Acquisition of CenterPoint’s Ohio Gas Utility Business October 21, 2025 .2

Safe Harbor For Forward-Looking Statements This presentation contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including statements regarding the impact of National Fuel Gas Company’s (“National Fuel” or the “Company”) planned acquisition of the Ohio gas utility business of CenterPoint Energy, Inc., and statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar expressions. All statements other than statements of historical fact, including statements concerning plans, objectives, goals, projections, strategies, future events or performance and underlying assumptions, are forward-looking statements. Actual outcomes or results may differ materially from the forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and other factors, including, but not limited to, conditions to the completion of the transaction, such as receipt of required regulatory clearance not being satisfied; closing of the transaction being delayed or not occurring at all; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the purchase agreement; the inability of National Fuel to obtain financing, including permanent financing on acceptable terms or at all; National Fuel being unable to achieve the anticipated strategic, financial and other benefits of the transaction; the acquired business not performing as expected; National Fuel assuming unexpected risks, liabilities and obligations of the acquired business; significant transaction costs associated with the transaction; the risk that disruptions from the transaction will harm the businesses, including current plans and operations; the ability to retain and/or hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; and other factors relating to operations and financial performance discussed in National Fuel’s filings with the SEC. It is not possible to predict or identify all risk factors. Consequently, the foregoing list should not be considered to be a complete set of all potential uncertainties or risk factors. More complete descriptions and listings of these uncertainties and risk factors can be found in our Annual Report on Form 10-K for the year ended September 30, 2024 and in subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K. You should consider all risks, uncertainties and other factors identified above and in those SEC reports carefully when evaluating the forward-looking statements in this presentation. Although the forward-looking statements contained in this presentation are based on expectations, beliefs and projections expressed in good faith and believed by National Fuel to have a reasonable basis, there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. Such forward-looking statements are made based on information available as of the date of this presentation, and, except as required by law, National Fuel undertakes no obligation to, and expressly disclaims any obligation to, revise or update such statements to reflect new information or subsequent events or circumstances.

