherm and Modine Timeline & Closing Conditions (1) Includes pro forma adjustments, estimated standalone costs and other adjustments |

| • World’s largest independent manufacturer of heat transfer coils, used in a variety of applications and markets • Provider of commercial refrigeration coolers leveraging low-GWP natural refrigerants • Market leader in anti-corrosion coating products and application services to OEMs and distributors • Aim to reposition the portfolio by increasing the focus on higher-margin products and systems while optimizing the margin on lower-margin component sales by applying 80/20 principles Heat Transfer Solutions Overview 23 OE & Aftermarket Coils Performance Coatings Commercial Refrigeration Data Center Cooling Heat Pumps Refrigeration Coolers Commercial and Residential HVAC Products and Solutions Key End Markets |

| HVAC Technologies Overview 24 • North America’s leading unit heater manufacturer, used in greenhouse, garage and various other end-use applications with strong brand recognition, established sales channels, and expansive product offering which was recently expanded through acquisitions of AbsolutAire, L.B. White and Climate by Design International • Provider of indoor air quality products to the K-12 education market and other commercial applications, including healthcare and pharma • Aim to maintain leading market share position with applications in defensible, niche markets, while accelerating growth organically through new product development, and inorganically through strategic acquisitions Commercial & Residential Unit Heaters Products and Solutions Key End Markets Commercial & Industrial Heating Indoor Air Quality - Schools Residential Heating Custom Air Handlers Commercial IAQ Make-Up Air Systems Vertical & Horizontal Unit Ventilators |

| Data Centers Overview 25 • Provider of full system solutions for data center cooling with a suite of products designed to deliver flexible solutions and superior service • Key end markets include Hyperscale, Colocation, and NeoCloud data centers along with Edge and Telecom markets • Centralized smart building management systems that remotely monitor performance and energy consumption • Aim to leverage the Airedale brand to expand into telecom and edge applications, while supporting rapid growth by investing in capacity expansion and technology Air Wall Immersion Cooling Chiller CRAH/CRAC Controls Products and Solutions Cooler DEC AHU CDU Modular |

