| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant Rule 14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Nordson Corporation

28601 Clemens Road

Westlake, Ohio 44145

January 16, 2026

Dear Shareholder:

On behalf of the Board of Directors of Nordson Corporation (the “Board of Directors”), it is my pleasure to invite you to attend our virtual annual meeting of shareholders (the “Annual Meeting”), which will be conducted in an audio-only format on Monday, March 2, 2026, at 8:30 a.m. Eastern Time. You will be able to attend the Annual Meeting online by registering at www.proxydocs.com/NDSN, where you will be able to vote your shares electronically, and submit your questions during the Annual Meeting. As the Annual Meeting is being held in a virtual format only, you will not be able to attend the Annual Meeting in person.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the proposals that will be discussed and voted upon during the Annual Meeting. It is important that you vote your shares whether or not you plan to virtually attend the Annual Meeting. You have a choice of voting through the internet, by telephone, or by returning the proxy/voting instruction card by mail. You may also vote electronically during the Annual Meeting. Please refer to the instructions in the proxy materials.

On behalf of management and the Board of Directors, I want to thank you for your continued support and confidence in 2026.

|

Sincerely,

VICTOR RICHEY, JR.

Chair of the Board of Directors |

TABLE OF CONTENTS

Website References

Throughout this proxy statement, we identify certain materials that are available in full on our website. The information contained on, or available through Nordson’s internet website is not and shall not be deemed to be, incorporated by reference in this proxy statement.

Forward-looking Statements

This proxy statement contains forward-looking statements within the meaning of the federal securities laws. Forward looking statements may be identified by the use of words such as “believe,” “expect,” “plans,” “intends,” “may,” “strategy,” “target,” “goals,” “anticipate,” and other similar words, and include, without limitation, our expectations about our future financial performance, earnings and dividend growth. These statements are subject to certain risks, uncertainties, and other factors, which could cause actual results to differ materially from those anticipated. Such risks include those contained in Nordson’s Annual Report on Form 10-K for the year ended October 31, 2025 and other documents Nordson files with the Securities and Exchange Commission. These risks are not comprehensive and given these and other possible risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Any forward-looking statements made by Nordson speak only as of the date on which they are made. Nordson is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

Nordson Corporation

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

To Be Held Monday, March 2, 2026

| Date and Time: | Monday, March 2, 2026 8:30 a.m. Eastern Time | |

| Place: | Virtually, Via Audio-Only To attend the Annual Meeting you must register at www.proxydocs.com/NDSN | |

| Proposals: | 1. To elect three director nominees to our Board of Directors;

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2026;

3. To approve, on an advisory basis, the compensation of our named executive officers; and

4. To transact other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. | |

| Record Date: | Close of business on January 2, 2026 | |

We have provided access to our proxy materials over the internet at www.proxydocs.com/NDSN by mailing our shareholders a Notice of Internet Availability of Proxy Materials or, upon your request, by mailing this Proxy Statement and the enclosed proxy/voting instruction card on or about January 16, 2026. The Notice of Internet Availability of Proxy Materials provides information on how shareholders can obtain paper copies of our proxy materials, if they so choose.

Our Proxy Statement, and our Annual Report on Form 10-K for the fiscal year ended October 31, 2025, are also available at: https://investors.nordson.com/financials/default.aspx#annual-reports. The Board of Directors has determined that shareholders of record at the close of business on January 2, 2026 are entitled to notice of, and to vote during, the Annual Meeting.

By Order of the Board of Directors,

Jennifer McDonough

Executive Vice President, General Counsel

and Secretary

January 16, 2026

Westlake, Ohio

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on March 2, 2026:

The proxy materials, including this Proxy Statement, and the Annual Report for the fiscal year ended

October 31, 2025, are available at:

www.proxydocs.com/NDSN

Nordson Corporation – 2026 Proxy Statement | 1

PROXY STATEMENT SUMMARY

This summary highlights select information about Nordson’s 2026 Annual Meeting of Shareholders and our corporate governance and executive compensation practices. These charts do not contain all of the information provided elsewhere in this Proxy Statement; therefore you should read the entire proxy statement carefully before voting.

We first released this proxy statement and the accompanying proxy materials to shareholders on or about January 16, 2026.

|

ANNUAL MEETING INFORMATION

| ||||

| DATE & TIME | LOCATION | RECORD DATE | ||

|

|

|

| ||

| Monday, March 2, 2026

8:30 a.m. Eastern Time |

Virtually, via the internet. www.proxydocs.com/NDSN

|

January 2, 2026 | ||

|

VOTING MATTERS AND BOARD RECOMMENDATIONS

| ||||||

| PROPOSALS | REQUIRED VOTE | BOARD RECOMMENDATION |

PAGE | |||

| Proposal 1 Elect three directors to our Board of Directors |

Each nominee must receive a plurality of the votes cast. | FOR each nominee |

8 | |||

| Proposal 2 Ratify the appointment of Ernst & Young LLP as our independent registered public accounting |

This non-binding proposal will be considered approved if more votes are cast in favor than against. | FOR | 34 | |||

| Proposal 3 Approve, on an advisory basis, the |

This non-binding proposal will be considered approved if more votes are cast in favor than against. | FOR | 39 | |||

|

HOW TO VOTE

| ||||||

| VIA THE INTERNET | BY TELEPHONE | BY MAIL | AT THE MEETING | |||

|

|

|

|

| |||

| www.proxypush.com/NDSN | Call 1-866-868-2638 in the U.S. or Canada |

Follow the instructions on the proxy/voting instruction card |

Attend our Annual Meeting and vote electronically | |||

Abstentions as to any matter are counted in determining the presence of a quorum at the Annual Meeting. Abstentions are not included in the vote count for election of directors. However, abstentions will affect the outcome of the votes on Proposals 2 and 3, being equivalent to votes “against” the proposals.

We will also consider any other matters that may properly be brought before the Annual Meeting and any postponement(s) or adjournment(s) thereof. As of the date of this Proxy Statement, we have not received notice of other matters that may be properly presented at the Annual Meeting.

2 | Nordson Corporation – 2026 Proxy Statement

GOVERNANCE HIGHLIGHTS

| BOARD SNAPSHOT

|

GOVERNANCE PROFILE

| |||

|

|

Board Composition

|

|||

• Board Size

|

10 | |||

• Number of Independent Directors

|

9 | |||

• Independent Chair of the Board

|

Yes | |||

• Percentage of Independent Committee Members

|

100% | |||

• Limit on Director Services on Other Boards

|

Yes | |||

• Mandatory Retirement Age Policy

|

Yes | |||

• Resignation Policy

|

Yes

| |||

|

Corporate Governance

|

||||

• Board and Committee Meetings Held in 2025

|

18 | |||

• Directors Attending Fewer than 75% of Meetings

|

0 | |||

• Regular Executive Sessions of Independent Directors

|

Yes | |||

• Annual Board and Committee Self-Evaluations

|

Yes | |||

• Annual Independent Director Evaluation of President & CEO

|

Yes | |||

• Majority Voting Policy For Directors

|

Yes | |||

• Risk Oversight by Full Board and Committees

|

Yes | |||

• Strong Board Oversight of Corporate Responsibility

|

Yes | |||

• Strong Board Oversight of Cybersecurity

|

Yes | |||

• Strong Board Oversight Of Corporate Culture And Strategy

|

Yes

| |||

|

Stakeholder and Governance Practices

|

||||

• One Share, One Vote Standard

|

Yes | |||

• No Shareholder Rights Or “poison Pill”

|

Yes | |||

• Shareholder Rights To Call A Special Meeting**

|

Yes | |||

• Corporate Responsibility Report With Climate Targets

|

Yes | |||

• Code of Conduct for Directors, NEOs and Employees

|

Yes | |||

• Supplier Code of Conduct

|

Yes | |||

• Insider Trading, Anti-Hedging/ Pledging Policy

|

Yes | |||

• Independent Auditor: Ernst & Young LLP

|

Yes

| |||

|

Compensation Practices

|

||||

• Pay for Performance

|

Yes | |||

• Annual Say-on-Pay Advisory Vote

|

Yes | |||

• Compensation Aligned With Strategic Initiatives

|

Yes | |||

• Incentive Plans Do Not Encourage Excessive Risk Taking

|

Yes | |||

• No Excessive Perquisites

|

Yes | |||

• Robust Share Ownership Guidelines for Directors and NEOs

|

Yes | |||

• Clawback Policy

|

Yes | |||

• Double-trigger Change In Control Policy

|

Yes | |||

• Severance Policy

|

Yes | |||

• Independent Compensation Consultant-FW Cook

|

Yes | |||

• CEO Pay Ratio

|

130:1

| |||

| ** | Special meetings can be called by shareholders holding at least 50% of the voting power |

