Investor Presentation Fiscal 2025 – 4th Quarter & Full Year Update November 5, 2025

National Fuel Gas Company Company Overview (3) Recent Highlights (6) Why National Fuel? (10) Financial Overview (15) Integrated Upstream & Gathering Highlights (19) Pipeline & Storage and Utility Highlights (30) Guidance & Other Financial Information (45)

Company Overview Left picture: Seneca Resources rig in Tioga County, PA. Right picture: Buffalo Bills’ New Highmark Stadium construction in Orchard Park, NY. Corporate HQ: Buffalo, NY ~2,300 employees NYSE: NFG Market Cap: ~$7.2B 123 Years of consecutive dividend payments 55 Years of consecutive dividend increases >10% Adjusted EPS Growth FY24-FY27E Investment Grade credit rating 25% reduction in methane emissions since 2020 Note: This presentation includes forward-looking statements. Please review the safe harbor for forward looking statements at the end of this presentation. Market capitalization is presented as of November 3, 2025.

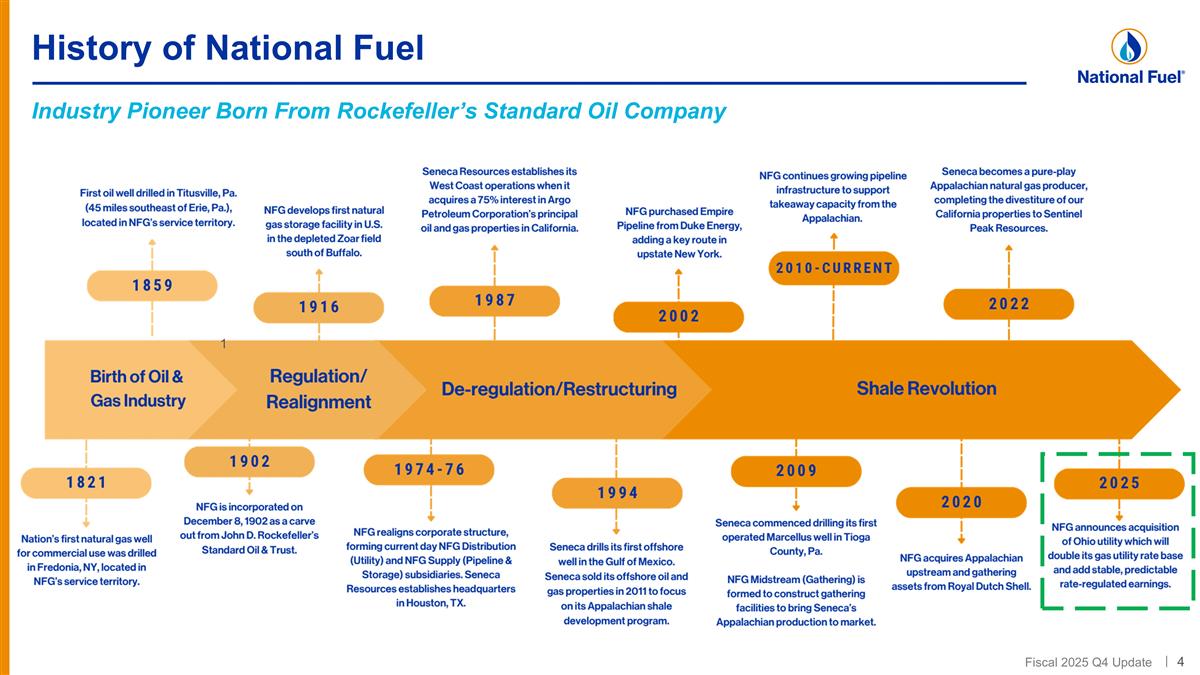

History of National Fuel Industry Pioneer Born From Rockefeller’s Standard Oil Company 4

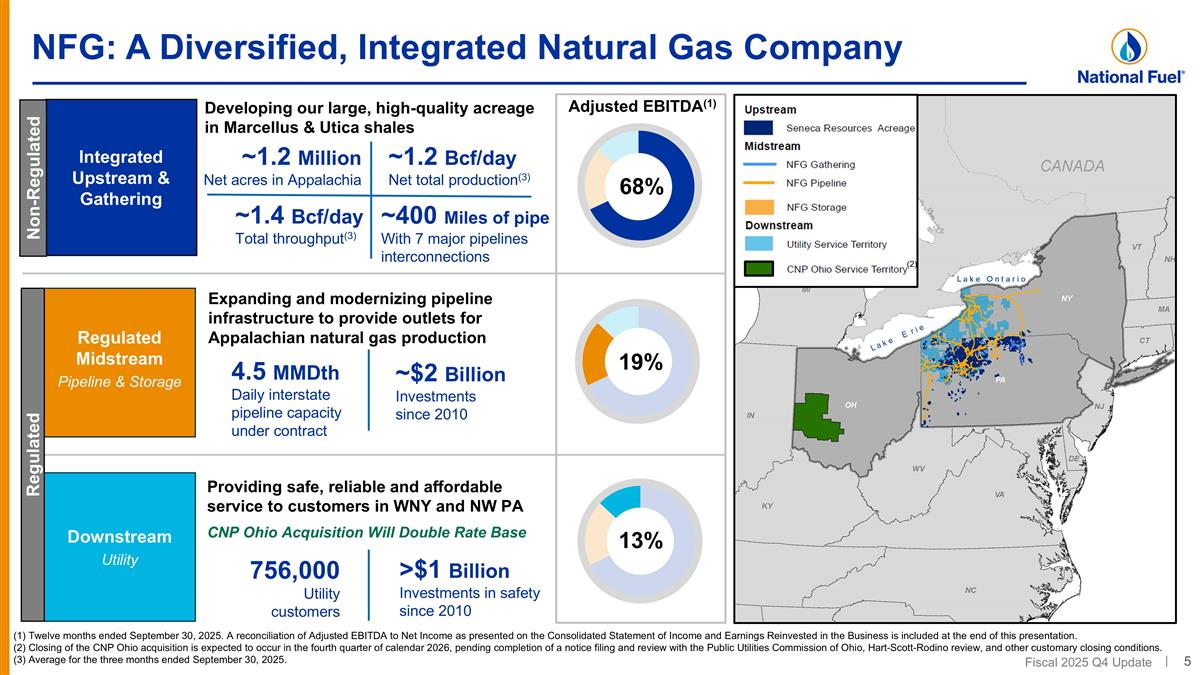

NFG: A Diversified, Integrated Natural Gas Company Developing our large, high-quality acreage in Marcellus & Utica shales Providing safe, reliable and affordable service to customers in WNY and NW PA CNP Ohio Acquisition Will Double Rate Base Integrated Upstream & Gathering Regulated Midstream Pipeline & Storage Downstream Utility Expanding and modernizing pipeline infrastructure to provide outlets for Appalachian natural gas production ~1.2 Million Net acres in Appalachia ~1.2 Bcf/day Net total production(3) ~$2 Billion Investments since 2010 4.5 MMDth Daily interstate pipeline capacity under contract 756,000 Utility customers >$1 Billion Investments in safety since 2010 68% 19% 13% Adjusted EBITDA(1) Non-Regulated Regulated ~1.4 Bcf/day Total throughput(3) ~400 Miles of pipe With 7 major pipelines interconnections (1) Twelve months ended September 30, 2025. A reconciliation of Adjusted EBITDA to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. (2) Closing of the CNP Ohio acquisition is expected to occur in the fourth quarter of calendar 2026, pending completion of a notice filing and review with the Public Utilities Commission of Ohio, Hart-Scott-Rodino review, and other customary closing conditions. (3) Average for the three months ended September 30, 2025. (2)

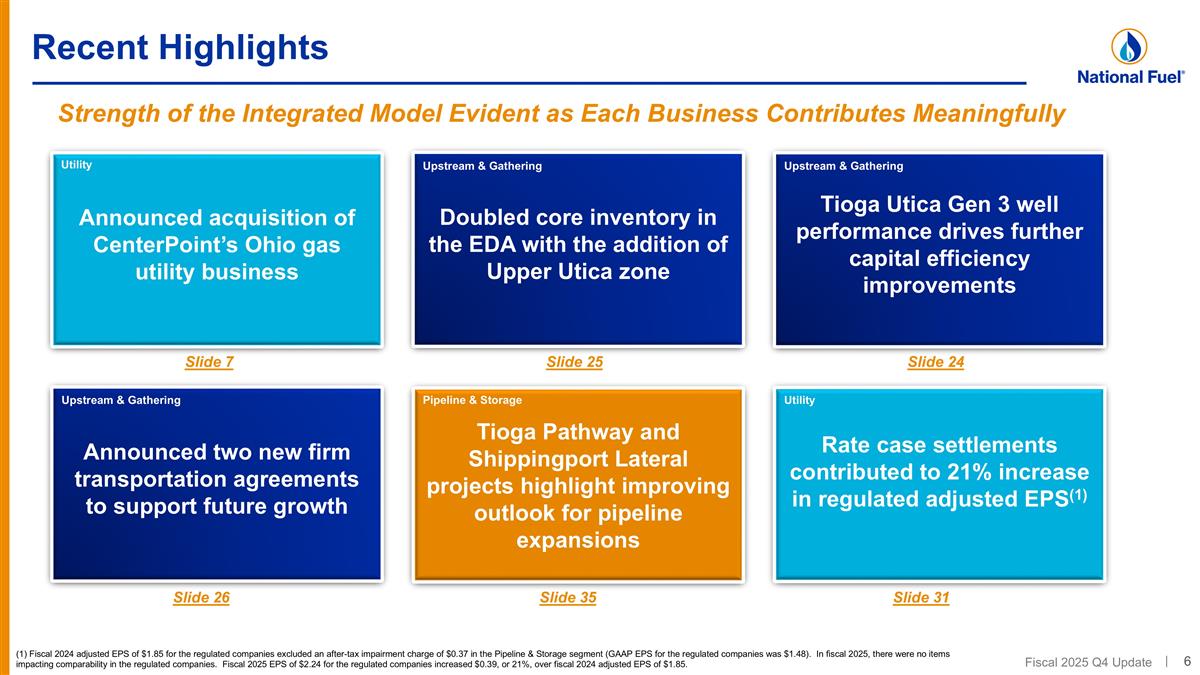

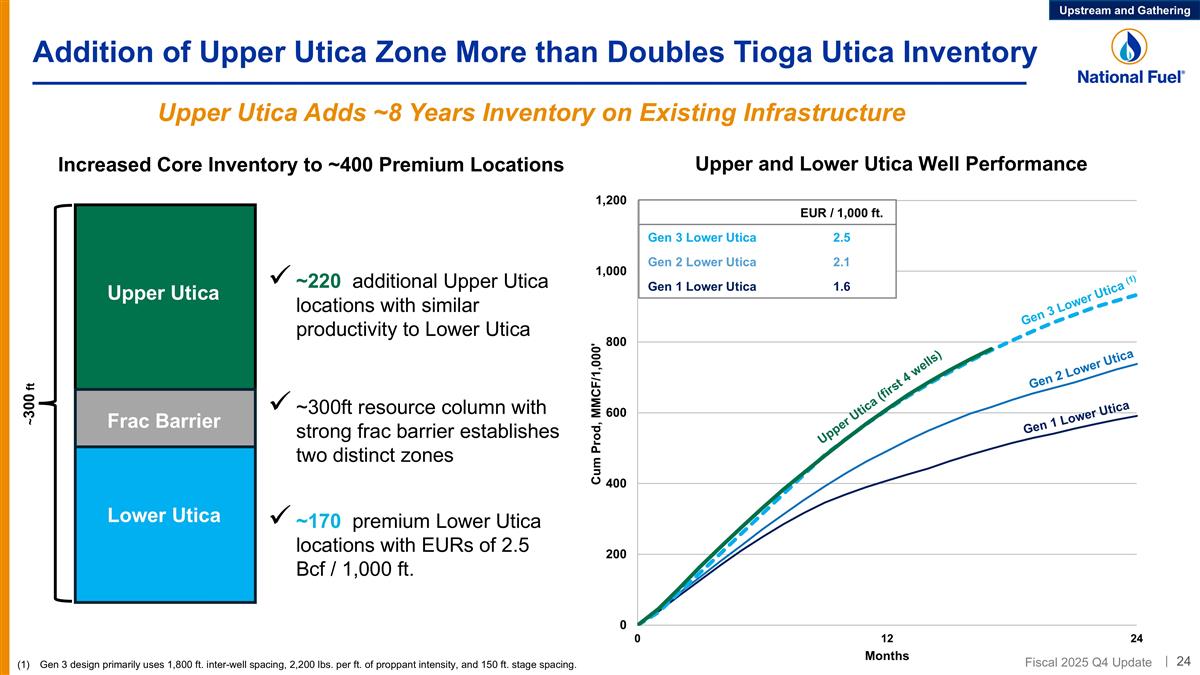

Recent Highlights Strength of the Integrated Model Evident as Each Business Contributes Meaningfully Announced two new firm transportation agreements to support future growth Doubled core inventory in the EDA with the addition of Upper Utica zone Tioga Pathway and Shippingport Lateral projects highlight improving outlook for pipeline expansions Rate case settlements contributed to 21% increase in regulated adjusted EPS(1) Slide 35 Announced acquisition of CenterPoint’s Ohio gas utility business Slide 7 Slide 31 Slide 26 Slide 25 Tioga Utica Gen 3 well performance drives further capital efficiency improvements Slide 24 Utility Utility Pipeline & Storage Upstream & Gathering Upstream & Gathering Upstream & Gathering (1) Fiscal 2024 adjusted EPS of $1.85 for the regulated companies excluded an after-tax impairment charge of $0.37 in the Pipeline & Storage segment (GAAP EPS for the regulated companies was $1.48). In fiscal 2025, there were no items impacting comparability in the regulated companies. Fiscal 2025 EPS of $2.24 for the regulated companies increased $0.39, or 21%, over fiscal 2024 adjusted EPS of $1.85.

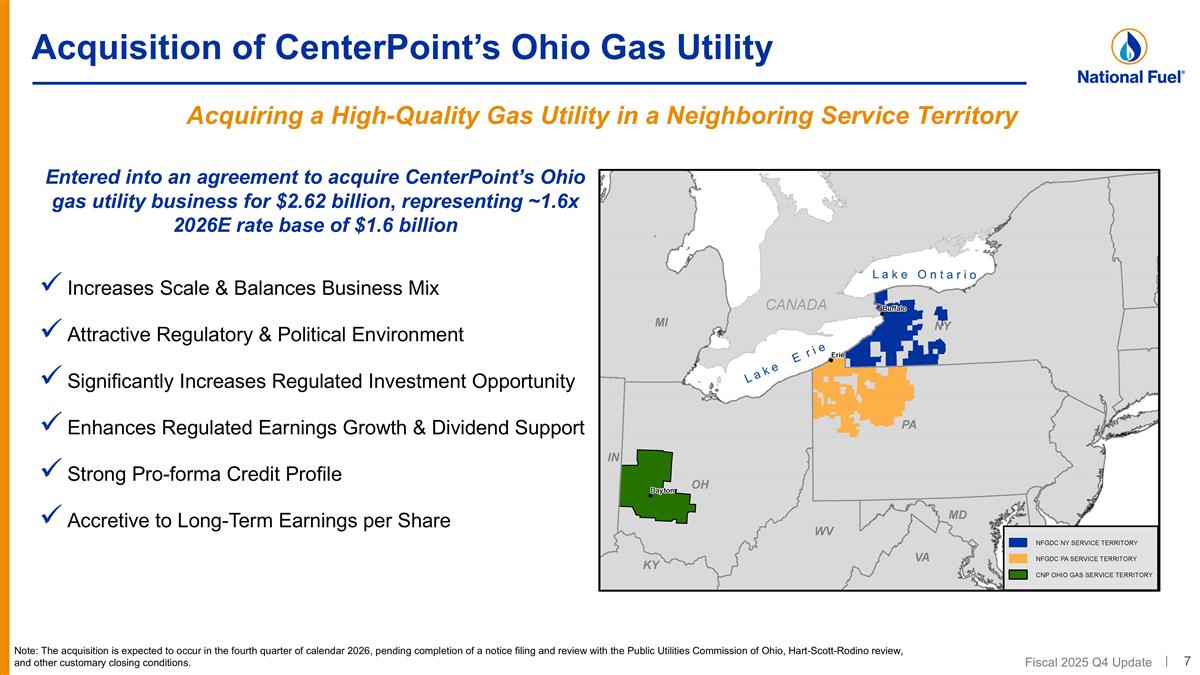

Acquisition of CenterPoint’s Ohio Gas Utility Acquiring a High-Quality Gas Utility in a Neighboring Service Territory Entered into an agreement to acquire CenterPoint’s Ohio gas utility business for $2.62 billion, representing ~1.6x 2026E rate base of $1.6 billion Increases Scale & Balances Business Mix Attractive Regulatory & Political Environment Significantly Increases Regulated Investment Opportunity Enhances Regulated Earnings Growth & Dividend Support Strong Pro-forma Credit Profile Accretive to Long-Term Earnings per Share Note: The acquisition is expected to occur in the fourth quarter of calendar 2026, pending completion of a notice filing and review with the Public Utilities Commission of Ohio, Hart-Scott-Rodino review, and other customary closing conditions.

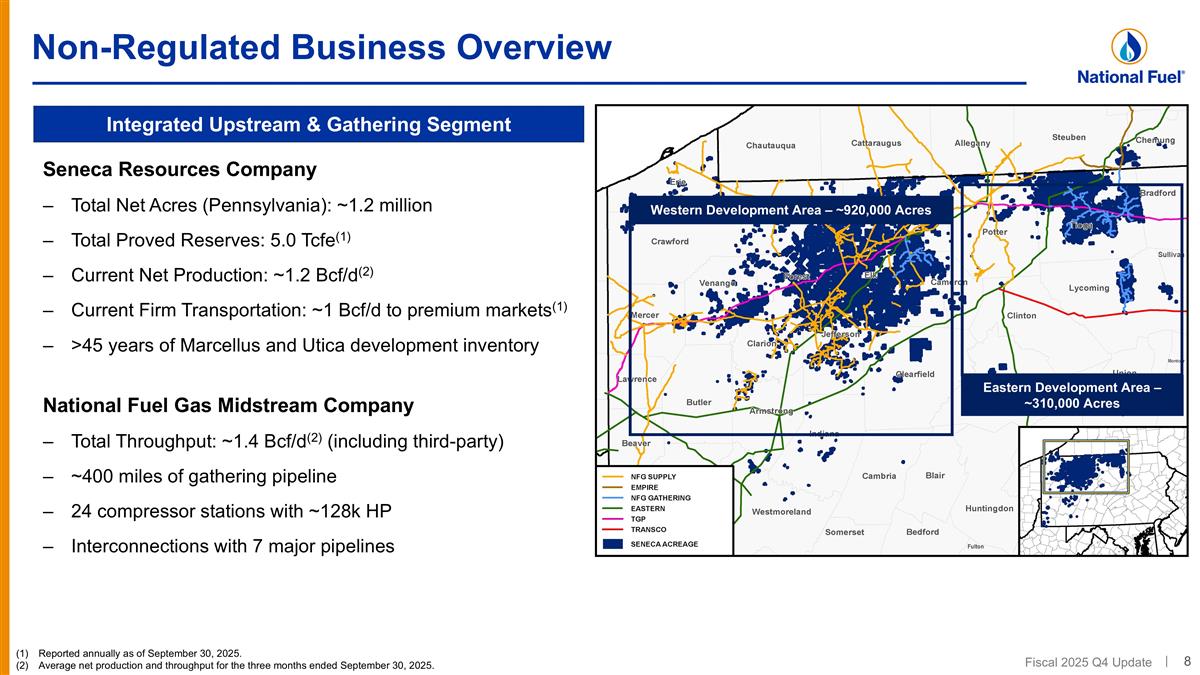

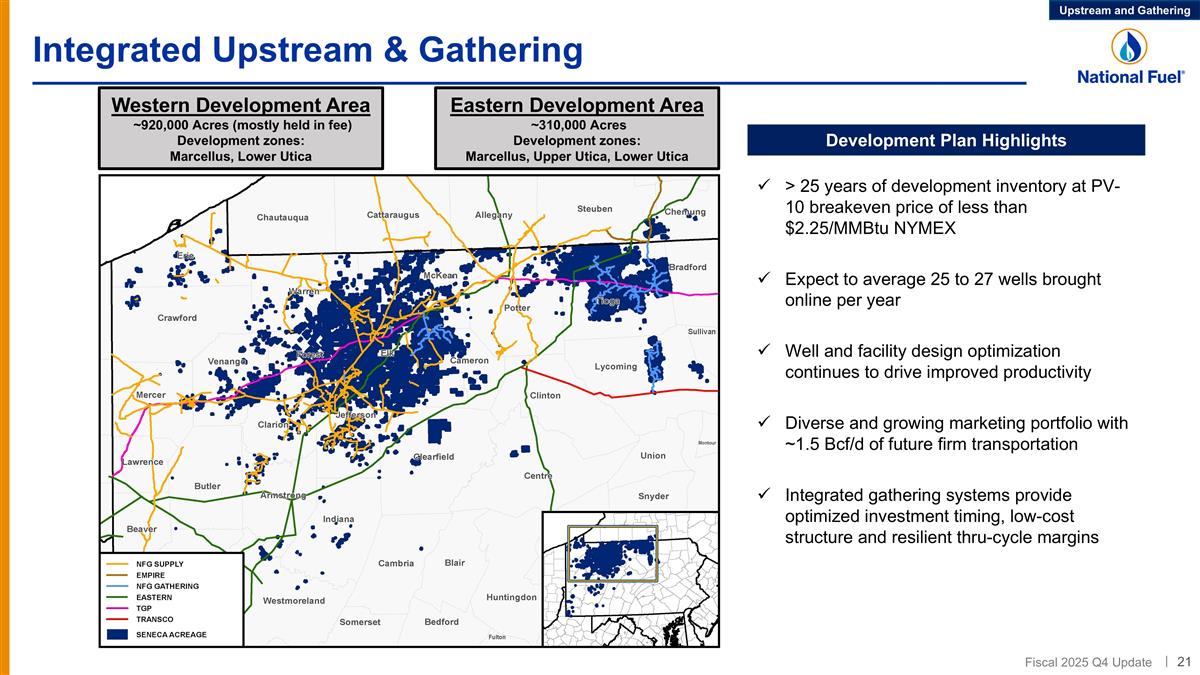

Western Development Area – ~920,000 Acres Eastern Development Area – ~310,000 Acres Non-Regulated Business Overview Reported annually as of September 30, 2025. Average net production and throughput for the three months ended September 30, 2025. Integrated Upstream & Gathering Segment Seneca Resources Company Total Net Acres (Pennsylvania): ~1.2 million Total Proved Reserves: 5.0 Tcfe(1) Current Net Production: ~1.2 Bcf/d(2) Current Firm Transportation: ~1 Bcf/d to premium markets(1) >45 years of Marcellus and Utica development inventory National Fuel Gas Midstream Company Total Throughput: ~1.4 Bcf/d(2) (including third-party) ~400 miles of gathering pipeline 24 compressor stations with ~128k HP Interconnections with 7 major pipelines