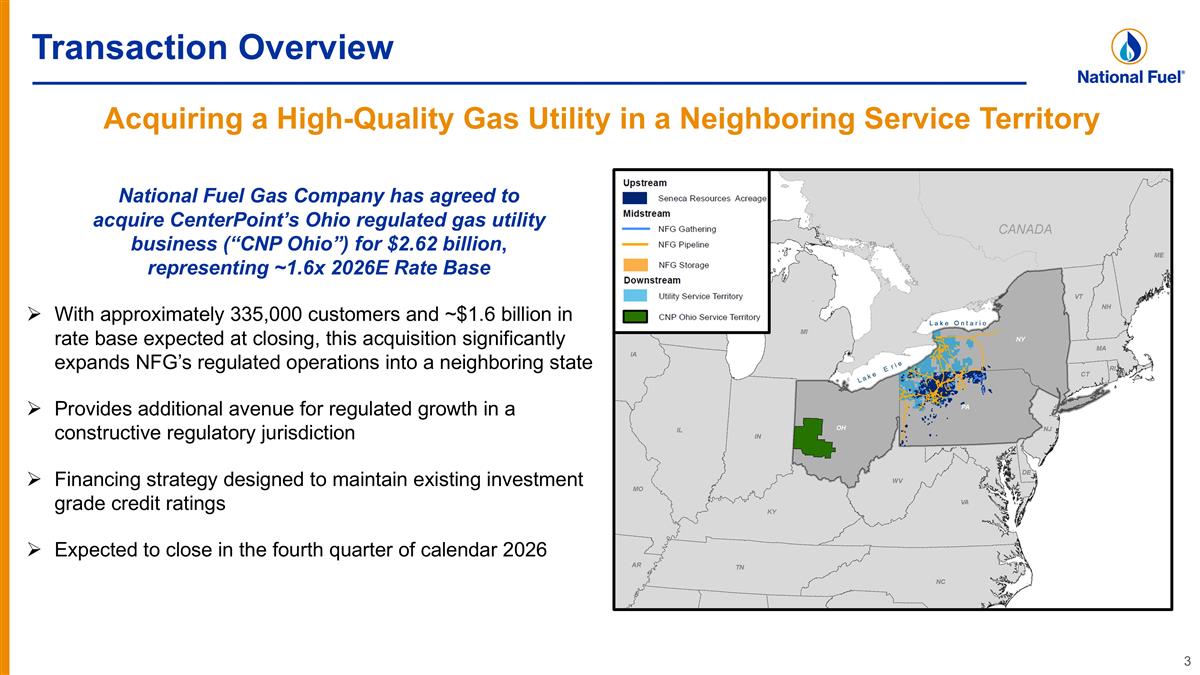

Transaction Overview Acquiring a High-Quality Gas Utility in a Neighboring Service Territory National Fuel Gas Company has agreed to acquire CenterPoint’s Ohio regulated gas utility business (“CNP Ohio”) for $2.62 billion, representing ~1.6x 2026E Rate Base With approximately 335,000 customers and ~$1.6 billion in rate base expected at closing, this acquisition significantly expands NFG’s regulated operations into a neighboring state Provides additional avenue for regulated growth in a constructive regulatory jurisdiction Financing strategy designed to maintain existing investment grade credit ratings Expected to close in the fourth quarter of calendar 2026

CenterPoint Ohio Acquisition Delivers Significant Value Increases Scale & Balances Business Mix National Fuel will now serve ~1.1 million customers and is doubling its gas utility rate base, adding stable, predictable rate-regulated earnings and cash flows Attractive Regulatory & Political Environment Diversifies utility operations into Ohio, which offers constructive ratemaking and policies supportive of natural gas Enhances Regulated Earnings Growth & Dividend Support Increase in regulated earnings and the ability to further invest in CNP Ohio over the long-term enhances NFG’s ability to continue to deliver on its long track-record of dividend growth, which now stands at 55 years ✓ ✓ ✓ ✓ Significantly Increases Regulated Investment Opportunity With $900 million of capital spending expected over the next five years, the reinvestment of free cash flow from National Fuel’s upstream and gathering operations into growing rate base is accretive to long-term earnings and shareholder value ✓ Strong Pro-forma Credit Profile Increased regulated earnings, high cash flow conversion from CNP Ohio’s current ratemaking construct, and prudent financing strategy support existing investment grade credit ratings ✓ Accretive to Earnings per Share Immediately accretive to regulated earnings, with consolidated adjusted operating results expected to be neutral in fiscal 2028, the first complete year after closing, and accretive thereafter(1) (1) Excluding acquisition-related costs. Based on current natural gas strip.