Nordson Corporation – 2026 Proxy Statement | 3

2025 HIGHLIGHTS

FINANCIAL

| Sales | EBITDA(1) | Operating Profit | ||||||||||||||||||

|

$2.8 Billion

A Nordson Record

|

$900 Million

A Nordson Record

|

$712 Million

25% of Sales

|

||||||||||||||||||

|

| ||||||||||||||||||||

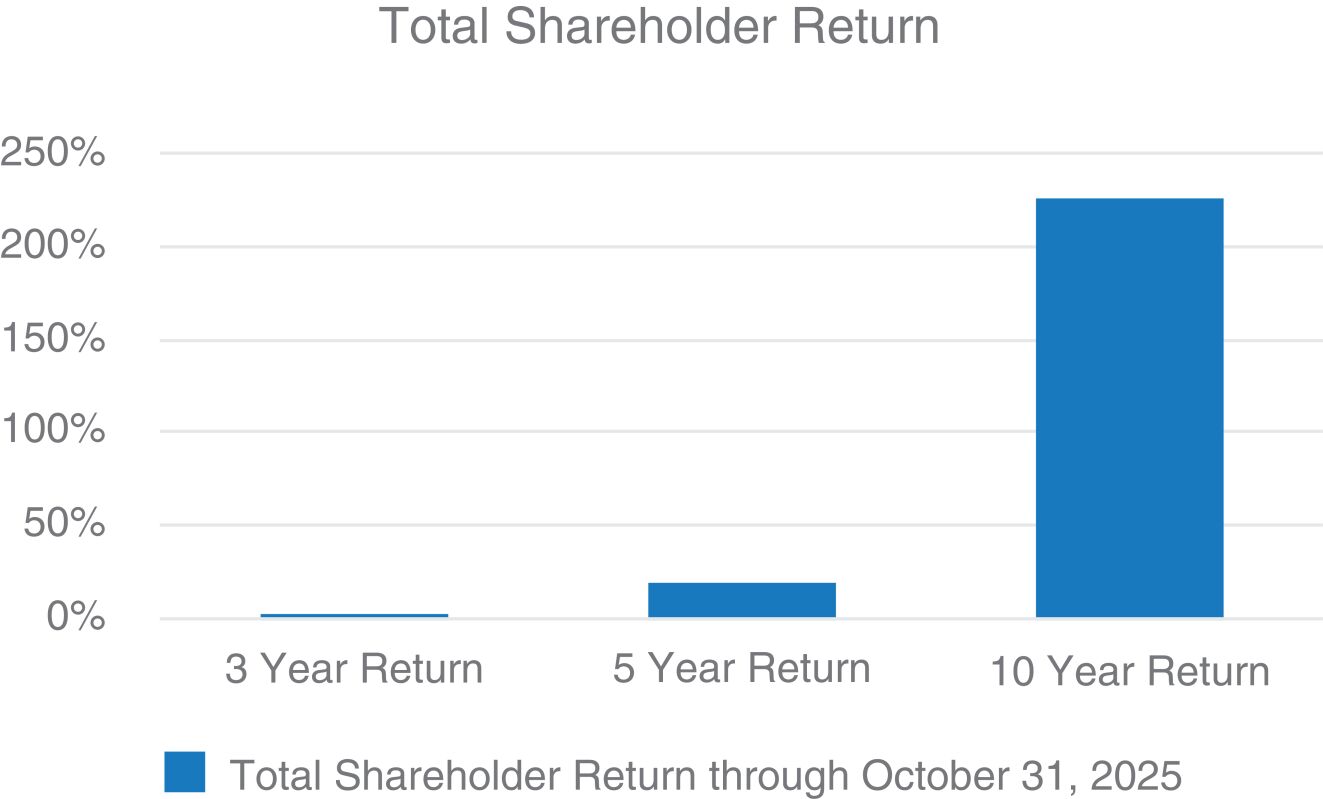

| Dividends Paid | Total Shareholder Return(2) | Net Income/Free Cash Flow(1) | ||||||||||||||||||

| $179 Million

62nd consecutive year dividend has increased

|

10 Year = 226% | $484 Million/ $661 Million

FCF 136% of net income

|

||||||||||||||||||

GOVERNANCE

| Board Refreshment | Leadership Changes | Corporate Responsibility | ||||||||||||||||||||||

• Ginger Jones was appointed as Audit Committee Chair in March 2025, bringing our standing committees chaired by women to 50%. |

• Jim DeVries, Executive Vice President, Continuous Improvement, announced his retirement effective in March 2026 following an incredible 40 year career with Nordson.

• Justin Hall was promoted to Executive Vice President, Medical Fluid Solutions following Stephen Lovass’s cessation to serve as segment leader in April 2025.

|

• We published our Corporate Responsibility Update in October 2025, which showed continued progress on our corporate responsibility-related strategies.

|

||||||||||||||||||||||

| 1. | See Reconciliation of Financial Measures (Unaudited) following the Questions and Answers About the Annual Meeting and These Proxy Materials section of this Proxy Statement. |

| 2. | “Total Shareholder Return” is defined as (share price end of period – share price start of period + dividends paid) / share price start of period. |