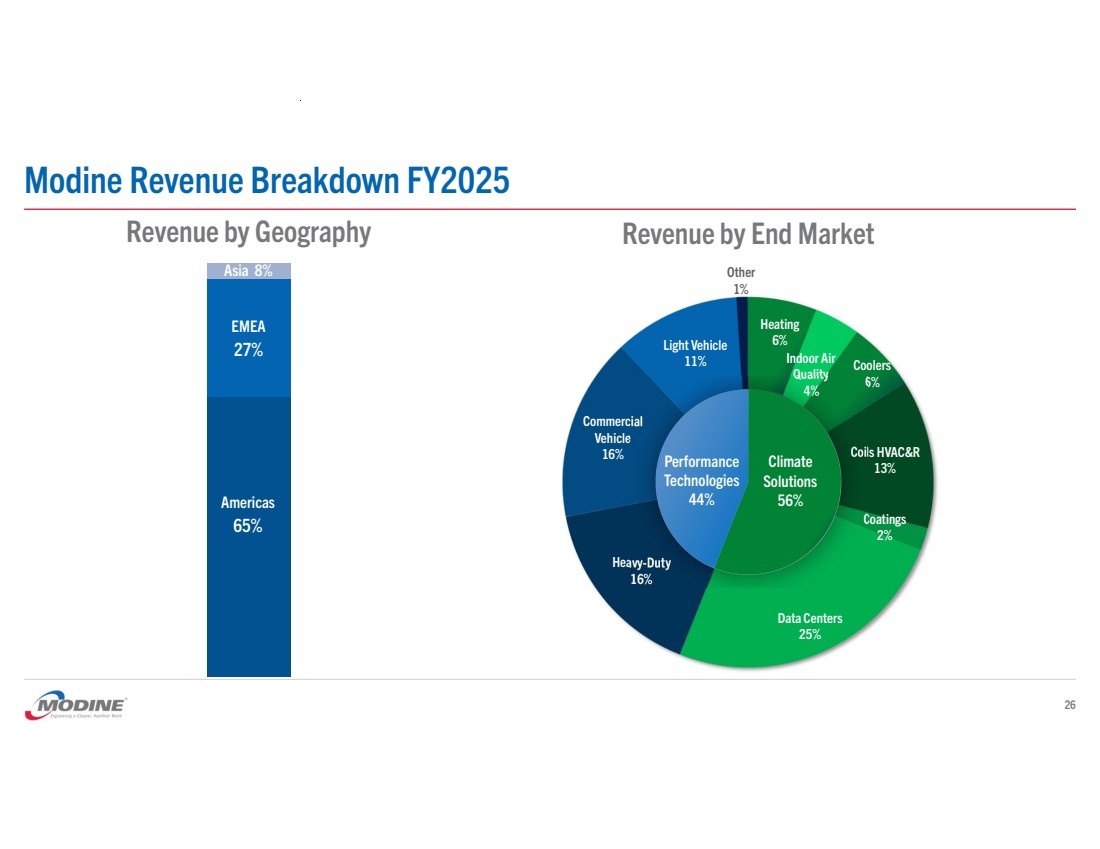

| Modine Revenue Breakdown FY2025 26 Revenue by Geography Revenue by End Market Heating 6% Indoor Air Quality 4% Coolers 6% Coils HVAC&R 13% Coatings 2% Data Centers 25% Heavy-Duty 16% Commercial Vehicle 16% Light Vehicle 11% Other 1% Climate Solutions 56% Performance Technologies Americas 44% 65% EMEA 27% Asia 8% |