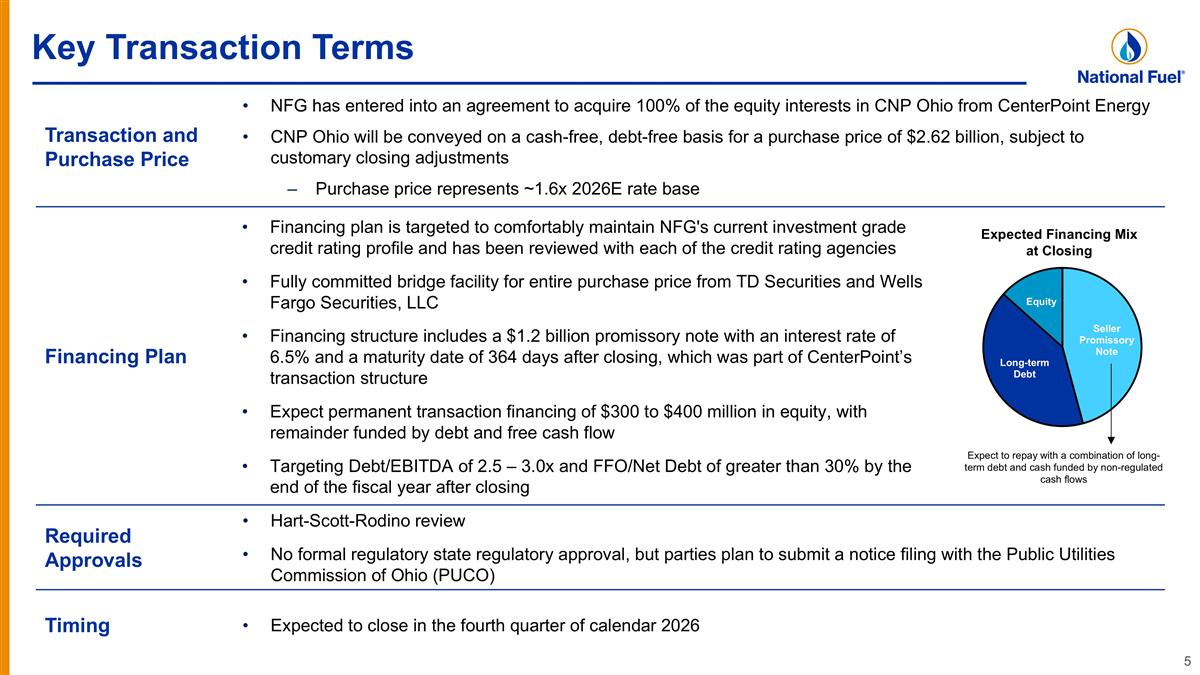

Key Transaction Terms Transaction and Purchase Price NFG has entered into an agreement to acquire 100% of the equity interests in CNP Ohio from CenterPoint Energy CNP Ohio will be conveyed on a cash-free, debt-free basis for a purchase price of $2.62 billion, subject to customary closing adjustments Purchase price represents ~1.6x 2026E rate base Financing Plan Required Approvals Hart-Scott-Rodino review No formal regulatory state regulatory approval, but parties plan to submit a notice filing with the Public Utilities Commission of Ohio (PUCO) Timing Expected to close in the fourth quarter of calendar 2026 Expected Financing Mix at Closing Financing plan is targeted to comfortably maintain NFG's current investment grade credit rating profile and has been reviewed with each of the credit rating agencies Fully committed bridge facility for entire purchase price from TD Securities and Wells Fargo Securities, LLC Financing structure includes a $1.2 billion promissory note with an interest rate of 6.5% and a maturity date of 364 days after closing, which was part of CenterPoint’s transaction structure Expect permanent transaction financing of $300 to $400 million in equity, with remainder funded by debt and free cash flow Targeting Debt/EBITDA of 2.5 – 3.0x and FFO/Net Debt of greater than 30% by the end of the fiscal year after closing

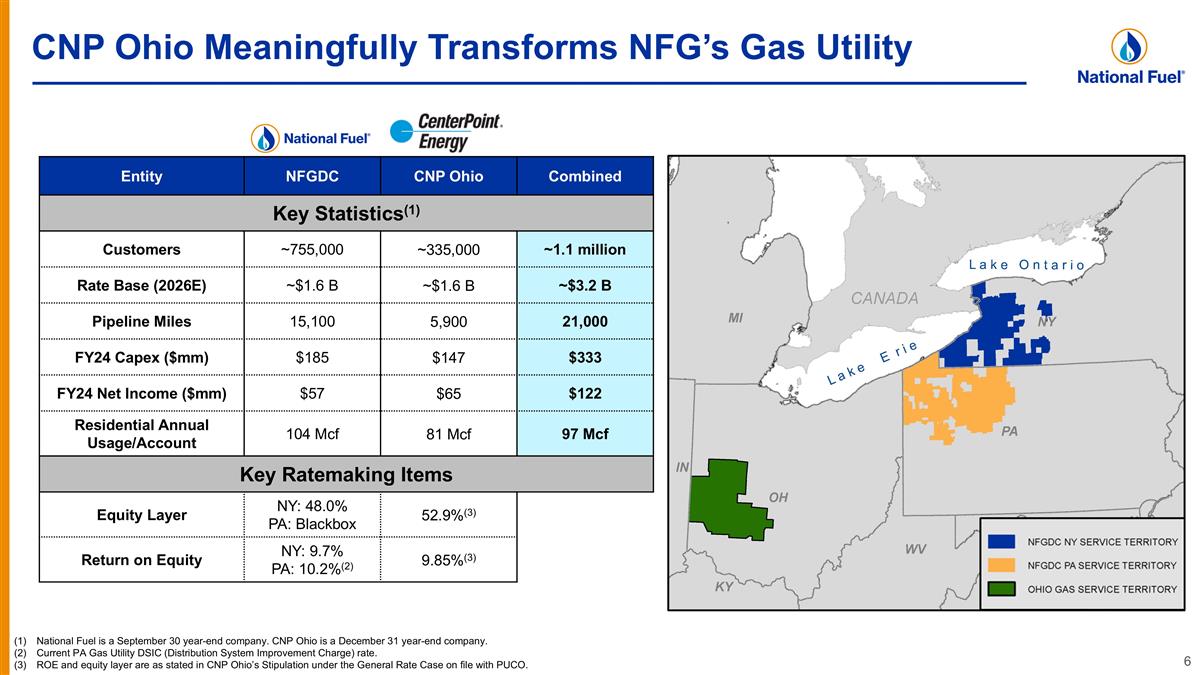

CNP Ohio Meaningfully Transforms NFG’s Gas Utility National Fuel is a September 30 year-end company. CNP Ohio is a December 31 year-end company. Current PA Gas Utility DSIC (Distribution System Improvement Charge) rate. ROE and equity layer are as stated in CNP Ohio’s Stipulation under the General Rate Case on file with PUCO. Entity NFGDC CNP Ohio Combined Key Statistics(1) Customers ~755,000 ~335,000 ~1.1 million Rate Base (2026E) ~$1.6 B ~$1.6 B ~$3.2 B Pipeline Miles 15,100 5,900 21,000 FY24 Capex ($mm) $185 $147 $333 FY24 Net Income ($mm) $57 $65 $122 Residential Annual Usage/Account 104 Mcf 81 Mcf 97 Mcf Key Ratemaking Items Equity Layer NY: 48.0% PA: Blackbox 52.9%(3) Return on Equity NY: 9.7% PA: 10.2%(2) 9.85%(3)