4 | Nordson Corporation – 2026 Proxy Statement

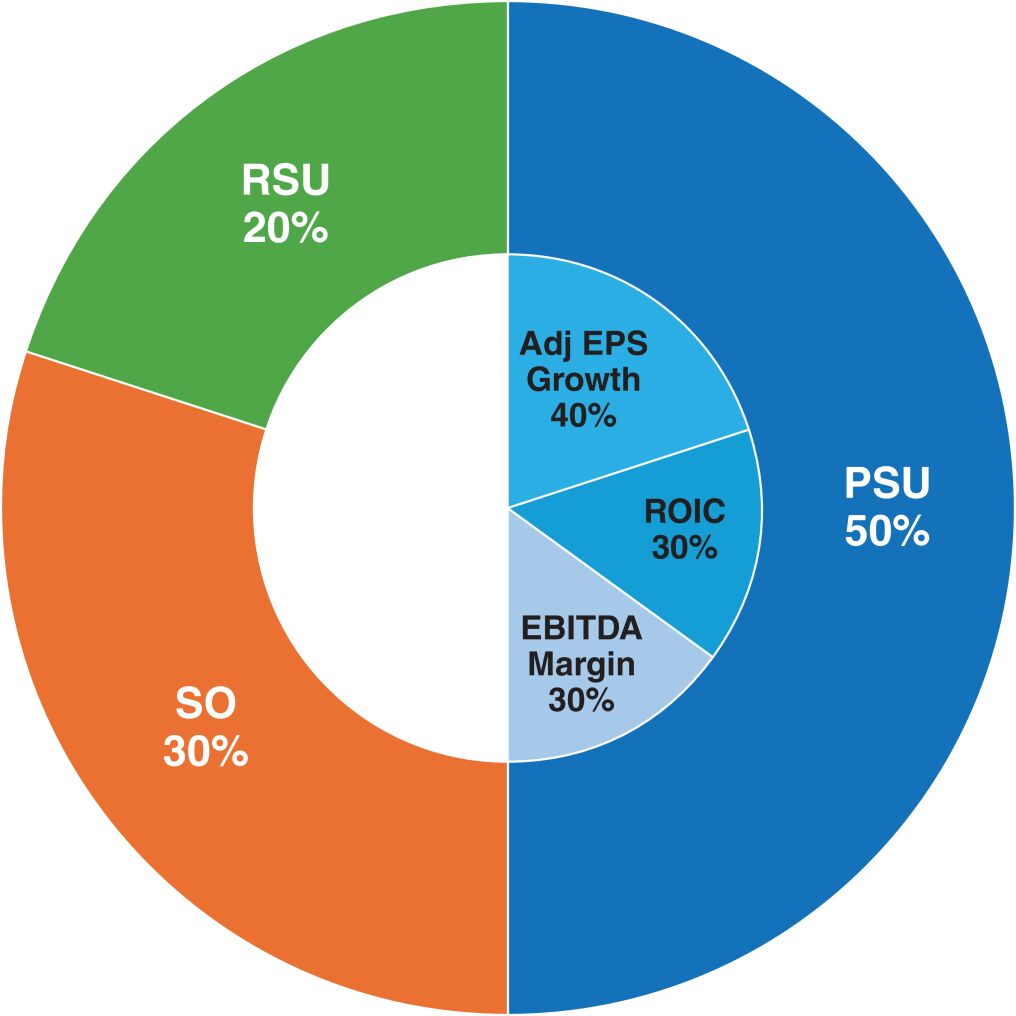

COMPENSATION

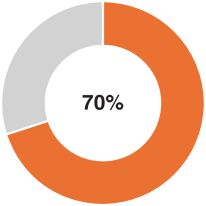

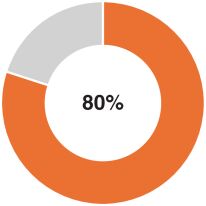

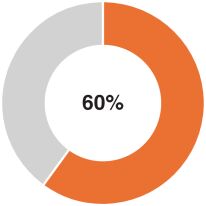

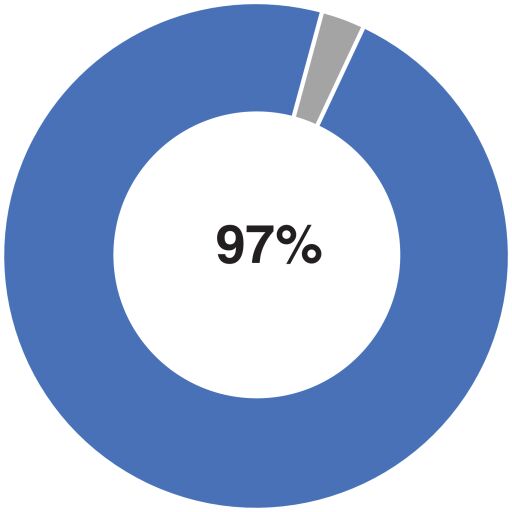

| SAY-ON-PAY |

INCENTIVE BASED COMPENSATION PAYMENTS

| |

|

Votes cast in favor at our last Annual Meeting:

|

Based on our 2025 financial performance, our incentive-based compensation payments were as follows:

• Annual Cash Incentive Award:

¡ CEO: 101% of Target

¡ All other NEOs: 88% - 101% of Target

• Performance Share Incentive Award: 65% of Target

|

Nordson Corporation – 2026 Proxy Statement | 5

DIRECTORS SERVING ON BOARDS OF OTHER PUBLIC COMPANIES

Board service by members of our Board is set forth in our Governance Guidelines, which provides that directors who are not executive officers of a public company may serve on up to three other public company boards, and directors who also serve as an executive officer of a public company may serve on a maximum of one other public company board. The following table shows our directors as of our record date, January 2, 2026, and the public company boards upon which they serve other than ours:

|

Director

|

Other Public Companies

| |

| Annette Clayton | Oshkosh Corporation (NYSE: OSK) NXP Semiconductors N.V. (Nasdaq: NXPI) Duke Energy Corporation (NYSE: DUK) | |

| John DeFord | Globus Medical Inc. (NYSE: GMED) Maravai LifeSciences Holdings, Inc. (Nasdaq: MRVI) | |

| Frank Jaehnert | Itron, Inc. (Nasdaq: ITRI) | |

| Ginger Jones | Tronox Holding plc (NYSE: TROX) Holley, Inc. (NYSE: HLLY) | |

| Christopher Mapes | The Timken Company (NYSE: TKR) A.O. Smith Corporation (NYSE: AOS) RPM International Inc. (NYSE: RPM) | |

| Michael Merriman, Jr. | Regis Corporation (NYSE: RGS) | |

| Milton Morris | Embecta Corporation (Nasdaq: EMBC) Myomo, Inc. (NYSE: MYO) | |

| Sundaram Nagarajan (CEO) | Wesco International, Inc. (NYSE: WCC) | |

| Jennifer Parmentier | Parker-Hannifin Corporation (NYSE: PH) | |

| Victor Richey, Jr. (Chair) | Thermon Group Holdings, Inc. (NYSE: THR) | |

6 | Nordson Corporation – 2026 Proxy Statement

NORDSON CORPORATION

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

March 2, 2026

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) of Nordson Corporation for use at the 2026 Annual Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting will be held virtually, via live audio-only webcast on Monday, March 2, 2026, at 8:30 a.m. Eastern Time, for the following purposes:

| 1. | To elect three director nominees to our Board of Directors; |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2026; |

| 3. | To approve, on an advisory basis, the compensation of our named executive officers; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement. |

The Notice of Internet Availability of Proxy Materials or, if requested, the Proxy Statement and the accompanying proxy/voting instruction card were first mailed to shareholders on or about January 16, 2026.

We are holding the Annual Meeting virtually. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit your questions during the Annual Meeting by registering in advance at www.proxydocs.com/NDSN. You will not be able to attend the Annual Meeting in person. This Proxy Statement includes more information about the procedures for the virtual Annual Meeting.

This Proxy Statement contains important information regarding our Annual Meeting, the proposals on which you are being asked to vote, information you may find useful in determining how to vote, and information about voting procedures. As used in this Proxy Statement, “we,” “us,” “our,” “Nordson,” or the “Company” refers to Nordson Corporation.

Nordson Corporation – 2026 Proxy Statement | 7

PROPOSAL 1: ELECTION OF DIRECTORS

The Governance and Sustainability Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the Annual Meeting. Our Board is divided into three classes, with each class serving for three-year terms. The Board is currently comprised of ten directors, with one class having four directors and two classes having three directors.

The Governance and Sustainability Committee has recommended, and the Board has approved, the persons named as nominees and, unless otherwise marked, a duly executed and properly submitted proxy will be voted for those nominees. Nominees Christopher Mapes, Michael Merriman, Jr., and Sundaram Nagarajan, currently serve as directors. All nominees have agreed to stand for election for a three-year term. Annette Clayton, whose term expires at the Annual Meeting, is not being nominated for re-election. The Board is grateful to Ms. Clayton for her leadership and contributions during her tenure.

In assessing each director nominee and the composition of the Board as a whole, the Governance and Sustainability Committee considers a range of experiences, qualifications, attributes, and skills that the Committee believes enable a director nominee to make significant contributions to the Board, Nordson, and our shareholders.

8 | Nordson Corporation – 2026 Proxy Statement

Director Nominee Skills and Experience

The current-serving directors, including the nominees, collectively have a mix of various skills and qualifications, some of which are listed in the table below. These collective attributes enable the Board to provide insightful leadership as it strives to advance our strategies and deliver returns to shareholders.

| Skills, Qualifications and Background |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

CEO OR SENIOR MANAGEMENT LEADERSHIP

Experience serving as the Chief Executive Officer or other executive leadership role.

We seek to have directors with experience driving strategic direction and growth of an organization, with hands-on leadership experience in core management areas, such as financial reporting, compliance, risk management, and leadership development. |

|

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| PUBLIC COMPANY BOARD SERVICE

Experience as a board member of another publicly traded company.

We seek to have directors with broad knowledge of corporate governance practices, and experience with relations between a board and senior management to support accountability, transparency, responsiveness and protection of shareholder interests. |

|

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| FINANCIAL ACUMEN AND EXPERTISE

Experience or expertise in financial accounting and reporting or the financial management of a major organization.

We seek to have directors with an understanding of finance and financial reporting processes to monitor and assess our operating and strategic performance and ensure robust controls and accurate financial reporting. |

|

● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||

|

|

CORPORATE FINANCE AND M&A EXPERIENCE

Experience in corporate lending or borrowing, capital market transactions, significant mergers or acquisitions (“M&A”), private equity, or investment banking.

We seek to have directors with transactional experience to oversee the assessment of opportunities consistent with our strategic priorities. |

|

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| INDUSTRY, END MARKETS AND GROWTH AREAS BACKGROUND

Knowledge of or experience in the Company’s specific industry.

We seek to have directors that bring valuable perspectives on issues specific to our business based on their significant experience in our industries, the end markets we serve, and growth areas. |

|

● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||

| INTERNATIONAL EXPERIENCE

Experience doing business internationally.

We seek to have directors with international experience that provide valuable perspectives on our global operations and regulatory compliance, and support key strategic decision-making in international markets. |

|

● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||

| DIGITAL AND TECHNOLOGY INNOVATION

Experience or expertise in digital, technology, artificial intelligence, or cybersecurity.

We seek to have directors with experience in digital, technology, artificial intelligence or cybersecurity matters to enhance the Board’s understanding of risks and opportunities related to our high-impact innovation strategy. |

|

● | ● | ● | ● | ● | ● | |||||||||||||||||||

See director biographies beginning on page 11 for further detail.

Nordson Corporation – 2026 Proxy Statement | 9

Our Board recognizes the importance of Board refreshment to ensure that the directors possess a composite set of skills, experience, and qualifications necessary to successfully oversee the Company’s strategic priorities. We do not believe in a specific limit for the overall length of time an independent director may serve; however, we believe that the tenure spectrum of our directors should provide an effective mix of deep knowledge and new perspectives. Our Governance Guidelines provide that a director is expected to retire on or before the annual meeting immediately following a director’s 72nd birthday. We periodically rotate the chairs of each of our committees to ensure continued diverse perspectives. As a result of our refreshment, as of our record date for the Annual Meeting, the average tenure of our independent directors is 7 years, the average age of our independent directors is 63 years.