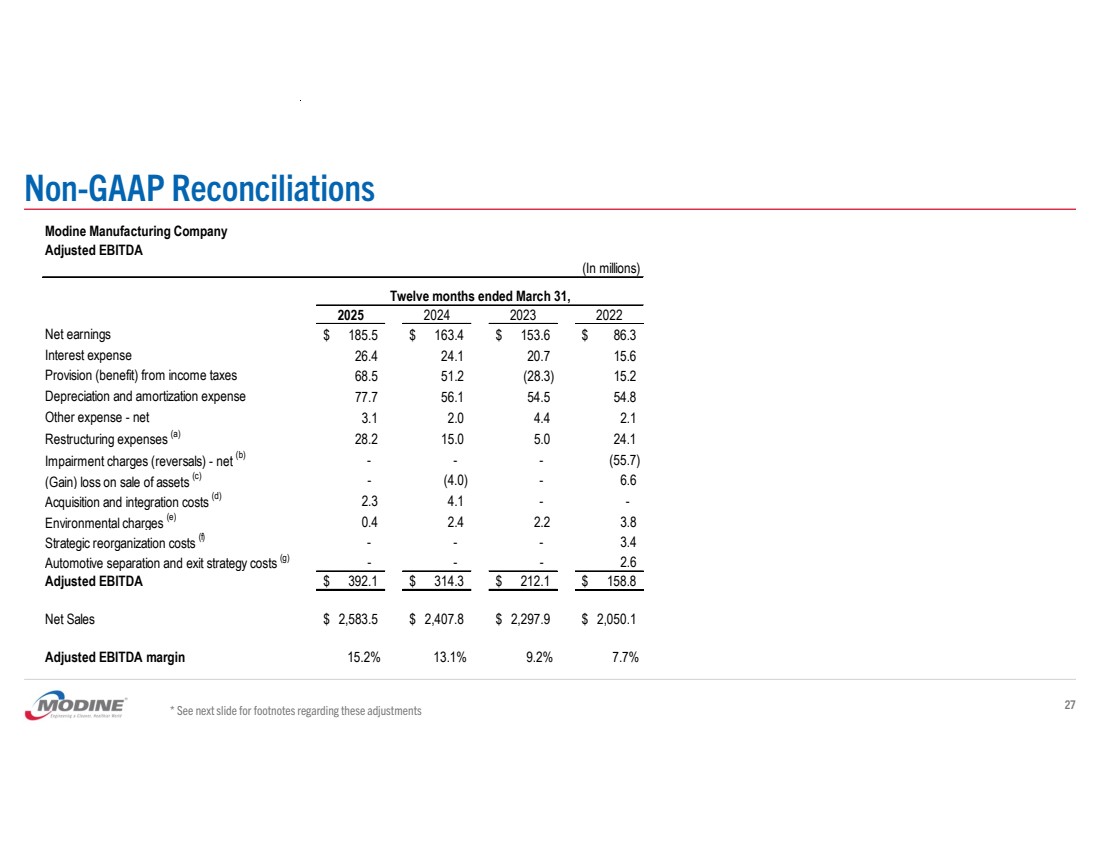

| Non-GAAP Reconciliations 27 * See next slide for footnotes regarding these adjustments Modine Manufacturing Company Adjusted EBITDA (In millions) 2025 2024 2023 2022 Net earnings $ 185.5 $ 163.4 $ 153.6 $ 86.3 Interest expense 26.4 24.1 20.7 15.6 Provision (benefit) from income taxes 68.5 51.2 (28.3) 15.2 Depreciation and amortization expense 77.7 56.1 54.5 54.8 Other expense - net 3.1 2.0 4.4 2.1 Restructuring expenses (a) 28.2 15.0 5.0 24.1 Impairment charges (reversals) - net (b) - - - (55.7) (Gain) loss on sale of assets (c) - (4.0) - 6.6 Acquisition and integration costs (d) 2.3 4.1 - - Environmental charges (e) 0.4 2.4 2.2 3.8 Strategic reorganization costs (f) - - - 3.4 Automotive separation and exit strategy costs (g) - - - 2.6 Adjusted EBITDA $ 392.1 $ 314.3 $ 212.1 $ 158.8 Net Sales $ 2,583.5 $ 2,407.8 $ 2,297.9 $ 2,050.1 Adjusted EBITDA margin 15.2% 13.1% 9.2% 7.7% Twelve months ended March 31, |