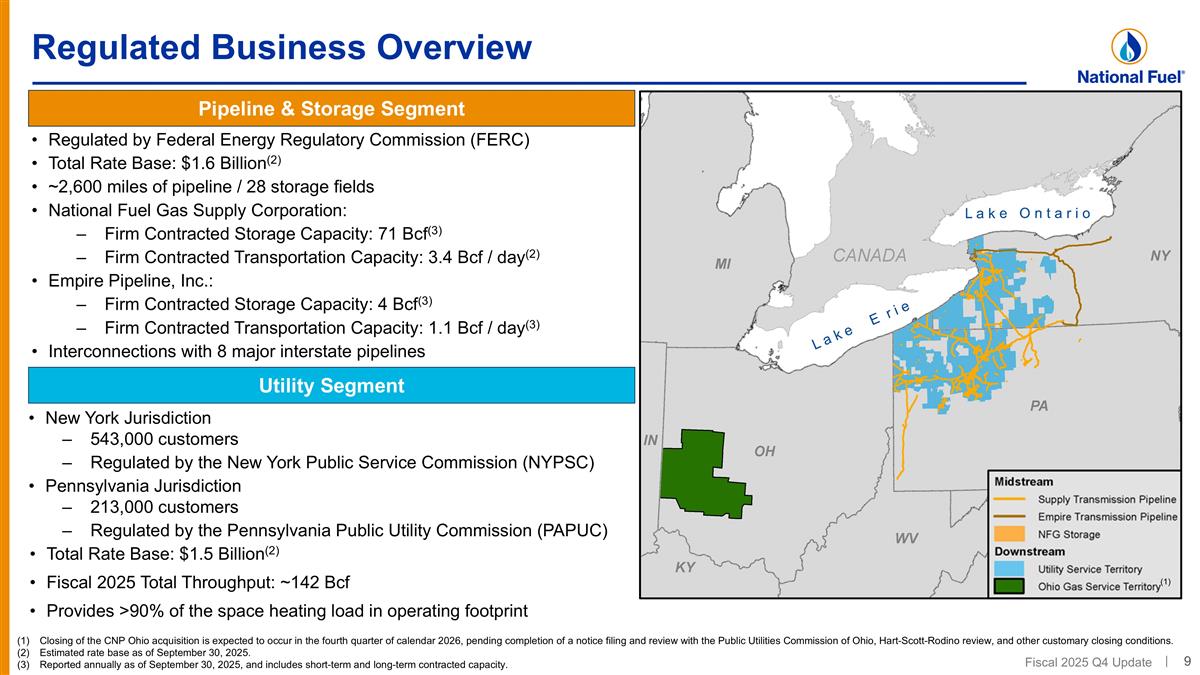

Regulated Business Overview Pipeline & Storage Segment Utility Segment Regulated by Federal Energy Regulatory Commission (FERC) Total Rate Base: $1.6 Billion(2) ~2,600 miles of pipeline / 28 storage fields National Fuel Gas Supply Corporation: Firm Contracted Storage Capacity: 71 Bcf(3) Firm Contracted Transportation Capacity: 3.4 Bcf / day(2) Empire Pipeline, Inc.: Firm Contracted Storage Capacity: 4 Bcf(3) Firm Contracted Transportation Capacity: 1.1 Bcf / day(3) Interconnections with 8 major interstate pipelines New York Jurisdiction 543,000 customers Regulated by the New York Public Service Commission (NYPSC) Pennsylvania Jurisdiction 213,000 customers Regulated by the Pennsylvania Public Utility Commission (PAPUC) Total Rate Base: $1.5 Billion(2) Fiscal 2025 Total Throughput: ~142 Bcf Provides >90% of the space heating load in operating footprint Closing of the CNP Ohio acquisition is expected to occur in the fourth quarter of calendar 2026, pending completion of a notice filing and review with the Public Utilities Commission of Ohio, Hart-Scott-Rodino review, and other customary closing conditions. Estimated rate base as of September 30, 2025. Reported annually as of September 30, 2025, and includes short-term and long-term contracted capacity. (1)

Why National Fuel? Optimized capital allocation Lower cost of capital Operational synergies Improved profitability Regulated earnings growth from modernization, expansion and Ohio utility acquisition Increasing free cash flow driven by improving upstream & gathering capital efficiencies Responsibly Reduce Emissions Continued progress toward emissions reduction targets Enhanced GHG disclosures on sustainability initiatives 123 consecutive years of dividend payments 55 consecutive years of dividend increases Long-Standing History of Shareholder Returns Responsibly Reducing Emissions Visibility on Long-Term EPS & FCF Growth Strong Integrated Returns

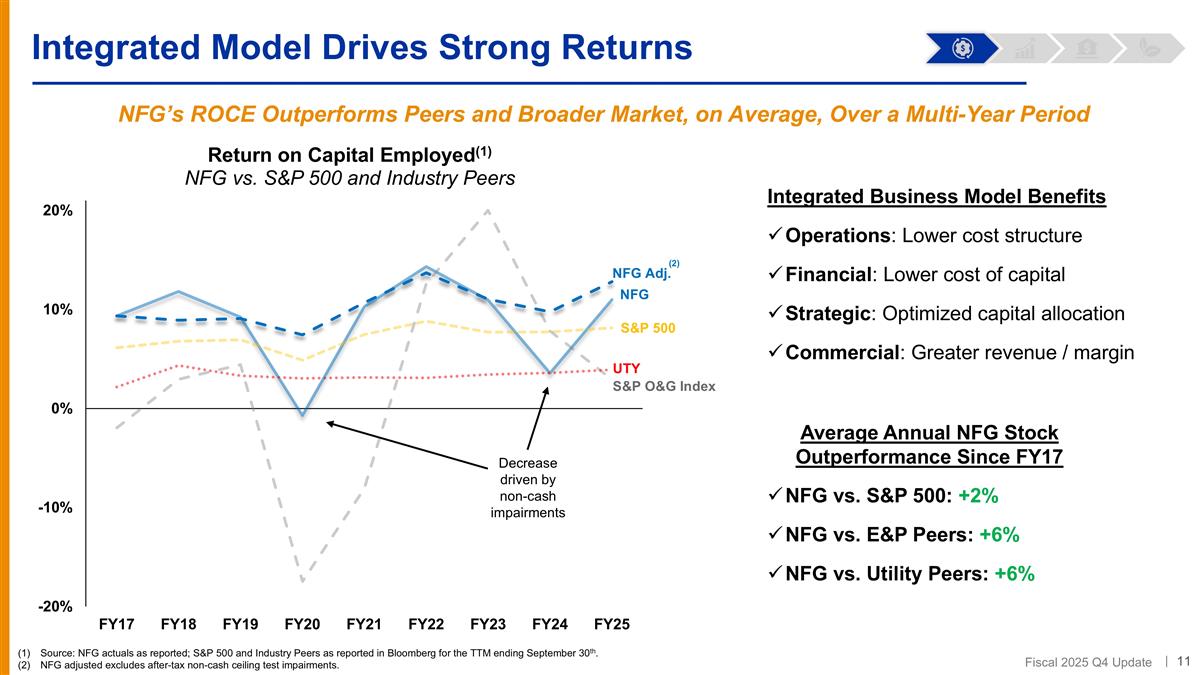

Integrated Model Drives Strong Returns Source: NFG actuals as reported; S&P 500 and Industry Peers as reported in Bloomberg for the TTM ending September 30th. NFG adjusted excludes after-tax non-cash ceiling test impairments. Average Annual NFG Stock Outperformance Since FY17 NFG vs. S&P 500: +2% NFG vs. E&P Peers: +6% NFG vs. Utility Peers: +6% NFG’s ROCE Outperforms Peers and Broader Market, on Average, Over a Multi-Year Period Decrease driven by non-cash impairments S&P O&G Index NFG S&P 500 UTY Integrated Business Model Benefits Operations: Lower cost structure Financial: Lower cost of capital Strategic: Optimized capital allocation Commercial: Greater revenue / margin NFG Adj. (2)

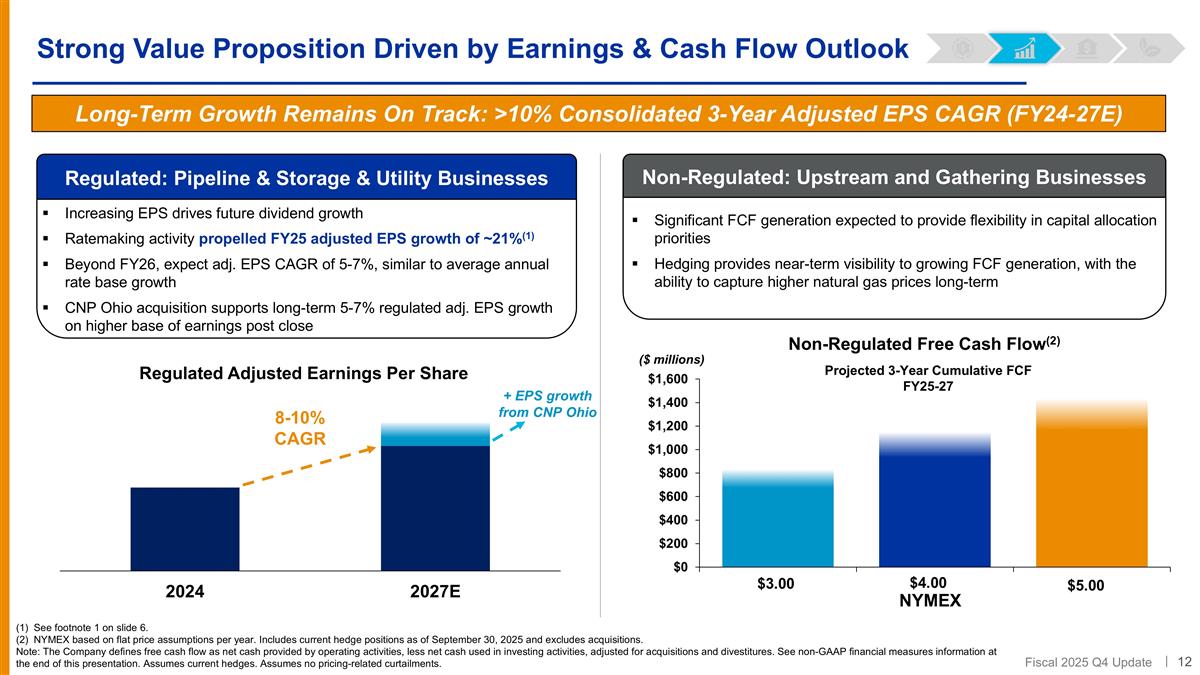

(1) See footnote 1 on slide 6. (2) NYMEX based on flat price assumptions per year. Includes current hedge positions as of September 30, 2025 and excludes acquisitions. Note: The Company defines free cash flow as net cash provided by operating activities, less net cash used in investing activities, adjusted for acquisitions and divestitures. See non-GAAP financial measures information at the end of this presentation. Assumes current hedges. Assumes no pricing-related curtailments. Strong Value Proposition Driven by Earnings & Cash Flow Outlook Increasing EPS drives future dividend growth Ratemaking activity propelled FY25 adjusted EPS growth of ~21%(1) Beyond FY26, expect adj. EPS CAGR of 5-7%, similar to average annual rate base growth CNP Ohio acquisition supports long-term 5-7% regulated adj. EPS growth on higher base of earnings post close Regulated: Pipeline & Storage & Utility Businesses Significant FCF generation expected to provide flexibility in capital allocation priorities Hedging provides near-term visibility to growing FCF generation, with the ability to capture higher natural gas prices long-term Non-Regulated: Upstream and Gathering Businesses Non-Regulated Free Cash Flow(2) 8-10% CAGR Regulated Adjusted Earnings Per Share ($ millions) $3.00 $4.00 $5.00 NYMEX Long-Term Growth Remains On Track: >10% Consolidated 3-Year Adjusted EPS CAGR (FY24-27E) + EPS growth from CNP Ohio 12

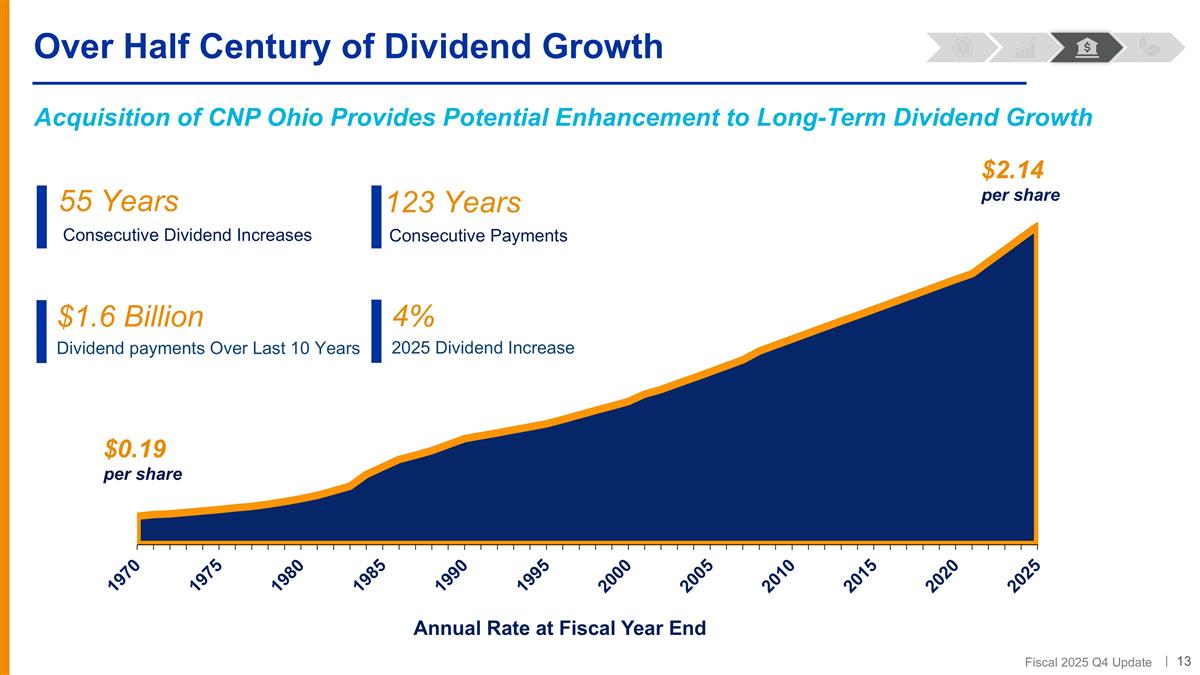

Over Half Century of Dividend Growth $1.6 Billion Dividend payments Over Last 10 Years $2.14 per share 55 Years Consecutive Dividend Increases $0.19 per share 123 Years Consecutive Payments 4% 2025 Dividend Increase Acquisition of CNP Ohio Provides Potential Enhancement to Long-Term Dividend Growth

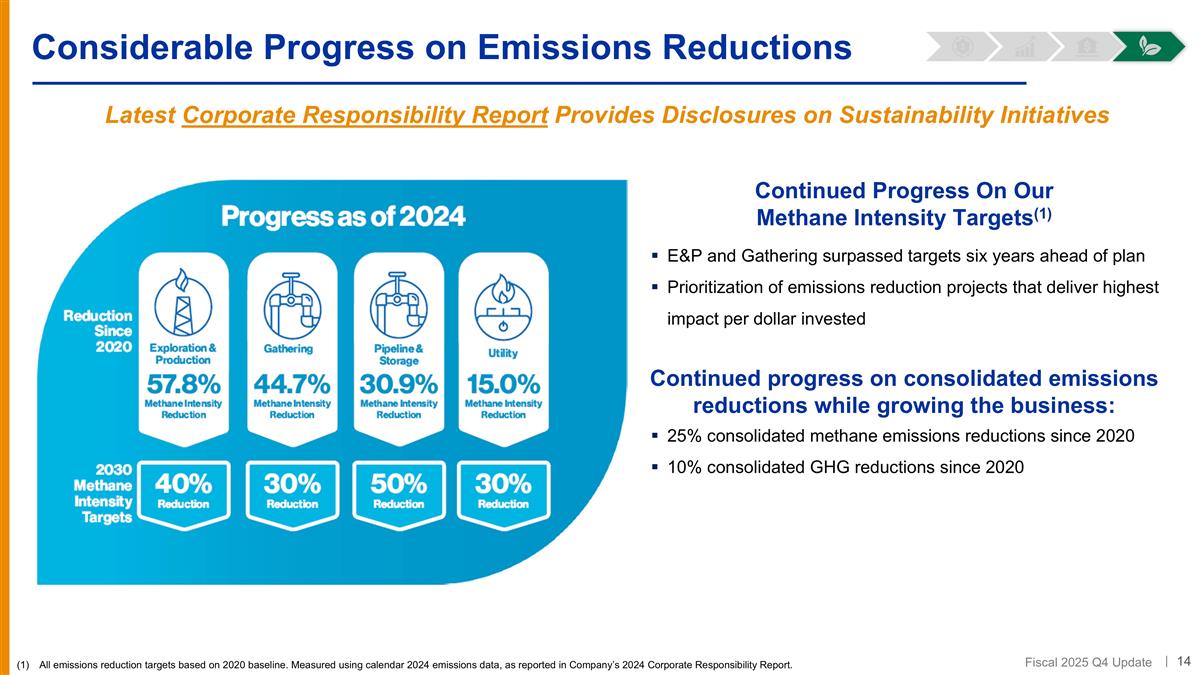

Considerable Progress on Emissions Reductions All emissions reduction targets based on 2020 baseline. Measured using calendar 2024 emissions data, as reported in Company’s 2024 Corporate Responsibility Report. Continued Progress On Our Methane Intensity Targets(1) E&P and Gathering surpassed targets six years ahead of plan Prioritization of emissions reduction projects that deliver highest impact per dollar invested Continued progress on consolidated emissions reductions while growing the business: 25% consolidated methane emissions reductions since 2020 10% consolidated GHG reductions since 2020 Latest Corporate Responsibility Report Provides Disclosures on Sustainability Initiatives