In determining whether to recommend a director for re-election, the Governance and Sustainability Committee considers, among other attributes, the director’s skills and expertise, availability and ability to attend both regular and ad hoc meetings, participation in and contributions to the activities of the Board, the results of the annual Board evaluation, and past meeting attendance.

The name and age (as of the Annual Meeting) of each of the three nominees for election as directors, as well as current directors whose terms will continue after the Annual Meeting, are listed in the next section, together with their principal occupation for at least the past five years, the year each became a director of the Company and certain other relevant information.

Proxies that are duly executed and properly submitted but do not withhold the authority to vote for any or all of the nominees will be voted for the election as directors of all of the nominees named below. At this time, the Board is not aware of any reason that would prevent any nominee from being a candidate at the Annual Meeting. However, in the event any one or more of such nominees becomes unavailable for election, proxies will be voted in accordance with the best judgment of the proxy holder.

10 | Nordson Corporation – 2026 Proxy Statement

Nominees for Term Expiring in 2029

|

Career Highlights and Qualifications

Mr. Mapes retired as president and chief executive officer of Lincoln Electric Holdings, Inc. (Nasdaq: LECO) (global manufacturer of arc welding and automation solutions) in December 2023, a position he held since December 2012 after serving as chief operating officer in 2011. He also retired as Executive Chair of Lincoln Electric in December 2024, and served as a director since 2010. Prior to that, he served as executive vice president and a divisional president of A.O. Smith Corporation (NYSE: AOS) (residential and commercial water heater and boiler manufacturing) until its divestiture in 2011.

Attributes and Skills

Mr. Mapes’ experience spans more than 35 years of industrial manufacturing in large, global, publicly-traded companies. Beyond his keen understanding of the manufacturing industry, Mr. Mapes has significant experience developing and implementing strategic operating plans, mergers and acquisitions, global operations and international compliance. Additionally, his service on other public boards enables Mr. Mapes to provide meaningful insight on corporate governance and financial matters.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Mapes represents each of the key skills and qualifications noted for him in the Director Skills Matrix on page 9, and will continue to effectively serve our Board, our business, our management team and our shareholders. | |||

| CHRISTOPHER MAPES |

||||

|

Director Since 2024 |

||||

|

Age 64 |

||||

|

Retired President and CEO, Lincoln Electric Holdings, Inc. |

||||

|

Committees: Audit |

||||

|

Other Public Directorships (current in bold) |

||||

| The Timken Company (NYSE: TKR) RPM International Inc. (NYSE: RPM)

Lincoln Electric Holdings, Inc. (Nasdaq: LECO) (2010-2024) |

Nordson Corporation – 2026 Proxy Statement | 11

|

Career Highlights and Qualifications

Mr. Merriman served as Chair of our Board from February 2018 to March 2024. Mr. Merriman is a business consultant for Product Launch Ventures, LLC, a company that he founded in 2004 to pursue consumer product opportunities and provide business advisory services. Previously, Mr. Merriman was an operating and strategic advisor of Resilience Capital Partners LLC, a private equity firm, from 2008 until 2017. Prior to that, Mr. Merriman served as president and chief executive officer of Lamson & Sessions Co. (formerly, NYSE: LMS) (thermoplastic conduit manufacturing) and as senior vice president and chief financial officer of American Greetings Corporation (formerly, NYSE: AM) (greeting card manufacture and design).

Attributes and Skills

Mr. Merriman’s prior roles as a public company chief executive officer and chief financial officer, his history of service on the multiple public company boards, and his experience at Resilience all provide him with valuable experience and significant knowledge in the areas of executive management, strategy, corporate governance, acquisitions and divestitures, finance and financial reporting, product development expertise, and investor relations. Mr. Merriman has extensive finance, financial reporting, and accounting expertise and was formerly a certified public accountant, which provides the Board with valuable financial expertise.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Merriman represents each of the key skills and qualifications noted for him in the Director Skills Matrix on page 9, and will continue to effectively serve our Board, our business, our management team and our shareholders. | |||

|

MICHAEL MERRIMAN, JR. |

||||

|

Director Since 2008 |

||||

|

Age 69 |

||||

|

Business Consultant, Product Launch Ventures, LLC |

||||

|

Committees: Executive, Compensation (Chair) |

||||

|

Other Public Directorships (current in bold) |

||||

| Regis Corporation (NYSE: RGS)

Invacare Corporation (NYSE: IVC) (2014-2018), (2022-2023)

OMNOVA Solutions Inc. (formerly, NYSE: OMN) (2008-2020) |

12 | Nordson Corporation – 2026 Proxy Statement

|

Career Highlights and Qualifications

Mr. Nagarajan has served as Nordson’s President and Chief Executive Officer since August 2019. He joined Nordson following a 23-year career with Illinois Tool Works Inc. (NYSE: ITW), (FORTUNE® 200 manufacturer of industrial products and equipment). In his last role at Illinois Tool Works, Mr. Nagarajan served as executive vice president, ITW Automotive OEM Segment, a position he held since 2015. Prior to that he held various executive and managerial roles of increasing responsibility.

Attributes and Skills

Mr. Nagarajan is the only member of Nordson’s management serving on our Board. He brings to the Board significant global manufacturing experience, with a focus on creating value for customers through innovation and industry-leading excellence in quality and delivery. Mr. Nagarajan has an intimate understanding of management, leadership, strategy development and day-to-day operations of global companies. He has been instrumental in driving and implementing strategies to strengthen our financial performance, culture, values, purpose, employee engagement, customer experience, profitable growth and management of corporate responsibility initiatives, cybersecurity and other significant risks and opportunities.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Nagarajan represents each of the key skills and qualifications noted for him in the Director Skills Matrix on page 9, and will continue to effectively serve our Board, our business, our management team and our shareholders. | |||

| SUNDARAM NAGARAJAN |

||||

|

Director Since 2019 |

||||

|

Age 63 |

||||

|

President and CEO, Nordson Corporation |

||||

|

Committees: Executive |

||||

|

Other Public Directorships (current in bold) |

||||

| Wesco International, Inc.

Sonoco Products Company (NYSE: SON) (2015-2022)

|

Nordson Corporation – 2026 Proxy Statement | 13

Current Directors with Terms Expiring in 2027

|

Career Highlights and Qualifications

Now retired, Mr. Jaehnert served as chief executive officer and president of Brady Corporation (NYSE: BRC) (high performance labels, signage, printers, and software) from 2003 through 2013. Previously, he served as a divisional president and chief financial officer of Brady Corporation and held various financial positions in Germany and in the United States for Robert Bosch GmbH (international manufacturer). Mr. Jaehnert has earned a NACD Directorship Certification and was named as an NACD Directorship 100 honoree for the years 2020 and 2024. Mr. Jaehnert also earned a Certificate in Cybersecurity through the NACD/Software Institute of Carnegie Mellon University in 2023.

Attributes and Skills

Mr. Jaehnert has served in the public company leadership capacities noted above as well as other significant leadership roles at global companies. His experience includes leading and overseeing corporate strategy, profitable growth, mergers and acquisitions, corporate governance, and financial performance, including corporate finance, financial reporting, risk management, capital allocation and strategic planning. Additionally, Mr. Jaehnert is an Audit Committee Financial Expert for Nordson and has significant experience, perspective and insight from his service and leadership with other public company boards. | |||

| FRANK JAEHNERT |

||||

|

Director Since 2012 |

||||

|

Age 68 |

||||

|

Retired President and CEO, Brady Corporation |

||||

|

Committees: Audit, Governance and |

||||

|

Other Public Directorships (current in bold) |

||||

| Itron, Inc. (Nasdaq: ITRI)

Briggs & Stratton Corporation (formerly NYSE: BGG) (2014-2021)

|

14 | Nordson Corporation – 2026 Proxy Statement

|

Career Highlights and Qualifications

Now retired, Ms. Jones served as the senior vice president and chief financial officer of Cooper Tire & Rubber Company (tire manufacturing), from 2014 until her retirement in 2018. Prior to joining Cooper, Ms. Jones served as chief financial officer of Plexus Corporation (Nasdaq: PLXS) (electronics manufacturing) from 2007 to 2014.