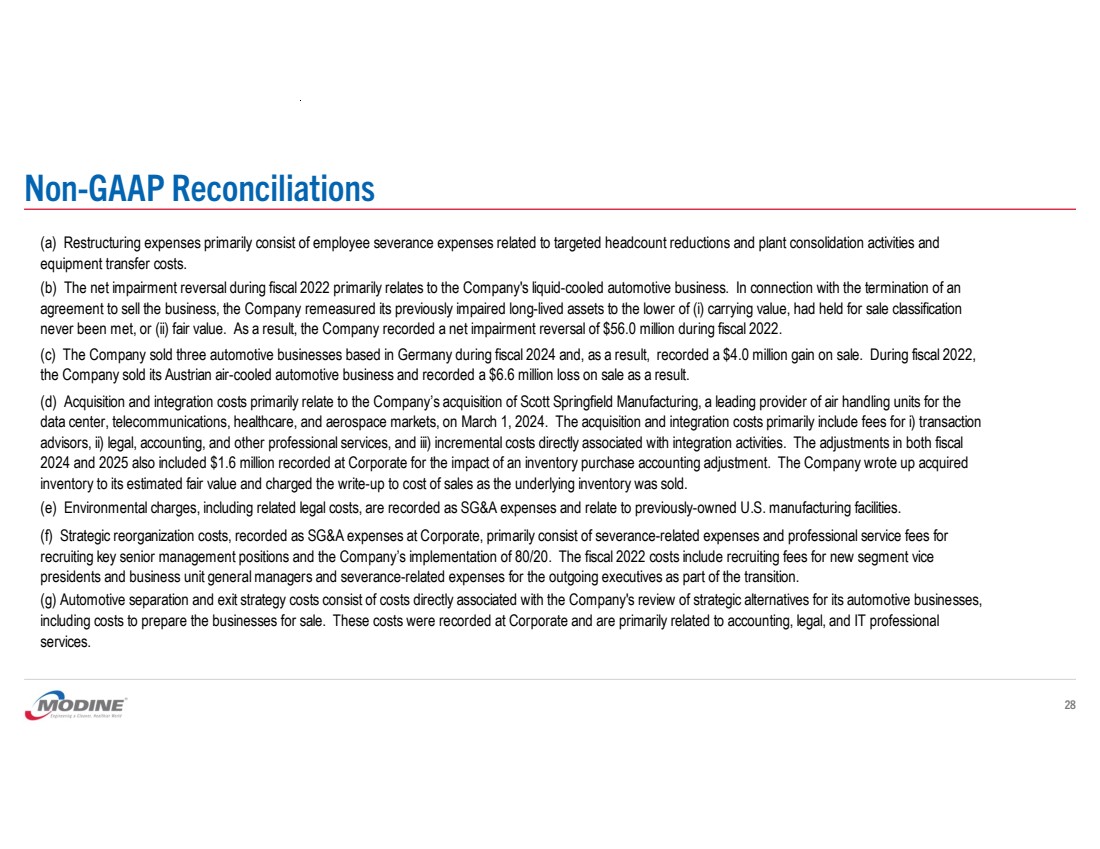

| Non-GAAP Reconciliations 28 (f) Strategic reorganization costs, recorded as SG&A expenses at Corporate, primarily consist of severance-related expenses and professional service fees for recruiting key senior management positions and the Company’s implementation of 80/20. The fiscal 2022 costs include recruiting fees for new segment vice presidents and business unit general managers and severance-related expenses for the outgoing executives as part of the transition. (g) Automotive separation and exit strategy costs consist of costs directly associated with the Company's review of strategic alternatives for its automotive businesses, including costs to prepare the businesses for sale. These costs were recorded at Corporate and are primarily related to accounting, legal, and IT professional services. (a) Restructuring expenses primarily consist of employee severance expenses related to targeted headcount reductions and plant consolidation activities and equipment transfer costs. (e) Environmental charges, including related legal costs, are recorded as SG&A expenses and relate to previously-owned U.S. manufacturing facilities. (b) The net impairment reversal during fiscal 2022 primarily relates to the Company's liquid-cooled automotive business. In connection with the termination of an agreement to sell the business, the Company remeasured its previously impaired long-lived assets to the lower of (i) carrying value, had held for sale classification never been met, or (ii) fair value. As a result, the Company recorded a net impairment reversal of $56.0 million during fiscal 2022. (d) Acquisition and integration costs primarily relate to the Company’s acquisition of Scott Springfield Manufacturing, a leading provider of air handling units for the data center, telecommunications, healthcare, and aerospace markets, on March 1, 2024. The acquisition and integration costs primarily include fees for i) transaction advisors, ii) legal, accounting, and other professional services, and iii) incremental costs directly associated with integration activities. The adjustments in both fiscal 2024 and 2025 also included $1.6 million recorded at Corporate for the impact of an inventory purchase accounting adjustment. The Company wrote up acquired inventory to its estimated fair value and charged the write-up to cost of sales as the underlying inventory was sold. (c) The Company sold three automotive businesses based in Germany during fiscal 2024 and, as a result, recorded a $4.0 million gain on sale. During fiscal 2022, the Company sold its Austrian air-cooled automotive business and recorded a $6.6 million loss on sale as a result. |