Financial Overview

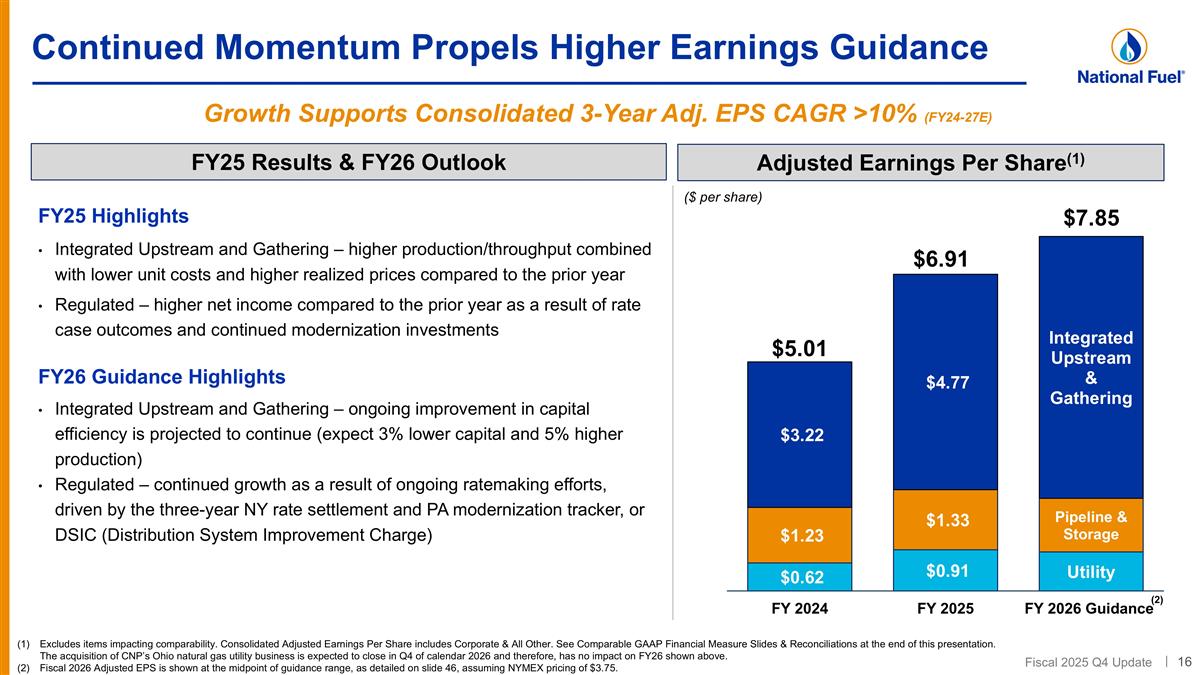

Continued Momentum Propels Higher Earnings Guidance Growth Supports Consolidated 3-Year Adj. EPS CAGR >10% (FY24-27E) Adjusted Earnings Per Share(1) ($ per share) Excludes items impacting comparability. Consolidated Adjusted Earnings Per Share includes Corporate & All Other. See Comparable GAAP Financial Measure Slides & Reconciliations at the end of this presentation. The acquisition of CNP’s Ohio natural gas utility business is expected to close in Q4 of calendar 2026 and therefore, has no impact on FY26 shown above. Fiscal 2026 Adjusted EPS is shown at the midpoint of guidance range, as detailed on slide 46, assuming NYMEX pricing of $3.75. FY25 Highlights Integrated Upstream and Gathering – higher production/throughput combined with lower unit costs and higher realized prices compared to the prior year Regulated – higher net income compared to the prior year as a result of rate case outcomes and continued modernization investments FY26 Guidance Highlights Integrated Upstream and Gathering – ongoing improvement in capital efficiency is projected to continue (expect 3% lower capital and 5% higher production) Regulated – continued growth as a result of ongoing ratemaking efforts, driven by the three-year NY rate settlement and PA modernization tracker, or DSIC (Distribution System Improvement Charge) FY25 Results & FY26 Outlook (2) 16

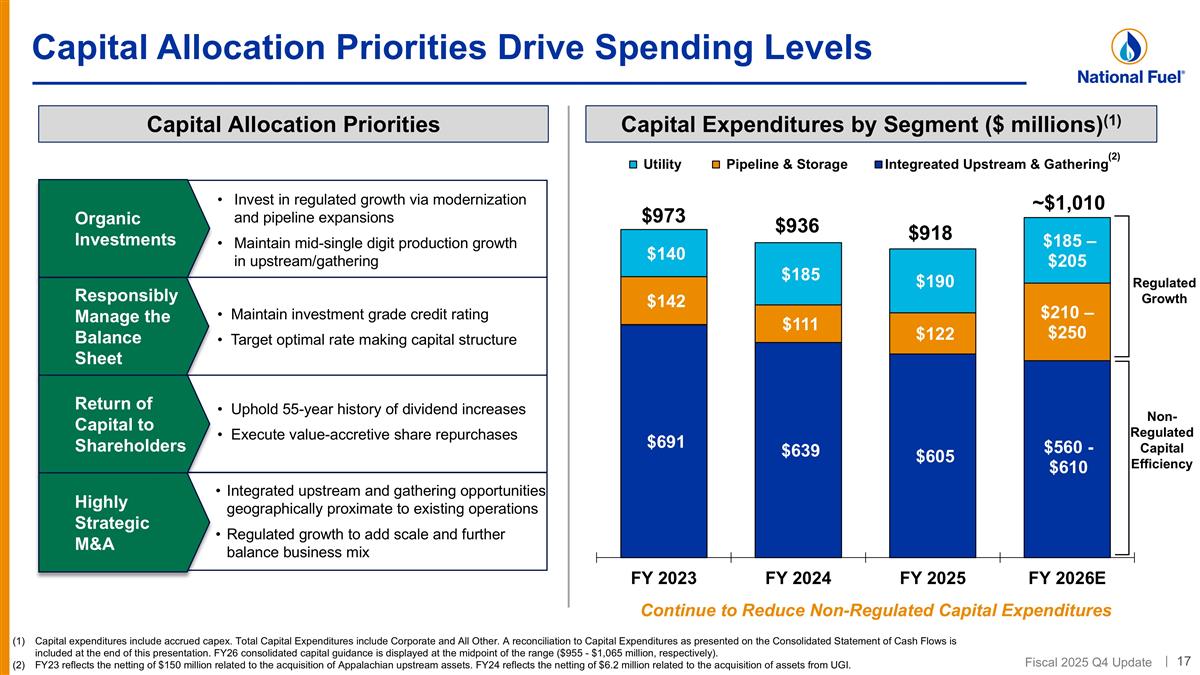

Capital Allocation Priorities Drive Spending Levels (2) Capital expenditures include accrued capex. Total Capital Expenditures include Corporate and All Other. A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY26 consolidated capital guidance is displayed at the midpoint of the range ($955 - $1,065 million, respectively). FY23 reflects the netting of $150 million related to the acquisition of Appalachian upstream assets. FY24 reflects the netting of $6.2 million related to the acquisition of assets from UGI. Capital Expenditures by Segment ($ millions)(1) Capital Allocation Priorities Organic Investments Responsibly Manage the Balance Sheet Return of Capital to Shareholders Highly Strategic M&A Invest in regulated growth via modernization and pipeline expansions Maintain mid-single digit production growth in upstream/gathering Maintain investment grade credit rating Target optimal rate making capital structure Uphold 55-year history of dividend increases Execute value-accretive share repurchases Integrated upstream and gathering opportunities geographically proximate to existing operations Regulated growth to add scale and further balance business mix Regulated Growth Non- Regulated Capital Efficiency Continue to Reduce Non-Regulated Capital Expenditures

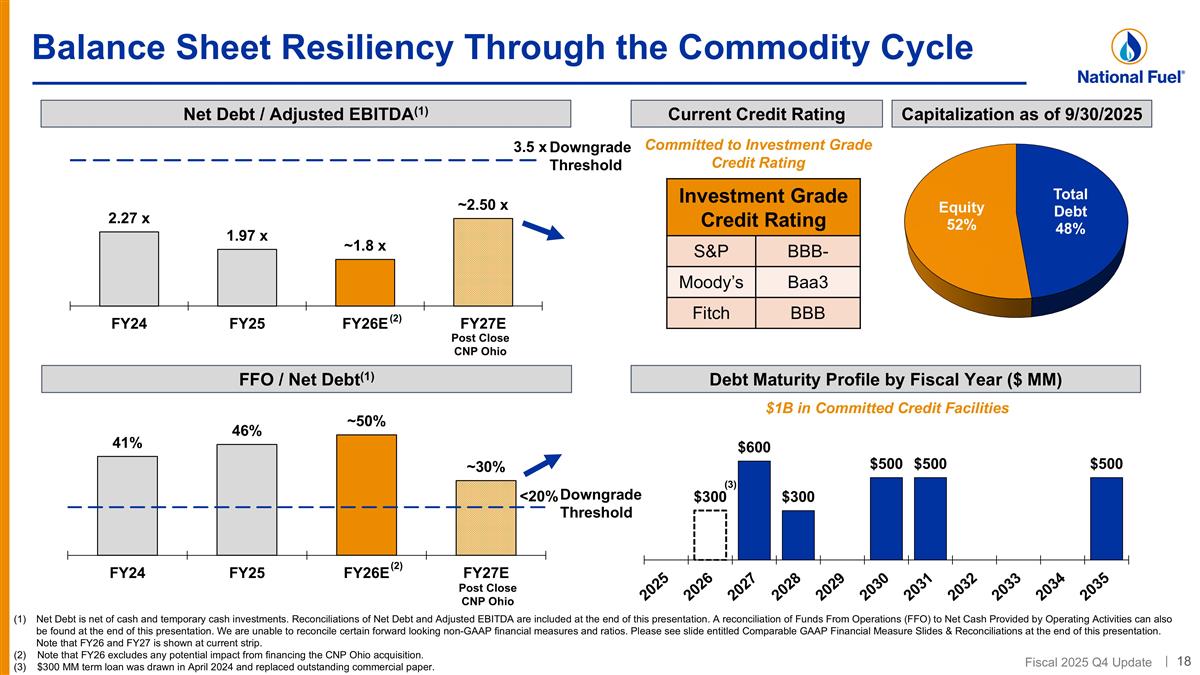

Balance Sheet Resiliency Through the Commodity Cycle Net Debt / Adjusted EBITDA(1) Net Debt is net of cash and temporary cash investments. Reconciliations of Net Debt and Adjusted EBITDA are included at the end of this presentation. A reconciliation of Funds From Operations (FFO) to Net Cash Provided by Operating Activities can also be found at the end of this presentation. We are unable to reconcile certain forward looking non-GAAP financial measures and ratios. Please see slide entitled Comparable GAAP Financial Measure Slides & Reconciliations at the end of this presentation. Note that FY26 and FY27 is shown at current strip. (2) Note that FY26 excludes any potential impact from financing the CNP Ohio acquisition. (3) $300 MM term loan was drawn in April 2024 and replaced outstanding commercial paper. Current Credit Rating Investment Grade Credit Rating S&P BBB- Moody’s Baa3 Fitch BBB Investment Grade Credit Rating Committed to Investment Grade Credit Rating Debt Maturity Profile by Fiscal Year ($ MM) FFO / Net Debt(1) Capitalization as of 9/30/2025 Downgrade Threshold Downgrade Threshold (3) $1B in Committed Credit Facilities Post Close CNP Ohio Post Close CNP Ohio (2) (2)

Integrated Upstream and Gathering Business Highlights

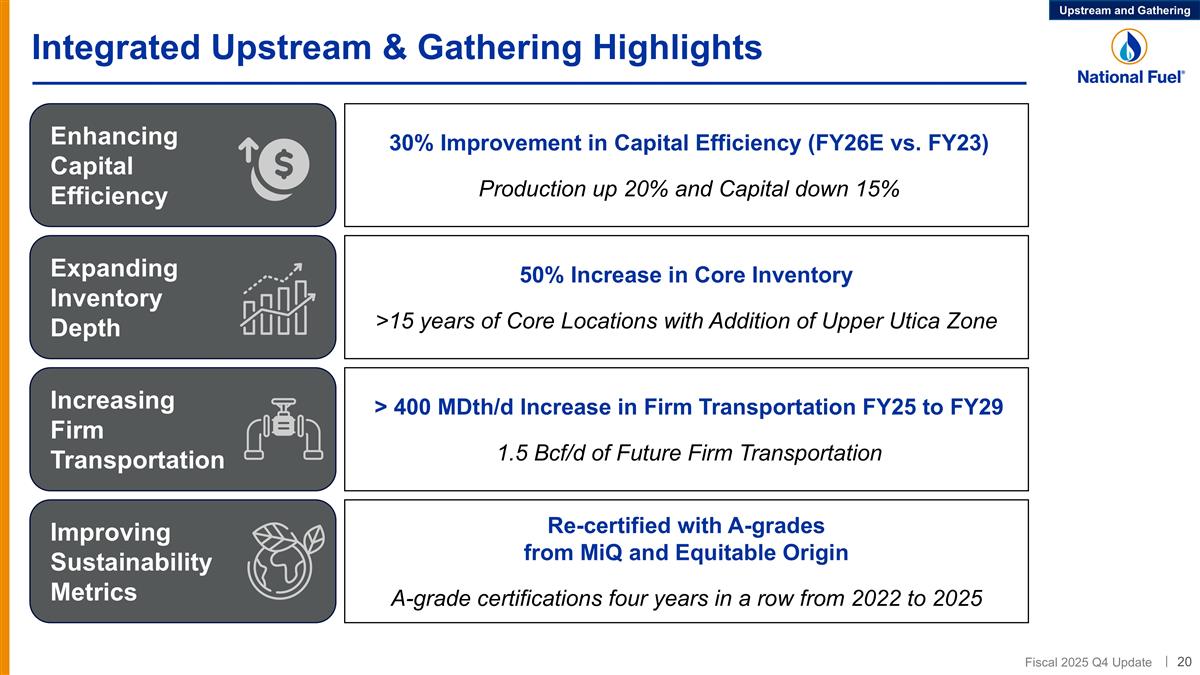

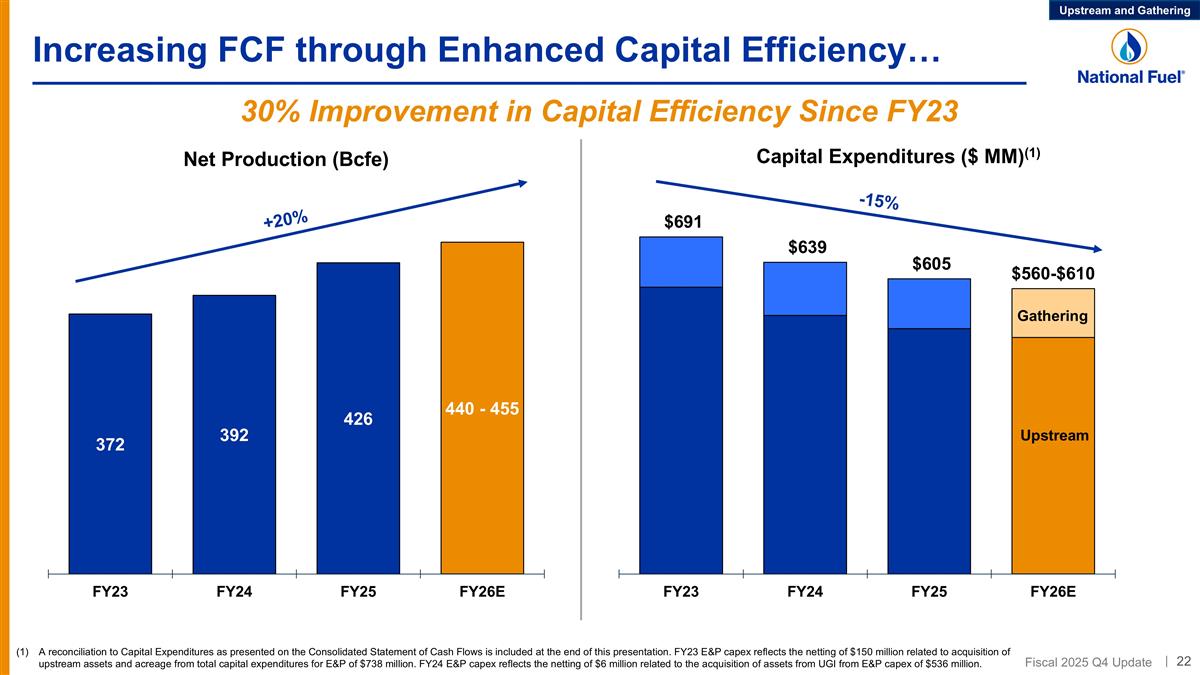

Integrated Upstream & Gathering Highlights 30% Improvement in Capital Efficiency (FY26E vs. FY23) Production up 20% and Capital down 15% 50% Increase in Core Inventory >15 years of Core Locations with Addition of Upper Utica Zone > 400 MDth/d Increase in Firm Transportation FY25 to FY29 1.5 Bcf/d of Future Firm Transportation Re-certified with A-grades from MiQ and Equitable Origin A-grade certifications four years in a row from 2022 to 2025 Enhancing Capital Efficiency Expanding Inventory Depth Increasing Firm Transportation Improving Sustainability Metrics Upstream and Gathering 20

Integrated Upstream & Gathering Eastern Development Area ~310,000 Acres Development zones: Marcellus, Upper Utica, Lower Utica > 25 years of development inventory at PV-10 breakeven price of less than $2.25/MMBtu NYMEX Expect to average 25 to 27 wells brought online per year Well and facility design optimization continues to drive improved productivity Diverse and growing marketing portfolio with ~1.5 Bcf/d of future firm transportation Integrated gathering systems provide optimized investment timing, low-cost structure and resilient thru-cycle margins Western Development Area ~920,000 Acres (mostly held in fee) Development zones: Marcellus, Lower Utica Development Plan Highlights Upstream and Gathering 21

Increasing FCF through Enhanced Capital Efficiency… A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY23 E&P capex reflects the netting of $150 million related to acquisition of upstream assets and acreage from total capital expenditures for E&P of $738 million. FY24 E&P capex reflects the netting of $6 million related to the acquisition of assets from UGI from E&P capex of $536 million. 30% Improvement in Capital Efficiency Since FY23 +20% -15% Capital Expenditures ($ MM)(1) Net Production (Bcfe) Gathering Upstream Upstream and Gathering

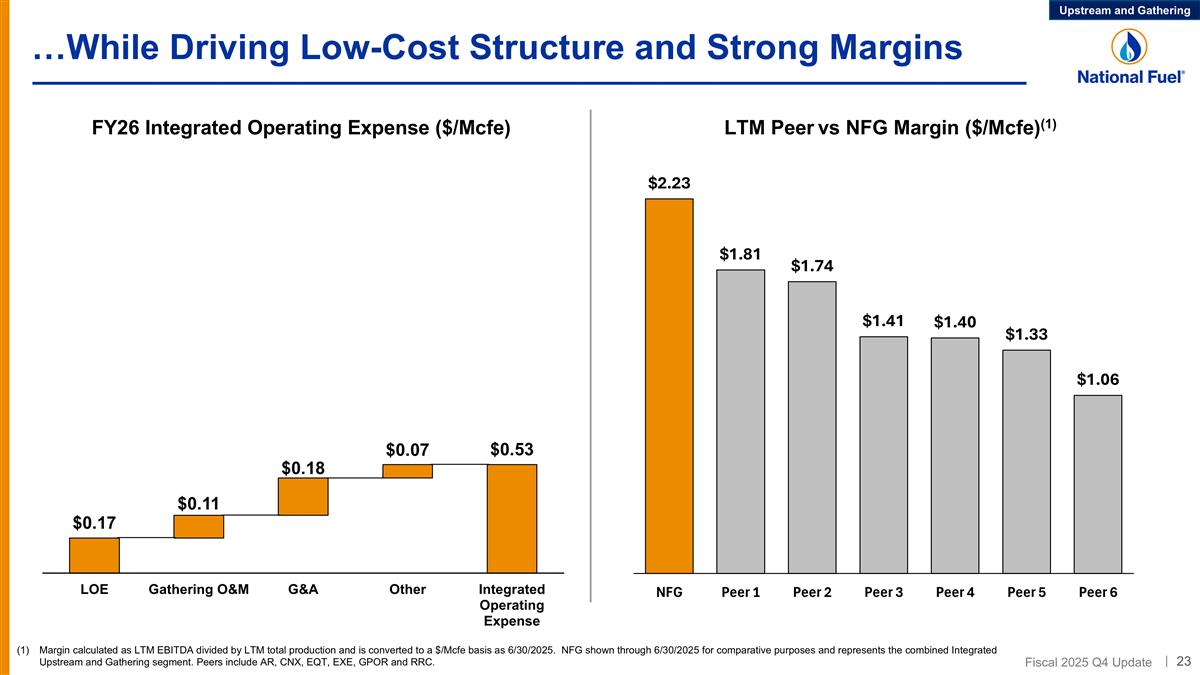

…While Driving Low-Cost Structure and Strong Margins Margin calculated as LTM EBITDA divided by LTM total production and is converted to a $/Mcfe basis as 6/30/2025. NFG shown through 6/30/2025 for comparative purposes and represents the combined Integrated Upstream and Gathering segment. Peers include AR, CNX, EQT, EXE, GPOR and RRC. LTM Peer vs NFG Margin ($/Mcfe)(1) FY26 Integrated Operating Expense ($/Mcfe) Upstream and Gathering