Attributes and Skills

Ms. Jones brings more than 30 years of accounting and finance skills, in industries ranging from consumer goods, industrial manufacturing, supply chain management and software. In addition to her strong financial acumen, Ms. Jones has meaningful expertise in business strategy and operations, mergers and acquisitions, corporate governance, and understands the unique challenges that come with operating a global business. Ms. Jones’ also brings her experience on previous and currently held board positions on other publicly traded companies, including with audit committees and is an Audit Committee Financial Expert for Nordson. | |||

| GINGER JONES |

||||

|

Director Since 2019 |

||||

|

Age 61 |

||||

|

Retired Senior Vice President and Chief Financial Officer, Cooper Tire & Rubber Company |

||||

|

Committees: Executive, Audit (Chair), |

||||

|

Other Public Directorships (current in bold) |

||||

| Tronox Holdings plc (NYSE: TROX)

Libbey, Inc. (formerly NYSE: LBY) (2013-2020)

|

Nordson Corporation – 2026 Proxy Statement | 15

|

Career Highlights and Qualifications

Dr. Morris currently serves as a Principal of MEHL BioMedical, LLC (biomedical consulting services), where he has provided consulting services to start-up companies in the biomedical device industry since 2015. Dr. Morris retired from Neuspera Medical Inc., a privately held company (medical technology), where he served as president and chief executive officer from 2015 to 2022. He previously was the senior vice president, research and development of Cyberonics, Inc., maker of the Vagus Nerve Stimulation (VNS Therapy) System from 2009 through 2014. His prior work experience also includes serving as a director, program management and operations of InnerPulse, Inc., (medical technology), as well as director, marketing and arrhythmia franchise leader of Boston Scientific Corporation (NYSE: BSX) (multinational medical device manufacturing). Dr. Morris has earned a NACD Directorship Certification and certification in Cybersecurity through the National Association of Corporate Directors.

Attributes and Skills

Dr. Morris brings to the Board significant new product development experiences in the medical device markets. Dr. Morris’s robust business leadership experience gives him expertise in global decentralized organizations, mergers and acquisitions, international compliance, and affords the Board a unique perspective in identifying strategic and tactical risks attendant to the medical device market. | |||

| MILTON MORRIS |

||||

|

Director Since 2022 |

||||

|

Age 56 |

||||

|

Principal of MEHL BioMedical, LLC |

||||

|

Committees: Audit, Governance and |

||||

|

Other Public Directorships (current in bold) |

||||

| Embecta Corp. (Nasdaq: EMBC) Myomo, Inc. (NYSE: MYO)

|

16 | Nordson Corporation – 2026 Proxy Statement

Current Directors with Terms Expiring in 2028

|

Career Highlights and Qualifications

Dr. DeFord is currently chairman, chief executive officer and president of Samothrace Medical Innovations, Inc., a privately held medical technology company, which he co-founded in March 2022. Previously, Dr. DeFord served as executive vice president and chief technology officer of Becton, Dickinson and Company (NYSE: BDX) (medical technology and manufacturing) from 2017 until 2021. Prior to that, he was senior vice president of Science, Technology and Clinical Affairs for C.R. Bard, Inc. (medical technology manufacturing), which was acquired by BDX in 2017, managing director of Early Stage Partners, a venture capital fund, and president and chief executive officer of Cook Incorporated, a privately held medical device manufacturer.

Attributes and Skills

Dr. DeFord brings a wealth of diverse experiences resulting from serving in various leadership positions over the past 35 years, he holds 14 U.S. patents, is the author of numerous peer-reviewed scientific papers, and has a Ph.D in Electrical Engineering. His experience also includes leading and overseeing mergers and acquisitions and corporate governance initiatives. Dr. DeFord’s expertise in the medical device sector and executive experience in multi-billion dollar, global companies enable him to make significant contributions to discussions regarding the Company’s strategy and growth.

| |||

| JOHN DEFORD |

||||

|

Director Since 2020 |

||||

|

Age 64 |

||||

|

Chairman, CEO and President, Samothrace Medical Innovations, Inc. |

||||

|

Committees: Compensation, Governance and Sustainability |

||||

|

Other Public Directorships (current in bold) |

||||

| Globus Medical Inc. (NYSE: GMED) Maravai LifeSciences Holdings, Inc. (Nasdaq: MRVI)

NuVasive, Inc. (Nasdaq: NUVA)

|

Nordson Corporation – 2026 Proxy Statement | 17

|

Career Highlights and Qualifications

Ms. Parmentier has served as chair of the board and chief executive officer of Parker-Hannifin Corp. (NYSE: PH) (motion control manufacturing) since January 2023. Immediately prior to her current role, Ms. Parmentier served as the chief operating officer at Parker-Hannifin from August 2021 to January 2023. She also served as vice president and president of Motion Systems Group from February 2019 to August 2021, vice president and president of the Engineered Materials Group from September 2015 to February 2019, and general manager for the Hose Products Division in the Fluid Connectors Group since joining Parker-Hannifin in 2008.

Attributes and Skills

Ms. Parmentier brings strong international operating experience in the industrial sector to the Board. Her experiences, specifically her career with Parker-Hannifin, which serves a diverse market base spanning mobile, industrial, and aerospace clients, enables her to make significant contributions to discussions regarding the Company’s diverse and complex global organization. She also has extensive experience in financial planning and performance, mergers and acquisitions, employee engagement, management of corporate initiatives and other corporate governance matters.

| |||

| JENNIFER PARMENTIER |

||||

|

Director Since 2020 |

||||

|

Age 58 |

||||

|

Chair of Board and CEO, Parker-

|

||||

|

Committees: Executive, Compensation, Governance and Sustainability (Chair) |

||||

|

Other Public Directorships (current in bold) |

||||

| Parker-Hannifin Corp. (NYSE: PH)

|

18 | Nordson Corporation – 2026 Proxy Statement

|

Career Highlights and Qualifications

Mr. Richey has served as Chair of our Board since March 2024. Now retired, Mr. Richey served as executive chair of the board of ESCO Technologies Inc. (NYSE: ESE) (fluid management manufacturing) from January 2023 to June 2023. He previously served as ESCO Technologies’ chair of the board, president, and chief executive officer from 2003 to 2022.

Attributes and Skills

Mr. Richey has extensive experience in senior leadership of a diversified global producer and marketer of technology, and he has significant executive management and board experience at public and private companies within several of our end markets, including the semiconductor industry, which provides our Board with a breadth of skills critical to its oversight responsibility. He also has extensive expertise in mergers and acquisitions and the ability to provide accountability, transparency and protection of shareholder interests.

| |||

| VICTOR RICHEY, JR. |

||||

|

Director Since 2010 |

||||

|

Age 68 |

||||

|

Retired President and CEO, ESCO Technologies, Inc. |

||||

|

Committees: Executive (Chair) |

||||

|

Other Public Directorships (current in bold) |

||||

| Thermon Group Holdings, Inc.

ESCO Technologies Inc. (NYSE: ESE) (2006-2023)

|

No shareholder or group that beneficially owns 1% or more of our outstanding common shares has recommended a candidate for election as a director at the 2026 Annual Meeting.

Cumulative Voting

Voting for directors will be cumulative if any shareholder provides notice in writing to the President, an Executive Vice President, or the Secretary of Nordson of a desire to have cumulative voting. The notice must be received at least 48 hours before the time set for the Annual Meeting, and an announcement of the notice must be made at the beginning of the meeting by the Chair or the Secretary, or by or on behalf of the shareholder giving the notice. If cumulative voting is in effect, each shareholder will be entitled to cast, in the election of directors, a number of votes equal to the product of the number of directors to be elected multiplied by the number of shares that the shareholder is voting. Shareholders may cast all of these votes for one nominee or distribute them among several nominees, as they see fit. If cumulative voting is in effect, shares represented by each properly submitted proxy will also be voted on a cumulative basis, with the votes distributed among the nominees in accordance with the judgment of the persons named on the proxy/voting instruction card.

To date, we have not received a notice from any shareholder of his, her, or its intention to request cumulative voting.

Majority Voting Policy

The Director nominees receiving the greatest number of votes will be elected (plurality standard). However, our majority voting policy states that any Director who fails to receive a majority of the votes cast in his/her favor is required to submit his/her resignation to the Board. The Governance and Sustainability Committee of the Board

Nordson Corporation – 2026 Proxy Statement | 19

would then consider each resignation and determine whether to accept or reject it. Abstentions and broker non-votes will have no effect on the election of a Director and are not counted under our majority voting policy.

Required Vote

The election of directors requires the affirmative vote of the holders of a plurality of the shares of common stock voting at the Annual Meeting. Under the plurality voting standard, the nominees receiving the most “for” votes will be elected, regardless of whether any nominee received a majority of the votes. Only shares that are voted in favor of a particular nominee will be counted toward the nominee’s achievement of a plurality. Shares present at the meeting that are not voted for a particular nominee or shares present by proxy where the shareholder properly withheld authority to vote for the nominee (including broker non-votes) will not be counted toward the nominee’s achievement of a plurality, but will be counted for quorum purposes.

RECOMMENDATION REGARDING PROPOSAL 1:

The Board of Directors recommends that

you vote “FOR” all three nominees as directors.

Proxies received by the Board will be voted for all nominees

unless shareholders specify a different vote.