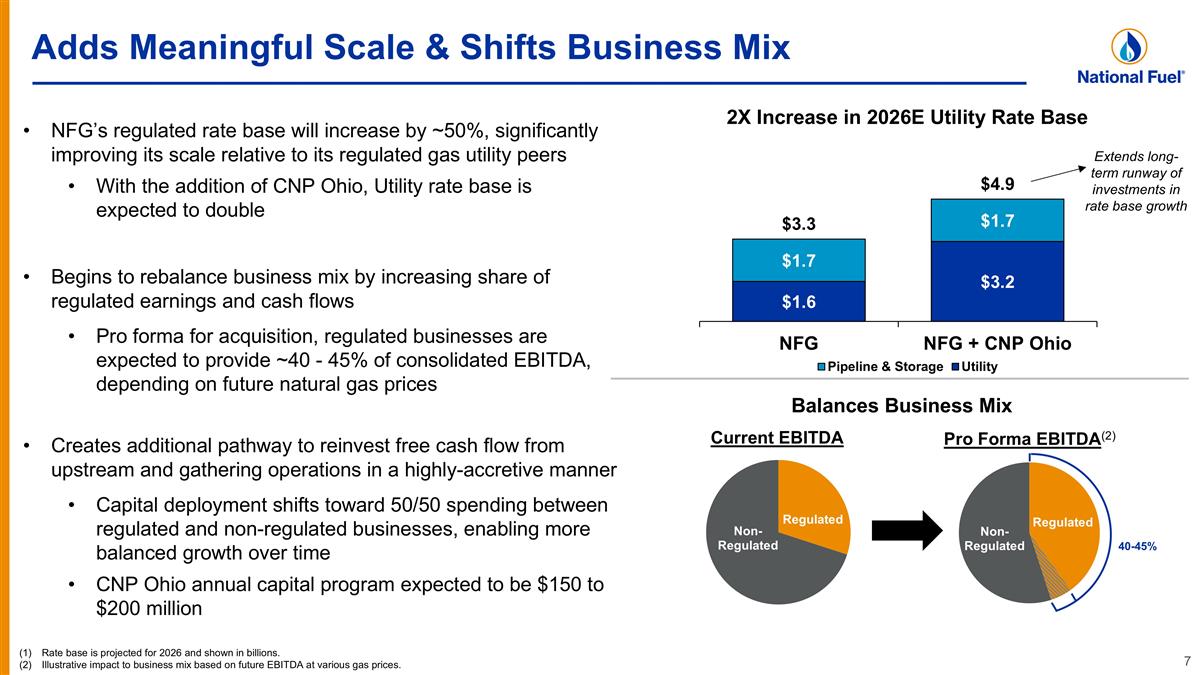

NFG’s regulated rate base will increase by ~50%, significantly improving its scale relative to its regulated gas utility peers With the addition of CNP Ohio, Utility rate base is expected to double Begins to rebalance business mix by increasing share of regulated earnings and cash flows Pro forma for acquisition, regulated businesses are expected to provide ~40 - 45% of consolidated EBITDA, depending on future natural gas prices Creates additional pathway to reinvest free cash flow from upstream and gathering operations in a highly-accretive manner Capital deployment shifts toward 50/50 spending between regulated and non-regulated businesses, enabling more balanced growth over time CNP Ohio annual capital program expected to be $150 to $200 million Adds Meaningful Scale & Shifts Business Mix Rate base is projected for 2026 and shown in billions. Illustrative impact to business mix based on future EBITDA at various gas prices. 2X Increase in 2026E Utility Rate Base Extends long-term runway of investments in rate base growth Balances Business Mix Current EBITDA Pro Forma EBITDA(2) 40-45%