~220 additional Upper Utica locations with similar productivity to Lower Utica ~300ft resource column with strong frac barrier establishes two distinct zones ~170 premium Lower Utica locations with EURs of 2.5 Bcf / 1,000 ft. Addition of Upper Utica Zone More than Doubles Tioga Utica Inventory Upper Utica Adds ~8 Years Inventory on Existing Infrastructure Increased Core Inventory to ~400 Premium Locations Upper Utica Lower Utica Frac Barrier ~300 ft Gen 3 design primarily uses 1,800 ft. inter-well spacing, 2,200 lbs. per ft. of proppant intensity, and 150 ft. stage spacing. Upper and Lower Utica Well Performance Gen 1 Lower Utica Gen 2 Lower Utica Gen 3 Lower Utica (1) Upper Utica (first 4 wells) EUR / 1,000 ft. Gen 3 Lower Utica 2.5 Gen 2 Lower Utica 2.1 Gen 1 Lower Utica 1.6 Upstream and Gathering

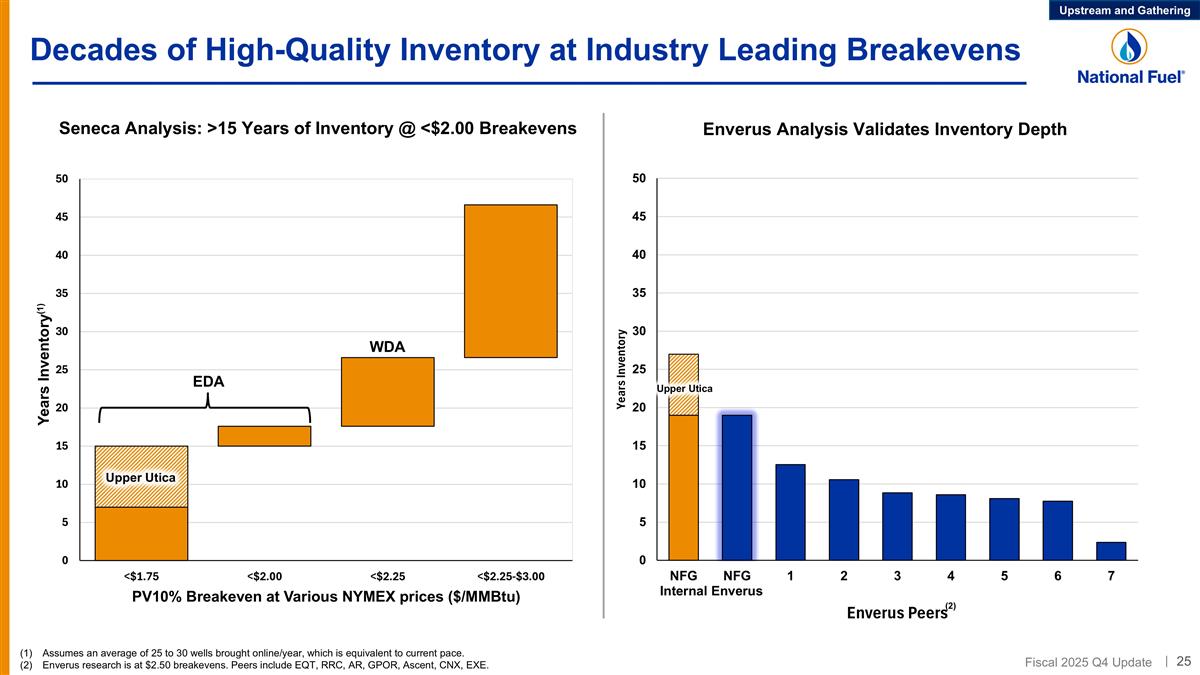

Decades of High-Quality Inventory at Industry Leading Breakevens Assumes an average of 25 to 30 wells brought online/year, which is equivalent to current pace. Enverus research is at $2.50 breakevens. Peers include EQT, RRC, AR, GPOR, Ascent, CNX, EXE. Enverus Analysis Validates Inventory Depth (1) EDA WDA Seneca Analysis: >15 Years of Inventory @ <$2.00 Breakevens (2) Upper Utica Upper Utica Upstream and Gathering

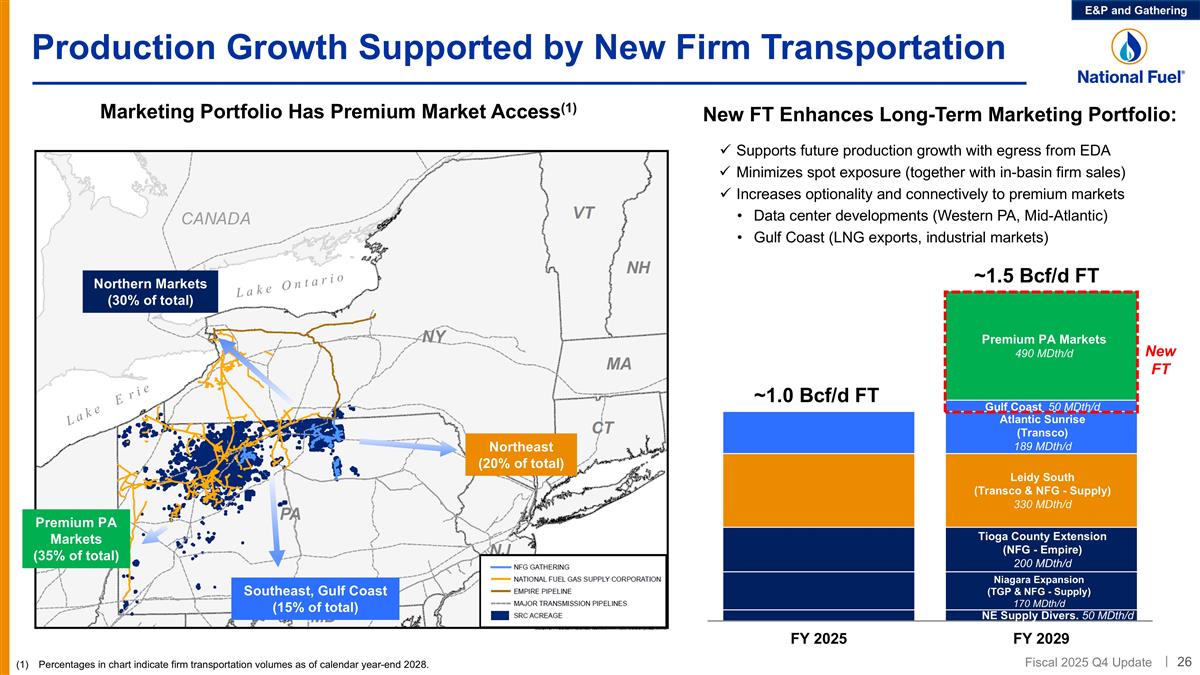

Production Growth Supported by New Firm Transportation Marketing Portfolio Has Premium Market Access(1) New FT Enhances Long-Term Marketing Portfolio: Supports future production growth with egress from EDA Minimizes spot exposure (together with in-basin firm sales) Increases optionality and connectively to premium markets Data center developments (Western PA, Mid-Atlantic) Gulf Coast (LNG exports, industrial markets) Northern Markets (30% of total) Southeast, Gulf Coast (15% of total) Northeast (20% of total) Percentages in chart indicate firm transportation volumes as of calendar year-end 2028. NE Supply Divers. 50 MDth/d Niagara Expansion (TGP & NFG - Supply) 170 MDth/d Atlantic Sunrise (Transco) 189 MDth/d Tioga County Extension (NFG - Empire) 200 MDth/d Premium PA Markets (35% of total) E&P and Gathering Premium PA Markets 490 MDth/d ~1.0 Bcf/d FT ~1.5 Bcf/d FT Gulf Coast 50 MDth/d Leidy South (Transco & NFG - Supply) 330 MDth/d New FT 26

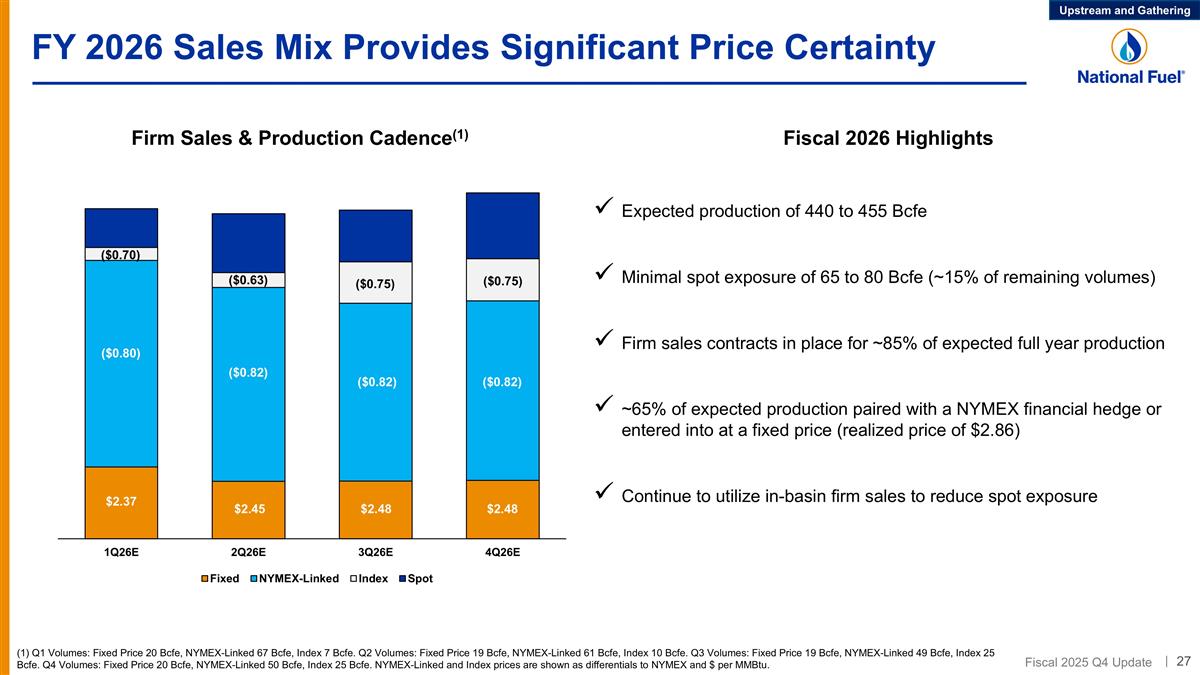

FY 2026 Sales Mix Provides Significant Price Certainty 440 to 455 Bcfe (1) Q1 Volumes: Fixed Price 20 Bcfe, NYMEX-Linked 67 Bcfe, Index 7 Bcfe. Q2 Volumes: Fixed Price 19 Bcfe, NYMEX-Linked 61 Bcfe, Index 10 Bcfe. Q3 Volumes: Fixed Price 19 Bcfe, NYMEX-Linked 49 Bcfe, Index 25 Bcfe. Q4 Volumes: Fixed Price 20 Bcfe, NYMEX-Linked 50 Bcfe, Index 25 Bcfe. NYMEX-Linked and Index prices are shown as differentials to NYMEX and $ per MMBtu. Expected production of 440 to 455 Bcfe Minimal spot exposure of 65 to 80 Bcfe (~15% of remaining volumes) Firm sales contracts in place for ~85% of expected full year production ~65% of expected production paired with a NYMEX financial hedge or entered into at a fixed price (realized price of $2.86) Continue to utilize in-basin firm sales to reduce spot exposure Fiscal 2026 Highlights Upstream and Gathering ($0.75) ($0.75) ($0.82) ($0.82) $2.48 $2.48 Firm Sales & Production Cadence(1) ($0.70) ($0.63) ($0.80) ($0.82) $2.37 $2.45

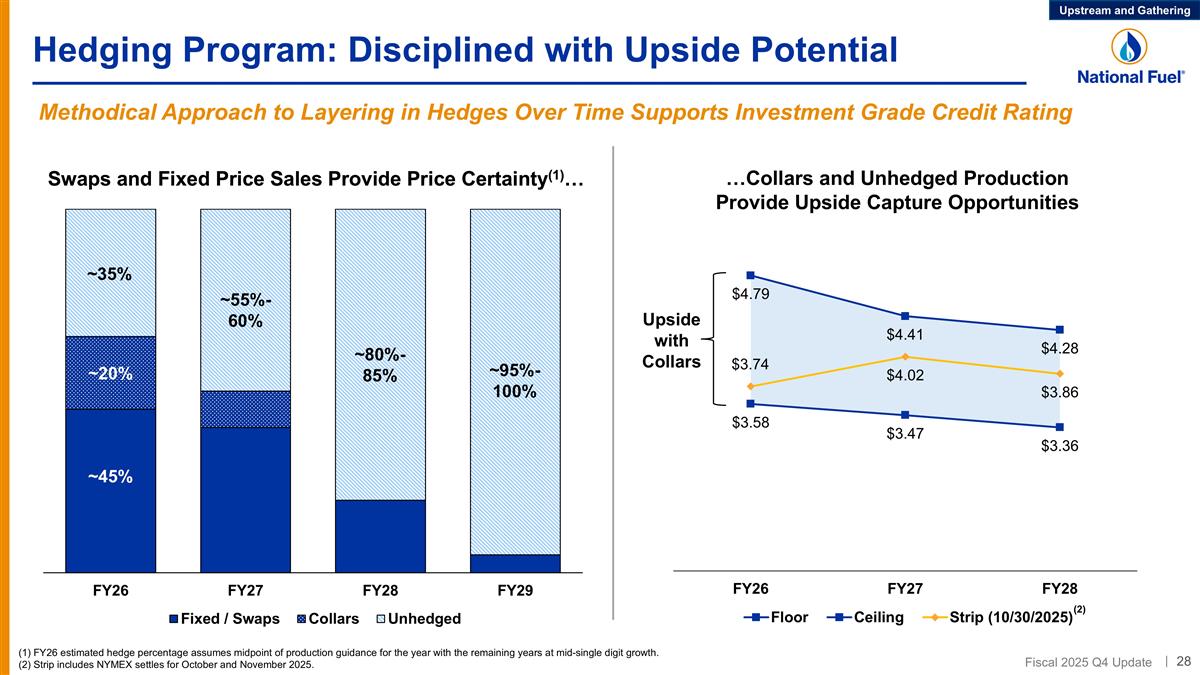

…Collars and Unhedged Production Provide Upside Capture Opportunities Hedging Program: Disciplined with Upside Potential Methodical Approach to Layering in Hedges Over Time Supports Investment Grade Credit Rating Swaps and Fixed Price Sales Provide Price Certainty(1)… Swaps and Fixed Price Sales Provide Price Certainty(1)… ~60% ~45% ~35% ~55%- 60% ~80%- 85% ~95%- 100% ~20% ~45% Upside with Collars FY26 estimated hedge percentage assumes midpoint of production guidance for the year with the remaining years at mid-single digit growth. Strip includes NYMEX settles for October and November 2025. (2) Upstream and Gathering

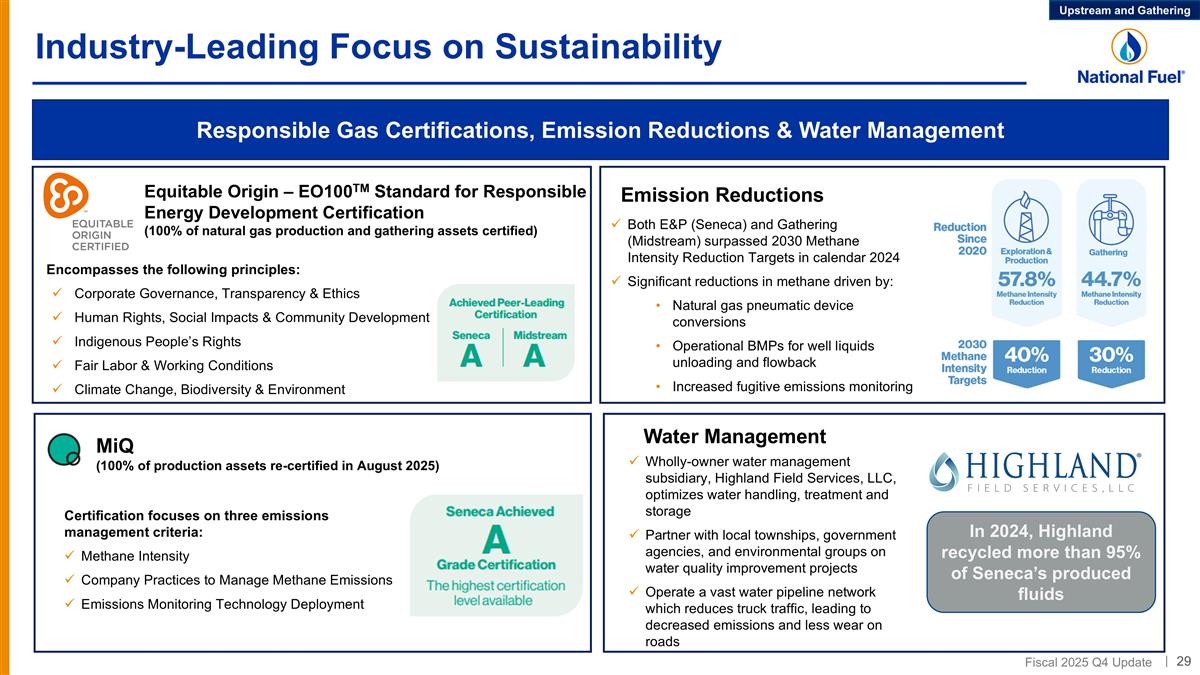

Industry-Leading Focus on Sustainability Responsible Gas Certifications, Emission Reductions & Water Management Equitable Origin – EO100TM Standard for Responsible Energy Development Certification (100% of natural gas production and gathering assets certified) Certification focuses on three emissions management criteria: Methane Intensity Company Practices to Manage Methane Emissions Emissions Monitoring Technology Deployment MiQ (100% of production assets re-certified in August 2025) Encompasses the following principles: Corporate Governance, Transparency & Ethics Human Rights, Social Impacts & Community Development Indigenous People’s Rights Fair Labor & Working Conditions Climate Change, Biodiversity & Environment Emission Reductions Water Management Wholly-owner water management subsidiary, Highland Field Services, LLC, optimizes water handling, treatment and storage Partner with local townships, government agencies, and environmental groups on water quality improvement projects Operate a vast water pipeline network which reduces truck traffic, leading to decreased emissions and less wear on roads Both E&P (Seneca) and Gathering (Midstream) surpassed 2030 Methane Intensity Reduction Targets in calendar 2024 Significant reductions in methane driven by: Natural gas pneumatic device conversions Operational BMPs for well liquids unloading and flowback Increased fugitive emissions monitoring In 2024, Highland recycled more than 95% of Seneca’s produced fluids Upstream and Gathering