20 | Nordson Corporation – 2026 Proxy Statement

CORPORATE GOVERNANCE

Corporate Governance Documents

The following corporate governance documents are available at https://www.nordson.com/en/About-Us/Corporate-Governance:

| • | Governance Guidelines |

| • | Committee Charters |

| • | Conflict Minerals Policy |

| • | Related Persons Transaction Policy |

| • | Share Ownership Guidelines |

| • | Code of Ethics and Business Conduct |

| • | Suppliers Code of Conduct |

The Governance Guidelines contain general principles regarding the functions of Nordson’s Board and Board committees and the Director Recruitment and Performance Guidelines. The Annual Report to Shareholders, which includes the Annual Report on Form 10-K for the fiscal year ended October 31, 2025 (the “2025 Annual Report”) and this Proxy Statement, are available at: https://investors.nordson.com/financials/annual-reports/default.aspx. Upon request, copies of the Annual Report to Shareholders will be mailed to you (at no charge) by contacting Nordson Corporation, Attn: Corporate Communications, 28601 Clemens Road, Westlake, Ohio 44145. The information in, or that can be accessed through, our internet site is not part of this Proxy Statement, and all references in this document to our internet site are for informational or reference purposes only.

Code of Ethics and Business Conduct

We have a Code of Ethics and Business Conduct (the “Code”) that applies to all Nordson directors, officers, employees, and its subsidiaries, wherever located. Our Code contains the general guidelines and principles for conducting Nordson’s business consistent with the highest standards of business ethics. Our Code embodies our five guiding values, which form the foundation of our Company: Integrity, Excellence, Passion for Our Customers, Energy, and Respect for People. Our employees are expected to report all suspected violations of Company policies and the law, including incidents of harassment or discrimination, directly to their managers, human resources, or the Chief Compliance Officer. We also provide confidential, anonymous reporting through our third-party helpline, which is available 24 hours per day, seven days per week via a toll-free telephone line or the internet. We provide interpreters who speak the reporter’s preferred language. We will take appropriate steps to investigate all reports we receive through these channels and will take appropriate action. Under no circumstances will our employees be subject to any disciplinary or retaliatory action for reporting, in good faith, a possible violation of our Code or applicable law or for cooperating in any investigation of a possible violation.

Shareholder Engagement, Corporate Responsibility, and Sustainability

We recognize that managing our economic, and corporate responsibility matters and strategies enhances our ability to deliver results over the long term for shareholders, employees, our communities, and other stakeholders. Our Board oversees our corporate responsibility efforts, while cross functional teams of senior management drive these and our sustainability efforts throughout the Company. Further information about our Corporate Responsibility and Sustainability initiatives can be found on our website at https://www.nordson.com/en/about-us/corporate-responsibility.

Sharing the Nordson story and being accessible to our shareholders is a priority for Nordson. In 2025, we engaged over 200 institutional investors and analysts through phone calls, virtual and in-person conferences, and virtual and in-person road trips hosted by sell-side research analysts. Key themes from these conversations included the diversity of our end markets and geographies, growth drivers of our business, the ongoing deployment of the NBS Next growth framework and capital deployment, including our acquisition strategy.

In October 2025, Nordson published its latest Corporate Responsibility Update. The report continues to reflect an intentional, systemic approach to organizing and communicating our commitments, accomplishments and aspirations through a corporate responsibility lens. To view the 2025 and previous reports, visit https://www.nordson.com/en/about-us/corporate-responsibility

Nordson Corporation – 2026 Proxy Statement | 21

Director Independence

In accordance with the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”), and our Governance Guidelines, the Board must consist of a majority of independent directors. The Board has determined that all of our current directors, except Mr. Nagarajan, are independent under these standards. Mr. Nagarajan is not an independent director because he serves as our President and Chief Executive Officer. Our Governance Guidelines also require that our Audit, Compensation, and Governance and Sustainability committees each be comprised solely of independent directors who meet all the independence and experience requirements of Nasdaq.

In determining independence, each year the Board affirmatively determines, among other things, whether directors have a “material relationship” with Nordson. When assessing the “materiality” of a director’s relationship with Nordson, the Board considers all relevant facts and circumstances, including a consideration of the persons or organizations with which the director has an affiliation. Where an affiliation is present, the Board considers the frequency or regularity of the provision of services, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to Nordson as those prevailing at the time from unrelated parties for comparable transactions. With respect to Audit Committee members, the Board must affirmatively determine that these directors, in addition to the general independence requirements described above, satisfy certain financial education requirements and do not, among other things, accept any consulting, advisory, or other compensatory fee from Nordson. With respect to Compensation Committee members, the Board must consider, in addition to the general independence requirements described above, the source of compensation of the members, including any consulting, advisory or other compensatory fee paid by Nordson to these directors, and whether the directors are affiliated with Nordson, a subsidiary of Nordson or an affiliate of a subsidiary of Nordson.

22 | Nordson Corporation – 2026 Proxy Statement

As part of our commitment to ensuring director independence, and in accordance with our Related Person Transaction Policy (described in more detail below) we have a monitoring and reporting program with respect to products supplied by, or to, a company that may employ a director or may have a director serving on its board to identify and address any potential conflicts of interest resulting from our relationship. In 2025, all transactions and relationships evaluated by the Board involved only immaterial ordinary course of business purchase and sale of goods and services at companies where our directors serve as an officer or director. The table below more particularly describes the transactions and relationships the Board considered in the 2025 fiscal year and, in each case, the amounts involved were less than the greater of $1 million or 1% of our and the recipient’s respective annual revenues in each of the last three years.

| Director / Nominee | Entity and Relationship | Transactions |

% of Entity’s Annual Revenues in each of

|

|||||

| Annette Clayton |

NXP Semiconductors N. V. Director |

We sell products to NXP Semiconductors N.V. | Less than 1% |

| ||||

|

|

OshKosh Corporation Director |

We sell products to OshKosh Corporation | Less than 1% |

| ||||

|

|

Schneider Electric Retired President and CEO |

We sell products to Schneider Electric | Less than 1% |

| ||||

|

|

Duke Energy Corporation Director |

We purchase products from Duke Energy Corporation | Less than 1% |

| ||||

| John DeFord |

Globus Medical Inc. Director |

We sell products to Globus Medical |

Less than 1% |

| ||||

|

|

NuVasive, Inc. Former Director |

We sell products to NuVasive, Inc. |

Less than 1% |

| ||||

| Frank Jaehnert |

Itron, Inc. Director |

We sell products to Itron, Inc. | Less than 1% |

| ||||

| Ginger Jones |

Tronox Holdings PLC Director |

We sell products to Tronox Holdings PLC |

Less than 1% |

| ||||

| Christopher Mapes |

A.O. Smith Corporation Director |

We sell products to A.O. Smith Corporation | Less than 1% |

| ||||

|

|

The Timken Company Director |

We sell products to The Timken Company | Less than 1% |

| ||||

| Michael Merriman, Jr. |

Regis Corporation Director |

We sell products to Regis Corporation | Less than 1% |

| ||||

| Sundaram Nagarajan |

Wesco International, Inc. Director |

We sell products to and purchase products from Wesco International | Less than 1% |

| ||||

| Jennifer Parmentier |

Parker-Hannifin Corporation Director and CEO |

We sell products to and purchase products from Parker-Hannifin Corporation. | Less than 1% |

| ||||

| Victor Richey, Jr. |

ESCO Technologies Inc. Retired Director, President and CEO |

We sell products to and purchase products from ESCO Technologies Inc. | Less than 1% |

| ||||

Based on this review and the information provided in response to annual questionnaires completed by each independent director regarding employment, business, familial, compensation, and other relationships with the Company and management, the Board has determined that every director that served during 2025 and director nominee (i) has no material relationship with Nordson, (ii) satisfies all of the Nasdaq independence standards and our independence standards, and (iii) is independent, with the exception of Mr. Nagarajan, who is an employee director. The Board has also determined that each member and chair of its Audit, Compensation, and Governance and Sustainability committees are independent directors. For more information on our review standards for related party transactions, see “Review of Transactions with Related Persons” below.

Nordson Corporation – 2026 Proxy Statement | 23

Review and Approval of Transactions with Related Persons

The Board has adopted a written policy regarding the review and approval of transactions between the Company and its subsidiaries and certain persons that are required to be disclosed in proxy statements, which are commonly referred to as “related persons transactions.” Related persons include our directors, nominees for election as a director, persons controlling over 5% of our common shares, executive officers, and the immediate family members of each of these individuals. Under the written policy, Nordson’s Audit Committee is responsible for reviewing any related persons transactions and will consider factors it deems appropriate, including but not limited to, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related person’s interest in the transaction. To the extent any member of the Audit Committee is involved in any transaction under review, that member recuses him or herself.