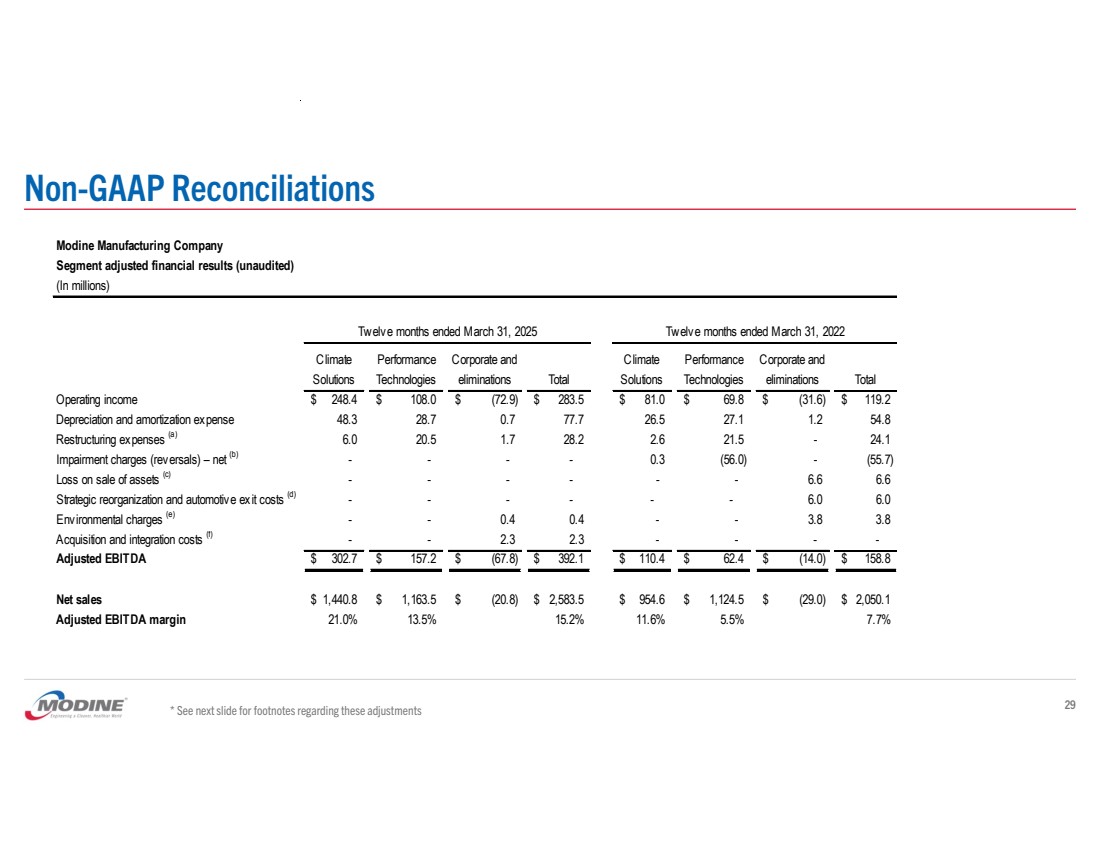

| Non-GAAP Reconciliations 29 * See next slide for footnotes regarding these adjustments Modine Manufacturing Company Segment adjusted financial results (unaudited) (In millions) Climate Solutions Performance Technologies Corporate and eliminations Total Climate Solutions Performance Technologies Corporate and eliminations Total Operating income $ 248.4 $ 108.0 $ (72.9) $ 283.5 $ 81.0 $ 69.8 $ (31.6) $ 119.2 Depreciation and amortization expense 48.3 28.7 0.7 77.7 26.5 27.1 1.2 54.8 Restructuring expenses (a) 6.0 20.5 1.7 28.2 2.6 21.5 - 24.1 Impairment charges (reversals) – net (b) - - - - 0.3 (56.0) - (55.7) Loss on sale of assets (c) - - - - - - 6.6 6.6 Strategic reorganization and automotive exit costs (d) - - - - - - 6.0 6.0 Environmental charges (e) - - 0.4 0.4 - - 3.8 3.8 Acquisition and integration costs (f) - - 2.3 2.3 - - - - Adjusted EBITDA $ 302.7 $ 157.2 $ (67.8) $ 392.1 $ 110.4 $ 62.4 $ (14.0) $ 158.8 Net sales $ 1,440.8 $ 1,163.5 $ (20.8) $ 2,583.5 $ 954.6 $ 1,124.5 $ (29.0) $ 2,050.1 Adjusted EBITDA margin 21.0% 13.5% 15.2% 11.6% 5.5% 7.7% Twelve months ended March 31, 2025 Twelve months ended March 31, 2022 |