Pipeline & Storage and Utility Overview Business Highlights

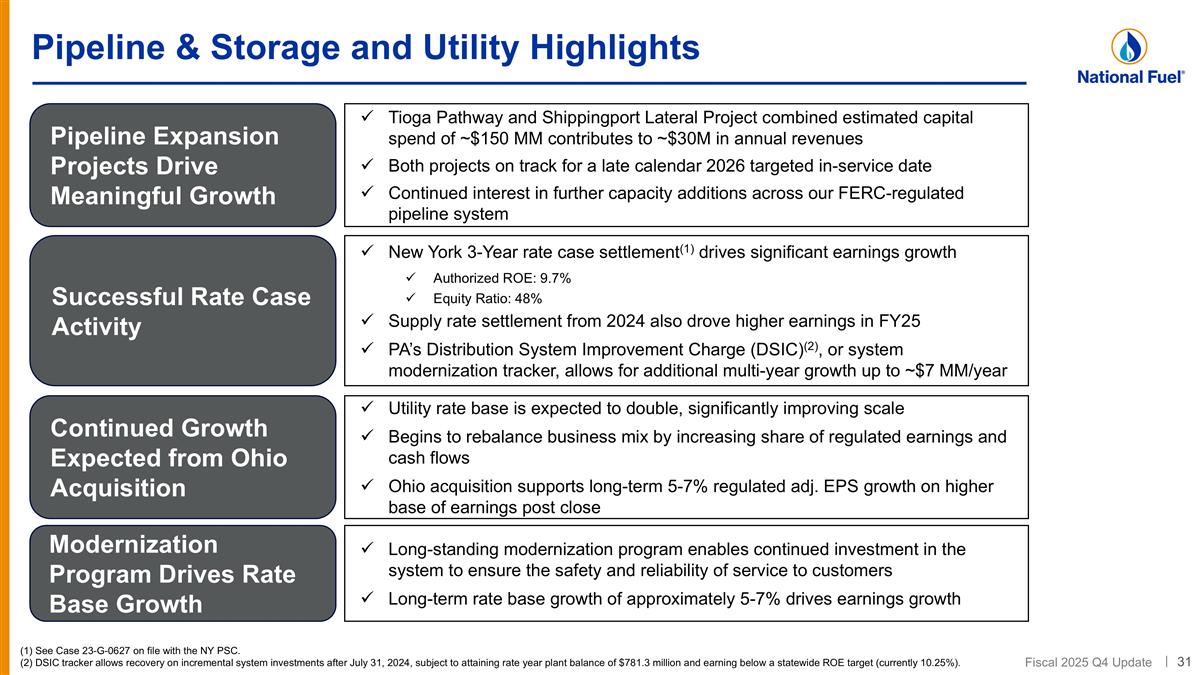

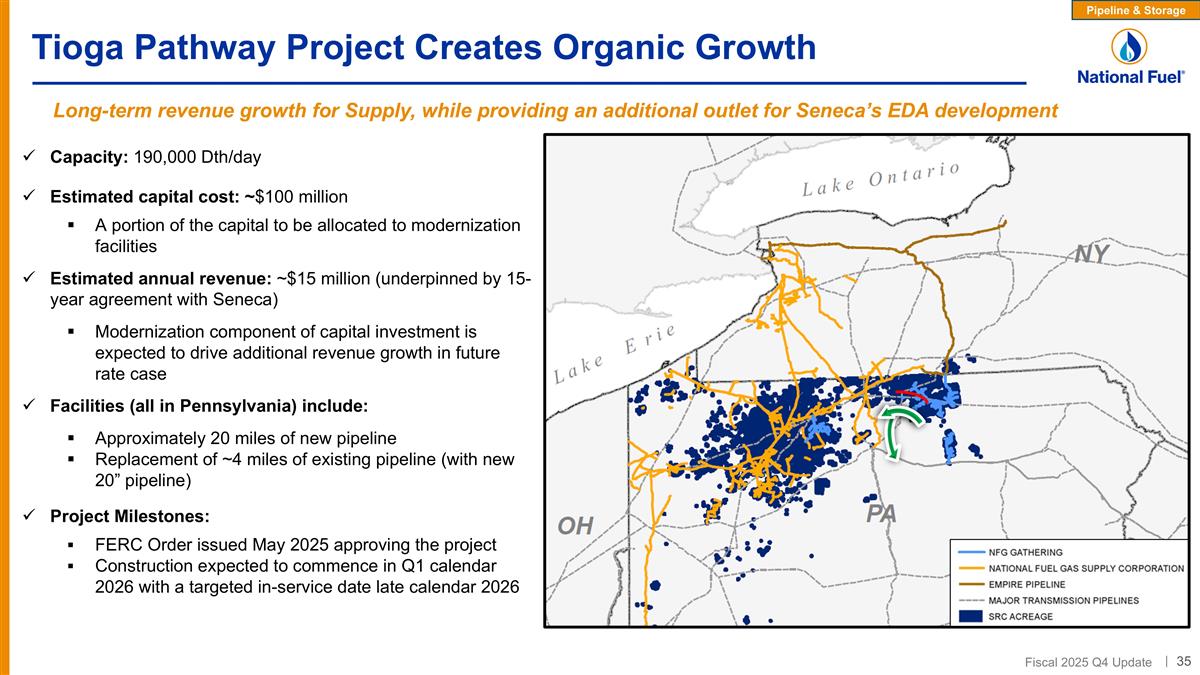

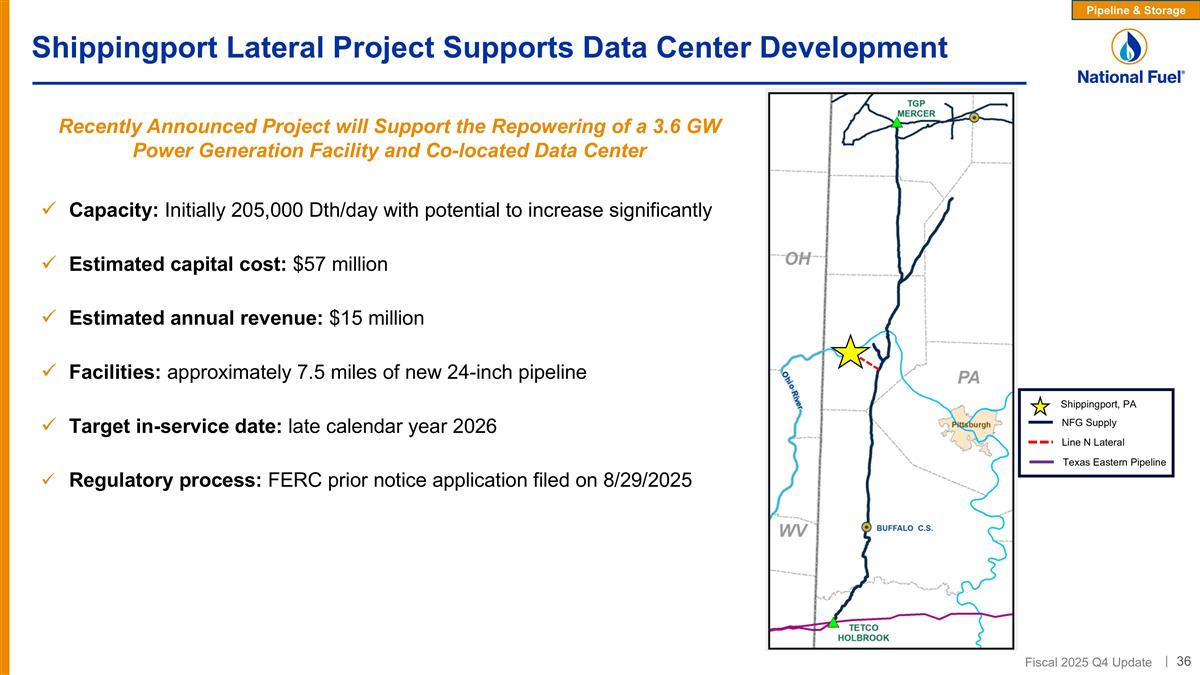

Pipeline & Storage and Utility Highlights Tioga Pathway and Shippingport Lateral Project combined estimated capital spend of ~$150 MM contributes to ~$30M in annual revenues Both projects on track for a late calendar 2026 targeted in-service date Continued interest in further capacity additions across our FERC-regulated pipeline system New York 3-Year rate case settlement(1) drives significant earnings growth Authorized ROE: 9.7% Equity Ratio: 48% Supply rate settlement from 2024 also drove higher earnings in FY25 PA’s Distribution System Improvement Charge (DSIC)(2), or system modernization tracker, allows for additional multi-year growth up to ~$7 MM/year Utility rate base is expected to double, significantly improving scale Begins to rebalance business mix by increasing share of regulated earnings and cash flows Ohio acquisition supports long-term 5-7% regulated adj. EPS growth on higher base of earnings post close Pipeline Expansion Projects Drive Meaningful Growth Successful Rate Case Activity Continued Growth Expected from Ohio Acquisition (1) See Case 23-G-0627 on file with the NY PSC. (2) DSIC tracker allows recovery on incremental system investments after July 31, 2024, subject to attaining rate year plant balance of $781.3 million and earning below a statewide ROE target (currently 10.25%). Long-standing modernization program enables continued investment in the system to ensure the safety and reliability of service to customers Long-term rate base growth of approximately 5-7% drives earnings growth Modernization Program Drives Rate Base Growth 31

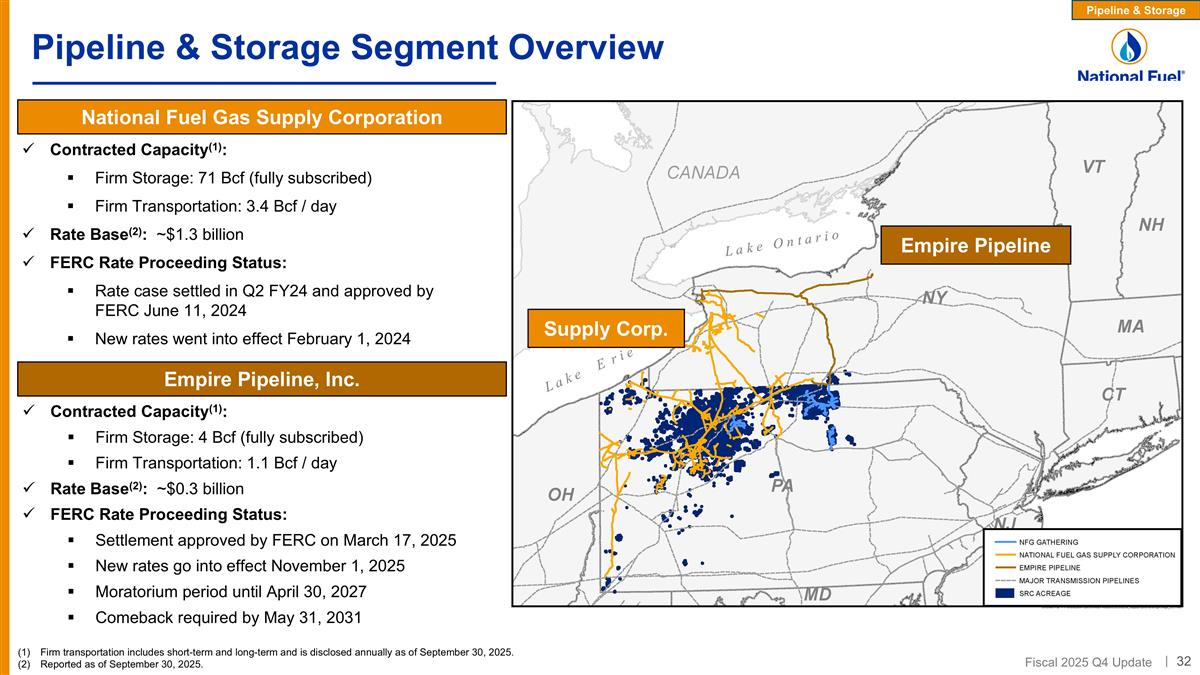

Pipeline & Storage Segment Overview Firm transportation includes short-term and long-term and is disclosed annually as of September 30, 2025. Reported as of September 30, 2025. Empire Pipeline, Inc. National Fuel Gas Supply Corporation Empire Pipeline Supply Corp. Contracted Capacity(1): Firm Storage: 71 Bcf (fully subscribed) Firm Transportation: 3.4 Bcf / day Rate Base(2): ~$1.3 billion FERC Rate Proceeding Status: Rate case settled in Q2 FY24 and approved by FERC June 11, 2024 New rates went into effect February 1, 2024 Contracted Capacity(1): Firm Storage: 4 Bcf (fully subscribed) Firm Transportation: 1.1 Bcf / day Rate Base(2): ~$0.3 billion FERC Rate Proceeding Status: Settlement approved by FERC on March 17, 2025 New rates go into effect November 1, 2025 Moratorium period until April 30, 2027 Comeback required by May 31, 2031 Pipeline & Storage

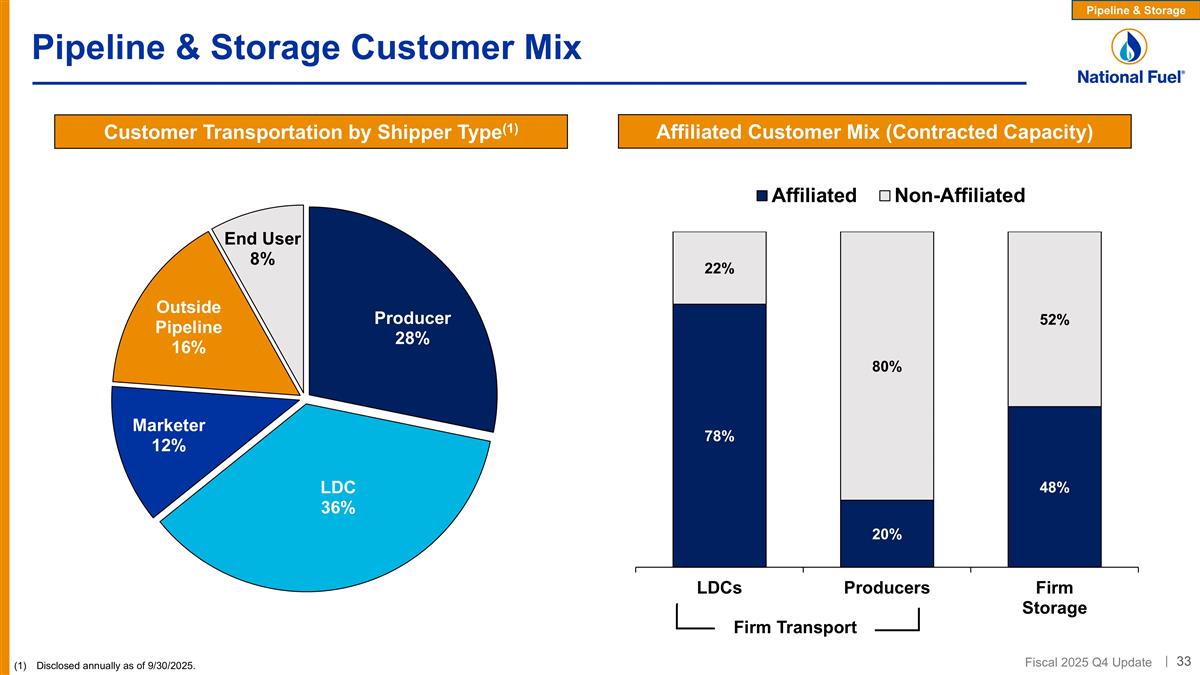

Pipeline & Storage Customer Mix Customer Transportation by Shipper Type(1) Affiliated Customer Mix (Contracted Capacity) Disclosed annually as of 9/30/2025. Pipeline & Storage Firm Transport

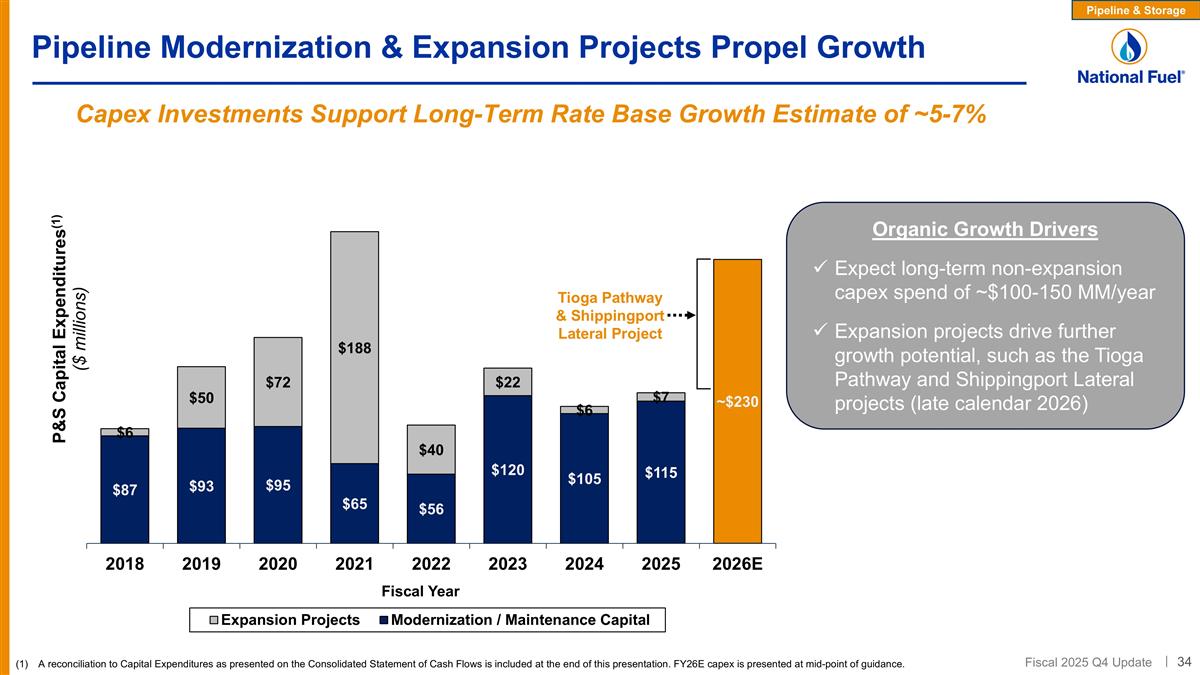

Pipeline Modernization & Expansion Projects Propel Growth A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY26E capex is presented at mid-point of guidance. Capex Investments Support Long-Term Rate Base Growth Estimate of ~5-7% Pipeline & Storage Organic Growth Drivers Expect long-term non-expansion capex spend of ~$100-150 MM/year Expansion projects drive further growth potential, such as the Tioga Pathway and Shippingport Lateral projects (late calendar 2026) Tioga Pathway & Shippingport Lateral Project 34

Tioga Pathway Project Creates Organic Growth Capacity: 190,000 Dth/day Estimated capital cost: ~$100 million A portion of the capital to be allocated to modernization facilities Estimated annual revenue: ~$15 million (underpinned by 15-year agreement with Seneca) Modernization component of capital investment is expected to drive additional revenue growth in future rate case Facilities (all in Pennsylvania) include: Approximately 20 miles of new pipeline Replacement of ~4 miles of existing pipeline (with new 20” pipeline) Project Milestones: FERC Order issued May 2025 approving the project Construction expected to commence in Q1 calendar 2026 with a targeted in-service date late calendar 2026 Pipeline & Storage Long-term revenue growth for Supply, while providing an additional outlet for Seneca’s EDA development

Shippingport Lateral Project Supports Data Center Development Pipeline & Storage Capacity: Initially 205,000 Dth/day with potential to increase significantly Estimated capital cost: $57 million Estimated annual revenue: $15 million Facilities: approximately 7.5 miles of new 24-inch pipeline Target in-service date: late calendar year 2026 Regulatory process: FERC prior notice application filed on 8/29/2025 NFG Supply Line N Lateral Shippingport, PA Texas Eastern Pipeline Recently Announced Project will Support the Repowering of a 3.6 GW Power Generation Facility and Co-located Data Center