Our monitoring and reporting program with respect to transactions involving products supplied by, or to, a company that may employ a director or may have a director serving on its board includes all relevant transactions collectively over $120,000 in one annual period. Under the program, we reviewed all relevant transactions with all of these companies for 2025. Our Audit Committee determined that any related persons transactions were neither material nor significant to either Nordson or the respective director’s company based on our written policy and the guidelines set forth in Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All transactions were conducted at arms-length. Additional information on the related persons transaction review is set forth under the caption “Director Independence” above.

Compensation Committee Interlocks and Insider Participation

There are no matters relating to compensation committee interlocks or insider participation that we are required to report.

Director Qualifications

We believe that the Board, as a whole, should reflect a combination of skills, professional experience, and a range of backgrounds necessary to oversee the Company’s business. The Governance and Sustainability Committee periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future, considering the Company’s current situation and strategic plans. Through its selection and vetting process, the Governance and Sustainability Committee seeks not only to identify directors that meet desired qualifications, but also to enhance the diversity of the Board in areas such as professional experience, knowledge, skills, and age, and to obtain a variety of occupational, educational, and personal backgrounds on the Board in order to provide a range of viewpoints and perspectives. This focus on identifying and nominating qualified directors from various backgrounds has enabled the Company to assemble a Board comprised of high caliber directors with a range of expertise and viewpoints.

24 | Nordson Corporation – 2026 Proxy Statement

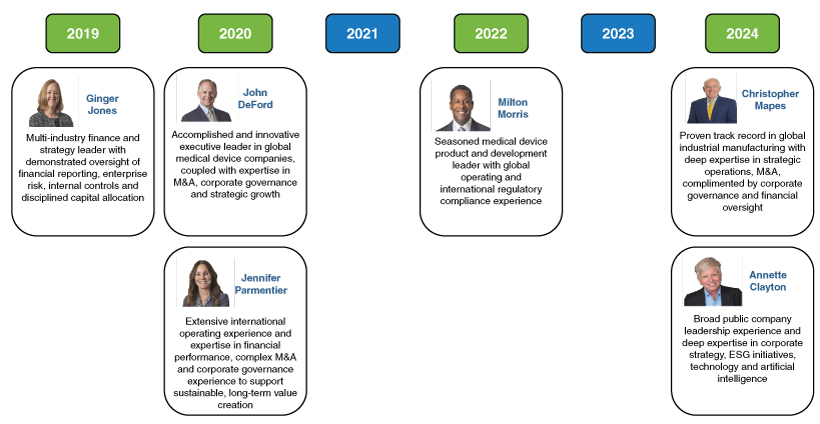

Board Refreshment Timeline

Since 2019, the Governance and Sustainability Committee’s intentional approach to director succession and refreshment has added six new directors, enhancing the Board’s mix of skills, experience, and tenure to support the Company’s long-term strategy.

Consideration of Director Candidates Recommended by Shareholders

Under its charter, the Governance and Sustainability Committee is responsible for reviewing shareholder nominations of directors. The Governance and Sustainability Committee’s considers shareholder-nominated candidates on the same basis and in the same manner as it considers recommendations from other sources. For more information on how a shareholder can recommend a candidate, see the “Questions and Answers About the Annual Meeting and These Proxy Materials” section of this proxy statement.

Board Leadership Structure

Our Governance Guidelines require us to have either an independent Chair of the Board or a presiding independent director if the Chair is not an independent director. The Governance Guidelines set forth the responsibilities of the Chair of the Board and the Presiding Director when the Chair of the Board is not an independent director.

At present, we have an independent Chair of the Board separate from the Chief Executive Officer position. We separate the Chair of the Board and Chief Executive Officer positions to enhance independent oversight of management and to allow our Chief Executive Officer to focus his time and energy on setting the strategic direction for the Company, overseeing daily operations, engaging with external constituents, developing and mentoring our future leaders, and promoting employee engagement at all levels of the organization. Our independent Chair of the Board leads the Board in the performance of its duties by establishing agendas and ensuring appropriate meeting content (in collaboration with our Chief Executive Officer), presiding during regularly held executive sessions with our independent directors, actively engaging with all independent directors and our Chief Executive Officer between Board meetings, and providing overall guidance to our Chief Executive Officer as to the Board’s views and perspectives, particularly on the strategic direction of the Company.

Nordson Corporation – 2026 Proxy Statement | 25

Meetings of the Board of Directors

The Board held seven meetings and our three standing committees held 18 meetings during fiscal year 2025. Nordson’s Governance Guidelines require attendance and active participation by directors at Board and committee meetings. In fiscal year 2025, each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board held during the period for which he or she served as a director and (ii) the total number of meetings held by all committees on which he or she served (during the period that he or she served). Directors are encouraged to attend the Annual Meeting. All of Nordson’s directors serving at the time attended the 2025 Annual Meeting of Shareholders held on March 4, 2025.

Executive Sessions of Independent Directors

Pursuant to our Governance Guidelines, independent directors meet in regularly scheduled executive sessions without management. The independent Chair of the Board chairs all regularly scheduled executive sessions of the Board, and also has authority to convene meetings of the independent directors at any time with appropriate notice.

Risk Oversight

The Board plays an active role, both as a whole and through focused reviews at the committee level, in the oversight and management of the Company’s risks. Management is responsible for the Company’s day-to-day risk management activities and oversees areas of material risk, which include operational, financial, legal and regulatory, human capital, information technology, cybersecurity, artificial intelligence, and physical security, corporate responsibility and strategic and reputational risks. The Company has established an enterprise risk framework for identifying, aggregating, and evaluating risk across the enterprise. The risk framework is integrated with the Company’s annual planning, audit scoping, and control evaluation management by its internal auditor.

The involvement of the Board in regularly assessing our business strategy, through dedicated annual reviews and periodic tailored sessions, is a key part of its oversight of risk management, its assessment of management’s appetite for risk, and its determination of what constitutes an appropriate level of risk for Nordson. The Board receives updates from management and guidance from outside advisors regarding this oversight responsibility.

In addition, the Board receives regular updates from management regarding matters critical to the business, which may include the safety of our workforce, supply chain interruptions, material availability, labor shortages and potential operational or financial implications of all these issues. The Board also oversees emerging areas of risk, such as artificial intelligence and technology, to ensure proper oversight of management’s approach to novel risks facing the business.

Assisting the Board with its oversight responsibilities, each of our Board committees oversee certain aspects of risk management as presented below:

| Audit Committee | Compensation Committee | Governance and Sustainability Committee |

||||||||||||||||||||||

| Risks associated with financial matters, financial reporting, accounting, disclosure, cybersecurity, and internal controls.

|

Risks associated with the establishment and administration of executive compensation and equity-based compensation programs, performance management of officers, and human capital management.

|

Risks associated with Board independence, effectiveness and organization, director succession and corporate responsibility oversight.

|

||||||||||||||||||||||

The Audit and Compensation Committees also rely on the advice and counsel of our independent auditors and independent compensation consultant, respectively, to raise awareness of any risks that may arise during their regular reviews of our financial statements, audit work, and executive compensation policies and practices.

26 | Nordson Corporation – 2026 Proxy Statement

Like all businesses, we face cybersecurity threats, as we rely on information systems and the internet to conduct our business activities. In light of the pervasive and increasing threat from cyberattacks, the Audit Committee, with input from management, identifies, assesses and monitors the Company’s cybersecurity and other information technology risks and threats and the measures implemented by the Company to mitigate and prevent cyberattacks, and the Board receives periodic reports from the Audit Committee and management on the Company’s cybersecurity program.

While our Governance and Sustainability Committee has primary oversight of governance and corporate responsibility matters for the Company, certain aspects of risk oversight related to corporate responsibility matters fall to the Board or to other committees, e.g., Audit (financial, environmental, and regulatory under our Enterprise Risk Management program) or Compensation (human capital) Committees.

Senior management attends Board and committee meetings at the invitation of the Board or its committees, respectively, and is available to address any questions or concerns raised by the Board on risk management and any other matters.

The Board is updated on each committee’s risk oversight and other activities via meeting reports from each committee chair to the full Board at each Board meeting.

The Board’s Role in Talent Development

A primary responsibility of the Board is to ensure that we have the appropriate management talent to successfully execute our strategies. Our Board believes that effective talent development is critical to Nordson’s continued success. Our Board’s involvement in leadership development and succession planning is systematic and ongoing. The Board plans for CEO succession and oversees management’s planning for succession of other key executive positions. Our Board calendar includes at least one meeting each year during which the Board conducts a detailed review of the Company’s talent strategies, leadership pipeline, and succession plans for key executive positions. The Compensation Committee oversees the process of succession planning and implements programs to retain and motivate key talent. To assist the Board, the CEO annually provides the Board with an in-depth assessment of senior managers and their potential to succeed to the position of CEO or other key executive positions.