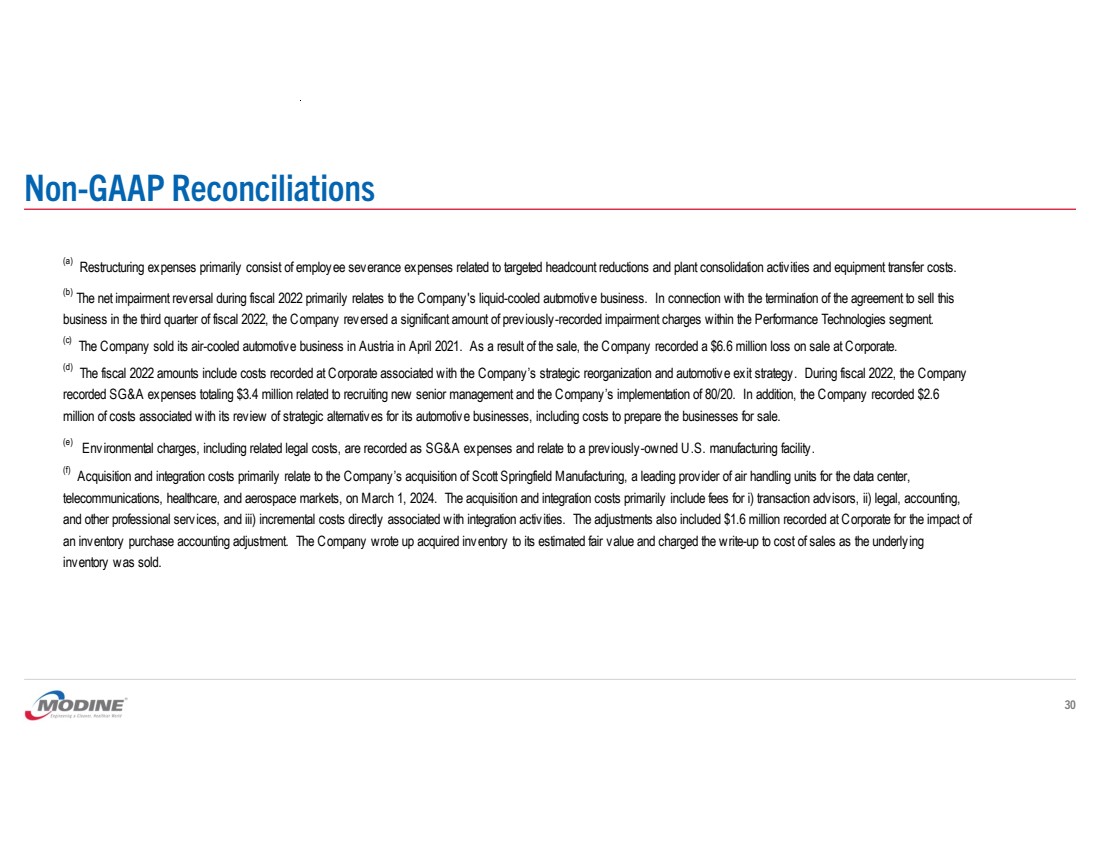

| Non-GAAP Reconciliations 30 (f) Acquisition and integration costs primarily relate to the Company’s acquisition of Scott Springfield Manufacturing, a leading provider of air handling units for the data center, telecommunications, healthcare, and aerospace markets, on March 1, 2024. The acquisition and integration costs primarily include fees for i) transaction advisors, ii) legal, accounting, and other professional services, and iii) incremental costs directly associated with integration activities. The adjustments also included $1.6 million recorded at Corporate for the impact of an inventory purchase accounting adjustment. The Company wrote up acquired inventory to its estimated fair value and charged the write-up to cost of sales as the underlying inventory was sold. (a) Restructuring expenses primarily consist of employee severance expenses related to targeted headcount reductions and plant consolidation activities and equipment transfer costs. (b) The net impairment reversal during fiscal 2022 primarily relates to the Company's liquid-cooled automotive business. In connection with the termination of the agreement to sell this business in the third quarter of fiscal 2022, the Company reversed a significant amount of previously-recorded impairment charges within the Performance Technologies segment. (c) The Company sold its air-cooled automotive business in Austria in April 2021. As a result of the sale, the Company recorded a $6.6 million loss on sale at Corporate. (d) The fiscal 2022 amounts include costs recorded at Corporate associated with the Company’s strategic reorganization and automotive exit strategy. During fiscal 2022, the Company recorded SG&A expenses totaling $3.4 million related to recruiting new senior management and the Company’s implementation of 80/20. In addition, the Company recorded $2.6 million of costs associated with its review of strategic alternatives for its automotive businesses, including costs to prepare the businesses for sale. (e) Environmental charges, including related legal costs, are recorded as SG&A expenses and relate to a previously-owned U.S. manufacturing facility. |