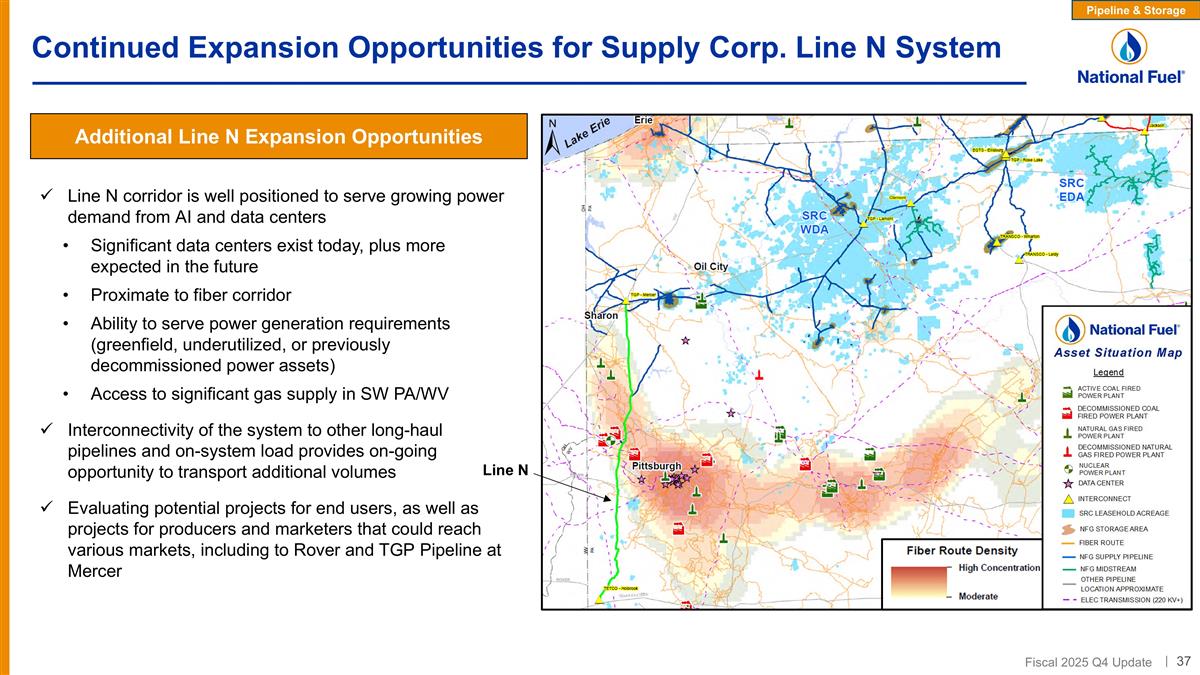

Continued Expansion Opportunities for Supply Corp. Line N System Pipeline & Storage Additional Line N Expansion Opportunities Line N corridor is well positioned to serve growing power demand from AI and data centers Significant data centers exist today, plus more expected in the future Proximate to fiber corridor Ability to serve power generation requirements (greenfield, underutilized, or previously decommissioned power assets) Access to significant gas supply in SW PA/WV Interconnectivity of the system to other long-haul pipelines and on-system load provides on-going opportunity to transport additional volumes Evaluating potential projects for end users, as well as projects for producers and marketers that could reach various markets, including to Rover and TGP Pipeline at Mercer Line N

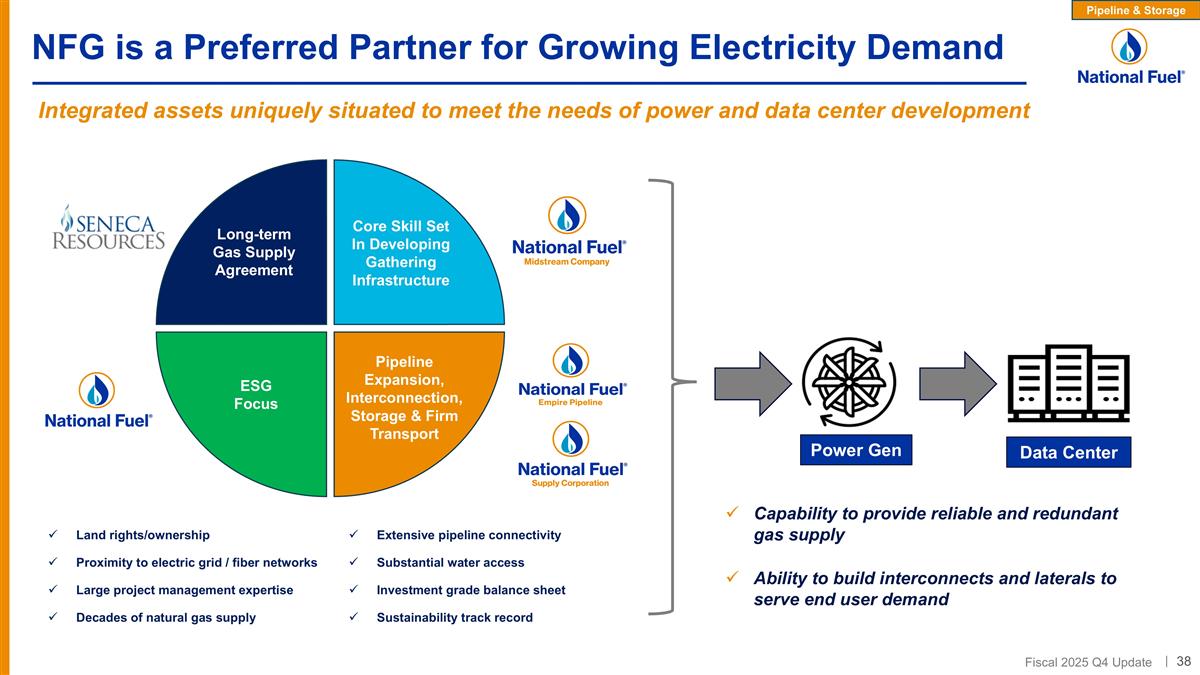

Power Gen Data Center Integrated assets uniquely situated to meet the needs of power and data center development NFG is a Preferred Partner for Growing Electricity Demand Capability to provide reliable and redundant gas supply Ability to build interconnects and laterals to serve end user demand Long-term Gas Supply Agreement Core Skill Set In Developing Gathering Infrastructure Pipeline Expansion, Interconnection, Storage & Firm Transport ESG Focus Land rights/ownership Extensive pipeline connectivity Proximity to electric grid / fiber networks Substantial water access Large project management expertise Investment grade balance sheet Decades of natural gas supply Sustainability track record Pipeline & Storage

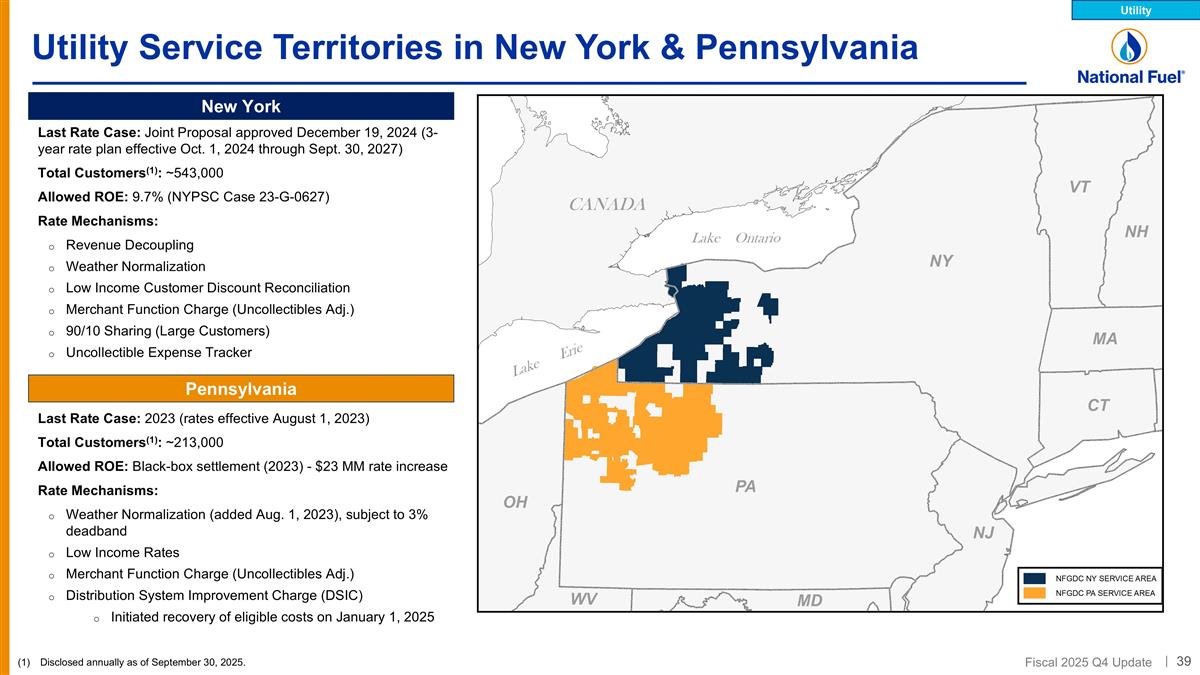

Utility Service Territories in New York & Pennsylvania New York Last Rate Case: Joint Proposal approved December 19, 2024 (3-year rate plan effective Oct. 1, 2024 through Sept. 30, 2027) Total Customers(1): ~543,000 Allowed ROE: 9.7% (NYPSC Case 23-G-0627) Rate Mechanisms: Revenue Decoupling Weather Normalization Low Income Customer Discount Reconciliation Merchant Function Charge (Uncollectibles Adj.) 90/10 Sharing (Large Customers) Uncollectible Expense Tracker Pennsylvania Last Rate Case: 2023 (rates effective August 1, 2023) Total Customers(1): ~213,000 Allowed ROE: Black-box settlement (2023) - $23 MM rate increase Rate Mechanisms: Weather Normalization (added Aug. 1, 2023), subject to 3% deadband Low Income Rates Merchant Function Charge (Uncollectibles Adj.) Distribution System Improvement Charge (DSIC) Initiated recovery of eligible costs on January 1, 2025 Disclosed annually as of September 30, 2025. Utility

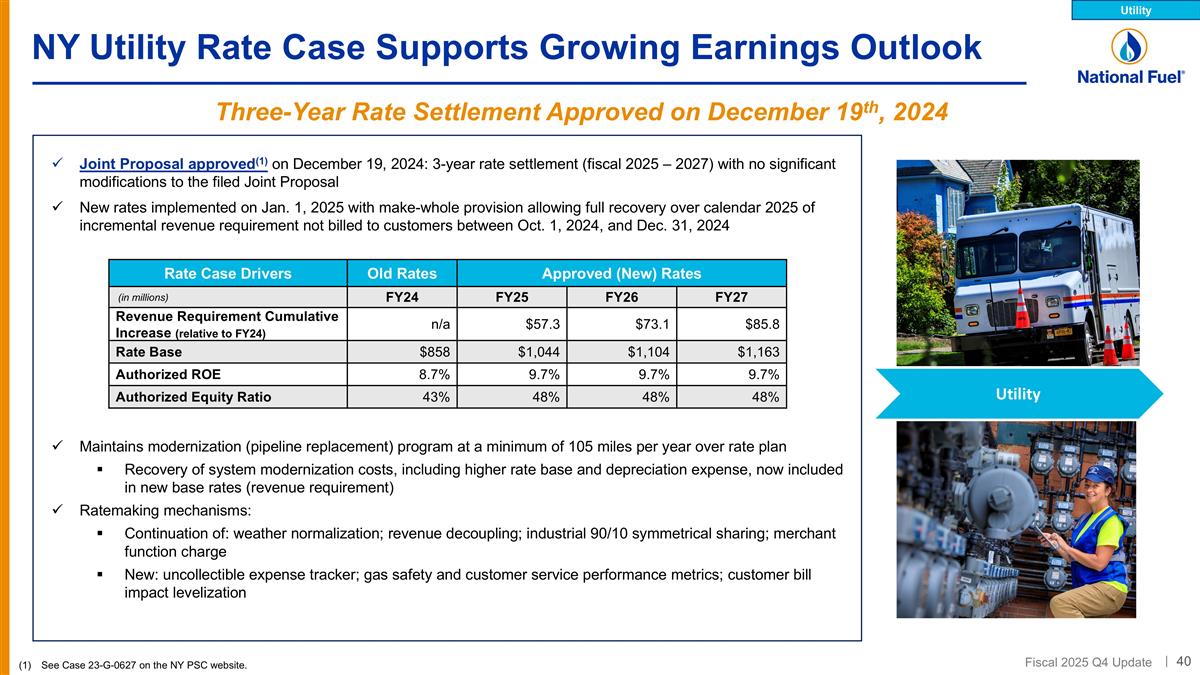

NY Utility Rate Case Supports Growing Earnings Outlook Three-Year Rate Settlement Approved on December 19th, 2024 Joint Proposal approved(1) on December 19, 2024: 3-year rate settlement (fiscal 2025 – 2027) with no significant modifications to the filed Joint Proposal New rates implemented on Jan. 1, 2025 with make-whole provision allowing full recovery over calendar 2025 of incremental revenue requirement not billed to customers between Oct. 1, 2024, and Dec. 31, 2024 Maintains modernization (pipeline replacement) program at a minimum of 105 miles per year over rate plan Recovery of system modernization costs, including higher rate base and depreciation expense, now included in new base rates (revenue requirement) Ratemaking mechanisms: Continuation of: weather normalization; revenue decoupling; industrial 90/10 symmetrical sharing; merchant function charge New: uncollectible expense tracker; gas safety and customer service performance metrics; customer bill impact levelization See Case 23-G-0627 on the NY PSC website. Rate Case Drivers Old Rates Approved (New) Rates (in millions) FY24 FY25 FY26 FY27 Revenue Requirement Cumulative Increase (relative to FY24) n/a $57.3 $73.1 $85.8 Rate Base $858 $1,044 $1,104 $1,163 Authorized ROE 8.7% 9.7% 9.7% 9.7% Authorized Equity Ratio 43% 48% 48% 48% Utility Utility

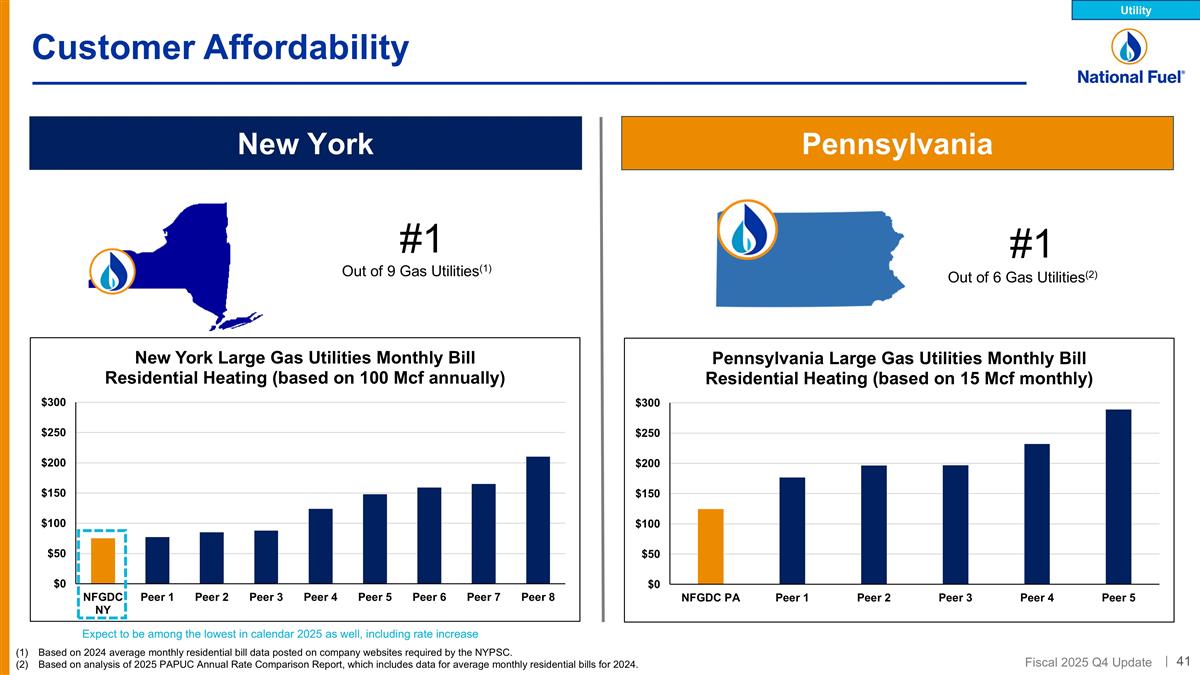

Customer Affordability New York Pennsylvania Based on 2024 average monthly residential bill data posted on company websites required by the NYPSC. Based on analysis of 2025 PAPUC Annual Rate Comparison Report, which includes data for average monthly residential bills for 2024. Utility #1 Out of 9 Gas Utilities(1) #1 Out of 6 Gas Utilities(2) Expect to be among the lowest in calendar 2025 as well, including rate increase

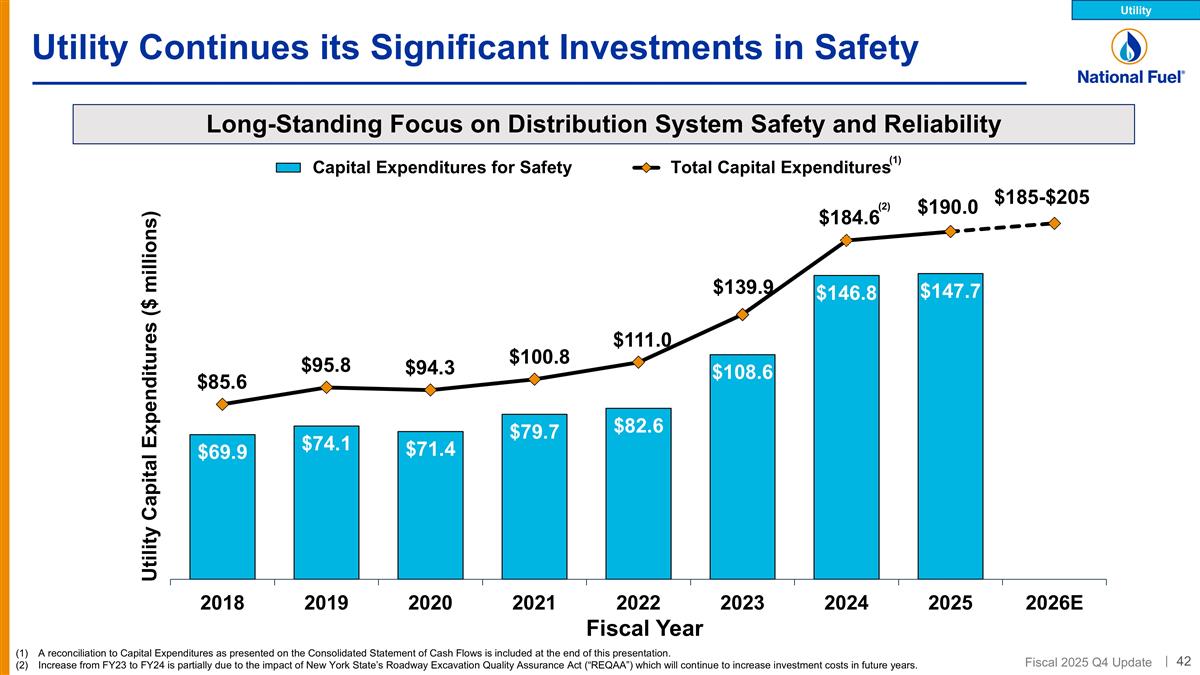

Utility Continues its Significant Investments in Safety (1) A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. Increase from FY23 to FY24 is partially due to the impact of New York State’s Roadway Excavation Quality Assurance Act (“REQAA”) which will continue to increase investment costs in future years. Long-Standing Focus on Distribution System Safety and Reliability Utility (2)