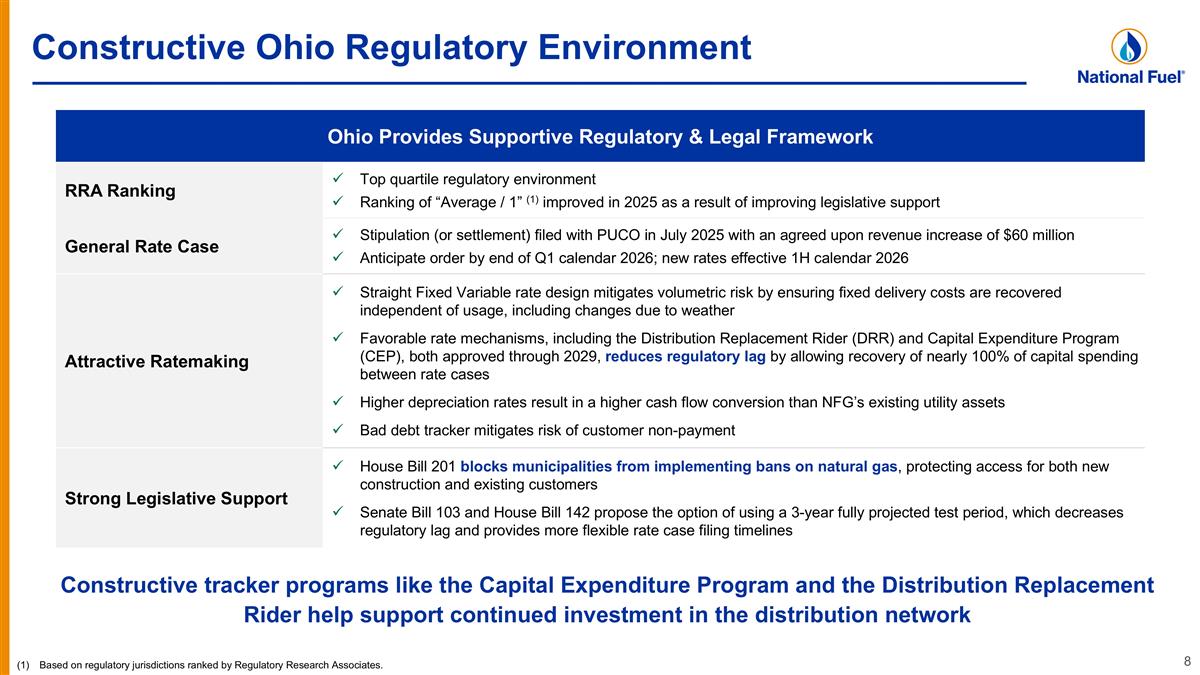

Constructive Ohio Regulatory Environment Based on regulatory jurisdictions ranked by Regulatory Research Associates. Ohio Provides Supportive Regulatory & Legal Framework RRA Ranking Top quartile regulatory environment Ranking of “Average / 1” (1) improved in 2025 as a result of improving legislative support General Rate Case Stipulation (or settlement) filed with PUCO in July 2025 with an agreed upon revenue increase of $60 million Anticipate order by end of Q1 calendar 2026; new rates effective 1H calendar 2026 Attractive Ratemaking Straight Fixed Variable rate design mitigates volumetric risk by ensuring fixed delivery costs are recovered independent of usage, including changes due to weather Favorable rate mechanisms, including the Distribution Replacement Rider (DRR) and Capital Expenditure Program (CEP), both approved through 2029, reduces regulatory lag by allowing recovery of nearly 100% of capital spending between rate cases Higher depreciation rates result in a higher cash flow conversion than NFG’s existing utility assets Bad debt tracker mitigates risk of customer non-payment Strong Legislative Support House Bill 201 blocks municipalities from implementing bans on natural gas, protecting access for both new construction and existing customers Senate Bill 103 and House Bill 142 propose the option of using a 3-year fully projected test period, which decreases regulatory lag and provides more flexible rate case filing timelines Constructive tracker programs like the Capital Expenditure Program and the Distribution Replacement Rider help support continued investment in the distribution network

Strategically Executing on NFG's Growth Strategy Transaction Executes on NFG's Growth Strategy Provides additional avenue for regulated earnings growth Enhances the outlook for continued dividend growth Immediately accretive to regulated earnings Consolidated adjusted earnings per share expected to be neutral in fiscal 2028, at current natural gas prices, and accretive thereafter Responsibly Reduce Emissions Rebalances the business mix Constructive regulatory environment in neighboring state Higher regulated earnings mix favorably impacts credit profile Prudent financing structure demonstrates commitment to maintaining NFG’s investment grade rating Supports Investment Grade Credit Rating Aligned with NFG’s Strategic Objectives Accretive to Earnings Per Share Supports Long-term Growth and Dividends