Self-Assessments

On a regular basis, the Board conducts a self-assessment of the Board as a whole to determine, among other matters, whether the Board is functioning effectively. The independent directors also undertake a peer assessment of other independent directors as part of this self-assessment process. Each committee of the Board also conducts a self-assessment of the committee’s effectiveness. The Board considers the results of this process when determining whether incumbent directors continue to demonstrate the attributes that should be reflected on the Board, or whether changes to membership are appropriate.

Nordson Corporation – 2026 Proxy Statement | 27

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has three standing committees – the Audit Committee, the Compensation Committee, and the Governance and Sustainability Committee. The Board also has an Executive Committee that convenes on an as-needed basis. The respective committee functions, memberships, and number of meetings held during fiscal year 2025 for our three standing committees are listed below. A more detailed discussion of the purposes, duties, and responsibilities for each of the committees can be found in the respective committee charters, which are available at: https://www.nordson.com/en/about-us/corporate-governance.

|

Audit Committee |

No. of meetings in 2025: 8 | |||

| Members | Key Responsibilities | |||

|

Ginger Jones (Chair)

Annette Clayton

Frank Jaehnert

Christopher Mapes

Milton Morris |

• Review the proposed audits (including both independent and internal audits) for each fiscal year, the results of these audits, and the adequacy of our systems of internal controls over financial reporting;

• Select, retain, compensate, oversee and terminate, if necessary, the independent auditors for each fiscal year;

• Establish and oversee procedures for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls, or auditing matters;

• Review, approve and oversee all related-persons transactions; and

• Provide oversight of cybersecurity risks. | |||

| Independence/Qualifications | ||||

• All Audit Committee members are independent under Nasdaq listing standards, our Governance Guidelines and the heightened independence requirements applicable to audit committee members under SEC rules. Each of Mr. Jaehnert and Ms. Jones are independent directors under Nasdaq listing standards.

• The Board has determined that Mr. Jaehnert and Ms. Jones each qualify as an “audit committee financial expert” pursuant to SEC rules. | ||||

|

Compensation Committee |

No. of meetings in 2025: 6 | |||

| Members | Key Responsibilities |

|||

|

Michael Merriman (Chair)

John DeFord

Ginger Jones

Jennifer Parmentier |

• Review and approve compensation for our executive officers;

• Administer the incentive and equity participation plans under which we compensate our executive officers;

• Provide oversight to executive talent and management succession planning, other than chief executive officer succession, which is a responsibility of the entire Board; and

• Oversee the strong links between executive compensation and performance of our business by: (i) holding executive sessions (without management present) at every regularly scheduled committee meeting; (ii) engaging an independent compensation consultant to advise on executive compensation issues, including peer benchmarking data; (iii) examining peer group compensation structures, goals, and financial performance; and (iv) basing incentive/variable pay on the achievement of financial and operating performance goals to foster alignment with shareholder interests. | |||

| Independence/Qualifications | ||||

• All Compensation Committee members are independent under Nasdaq listing standards and our Governance Guidelines. | ||||

|

Governance and Sustainability Committee |

No. of meetings in 2025: 4 | |||

| Members | Key Responsibilities |

|||

|

Jennifer Parmentier (Chair)

John DeFord

Frank Jaehnert

Milton Morris |

• Assist the Board by identifying individuals qualified to serve as directors, and to recommend to the Board the director nominees for each annual meeting of shareholders;

• Review and recommend to the Board qualifications for committee membership and committee structure and operations;

• Oversee the Company’s strategy for corporate responsibility programs;

• Develop and recommend to the Board a set of corporate governance policies and procedures;

• Develop, administer, and oversee the self-assessment process for the Board and its committees;

• Oversee management’s development of an orientation program for new directors; and

• Review director’s compensation. | |||

| Independence/Qualifications | ||||

• All Governance and Sustainability Committee members are independent under Nasdaq listing standards and our Governance Guidelines.

| ||||

28 | Nordson Corporation – 2026 Proxy Statement

The Audit Committee has confirmed Ernst & Young LLP’s independence from management and the Company, including compatibility of non-audit services with the auditors’ independence. The Audit Committee Report to the Board is at page 36 of this Proxy Statement.

Nordson Corporation – 2026 Proxy Statement | 29

DIRECTOR COMPENSATION

Objectives of Director Compensation

Impactful non-employee directors are critical to our success. We believe that the primary duties of non-employee directors are (1) to effectively represent the long-term interests of our shareholders and (2) to provide guidance to management. As such, our compensation program for non-employee directors is designed to meet several key objectives:

| • | Adequately compensate directors for their responsibilities and time commitments and for the personal liabilities and risks that they face as directors of a public company; |

| • | Attract the highest caliber non-employee directors by offering a compensation program consistent with those at companies of similar size, complexity, and business character; |

| • | Align the interests of directors with our shareholders by providing a significant portion of compensation in equity and requiring directors to own our stock; |

| • | Provide compensation that is simple and transparent to shareholders and reflects corporate governance best practices; and |

| • | Where possible, provide flexibility in the form and timing of payments. |

Elements of Director Compensation

We believe that the following features of our director compensation program support the objectives above:

| • | We provide cash compensation through retainers for Board and committee service, as well as supplemental cash retainers to the Chair of the Board and chairs of our standing Board committees. The supplemental retainers compensate directors for the additional responsibilities and time commitments involved with chair responsibilities. |

| • | We do not provide separate Board and committee meeting fees. |

| • | All of the non-employee directors receive annual awards of restricted share units that vest 100% on the last day of the fiscal year. |

| • | As a practice, we do not grant securities to address any decrease in the market value of equity securities granted as compensation or held, directly or indirectly, by any officer, director, or other employee. |

| • | We pay for, provide, or reimburse directors for expenses incurred to attend Board and committee meetings and select director education programs. |

| • | Directors do not have a retirement plan but are afforded business travel and accident insurance coverage. |

| • | Our share ownership guidelines require non-employee directors to own at least five times their annual cash retainer in Nordson common shares. |

| • | Directors are prohibited from pledging or hedging Nordson common shares. |

Determining Director Compensation. The Governance and Sustainability Committee oversees, reviews, and reports to the Board on director compensation. The Governance and Sustainability Committee bi-annually reviews competitive market data for non-employee director compensation and makes recommendations to the Board for its approval. The Governance and Sustainability Committee is assisted in performing its duties by the Compensation Committee’s independent compensation consultant, which was Exequity LLP (“Exequity”) during 2024 and is now FW Cook, effective January 1, 2025.

Exequity’s review during 2024 for 2025 compensation consisted of an analysis of competitive market data from a selected peer group of companies approved by the Compensation Committee. The peer group is consistent with the peer group used for the executive compensation review conducted during 2025.

30 | Nordson Corporation – 2026 Proxy Statement

Effective November 1, 2024, following a recommendation from Exequity, the Board approved an increase in non-employee director compensation following a comprehensive review of market practices and the responsibilities of our directors. The annual cash retainer was raised from $90,000 to $100,000, and the value of annual equity grants increased from $165,000 to $190,000. The Board chair annual cash retainer was also increased from $100,000 to $115,000. These adjustments align our program with peer benchmarks and support the recruitment and retention of highly qualified directors. Directors may elect to defer cash retainers under the Company’s deferred compensation plan, and equity awards remain subject to our share ownership guidelines.

The components and respective amounts of non-employee director compensation for 2025 were:

| ANNUAL DIRECTOR COMPENSATION(1) | ANNUAL CHAIR COMPENSATION | |||||||

|

|

Chair of the Board

|

$115,000

| ||||||

|

Audit Committee Chair

|

$20,000

| |||||||

|

Compensation Committee Chair

|

$15,000

| |||||||

|

Governance and Sustainability Committee Chair

|

$15,000

| |||||||

| (1) | The number of restricted share units granted is determined by dividing the target dollar value by the trailing 30-day average closing price of Nordson common shares. |

Annual Cash Retainer. The cash retainers are paid in equal quarterly installments. Generally, for directors who join the Board after the commencement of a fiscal year, the annual retainer is prorated based on the number of days remaining in the fiscal year.

Annual Equity Award. Restricted share unit awards are granted annually and are effective the first business day of the fiscal year. The awards vest 100% on the last day of the fiscal year. If a director retires from the Board prior to the vesting date, restricted share units are forfeited on a pro-rata basis, based on the number of days served prior to retirement. If a director is appointed by the Board or elected by the shareholders after the commencement of a fiscal year, generally, the restricted share unit award is prorated based on the number of days remaining in the fiscal year. If restricted share units are not deferred, then the units and accrued dividend equivalents convert to Nordson common shares on a one-for-one basis on the vesting date.