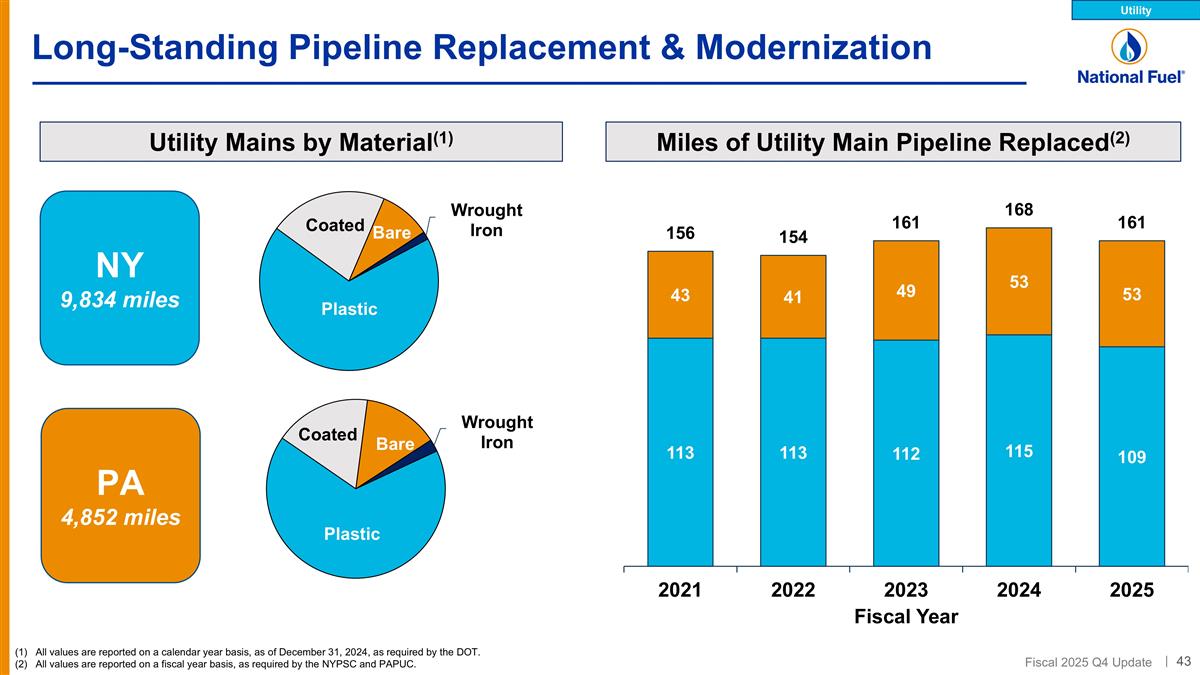

Long-Standing Pipeline Replacement & Modernization NY 9,834 miles PA 4,852 miles Miles of Utility Main Pipeline Replaced(2) Utility Mains by Material(1) (1) All values are reported on a calendar year basis, as of December 31, 2024, as required by the DOT. (2) All values are reported on a fiscal year basis, as required by the NYPSC and PAPUC. Utility

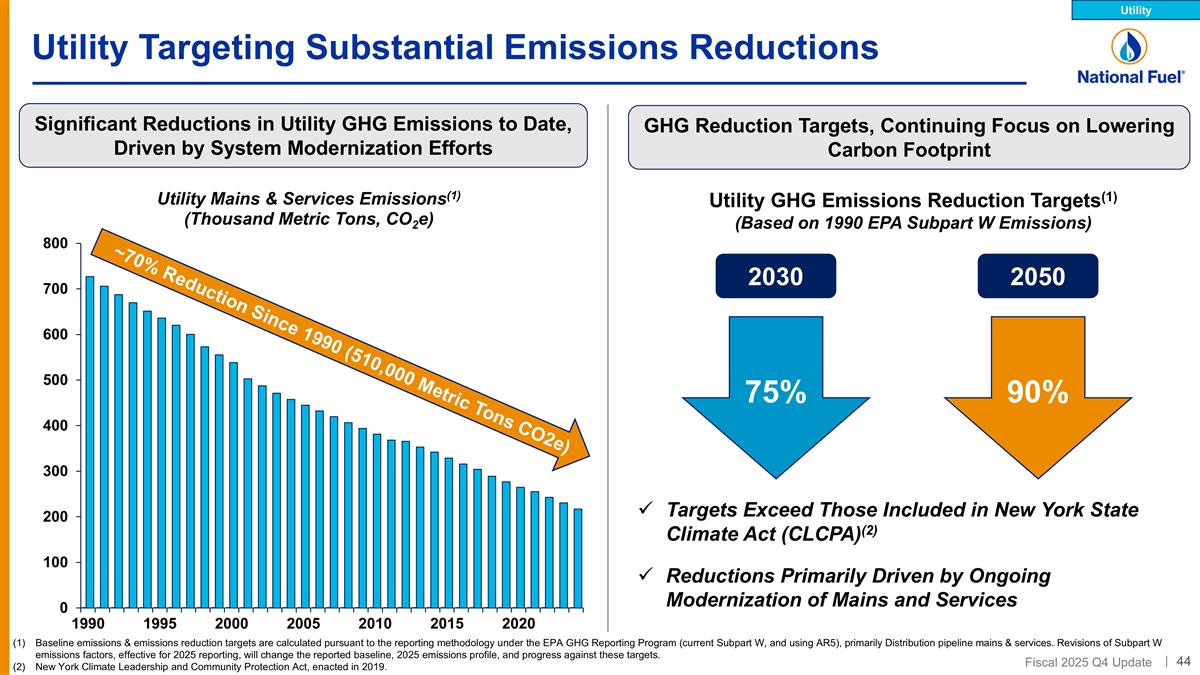

Baseline emissions & emissions reduction targets are calculated pursuant to the reporting methodology under the EPA GHG Reporting Program (current Subpart W, and using AR5), primarily Distribution pipeline mains & services. Revisions of Subpart W emissions factors, effective for 2025 reporting, will change the reported baseline, 2025 emissions profile, and progress against these targets. New York Climate Leadership and Community Protection Act, enacted in 2019. Targets Exceed Those Included in New York State Climate Act (CLCPA)(2) Reductions Primarily Driven by Ongoing Modernization of Mains and Services Utility Targeting Substantial Emissions Reductions 2030 75% Significant Reductions in Utility GHG Emissions to Date, Driven by System Modernization Efforts GHG Reduction Targets, Continuing Focus on Lowering Carbon Footprint ~70% Reduction Since 1990 (510,000 Metric Tons CO2e) Utility GHG Emissions Reduction Targets(1) (Based on 1990 EPA Subpart W Emissions) 90% 2050 Utility

Guidance & Other Financial Information Contact Information: Natalie Fischer, Director of Investor Relations (716) 857-7315 fischern@natfuel.com

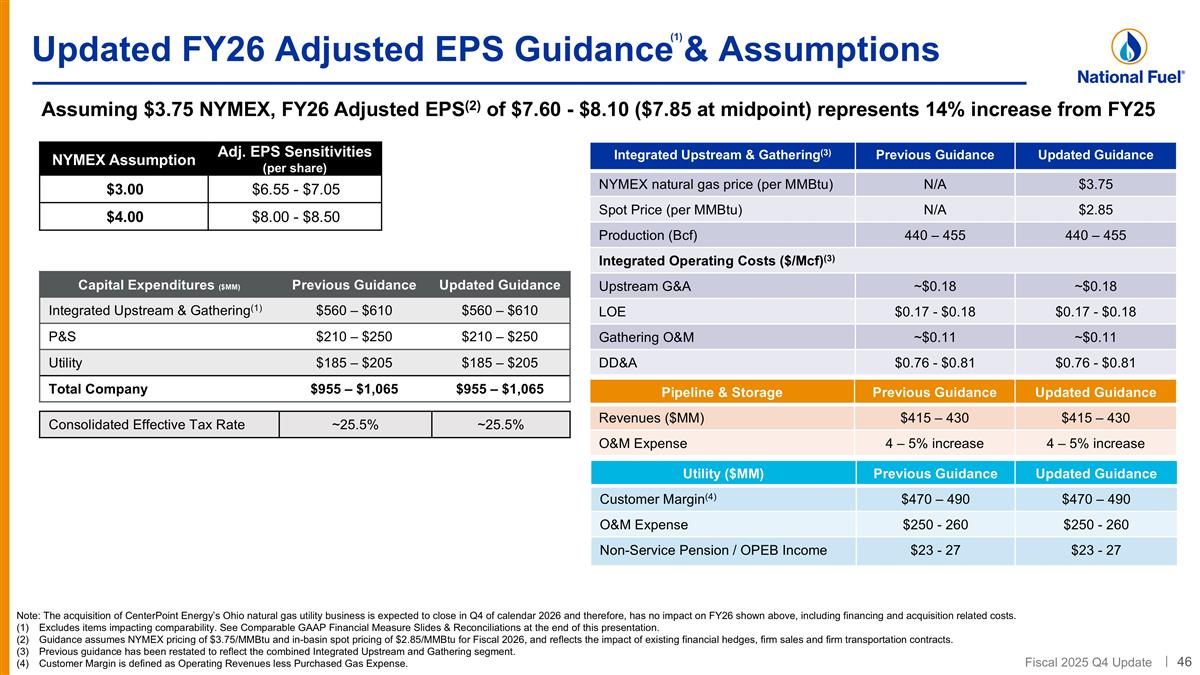

Updated FY26 Adjusted EPS Guidance & Assumptions Note: The acquisition of CenterPoint Energy’s Ohio natural gas utility business is expected to close in Q4 of calendar 2026 and therefore, has no impact on FY26 shown above, including financing and acquisition related costs. Excludes items impacting comparability. See Comparable GAAP Financial Measure Slides & Reconciliations at the end of this presentation. Guidance assumes NYMEX pricing of $3.75/MMBtu and in-basin spot pricing of $2.85/MMBtu for Fiscal 2026, and reflects the impact of existing financial hedges, firm sales and firm transportation contracts. Previous guidance has been restated to reflect the combined Integrated Upstream and Gathering segment. Customer Margin is defined as Operating Revenues less Purchased Gas Expense. Consolidated Effective Tax Rate ~25.5% ~25.5% Integrated Upstream & Gathering(3) Previous Guidance Updated Guidance NYMEX natural gas price (per MMBtu) N/A $3.75 Spot Price (per MMBtu) N/A $2.85 Production (Bcf) 440 – 455 440 – 455 Integrated Operating Costs ($/Mcf)(3) Upstream G&A ~$0.18 ~$0.18 LOE $0.17 - $0.18 $0.17 - $0.18 Gathering O&M ~$0.11 ~$0.11 DD&A $0.76 - $0.81 $0.76 - $0.81 Pipeline & Storage Previous Guidance Updated Guidance Revenues ($MM) $415 – 430 $415 – 430 O&M Expense 4 – 5% increase 4 – 5% increase Utility ($MM) Previous Guidance Updated Guidance Customer Margin(4) $470 – 490 $470 – 490 O&M Expense $250 - 260 $250 - 260 Non-Service Pension / OPEB Income $23 - 27 $23 - 27 Capital Expenditures ($MM) Previous Guidance Updated Guidance Integrated Upstream & Gathering(1) $560 – $610 $560 – $610 P&S $210 – $250 $210 – $250 Utility $185 – $205 $185 – $205 Total Company $955 – $1,065 $955 – $1,065 (1) NYMEX Assumption Adj. EPS Sensitivities (per share) $3.00 $6.55 - $7.05 $4.00 $8.00 - $8.50 Assuming $3.75 NYMEX, FY26 Adjusted EPS(2) of $7.60 - $8.10 ($7.85 at midpoint) represents 14% increase from FY25 46

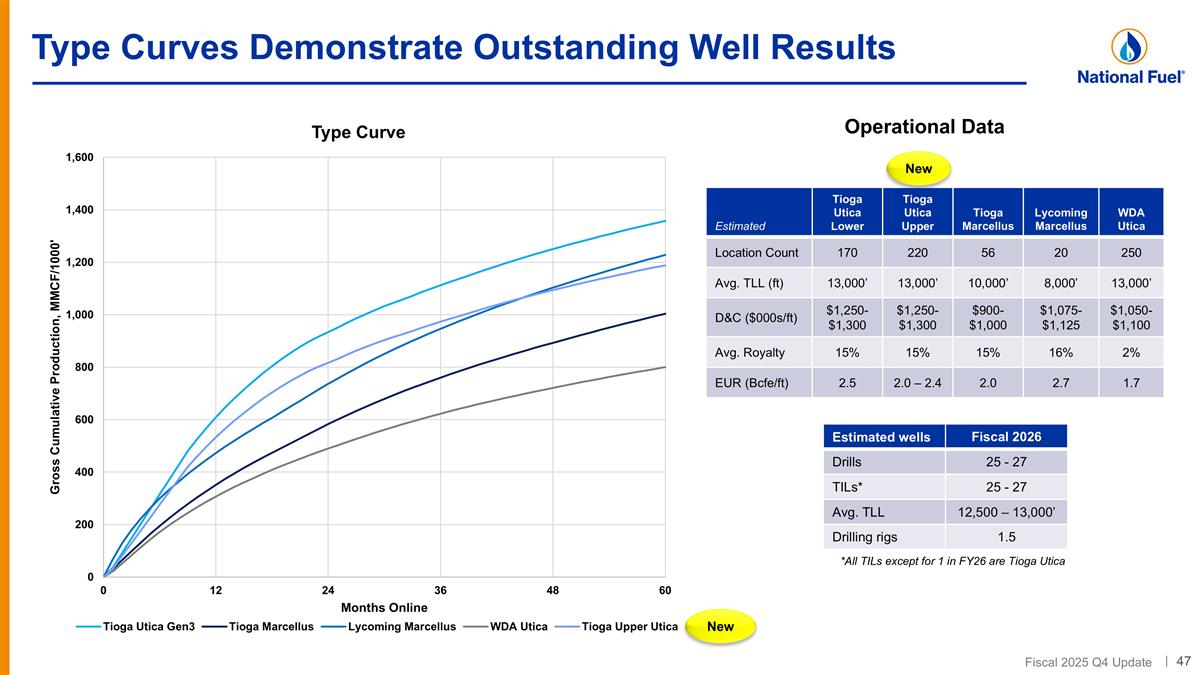

Type Curves Demonstrate Outstanding Well Results *All TILs except for 1 in FY26 are Tioga Utica Estimated wells Fiscal 2026 Drills 25 - 27 TILs* 25 - 27 Avg. TLL 12,500 – 13,000’ Drilling rigs 1.5 Estimated Tioga Utica Lower Tioga Utica Upper Tioga Marcellus Lycoming Marcellus WDA Utica Location Count 170 220 56 20 250 Avg. TLL (ft) 13,000’ 13,000’ 10,000’ 8,000’ 13,000’ D&C ($000s/ft) $1,250- $1,300 $1,250- $1,300 $900- $1,000 $1,075- $1,125 $1,050- $1,100 Avg. Royalty 15% 15% 15% 16% 2% EUR (Bcfe/ft) 2.5 2.0 – 2.4 2.0 2.7 1.7 Operational Data New New

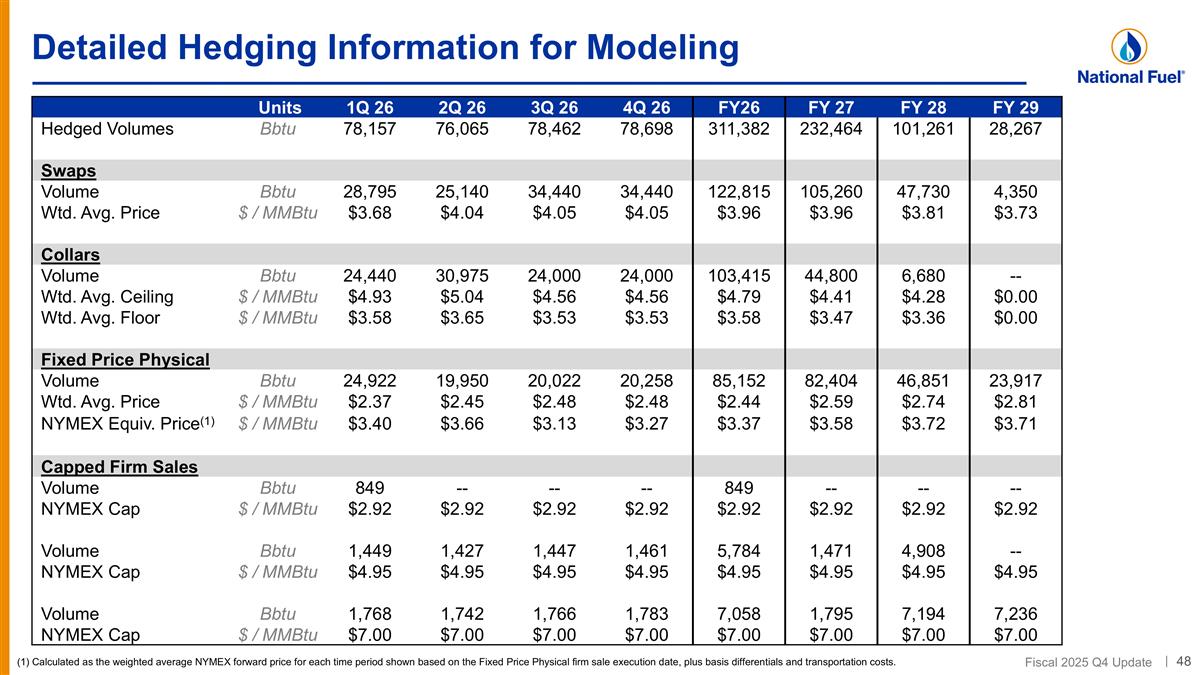

Detailed Hedging Information for Modeling Calculated as the weighted average NYMEX forward price for each time period shown based on the Fixed Price Physical firm sale execution date, plus basis differentials and transportation costs. Units 1Q 26 2Q 26 3Q 26 4Q 26 FY26 FY 27 FY 28 FY 29 Hedged Volumes Bbtu 78,157 76,065 78,462 78,698 311,382 232,464 101,261 28,267 Swaps Volume Bbtu 28,795 25,140 34,440 34,440 122,815 105,260 47,730 4,350 Wtd. Avg. Price $ / MMBtu $3.68 $4.04 $4.05 $4.05 $3.96 $3.96 $3.81 $3.73 Collars Volume Bbtu 24,440 30,975 24,000 24,000 103,415 44,800 6,680 -- Wtd. Avg. Ceiling $ / MMBtu $4.93 $5.04 $4.56 $4.56 $4.79 $4.41 $4.28 $0.00 Wtd. Avg. Floor $ / MMBtu $3.58 $3.65 $3.53 $3.53 $3.58 $3.47 $3.36 $0.00 Fixed Price Physical Volume Bbtu 24,922 19,950 20,022 20,258 85,152 82,404 46,851 23,917 Wtd. Avg. Price $ / MMBtu $2.37 $2.45 $2.48 $2.48 $2.44 $2.59 $2.74 $2.81 NYMEX Equiv. Price(1) $ / MMBtu $3.40 $3.66 $3.13 $3.27 $3.37 $3.58 $3.72 $3.71 Capped Firm Sales Volume Bbtu 849 -- -- -- 849 -- -- -- NYMEX Cap $ / MMBtu $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 Volume Bbtu 1,449 1,427 1,447 1,461 5,784 1,471 4,908 -- NYMEX Cap $ / MMBtu $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 Volume Bbtu 1,768 1,742 1,766 1,783 7,058 1,795 7,194 7,236 NYMEX Cap $ / MMBtu $7.00 $7.00 $7.00 $7.00 $7.00 $7.00 $7.00 $7.00

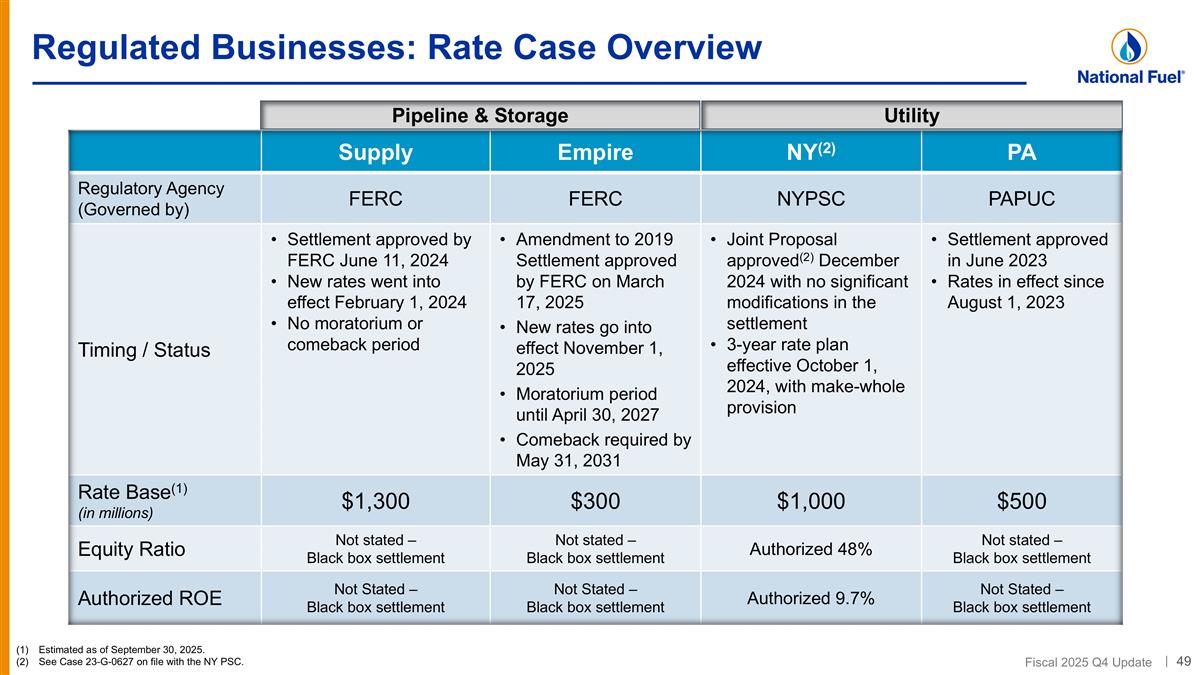

Regulated Businesses: Rate Case Overview Supply Empire NY(2) PA Regulatory Agency (Governed by) FERC FERC NYPSC PAPUC Timing / Status Settlement approved by FERC June 11, 2024 New rates went into effect February 1, 2024 No moratorium or comeback period Amendment to 2019 Settlement approved by FERC on March 17, 2025 New rates go into effect November 1, 2025 Moratorium period until April 30, 2027 Comeback required by May 31, 2031 Joint Proposal approved(2) December 2024 with no significant modifications in the settlement 3-year rate plan effective October 1, 2024, with make-whole provision Settlement approved in June 2023 Rates in effect since August 1, 2023 Rate Base(1) (in millions) $1,300 $300 $1,000 $500 Equity Ratio Not stated – Black box settlement Not stated – Black box settlement Authorized 48% Not stated – Black box settlement Authorized ROE Not Stated – Black box settlement Not Stated – Black box settlement Authorized 9.7% Not Stated – Black box settlement Pipeline & Storage Utility Estimated as of September 30, 2025. See Case 23-G-0627 on file with the NY PSC.