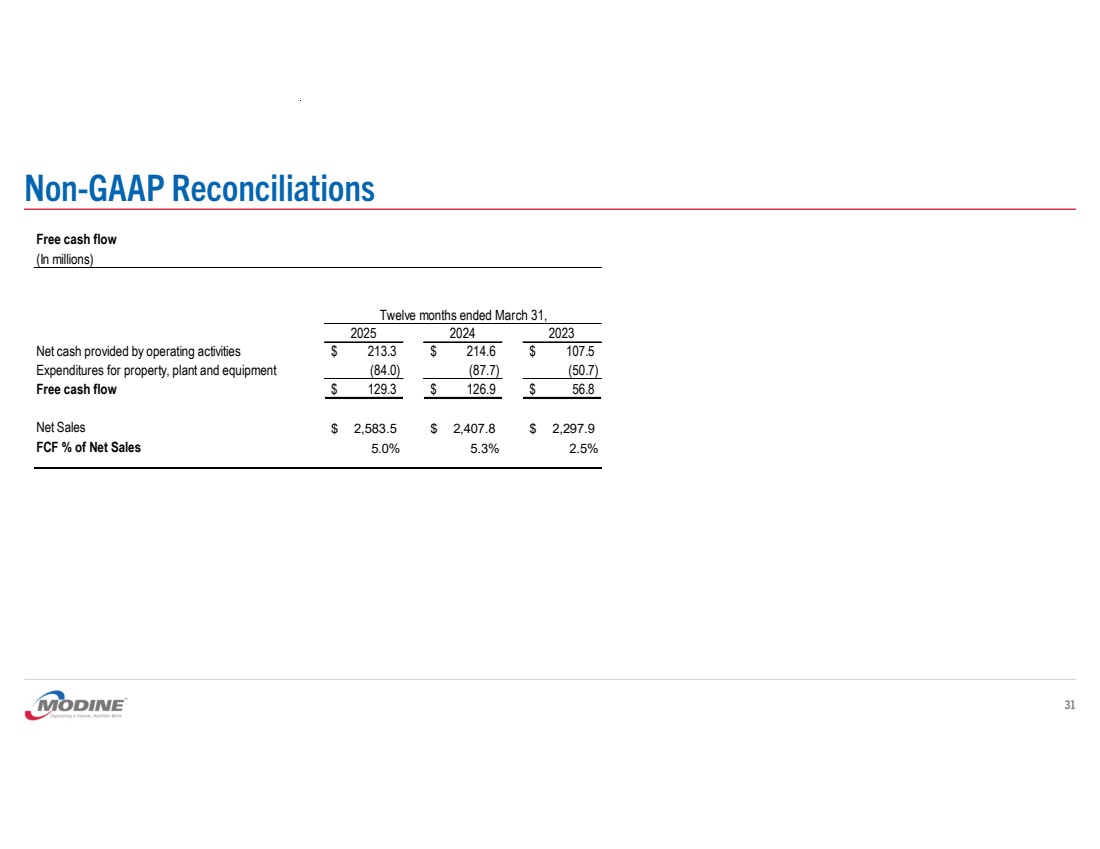

| Non-GAAP Reconciliations 31 Free cash flow (In millions) 2025 2024 2023 Net cash provided by operating activities $ 213.3 $ 214.6 $ 107.5 Expenditures for property, plant and equipment (84.0) (87.7) (50.7) Free cash flow $ 129.3 $ 126.9 $ 56.8 Net Sales $ 2,583.5 $ 2,407.8 $ 2,297.9 FCF % of Net Sales 5.0% 5.3% 2.5% Twelve months ended March 31, |

| Forward-Looking Non-GAAP Financial Measures 32 This presentation includes forward-looking projections of non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, and free cash flow. The projections are based on management’s expectations of future financial results. For example, the Company’s fiscal 2026 guidance includes adjusted EBITDA, which is a non-GAAP financial measure. The full-year fiscal 2026 guidance includes the Company’s estimates for interest expense of approximately $30 to $34 million, a provision for income taxes of approximately $72 to $76 million, and depreciation and amortization expense of approximately $77 to $82 million. The non-GAAP financial measure also excludes certain cash and non-cash expenses or gains. These expenses and gains may be significant and include items such as restructuring expenses (including severance and equipment transfer costs), impairment charges, pension termination charges, acquisition and disposition costs, and certain other items. Estimates of other expenses and gains for the remainder of fiscal 2026 that will be excluded for the non-GAAP financial measure are not available due to the low visibility and unpredictability of these items. |