Comparable GAAP Financial Measure Slides & Reconciliations This presentation contains certain non-GAAP financial measures. For pages that contain non-GAAP financial measures, pages containing the most directly comparable GAAP financial measures and reconciliations are provided in the slides that follow. The Company believes that its non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s ongoing operating results or liquidity and for comparing the Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP. Management defines adjusted earnings and adjusted earnings per share as reported GAAP earnings before items impacting comparability. Management defines adjusted EBITDA as reported GAAP earnings before the following items: interest expense, income taxes, depreciation, depletion and amortization, other income and deductions, impairments, and other items reflected in operating income that impact comparability. Management defines free cash flow as net cash provided by operating activities, less net cash used in investing activities, adjusted for acquisitions and divestitures. The Company is unable to provide a reconciliation of projected free cash flow as described in this presentation to its respective comparable financial measure calculated in accordance with GAAP without unreasonable efforts. This is due to our inability to reliably predict the comparable GAAP projected metrics, including operating income and total production costs, given the unknown effect, timing, and potential significance of certain income statement items. Reconciliations of forward-looking non-GAAP financial measures and non-GAAP ratios to comparable GAAP measures are not available due to the challenges and impracticability of estimating certain items, particularly depreciation and depletion expense, interest expense, income tax expense (benefit), other potential adjustments and charges, including ceiling test impairments, and non-cash unrealized derivative fair value gains and losses that are subject to market variability. Because of those challenges, a reconciliation of forward-looking non-GAAP financial measures and non-GAAP ratios is not available without unreasonable effort.

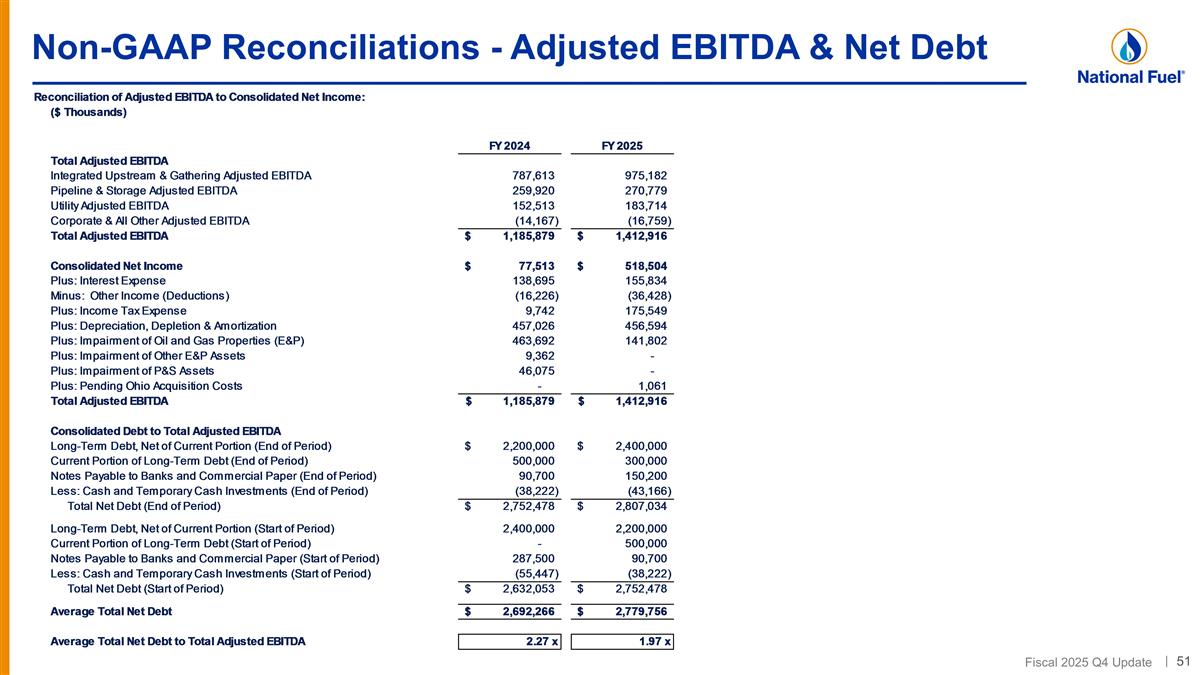

Non-GAAP Reconciliations - Adjusted EBITDA & Net Debt

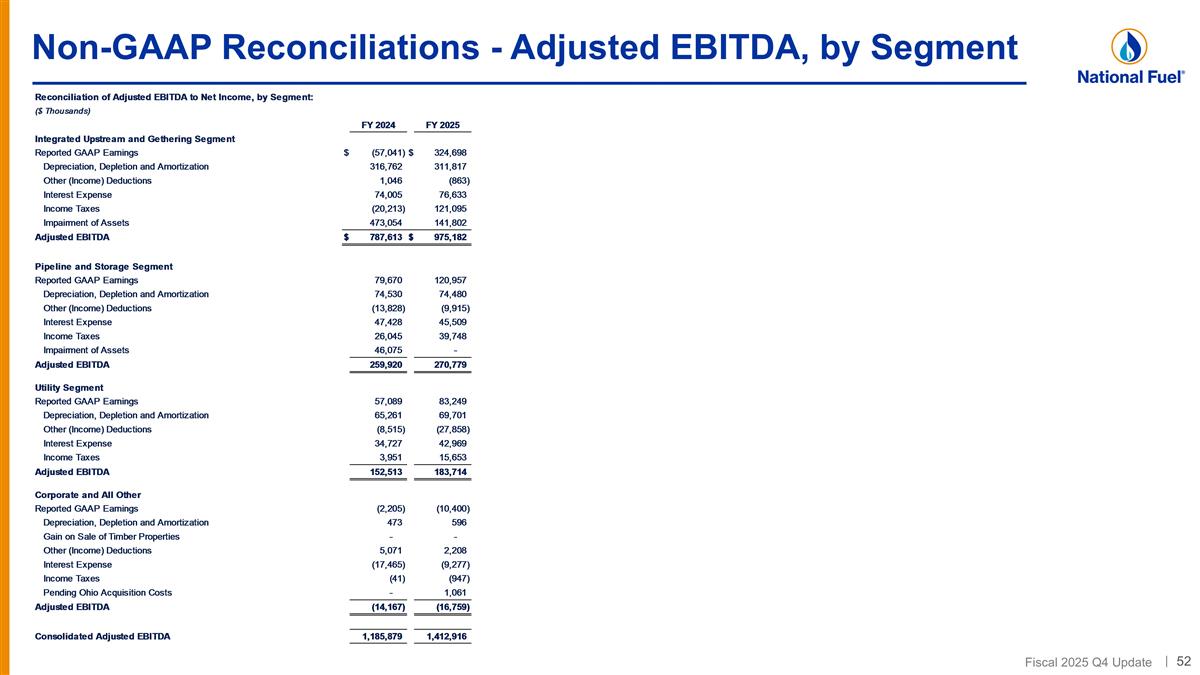

Non-GAAP Reconciliations - Adjusted EBITDA, by Segment

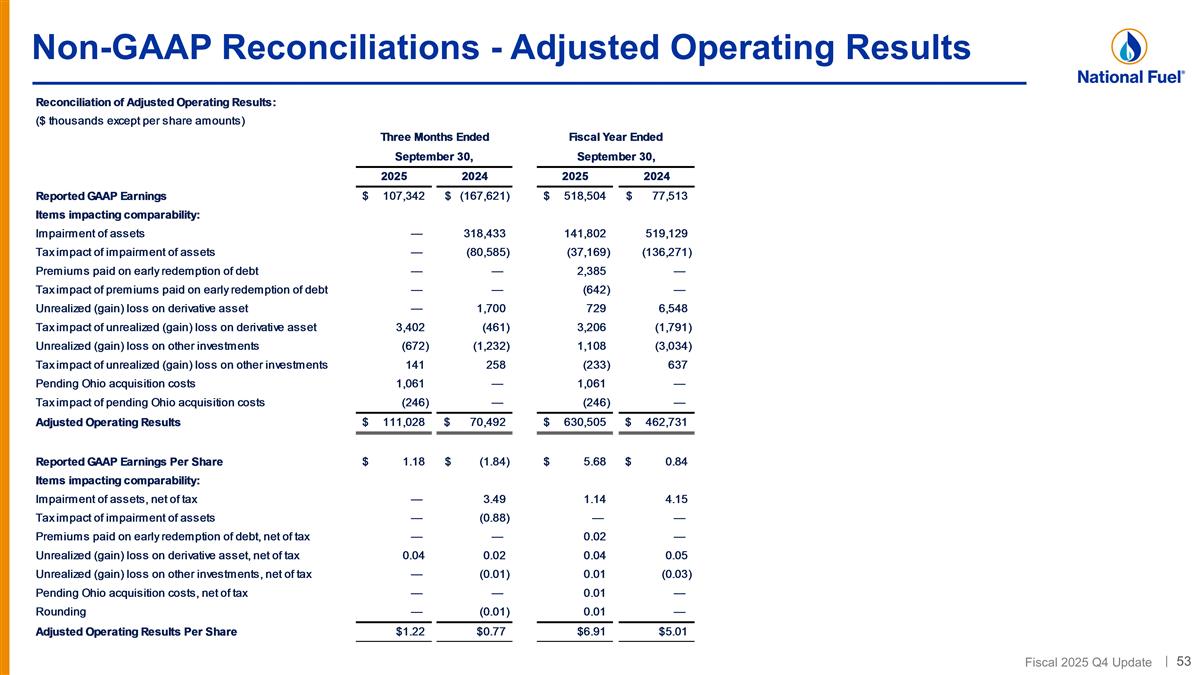

Non-GAAP Reconciliations - Adjusted Operating Results

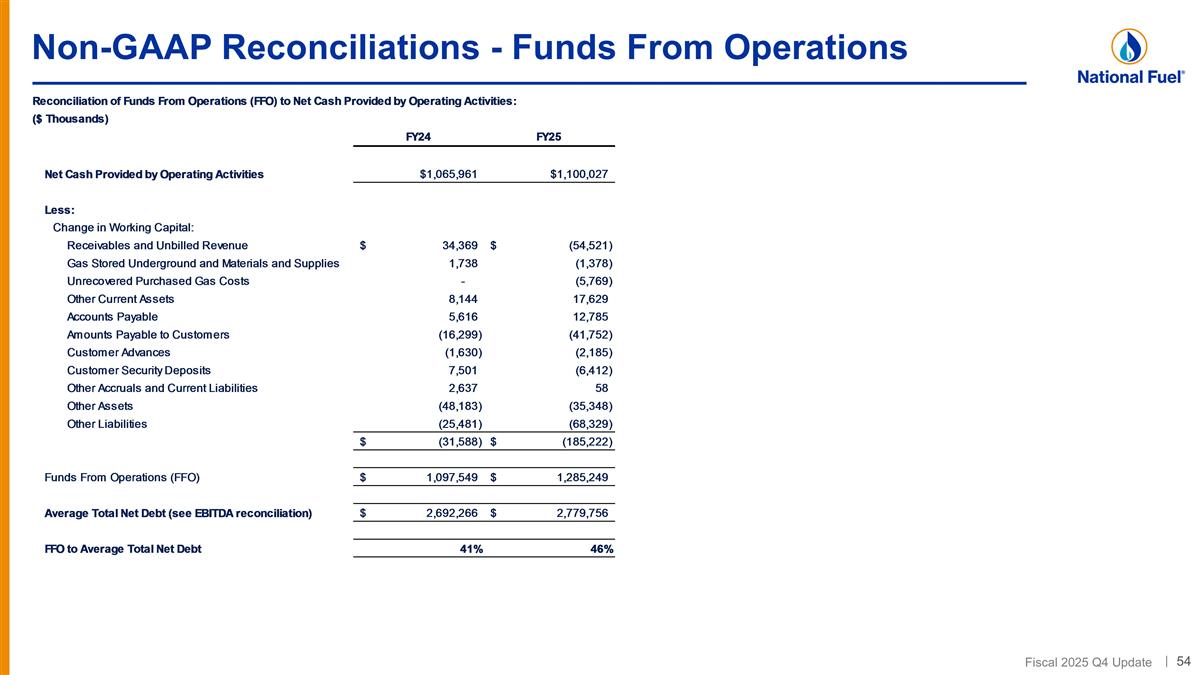

Non-GAAP Reconciliations - Funds From Operations

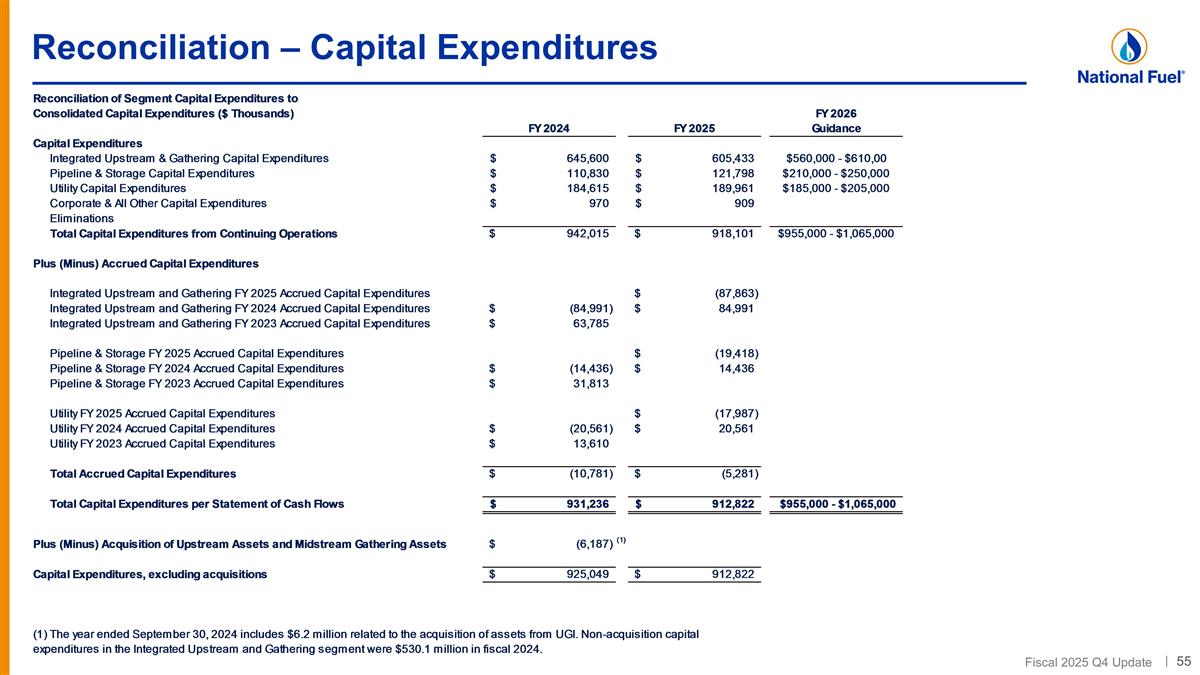

Reconciliation – Capital Expenditures

Safe Harbor For Forward Looking Statements This presentation may contain “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including statements regarding future prospects, plans, objectives, goals, projections, estimates of gas quantities, strategies, future events or performance and underlying assumptions, capital structure, anticipated capital expenditures, completion of construction projects, projections for pension and other post-retirement benefit obligations, impacts of the adoption of new accounting rules, and possible outcomes of litigation or regulatory proceedings, as well as statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar expressions. Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Company’s expectations, beliefs and projections are expressed in good faith and are believed by the Company to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors, the following are important factors that could cause actual results to differ materially from those discussed in the forward-looking statements: changes in laws, regulations or judicial interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and production activities such as hydraulic fracturing; governmental/regulatory actions, initiatives and proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design, retained natural gas and system modernization), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; changes in economic conditions, including the imposition of additional tariffs on U.S. imports and related retaliatory tariffs, inflationary pressures, supply chain issues, liquidity challenges, and global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the Company’s ability to complete strategic transactions, including receipt of required regulatory clearances and satisfaction of other conditions to closing; governmental/regulatory actions and/or market pressures to reduce or eliminate reliance on natural gas; the Company’s ability to estimate accurately the time and resources necessary to meet emissions targets; changes in the price of natural gas; impairments under the SEC’s full cost ceiling test for natural gas reserves; the creditworthiness or performance of the Company’s key suppliers, customers and counterparties; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable terms for working capital, capital expenditures, other investments, and acquisitions, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; changes in price differentials between similar quantities of natural gas sold at different geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; the impact of information technology disruptions, cybersecurity or data security breaches, including the impact of issues that may arise from the use of artificial intelligence technologies; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas reserves, including among others geology, lease availability and costs, title disputes, weather conditions, water availability and disposal or recycling opportunities of used water, shortages, delays or unavailability of equipment and services required in drilling operations, insufficient gathering, processing and transportation capacity, the need to obtain governmental approvals and permits, and compliance with environmental laws and regulations; increased costs or delays or changes in plans with respect to Company projects or related projects of other companies, as well as difficulties or delays in obtaining necessary governmental approvals, permits or orders or in obtaining the cooperation of interconnecting facility operators; increasing health care costs and the resulting effect on health insurance premiums and on the obligation to provide other post-retirement benefits; other changes in price differentials between similar quantities of natural gas having different quality, heating value, hydrocarbon mix or delivery date; the cost and effects of legal and administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; negotiations with the collective bargaining units representing the Company’s workforce, including potential work stoppages during negotiations; uncertainty of natural gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas; changes in demographic patterns and weather conditions (including those related to climate change); changes in the availability, price or accounting treatment of derivative financial instruments; changes in laws, actuarial assumptions, the interest rate environment and the return on plan/trust assets related to the Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities or acts of war, as well as economic and operational disruptions due to third-party outages; significant differences between the Company’s projected and actual capital expenditures and operating expenses; or increasing costs of insurance, changes in coverage and the ability to obtain insurance. Forward-looking statements include estimates of gas quantities. Proved gas reserves are those quantities of gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible under existing economic conditions, operating methods and government regulations. Other estimates of gas quantities, including estimates of probable reserves, possible reserves, and resource potential, are by their nature more speculative than estimates of proved reserves. Accordingly, estimates other than proved reserves are subject to substantially greater risk of being actually realized. Investors are urged to consider closely the disclosure in our Form 10-K available at www.nationalfuel.com. You can also obtain this form on the SEC’s website at www.sec.gov. Forward-looking and other statements in this presentation regarding methane and greenhouse gas reduction plans and goals are not an indication that these statements are necessarily material to investor or required to be disclosed in our filings with the SEC. In addition, historical, current and forward-looking statements regarding methane and greenhouse gas emissions may be based on standards for measuring progress that are still developing, internal controls, and processes that continue to evolve and assumptions that are subject to change in the future. For a discussion of the risks set forth above and other factors that could cause actual results to differ materially from results referred to in the forward-looking statements, see “Risk Factors” in the Company’s Form 10-K for the fiscal year ended September 30, 2024, and the Forms 10-Q for the quarters ended December 31, 2024, March 31, 2025, and June 30, 2025. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date thereof or to reflect the occurrence of unanticipated events.